A Mortgage Application Document Sample for Property Financing serves as a comprehensive template outlining the necessary paperwork and information required to apply for a home loan. It typically includes sections for personal details, income verification, property information, and credit history to streamline the approval process. Utilizing this document sample ensures accuracy and completeness, enhancing the likelihood of securing property financing efficiently.

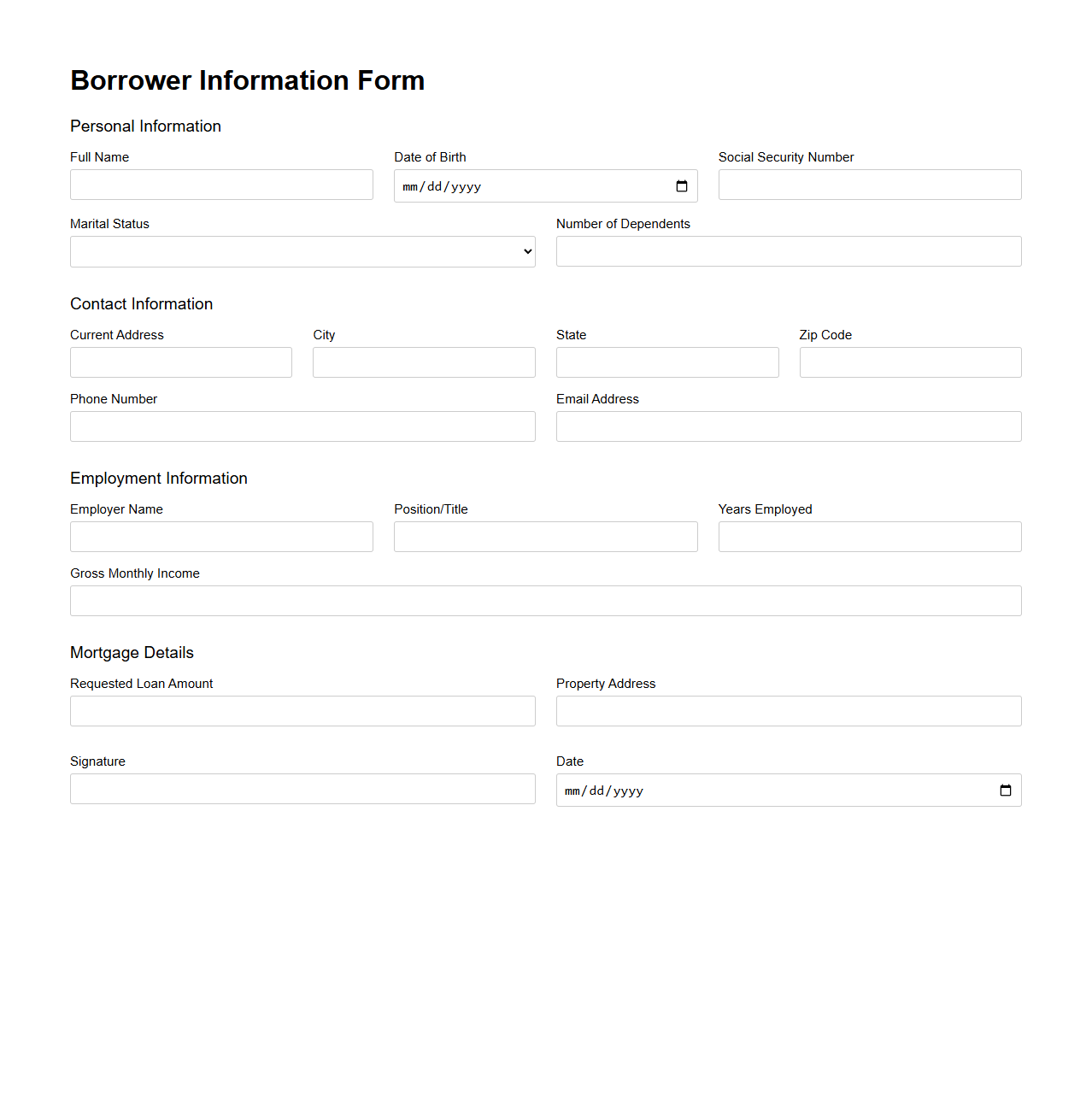

Borrower Information Form for Mortgage Application

The

Borrower Information Form for a mortgage application is a critical document used by lenders to collect detailed personal, financial, and employment information from the borrower. This form includes data such as income, assets, liabilities, credit history, and contact details to assess the borrower's creditworthiness and ability to repay the loan. Accurate and complete information on this form helps streamline the mortgage approval process and ensures compliance with lending regulations.

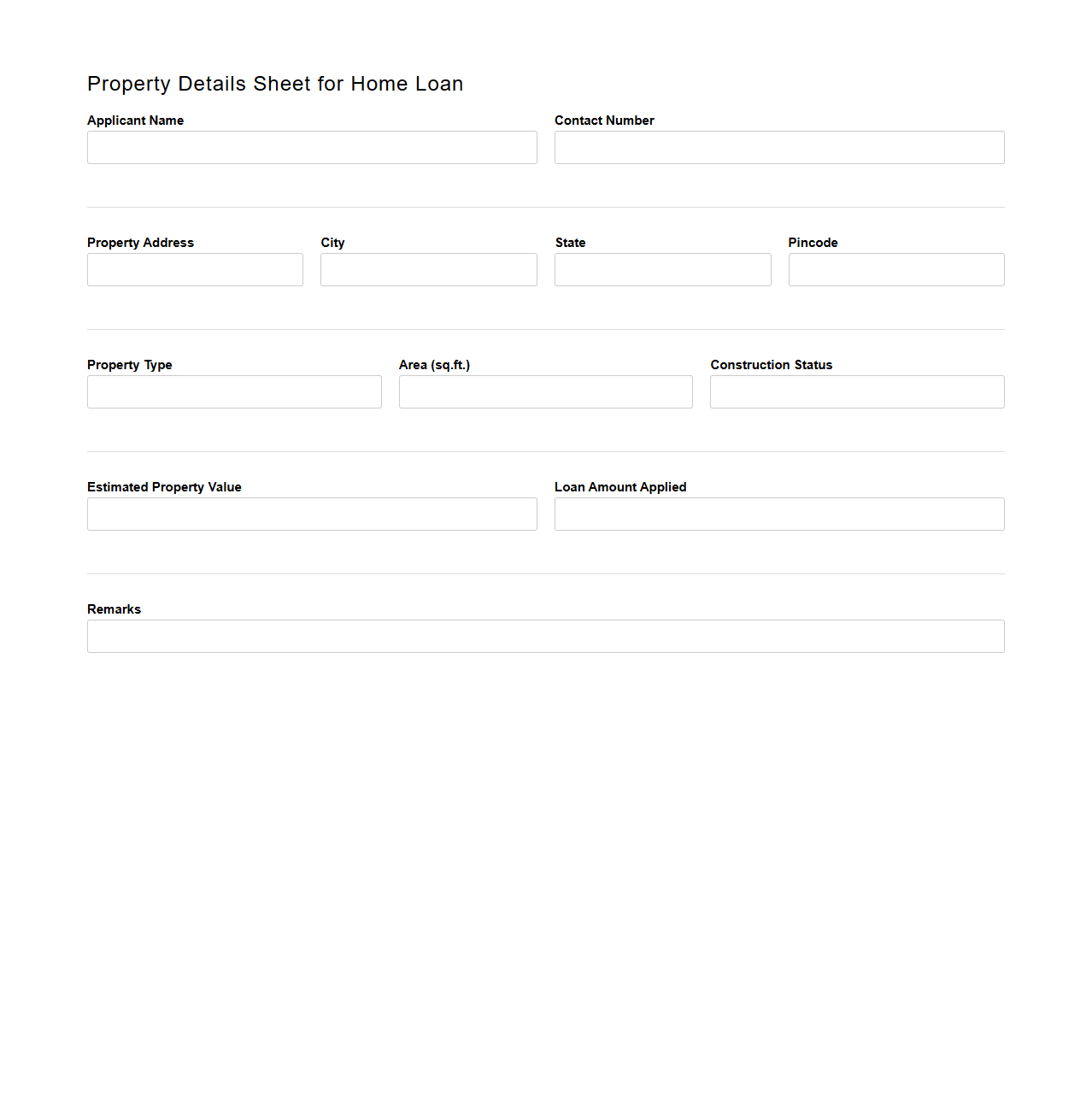

Property Details Sheet for Home Loan

A

Property Details Sheet for a home loan document is a crucial form that captures comprehensive information about the property being financed, including its location, size, ownership details, and current market value. This sheet helps lenders assess the collateral's worth and verify property legitimacy, serving as a key component in the loan approval process. Accurate details within this document ensure smooth verification and contribute to a faster home loan disbursement.

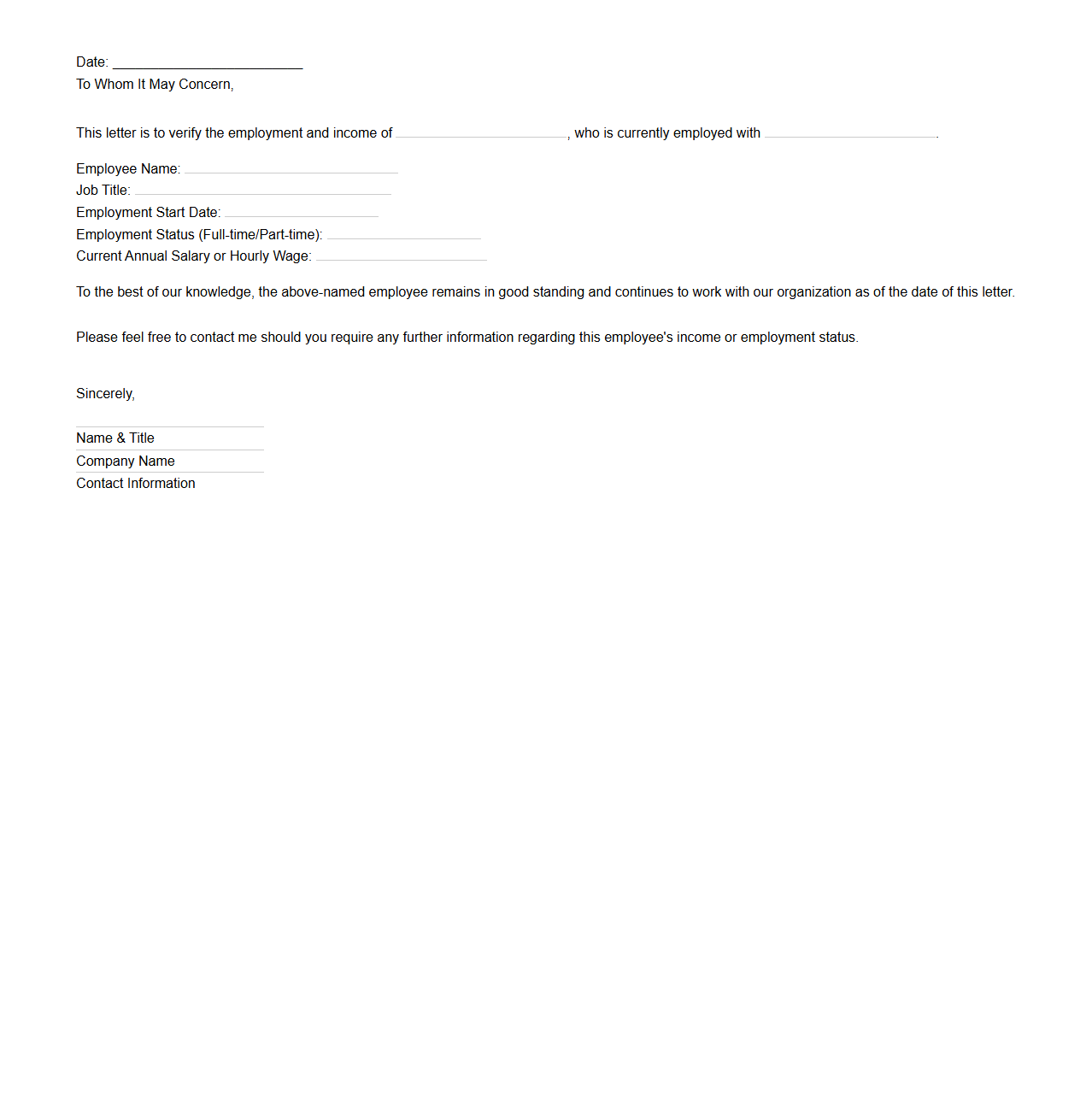

Income Verification Letter for Mortgage Approval

An

Income Verification Letter for mortgage approval is a formal document provided by an employer or financial institution that confirms an individual's earnings and employment status. This letter is essential for lenders to assess a borrower's ability to repay the mortgage loan by verifying consistent income sources. It typically includes details such as job title, salary, employment duration, and contact information of the issuer, ensuring transparency and credibility in the mortgage application process.

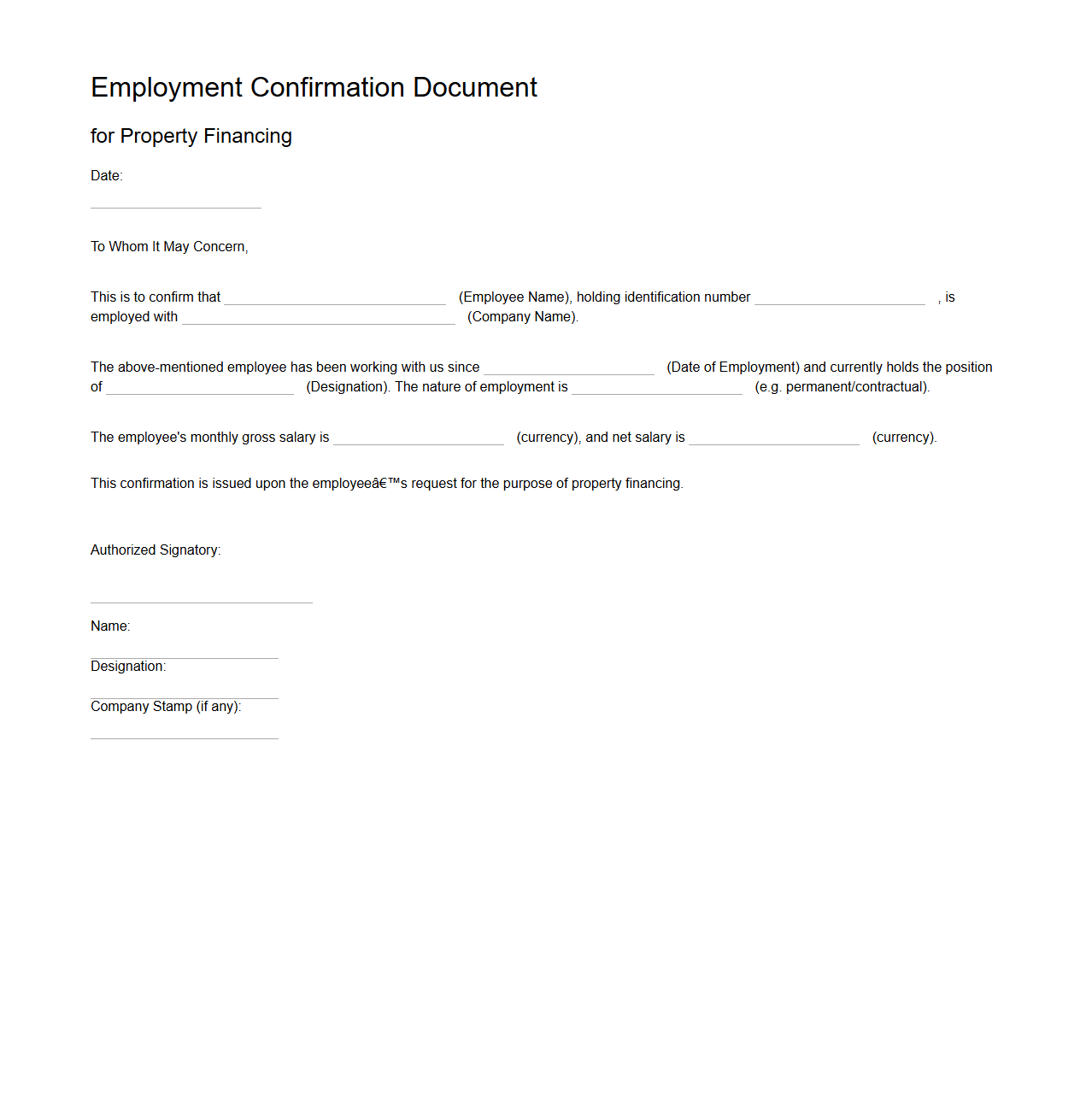

Employment Confirmation Document for Property Financing

An

Employment Confirmation Document for property financing verifies a borrower's current job status, salary, and employment duration, ensuring lenders assess income stability and repayment ability. This document typically includes official letters from the employer, pay slips, or employment contracts, which provide reliable proof of steady income. Lenders require this confirmation to minimize financial risks and validate the borrower's eligibility for mortgage approval.

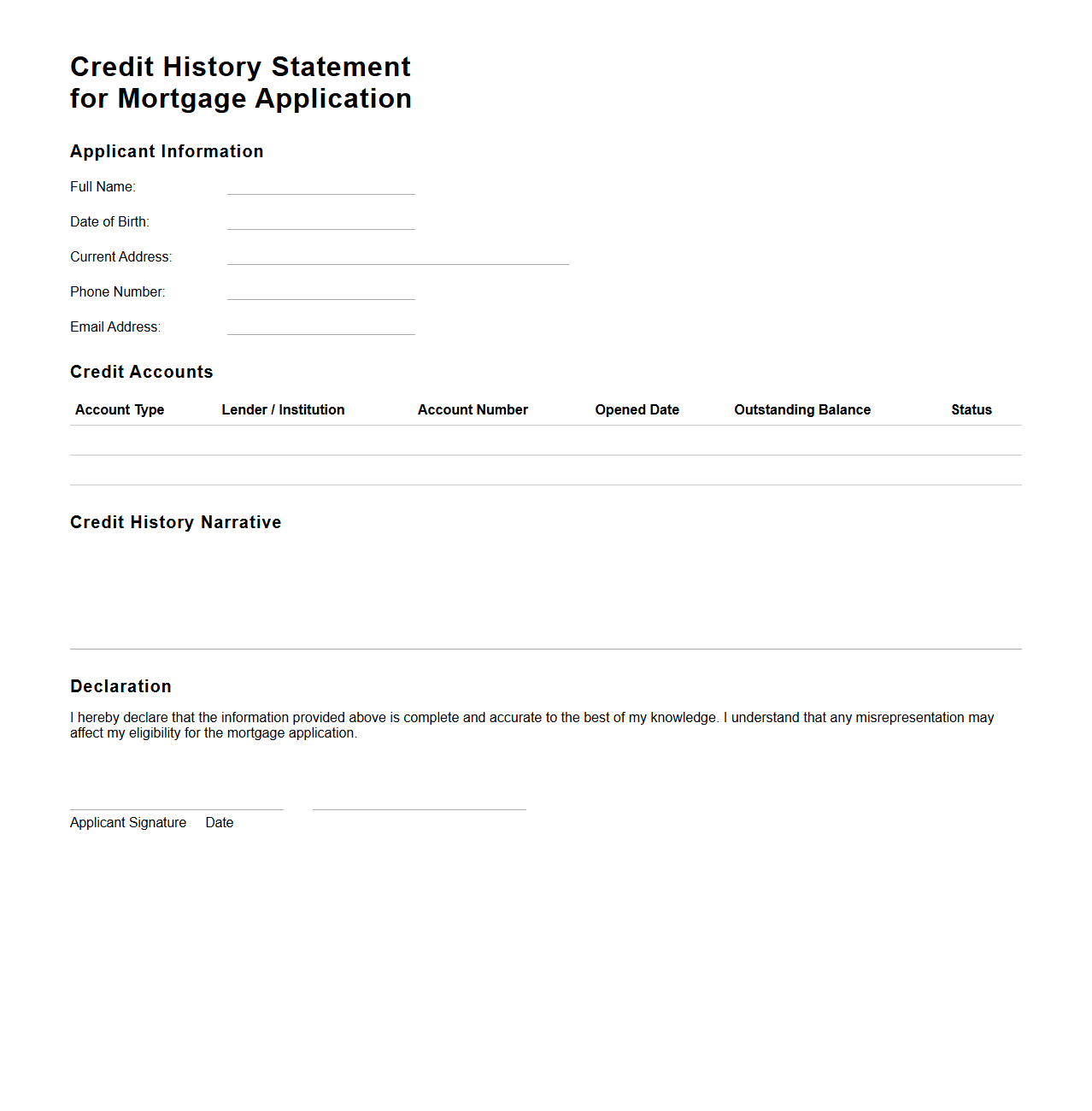

Credit History Statement for Mortgage Application

A

Credit History Statement for a mortgage application is a detailed record of an applicant's borrowing and repayment behavior, including credit accounts, payment history, outstanding debts, and public records like bankruptcies or liens. This document helps lenders assess the applicant's creditworthiness and ability to meet mortgage obligations by analyzing past financial behavior. Accurate and comprehensive credit history information is crucial for securing favorable loan terms and interest rates.

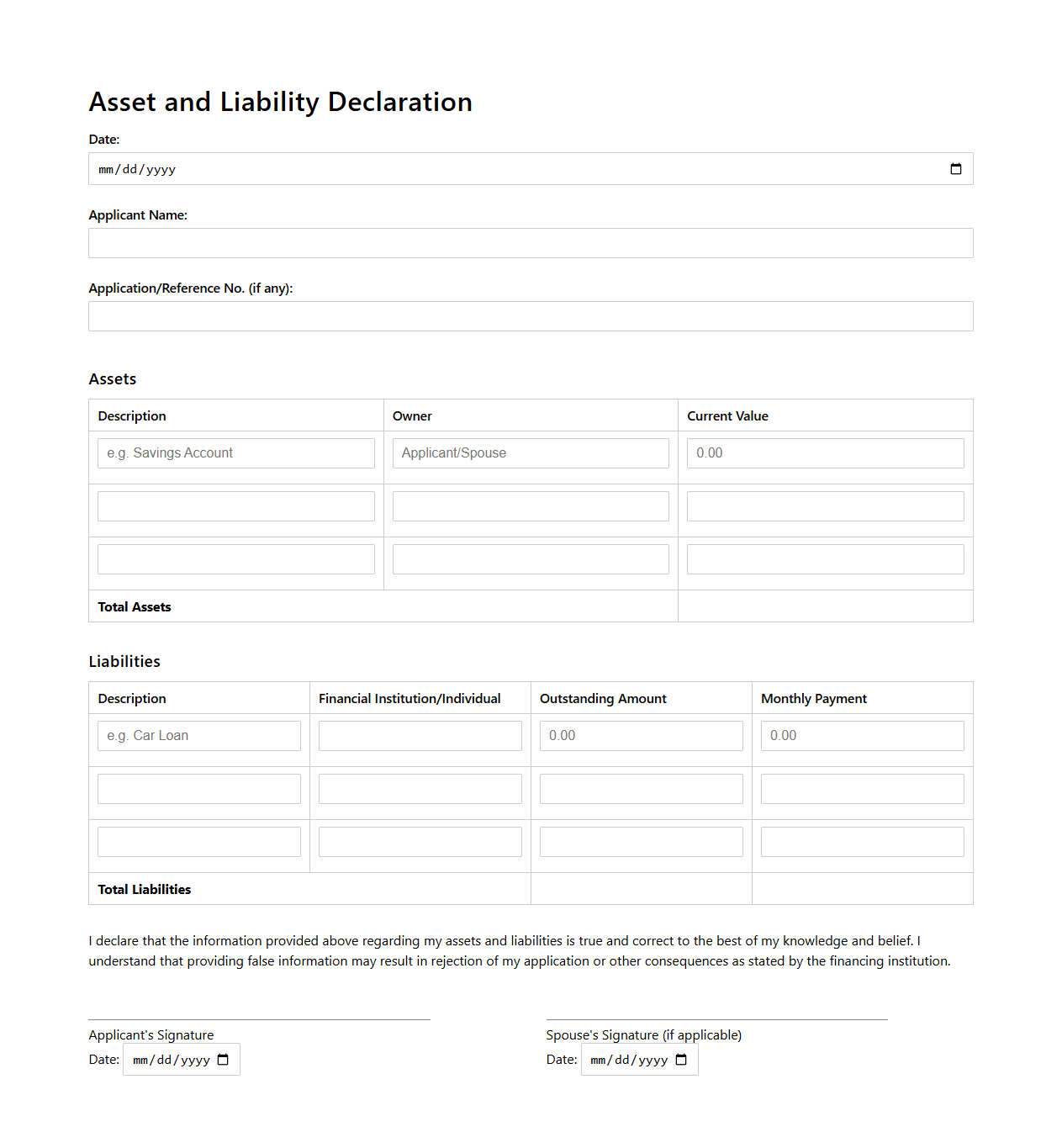

Asset and Liability Declaration for Home Financing

An

Asset and Liability Declaration for home financing is a detailed financial statement required by lenders to assess a borrower's financial stability and creditworthiness. This document lists all assets, such as savings accounts, investments, and properties, alongside liabilities including loans, credit card debts, and other financial obligations. Accurate completion of this declaration enables lenders to evaluate risk and determine appropriate loan terms.

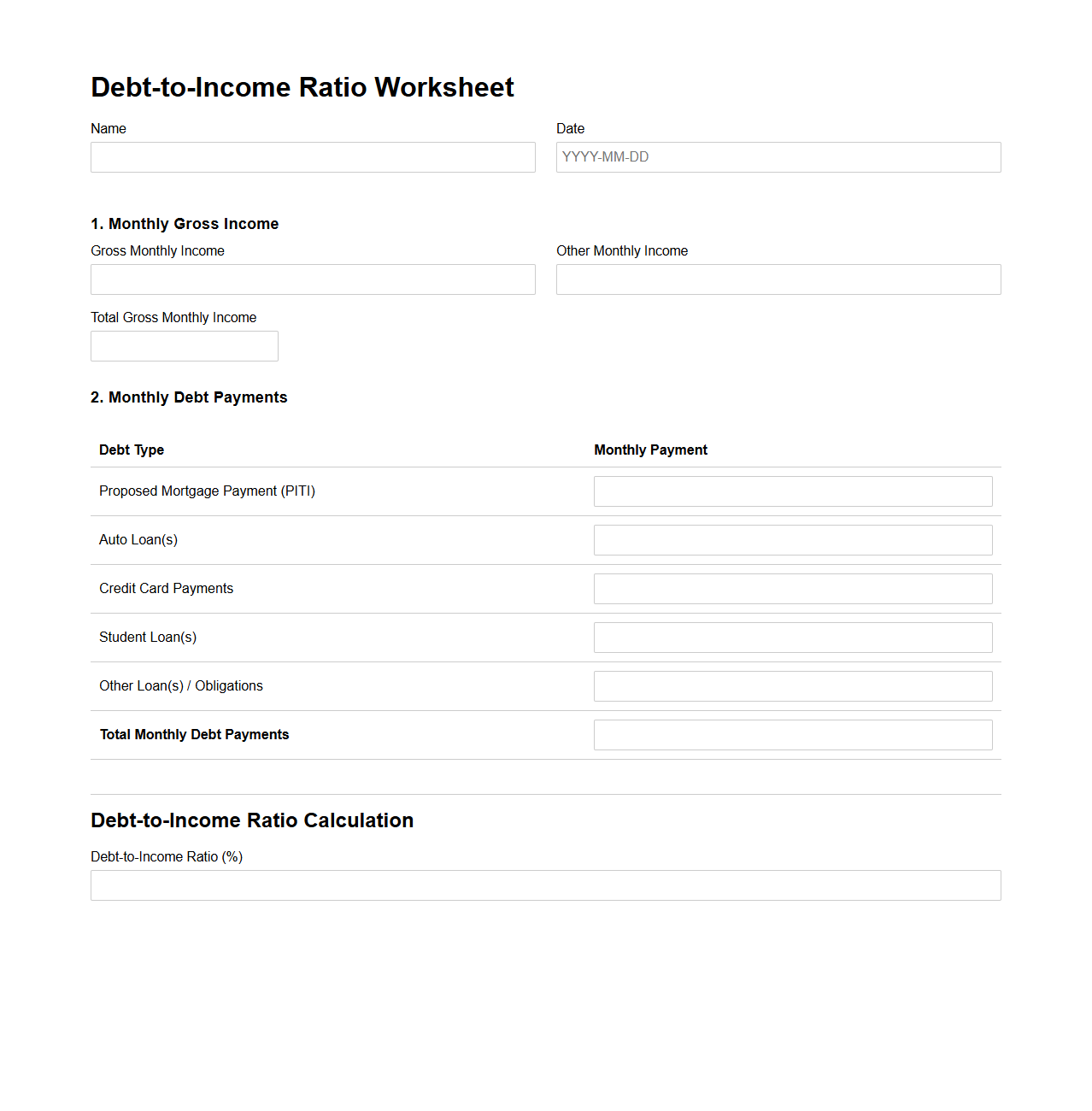

Debt-to-Income Ratio Worksheet for Mortgage Assessment

A

Debt-to-Income Ratio Worksheet for mortgage assessment is a financial document used by lenders to evaluate a borrower's ability to manage monthly debts relative to their gross income. This worksheet itemizes all monthly debt payments, including loans, credit cards, and housing costs, and calculates the ratio as a percentage to determine loan eligibility. Accurate completion of this worksheet helps ensure responsible lending and financial stability for both borrower and lender.

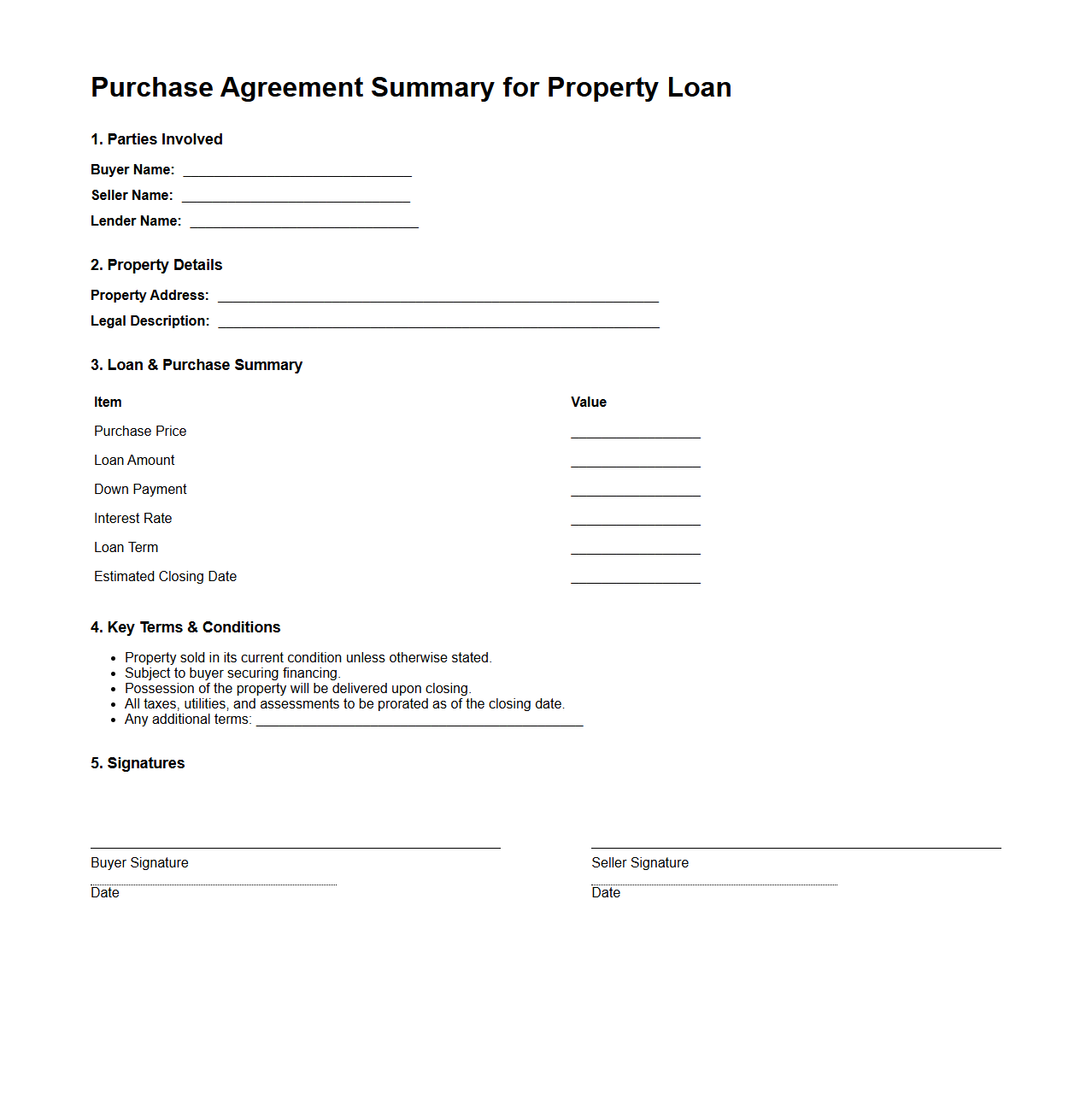

Purchase Agreement Summary for Property Loan

A

Purchase Agreement Summary for a property loan document outlines key details of the property purchase transaction, including buyer and seller information, property description, purchase price, payment terms, and contingencies. This summary helps lenders quickly verify critical contract terms and assess the loan application's validity. It serves as a concise reference to ensure all parties understand the fundamental aspects of the agreement during the underwriting process.

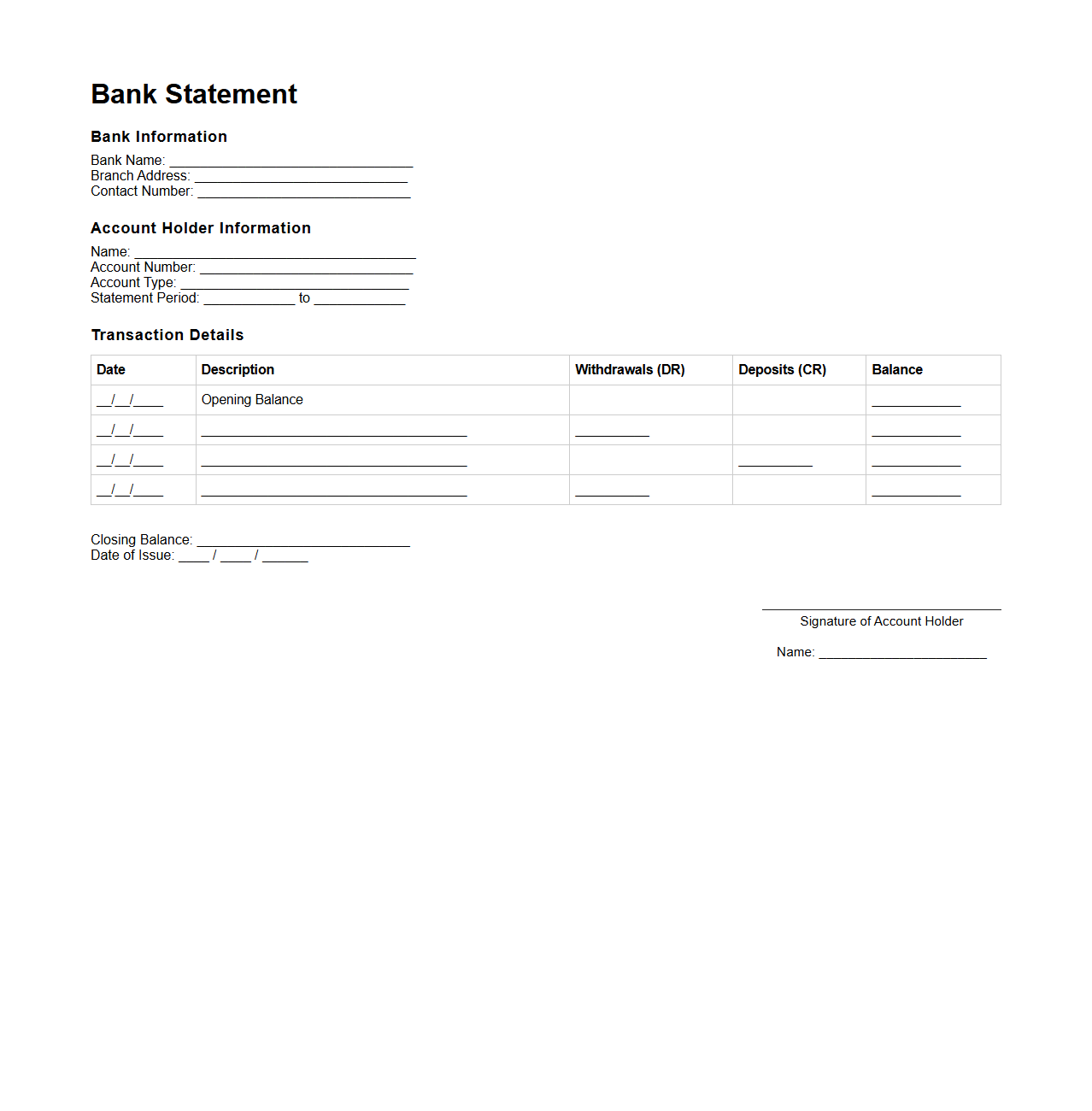

Bank Statement Template for Mortgage Submission

A

Bank Statement Template for Mortgage Submission is a standardized document used to present financial transactions and account balances clearly during the mortgage application process. It helps lenders verify an applicant's income, expenses, and financial stability by providing a consistent format for analyzing bank activity. This template ensures that all relevant information, such as deposits, withdrawals, and available funds, is accurately and transparently displayed to support loan approval decisions.

Identification Verification Form for Property Financing

The

Identification Verification Form for property financing is a critical document used by lenders to confirm the identity of applicants seeking a mortgage or loan. It typically requires personal details, government-issued identification numbers, and supporting documents to ensure compliance with anti-fraud and anti-money laundering regulations. Accurate completion of this form helps protect both the lender and borrower by verifying the authenticity of the applicant's identity before approving financing.

What supporting income verification documents are required for self-employed mortgage applicants?

Self-employed mortgage applicants must provide tax returns for the last two years to verify their income. Additionally, profit and loss statements prepared by a certified accountant are essential. Bank statements and 1099 forms can also support income verification.

How should foreign asset documents be submitted for cross-border property financing?

Foreign asset documents must be translated into English by a certified translator. They should also be notarized or authenticated to ensure validity. Submission is usually required via secure digital platforms or as certified physical copies.

Are there specific document formats required for digital mortgage applications?

Commonly accepted formats for digital mortgage applications include PDF, JPEG, and PNG files. Documents must be clear, legible, and free from tampering to be approved. Lenders often specify file size limits and require documents to be scanned in color.

What documentation is needed to verify gifted down payment funds?

A gift letter stating that the funds are a gift and do not require repayment is mandatory. Donor's bank statements showing the gifted amount's withdrawal must also be provided. The recipient's bank statements reflecting the deposit of the gift are typically required as well.

How recent must bank statements be for mortgage application approval?

Most lenders require bank statements from the past 30 to 90 days to assess current financial status. Statements must clearly show deposits, withdrawals, and account balances. Having the most recent statements helps ensure accurate income and asset verification.

More Real estate Templates