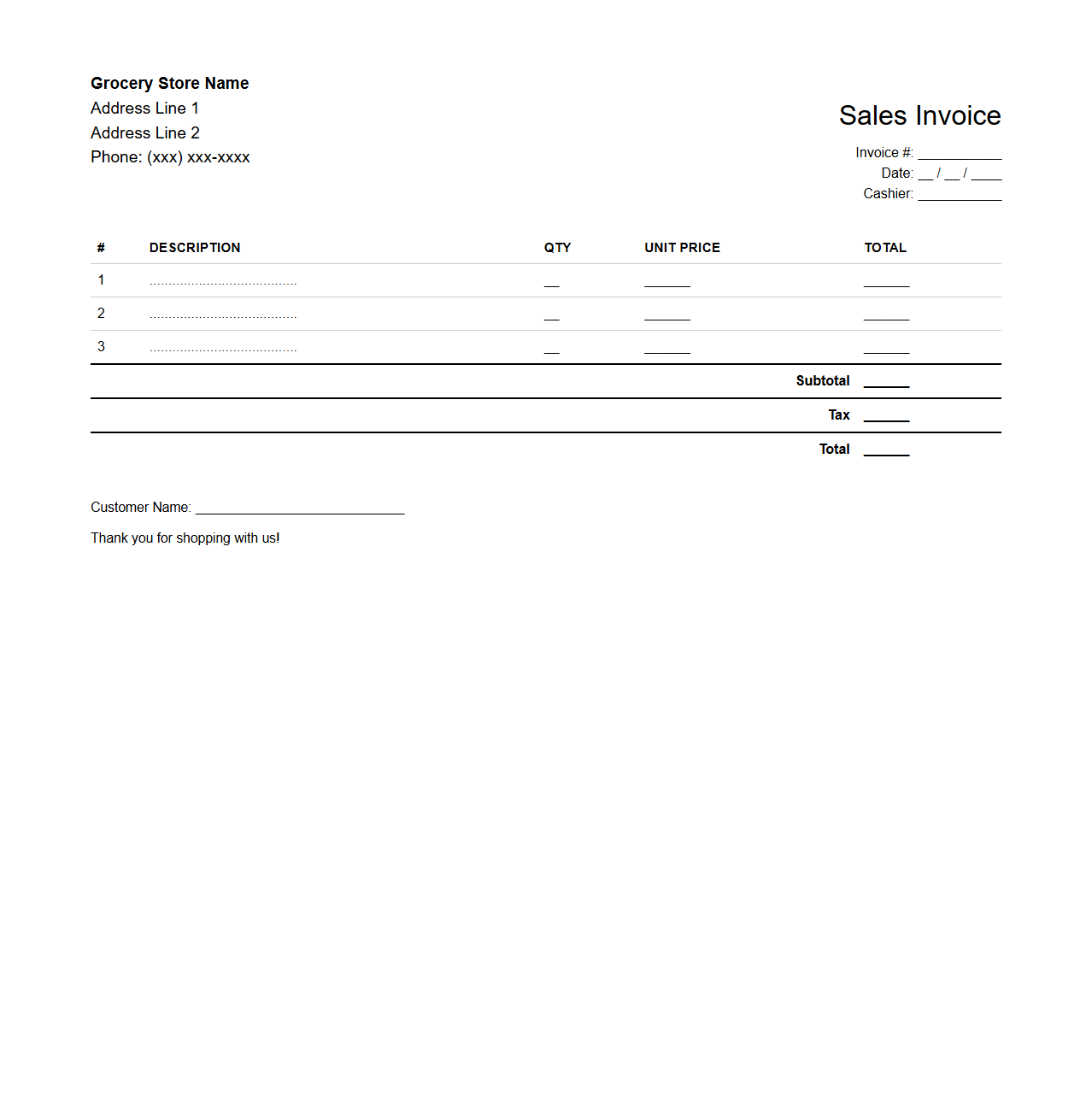

Grocery Store Sales Invoice Template

A

Grocery Store Sales Invoice Template is a pre-designed document used to record the sale of goods in a grocery store, detailing item descriptions, quantities, prices, and total amounts. It serves as an official receipt for customers and a record for business inventory and financial tracking. Businesses use this template to ensure accurate and professional invoicing while streamlining the sales process.

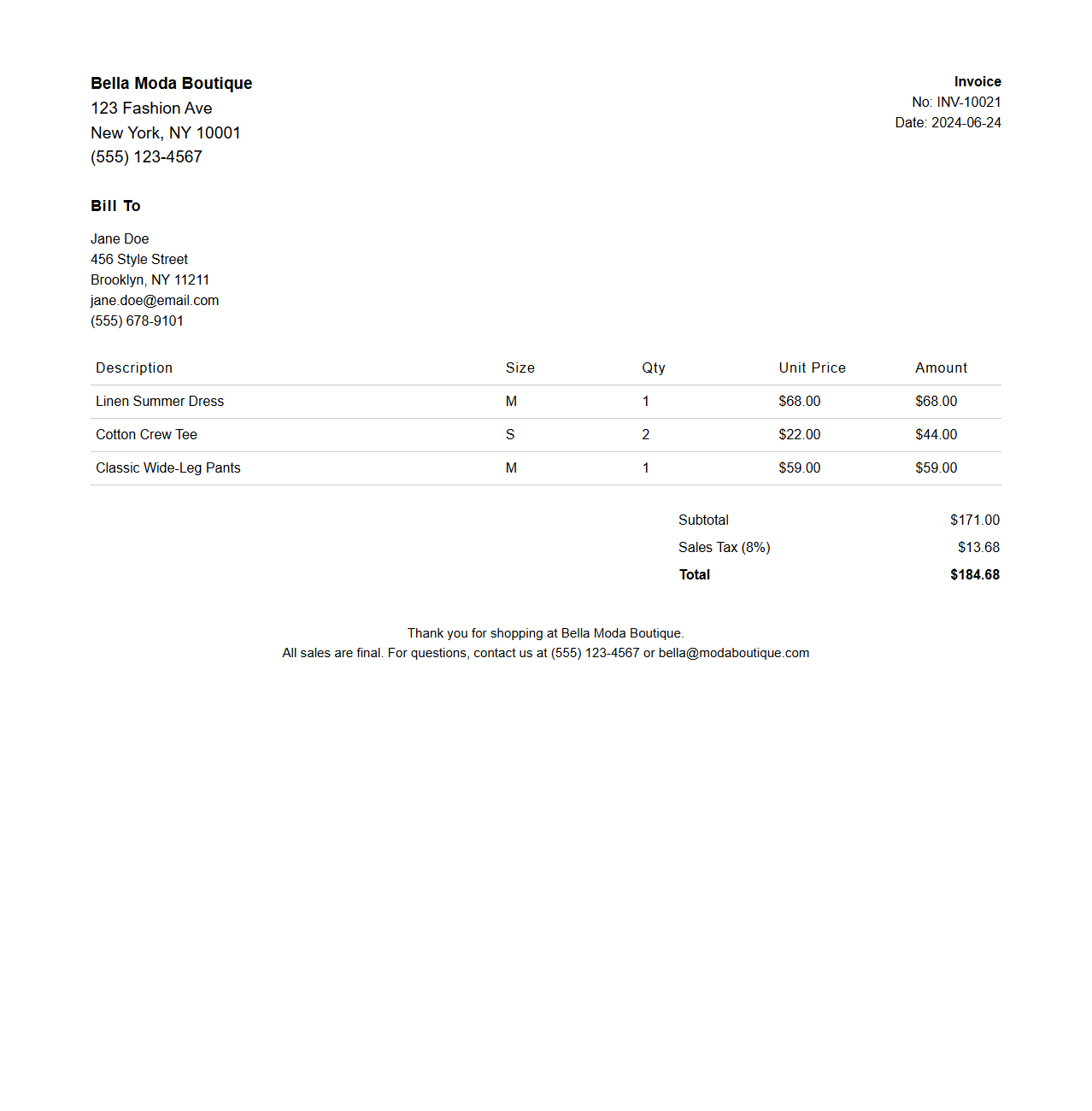

Clothing Boutique Retail Invoice Example

A

Clothing Boutique Retail Invoice Example document serves as a detailed record of a financial transaction between a clothing boutique and its customer, itemizing purchased apparel, quantities, prices, and total amount due. This invoice typically includes essential information such as the boutique's name, contact details, invoice number, date of sale, and payment terms, ensuring clarity and accuracy in sales reporting. Retailers use this document to track inventory, manage accounts receivable, and provide customers with proof of purchase for returns or exchanges.

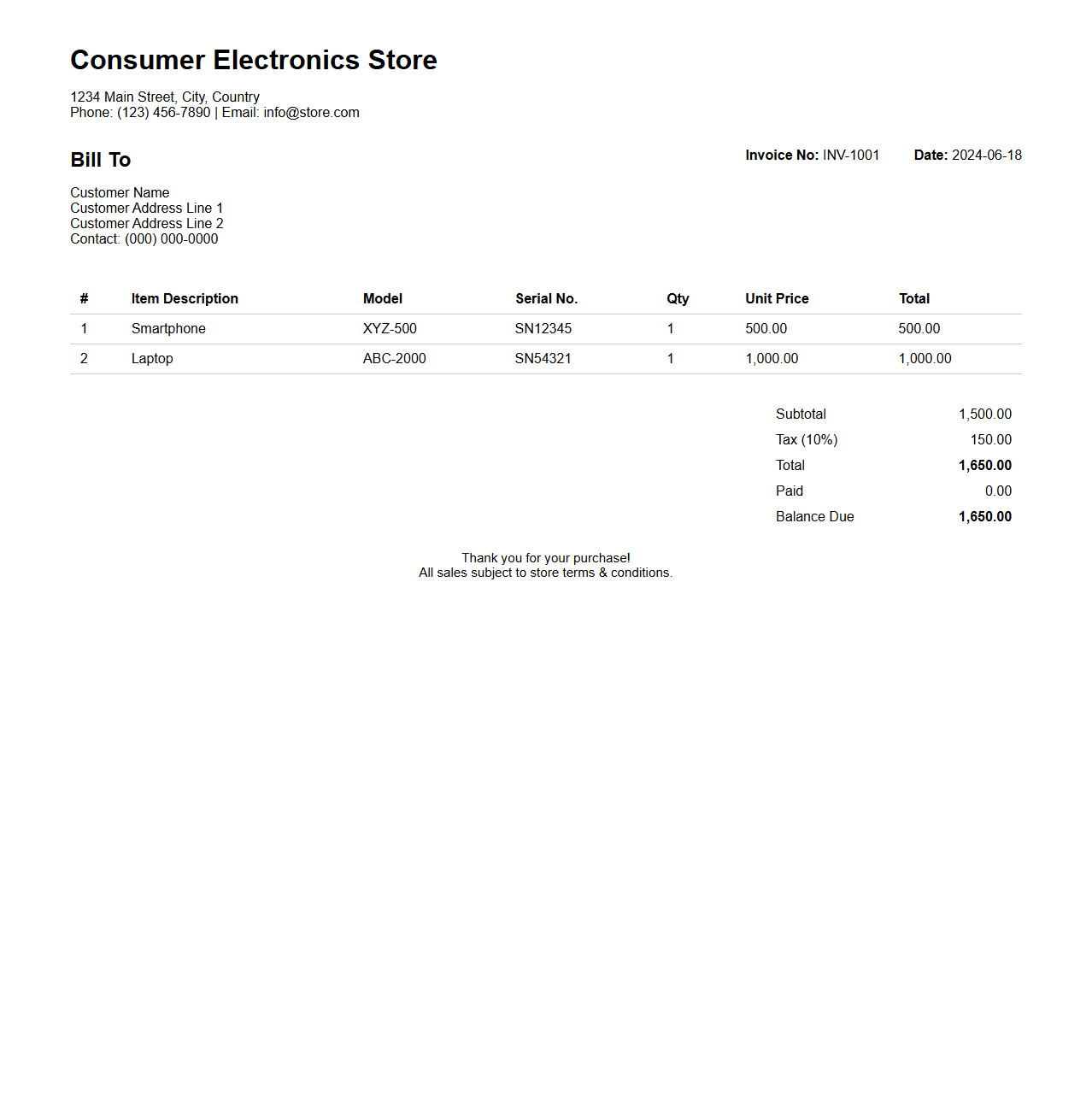

Consumer Electronics Store Sales Invoice Format

A

Consumer Electronics Store Sales Invoice Format document serves as a detailed record of a transaction between the store and the customer, outlining the purchased electronic products, quantities, unit prices, total amount, taxes, and payment details. This format ensures transparency, accuracy, and legal compliance while facilitating inventory tracking and after-sales service. It typically includes essential elements such as store name, customer information, invoice number, date of purchase, and warranty information for electronic devices.

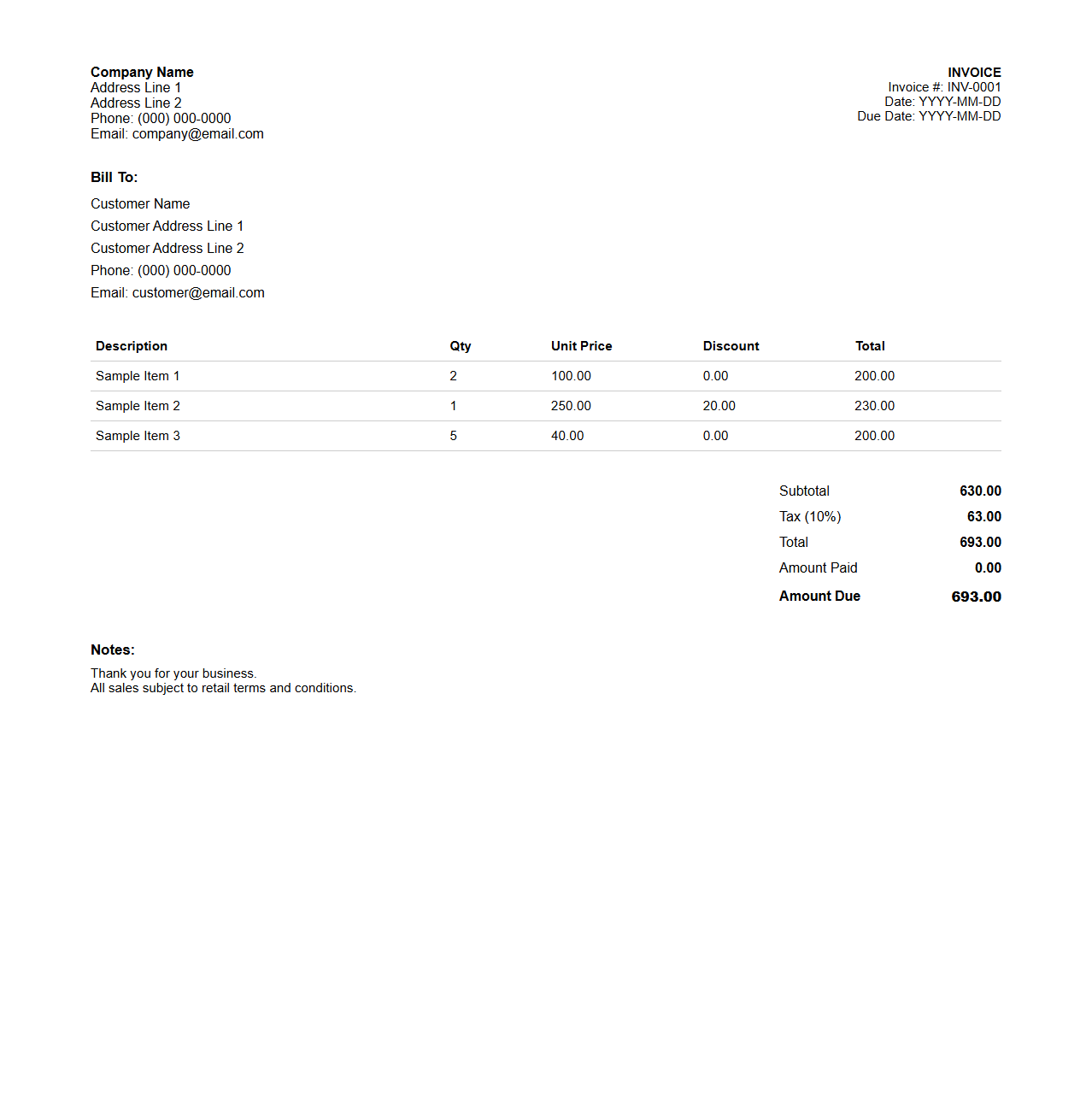

General Merchandise Retail Invoice Layout

A

General Merchandise Retail Invoice Layout document outlines the structured format used for billing and recording sales transactions in retail stores. It typically includes essential details such as the retailer's information, item descriptions, quantities, prices, taxes, and total amount payable. This document ensures transparent communication between the retailer and the customer while facilitating accurate financial record-keeping.

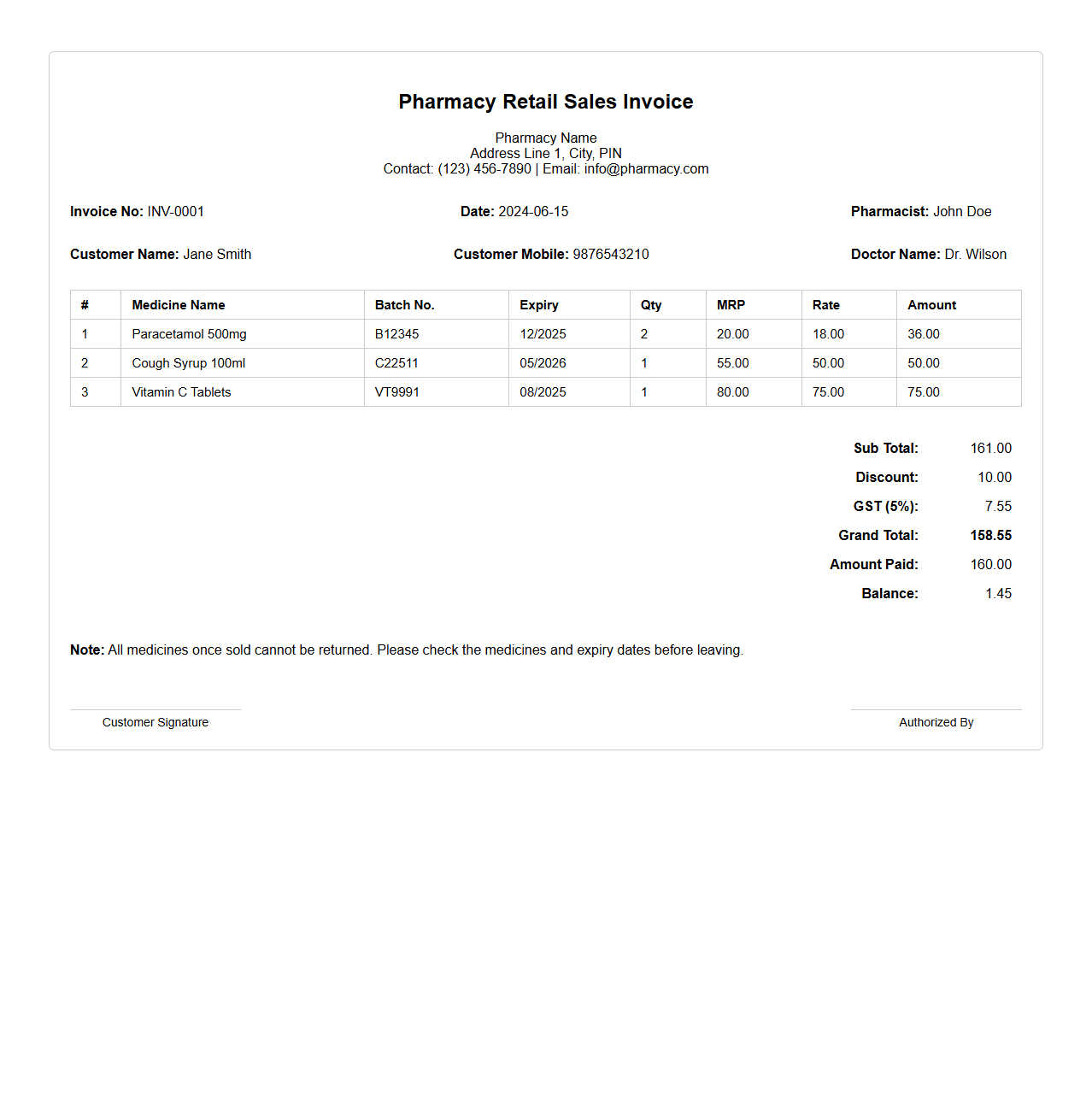

Pharmacy Retail Sales Invoice Sample

A

Pharmacy Retail Sales Invoice Sample document is a detailed record showcasing the sale of pharmaceutical products to customers, including item descriptions, quantities, prices, and transaction dates. It serves as proof of purchase and helps pharmacies maintain accurate sales records for inventory management and financial accounting. This document is essential for both regulatory compliance and customer reference in pharmaceutical retail operations.

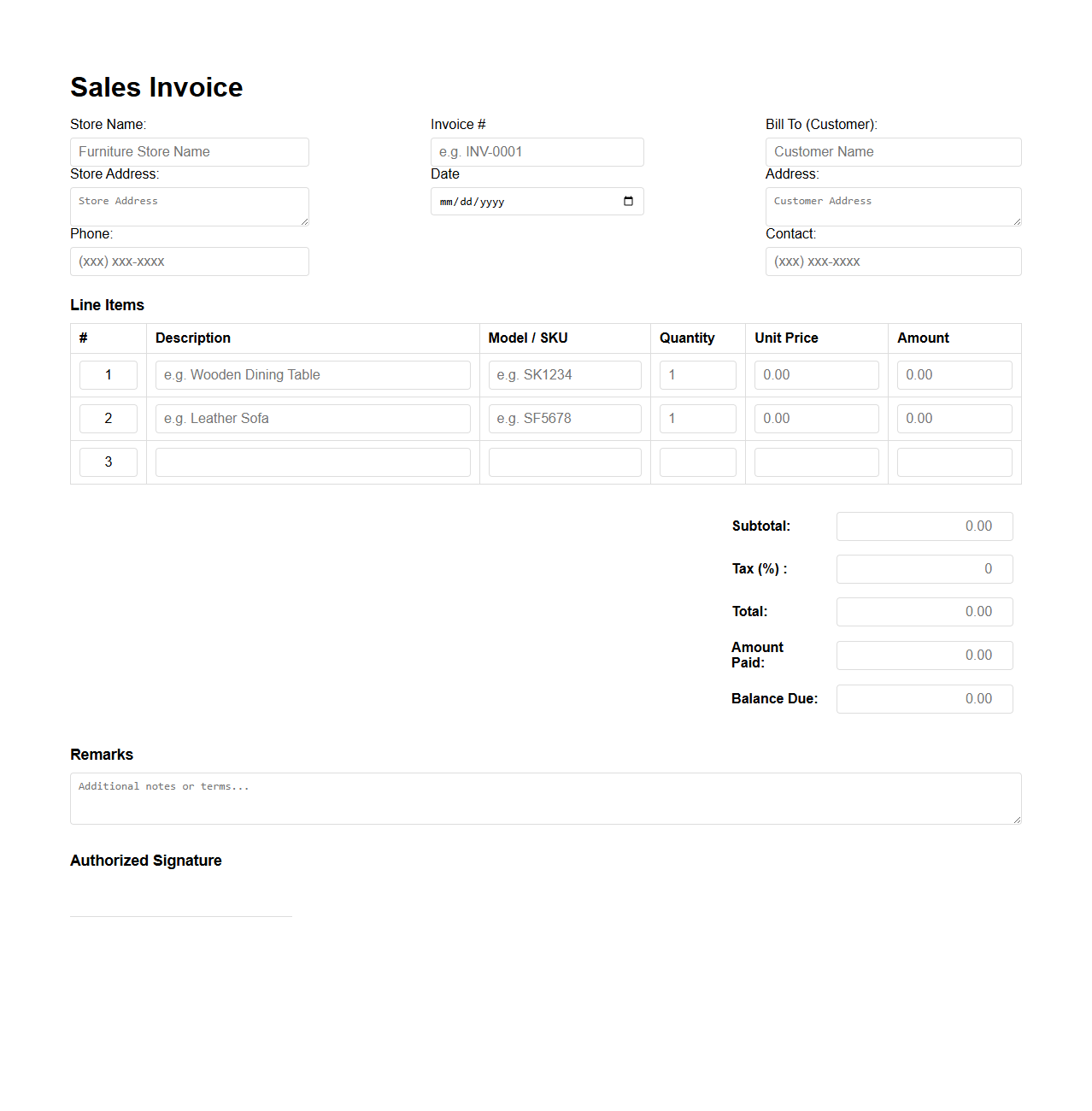

Furniture Store Sales Invoice Form

A

Furniture Store Sales Invoice Form is a detailed document used by furniture retailers to record the sale of products to customers, including item descriptions, quantities, prices, and payment terms. This form serves as proof of purchase and assists in inventory tracking, accounting, and warranty management. It also facilitates clear communication between the store and the customer regarding transaction specifics and obligations.

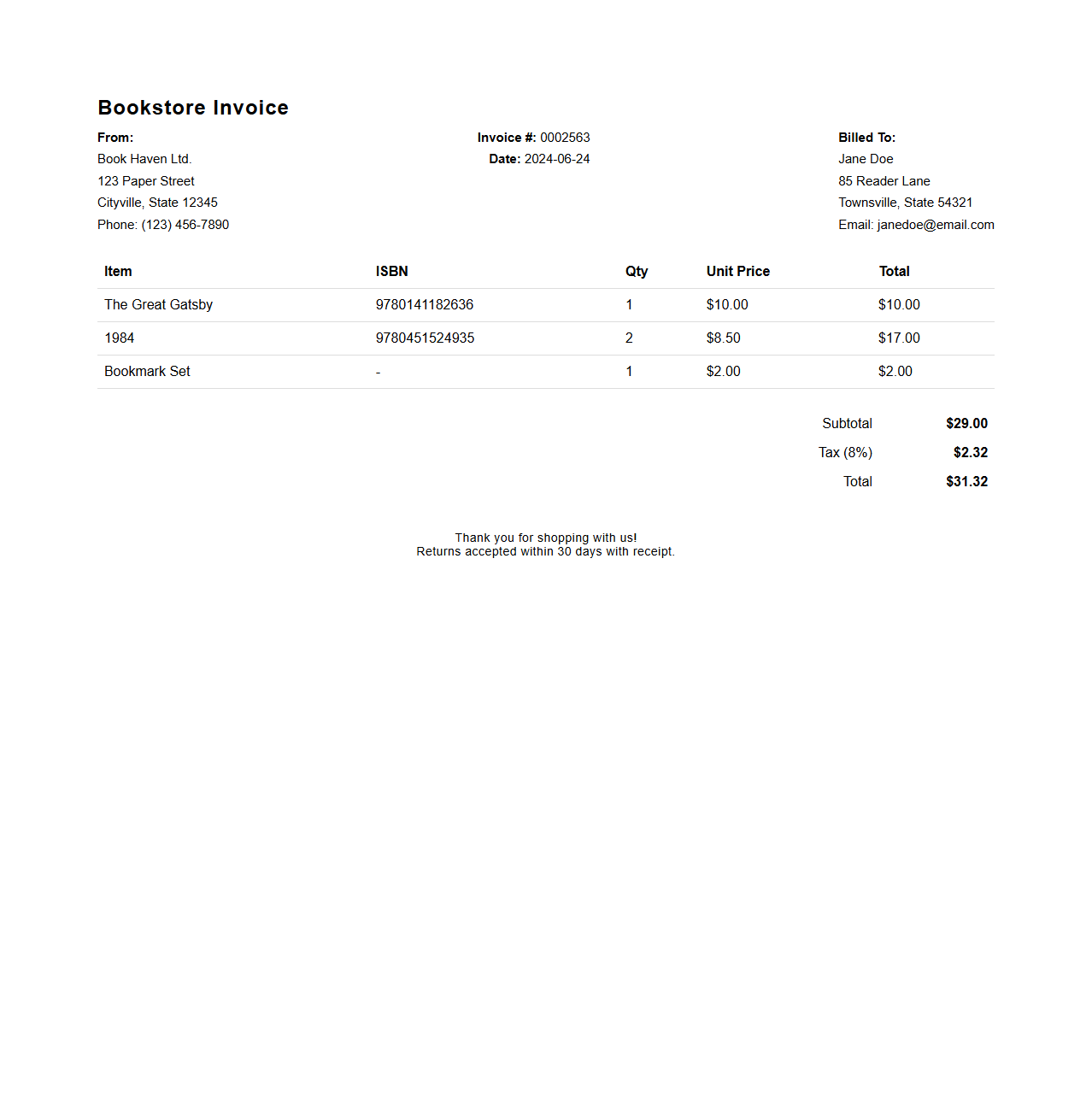

Bookstore Retail Invoice Sample

A

Bookstore Retail Invoice Sample document serves as a detailed record of a transaction between a bookstore and its customer, listing purchased items, quantities, prices, and total amount paid. It provides essential information such as invoice number, date, payment method, and store details, facilitating accurate bookkeeping and inventory management. This document is crucial for both customer verification and accounting purposes, ensuring transparency in sales and purchase records.

Jewelry Shop Sales Invoice Document

A

Jewelry Shop Sales Invoice Document is an official record detailing the transaction between a jewelry store and a customer, including the items purchased, prices, quantities, and payment terms. It serves as proof of sale, helps track inventory, and provides essential information for accounting and tax purposes. This document typically includes unique invoice numbers, customer details, and descriptions of precious metals and gemstones involved in the purchase.

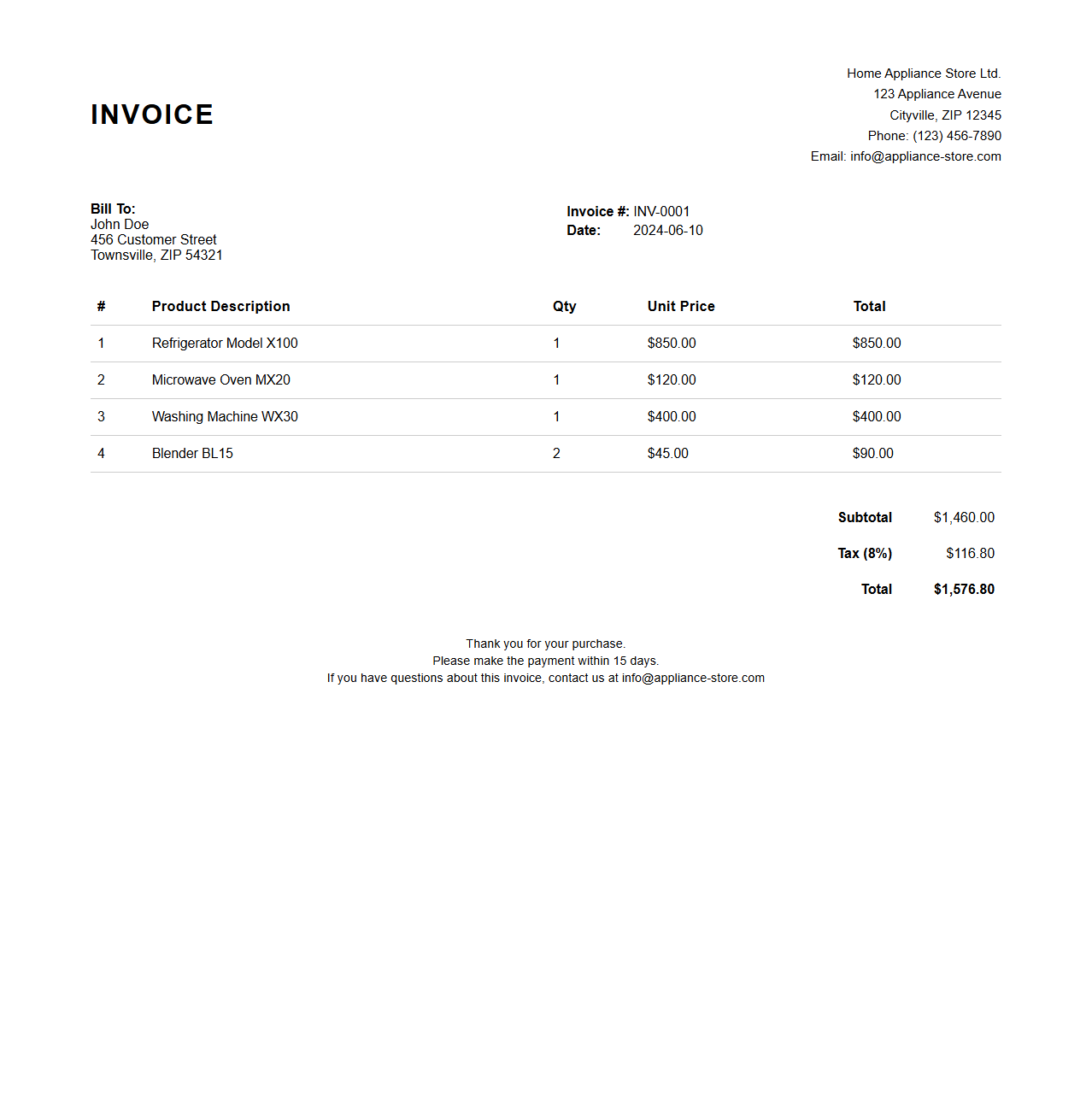

Home Appliances Retail Invoice Sample

A

Home Appliances Retail Invoice Sample document serves as a detailed transaction record between a retailer and a customer, listing purchased appliances such as refrigerators, washing machines, and microwaves. It includes essential information like item descriptions, quantities, prices, taxes, and total amount payable. This sample aids businesses in maintaining accurate sales records and ensures transparency for buyers during appliance purchases.

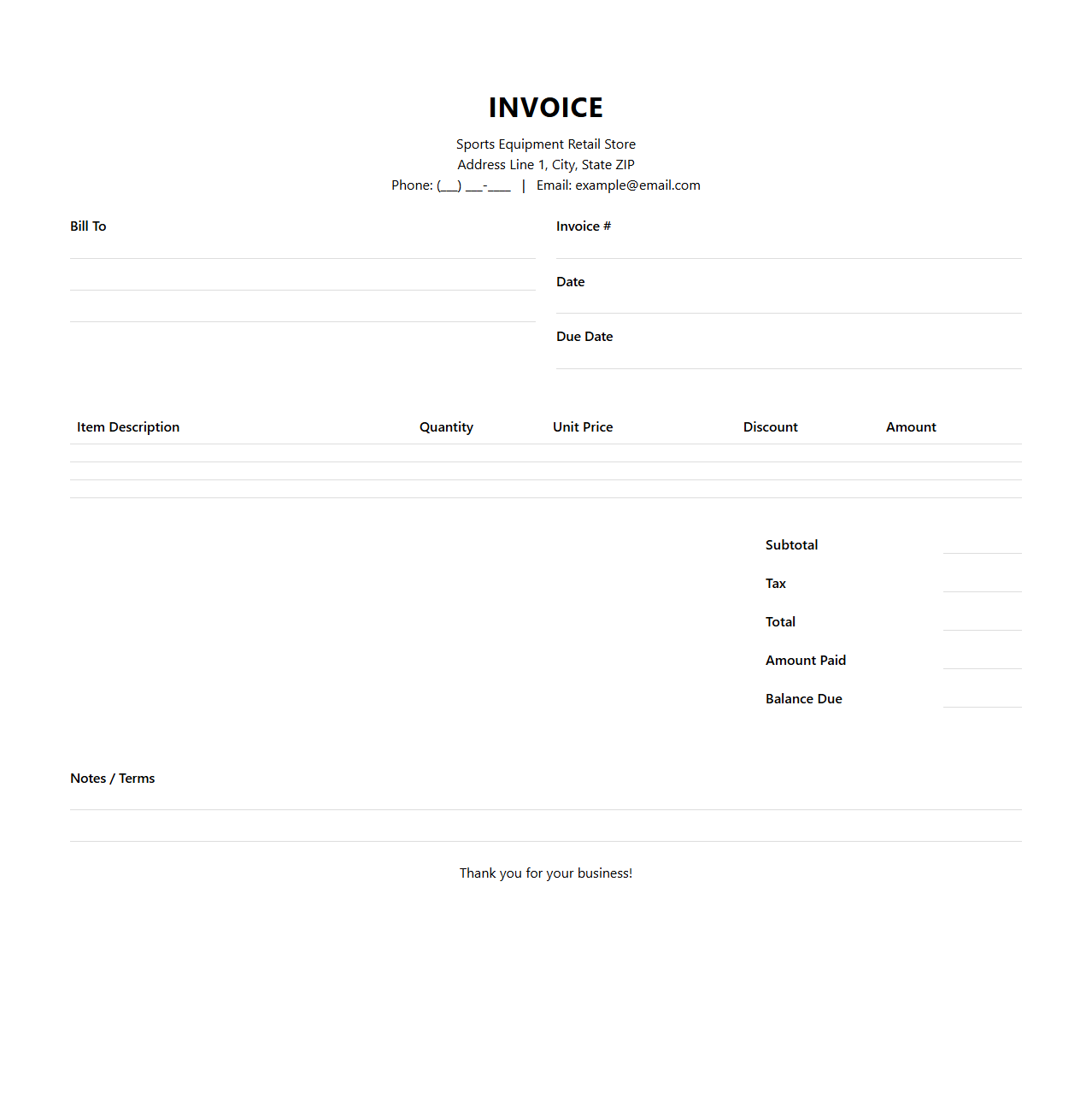

Sports Equipment Retail Sales Invoice Template

A

Sports Equipment Retail Sales Invoice Template document is a pre-designed format used by sellers to itemize and record the sale of sports gear, ensuring accurate billing and transaction tracking. It includes essential details such as product descriptions, quantities, prices, taxes, discounts, and total amounts due. This template streamlines the invoicing process for retail businesses, enhancing financial management and customer communication.

What are the essential fields typically included in a sales invoice document for retail?

A retail sales invoice typically includes the invoice number, date of transaction, and the seller's contact details. It also lists the item descriptions, quantities, unit prices, and total amount due. Additionally, payment terms and methods are clearly stated to guide the transaction process.

How does a sales invoice differentiate between taxable and non-taxable items?

The invoice clearly marks each item's tax status by separating taxable and non-taxable goods. Taxable items have the applicable tax rate and amount calculated and displayed beside them. This differentiation ensures accurate tax reporting and clarity for both buyer and seller.

What information on the invoice ensures legal and financial compliance in retail transactions?

Legal compliance is maintained by including the seller's business registration details and valid tax identification numbers. The invoice must also feature transaction dates and payment terms to meet fiscal regulations. Accurate totals with tax calculations help fulfill accounting standards and audit requirements.

How does the invoice document support inventory and revenue tracking for retail businesses?

Each sales invoice records sold quantities that aid in updating inventory levels promptly. The detailed pricing and totals contribute to accurate revenue tracking within financial systems. By consolidating transaction data, businesses can forecast sales trends and manage stock efficiently.

What customer and transaction details must be clearly presented on a retail sales invoice?

The invoice must display the customer's name and contact information to validate the sale and support follow-up. Clear presentation of the transaction date, items purchased, and payment method ensures transparency. This information helps both parties maintain accurate records for future reference or dispute resolution.