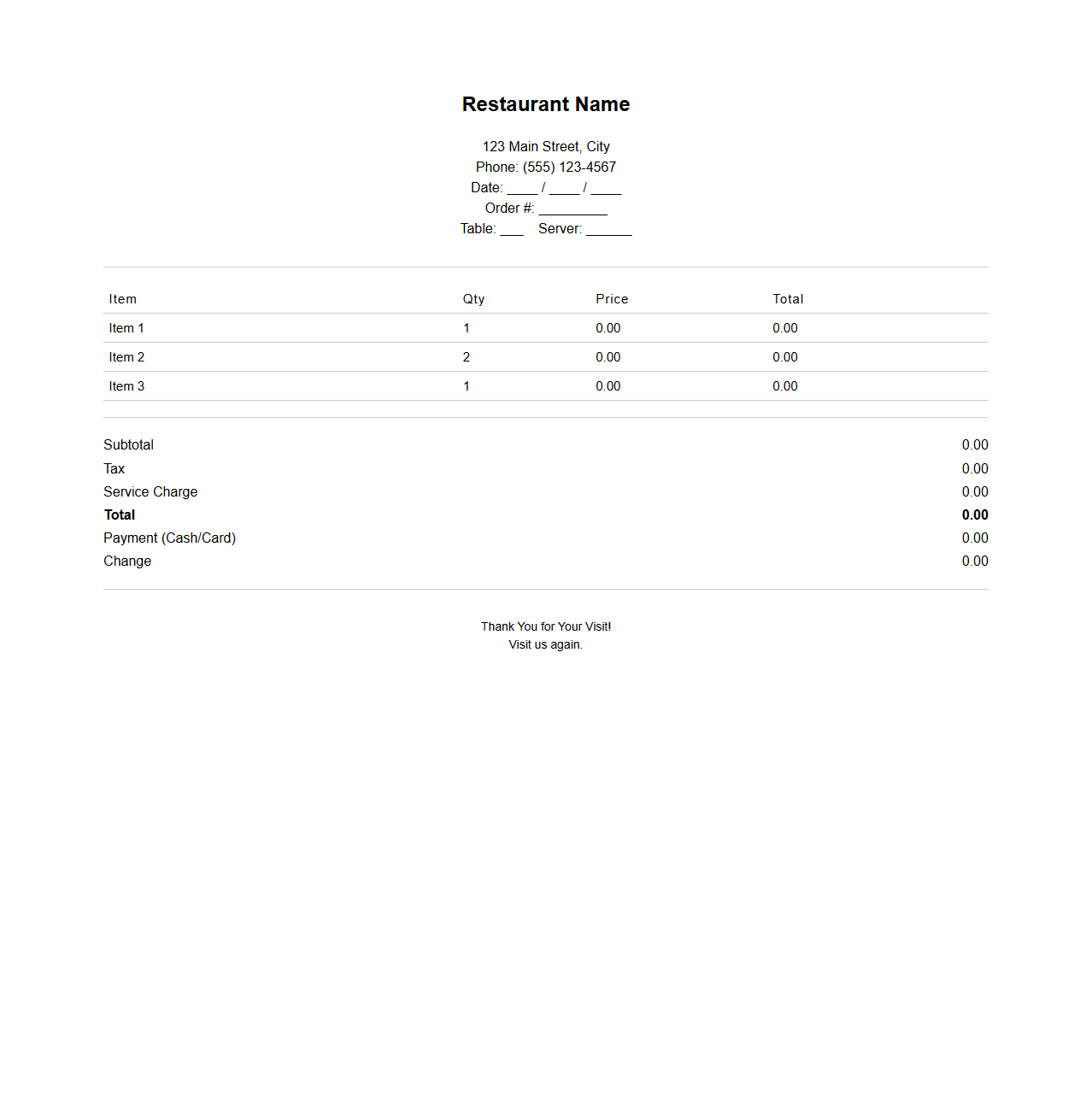

Restaurant Sales Receipt Template for POS Systems

A

Restaurant Sales Receipt Template for POS Systems is a pre-formatted document designed to capture and display detailed transactional information during restaurant sales. It typically includes itemized orders, prices, taxes, payment methods, and timestamps, ensuring accuracy and clarity for both customers and management. This template streamlines order processing and supports inventory tracking, financial reporting, and customer record-keeping within modern point-of-sale systems.

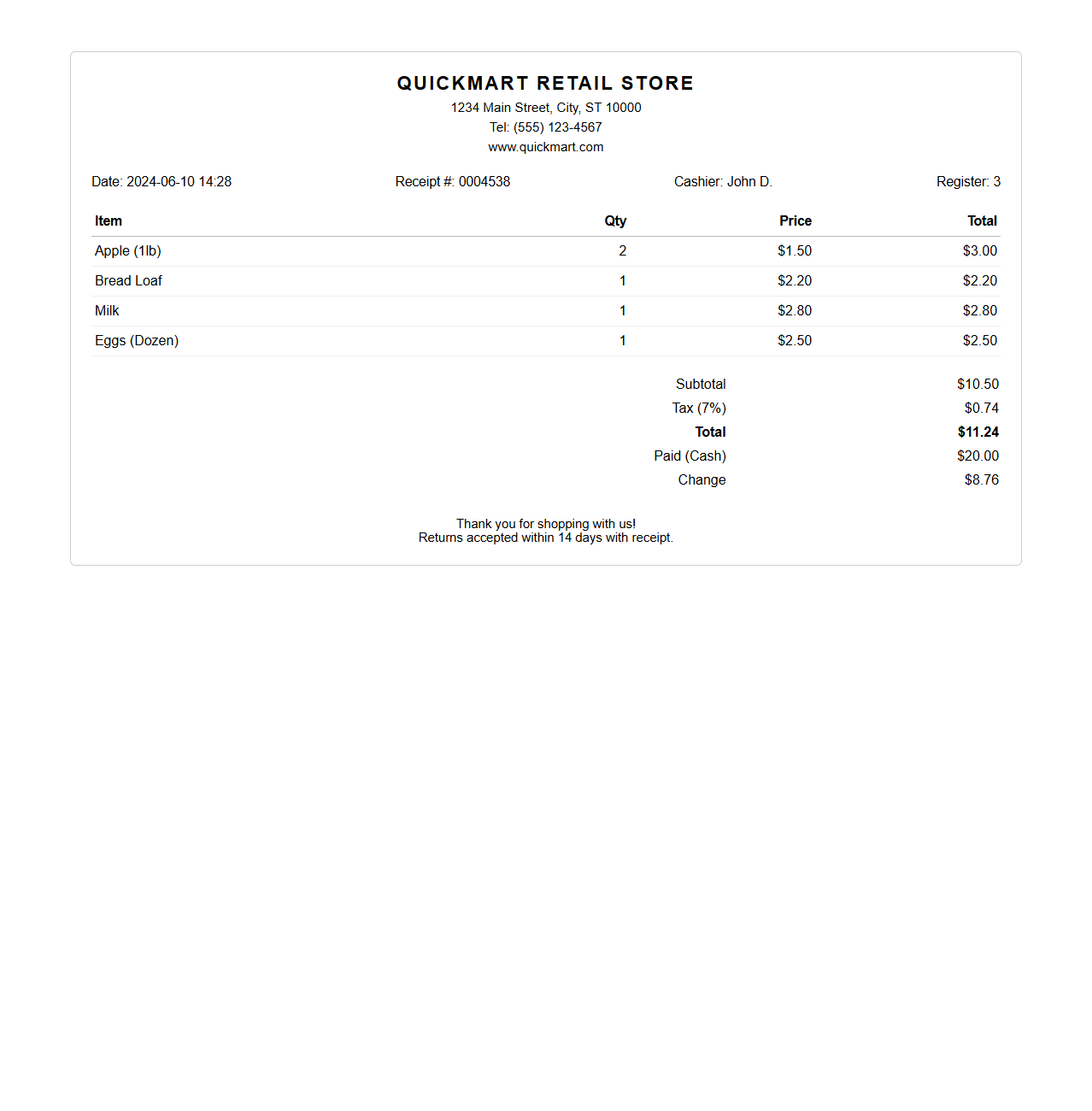

Retail Store POS Receipt Example

A

Retail Store POS Receipt Example document demonstrates the typical format and essential components of a point-of-sale receipt generated during a retail transaction. It includes critical details such as the store name, transaction date and time, item descriptions, quantities, prices, taxes, discounts, and the total amount paid. This example helps retailers standardize receipts for customer transparency, inventory tracking, and sales record accuracy.

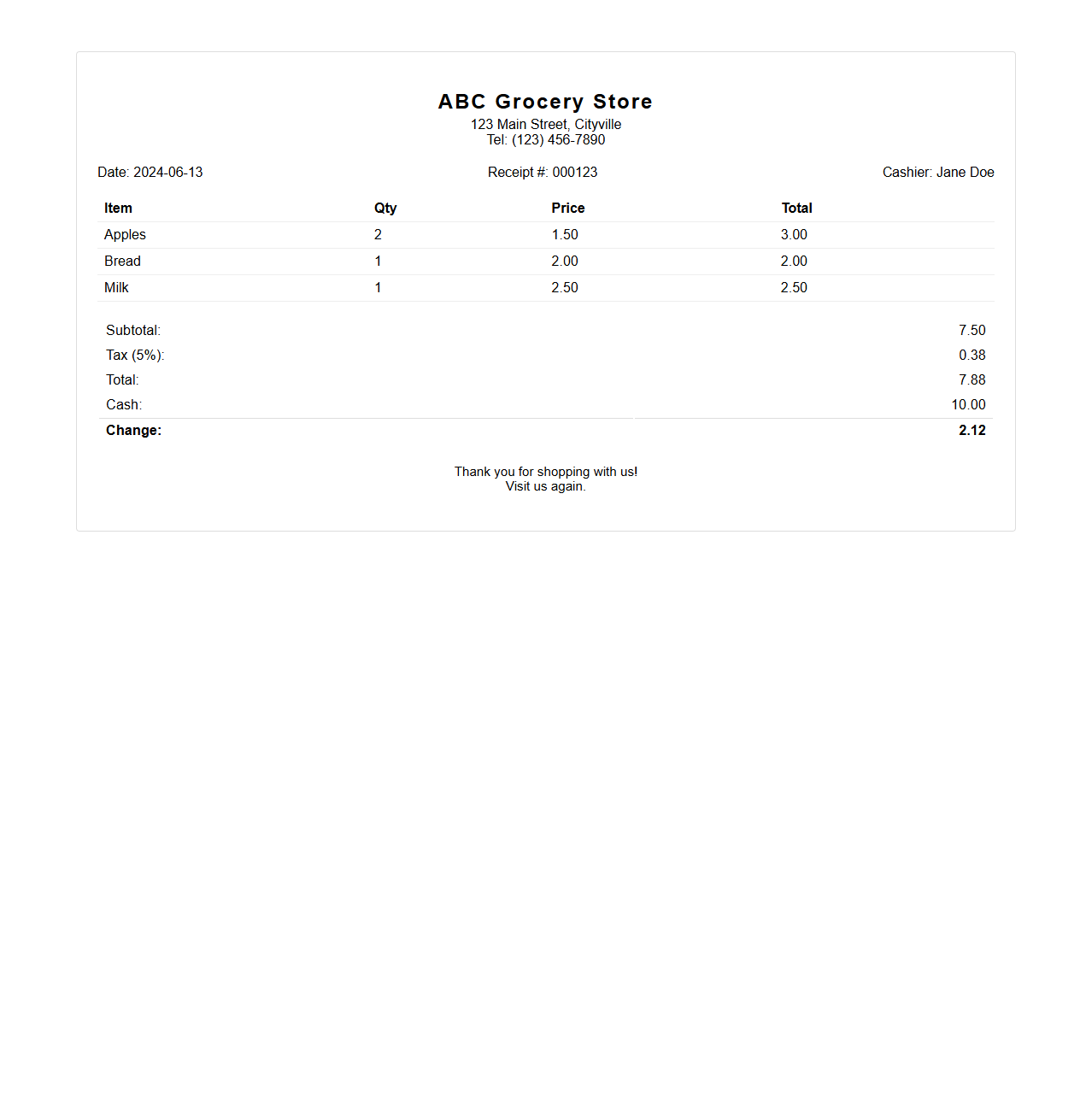

Grocery Store Sales Receipt Format for Point of Sale

A

Grocery Store Sales Receipt Format for Point of Sale (POS) documents serves as a detailed proof of purchase, listing all items bought, quantities, prices, discounts, and taxes applied during a transaction. It includes essential details such as transaction date, store information, payment method, and total amount due, ensuring transparency and accuracy for both the retailer and customer. This format aids in inventory management, financial tracking, and customer service by providing a clear and organized record of each sale.

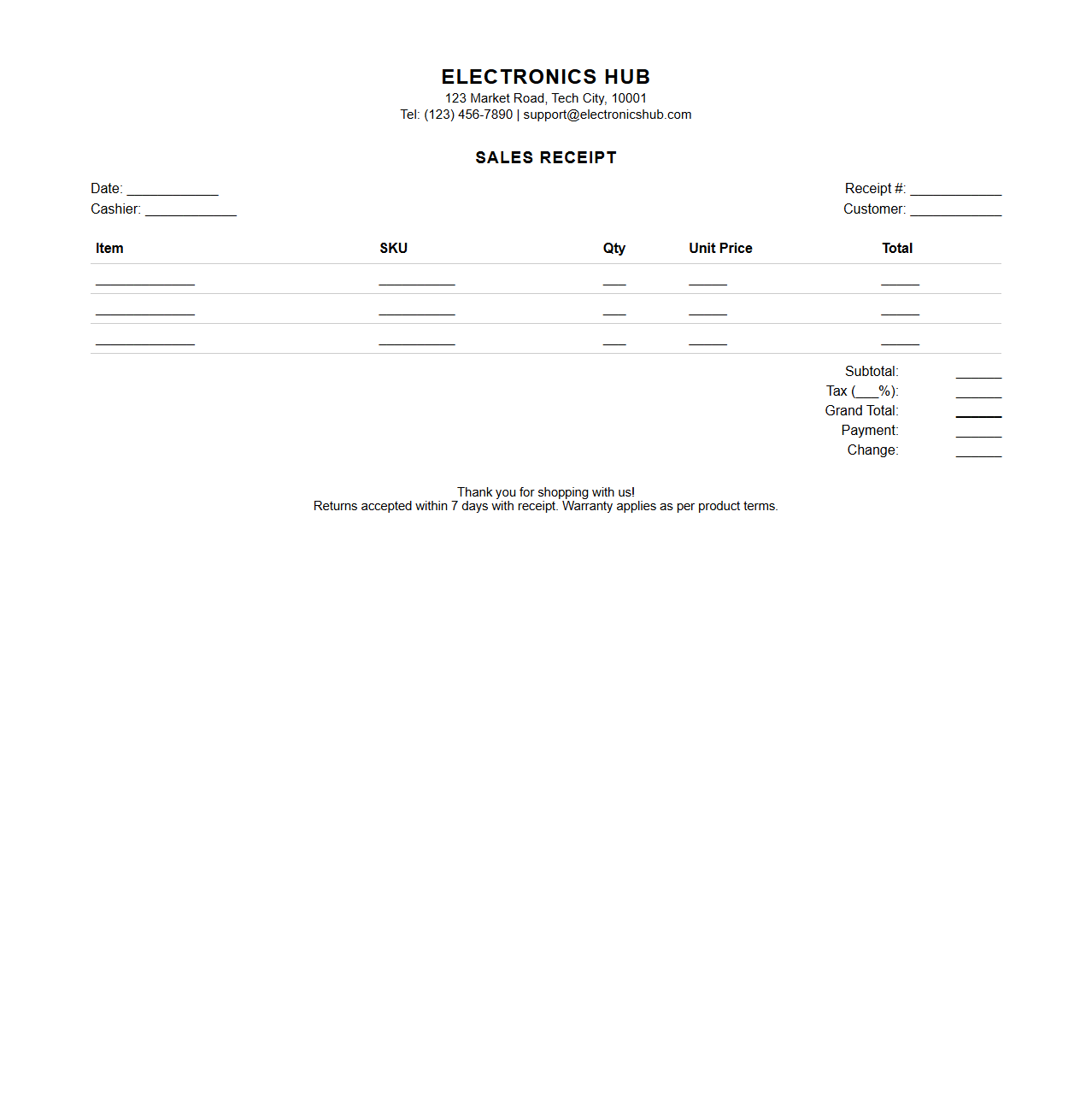

Electronics Shop POS Sales Receipt Layout

The

Electronics Shop POS Sales Receipt Layout document defines the structured format and essential elements of a sales receipt generated by a point-of-sale system in an electronics store. It includes detailed sections such as item descriptions, quantities, unit prices, total amounts, taxes, discounts, and payment methods, ensuring clarity and accuracy in transaction records. This layout optimizes customer experience and compliance with financial regulations by providing a consistent and professional receipt presentation.

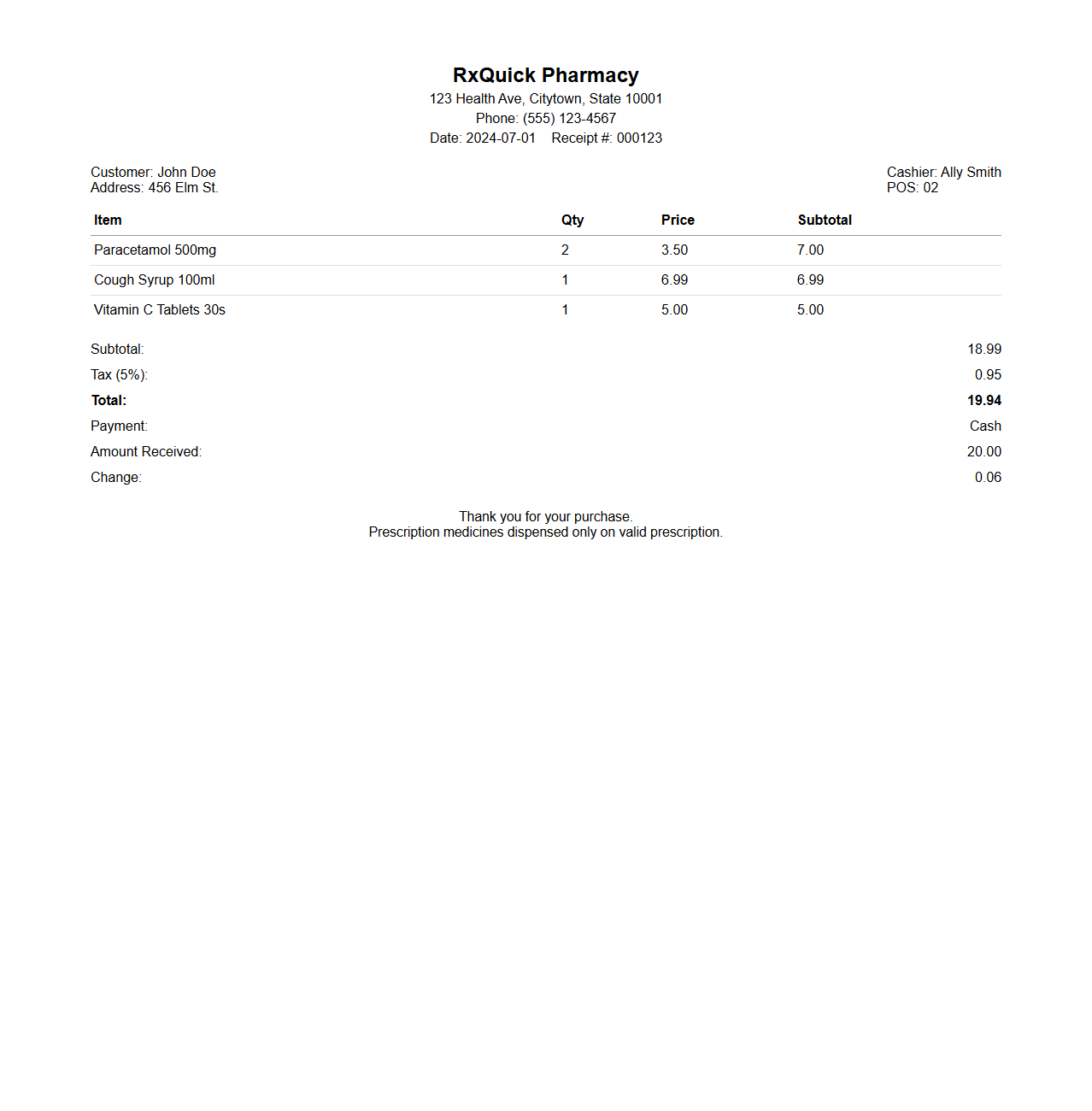

Pharmacy Sales Receipt Example for POS

A

Pharmacy Sales Receipt Example for a POS document details the transaction of pharmaceutical products, including medication names, quantities, prices, and applicable taxes. It serves as proof of purchase and helps maintain accurate inventory records and compliance with healthcare regulations. This receipt typically includes patient information, prescription details, payment methods, and transaction timestamps to ensure transparency and traceability in pharmacy sales.

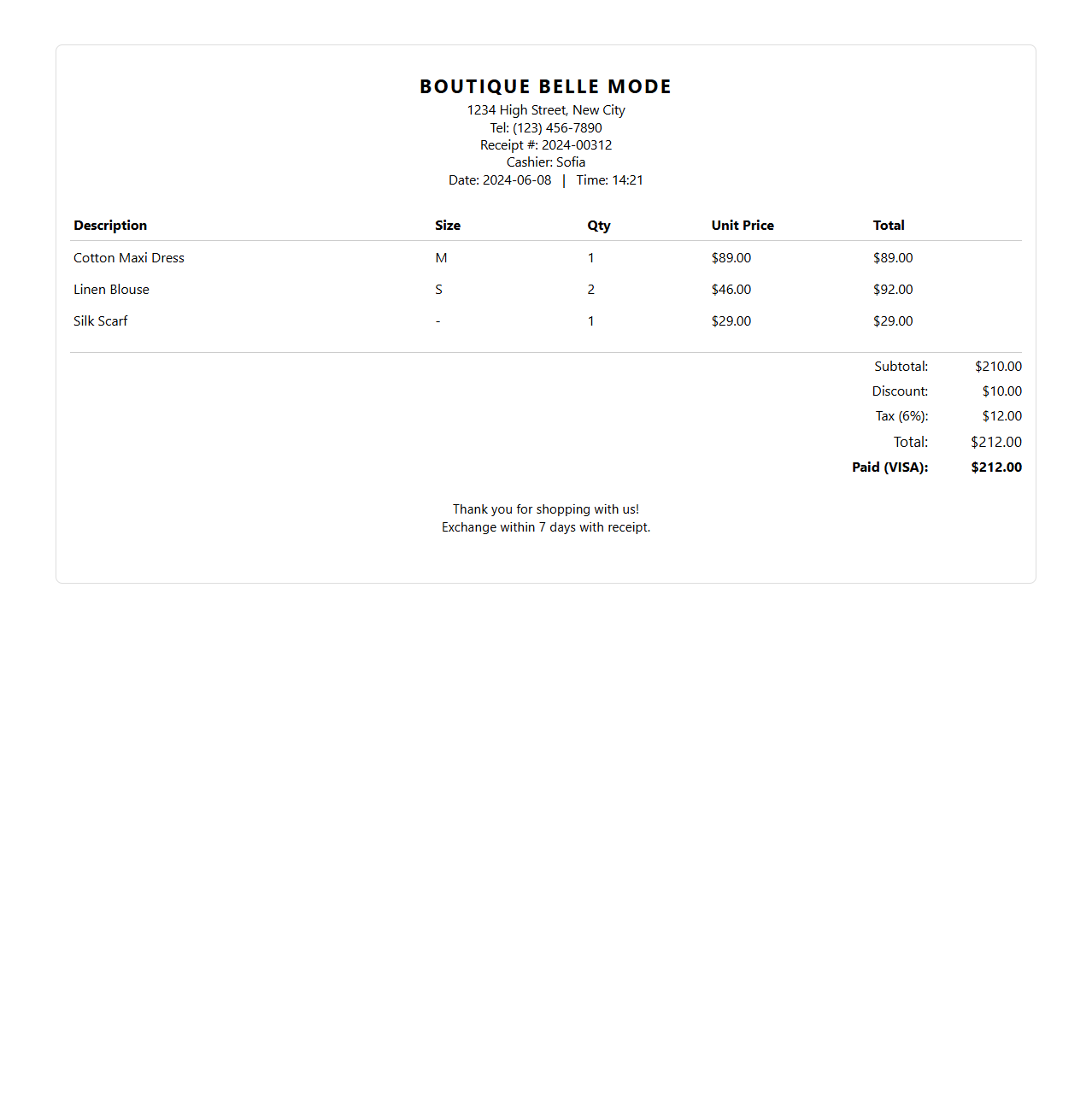

Boutique POS System Receipt Sample

A

Boutique POS System Receipt Sample document serves as a detailed template showcasing the format and content of a point-of-sale receipt generated by specialized boutique retail software. It includes itemized product descriptions, quantities, prices, taxes, discounts, and payment details tailored for small to medium-sized fashion or specialty stores. This sample helps retailers ensure accurate transaction records, streamline customer service, and maintain compliance with financial reporting standards.

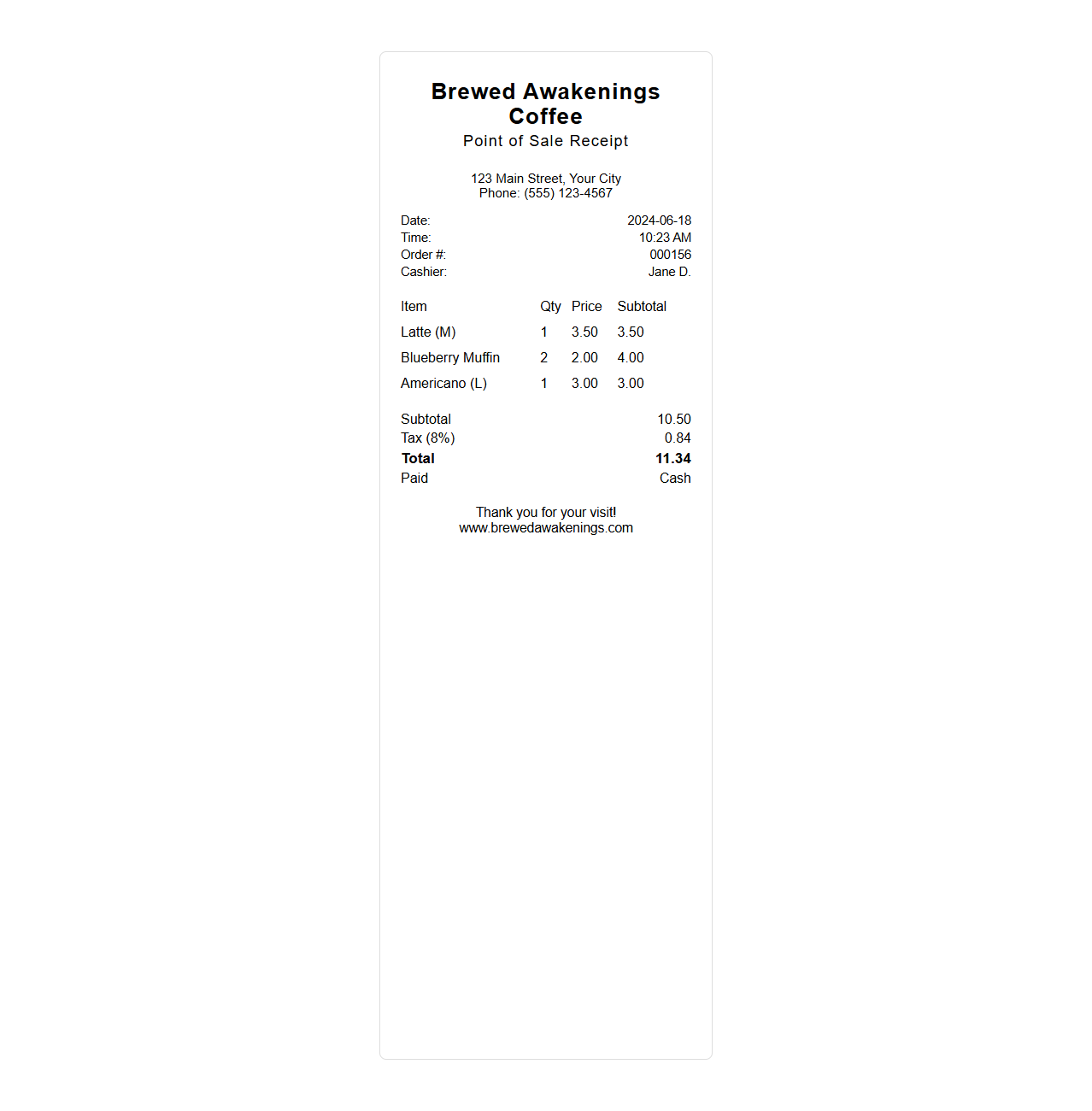

Coffee Shop Point of Sale Receipt Template

A

Coffee Shop Point of Sale Receipt Template document is a pre-designed format used to generate detailed sales receipts for coffee shop transactions, including itemized lists of purchased beverages and snacks, prices, quantities, and total amounts. It helps streamline bookkeeping and enhances customer service by providing clear, professional proof of purchase. This template often incorporates space for payment methods, taxes, and business contact information to ensure compliance and record accuracy.

Bookstore Sales Receipt Format for POS

A

Bookstore Sales Receipt Format for POS documents is a structured template used to record transaction details at the point of sale in bookstores. It typically includes essential information such as the book titles, quantities, prices, subtotal, taxes, discounts, total amount paid, payment method, store details, and transaction date and time. This format ensures accurate tracking of sales, inventory management, and customer reference for purchases.

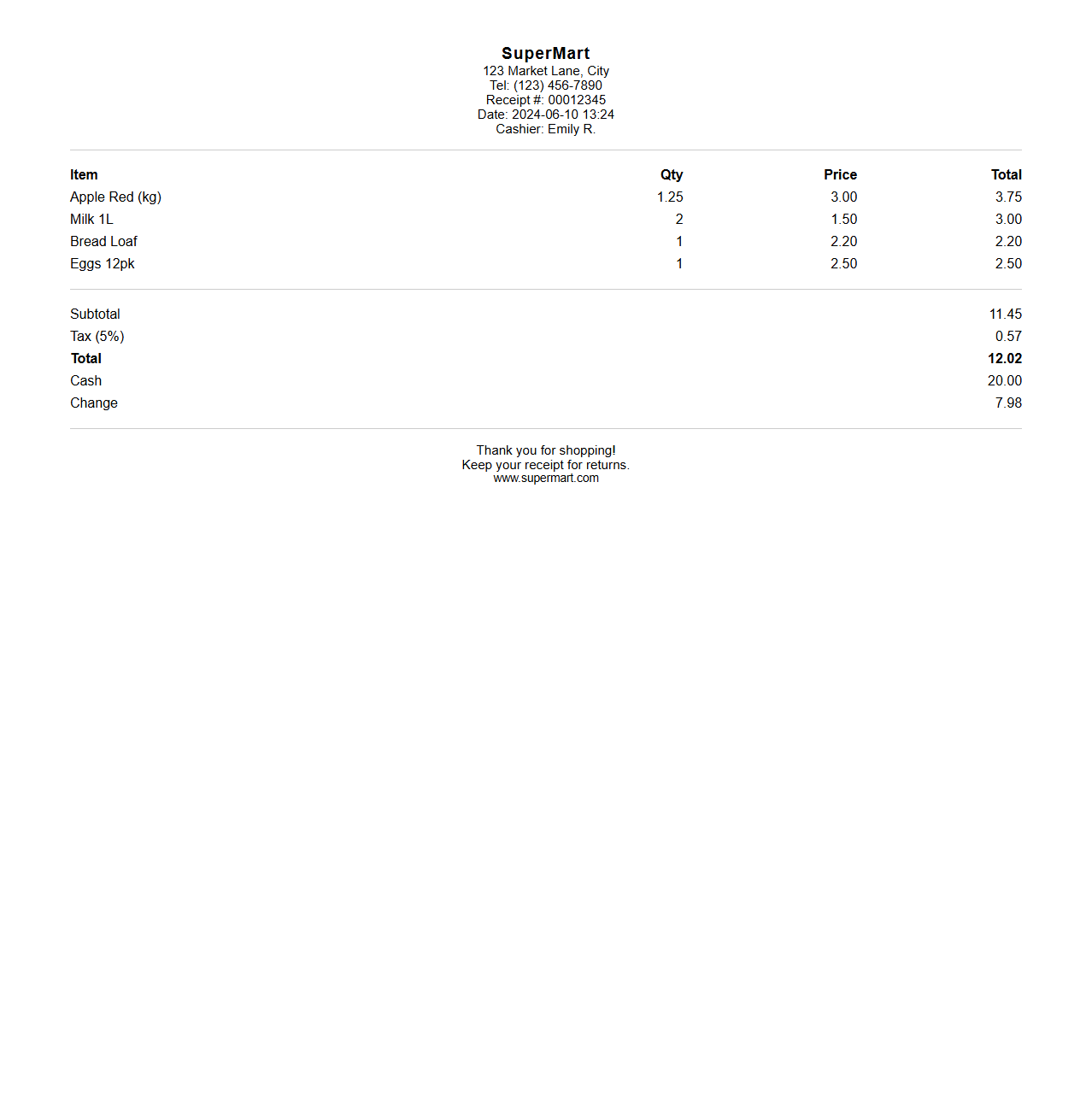

Supermarket POS Receipt Example

A

Supermarket POS Receipt Example document illustrates the typical layout and details found on a point-of-sale receipt from a supermarket transaction. It includes essential data such as item names, quantities, prices, discounts, taxes, total amount paid, payment method, date and time of purchase, and store information. This document helps businesses optimize transaction records, streamline inventory management, and provide clear proof of purchase to customers.

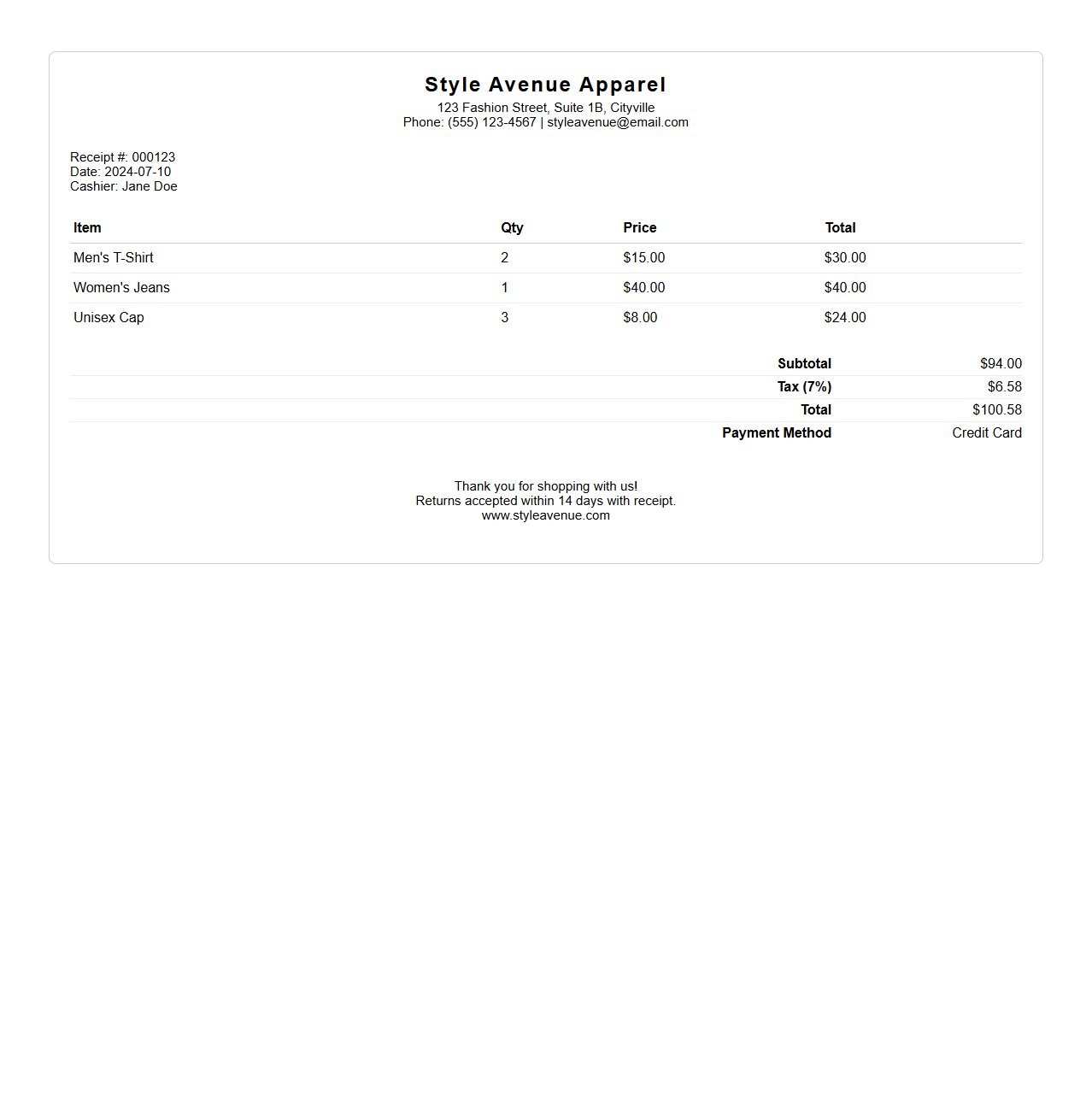

Clothing Store Sales Receipt Template for Point of Sale

A

Clothing Store Sales Receipt Template for Point of Sale (POS) systems is a pre-designed document that records transaction details such as item descriptions, quantities, prices, taxes, and total amounts. It ensures accurate, professional, and efficient documentation of sales, helping both retailers and customers keep track of purchases and returns. This template integrates seamlessly with POS software to streamline checkout processes and maintain organized financial records.

What essential information should a sales receipt document contain for point of sale transactions?

A sales receipt must include the date and time of the transaction to ensure accurate record-keeping. It should list the purchased items with their prices, quantities, and total amount paid. Additionally, the receipt must display the payment method and the store's identifying information, such as name and address.

How does a sales receipt serve as proof of purchase in a retail environment?

A sales receipt is the primary evidence that a transaction has taken place between the buyer and seller. It verifies the purchase details, enabling customers to claim warranties or exchange products. Retailers rely on receipts to resolve disputes and confirm the legitimacy of returns and refunds.

In what ways must a point of sale receipt format comply with legal or tax regulations?

Receipts must include tax identification numbers and show applicable sales tax breakdowns to comply with government regulations. The format often requires transparent pricing and total amounts to ensure tax accuracy. Businesses must retain receipts in standardized formats to support auditing and financial reporting requirements.

Which elements on a sales receipt help facilitate product returns or exchanges?

Key elements such as the transaction date, item descriptions, and prices assist in verifying the original purchase during returns or exchanges. The payment method and receipt number also help track the transaction in the retailer's system. Clear return policies printed on the receipt further guide customers through the return or exchange process.

How can electronic and printed sales receipt formats differ in point of sale systems?

Electronic receipts often include interactive features like clickable links for feedback or digital warranties, unlike printed receipts. Printed receipts provide immediate tangible proof, while electronic versions can be stored and accessed remotely for convenience. The format differences impact how customers manage and retrieve purchase information.