A Legal Notice Document Sample for Debt Recovery serves as a formal template used to notify a debtor about outstanding payments. This document outlines the amount owed, payment deadline, and possible legal actions if the debt remains unpaid. Utilizing a clear and professional legal notice helps ensure effective communication and can expedite the recovery process.

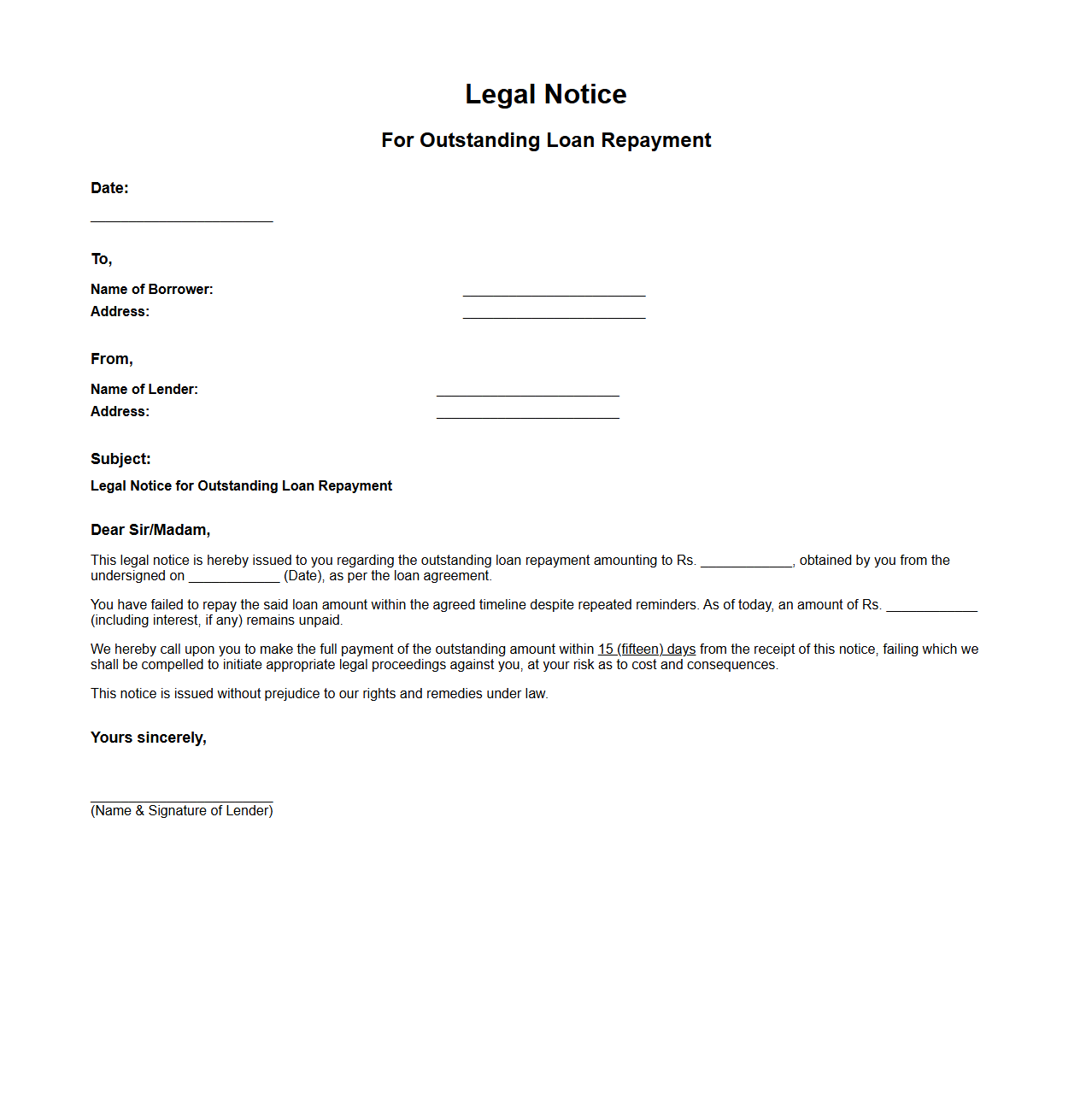

Legal Notice Format for Outstanding Loan Repayment

A

Legal Notice Format for Outstanding Loan Repayment is a formal document used by lenders to demand repayment of overdue loan amounts from borrowers. This notice typically includes details such as the borrower's information, loan account number, total outstanding amount, repayment deadline, and consequences of non-payment, ensuring clarity and legal compliance. It serves as an official communication to prompt timely settlement and may be used as evidence in legal proceedings if the borrower fails to respond.

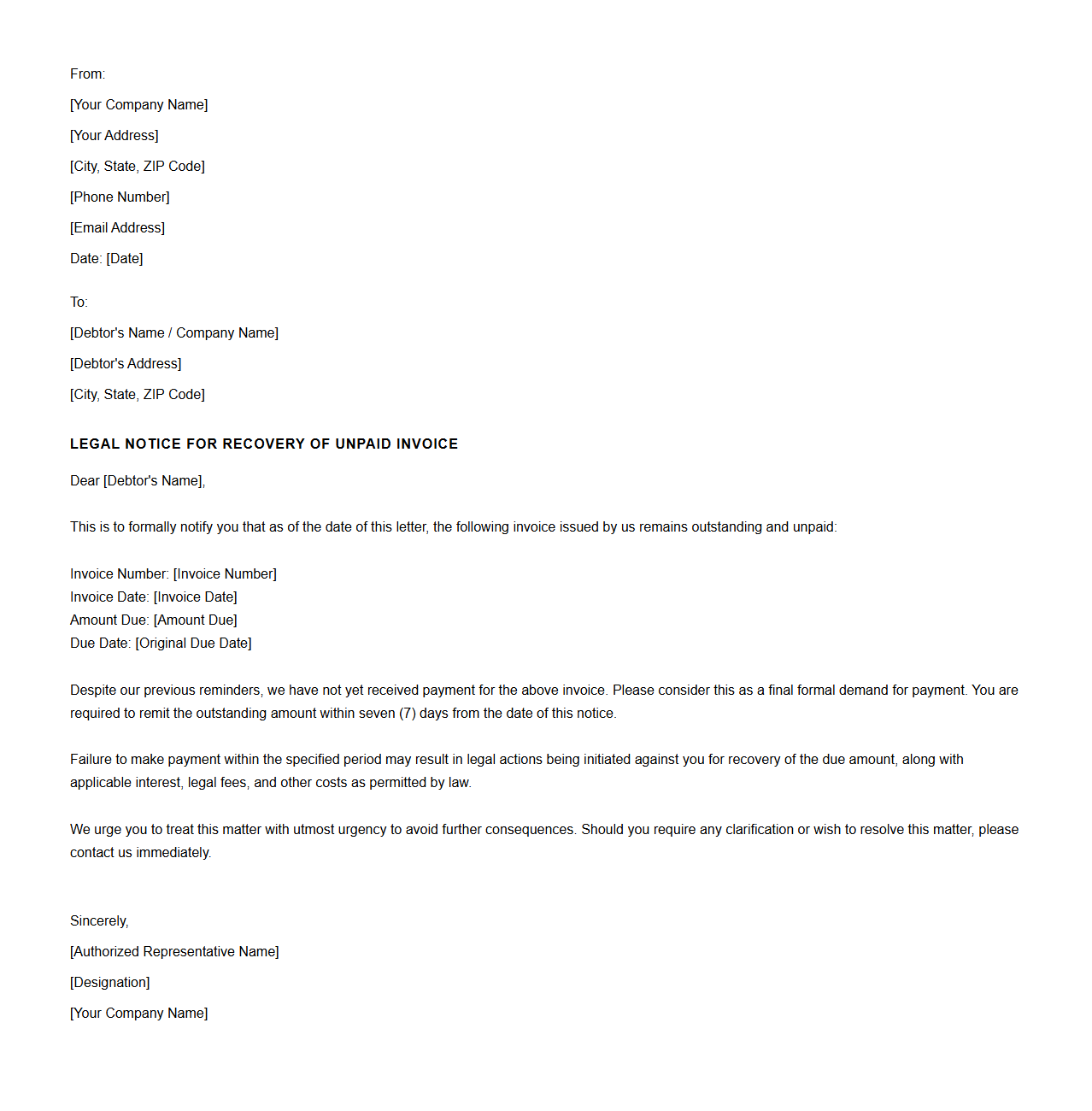

Debt Recovery Legal Notice for Unpaid Invoice

A

Debt Recovery Legal Notice for Unpaid Invoice is a formal document sent by a creditor to notify a debtor of overdue payments and demand settlement within a specified timeframe. This notice serves as a critical step in initiating legal proceedings if the debt remains unresolved, ensuring the creditor's rights are protected. It typically includes details of the outstanding amount, invoice number, due date, and consequences of non-payment.

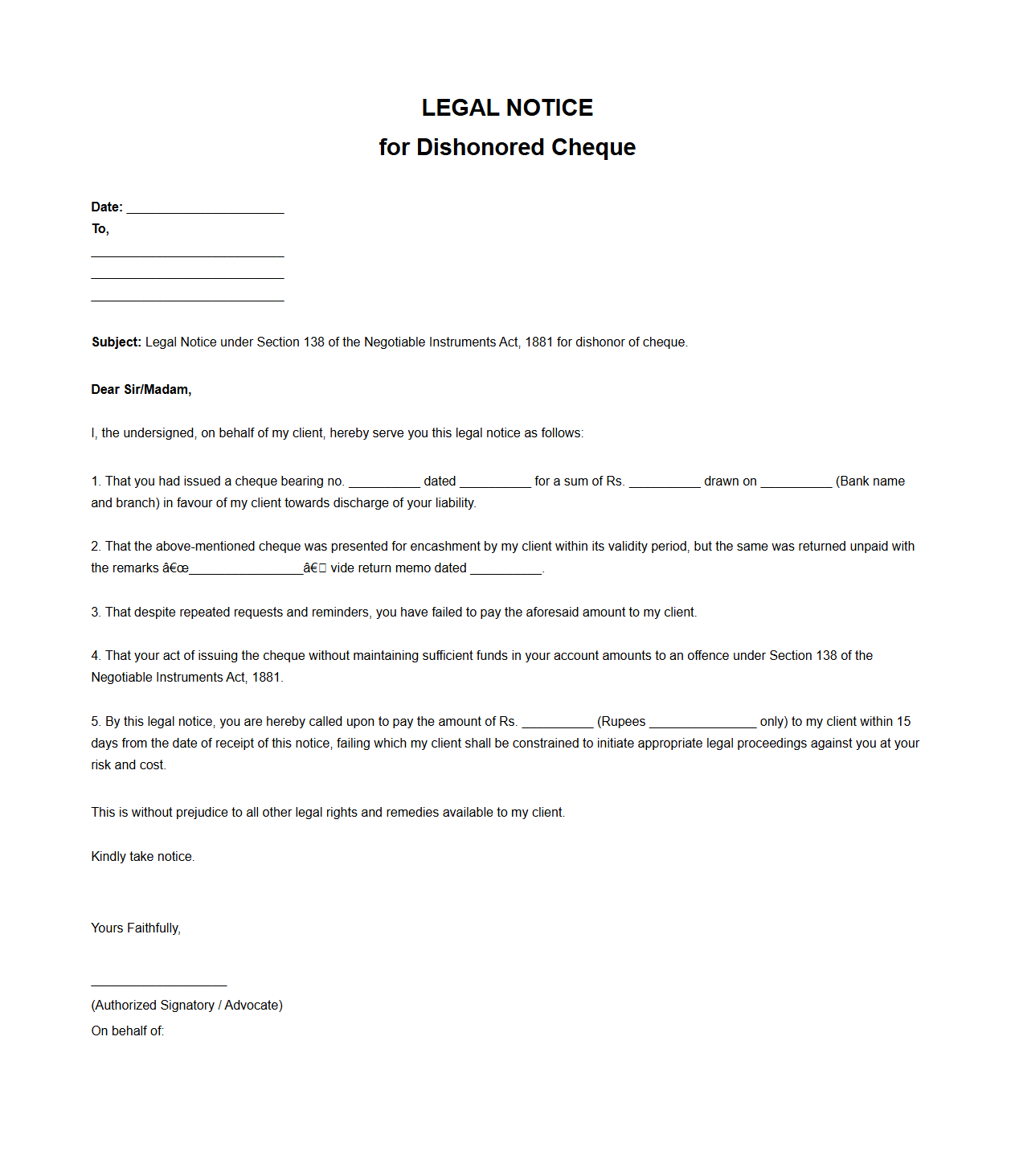

Legal Notice Template for Dishonored Cheque

A

Legal Notice Template for Dishonored Cheque is a formal document used to notify the issuer of a bounced cheque about the default and demand payment within a specified time. It serves as an official communication to initiate legal action if the payment is not settled promptly. This template typically includes details such as the cheque number, date of issue, reason for dishonor, and consequences of non-payment under the Negotiable Instruments Act.

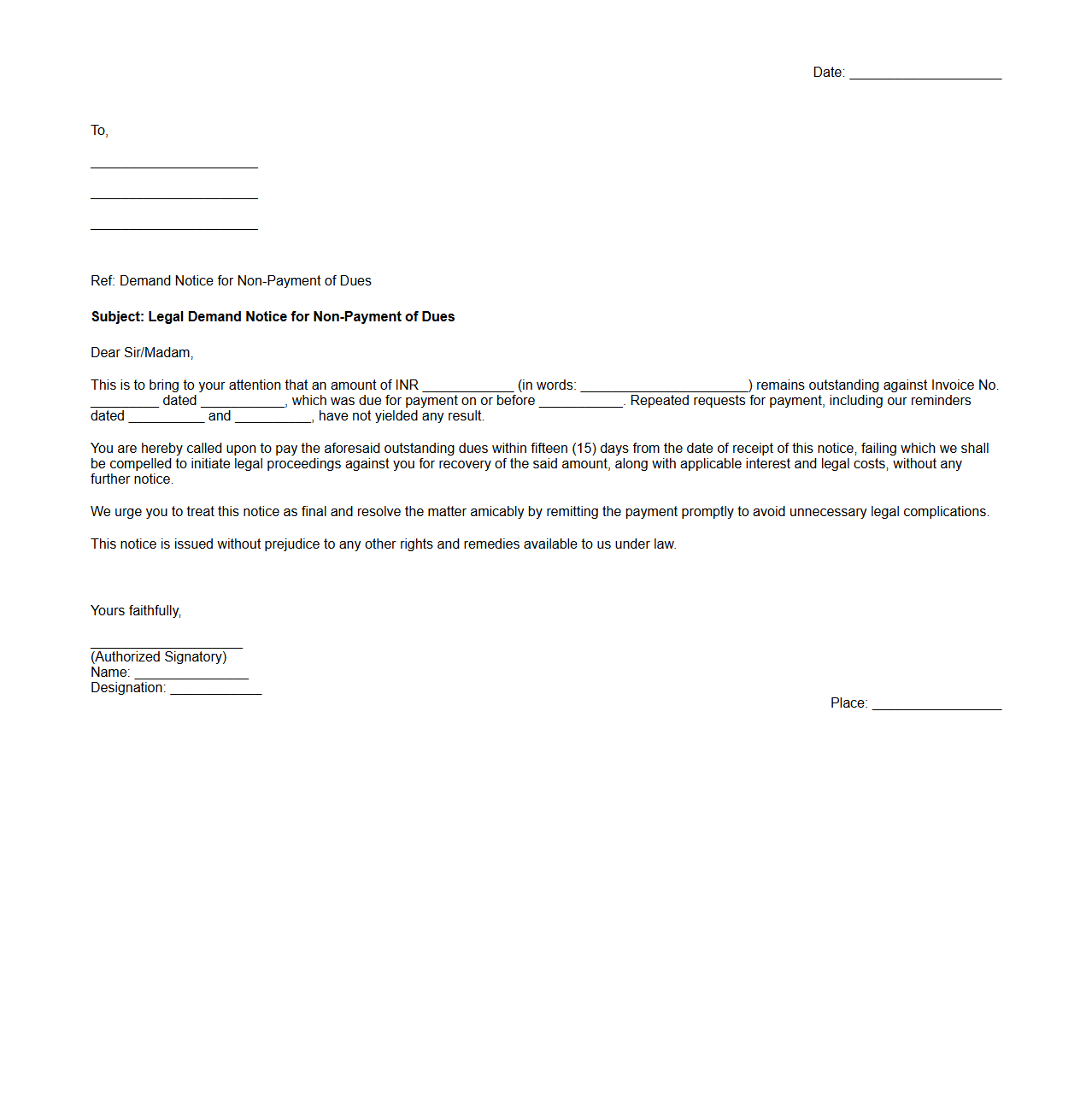

Legal Demand Notice for Non-Payment of Dues

A

Legal Demand Notice for Non-Payment of Dues is a formal written communication sent by a creditor to a debtor, demanding the payment of outstanding amounts within a specified time frame. This document serves as an official warning before initiating legal proceedings and typically includes details such as the amount owed, due date, consequences of non-payment, and reference to the contractual agreement. It helps in documenting evidence of attempts to resolve the issue amicably, strengthening the creditor's position in any subsequent legal action.

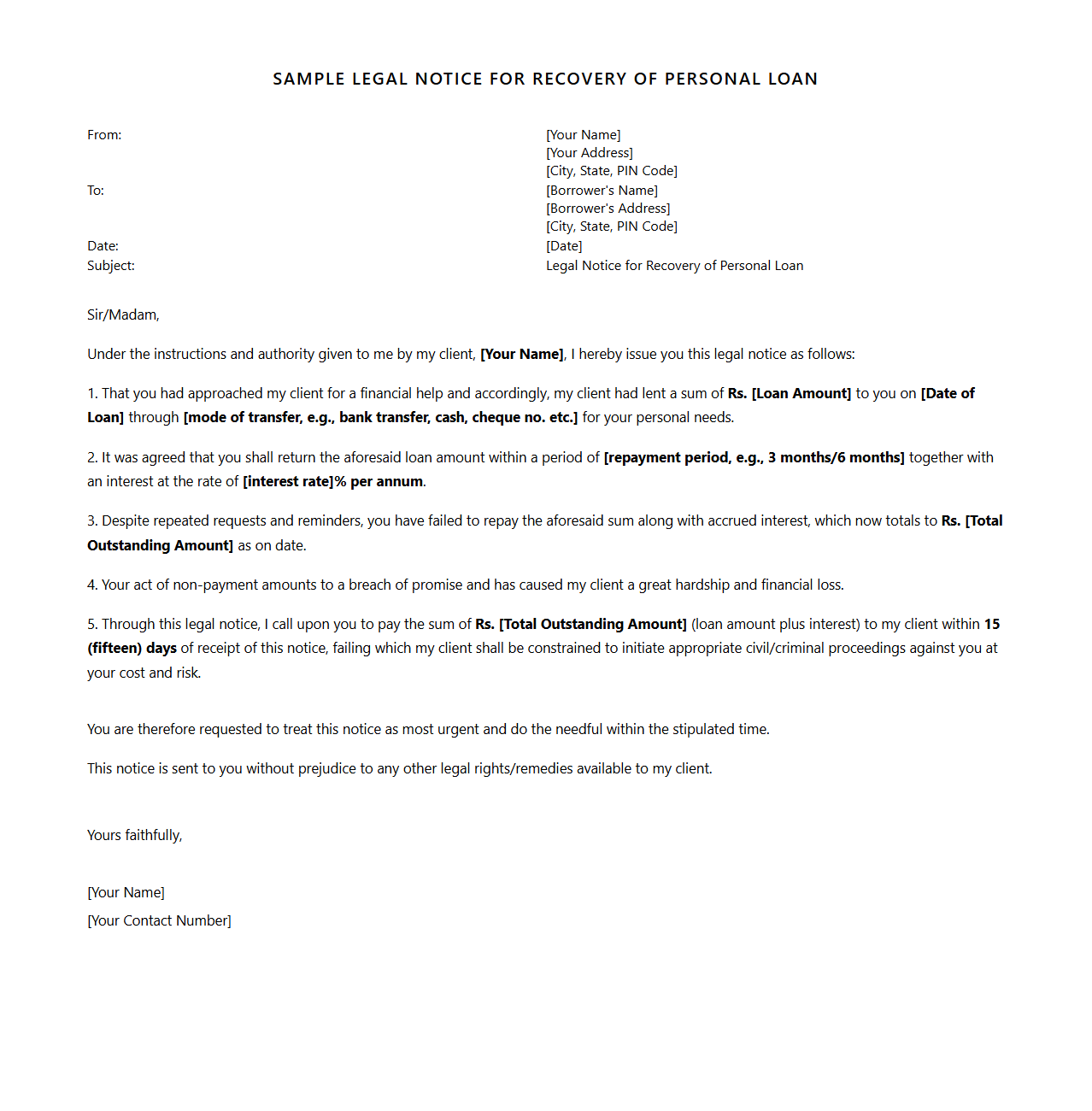

Sample Legal Notice for Recovery of Personal Loan

A

Sample Legal Notice for Recovery of Personal Loan is a formal document sent by a lender to a borrower who has defaulted on loan repayments. It serves as an official demand for repayment within a specified timeframe and outlines the consequences of non-payment, including potential legal action. This notice helps initiate the recovery process while providing clear evidence of communication for possible court proceedings.

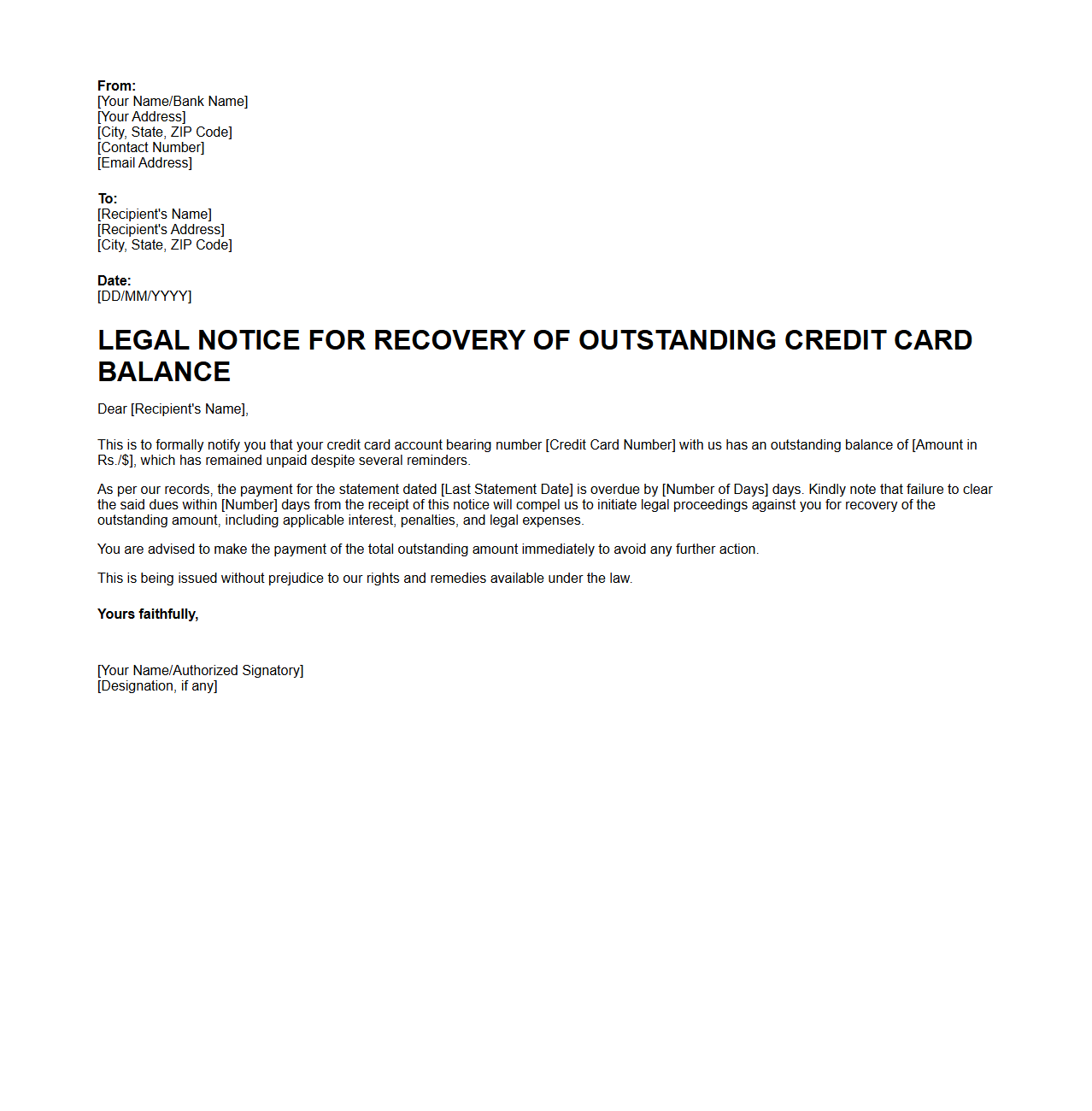

Legal Notice for Recovery of Outstanding Credit Card Balance

A

Legal Notice for Recovery of Outstanding Credit Card Balance is a formal written communication sent by a creditor or financial institution to a cardholder who has failed to pay the owed credit card amount within the stipulated time. This document outlines the total outstanding balance, demands immediate payment, and warns of potential legal action if the debt remains unsettled. It serves as an essential step in the debt recovery process, establishing a clear record of the creditor's intent to recover funds through legal means if necessary.

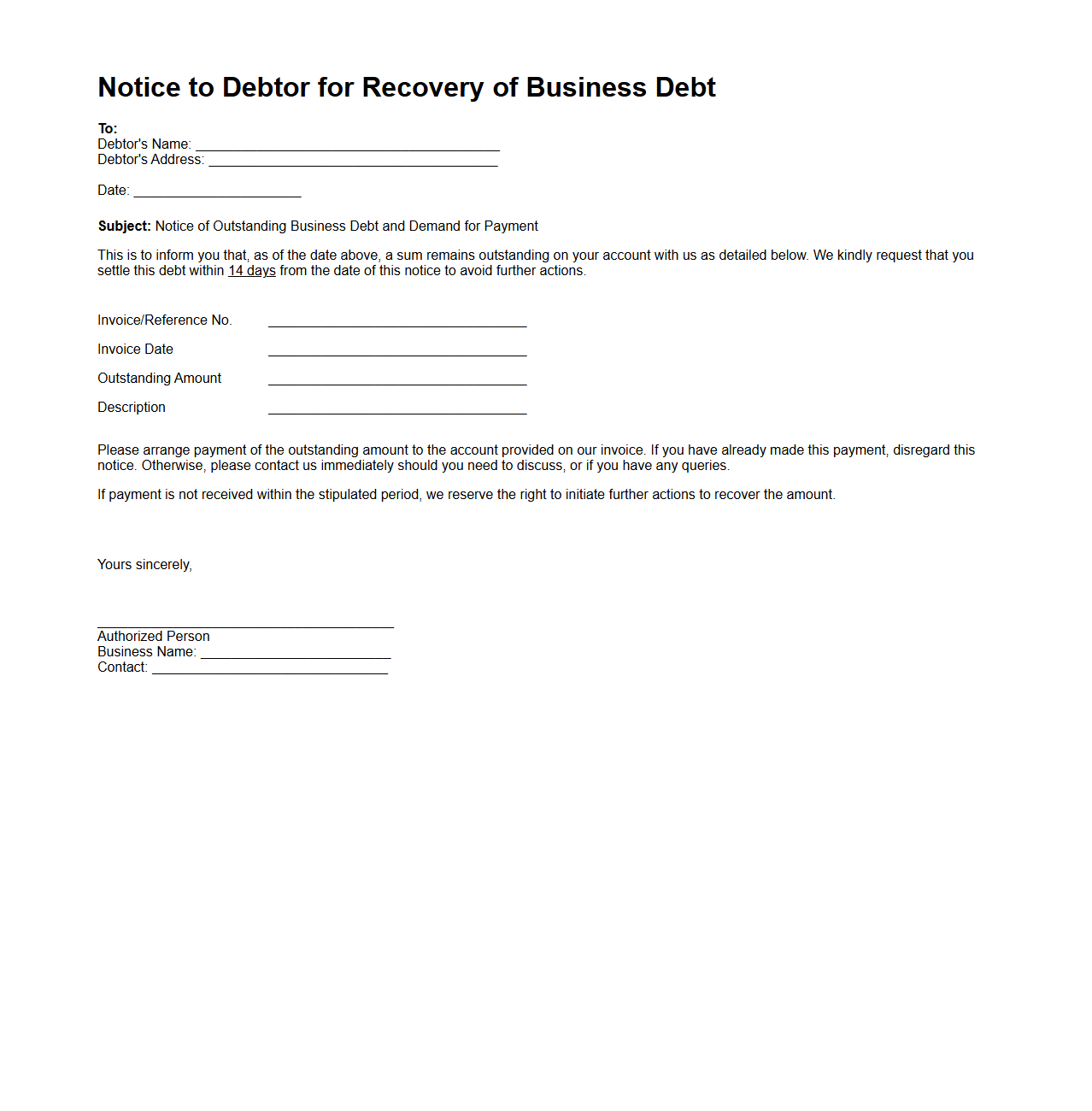

Notice to Debtor for Recovery of Business Debt

A

Notice to Debtor for Recovery of Business Debt is a formal document sent to a debtor to demand payment for outstanding business-related debts. It clearly outlines the amount owed, the due date for payment, and potential legal actions if the debt remains unpaid. This notice serves as an essential step in debt recovery processes, ensuring compliance with legal requirements before pursuing further enforcement measures.

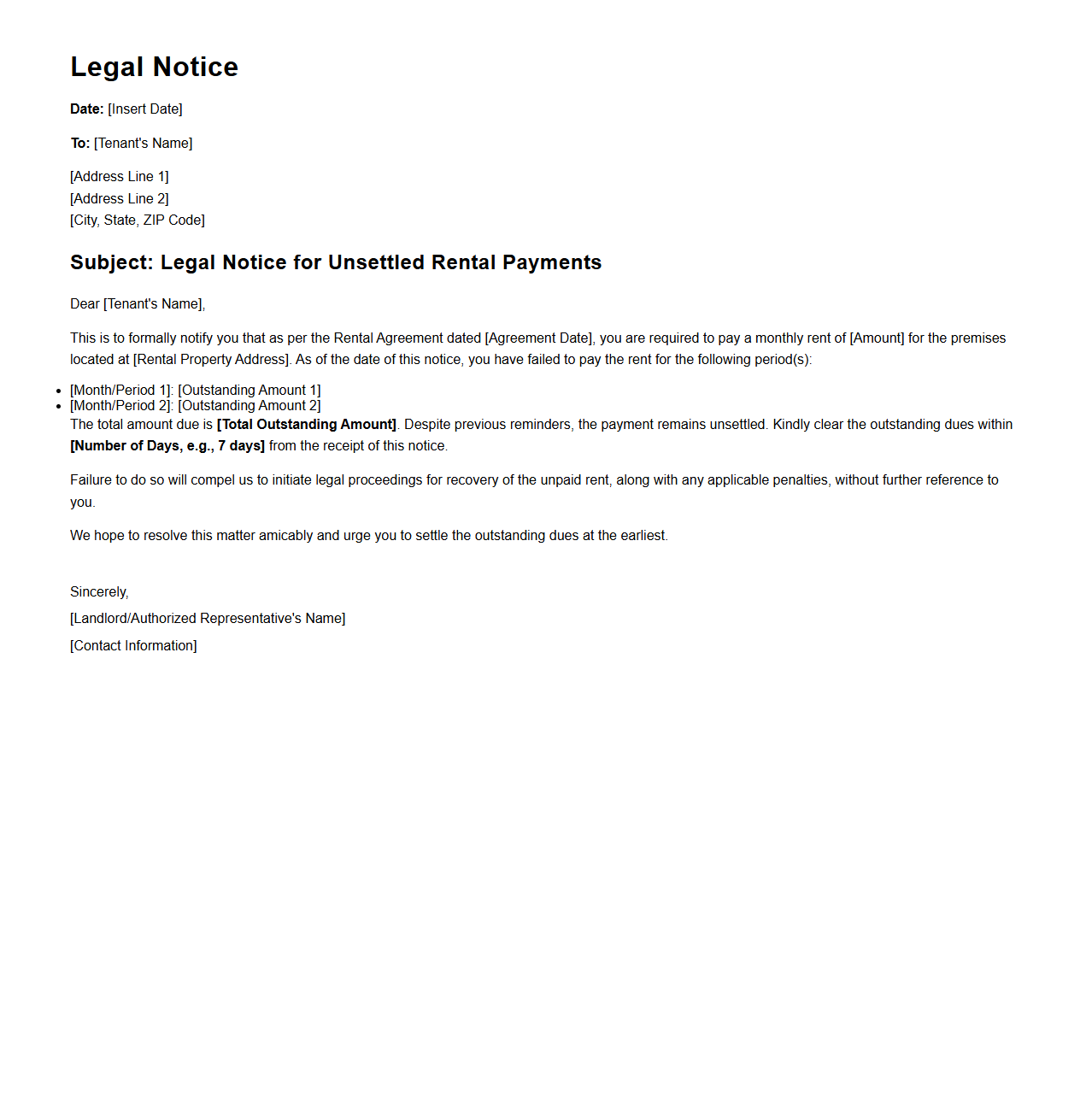

Legal Notice Example for Unsettled Rental Payments

A

Legal Notice for Unsettled Rental Payments is a formal document issued by landlords to tenants who have failed to pay rent within the agreed timeframe. It outlines the outstanding amount, specifies a deadline for payment, and warns of potential legal actions if the debt remains unpaid. This notice serves as an essential step in enforcing rental agreements and protecting landlords' rights.

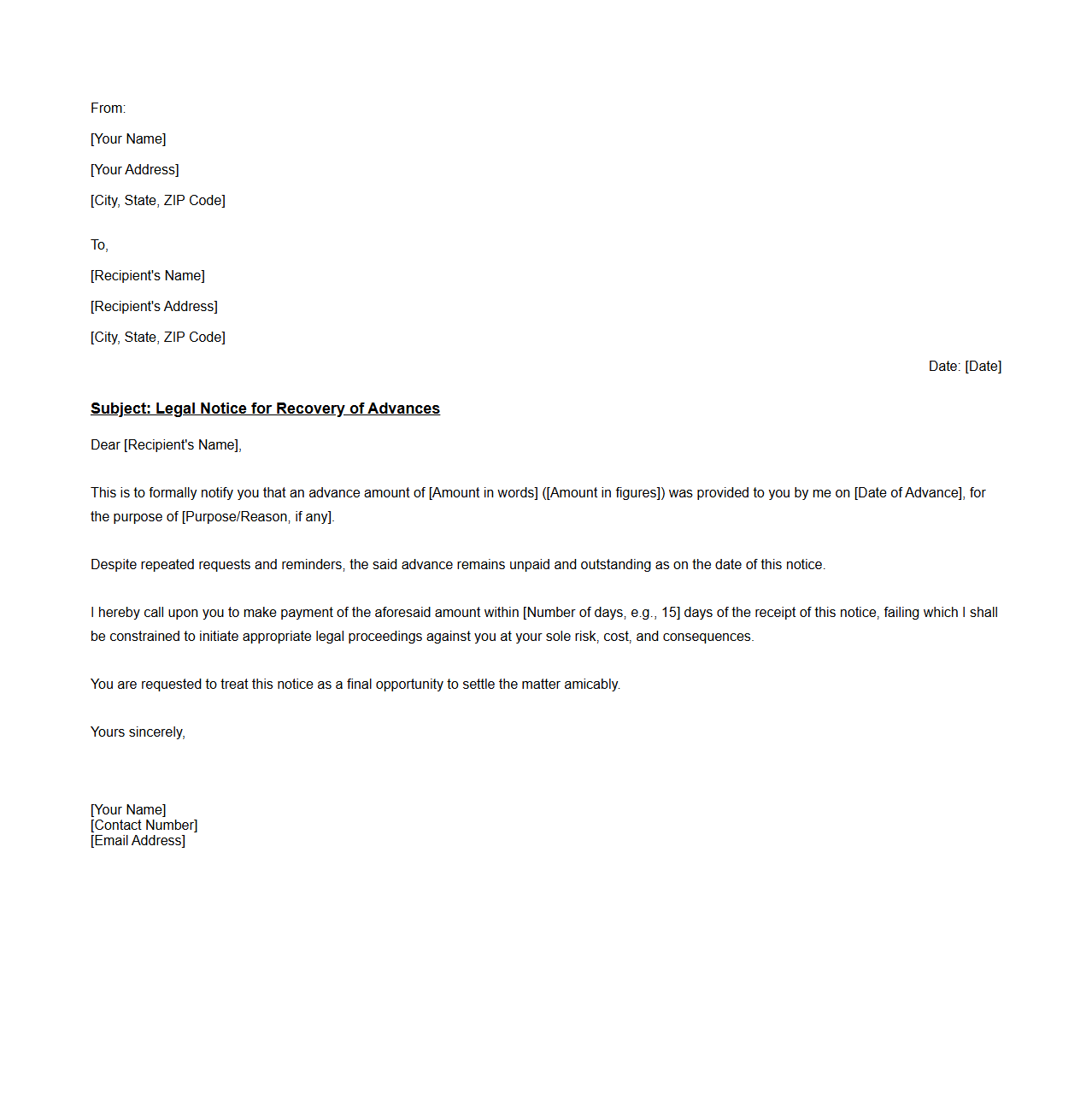

Formal Legal Notice for Recovery of Advances

A

Formal Legal Notice for Recovery of Advances is an official document issued by a lender or creditor to a borrower or debtor demanding repayment of funds previously advanced. This notice serves as a written reminder and a precursor to legal action, outlining the amount due and the deadline for payment. It is a critical step in the debt recovery process, ensuring that the creditor's claims are legally documented and communicated.

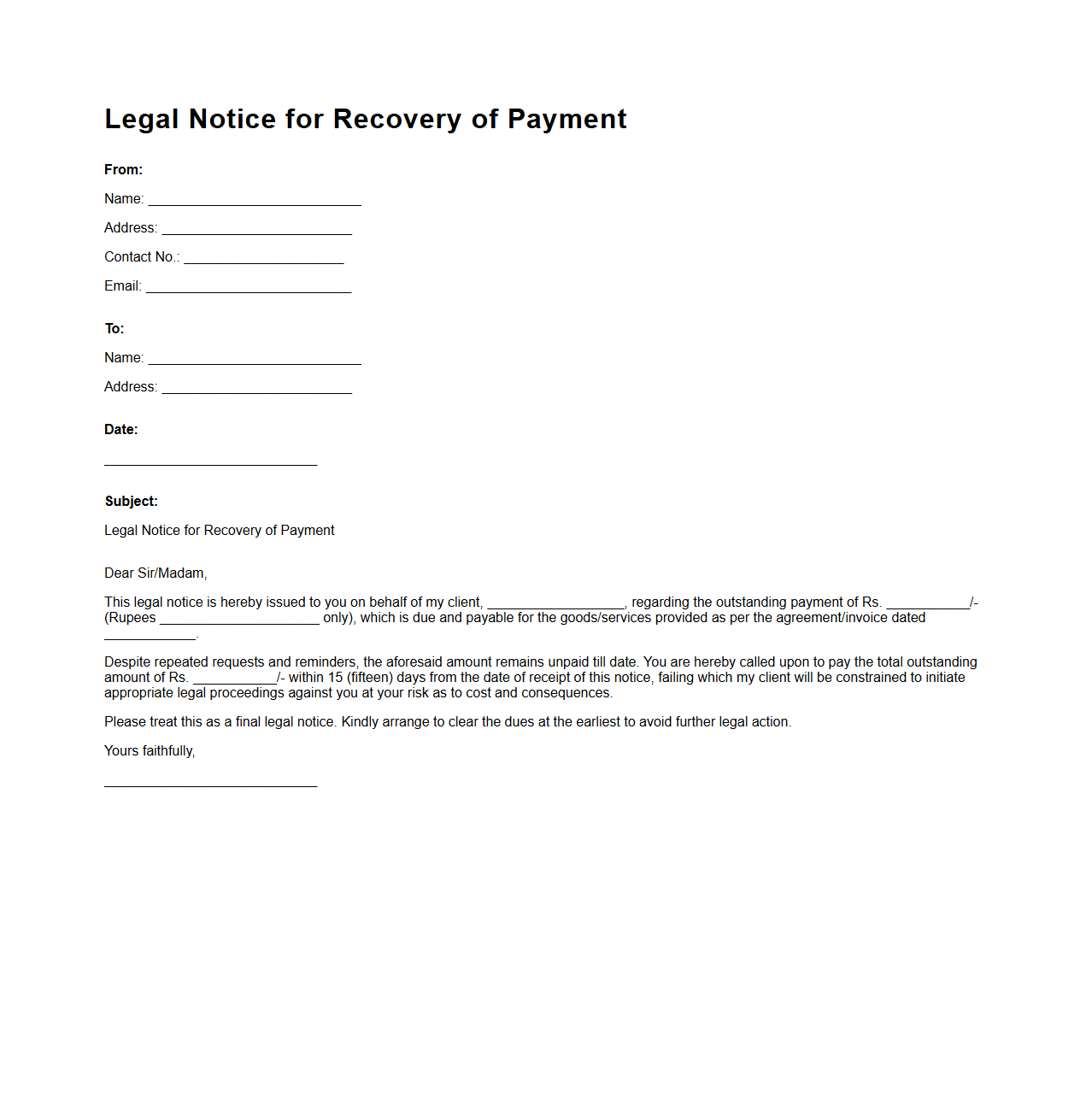

Legal Notice for Recovery of Payment from Client

A

Legal Notice for Recovery of Payment is a formal document issued to a client who has defaulted on payment obligations, serving as an official demand for clearing outstanding dues. This notice outlines the amount owed, payment deadline, and potential legal consequences if the payment is not settled, strengthening the creditor's position in case of further legal action. It plays a crucial role in the debt recovery process by establishing clear communication and legal intent to recover the unpaid amount.

What key clauses should be included in a legal notice document for debt recovery?

A legal notice for debt recovery must include the details of the debt, including the principal amount and any accrued interest. It should clearly state the deadline for payment and consequences of non-payment. Additionally, the notice should specify the legal action that will be initiated if the debt is not settled.

How should service of the legal notice be documented for legal validity?

Service of a legal notice should be documented through registered post with acknowledgment due to ensure proof of delivery. Alternatively, personal delivery with a signed receipt or courier service receipt can be used. Maintaining a copy of the dispatch and delivery receipts is essential for establishing legal validity.

What statutory timeline applies for debtor response after receiving a legal notice?

The statutory timeline for a debtor to respond to a legal notice typically ranges from 15 to 30 days, depending on jurisdiction. This period allows the debtor to either settle the debt or raise any defenses. Failure to respond within the stipulated timeframe often permits the creditor to initiate legal proceedings.

How can evidence of prior communication strengthen a debt recovery legal notice?

Including evidence of prior communication such as emails, messages, or earlier notices can reinforce the credibility of the debt recovery notice. It demonstrates the creditor's ongoing attempts to resolve the matter amicably. This documentation helps establish a timeline of efforts which may favor the creditor in court.

Which legal provisions govern interest claims in debt recovery notices?

Interest claims in debt recovery are governed by statutory provisions such as the Indian Contract Act, 1872 and specific State Money Lenders Acts. The rate of interest and compounding rules must comply with these legal frameworks. Any interest claimed must be clearly disclosed and justified in the legal notice.