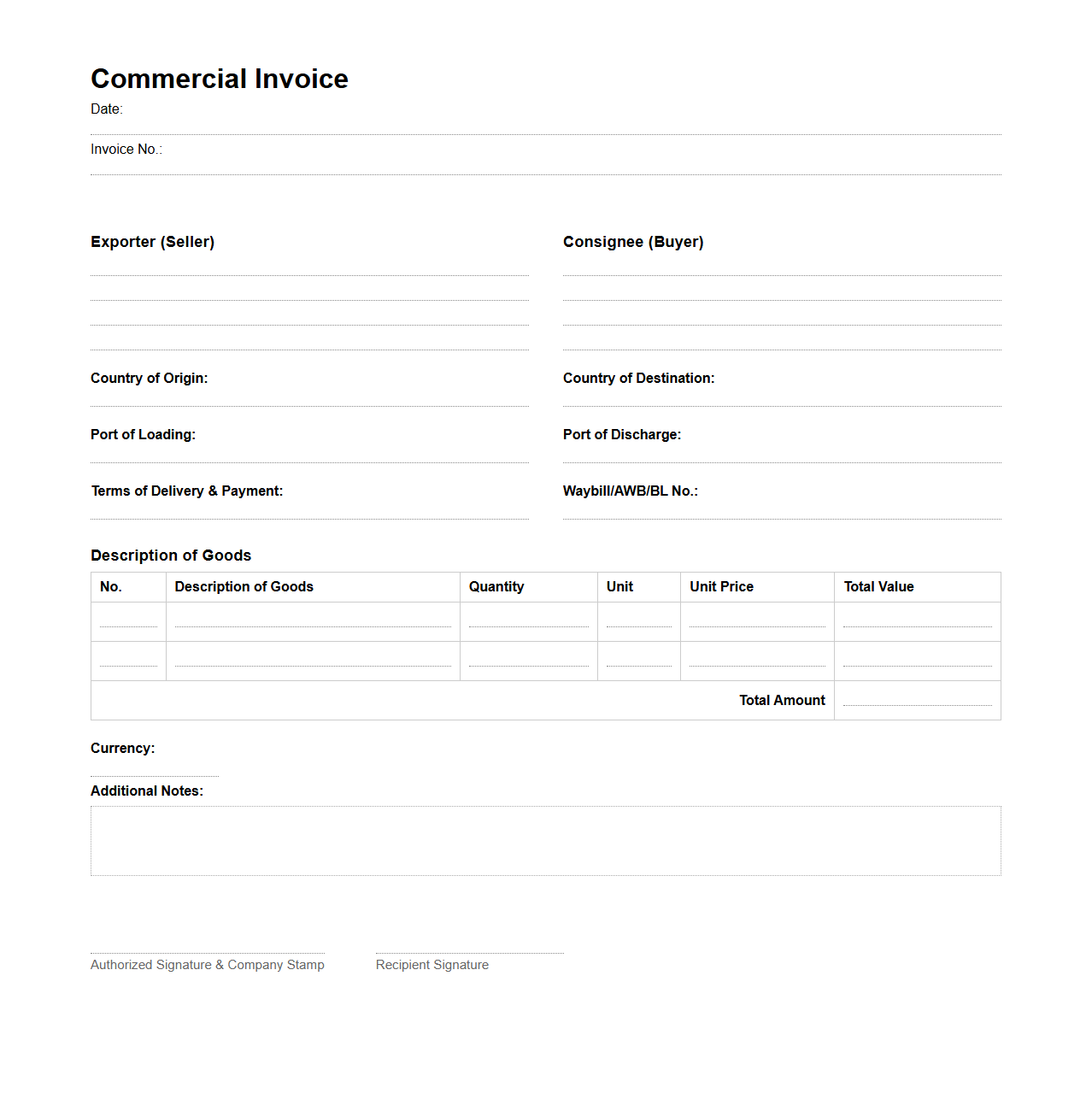

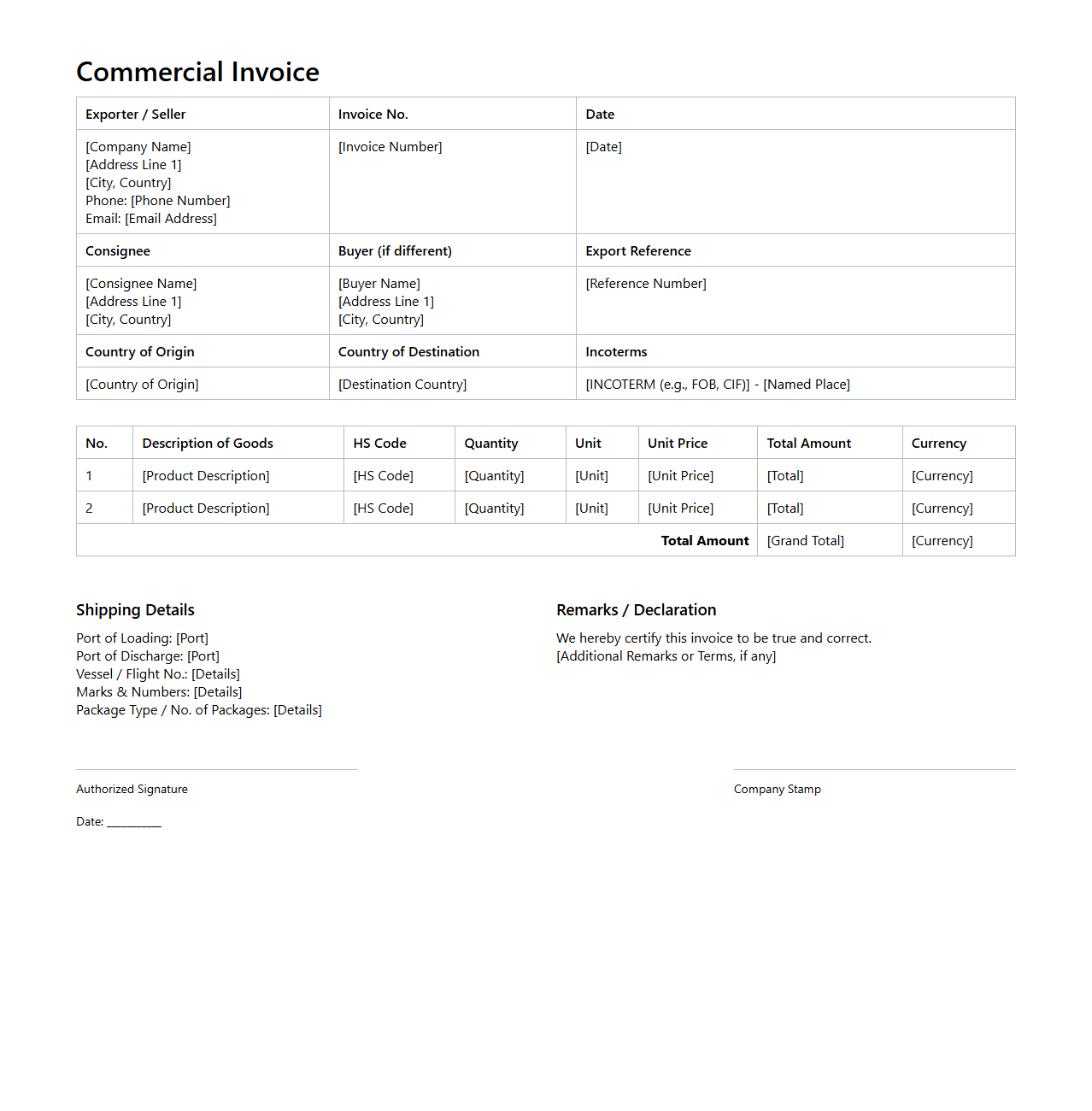

Template for Export Commercial Invoice

A

Template for Export Commercial Invoice is a standardized document used in international trade to detail the transaction between the exporter and importer. It includes essential information such as product descriptions, quantities, prices, shipping details, and payment terms, ensuring compliance with customs regulations. This template streamlines the invoicing process, reduces errors, and facilitates smooth clearance at customs and accurate financial records.

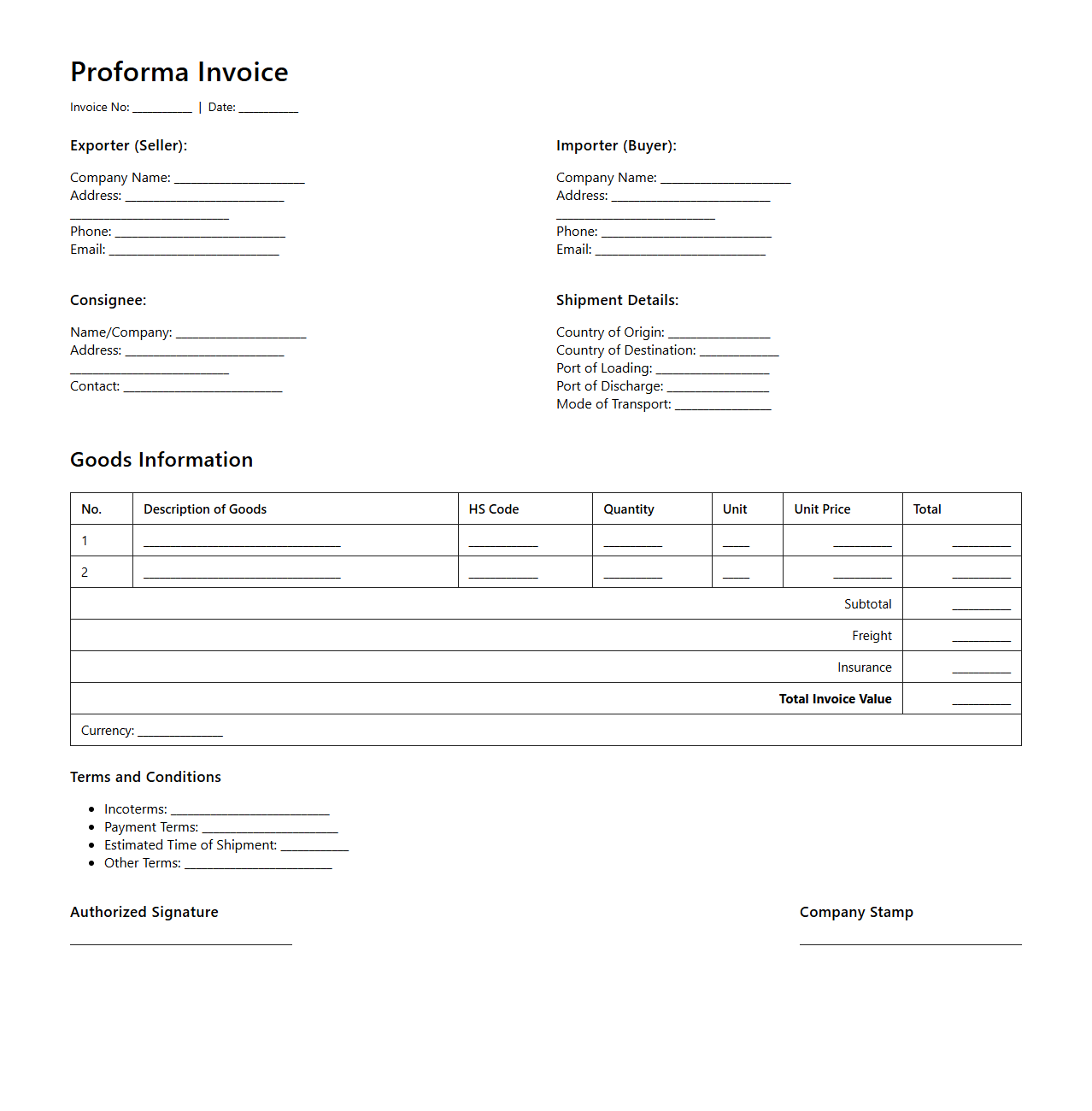

Proforma Invoice Example for International Shipments

A

Proforma Invoice for international shipments is a preliminary bill of sale sent to buyers before the actual shipment of goods, outlining the description, quantity, and value of the products. It serves as a customs declaration to facilitate import clearance and helps buyers arrange payment or secure financing. This document is essential for ensuring transparency and smooth processing in cross-border trade transactions.

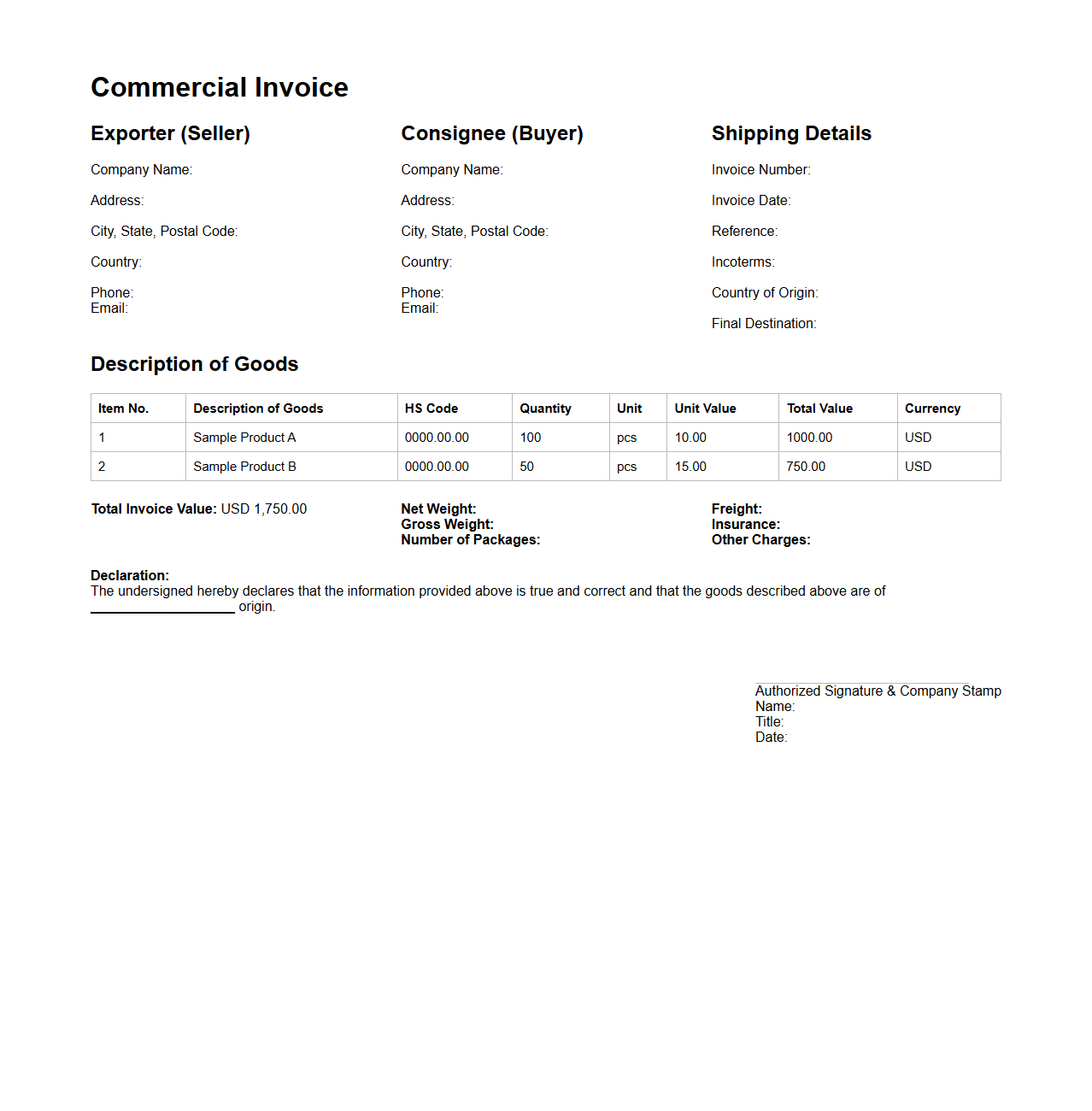

Blank Commercial Invoice for Export Transactions

A

Blank Commercial Invoice for Export Transactions is a standardized document template used by exporters to detail the goods being shipped, their quantities, prices, and terms of sale without specific shipment data filled in. This form facilitates smoother export processes by allowing exporters to prepare accurate and compliant invoices quickly once shipment details are finalized. It serves as an essential tool for customs clearance, international trade compliance, and payment collection in cross-border transactions.

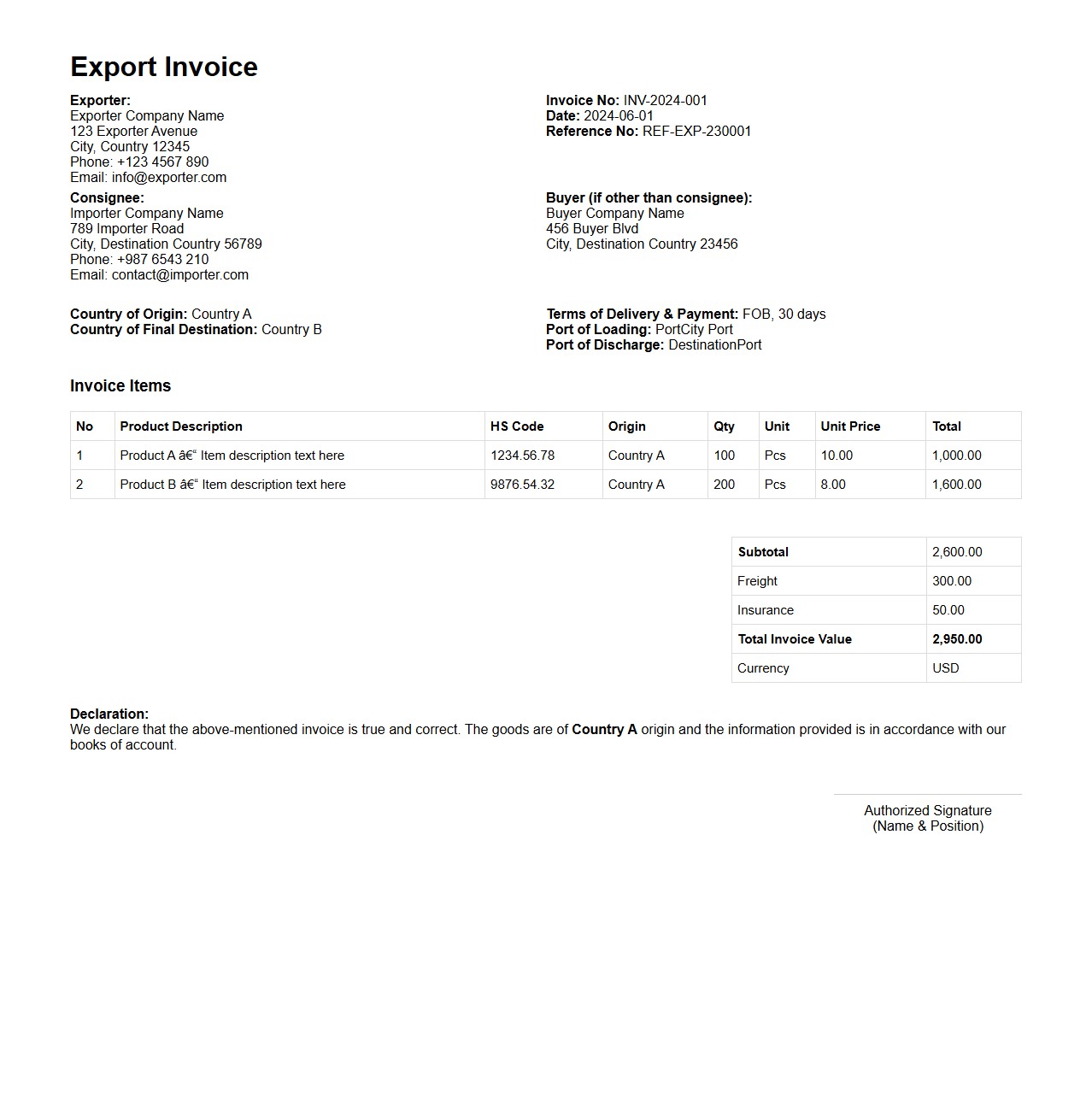

Completed Commercial Invoice Sample for Customs

A

Completed Commercial Invoice Sample for customs document serves as a detailed record of goods being shipped internationally, outlining essential information such as product descriptions, quantities, values, and buyer and seller details. This document facilitates customs clearance by providing accurate data for calculating duties, taxes, and compliance with trade regulations. It ensures transparent communication between exporters, importers, and customs authorities, reducing delays and legal issues during shipment processing.

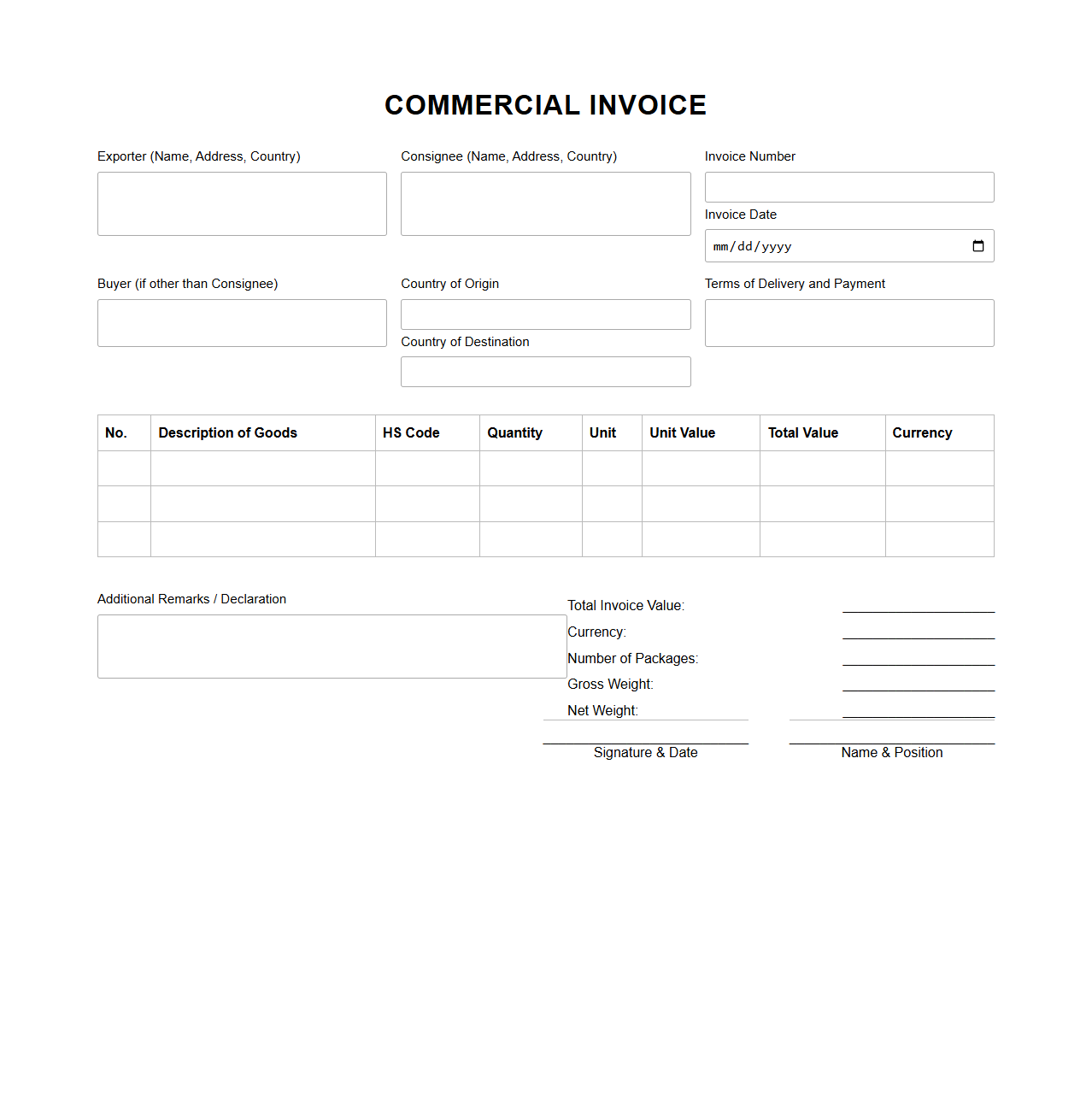

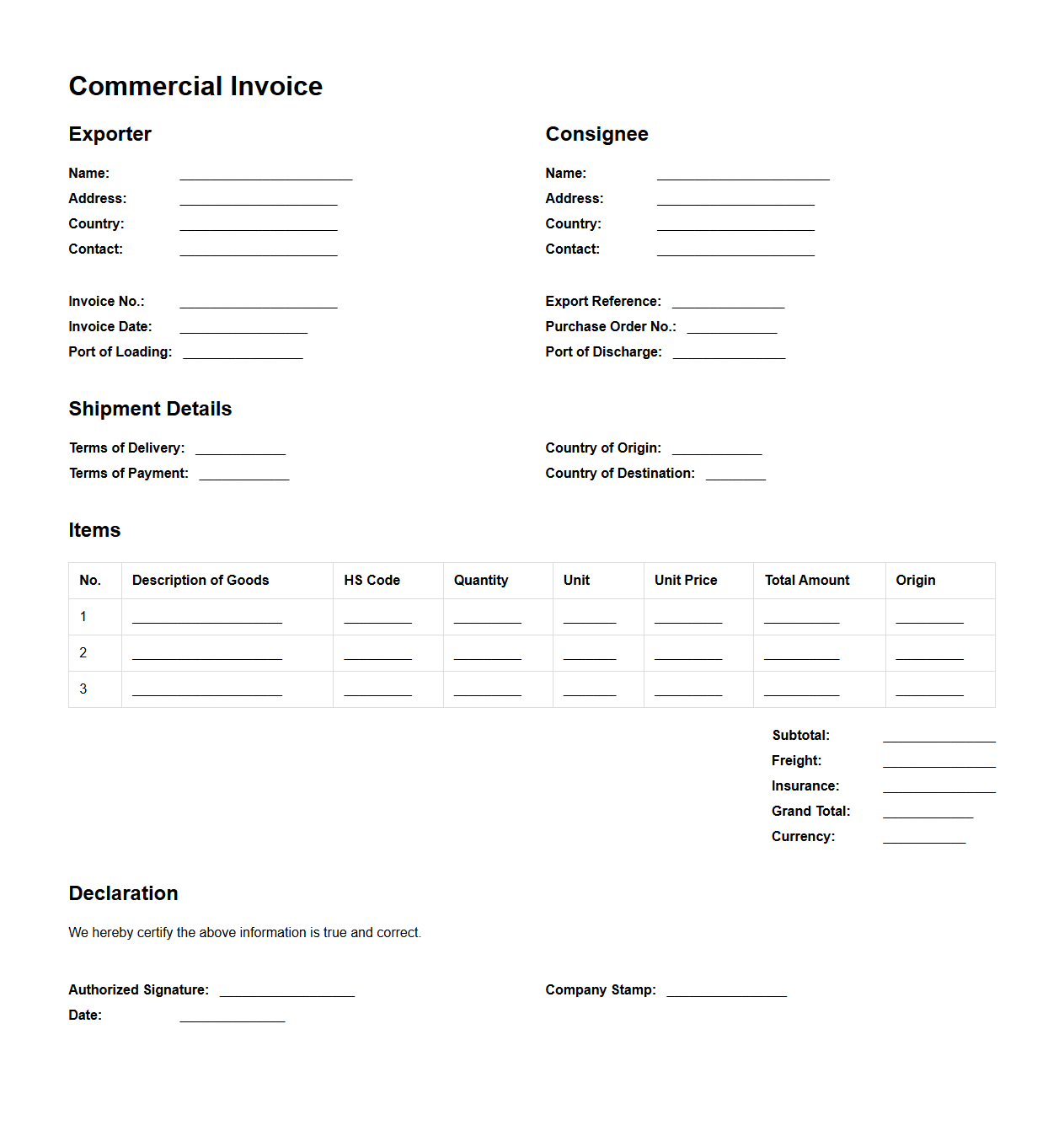

Multi-Item Commercial Invoice for Export Logistics

A

Multi-Item Commercial Invoice for export logistics is a detailed document listing multiple products shipped in a single consignment, specifying each item's description, quantity, unit price, and total value. This invoice ensures accurate customs clearance and facilitates international trade by providing necessary information for tariff classification, duties assessment, and regulatory compliance. It serves as a critical record for buyers, sellers, freight forwarders, and customs authorities throughout the export process.

Detailed Export Invoice with HS Codes

A

Detailed Export Invoice with HS Codes is a comprehensive shipping document used in international trade that itemizes goods being exported along with their corresponding Harmonized System (HS) codes. These codes classify products by standardized numerical identifiers recognized globally, facilitating customs clearance, tariff calculation, and trade compliance. This invoice enhances transparency, ensures accurate duty assessment, and helps avoid shipment delays by providing precise product descriptions linked to the applicable regulatory frameworks.

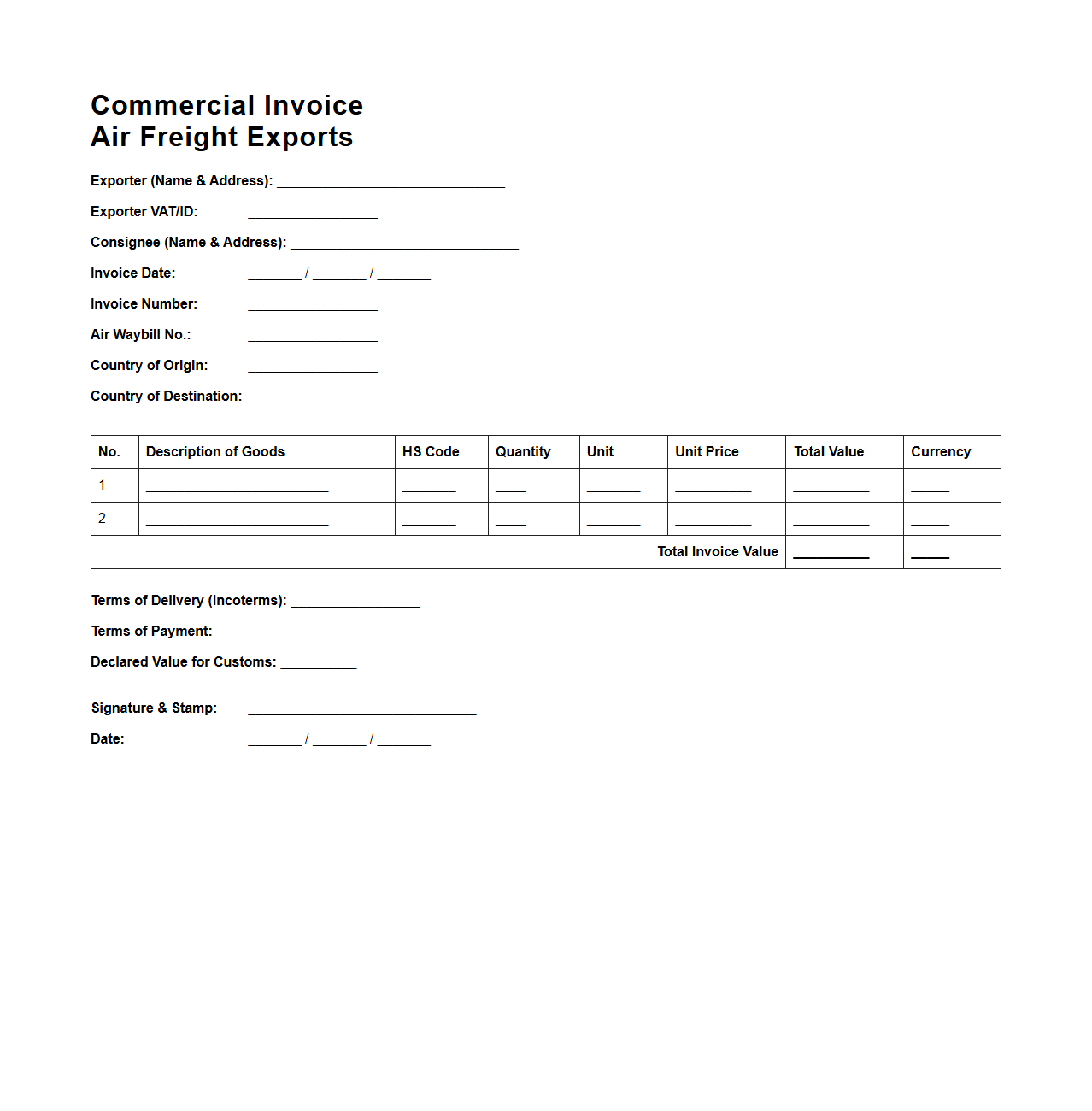

Sample Commercial Invoice for Air Freight Exports

A

Sample Commercial Invoice for Air Freight Exports serves as a critical document detailing the transaction between the exporter and importer, outlining goods description, quantity, value, and shipping terms. It facilitates customs clearance by providing essential information required for calculating duties and taxes, ensuring compliance with international trade regulations. This invoice acts as both a legal proof of sale and a financial document that supports accurate billing and shipment tracking in air freight logistics.

Export Commercial Invoice with Incoterms

An

Export Commercial Invoice with Incoterms is a crucial document in international trade detailing the sale transaction between exporter and importer, including product descriptions, prices, and terms of sale. It specifies the agreed Incoterms, which define the responsibilities, risks, and costs borne by each party during shipment. This document ensures transparency, compliance with customs regulations, and smooth transaction processing worldwide.

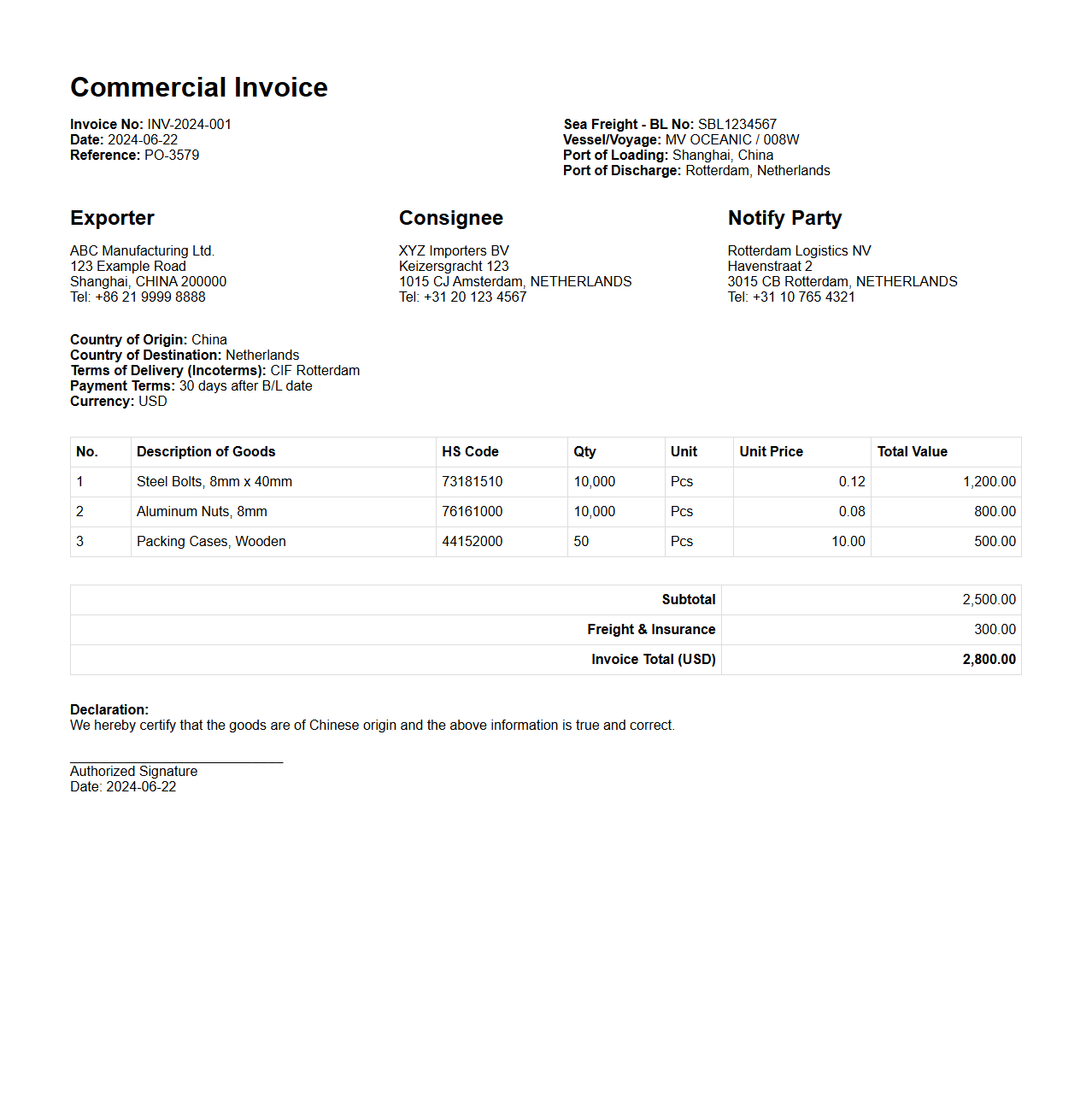

Commercial Invoice Example for Sea Freight Shipments

A

Commercial Invoice for sea freight shipments is a crucial document that details the transaction between the exporter and importer, including the description of goods, quantity, value, and terms of sale. It serves as a primary customs declaration and helps in calculating duties, taxes, and tariffs for international shipping. This invoice ensures smooth clearance at ports and accurate record-keeping for both parties involved in sea freight logistics.

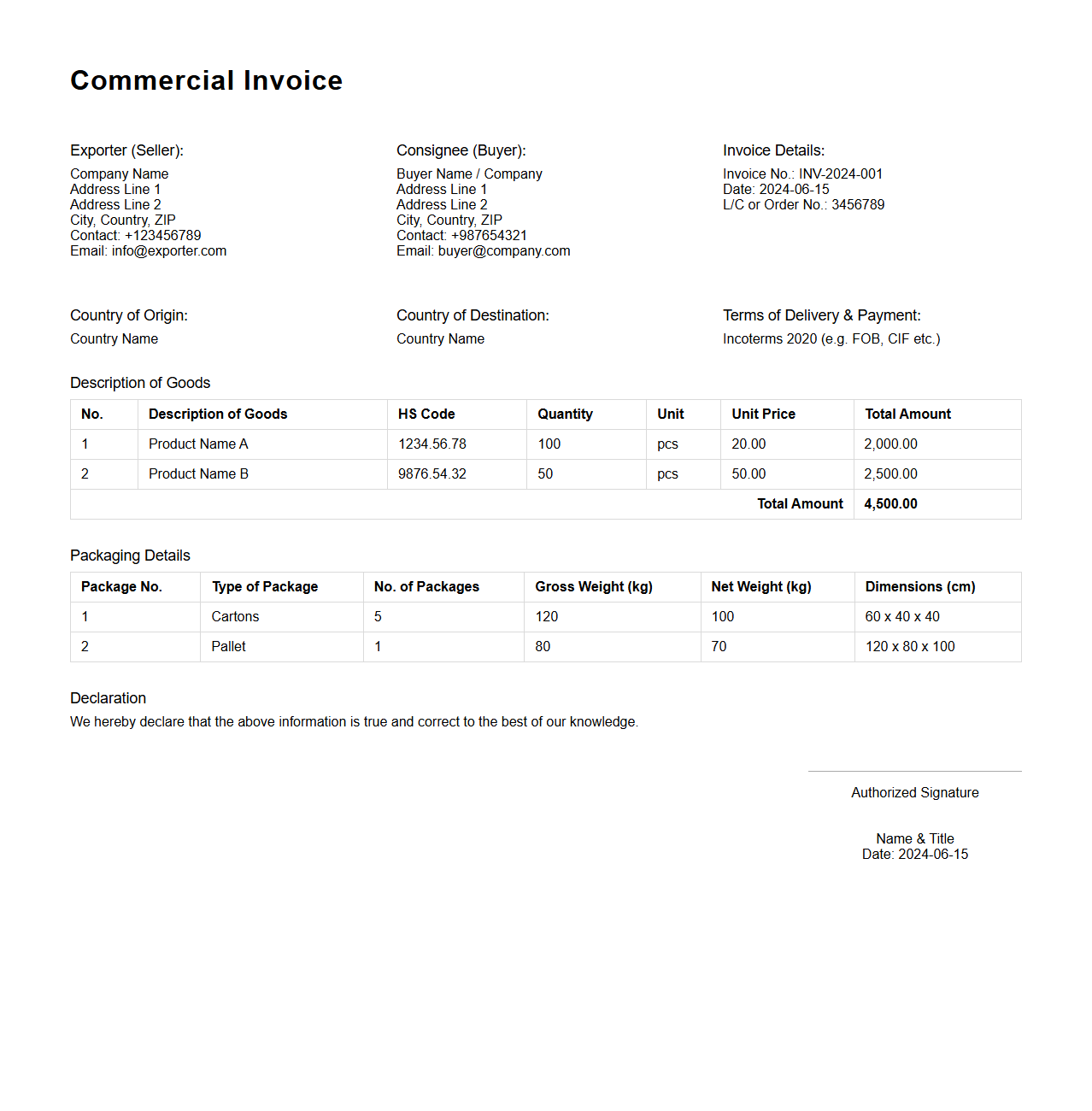

Commercial Invoice with Packaging Details for Export

A

Commercial Invoice with Packaging Details for export is a critical document that outlines the transaction between the exporter and importer, detailing product descriptions, quantities, prices, and payment terms. It includes comprehensive packaging information such as dimensions, weight, types of packaging materials, and the number of packages, which helps customs authorities assess duties and ensures proper handling during shipping. This document is essential for smooth customs clearance, logistical planning, and verifying the shipment's contents against purchase orders.

What are the essential elements required in a commercial invoice for export logistics?

A commercial invoice must include detailed information such as the seller's and buyer's names and addresses to establish parties involved. It should list the description, quantity, and value of the goods being shipped to ensure accurate processing. Additionally, details like the terms of sale, payment terms, and shipping date are vital to facilitate smooth export logistics.

How does a commercial invoice facilitate customs clearance in international trade?

The commercial invoice serves as a primary document for customs by providing accurate details on the goods' nature, quantity, and value. It helps customs authorities verify compliance with import regulations and assess applicable tariffs. This transparency expedites clearance, reducing delays and potential additional costs during international trade.

In what ways does the commercial invoice reflect the terms of sale and payment agreements?

The commercial invoice explicitly outlines terms of sale such as Incoterms, which clarify responsibilities between buyer and seller. It also indicates the payment method and terms, helping both parties understand when and how payment should be made. These details ensure legal and financial obligations are clearly communicated and enforceable.

How is product classification (HS code) represented in a commercial invoice for exports?

The HS code is included on the commercial invoice to specify the product's tariff classification according to the Harmonized System. This code standardizes product identification globally, aiding in accurate customs duty assessment. Including the HS code minimizes errors and speeds up the export documentation process.

What information on the commercial invoice is critical for determining export duties and taxes?

Key data such as the product description, quantity, value, and HS code directly influence the calculation of export duties and taxes. The invoice's declared value establishes the customs value, which is the basis for duty assessment. Accurate information ensures compliance and correct taxation, preventing legal and financial penalties.