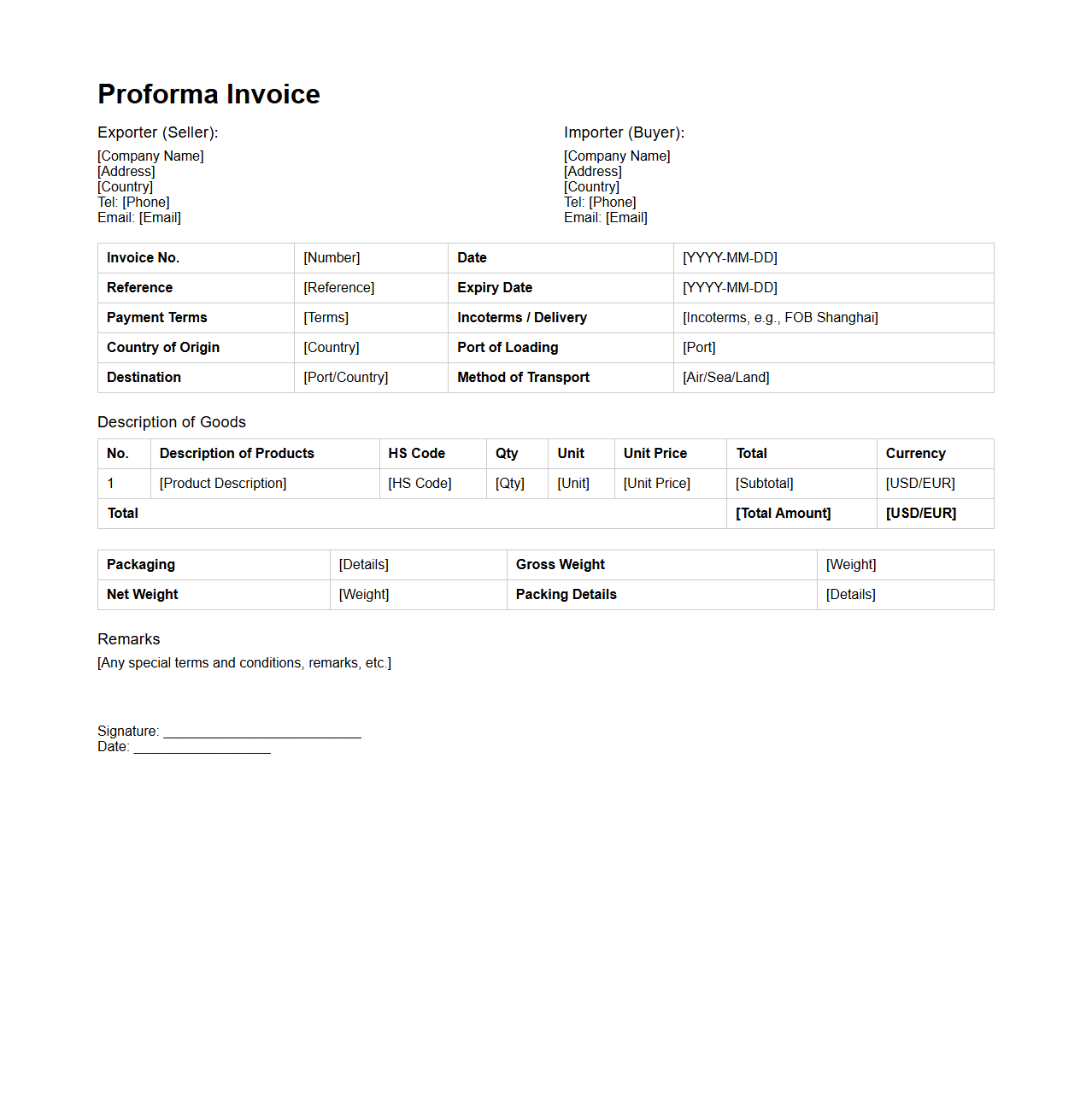

Proforma Invoice Template for International Trade

A Proforma Invoice Template for International Trade document serves as a preliminary bill of sale that outlines the terms of a transaction between a buyer and seller before the goods are shipped. It includes detailed information such as descriptions of the products, quantities, prices, shipping costs, and payment terms, helping both parties agree on the transaction specifics. Using a

Proforma Invoice Template ensures clarity, reduces disputes, and facilitates customs clearance by providing accurate data for import/export processes.

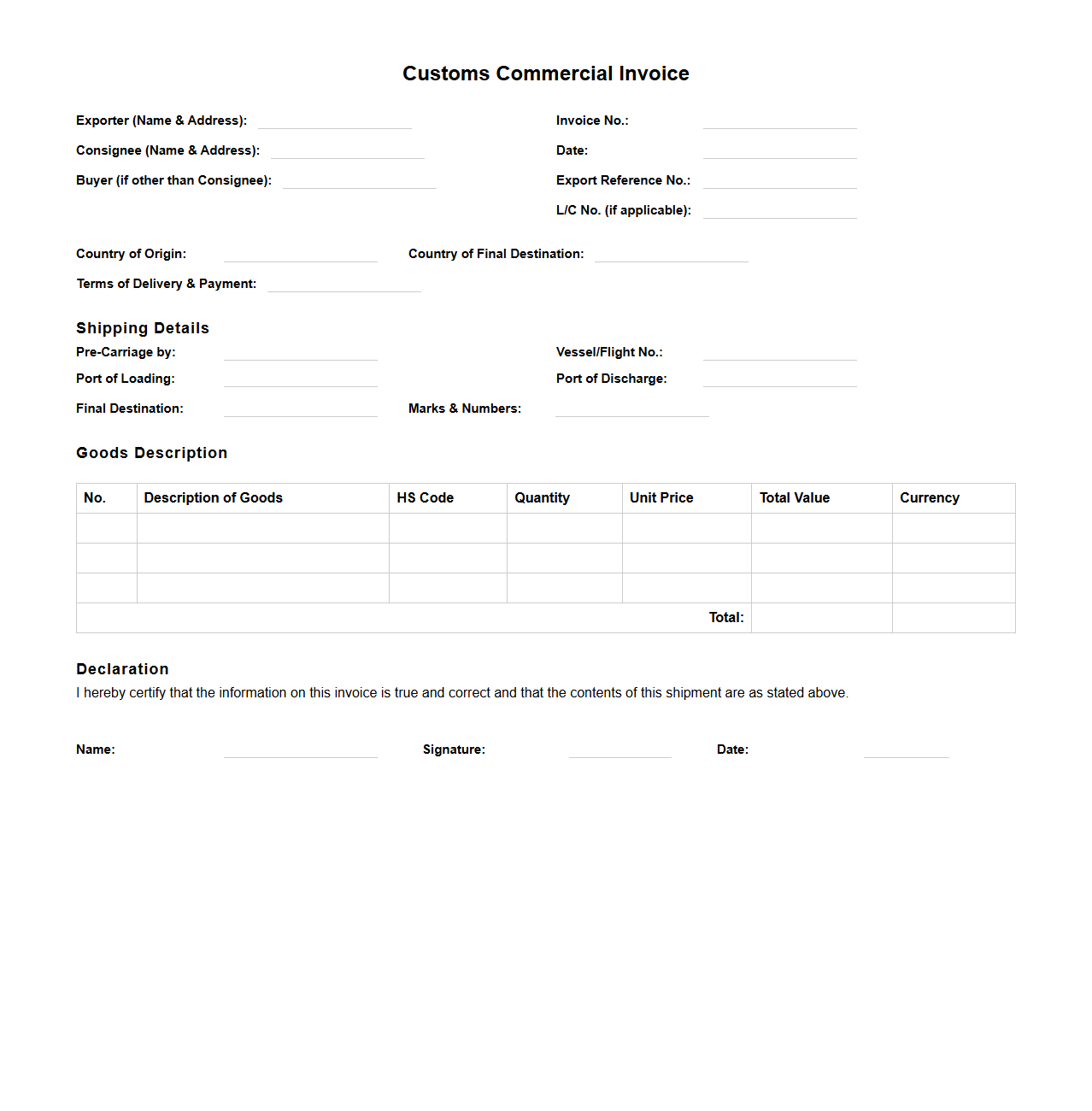

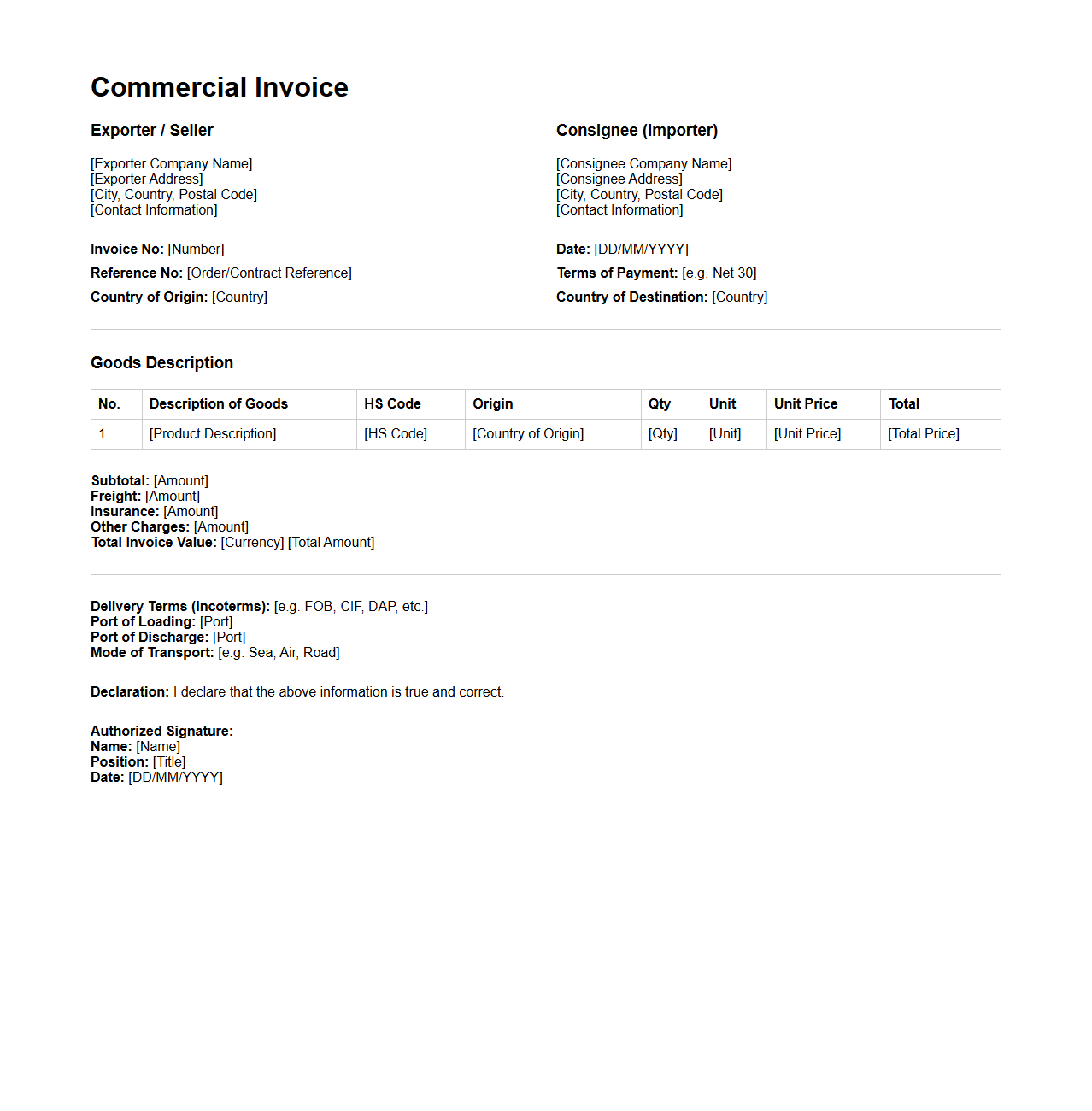

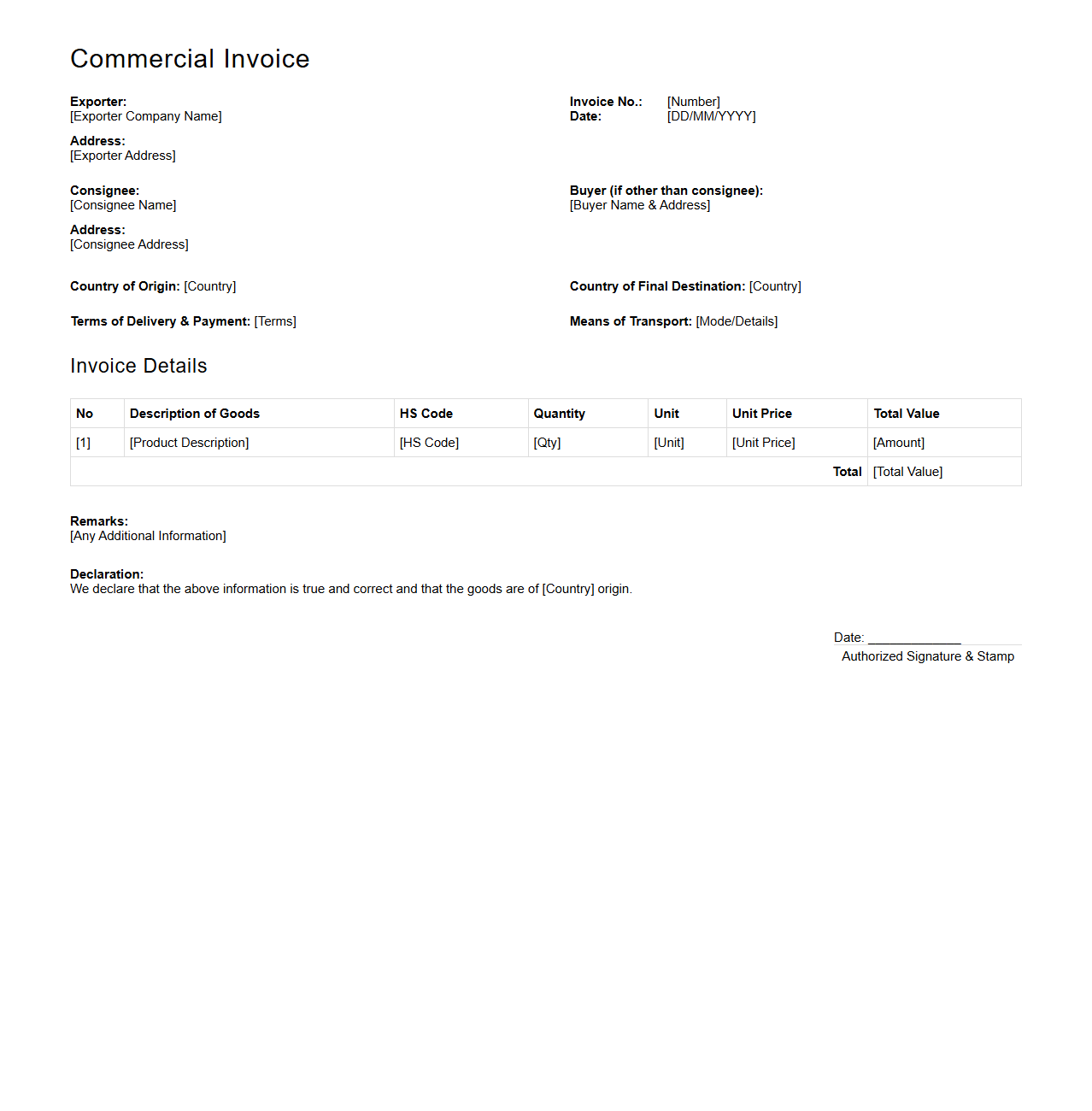

Customs Commercial Invoice Format for Export

A

Customs Commercial Invoice Format is a standardized document used in international trade to detail the transaction between the exporter and the importer. It includes essential information such as the description of goods, quantities, unit prices, total value, currency, shipping details, and the country of origin. This document facilitates customs clearance by providing authorities with accurate data to assess duties, taxes, and compliance with import regulations.

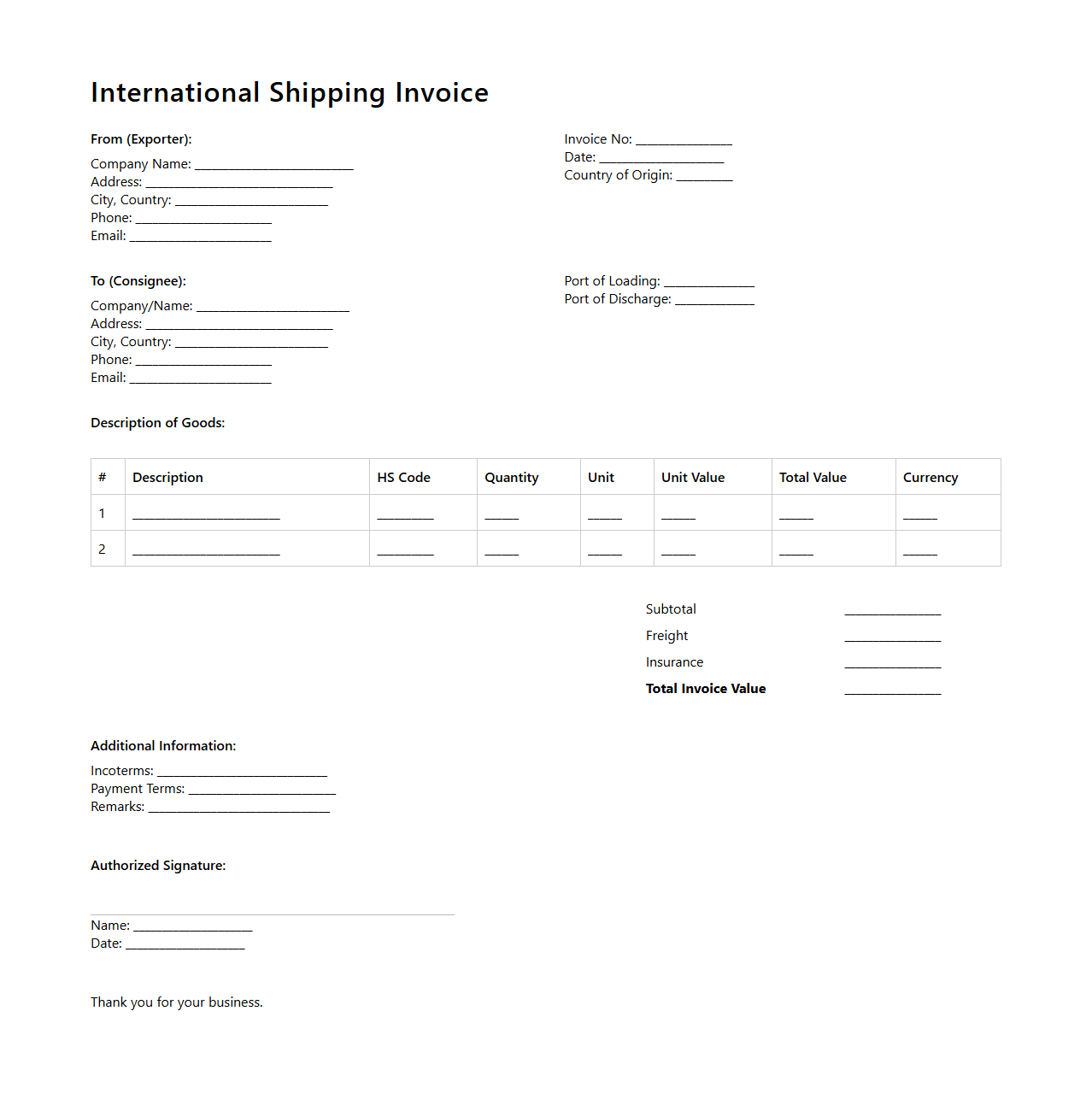

International Shipping Invoice Example

An

International Shipping Invoice Example document serves as a detailed record of goods being transported across borders, outlining product descriptions, quantities, unit prices, total value, and shipping information. It facilitates customs clearance, ensures compliance with international trade regulations, and helps calculate duties and taxes. This invoice is essential for verifying shipment contents and streamlining the global logistics process.

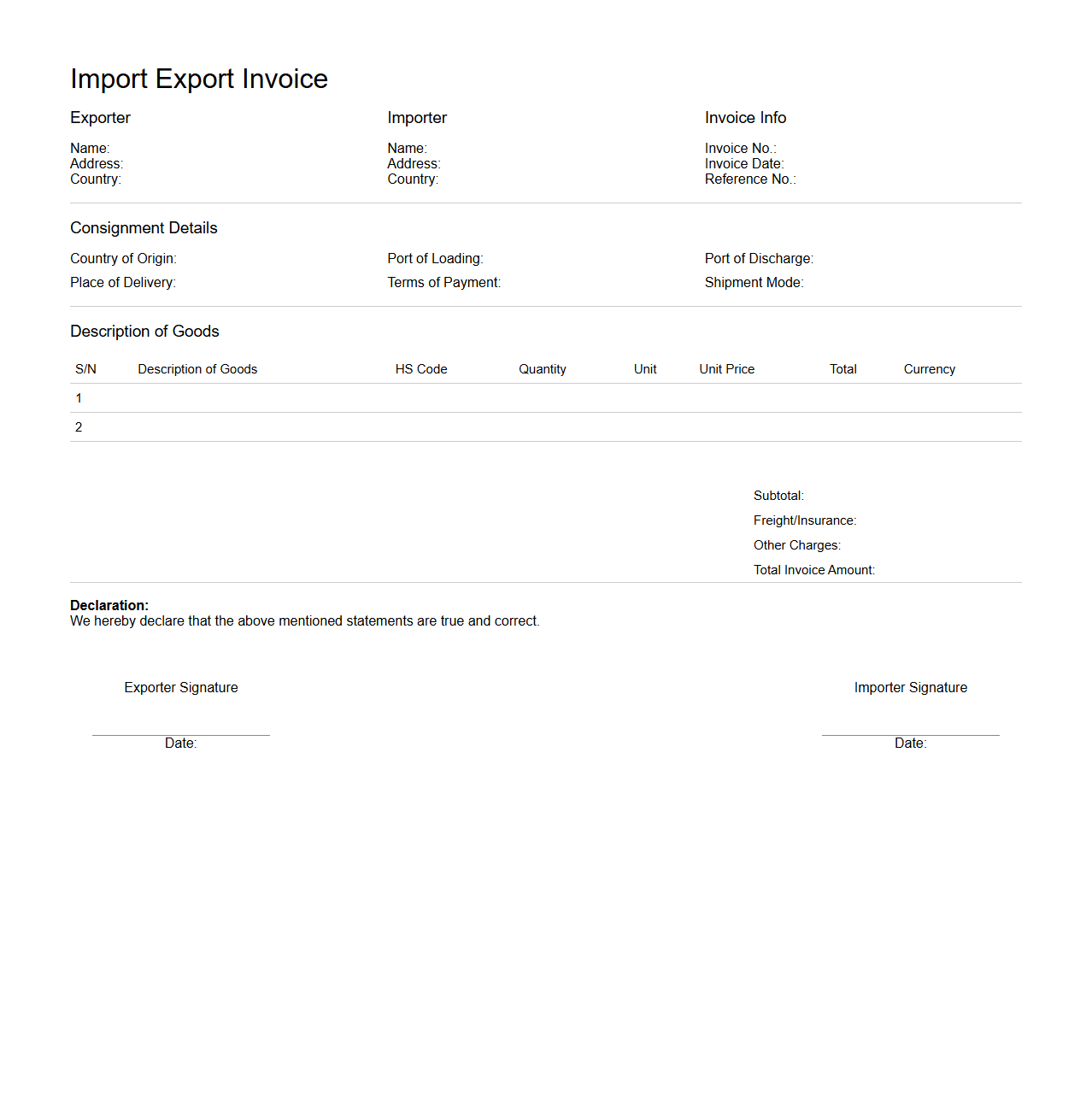

Import Export Invoice Sample Form

An

Import Export Invoice Sample Form document serves as a standardized template outlining the details of a commercial transaction between a buyer and seller across international borders. It includes essential information such as product description, quantity, price, shipping terms, and payment conditions, which facilitates customs clearance and financial reconciliation. This document ensures transparency, accuracy, and compliance with international trade regulations.

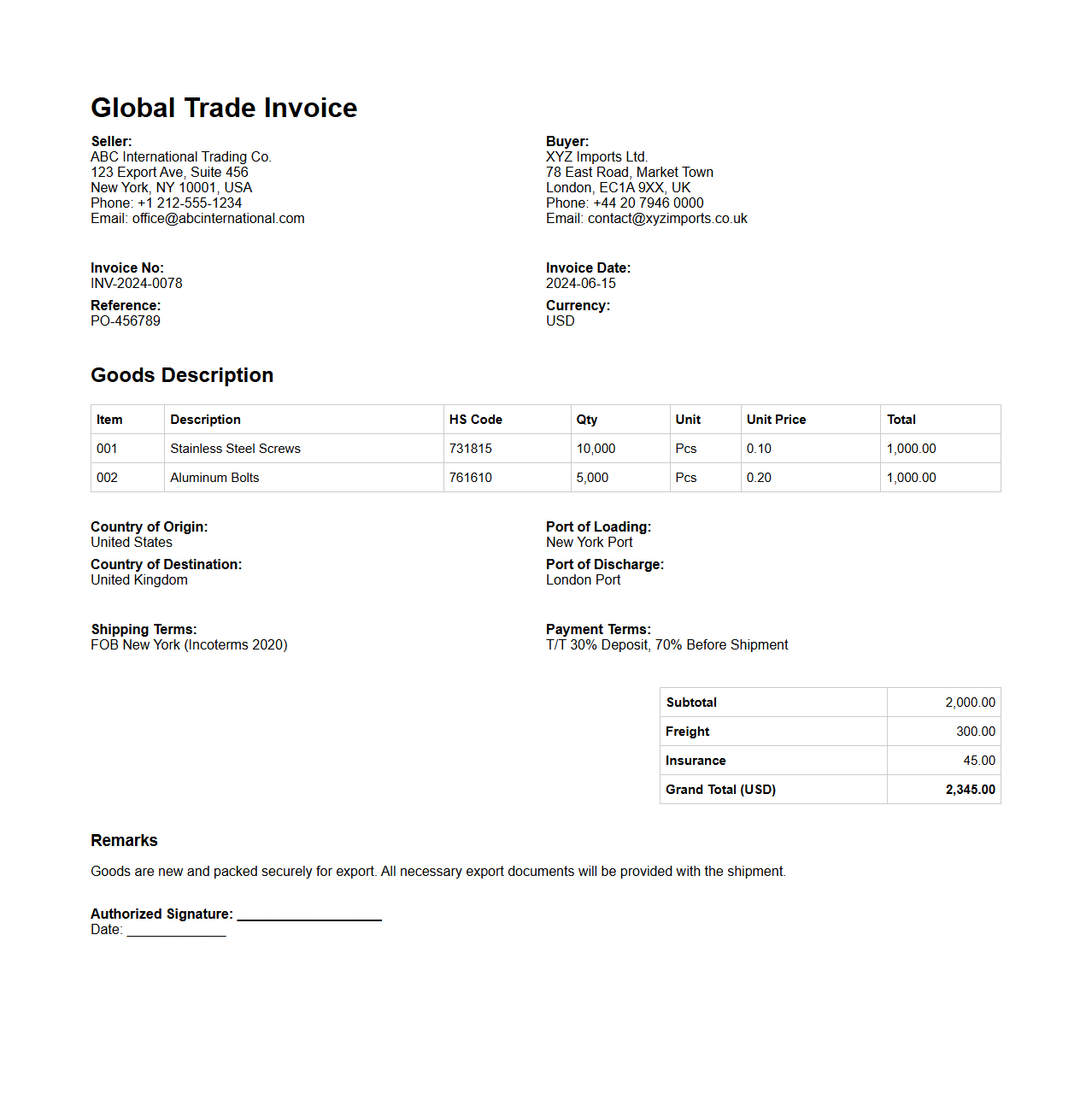

Global Trade Invoice Document Example

A

Global Trade Invoice Document Example provides a standardized template illustrating the essential components required for international commercial transactions, including buyer and seller details, product descriptions, quantities, prices, and payment terms. This document is crucial for customs clearance, tax calculations, and ensuring compliance with global trade regulations. Businesses use such examples to accurately prepare invoices that facilitate smooth cross-border trade and avoid shipment delays.

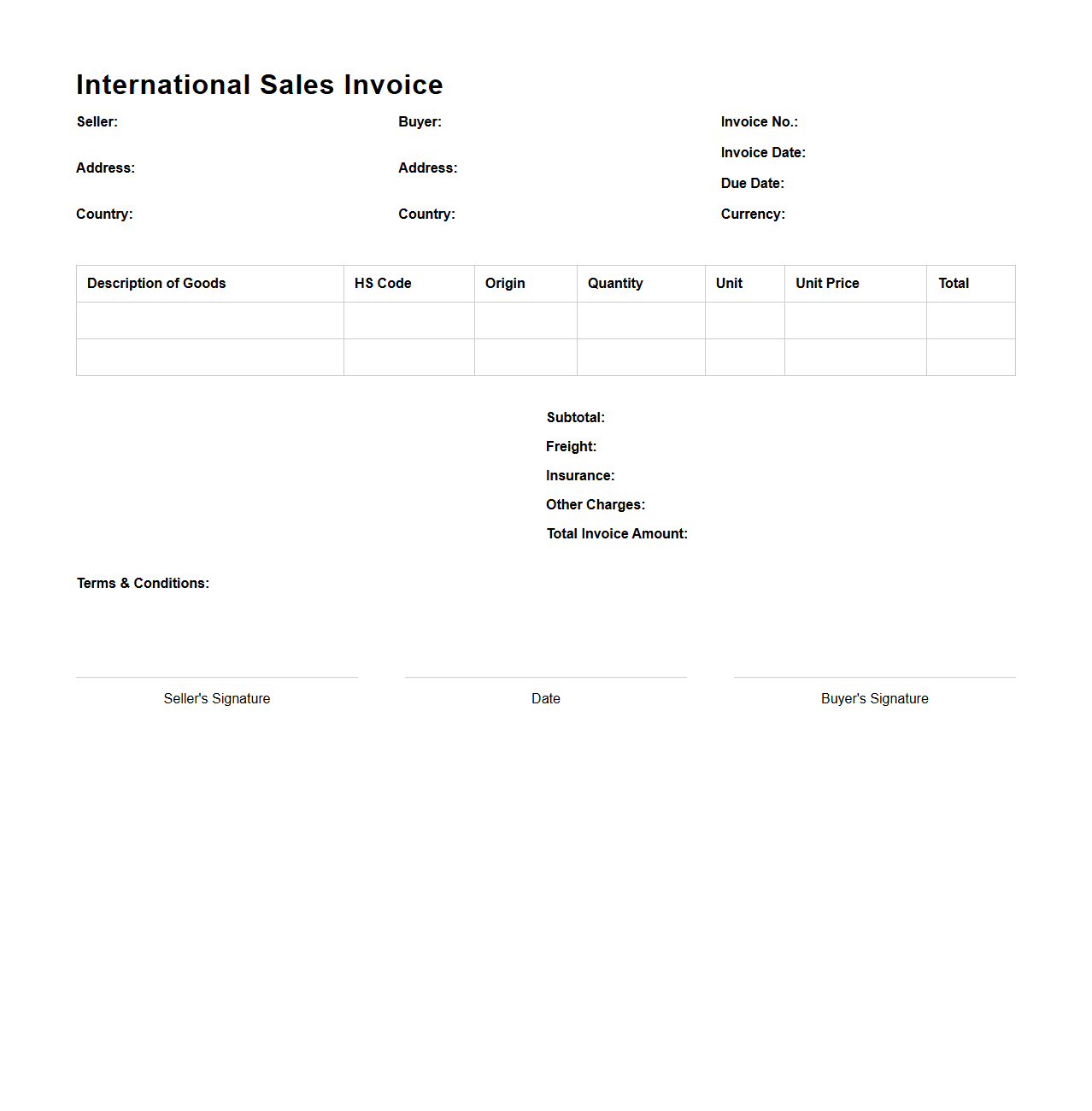

International Sales Invoice Layout

An

International Sales Invoice Layout document outlines the structured format used to detail the sale of goods or services across borders. It includes essential information such as seller and buyer details, product descriptions, quantities, prices, currency, payment terms, and shipping information to ensure clarity and compliance with international trade regulations. This layout facilitates accurate billing, customs clearance, and smooth financial transactions between global business partners.

Cross-Border Commercial Invoice Structure

A Cross-Border Commercial Invoice Structure document serves as a standardized format detailing the transaction between the seller and buyer in international trade. It includes critical elements such as product description, quantity, value, origin, and terms of sale to ensure compliance with customs regulations and facilitate smooth customs clearance. This

document is essential for accurate tariff classification, customs duty assessment, and provides proof of transaction for cross-border shipments.

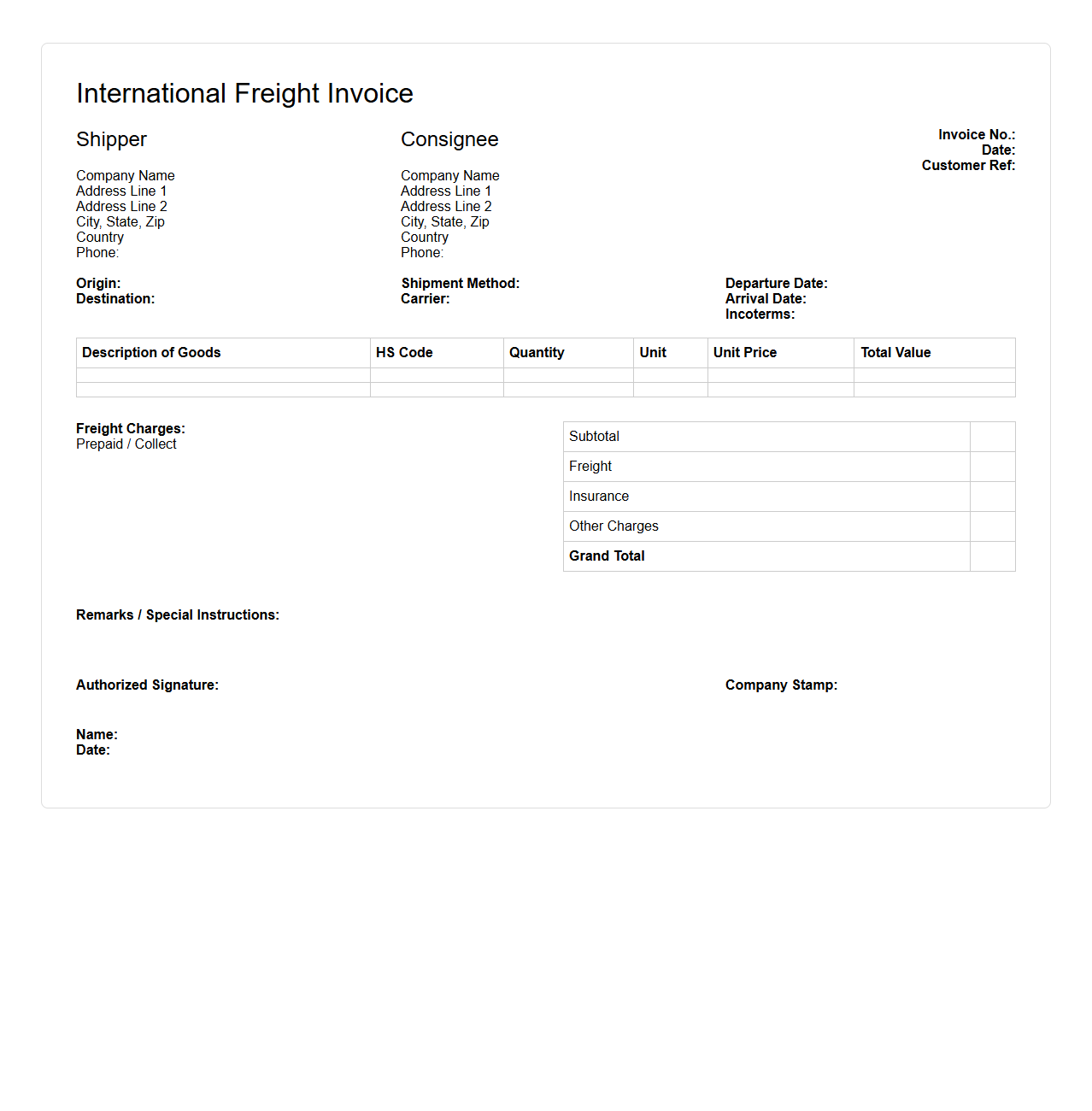

International Freight Invoice Sample

An

International Freight Invoice Sample document outlines the detailed charges associated with the shipment of goods across international borders, including freight costs, handling fees, and customs duties. This document serves as a key reference for verifying payment amounts, ensuring compliance with international trade regulations, and facilitating smooth customs clearance. Accurate freight invoices help businesses manage logistics expenses and maintain transparent financial records.

Export Documentation Commercial Invoice Template

The

Export Documentation Commercial Invoice Template is a crucial document used in international trade to itemize goods sold and shipped by an exporter to a buyer in another country. It details product descriptions, quantities, prices, payment terms, and shipment information, serving as a legal proof of sale and facilitating customs clearance. This template ensures accuracy and consistency, reducing delays in export transactions and compliance with regulatory requirements.

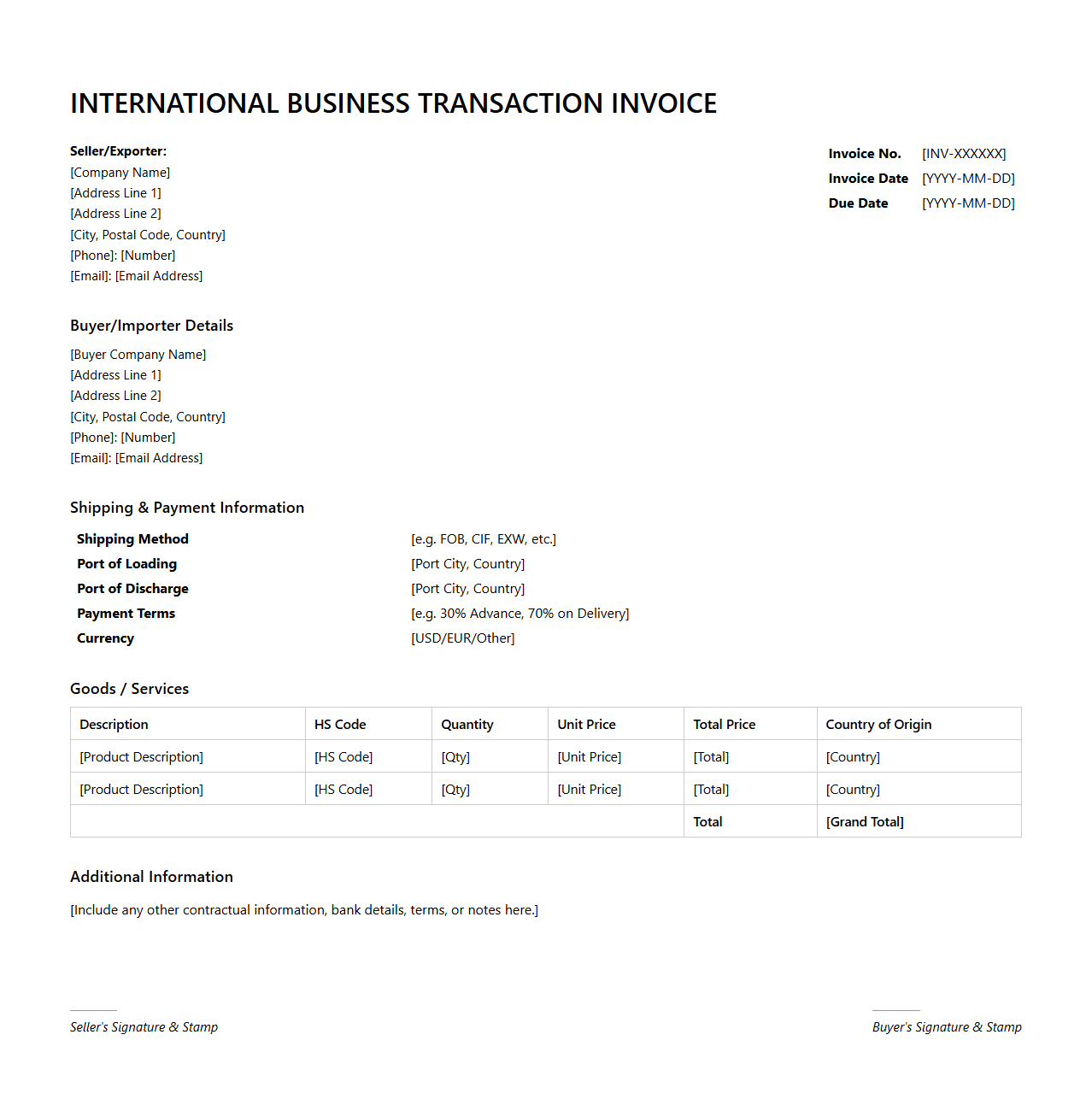

International Business Transaction Invoice Model

An

International Business Transaction Invoice Model document standardizes the invoicing process for cross-border trade by outlining essential details such as buyer and seller information, product descriptions, quantities, prices, payment terms, and shipping instructions. This ensures clear communication and compliance with international trade regulations, minimizing discrepancies and facilitating smoother customs clearance. Utilizing such a model enhances accuracy, transparency, and efficiency in global commercial transactions.

What essential information identifies the parties involved in this commercial invoice document?

The parties involved are identified through the seller's and buyer's names and addresses. This includes the exporter and importer contact details, ensuring clear accountability. Accurate identification is critical for legal and logistical accuracy in international trade.

Which sections specify the description, quantity, and value of the goods being shipped?

The invoice contains a detailed goods description section listing each item, including quantity and unit price. This area also summarizes the total value of the shipment for clarity. Such details are essential for customs and shipment verification.

How does the document indicate terms of payment and shipment for international trade compliance?

The invoice outlines the payment terms specifying methods and deadlines to ensure prompt processing. It also states the shipment terms like Incoterms to clarify responsibilities between buyer and seller. These sections minimize misunderstandings and support compliance with trade laws.

Where are the details of taxes, duties, and currency clearly stated in the invoice sample?

Details of taxes, duties, and currency are prominently displayed near the total amount due section. This ensures transparency regarding additional costs and the currency used in the transaction. Proper declaration aids customs clearance and financial accuracy.

What fields on the sample ensure alignment with customs regulations and international trade standards?

The invoice includes fields for HS codes, country of origin, and export control information to comply with customs regulations. Additionally, official signatures and invoice numbers strengthen traceability. These details guarantee adherence to international trade standards.