A End-of-Day Reconciliation Document Sample for Retail Finance provides a structured template to accurately match daily sales with recorded transactions, ensuring financial accuracy. This document helps identify discrepancies between cash, credit card payments, and sales records, streamlining audit processes. Retail managers rely on this tool to maintain accountability and improve cash flow management.

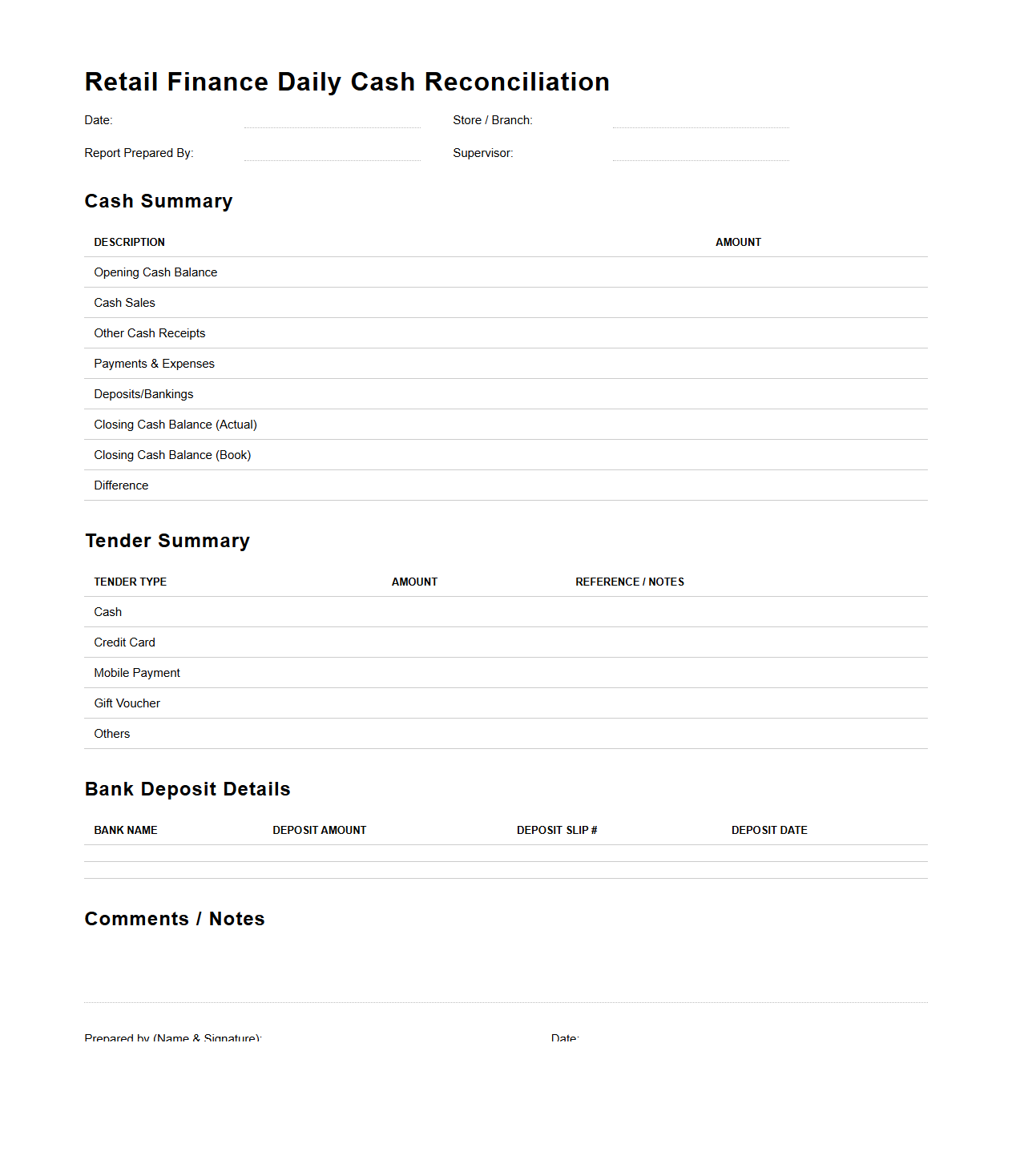

Retail Finance Daily Cash Reconciliation Report Template

The

Retail Finance Daily Cash Reconciliation Report Template document is designed to systematically track and verify daily cash transactions within retail operations. This template helps finance teams identify discrepancies between recorded sales and actual cash on hand, ensuring accurate financial reporting and preventing cash losses. By organizing data such as opening balance, sales totals, cash receipts, and discrepancies, it supports efficient cash management and accountability.

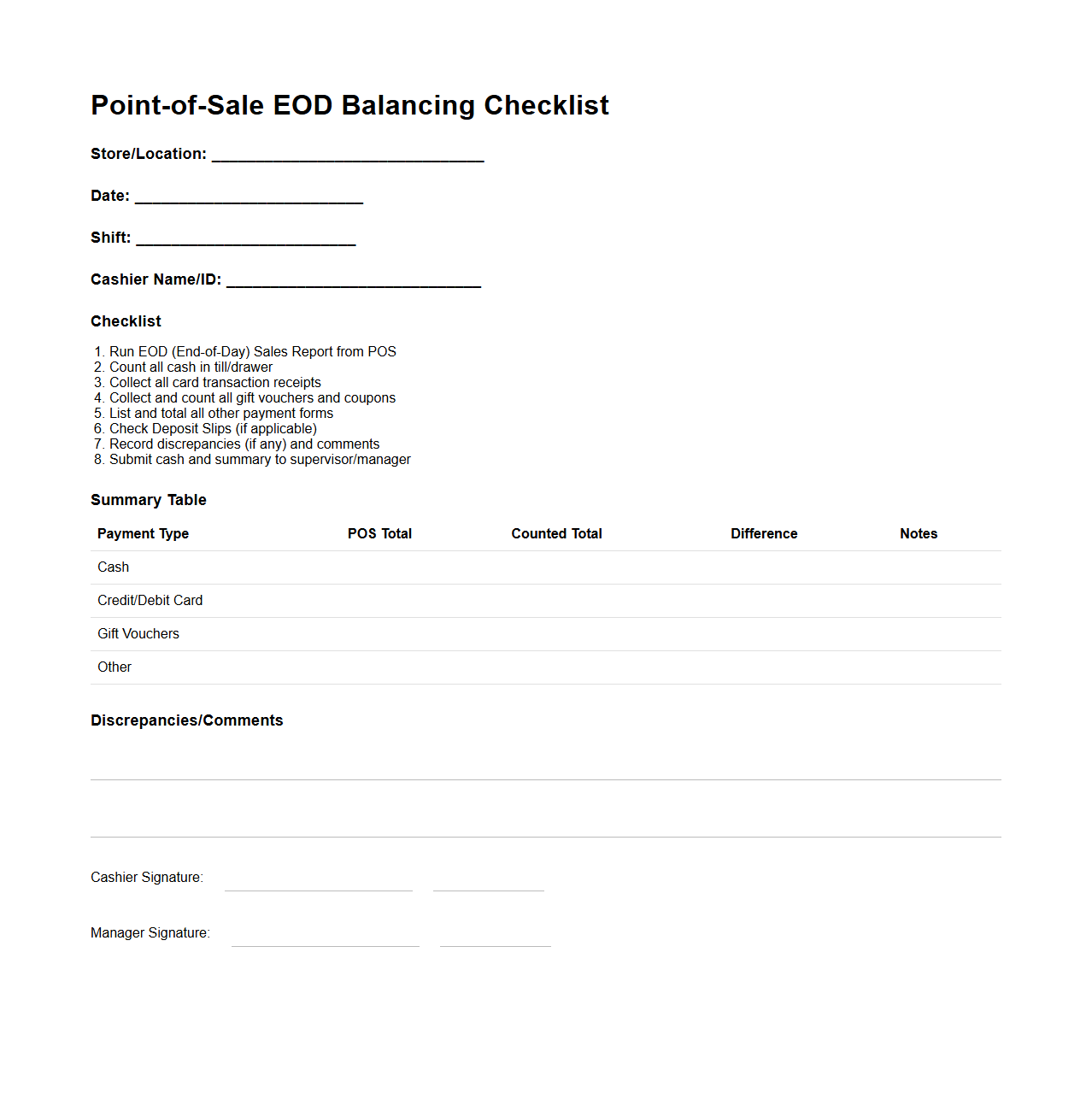

Point-of-Sale EOD Balancing Checklist Example

The Point-of-Sale EOD Balancing Checklist Example document provides a structured framework to ensure accurate reconciliation of daily sales transactions and cash drawer amounts at the end of each business day. It includes key items such as verifying cash totals, credit card receipts, and sales reports against the cash register data to detect discrepancies and prevent financial errors. This checklist is essential for maintaining

financial integrity and streamlining the closing process in retail or hospitality environments.

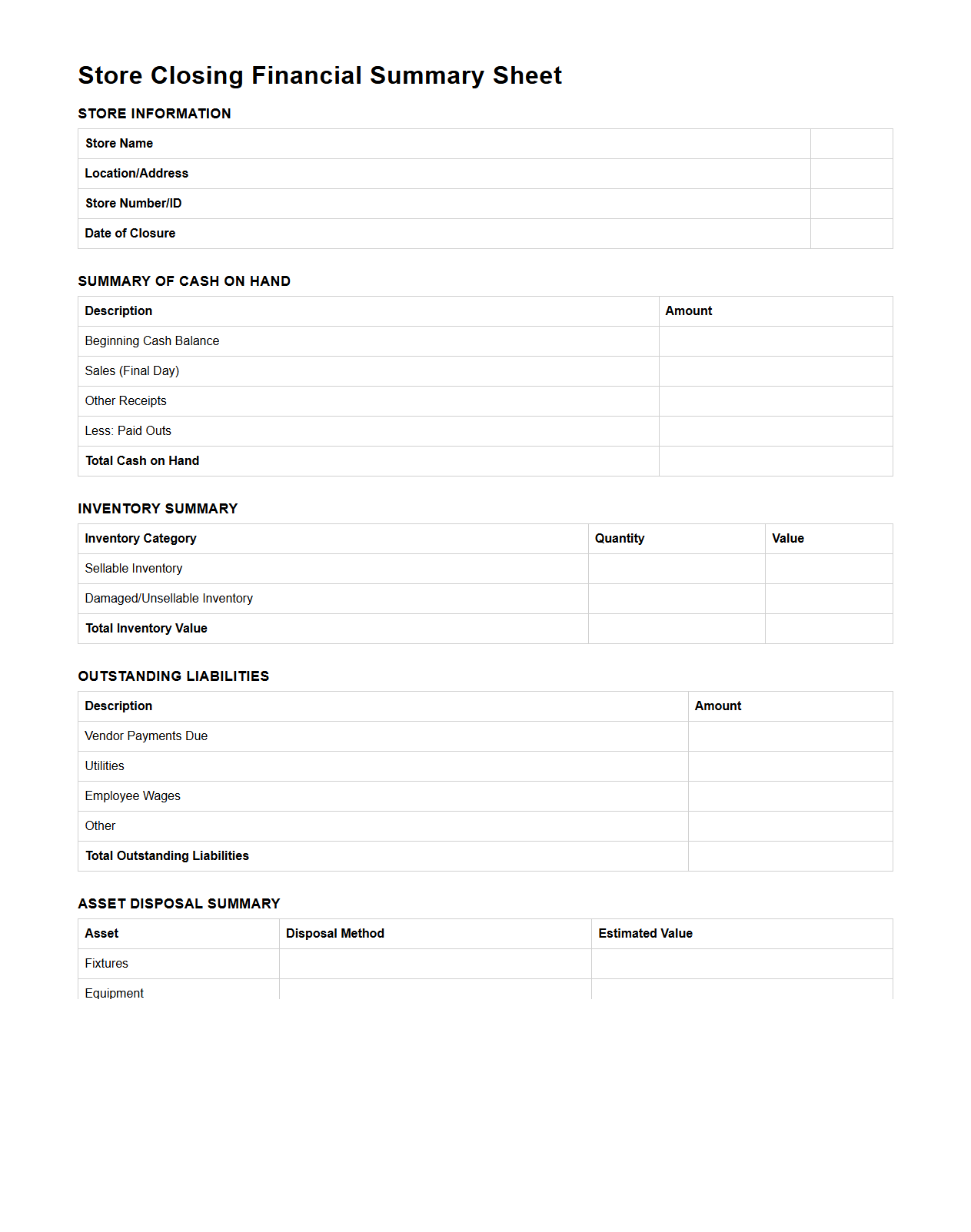

Store Closing Financial Summary Sheet Sample

A

Store Closing Financial Summary Sheet Sample document provides a detailed overview of all financial transactions and accounts related to the closing of a retail store. It includes key data such as final sales figures, outstanding expenses, asset liquidation values, and any liabilities or debts to be resolved. This summary assists stakeholders in understanding the store's financial position at closing and guides decision-making for final settlements.

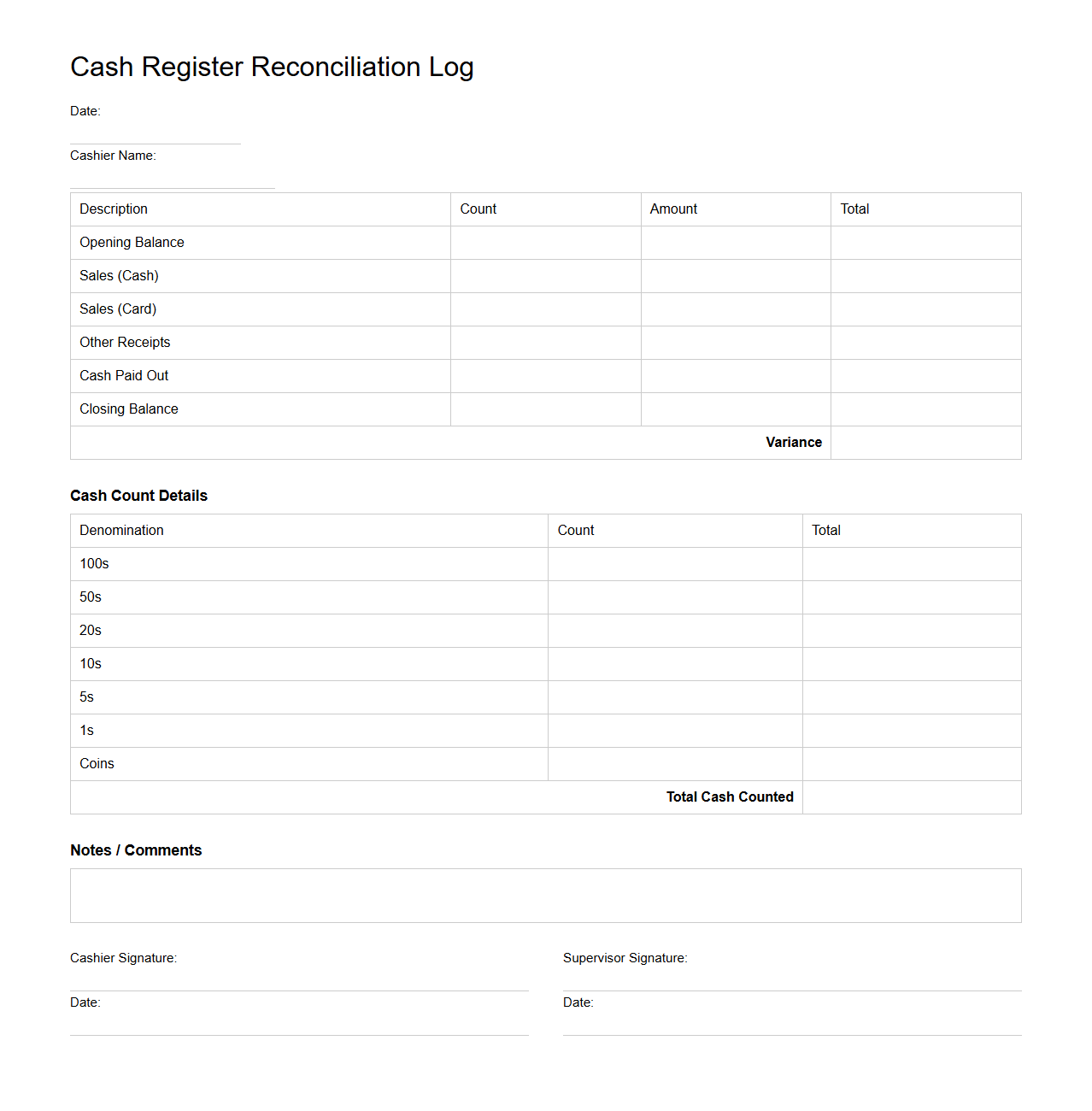

Cash Register Reconciliation Log Format

A

Cash Register Reconciliation Log Format document is a structured record used to verify and balance cash transactions processed through a cash register. It details daily sales, cash inflows and outflows, discrepancies, and final cash totals to ensure accuracy and accountability in financial management. This log format helps businesses maintain transparent records and simplifies audit processes.

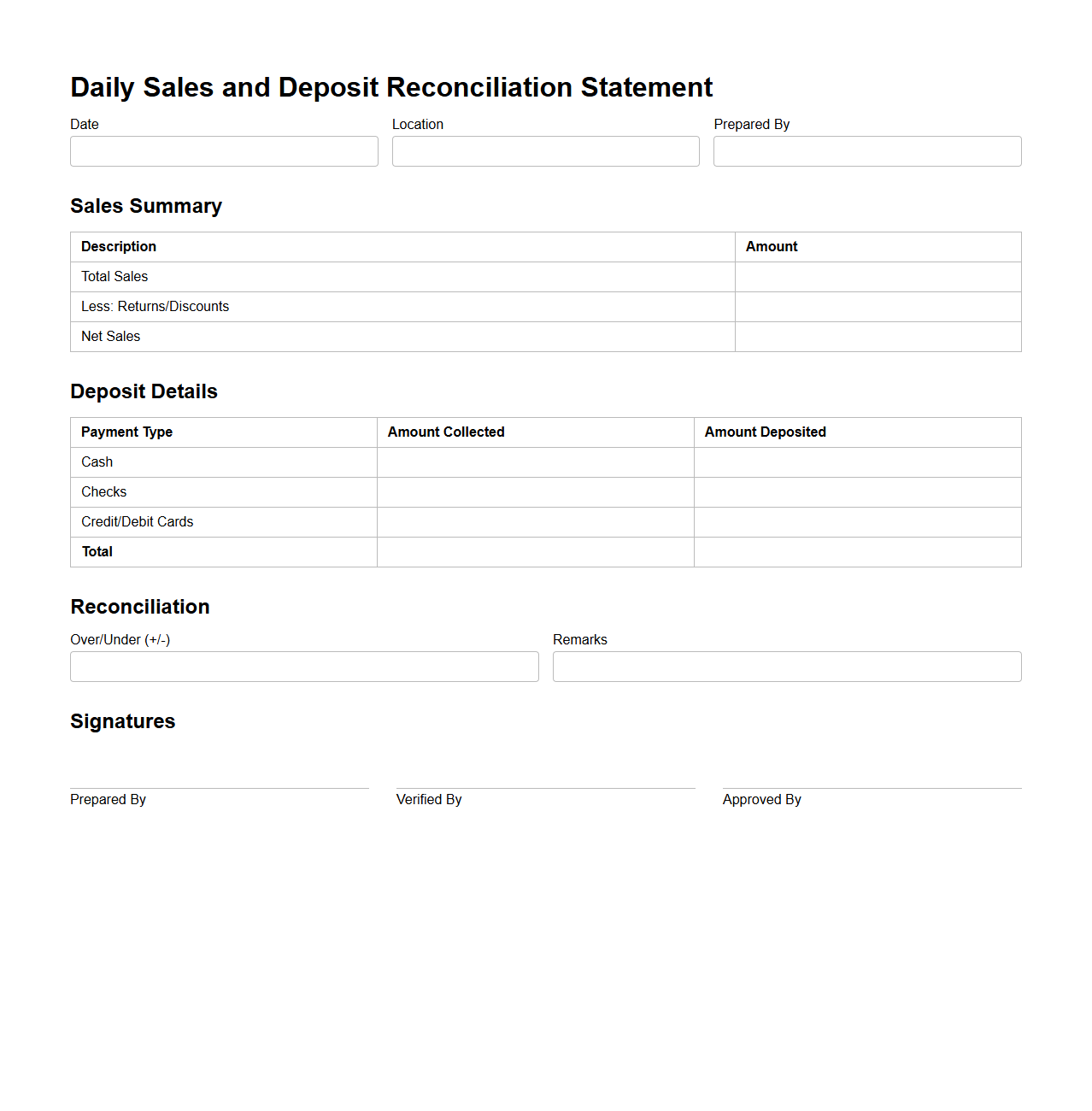

Daily Sales and Deposit Reconciliation Statement

The

Daily Sales and Deposit Reconciliation Statement is a financial document that tracks and verifies daily sales transactions against bank deposits to ensure accuracy and prevent discrepancies. It systematically compares point-of-sale data with bank statements, highlighting any inconsistencies for further investigation. This statement is crucial for maintaining transparent financial records and supporting effective cash flow management.

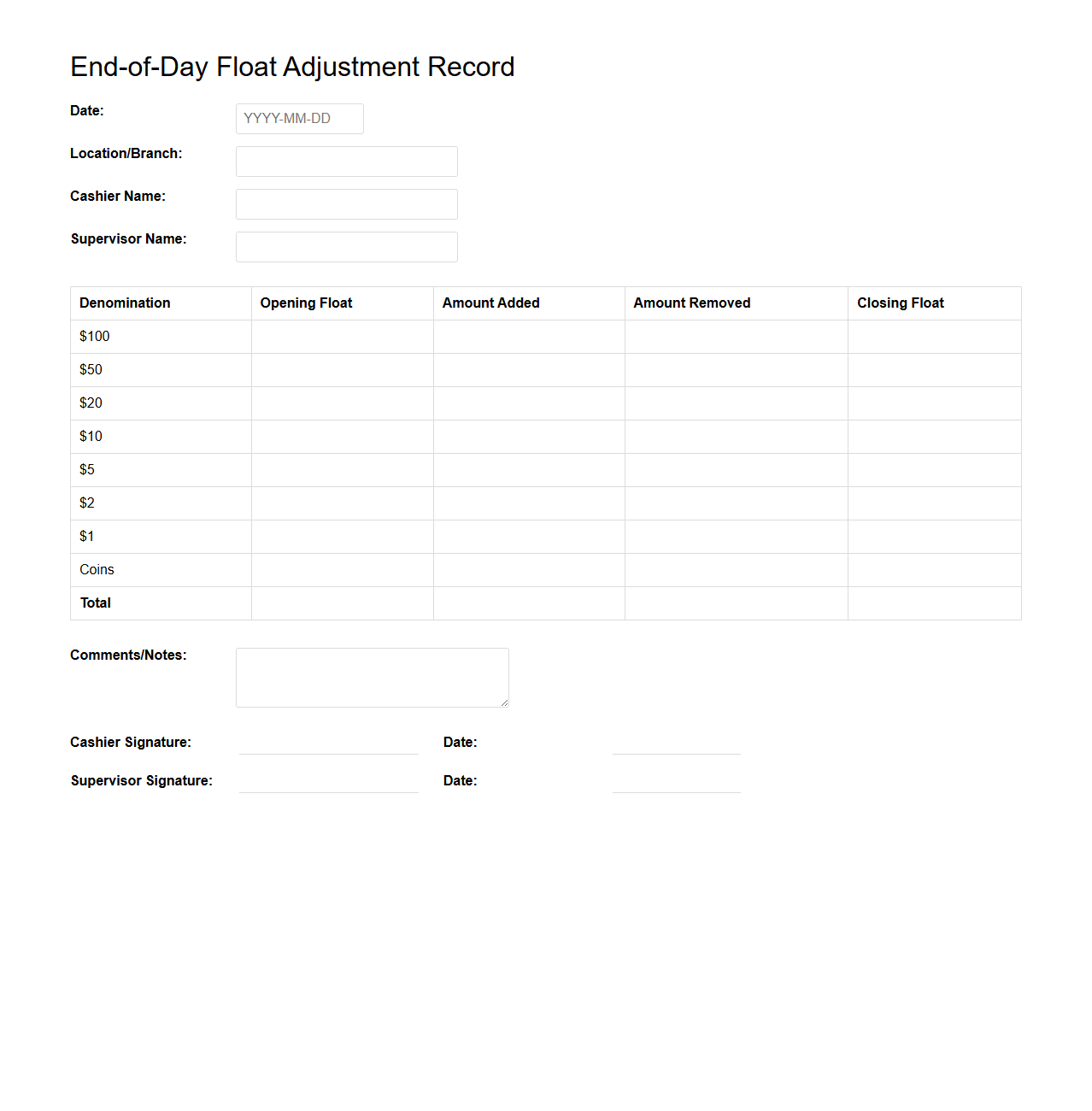

End-of-Day Float Adjustment Record

The

End-of-Day Float Adjustment Record document tracks discrepancies between expected and actual cash float amounts at the close of business. It ensures accurate reconciliation of cash transactions by documenting any adjustments needed due to errors, overages, or shortages. This record is essential for maintaining financial accountability and preventing discrepancies in daily cash handling processes.

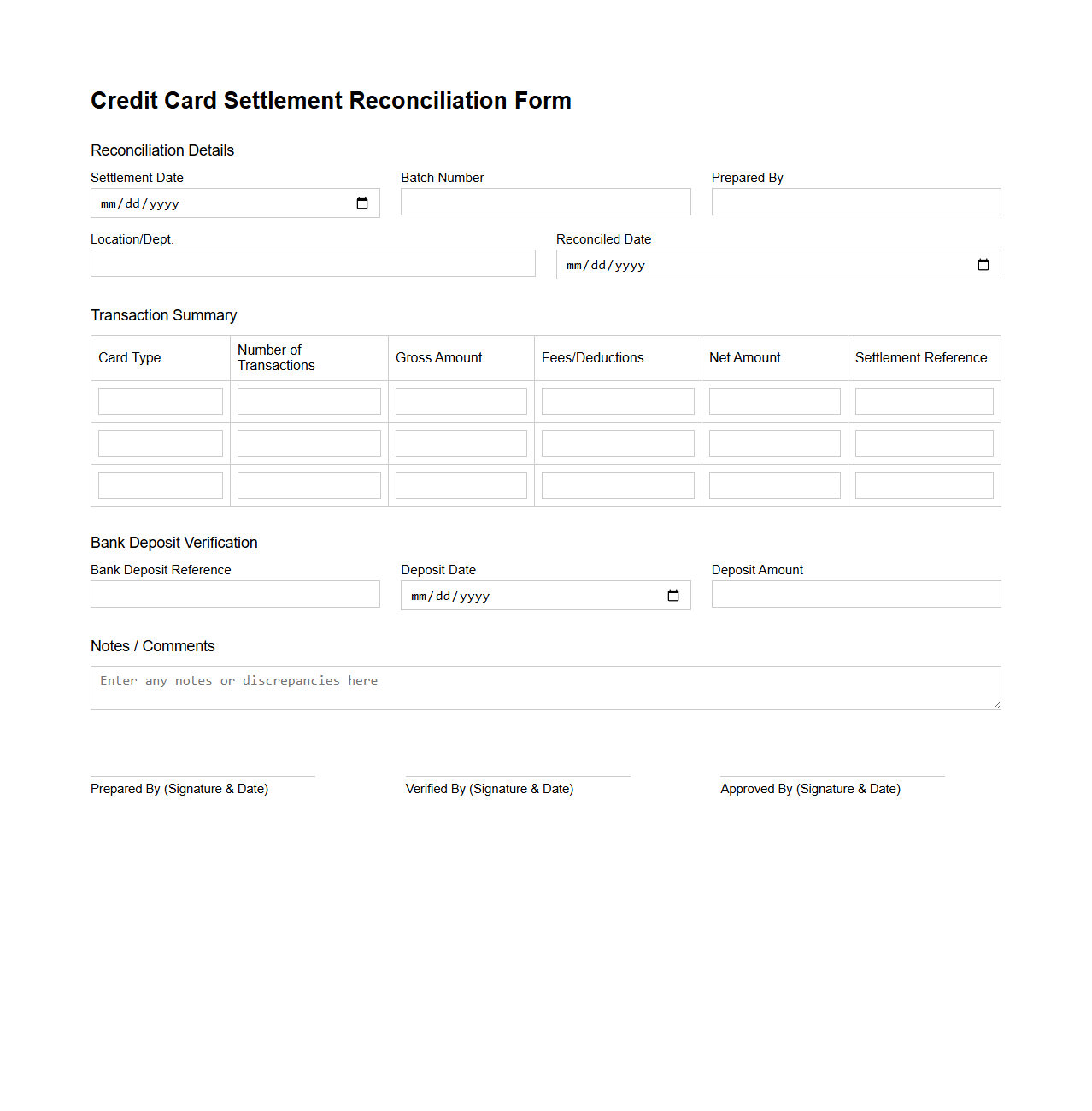

Credit Card Settlement Reconciliation Form

A

Credit Card Settlement Reconciliation Form is a financial document used to match credit card payment transactions with corresponding settlement amounts received by a business. It helps identify discrepancies between the amounts charged to customers and the funds deposited by payment processors, ensuring accurate accounting records. This form is essential for maintaining transparency and resolving any payment disputes efficiently.

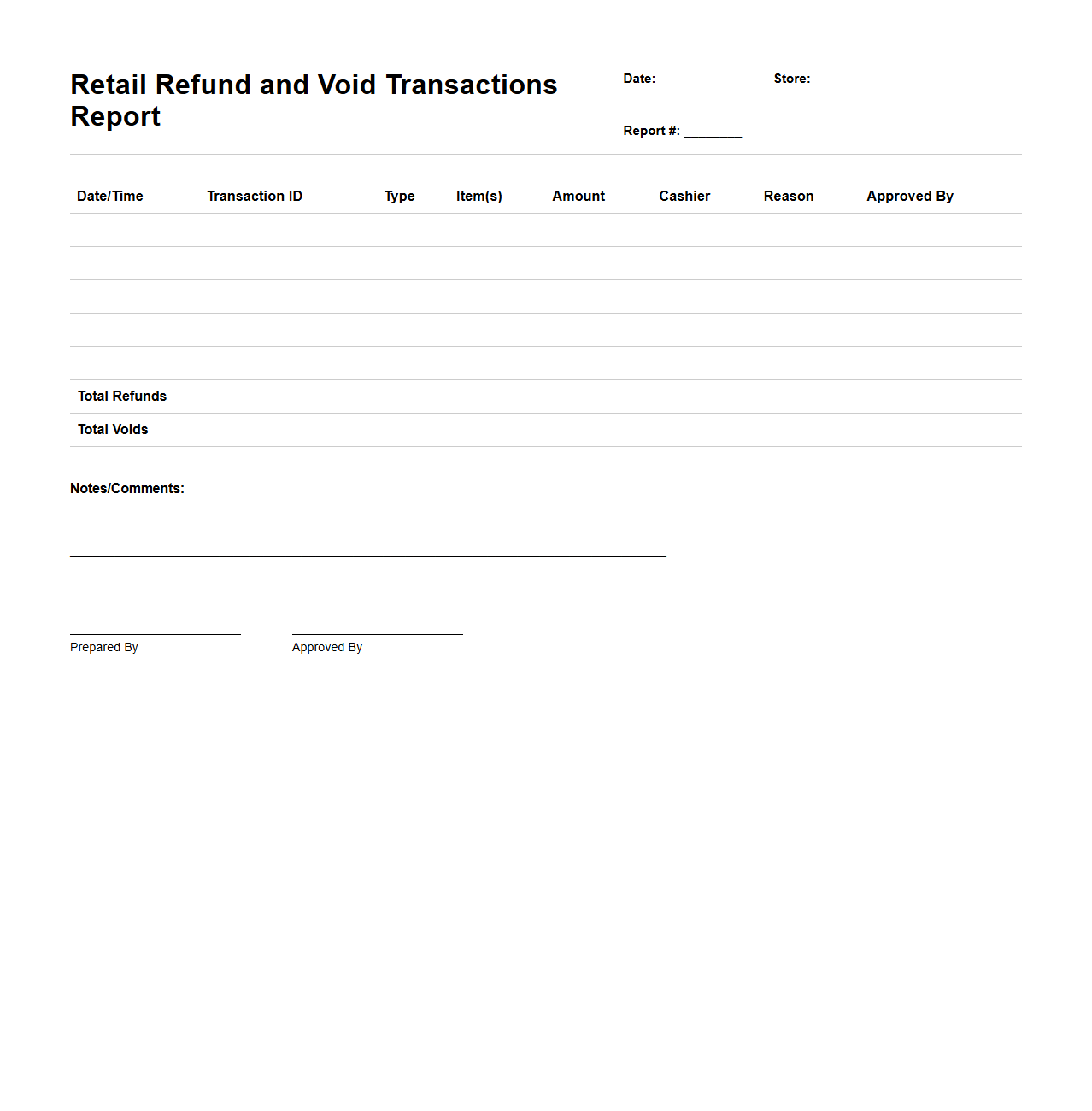

Retail Refund and Void Transactions Report

The

Retail Refund and Void Transactions Report is a detailed document that tracks all customer refunds and voided sales within a specific period. It provides essential data on transaction reversals, helping businesses monitor discrepancies, identify potential fraud, and evaluate refund patterns. This report supports financial reconciliation and enhances accuracy in retail operations by offering clear insights into transaction adjustments.

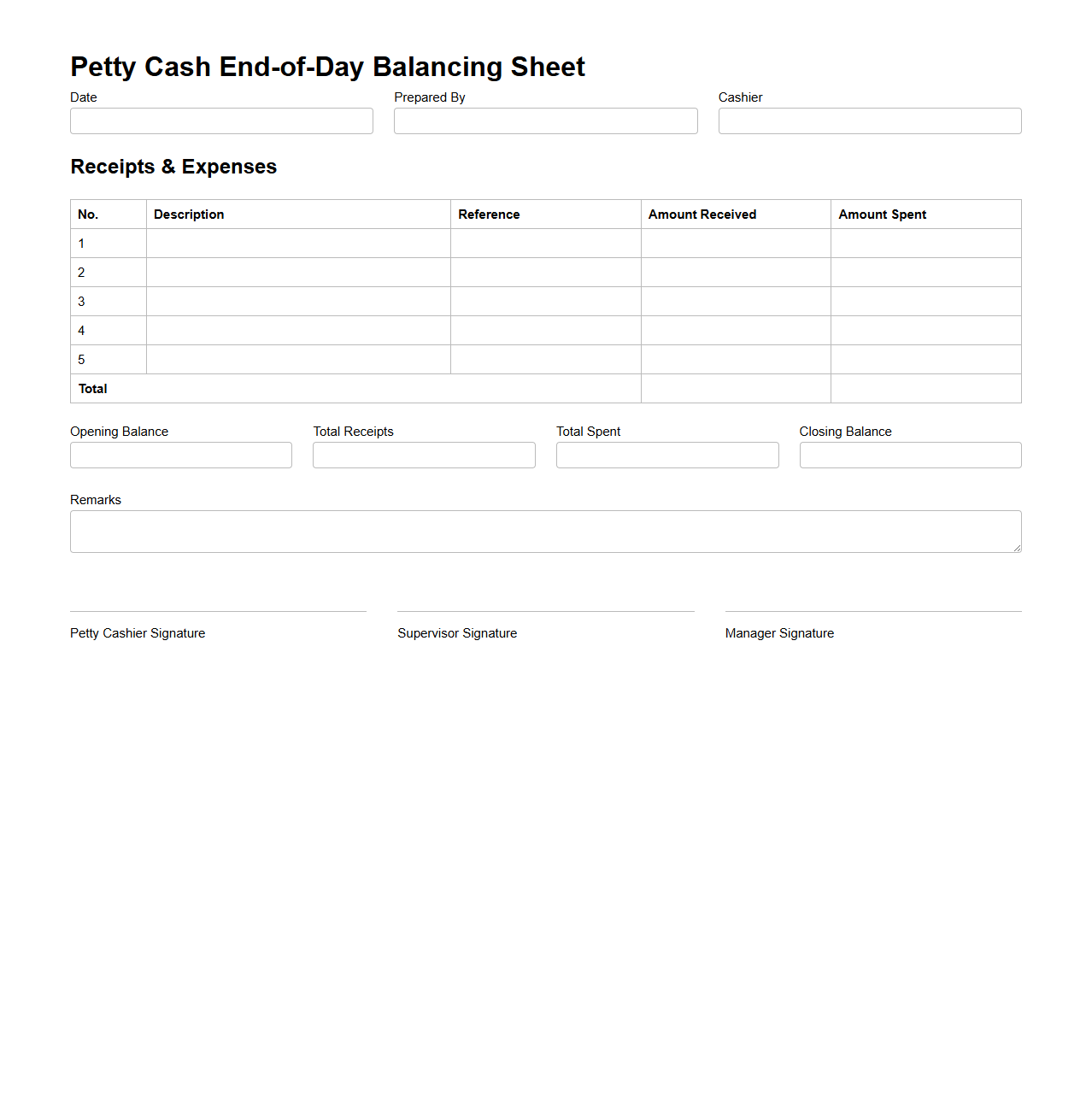

Petty Cash End-of-Day Balancing Sheet

The

Petty Cash End-of-Day Balancing Sheet document is a financial record used to reconcile small cash transactions made throughout the day. It details the starting cash balance, total expenses, receipts, and the closing cash amount to ensure accuracy and accountability. This sheet helps prevent discrepancies by verifying that the physical cash matches the recorded transactions at the end of each business day.

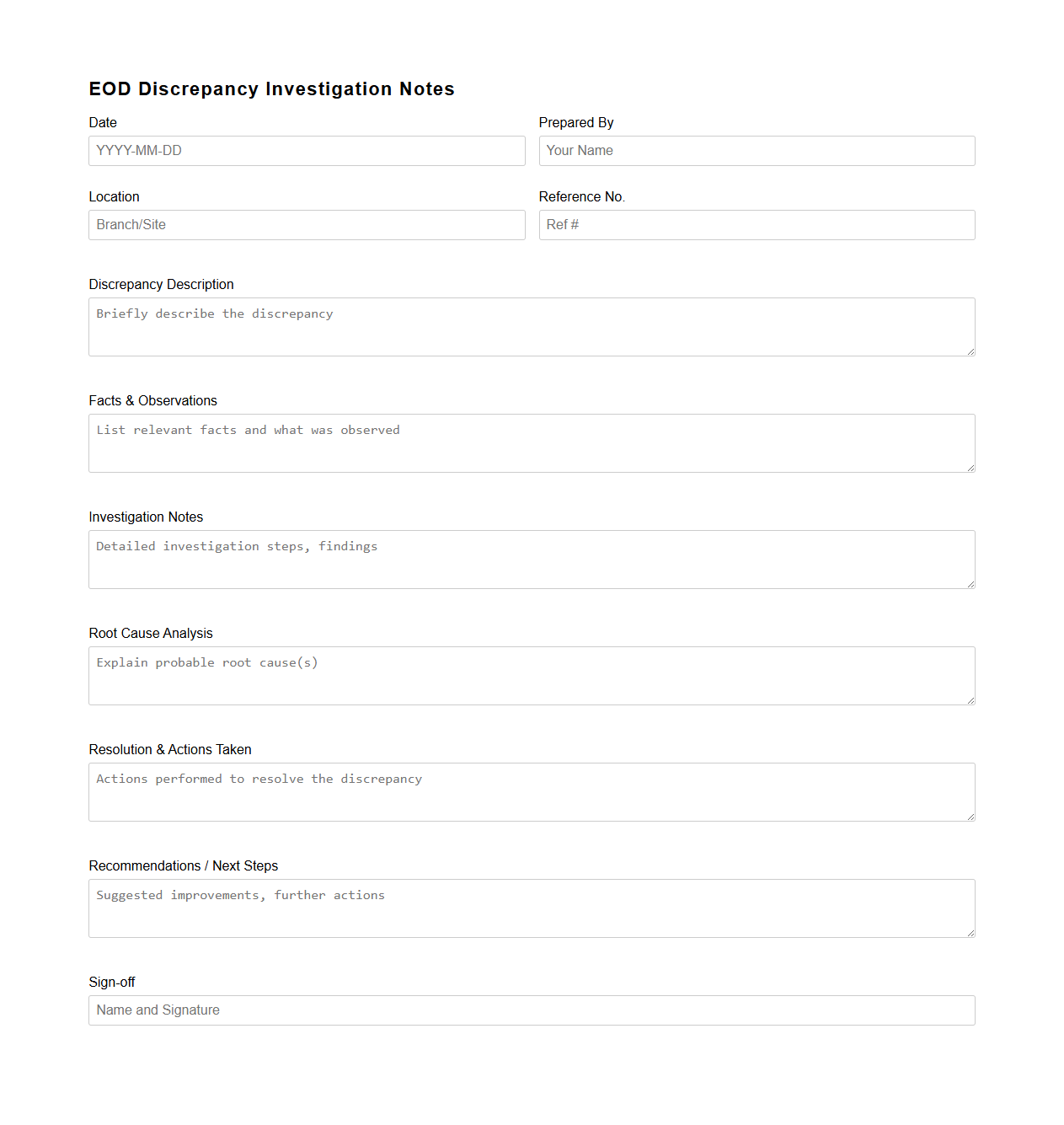

EOD Discrepancy Investigation Notes Template

The

EOD Discrepancy Investigation Notes Template document is designed to systematically capture and organize details related to end-of-day financial or operational discrepancies. It ensures accurate documentation of investigation findings, including identified issues, actions taken, and resolutions for future reference and audit purposes. This template enhances consistency and efficiency in tracking and resolving discrepancies across departments.

What transactions are included in the End-of-Day Reconciliation Document for retail finance operations?

The End-of-Day Reconciliation Document includes all cash transactions, credit card payments, and electronic fund transfers processed throughout the day. It also records sales, refunds, and any adjustments made to customer accounts. This comprehensive list ensures that every financial movement is tracked for accuracy and completeness.

How are discrepancies between expected and actual cash balances identified and documented?

Discrepancies are identified by comparing the expected cash balance based on recorded transactions with the actual cash counted at the end of the day. Any differences are flagged and documented in detail, including the suspected reasons and related transaction references. This documentation creates a clear audit trail for further investigation.

What procedure does the document outline for handling reconciliation variances?

The document requires immediate reporting of reconciliation variances to the finance supervisor or manager for review. It outlines steps for investigating the cause, including checking transaction records and cash handling processes. Corrective actions, such as adjustments or additional training, are then implemented to prevent future discrepancies.

Which roles or departments are responsible for approving and verifying the contents of the reconciliation document?

The approval and verification responsibilities primarily lie with the retail finance department and the internal audit team. Store managers also play a key role in initial verification before submission. This segregation of duties ensures accountability and reduces the risk of errors or fraudulent activities.

How does the document ensure compliance with internal controls and financial reporting standards?

The reconciliation document follows strict internal control procedures by requiring multiple levels of review and authorization. It is designed to align with applicable financial reporting standards, ensuring accurate and consistent financial records. Regular audits and compliance checks further reinforce adherence to these protocols.