A Cash Reconciliation Document Sample for Retail Cashier helps ensure accurate tracking of daily cash transactions by comparing recorded sales against actual cash on hand. This document typically includes sections for opening balance, sales receipts, cash withdrawals, and closing balance to detect discrepancies. Utilizing a standardized template improves accountability and simplifies the audit process for retail operations.

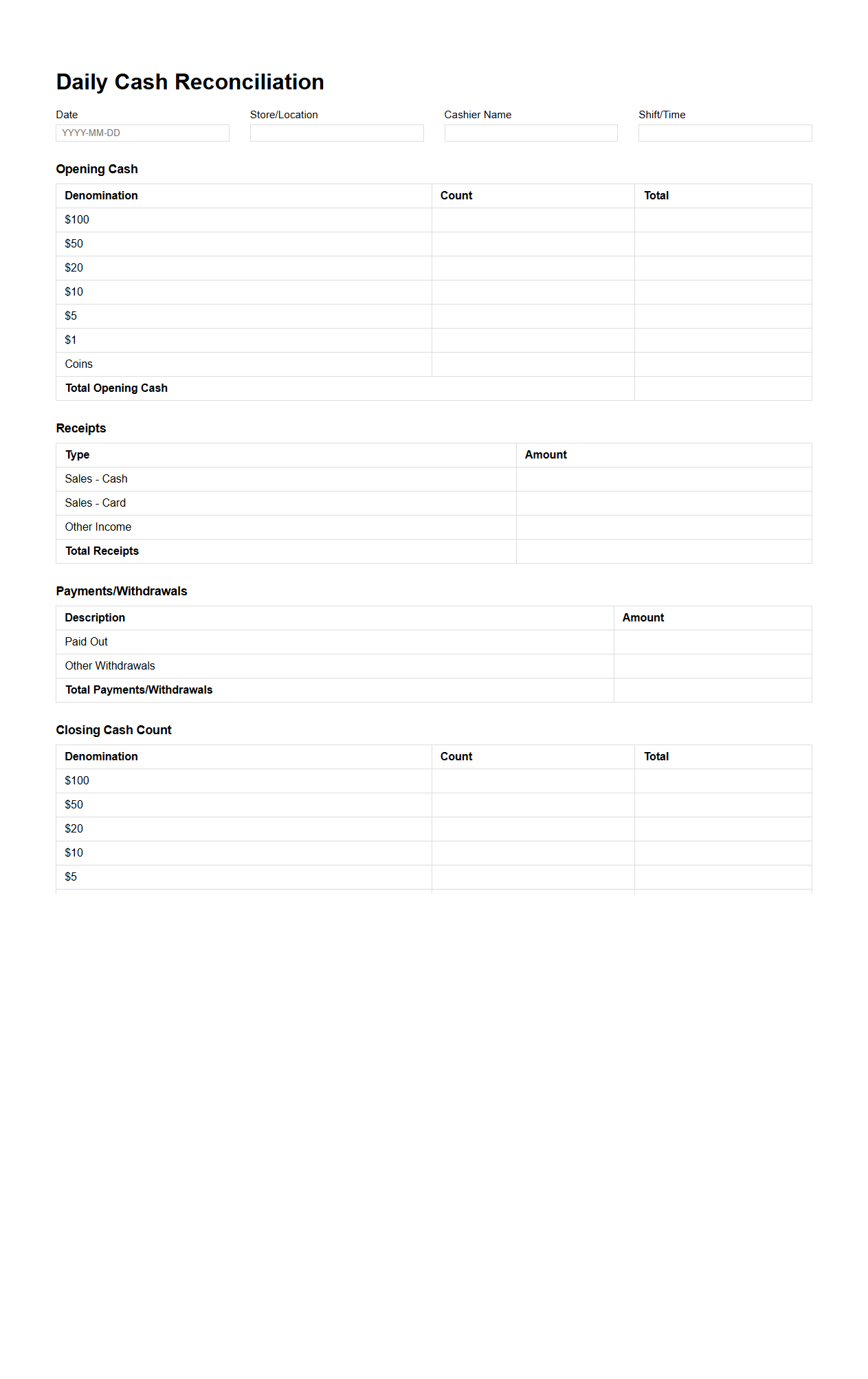

Daily Cash Reconciliation Template for Retail Cashiers

The

Daily Cash Reconciliation Template for retail cashiers is a structured document designed to accurately track and verify cash transactions at the end of each business day. It helps ensure that sales revenue matches the cash counted, minimizing discrepancies and enhancing financial accuracy. This template typically includes sections for recording sales totals, cash received, expenses, and any overages or shortages.

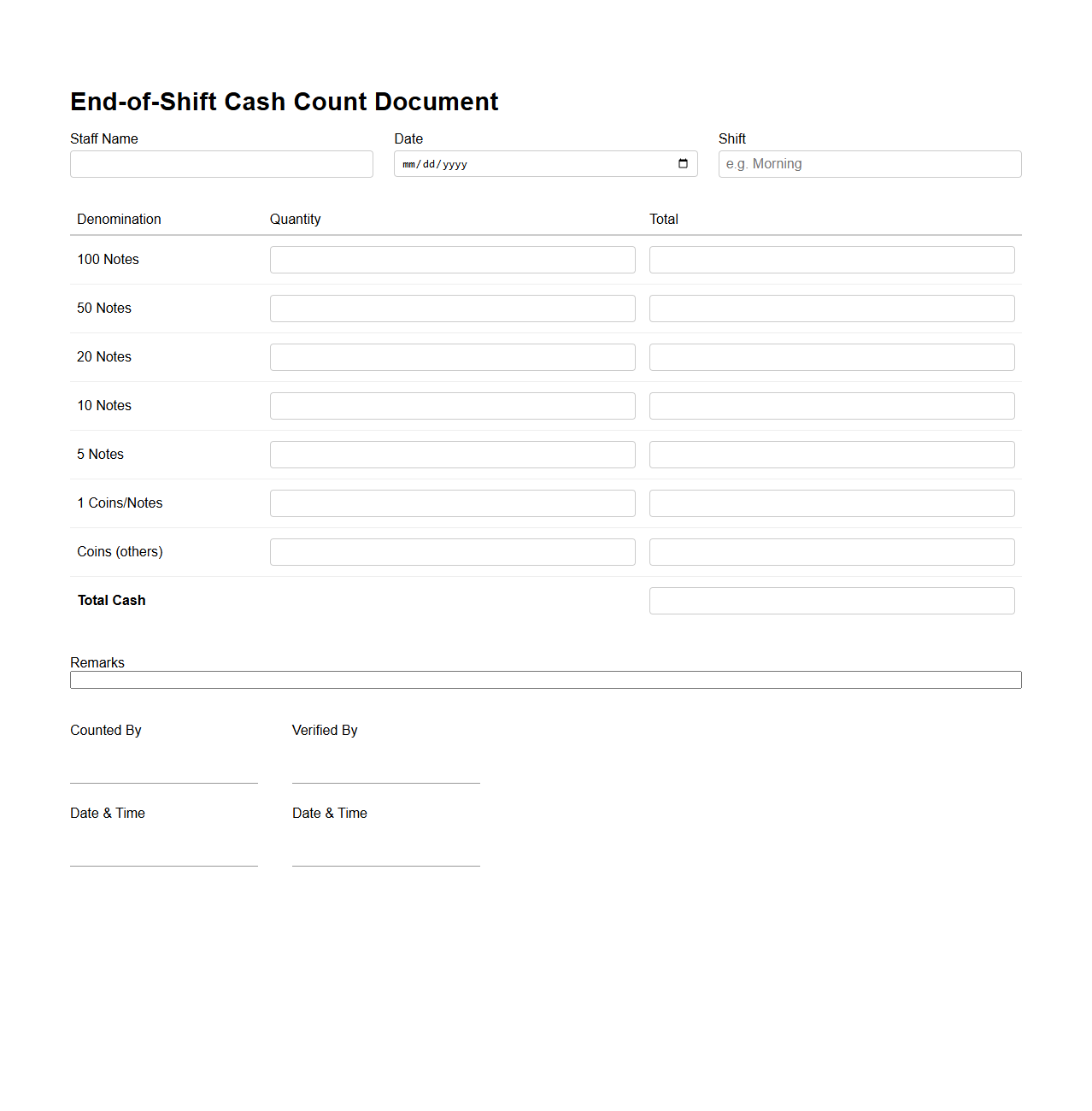

End-of-Shift Cash Count Document for Retail Staff

The

End-of-Shift Cash Count Document is a critical retail tool used to accurately record the total cash on hand at the conclusion of a staff member's shift. This document ensures financial accountability by detailing the cash received, change given, and any discrepancies noted during the shift. It supports audit trails and helps maintain transparent cash management processes for retail operations.

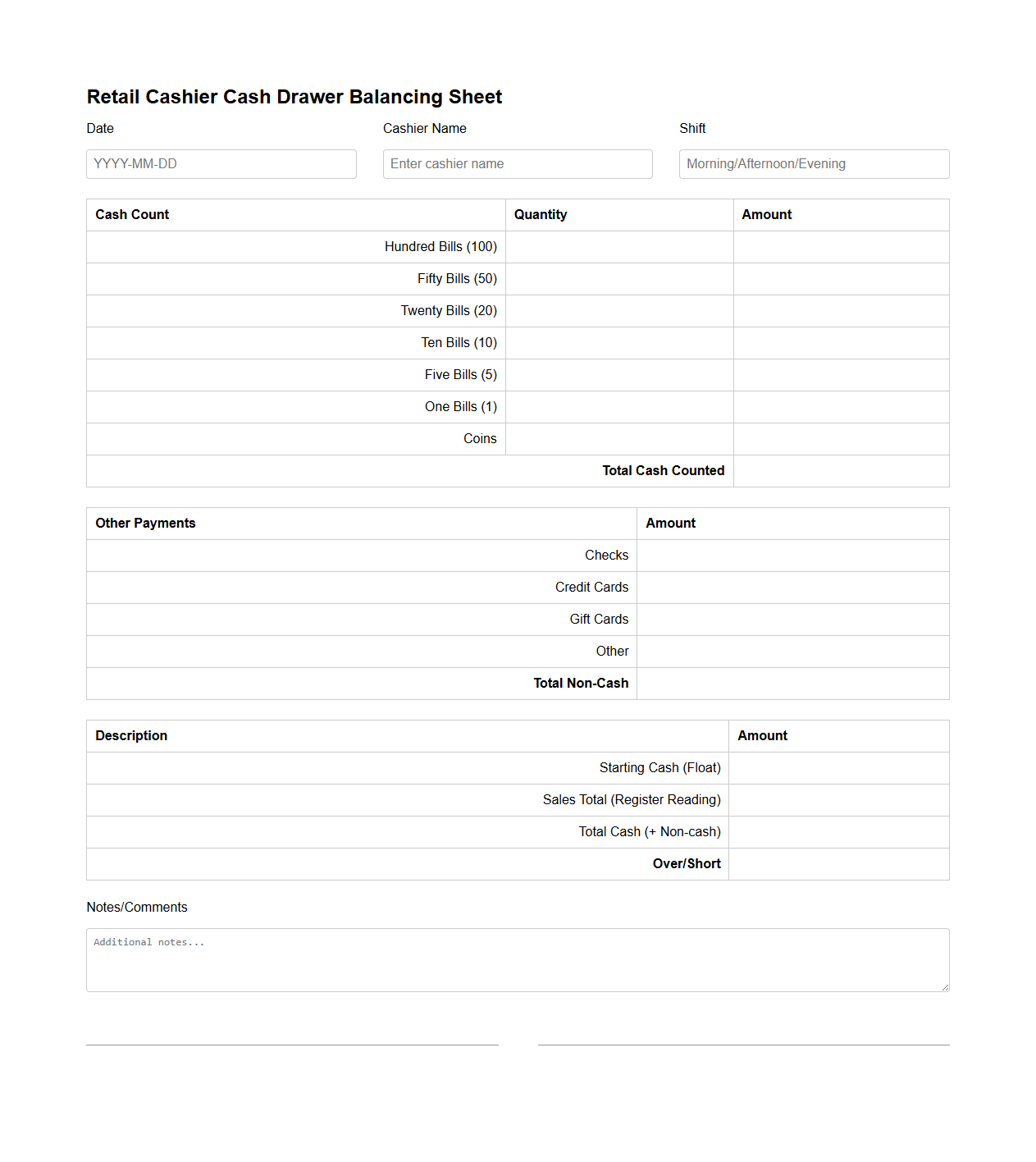

Retail Cashier Cash Drawer Balancing Sheet

A

Retail Cashier Cash Drawer Balancing Sheet document is used to accurately record and verify the cash transactions handled by a cashier during a work shift. It helps ensure the cash drawer's total amount matches the sales recorded, minimizing errors and discrepancies. This document typically includes fields for opening and closing cash amounts, sales totals, and any cash adjustments or discrepancies identified.

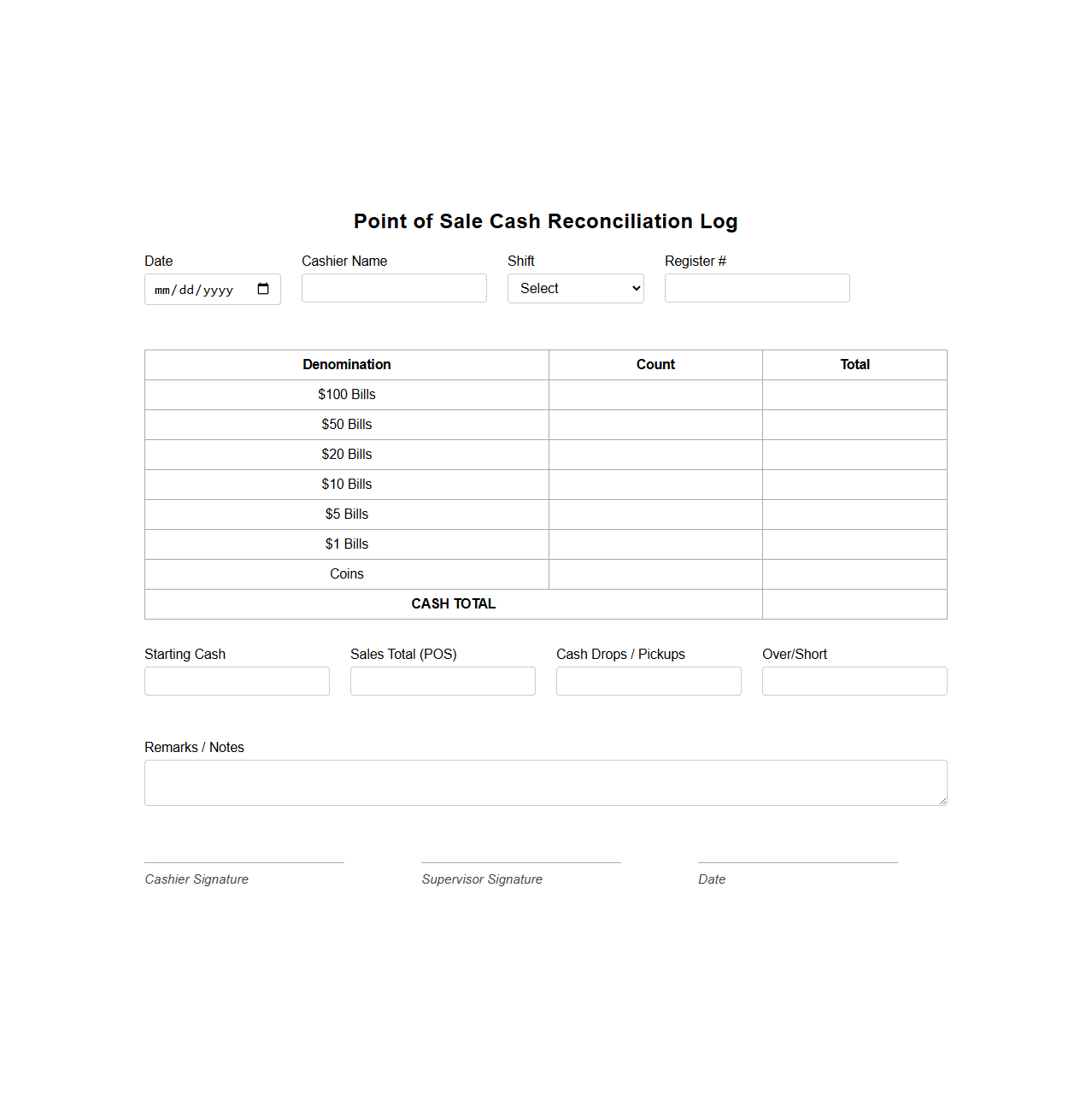

Point of Sale Cash Reconciliation Log

The

Point of Sale Cash Reconciliation Log document is a crucial record used to track and verify daily cash transactions at retail locations. It details the opening cash amount, total sales, cash received, and any discrepancies between expected and actual cash on hand. This log ensures accurate financial reporting and supports internal audits by providing a transparent account of cash flow.

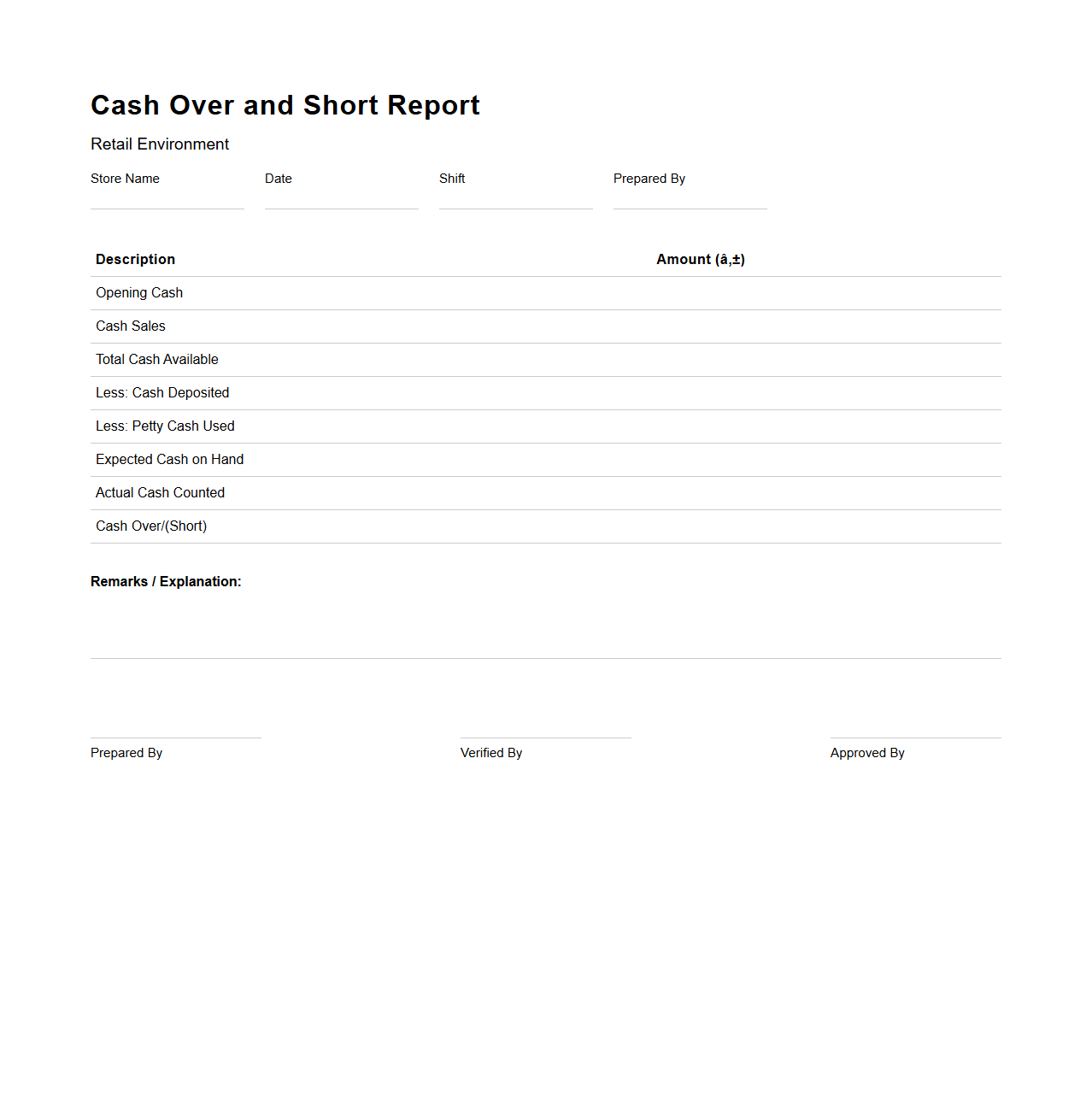

Cash Over and Short Report for Retail Environments

The

Cash Over and Short Report in retail environments is a critical financial document used to track discrepancies between the expected cash amount and the actual cash counted at the end of a shift or business day. This report helps identify cash handling errors, theft, or operational inefficiencies by providing detailed records of overages and shortages in cash drawers. Retail managers rely on this report to maintain accurate financial control and ensure accountability among staff.

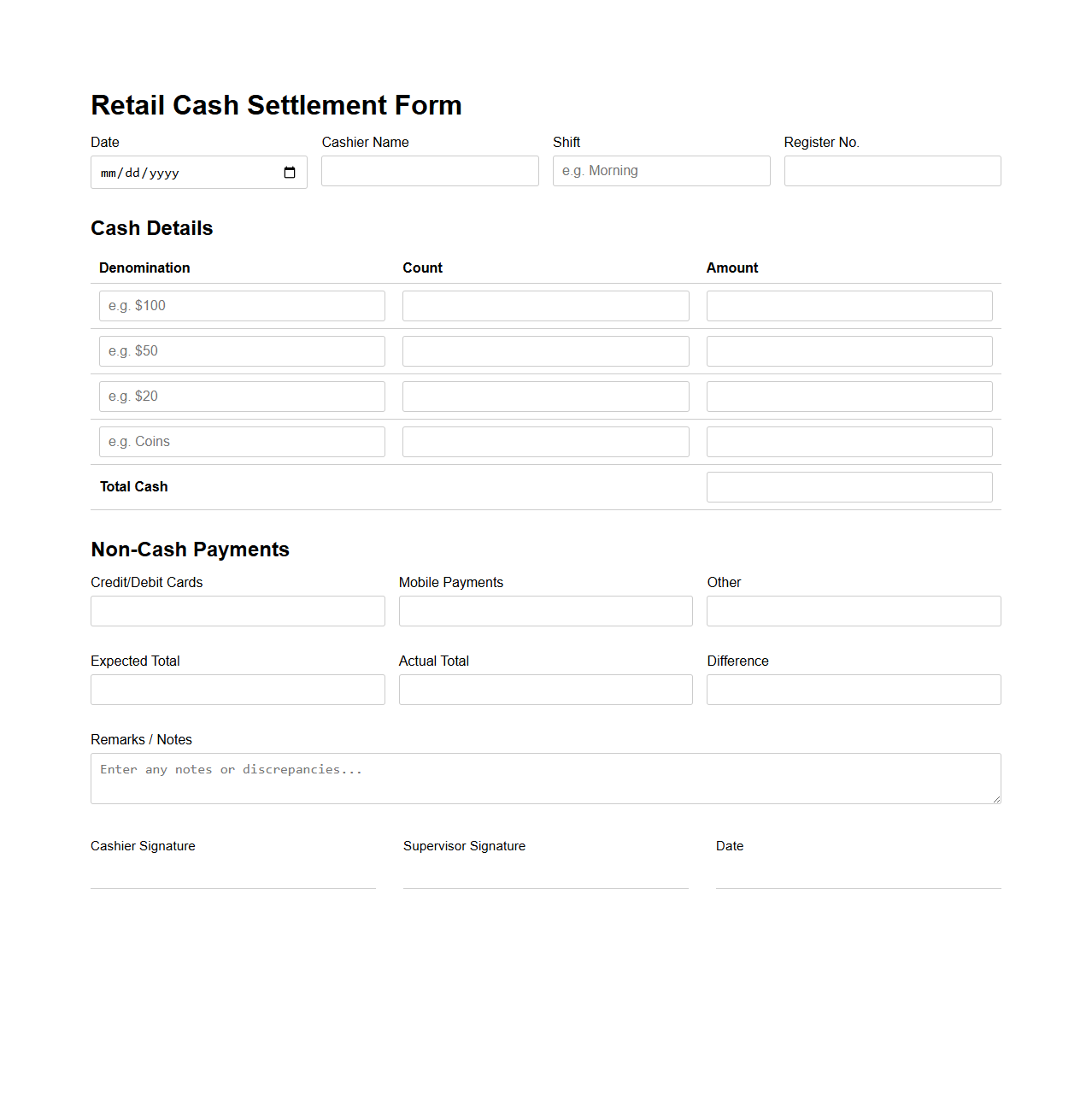

Retail Cash Settlement Form for Cashiers

The

Retail Cash Settlement Form is a crucial document used by cashiers to reconcile daily cash transactions at the end of their shift. It records details such as total sales, cash received, and any discrepancies between expected and actual cash amounts. This form ensures accurate financial reporting and accountability in retail operations.

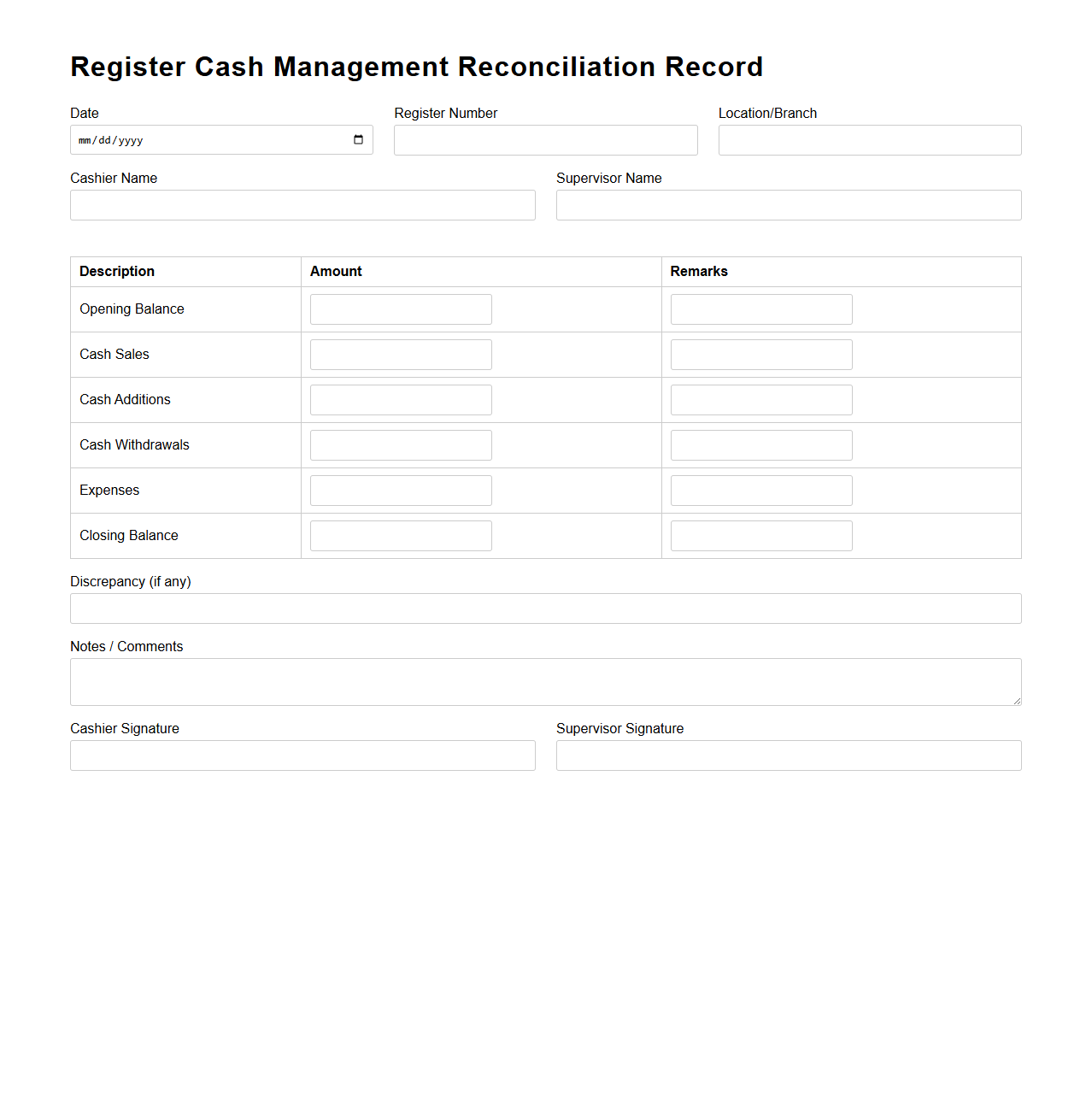

Register Cash Management Reconciliation Record

The

Register Cash Management Reconciliation Record document is a financial record used to match and verify cash transactions within an organization's cash management system. It ensures accuracy by reconciling cash inflows and outflows against bank statements or internal records, identifying discrepancies for timely correction. This document is essential for maintaining financial integrity and supporting audit compliance in cash handling processes.

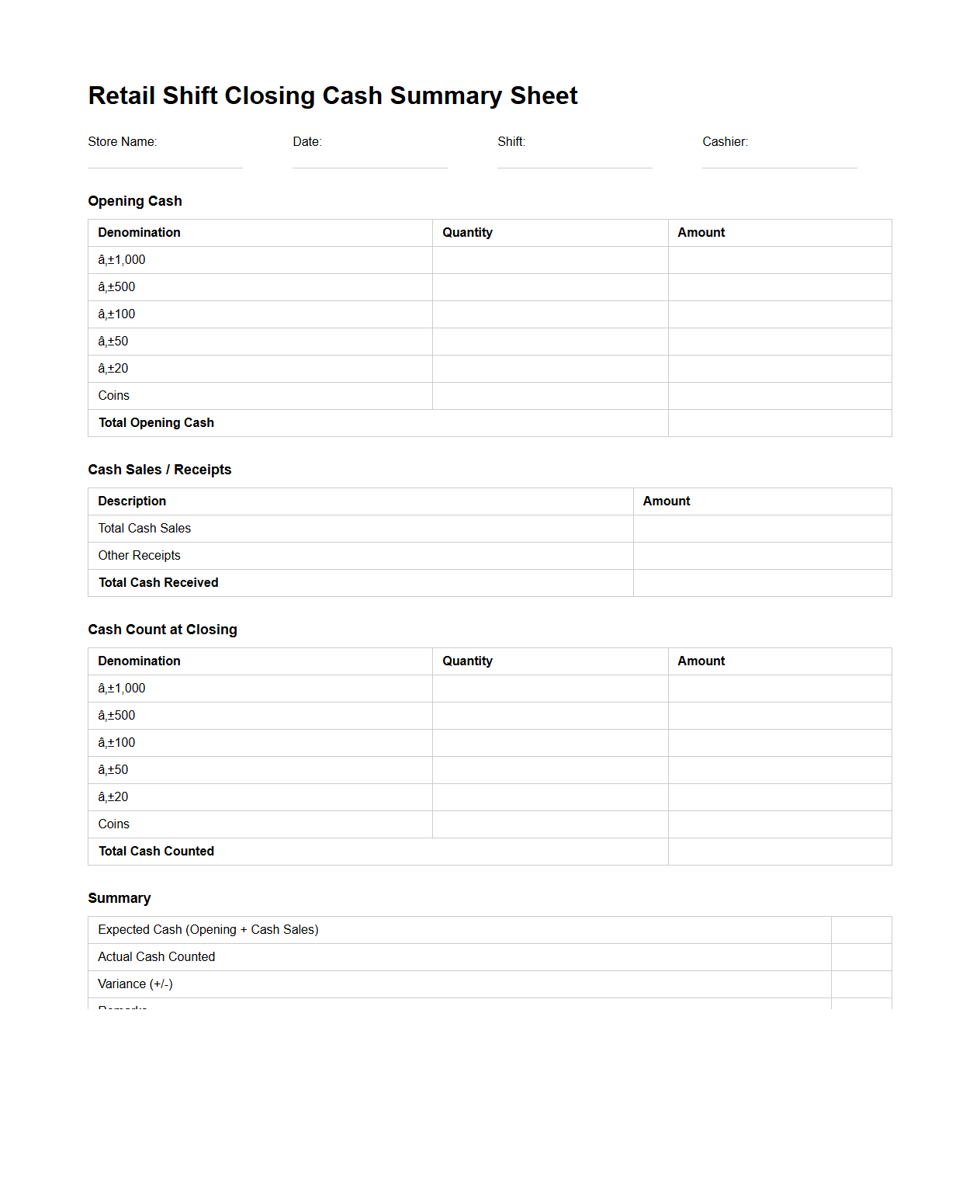

Retail Shift Closing Cash Summary Sheet

The

Retail Shift Closing Cash Summary Sheet document is a crucial record used to reconcile cash transactions at the end of a retail shift. It details cash inflows, outflows, and discrepancies to ensure accurate financial reporting and accountability. Retail managers utilize this summary to verify cash register balances and maintain transparent audit trails.

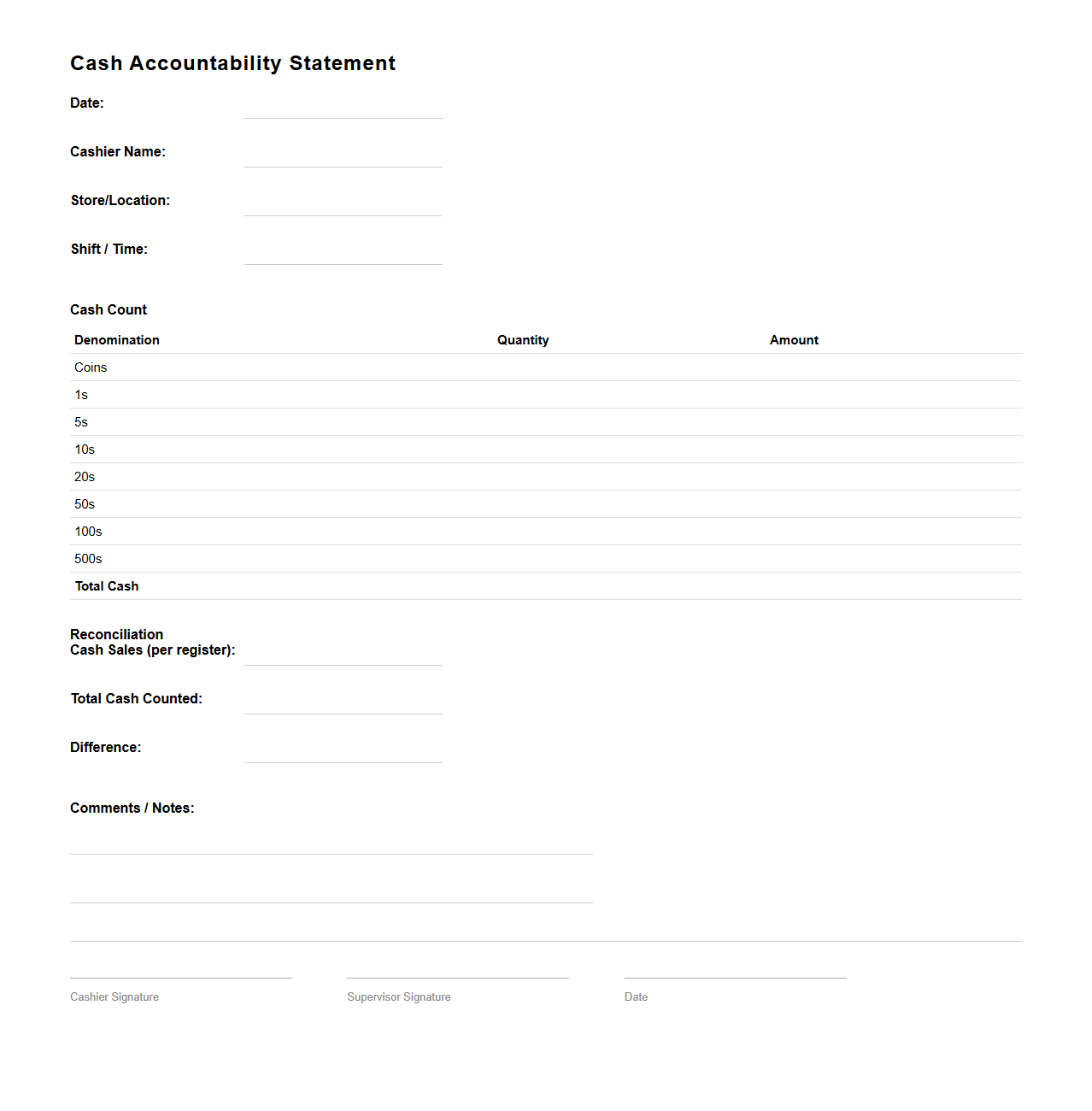

Cash Accountability Statement for Retail Cashier

A

Cash Accountability Statement for retail cashiers is a detailed financial document that tracks and verifies the amount of cash handled during a specific shift or period. It records cash sales, refunds, and withdrawals, ensuring accuracy between the physical cash in the register and the sales recorded in the system. This statement is essential for preventing discrepancies, fraud, and ensuring transparent cash management in retail operations.

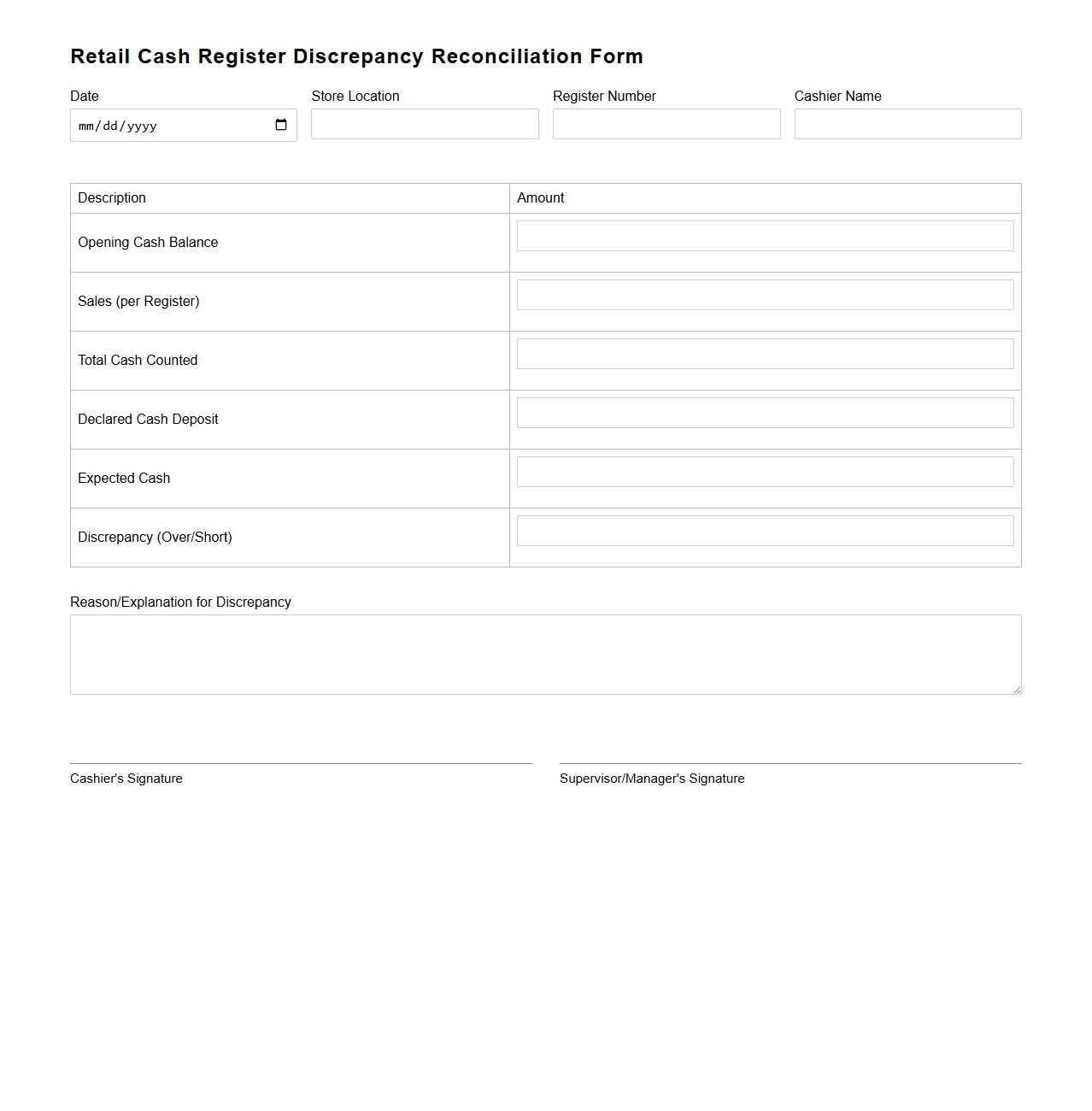

Retail Cash Register Discrepancy Reconciliation Form

The Retail Cash Register Discrepancy Reconciliation Form is a crucial document used to identify and resolve differences between recorded sales and actual cash in the register. It helps track

cash discrepancies such as overages or shortages, ensuring accurate financial reporting and accountability. This form supports regular audits and improves cash handling procedures in retail environments.

What key information should be included in a Cash Reconciliation Document for retail cashiers?

A Cash Reconciliation Document must include the opening cash balance, total sales, cash collected, and expected cash amount. It should also record any withdrawals or deposits made during the shift. Additionally, the document should feature cashier identification and the date for proper tracking.

How does the document ensure accountability and accuracy in daily cash handling?

The document enforces accountability by requiring cashiers to sign off on the reported amounts and discrepancies. It acts as a control measure to verify that all cash transactions match recorded sales. The process helps reduce errors and deter potential theft or mismanagement.

Which sections of the sample document help identify discrepancies between expected and actual cash amounts?

The sections labeled "Expected Cash" and "Actual Cash Count" are crucial for spotting discrepancies. These fields allow cashiers and supervisors to compare totals and highlight shortages or overages. A designated discrepancy report section further aids in documenting any differences found.

What procedures are outlined in the document for reporting cash overages or shortages?

The document mandates immediate reporting of any cash overages or shortages to the store manager or supervisor. It requires detailed notes explaining the possible causes for the discrepancy. These procedures ensure timely investigation and resolution of any cash handling issues.

How is final cash balance verification documented and authenticated in the sample?

Final cash balance verification is documented by recording the closing cash amount alongside signatures from both the cashier and a supervisor. This dual-signature process provides authentication and confirms that the count has been jointly verified. The document also typically includes a timestamp to record when verification occurred.