A Grievance Submission Document Sample for Health Insurance provides a clear format to formally report issues related to health insurance claims, policy coverage, or service dissatisfaction. This sample outlines necessary details such as policyholder information, description of the grievance, and desired resolution to ensure effective communication with the insurance provider. Using a structured template helps streamline the complaint process and improves the chances of a timely response.

Health Insurance Claim Dispute Grievance Letter

A

Health Insurance Claim Dispute Grievance Letter is a formal document used to challenge or appeal a denied or underpaid health insurance claim. It outlines the specific reasons for disagreement with the insurance company's decision and provides supporting evidence such as medical records and billing information. This letter aims to prompt a thorough review and resolution of the claim dispute to ensure rightful reimbursement or coverage.

Appeal Letter for Denied Health Insurance Coverage

An

Appeal Letter for Denied Health Insurance Coverage is a formal document submitted by a policyholder to contest a health insurance provider's decision to deny a claim or coverage. This letter presents clear evidence, relevant medical records, and a detailed explanation to support the necessity of the requested coverage or treatment. Properly crafted appeal letters increase the chances of overturning the denial and securing the benefits entitled under the health insurance policy.

Formal Complaint Letter Against Health Insurance Provider

A

Formal Complaint Letter Against Health Insurance Provider is a written document used to express dissatisfaction regarding claims handling, policy coverage, or customer service issues. It serves as an official record detailing the specific problems encountered, such as claim denials or billing errors, to initiate a resolution process with the insurer. This letter often includes policy details, dates, and relevant correspondence to ensure clarity and facilitate an effective response.

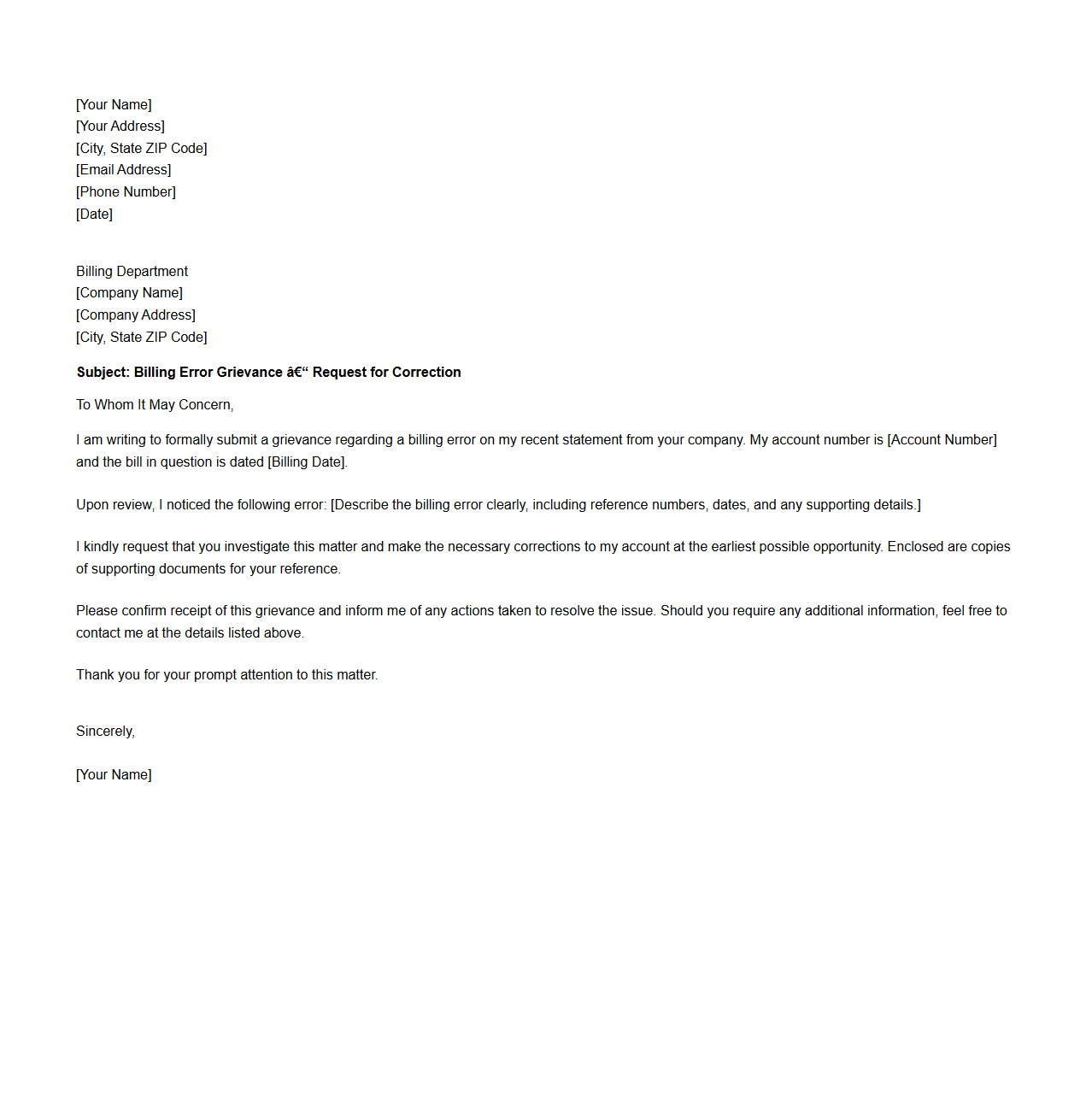

Sample Letter for Billing Error Grievance Submission

A

Sample Letter for Billing Error Grievance Submission is a formal document used by consumers to notify a company or service provider about discrepancies in their billing statement. This letter outlines specific billing errors, requests a prompt investigation, and seeks correction or refund. It serves as an official record to facilitate dispute resolution and ensure accurate financial transactions.

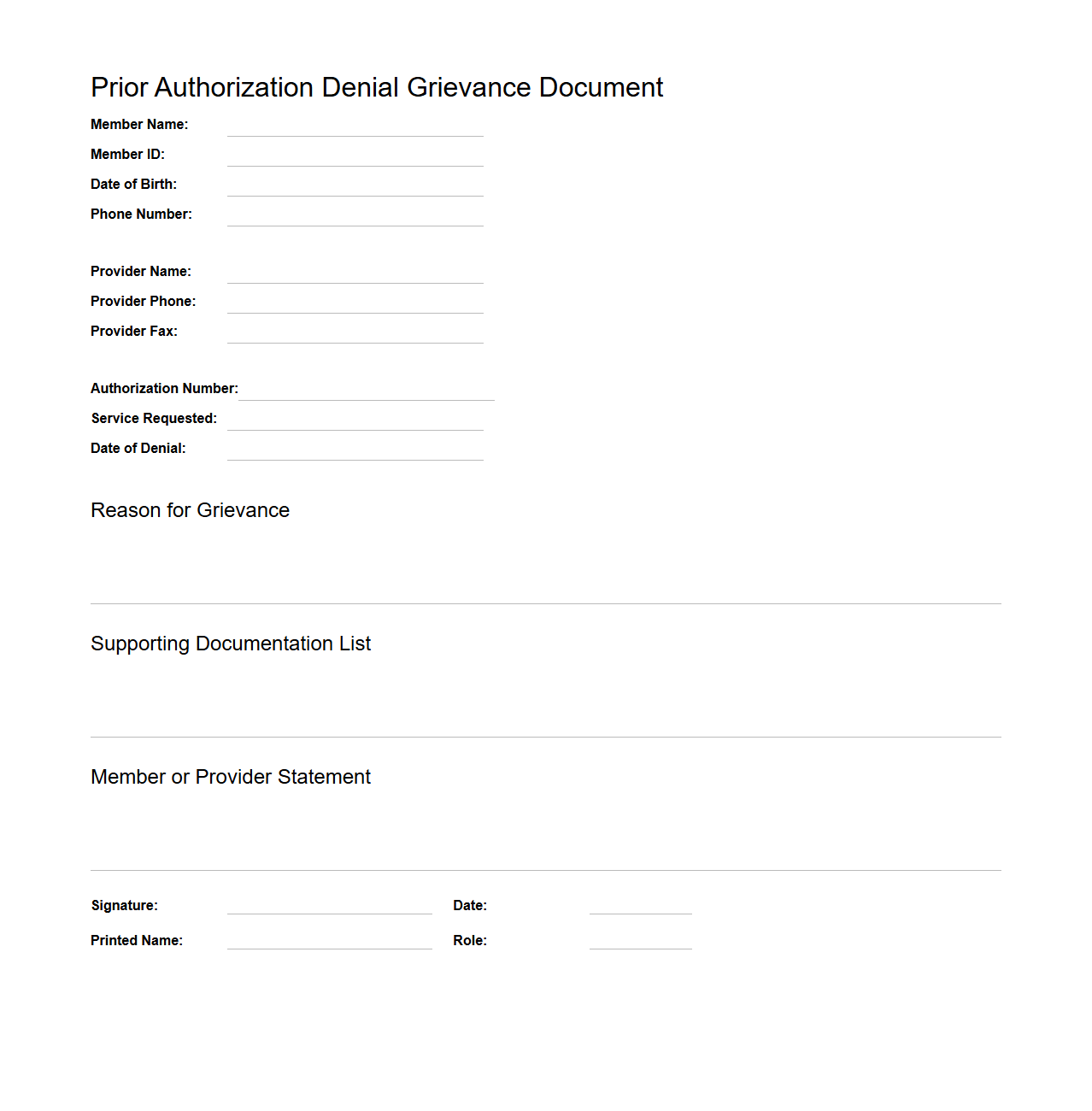

Prior Authorization Denial Grievance Document

A

Prior Authorization Denial Grievance Document is a formal record submitted by healthcare providers or patients challenging a health insurer's refusal to approve a requested medical service or medication. This document systematically details the reasons for the denial, medical necessity, and supporting evidence to appeal the decision. It plays a crucial role in ensuring patients receive appropriate care by documenting grievances and facilitating an expedited review process.

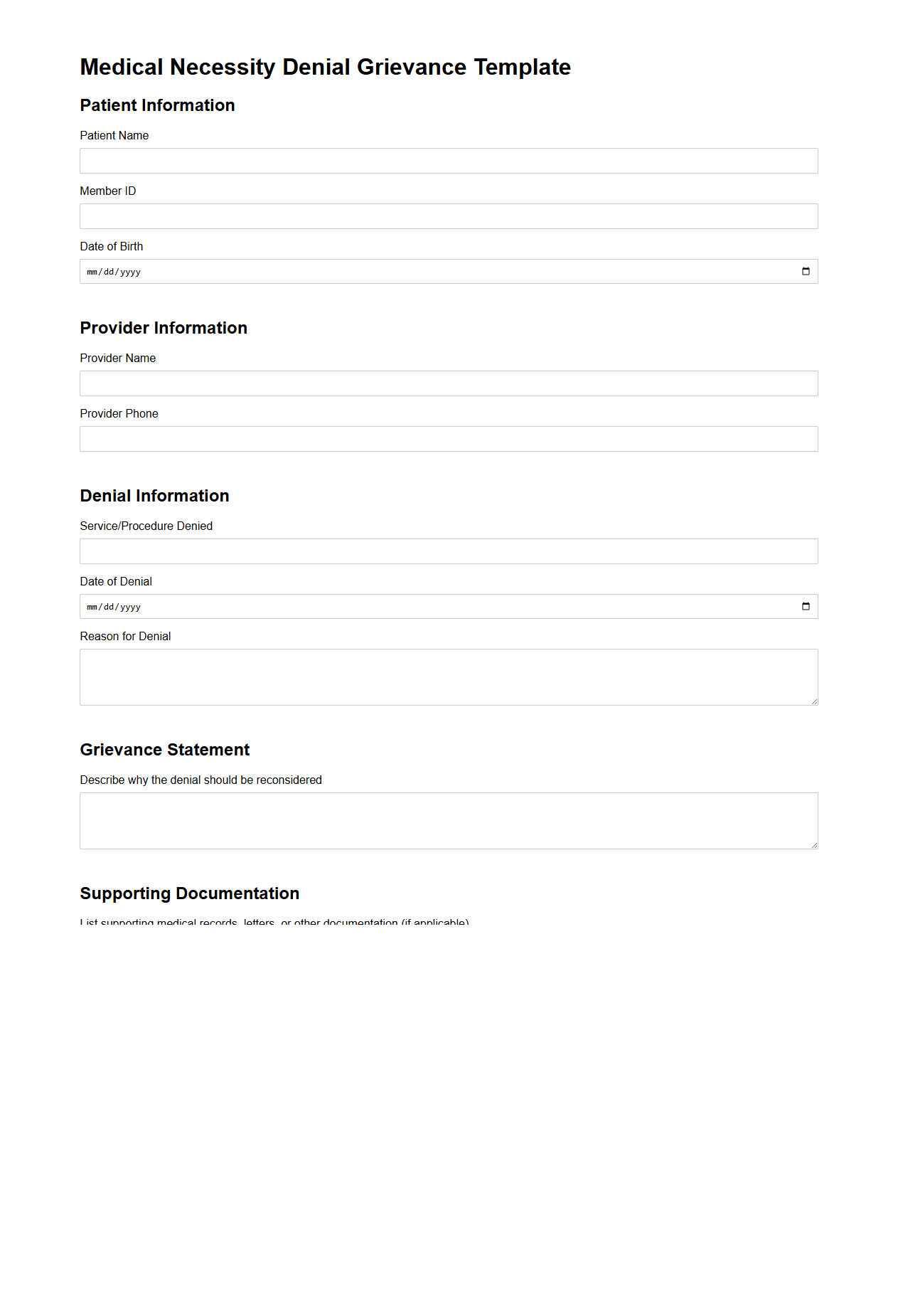

Medical Necessity Denial Grievance Template

A

Medical Necessity Denial Grievance Template document is a structured form used by patients or healthcare providers to formally dispute a health insurance company's refusal to cover medical treatments or services deemed necessary. It outlines critical information such as patient details, treatment specifics, denial reasons, and supporting medical evidence to facilitate an effective appeal process. This template ensures clarity, consistency, and adherence to insurance grievance protocols, improving the chances of overturning incorrect denials.

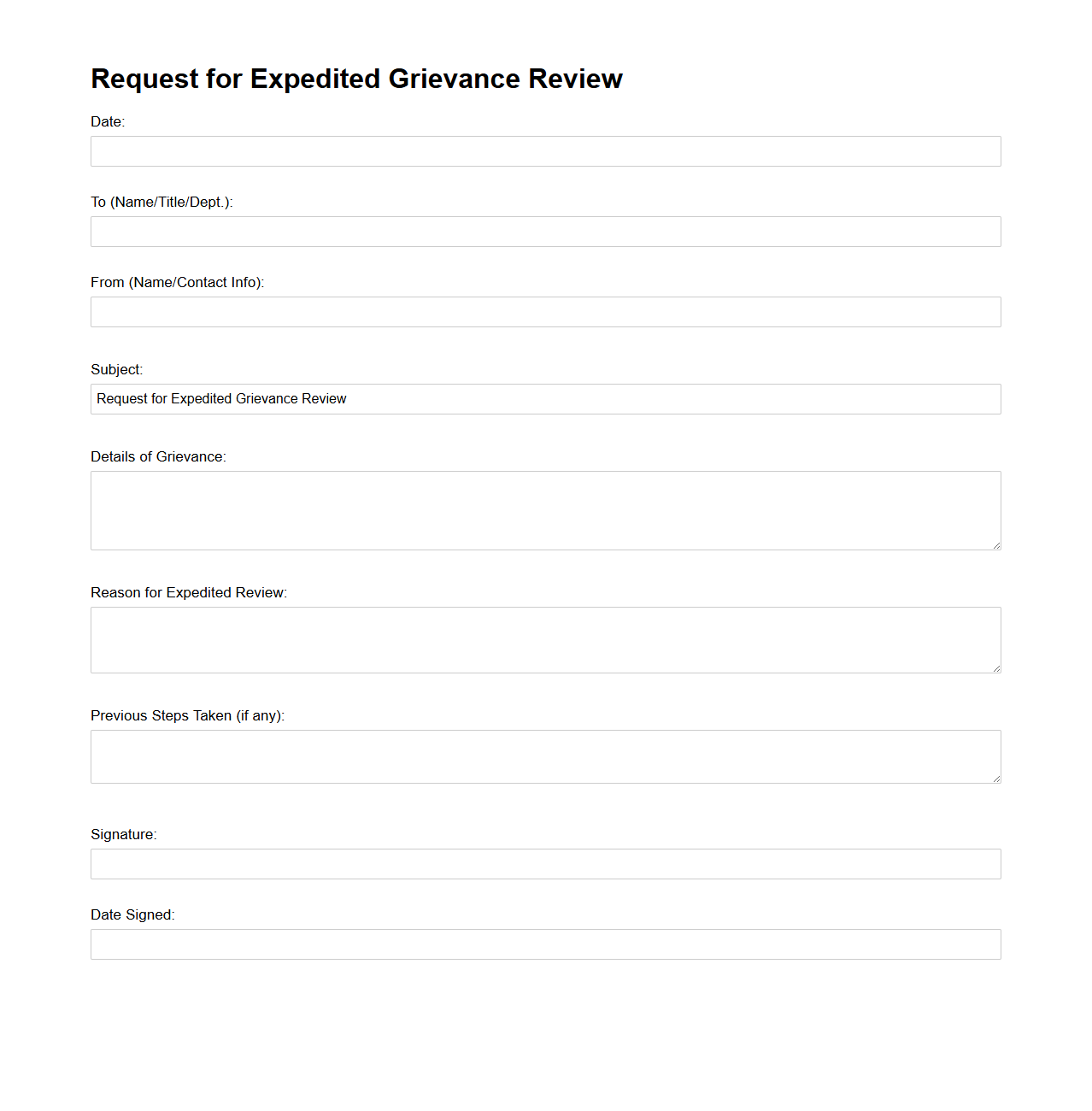

Request for Expedited Grievance Review Sample

A

Request for Expedited Grievance Review Sample document serves as a formal template to appeal urgent complaints or disputes requiring faster resolution within healthcare or insurance processes. This document outlines specific patient or member information, the nature of the grievance, and justification for the expedited review based on medical necessity or potential harm. Using a well-structured sample ensures clarity, compliance with regulatory guidelines, and improves the chances of swift response from the reviewing entity.

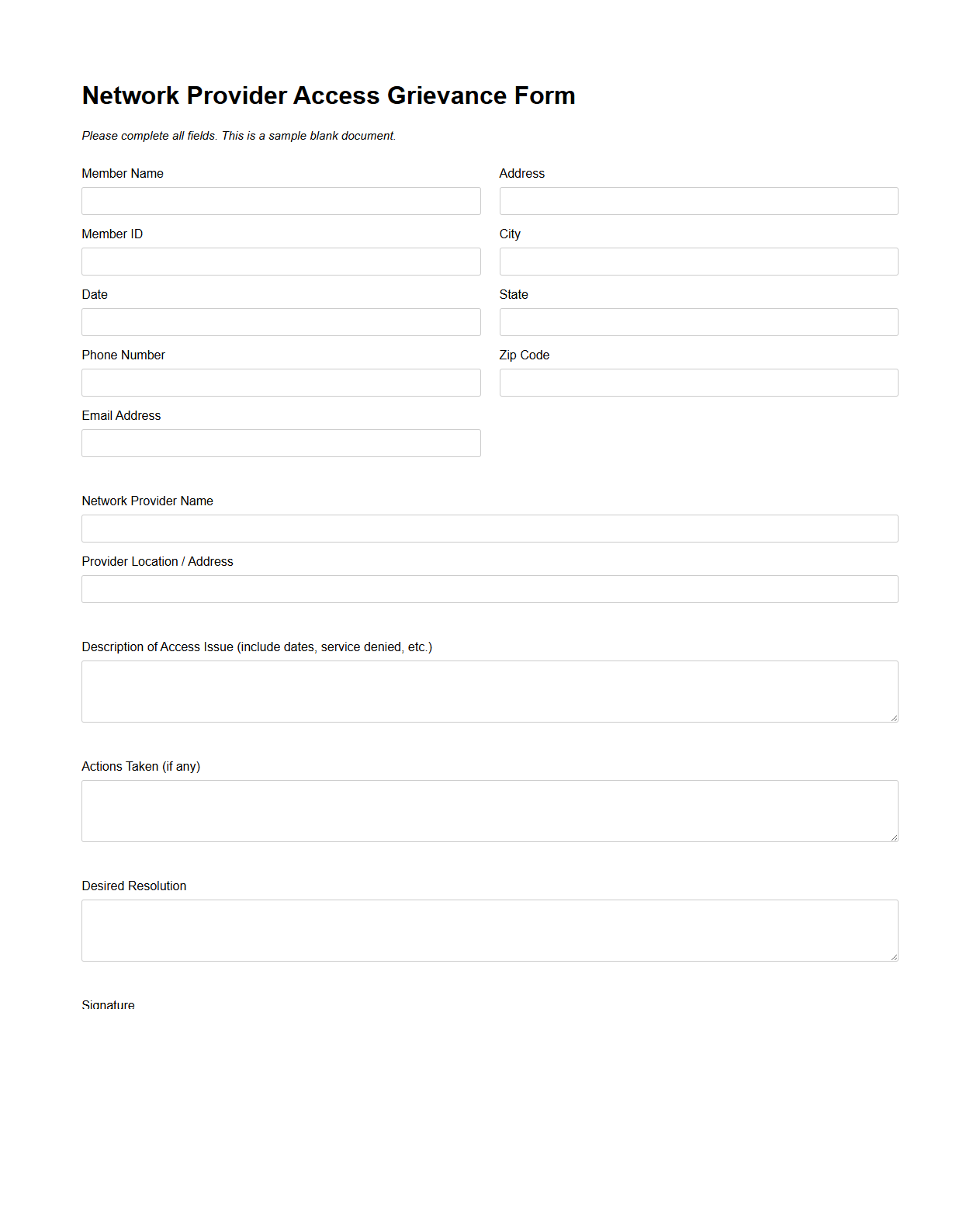

Network Provider Access Grievance Form

The

Network Provider Access Grievance Form is a formal document used by healthcare providers to report issues related to access within a managed care network. This form captures specific concerns such as delays in credentialing, network participation barriers, or unfair practices that affect provider access to the network. It ensures that grievances are documented systematically for timely resolution and compliance with regulatory standards.

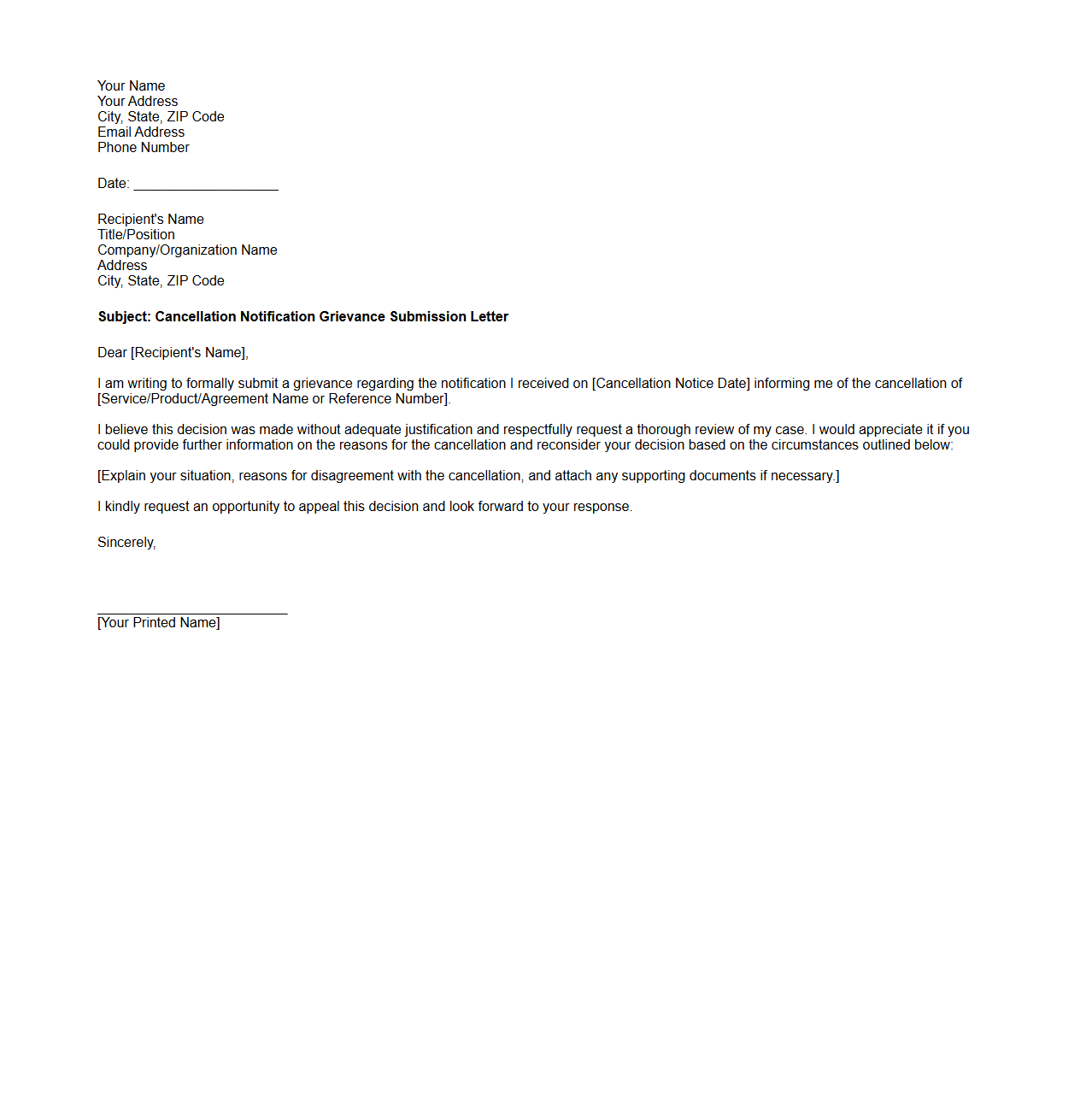

Cancellation Notification Grievance Submission Letter

A

Cancellation Notification Grievance Submission Letter is a formal document used to express dissatisfaction or dispute regarding the cancellation of a service, membership, or contract. It serves as an official request for reconsideration or resolution by outlining specific concerns and providing relevant details about the cancellation event. This letter helps ensure clear communication between the complainant and the service provider, facilitating a structured process for grievance redressal.

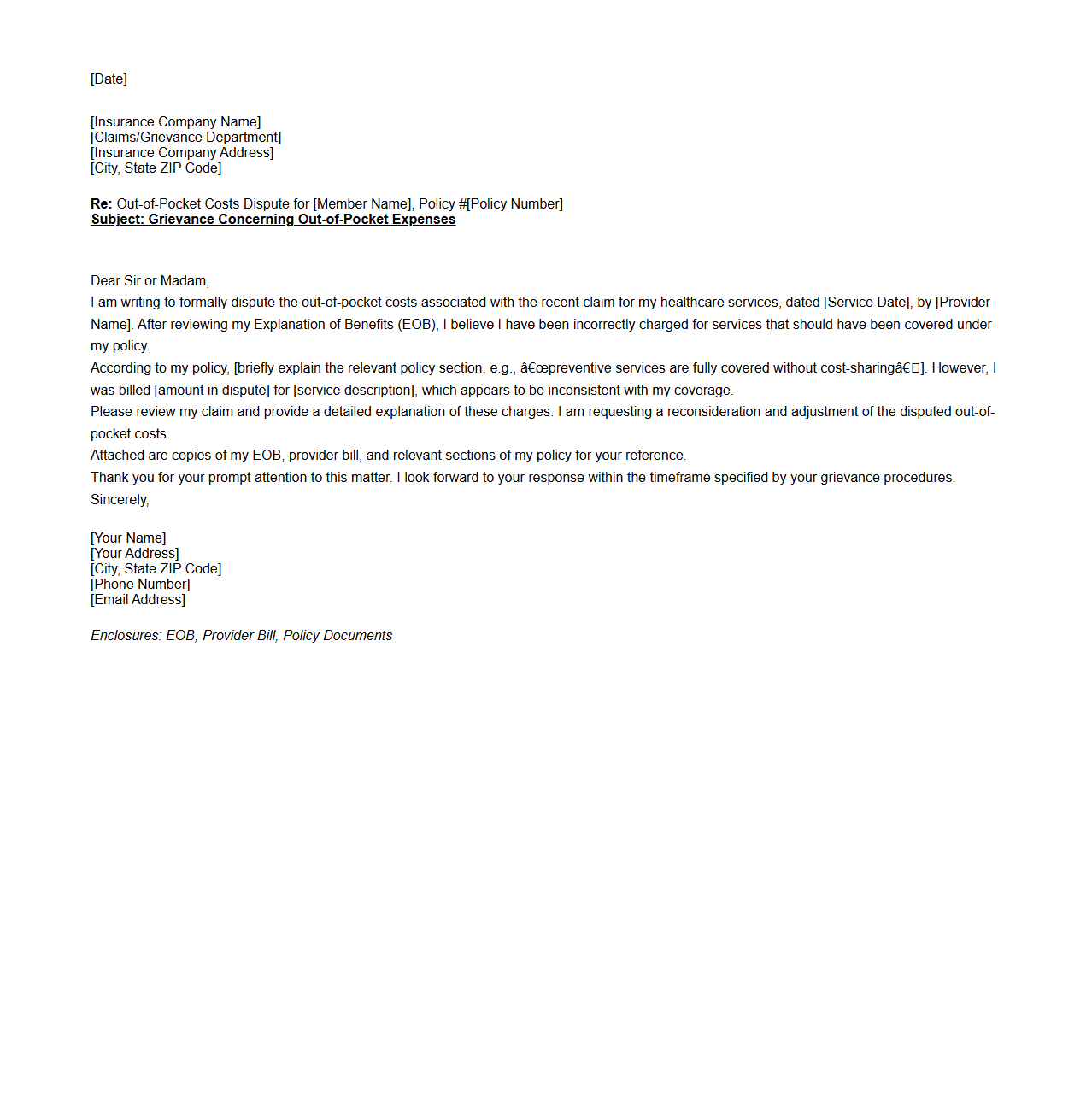

Out-of-Pocket Costs Dispute Grievance Letter

An

Out-of-Pocket Costs Dispute Grievance Letter is a formal document used by individuals to challenge charges they believe were incorrectly billed or not covered by their insurance provider. This letter details the disputed expenses and provides supporting evidence to request a review or adjustment of the out-of-pocket costs incurred. It serves as a critical communication tool in resolving billing discrepancies and ensuring accurate financial responsibility.

Information Required to Identify the Policyholder in a Grievance Submission Document

To accurately identify the policyholder, the grievance submission must include the full name, policy number, and contact details. This ensures that the insurance provider can quickly locate the correct insurance policy and verify the complainant's identity. Including an identification number like the National ID or social security number can further support the verification process.

Specific Details About the Grievance Incident

The document must clearly state the date and location of the grievance incident to provide a timeline. It should also describe the nature of the complaint, detailing the service or claim involved and what went wrong. Precise and factual descriptions help the insurer understand the context and cause of the issue.

Supporting Documents to Strengthen a Health Insurance Grievance Submission

Attaching relevant supporting documents like medical bills, correspondence, test results, and prior claim approvals is essential. These documents validate the complaint and demonstrate the legitimacy of the grievance. Including official letters or medical reports adds credibility and increases the chance of a favorable review.

How the Sample Document Outlines Desired Resolution or Action

The grievance document should explicitly state the desired resolution, such as reimbursement, claim approval, or policy amendment. It clearly communicates the complainant's expectation for corrective action from the insurance provider. This clarity helps avoid misunderstandings and guides the provider's response accordingly.

Process and Timeline for Acknowledgment and Resolution

The grievance submission sample outlines a specific timeline for acknowledgment, often within a few business days after receipt. It also defines an estimated period for resolution, typically 15 to 30 days, depending on policy guidelines. This process ensures transparent communication and timely handling of the complaint by the insurer.