A Consent to Disclosure Document Sample for Personal Injury Insurance is a formal agreement that allows insurance companies to share an individual's personal injury claim information with authorized parties. This document ensures compliance with privacy laws while facilitating the efficient handling of insurance claims. It clearly outlines the scope and conditions under which disclosure is permitted, protecting both the claimant's rights and the insurer's responsibilities.

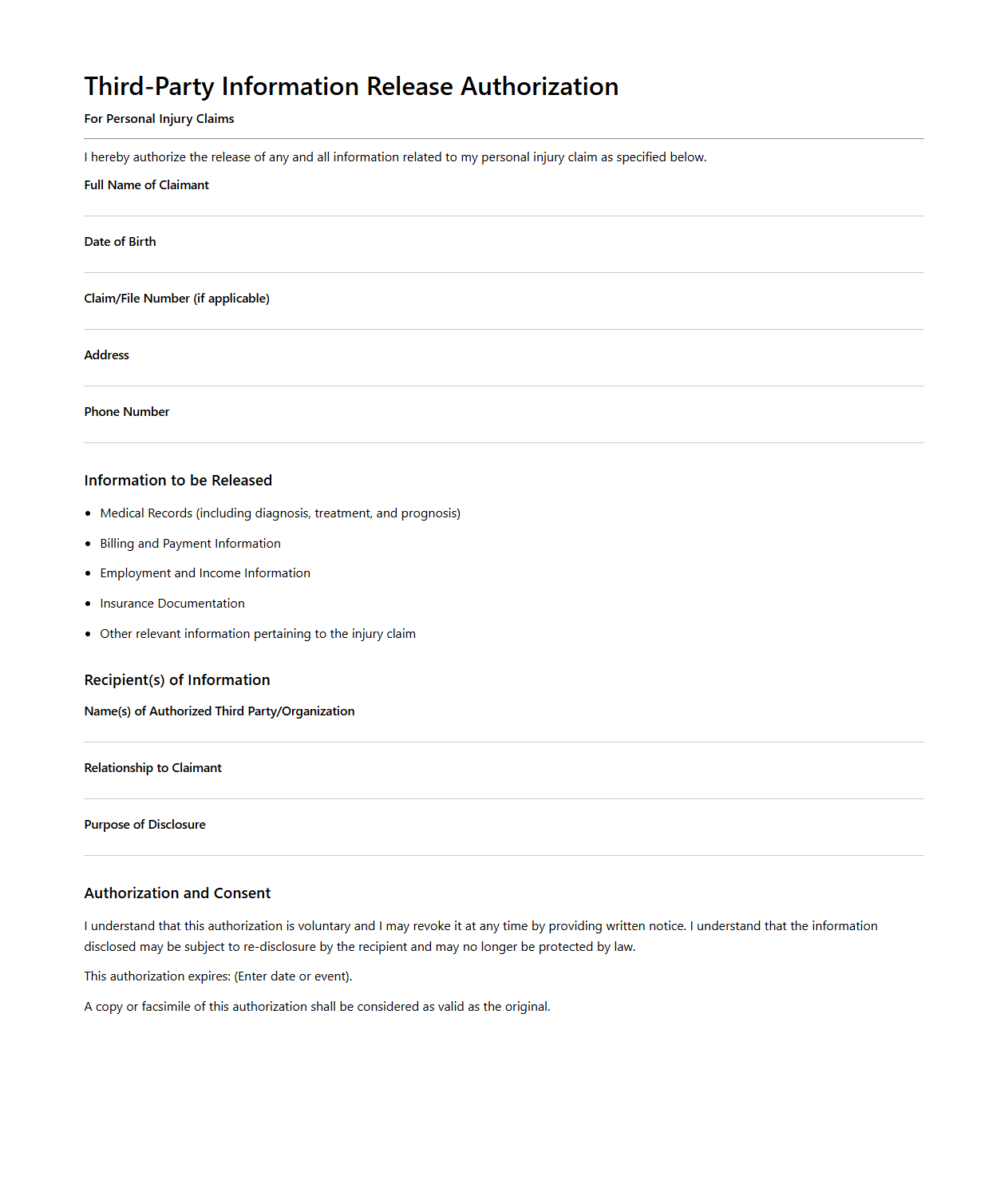

Third-Party Information Release Authorization for Personal Injury Claims

The

Third-Party Information Release Authorization for Personal Injury Claims is a legal document that permits insurance companies, healthcare providers, or legal representatives to obtain relevant medical, employment, and accident-related information from third parties. This authorization ensures timely access to critical data required to evaluate the validity and extent of a personal injury claim accurately. Proper execution of this document facilitates efficient claim processing and protects the claimant's rights during settlement negotiations or litigation.

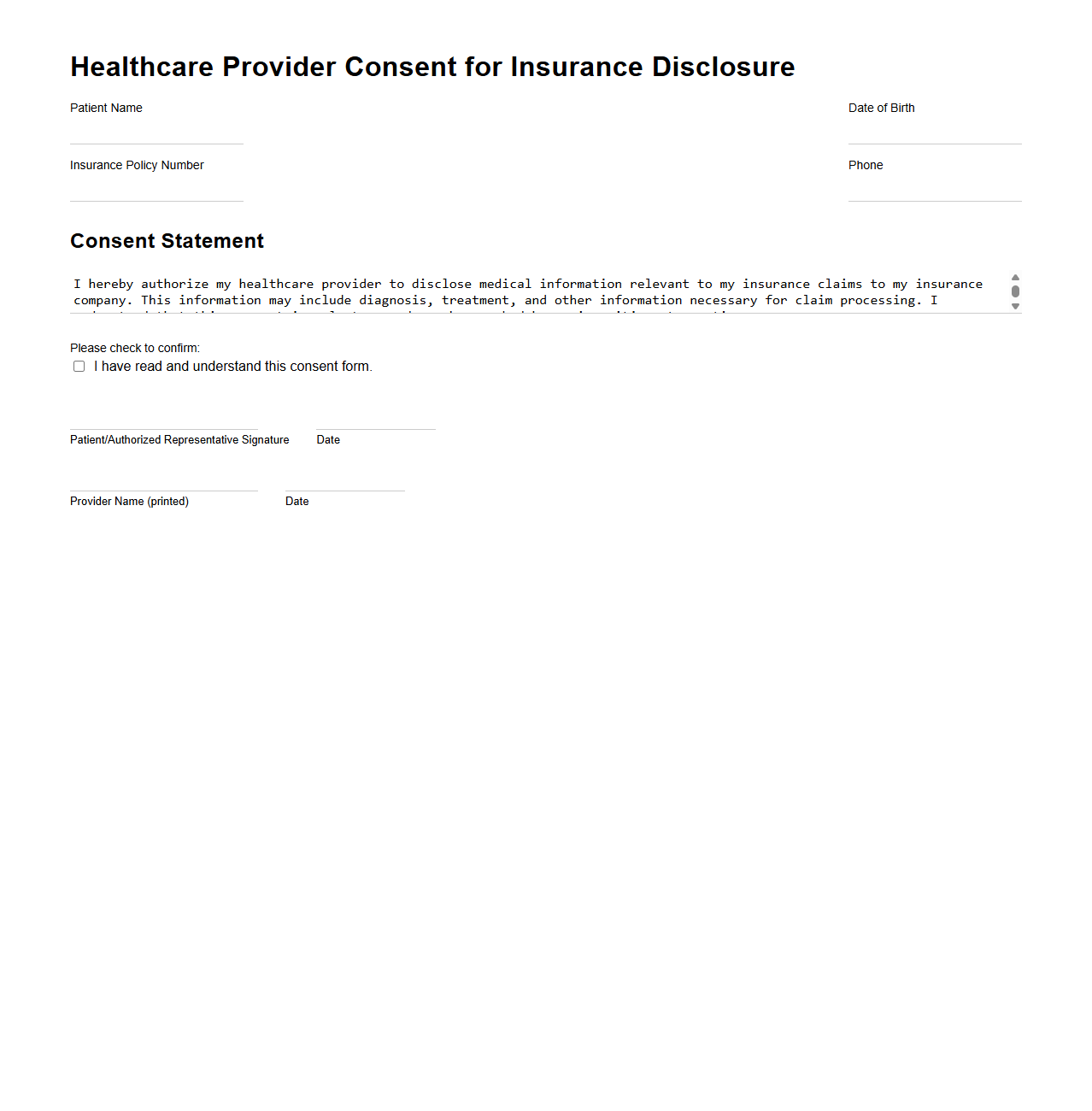

Healthcare Provider Consent for Insurance Disclosure

A

Healthcare Provider Consent for Insurance Disclosure document authorizes medical professionals to share a patient's health information with insurance companies for claims processing and coverage verification. This consent ensures compliance with privacy laws like HIPAA while facilitating accurate billing and reimbursement. Patients retain control over the extent of information disclosed, safeguarding their personal health data.

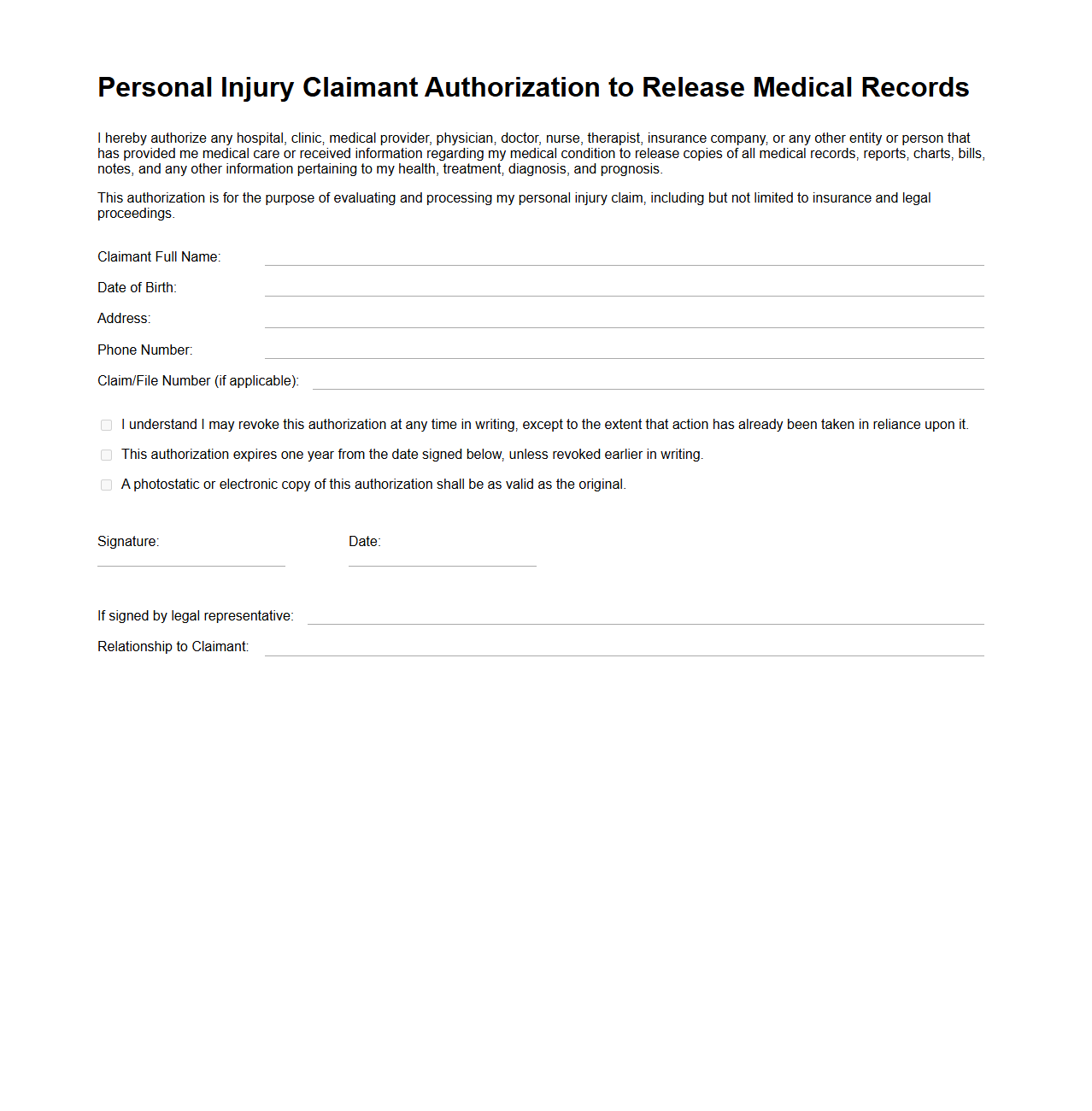

Personal Injury Claimant Authorization to Release Medical Records

A

Personal Injury Claimant Authorization to Release Medical Records document is a legal form that grants permission for medical providers to share an individual's health information with authorized parties involved in a personal injury claim. This authorization is essential for verifying the extent of injuries and supporting evidence during insurance claims or litigation processes. Ensuring the document is accurately completed helps protect privacy while enabling timely access to critical medical records.

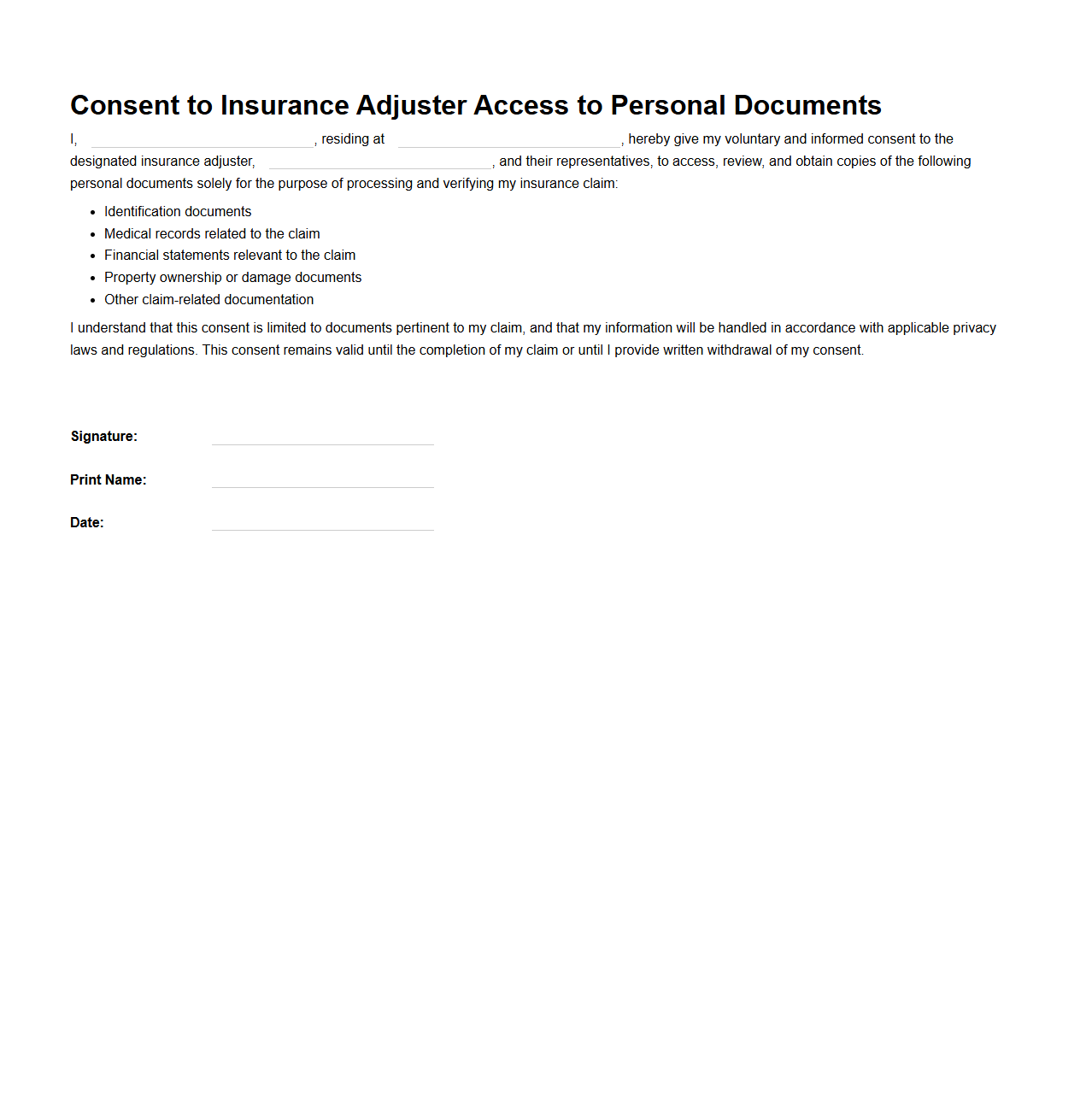

Consent to Insurance Adjuster Access to Personal Documents

The

Consent to Insurance Adjuster Access to Personal Documents document authorizes an insurance adjuster to review specific personal records relevant to a claim. This consent facilitates the verification process, ensuring accurate assessment and timely processing of insurance claims. It typically includes details about the types of documents accessible and the duration of the permission granted.

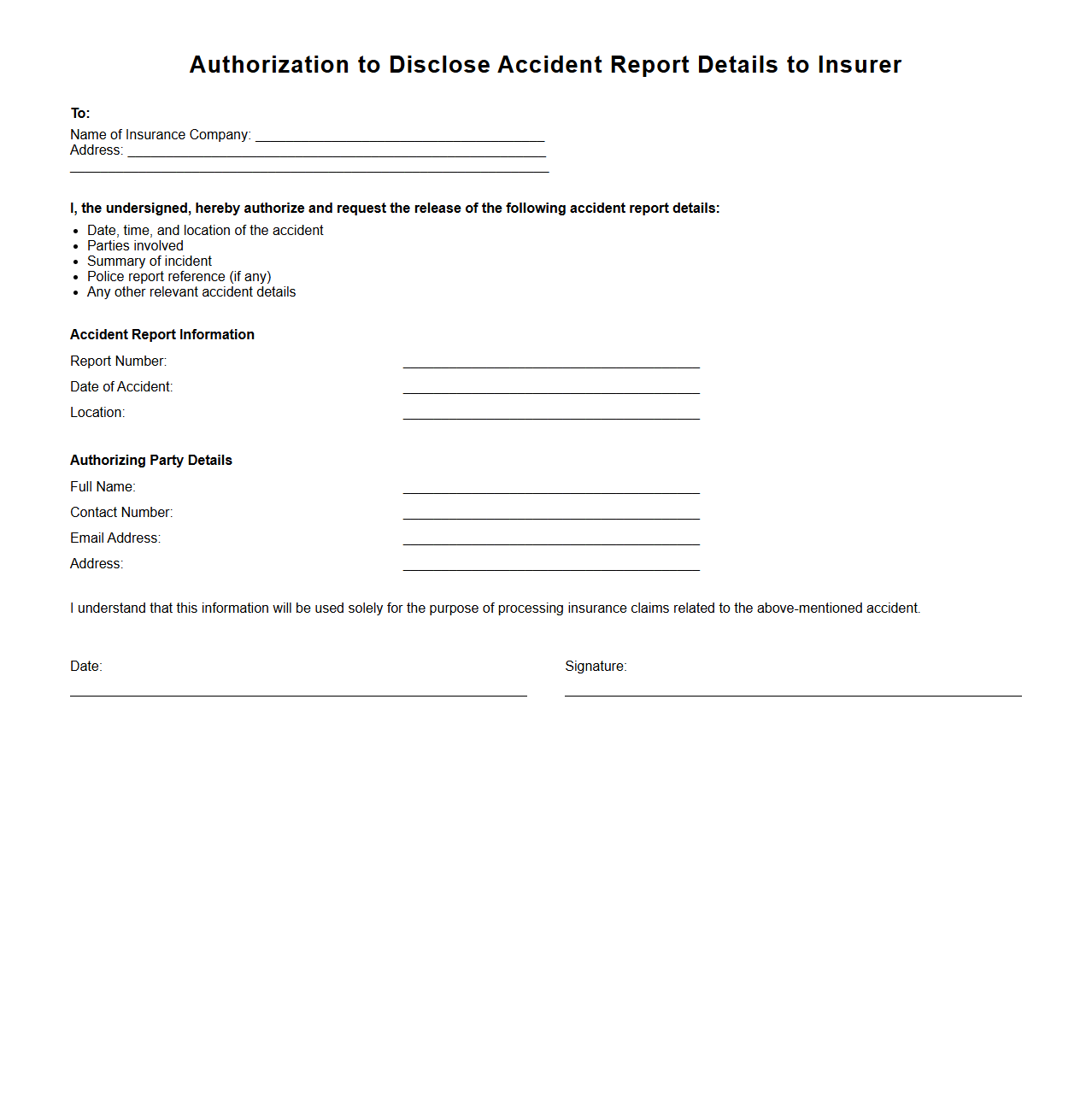

Authorization to Disclose Accident Report Details to Insurer

The

Authorization to Disclose Accident Report Details to Insurer document grants permission for the release of specific accident information to an insurance company. This authorization enables insurers to access relevant details necessary for claim processing and verification. Maintaining this consent helps ensure a smooth and transparent claims investigation.

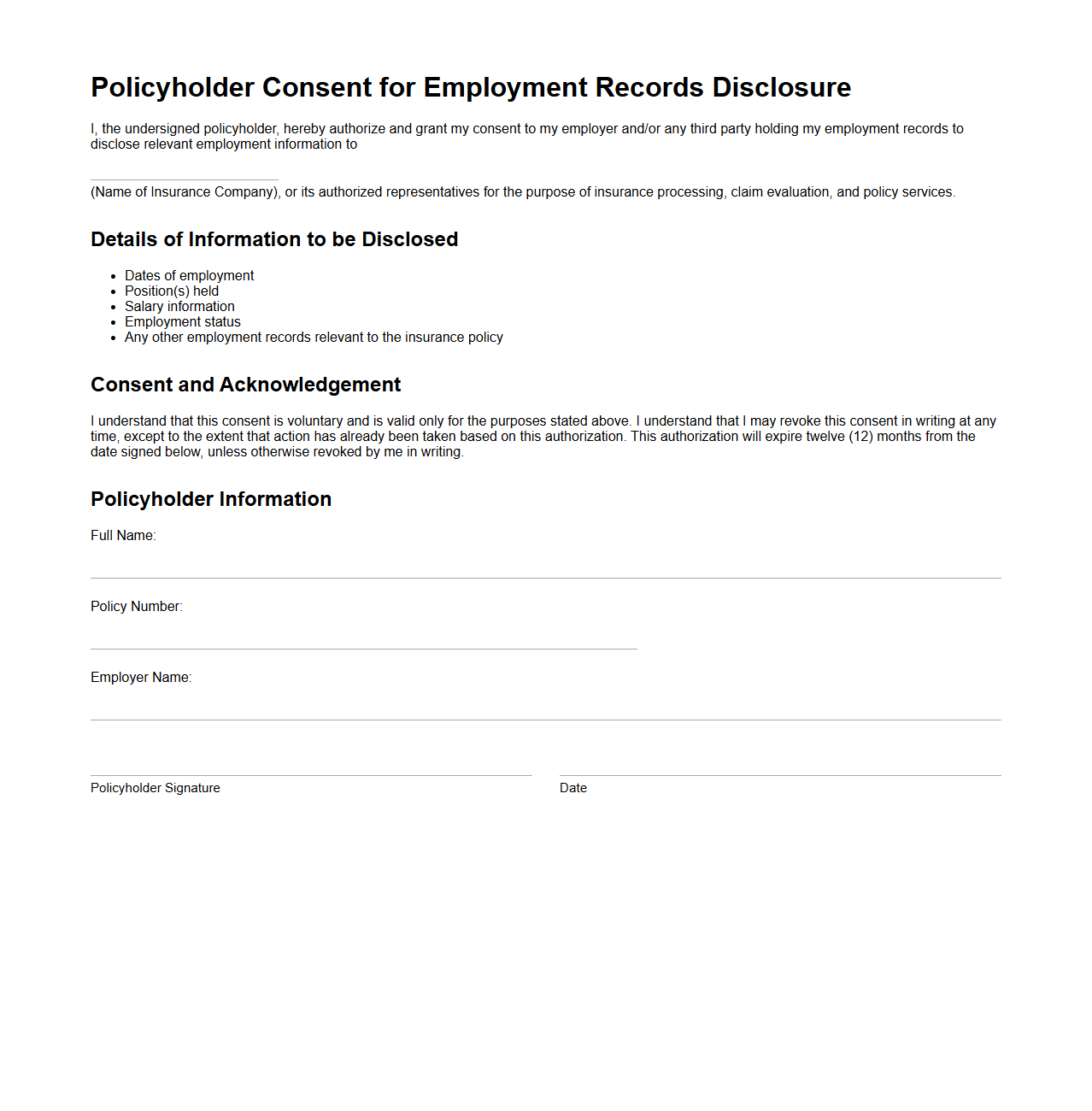

Policyholder Consent for Employment Records Disclosure

The

Policyholder Consent for Employment Records Disclosure document authorizes an employer or insurance company to access and share an individual's employment history and related records. This consent is crucial for verifying employment details during insurance underwriting, claims processing, or eligibility determinations. It ensures compliance with privacy regulations by obtaining explicit permission before disclosing sensitive employment information.

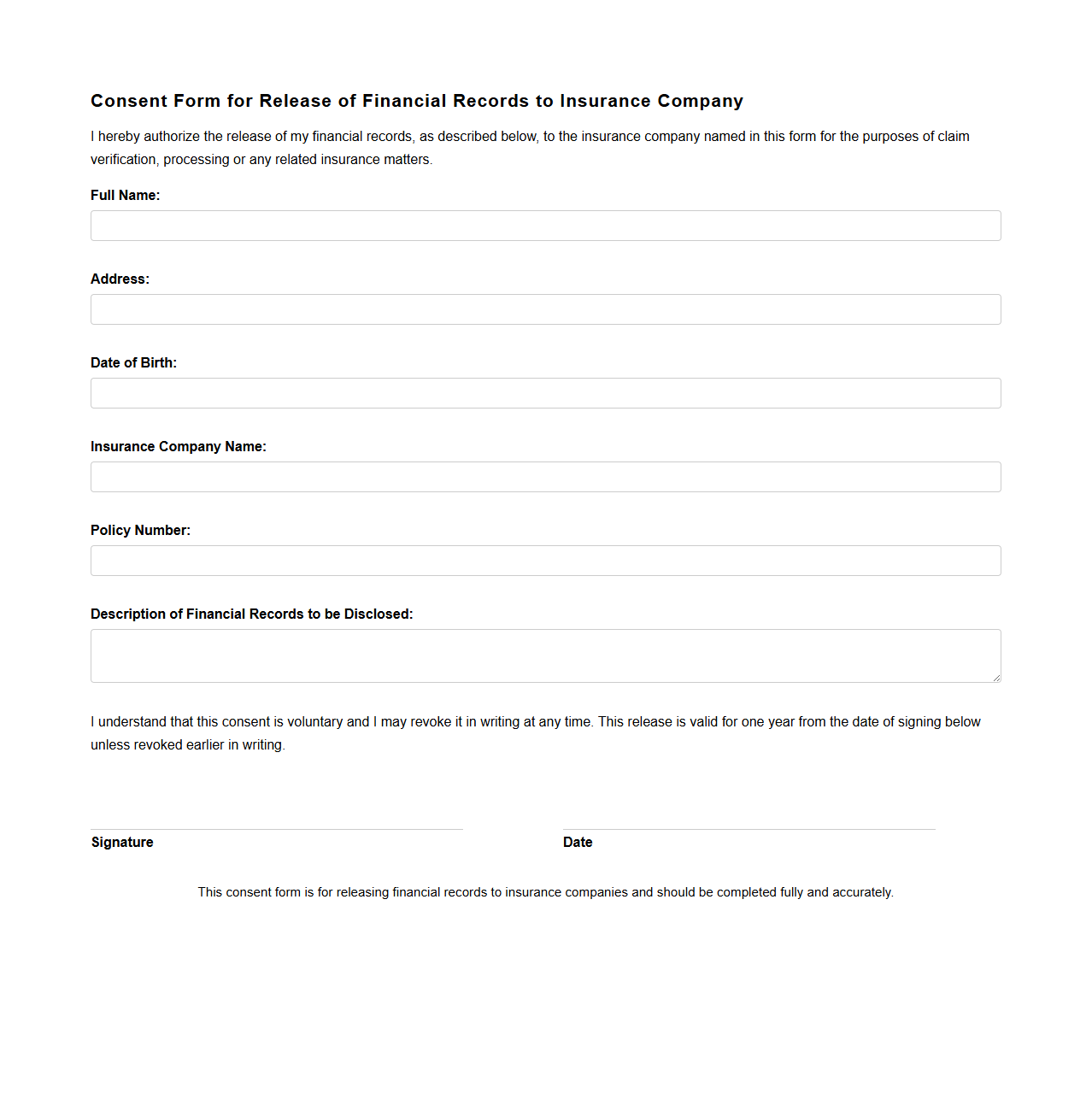

Consent Form for Release of Financial Records to Insurance Company

A

Consent Form for Release of Financial Records to Insurance Company is a legal document that authorizes an insurance provider to access an individual's financial information. This form ensures compliance with privacy laws while enabling the company to verify financial details for claims processing, underwriting, or eligibility assessment. Signing this consent protects both parties by establishing clear permission for the release and use of sensitive financial data.

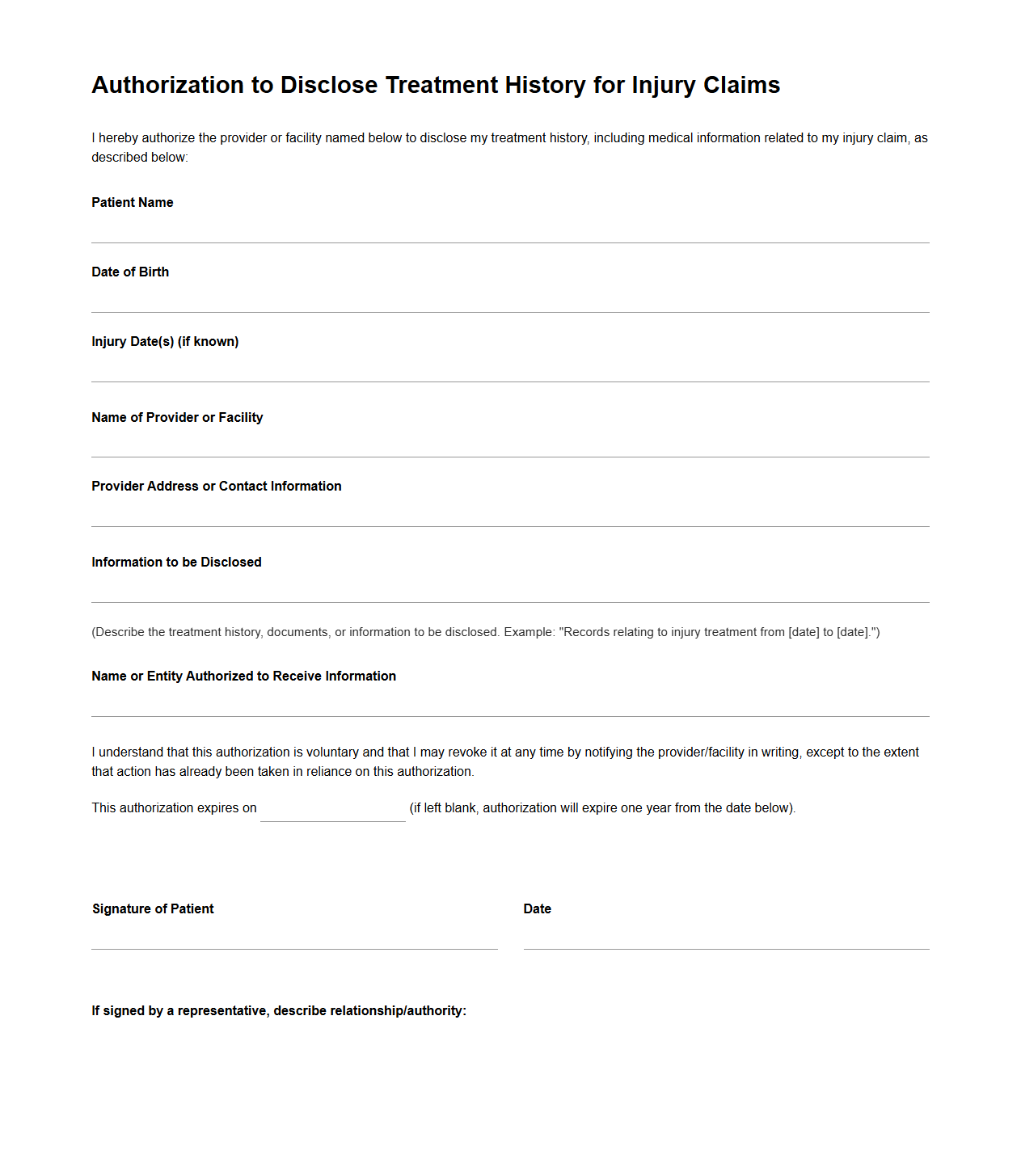

Authorization to Disclose Treatment History for Injury Claims

The

Authorization to Disclose Treatment History for Injury Claims document is a legal form that grants permission to healthcare providers to share a patient's medical records related to treatment for injuries. This authorization is essential for insurance companies, employers, or legal representatives to verify and process injury claims accurately. It ensures compliance with privacy laws while facilitating the efficient handling of medical information necessary for claim evaluations.

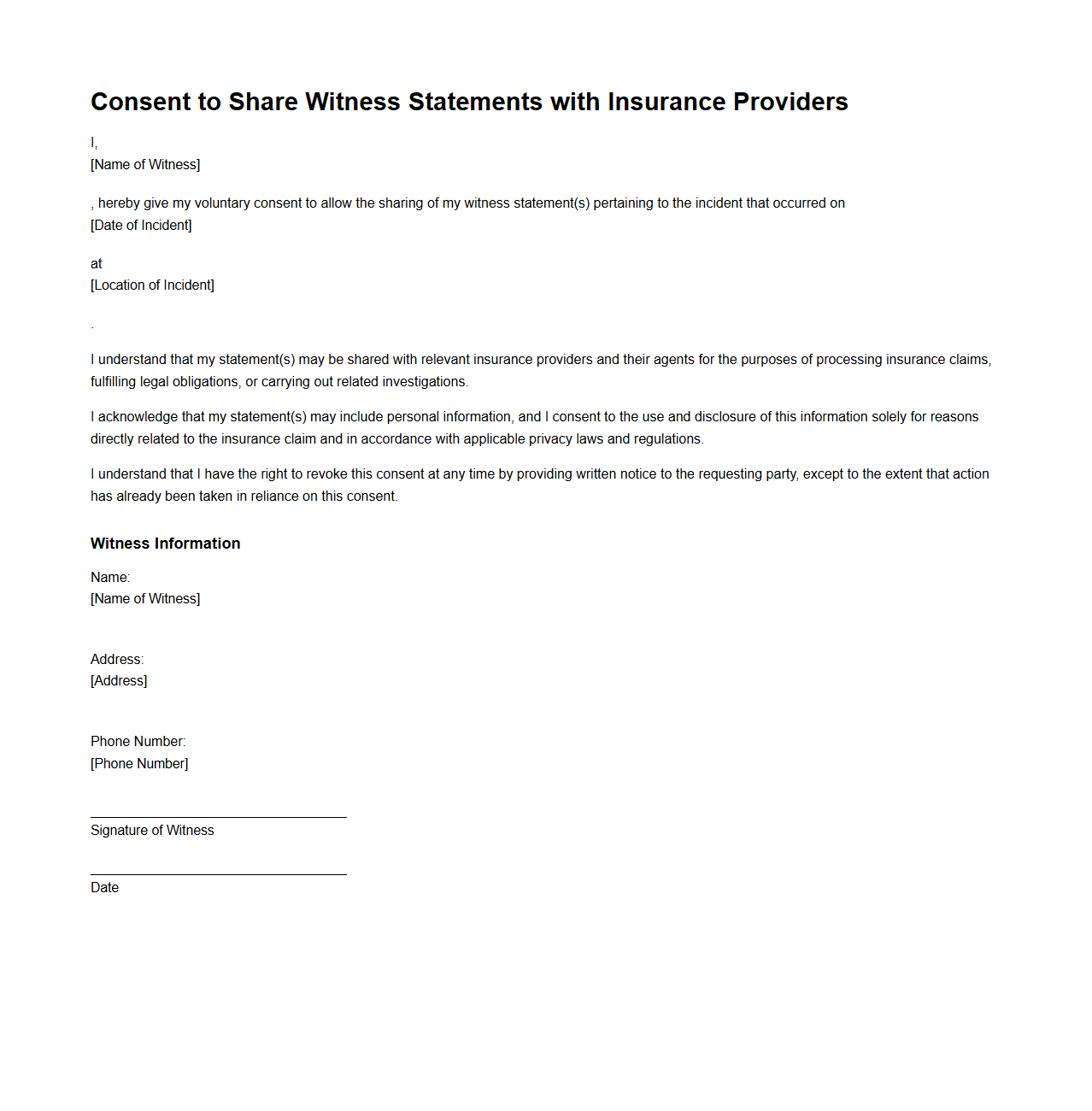

Consent to Share Witness Statements with Insurance Providers

The

Consent to Share Witness Statements with Insurance Providers document is a legal form that authorizes the sharing of witness testimony related to an accident or claim. It ensures compliance with privacy regulations while enabling insurers to obtain crucial information for claim assessment. This consent facilitates transparent communication between witnesses and insurance companies, expediting the claims investigation process.

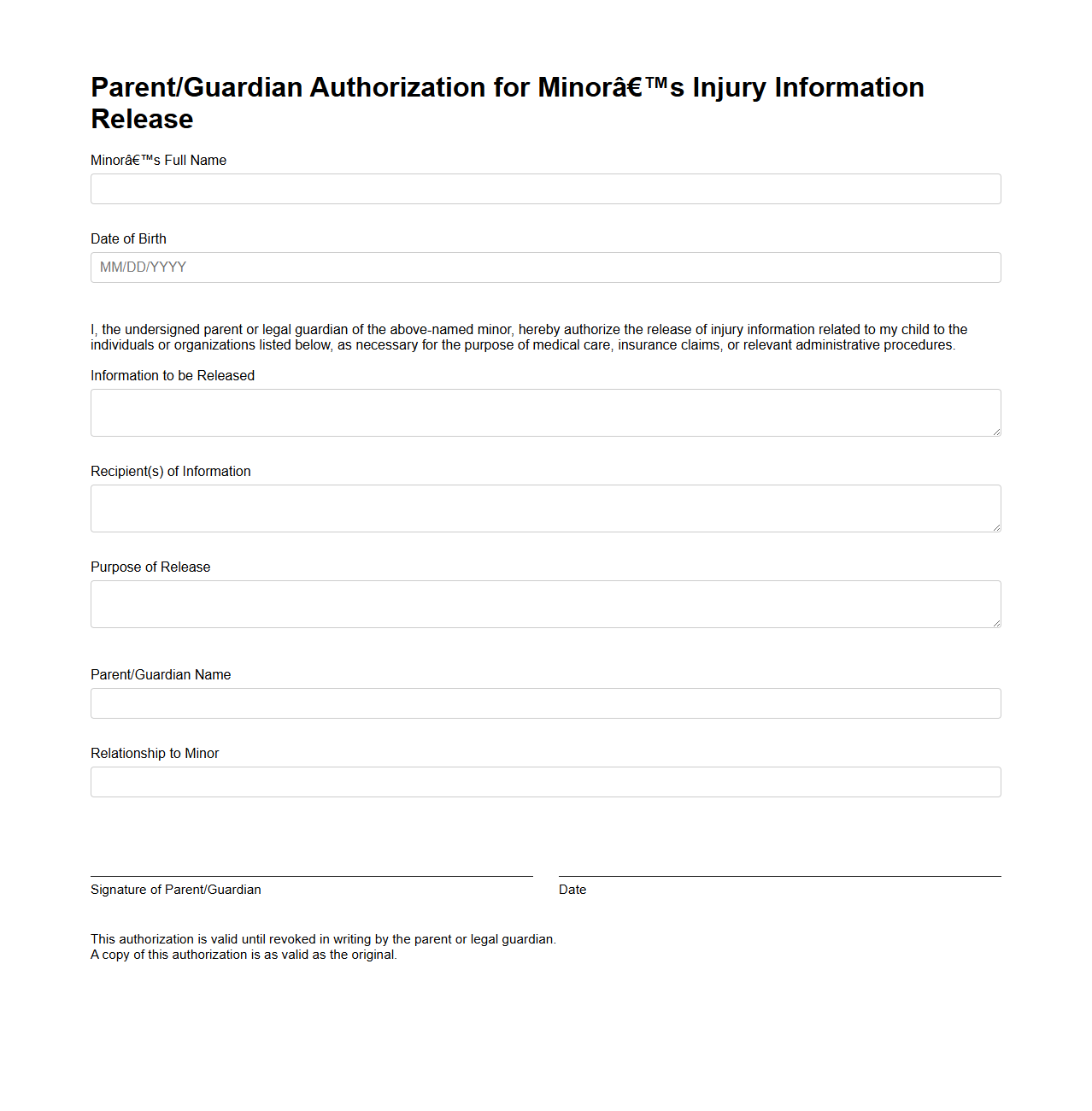

Parent/Guardian Authorization for Minor’s Injury Information Release

The

Parent/Guardian Authorization for Minor's Injury Information Release document grants legal consent for healthcare providers or institutions to share a minor's injury-related medical information with designated individuals or entities. This authorization ensures compliance with privacy laws such as HIPAA, safeguarding the minor's health data while facilitating appropriate communication and treatment coordination. Parents or guardians must sign this form to allow the release of sensitive injury details for legal, medical, or insurance purposes.

What specific personal information is being disclosed in this Consent to Disclosure Document?

The Consent to Disclosure Document specifically discloses personal injury insurance information. This includes details about the individual's insurance coverage, claim status, and medical records related to the injury. The document ensures that such sensitive information is protected yet available for authorized purposes.

To whom is the disclosure of information authorized, according to this document?

The disclosure is authorized to designated third parties such as insurance companies, legal representatives, and healthcare providers. These entities are permitted to receive the personal information for processing claims or providing necessary medical treatment. The document strictly limits authorization to these specified recipients to maintain confidentiality.

What is the stated purpose for disclosing the personal injury insurance information?

The primary purpose of disclosing personal injury insurance information is for claim assessment and management. This enables insurance companies and legal parties to evaluate the claim's validity and facilitate appropriate benefit distribution. Additionally, it supports coordination between healthcare providers and insurers for treatment and cost coverage.

How long is the consent for disclosure valid as outlined in the sample document?

The consent for disclosure remains valid for a specified duration, often until the completion of the claim process or a predetermined expiration date. This timeframe ensures that the information can be used as needed without indefinite access. After expiration, further disclosure requires renewed consent from the individual.

What are the rights of the individual regarding revocation or withdrawal of consent in this document?

The individual retains the right to revocate or withdraw their consent at any time by providing written notice. This action halts any future disclosures, safeguarding their privacy. However, withdrawal does not affect information already shared under prior consent, maintaining the integrity of previous transactions.