A Reinstatement Application Document Sample for Lapsed Policy provides a clear template to help policyholders request the revival of insurance coverage after a lapse. This document typically includes personal details, policy information, reasons for non-payment, and a declaration of good health. Using a well-structured sample ensures accuracy and completeness, increasing the chances of successful reinstatement.

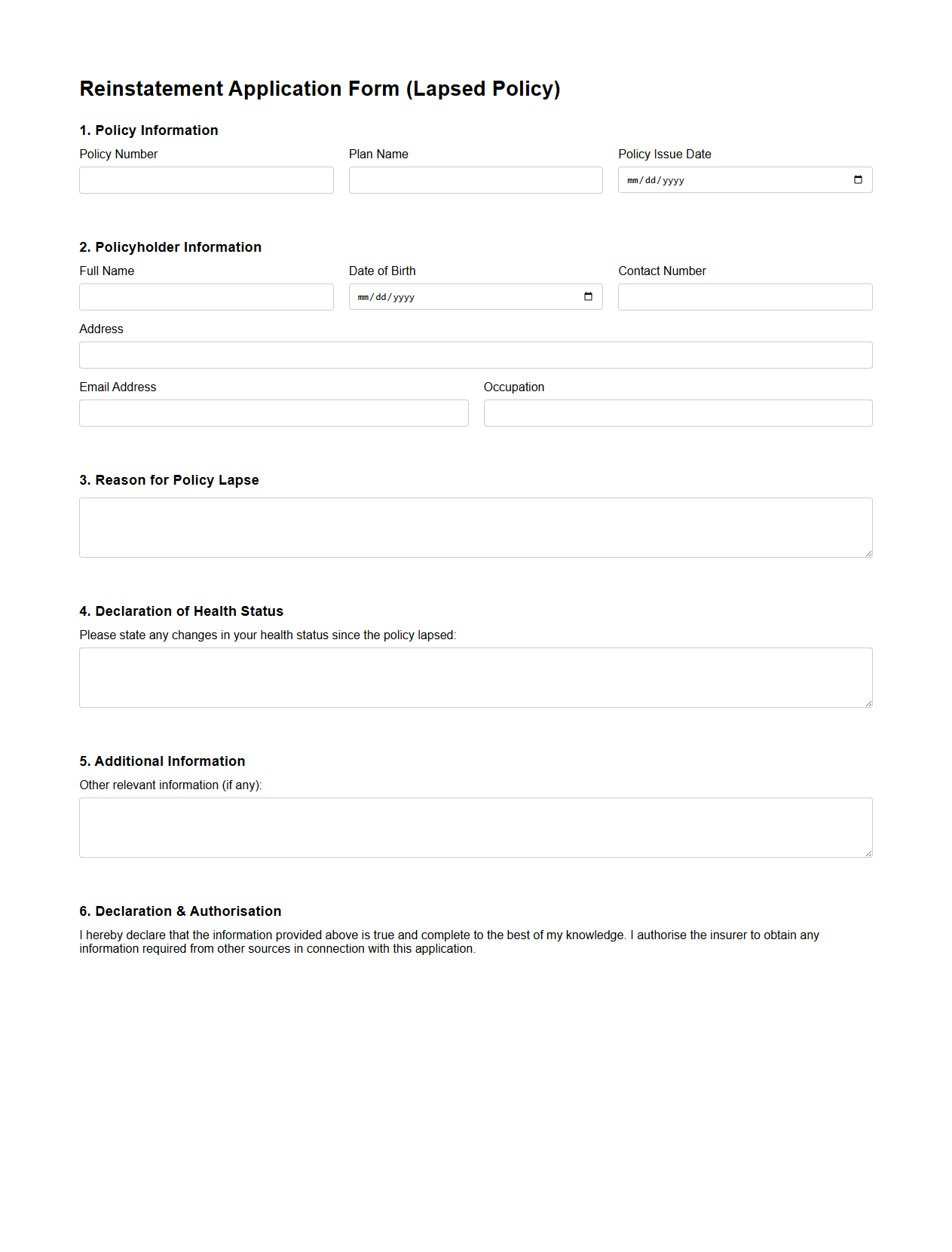

Reinstatement Application Form Template for Lapsed Policy

The

Reinstatement Application Form Template for Lapsed Policy document is a standardized form used by policyholders to request the revival of an insurance policy that has expired due to non-payment or lapse of premiums. It captures crucial information such as policy details, reasons for lapse, and declarations from the insured to facilitate the insurer's evaluation process. Completing this template accurately is essential for reinstating coverage and resuming policy benefits.

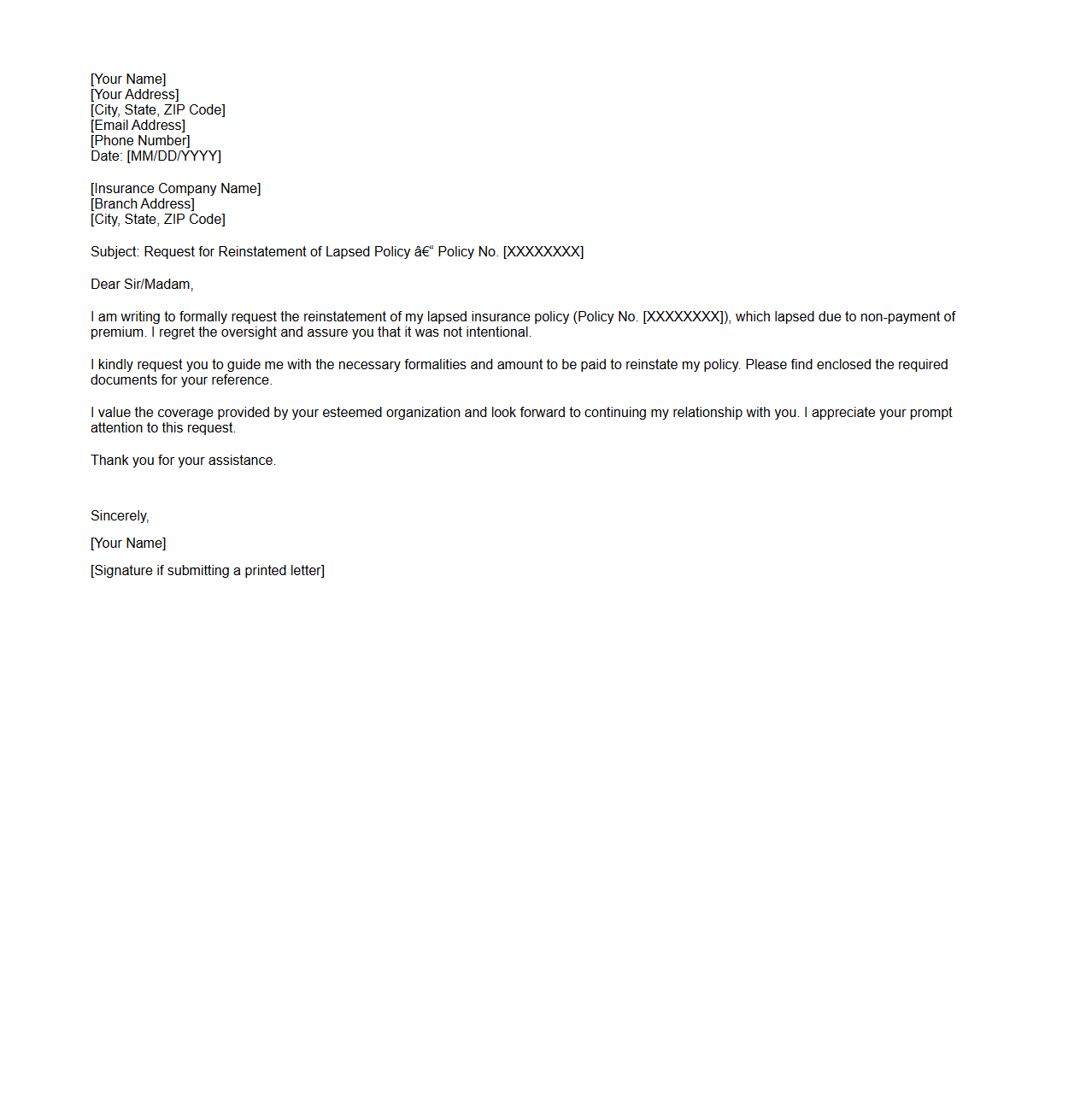

Lapsed Policy Reinstatement Request Letter Sample

A

Lapsed Policy Reinstatement Request Letter Sample document serves as a formal written appeal from a policyholder to the insurance company, requesting the reactivation of an insurance policy that has expired due to non-payment or other reasons. This letter typically includes essential details such as the policy number, date of lapse, reasons for the delay in payment, and a commitment to pay any outstanding premiums or fees. Using a well-structured sample letter helps ensure clarity and professionalism, increasing the chances of a successful policy reinstatement.

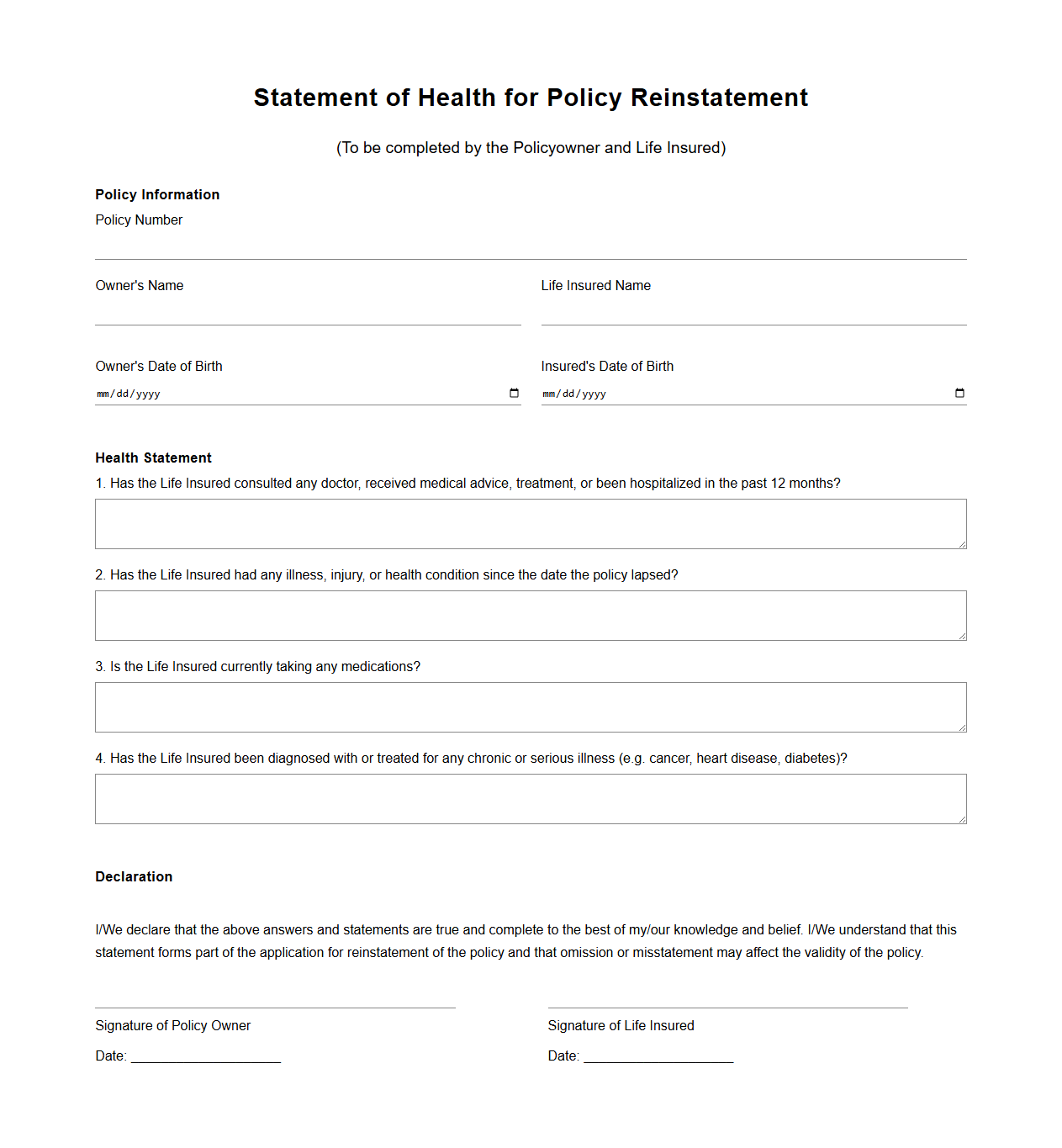

Statement of Health for Policy Reinstatement

A

Statement of Health for Policy Reinstatement is a document used by insurance companies to collect updated health information from policyholders seeking to reactivate a lapsed insurance policy. This statement typically includes questions about recent medical conditions, treatments, and lifestyle changes that impact the insured's risk profile. Accurate completion of this document helps insurers assess eligibility and determine the terms for reinstating coverage.

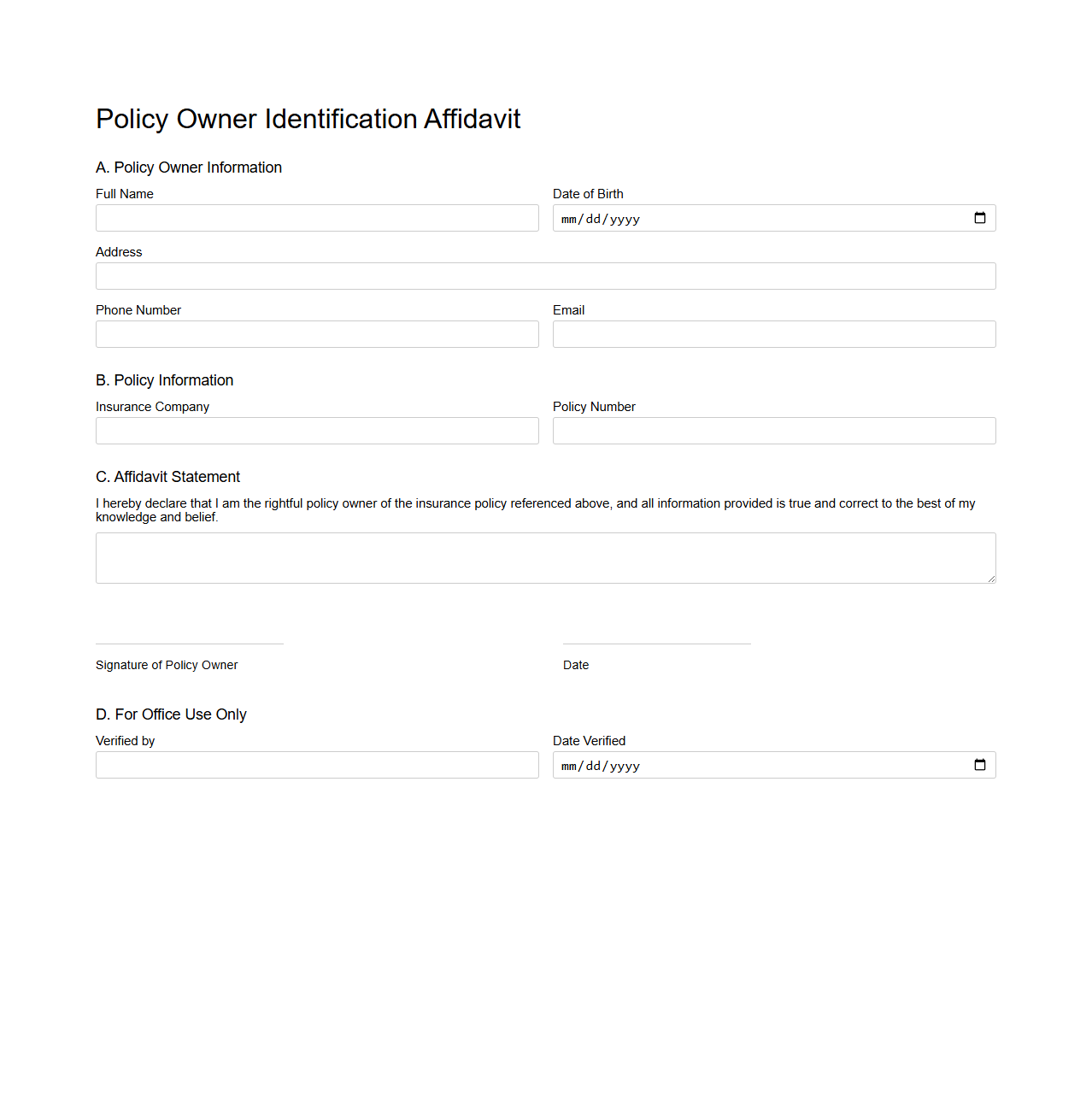

Policy Owner Identification Affidavit

A

Policy Owner Identification Affidavit is a legal document used to verify the identity of the individual who owns an insurance policy. It serves as formal proof required by insurance companies to prevent fraud and ensure rightful claim processing. This affidavit typically includes personal details, signatures, and may be notarized to authenticate the policy owner's status.

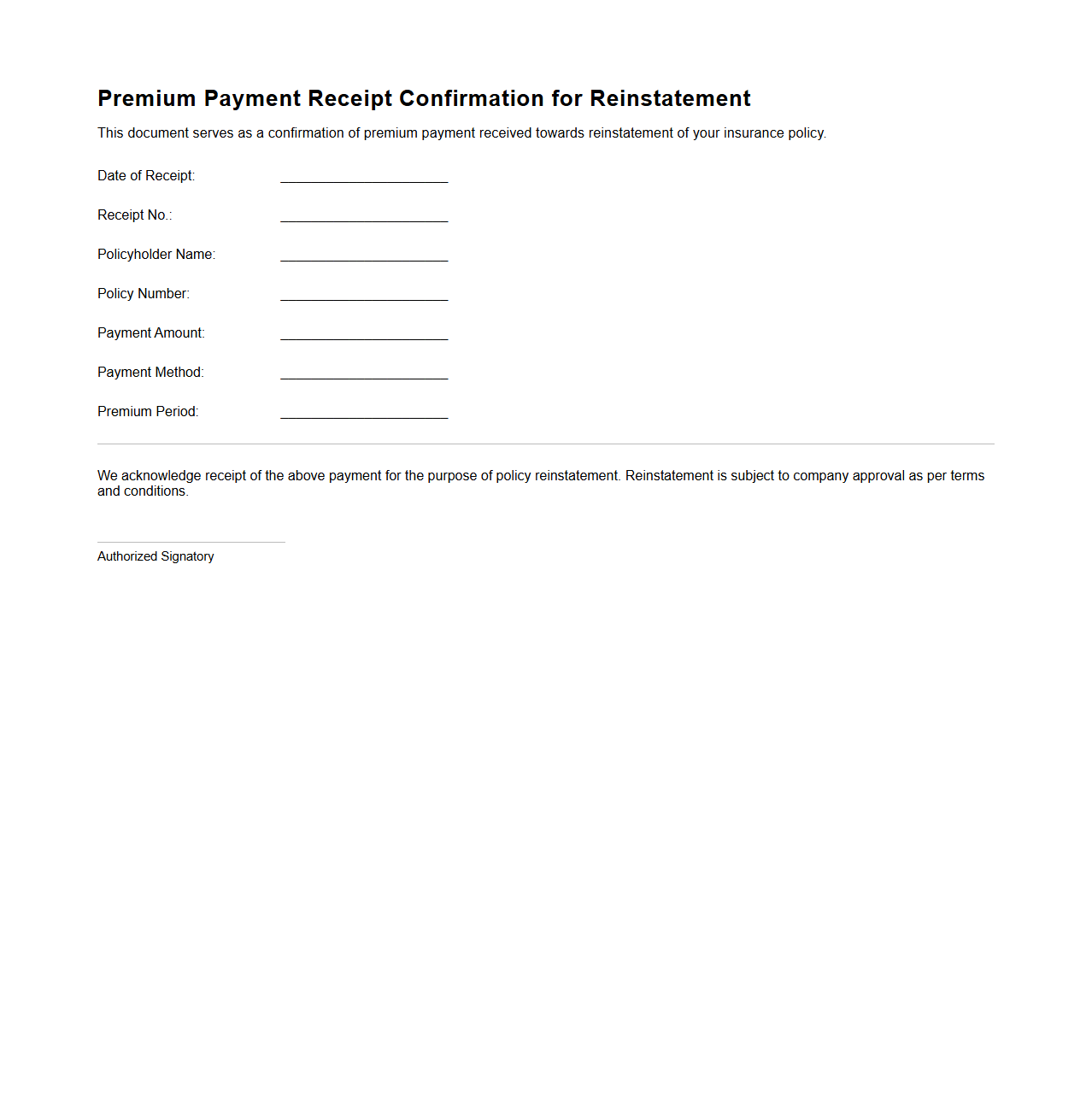

Premium Payment Receipt Confirmation for Reinstatement

The

Premium Payment Receipt Confirmation for Reinstatement is a crucial document that verifies the payment of overdue premiums required to reinstate a lapsed insurance policy. This confirmation serves as official proof that the policyholder has fulfilled the necessary financial obligations to reactivate coverage. Insurers use this receipt to process reinstatements, ensuring continuous protection without gaps in policy benefits.

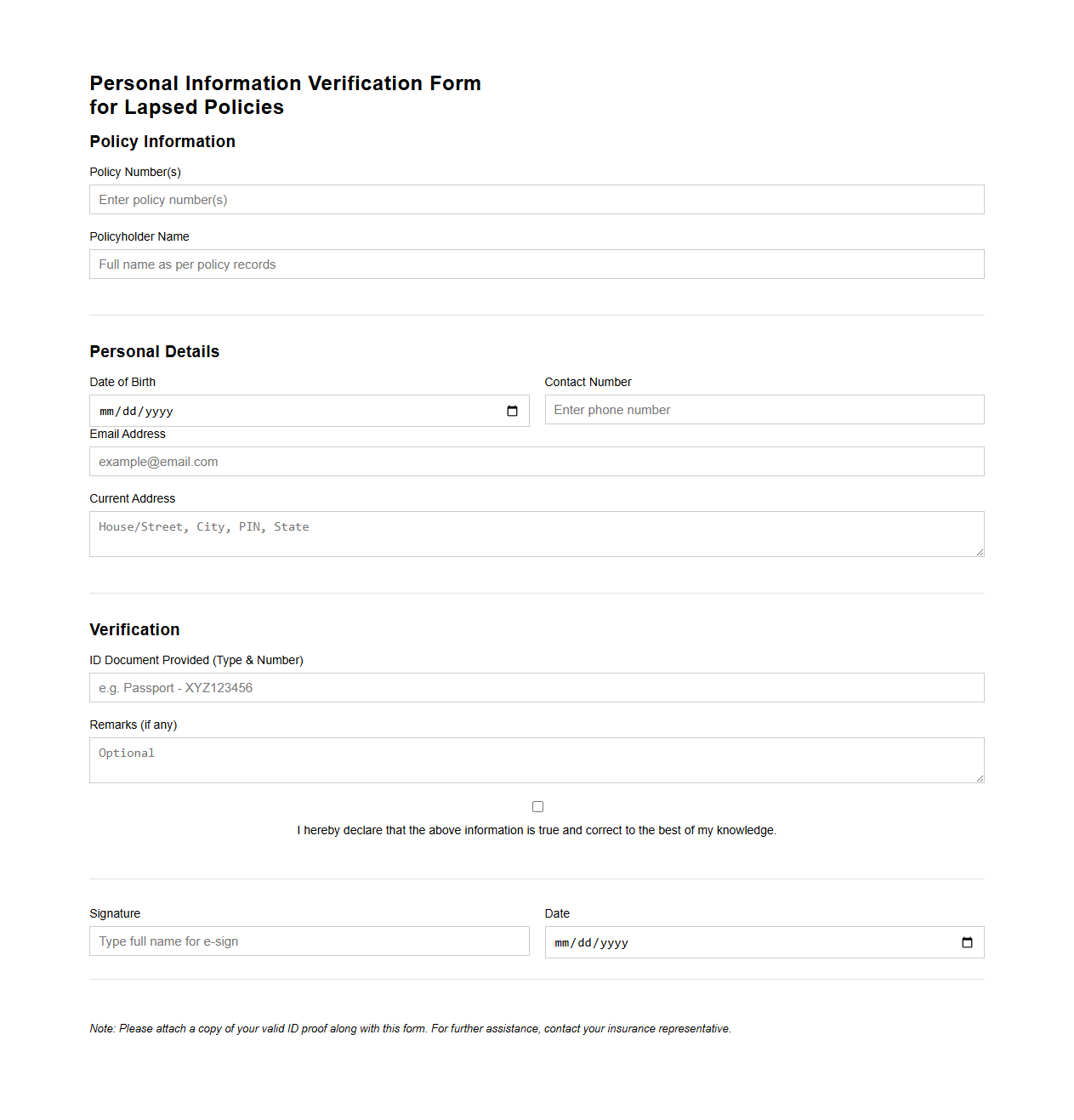

Personal Information Verification Form for Lapsed Policies

The

Personal Information Verification Form for Lapsed Policies is a crucial document used by insurance companies to confirm and update the policyholder's personal details after a policy lapse. This form helps ensure accuracy in records, facilitating the process of policy reinstatement or renewal by verifying identity, contact information, and other relevant personal data. Maintaining up-to-date information minimizes delays and errors in resuming coverage under previously lapsed insurance policies.

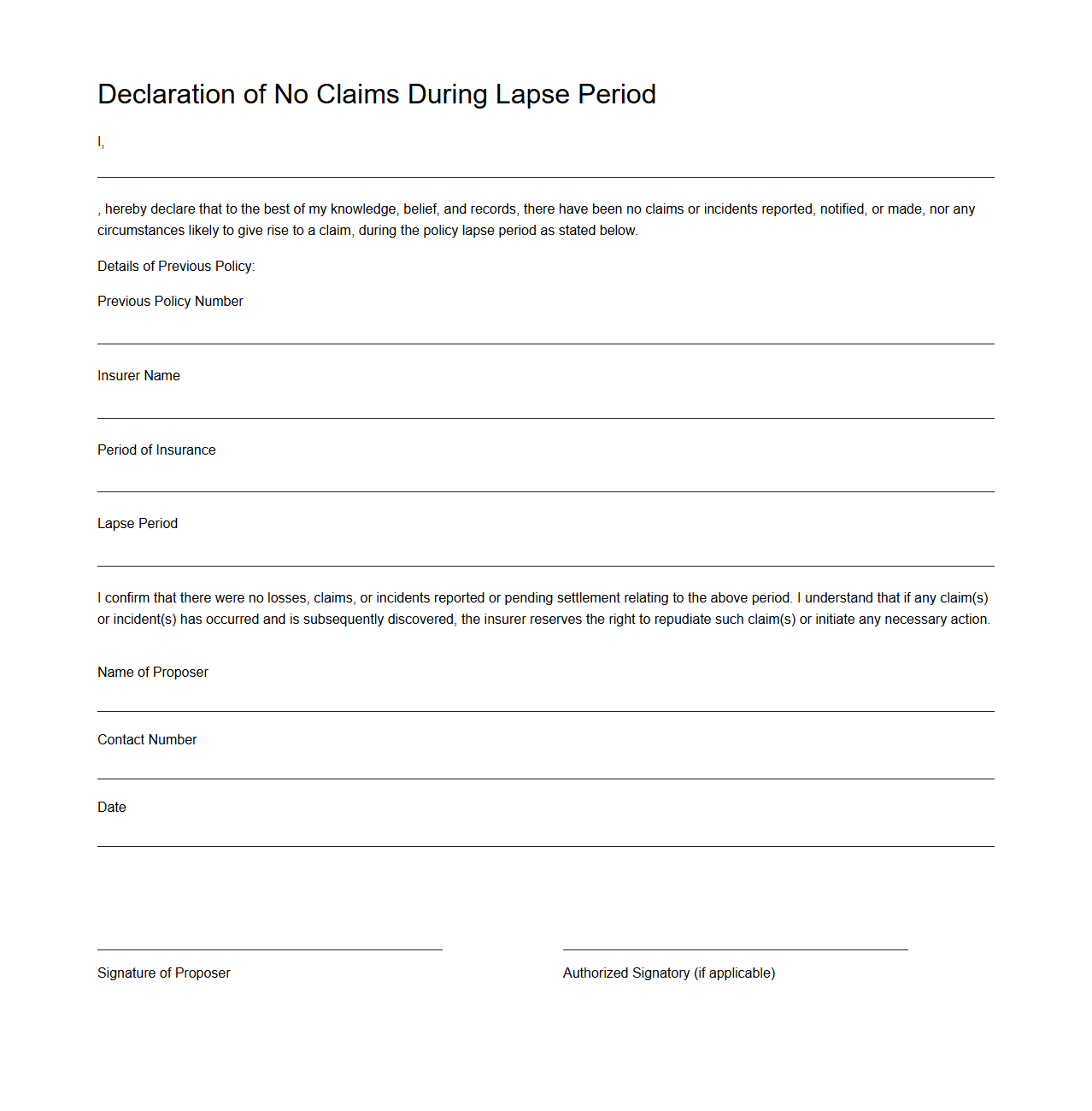

Declaration of No Claims During Lapse Period

The

Declaration of No Claims During Lapse Period is a legal document used to confirm that no claims have been made or arise against an insurance policy during the lapse period when coverage was inactive. This declaration is often required by insurers to reinstate or issue a new policy, ensuring transparency and risk assessment accuracy. It helps protect both the insurer and policyholder by establishing a clear record regarding claims history during the coverage gap.

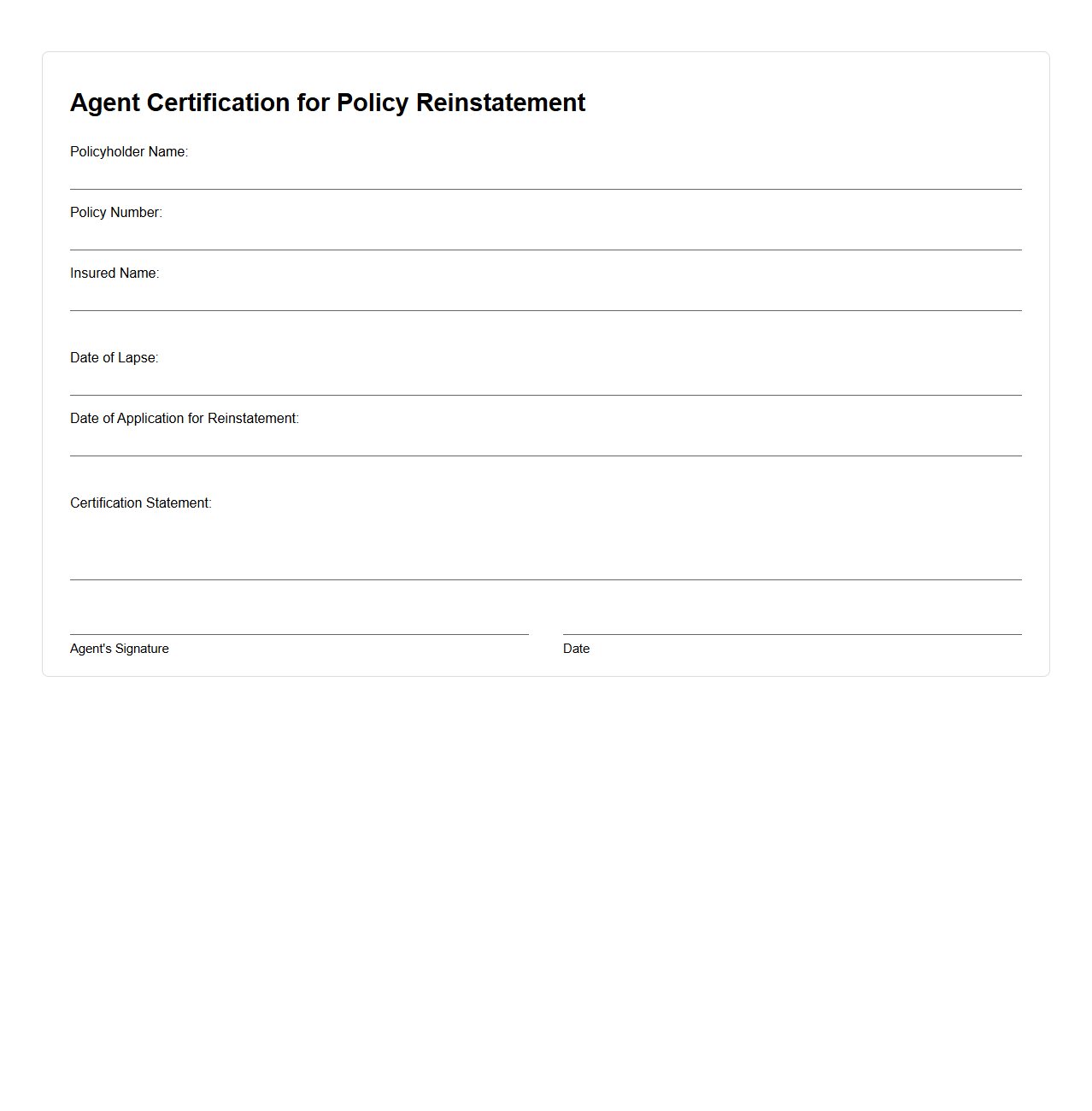

Agent Certification for Policy Reinstatement

Agent Certification for Policy Reinstatement is a critical document verifying that an insurance agent has reviewed and confirmed all necessary conditions and documentation for reinstating a lapsed policy. This certification ensures compliance with regulatory requirements and affirms the agent's responsibility in validating the policyholder's eligibility. The

Agent Certification safeguards the accuracy and integrity of the reinstatement process, facilitating efficient and legally compliant policy restoration.

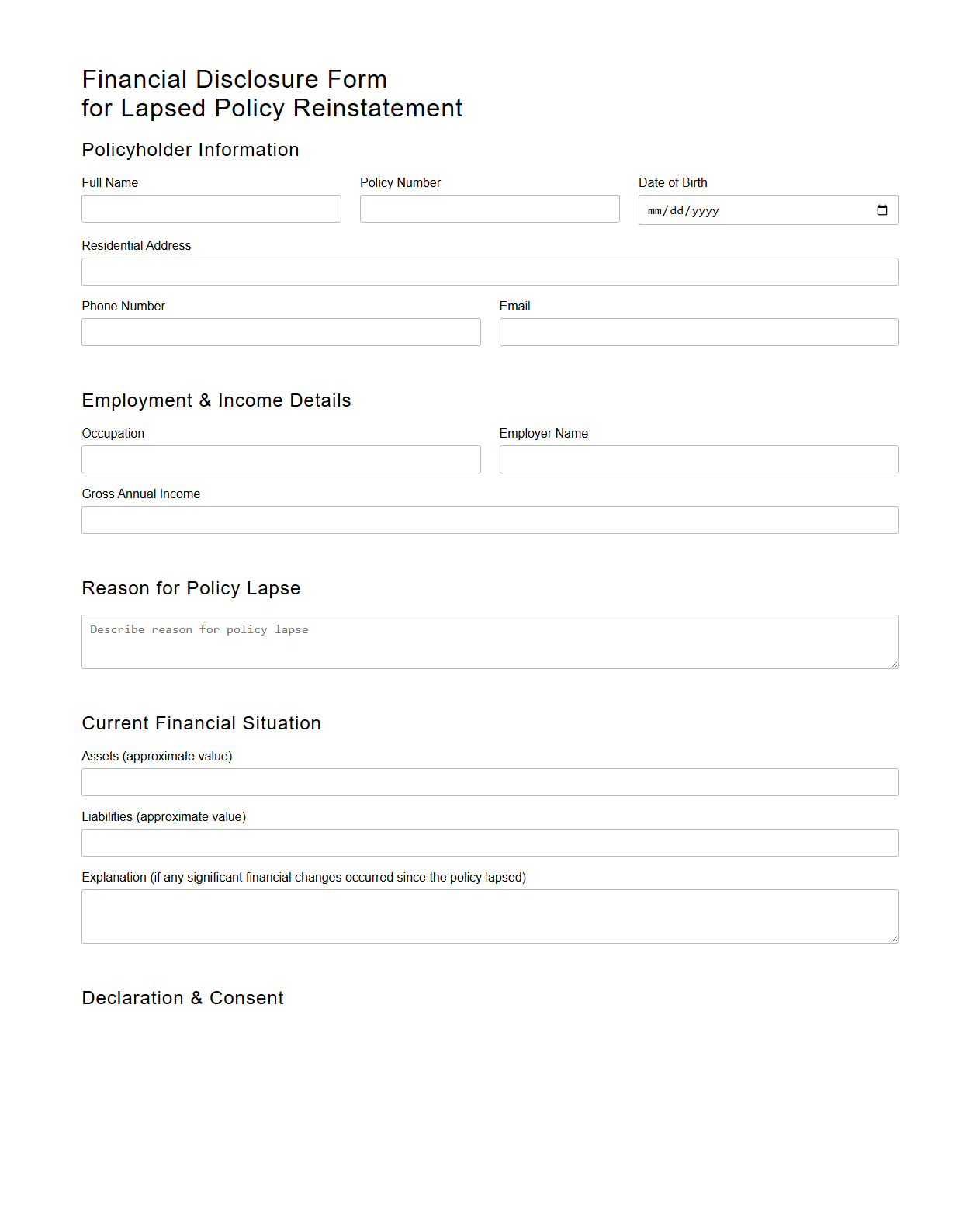

Financial Disclosure Form for Lapsed Policy Reinstatement

A

Financial Disclosure Form for Lapsed Policy Reinstatement is a crucial document that requires policyholders to provide detailed financial information to assess their eligibility for reinstating a lapsed insurance policy. This form helps insurers evaluate the applicant's current financial status, ensuring that the policyholder can sustain premium payments and meet policy obligations. Accurate completion of this form speeds up the reinstatement process by offering transparent financial insights that influence underwriting decisions.

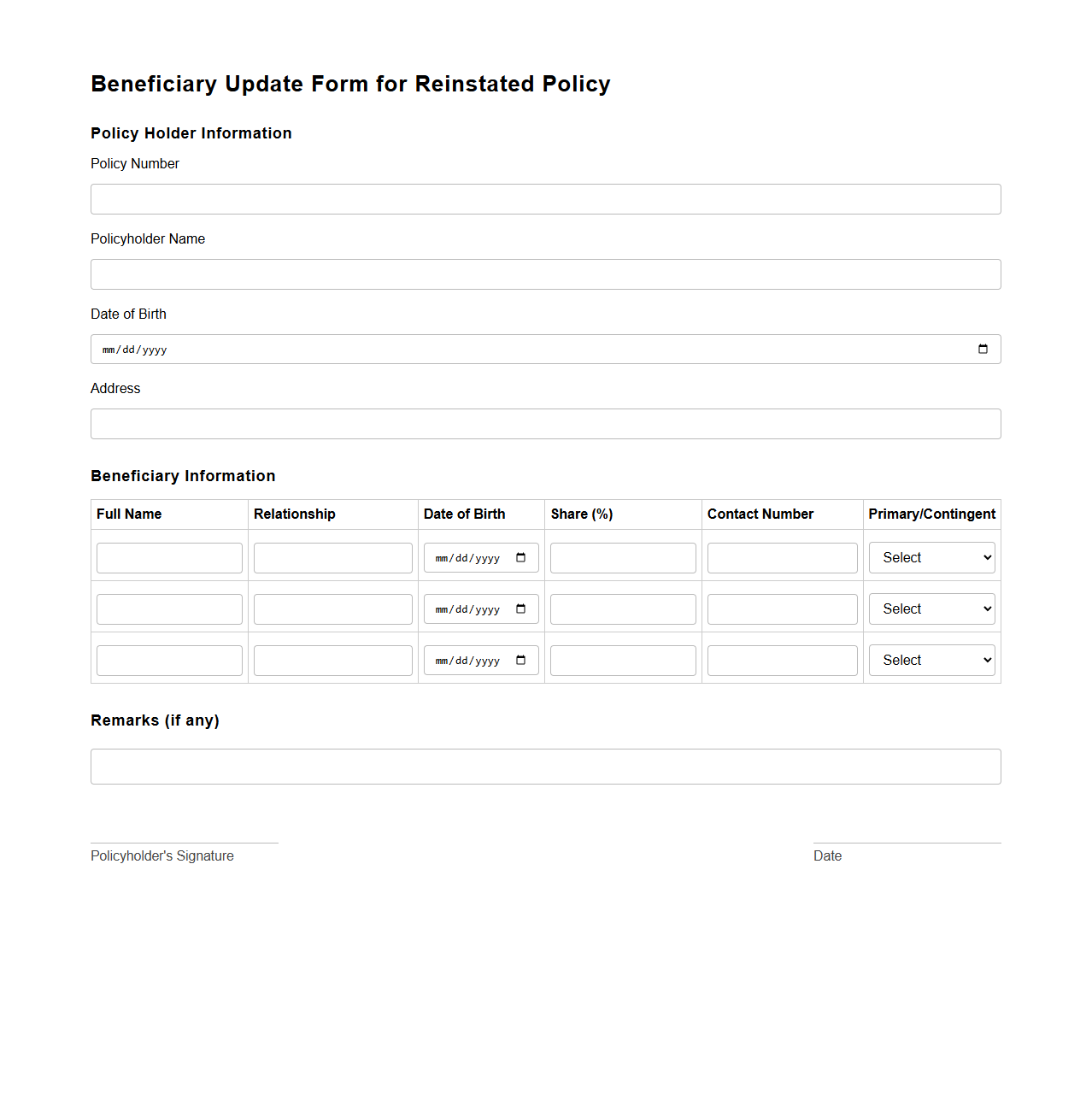

Beneficiary Update Form for Reinstated Policy

The

Beneficiary Update Form for a reinstated policy document allows policyholders to revise or confirm the designated beneficiaries after a policy has been reinstated following a lapse. This form ensures that the distribution of benefits aligns with the current wishes of the policyowner, maintaining accurate records for claim processing. Timely submission of the update form helps prevent disputes and facilitates smooth benefit payouts upon the insured event.

Information Required to Verify Policyholder's Identity

The reinstatement application document requires proof of identity to verify the policyholder. Commonly requested information includes government-issued IDs and policy numbers. This ensures the person applying is the legitimate holder of the lapsed policy.

Sections Outlining Eligibility Criteria for Reinstatement

The eligibility criteria for reinstatement are clearly detailed in specific sections of the document. These sections explain conditions like the maximum lapse period and outstanding premiums. Understanding these eligibility requirements is crucial before submitting an application.

Key Conditions or Declarations Applicant Must Acknowledge

The applicant must acknowledge important declarations such as truthful disclosure of information and agreement to policy terms. These conditions protect both the insurer and applicant by ensuring transparency. Compliance with these declarations is mandatory for reinstatement approval.

Specification of Required Payment or Premium Calculations

The document specifies how to calculate the required premium to reinstate the lapsed policy. It typically includes unpaid premiums plus any interest or fees incurred during the lapse period. Clear instructions are provided to avoid payment errors and delays.

Consequences of Providing False Information

The document clearly states that providing false information during the reinstatement process can lead to serious consequences. These may include application rejection or policy cancellation. Such measures ensure integrity and protect the insurer from fraud.