A Shareholders Agreement Document Sample outlines the rights, responsibilities, and obligations of shareholders within a corporation, ensuring clear rules for decision-making and conflict resolution. This document enhances corporate governance by establishing mechanisms for protecting minority interests and maintaining operational transparency. Using a well-structured sample helps streamline the creation of customized agreements tailored to specific corporate needs.

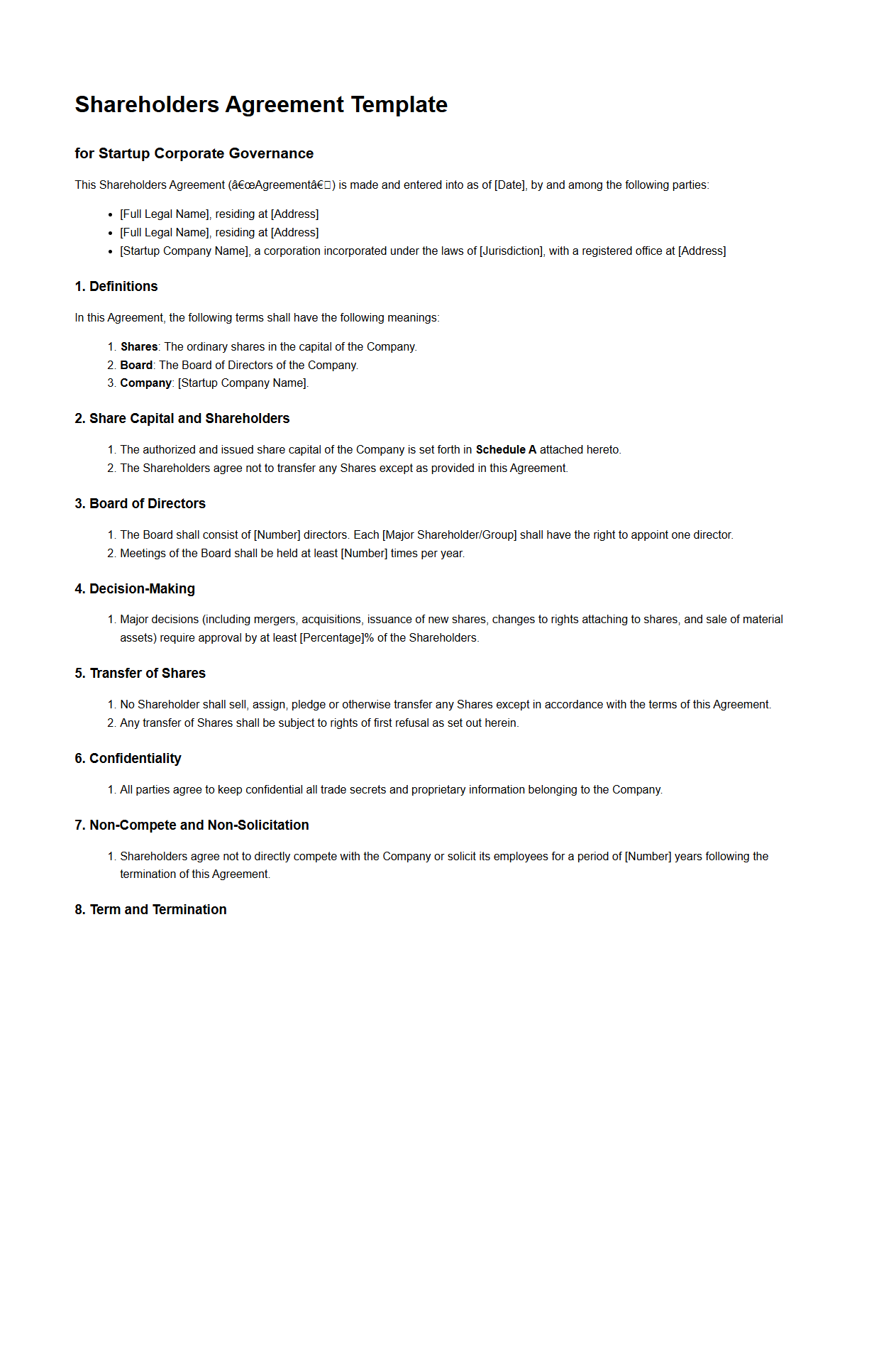

Shareholders Agreement Template for Startup Corporate Governance

A

Shareholders Agreement Template for startup corporate governance is a legally binding document that outlines the rights, responsibilities, and obligations of shareholders in a new company. It establishes rules for decision-making, equity ownership, dividend distribution, and dispute resolution to protect minority shareholders and ensure smooth business operations. This template serves as a critical framework to maintain transparency, prevent conflicts, and support the sustainable growth of the startup.

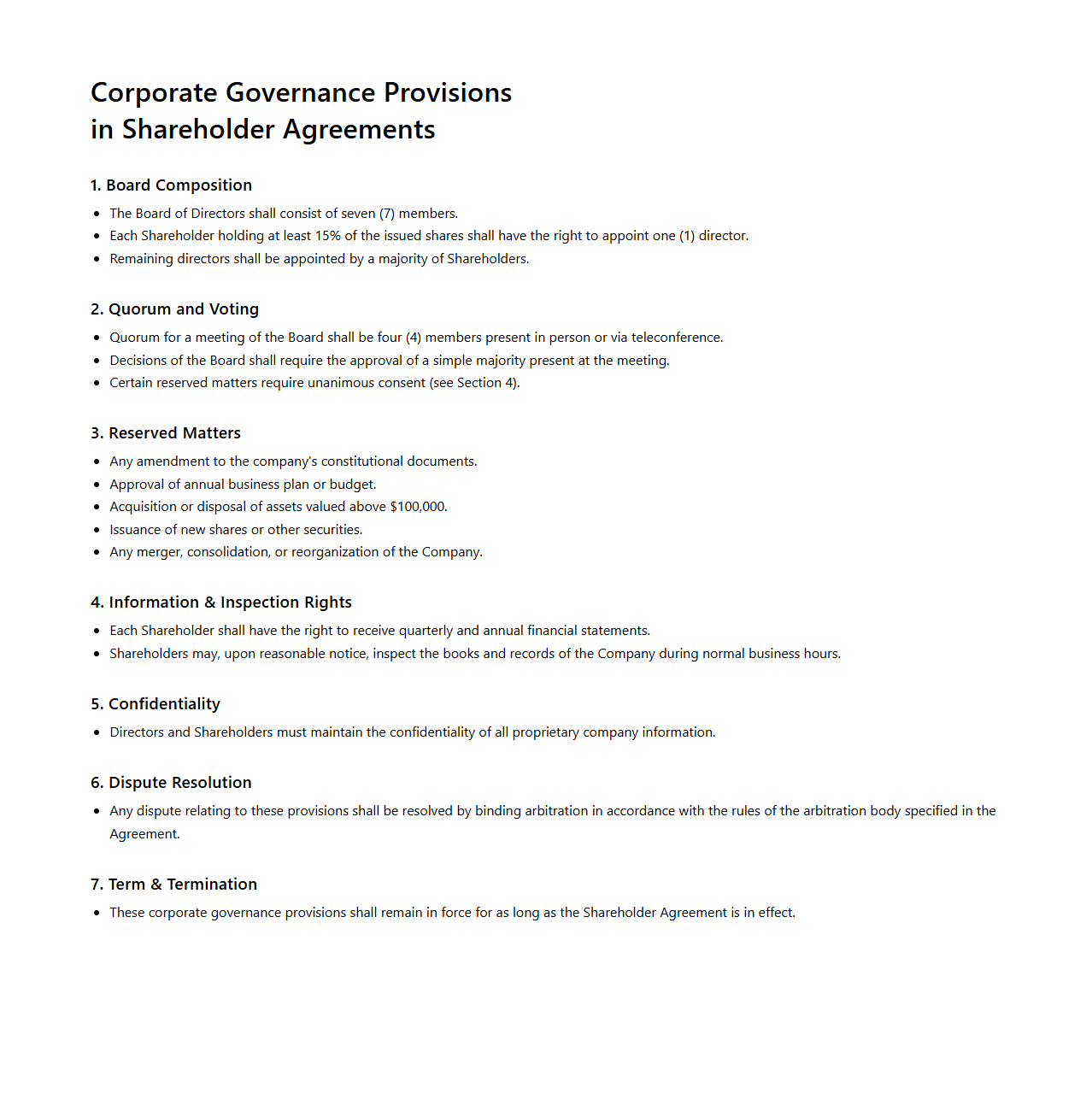

Corporate Governance Provisions in Shareholder Agreements

Corporate Governance Provisions in Shareholder Agreements define the rules and procedures that regulate decision-making processes, roles, and responsibilities among shareholders, directors, and executives within a company. These provisions include mechanisms for board composition, voting rights, conflict resolution, and the protection of minority shareholders' interests. Effective

Corporate Governance Provisions ensure transparency, accountability, and alignment of interests, fostering sustainable business growth and reducing potential disputes.

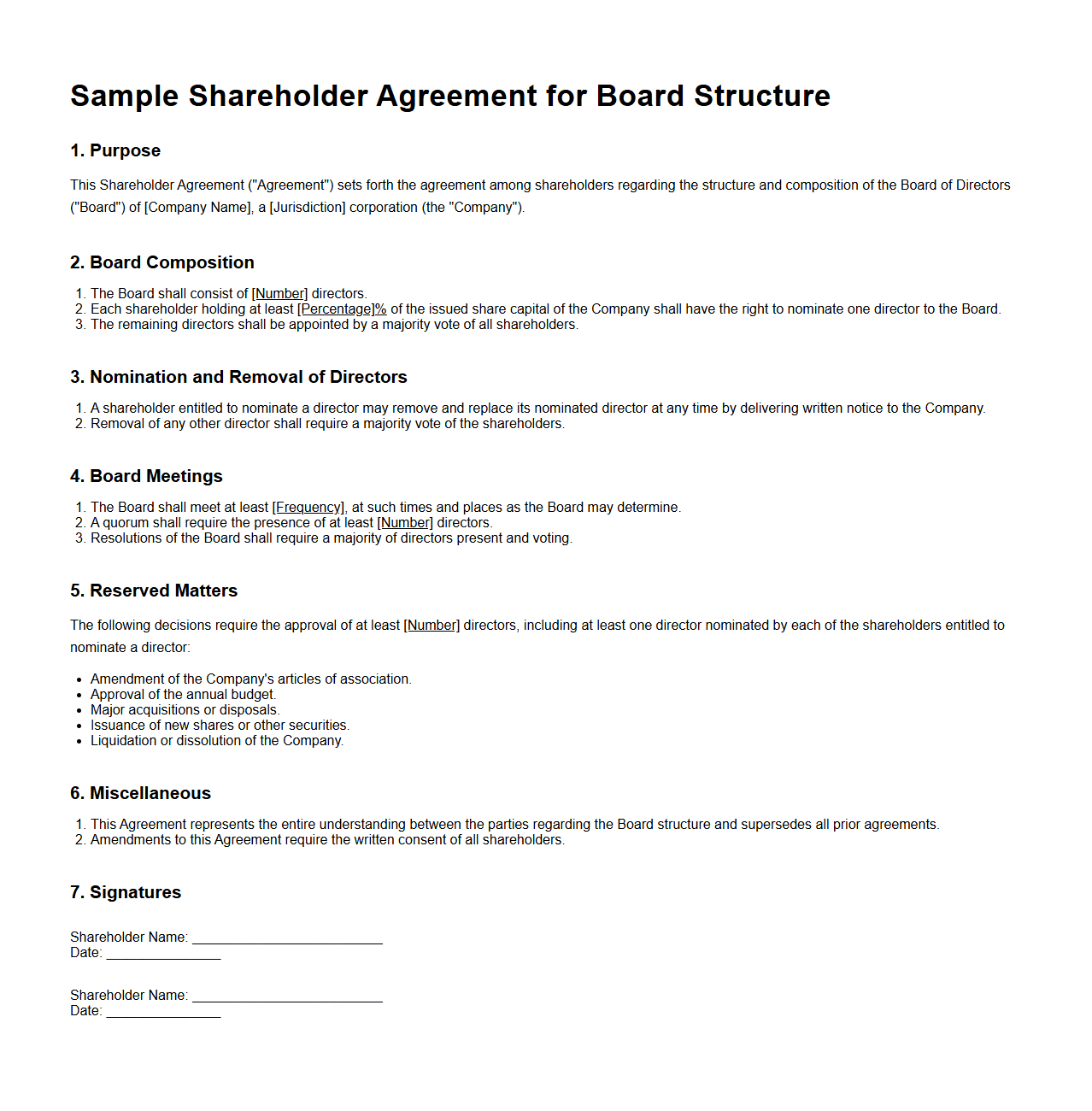

Sample Shareholder Agreement for Board Structure

A

Sample Shareholder Agreement for Board Structure document outlines the roles, responsibilities, and decision-making processes of a company's board of directors to ensure clear governance. It typically includes provisions on board composition, appointment and removal of directors, voting rights, and meeting protocols to protect shareholders' interests. This legal framework helps prevent conflicts and supports effective management by defining how the board operates within the shareholder agreements.

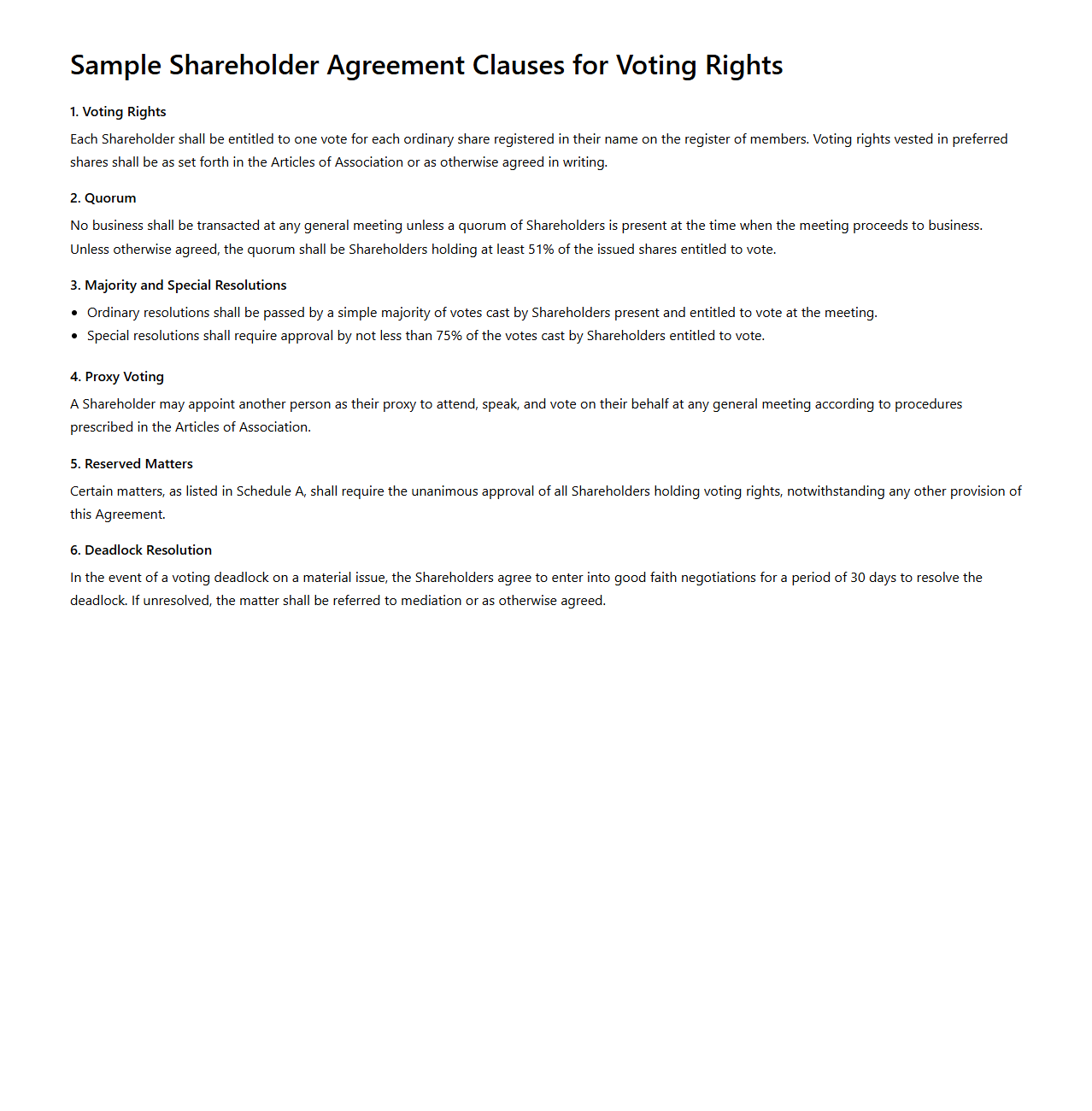

Shareholder Agreement Clauses for Voting Rights

A

Shareholder Agreement Clauses for Voting Rights document outlines the specific rules and provisions that govern how shareholders exercise their voting power within a company. It details the allocation of voting rights among shareholders, procedures for voting on key corporate decisions, and mechanisms to resolve disputes or deadlocks. This document ensures clarity and protection of shareholder interests by regulating voting processes in compliance with corporate governance standards.

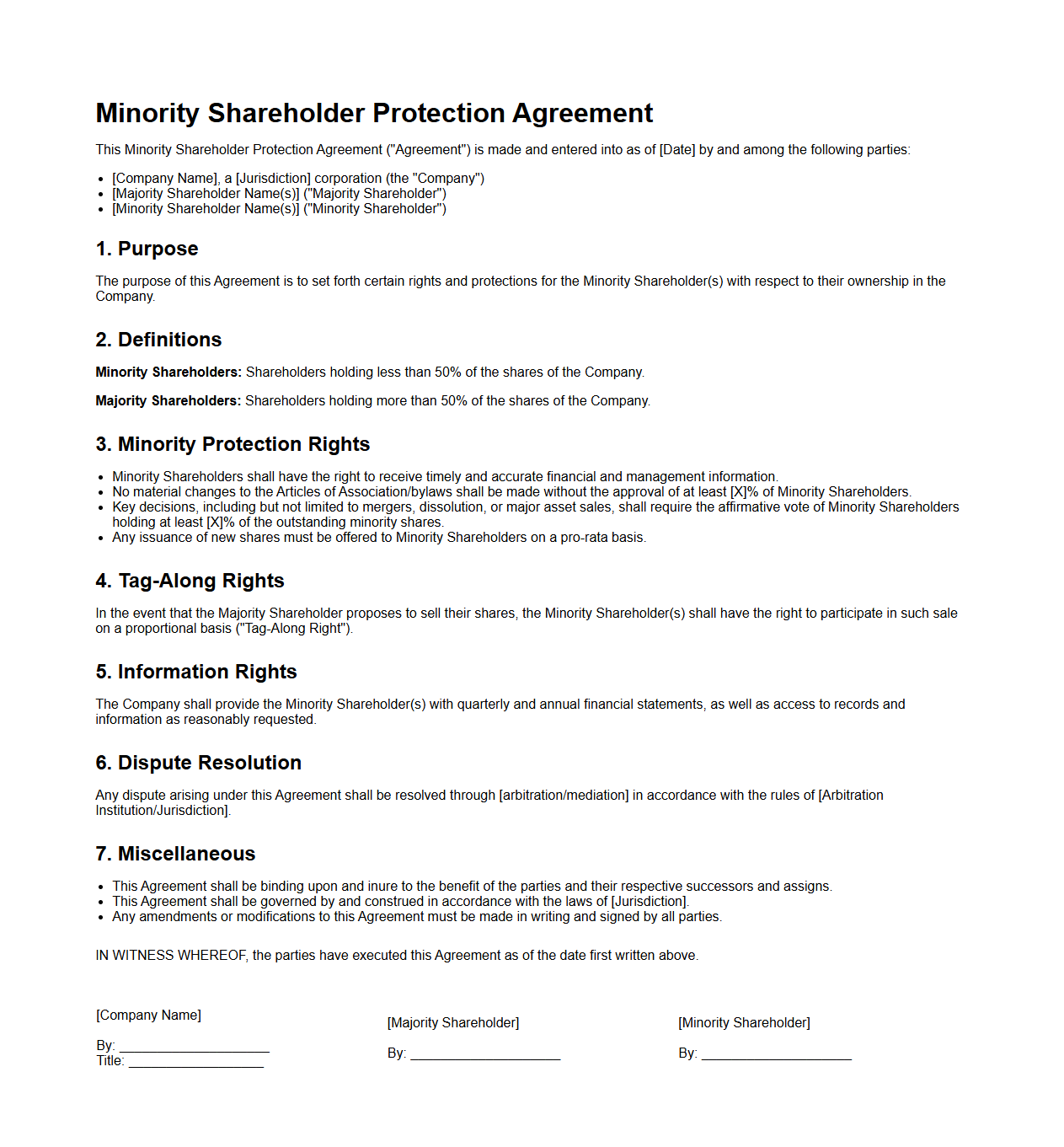

Minority Shareholder Protection Agreement Sample

A

Minority Shareholder Protection Agreement Sample document outlines the rights and safeguards granted to minority shareholders within a corporation, ensuring their interests are protected against potential majority shareholder decisions. This agreement typically covers voting rights, dividend entitlements, information access, and mechanisms to prevent unfair dilution of shares. Utilizing a well-structured sample helps companies draft tailored protections that promote transparency and equity in shareholder relationships.

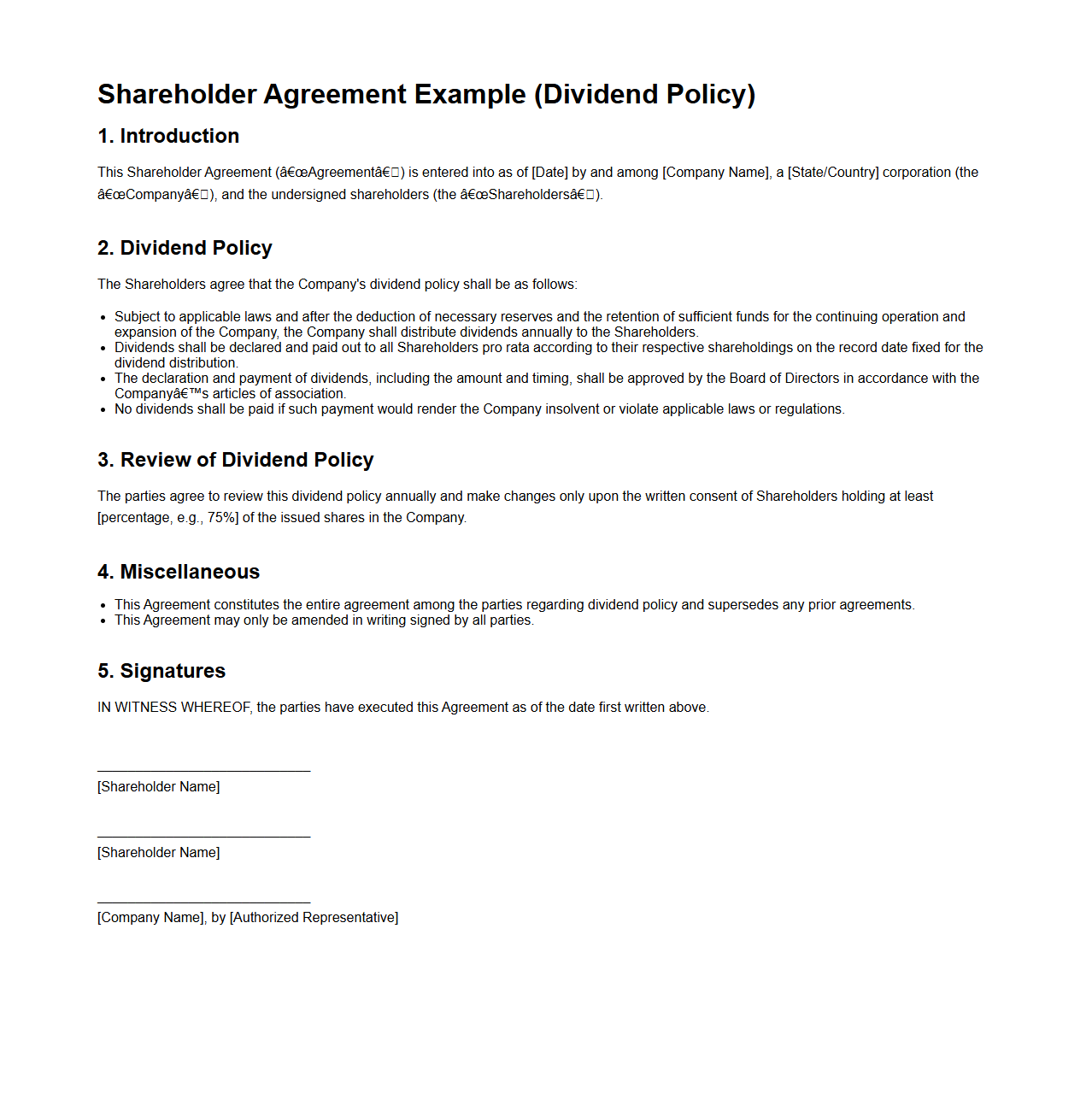

Shareholder Agreement Example for Dividend Policy

A

Shareholder Agreement Example for Dividend Policy document outlines the specific terms and conditions agreed upon by shareholders regarding the distribution of profits as dividends. It establishes clear guidelines on how and when dividends will be declared, ensuring transparency and aligning shareholder expectations. This agreement helps prevent disputes by defining roles, payout frequencies, and reinvestment rules related to company earnings.

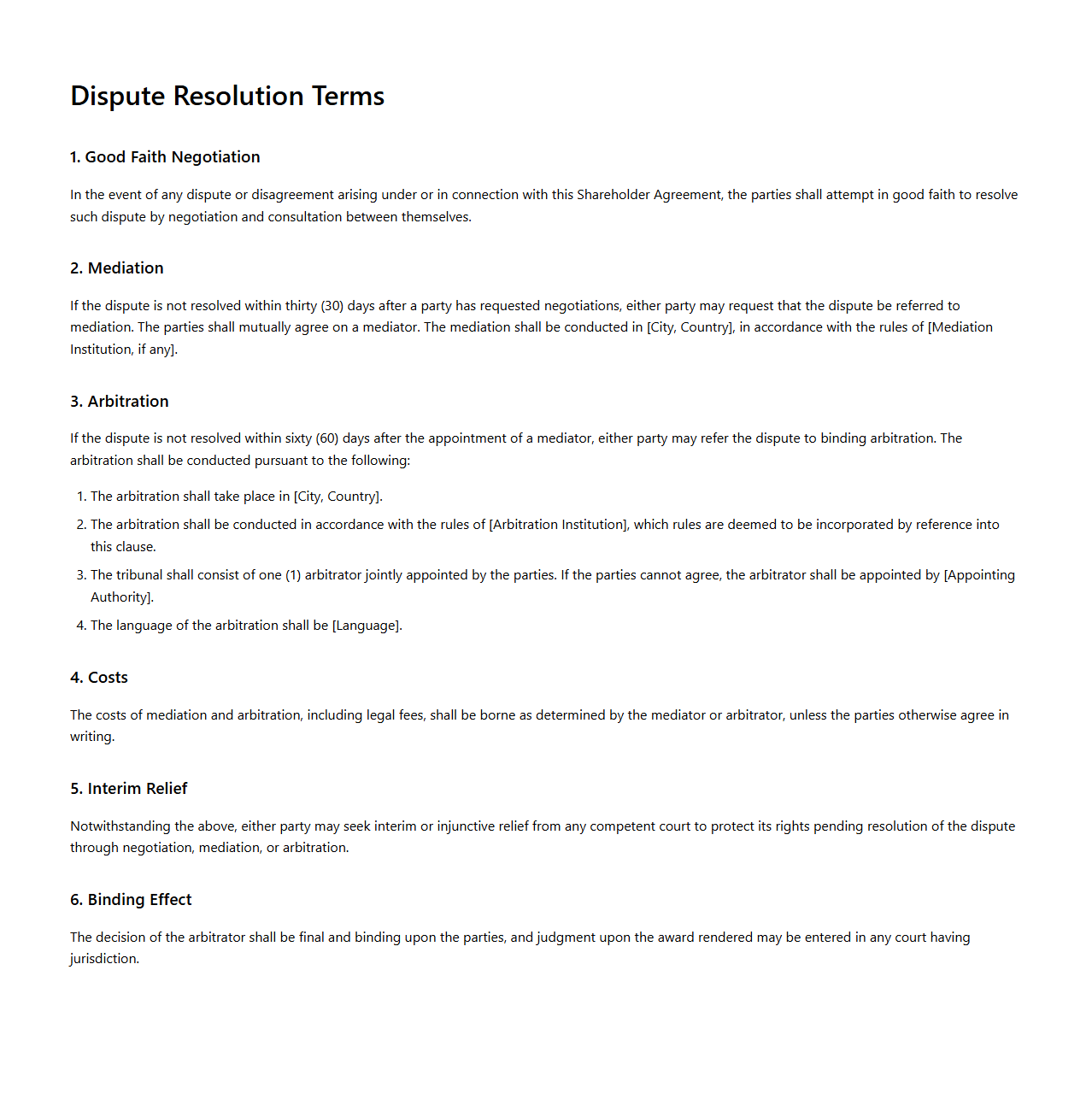

Dispute Resolution Terms in Shareholder Agreements

Dispute resolution terms in a shareholder agreement outline the procedures and mechanisms for resolving conflicts between shareholders, ensuring smooth governance and protecting investments. These clauses commonly specify methods such as negotiation, mediation, arbitration, or litigation to address disagreements efficiently and avoid prolonged legal battles. Clearly defined

dispute resolution terms help maintain business stability and uphold shareholder rights.

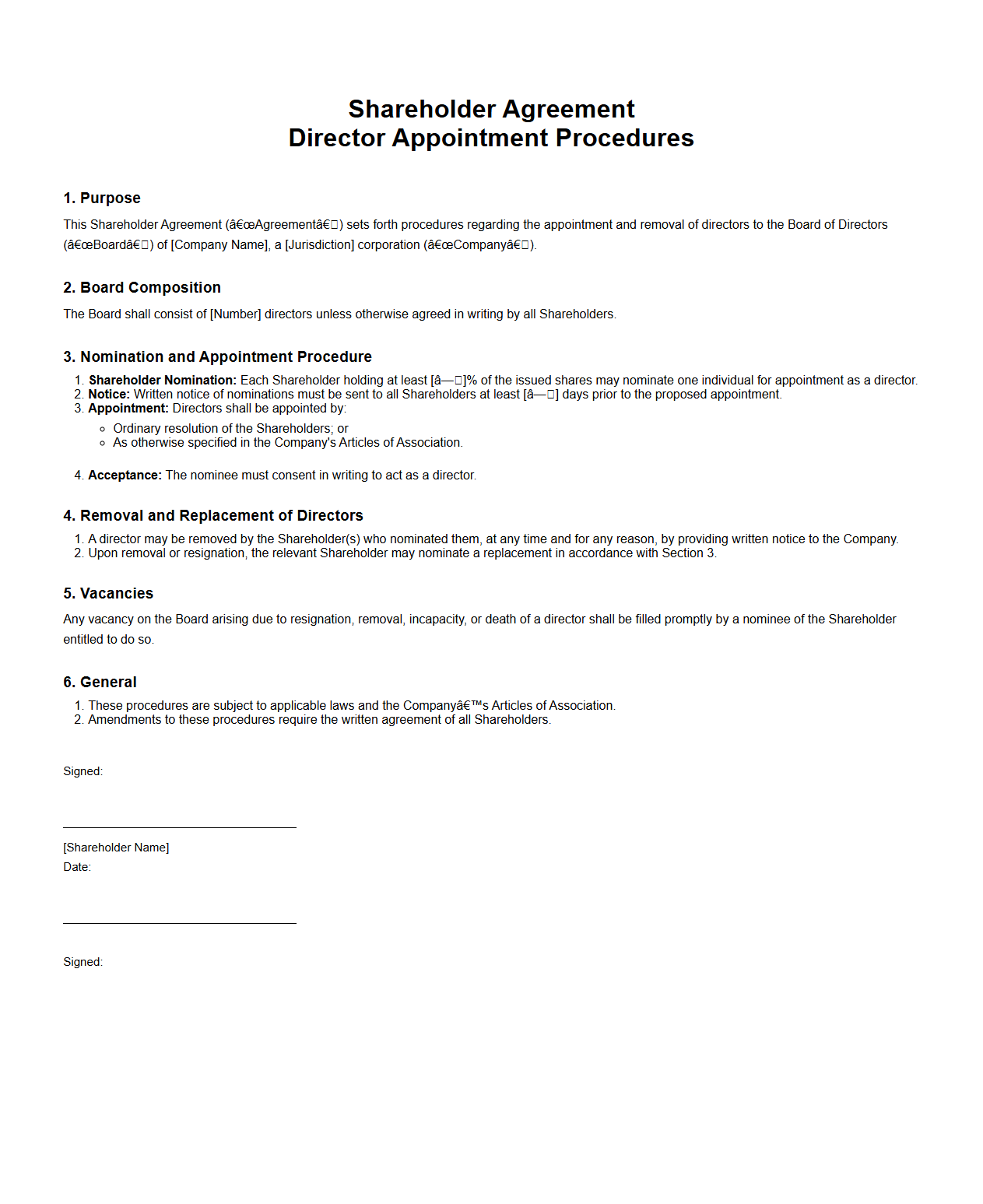

Shareholder Agreement for Director Appointment Procedures

A

Shareholder Agreement for Director Appointment Procedures document outlines the specific rules and processes shareholders must follow to appoint or remove directors within a company. It ensures clarity on voting rights, nomination criteria, and board composition to maintain balanced governance. This agreement helps prevent disputes by clearly defining each party's role and decision-making powers related to director appointments.

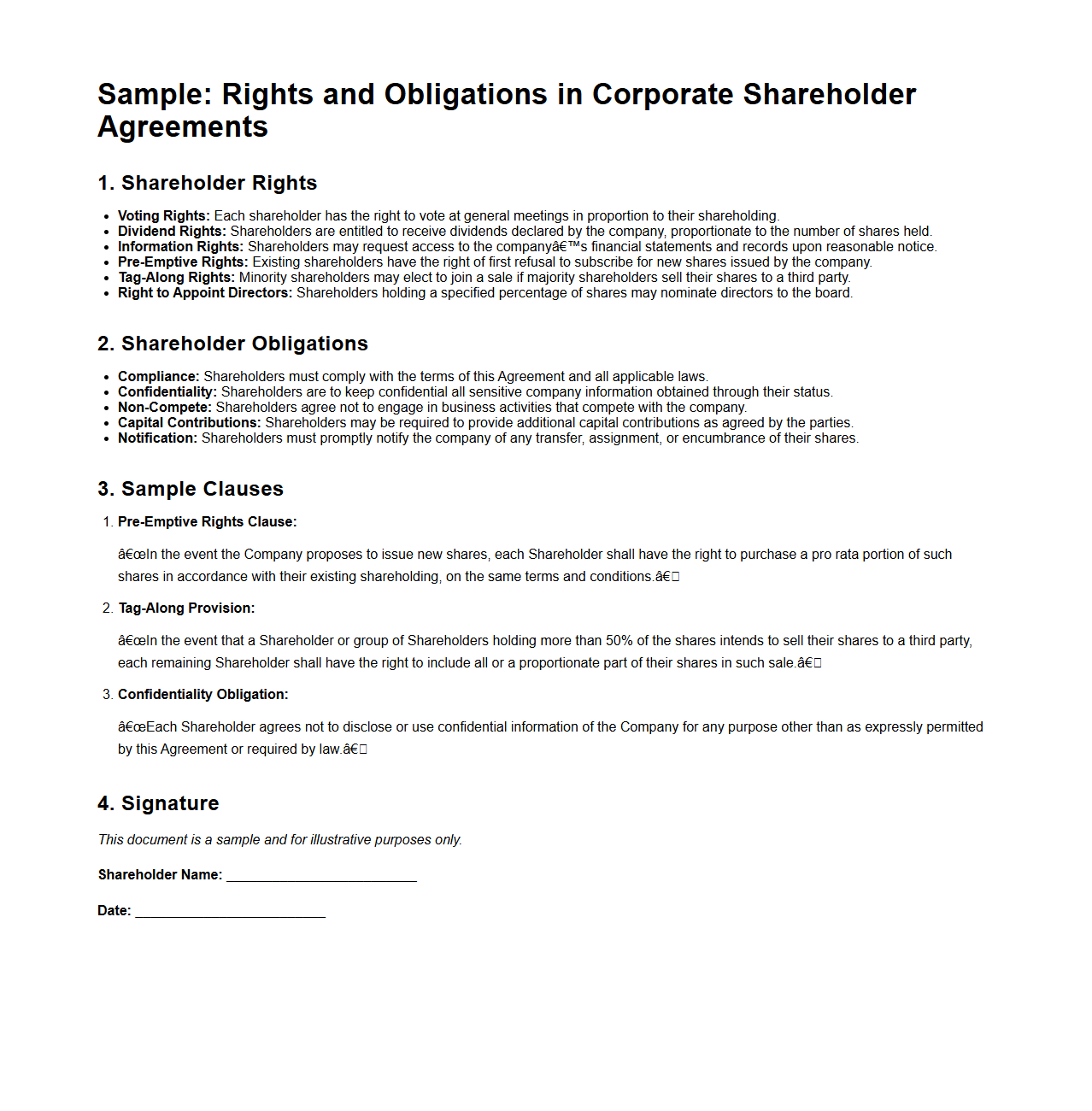

Rights and Obligations in Corporate Shareholder Agreements

Rights and Obligations in a

Corporate Shareholder Agreement define the specific entitlements and responsibilities of each shareholder, establishing how decisions are made, profits are distributed, and shares are transferred. These provisions ensure clarity on voting rights, dividend entitlements, and duties to the company, providing a legal framework that protects shareholders' interests and promotes corporate governance. Clear articulation of these terms minimizes disputes and aligns shareholder actions with the company's strategic goals.

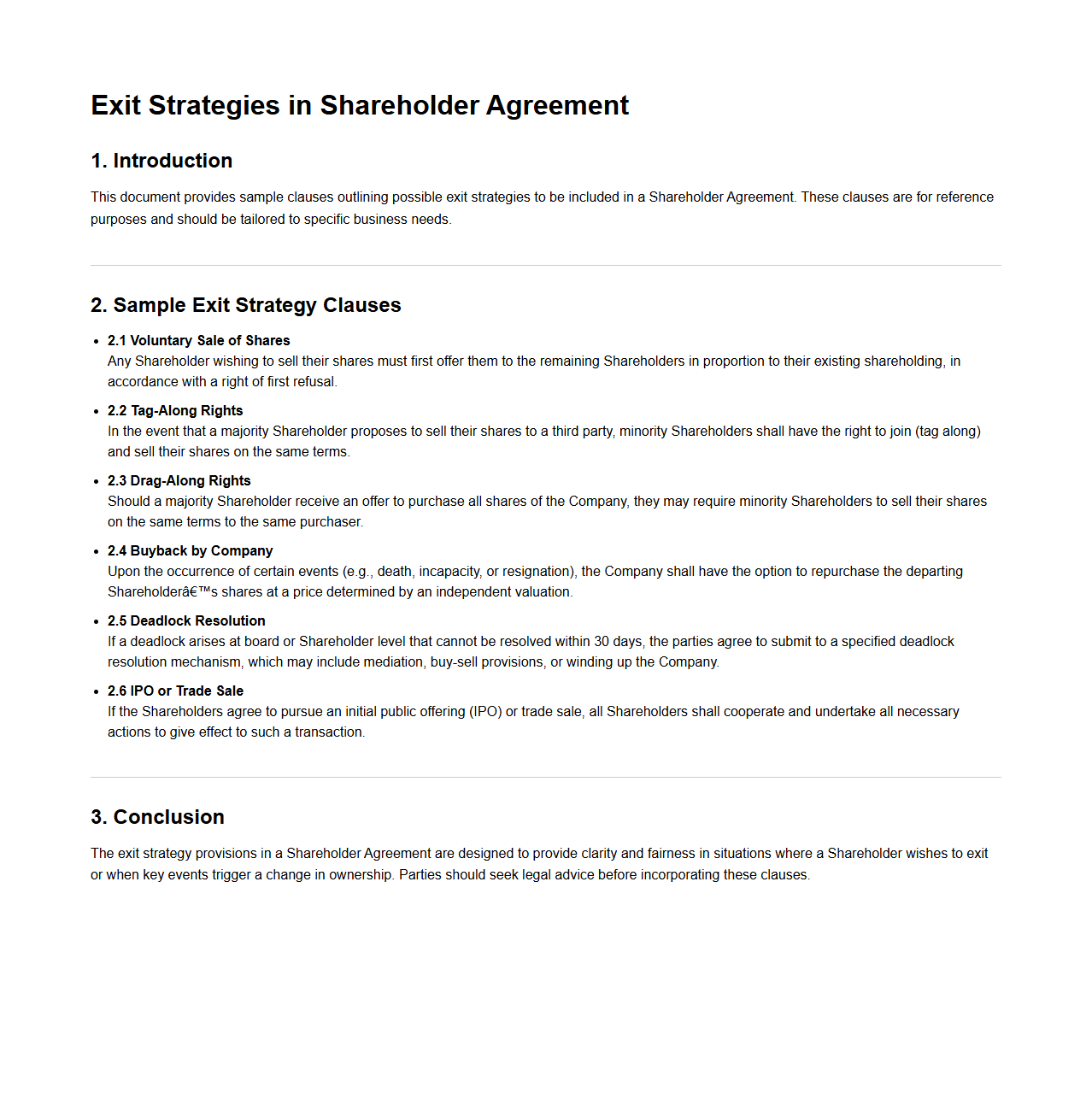

Exit Strategies in Shareholder Agreement Samples

Exit strategies in a

Shareholder Agreement outline the predefined methods and conditions under which shareholders can sell or transfer their shares. These provisions protect minority shareholders and ensure an orderly transition of ownership, often specifying mechanisms like buy-sell agreements, right of first refusal, or drag-along and tag-along rights. Clear exit strategies help prevent disputes and provide a structured approach for shareholders to realize their investment value.

How does the Shareholders Agreement address dispute resolution mechanisms among shareholders?

The Shareholders Agreement typically includes a detailed dispute resolution clause to handle conflicts among shareholders efficiently. It often prescribes mechanisms such as negotiation, mediation, and arbitration before escalating to litigation. This structured approach aims to minimize disruption and preserve shareholder relationships.

What are the voting thresholds for special corporate governance decisions under the agreement?

The voting thresholds for special corporate governance decisions are clearly defined to ensure major decisions receive adequate shareholder consent. These thresholds often require a supermajority, such as 66% or 75%, to approve significant matters like mergers or amendments. Setting these limits protects minority shareholders while facilitating decisive governance.

How are director appointments and removals governed in the Shareholders Agreement?

Director appointments and removals are governed by specific provisions in the Shareholders Agreement that balance control among shareholders. The agreement outlines nomination rights, approval processes, and circumstances under which a director can be removed. This ensures transparency and accountability in board composition.

What provisions outline minority shareholder protections in board governance matters?

Minority shareholder protections are embedded in the agreement to prevent oppression and secure fair treatment. These provisions may include veto rights, reserved matters, and representation rights on the board. They serve to safeguard the interests and influence of minority shareholders in company decisions.

How does the agreement handle information rights and access for shareholders regarding corporate governance?

The information rights section grants shareholders access to essential corporate documents and timely updates. It facilitates transparency by mandating regular reports, financial statements, and board meeting notices. Ensuring informed shareholders supports better governance and accountability.