A Loan Agreement Document Sample for Personal Lending provides a clear template outlining the terms and conditions between a lender and borrower for personal loans. It includes important details such as loan amount, repayment schedule, interest rate, and default consequences to protect both parties. Using this sample helps ensure legal compliance and smooth transaction management in personal lending arrangements.

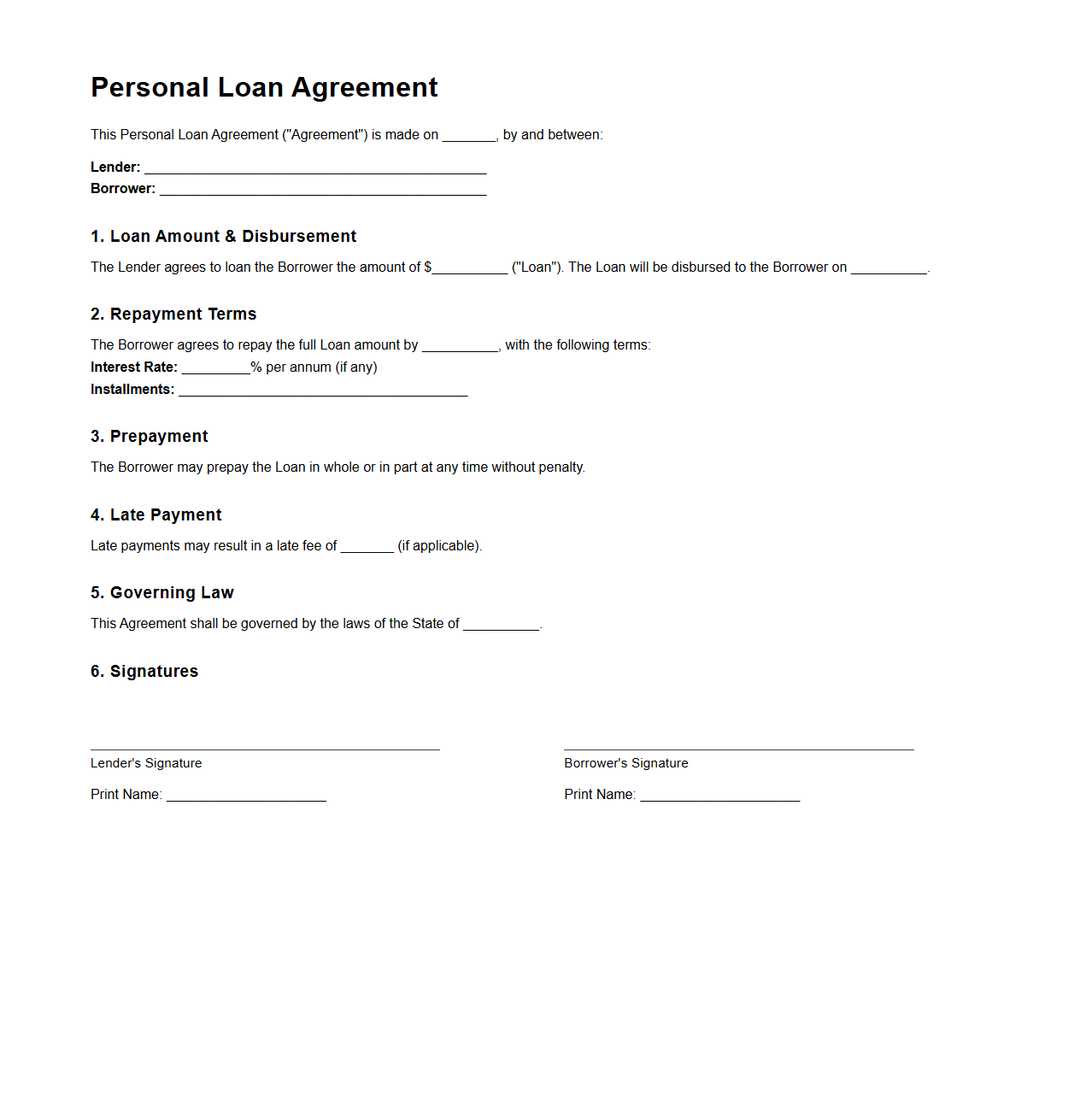

Simple Personal Loan Agreement Template

A

Simple Personal Loan Agreement Template document outlines the terms and conditions between a lender and borrower for a personal loan, including loan amount, interest rate, repayment schedule, and default consequences. This template ensures clarity and legal protection for both parties by clearly defining responsibilities and expectations. It serves as a customizable, straightforward contract useful for informal or small loan transactions.

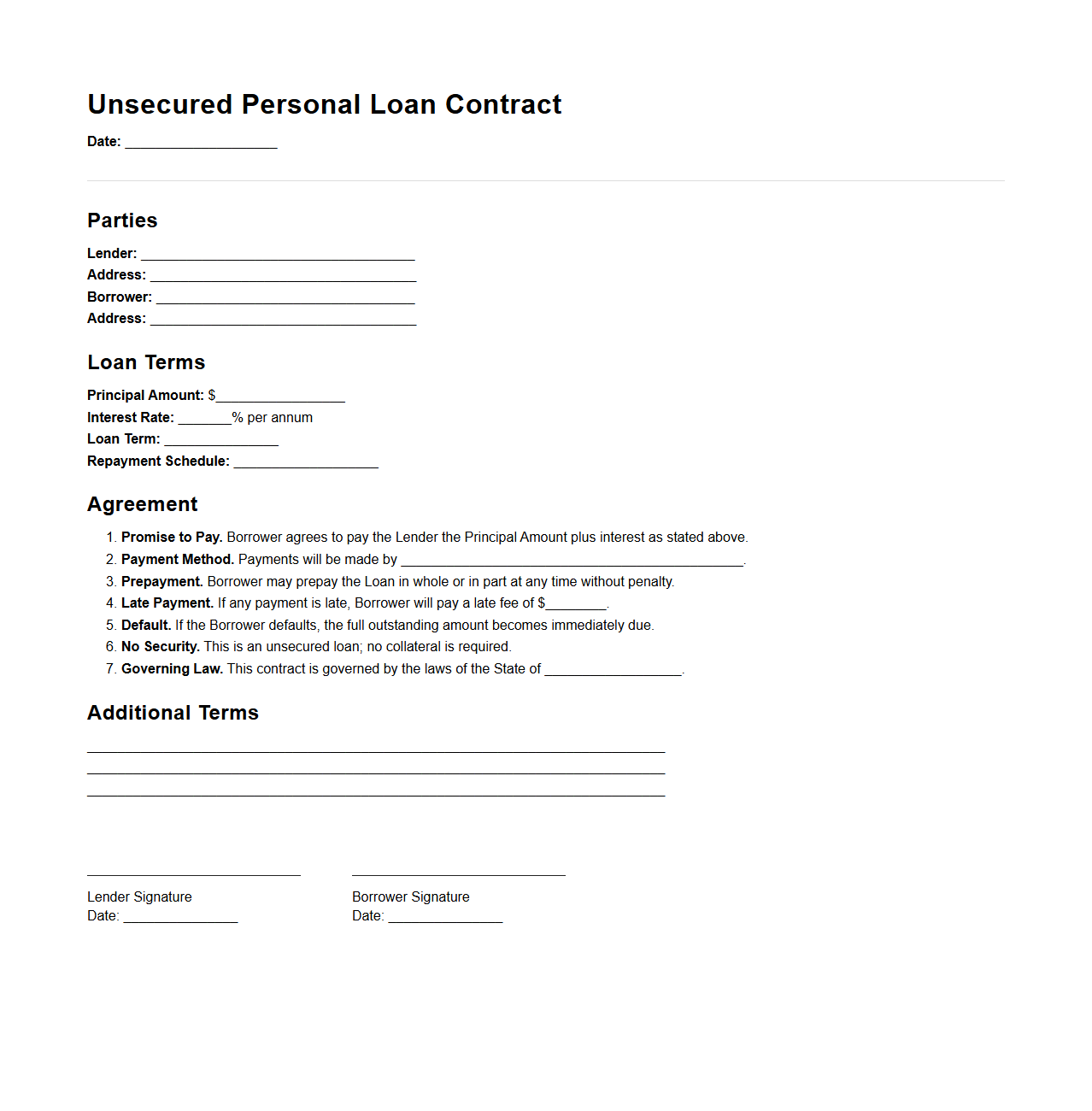

Unsecured Personal Loan Contract Example

An

Unsecured Personal Loan Contract Example document outlines the terms and conditions between a borrower and lender for a loan without collateral. It typically details the loan amount, interest rate, repayment schedule, and borrower obligations. This contract serves as a legally binding agreement ensuring clarity and protection for both parties throughout the loan term.

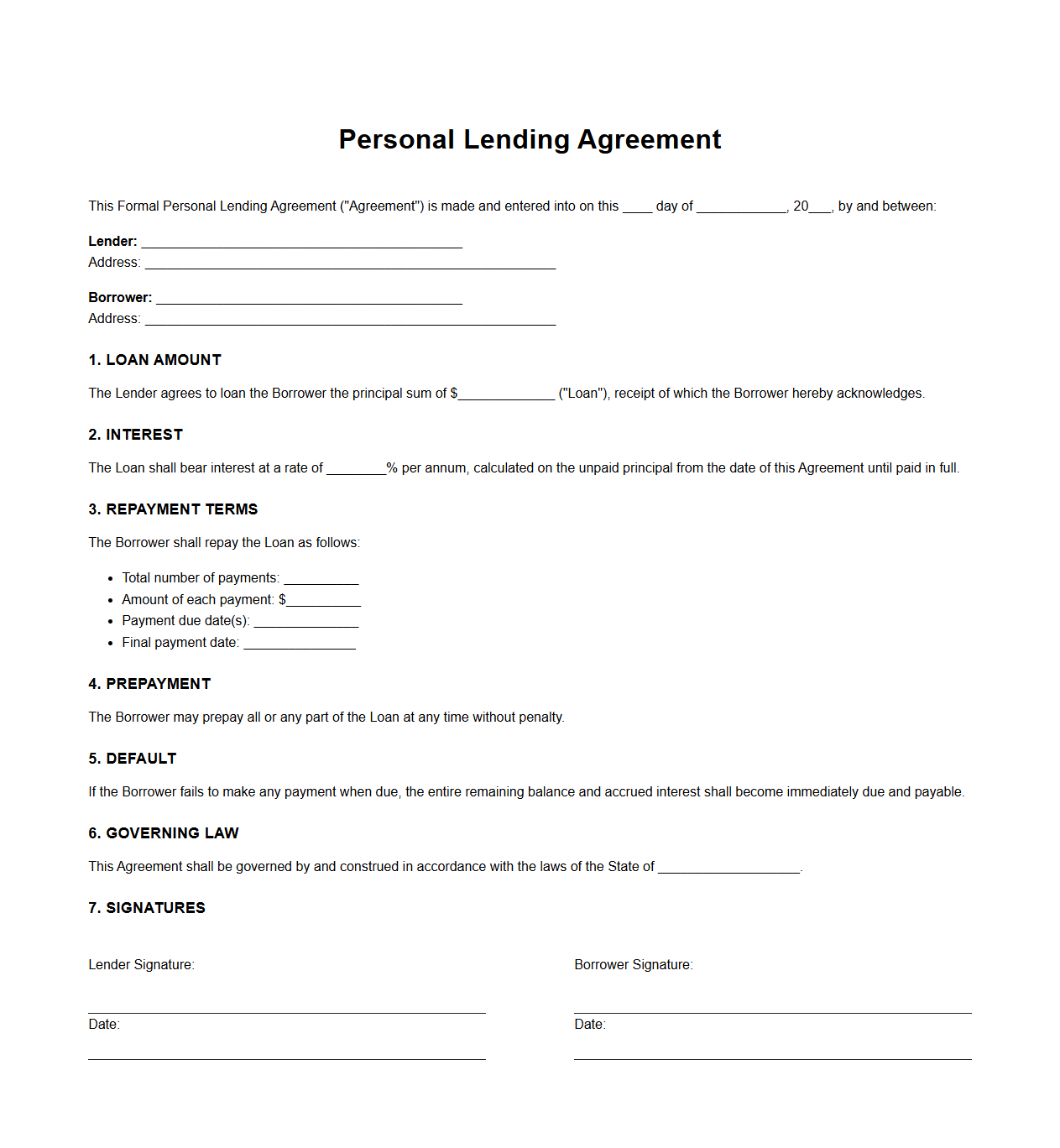

Formal Personal Lending Agreement Draft

A

Formal Personal Lending Agreement Draft document outlines the terms and conditions between a lender and borrower in a private loan arrangement. It specifies the loan amount, interest rate, repayment schedule, and obligations of both parties to protect their legal rights. This draft serves as a legally binding reference that helps prevent disputes and ensures clear communication throughout the lending process.

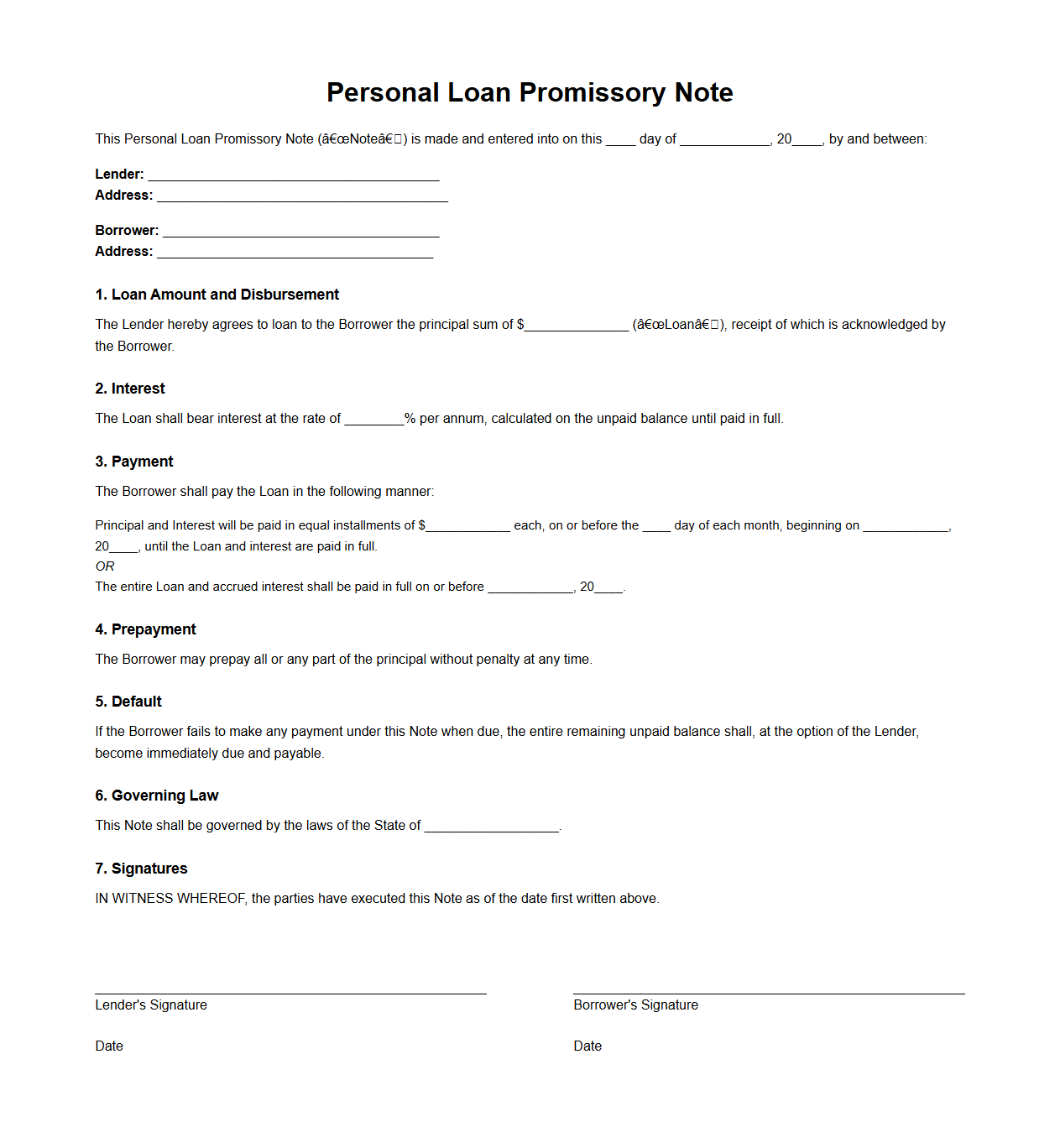

Standard Personal Loan Promissory Note

A

Standard Personal Loan Promissory Note is a legally binding document that outlines the terms and conditions of a personal loan agreement between a borrower and a lender. It specifies the loan amount, interest rate, repayment schedule, and penalties for default, ensuring both parties have a clear understanding of their obligations. This document serves as evidence of the loan and is essential for enforcing loan repayment.

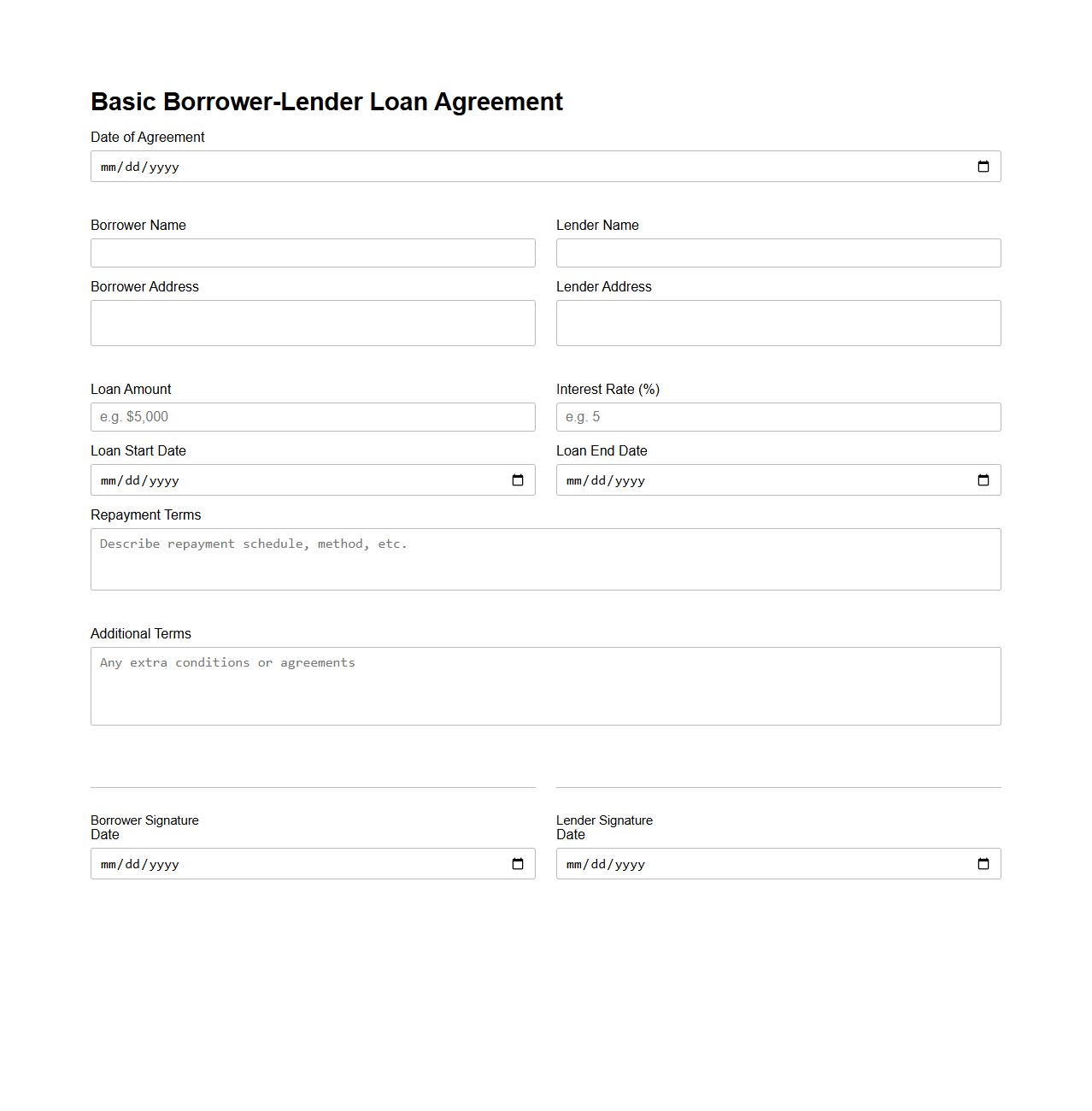

Basic Borrower-Lender Loan Agreement Form

A

Basic Borrower-Lender Loan Agreement Form document outlines the terms and conditions between the borrower and lender, including loan amount, interest rate, repayment schedule, and obligations of both parties. This legally binding contract ensures clarity and protects the rights of each party by specifying repayment deadlines and consequences of default. It serves as essential evidence in case of disputes and provides a structured framework for managing private or informal loans.

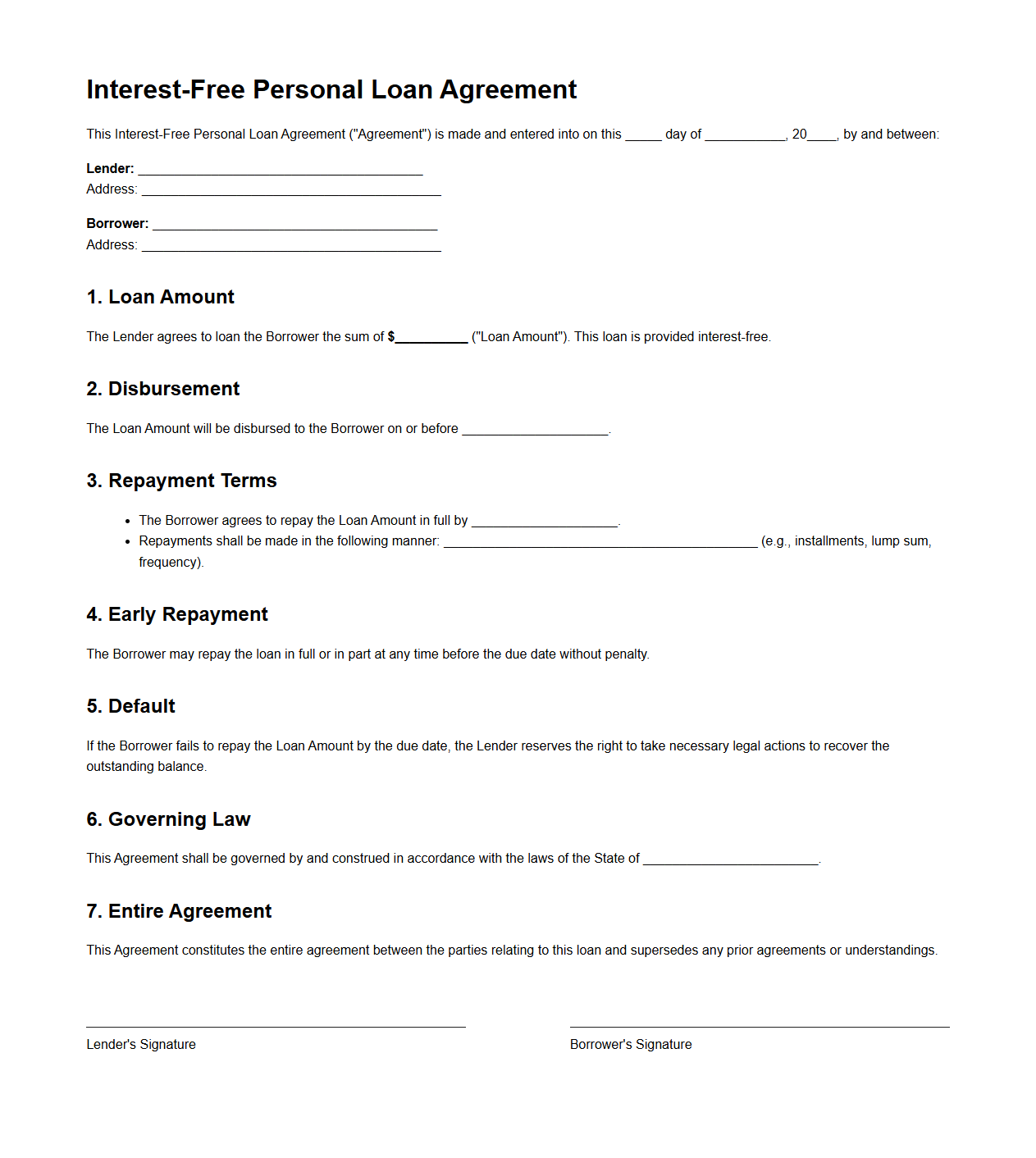

Interest-Free Personal Loan Agreement Sample

An

Interest-Free Personal Loan Agreement Sample document serves as a legally binding template outlining the terms and conditions for lending money without interest between parties. It specifies the principal amount, repayment schedule, and other essential clauses to protect both lender and borrower rights. This sample helps ensure clarity, prevents disputes, and facilitates smooth financial transactions.

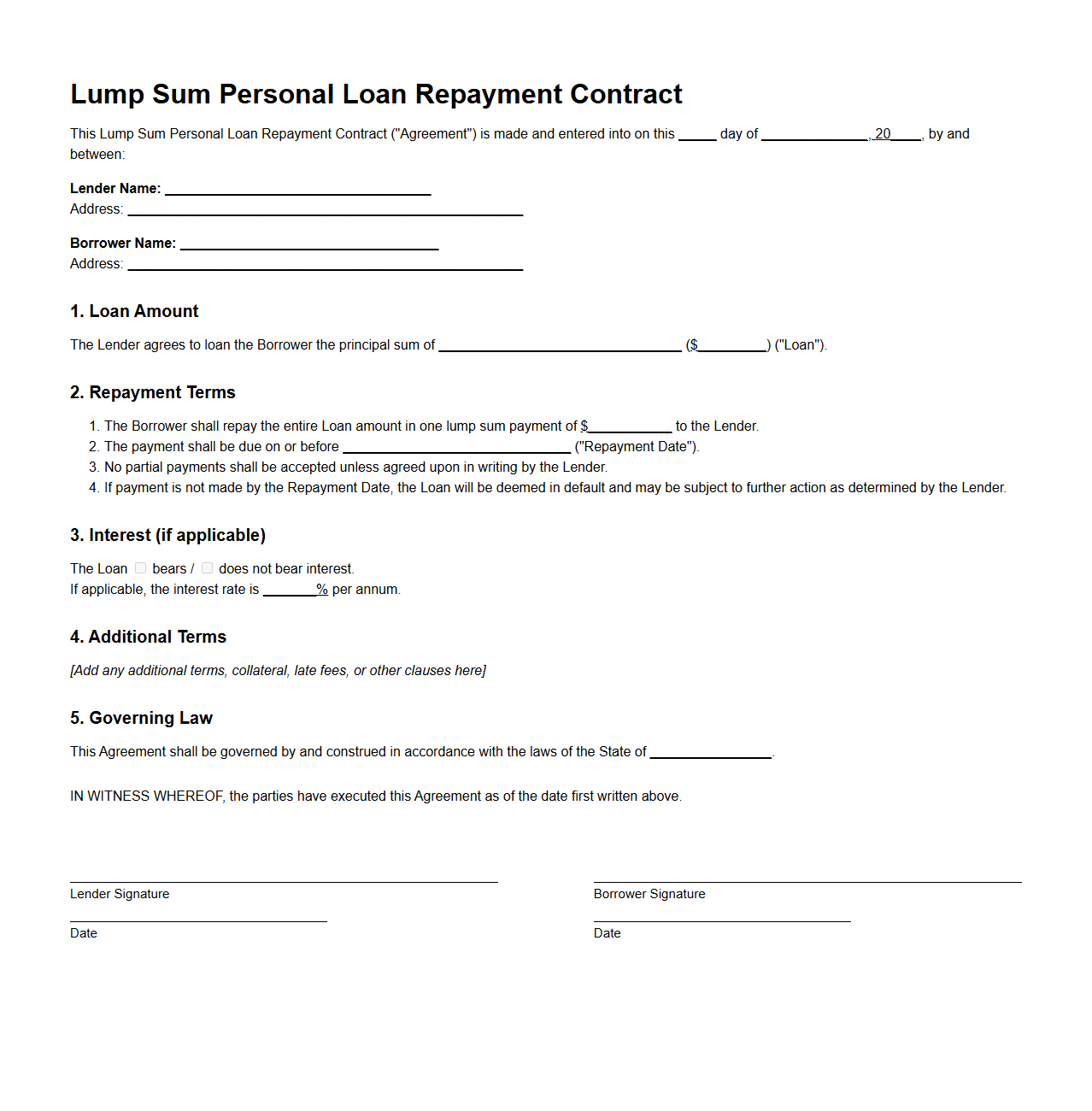

Lump Sum Personal Loan Repayment Contract

A

Lump Sum Personal Loan Repayment Contract document outlines the terms under which a borrower agrees to repay the entire outstanding loan amount in one single payment, rather than in multiple installments. This contract specifies the repayment date, total amount due, and any associated fees or penalties for early repayment. It serves as a legally binding agreement to ensure clarity and protect both lender and borrower during the repayment process.

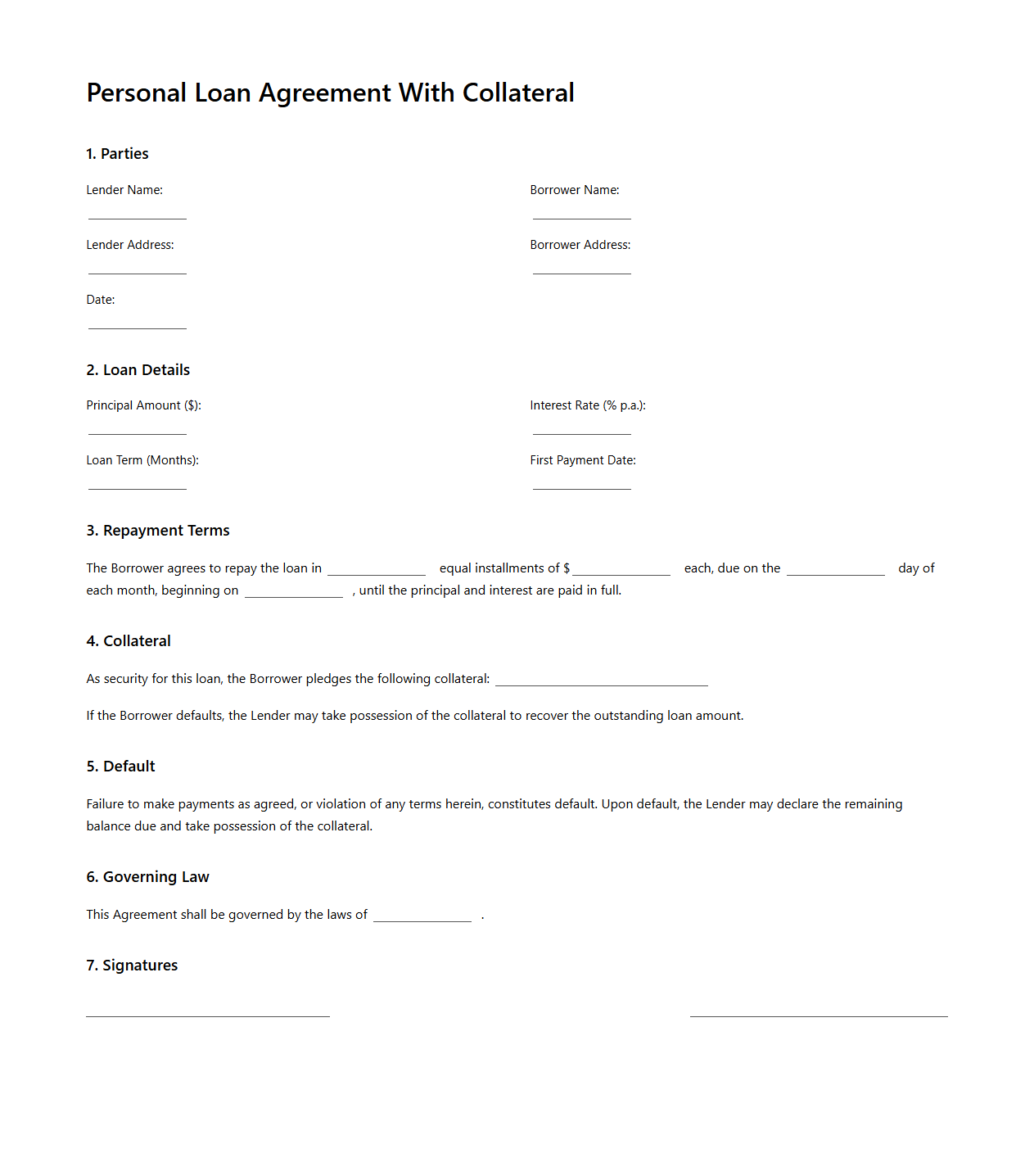

Personal Loan Agreement With Collateral Template

A

Personal Loan Agreement With Collateral Template is a legally binding document that outlines the terms and conditions of a loan secured by collateral provided by the borrower. This template specifies the loan amount, interest rate, repayment schedule, and details of the collateral used to guarantee the loan, ensuring protection for both lender and borrower. It serves as a clear reference to prevent disputes and enforce the loan agreement in case of default.

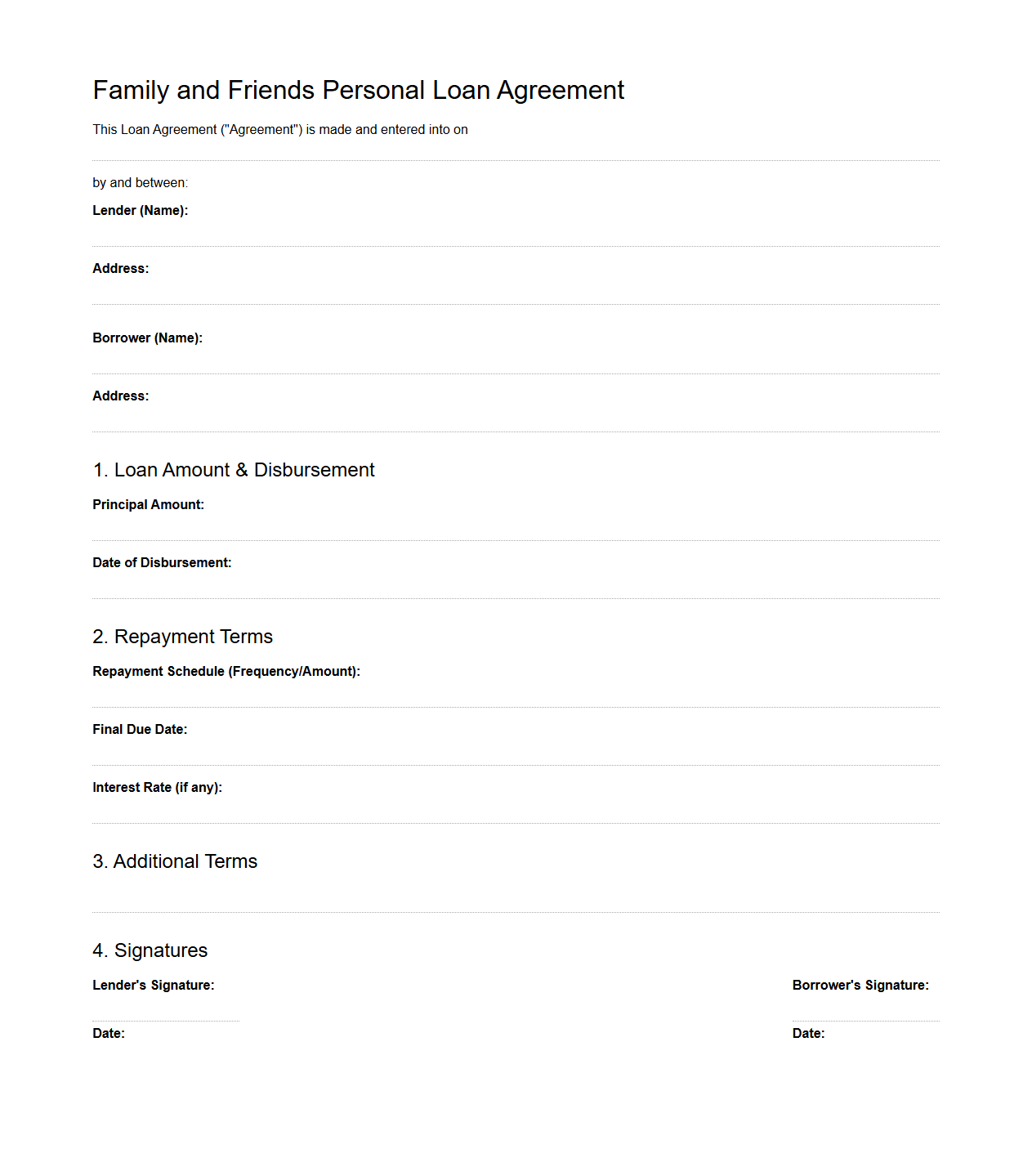

Family and Friends Personal Loan Agreement Example

A

Family and Friends Personal Loan Agreement Example document outlines the terms and conditions under which money is lent between close relations, ensuring clarity and mutual understanding. This agreement typically includes loan amount, repayment schedule, interest rates if applicable, and consequences of default. Using such a template helps prevent misunderstandings and protects both parties legally.

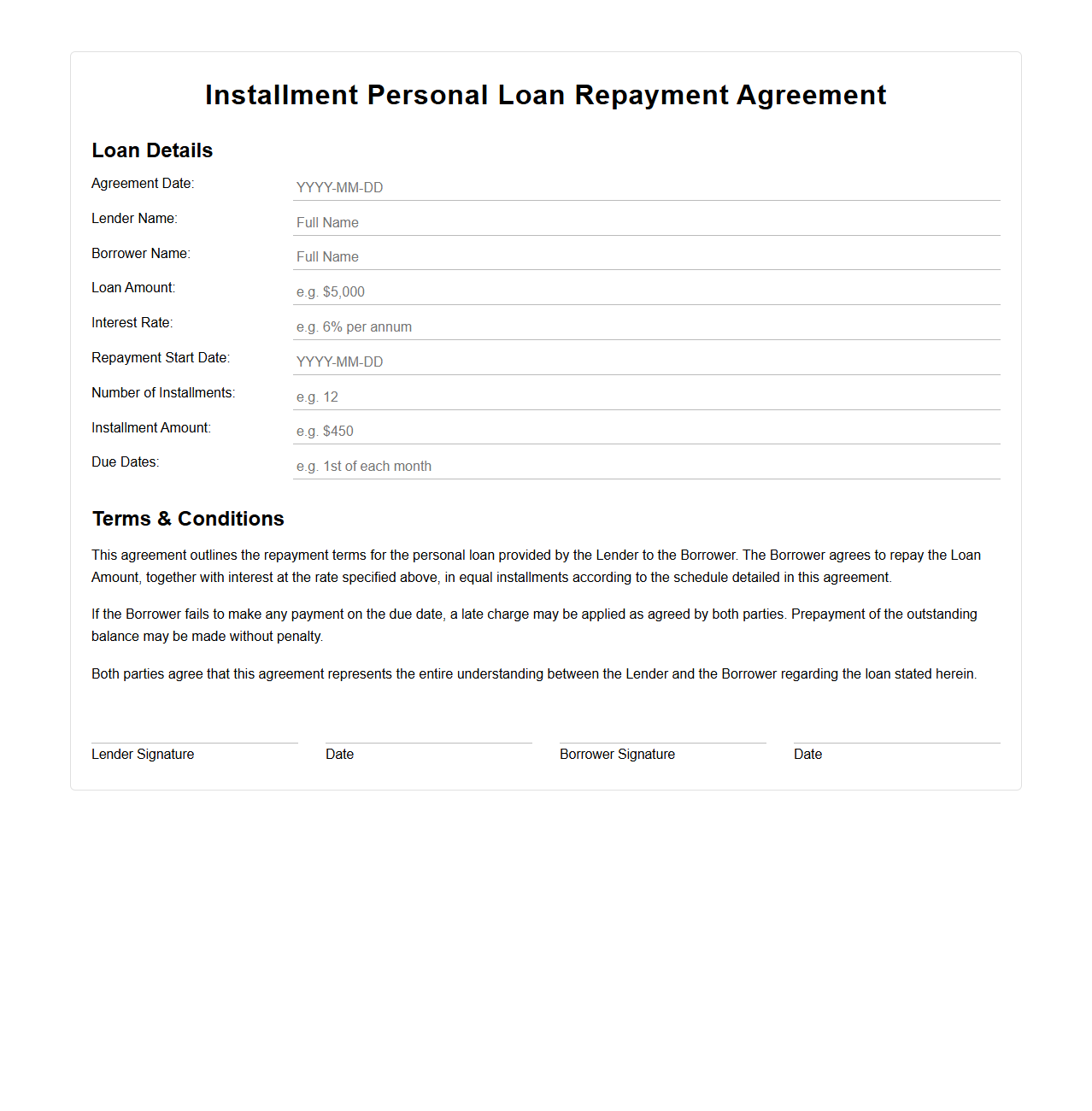

Installment Personal Loan Repayment Agreement

An

Installment Personal Loan Repayment Agreement document outlines the terms and conditions under which a borrower agrees to repay a personal loan in fixed installments over a specified period. It typically details the loan amount, interest rate, repayment schedule, and any penalties for late payments. This legally binding contract ensures clarity and mutual understanding between the lender and borrower regarding repayment obligations.

Specific Late Payment Penalty Clauses in the Loan Agreement

The loan agreement specifies a late payment penalty to encourage timely repayment. Borrowers are usually charged a percentage of the overdue amount after a grace period. This clause ensures lenders are compensated for delays and minimizes default risks.

Permissible Prepayment Terms and Fees

The document clearly outlines permissible prepayment terms to protect both borrower and lender interests. Some agreements allow early repayment without penalties, while others may impose a fee. These terms help manage the loan's financial implications and borrower flexibility.

Co-signer or Guarantor Obligations Detailed in the Agreement

The agreement specifies the roles and responsibilities of any co-signer or guarantor involved in the loan. Their obligations typically include assuming liability if the primary borrower defaults. This clause provides additional security for the lender.

Handling Default and Remedies for Personal Lending

The loan agreement defines actions and remedies available upon default, protecting lender interests. These may include acceleration of the loan, collection procedures, or legal action. Clear terms ensure that both parties understand the consequences of non-payment.

Personal Identification Requirements in the Documentation

Strict personal identification requirements are mandated to verify borrower identity and prevent fraud. Commonly required documents include government-issued IDs and proof of residence. These guidelines uphold the integrity of the lending process.