A Trust Deed Document Sample for Private Trusts outlines the legal framework and terms establishing the trust between the settlor and trustee. It specifies the duties, powers, and responsibilities of the trustee, along with the rights of beneficiaries. This document ensures clarity and compliance in managing private trusts effectively.

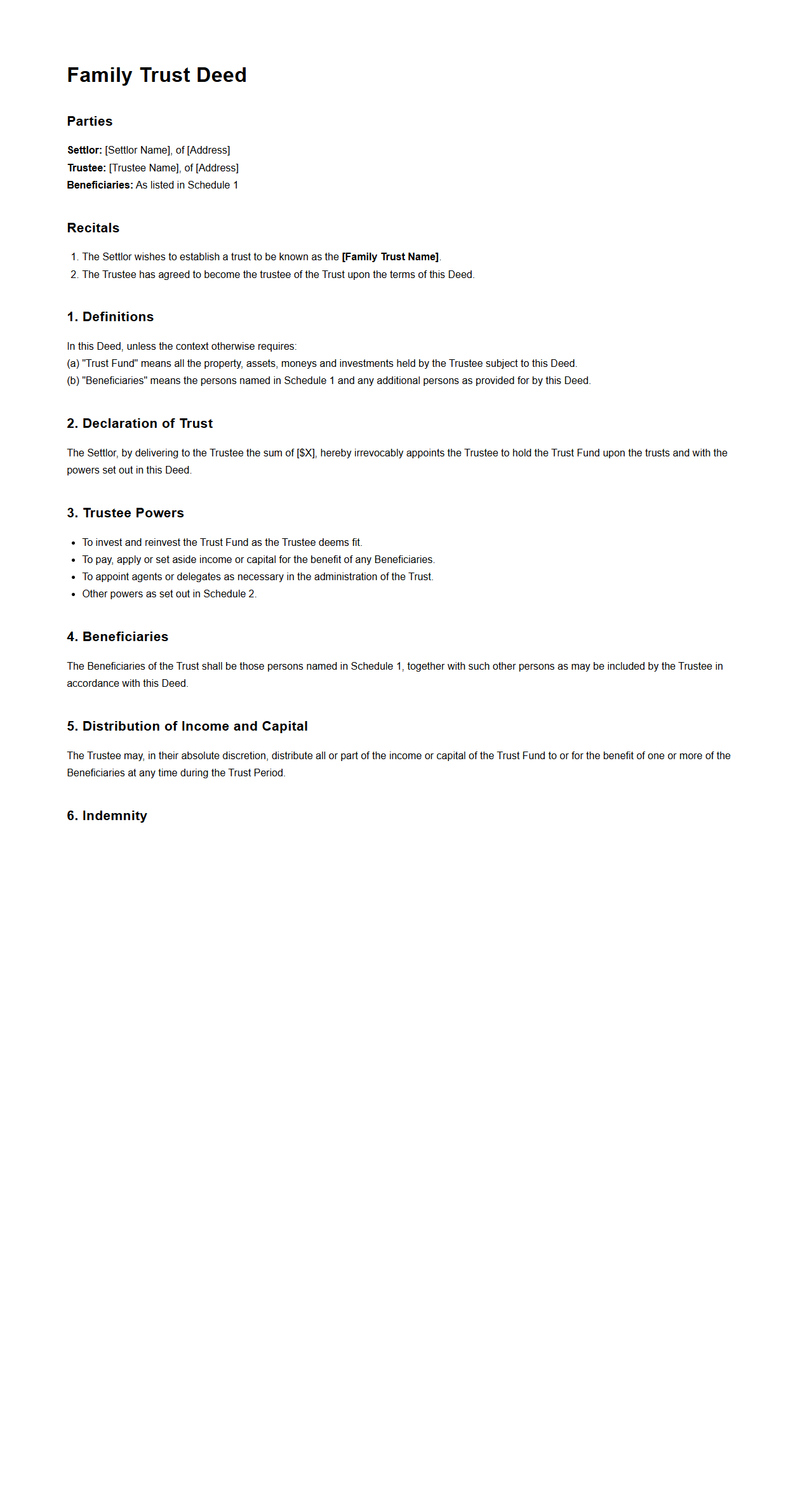

Family Trust Deed Example

A

Family Trust Deed Example is a legally binding document outlining the terms and conditions governing a family trust, including the roles of the trustee, beneficiaries, and the distribution of trust assets. It serves as a template to help set up a family trust, ensuring clarity on how income, capital, and property are managed and protected for future generations. This document is essential for estate planning, asset protection, and minimizing tax liabilities within a family unit.

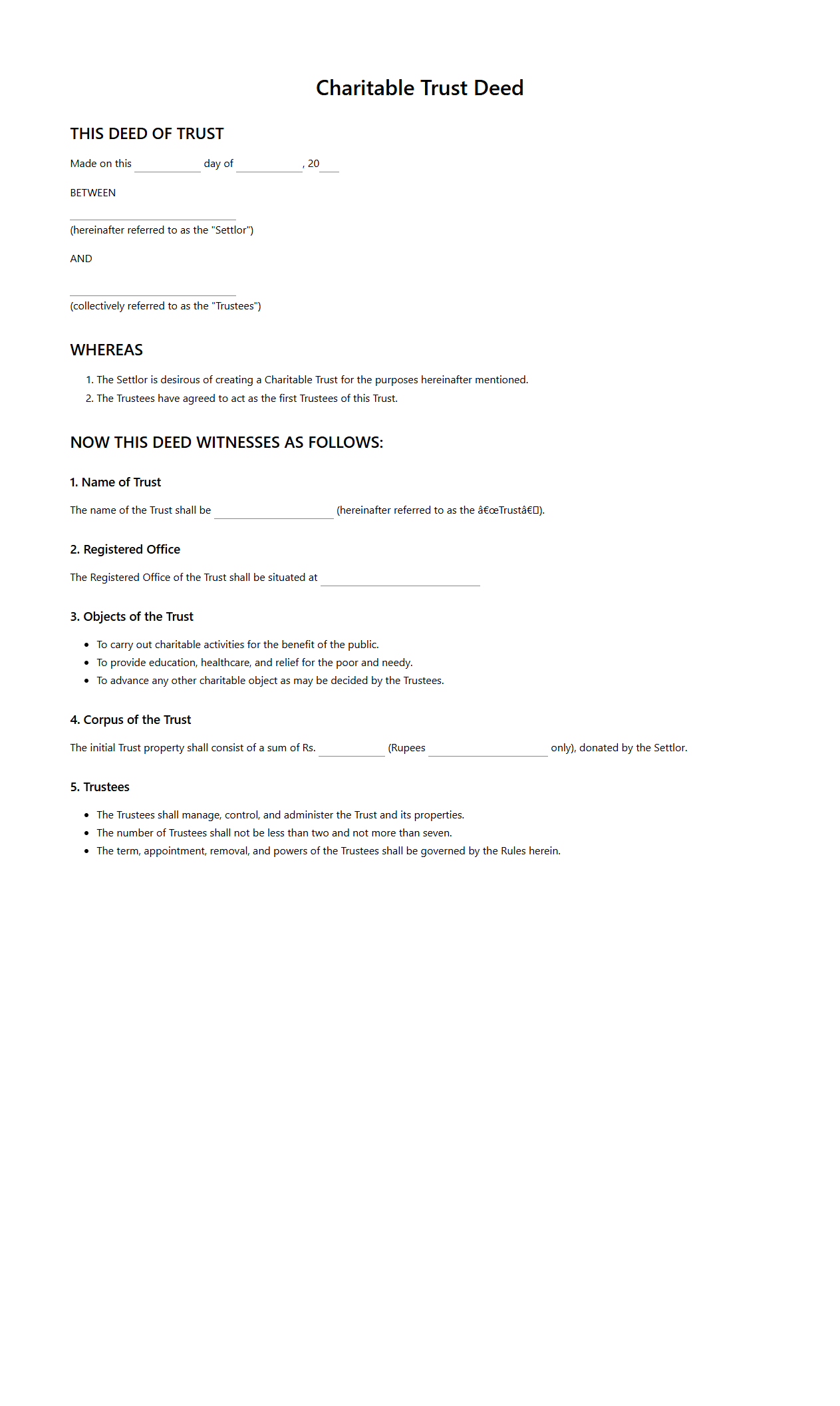

Charitable Trust Deed Template

A

Charitable Trust Deed Template document serves as a foundational legal framework to establish a charitable trust, outlining the purpose, objectives, and governance structure. It specifies the roles of trustees, beneficiaries, and the management of trust assets, ensuring compliance with applicable laws such as the Indian Trusts Act, 1882 or relevant jurisdictional regulations. Using this template streamlines the creation process, promotes transparency, and protects the interests of the charity and its donors.

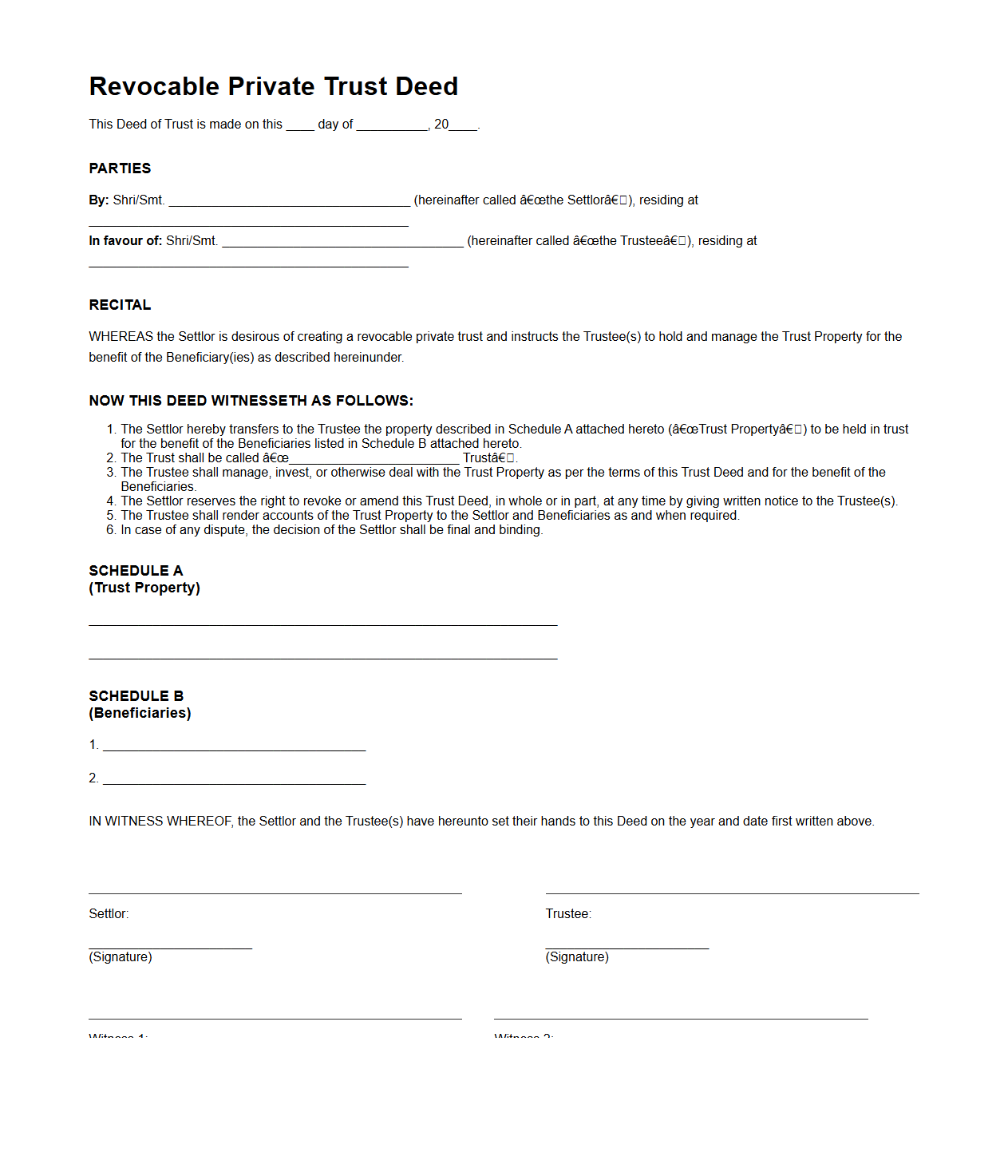

Revocable Private Trust Deed Format

A

Revocable Private Trust Deed Format document establishes a legal arrangement where the grantor retains the right to alter or revoke the trust during their lifetime. It outlines the terms, beneficiaries, trustee powers, and asset management details, ensuring flexibility and control over the trust property. This format is essential for personalized estate planning, allowing easy modifications without court intervention.

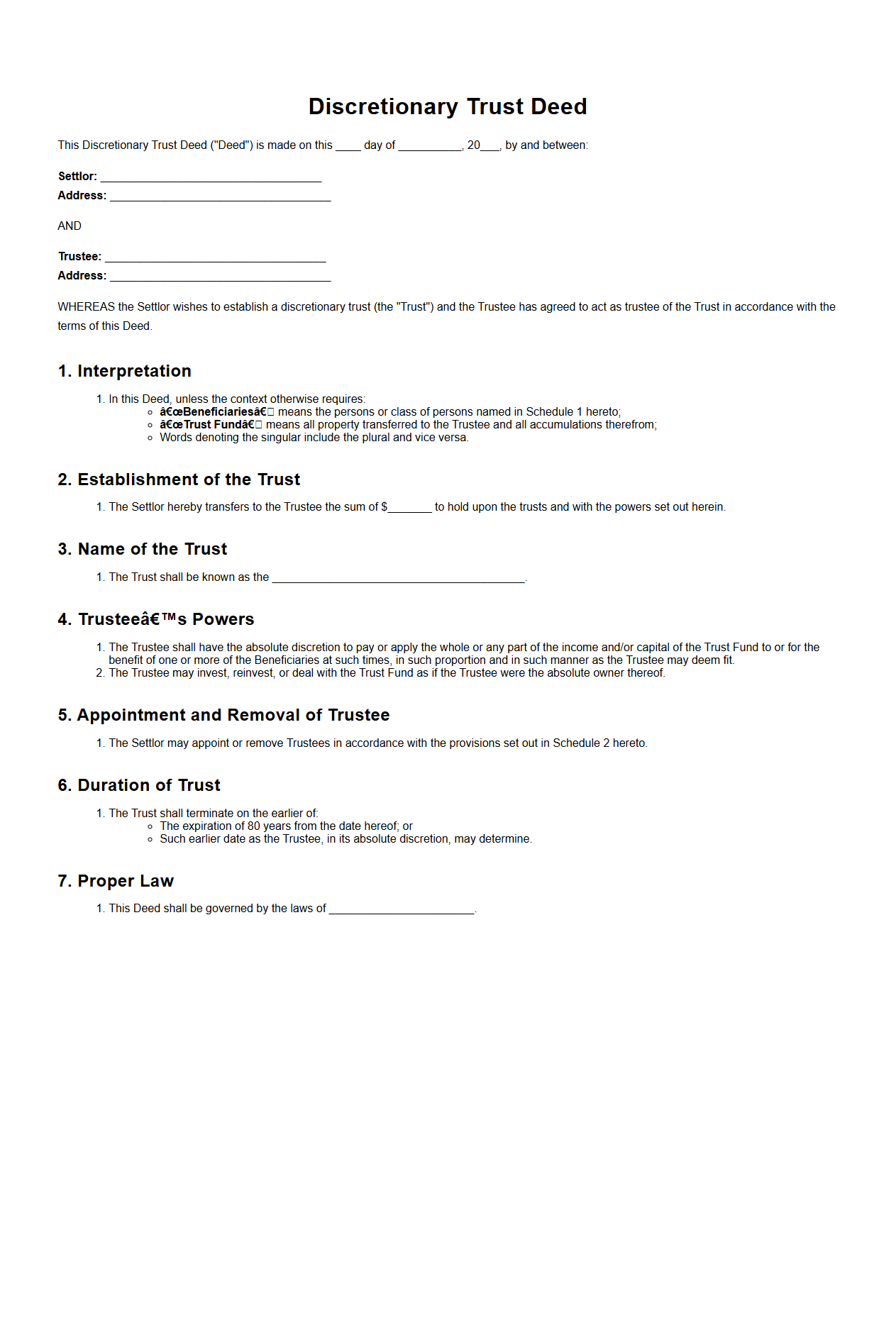

Discretionary Trust Deed Sample

A

Discretionary Trust Deed Sample document serves as a legal template outlining the terms and conditions governing the administration of a discretionary trust. It specifies the roles of trustees, the powers granted to them, and the flexible distribution of income or capital among beneficiaries. This sample helps legal professionals and individuals create customized trust deeds that comply with jurisdictional laws and protect the interests of all parties involved.

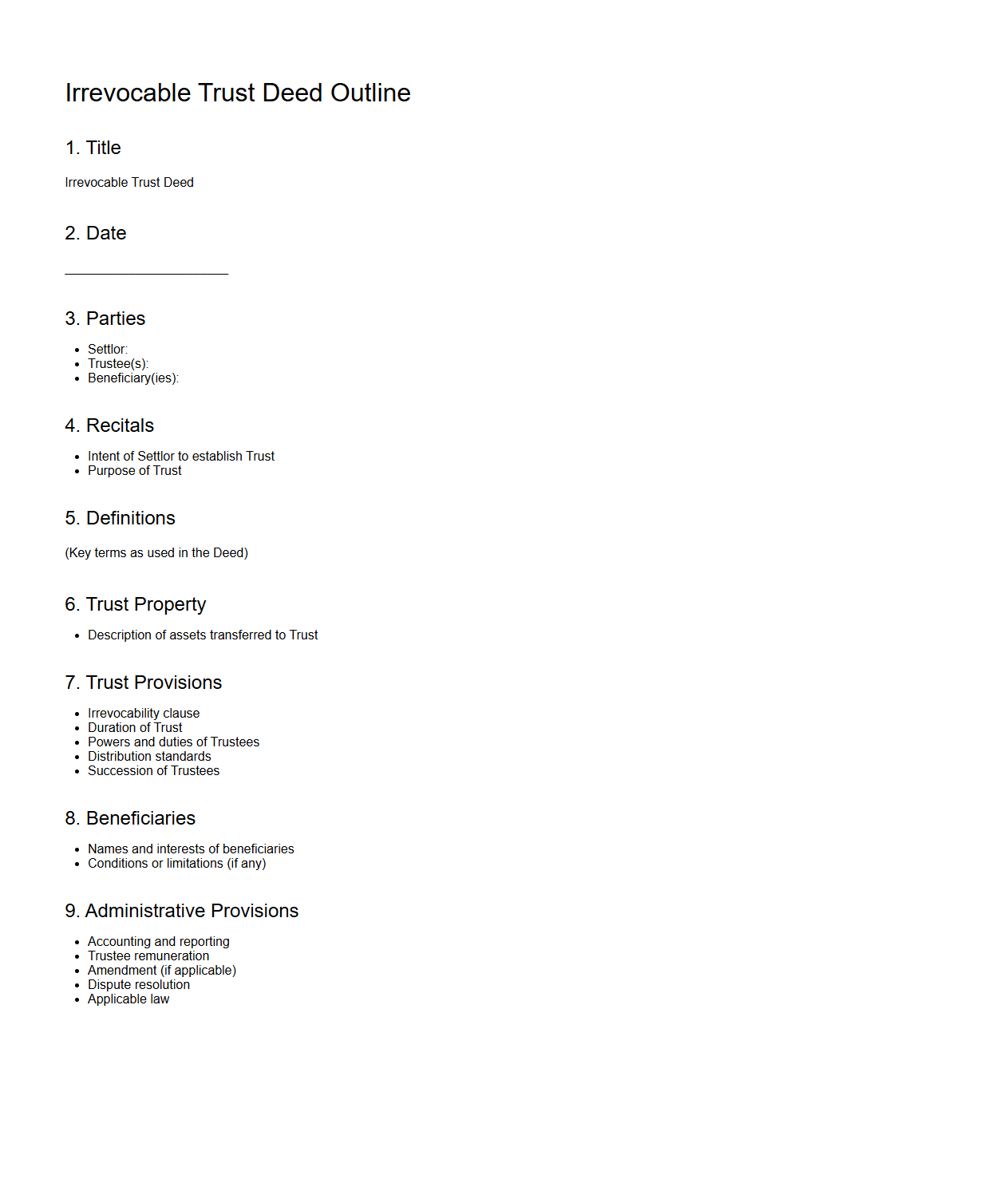

Irrevocable Trust Deed Outline

An

Irrevocable Trust Deed Outline document serves as a foundational legal agreement that establishes the terms and conditions under which assets are transferred into an irrevocable trust. It details the roles and responsibilities of the trustee, the rights of beneficiaries, and the specific instructions for managing and distributing trust property. This outline ensures clear, enforceable guidelines that protect the interests of all parties involved while preventing beneficiaries from altering or revoking the trust.

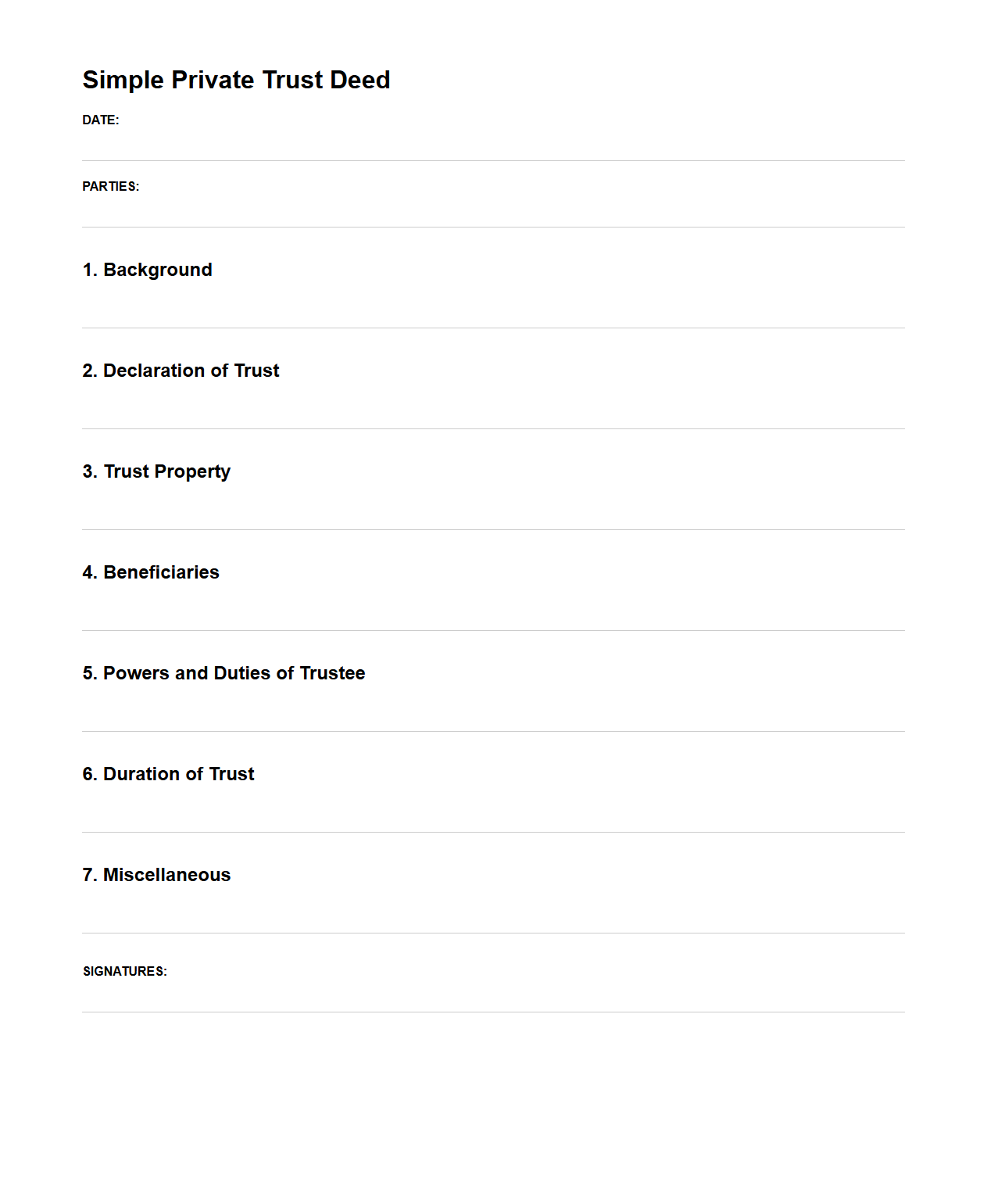

Simple Private Trust Deed Layout

A

Simple Private Trust Deed Layout document is a legal instrument that establishes a trust arrangement between a settlor and trustee, outlining the terms, powers, and responsibilities related to managing trust assets. It is designed to be straightforward, ensuring clarity in asset transfer, beneficiary rights, and trustee duties without the complexity of formal trust agreements. This document is commonly used in private transactions to safeguard interests while maintaining confidentiality and flexibility in trust administration.

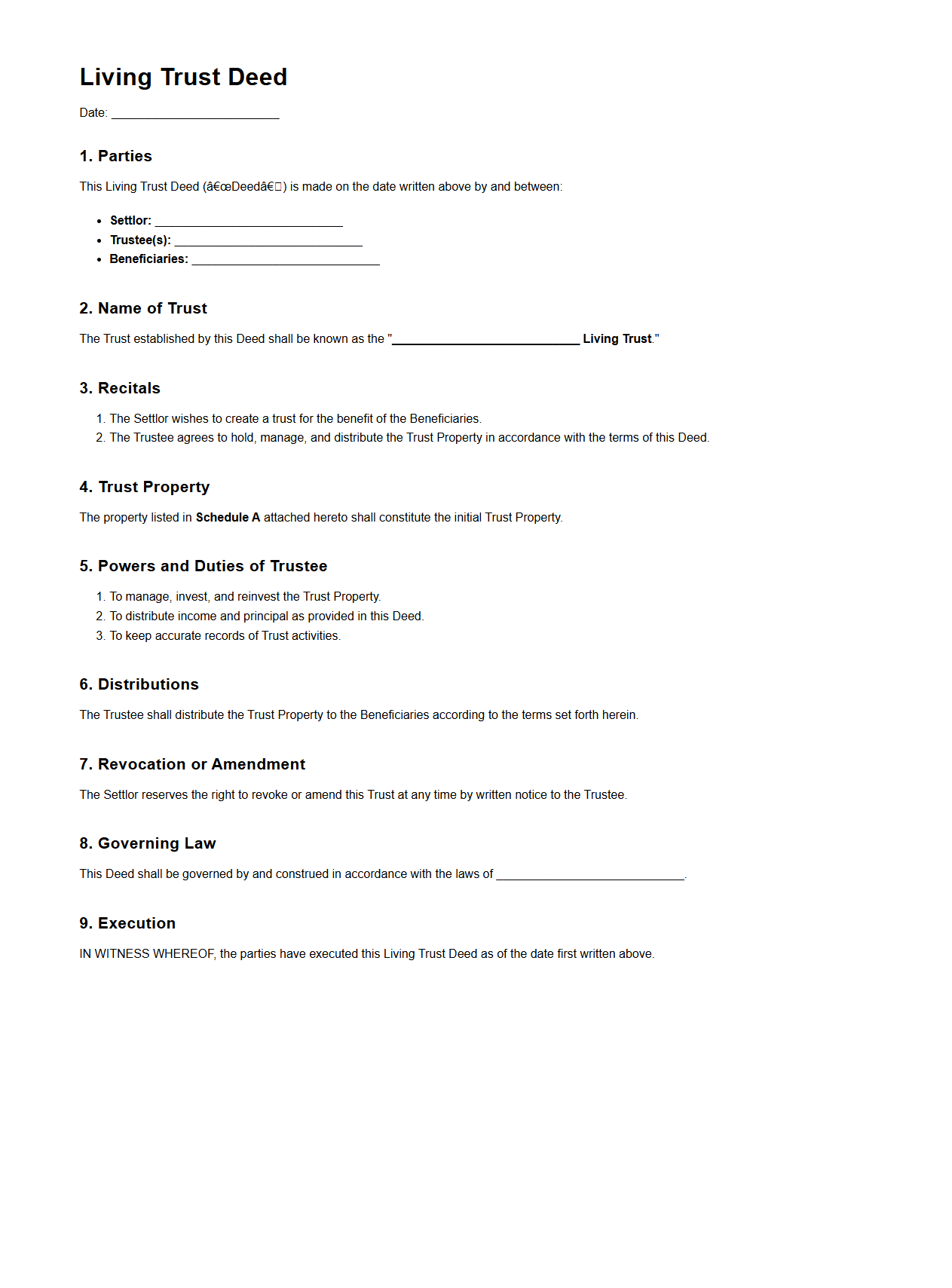

Living Trust Deed Model

A

Living Trust Deed Model document outlines the legal framework for creating a trust during a person's lifetime, allowing the grantor to transfer assets to a trustee for management and eventual distribution to beneficiaries. This document specifies terms, trustee powers, asset management guidelines, and beneficiary rights, ensuring seamless asset management and probate avoidance. It is essential for estate planning, providing flexibility and control over property distribution while maintaining privacy.

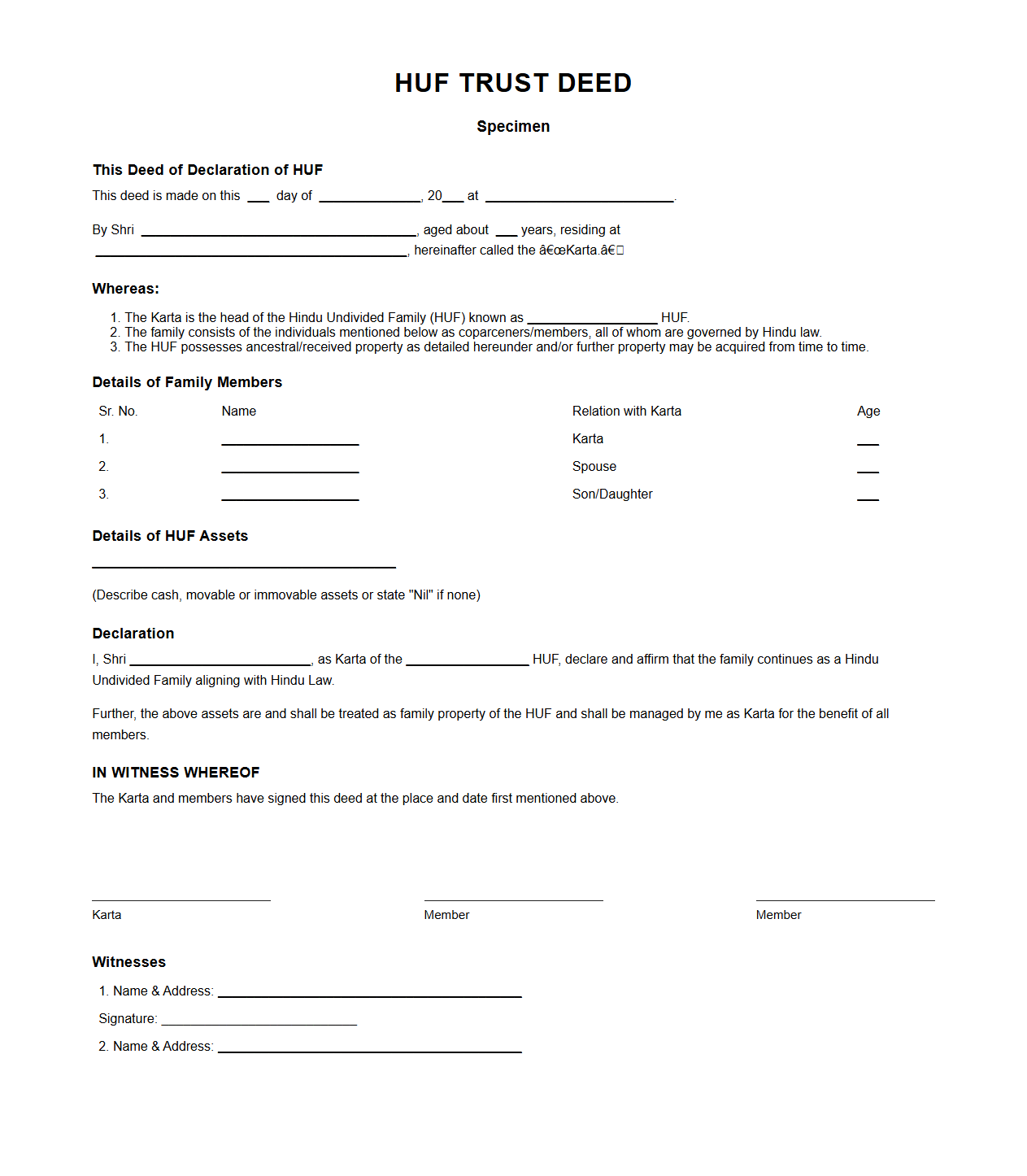

HUF Trust Deed Specimen

A

HUF Trust Deed Specimen document serves as a legal template outlining the formation, governance, and management of a Hindu Undivided Family (HUF) trust. It specifies the roles of the Karta, coparceners, and beneficiaries, detailing the distribution of assets and income within the family framework. This document is essential for ensuring transparent succession planning, tax benefits, and compliance with Indian trust laws.

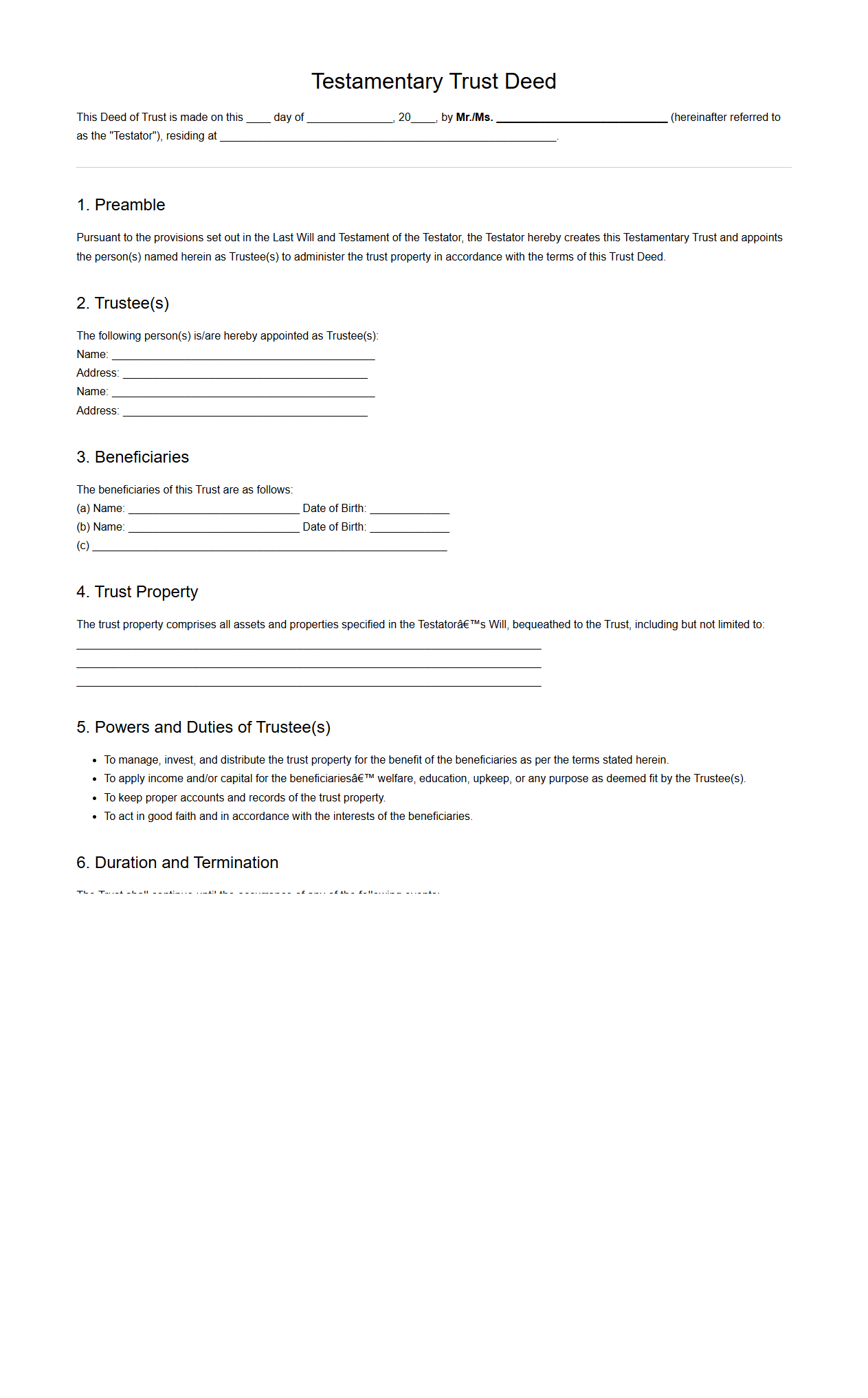

Testamentary Trust Deed Draft

A

Testamentary Trust Deed Draft is a legal document created during estate planning to establish a trust that comes into effect upon the death of the testator. It outlines the terms, beneficiaries, and management instructions for the trust assets, ensuring that the estate is distributed according to the testator's wishes. This draft serves as a crucial framework for solicitors and trustees to formalize and administer the trust efficiently.

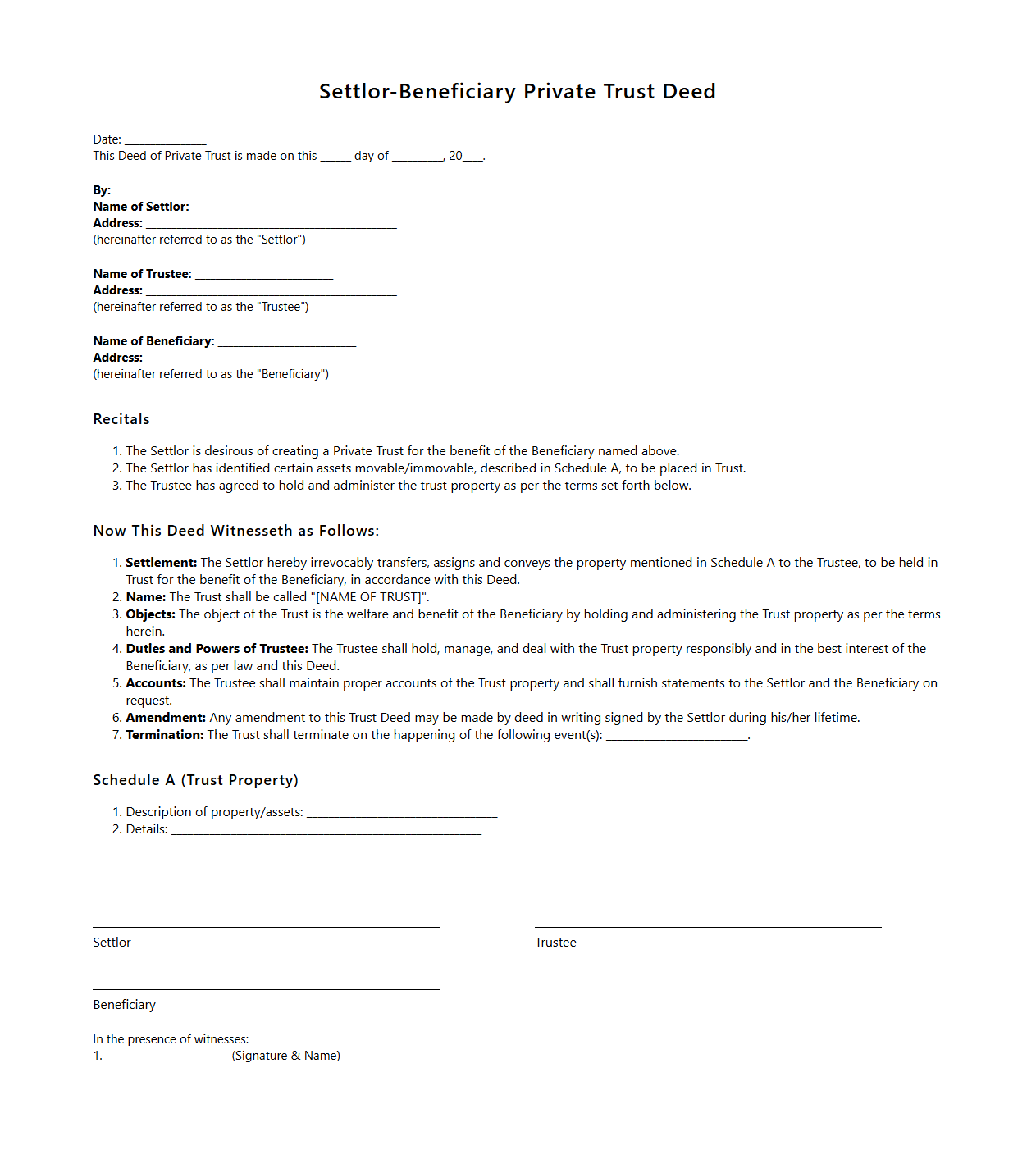

Settlor-Beneficiary Private Trust Deed

A

Settlor-Beneficiary Private Trust Deed document is a legal instrument that establishes a trust, specifying the roles and responsibilities of the settlor who creates the trust and the beneficiaries who will benefit from it. This document outlines the terms and conditions under which the trust assets are to be managed and distributed, ensuring compliance with relevant jurisdictional laws. It serves as a foundational agreement that governs the fiduciary duties of the trustee, protecting the interests of the beneficiaries.

What are the mandatory clauses required in a Private Trust Deed document?

A Private Trust Deed must include clauses defining the trust's name, purpose, and the settlor's details. It should clearly state the powers and duties of the trustees to ensure effective management. Additionally, the deed requires provisions for the appointment and removal of trustees.

How should the roles of trustees and beneficiaries be defined in the Trust Deed?

The trustees' roles in the Trust Deed should specify their responsibilities, powers, and fiduciary duties. Beneficiaries must be clearly identified with details on their interests and rights under the trust. This clear definition helps avoid legal disputes and ensures proper governance.

What legal formalities must be followed to register a Private Trust Deed?

To register a Private Trust Deed, the document must be executed on non-judicial stamp paper with the appropriate value. It requires signatures of all trustees and the settlor, witnessed legally. Registration with the local registrar is mandatory to give the trust legal recognition.

How can amendments to the Trust Deed be lawfully executed?

Any amendments to the Trust Deed must be made in writing and signed by all trustees. The deed should allow or specify procedures for modifications to prevent future conflicts. Legal consultation is advised to ensure compliance with governing trust laws.

What specific asset transfer procedures are detailed in the Trust Deed for Private Trusts?

The Trust Deed details explicit asset transfer procedures, including the mode of transferring property to trustees. It typically involves clear documentation and registration depending on asset type, like immovable property. These procedures ensure lawful possession and safeguarding of trust assets.