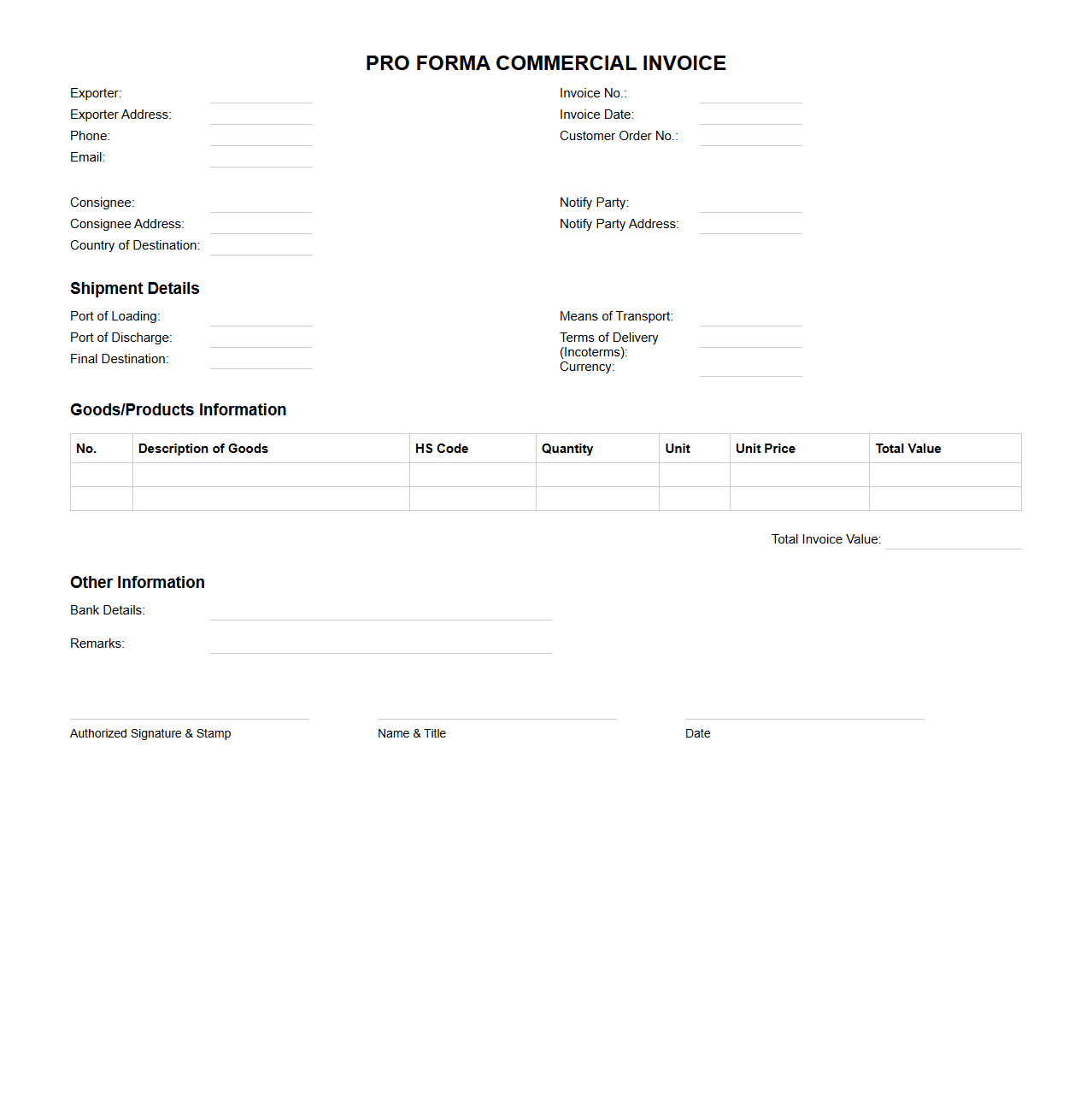

Pro Forma Commercial Invoice Template for Export Shipments

A

Pro Forma Commercial Invoice Template for export shipments is a preliminary bill of sale sent to buyers before the actual shipment of goods, detailing the estimated costs, quantities, and descriptions of the products. This document serves as a quotation and helps customs authorities assess duties and taxes during international trade. Exporters use this template to ensure accuracy in shipment documentation and streamline customs clearance processes.

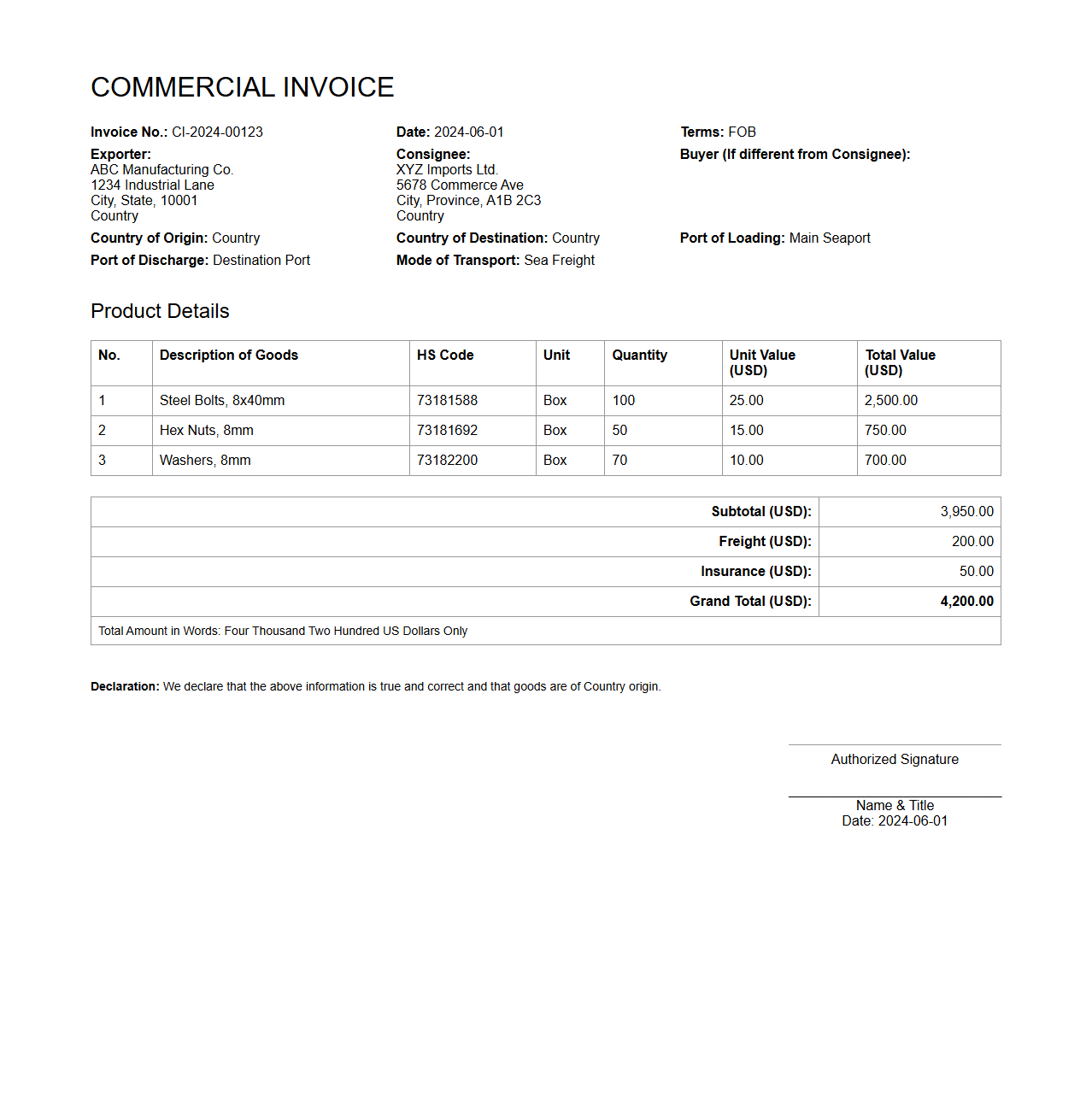

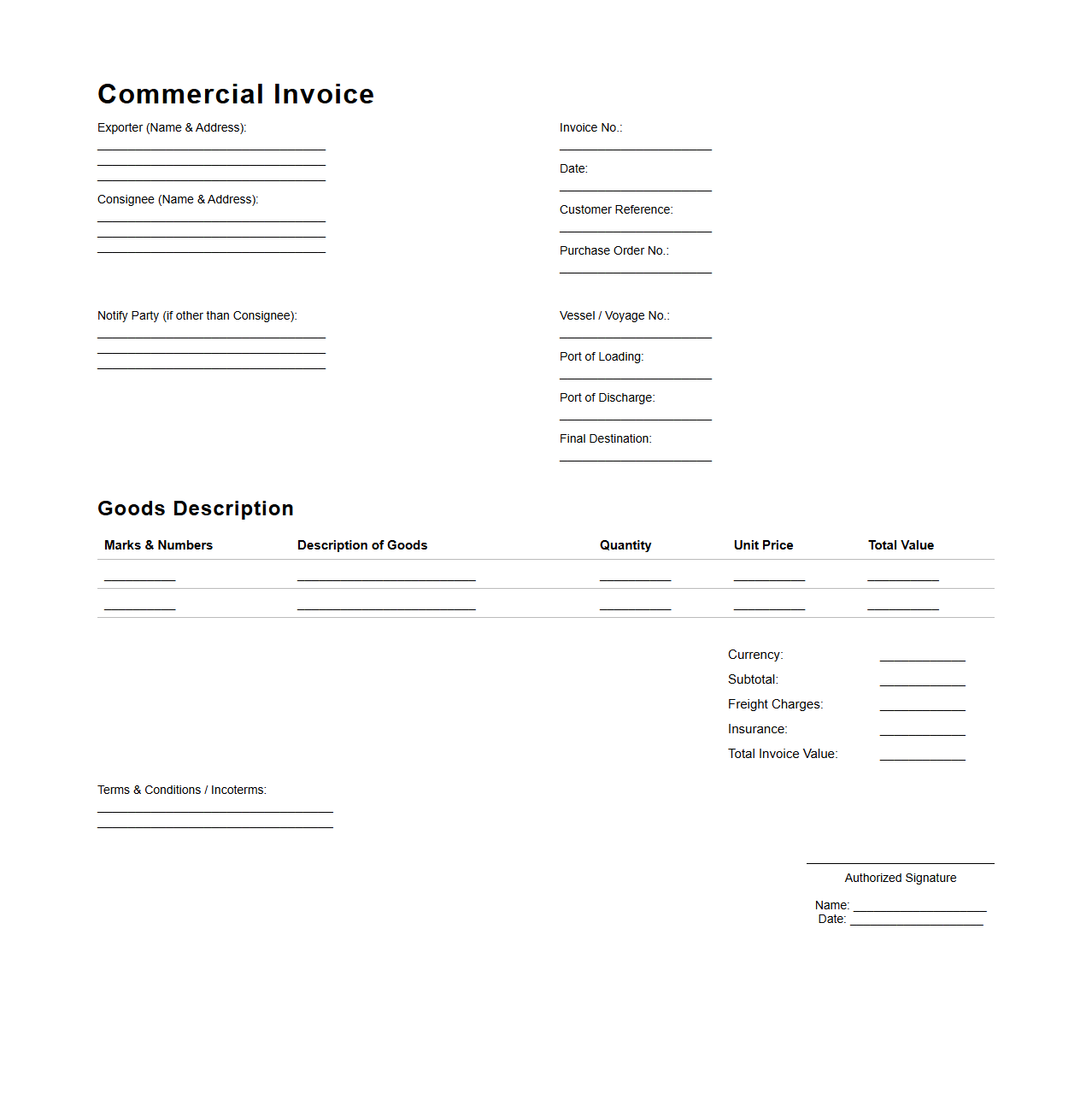

Detailed Commercial Invoice Example for Customs Clearance

A

Detailed Commercial Invoice for customs clearance is a critical document that itemizes the goods being shipped, including descriptions, quantities, unit prices, and total values. It provides customs authorities with essential information to assess duties, taxes, and ensure compliance with import regulations. This invoice typically includes seller and buyer details, shipment terms, and Harmonized System (HS) codes to facilitate smooth customs processing.

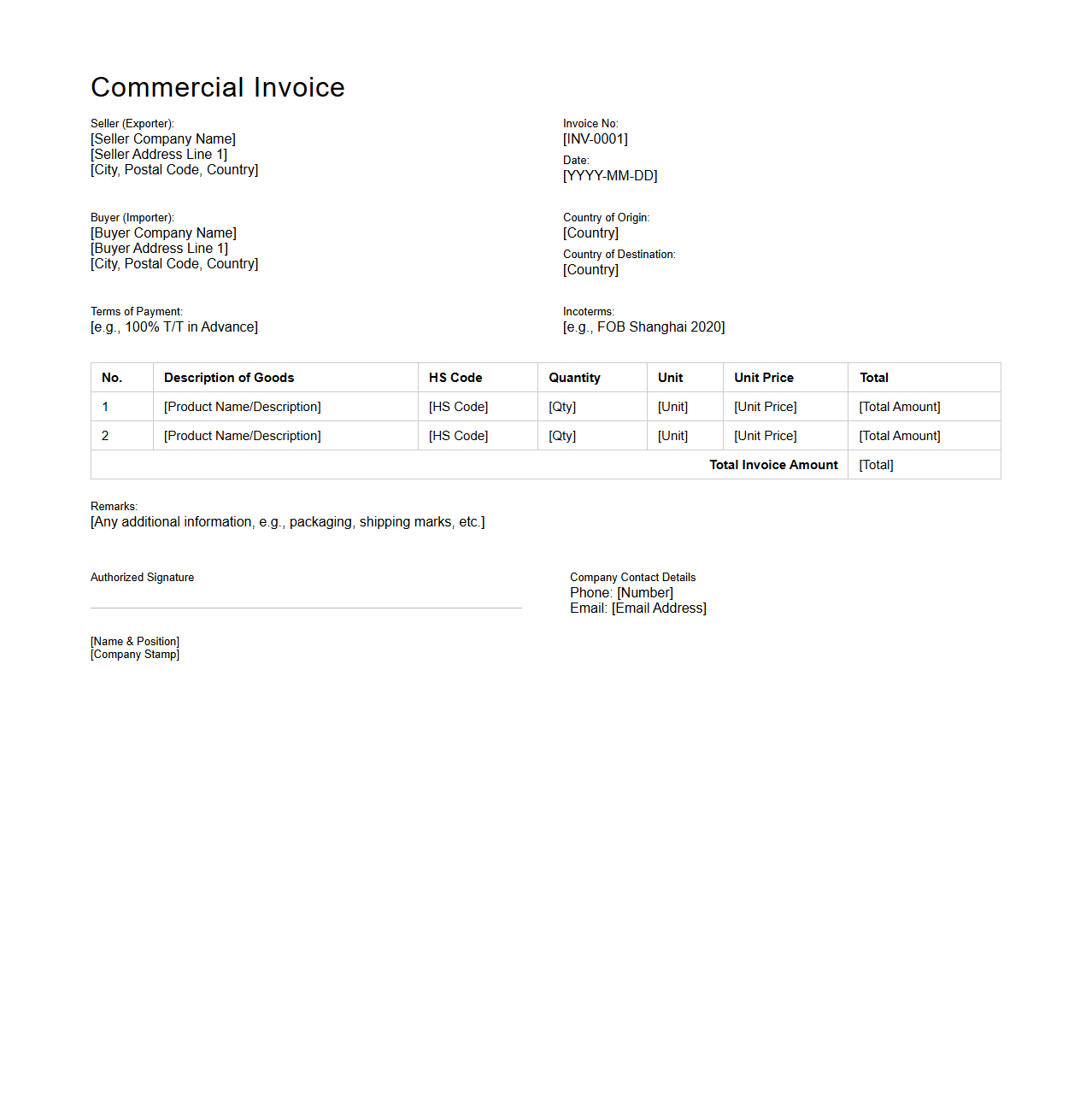

Commercial Invoice Sample with HS Code and Incoterms

A

Commercial Invoice Sample with HS Code and Incoterms document serves as a detailed bill of sale used in international trade, specifying product descriptions, quantities, and prices alongside the Harmonized System (HS) Code to classify goods for customs purposes. It includes Incoterms, which define the responsibilities, risks, and costs between the buyer and seller during shipment. This document ensures compliance with customs regulations, facilitates smooth clearance, and provides essential transaction details for accurate duties and taxes calculation.

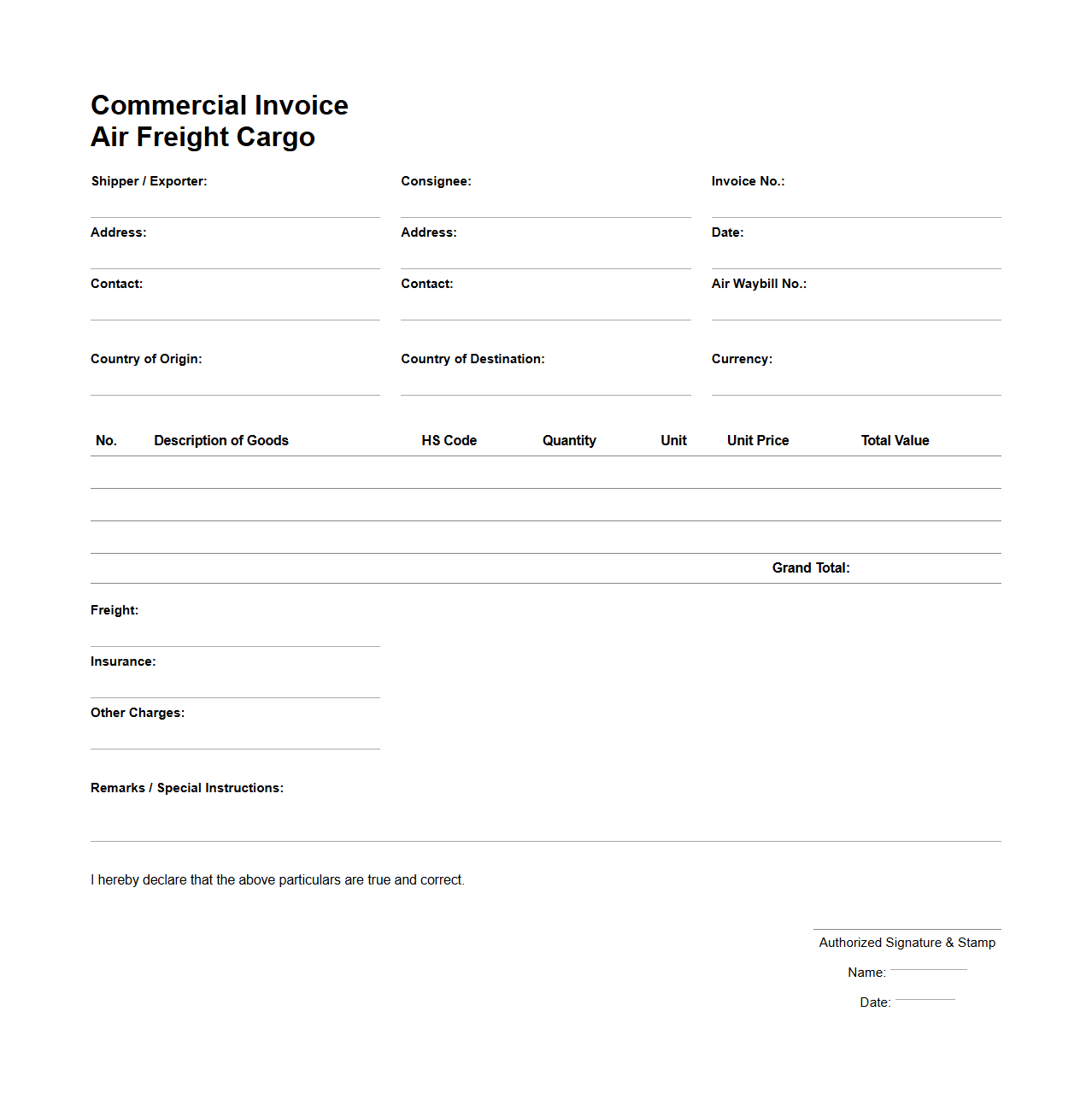

Commercial Invoice Format for Air Freight Cargo

A

Commercial Invoice Format for Air Freight Cargo is a standardized document that details the transaction between the exporter and importer, listing the goods shipped, their value, and terms of sale. This invoice serves as a critical customs declaration, facilitating the clearance process by providing essential information such as shipment weight, dimensions, freight charges, and tax details. Accurate completion of this format ensures compliance with international shipping regulations and smooth handling of air freight cargo through customs authorities.

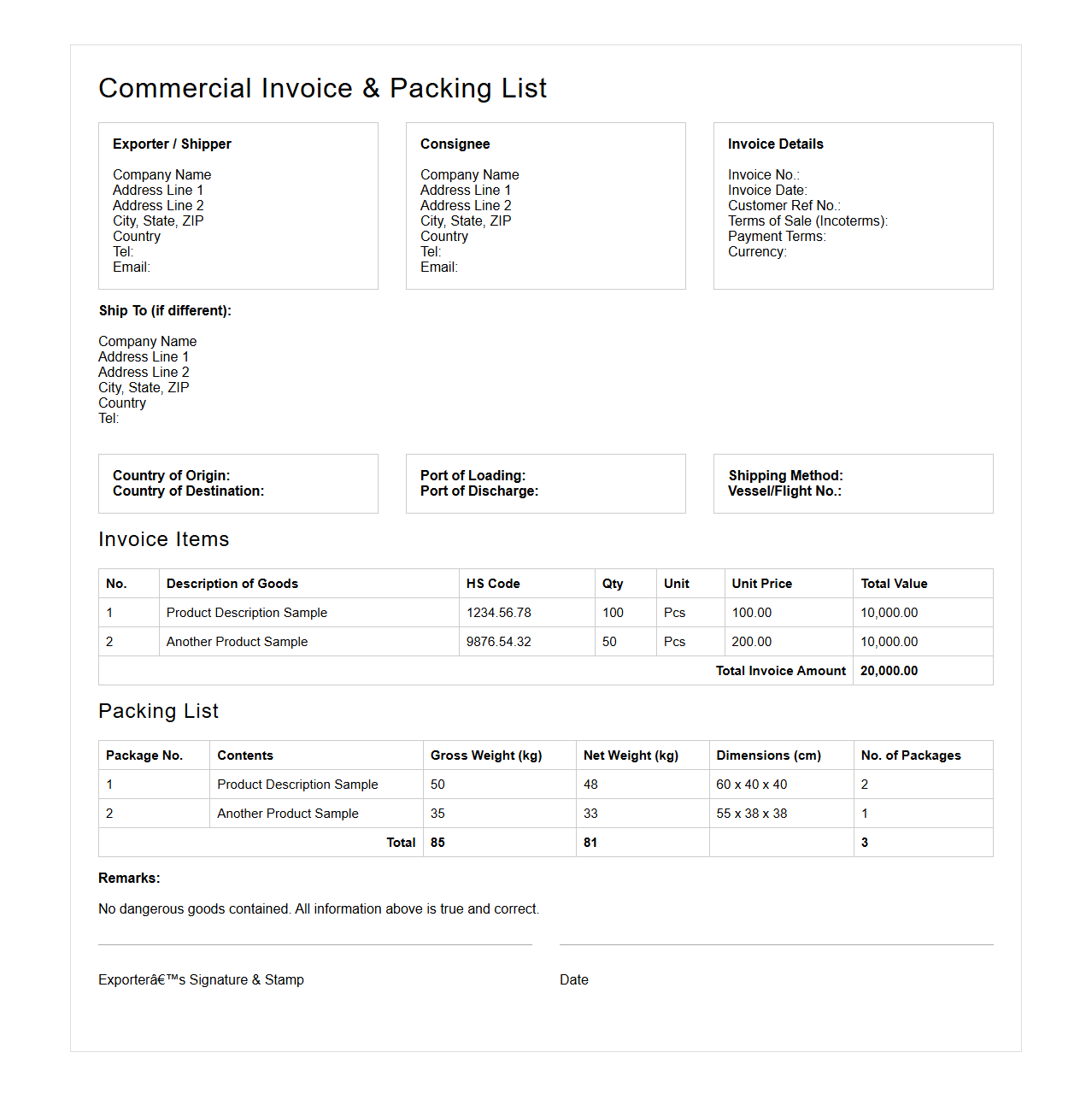

International Shipping Commercial Invoice with Packing List

The

International Shipping Commercial Invoice with Packing List is a crucial document used in global trade that details the transaction between the seller and buyer, including descriptions, quantities, and values of shipped goods. It serves as a legal proof for customs clearance, ensuring compliance with import/export regulations and facilitating accurate tariff assessments. The packing list supplements the invoice by providing specifics on packaging, weight, and dimensions, aiding logistics and inventory management.

Commercial Invoice Example for Sea Freight Shipments

A

Commercial Invoice Example for Sea Freight Shipments document serves as a detailed record outlining the sale transaction between the exporter and importer, specifying goods, quantities, and prices. It is essential for customs clearance, helping authorities assess duties and ensure compliance with import regulations. The document typically includes shipment details such as the shipper's and consignee's information, payment terms, and a description of the goods being transported via sea freight.

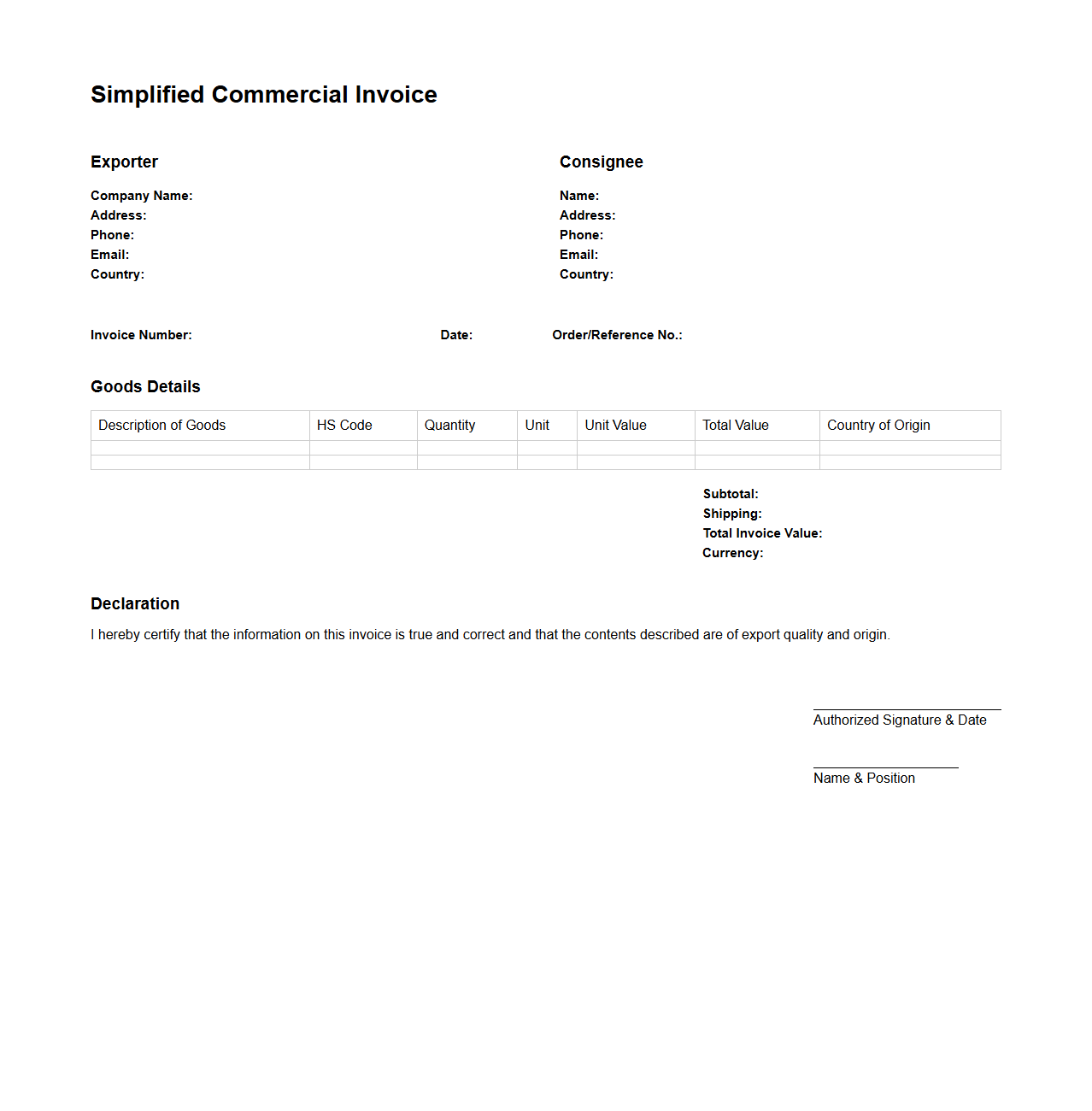

Simplified Commercial Invoice for E-commerce Export

A

Simplified Commercial Invoice for e-commerce export is a streamlined shipping document that facilitates faster customs clearance by including essential transaction details such as the seller, buyer, product description, quantity, and value. It is designed to reduce paperwork complexity while ensuring compliance with international trade regulations, particularly for low-value shipments. This document enhances efficiency in cross-border e-commerce by minimizing delays and simplifying the verification process for customs authorities.

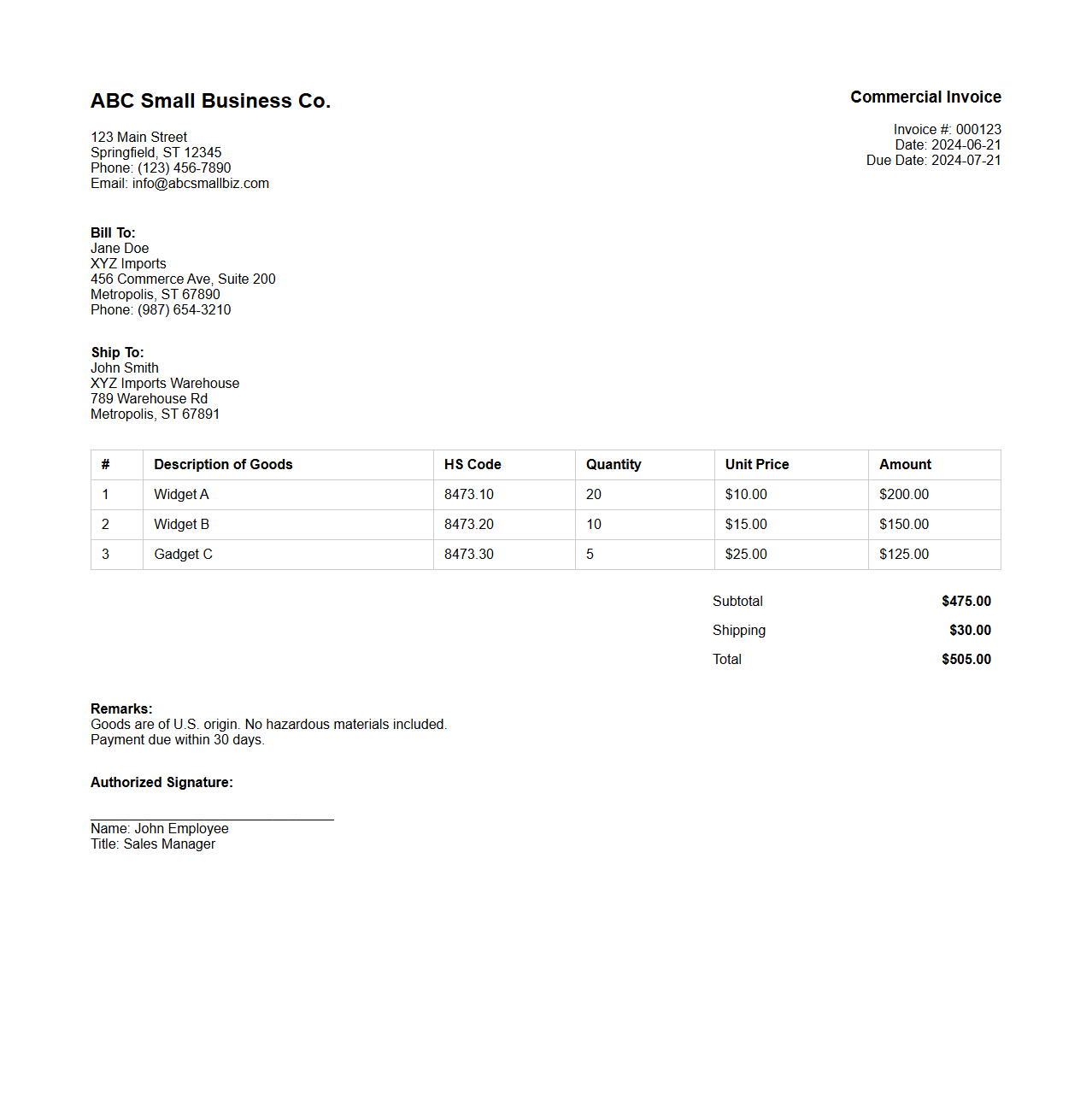

Commercial Invoice Sample for Small Businesses

A

Commercial Invoice Sample for Small Businesses is a standardized template used to detail the transaction between a seller and buyer, including product descriptions, quantities, prices, and payment terms. This document is essential for customs clearance, tax calculations, and financial record-keeping. Small businesses benefit from using such samples to ensure accuracy, professionalism, and compliance with international trade regulations.

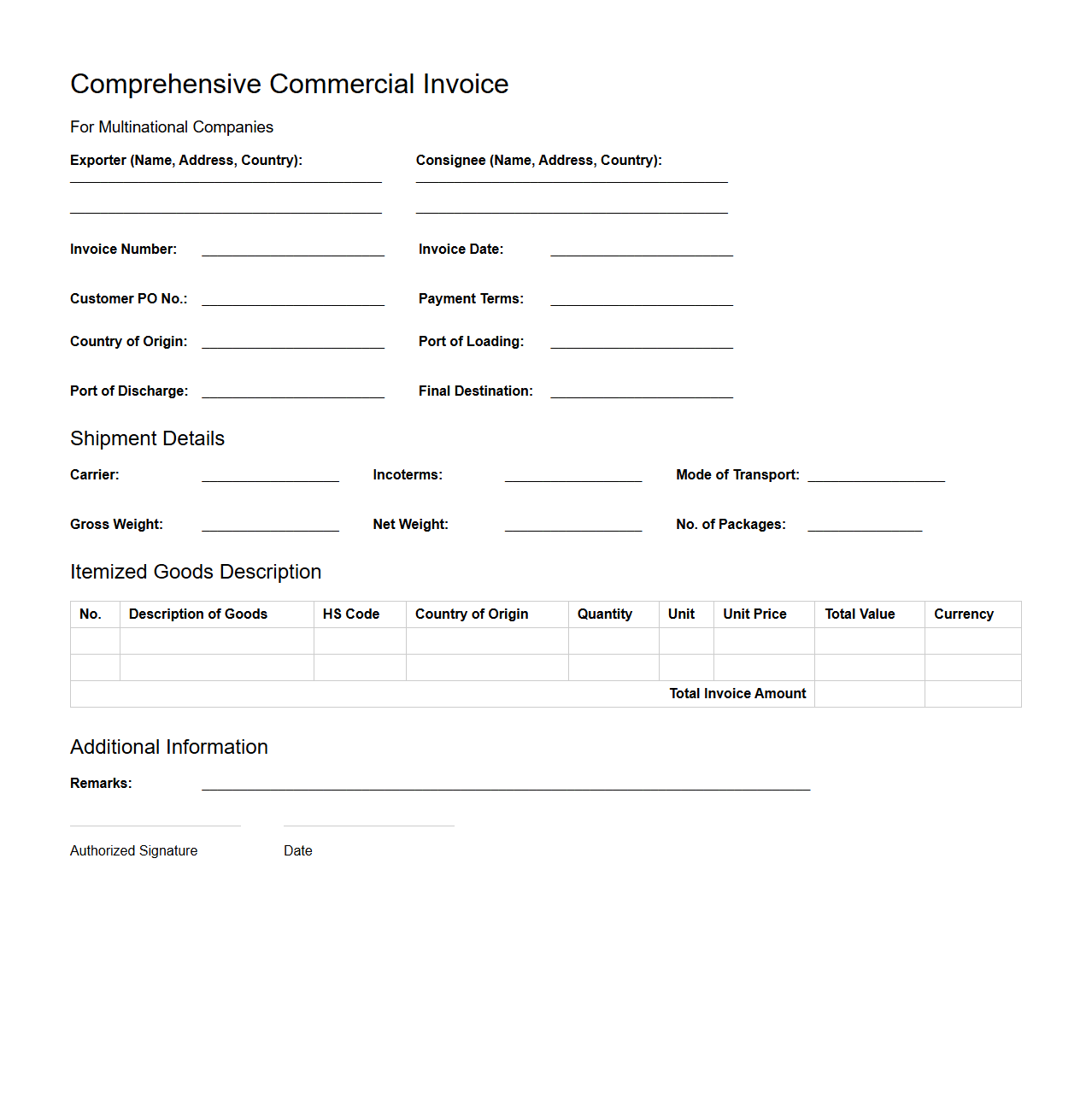

Comprehensive Commercial Invoice for Multinational Companies

A

Comprehensive Commercial Invoice for multinational companies is a detailed document that lists all goods sold in a transaction, including descriptions, quantities, unit prices, and total values. It provides essential information for customs clearance, tax calculations, and compliance with international trade regulations. This invoice ensures accurate shipment processing and facilitates smooth global supply chain operations.

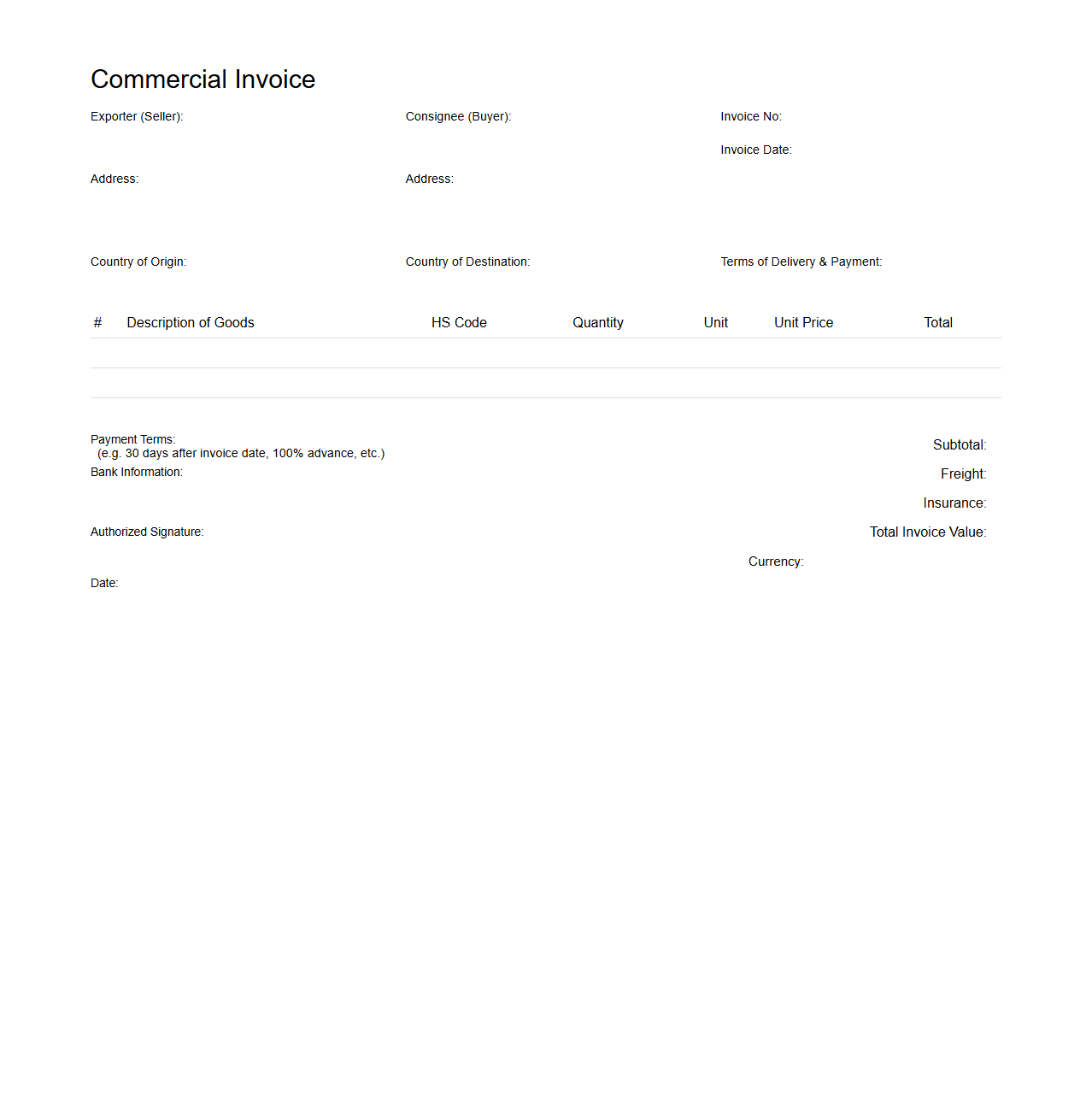

Commercial Invoice Template with Payment Terms for Global Trade

A

Commercial Invoice Template with Payment Terms for global trade serves as a vital document detailing the transaction between the exporter and importer, specifying product descriptions, quantities, unit prices, and total amounts. It outlines the agreed-upon payment terms, including deadlines, methods, and conditions, ensuring clarity and legal protection for both parties in international transactions. This template streamlines customs clearance, accounting, and dispute resolution by providing standardized financial and logistical information.

What key fields are required on a commercial invoice for international shipping?

A commercial invoice must include the seller's and buyer's information, a detailed description of the goods, and the country of origin. It should also have the invoice number, date, and payment terms clearly stated. These key fields ensure accurate processing and compliance with international shipping regulations.

How does a commercial invoice support customs clearance processes?

The commercial invoice provides customs authorities with essential details to verify the contents and value of the shipment. It serves as a primary document to assess whether the goods meet import regulations and standards. Properly prepared invoices help prevent delays and facilitate smooth customs clearance.

What information on a commercial invoice affects duties and taxes calculation?

The value of the goods, their classification under the Harmonized System (HS) code, and the country of origin are critical for calculating duties and taxes. The invoice must accurately state the currency and total amount payable. Any discrepancies in these details can lead to incorrect duty assessments or legal complications.

Which parties' details must be included on a standard commercial invoice?

A standard commercial invoice must include full contact information for both the exporter (seller) and the importer (buyer). It should detail names, addresses, and tax identification numbers if applicable. Including these parties' details ensures accountability and traceability throughout the shipping process.

How does a commercial invoice differ from a proforma invoice in international trade?

A commercial invoice is a final document used for payment and customs clearance, reflecting actual sale details. In contrast, a proforma invoice is a preliminary estimate provided before shipment to outline the terms and expected costs. Understanding these differences is vital for accurate documentation and transaction management in international trade.