A Customs Declaration Document Sample for Import Clearance provides a detailed template illustrating how to accurately declare imported goods to customs authorities. This document includes essential information such as product description, quantity, value, origin, and applicable tariffs to ensure compliance with import regulations. Proper use of this sample facilitates smoother customs processing and helps avoid delays or penalties.

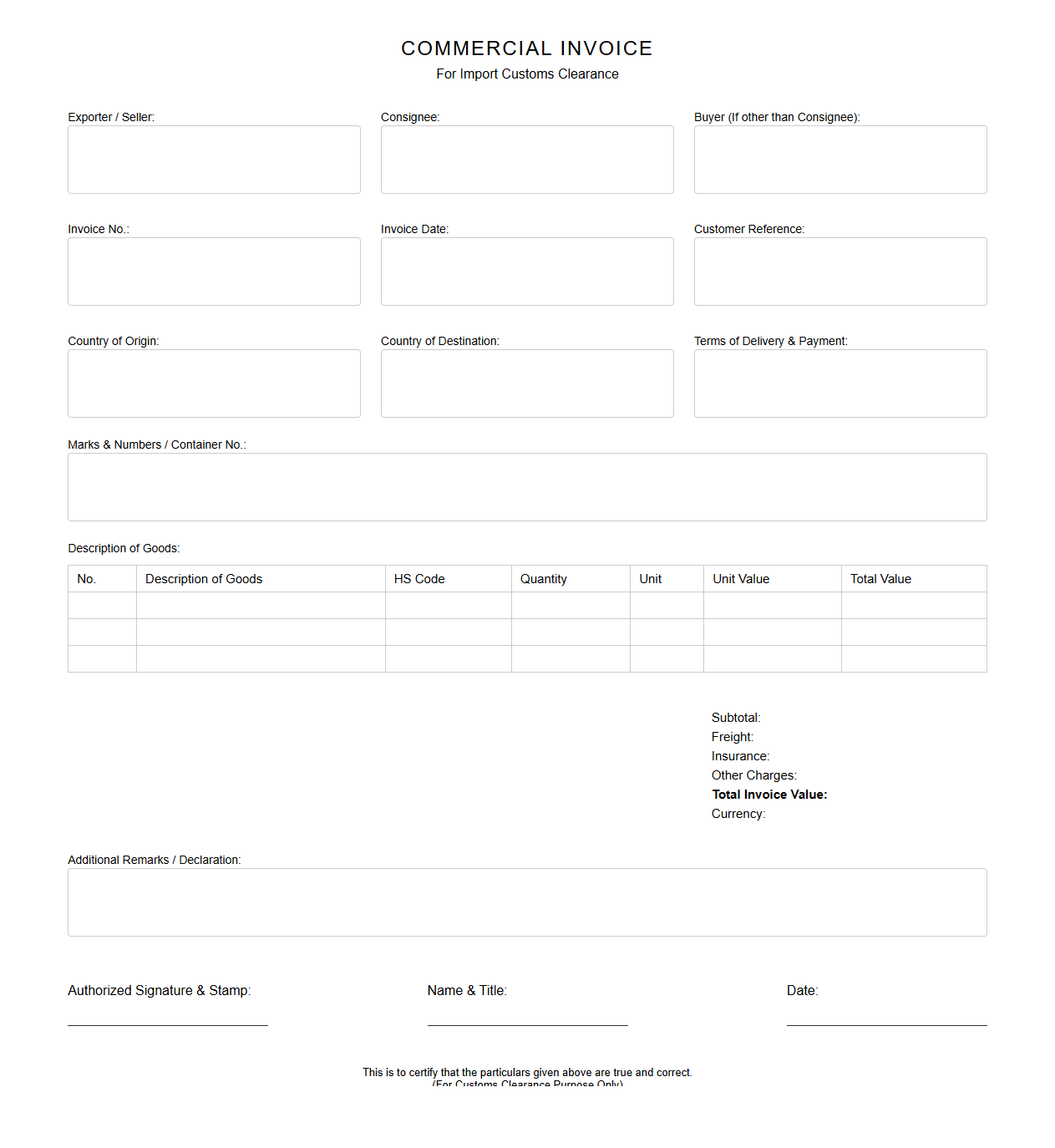

Commercial Invoice for Import Customs Clearance

A

Commercial Invoice is a critical document used in import customs clearance that details the transaction between the exporter and importer, including the description, quantity, and value of the goods. It serves as primary evidence for customs authorities to assess duties, taxes, and verify compliance with import regulations. Accurate information on the invoice ensures smooth clearance and prevents delays or penalties during the import process.

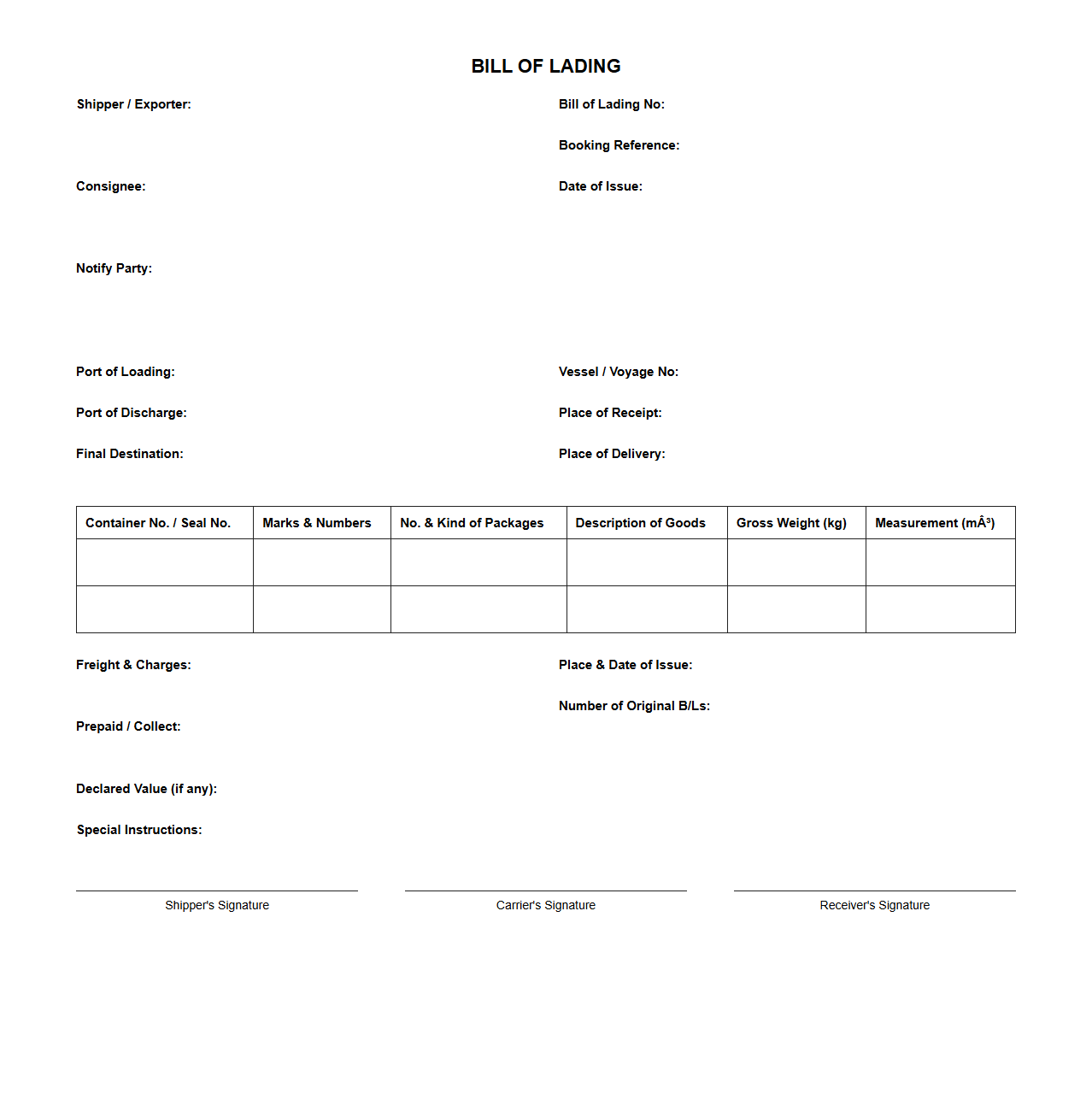

Bill of Lading Template for Import Declarations

A

Bill of Lading Template for Import Declarations is a standardized document used to detail the shipment information required for customs clearance during the import process. It includes critical data such as the shipper's details, consignee information, description of goods, quantity, weight, and shipping route. This template ensures accurate and efficient communication between exporters, importers, and customs authorities, facilitating compliance with import regulations and smooth cargo transit.

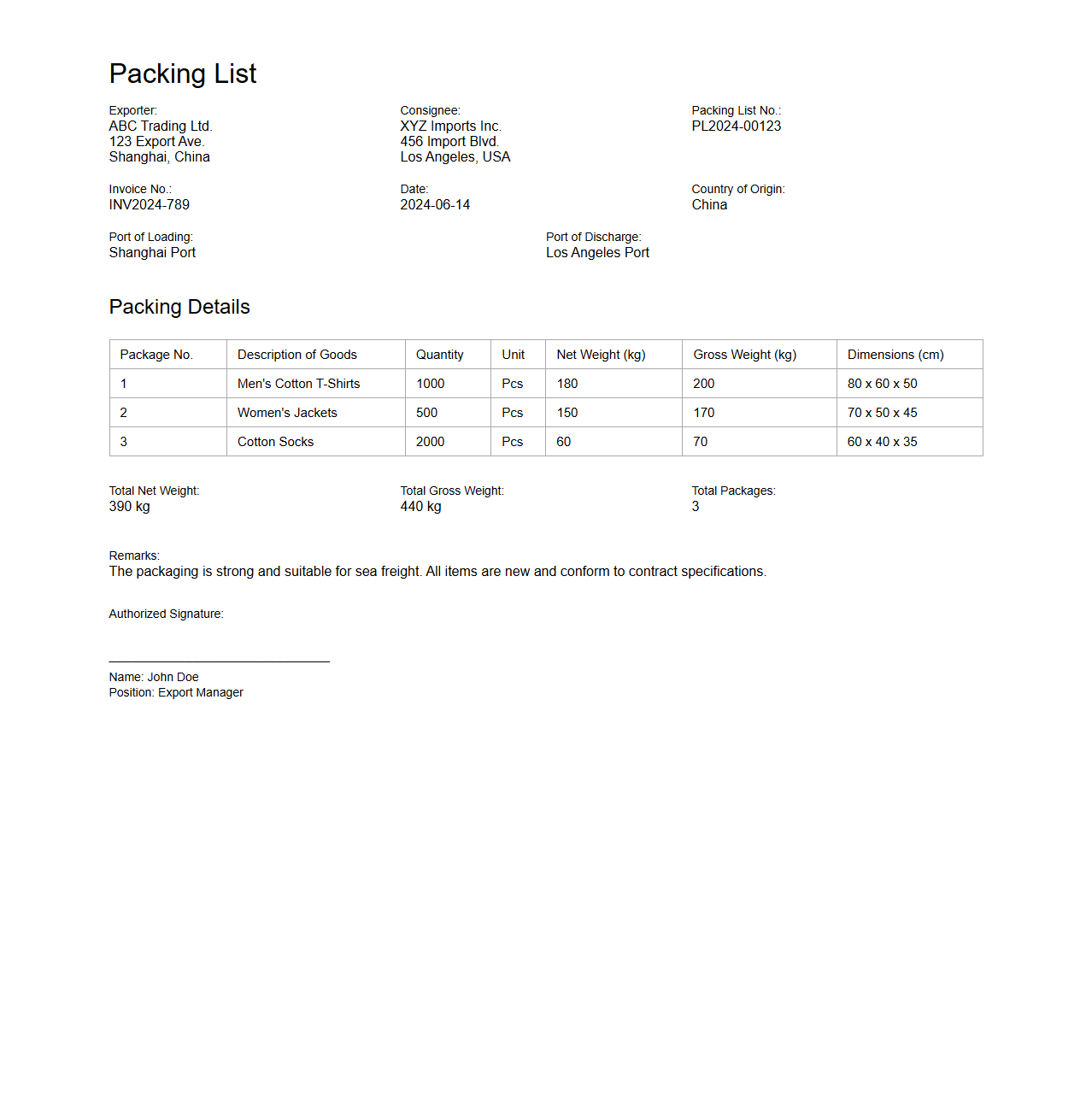

Packing List Example for Import Procedures

A

Packing List Example for import procedures document outlines the detailed contents of a shipment, including quantity, description, weight, and dimensions of each item. It serves as an essential reference for customs officials to verify the accuracy of shipped goods against commercial invoices and shipping documents. This document facilitates smooth clearance, reduces delays, and ensures compliance with international trade regulations.

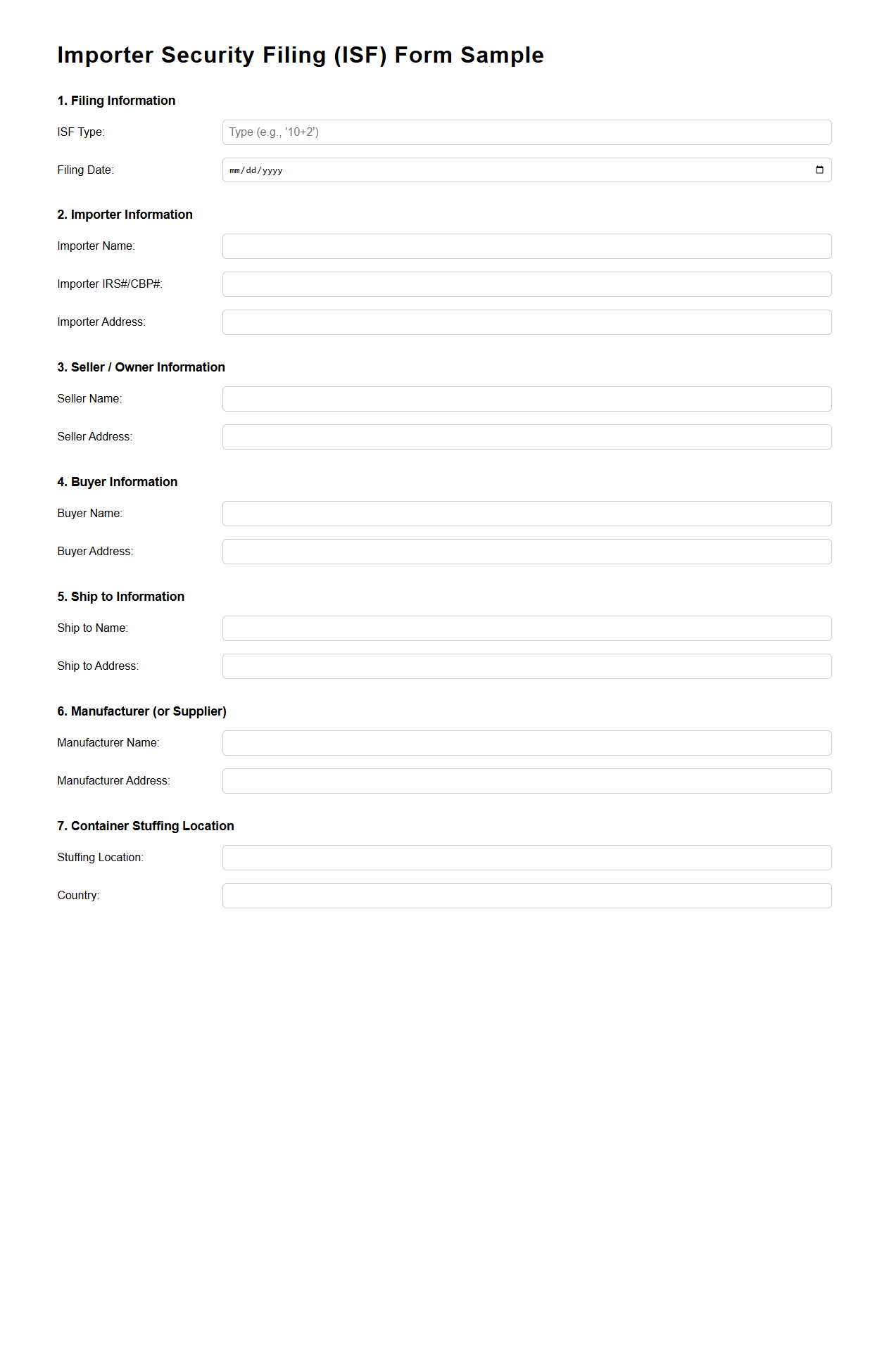

Importer Security Filing Form Sample

The

Importer Security Filing (ISF) Form Sample is a crucial document used by importers to comply with U.S. Customs and Border Protection (CBP) regulations. This form includes detailed shipment information such as the consignee, manufacturer, and country of origin, which must be submitted at least 24 hours before cargo is loaded onto vessels destined for the United States. Accurate completion of the ISF form helps ensure timely customs clearance and reduces the risk of penalties or shipment delays.

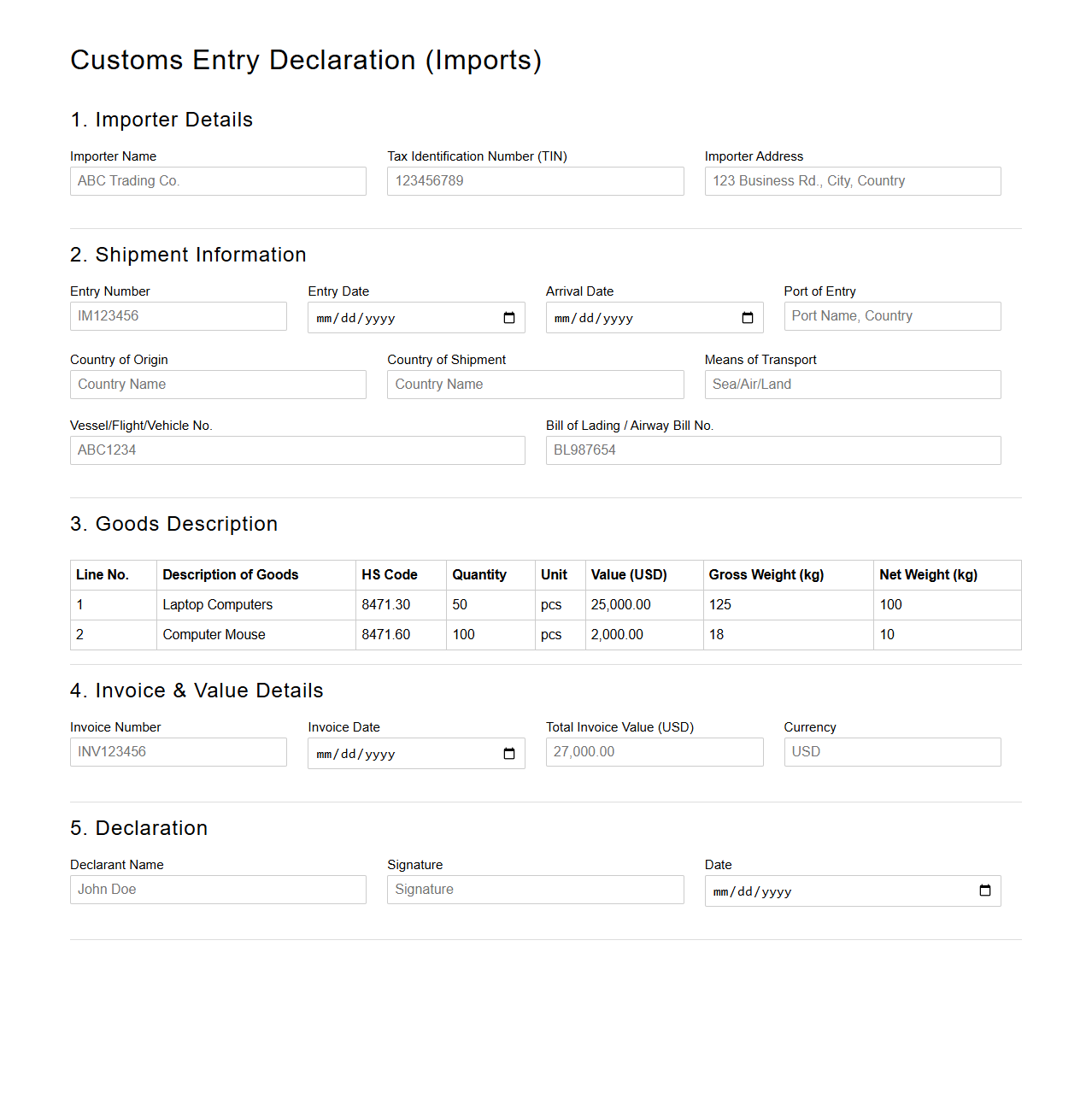

Customs Entry Declaration Example for Imports

A

Customs Entry Declaration Example for Imports document is a detailed form that importers submit to customs authorities, listing all goods brought into a country. It includes essential information such as shipment details, product descriptions, harmonized system codes, quantities, and values to ensure accurate duty assessment and regulatory compliance. This document facilitates the efficient processing of imported goods and helps prevent delays or penalties during customs clearance.

Certificate of Origin Document Sample

A

Certificate of Origin document sample serves as an official attestation identifying the country where the goods were manufactured or produced. This document is crucial in international trade, as it helps customs authorities determine tariff rates, verify compliance with trade agreements, and prevent fraud. Using a standardized Certificate of Origin sample ensures accuracy and streamlines the export-import process for businesses and regulatory bodies.

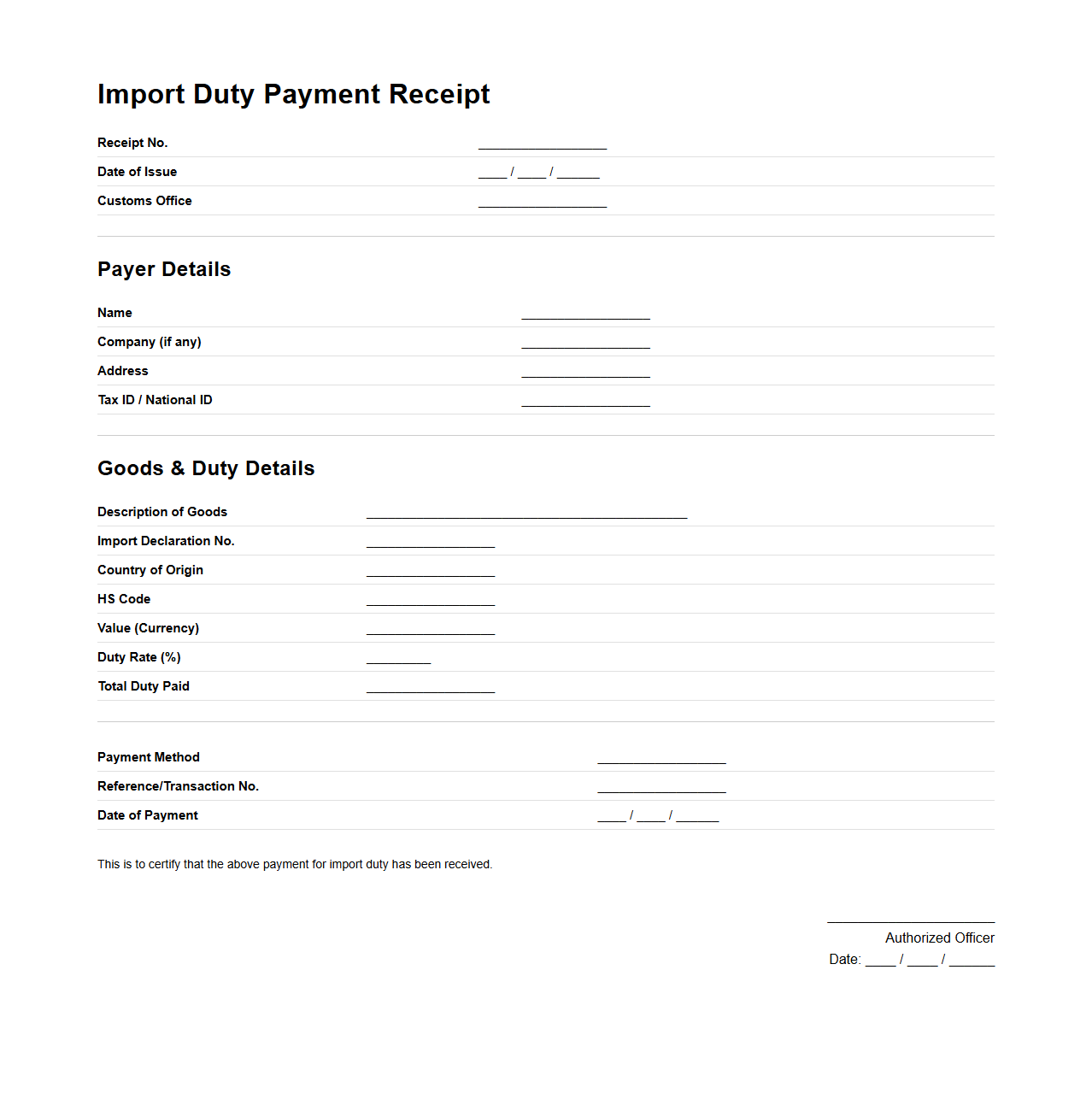

Import Duty Payment Receipt Template

An

Import Duty Payment Receipt Template document serves as a formal acknowledgment issued by customs or importing authorities confirming the payment of import duties on goods. It typically includes essential details such as the importer's name, invoice number, amount paid, payment date, and description of the imported items. This receipt is crucial for record-keeping, compliance verification, and facilitating the clearance of shipments in international trade.

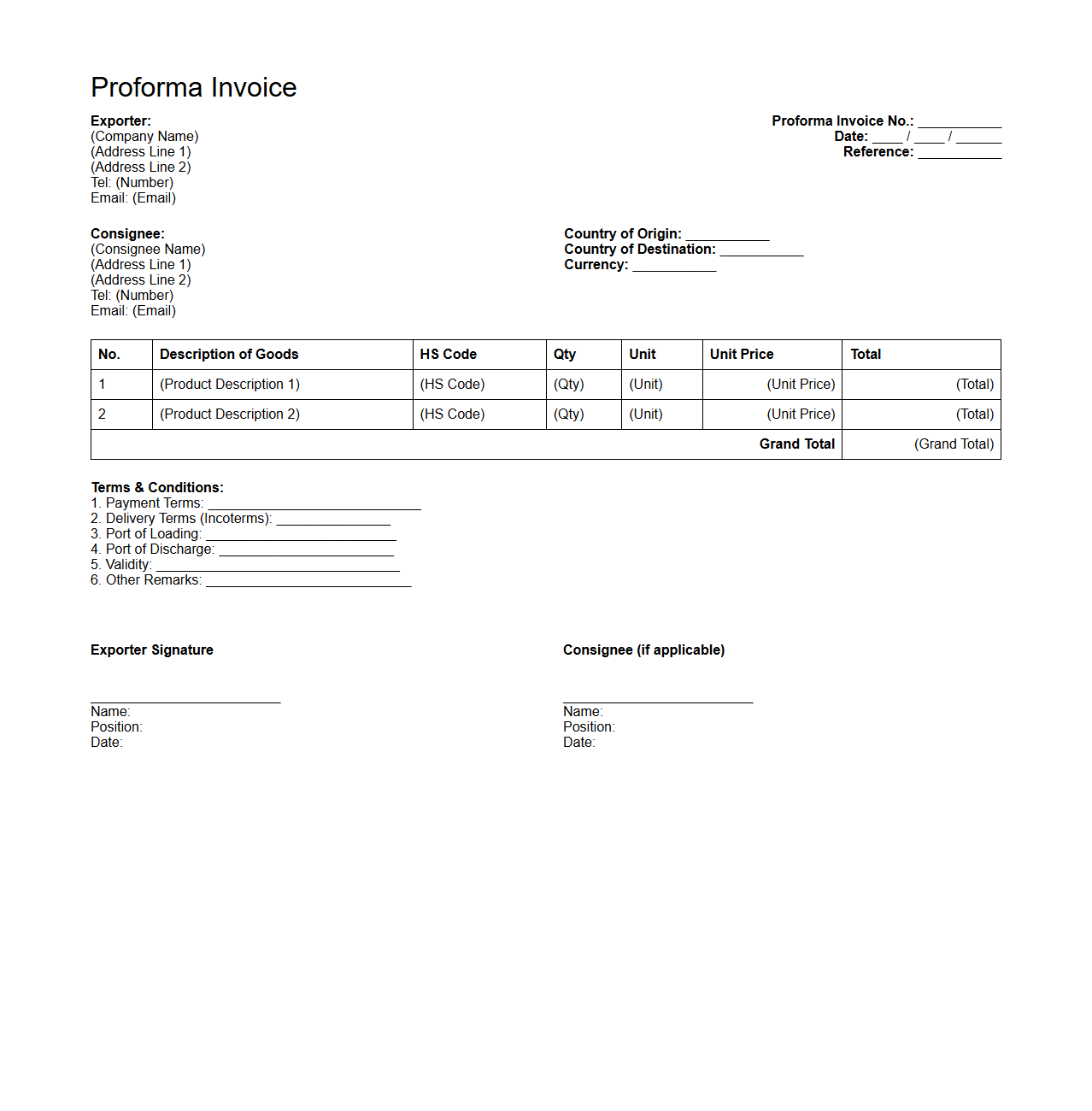

Proforma Invoice for Customs Clearance

A

Proforma Invoice for customs clearance is a preliminary bill of sale sent to buyers before shipping goods, detailing the merchandise, quantities, and agreed prices. It serves as a crucial document for customs authorities to assess duties and taxes, ensuring compliance with import regulations. Accurate and detailed proforma invoices expedite the clearance process, reducing delays and potential fines during international shipments.

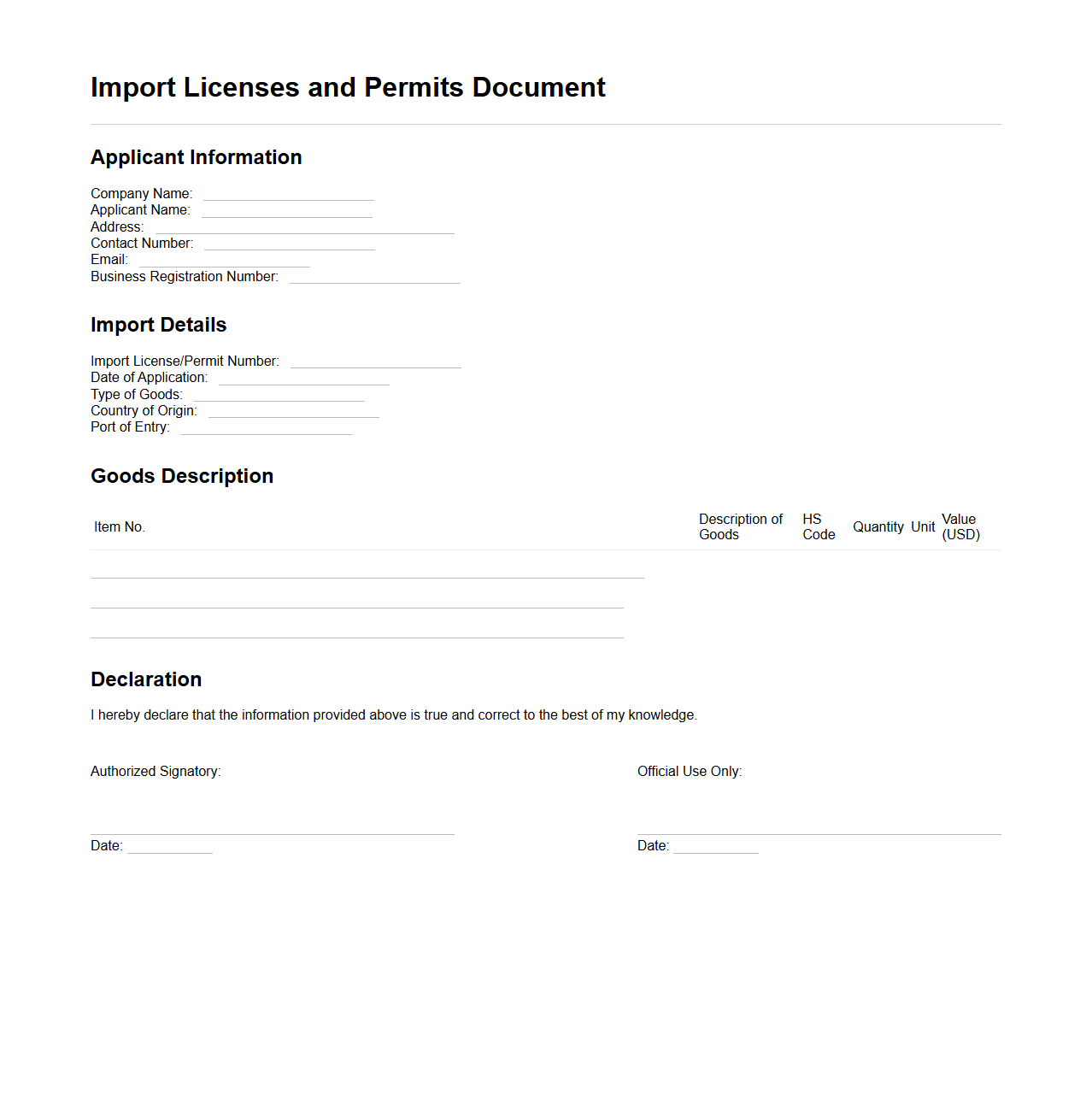

Import Licenses and Permits Document Example

An

Import Licenses and Permits Document example serves as a formal authorization required by customs authorities to regulate the entry of specific goods into a country. This document includes essential details such as importer identification, product description, quantity, and compliance with trade regulations. It ensures that imported products meet legal standards, preventing prohibited or restricted items from entering the market.

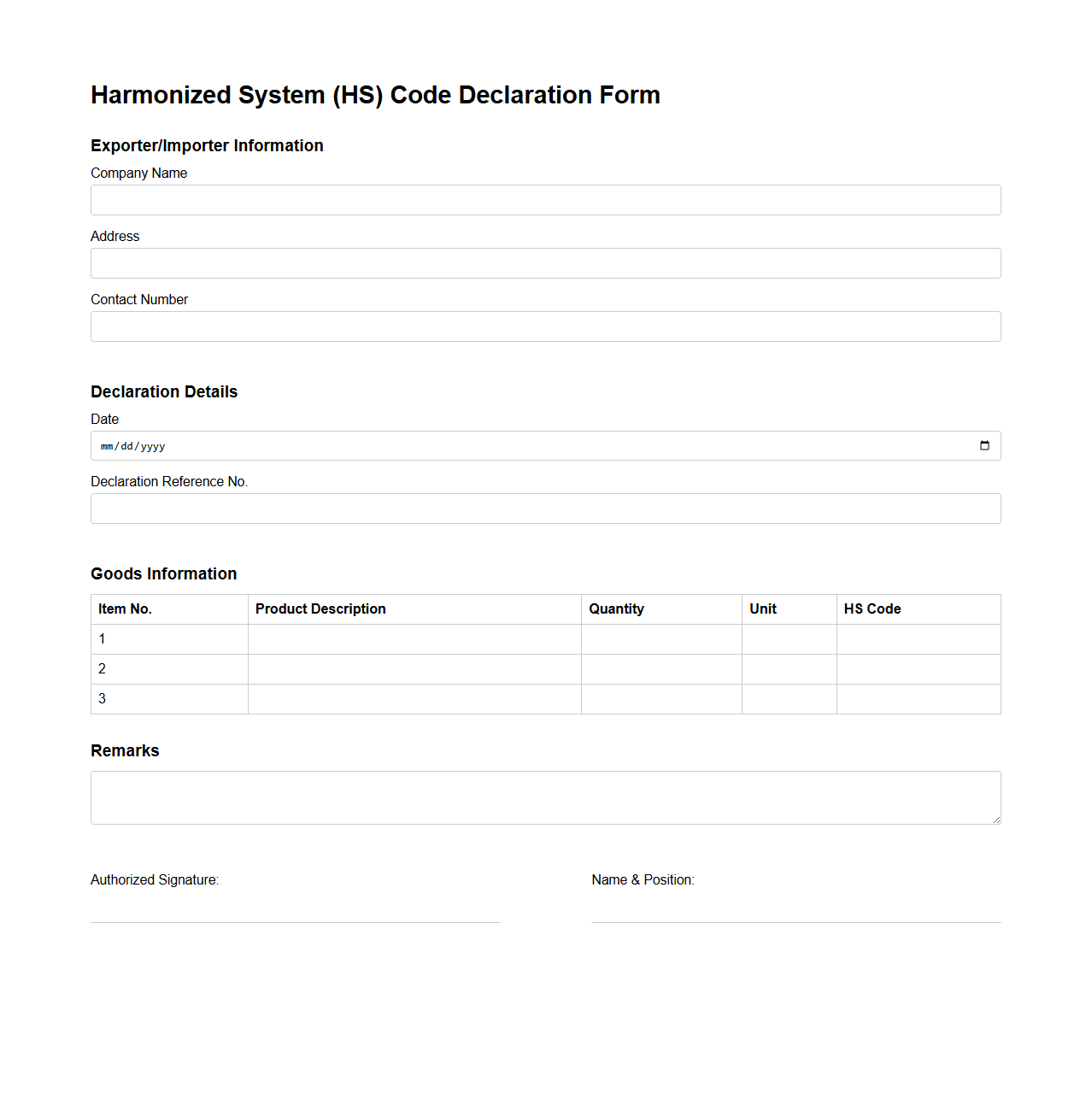

Harmonized System (HS) Code Declaration Form

The

Harmonized System (HS) Code Declaration Form is a standardized document used to classify goods in international trade according to the internationally recognized HS codes. This form ensures accurate tariff application, customs clearance, and statistical reporting by detailing the specific HS code corresponding to the product being shipped. Proper completion of the HS Code Declaration Form reduces delays, lowers the risk of misclassification penalties, and facilitates smoother cross-border transactions.

What key sections must be included in a standard Customs Declaration Document for import clearance?

A standard Customs Declaration Document must include sections detailing the importer and exporter information, shipment details, and itemized goods description. These sections ensure all necessary data for import clearance is captured accurately. Additionally, sections covering duties, taxes, and compliance certifications are essential to comply with regulations.

Which data fields are essential for identifying the importer and the shipment's origin?

The importer's name, address, and tax identification number are crucial for accurate identification. Shipment origin is confirmed through fields such as the country of export and the exporter's details. This information helps verify the authenticity and legality of the goods being imported.

How are product descriptions and HS codes typically structured within the customs declaration form?

Product descriptions in the customs form must be clear and detailed to reflect the exact nature of the goods. Harmonized System (HS) codes are standardized numerical codes that classify traded products internationally. Each HS code corresponds to a specific description, allowing customs authorities to assess duties and regulations accurately.

What evidence of compliance (e.g., permits, certificates) is usually required to accompany an import Customs Declaration Document?

Compliance evidence commonly includes import permits, certificates of origin, and health or safety certificates depending on the product. These documents confirm that the goods meet the importing country's regulatory requirements. Including this documentation helps prevent delays and ensures legal import clearance.

What role does the declared customs value play in the assessment and clearance process?

The declared customs value of imported goods forms the basis for calculating duties and taxes owed. This value must reflect the transaction price or a reasonable equivalent according to customs valuation rules. Accurate valuation is critical to avoid penalties and streamline the clearance process.