A Mortgage Application Document Sample for Home Buyers provides a clear template outlining the essential paperwork needed to apply for a home loan. This sample typically includes personal identification, income verification, credit history, and property details to streamline the approval process. Using a well-organized example helps buyers prepare accurate and complete documentation, increasing their chances of securing financing.

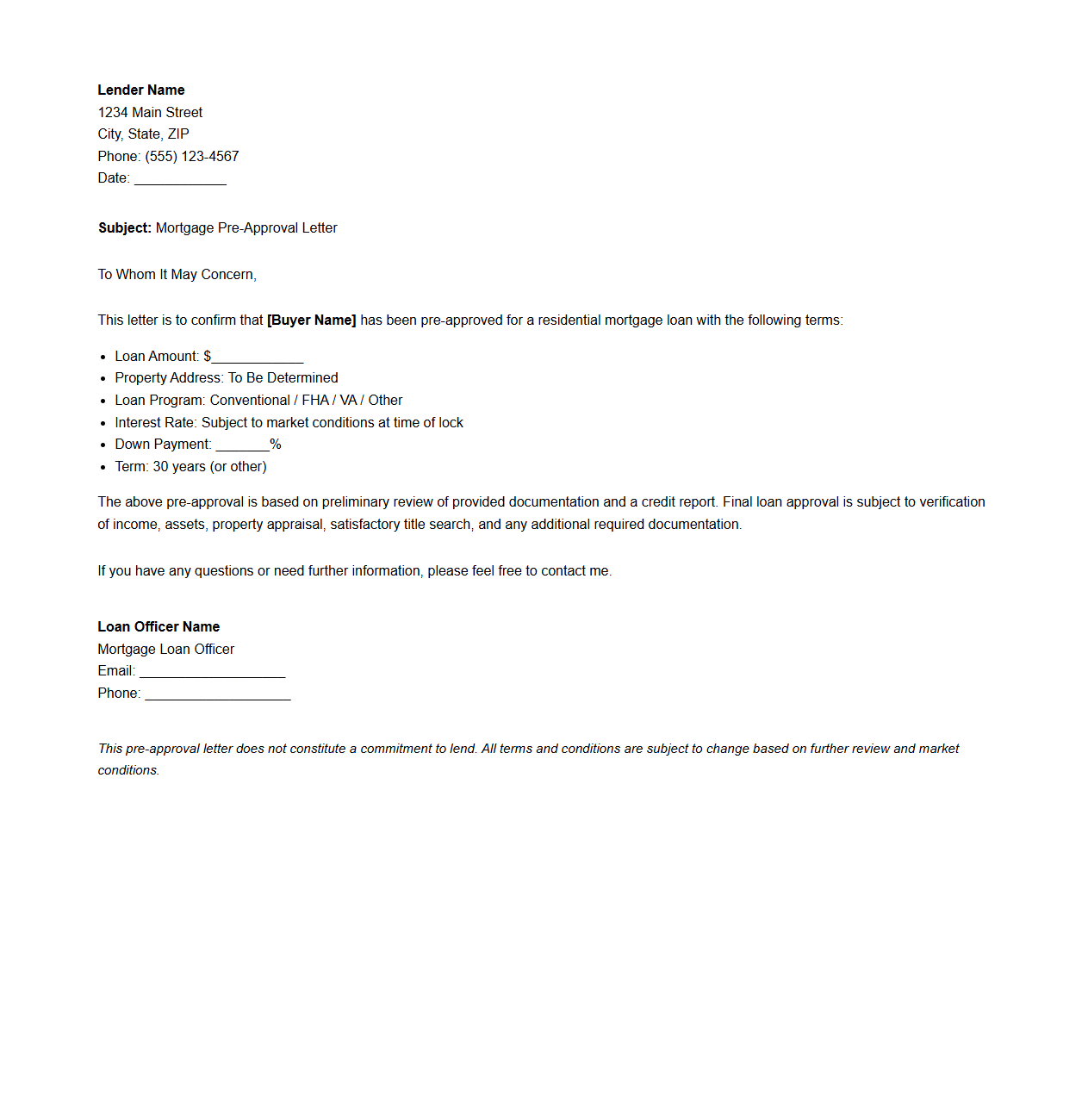

Mortgage Pre-Approval Letter Sample for Home Buyers

A

Mortgage Pre-Approval Letter Sample for home buyers is a formal document issued by a lender indicating the potential loan amount a buyer qualifies for based on their financial information. This letter helps buyers demonstrate to sellers their seriousness and ability to secure financing, often strengthening their position in competitive real estate markets. It typically includes the buyer's credit score, income verification, loan program details, and estimated borrowing capacity.

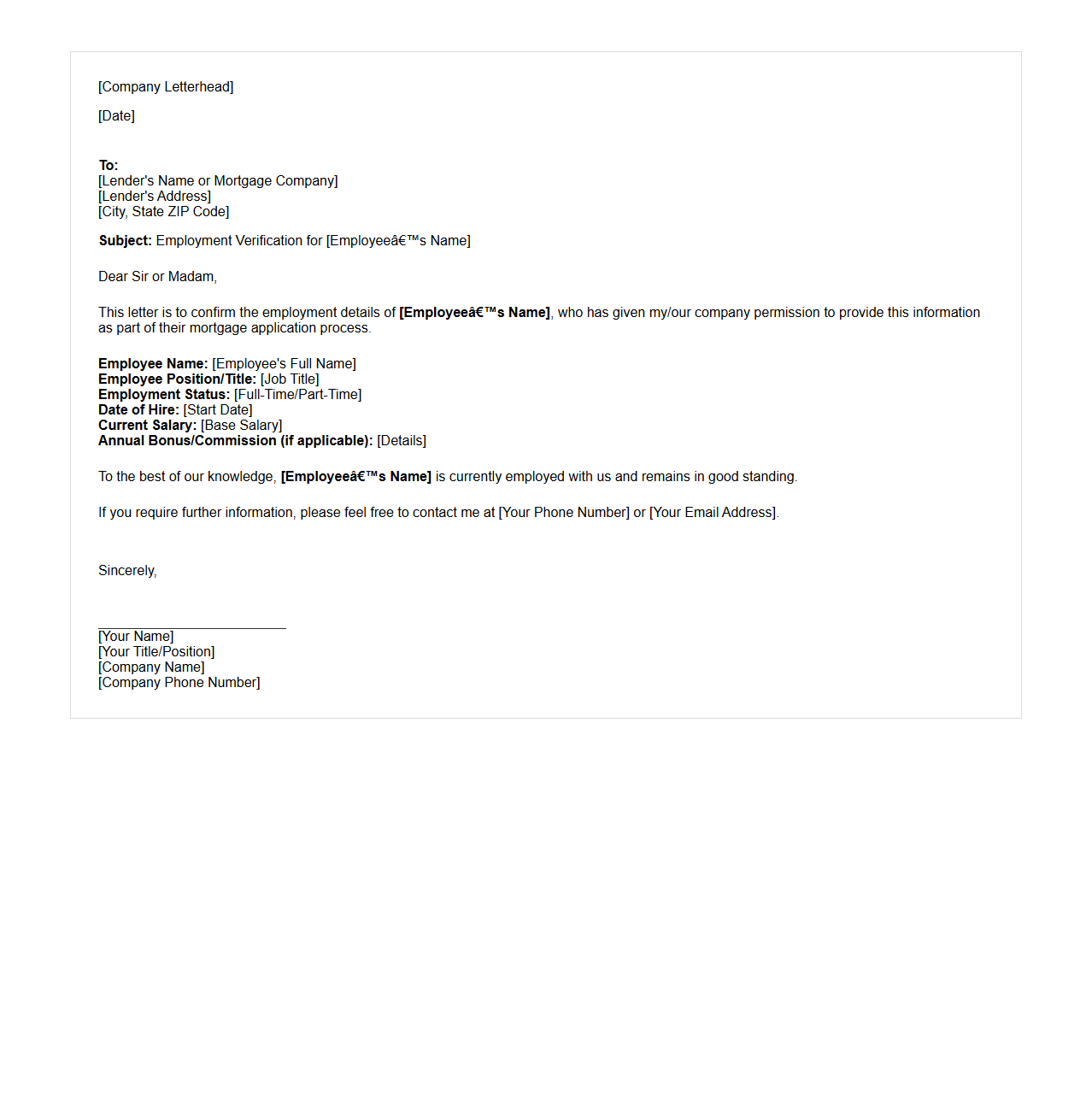

Employment Verification Letter Template for Mortgage Application

An

Employment Verification Letter Template for Mortgage Application is a standardized document used by employers to confirm an employee's job status, income, and duration of employment for mortgage lenders. This template ensures that essential details such as job title, salary, and employment dates are clearly communicated to support the borrower's loan approval process. Accurate and timely employment verification is critical in assessing the applicant's financial stability and ability to repay the mortgage.

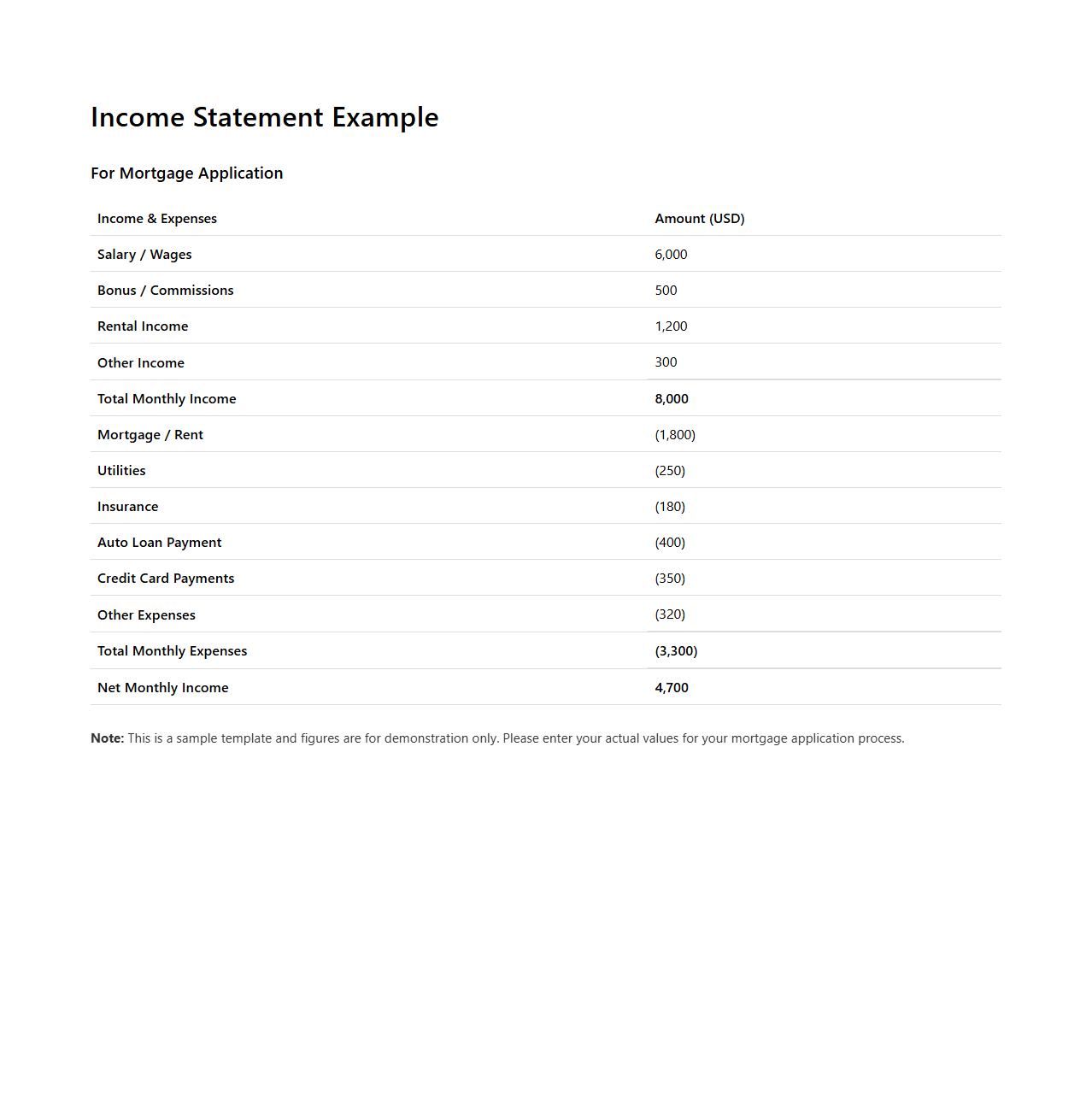

Income Statement Example for Mortgage Process

An Income Statement Example for Mortgage Process document outlines a detailed breakdown of an individual's or business's earnings and expenses over a specific period, crucial for evaluating financial stability during mortgage approval. It includes key components such as revenue, cost of goods sold, operating expenses, and net income, providing lenders with insight into cash flow consistency and repayment capacity. Understanding this

financial statement helps mortgage underwriters assess risk and determine borrower eligibility effectively.

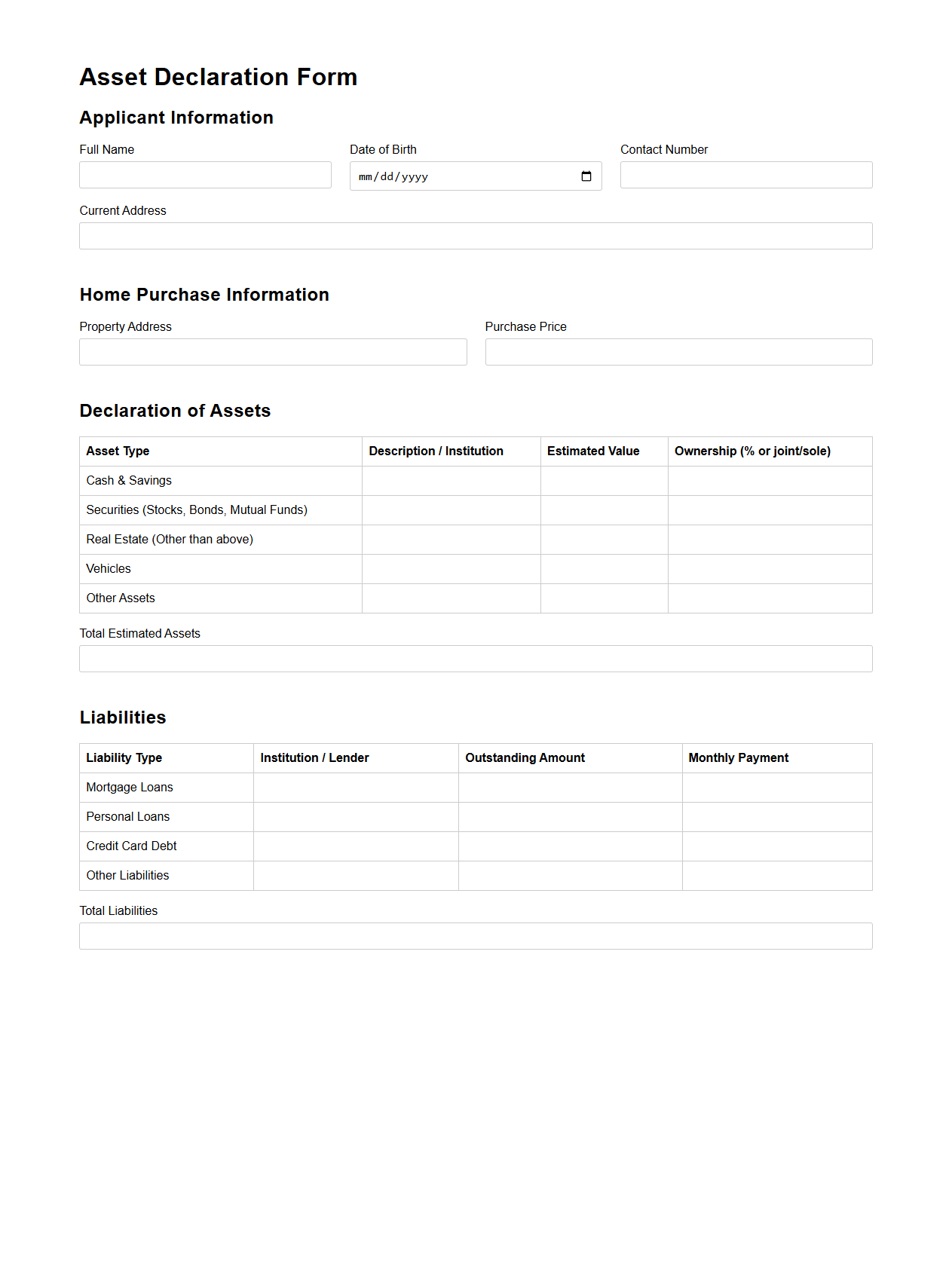

Asset Declaration Form Sample for Home Purchase

An

Asset Declaration Form Sample for Home Purchase document serves as a comprehensive record detailing an individual's financial assets during a property buying process. It includes information on cash, investments, properties, and other valuables that demonstrate the buyer's financial capacity. This form is essential for lenders and legal authorities to assess the buyer's financial credibility and ensure transparency in the transaction.

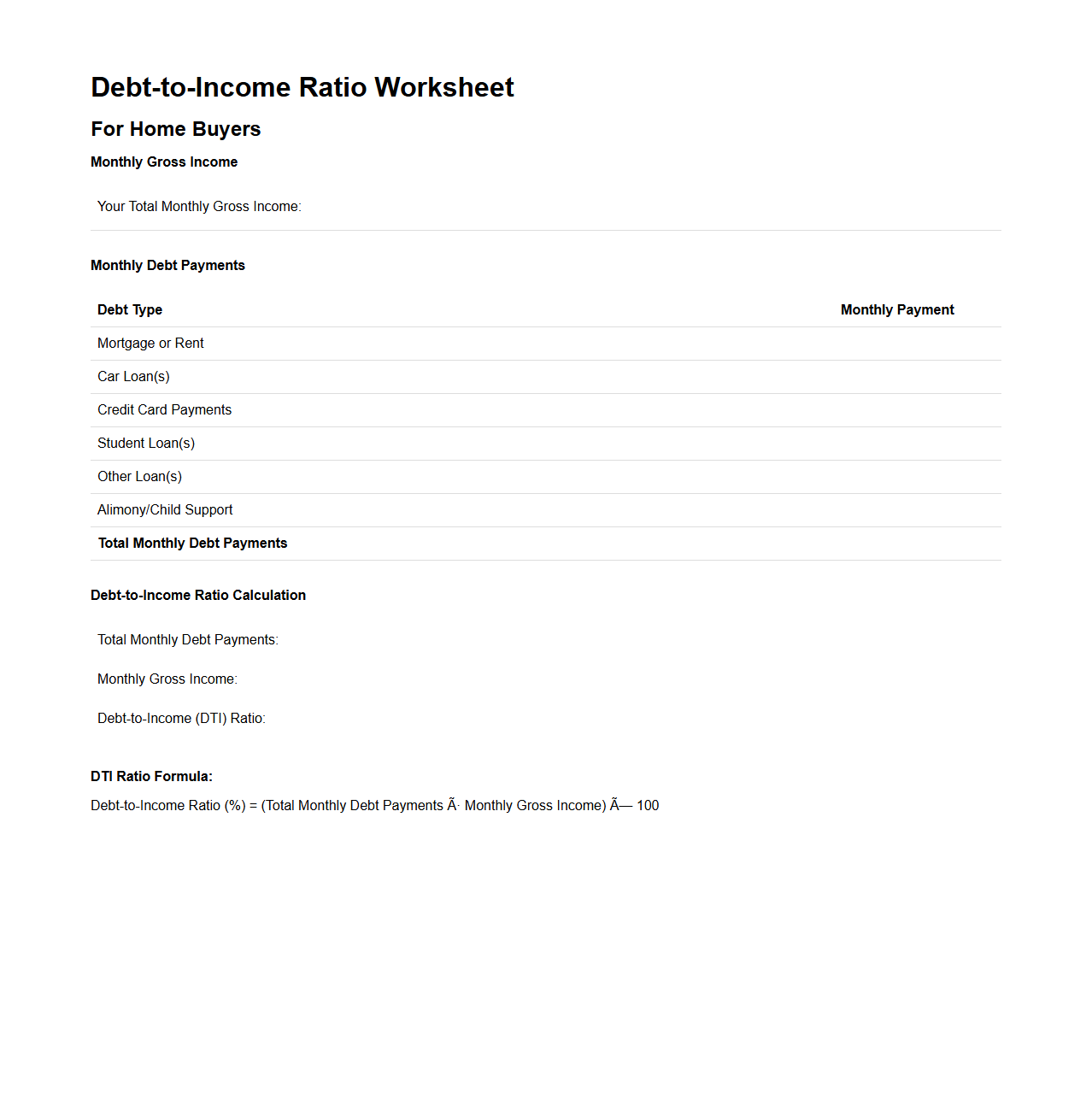

Debt-to-Income Ratio Worksheet for Home Buyers

A

Debt-to-Income Ratio Worksheet for home buyers is a financial tool used to calculate the percentage of a buyer's monthly income that goes toward paying debts. This document helps lenders assess a borrower's ability to manage monthly payments and repay a mortgage. It includes detailed entries for income sources, recurring debts, and monthly obligations to provide a clear picture of financial standing.

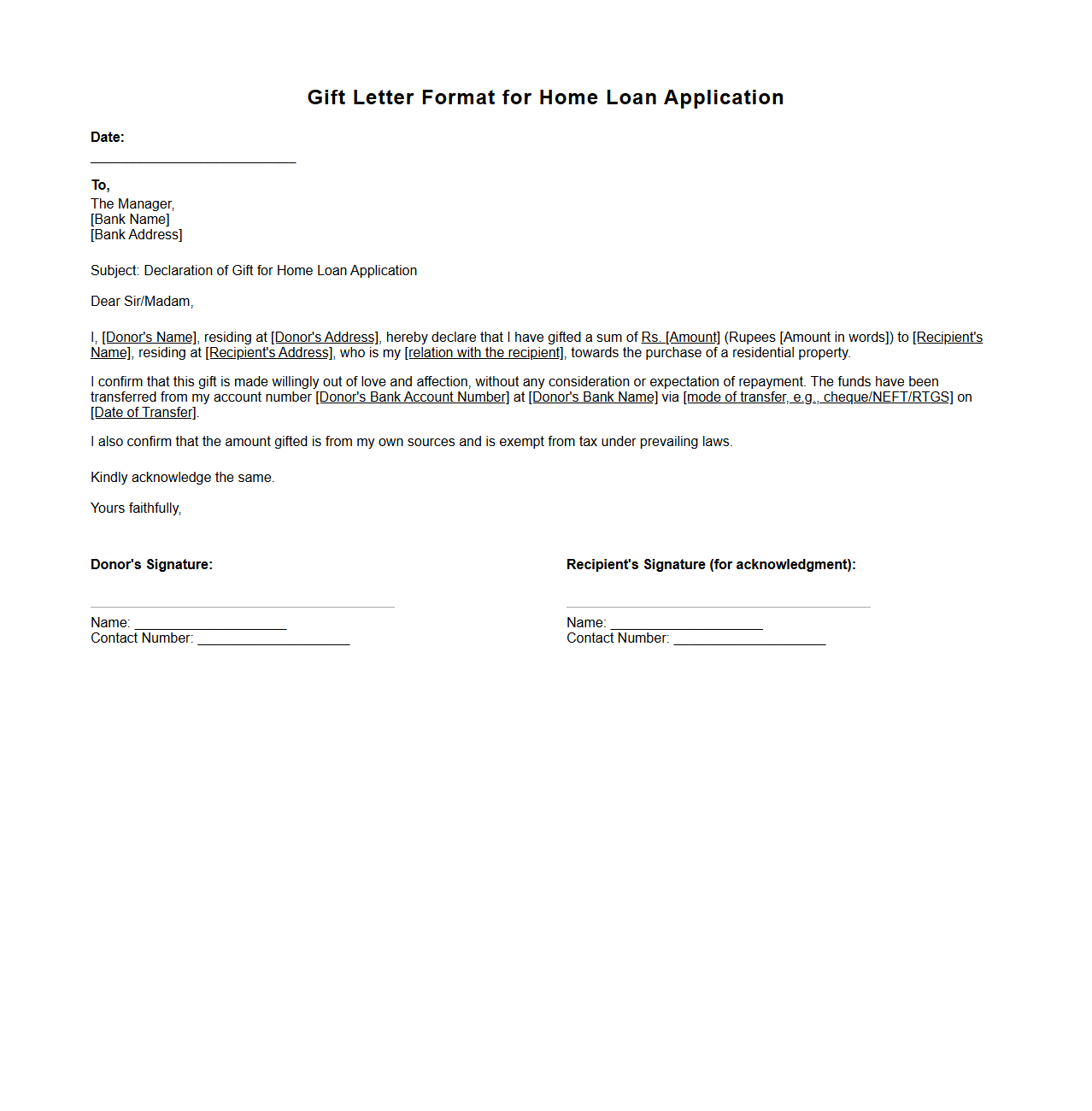

Gift Letter Format for Home Loan Application

A

Gift Letter Format for home loan application is a formal document that states the donor's intention to give a monetary gift to the loan applicant, typically for use as a down payment. This letter includes details such as the donor's name, relationship to the borrower, gift amount, and a clear statement that the funds are not a loan and do not require repayment. Lenders require this document to verify the source of funds and ensure compliance with loan underwriting guidelines.

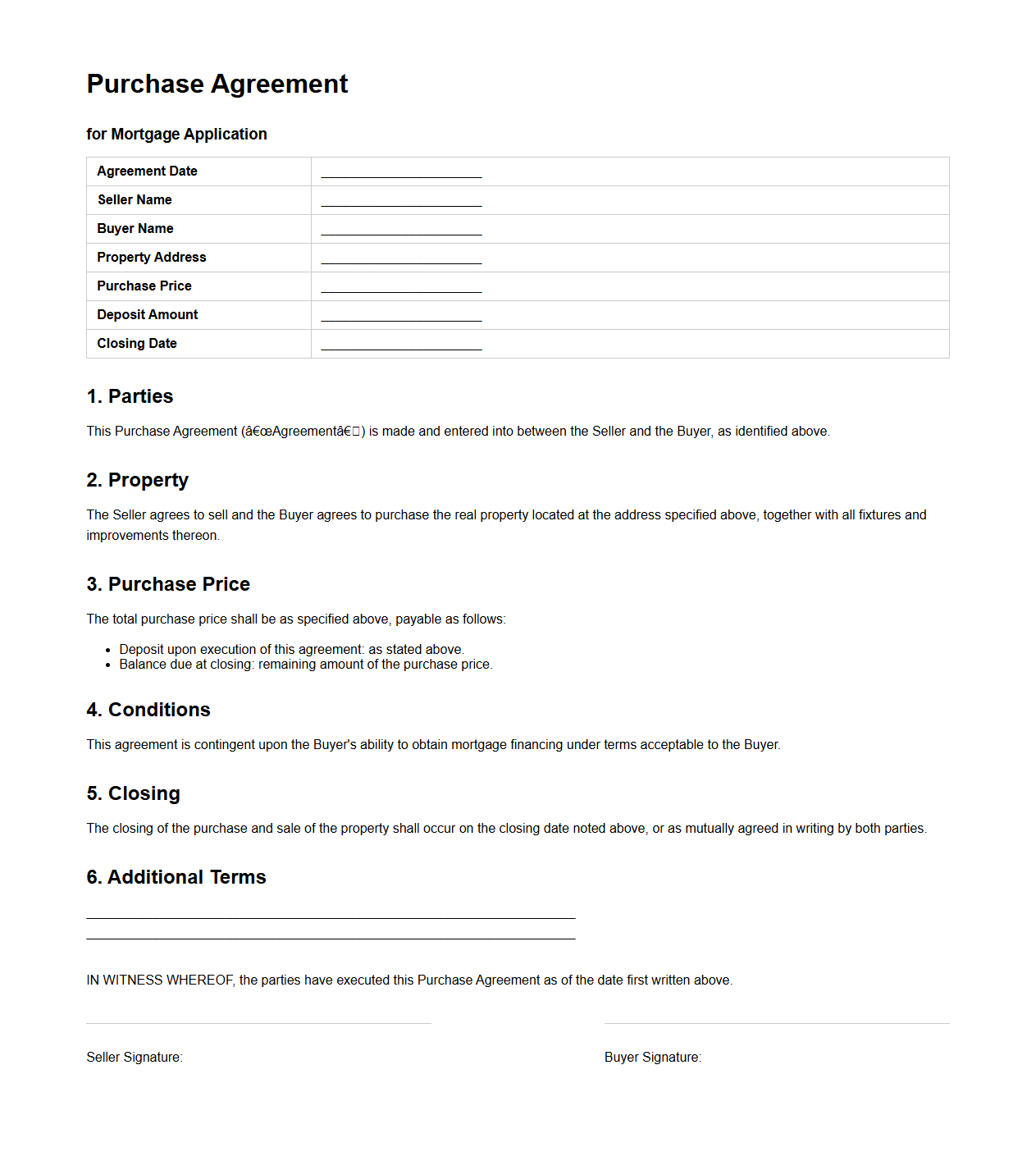

Purchase Agreement Sample for Mortgage Application

A

Purchase Agreement Sample for a mortgage application document outlines the terms and conditions agreed upon by the buyer and seller regarding the sale of a property. It typically includes essential details such as the purchase price, property description, contingencies, and timelines, ensuring both parties have clear expectations before finalizing the mortgage. Lenders use this document to verify the transaction details and assess the borrower's eligibility for mortgage approval.

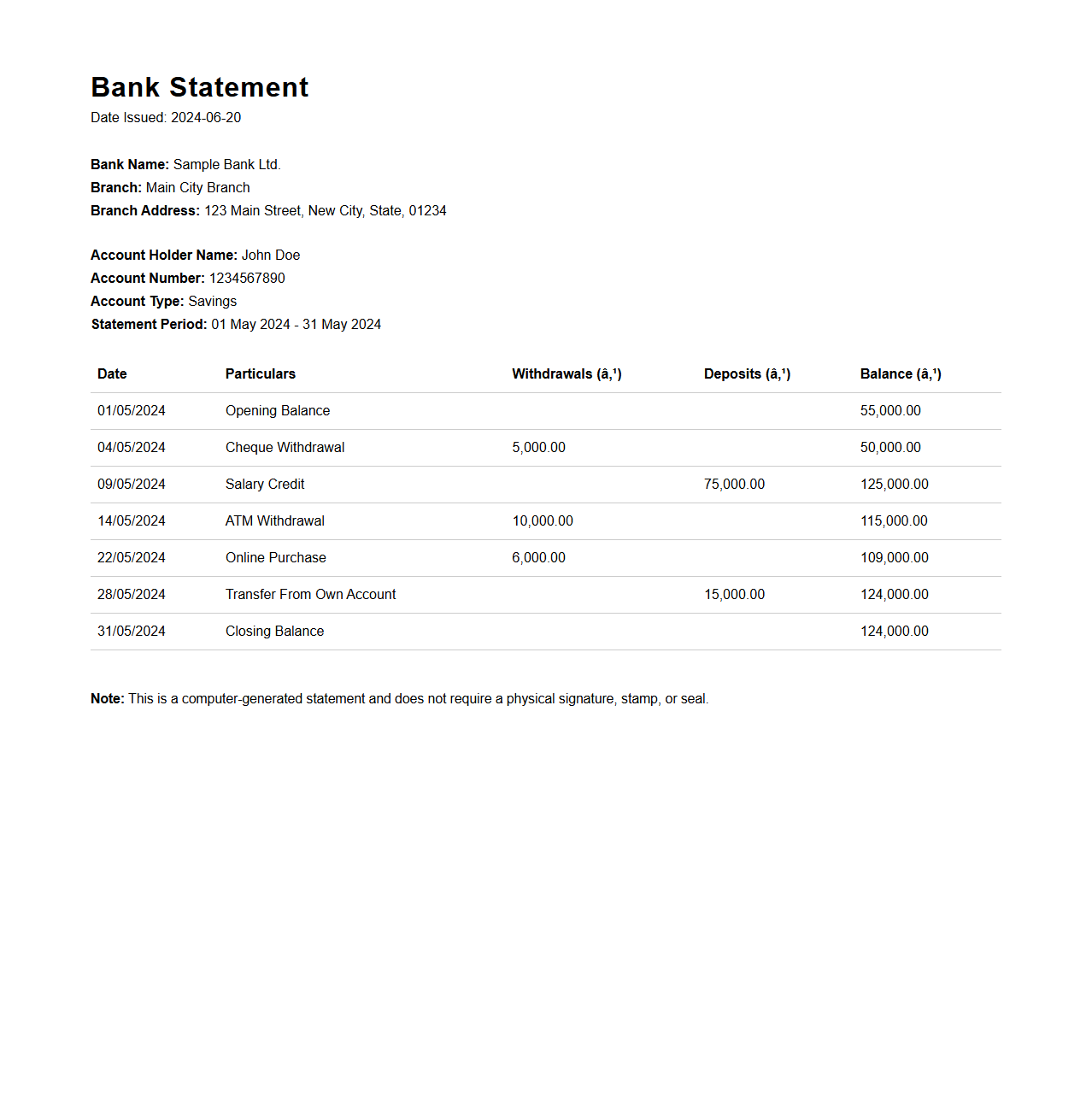

Bank Statement Example for Home Loan Processing

A

bank statement example for home loan processing is a detailed financial document that shows a borrower's transaction history over a specific period, typically three to six months. It helps lenders assess the applicant's financial stability, income consistency, and spending habits to determine loan eligibility. This statement includes information such as account holder details, deposits, withdrawals, and current balance, providing crucial evidence for loan approval decisions.

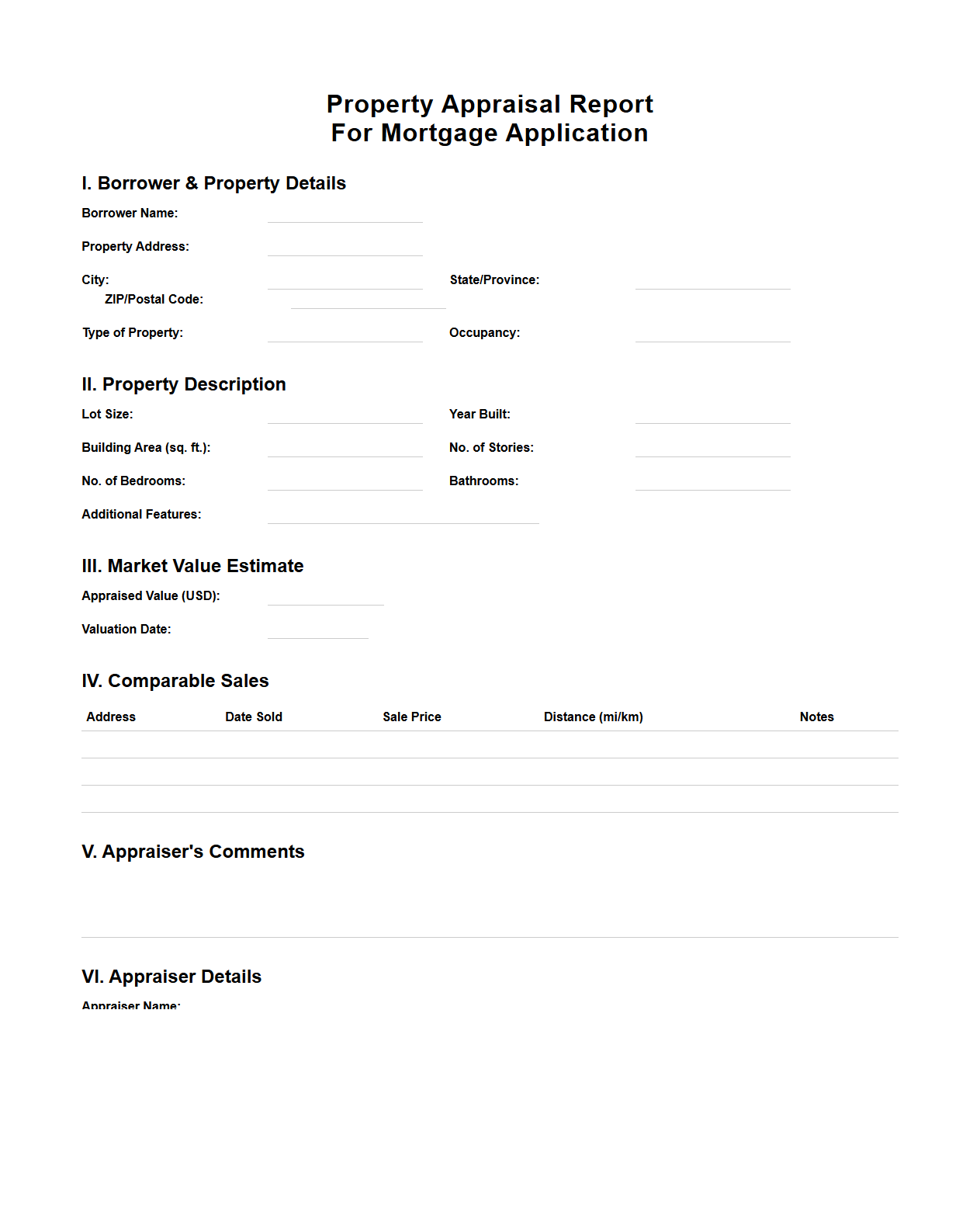

Property Appraisal Report Template for Mortgage Application

A

Property Appraisal Report Template for Mortgage Application is a standardized document used by appraisers to evaluate and present the estimated market value of a property. This template includes critical data such as property description, condition, comparable sales, and valuation methods, ensuring consistency and accuracy in the mortgage underwriting process. Lenders rely on this detailed report to assess risk and determine appropriate loan amounts for homebuyers.

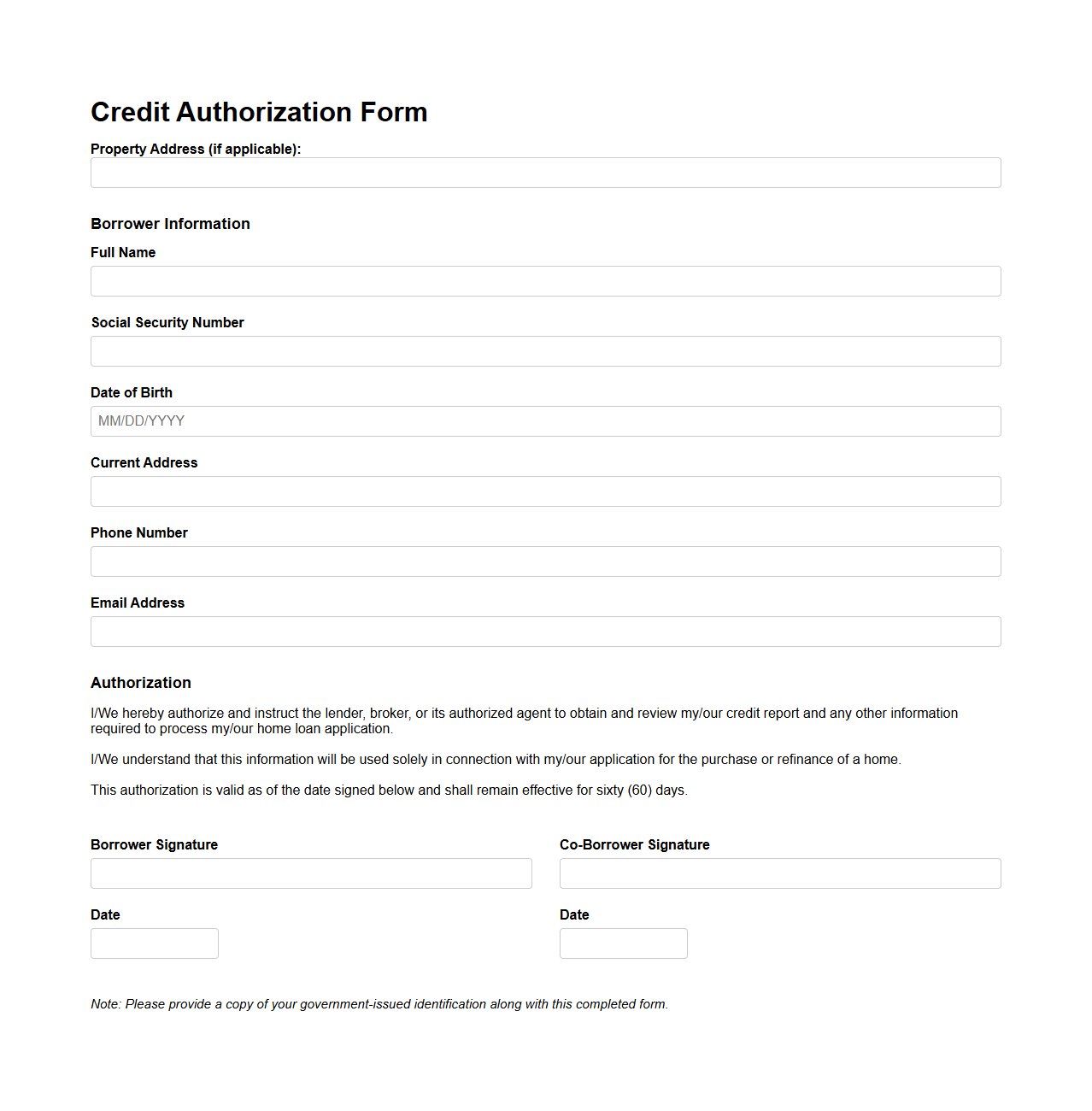

Credit Authorization Form Sample for Home Buyers

A

Credit Authorization Form Sample for Home Buyers is a document used to obtain permission from potential buyers to check their credit history during the mortgage application process. This form helps lenders verify creditworthiness and assess the risk associated with approving a loan. It typically includes personal information, consent statements, and signatures to comply with legal and privacy regulations.

What specific financial statements are required for self-employed mortgage applicants?

Self-employed mortgage applicants must provide personal and business tax returns for at least two years to verify income stability. They are also typically required to submit profit and loss statements and balance sheets for additional financial clarity. Lenders use these documents to assess the applicant's overall financial health and business viability.

How recent must pay stubs be when included in a mortgage application package?

Pay stubs included in a mortgage application package should generally be no older than 30 days to ensure current income verification. Lenders prefer recent pay stubs that show year-to-date earnings to confirm consistent income flow. Submitting outdated pay stubs may delay the approval process or require additional documentation.

Are translated copies of foreign income documents acceptable for mortgage processing?

Translated copies of foreign income documents are acceptable for mortgage processing if they are certified and accurately reflect the original information. It is essential that translations are performed by a qualified translator to avoid discrepancies or misunderstandings. Lenders may also request original documents alongside translations for thorough verification.

Which utility bills are most commonly requested as proof of residence during mortgage approval?

The most commonly requested utility bills for proof of residence include electricity, water, and gas bills. These documents must typically be issued within the last 30 to 60 days to be considered valid. They serve as evidence to confirm the borrower's stated residential address during the mortgage approval process.

What documentation is needed to verify gifted down payments in a mortgage application?

To verify gifted down payments, applicants must provide a gift letter stating that the funds are a gift and do not require repayment. Additionally, proof of transfer such as bank statements showing the movement of funds is required to validate the gift. Lenders often scrutinize this documentation to ensure compliance with mortgage underwriting guidelines.

More Real estate Templates