A Cash Reconciliation Document Sample for Retail Cashiering serves as a vital tool to accurately track and verify cash transactions at the end of a retail shift. This document helps ensure all cash receipts align with sales records, minimizing discrepancies and enhancing financial accountability. Retail managers and cashiers rely on this sample to streamline the reconciliation process and maintain accurate cash flow records.

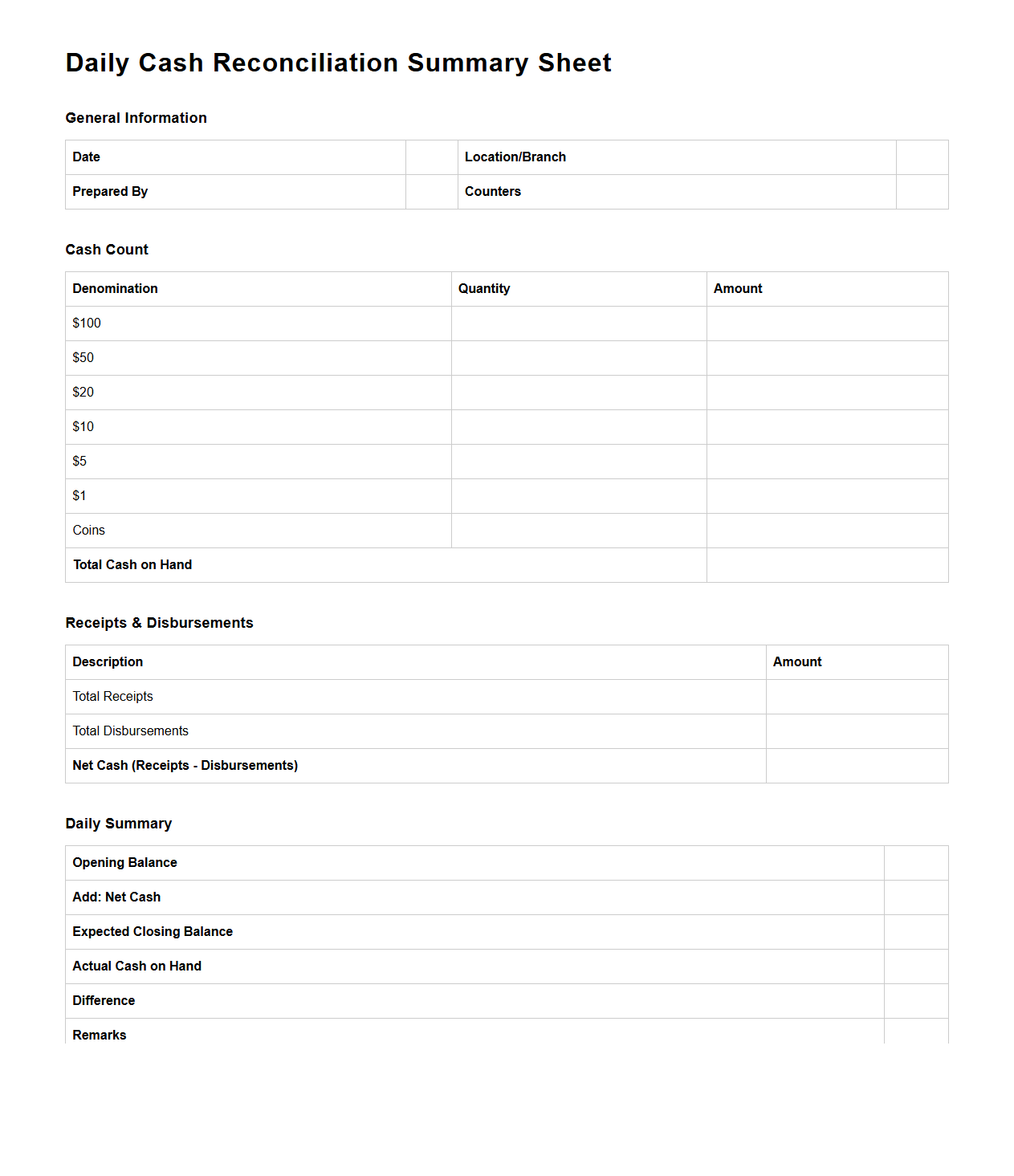

Daily Cash Reconciliation Summary Sheet

The

Daily Cash Reconciliation Summary Sheet document is used to track and verify the cash transactions of a business on a daily basis, ensuring accuracy between recorded cash inflows and outflows. It summarizes total cash received, payments made, and cash on hand at the end of the day, helping to identify discrepancies promptly. This sheet is essential for maintaining financial integrity and supporting audit processes in retail, hospitality, and other cash-intensive industries.

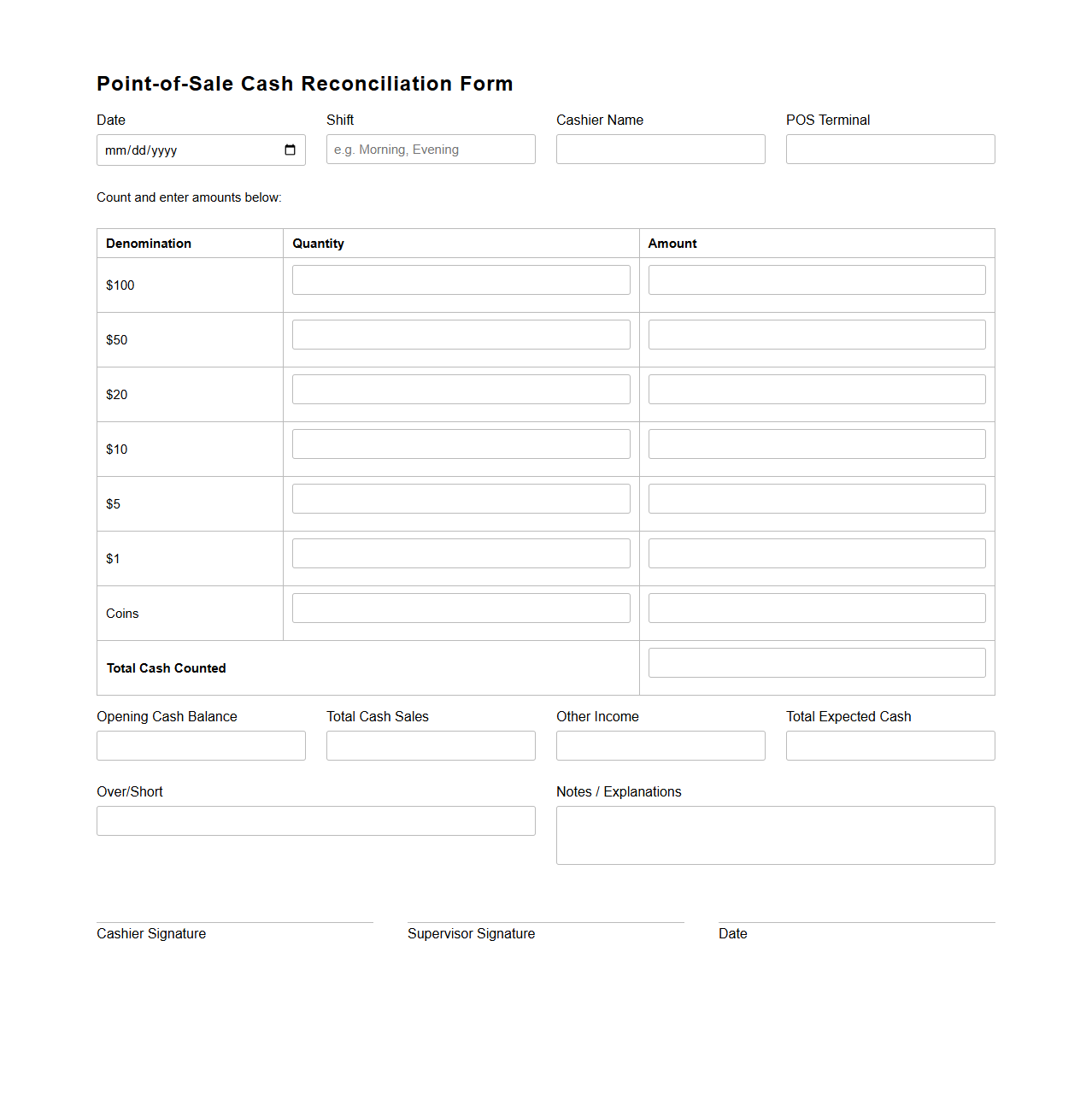

Point-of-Sale Cash Reconciliation Form

The

Point-of-Sale Cash Reconciliation Form document is used to accurately track and verify daily cash transactions at retail or service counters. It ensures that the cash collected matches the sales recorded in the point-of-sale system, helping to identify discrepancies and prevent financial errors or fraud. This form provides a detailed summary of cash inflow and outflow, supporting efficient financial management and accountability.

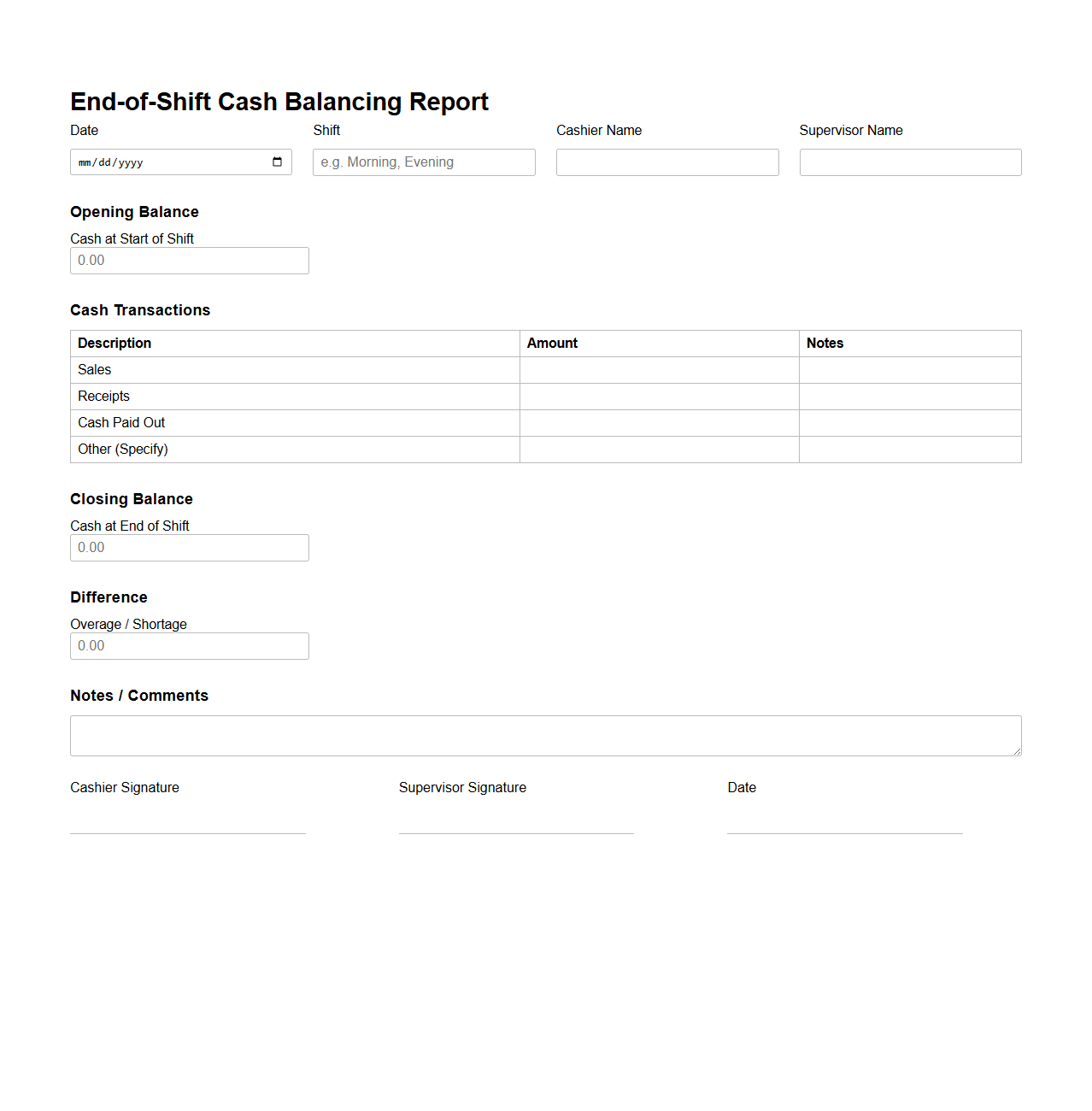

End-of-Shift Cash Balancing Report

The

End-of-Shift Cash Balancing Report document records the total cash transactions processed by an employee during their shift, ensuring accurate reconciliation between cash received and sales recorded. It details cash inflows, outflows, and discrepancies, providing a transparent record to prevent financial errors and theft. This report is essential for businesses to maintain precise accounting and support audit trails.

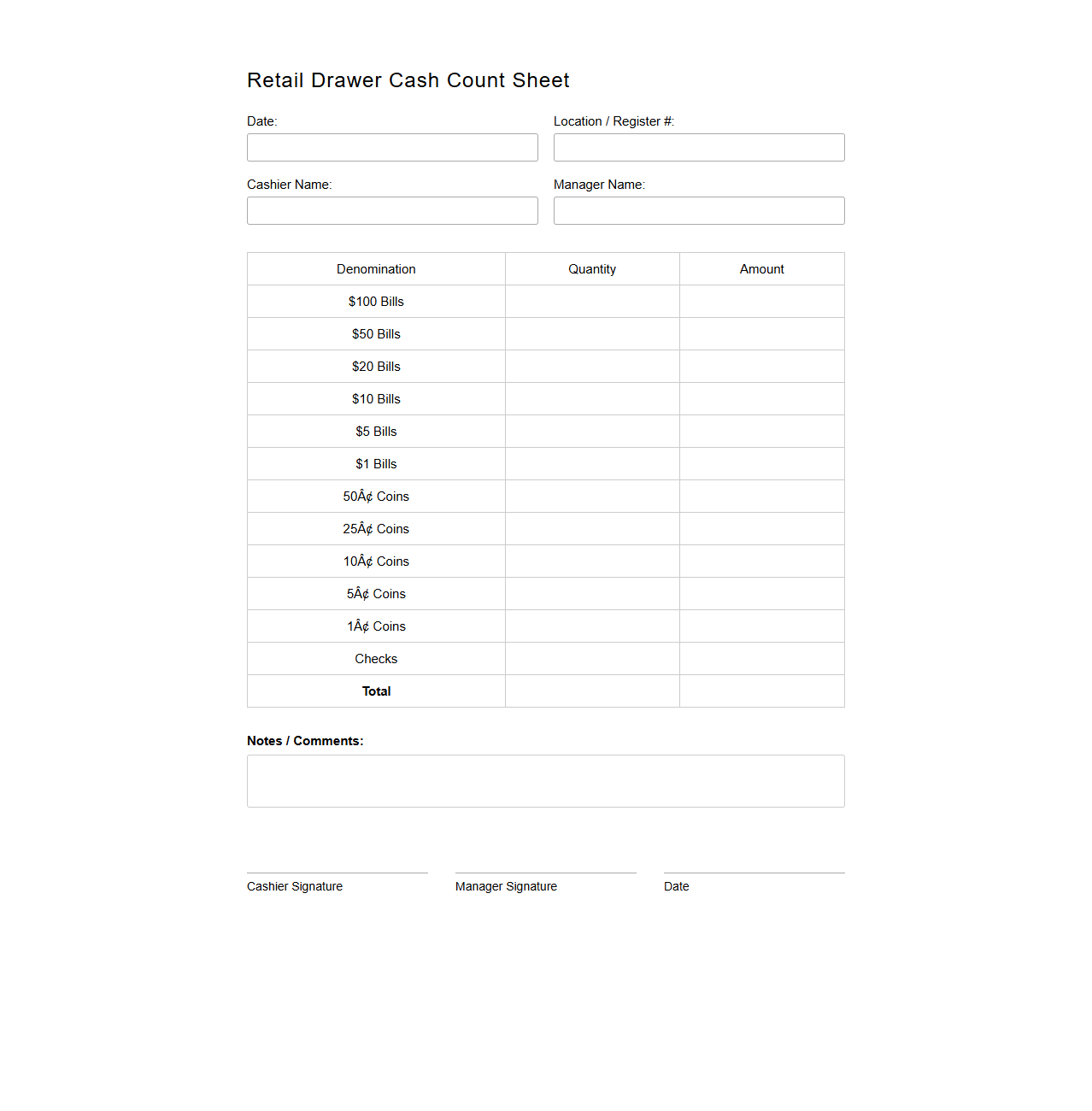

Retail Drawer Cash Count Sheet

A

Retail Drawer Cash Count Sheet is a critical document used by retail businesses to record the amount of cash in a cashier's drawer at the beginning and end of a shift. It helps ensure accurate cash management, track discrepancies, and maintain accountability for daily transactions. This sheet typically lists denominations of bills and coins, enabling a detailed count and verification process.

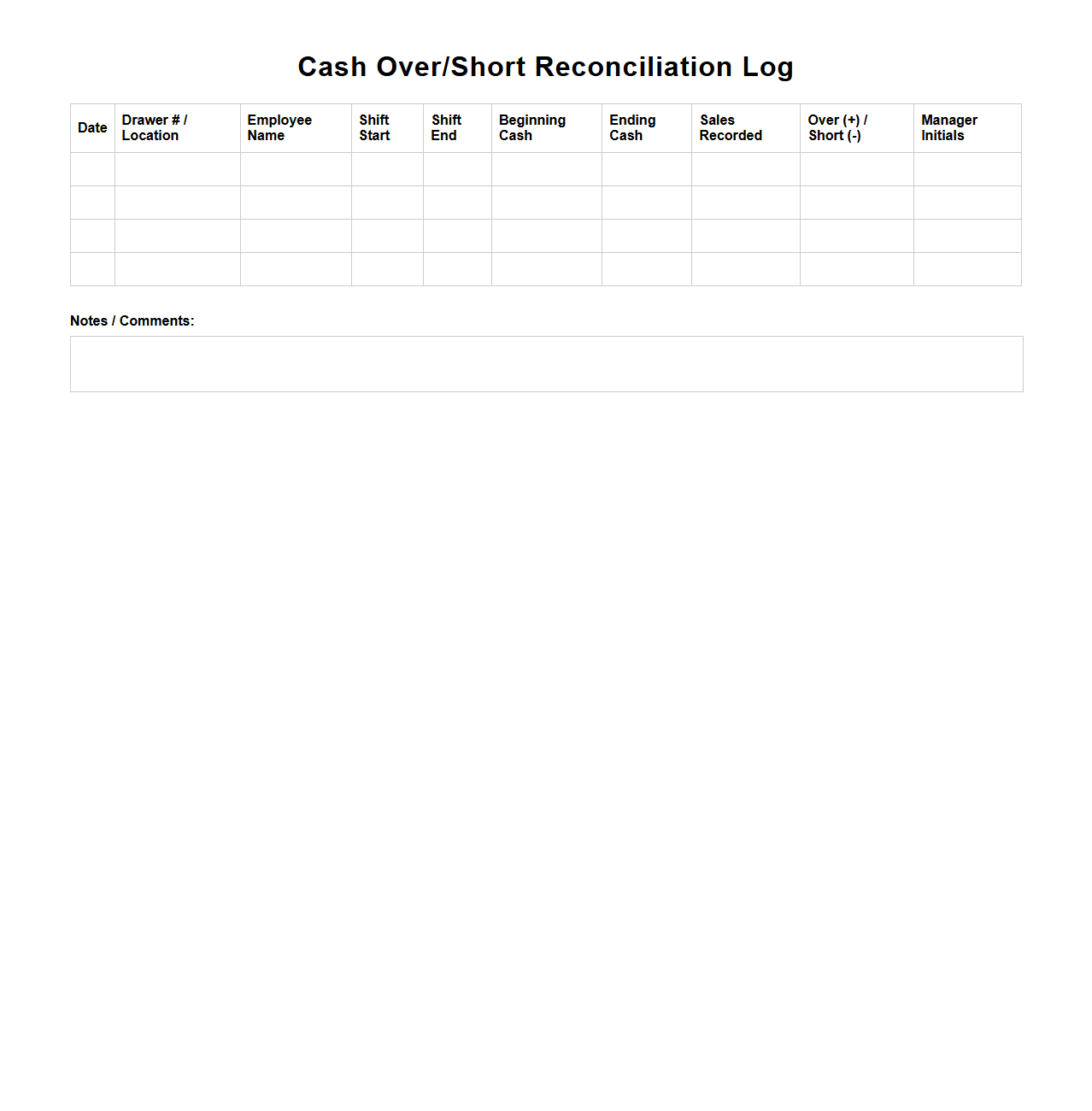

Cash Over/Short Reconciliation Log

The

Cash Over/Short Reconciliation Log document is used to track discrepancies between recorded cash amounts and actual cash counted during financial audits or daily cash handling. It helps identify and resolve variances by documenting overages or shortages, providing accountability and transparency in cash management. This log is essential for maintaining accurate financial records and supporting internal controls in businesses.

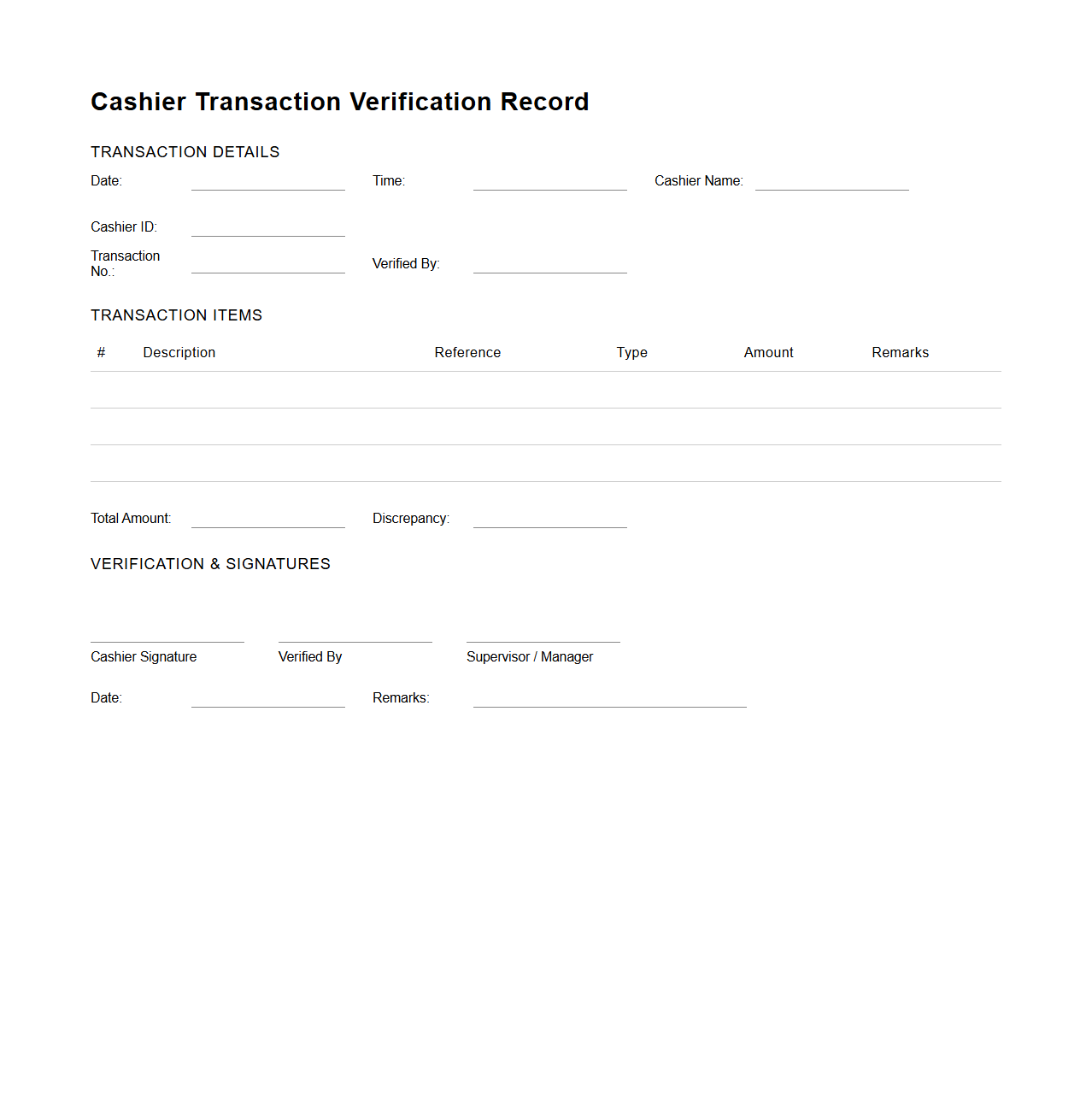

Cashier Transaction Verification Record

The

Cashier Transaction Verification Record document serves as an essential financial tool, ensuring accuracy and accountability in daily cash handling operations. It systematically logs each transaction processed by the cashier, including payments received, change given, and transaction times, facilitating easy auditing and fraud prevention. This record enhances internal controls by providing a transparent and verifiable trail for all cash-related activities within a business environment.

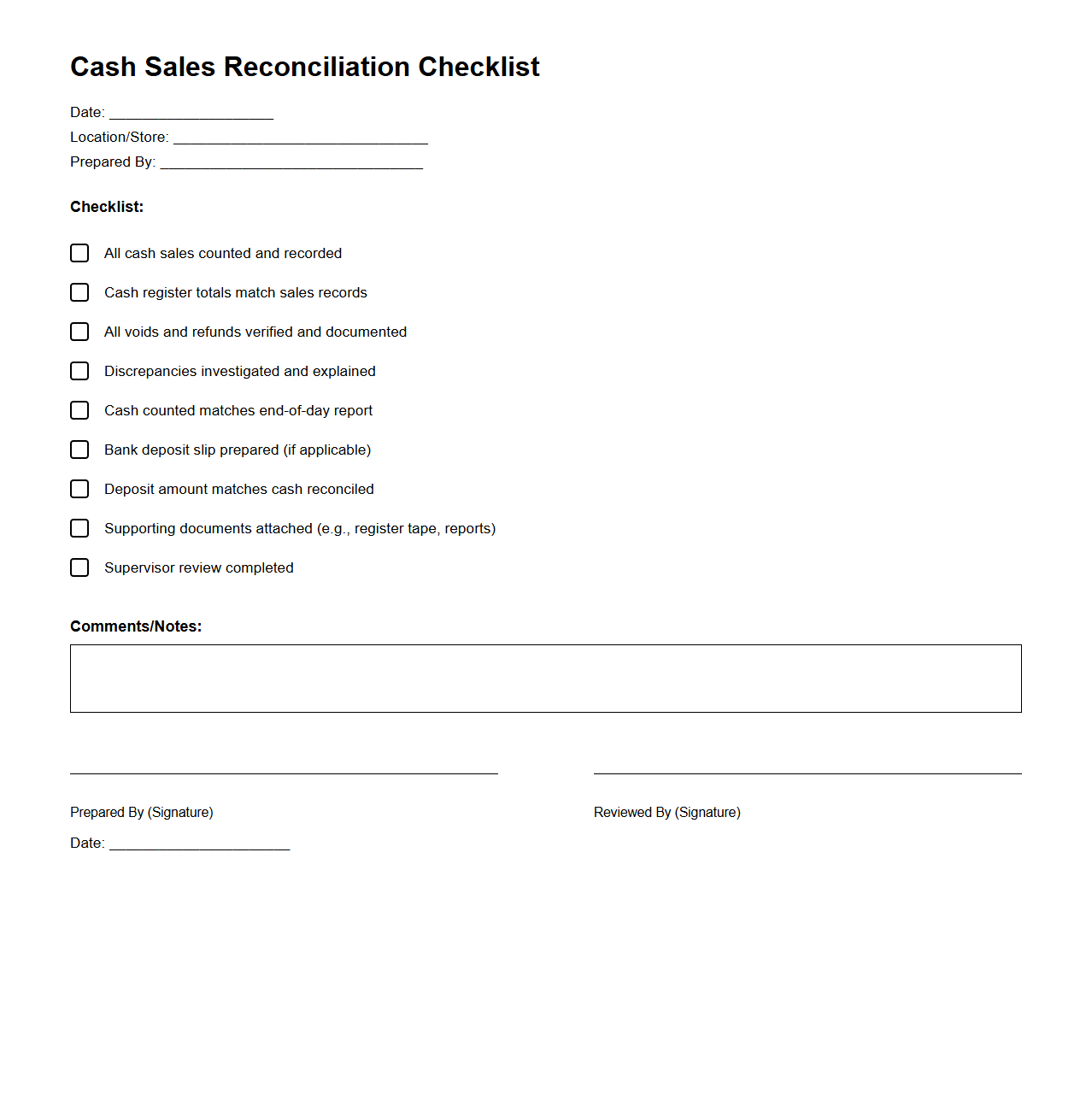

Cash Sales Reconciliation Checklist

A

Cash Sales Reconciliation Checklist document is used to verify and ensure the accuracy of cash sales transactions by comparing sales records with actual cash collected. This checklist helps identify discrepancies, prevent errors, and maintain proper financial controls in retail or business operations. Regular use of this document supports accurate accounting and fraud prevention.

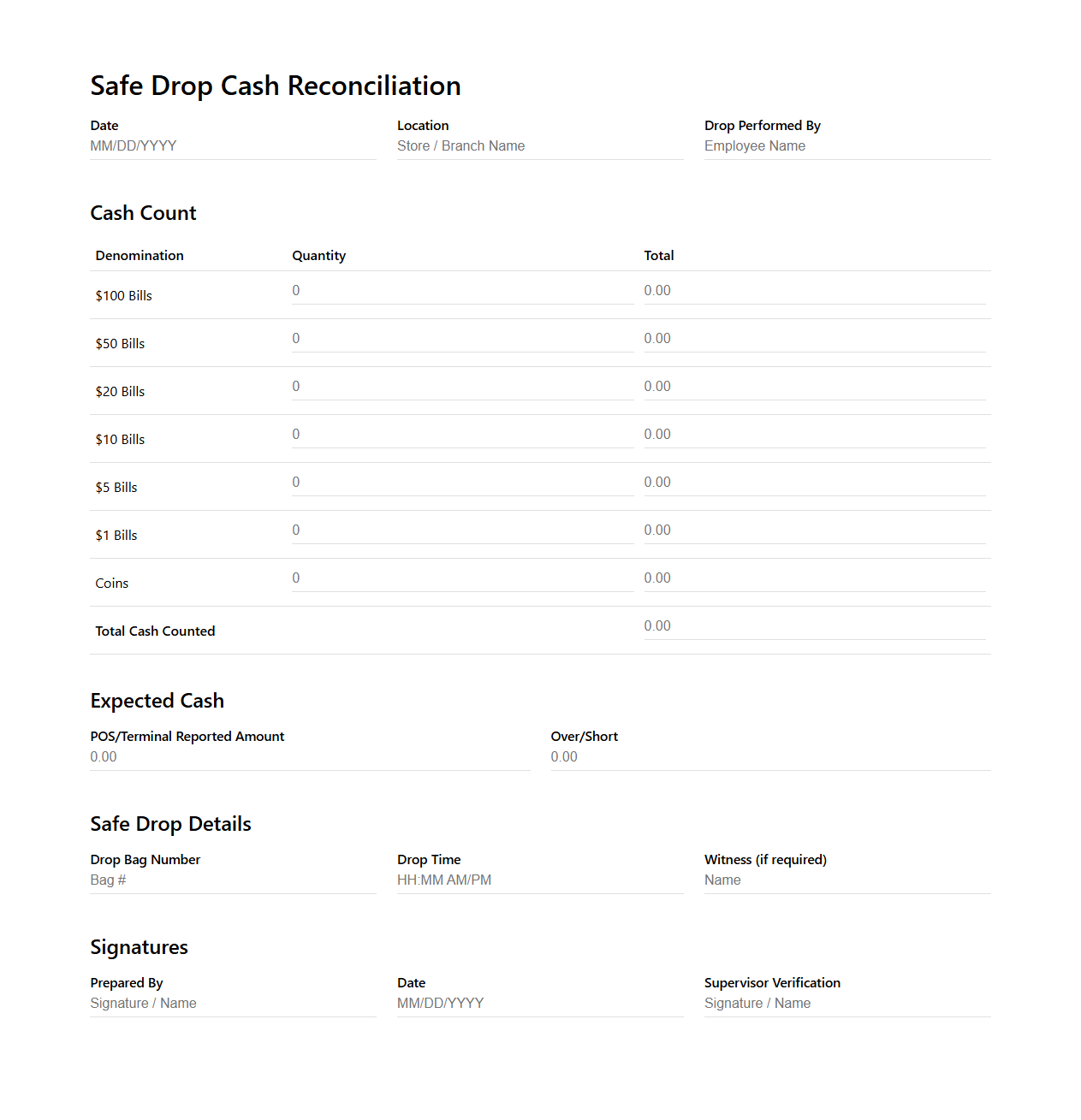

Safe Drop Cash Reconciliation Template

The

Safe Drop Cash Reconciliation Template document is a financial tool designed to accurately track and verify cash amounts deposited in secure locations within retail or hospitality environments. It facilitates error reduction by providing a systematic method for recording cash drops, ensuring accountability and transparency in cash handling processes. This template supports efficient daily reconciliation, helping businesses identify discrepancies promptly and maintain accurate cash flow records.

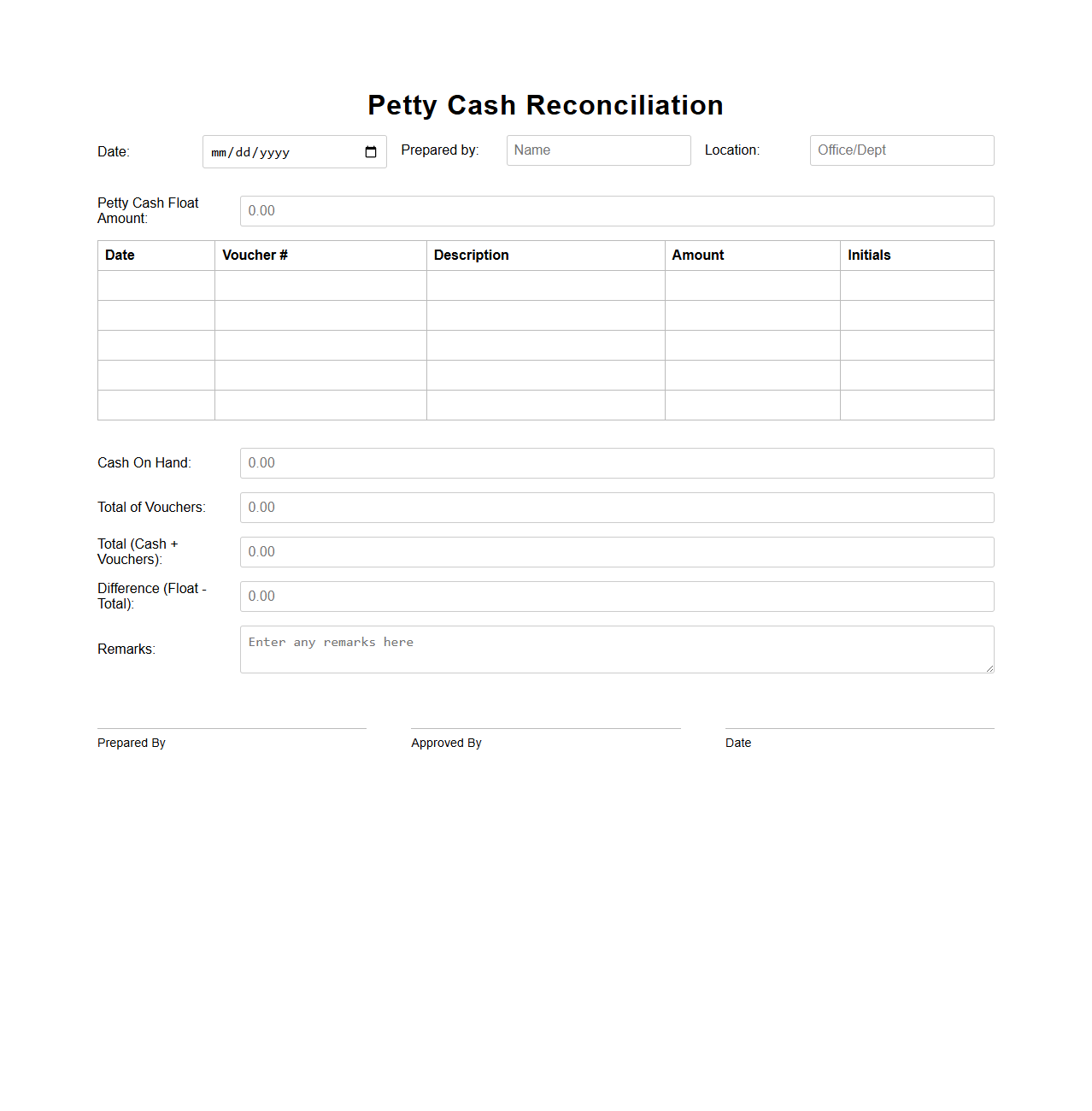

Petty Cash Reconciliation Document

A

Petty Cash Reconciliation Document is a financial record used to verify and balance the petty cash fund by comparing the cash on hand with the recorded expenses. It includes detailed receipts, vouchers, and a summary of expenditures to ensure accuracy and prevent discrepancies. This document is essential for maintaining transparency and accountability in managing small, day-to-day business expenses.

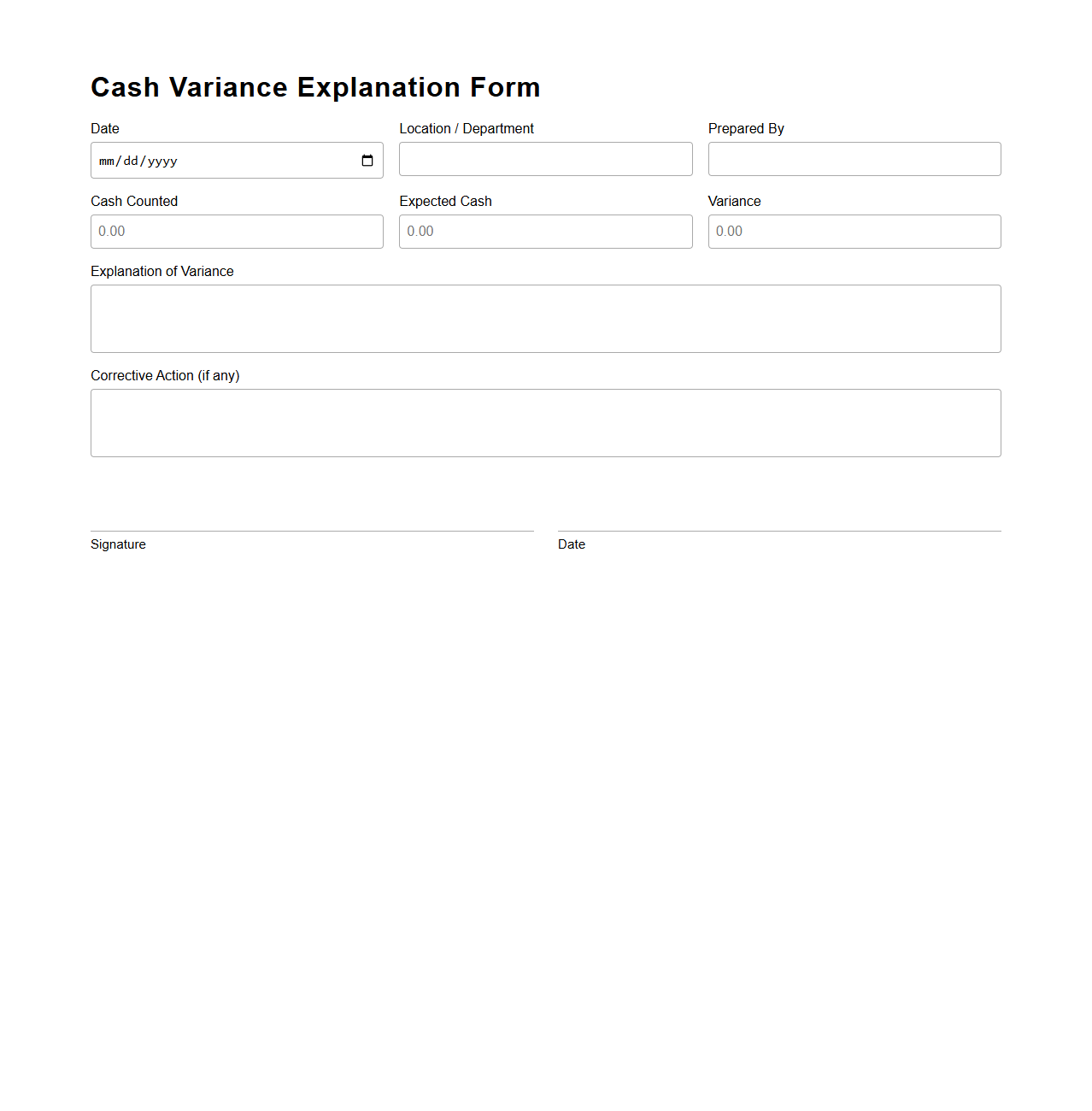

Cash Variance Explanation Form

The

Cash Variance Explanation Form document is used to record and explain discrepancies between the expected and actual cash amounts in financial transactions or cash handling processes. It captures details such as the variance amount, date, responsible person, and possible reasons for the difference, ensuring accountability and accurate financial reporting. This form is essential for internal controls, audit trails, and maintaining cash management integrity in organizations.

Main Components Required in a Retail Cash Reconciliation Document

The retail cash reconciliation document must include sections for total sales, cash received, and electronic transactions. It also requires detailed listings of beginning cash float and any cash withdrawals or deposits. These components ensure comprehensive tracking of all monetary exchanges during a retail shift.

Verification of Cash Accuracy versus Sales Recorded

This document compares the total cash received against the sales recorded in the point-of-sale system. By matching these figures, discrepancies such as overages or shortages can be immediately identified. Accurate verification helps maintain financial integrity in retail operations.

Sections Detailing Discrepancies and Resolution

The reconciliation sample includes a dedicated discrepancy report section outlining any cash overages, shortages, or errors found during counting. It also provides a resolution area for explanations, corrective actions, or notes from management. These sections are crucial for transparency and accountability.

Fields Capturing Employee Identification and Shift Timing

Employee identification fields, such as name and employee ID, along with shift start and end times, are prominently featured. These fields link the reconciliation data to specific personnel and time periods. This information is valuable for audit trails and accountability.

Ensuring Compliance with Cash Handling Standard Operating Procedures

The cash reconciliation document incorporates checkpoints that ensure adherence to standard operating procedures (SOPs), including proper cash counting and authorization signatures. It mandates verification steps that prevent theft or error during cash handling. Compliance helps safeguard retail assets and upholds company policies.