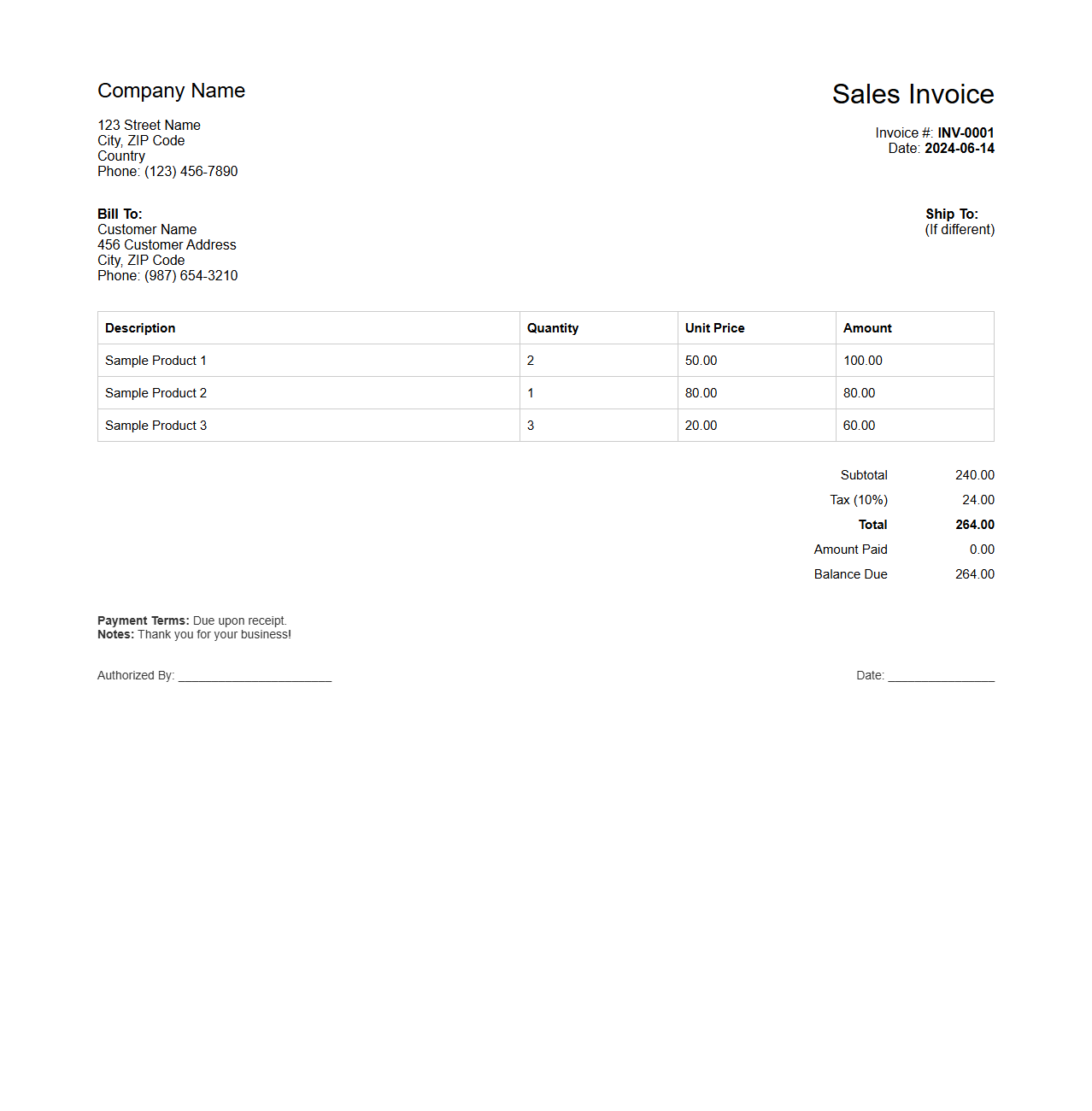

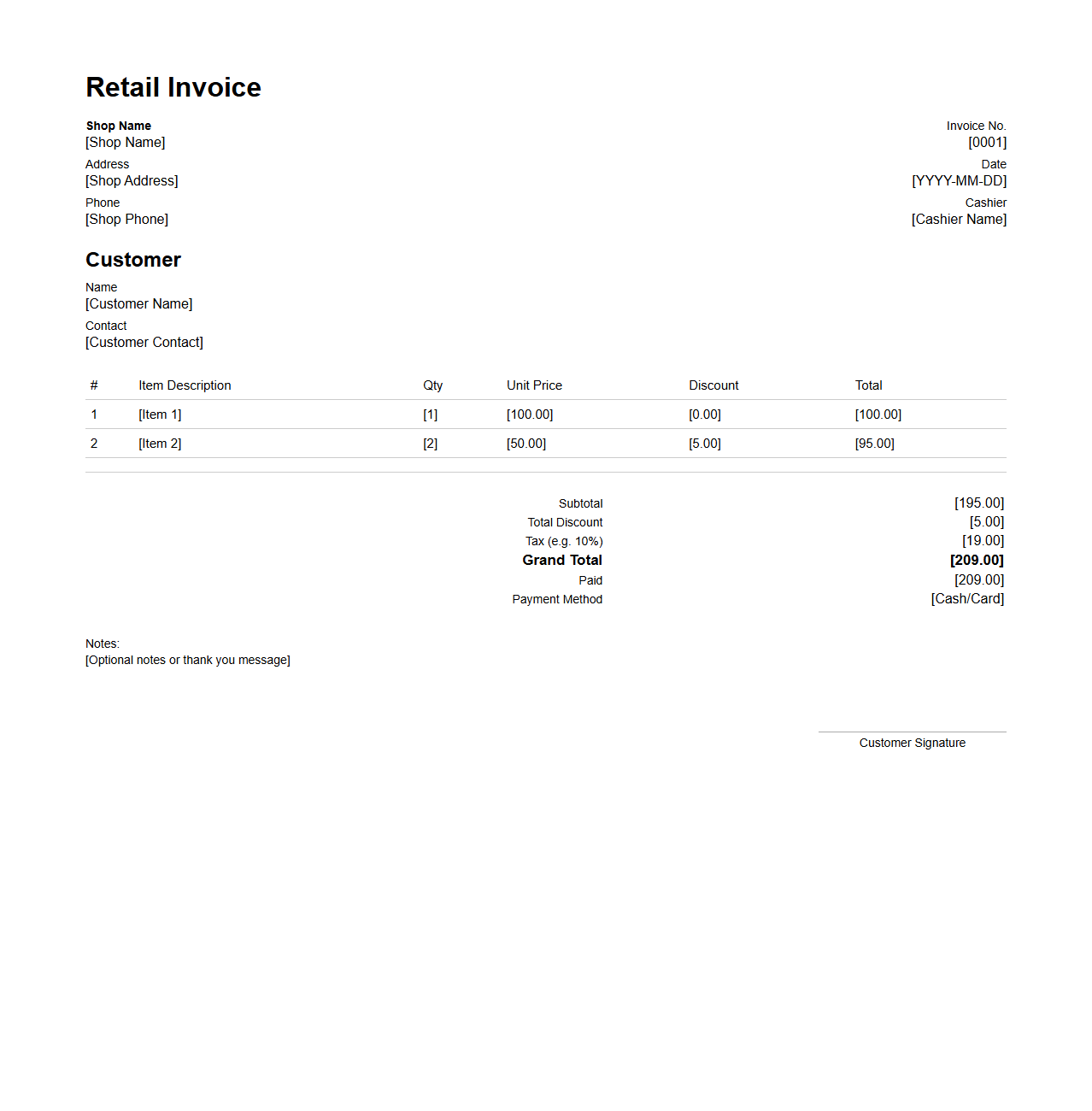

Standard Retail Sales Invoice Example

A

Standard Retail Sales Invoice Example document serves as a detailed record of a retail transaction, outlining the purchased items, quantity, price, and total amount due. This document is essential for both retailers and customers, providing proof of purchase and facilitating inventory management and financial tracking. It typically includes the store's information, date of sale, payment method, and terms, ensuring clarity and transparency in the sales process.

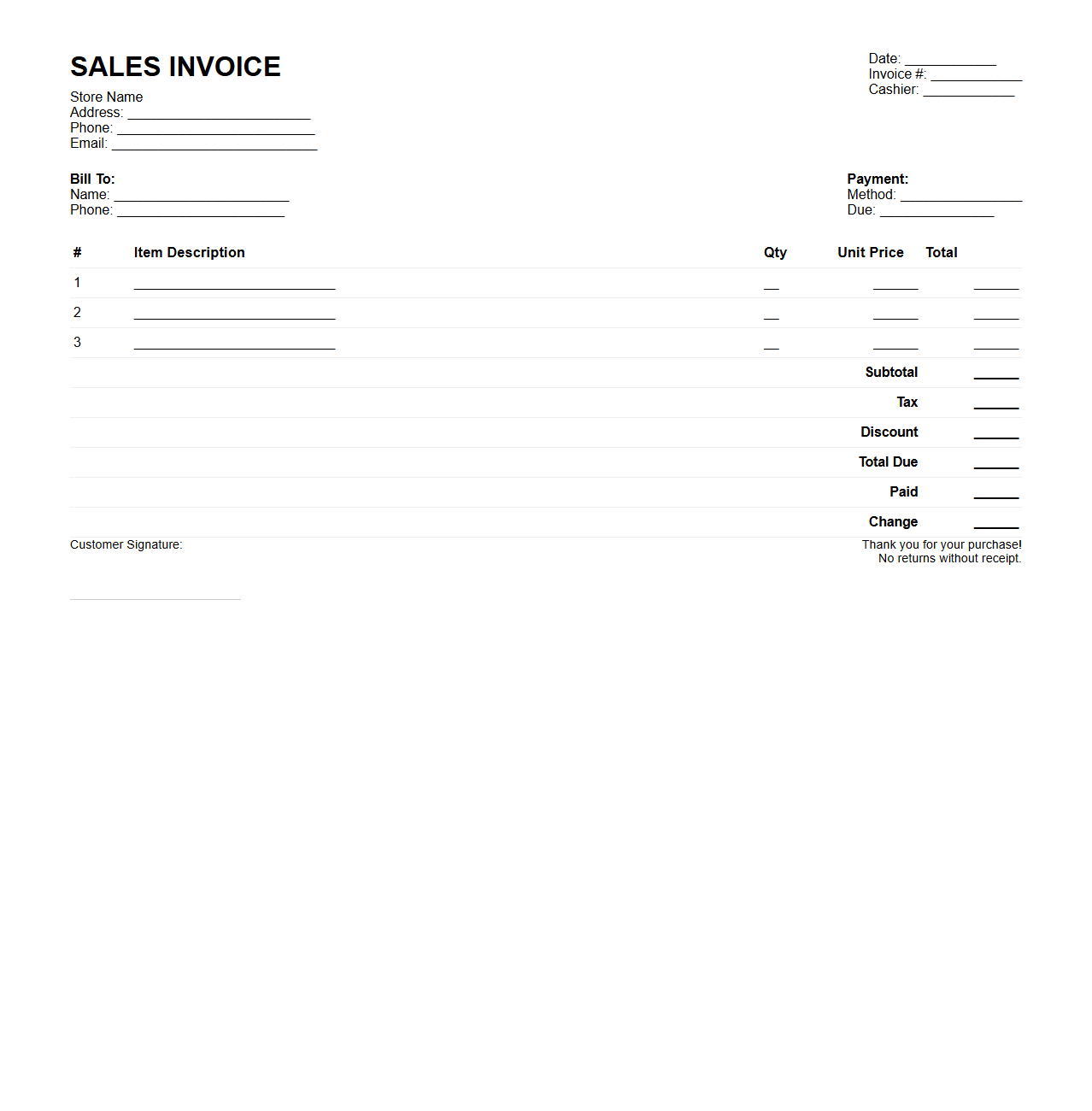

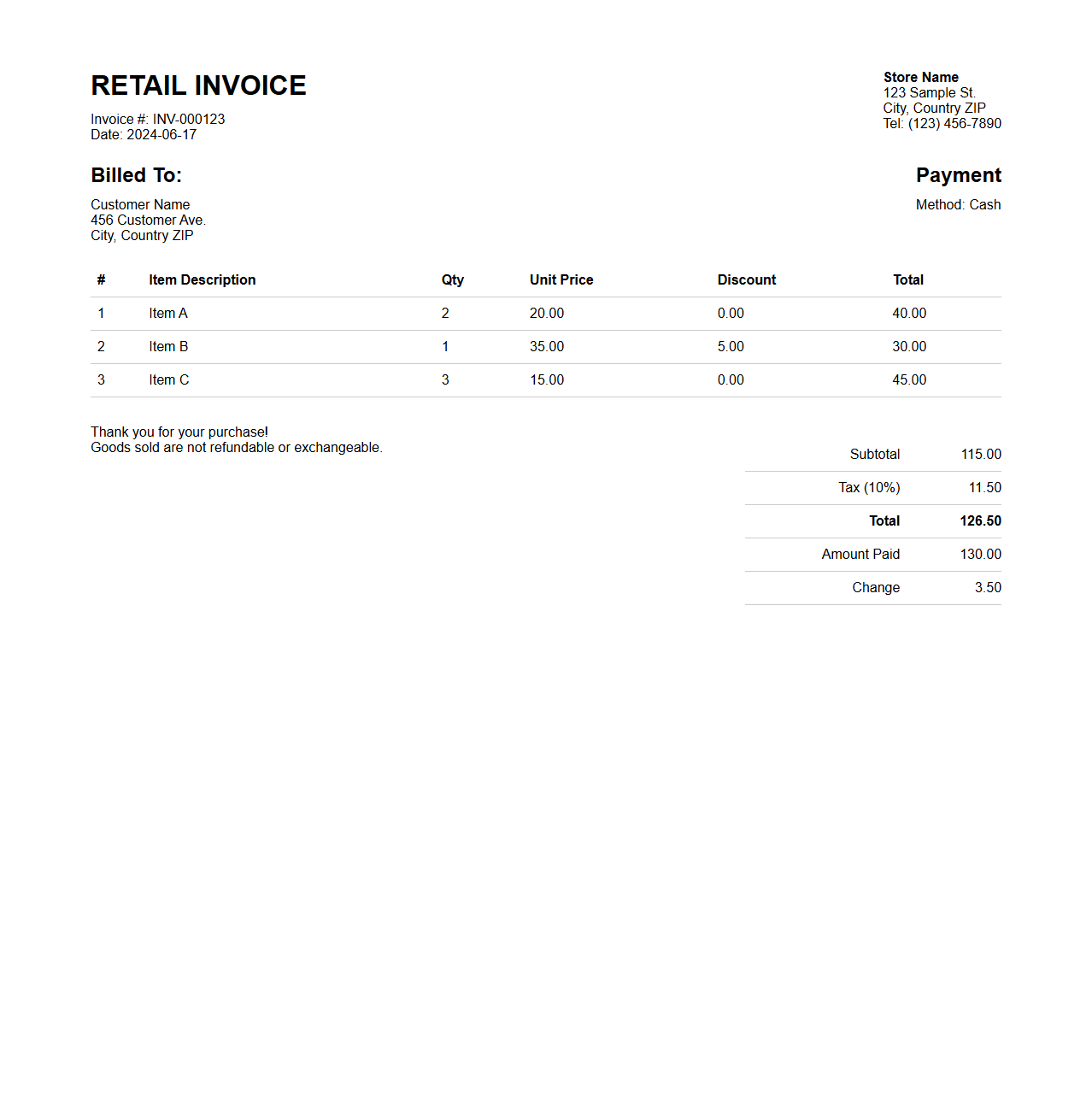

POS System Sales Invoice Template

A

POS System Sales Invoice Template document is a structured form used to record and itemize sales transactions conducted through a Point of Sale (POS) system. It includes essential details such as product descriptions, quantities, prices, taxes, and total amounts, ensuring accurate billing and inventory tracking. This template streamlines the checkout process and provides both businesses and customers with clear, professional sales records.

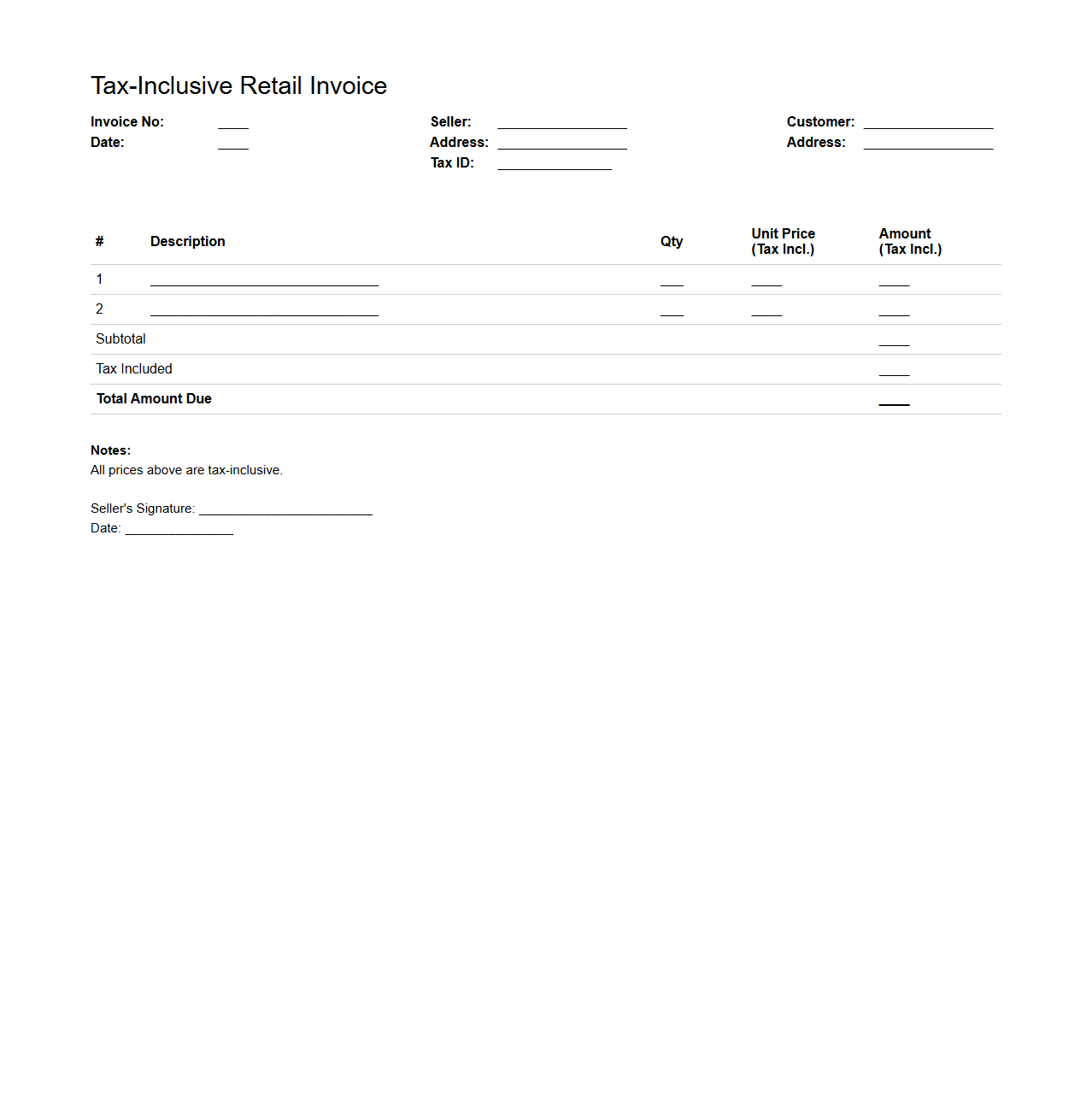

Tax-Inclusive Retail Invoice Sample

A

Tax-Inclusive Retail Invoice Sample document demonstrates how retail invoices present the total price including applicable taxes such as VAT or sales tax. This sample clearly itemizes product costs and embeds the tax amount within the final price, ensuring transparency for customers. Retailers use this format to comply with tax regulations and provide clear billing information on each transaction.

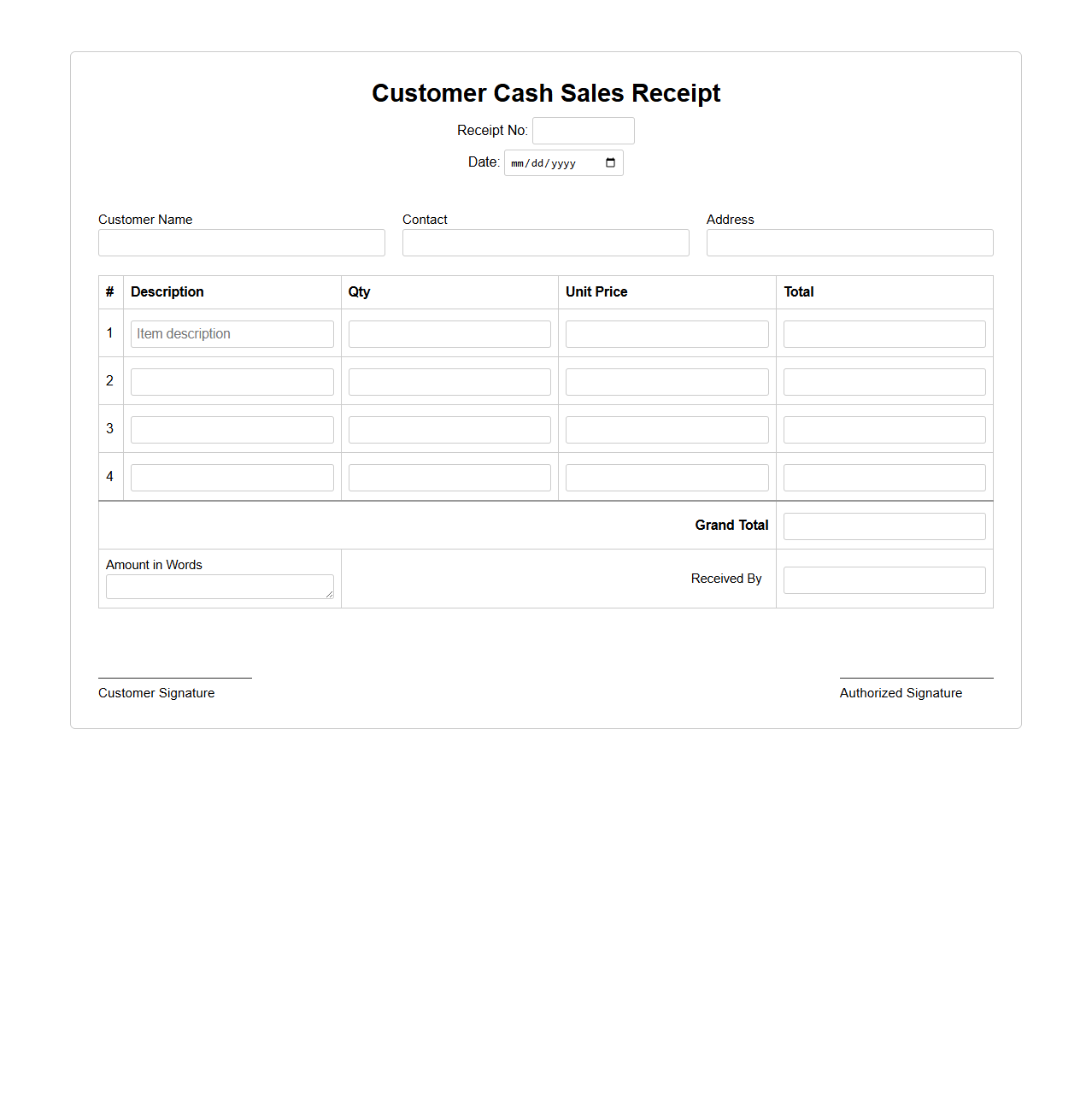

Customer Cash Sales Receipt Format

A

Customer Cash Sales Receipt Format document is a structured template used to record transactions where customers pay in cash for goods or services. It details essential information such as the date of sale, items purchased, quantity, price, total amount paid, and payment method to ensure transparency and accurate accounting. This format helps businesses maintain consistent records for financial tracking, customer verification, and audit purposes.

Itemized Retail Invoice for Physical Shops

An

Itemized Retail Invoice for physical shops is a detailed document that lists all purchased products or services, including quantities, prices, and applicable taxes. It serves as proof of purchase and helps both retailers and customers with accurate record-keeping, returns, and warranty claims. This document enhances transparency by clearly breaking down each item's cost, facilitating smooth financial transactions in retail environments.

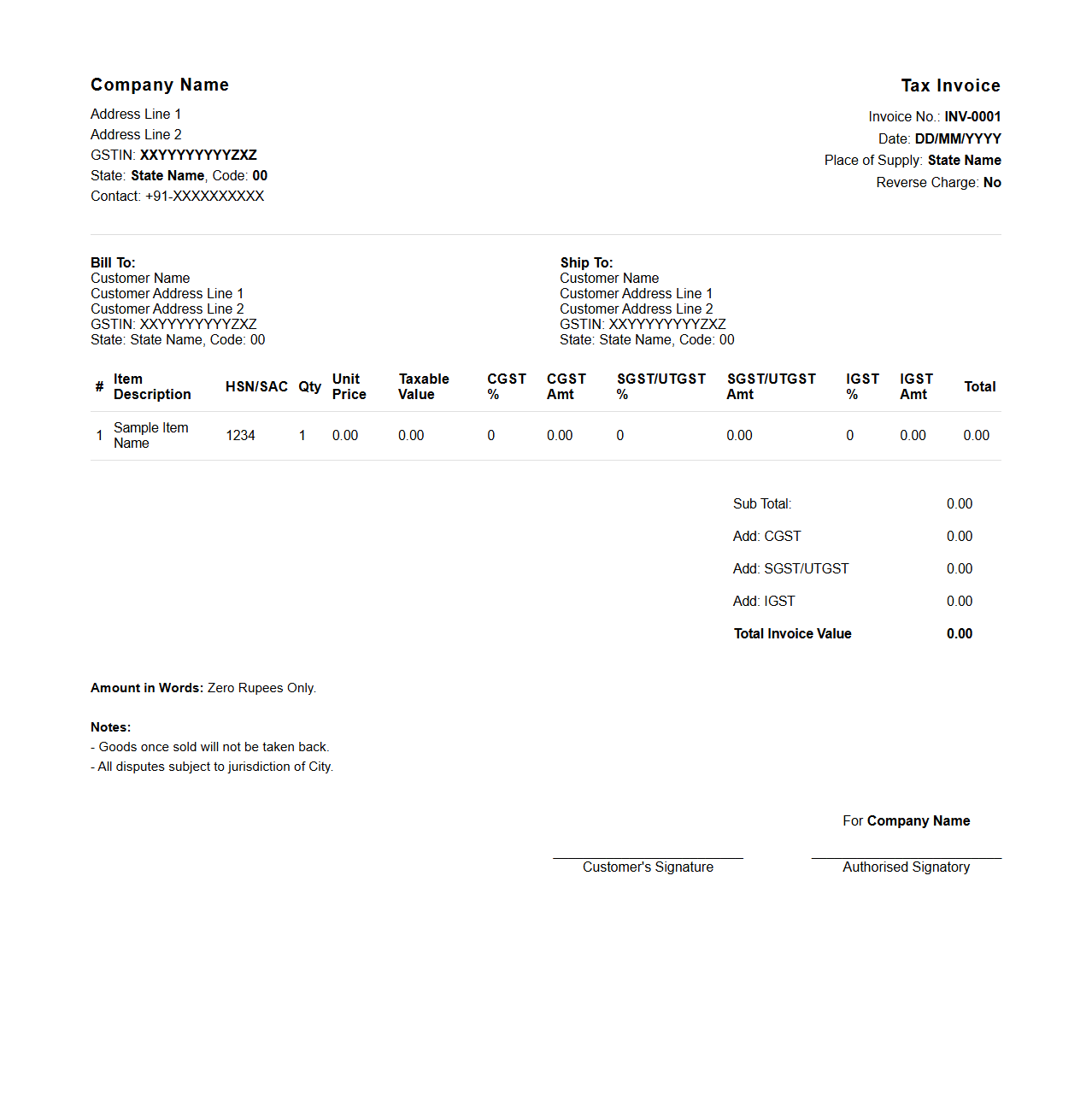

GST-Compliant Sales Invoice Sample

A

GST-compliant sales invoice sample document exemplifies the format and essential details required by the Goods and Services Tax (GST) regulations for billing transactions. It includes critical elements such as the supplier's GSTIN, invoice number, date, description of goods or services, tax rates, and the total GST amount charged to ensure legal compliance. This sample serves as a reliable reference for businesses to generate accurate and standardized invoices that align with GST audit requirements.

Multi-Item Retail Transaction Invoice

A

Multi-Item Retail Transaction Invoice document itemizes multiple products or services purchased in a single retail transaction, detailing quantities, prices, and total amounts. It serves as a formal record for both the customer and retailer, facilitating accurate billing, inventory management, and financial reporting. This document often includes essential data such as product codes, discounts, tax calculations, and payment methods.

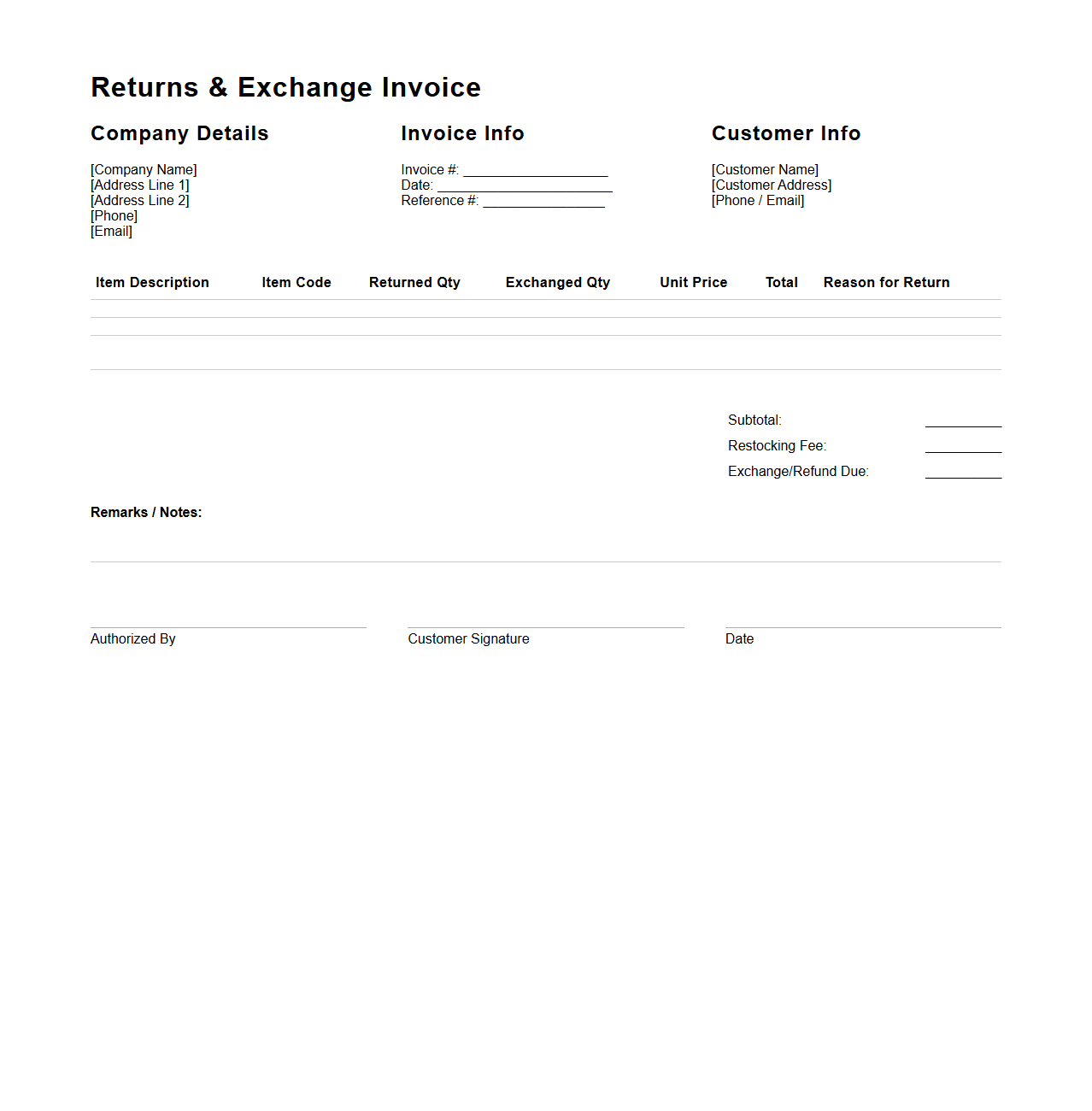

Returns and Exchange Invoice Template

A

Returns and Exchange Invoice Template is a standardized document used by businesses to efficiently record and process product returns or exchanges. It details essential information such as the original purchase, reason for return or exchange, product details, and customer data to ensure accurate tracking and inventory management. Utilizing this template streamlines customer service operations and maintains clear financial records related to returned or exchanged goods.

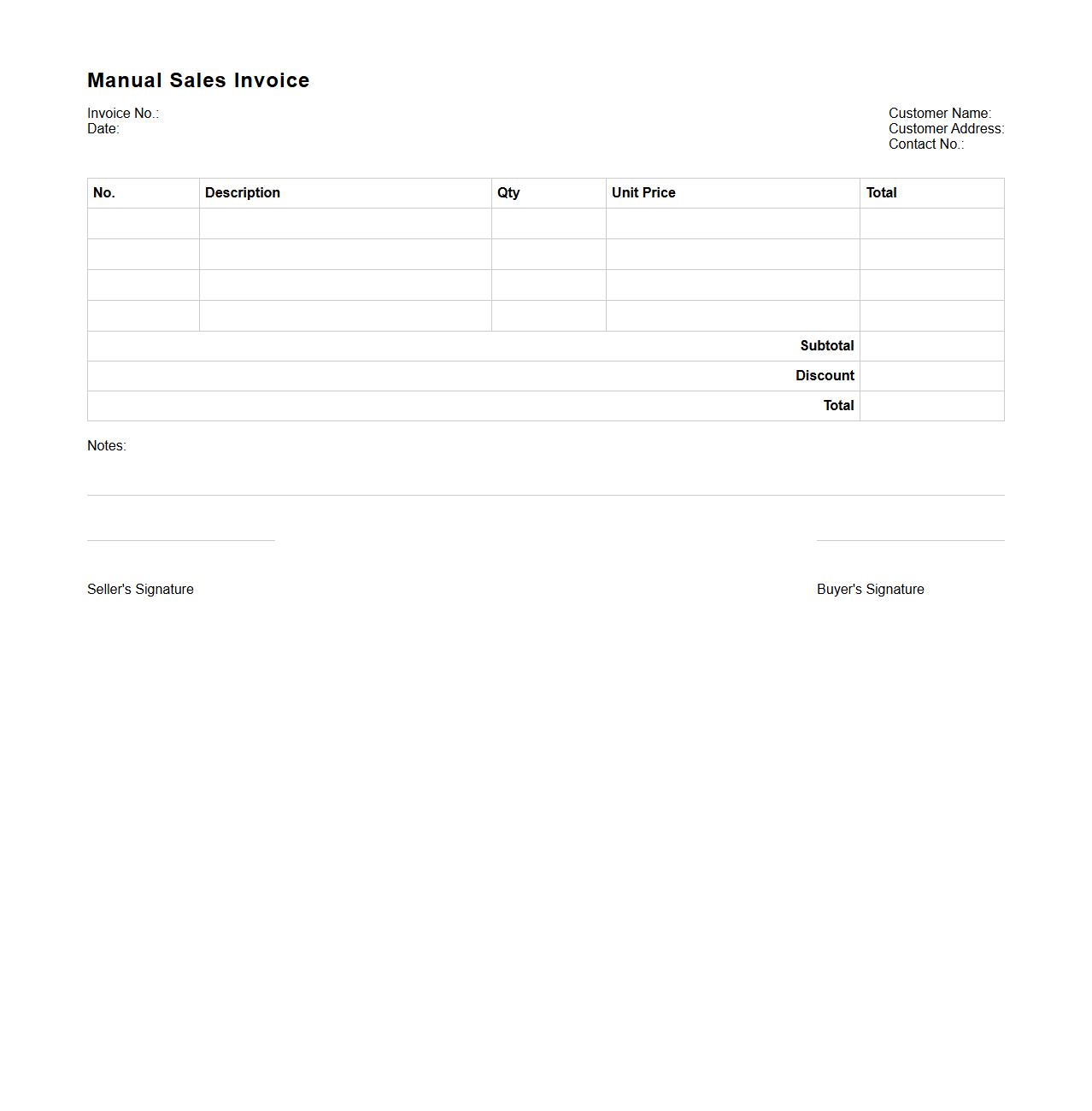

Manual Sales Invoice for Small Retailers

A

Manual Sales Invoice for Small Retailers document is a physical or printable form used to record sales transactions without relying on digital systems. It includes essential details such as customer information, product descriptions, quantities, prices, and payment terms, ensuring accurate tracking of sales and inventory. This document serves as proof of purchase for both the retailer and the customer, facilitating bookkeeping and tax compliance.

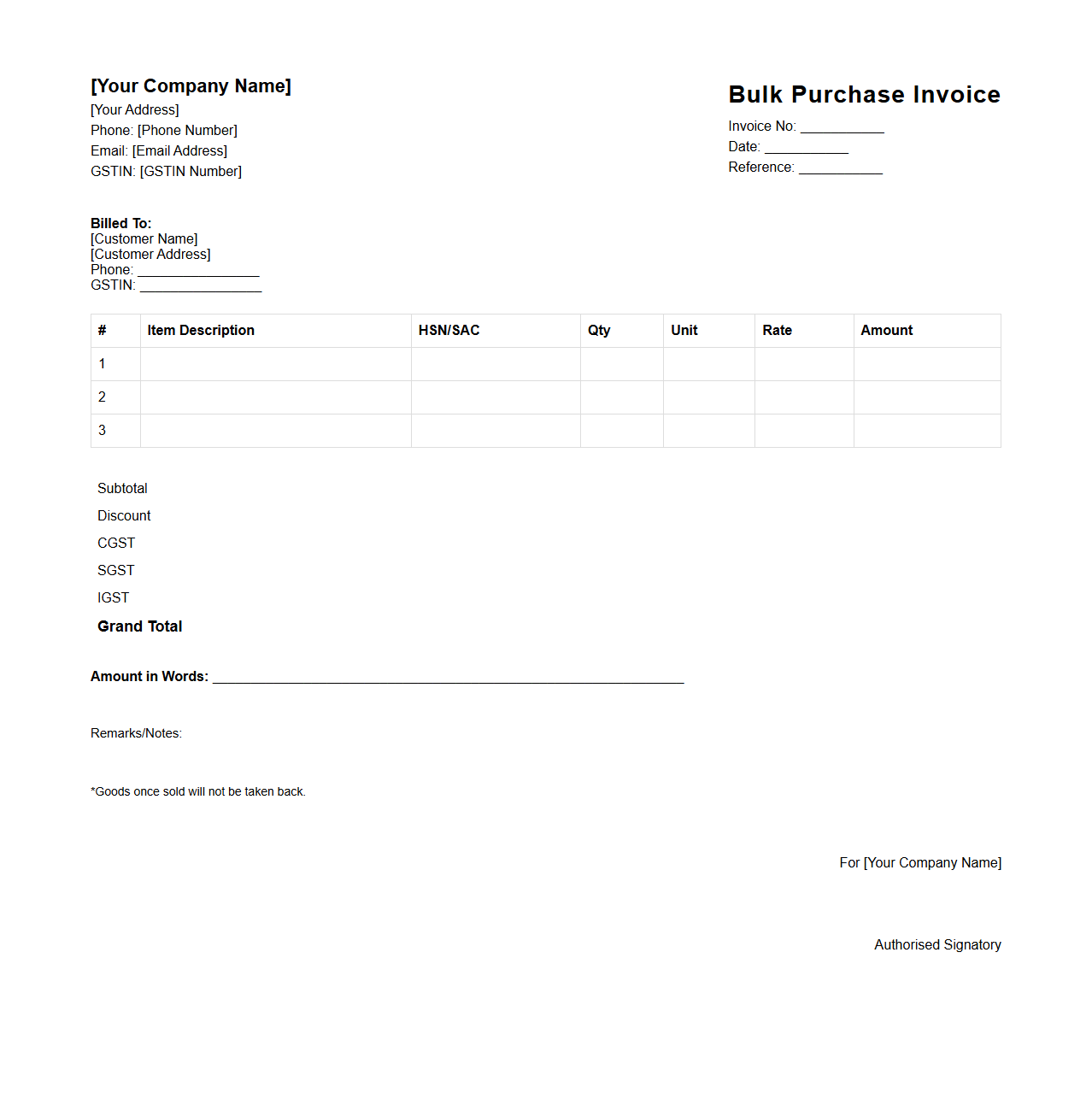

Bulk Purchase Invoice Format for Retail

The

Bulk Purchase Invoice Format for retail is a document template designed to record detailed information about large quantity purchases made by retailers from suppliers. It typically includes essential data such as item descriptions, quantities, unit prices, total amounts, purchase dates, supplier details, and payment terms to ensure clear financial records. This format streamlines inventory management, aids in accurate bookkeeping, and facilitates smooth supplier transactions.

What essential information should be included in a sales invoice for retail transactions?

A sales invoice for retail transactions must include the date of purchase and a unique invoice number. It should also list the buyer's and seller's contact details to ensure clear identification. Additionally, the total amount due, including taxes and discounts, must be clearly stated.

How does a sales invoice document support financial and inventory tracking?

The sales invoice acts as a crucial record for financial tracking, helping businesses monitor revenue and manage accounts receivable. It also aids in inventory control by detailing the quantities of each product sold. This enables accurate stock level adjustments and replenishment decisions.

Which parties are typically identified on a retail sales invoice?

A retail sales invoice typically identifies the buyer and the seller. The seller details often include business name, address, and tax identification number. The buyer's information usually contains the customer's name and contact information for record-keeping.

What role do itemized product descriptions and quantities play in a sales invoice?

Itemized product descriptions provide clarity on what products were purchased, specifying each item clearly. The inclusion of quantities helps determine the total cost and facilitates accurate inventory deductions. This transparency aids both the seller and buyer in verifying transaction details.

How is taxation and discount information presented and calculated on a sales invoice document?

Taxation is typically shown as a separate line item, calculated based on the pre-tax product total. Discounts are listed either as a percentage or a fixed amount and deducted before tax calculation. This ensures the final invoice amount accurately reflects all adjustments for proper payment processing.