A Inventory Adjustment Document Sample for Retail helps accurately record changes in stock levels due to damages, losses, or discrepancies. This document ensures proper tracking of inventory variations, maintaining accurate financial and operational records. Retailers use it to streamline inventory management and prevent stock inconsistencies.

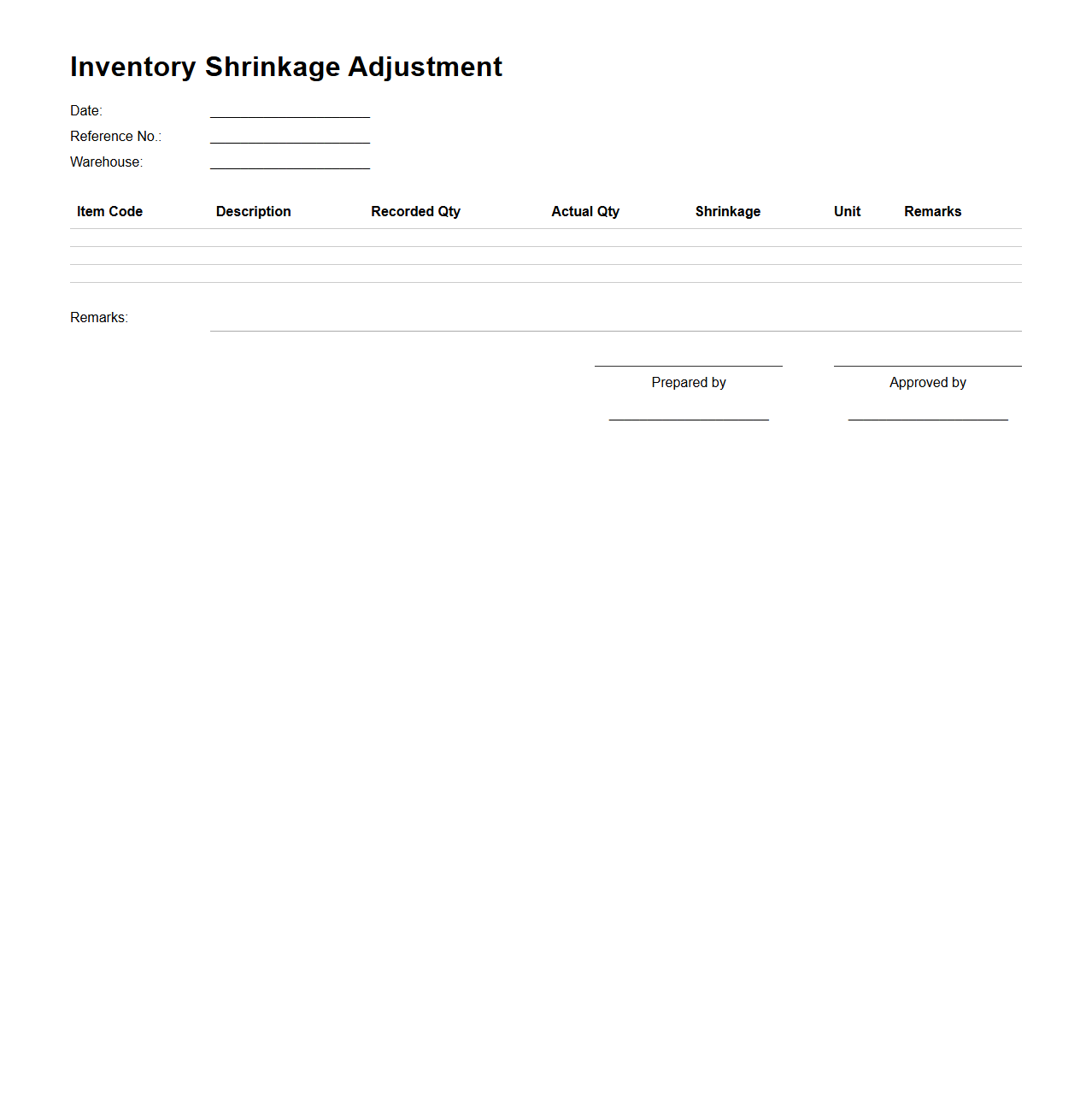

Inventory Shrinkage Adjustment Sample

An

Inventory Shrinkage Adjustment Sample document is a detailed record used by businesses to account for discrepancies between recorded inventory and actual stock levels. It helps identify and quantify inventory losses due to theft, damage, or errors, ensuring accurate financial reporting and inventory management. This document serves as a reference for adjusting inventory records and maintaining control over stock levels.

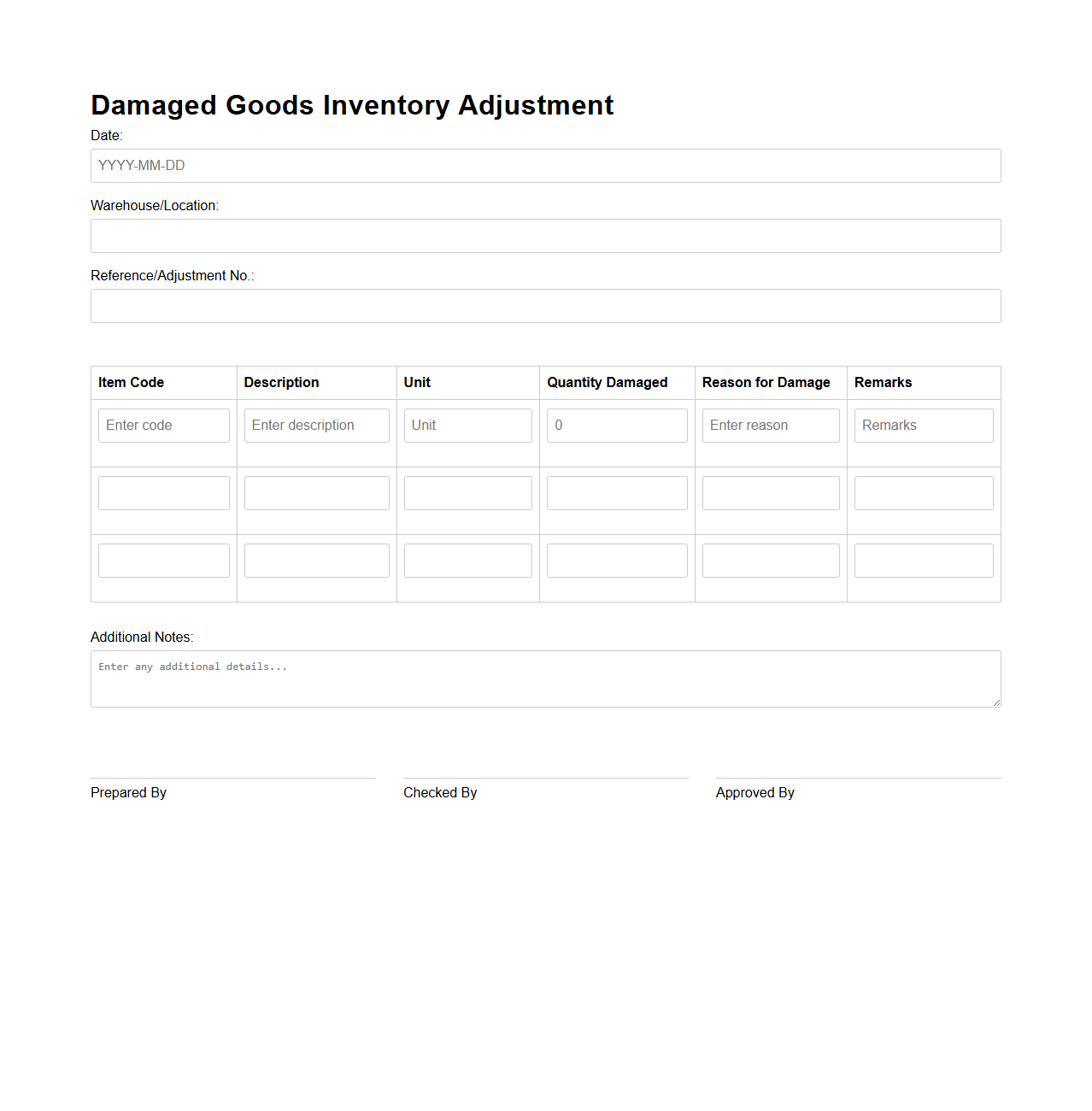

Damaged Goods Inventory Adjustment Template

The

Damaged Goods Inventory Adjustment Template document is designed to systematically record and manage inventory items that are damaged, ensuring accurate stock levels and preventing financial discrepancies. It typically includes fields for item identification, quantity damaged, date of damage, and reason for adjustment, facilitating transparent and efficient inventory control. Using this template aids in maintaining precise financial reporting and supports loss prevention strategies within supply chain management.

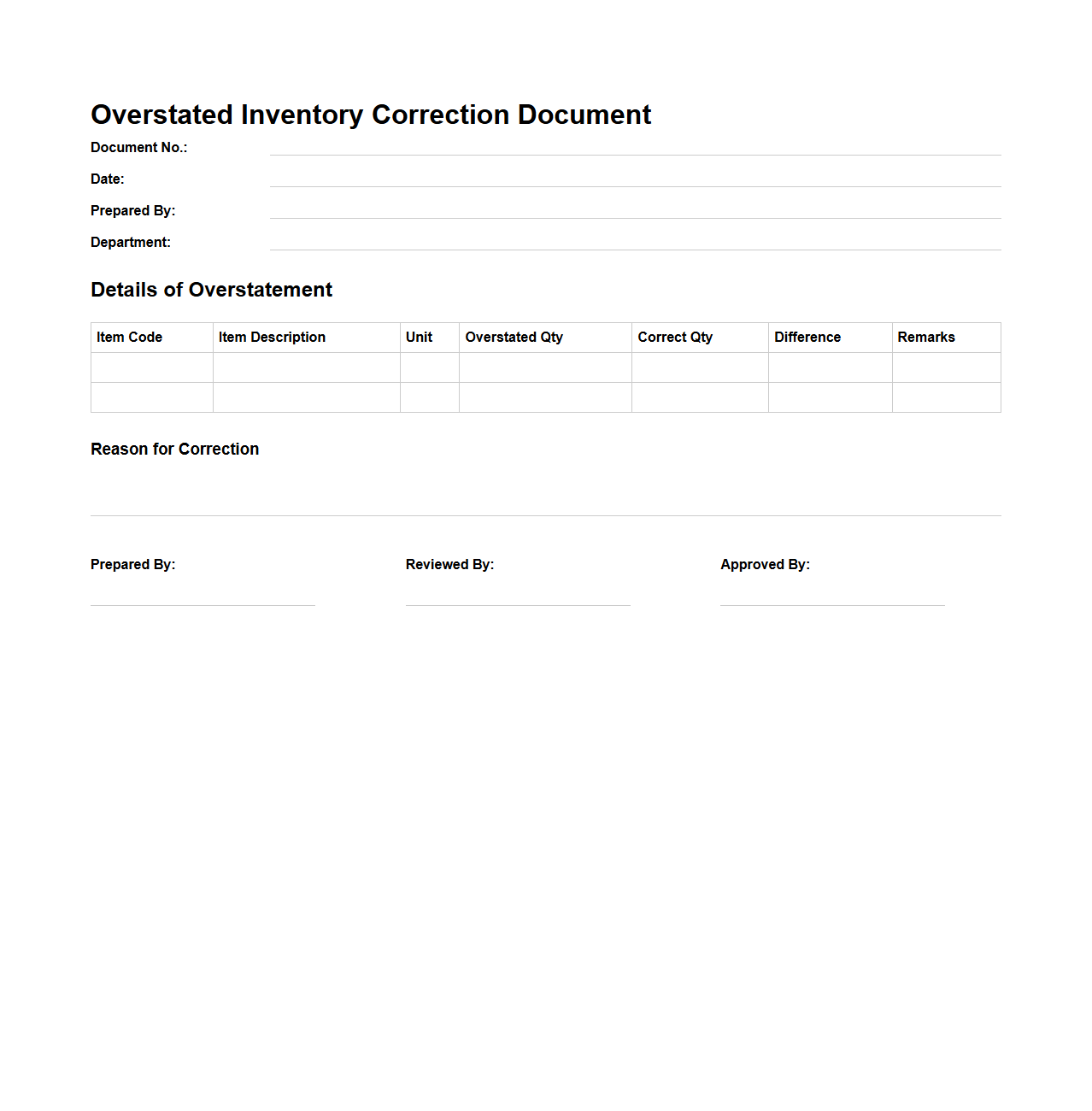

Overstated Inventory Correction Document

An

Overstated Inventory Correction Document is a formal record used to adjust inventory levels when quantities have been reported higher than actual stock on hand. This document ensures accurate financial reporting by correcting inventory values, preventing inflated asset statements and potential audit issues. It typically includes details such as the date of correction, items affected, and adjusted quantities to maintain transparent inventory management.

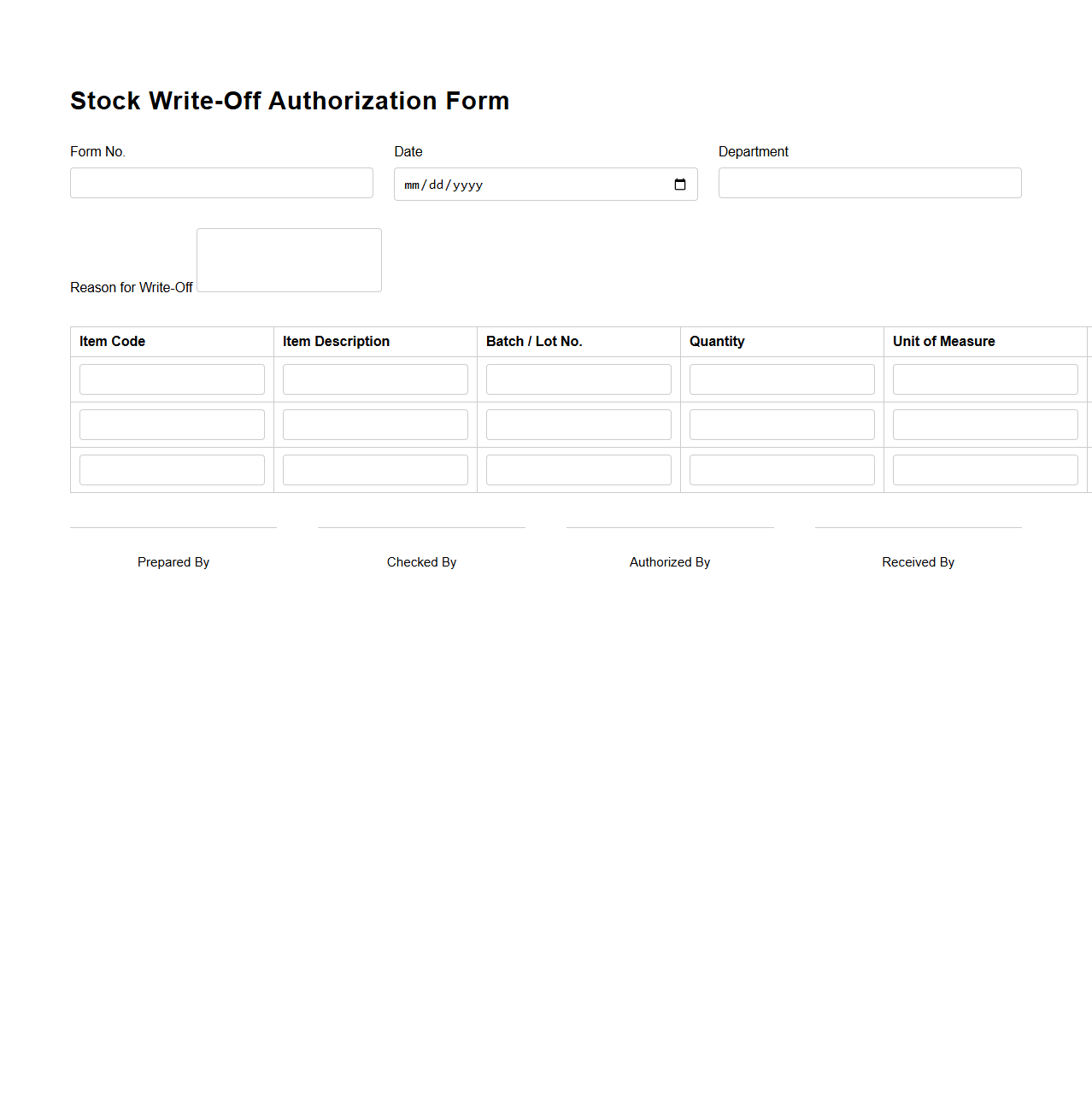

Stock Write-Off Authorization Form

A

Stock Write-Off Authorization Form is a crucial document used to officially approve the removal of obsolete, damaged, or unsellable inventory items from stock records. This form ensures proper tracking and accountability by requiring management authorization before adjusting inventory levels, helping maintain accurate financial and asset records. It typically includes details such as item descriptions, quantities, reasons for write-off, and signatures of responsible personnel.

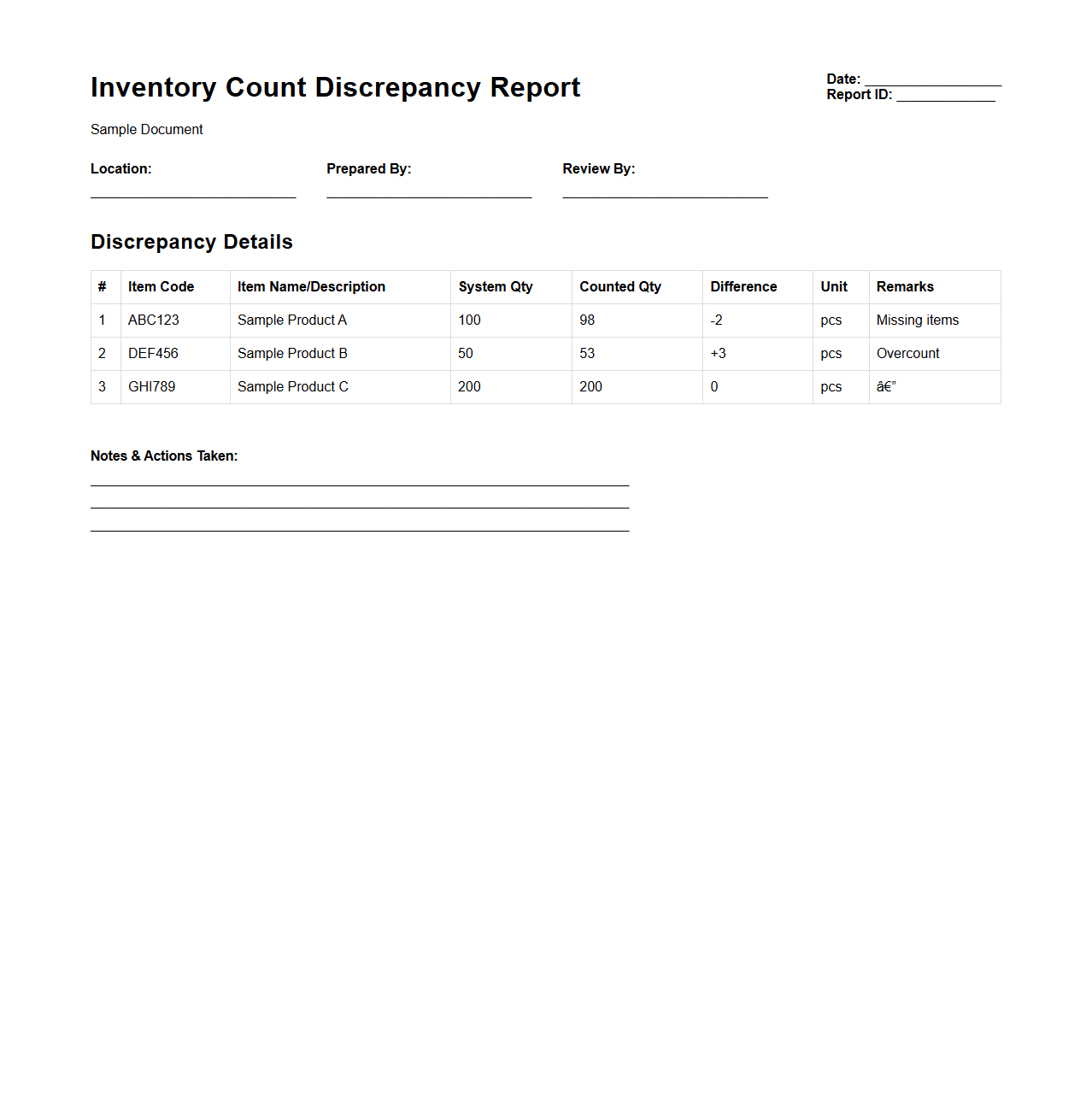

Inventory Count Discrepancy Report Sample

An

Inventory Count Discrepancy Report Sample document is a structured record used to identify and detail differences between physical inventory counts and recorded inventory levels. It highlights variances in quantities, enabling businesses to investigate causes such as theft, damage, or data entry errors. This report is essential for maintaining accurate inventory management and ensuring financial accuracy.

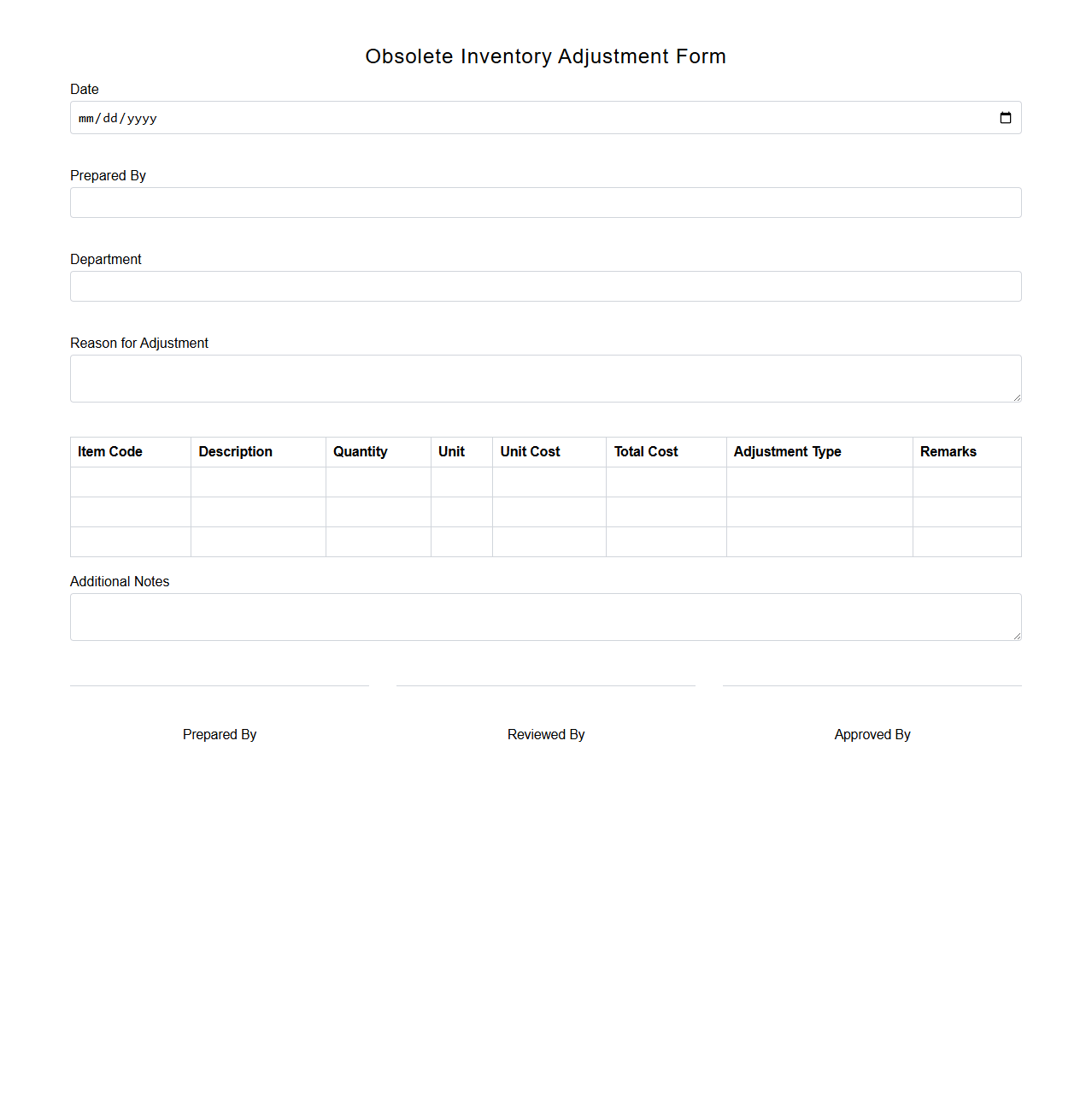

Obsolete Inventory Adjustment Form

The

Obsolete Inventory Adjustment Form document is used to record and authorize the removal or write-off of inventory items that are no longer usable or salable due to damage, expiration, or obsolescence. This form helps maintain accurate inventory records by adjusting stock levels and reflecting the true value of inventory in financial statements. It typically includes details like item description, quantity, reason for obsolescence, and approval signatures.

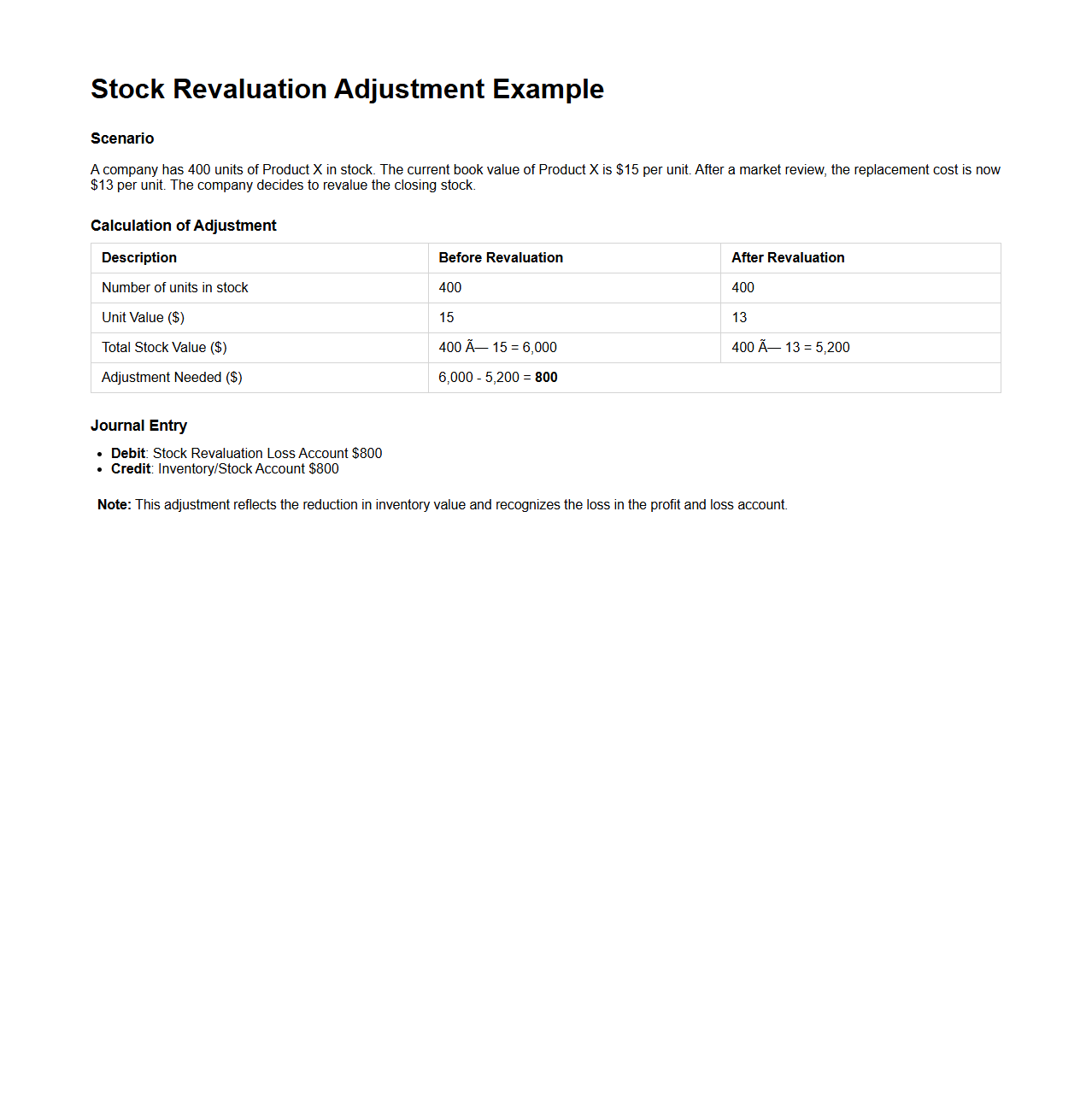

Stock Revaluation Adjustment Example

A

Stock Revaluation Adjustment Example document demonstrates the process of updating inventory values to reflect their current market prices, ensuring accurate financial reporting. It includes detailed calculations showing how stock values are adjusted for price fluctuations, obsolescence, or damage. This document is essential for accountants and auditors to verify that inventory is correctly valued on balance sheets.

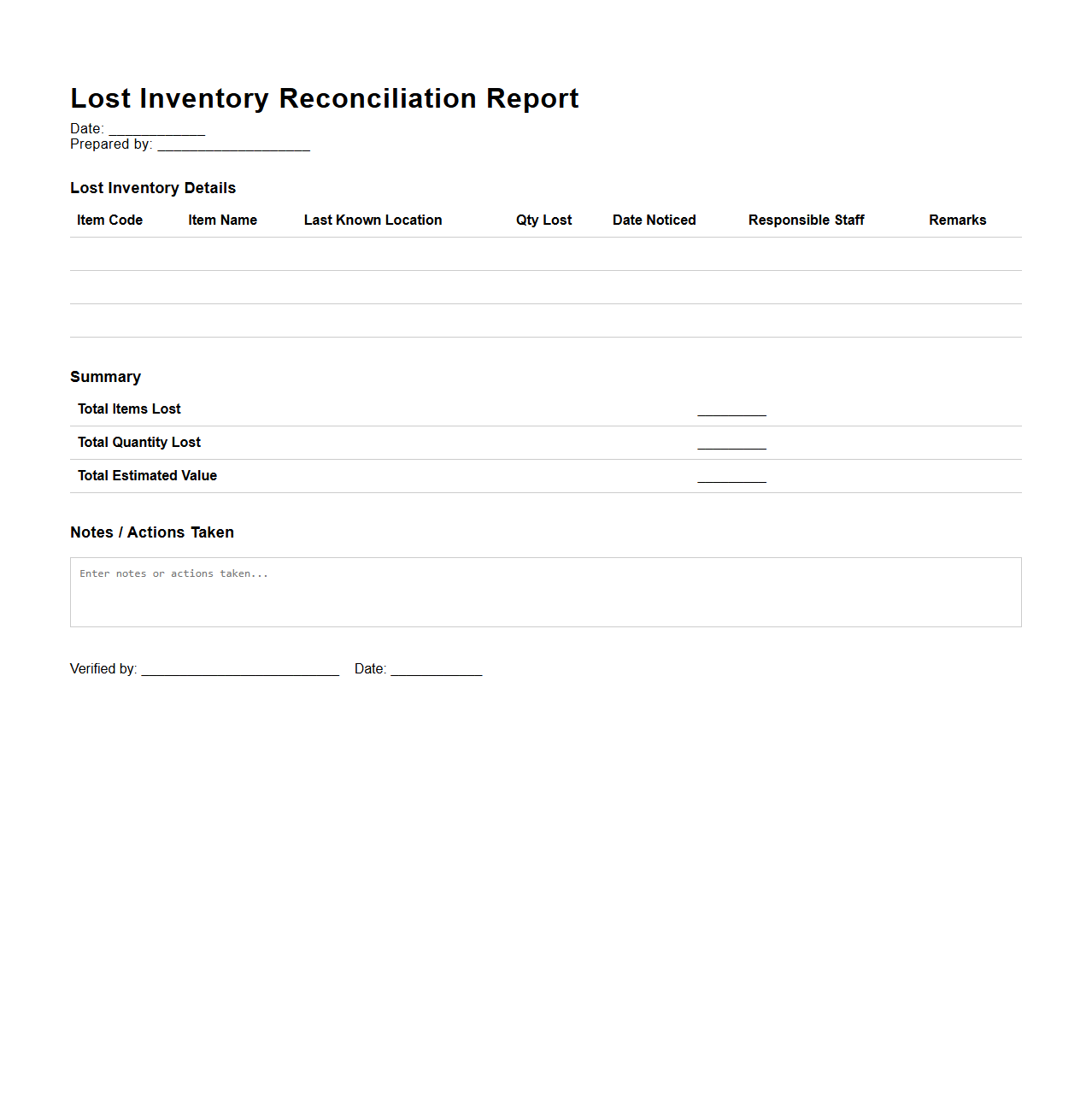

Lost Inventory Reconciliation Report

The

Lost Inventory Reconciliation Report document provides a detailed account of discrepancies between recorded inventory levels and actual stock physically available, helping organizations identify and reconcile losses. It includes item descriptions, quantities lost, reasons for discrepancies, and financial impact assessments to facilitate accurate inventory management. This report is essential for maintaining accurate financial records, improving loss prevention strategies, and enhancing supply chain transparency.

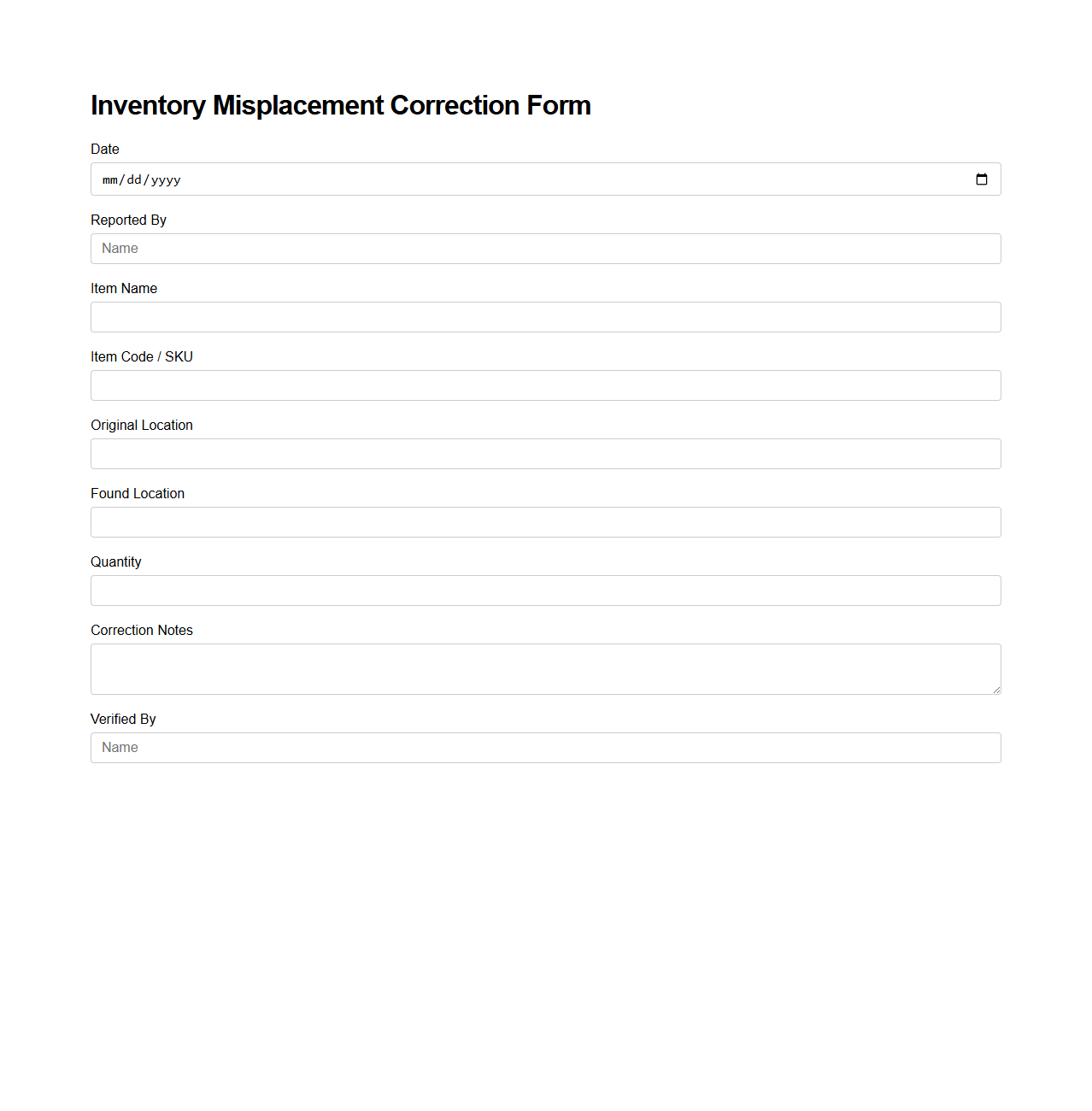

Inventory Misplacement Correction Form

The

Inventory Misplacement Correction Form is a critical document used to identify and rectify errors in the location or categorization of inventory items within a warehouse or storage facility. It ensures accurate tracking and accountability by recording details of misplacements, such as item descriptions, current and correct locations, and involved personnel. Proper use of this form helps maintain inventory accuracy, reduces stock discrepancies, and enhances overall operational efficiency.

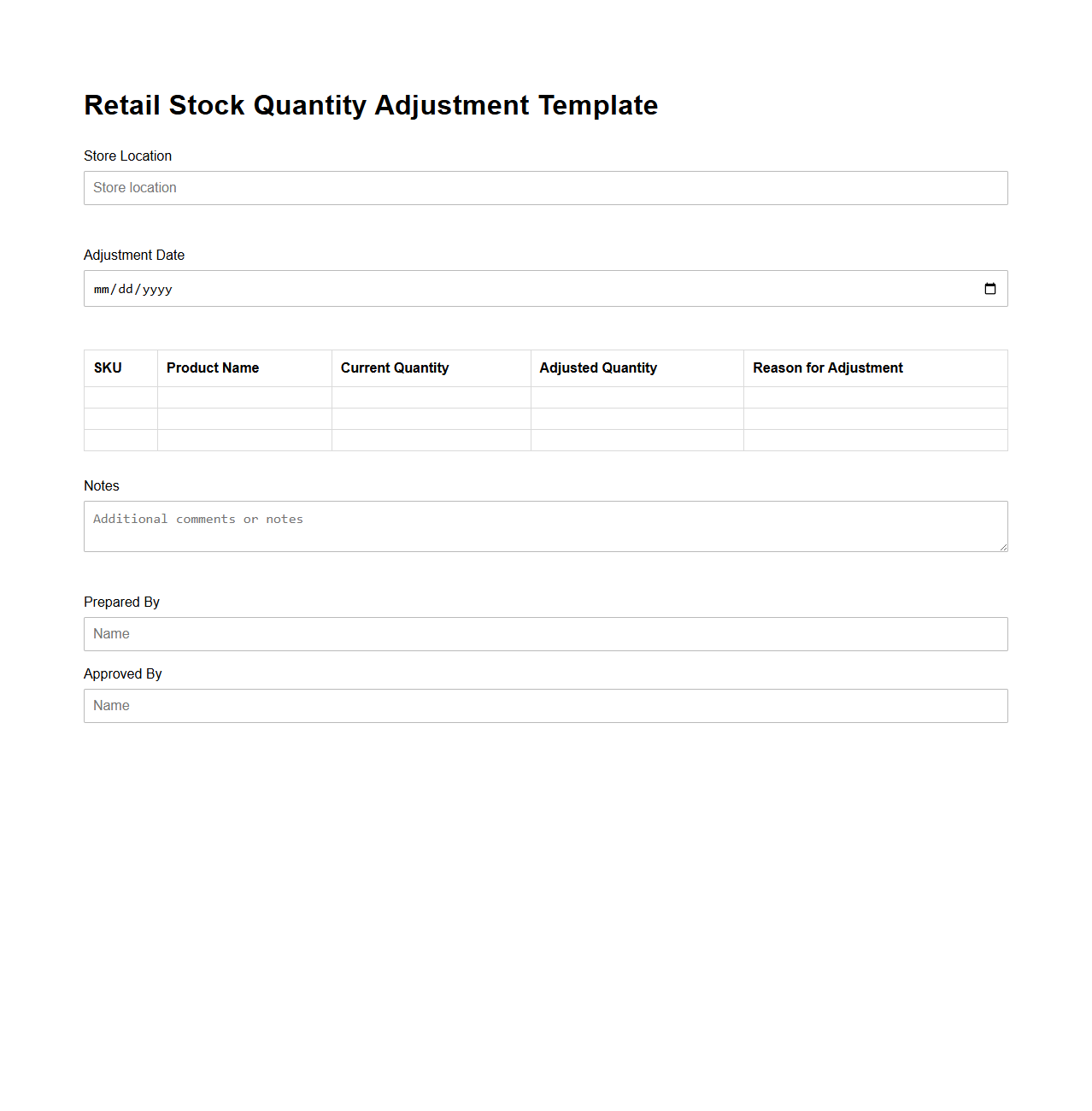

Retail Stock Quantity Adjustment Template

The

Retail Stock Quantity Adjustment Template document is a structured tool used to systematically record and manage changes in inventory levels within retail environments. It helps ensure accurate tracking of stock variations due to events like damage, theft, or restocking, facilitating precise inventory control. This document enhances accountability and supports effective decision-making by providing clear records of stock adjustments.

What is the primary purpose of an Inventory Adjustment Document in retail operations?

The primary purpose of an Inventory Adjustment Document is to accurately record changes in stock levels that occur outside of normal sales transactions. It helps maintain accurate inventory records by documenting discrepancies such as damaged goods, theft, or administrative errors. This ensures effective inventory management and financial reporting in retail operations.

Which key fields must be included in a retail Inventory Adjustment Document sample?

Key fields in an Inventory Adjustment Document typically include item description, SKU or barcode, adjustment quantity, reason for adjustment, and date of the change. Additionally, fields for the responsible employee and location of the inventory adjustment are crucial. These fields provide comprehensive details to properly account for the inventory changes.

How does the document differentiate between positive and negative inventory adjustments?

The document differentiates between positive and negative adjustments by designating quantities either as increases or decreases in stock levels. Positive adjustments add to the inventory count, such as found items or returns, while negative adjustments subtract items due to loss or damage. Clear designation ensures precise inventory balance updates.

What approval steps are typically required within an Inventory Adjustment Document workflow?

An effective workflow usually requires managerial or supervisor approval before finalizing the inventory adjustment to prevent unauthorized changes. Some systems may also require multiple levels of approval depending on the adjustment value or frequency. This approval step enhances accountability and controls within retail inventory management.

How does the document ensure traceability of inventory changes for audit purposes?

The Inventory Adjustment Document ensures traceability by recording detailed information such as the date, reason, and personnel responsible for each change. It often includes unique adjustment IDs and timestamps to create an audit trail linking adjustments to specific incidents. This traceability supports compliance and efficient auditing processes in retail operations.