A Supplier Invoice Document Sample for Retail Business provides a clear template outlining essential details such as supplier information, invoice number, purchase date, item descriptions, quantities, unit prices, and total amounts due. This document helps streamline payment processes, maintain accurate financial records, and ensure transparency between retailers and suppliers. Using a standardized invoice sample enhances efficiency in managing procurement and accounting tasks.

Supplier Invoice Template for Electronic Goods Retail

A

Supplier Invoice Template for Electronic Goods Retail document is a standardized form used by retailers to record and process invoices received from suppliers of electronic products. It typically includes details such as supplier information, product descriptions, quantities, unit prices, total costs, invoice numbers, and payment terms to ensure accuracy and streamline financial transactions. This template helps maintain organized records, facilitates quick verification of received goods, and supports efficient accounting procedures within the electronics retail sector.

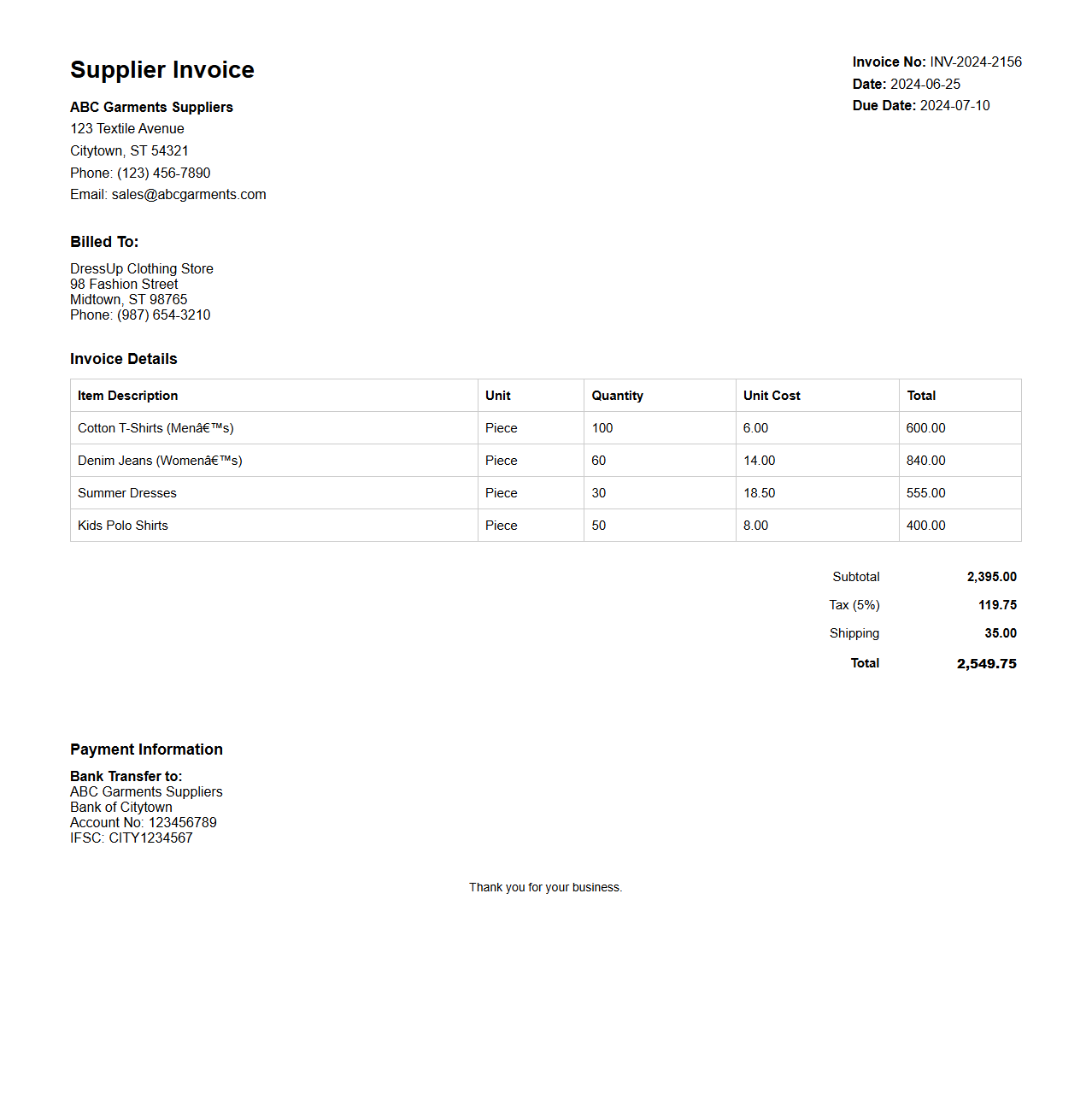

Supplier Invoice Sample for Clothing Store

A

Supplier Invoice Sample for Clothing Store document serves as a detailed record of goods purchased from a supplier, including item descriptions, quantities, prices, and payment terms. It helps clothing stores efficiently track inventory expenses, verify order accuracy, and streamline accounting processes. This document is essential for maintaining transparent financial records and managing supplier relationships effectively.

Supplier Invoice Format for Grocery Retailers

The

Supplier Invoice Format for Grocery Retailers document is a standardized template designed to ensure accurate billing and efficient transaction processing between grocery retailers and their suppliers. It includes essential details such as item descriptions, quantities, unit prices, total costs, and tax information, facilitating clear communication and financial record-keeping. Proper use of this format helps grocery retailers streamline inventory management, verify deliveries, and maintain compliance with accounting standards.

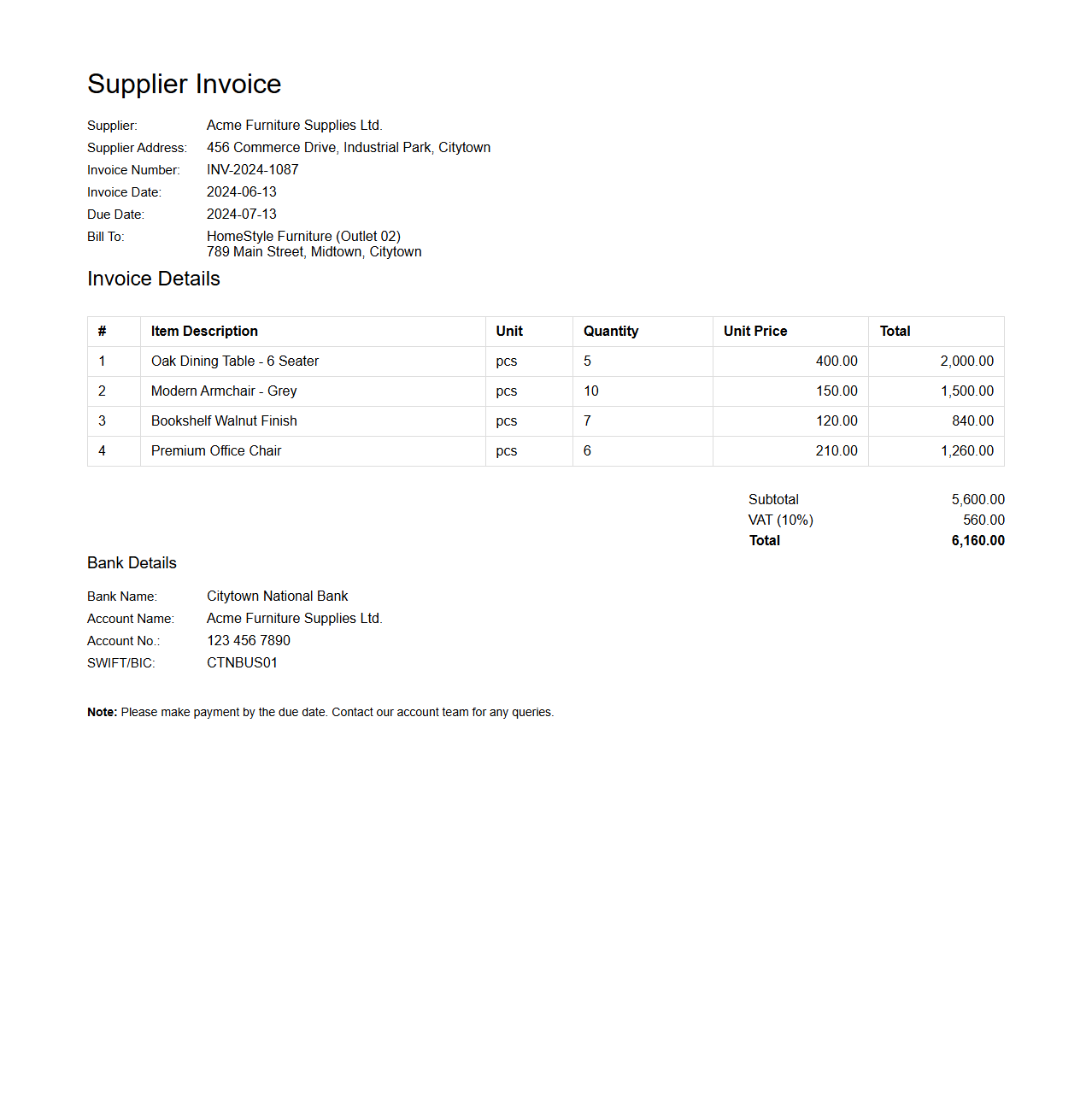

Supplier Invoice Example for Furniture Retail Outlets

A

Supplier Invoice Example for Furniture Retail Outlets document serves as a template illustrating how invoices should be formatted and detailed when purchasing furniture stock. It typically includes essential information such as supplier details, item descriptions, quantities, unit prices, total amounts, payment terms, and delivery dates, ensuring clear communication between retailers and suppliers. This document streamlines the procurement process, enhances accuracy in financial records, and facilitates smooth inventory management within furniture retail operations.

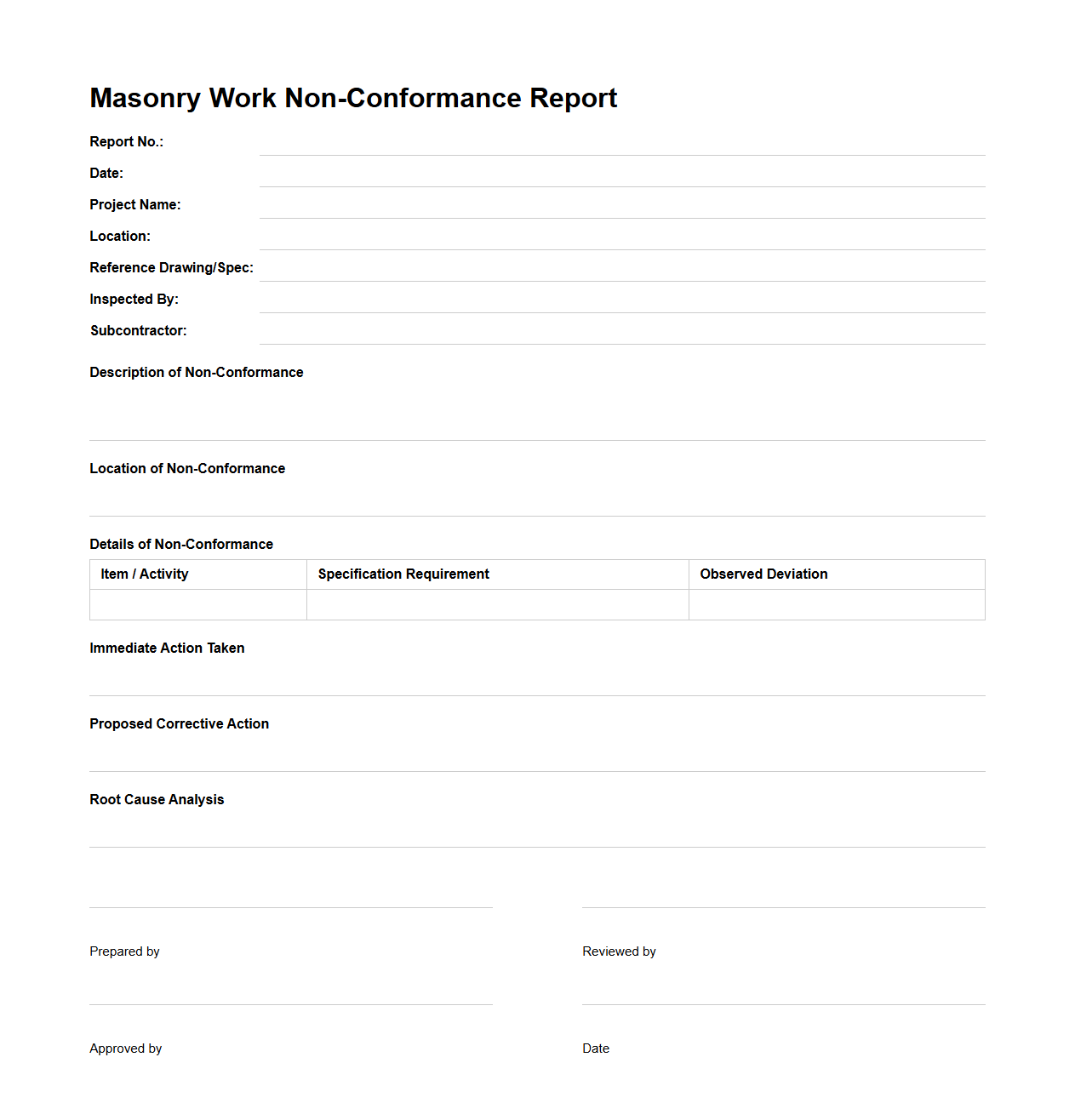

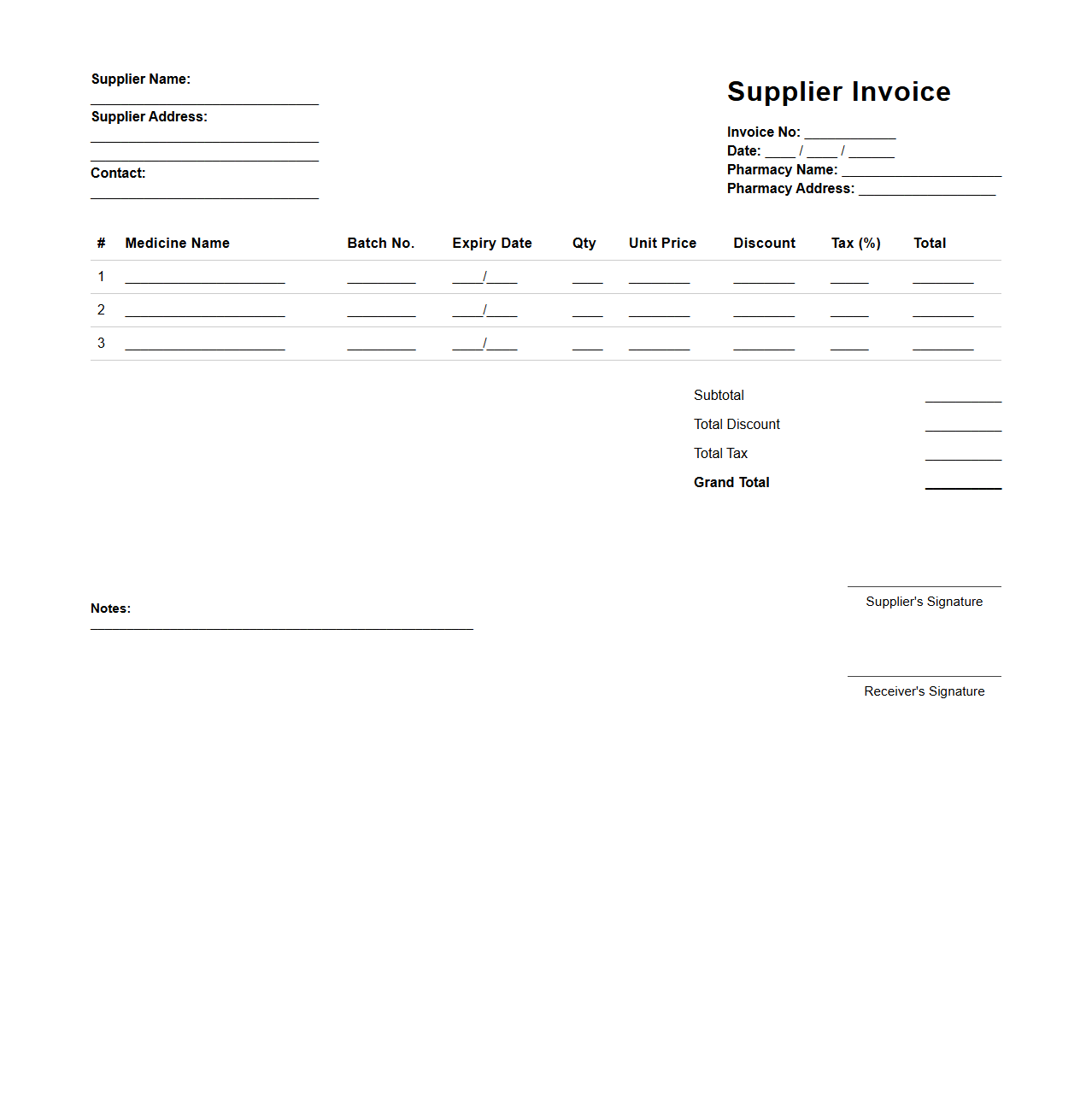

Supplier Invoice Document for Pharmacy Retail

A

Supplier Invoice Document in pharmacy retail is an essential financial record detailing the products supplied, quantities, prices, and payment terms between the pharmacy and its vendors. This document ensures accurate tracking of inventory costs and facilitates efficient accounts payable processing. It serves as proof of goods received and supports audit compliance and financial reporting.

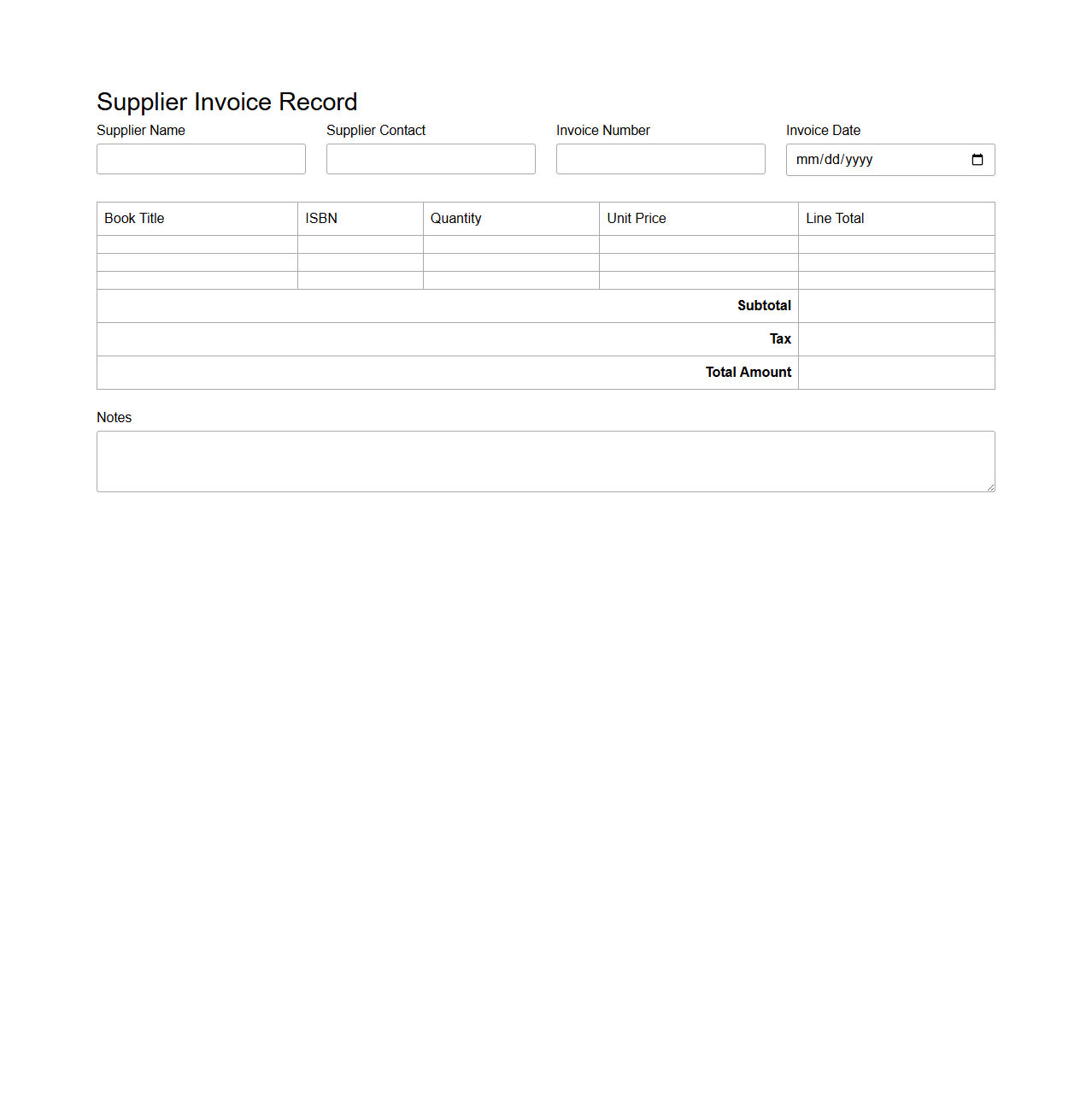

Supplier Invoice Record for Bookstore Retailers

The

Supplier Invoice Record for bookstore retailers is a critical document that details transactions between the bookstore and its suppliers, including book titles, quantities, prices, and payment terms. It serves as a verified record for inventory management, financial accounting, and auditing purposes, ensuring accurate tracking of purchases and vendor payments. This document helps maintain transparency and control over procurement processes, streamlining order reconciliation and budget monitoring.

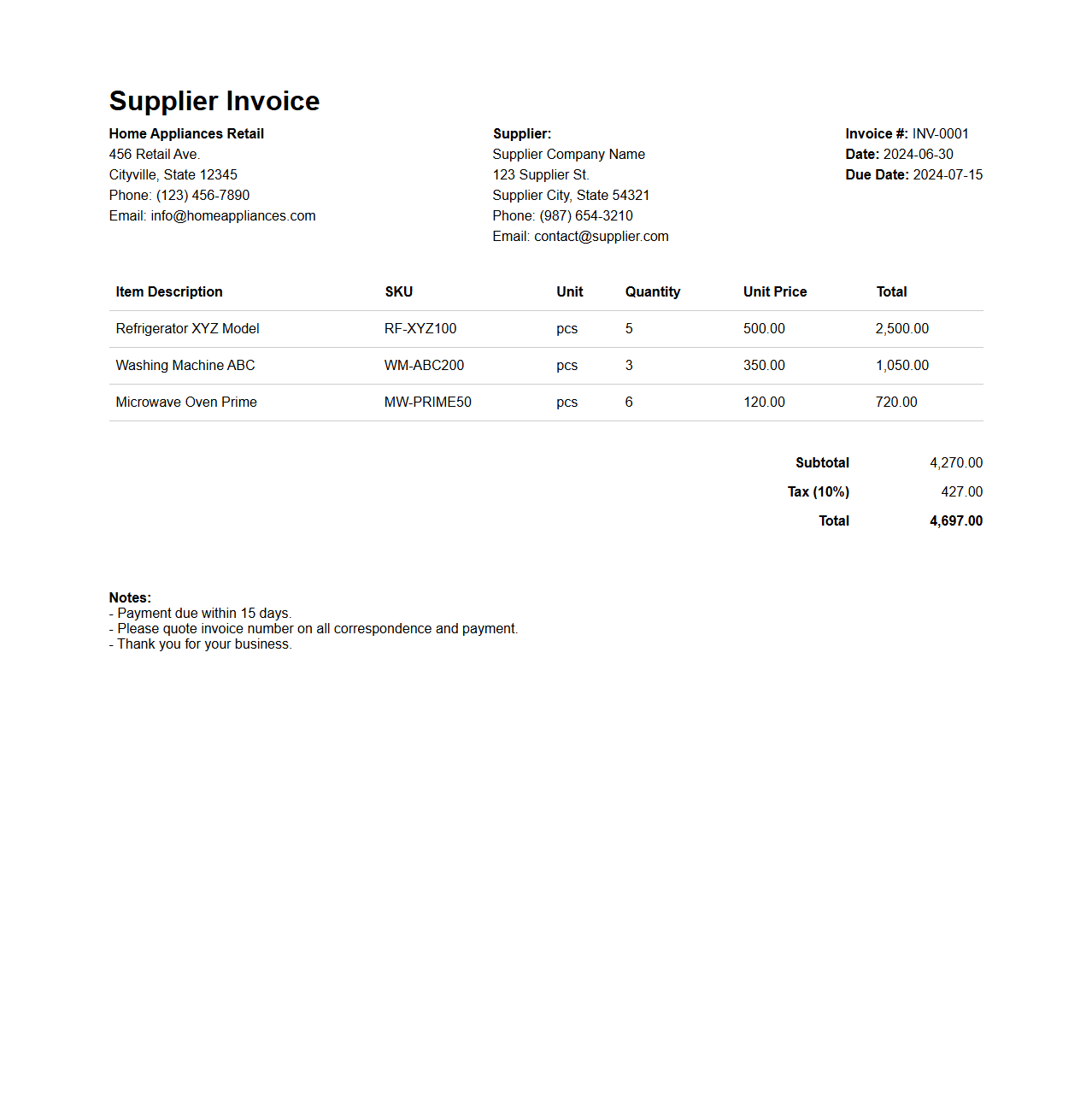

Supplier Invoice Layout for Home Appliances Retail

A

Supplier Invoice Layout for Home Appliances Retail is a standardized document template used to detail transactions between retailers and their suppliers, ensuring accurate recording of purchased appliances. It typically includes essential information such as supplier details, item descriptions, quantities, unit prices, taxes, and payment terms, facilitating efficient inventory management and financial reconciliation. This layout supports streamlined processing of invoices, reduces errors, and enhances supplier-retailer communication in the home appliances sector.

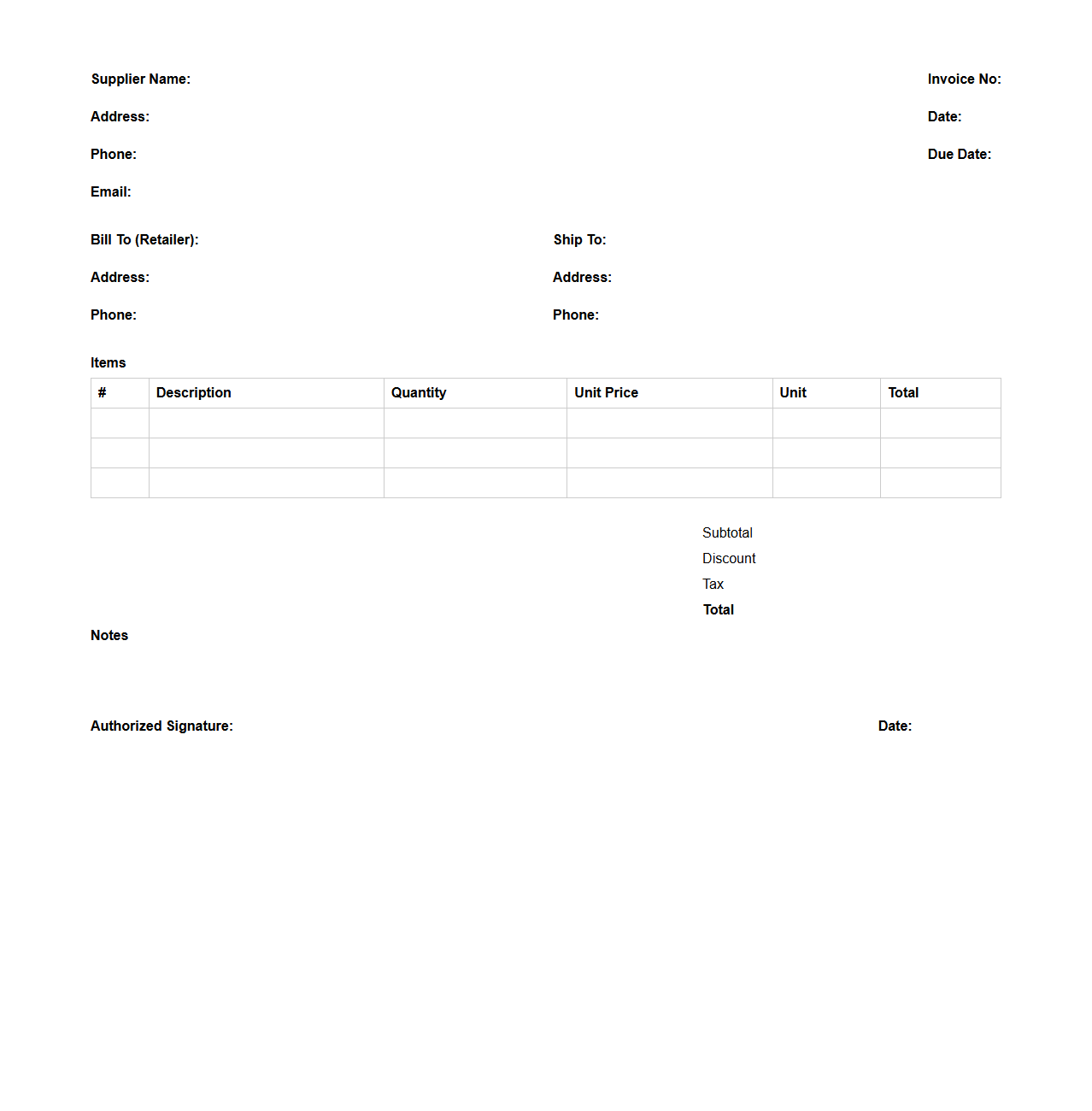

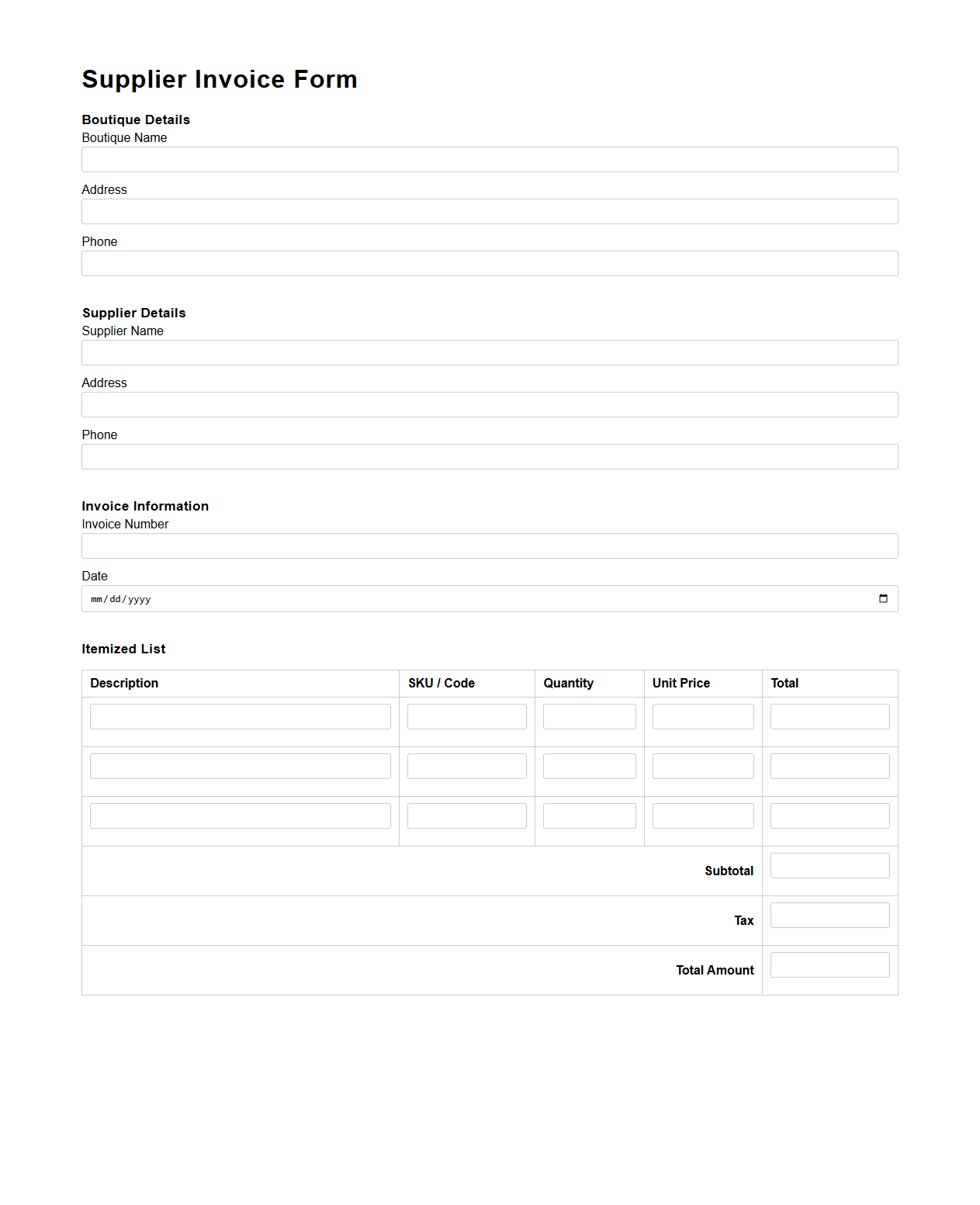

Supplier Invoice Form for Accessories Boutique

The

Supplier Invoice Form for Accessories Boutique is a crucial document that itemizes products supplied, quantities, prices, and payment terms associated with accessory orders. This form ensures accurate record-keeping, facilitates inventory management, and supports financial reconciliation between the boutique and its suppliers. Proper use of this invoice helps streamline procurement processes and maintain a transparent transaction history.

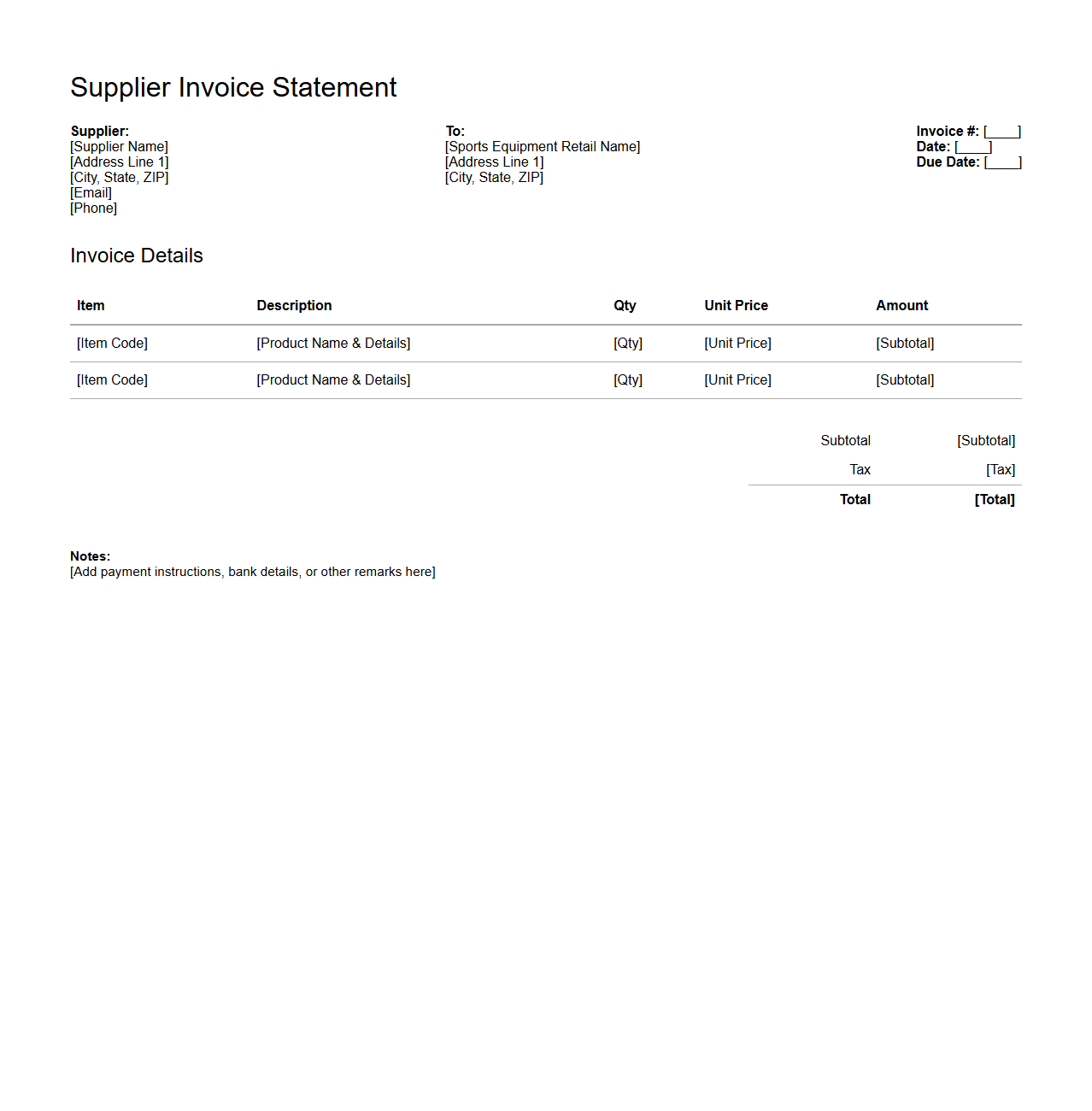

Supplier Invoice Statement for Sports Equipment Retail

A

Supplier Invoice Statement for a Sports Equipment Retail document is a detailed record that summarizes all invoices issued by a supplier to the retailer over a specific period. It includes essential information such as invoice numbers, dates, product descriptions, quantities, unit prices, and total amounts due. This document helps in tracking payment status, managing accounts payable, and ensuring accurate financial reconciliation between the sports equipment retailer and supplier.

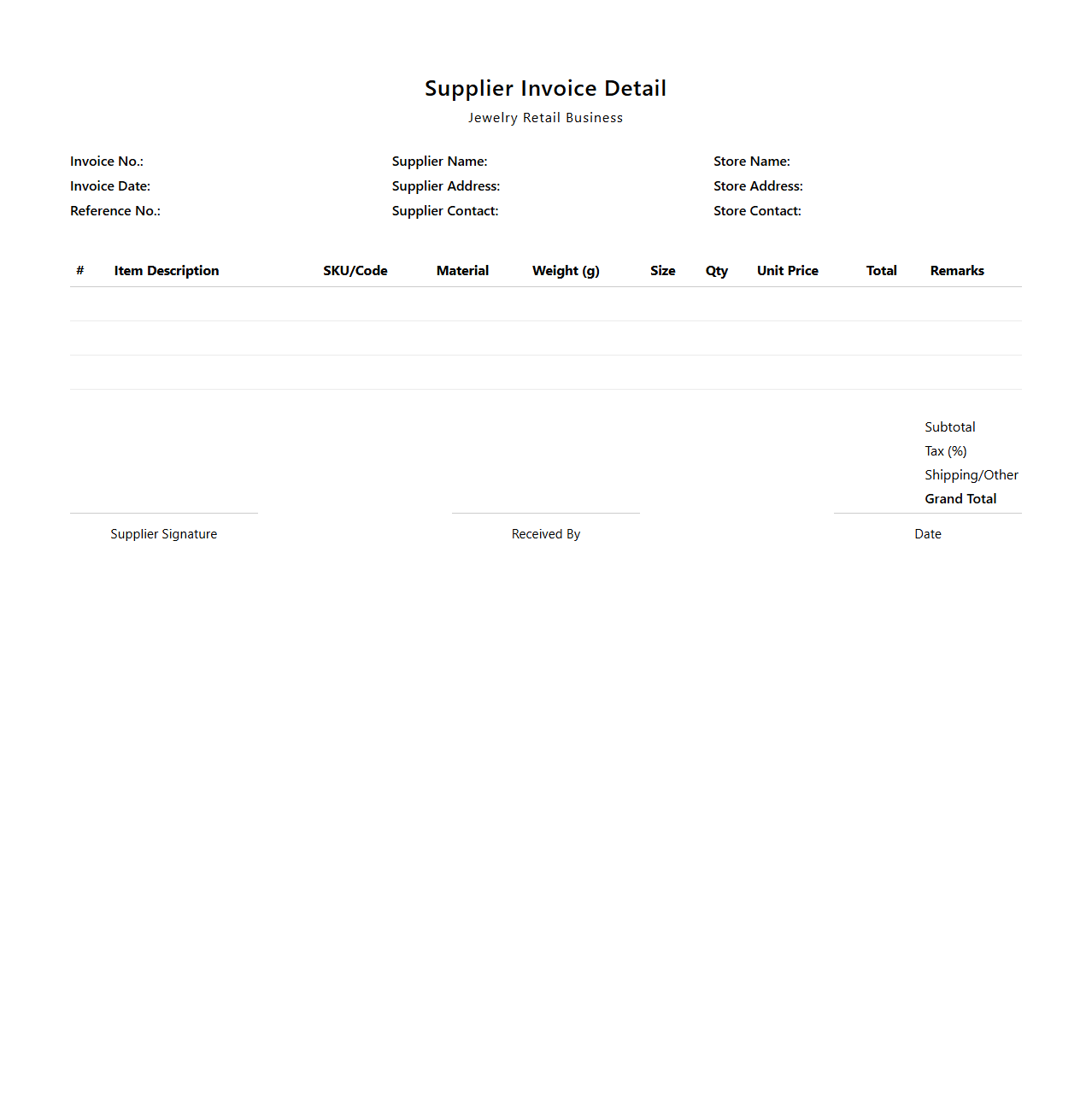

Supplier Invoice Detail for Jewelry Retail Business

The

Supplier Invoice Detail for Jewelry Retail Business is a comprehensive document that records itemized charges from suppliers, including descriptions, quantities, unit prices, and total costs for precious metals, gemstones, and crafted jewelry pieces. This document ensures accurate tracking of inventory costs and payment schedules, facilitating effective financial management and inventory reconciliation. It also enables audit trails and helps maintain supplier relationships by verifying order accuracy and timely payments.

What essential details should a supplier invoice document for a retail business include?

A supplier invoice for a retail business must include the supplier's name, address, and contact details to ensure proper identification. It should also list the purchased products or services, including quantities, unit prices, and total amounts. Additionally, the invoice must display the invoice number, date, payment terms, and applicable taxes for accurate processing.

How does the supplier invoice link to purchase orders and delivery receipts in retail transactions?

The supplier invoice serves as a key document that cross-references purchase orders and delivery receipts, ensuring consistency in retail transactions. It verifies that the goods or services invoiced match the quantities and specifications ordered and delivered. This linkage helps to prevent discrepancies and facilitates smooth approval and payment workflows.

In what ways does a supplier invoice impact inventory and accounts payable processes in retail?

Supplier invoices directly affect inventory management by confirming received items and updating stock levels accurately. They trigger accounts payable processes by recording the amount owed to suppliers, aiding in cash flow planning. Timely and accurate invoices help maintain financial integrity and streamline procurement operations.

What legal or tax information must be present on a retail supplier invoice document?

A retail supplier invoice must include mandatory tax identification numbers for both supplier and buyer to comply with tax regulations. It should clearly show tax rates, amounts, and applicable legal statements to ensure transparency and compliance. Proper documentation facilitates audits and avoids legal penalties.

How can errors in supplier invoice documents affect financial reporting and supplier relationships in retail?

Errors in a supplier invoice can lead to inaccurate financial reports, impacting budgeting and decision-making in retail businesses. Mistakes may cause payment delays or disputes, straining supplier relationships and affecting future negotiations. Ensuring invoice accuracy is crucial to maintain trust and operational efficiency.