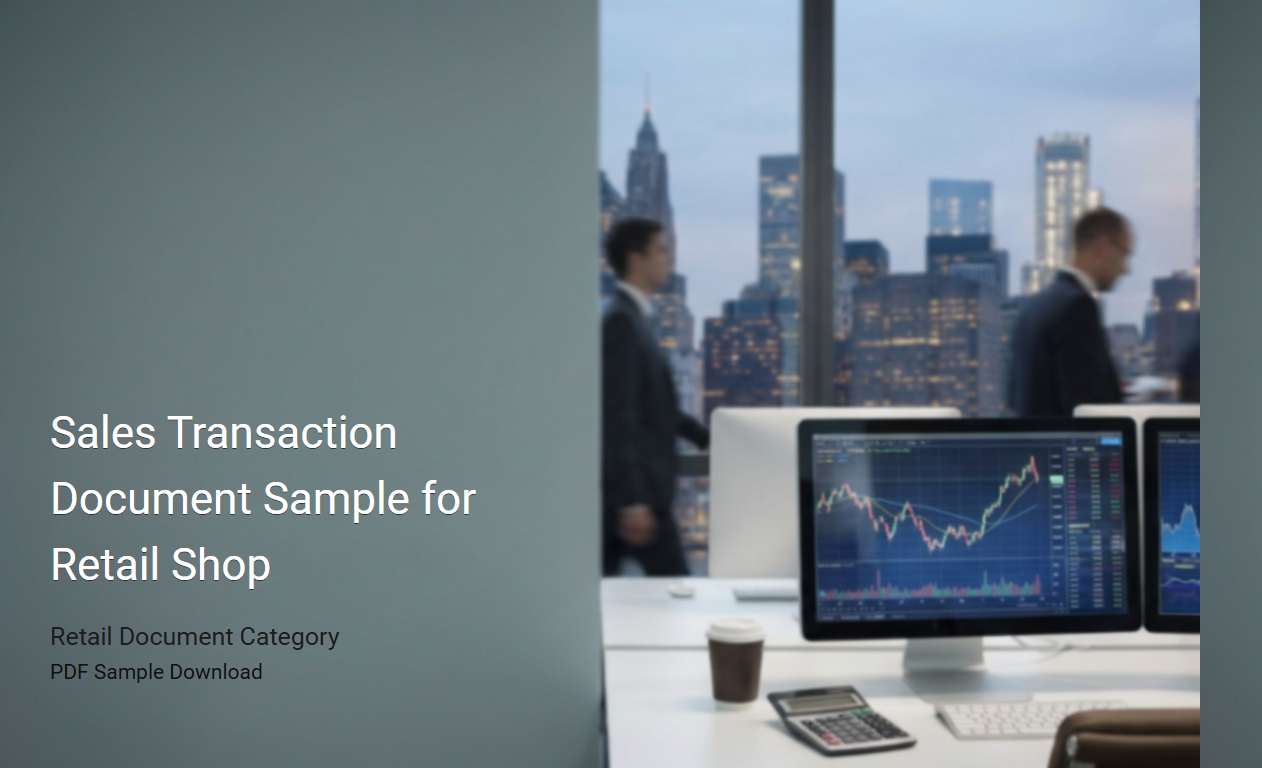

Retail Shop Sales Receipt Template

A

Retail Shop Sales Receipt Template document is a pre-designed form used by retail businesses to record transaction details, including items sold, prices, quantities, and payment methods. This template ensures consistent and accurate documentation for both the seller and customer, facilitating easy tracking of sales and inventory management. It often includes sections for store information, transaction date, customer details, and payment confirmation.

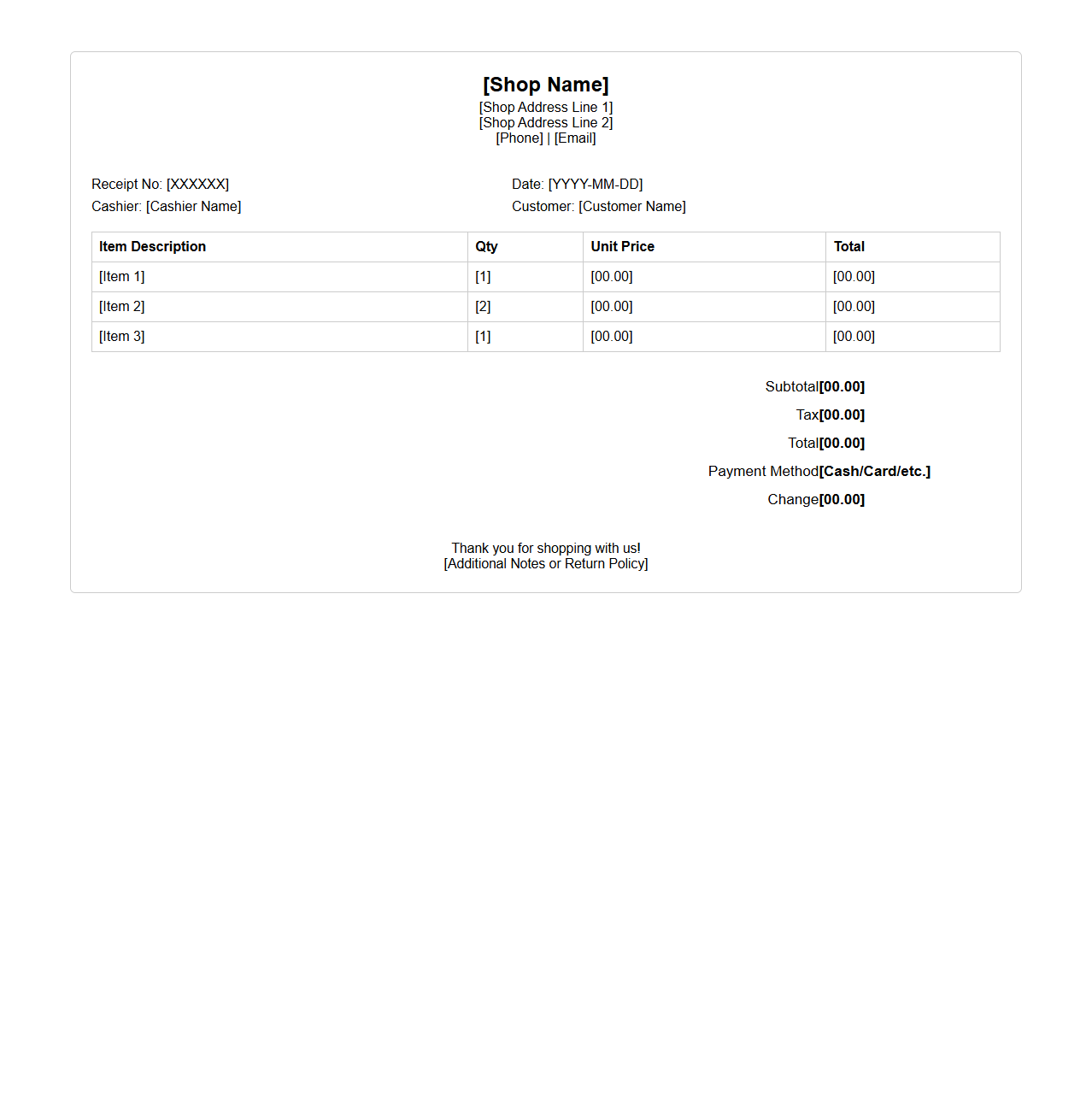

Point of Sale Invoice Format

A

Point of Sale Invoice Format document is a structured receipt generated at the time of a transaction, detailing the products or services sold, quantities, prices, taxes, and total amount payable. It serves as an official record for both the seller and buyer, ensuring transparency in the sales process and compliance with accounting standards. This format typically includes essential elements such as invoice number, date, payment method, and business contact information to facilitate accurate bookkeeping and customer reference.

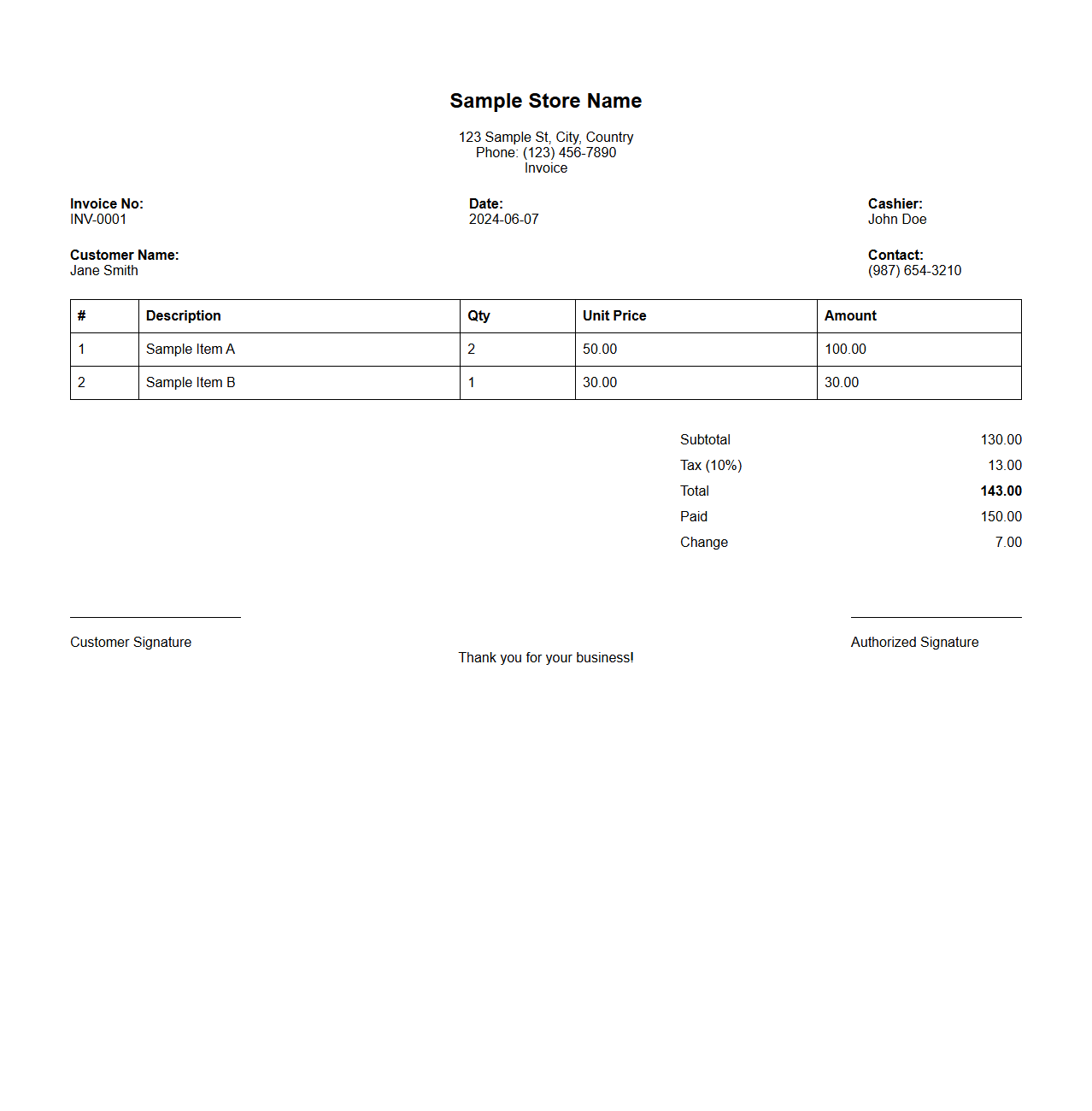

Cash Sales Voucher for Retail Store

A

Cash Sales Voucher for a retail store is a vital financial document that records the details of a cash transaction between the store and the customer. It includes essential information such as the date of sale, items sold, quantity, price, total amount received, and payment mode, ensuring accurate tracking of sales and cash flow. This voucher acts as proof of the transaction, facilitating auditing, inventory management, and financial reporting.

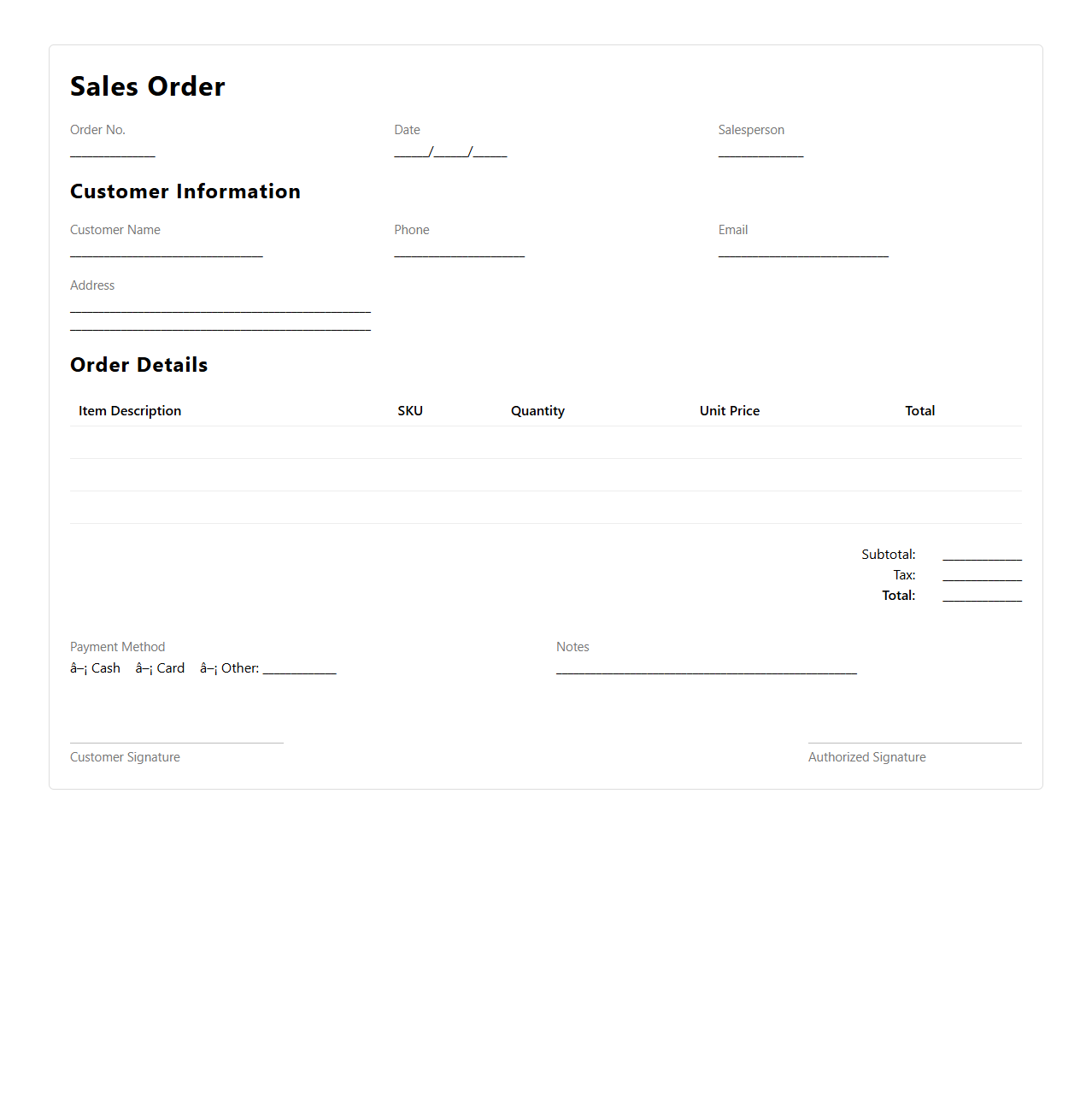

Sales Order Sample for Retail Transactions

A

Sales Order Sample for Retail Transactions document serves as a formal template that outlines the details of a customer's purchase request, including product descriptions, quantities, prices, and payment terms. It functions as an essential record for both the retailer and customer to confirm the specifics of the sale before fulfillment, ensuring accuracy in inventory management and billing. This document streamlines the transaction process by providing clear communication and legal proof of the agreed-upon sale terms.

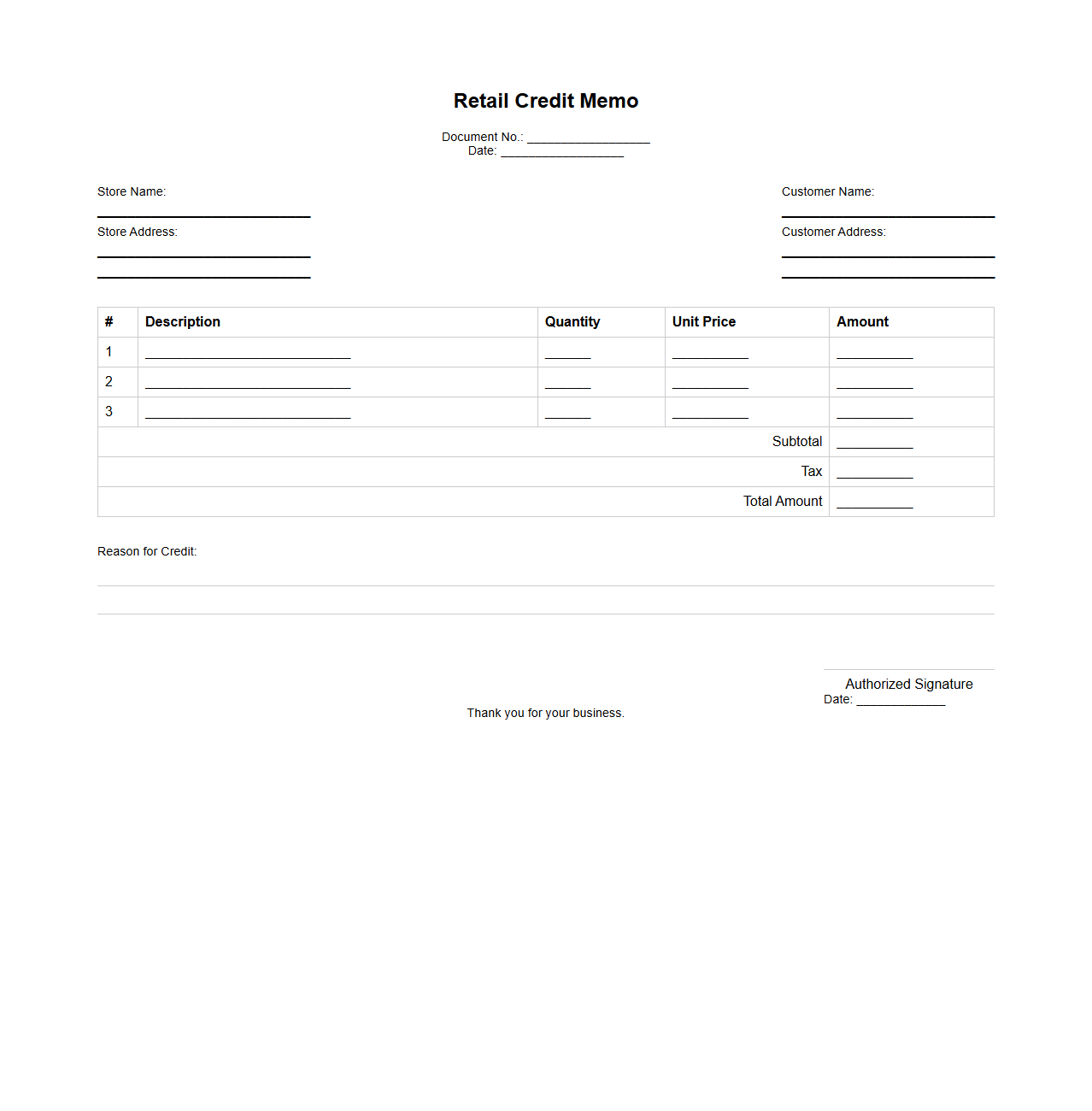

Retail Credit Memo Document

A

Retail Credit Memo Document is an official record issued by a retailer to document a credit transaction, often created when a customer returns merchandise or receives a refund. This document serves to adjust the customer's account balance, reflecting a decrease in the amount owed due to returned goods, pricing errors, or promotional adjustments. Retailers use credit memos to maintain accurate financial records and ensure proper inventory management within their point-of-sale systems.

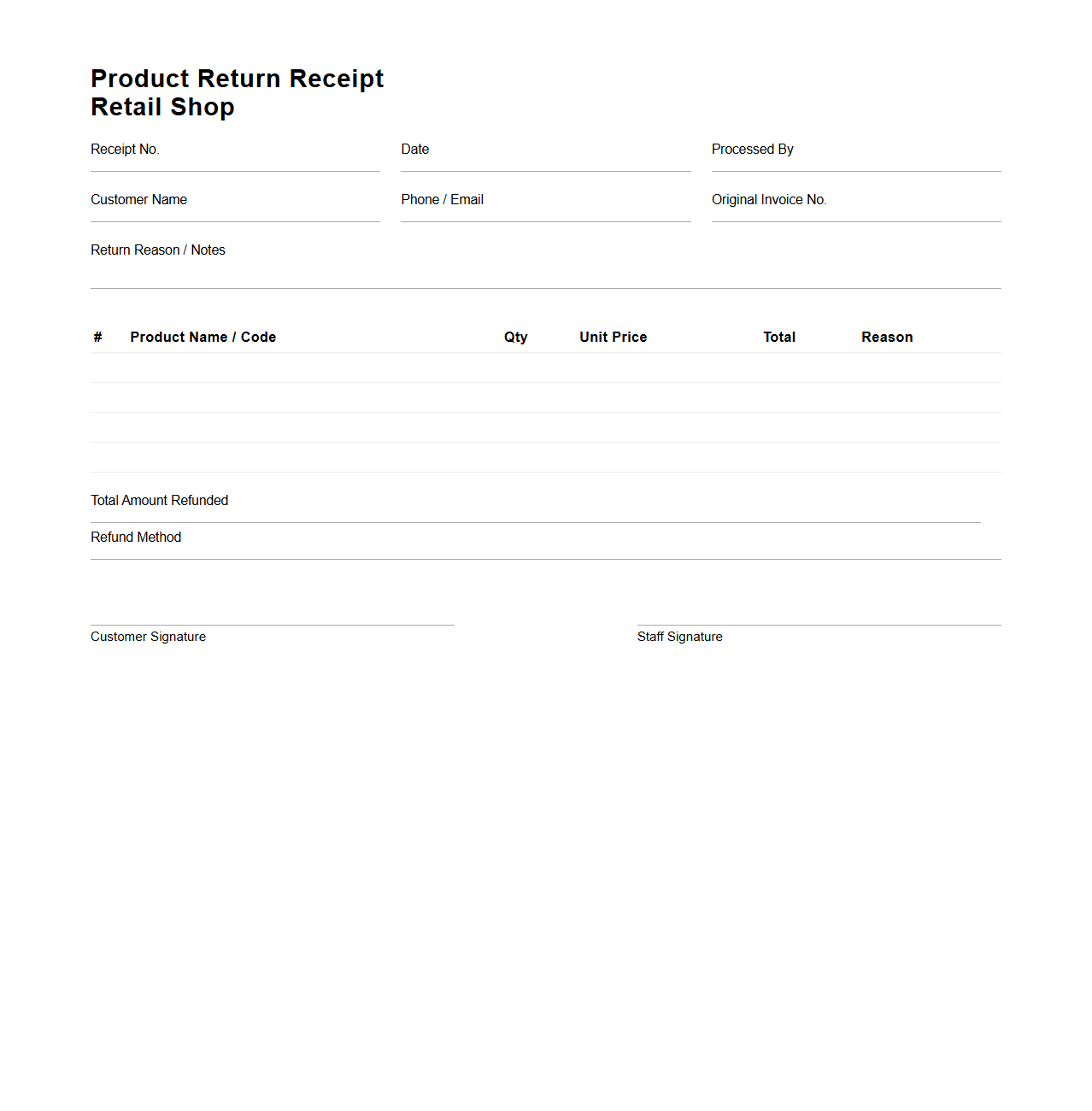

Product Return Receipt for Retail Shop

A

Product Return Receipt for a retail shop is a detailed document that records the return of purchased items from customers, specifying the products, quantities, and reasons for return. This receipt serves as proof of the transaction and helps track inventory adjustments and refund or exchange processes effectively. It ensures both the retailer and customer have a clear record for accountability and future reference.

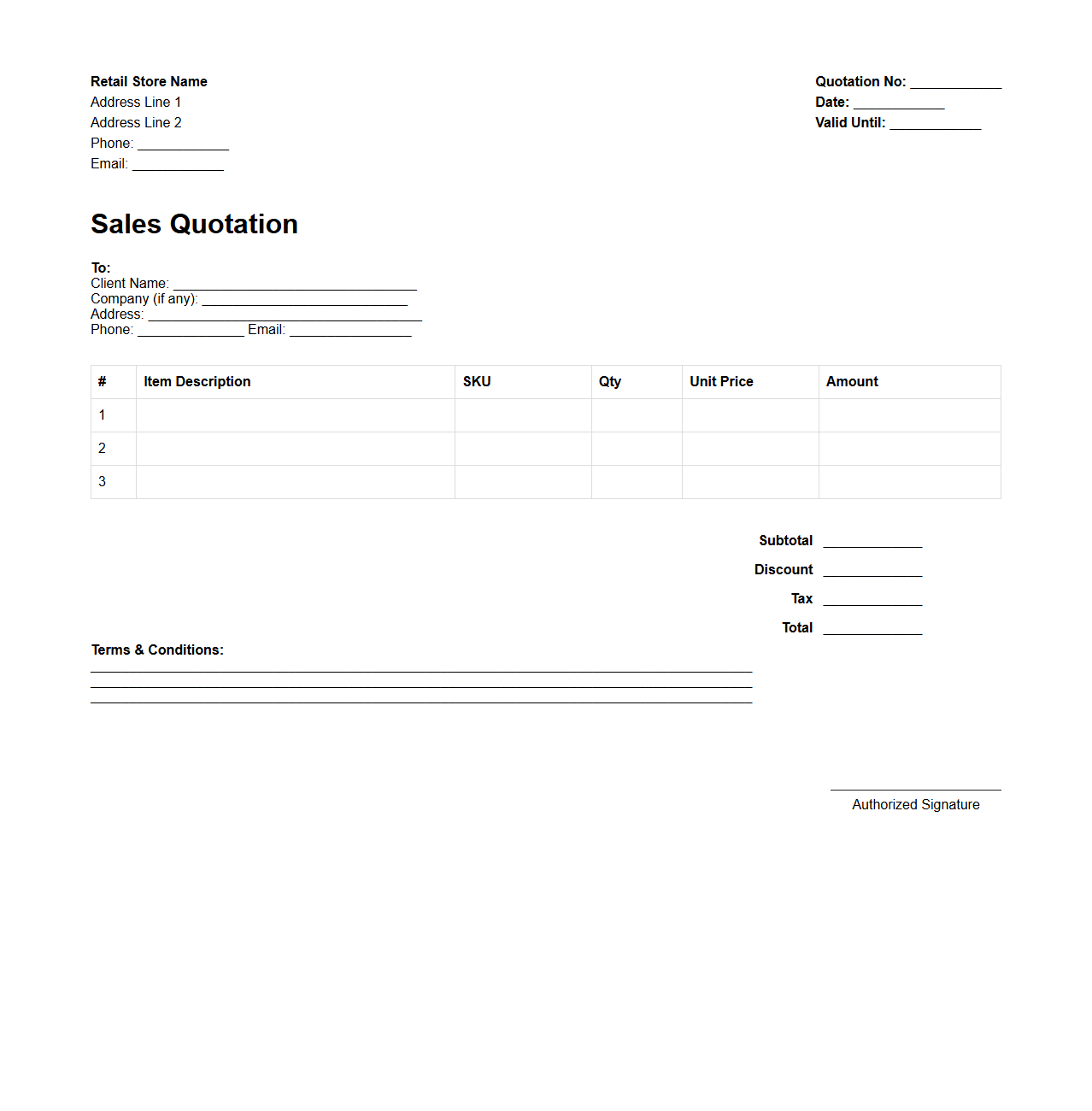

Sales Quotation Template for Retail Store

A

Sales Quotation Template for Retail Store document is a preformatted form used by retail businesses to provide detailed price quotes to potential customers. It outlines the products or services, quantities, individual prices, total costs, and terms of sale, ensuring clear communication and transparency. This template streamlines the sales process, enhances professionalism, and helps in maintaining accurate records for future reference.

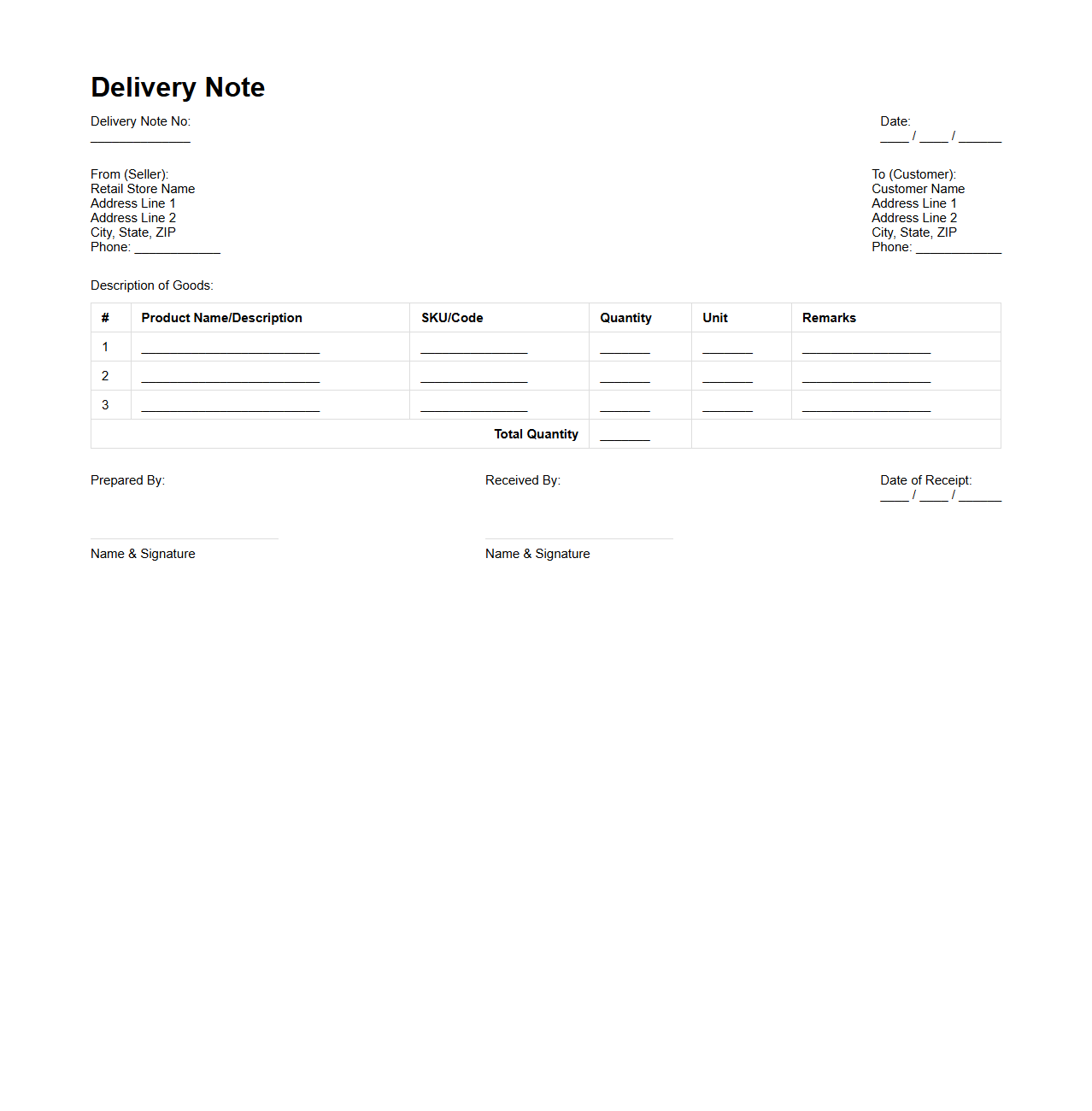

Delivery Note Example for Retail Transactions

A

Delivery Note Example for Retail Transactions document serves as a detailed record accompanying goods shipped to customers, listing items delivered, quantities, and delivery date. It helps verify that the customer received the correct products and supports inventory management and dispute resolution. This document also acts as proof of delivery and ensures transparency between the retailer and the buyer.

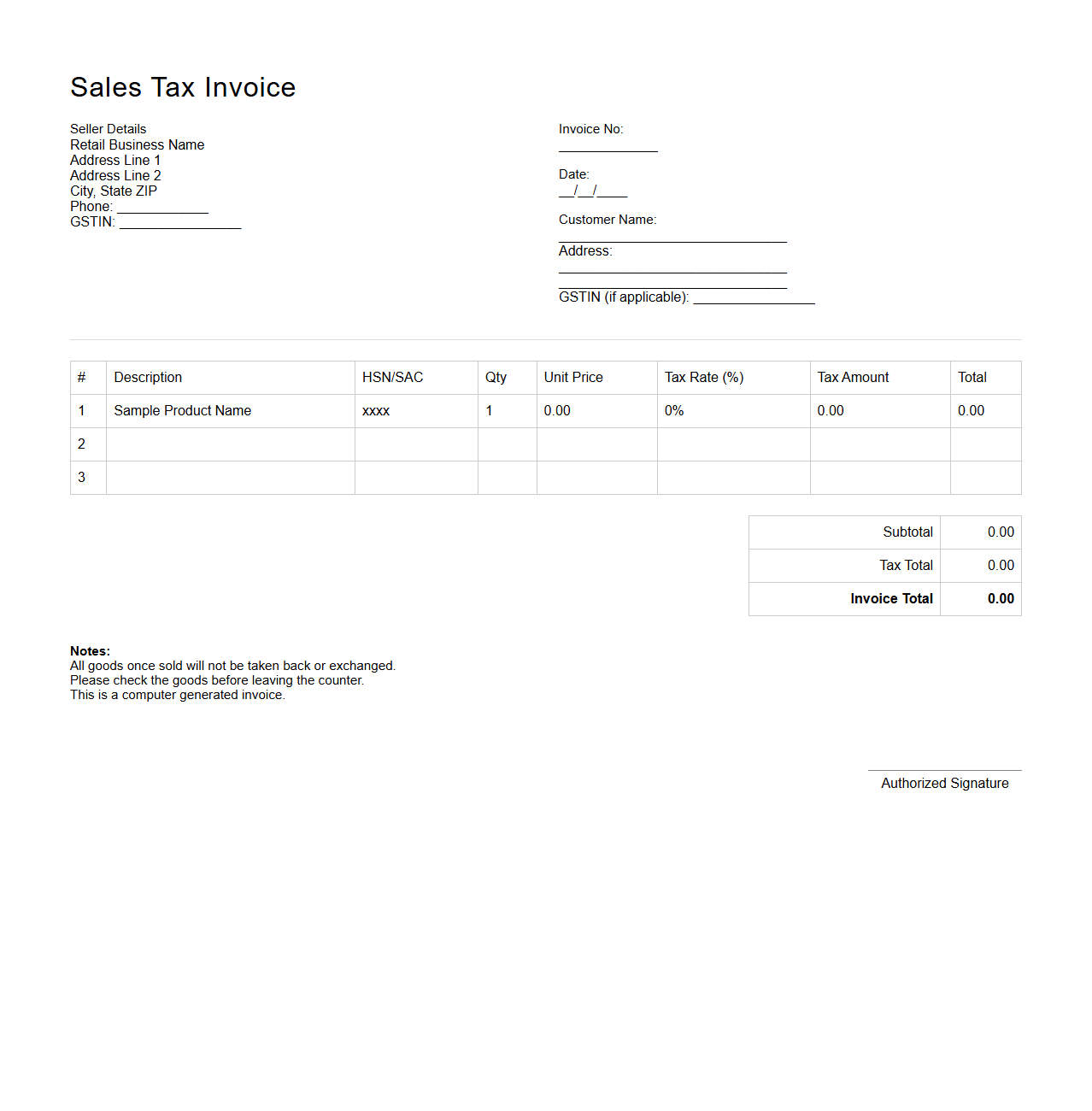

Sales Tax Invoice for Retail Business

A

Sales Tax Invoice for Retail Business is a crucial document that records the details of a transaction between a retailer and a customer, including the sale amount and applicable sales tax. This invoice helps businesses comply with local tax regulations by providing a clear breakdown of taxable goods or services and the corresponding tax charged. Maintaining accurate sales tax invoices ensures proper tax reporting and facilitates seamless audits by tax authorities.

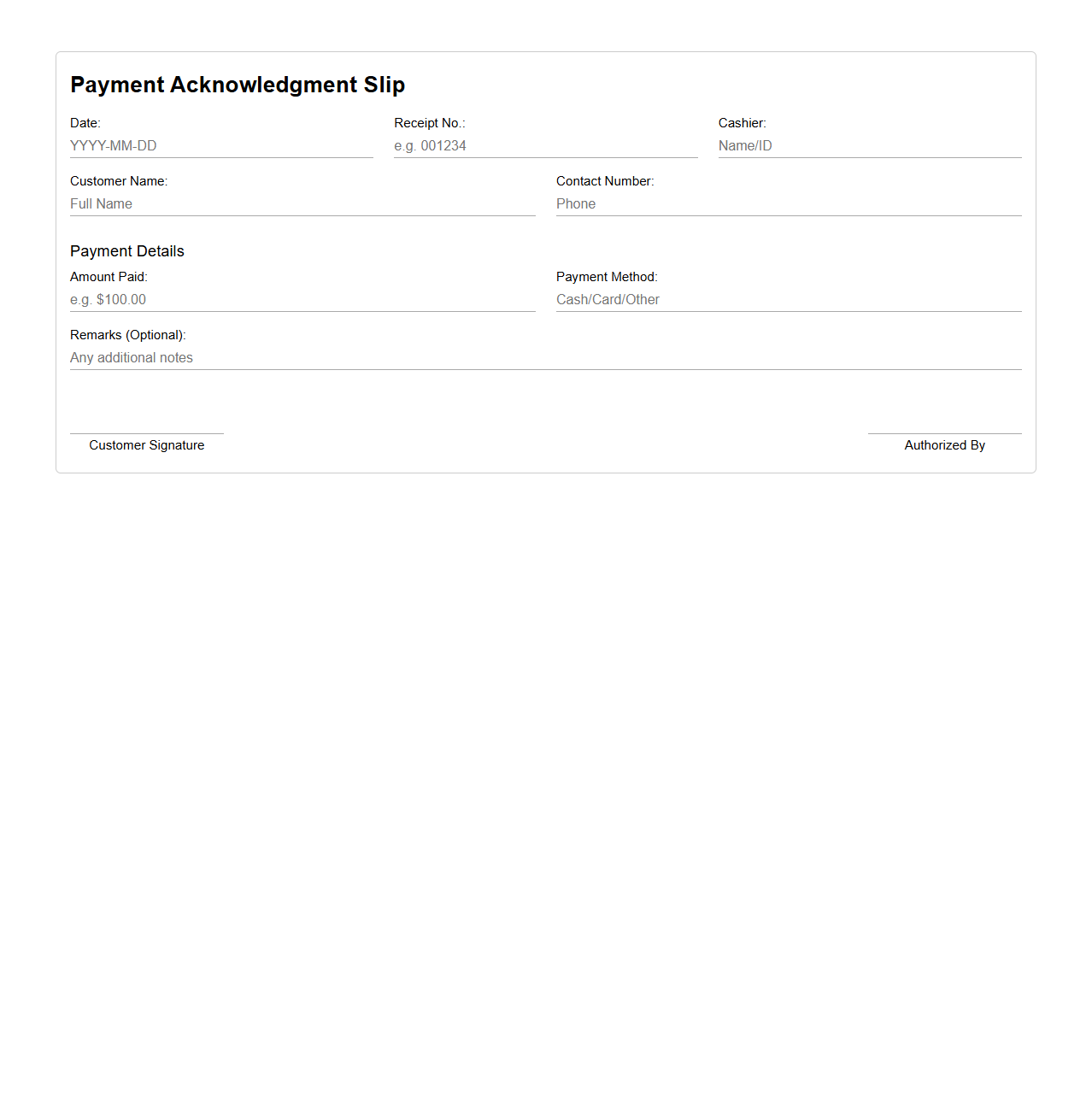

Payment Acknowledgment Slip for Retail Shop

A

Payment Acknowledgment Slip for a retail shop is a crucial document that serves as proof of payment made by a customer for goods or services. It details essential information such as the amount paid, payment method, date, and transaction reference, ensuring transparency and record-keeping for both the retailer and the customer. This slip helps prevent disputes, facilitates easy return or exchange processes, and maintains accurate financial records for the business.

What information uniquely identifies each sales transaction in the document?

The transaction ID is the primary data that uniquely identifies each sales transaction in the document. This unique identifier ensures each sale can be referenced without confusion. Additionally, the date and time of the transaction provide temporal context, helping to track when the sale occurred.

Which details specify the items or products sold in the transaction?

The product name and SKU number are key details that specify items sold in the transaction. Each product entry typically includes quantity and unit price, giving a complete view of what was purchased. These details help distinguish each item for inventory and billing purposes.

How is the total amount payable by the customer calculated and presented?

The total amount payable is calculated by summing the prices of all individual items after multiplying by their quantities. Additional taxes and discounts are applied to arrive at the final payable amount. This total is presented prominently to ensure clarity for the customer at the end of the transaction summary.

What fields capture customer identity and contact information in the document?

Customer name and address fields capture the essential identity information of the buyer. Contact details such as phone number and email address are also recorded for communication purposes. These fields ensure that the business can follow up or deliver goods accurately.

Which sections outline payment methods and transaction completion status?

The payment method section specifies if the transaction was completed using cash, credit card, or other payment options. The payment status field indicates whether the transaction is finalized or pending. These sections help in tracking transaction completion and reconciliation of payments in records.