The Payroll Information Document Sample for New Employees serves as a comprehensive template to capture essential payroll details such as employee identification, tax withholding preferences, and direct deposit information. This document ensures accurate and timely salary processing by standardizing data collection for HR and payroll departments. New employees benefit from clear instructions and organized fields, facilitating smooth onboarding and payroll setup.

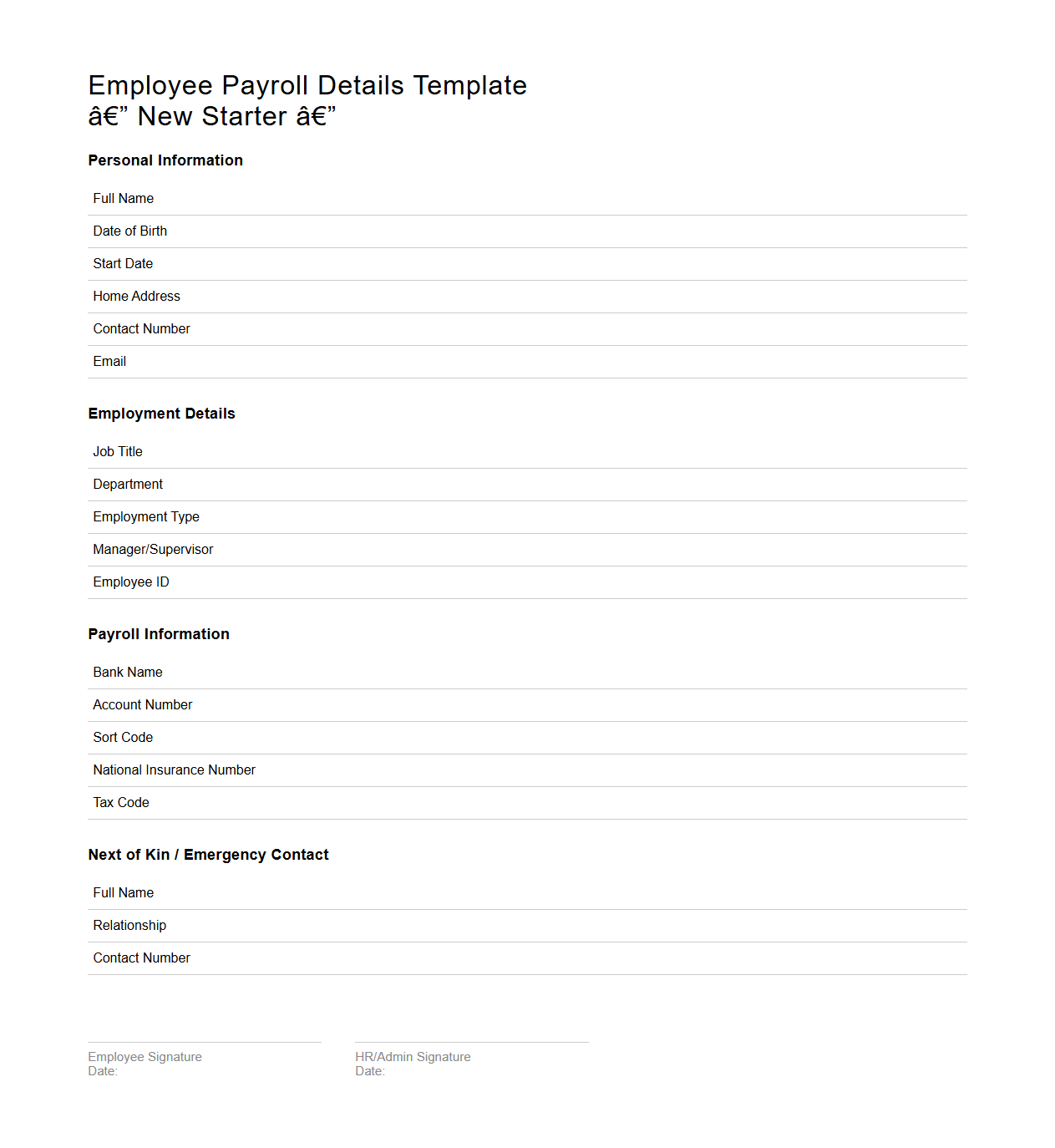

Employee Payroll Details Template for New Starters

The

Employee Payroll Details Template for new starters is a structured document designed to collect essential payroll information such as bank account details, tax identification numbers, and salary components. This template ensures accurate and timely processing of employee compensation while maintaining compliance with company policies and legal requirements. Using this document streamlines onboarding by capturing all payroll data in a standardized format, reducing administrative errors and delays.

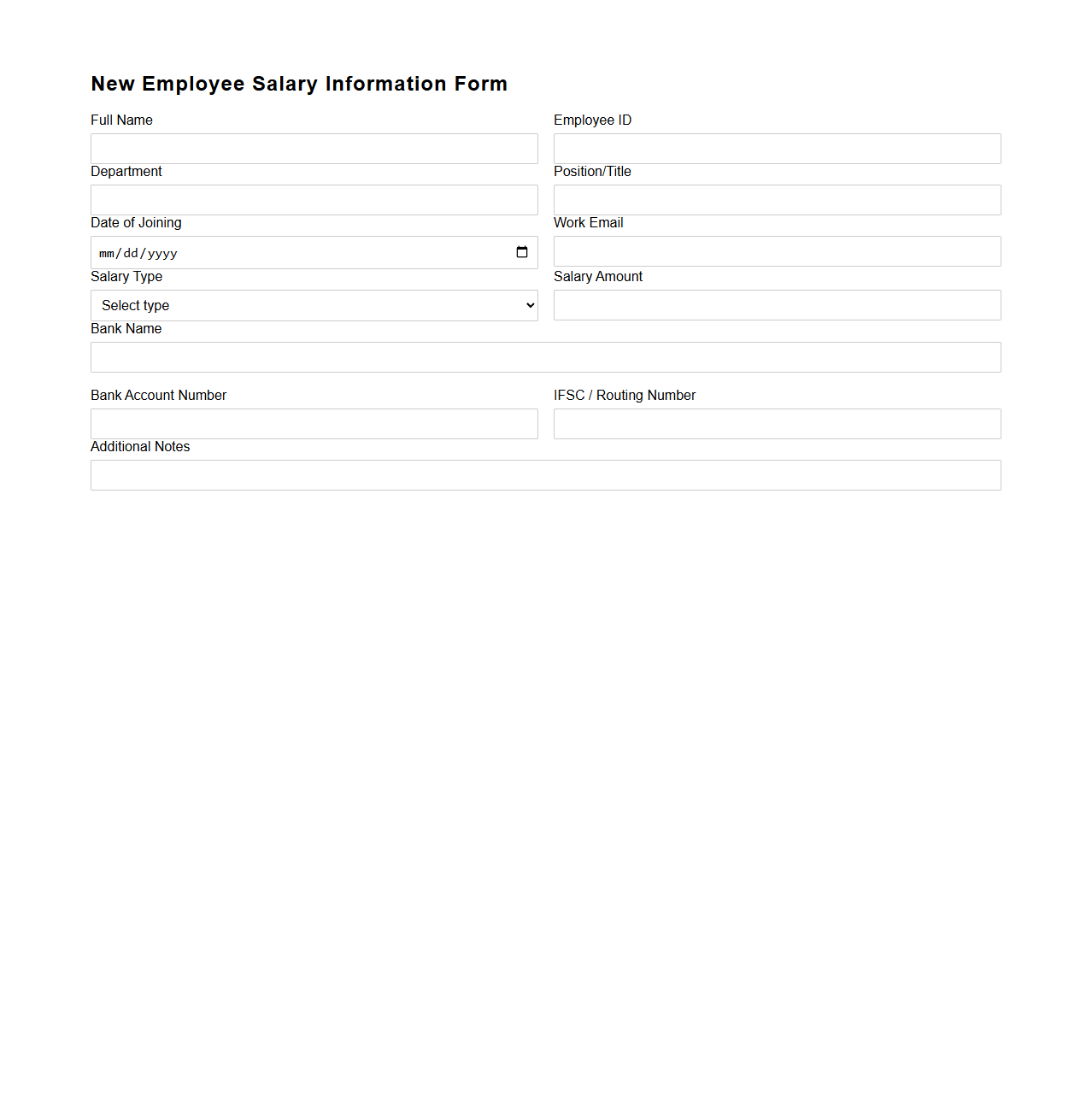

New Employee Salary Information Form

The

New Employee Salary Information Form is a crucial document used by organizations to record and verify the initial salary details of a newly hired employee. It typically includes fields for salary amount, payment frequency, job title, and any applicable bonuses or deductions. Accurate completion of this form ensures proper payroll processing and compliance with company policies and labor regulations.

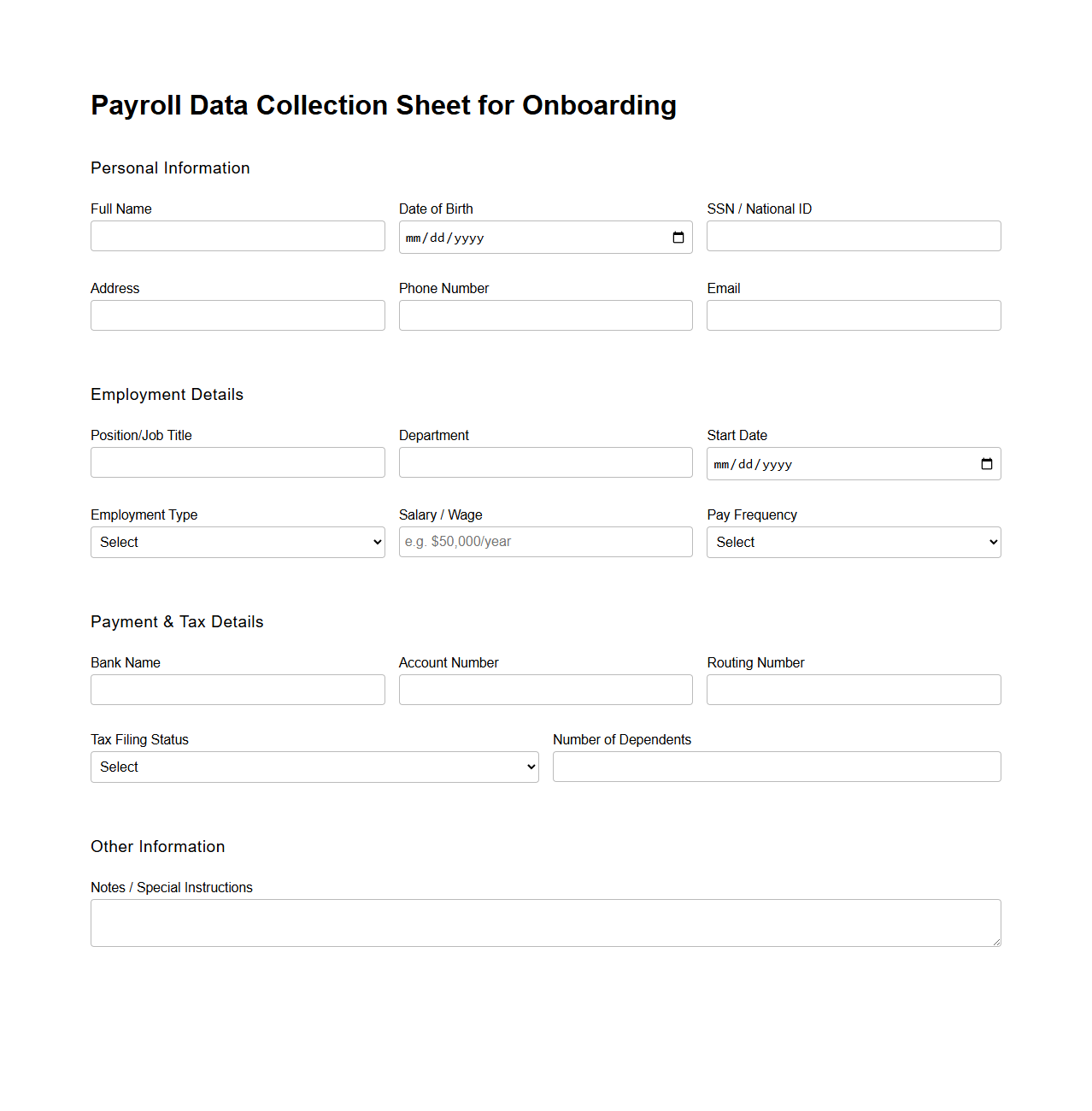

Payroll Data Collection Sheet for Onboarding

A

Payroll Data Collection Sheet for onboarding is a vital document used to gather essential employee information necessary for accurate salary processing and tax compliance. This sheet typically includes details such as bank account information, tax identification numbers, salary structure, and benefits data to ensure smooth and timely payroll management. Maintaining accurate payroll data helps organizations avoid payment errors and meet legal obligations efficiently.

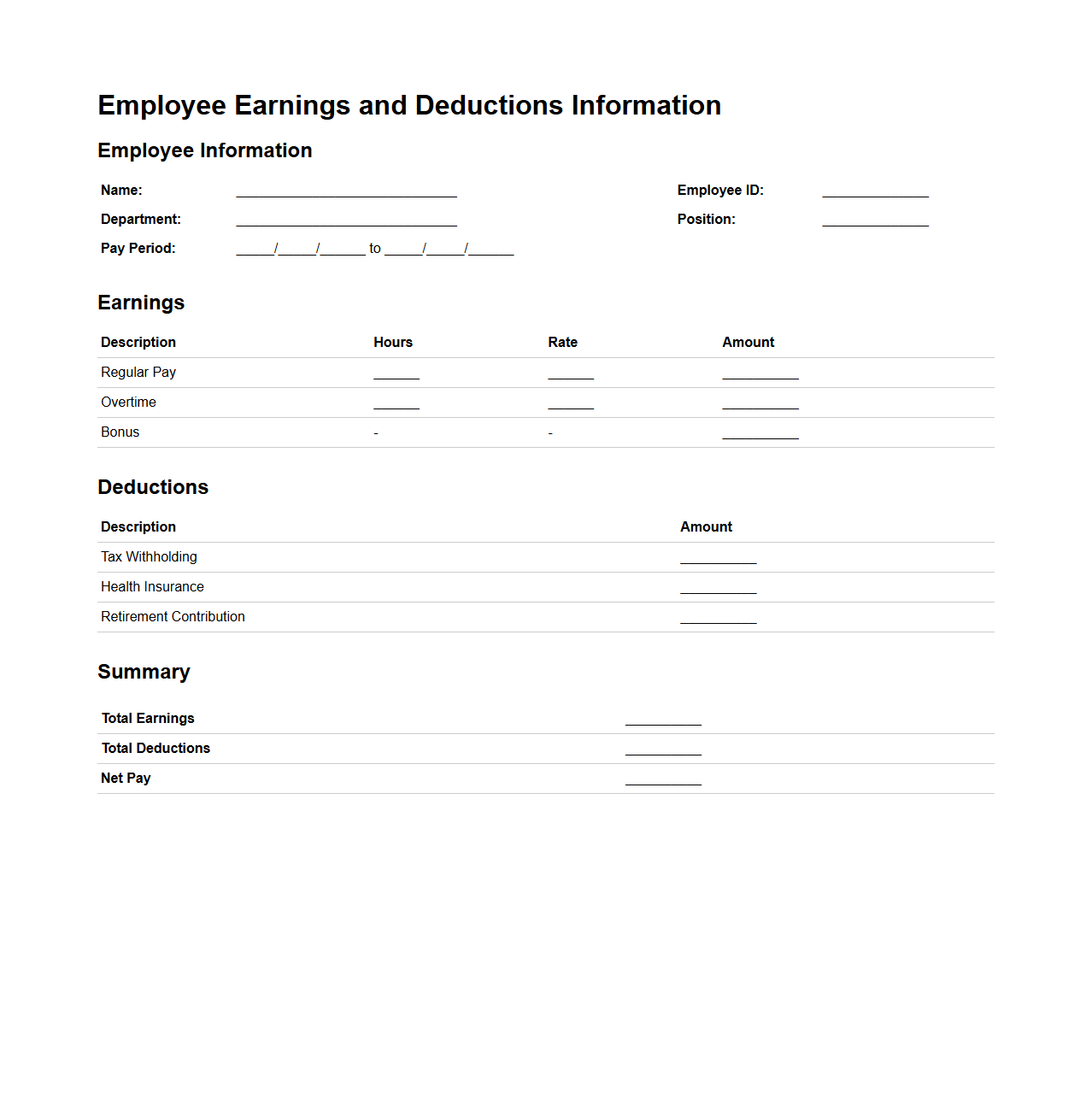

Employee Earnings and Deductions Information Sample

The

Employee Earnings and Deductions Information Sample document provides a detailed summary of an employee's gross earnings and all applicable payroll deductions within a specified pay period. It includes key data such as wages, bonuses, tax withholdings, retirement contributions, and insurance premiums, ensuring transparency and accuracy in payroll processing. Employers use this document to maintain compliance with labor laws and to help employees understand their net pay and benefits.

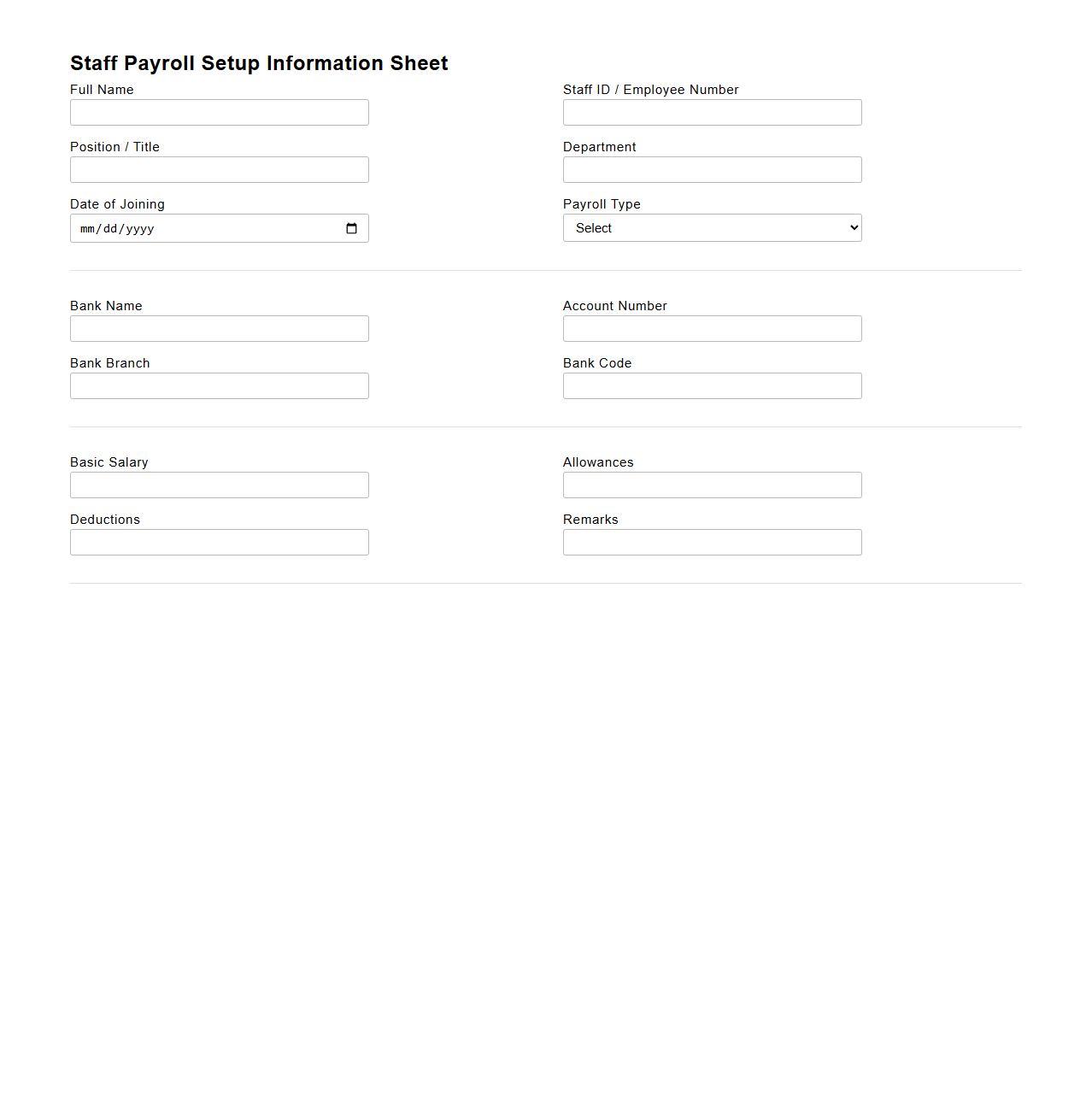

Staff Payroll Setup Information Sheet

The

Staff Payroll Setup Information Sheet is a critical document used to collect and organize employee payroll details including tax information, bank account data, and salary structure. It ensures accurate and compliant payroll processing by capturing essential information such as employee identification, payment schedules, and deduction preferences. This sheet serves as the foundational record for payroll administrators to streamline salary disbursement and maintain legal payroll compliance.

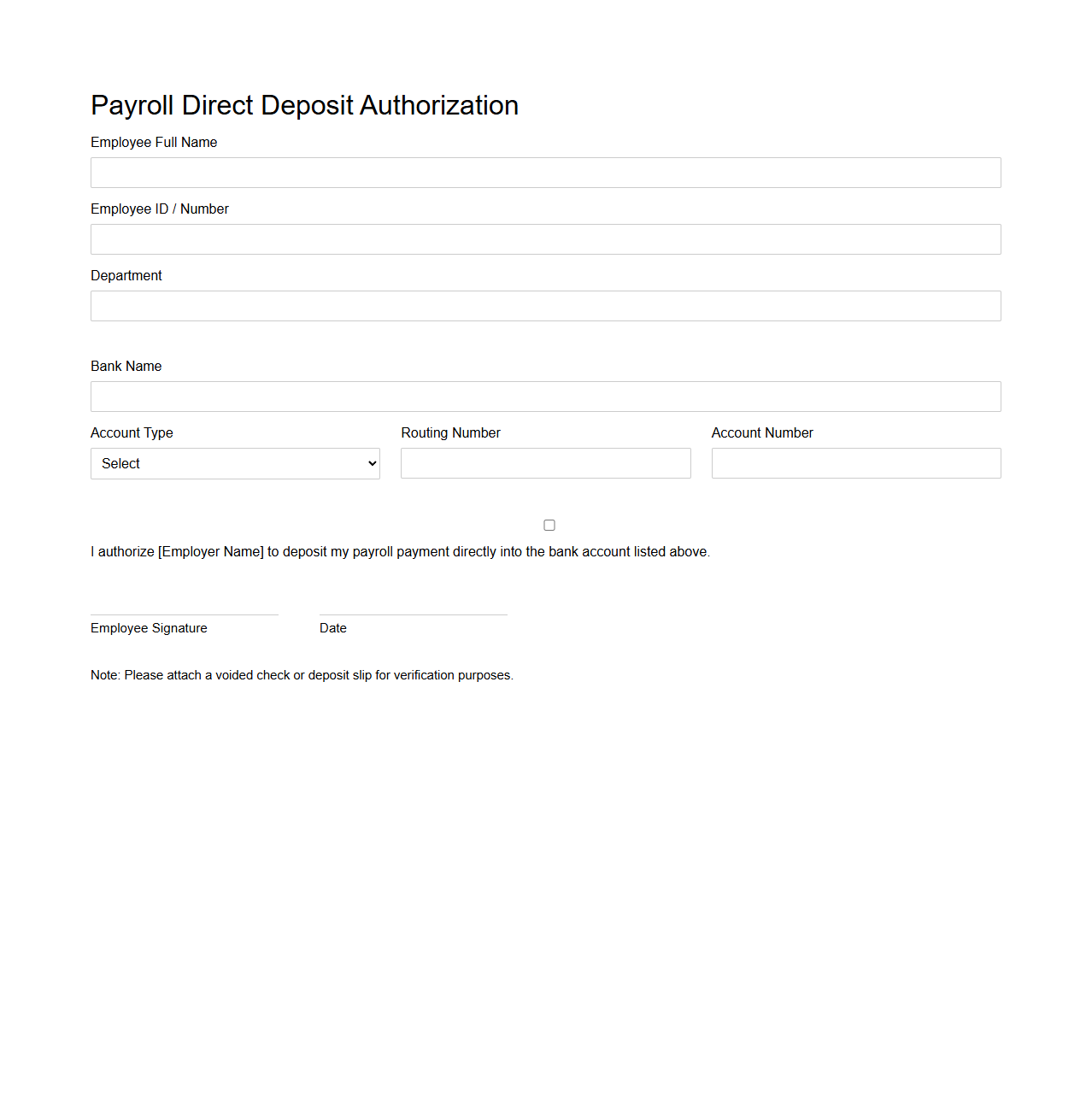

Payroll Direct Deposit Authorization Document

Payroll Direct Deposit Authorization Document is a formal agreement that allows employers to electronically transfer an employee's paycheck directly into their bank account. This document includes essential information such as bank account number, routing number, and authorization signature, ensuring secure and timely payment. Utilizing

payroll direct deposit authorization improves payment efficiency, reduces paper check handling, and enhances employee convenience.

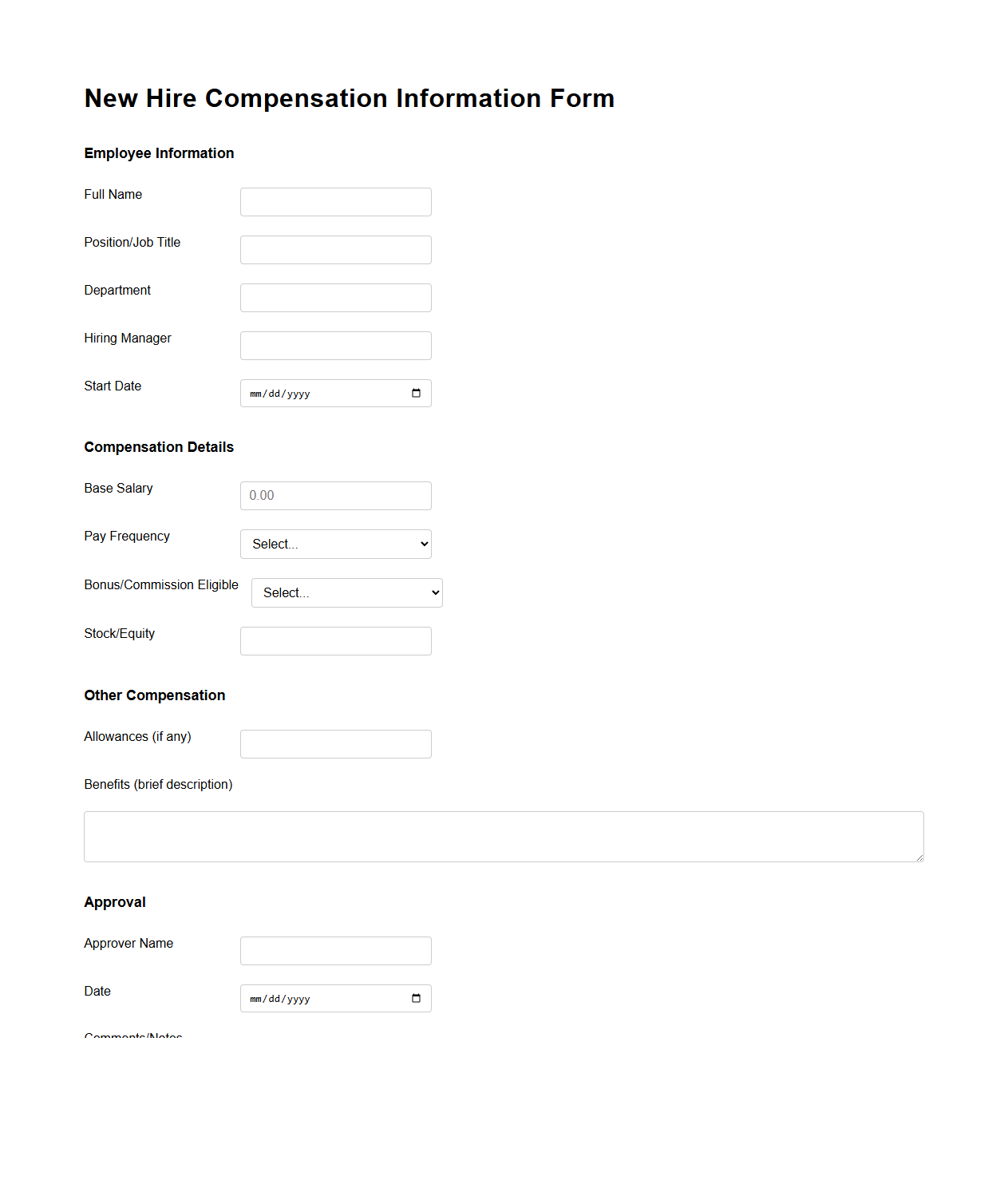

New Hire Compensation Information Form

The

New Hire Compensation Information Form is a critical document used by employers to outline and record the salary, bonuses, benefits, and other remuneration details for newly hired employees. It ensures accurate payroll setup, compliance with company policies, and helps streamline the onboarding process. This form serves as a reference for both HR departments and new hires to confirm the agreed-upon compensation package.

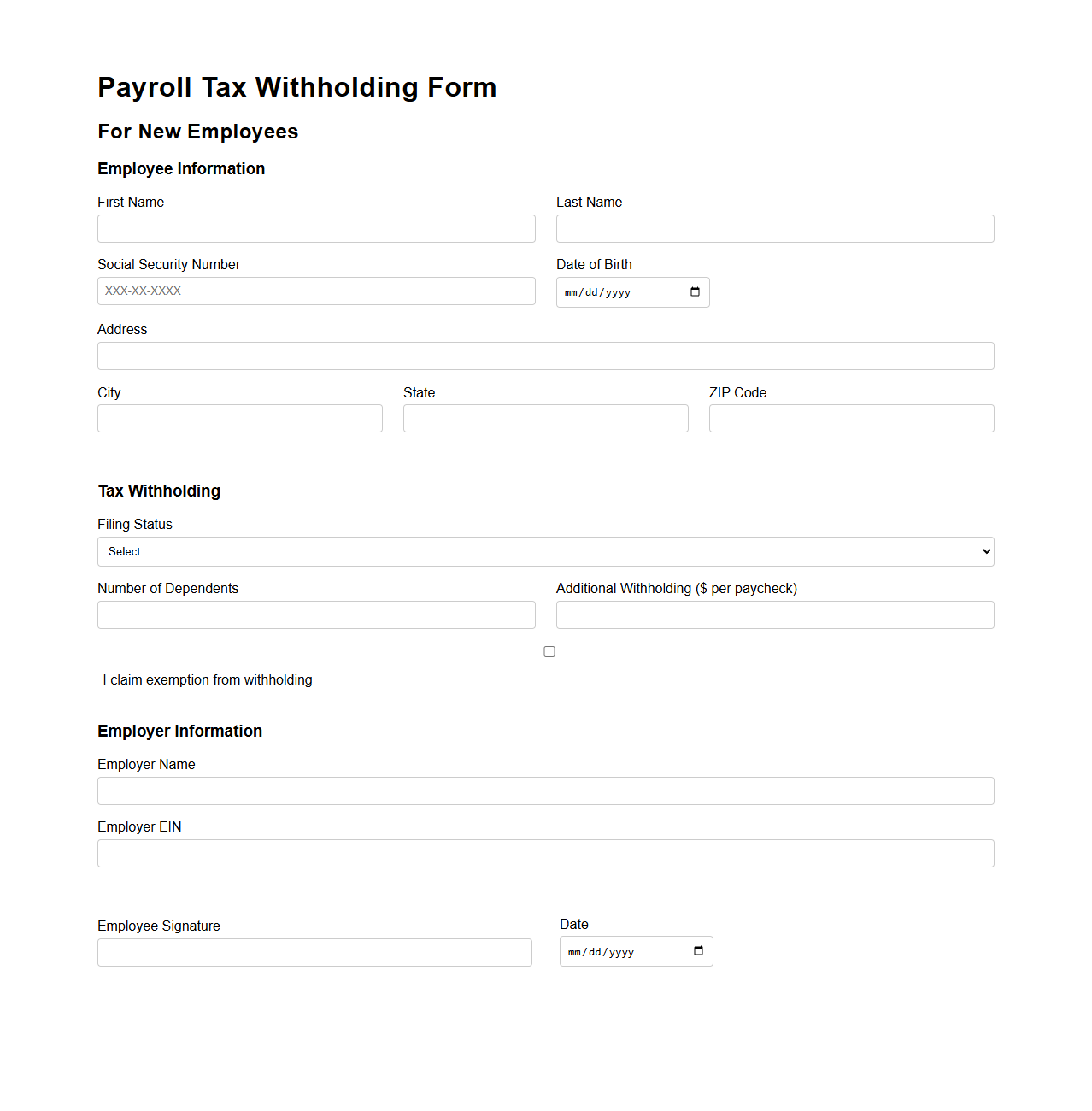

Payroll Tax Withholding Form for New Employees

The

Payroll Tax Withholding Form for New Employees is a critical document used to determine the correct amount of federal and state income taxes to withhold from an employee's paycheck. This form collects essential personal information, filing status, and withholding allowances to accurately calculate tax deductions in compliance with IRS regulations. Proper completion ensures employees avoid underpayment or overpayment of taxes, supporting accurate payroll processing and legal tax reporting.

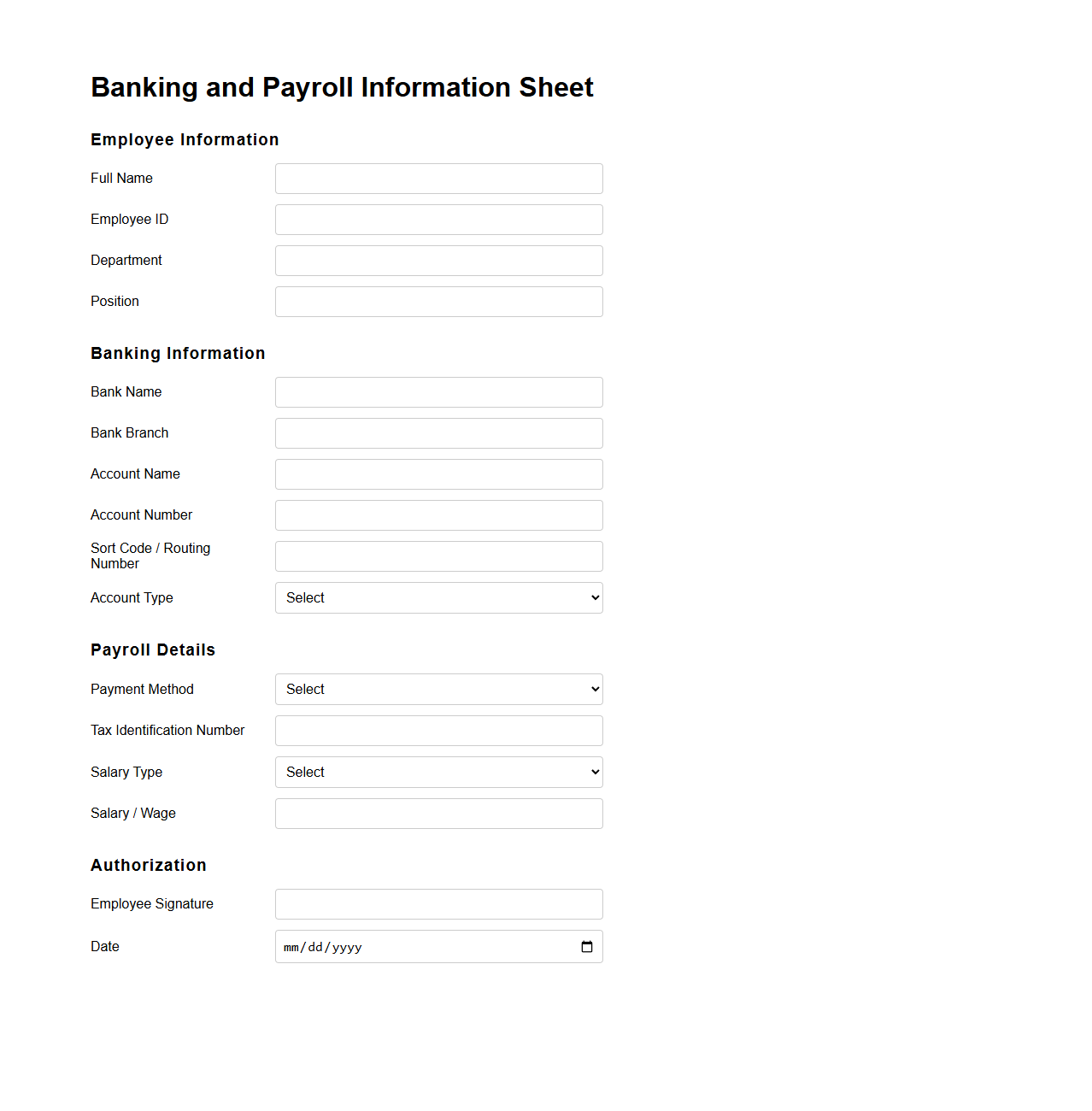

Banking and Payroll Information Sheet

A

Banking and Payroll Information Sheet is a crucial document that collects employees' bank account details and payroll preferences to ensure accurate salary deposits and tax compliance. It typically includes information such as bank name, account number, routing number, tax withholding status, and direct deposit instructions. This sheet streamlines payroll processing, minimizes errors, and facilitates timely payment distribution in organizations.

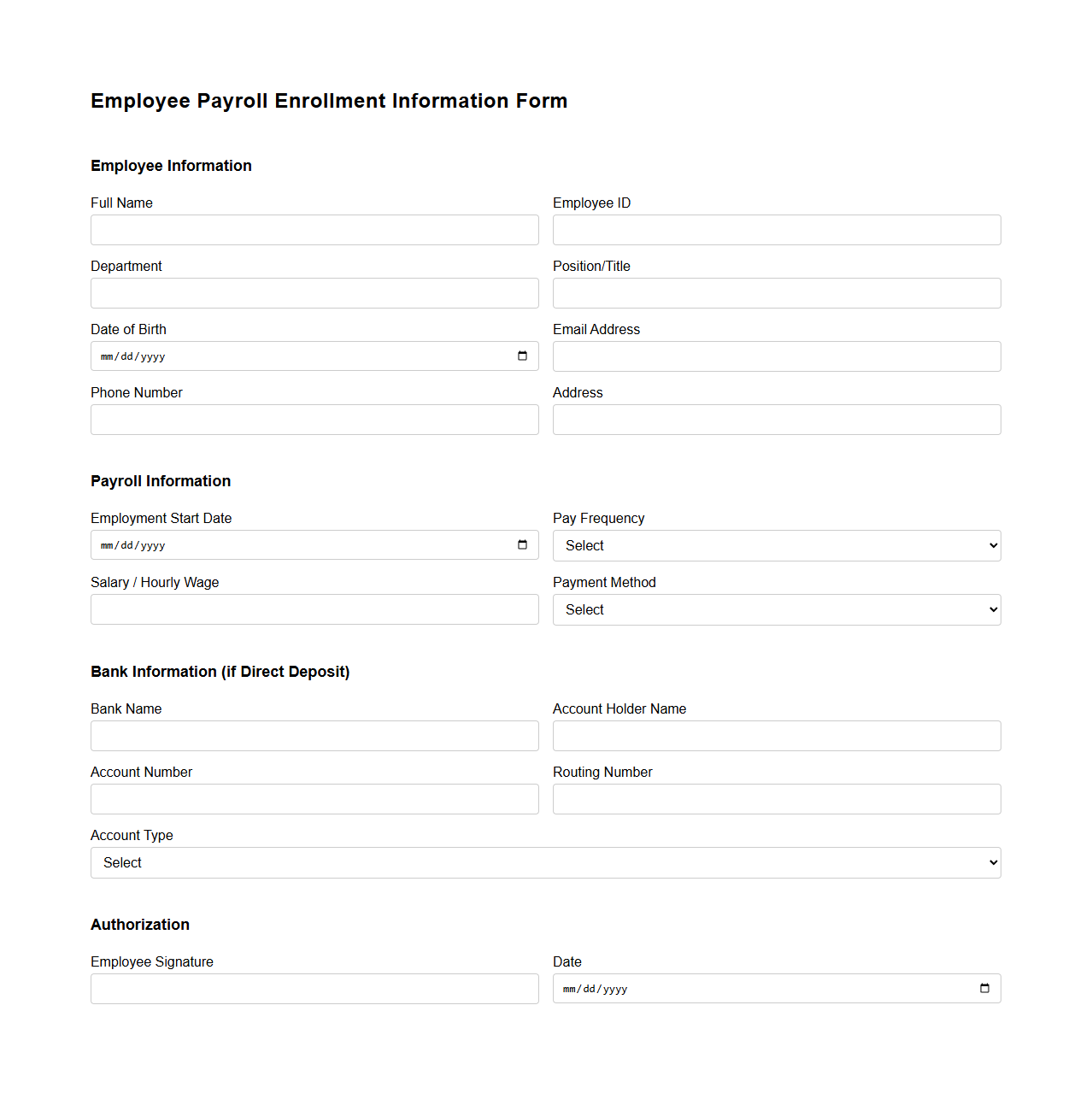

Employee Payroll Enrollment Information Form

The

Employee Payroll Enrollment Information Form is a critical document used to collect essential details from new hires or current employees for payroll processing purposes. It typically includes personal information, tax withholding preferences, direct deposit details, and benefit selections to ensure accurate and timely salary payments. Employers rely on this form to comply with tax regulations and streamline payroll administration.

What specific payroll deductions are outlined in the new employee letter?

The new employee letter clearly details mandatory payroll deductions such as federal income tax, Social Security, and Medicare. Additionally, it mentions voluntary deductions including health insurance premiums and retirement plan contributions. Employees are encouraged to review these deductions carefully to understand their impact on take-home pay.

How does the document address new hire payment schedule options?

The document outlines the payment schedule options available to new hires, typically ranging from bi-weekly to monthly pay periods. It emphasizes the importance of selecting a preferred schedule during onboarding to ensure timely payments. Clear instructions are provided on how to communicate any changes to the payroll department.

Are direct deposit setup instructions included in the payroll information letter?

Yes, the payroll information letter contains comprehensive direct deposit setup instructions for new employees. It guides employees through the process of submitting bank details securely to enable electronic payments. The letter also highlights the benefits of direct deposit, such as faster access to funds and reduced paperwork.

Which tax forms are referenced for payroll processing in the letter?

The letter references essential tax forms, including the W-4 form for federal tax withholding and state-specific withholding forms as applicable. It stresses the importance of submitting accurate and timely forms to ensure correct payroll deductions. Employees are reminded to update their tax information whenever there are changes in their personal circumstances.

Does the letter specify the protocol for reporting payroll discrepancies?

Yes, the letter specifies a clear protocol for reporting payroll discrepancies, urging employees to contact the payroll department immediately upon noticing errors. It details the steps for submitting discrepancy reports and the expected timeline for resolution. The letter assures employees that all concerns will be handled confidentially and promptly.

More Human resources Templates