A Beneficiary Designation Document Sample for Accident Insurance outlines the specific individuals or entities entitled to receive insurance benefits in the event of an accident. This document ensures clear communication of the policyholder's intentions, preventing disputes during claim processing. Properly completing a beneficiary designation protects loved ones by guaranteeing timely distribution of accident insurance proceeds.

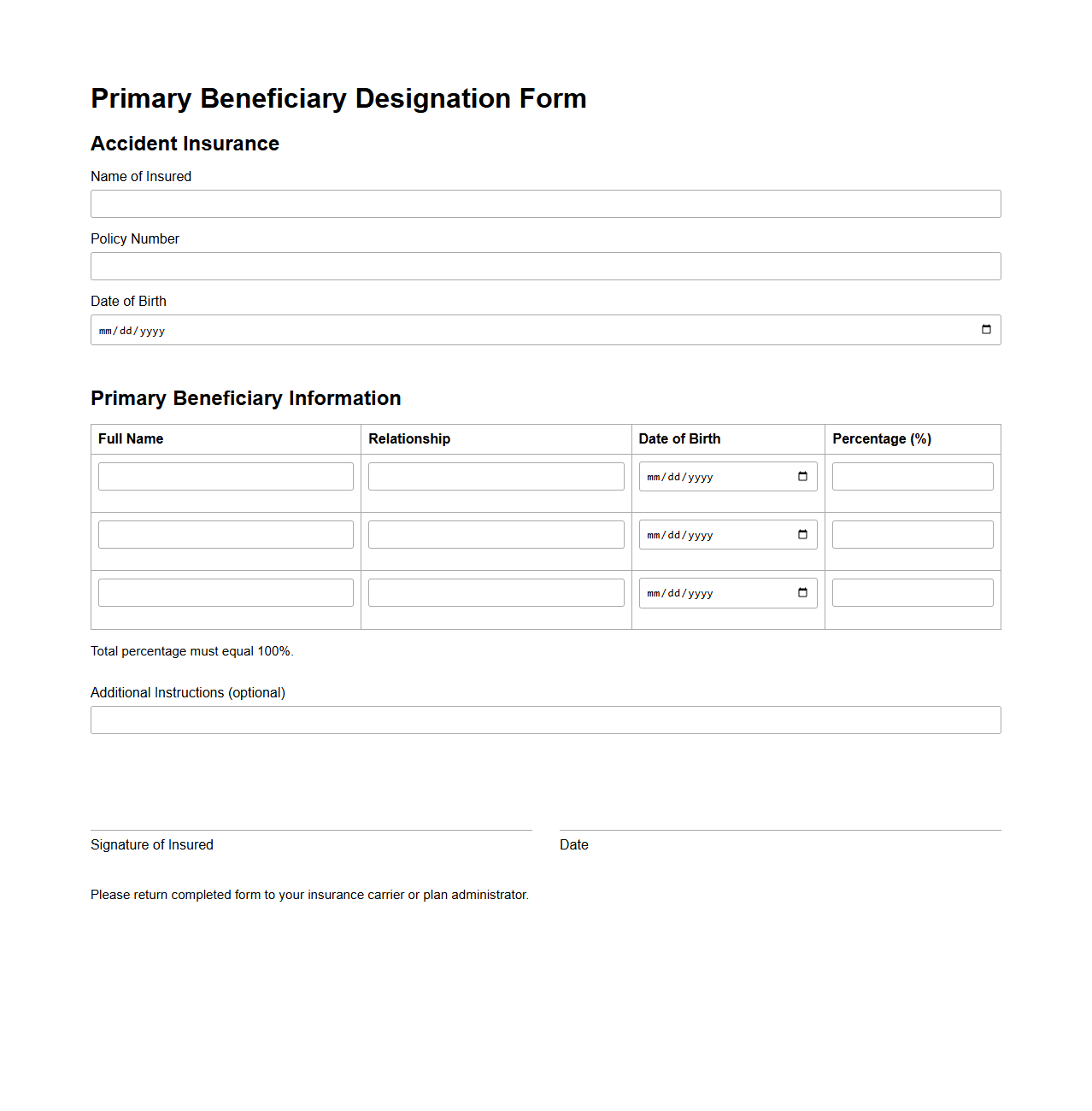

Primary Beneficiary Designation Form for Accident Insurance

The

Primary Beneficiary Designation Form for Accident Insurance is a crucial document that allows policyholders to specify who will receive the insurance benefits in the event of an accident-related claim. This form ensures that the payout from the accident insurance policy is directed according to the policyholder's wishes, providing clarity and preventing disputes among potential beneficiaries. Accurate completion of this form is essential for timely and efficient processing of benefits following an accident.

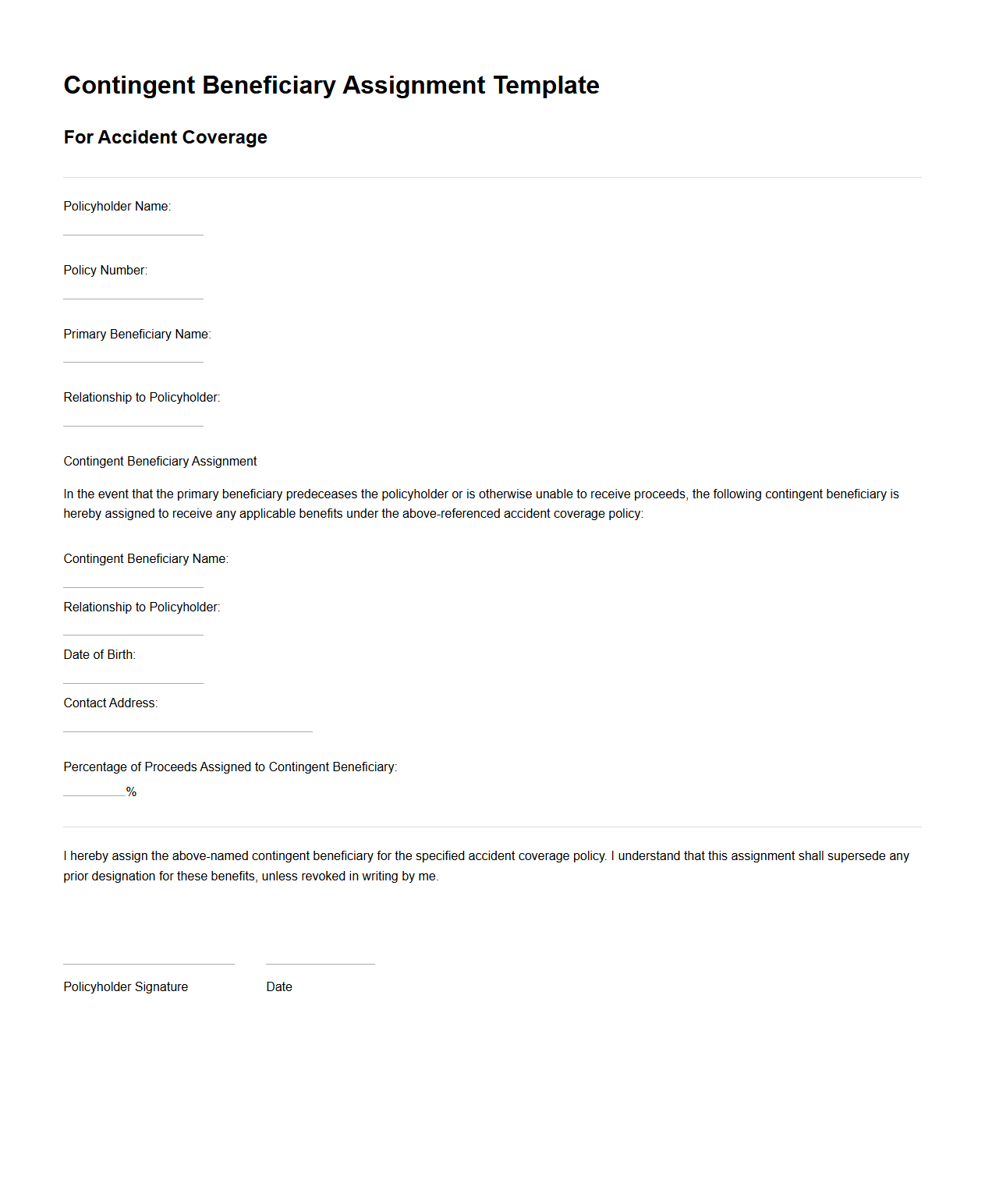

Contingent Beneficiary Assignment Template for Accident Coverage

A

Contingent Beneficiary Assignment Template for Accident Coverage document is a legally structured form that designates backup recipients for accident insurance benefits if the primary beneficiaries are unable to claim them. This template ensures clarity in benefit distribution by specifying alternate parties, reducing disputes during claims processing. It serves as an essential tool for individuals seeking to secure accident coverage payouts efficiently and accurately.

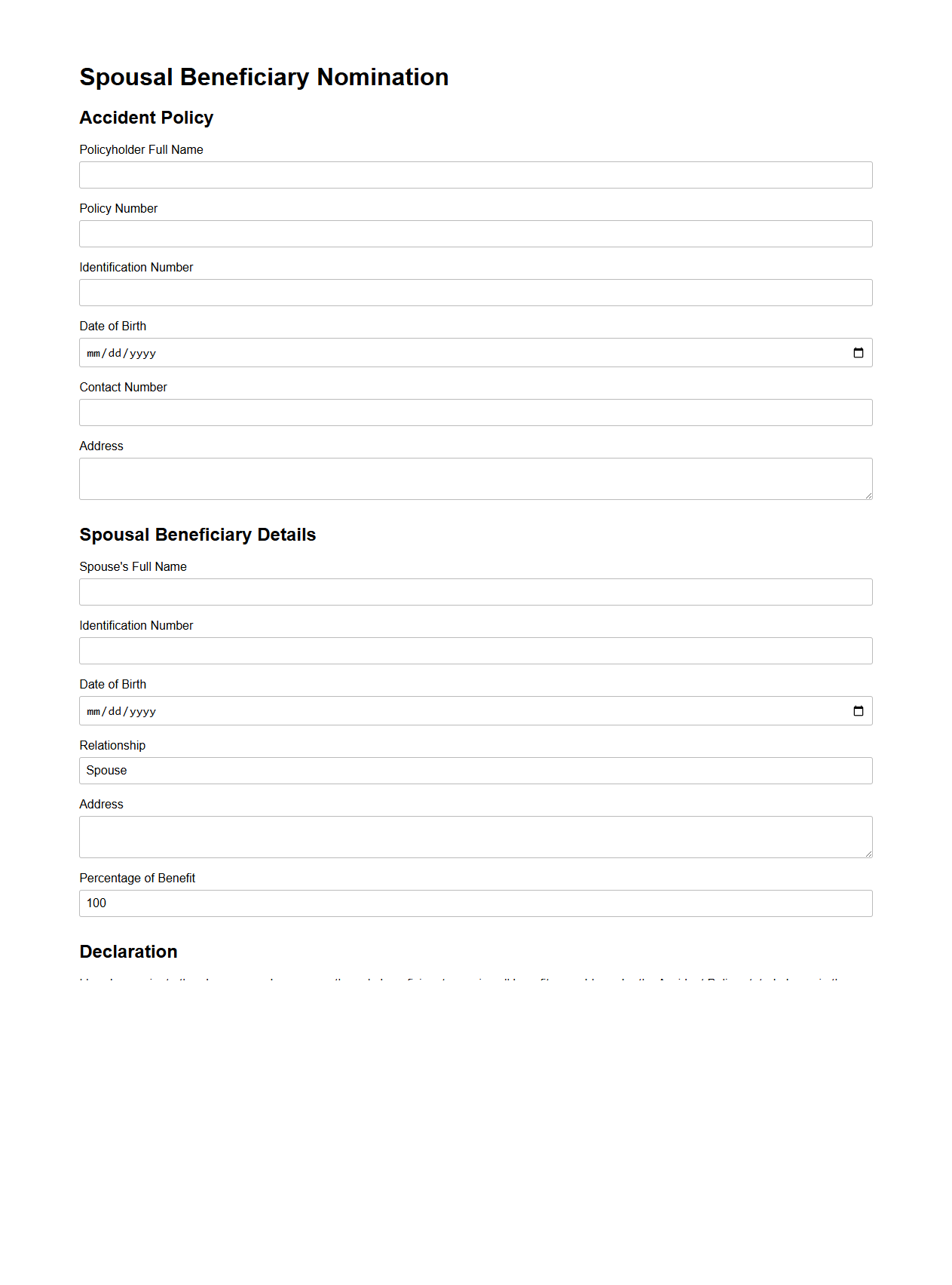

Spousal Beneficiary Nomination Document for Accident Policy

A

Spousal Beneficiary Nomination Document for an Accident Policy is a legal form that allows a policyholder to designate their spouse as the recipient of benefits in the event of an accident-related claim. This document ensures that the financial compensation from the accident policy is directed to the spouse without disputes or delays. Proper submission of this nomination is crucial to secure the spouse's rights and avoid probate complications during claims processing.

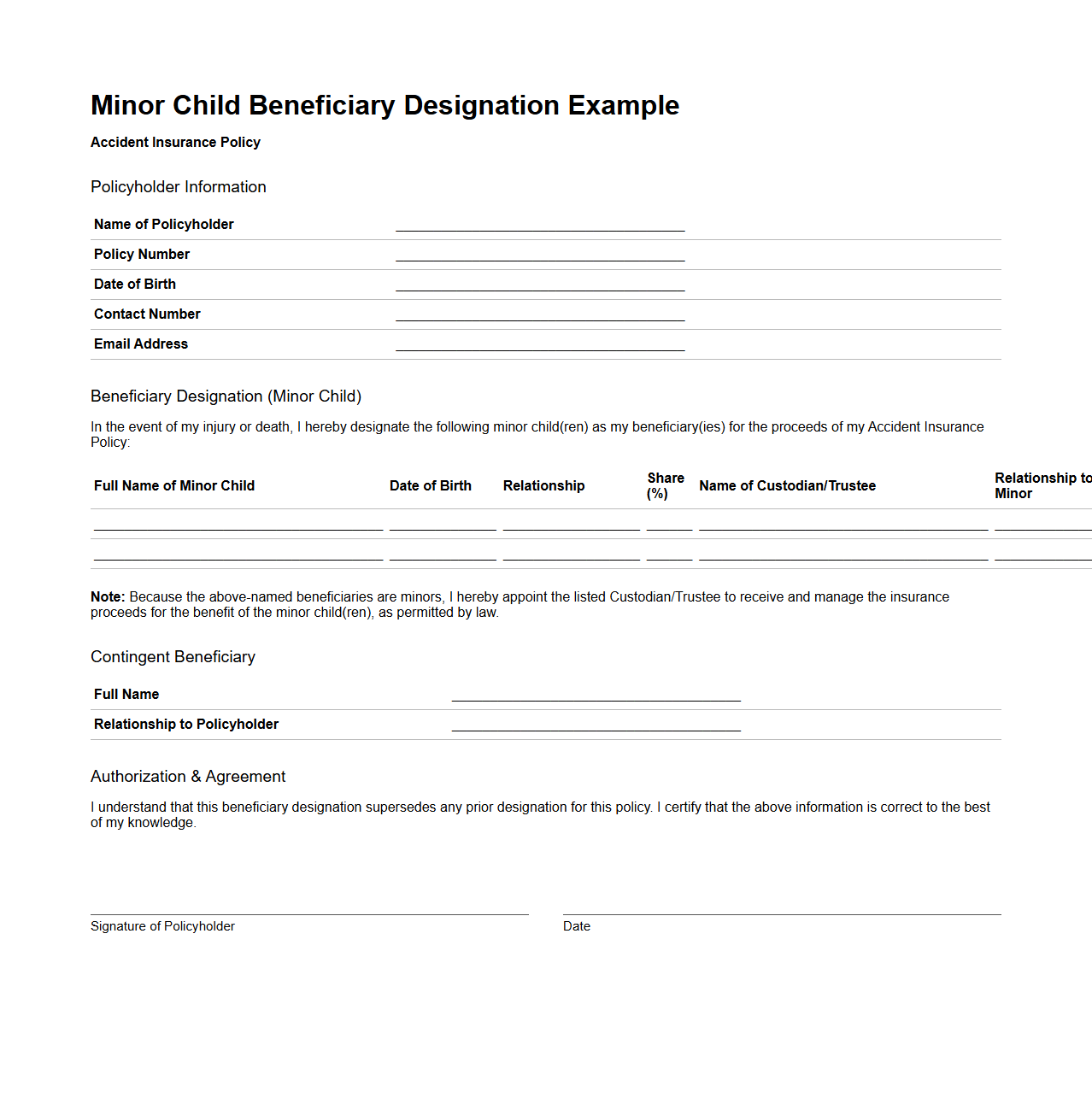

Minor Child Beneficiary Designation Example for Accident Insurance

A

Minor Child Beneficiary Designation for Accident Insurance is a legal document that specifies a minor child as the recipient of insurance benefits in the event of the policyholder's accident-related death or injury. It ensures the financial benefits are directed appropriately, often involving a custodian or trustee to manage the funds until the child reaches adulthood. This designation helps safeguard the minor's financial future by clearly outlining the beneficiary and related management instructions within the insurance policy.

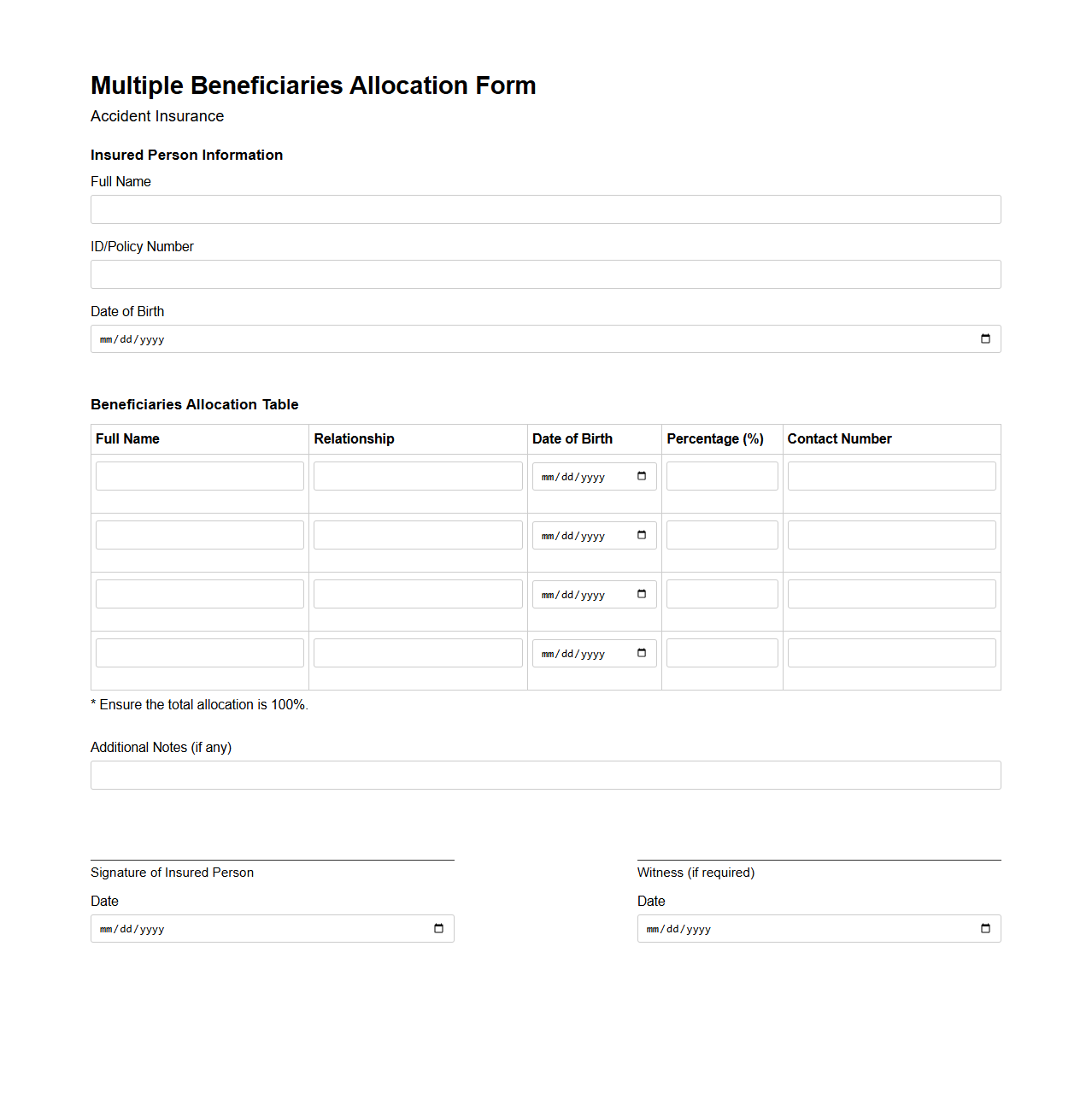

Multiple Beneficiaries Allocation Form for Accident Insurance

The

Multiple Beneficiaries Allocation Form for Accident Insurance is a crucial document that allows policyholders to designate several individuals or entities to receive insurance benefits in the event of an accident. This form specifies the percentage or amount of the total benefit each beneficiary will receive, ensuring clear and precise distribution according to the policyholder's wishes. Proper completion of this form helps prevent disputes and guarantees that the accident insurance payout is allocated efficiently and transparently.

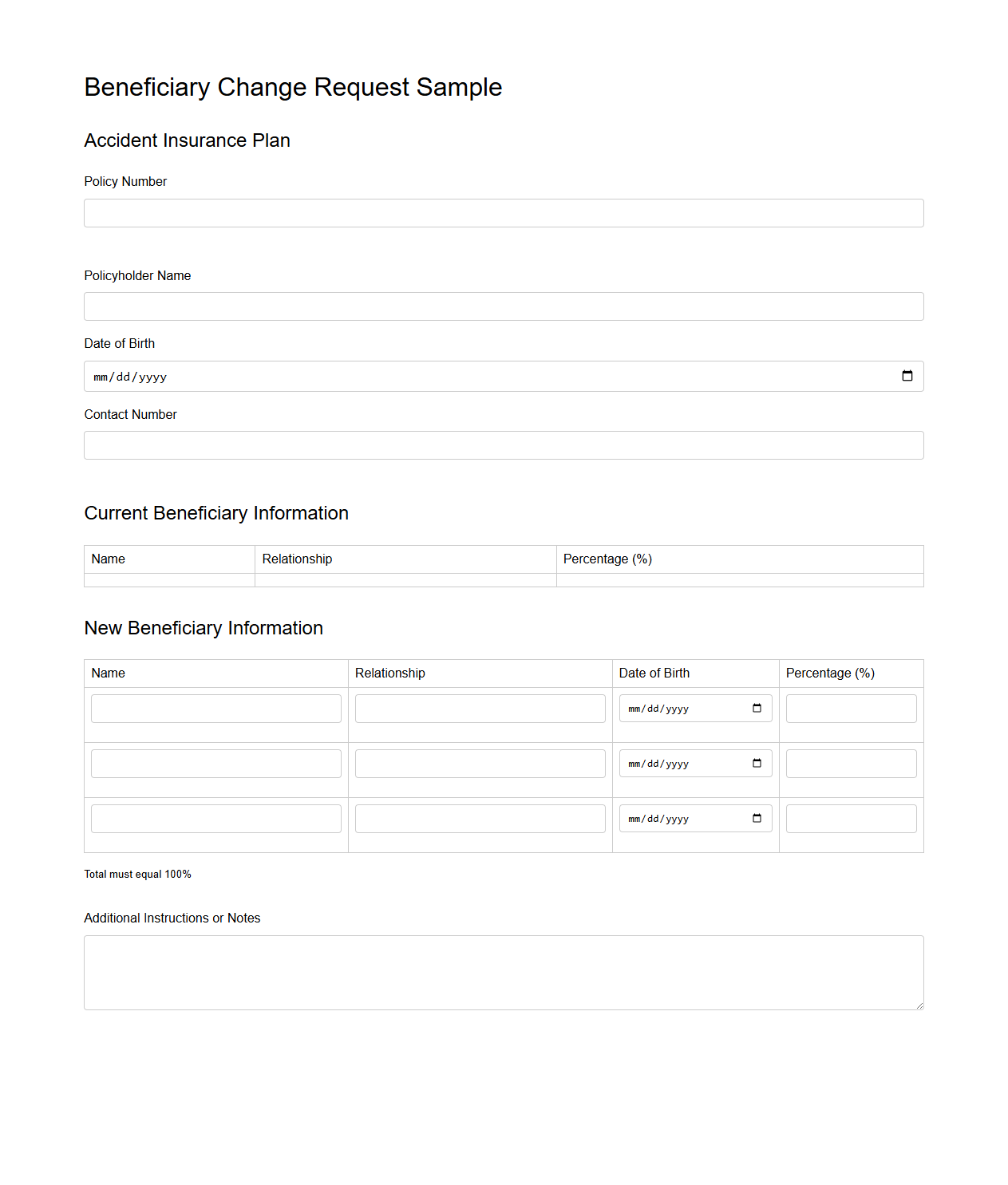

Beneficiary Change Request Sample for Accident Insurance Plan

A

Beneficiary Change Request Sample for an Accident Insurance Plan document provides a standardized template for policyholders to update or change the designated beneficiary of their accident insurance coverage. It ensures the insurer receives clear instructions on who should receive the insurance benefits in the event of a claim. This document typically includes policy details, current beneficiary information, and authorization signatures to validate the request.

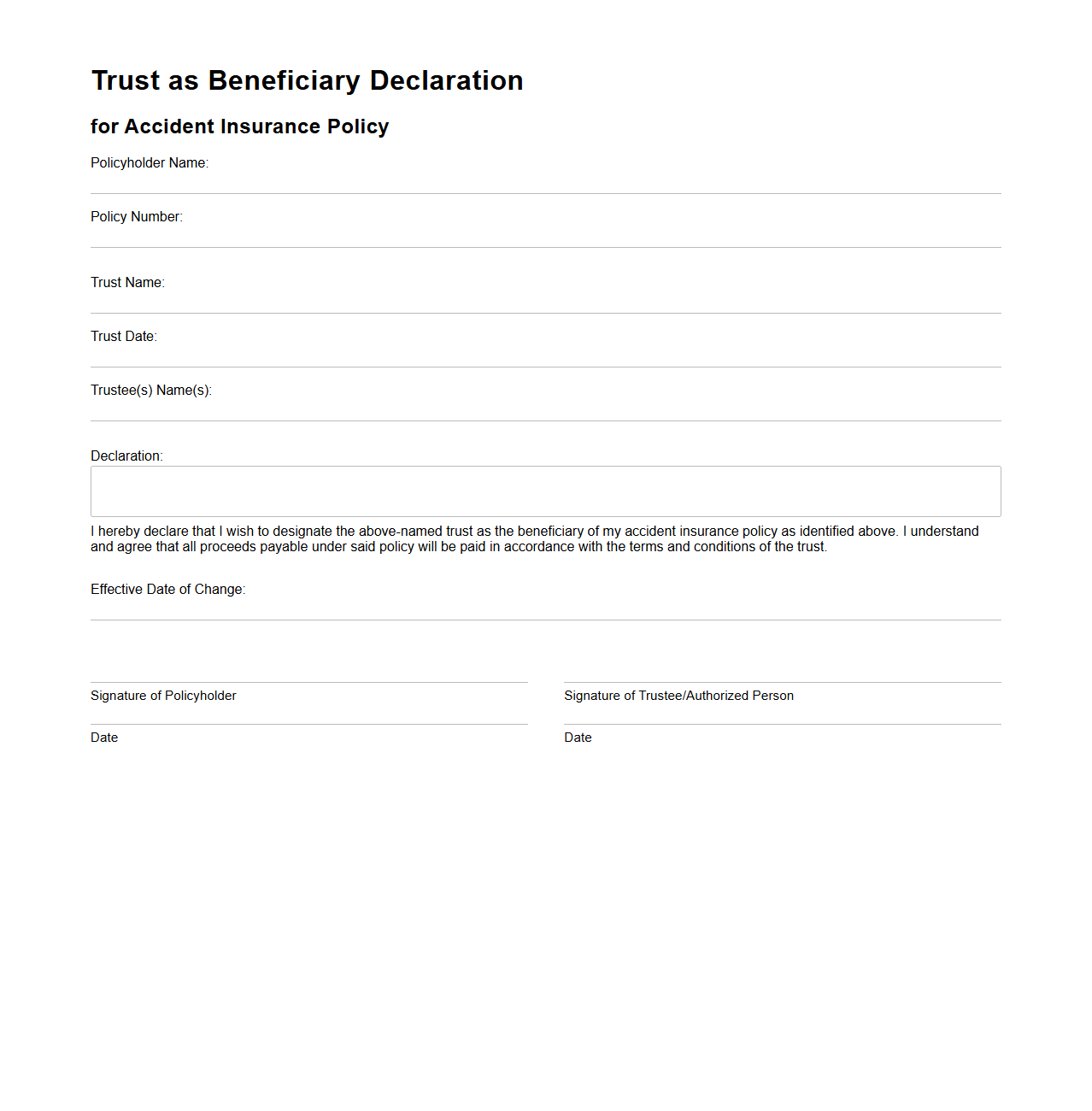

Trust as Beneficiary Declaration Format for Accident Insurance

Trust as Beneficiary Declaration Format for Accident Insurance is a legal document designating a

trust as the beneficiary of the insurance policy proceeds. This format ensures that the accident insurance benefits are managed and distributed according to the terms set forth in the trust agreement, providing financial protection and clarity for the insured's beneficiaries. It helps avoid probate and allows for controlled disbursement of funds to the trust's beneficiaries in case of an accident.

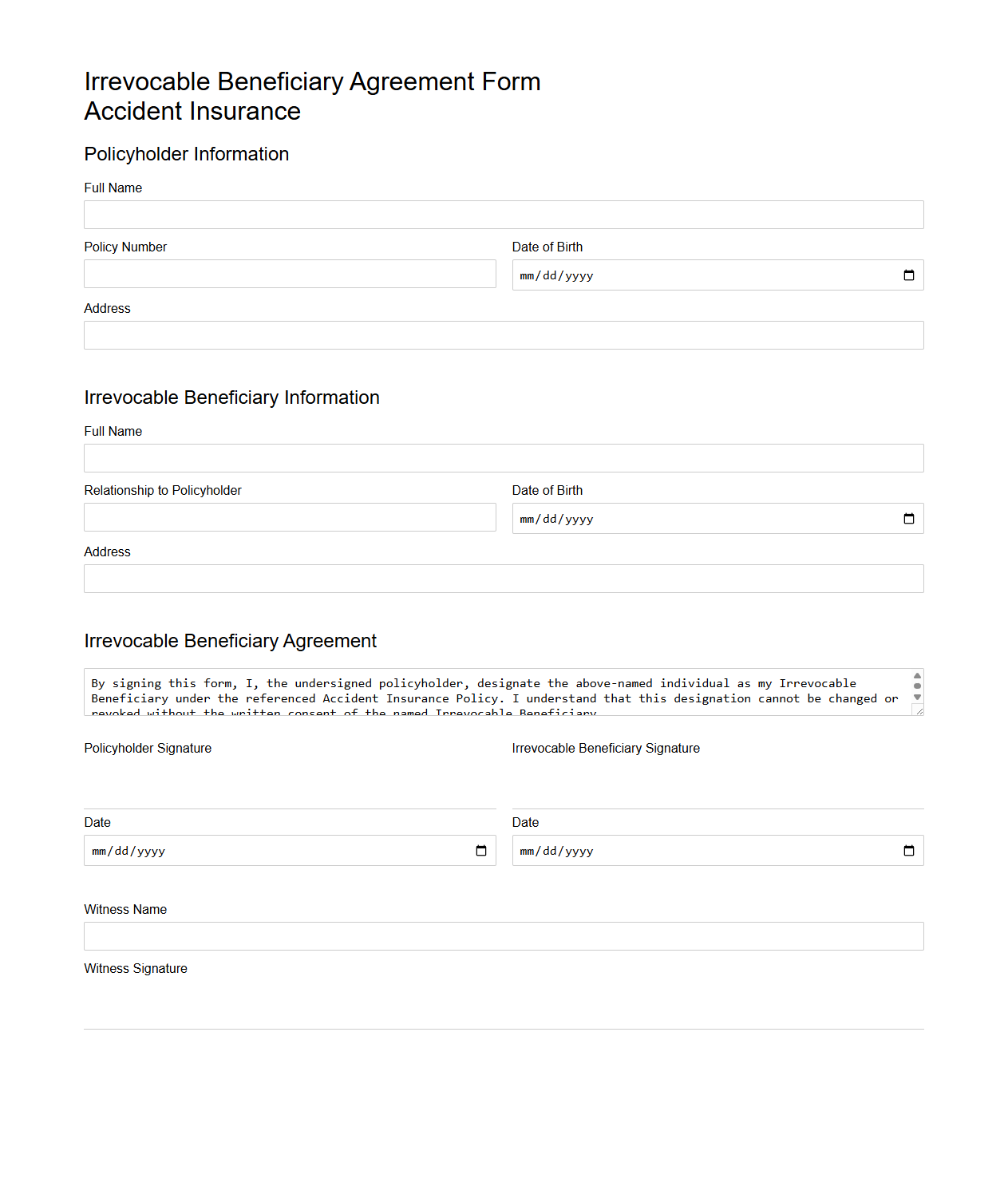

Irrevocable Beneficiary Agreement Form for Accident Insurance

An

Irrevocable Beneficiary Agreement Form for accident insurance is a legal document that designates a beneficiary who cannot be changed without their consent, ensuring the intended recipient receives the insurance proceeds after an accident. This form provides financial security by protecting the beneficiary's rights against any attempt by the policyholder to alter the beneficiary designation. It is commonly used in accident insurance policies to guarantee that benefits are paid directly and exclusively to the named beneficiary.

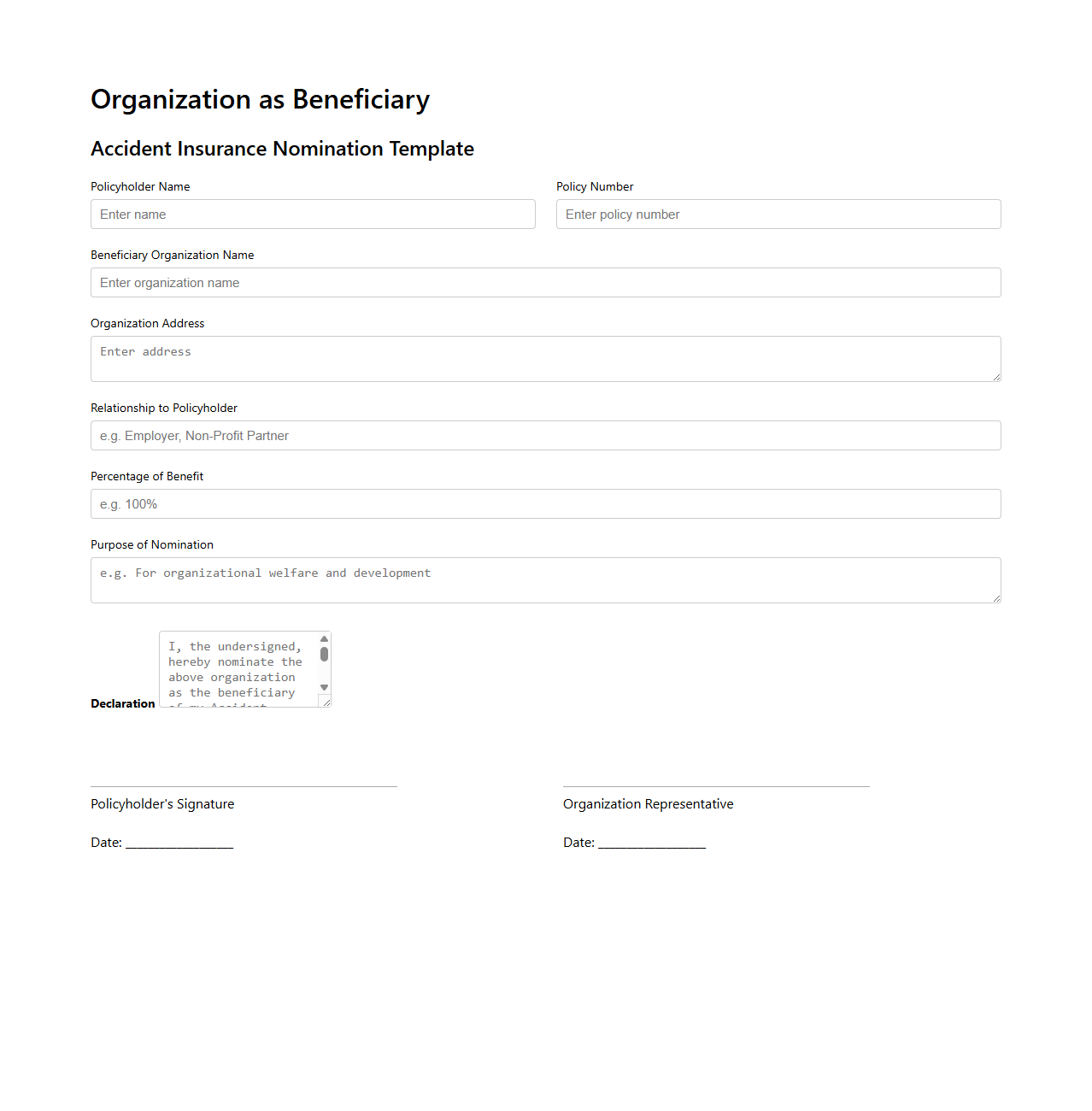

Organization as Beneficiary Template for Accident Insurance

The

Organization as Beneficiary Template for Accident Insurance document designates a specific organization as the recipient of insurance benefits in the event of an accident. This template ensures clarity in the distribution of funds, specifying the organization's role and the conditions under which it receives compensation. It streamlines the claims process by clearly defining beneficiary details, reducing potential disputes and facilitating prompt payouts.

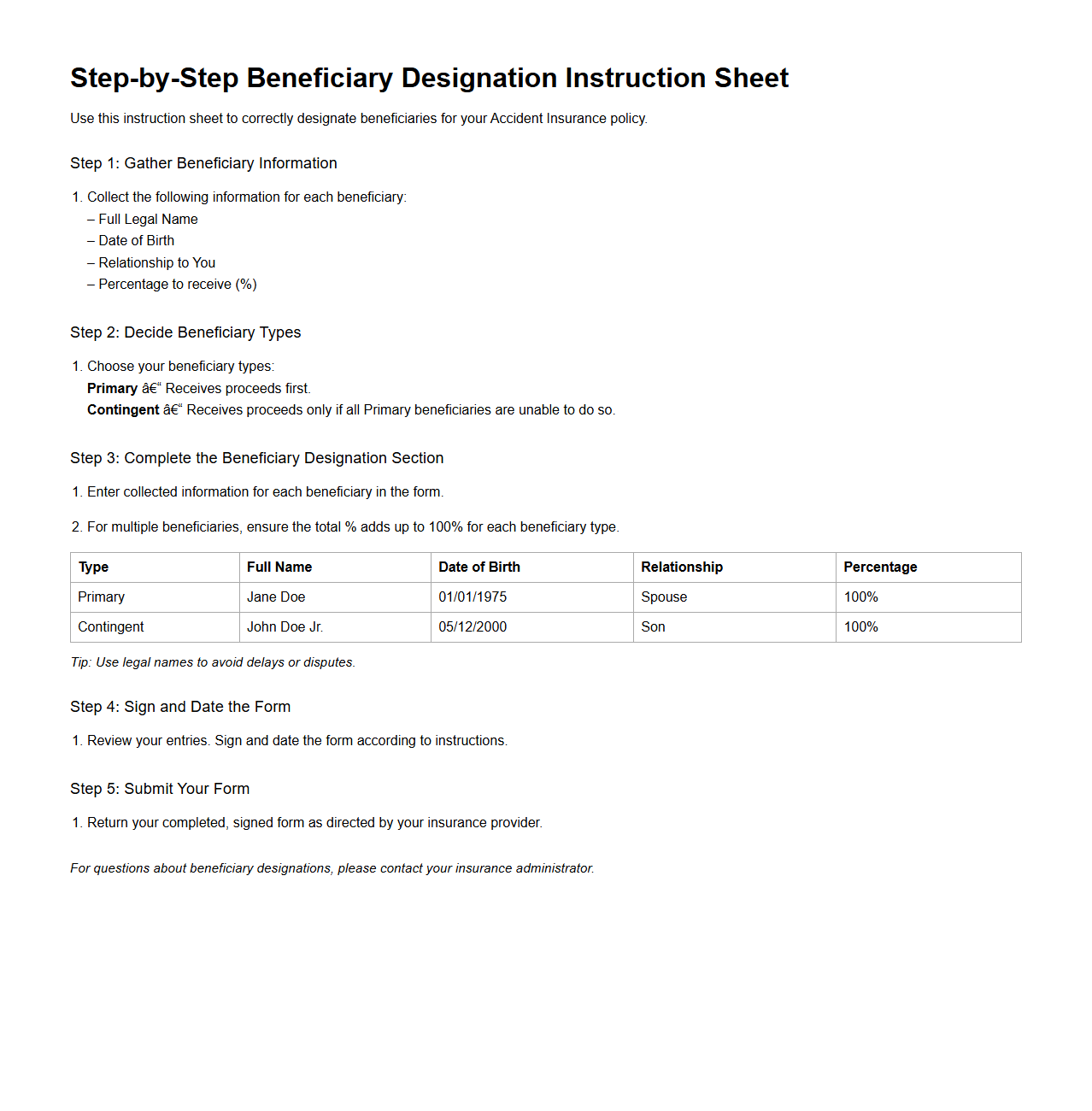

Step-by-Step Beneficiary Designation Instruction Sheet for Accident Insurance

The

Step-by-Step Beneficiary Designation Instruction Sheet for Accident Insurance is a detailed guide that helps policyholders accurately designate beneficiaries on their accident insurance policies. It outlines clear instructions to ensure proper completion of forms, avoiding errors that could delay or complicate benefit distribution. This document is essential for ensuring the insured's benefits are disbursed according to their wishes after an accident-related claim.

What essential information must be included in a Beneficiary Designation Document for accident insurance?

The Beneficiary Designation Document must include the full legal names of the beneficiaries to ensure accurate identification. It should clearly specify the percentage or portion of the benefits each beneficiary is entitled to receive. Additionally, the policyholder's signature and date of signing are crucial for validating the document.

How does the designation of primary and contingent beneficiaries affect the distribution of benefits?

Primary beneficiaries are the first recipients of the insurance benefits upon the insured event occurring. Contingent beneficiaries receive benefits only if all primary beneficiaries are deceased or unable to claim. This hierarchical structure ensures a clear and orderly distribution of benefits according to the policyholder's wishes.

What are the legal implications of not updating a beneficiary designation after significant life events?

Failing to update a beneficiary after major events like marriage or divorce can lead to unintended beneficiaries receiving the insurance proceeds. It may result in legal disputes and delays in benefit distribution, complicating the claims process. Maintaining an accurate beneficiary designation is essential to uphold the policyholder's intent and avoid probate issues.

In what situations can a beneficiary designation be contested or deemed invalid?

A beneficiary designation can be contested if there is evidence of fraud, coercion, or lack of capacity at the time of signing. It may also be invalid if it does not comply with the insurer's rules or if the document is improperly completed. Courts may intervene when there are conflicting claims or ambiguous designations, potentially reversing the beneficiary status.

How does the Beneficiary Designation Document interact with other estate planning documents, such as wills or trusts?

The Beneficiary Designation Document generally takes precedence over wills in distributing accident insurance benefits. It bypasses the probate process, allowing direct payment to named beneficiaries without delays. However, trusts can be named as beneficiaries, integrating the designation into broader estate planning strategies for more control over the funds.