A Beneficiary Change Document Sample for Term Life Insurance serves as a formal template to update the designated recipient of the policy benefits. This document ensures that the policyholder's wishes are clearly recorded and legally recognized, preventing disputes during the claim process. Using a correctly formatted sample helps streamline the submission and approval of beneficiary changes with the insurance provider.

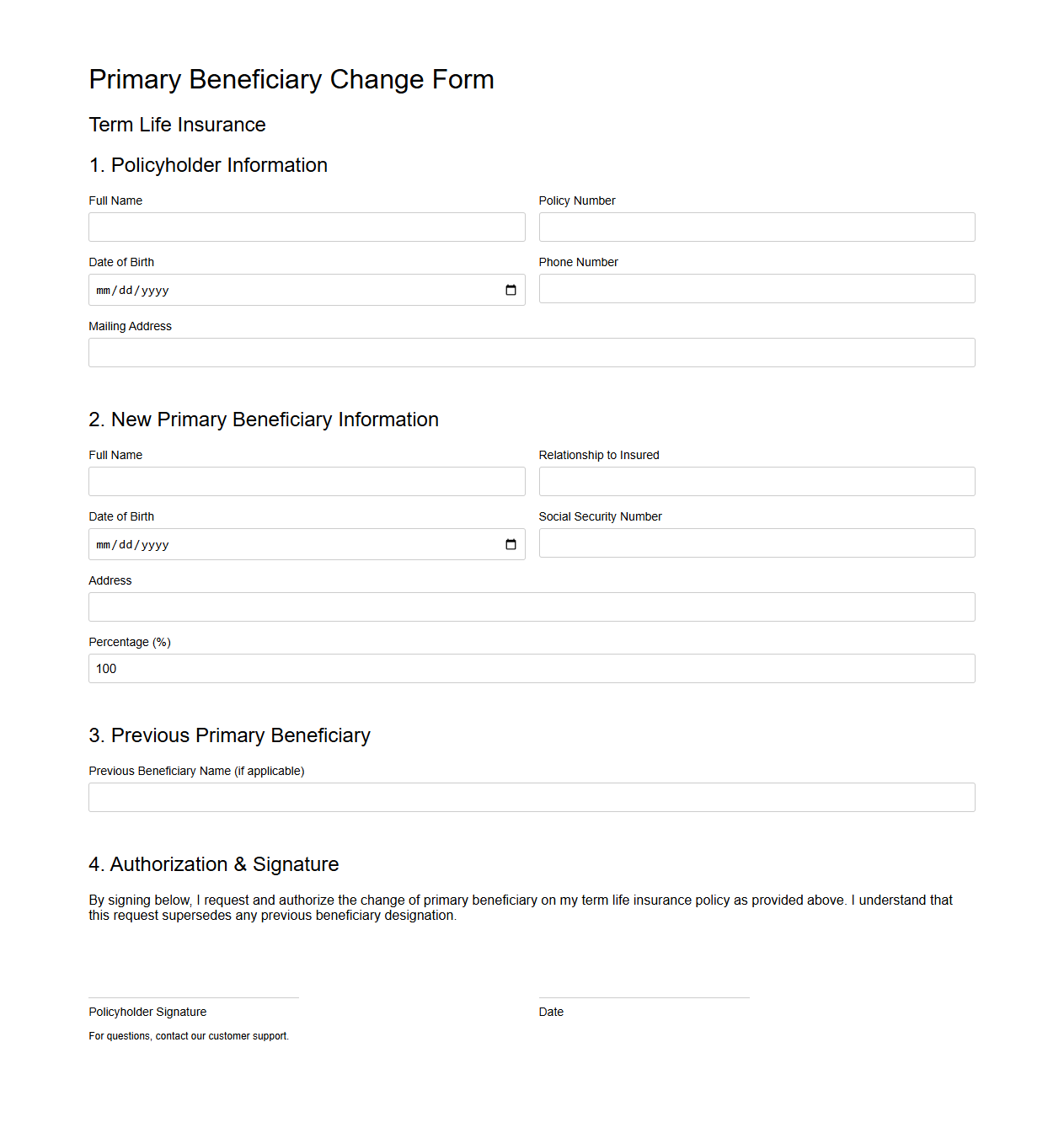

Primary Beneficiary Change Form for Term Life Insurance

The

Primary Beneficiary Change Form for Term Life Insurance is a critical document that allows policyholders to update or replace the designated primary beneficiary on their insurance policy. This form ensures that the death benefit is paid to the correct individual or entity as intended by the policyholder. Accurate completion and submission of this form to the insurance provider are essential for maintaining the desired distribution of benefits.

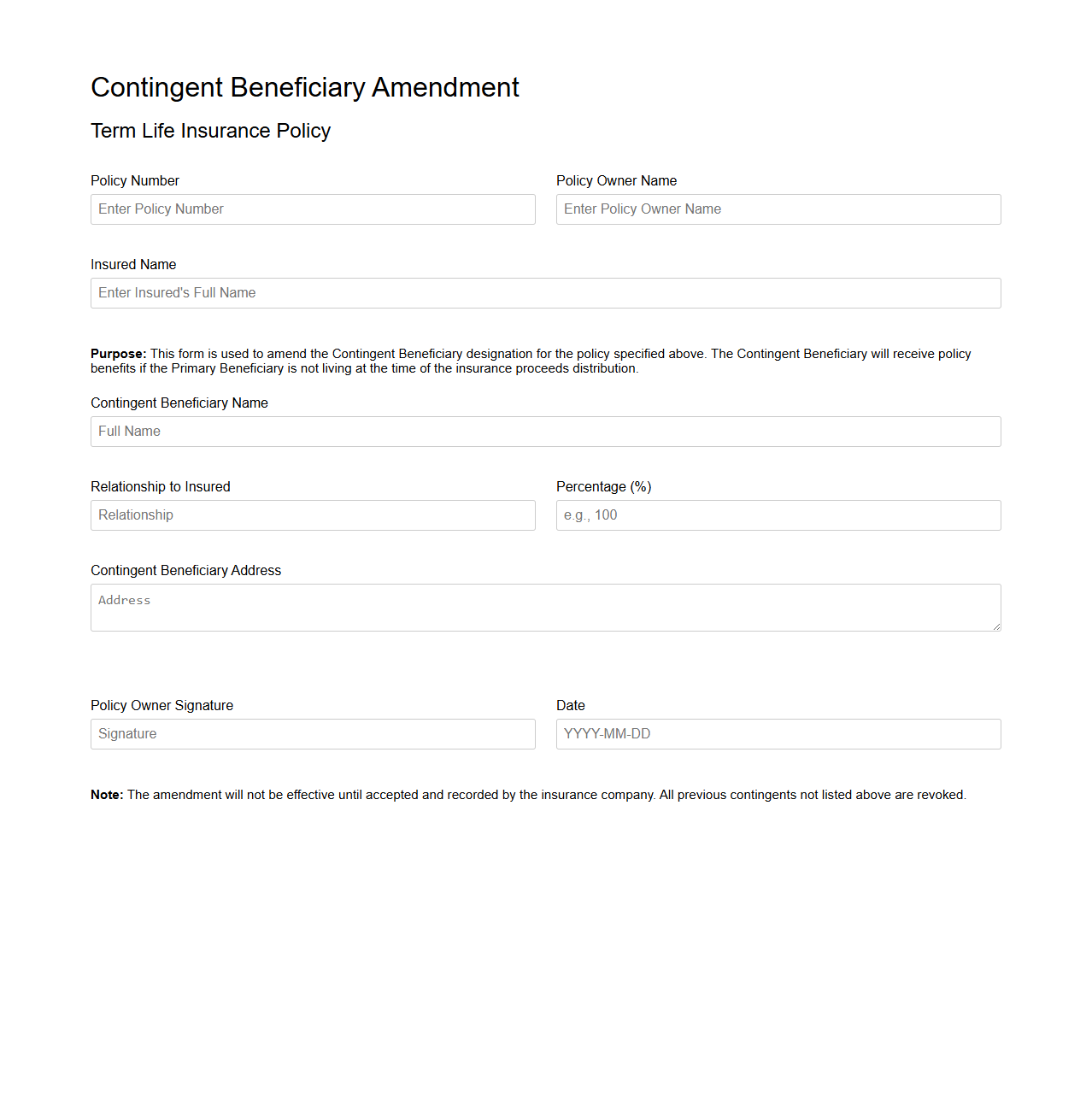

Contingent Beneficiary Amendment Sample for Term Life Policy

A

Contingent Beneficiary Amendment Sample for Term Life Policy document outlines the changes made to the secondary or backup beneficiary designation in a term life insurance policy. It specifies who will receive the policy benefits if the primary beneficiary is unable to claim them. This document is essential for ensuring the correct distribution of benefits according to updated beneficiary preferences.

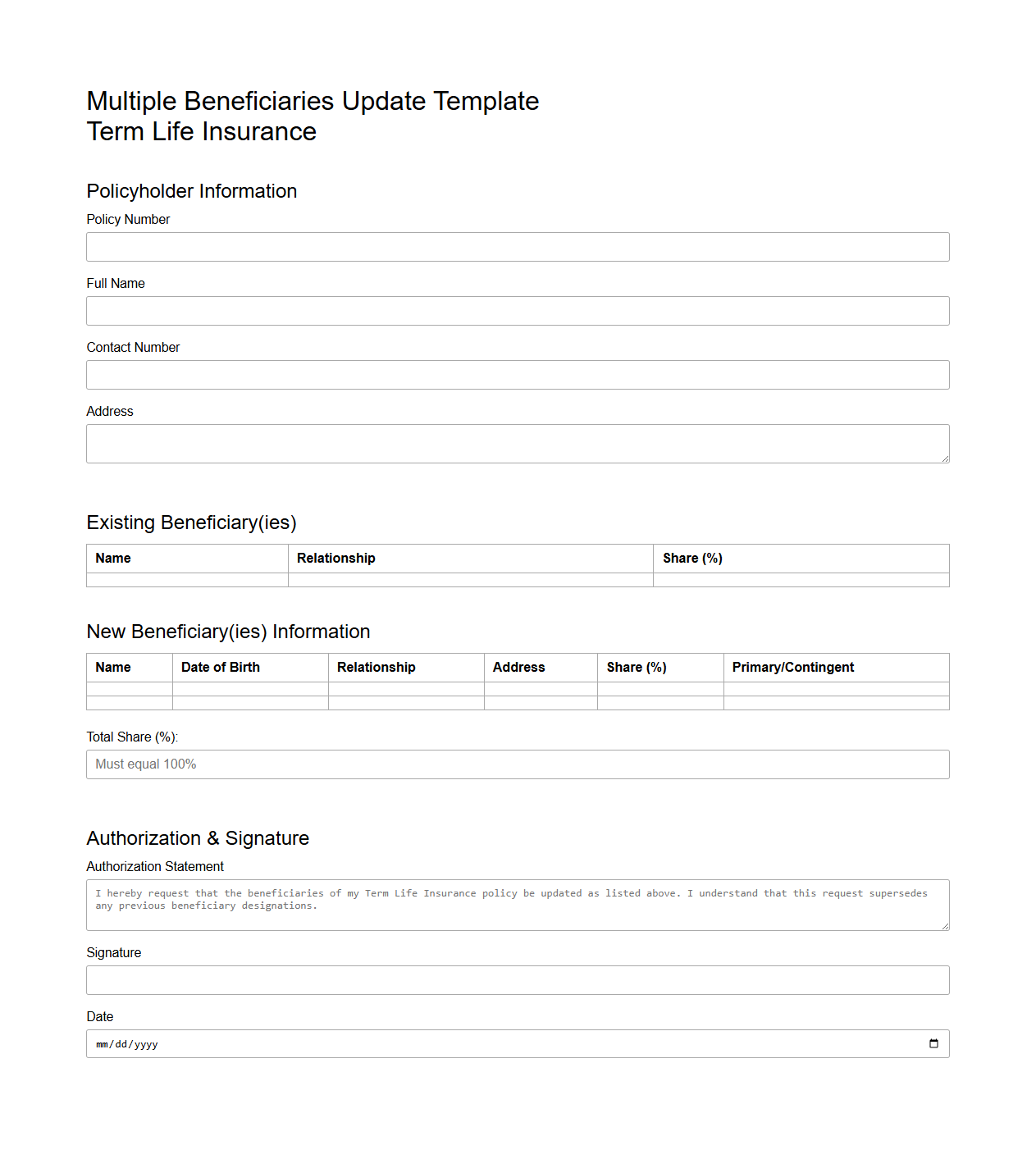

Multiple Beneficiaries Update Template for Term Life Insurance

The

Multiple Beneficiaries Update Template for Term Life Insurance document is a structured form used to designate or modify multiple beneficiaries for a policyholder's term life insurance. It ensures clear communication of beneficiary distribution, helping prevent disputes and facilitating prompt claims processing. This template streamlines updates by providing organized fields for names, contact information, and percentage allocations to each beneficiary.

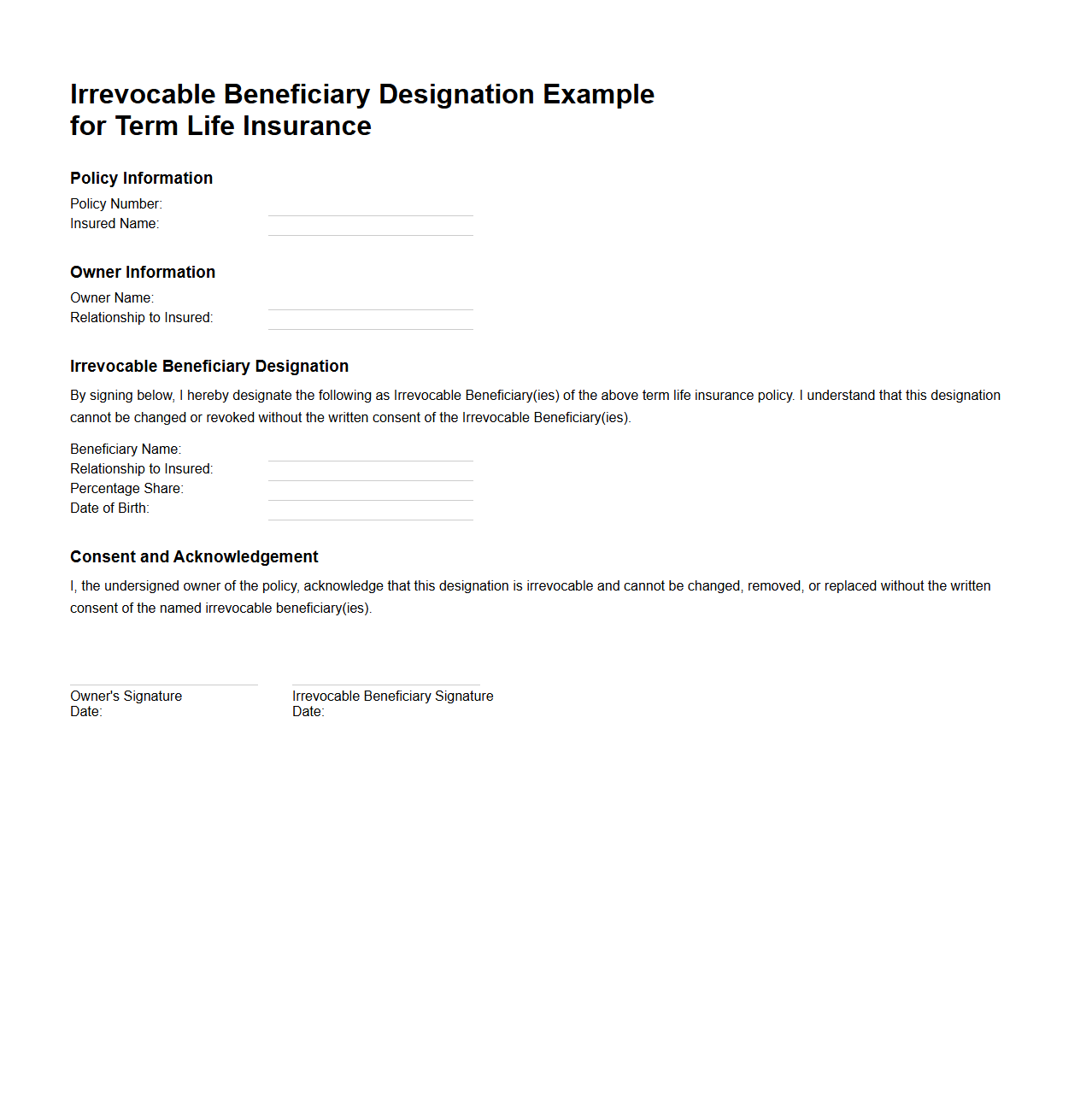

Irrevocable Beneficiary Designation Example for Term Life

An

Irrevocable Beneficiary Designation in a Term Life Insurance document means the policyholder cannot change or remove the beneficiary without their consent. This legal arrangement ensures the named beneficiary has a secured right to the death benefit, protecting their financial interests regardless of the policyholder's future decisions. Commonly used in divorce settlements or business agreements, this designation provides certainty and protection for the beneficiary's claim.

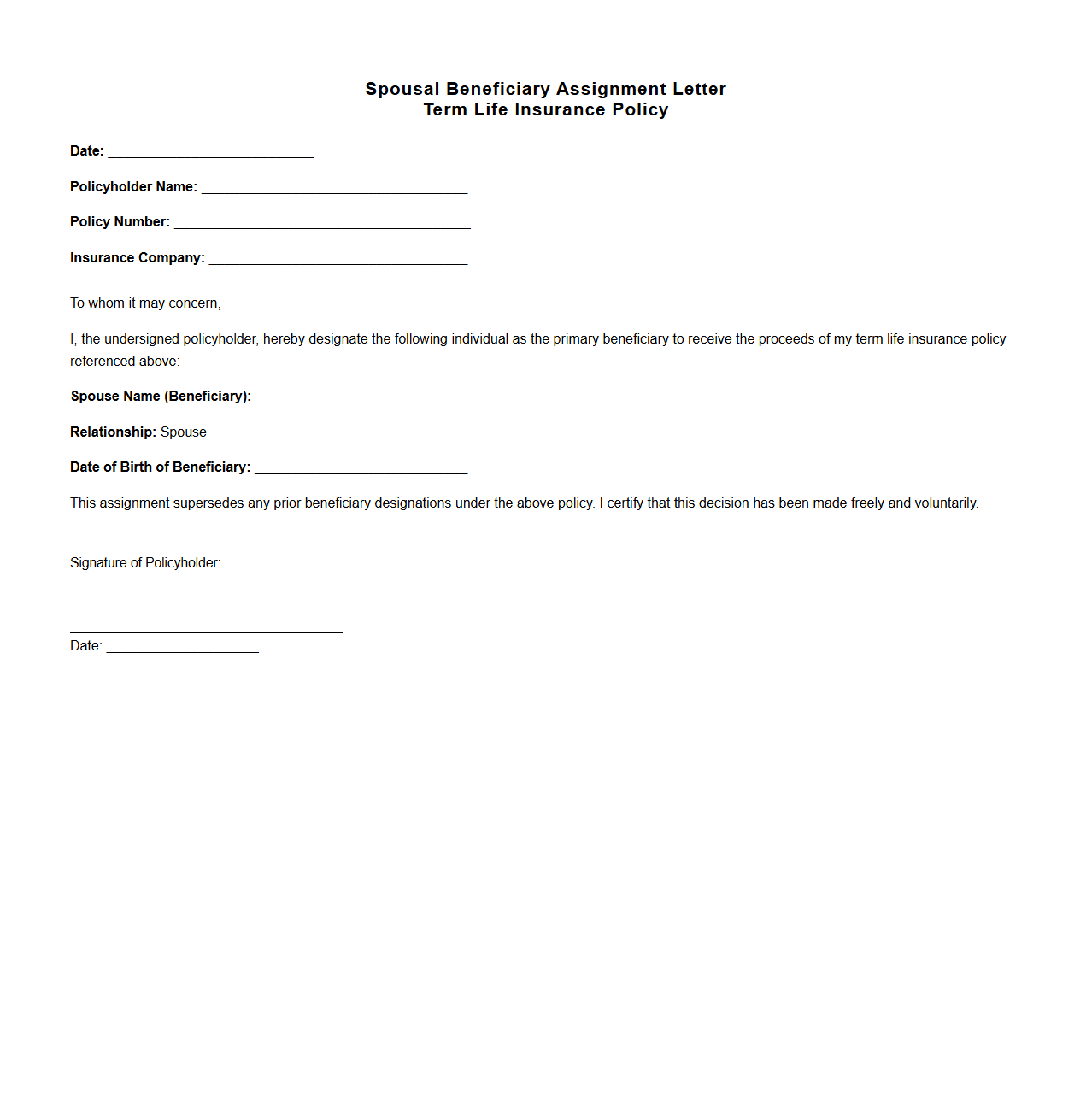

Spousal Beneficiary Assignment Letter for Term Life Insurance

A

Spousal Beneficiary Assignment Letter for Term Life Insurance is a legal document that allows a policyholder to designate their spouse as the primary beneficiary of the insurance proceeds. This letter ensures that, upon the policyholder's death, the death benefit is directly transferred to the spouse, bypassing probate. It provides clarity and legal confirmation of the spouse's entitlement, minimizing disputes and facilitating a smooth claims process.

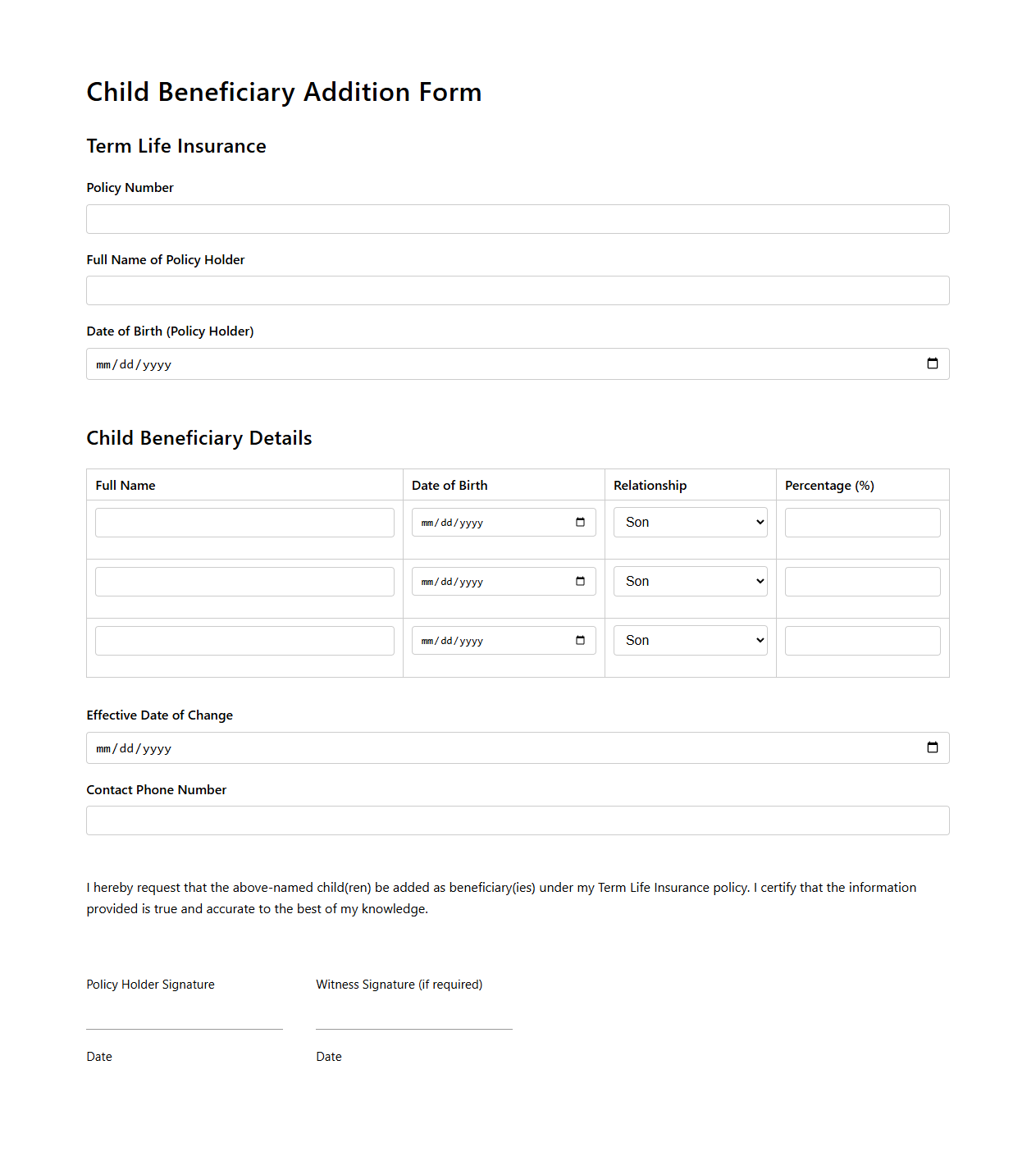

Child Beneficiary Addition Document for Term Life Insurance

The

Child Beneficiary Addition Document for Term Life Insurance is a legal form used to designate one or more children as beneficiaries of the policy proceeds. This document ensures that upon the policyholder's death, the specified children will receive the designated financial benefits from the term life insurance policy. Properly completing and submitting this form helps safeguard the financial future of the insured's minor dependents.

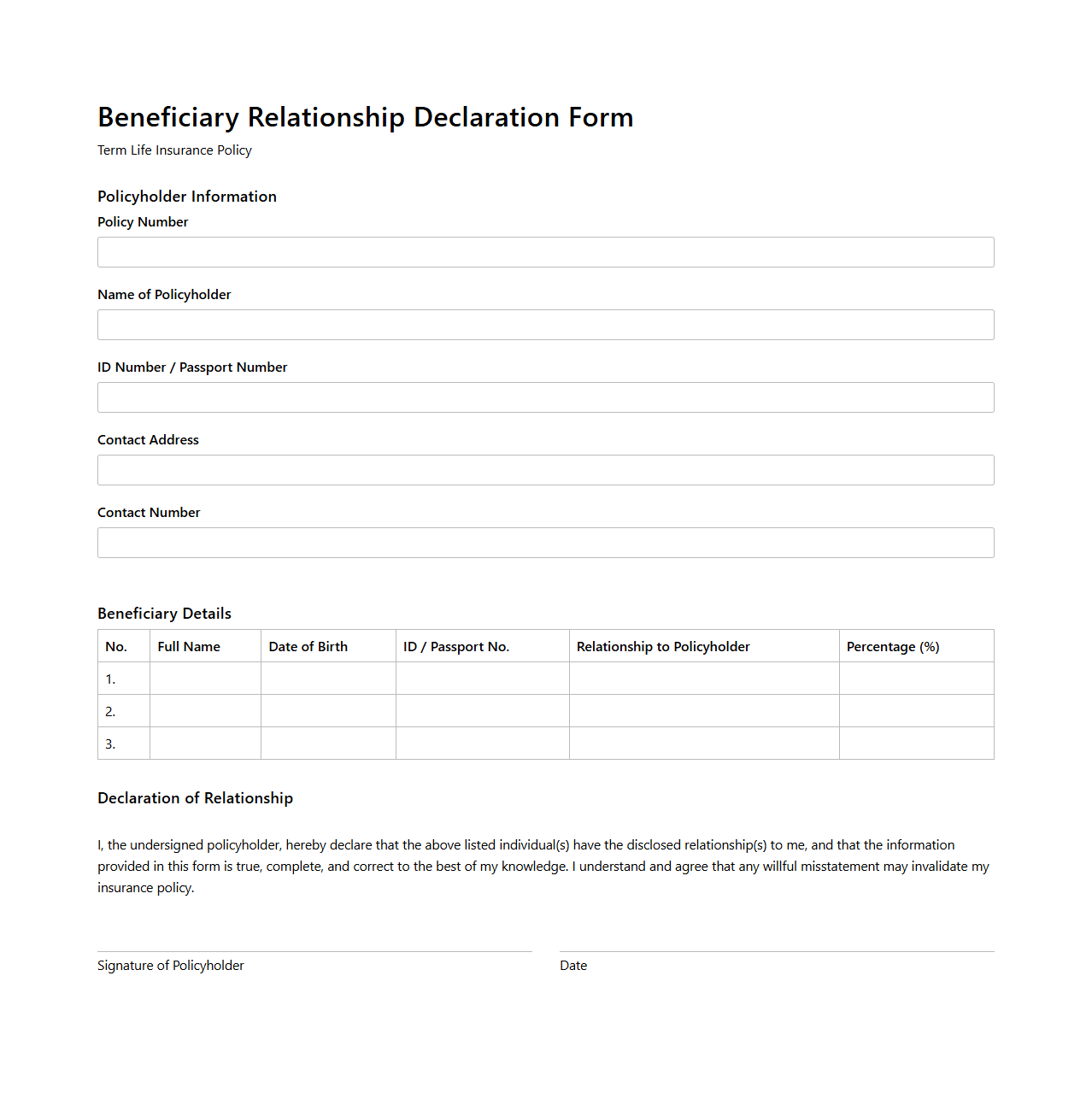

Beneficiary Relationship Declaration Form for Term Life Policy

The

Beneficiary Relationship Declaration Form for a Term Life Policy is a crucial document that specifies the relationship between the policyholder and the beneficiary. It ensures clarity regarding the beneficiary's entitlement and helps prevent disputes during claim settlements. Accurate completion of this form facilitates smooth and timely processing of death benefits under the term life insurance plan.

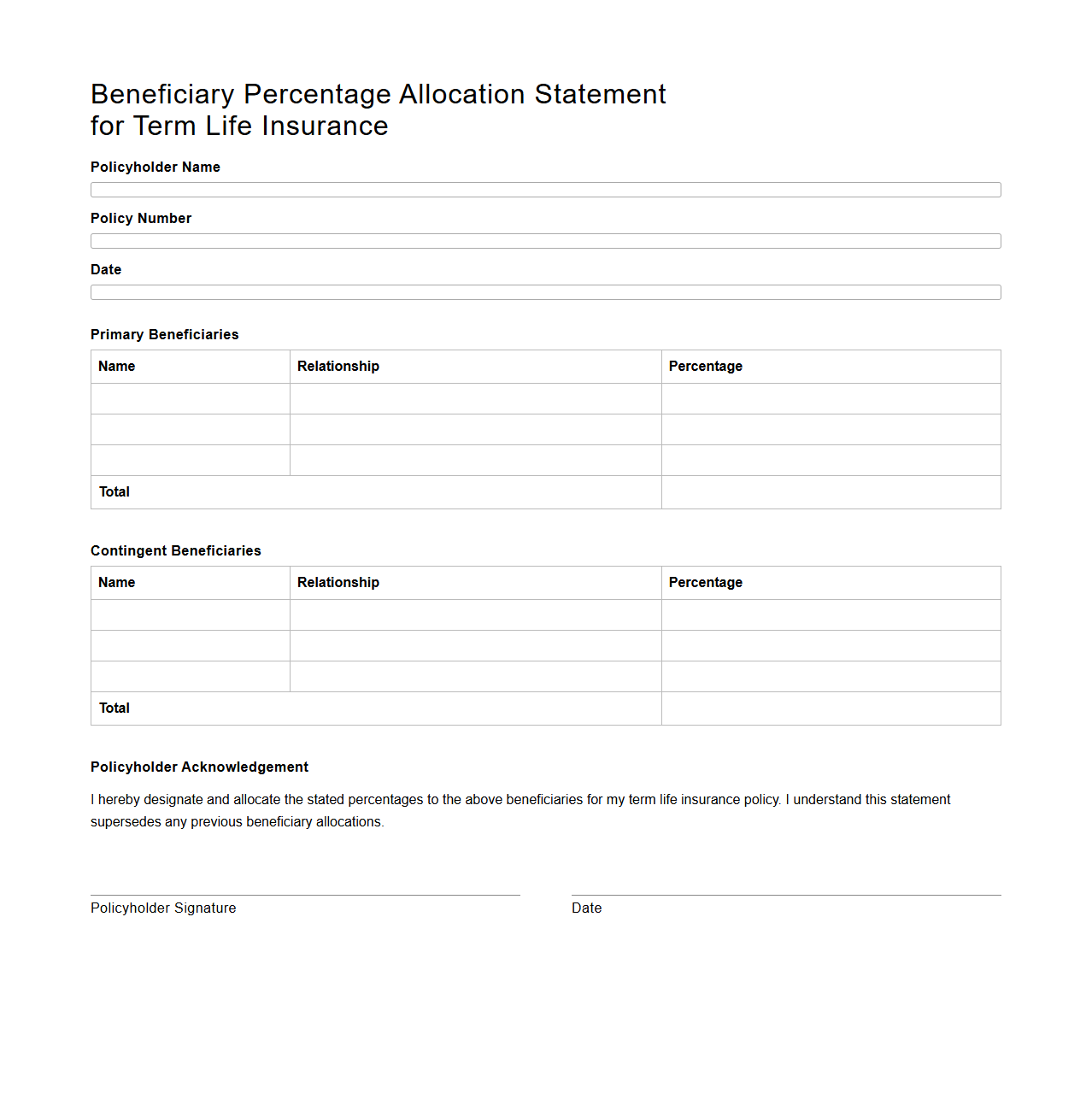

Beneficiary Percentage Allocation Statement for Term Life Insurance

The

Beneficiary Percentage Allocation Statement for Term Life Insurance specifies how the death benefit is divided among named beneficiaries. This document ensures clarity in distribution by assigning exact percentage shares to each beneficiary, preventing disputes or confusion. Properly completed, it guarantees that the insured's wishes are honored according to the specified allocations.

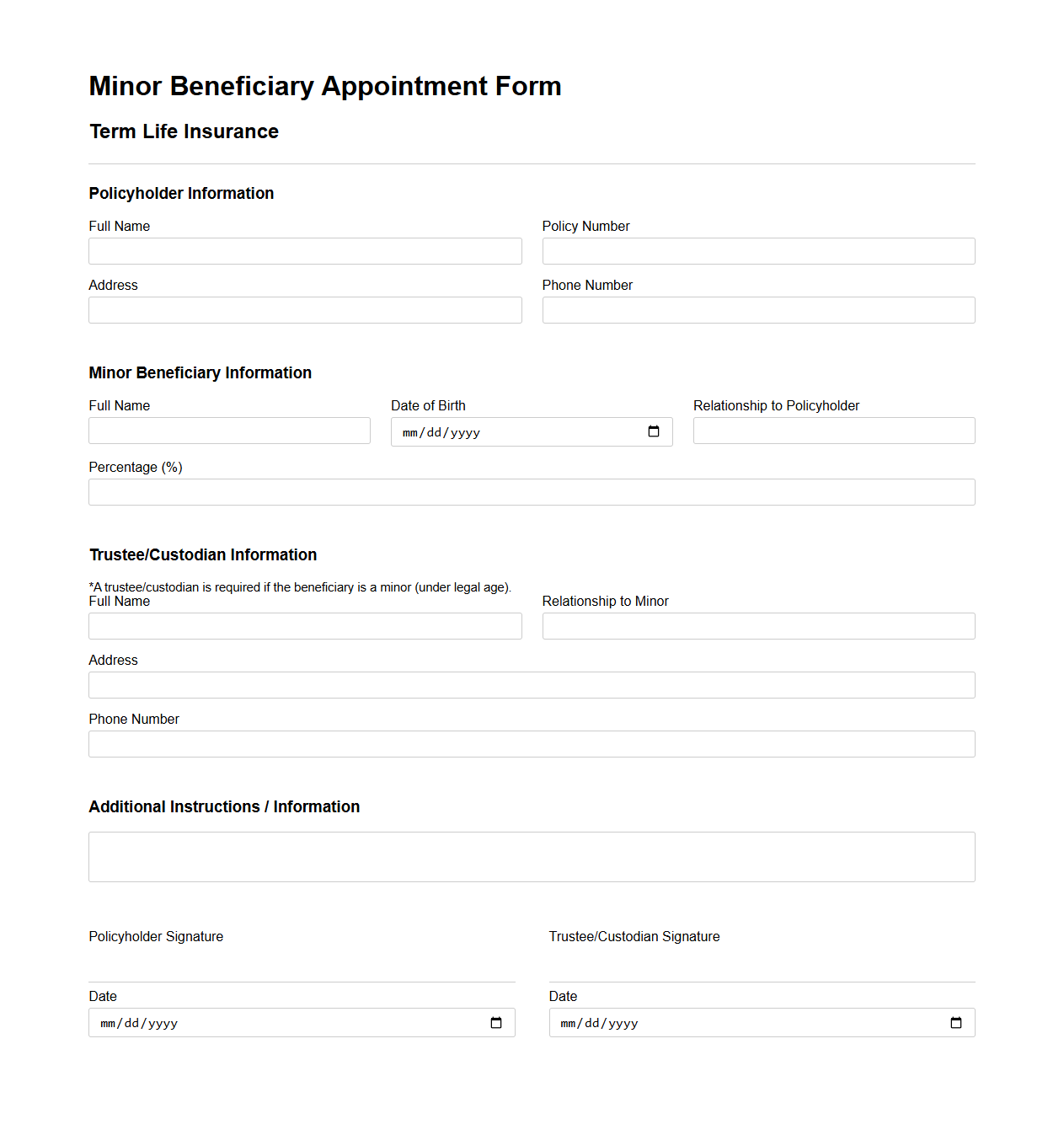

Minor Beneficiary Appointment Form for Term Life Insurance

The

Minor Beneficiary Appointment Form for Term Life Insurance allows policyholders to designate a guardian or custodian to manage the insurance proceeds on behalf of a minor beneficiary until they reach the age of majority. This form ensures that the minor beneficiary's financial interests are protected and that the death benefits are distributed according to the policyholder's wishes. Proper completion and submission of this document prevent legal complications and delays in accessing the insurance payout.

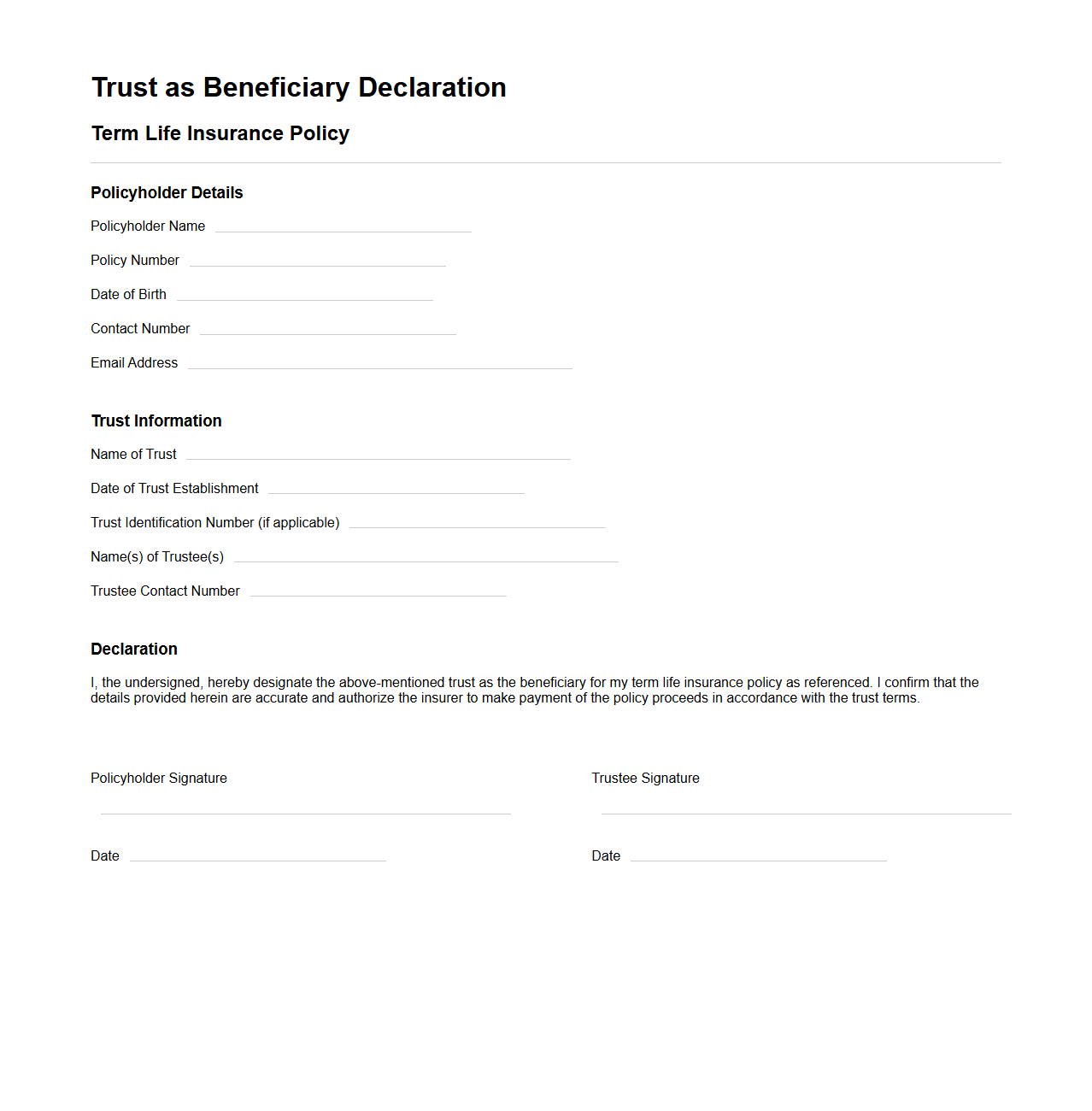

Trust as Beneficiary Declaration Template for Term Life Insurance

A

Trust as Beneficiary Declaration Template for term life insurance is a legal document that designates a trust as the recipient of the insurance proceeds upon the policyholder's death. This template ensures that the benefits are managed according to the trust's terms, providing financial security and clear distribution instructions. Using this declaration helps avoid probate, maintains privacy, and can offer tax advantages for the beneficiaries.

What essential information must be included to validate a beneficiary change on a term life insurance policy document?

To validate a beneficiary change on a term life insurance policy, the document must include the full names of the new beneficiaries. The policy number and the date of the requested change are crucial to ensure accurate processing. Additionally, clear identification of the relationship between the policyholder and each beneficiary is often required.

How does the Beneficiary Change Document ensure the policyholder's intent is clearly recorded?

The Beneficiary Change Document uses explicit language to specify the policyholder's intent regarding who will receive the benefits. It often includes a statement confirming that previous designations are revoked, eliminating ambiguity. The document also requires the policyholder's signature to validate the request as genuine and intentional.

In what ways can primary and contingent beneficiaries be differentiated on the Beneficiary Change Document?

The document clearly separates primary and contingent beneficiaries by listing them in distinct sections. Primary beneficiaries are designated to receive benefits first, while contingent beneficiaries are identified as backups. This distinction helps prevent confusion in claim processing when the primary beneficiary is unavailable.

Which parties require signatures and dating for the Beneficiary Change Document to be effective?

The policyholder's signature and date are essential for the Beneficiary Change Document to take effect. In some cases, a witness or a notary public's signature is also required to verify authenticity. Without proper signatures and dating, the document may be deemed invalid by the insurance company.

How are previous beneficiary designations addressed or revoked within the document sample?

The sample document typically includes a clause that explicitly revokes all prior beneficiary designations upon submission of the new change. This ensures that only the newly named beneficiaries are recognized. Such revocation prevents any conflicts or claims from former beneficiaries under the policy.