A Proof of Loss Document Sample for Homeowners Insurance provides a detailed template to help policyholders accurately report damages or losses to their property. This document typically includes sections for personal information, claim details, descriptions of the damaged property, and an itemized list of lost or damaged items. Using a well-structured sample ensures a faster claims process and improves communication with the insurance company.

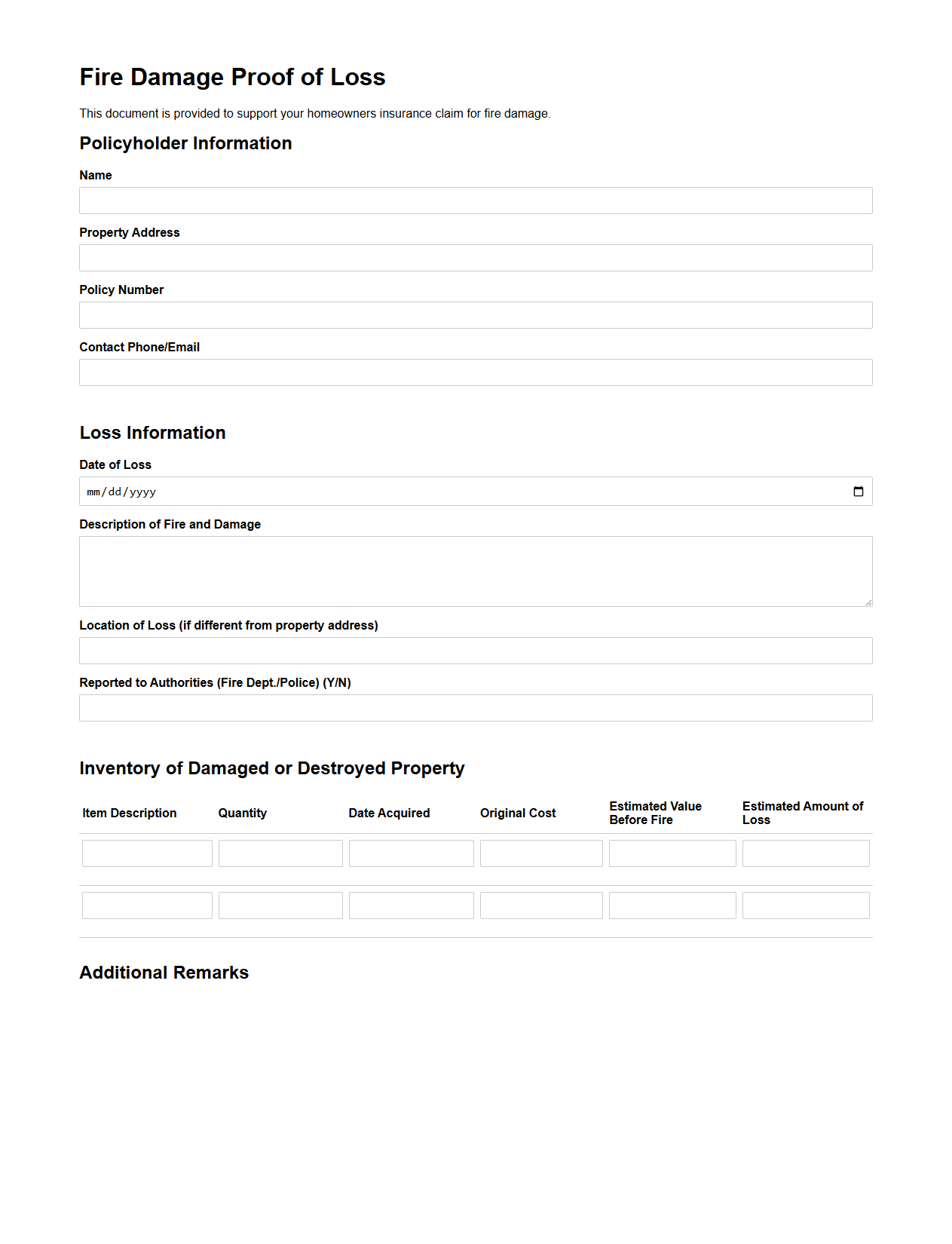

Fire Damage Proof of Loss Document for Homeowners Insurance

A

Fire Damage Proof of Loss Document for homeowners insurance is a formal statement submitted by the policyholder detailing the extent and value of property damaged or destroyed by fire. This document includes itemized lists of damaged belongings, repair estimates, and supporting evidence such as photos or receipts, serving as critical proof during the claims process. Insurers rely on this proof of loss to validate claims and determine appropriate compensation under the homeowner's policy.

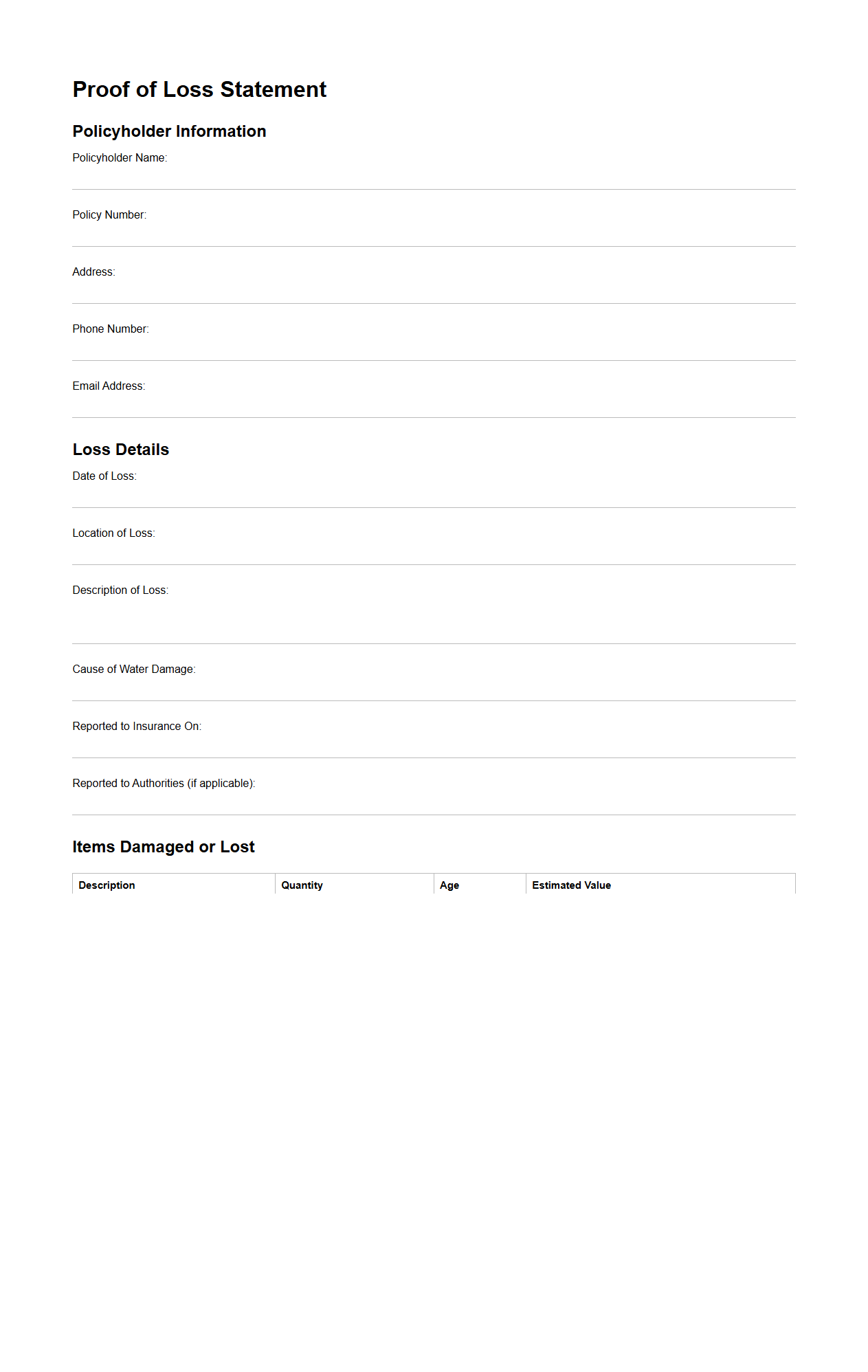

Water Damage Claim Proof of Loss Sample

A

Water Damage Claim Proof of Loss Sample document serves as a formal record submitted to insurance companies detailing the extent and value of damages caused by water incidents. This document includes itemized lists of damaged property, repair estimates, and relevant receipts or photos to support the claim. Accurate completion of the Proof of Loss is essential for expediting insurance reimbursement and ensuring coverage compliance.

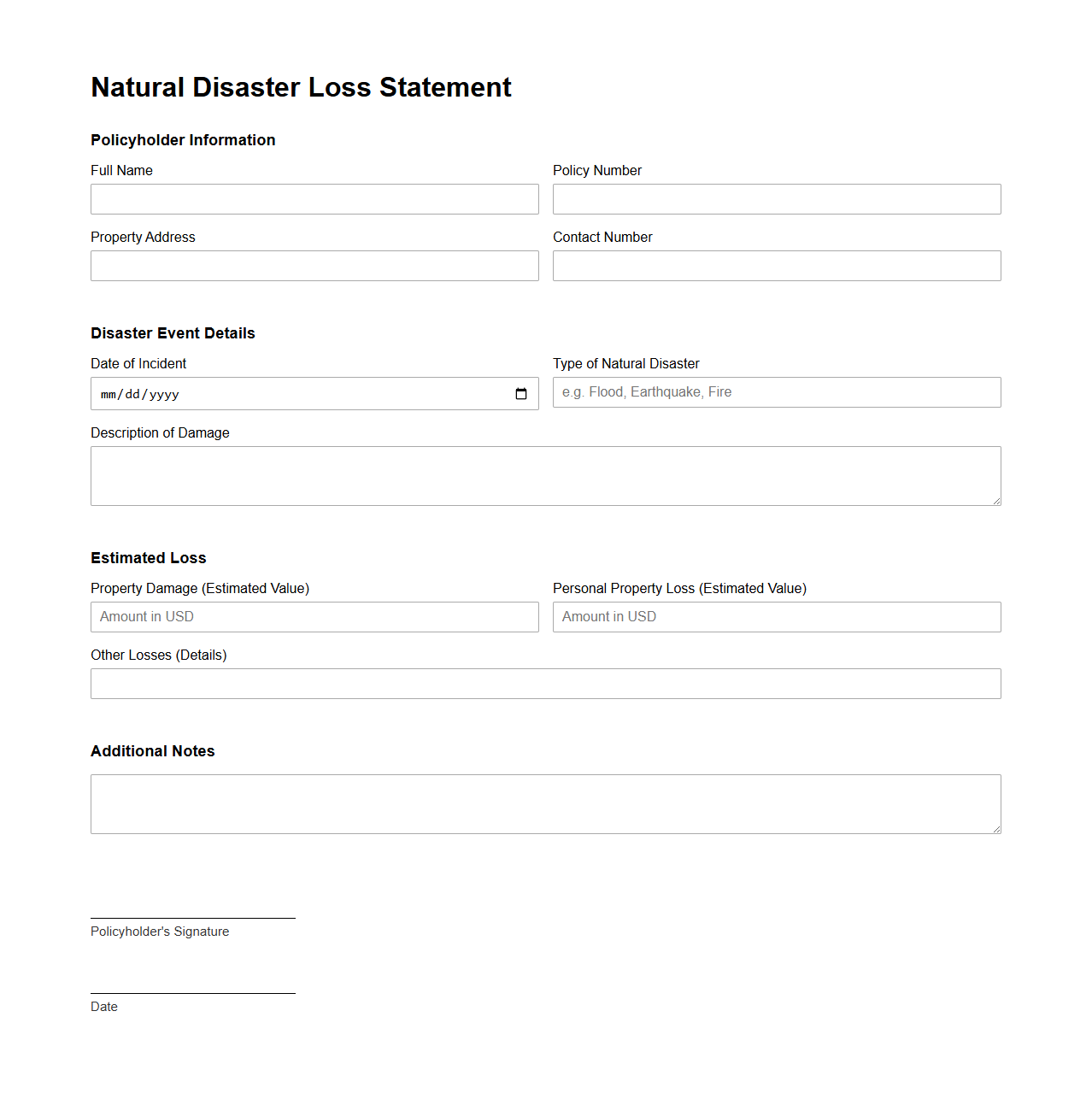

Natural Disaster Loss Statement for Homeowners Policy

A

Natural Disaster Loss Statement for a Homeowners Policy document is a detailed report submitted by the policyholder outlining damages caused by events such as hurricanes, earthquakes, floods, or wildfires. This statement includes specific information about the type, extent, and estimated cost of the damage to property and belongings, aiding insurers in processing claims accurately. Accurate documentation in this statement is crucial for timely compensation and coverage under the terms of the homeowners insurance policy.

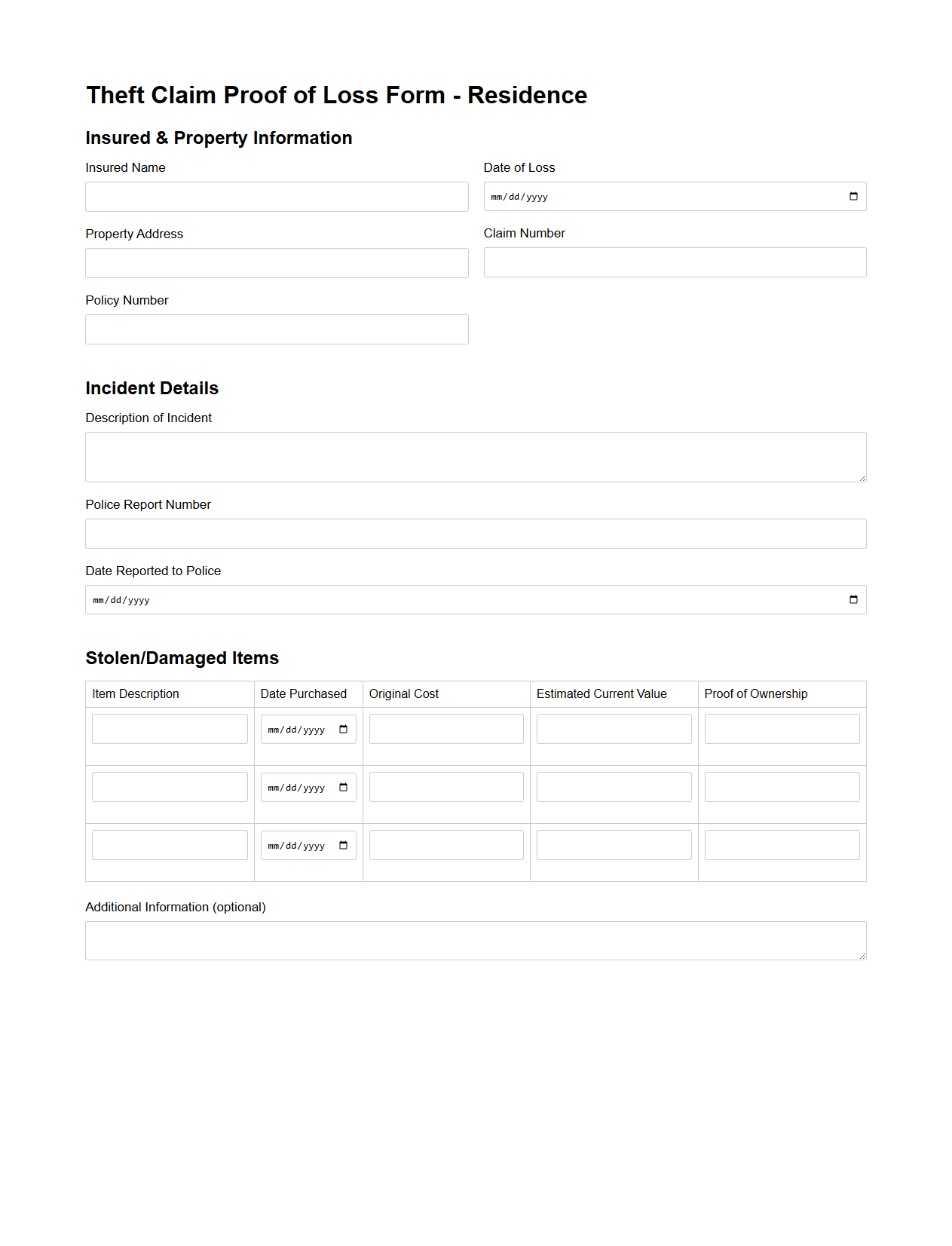

Theft Claim Proof of Loss Template for Residence

A

Theft Claim Proof of Loss Template for Residence document serves as a standardized form used by homeowners to report and substantiate stolen property to their insurance company. It includes detailed information such as a list of stolen items, their estimated values, date of loss, and any supporting evidence like police reports or receipts. This template streamlines the claims process by ensuring all necessary data is consistently documented for accurate and efficient insurance settlement.

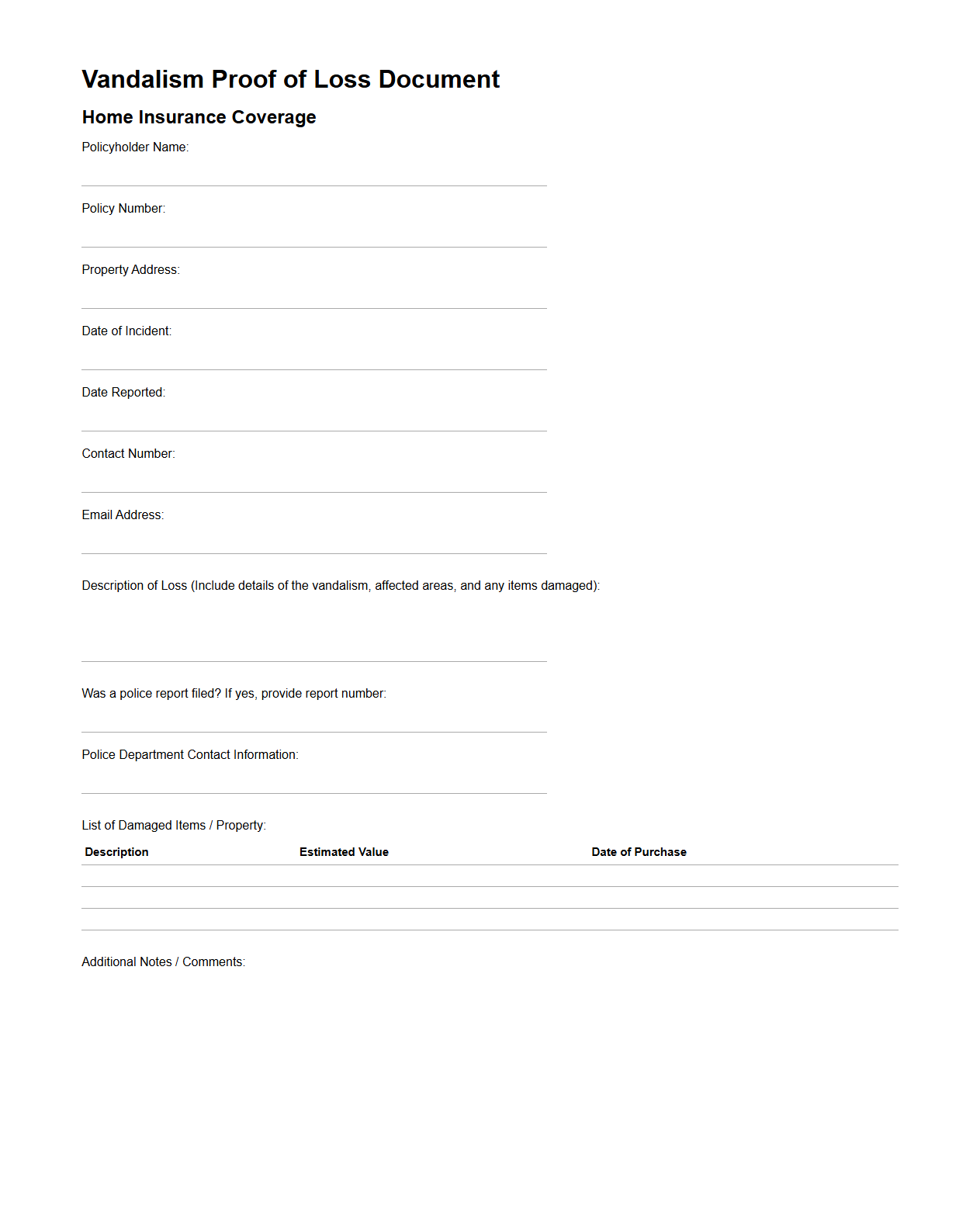

Vandalism Proof of Loss Document for Home Coverage

A

Vandalism Proof of Loss Document for Home Coverage is a formal statement submitted to an insurance company detailing the extent and value of damages caused by vandalism. It includes a thorough inventory of damaged property, estimated repair or replacement costs, and supporting evidence like photos or police reports. This document is essential for processing claims accurately and ensuring homeowners receive appropriate compensation under their policy.

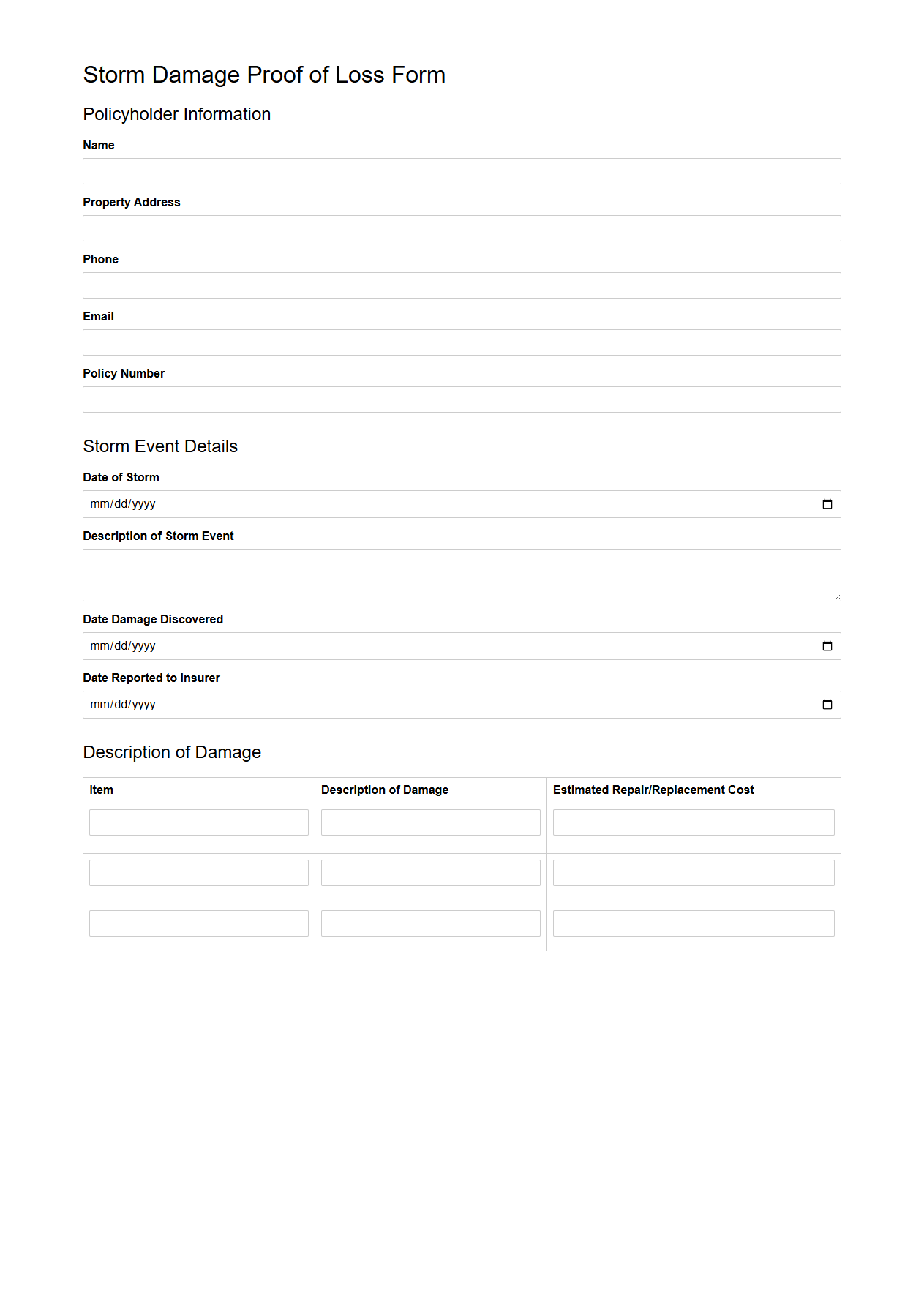

Storm Damage Proof of Loss Form for Homeowners

The

Storm Damage Proof of Loss Form for homeowners is a critical document used to formally report damages caused by severe weather events such as hurricanes, tornadoes, or hailstorms. This form provides detailed information about the extent of the property damage, including descriptions, estimated repair costs, and supporting evidence like photos or repair estimates. Submitting this document to your insurance company initiates the claim process and helps ensure you receive appropriate compensation for storm-related losses.

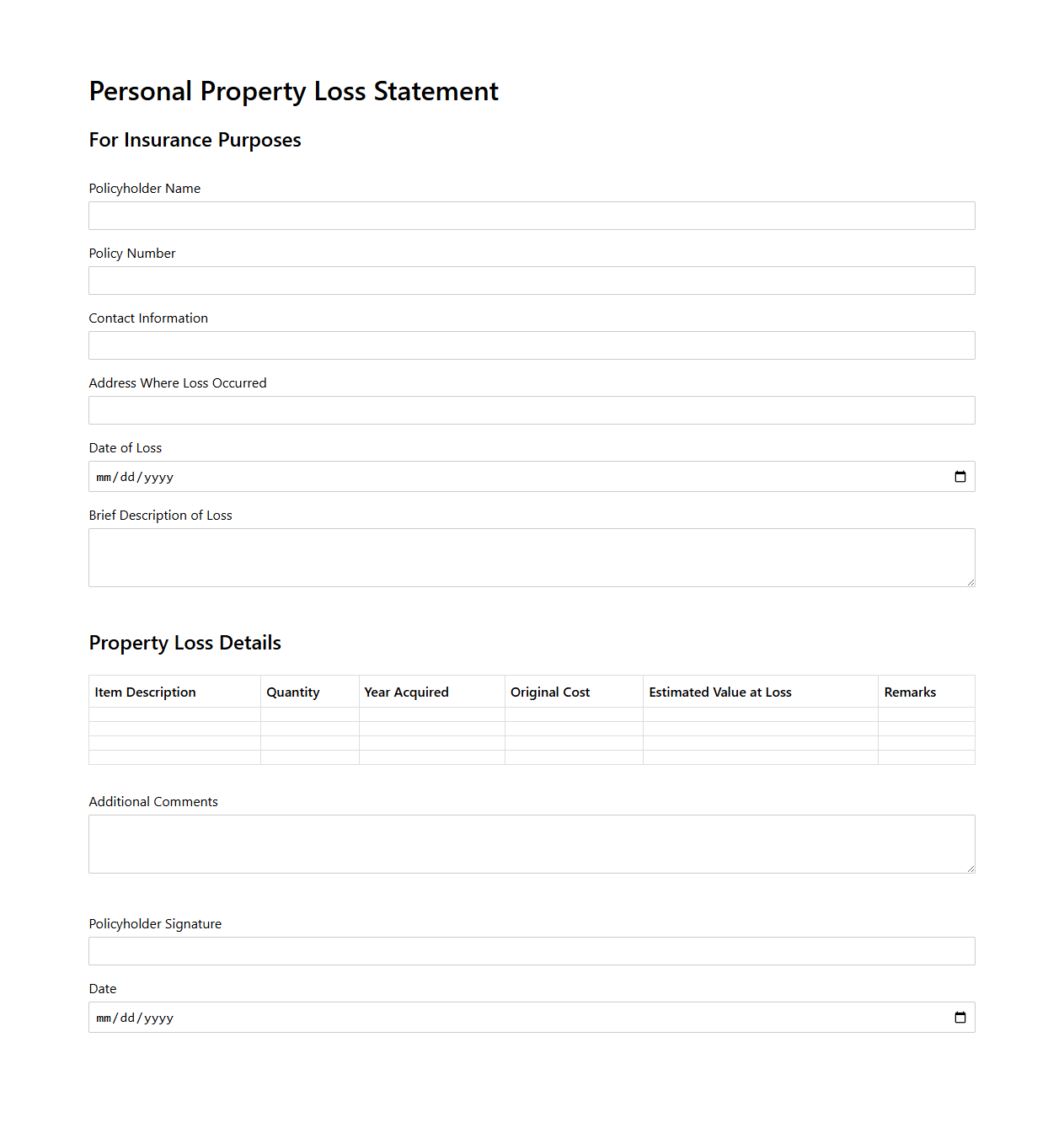

Personal Property Loss Statement for Insurance Purposes

A

Personal Property Loss Statement for insurance purposes is a detailed document that itemizes damaged, lost, or stolen personal belongings after an incident such as theft, fire, or natural disaster. It includes descriptions, values, purchase dates, and receipts or proof of ownership to support the insurance claim. This statement helps insurers assess the extent of loss and determine appropriate compensation.

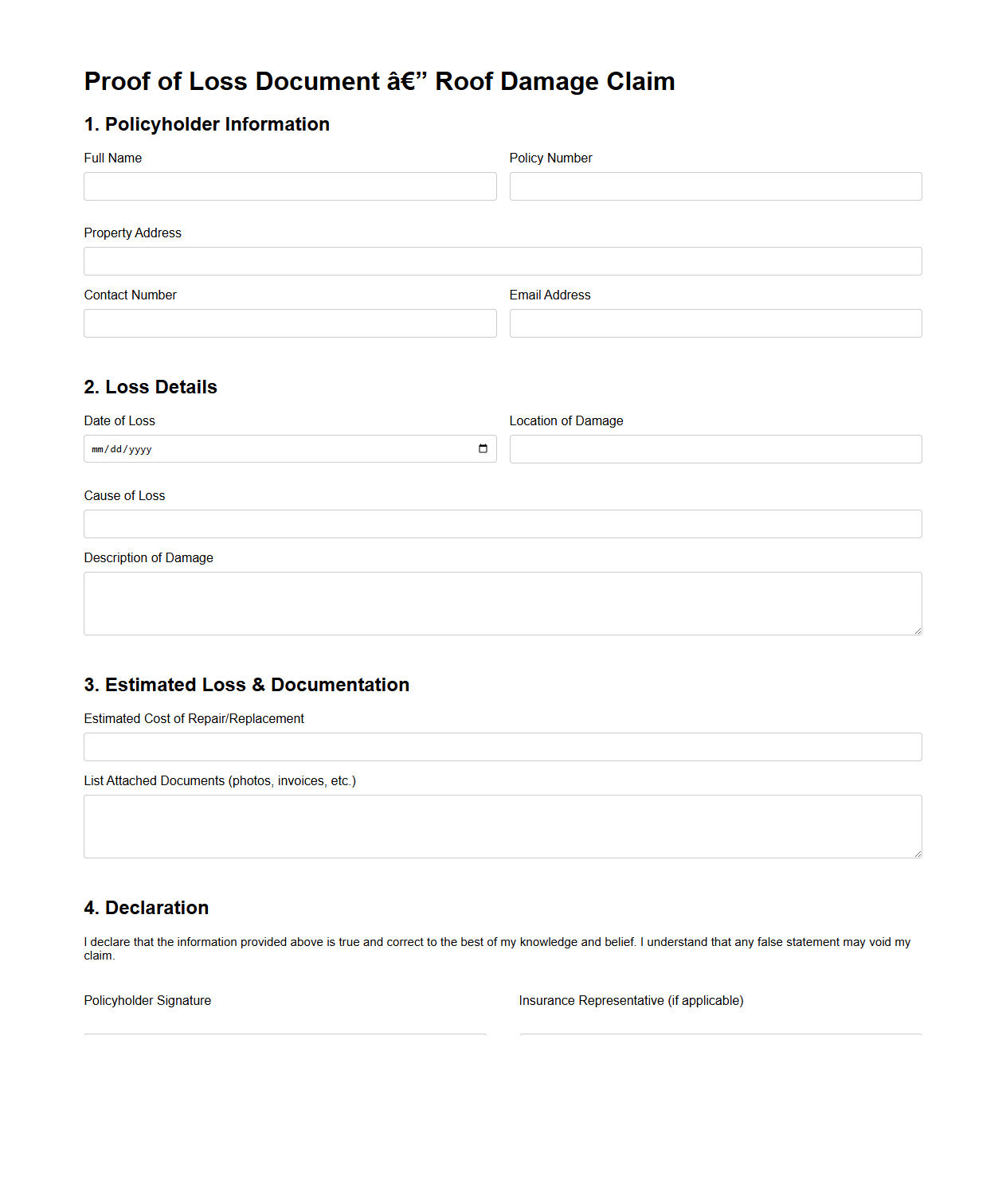

Roof Damage Claim Proof of Loss Document

A

Roof Damage Claim Proof of Loss Document serves as a critical piece of evidence submitted to insurance companies to validate and quantify the extent of damage sustained by a roof. This document typically includes detailed descriptions, photographs, repair estimates, and invoices that support the insured's claim for compensation. Properly preparing and submitting this proof of loss accelerates the claim approval process and ensures accurate settlement of roof damage claims.

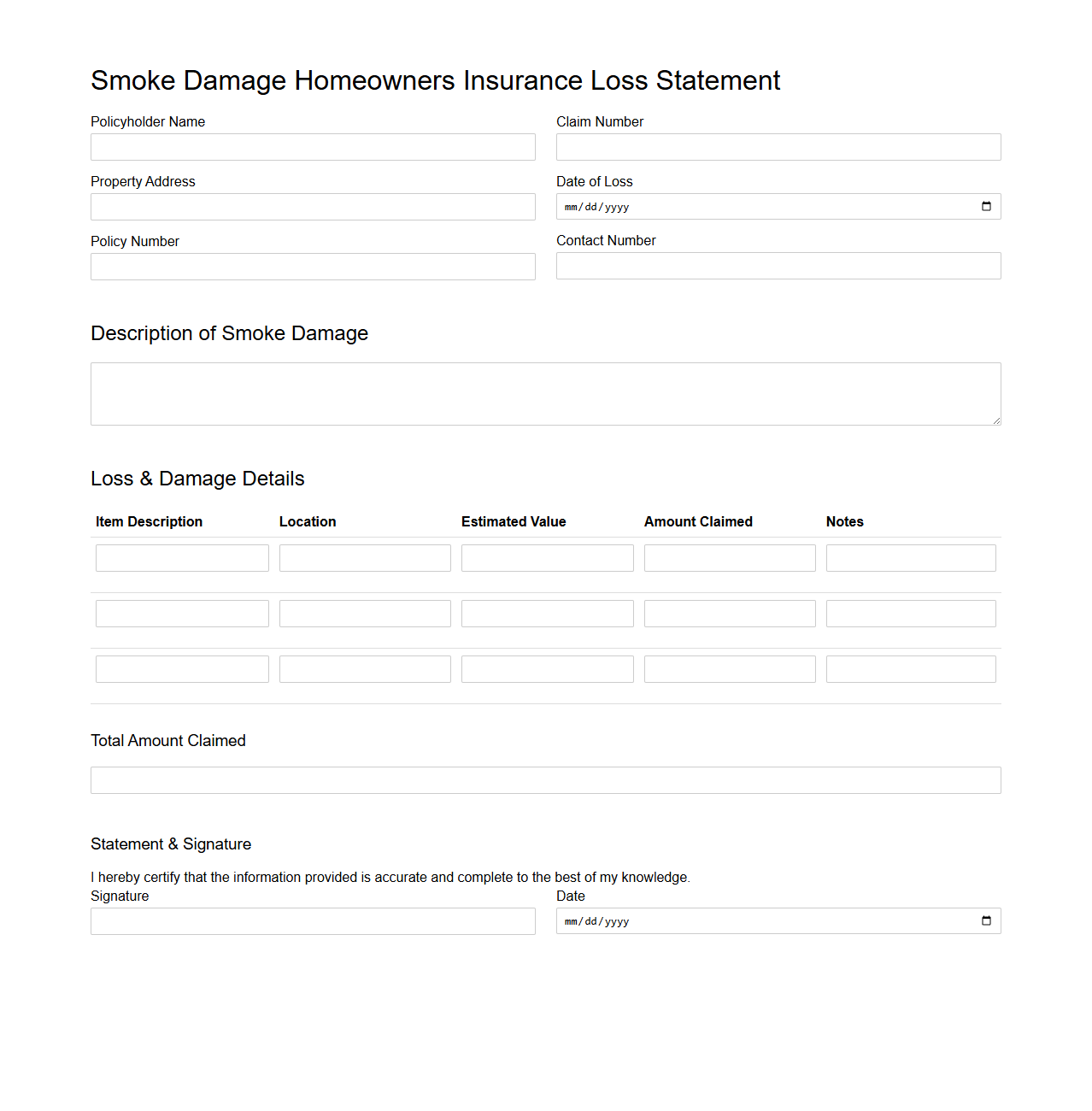

Smoke Damage Homeowners Insurance Loss Statement

A

Smoke Damage Homeowners Insurance Loss Statement is a formal document submitted to insurance companies to detail damages caused by smoke during a fire event. It includes descriptions of affected property, estimated repair costs, and any loss of personal belongings to support a homeowner's claim. This statement is critical for validating the extent of smoke damage and facilitating the insurance payout process.

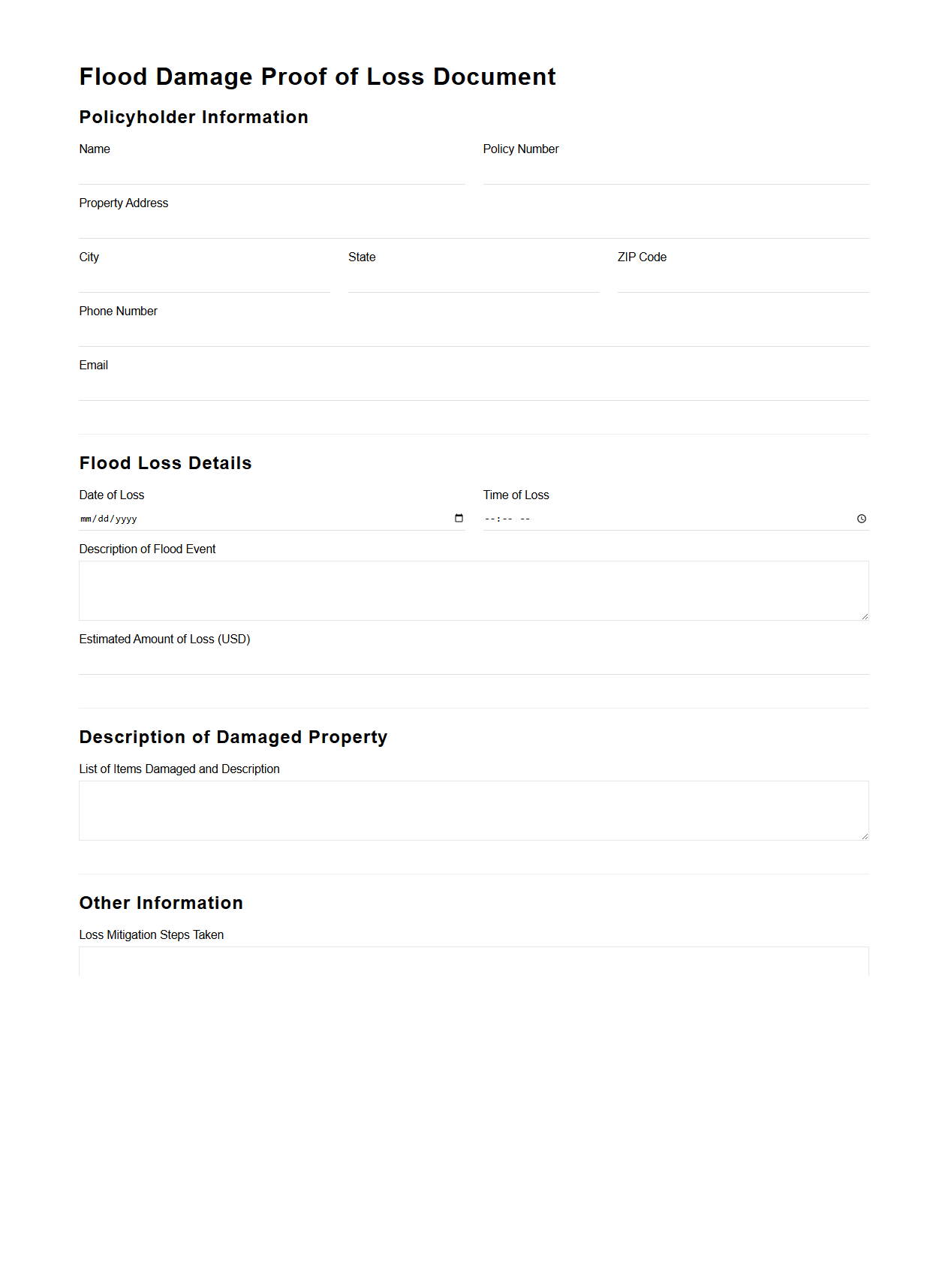

Flood Damage Proof of Loss Document for Residential Property

A

Flood Damage Proof of Loss Document for Residential Property is a formal claim submitted to an insurance company detailing the extent of flood-related damages to a homeowner's property. This document includes specific information such as the date of the flood, description of damaged items, repair estimates, and photographs, serving as critical evidence to process the insurance claim. Accurate completion of this form ensures timely compensation and helps homeowners recover financial losses from flood damage.

What essential details must be included in a Proof of Loss document for homeowners insurance claims?

A Proof of Loss document must include the claimant's name, policy number, and contact information. It should provide a detailed description of the damage or loss, specifying the date and cause. The document must also state the total amount claimed, supported by an itemized list of property losses.

How does a Proof of Loss sample demonstrate the process for itemizing damaged property and losses?

The sample shows a clear itemization of each damaged property piece with estimated values next to each item. It guides claimants to list specific descriptions such as brand, model, and condition before the incident. This ensures transparency and helps insurers accurately assess the extent of loss.

Which signatures and attestations are required for a Proof of Loss document to be considered valid by insurers?

A valid Proof of Loss must be signed by the policyholder to certify the accuracy of the claims. In some cases, a witness or notary signature is also required to attest the legitimacy of the statement. The document often includes a date to confirm when the claim was officially submitted.

How does the sample document clarify timeframes and deadlines for submitting a homeowners insurance claim?

The sample clearly states the deadline for submitting the Proof of Loss, usually within 60 days after the loss occurs. It emphasizes the importance of meeting these timeframes to avoid denial of the claim. This precise information helps homeowners comply with policy conditions promptly.

What supporting documentation is referenced or required in the Proof of Loss template to substantiate the claim?

The template typically references the need for photos of damaged property, repair estimates, and receipts for purchased items. It also advises attaching police or fire reports if applicable. These supporting documents strengthen the claim and facilitate faster processing by insurers.