A Reinstatement Request Document Sample for Disability Insurance provides a clear template for policyholders to formally request the reactivation of their disabled insurance coverage after a lapse. This document typically includes essential details such as policy number, reason for reinstatement, medical information, and a formal appeal to the insurance company. Using a well-structured sample ensures accuracy and completeness, increasing the chances of successful reinstatement.

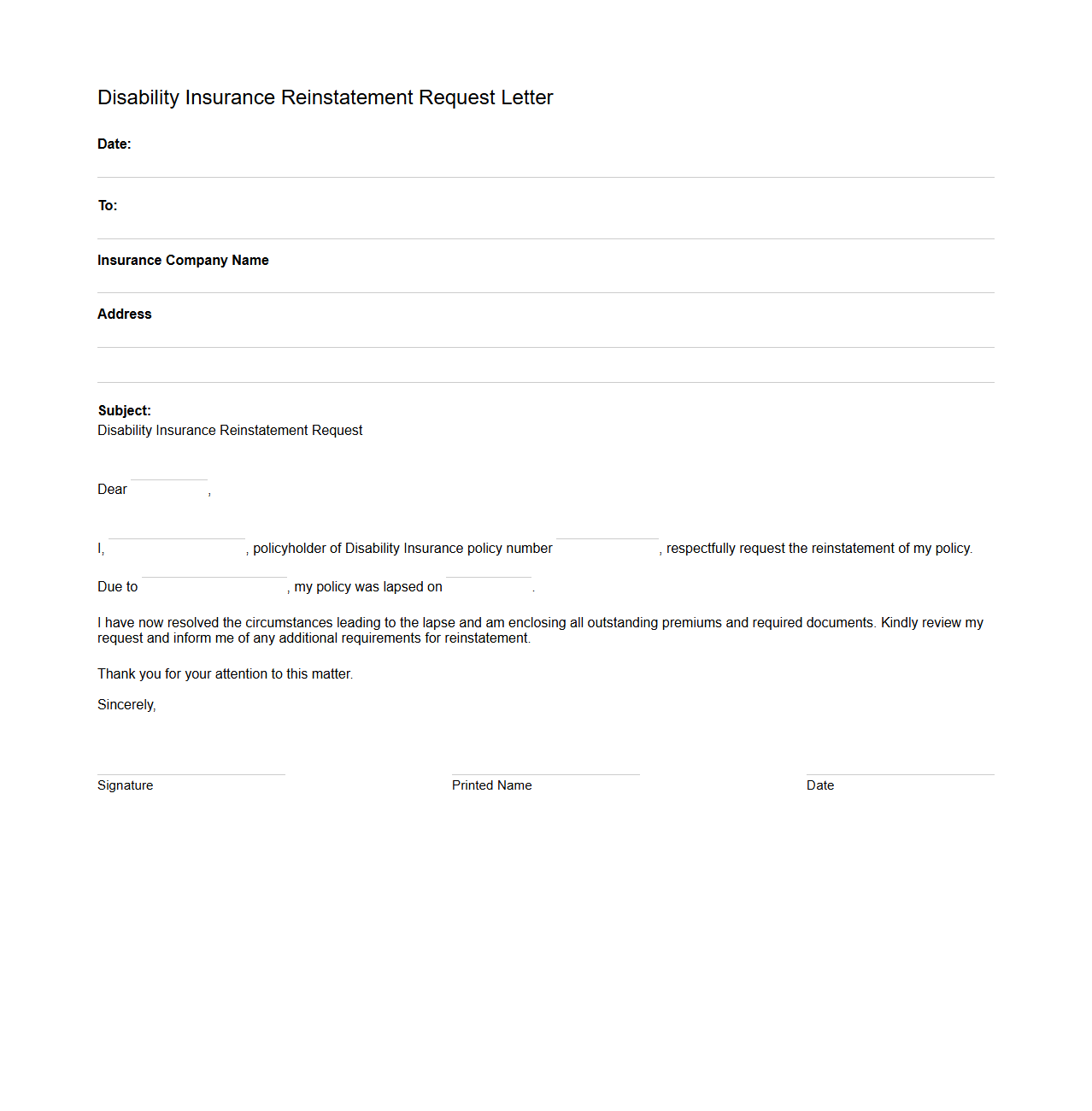

Disability Insurance Reinstatement Request Letter

A

Disability Insurance Reinstatement Request Letter is a formal document submitted by policyholders seeking to reactivate a lapsed disability insurance policy. This letter includes essential personal information, policy details, reasons for policy lapse, and a request to restore coverage. It serves as a critical communication tool between the insured and the insurance provider to resume protection and benefits under the disability insurance plan.

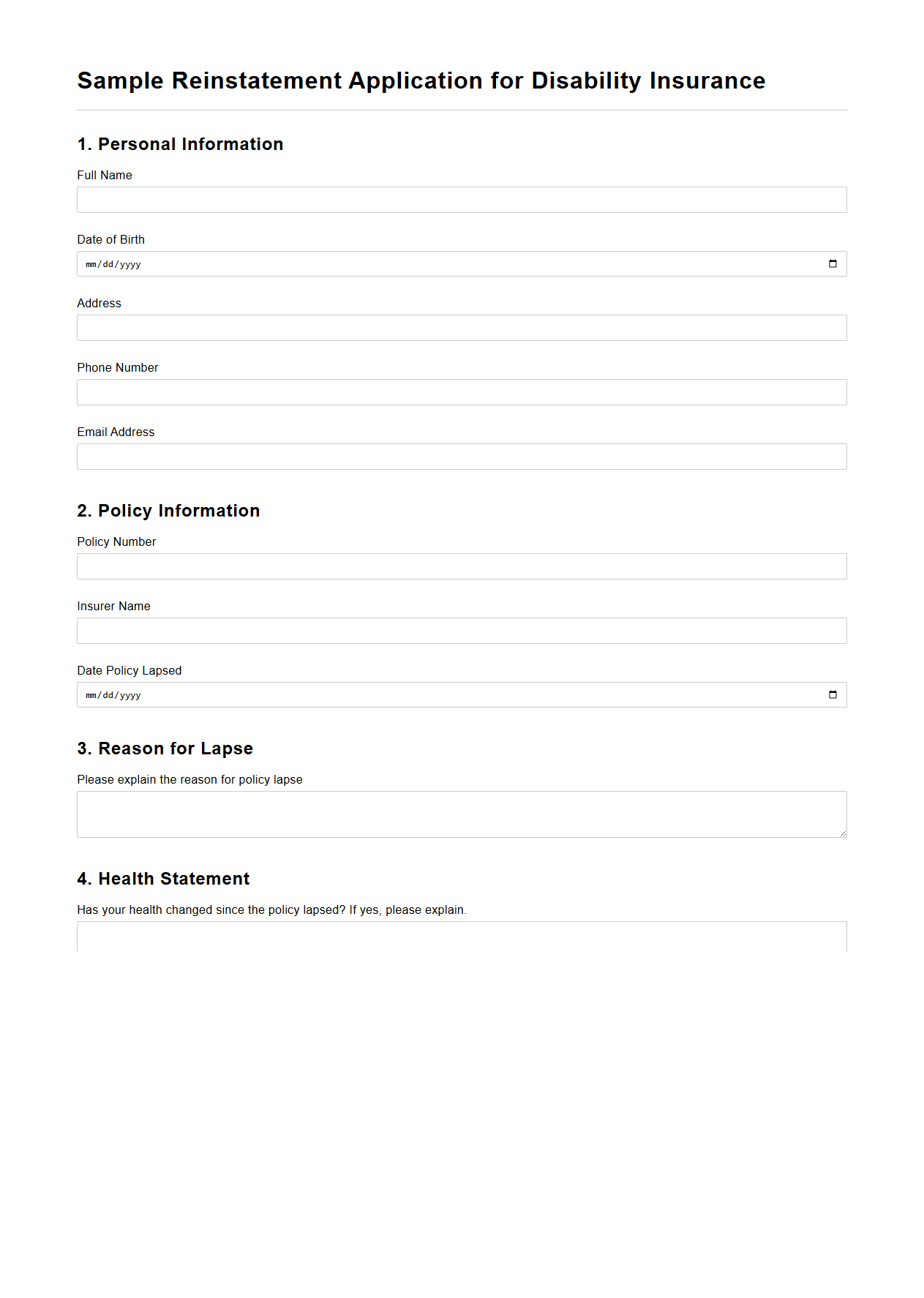

Sample Reinstatement Application for Disability Insurance

A

Sample Reinstatement Application for Disability Insurance document serves as a formal request to restore disability insurance coverage after a lapse or cancellation. It typically includes personal identification details, policy information, and justification for reinstatement, such as medical updates or proof of continued eligibility. This application helps policyholders regain benefits without undergoing a completely new underwriting process.

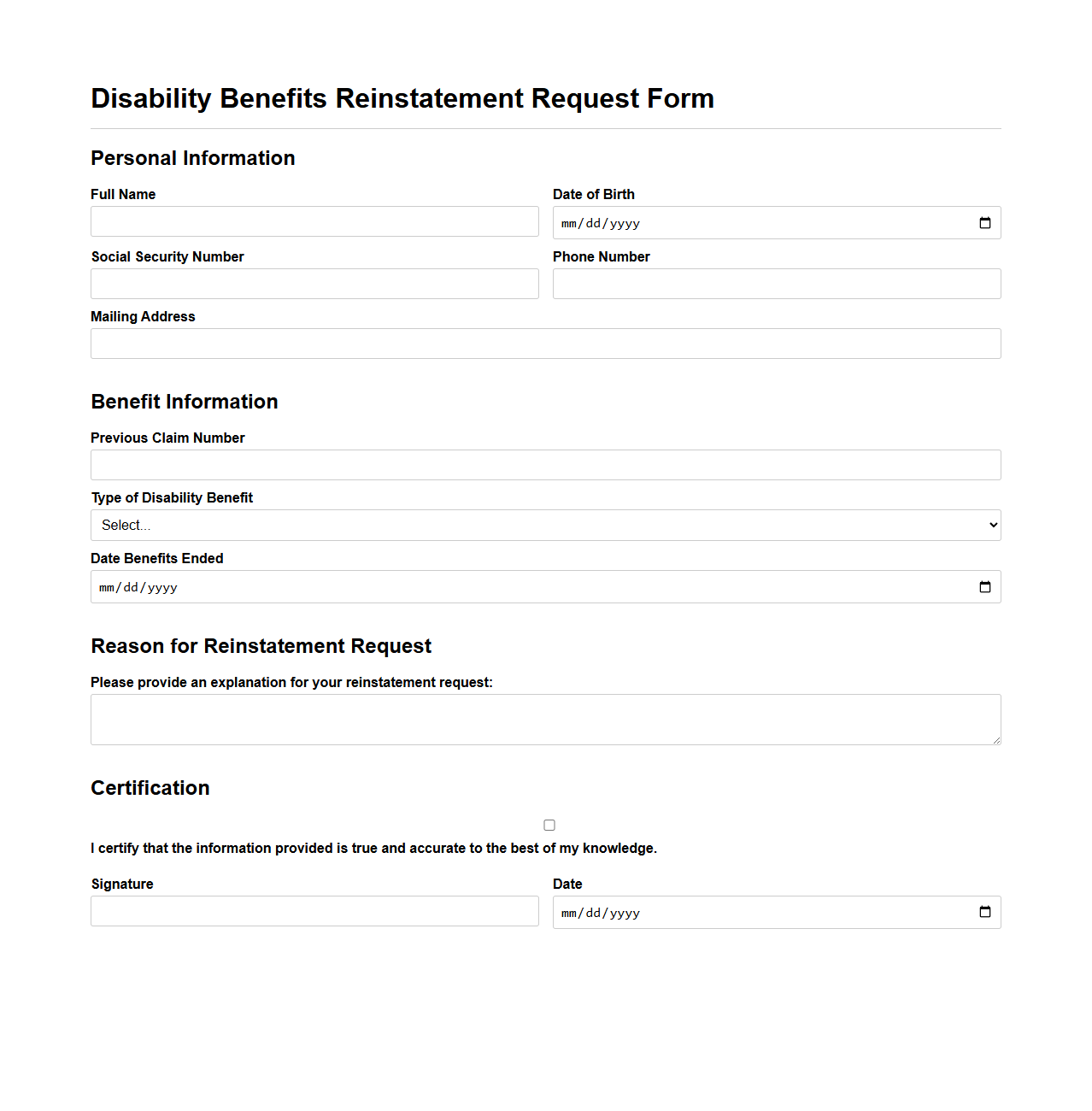

Disability Benefits Reinstatement Request Form

The

Disability Benefits Reinstatement Request Form is a crucial document used by individuals seeking to resume disability payments after they have been stopped due to return to work or other reasons. This form collects essential information about the claimant's current medical condition and employment status to determine eligibility for reinstating benefits. Timely submission of this form ensures continued financial support without delays in processing by the disability benefits agency.

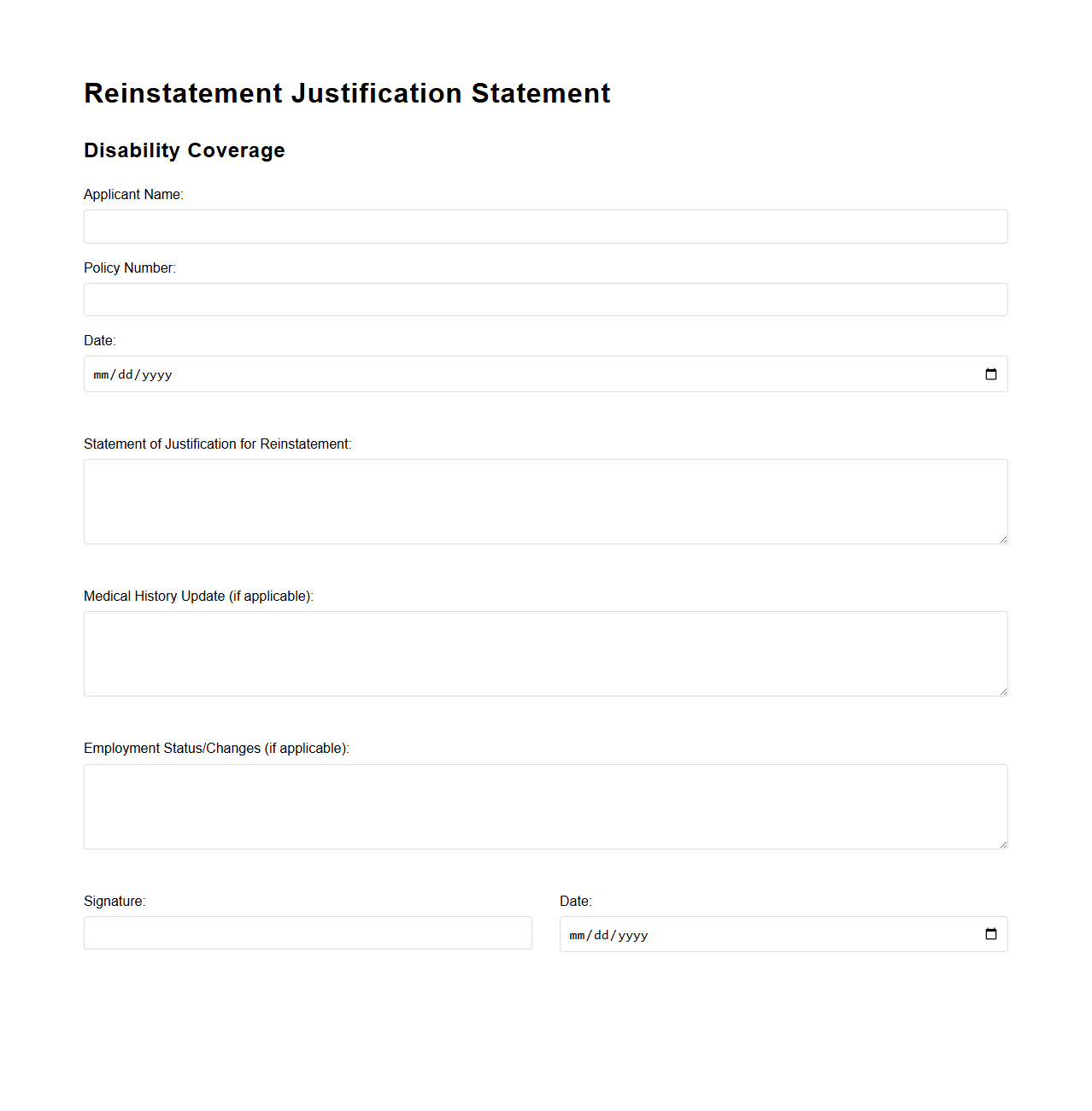

Reinstatement Justification Statement for Disability Coverage

A

Reinstatement Justification Statement for Disability Coverage is a formal document submitted to an insurance provider to explain the reasons for requesting the reinstatement of a previously lapsed disability insurance policy. It outlines the claimant's current health status, changes since policy lapse, and justification for why coverage should resume, often including medical evidence and financial information. This statement is crucial for insurers to assess risk and determine eligibility for policy reinstatement.

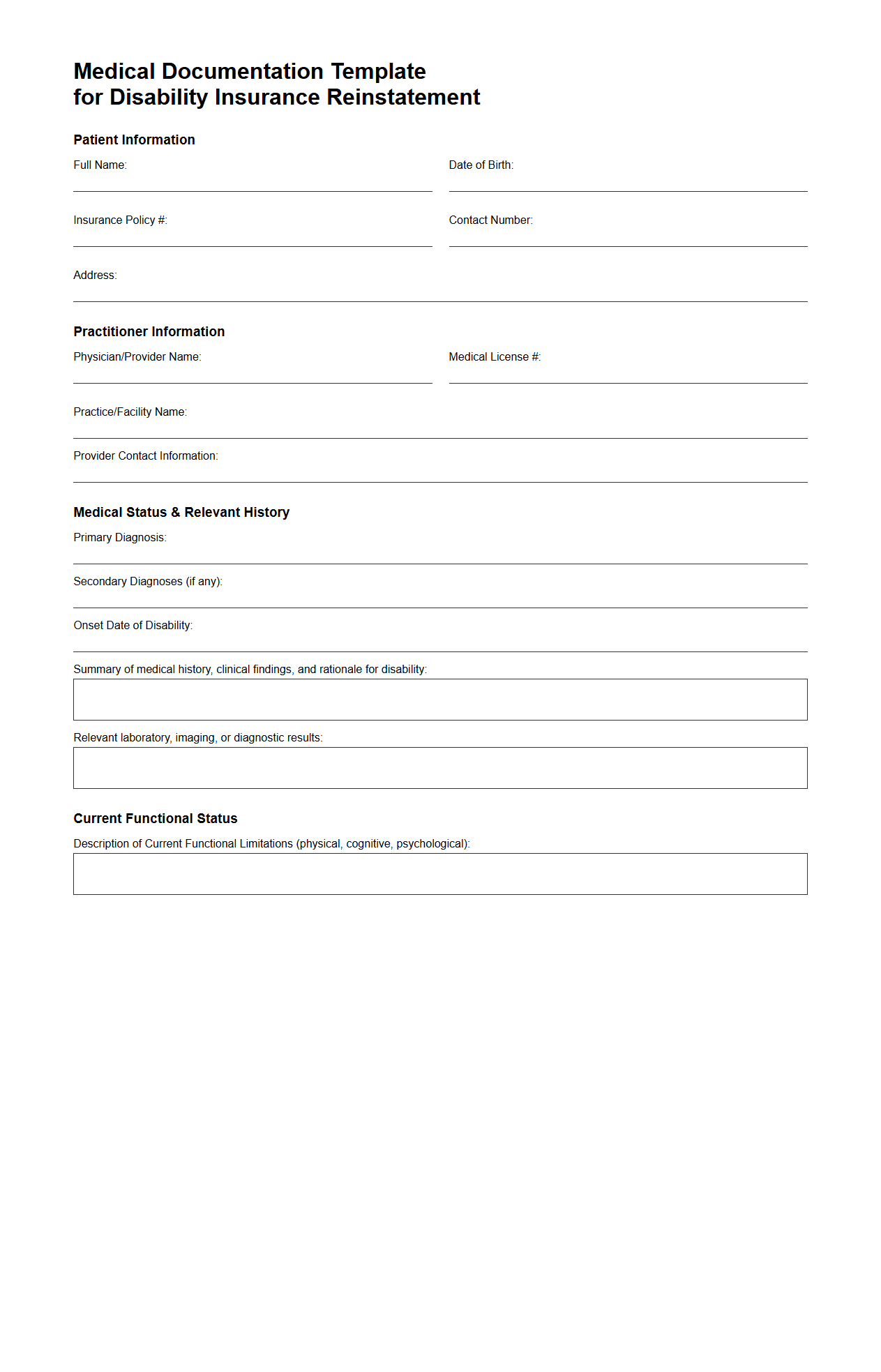

Medical Documentation Template for Disability Insurance Reinstatement

A

Medical Documentation Template for Disability Insurance Reinstatement is a standardized form used by healthcare providers to record and communicate a patient's current medical status and treatment history. This document is essential in demonstrating the persistence or recurrence of a disabling condition, supporting the policyholder's request to reactivate disability benefits. Accurate and detailed medical information within this template ensures a smoother process for insurance companies to evaluate and approve reinstatement claims.

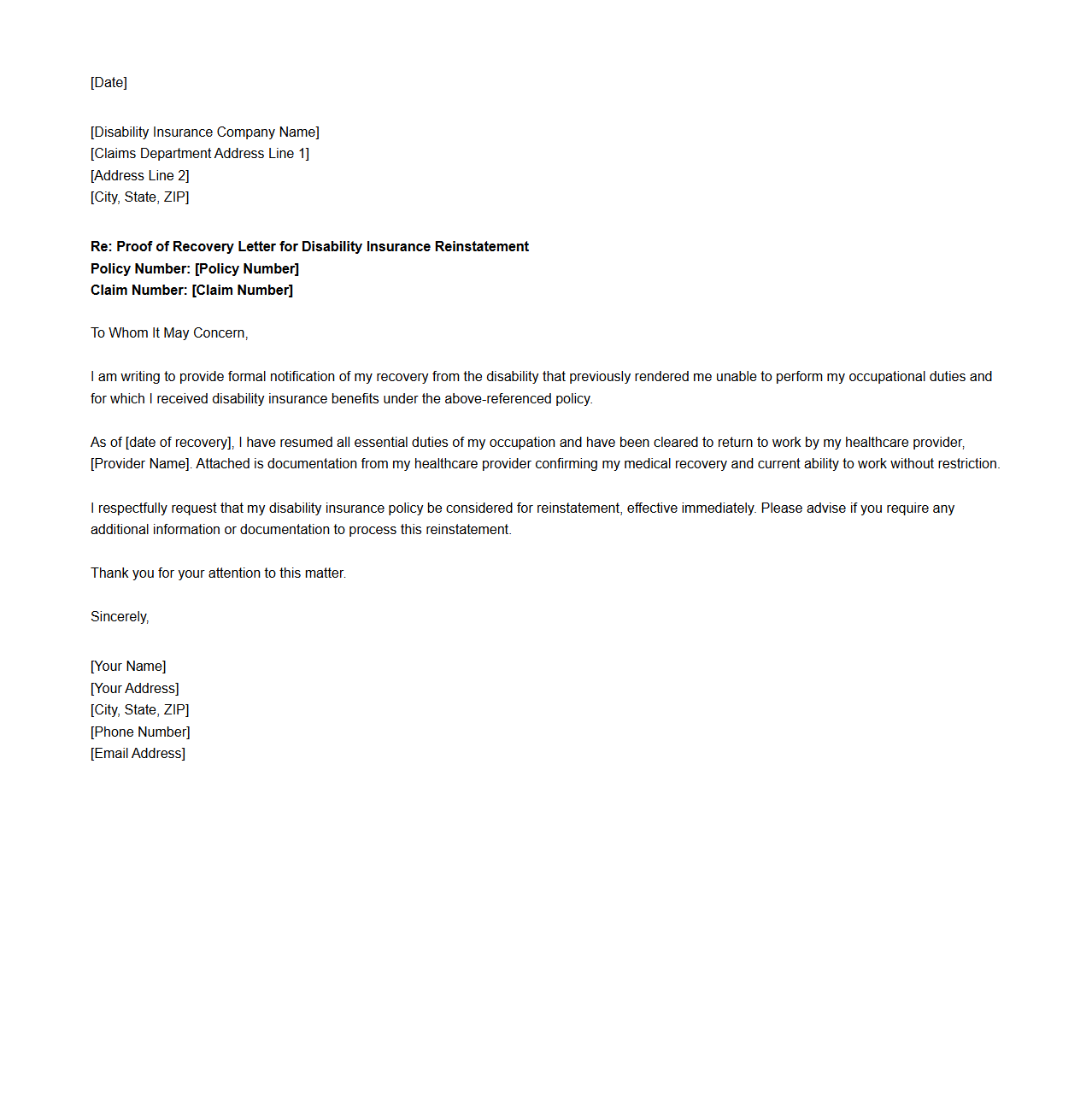

Proof of Recovery Letter for Disability Insurance Reinstatement

A

Proof of Recovery Letter for Disability Insurance Reinstatement is an official document provided by a healthcare professional that confirms an individual's recovery from a prior disabling condition. This letter substantiates the insured person's improved health status, enabling the insurance company to consider reinstating the disability coverage that was previously suspended or terminated. Insurers rely on this document to assess risk and validate eligibility for reinstating benefits under the policy terms.

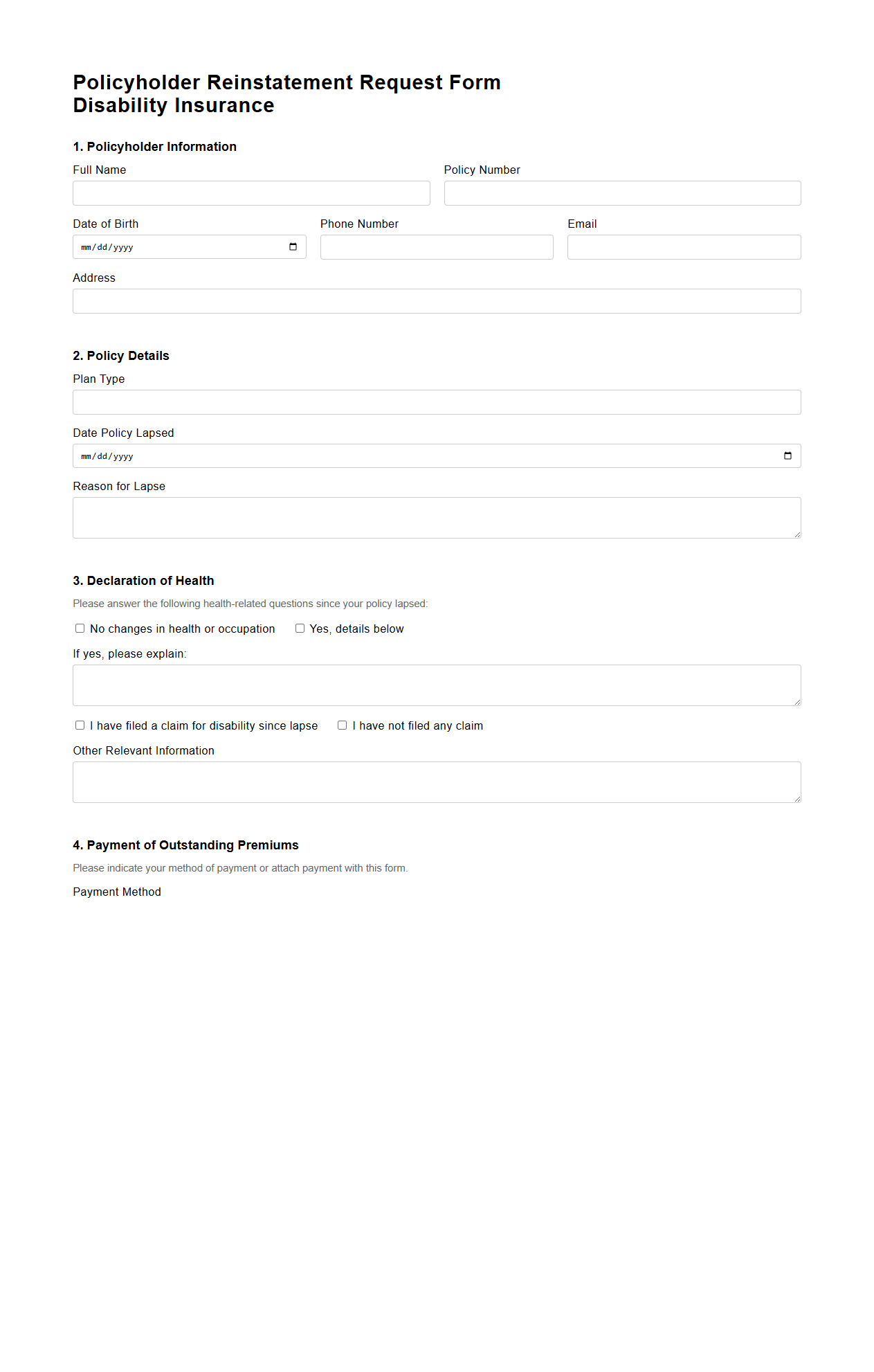

Policyholder Reinstatement Request Form for Disability Insurance

The

Policyholder Reinstatement Request Form for disability insurance is a crucial document used by policyholders to reactivate a lapsed insurance policy. It collects essential information regarding the policyholder's health status and reasons for discontinuation to assess eligibility for reinstatement. Insurers rely on this form to determine risk and resume coverage under the original policy terms.

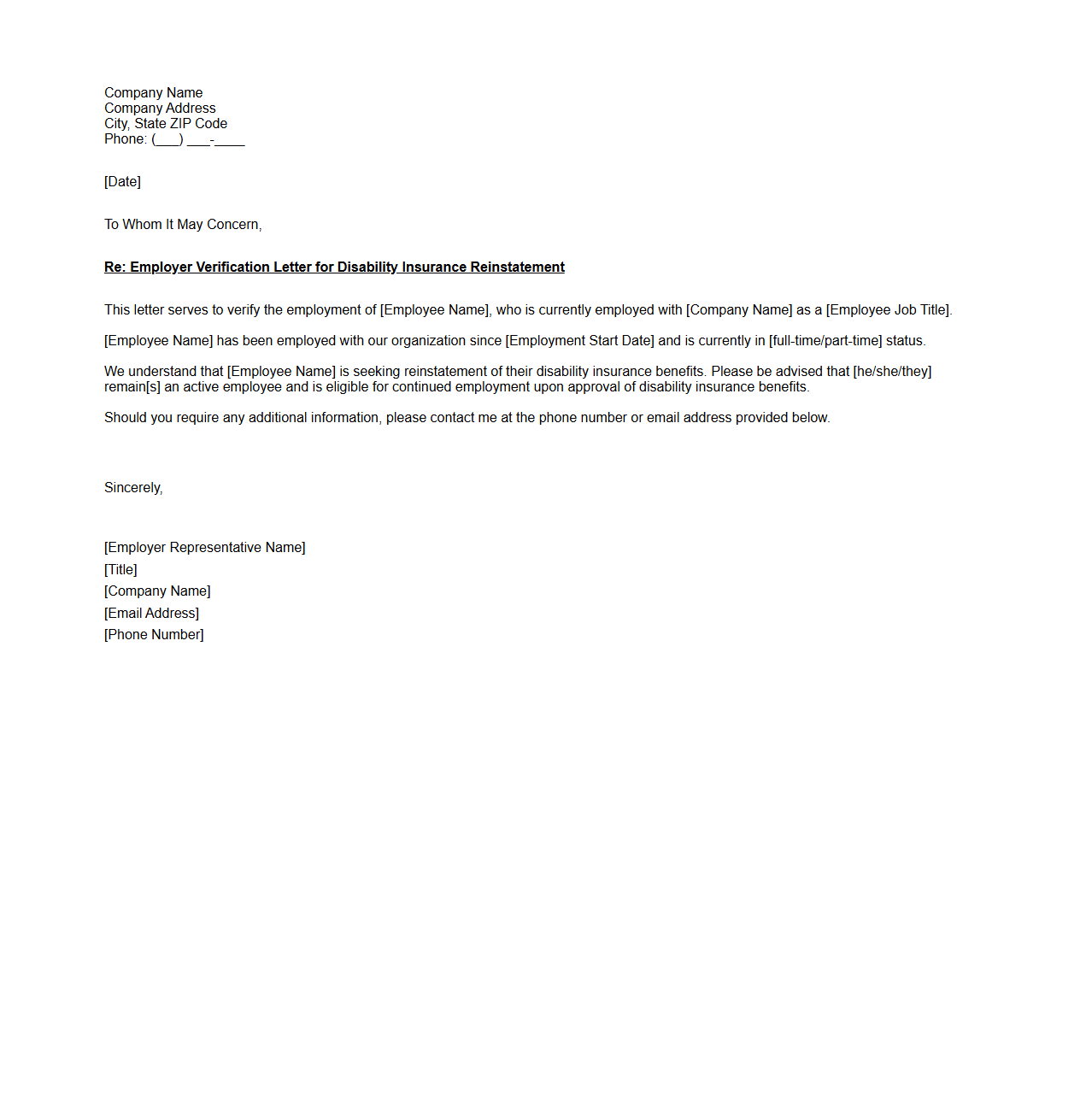

Employer Verification Letter for Disability Insurance Reinstatement

An

Employer Verification Letter for Disability Insurance Reinstatement is a formal document provided by an employer confirming an employee's job status, salary, and work history to support the reinstatement of disabled insurance benefits. This letter verifies that the employee continues to meet eligibility requirements and is essential for the insurance provider to process the reinstatement request. Accurate and detailed employer verification helps prevent delays and ensures seamless continuation of disability coverage.

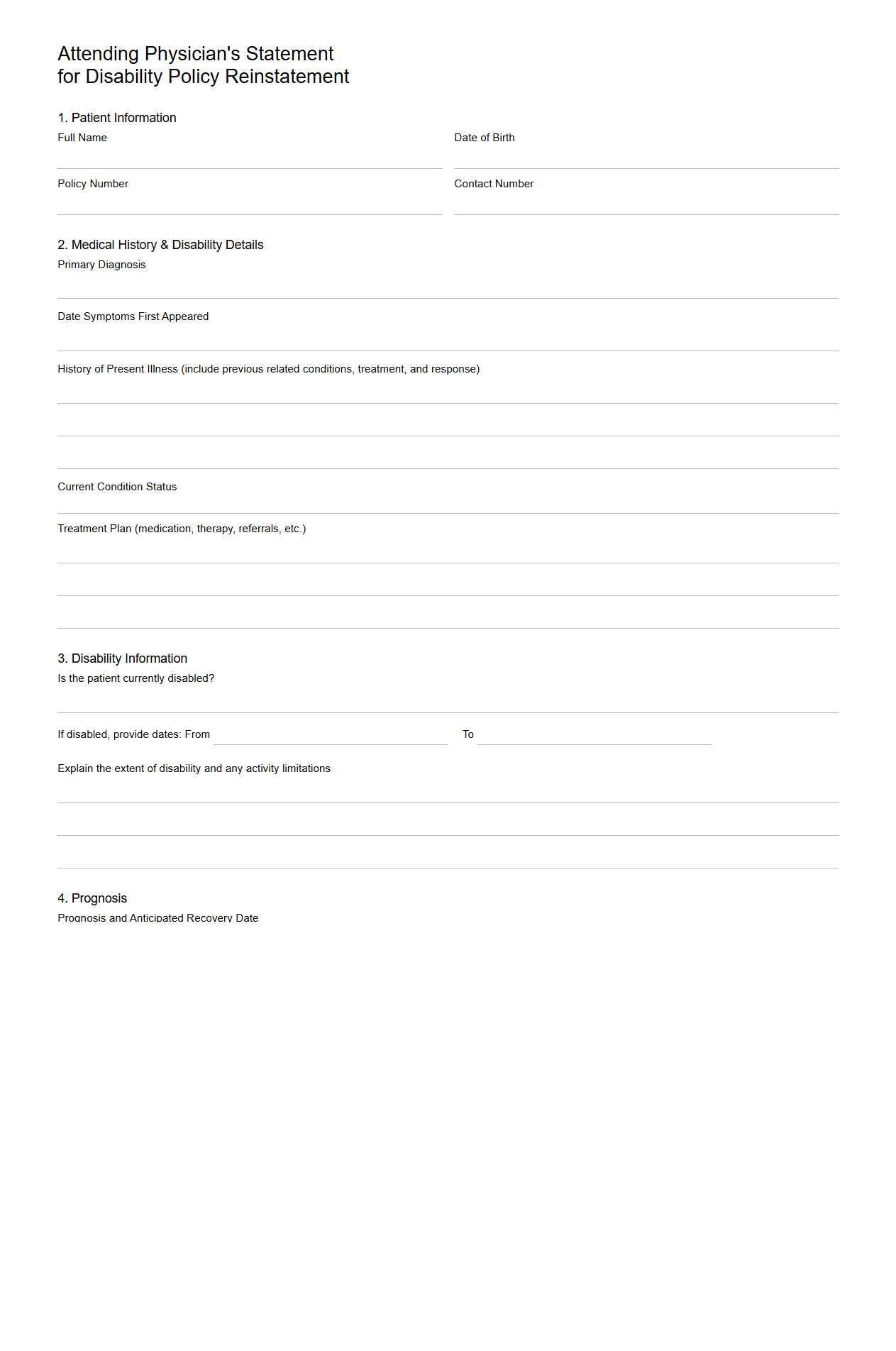

Attending Physician's Statement for Disability Policy Reinstatement

The

Attending Physician's Statement for Disability Policy Reinstatement is a detailed medical report completed by a healthcare provider to assess the claimant's current health status and capacity to resume work. This document includes diagnosis, treatment history, prognosis, and any functional limitations that impact the insured's ability to perform job-related tasks. Insurance companies require this statement to verify medical eligibility and ensure accurate evaluation for reinstating disability benefits.

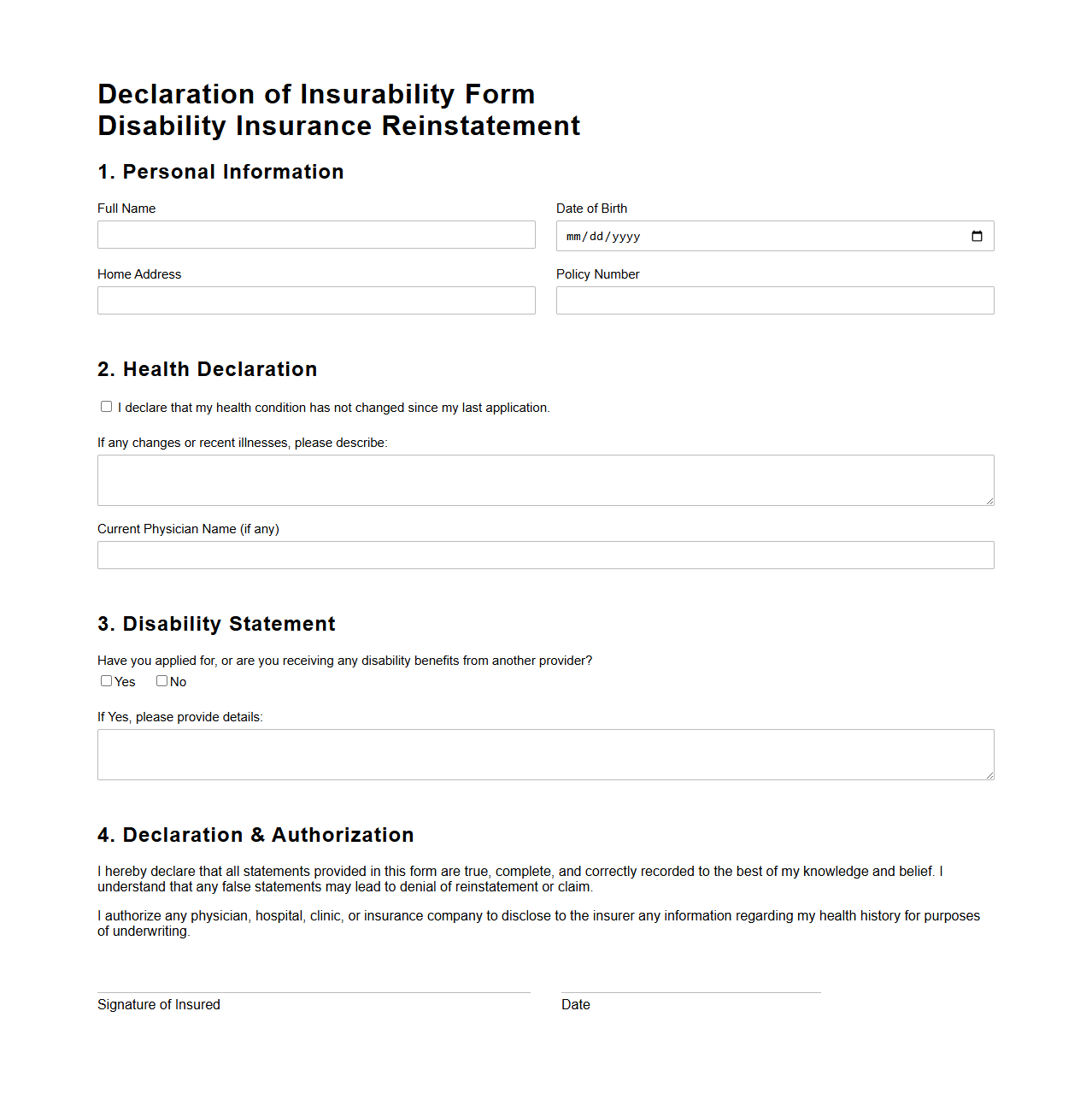

Declaration of Insurability Form for Disability Insurance Reinstatement

The

Declaration of Insurability Form for Disability Insurance Reinstatement is a crucial document used to assess an applicant's current health status before reactivating a lapsed disability insurance policy. This form gathers detailed medical information to determine if the insured qualifies for reinstatement without additional exclusions or premium changes. Insurance companies rely on this declaration to evaluate risk and ensure the policyholder meets underwriting criteria for continuous coverage.

What essential personal and policy information must be included in a reinstatement request document for disability insurance?

The applicant's full name and contact details must be clearly stated in the reinstatement request document. It is crucial to include the policy number and the date the policy lapsed for accurate processing. This information ensures that the insurance provider can efficiently locate and identify the existing disability insurance policy.

How should the reasons for policy lapse be clearly explained in the reinstatement request?

The applicant should provide a clear and concise explanation detailing the circumstances that led to the policy lapse. It is important to be honest and transparent about any missed payments or communication issues with the insurer. This explanation helps the insurance company understand the context and assess the feasibility of reinstating the policy.

What supporting documents are typically required to accompany a disability insurance reinstatement request?

Typically, the reinstatement request must be accompanied by proof of identity such as a government-issued ID and any relevant medical records. The insurer may also require financial documents to verify the applicant's ability to resume premium payments. These supporting documents strengthen the reinstatement case by providing verifiable evidence.

How should the applicant address their current health status within the request?

The applicant must provide a detailed update on their current health status including any recent medical evaluations or changes in condition. It is important to affirm that the applicant meets the policy's health requirements for reinstatement. Transparent and accurate health information helps the insurer assess risk and supports the evaluation process.

What assurances or statements should be included to demonstrate continued eligibility for disability insurance reinstatement?

The reinstatement request should include a declaration of continued eligibility, confirming compliance with all policy terms and conditions. The applicant should affirm that no disqualifying events or changes in risk factors have occurred since the policy lapsed. Providing these assurances helps to expedite the approval process and reinforces the applicant's commitment to maintaining coverage.