A Premium Payment Document Sample for Life Insurance serves as proof of payment made by the policyholder towards their life insurance policy. This document typically includes details such as the payment amount, date, policy number, and payment method. It is essential for maintaining accurate records and ensuring continuous coverage under the life insurance plan.

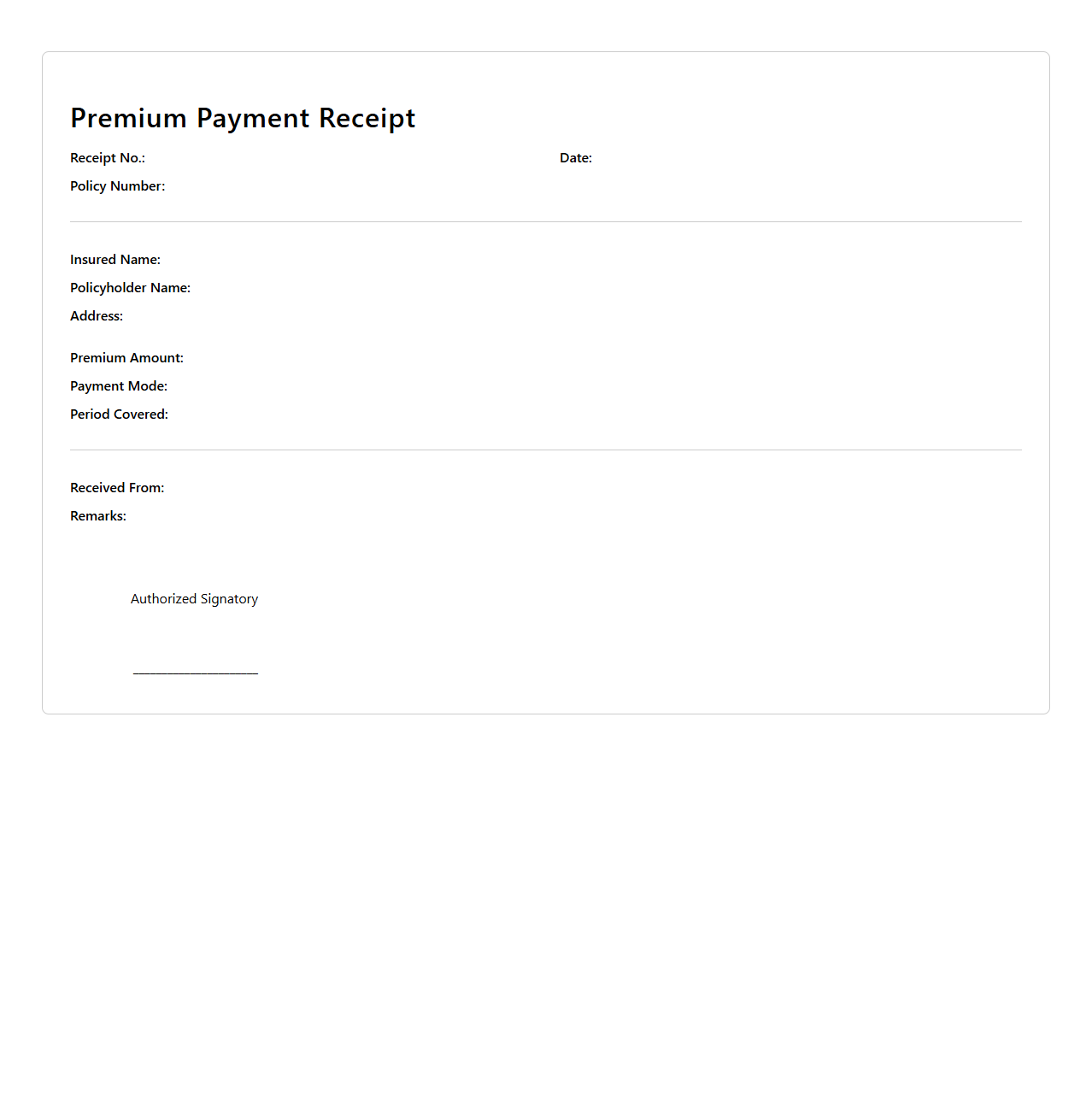

Premium Payment Receipt Example for Life Insurance Policy

A

Premium Payment Receipt for a life insurance policy is an official document issued by the insurer confirming the receipt of the policyholder's premium payment. It typically includes crucial details such as the policy number, payment date, amount paid, and mode of payment, serving as proof of transaction. This receipt is essential for record-keeping and may be required for future claims or policy servicing.

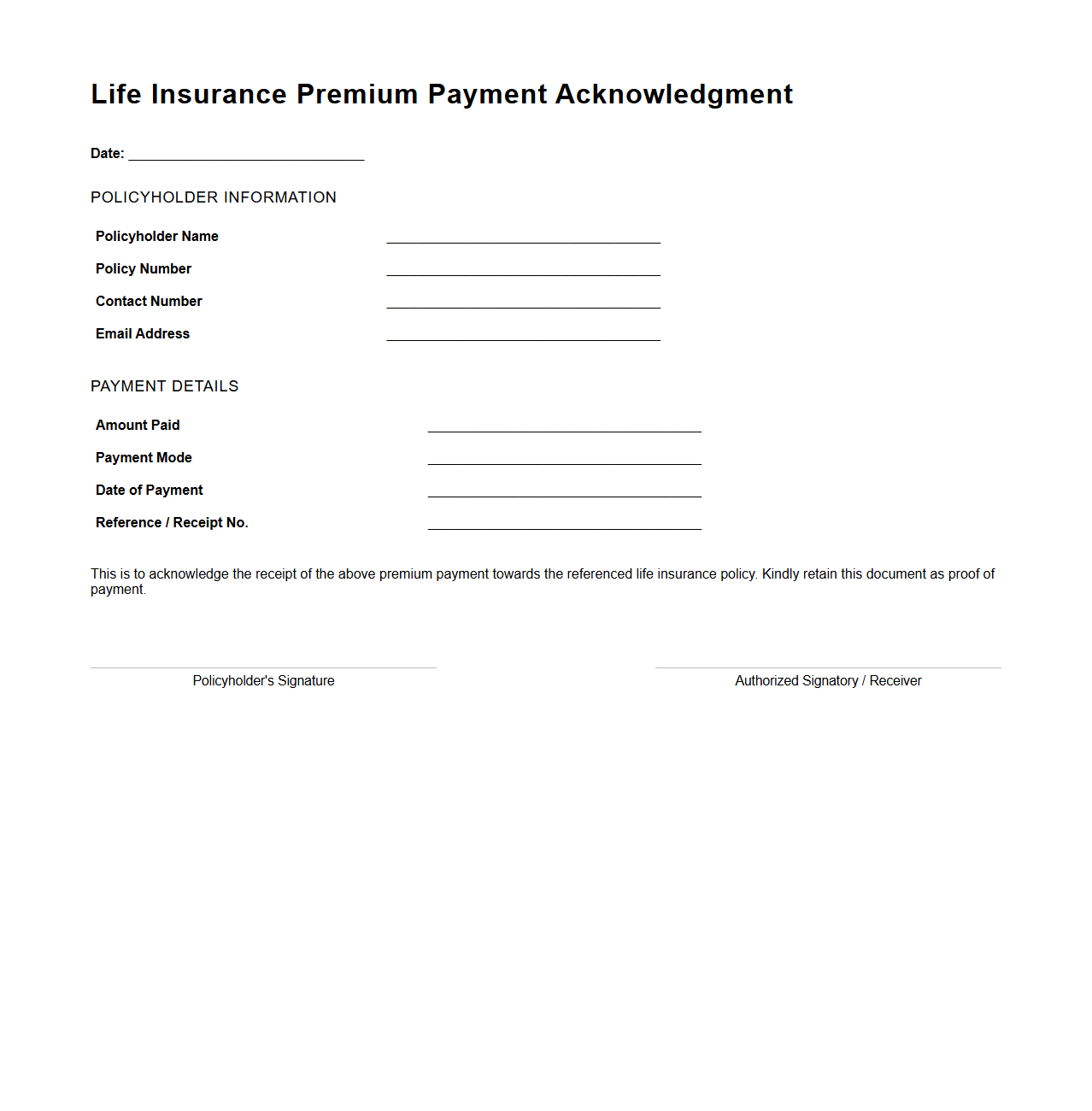

Life Insurance Premium Payment Acknowledgment Template

A

Life Insurance Premium Payment Acknowledgment Template is a formal document used by insurance companies to confirm receipt of a policyholder's premium payment. This template typically includes details such as the policyholder's name, insurance policy number, payment amount, payment date, and mode of payment, ensuring clear and accurate record-keeping. Using this document helps maintain transparency and trust between the insurer and the insured by providing official proof of the transaction.

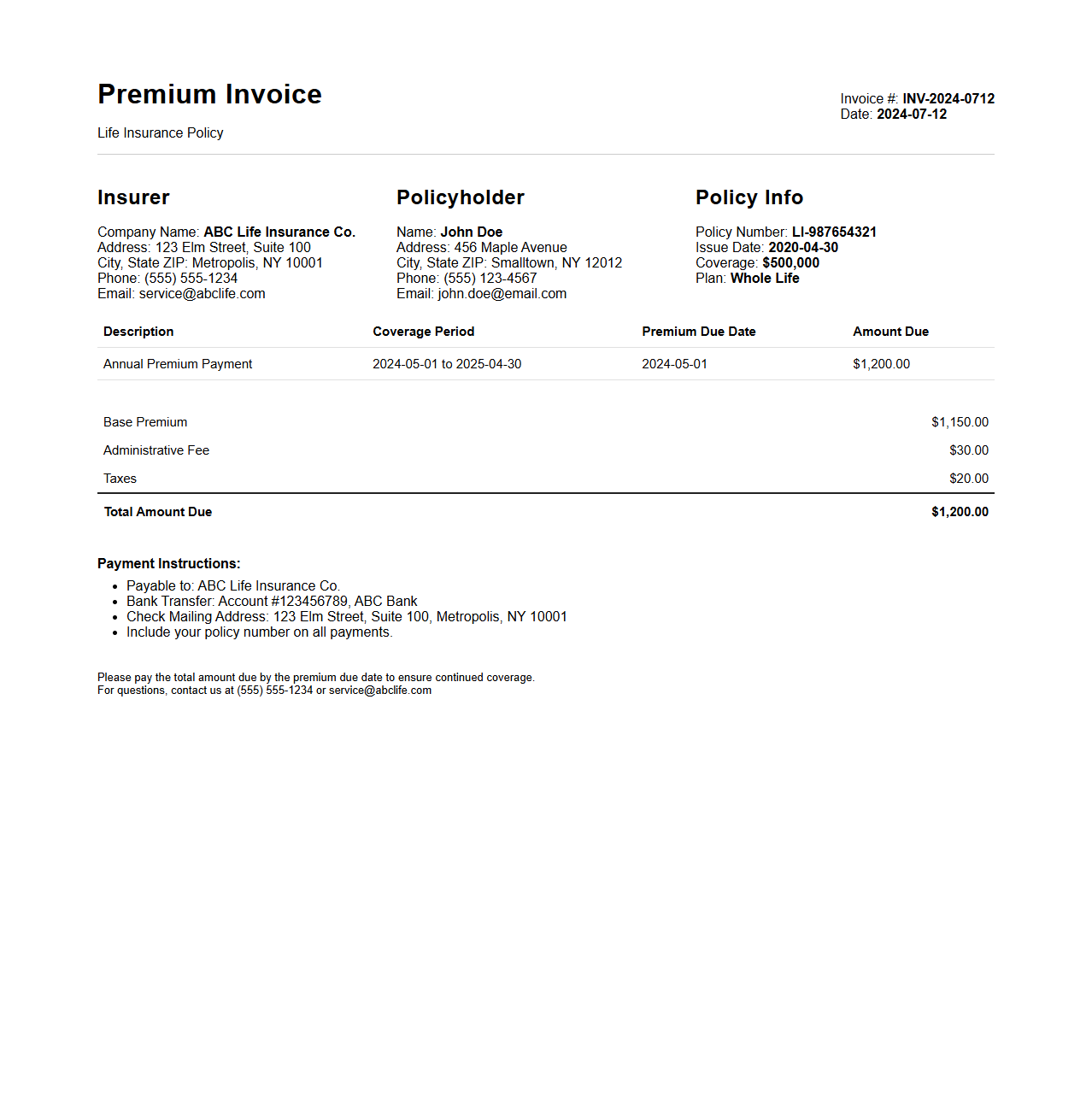

Life Insurance Policy Premium Invoice Sample

A

Life Insurance Policy Premium Invoice Sample document provides a detailed breakdown of the payment due for a life insurance plan, including the premium amount, policy number, payment due date, and coverage details. It serves as an official notice to the policyholder, ensuring timely payment to keep the insurance policy active and in good standing. This sample invoice helps customers understand the billing format and verify the accuracy of their premium charges.

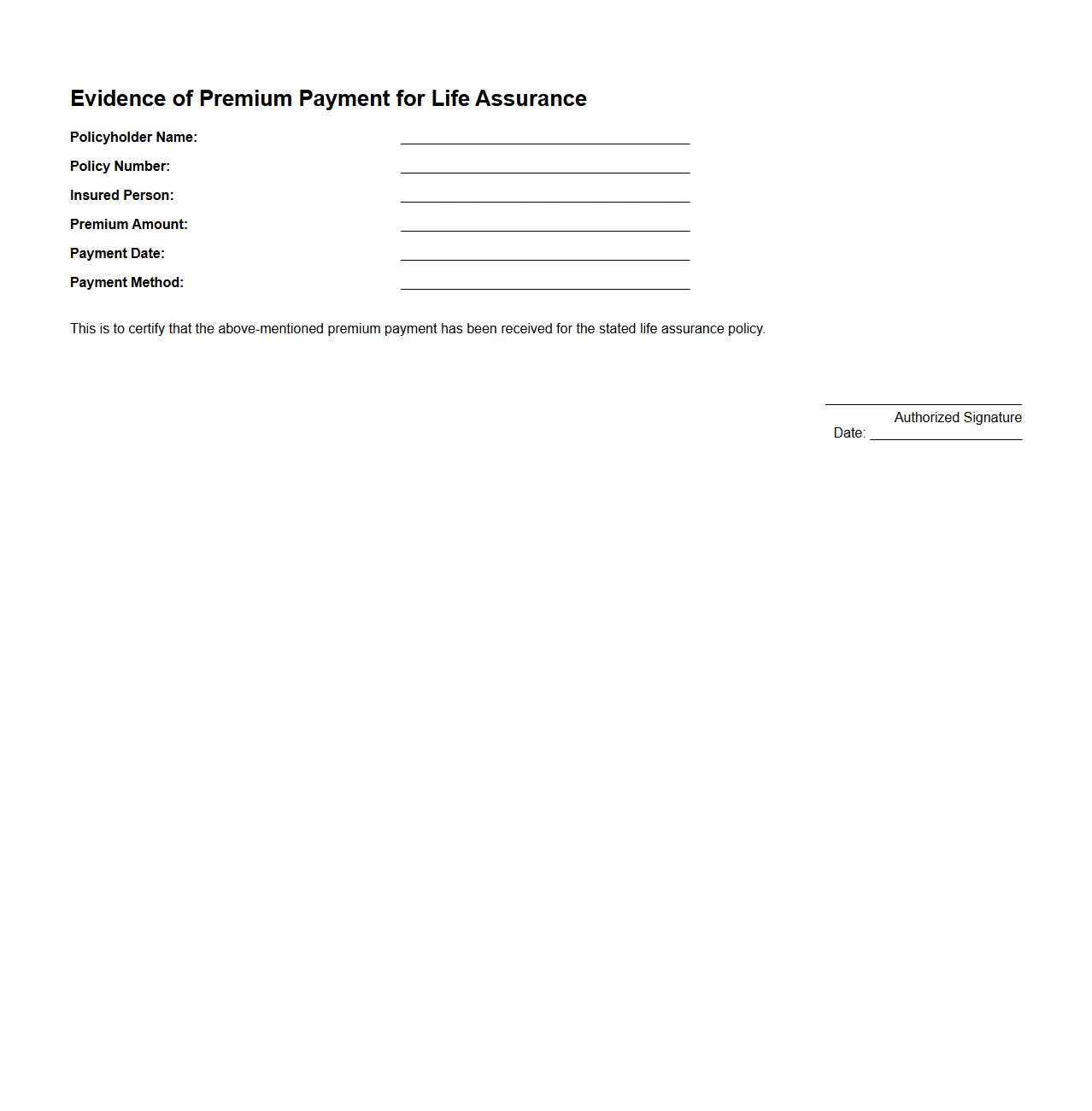

Evidence of Premium Payment for Life Assurance

Evidence of Premium Payment for life assurance is a vital document that confirms the policyholder has paid premiums as agreed in the insurance contract. It serves as proof to both the insurer and the insured that the policy remains active and benefits are secure. This document is crucial for claim processing, policy renewal, and dispute resolution.

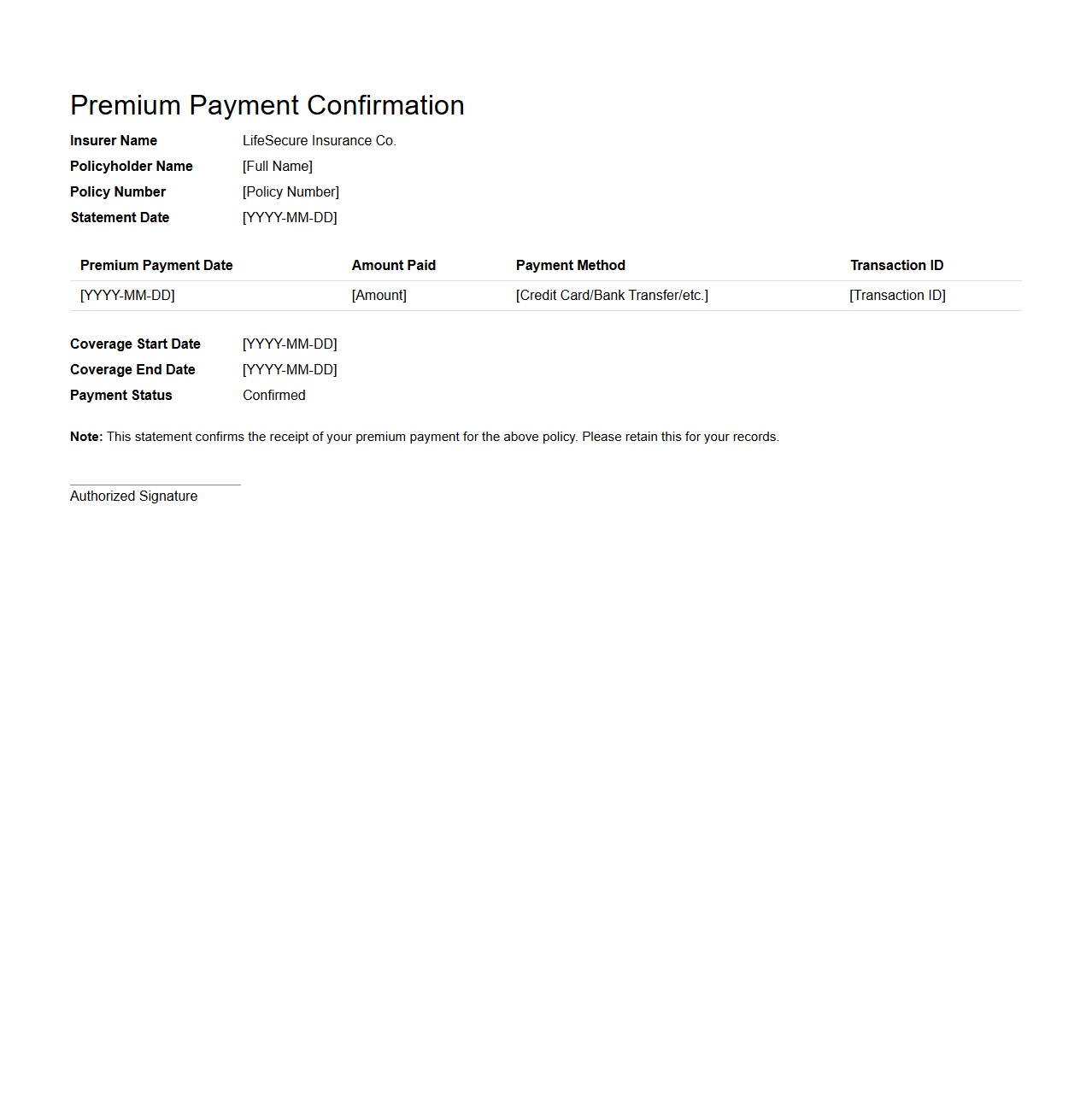

Life Insurer Premium Payment Confirmation Statement

A

Life Insurer Premium Payment Confirmation Statement is a formal document issued by insurance companies to confirm the receipt of premium payments from policyholders. It details the payment amount, date received, policy number, and coverage period, ensuring transparency and accurate record-keeping between the insurer and the insured. This statement serves as proof of payment and aids in maintaining updated policy status for claims and renewals.

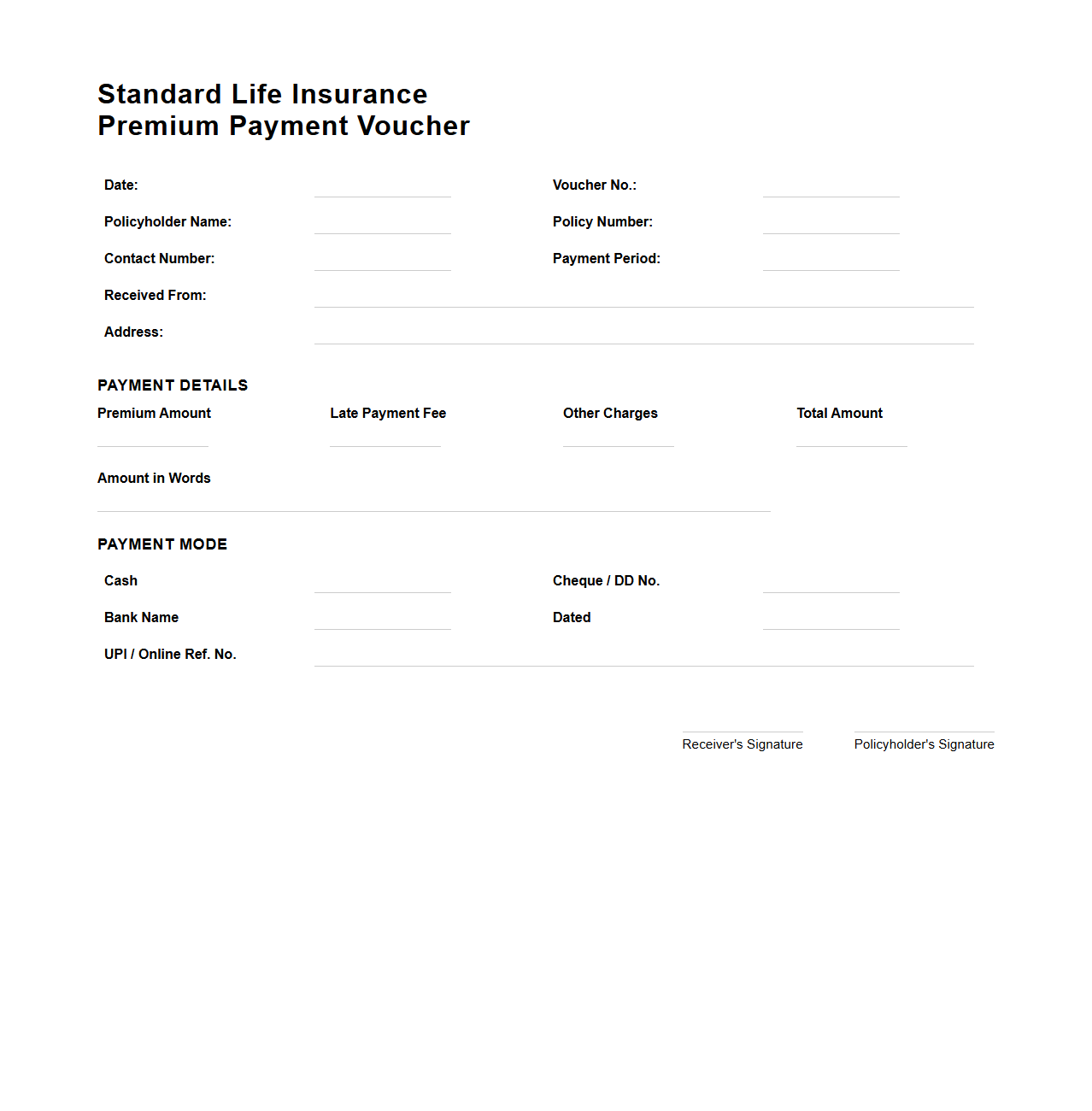

Standard Life Insurance Premium Payment Voucher

The

Standard Life Insurance Premium Payment Voucher is a formal document issued to policyholders as proof of payment for their insurance premium. It outlines crucial details such as the policy number, payment amount, due date, and payment method to ensure accurate record-keeping. This voucher facilitates smooth premium processing and helps maintain up-to-date insurance coverage status.

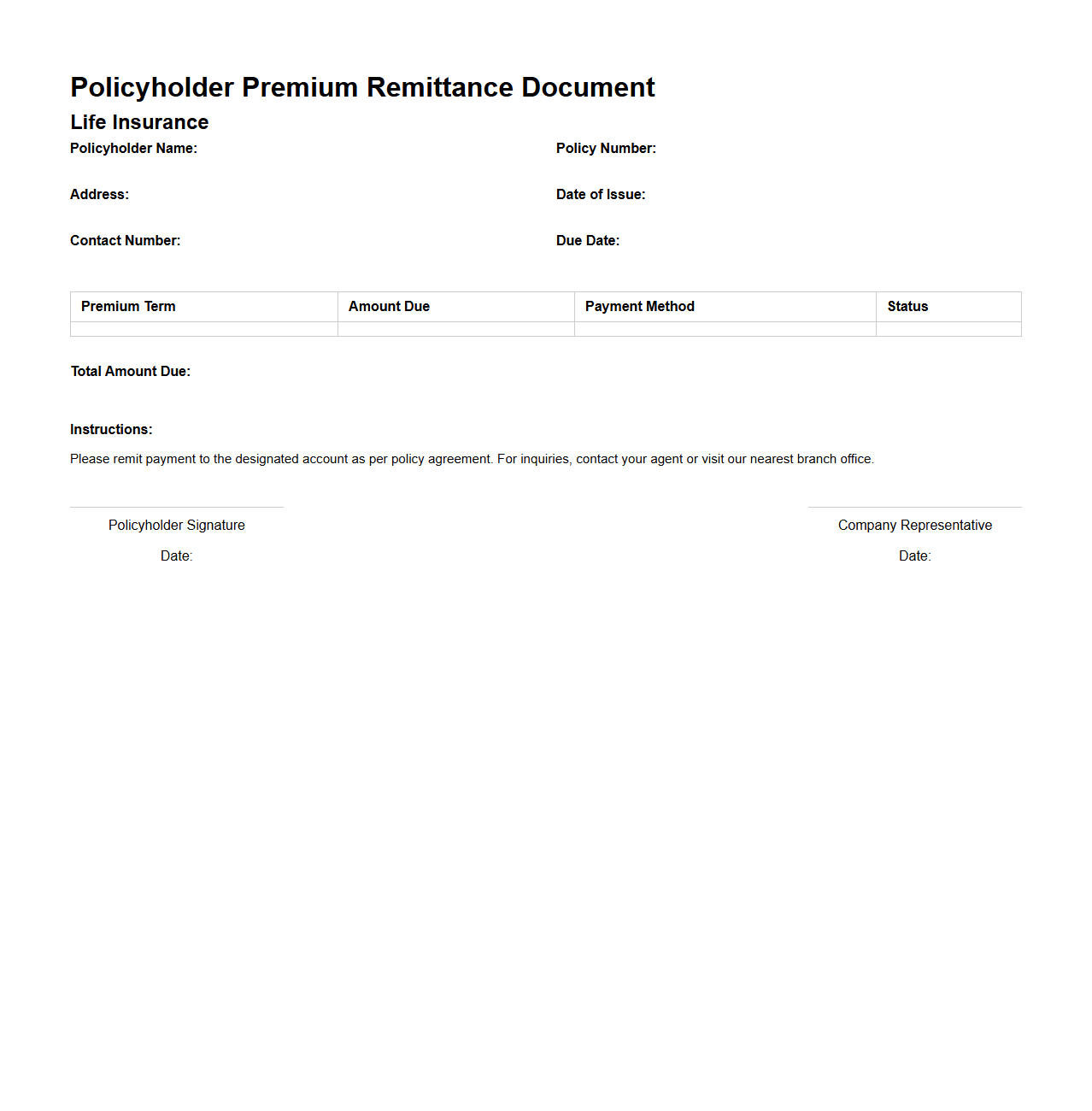

Policyholder Premium Remittance Document for Life Insurance

The

Policyholder Premium Remittance Document for life insurance is a critical record that details the payment made by the policyholder towards their insurance premium. This document serves as proof of payment, ensuring the continuous coverage of the life insurance policy and preventing policy lapses. It typically includes essential information such as the policy number, payment amount, payment date, and method of remittance, facilitating accurate tracking and reconciliation by the insurance company.

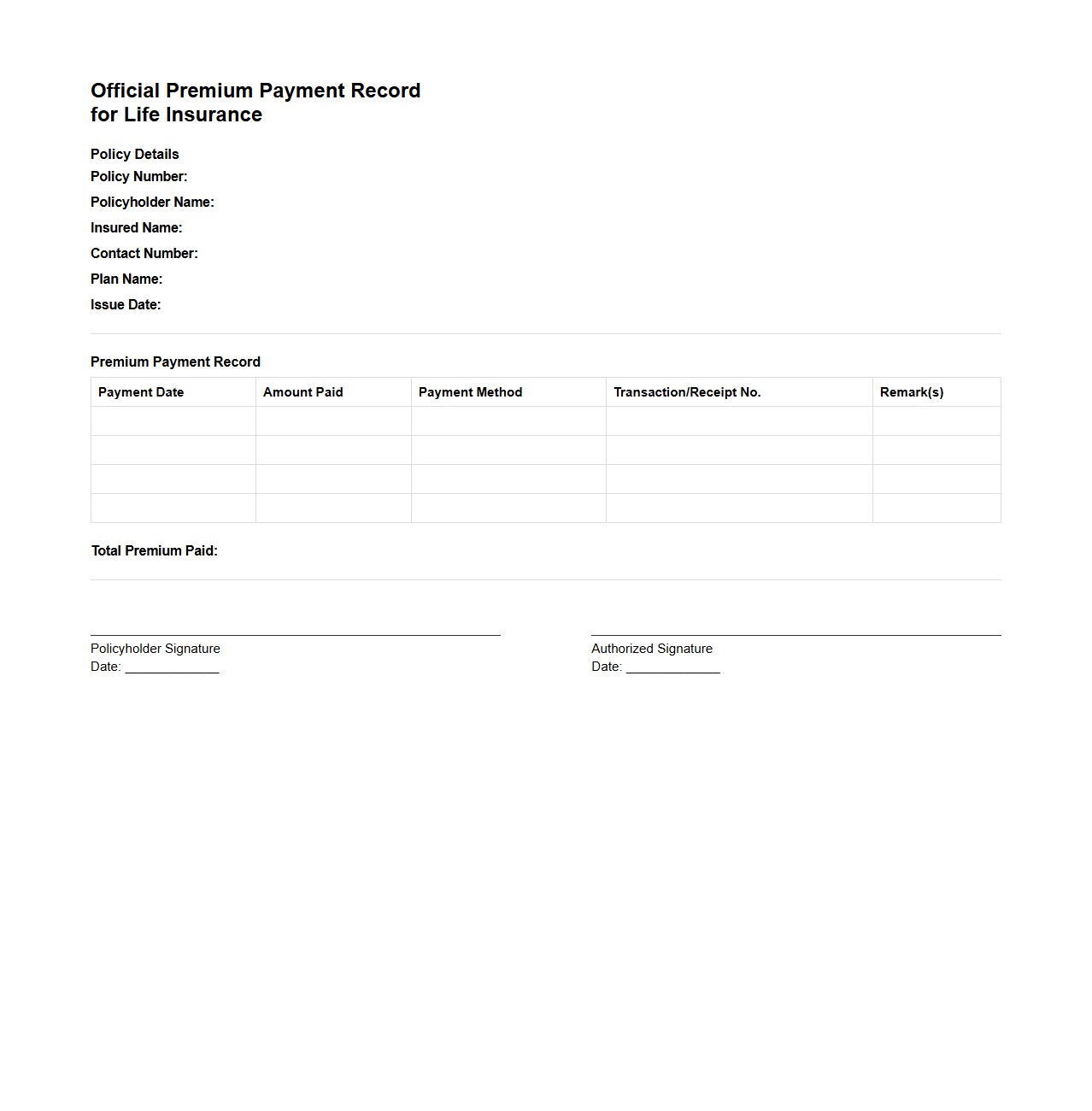

Official Premium Payment Record for Life Insurance

The

Official Premium Payment Record for life insurance is a detailed document that verifies all payments made towards a life insurance policy. It includes transaction dates, amounts paid, and outstanding balances, offering transparency and accountability for policyholders. This record is essential for claim processing, policy renewal, and financial planning.

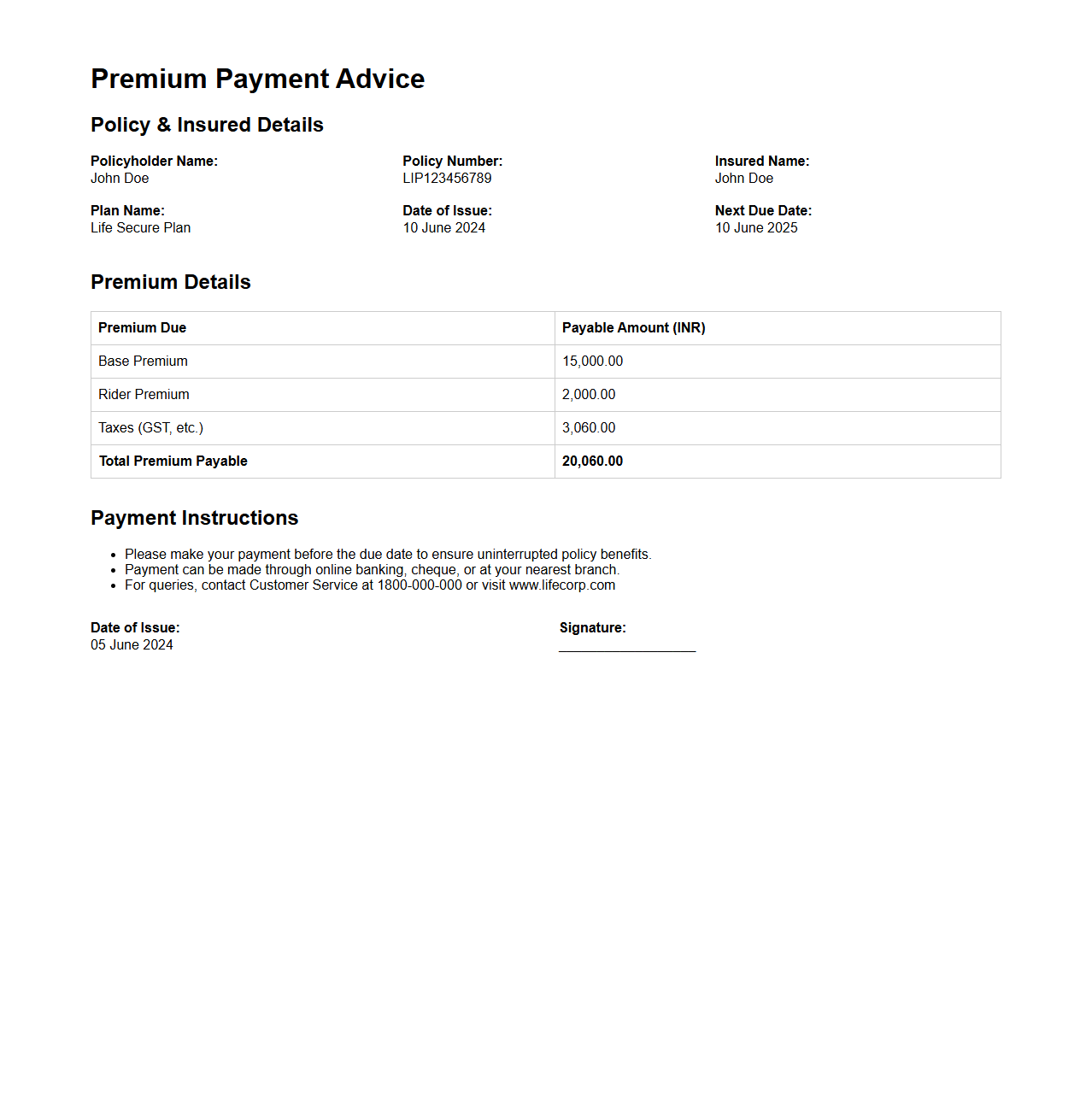

Sample Premium Payment Advice for Life Insurance Policy

A

Sample Premium Payment Advice for a Life Insurance Policy document outlines the detailed information required for making premium payments, including the policy number, payment amount, due date, and payment modes. This document serves as a confirmation slip for policyholders, ensuring accurate tracking of timely premium submissions to maintain policy validity. It aids in transparent communication between the insurer and insured, reducing payment errors and processing delays.

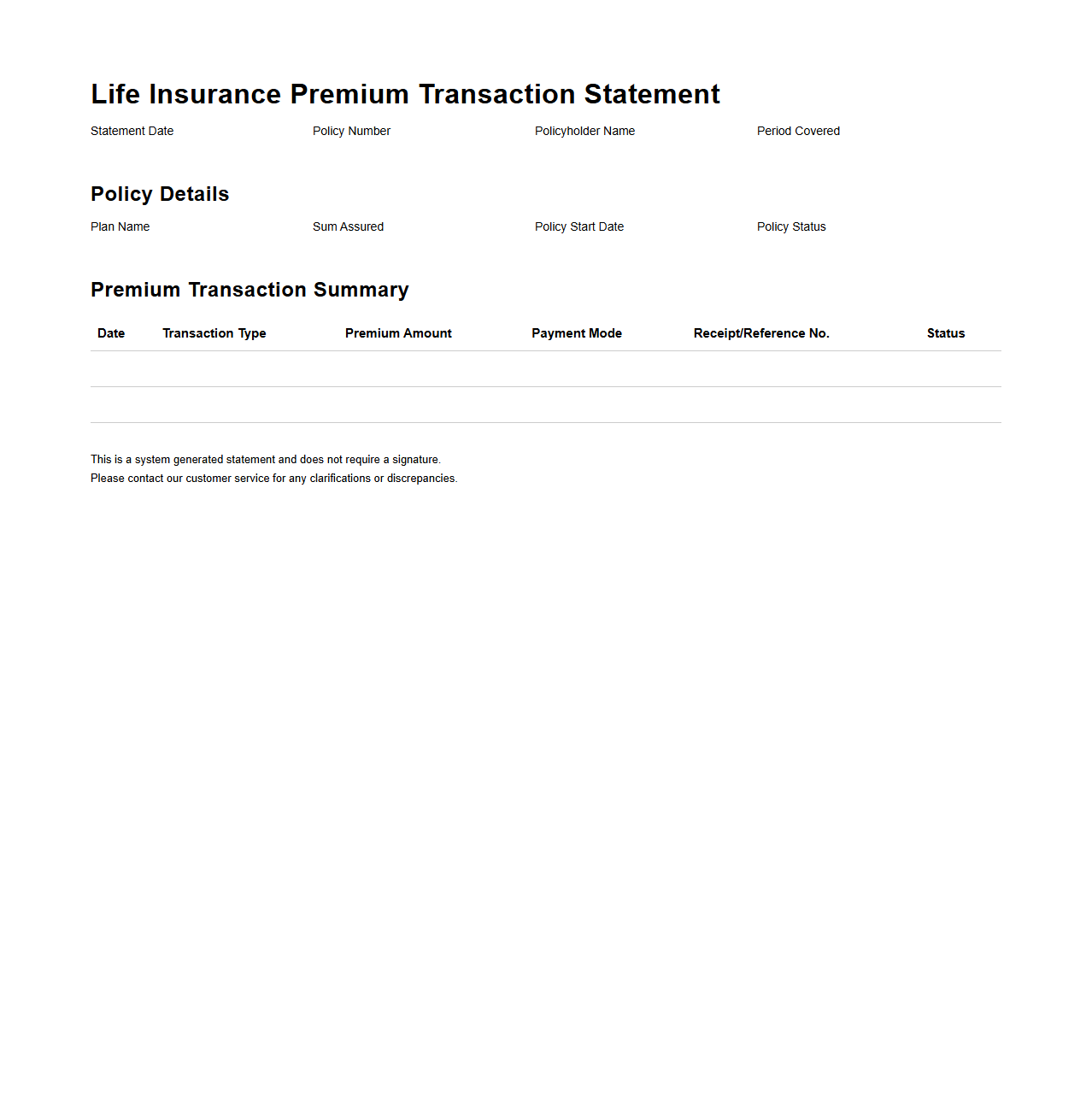

Life Insurance Premium Transaction Statement

The

Life Insurance Premium Transaction Statement document provides a detailed record of all premium payments made toward a life insurance policy within a specified period. It includes essential information such as payment dates, amounts, modes of payment, and policyholder details, aiding in accurate tracking of financial transactions related to the policy. This statement is crucial for policyholders and insurers to verify payments, resolve discrepancies, and maintain comprehensive financial records.

What is the purpose of the Premium Payment Document in a life insurance policy?

The Premium Payment Document serves as proof of payment for the insured's life insurance premium. It confirms the policyholder's commitment to keeping the insurance policy active. This document also acts as a record for both the insurer and the insured, ensuring transparency and accountability.

Which details must be verified on a life insurance Premium Payment Document?

Key details to verify on a Premium Payment Document include the policy number, payment amount, and payment date. It is essential to check the payer's name and the insurance company's official details. Ensuring these elements are accurate helps prevent possible coverage issues or payment disputes.

How does the document confirm payment receipt for the policyholder?

The Premium Payment Document typically contains a receipt or acknowledgment statement indicating the insurer has received the payment. It includes transactional information such as payment method and confirmation number. This confirmation reassures the policyholder that their coverage remains uninterrupted.

What information about policy coverage is typically included in the Premium Payment Document?

The document often summarizes the policy coverage terms, including the coverage period and benefits active during the payment interval. It may also mention the due date for the next premium payment. This helps the policyholder stay informed about their insurance status and upcoming obligations.

How can discrepancies in the Premium Payment Document be addressed by the policyholder?

If a policyholder notices inconsistencies in their Premium Payment Document, they should immediately contact their insurance provider. Providing evidence such as bank statements or prior receipts can support their claim. Prompt resolution ensures continuous coverage and maintains accurate insurance records.