A Proof of Loss Document Sample for Property Insurance provides a clear template for policyholders to detail the extent of damage or loss after an insured event. This document includes vital information such as the date of the incident, description of the property affected, estimated value of the loss, and supporting evidence like repair estimates or photos. Using a well-structured sample ensures accuracy and completeness when submitting a claim to the insurance company.

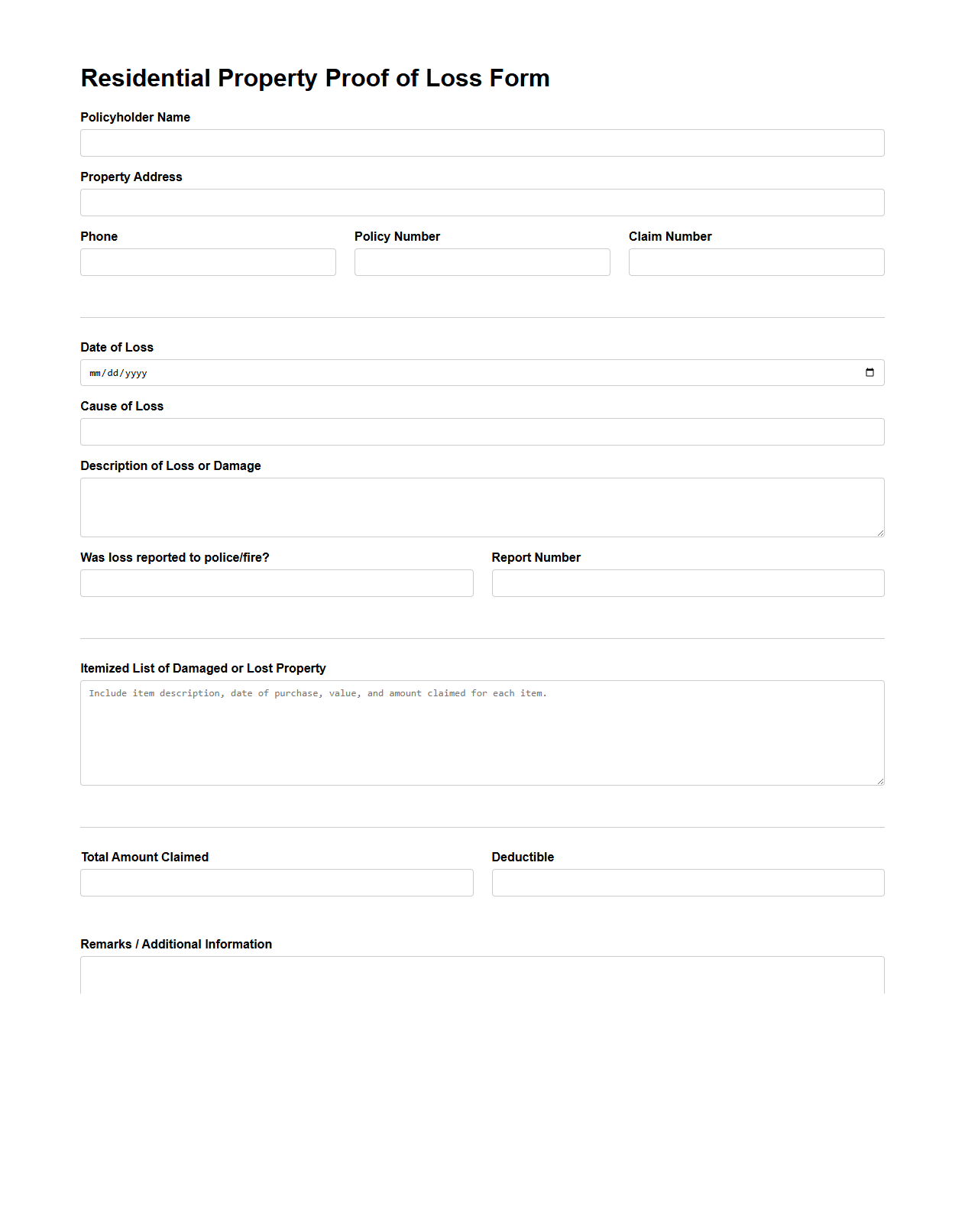

Residential Property Proof of Loss Form

The

Residential Property Proof of Loss Form is a crucial document used in insurance claims to detail the extent of damage or loss to a residential property. It provides a comprehensive itemization of damaged items, repair costs, and the circumstances surrounding the incident, allowing insurers to assess the validity and value of the claim. Accurate and timely submission of this form accelerates claim processing and facilitates fair compensation for homeowners.

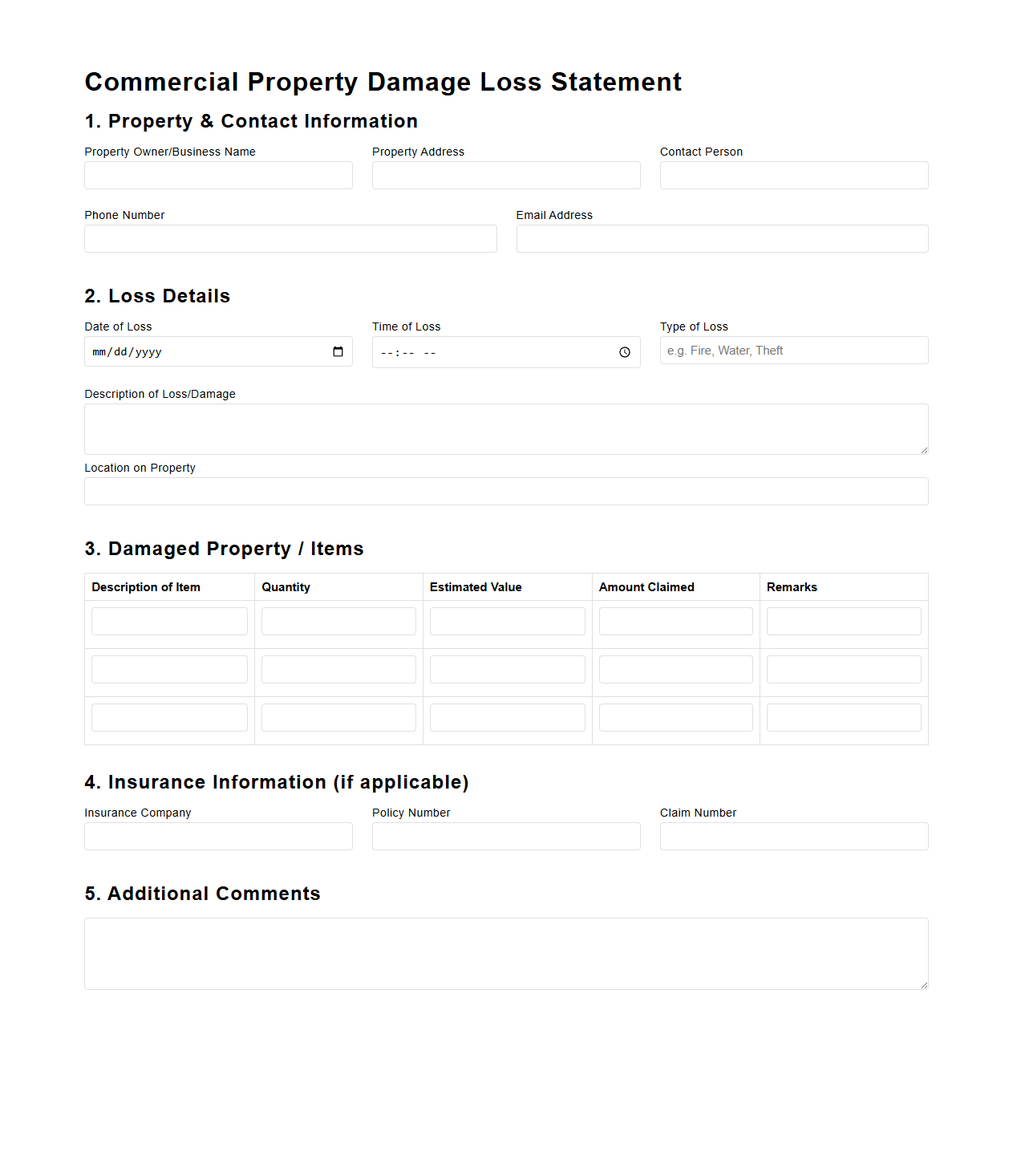

Commercial Property Damage Loss Statement

A Commercial Property Damage Loss Statement is a detailed document that outlines the extent and value of damages sustained by a commercial property due to incidents like fire, theft, or natural disasters. This statement serves as a crucial piece of evidence for insurance claims, enabling property owners to accurately quantify financial losses and support reimbursement requests. The document typically includes itemized descriptions, repair estimates, and photographic proof to ensure a comprehensive assessment of the

property damage.

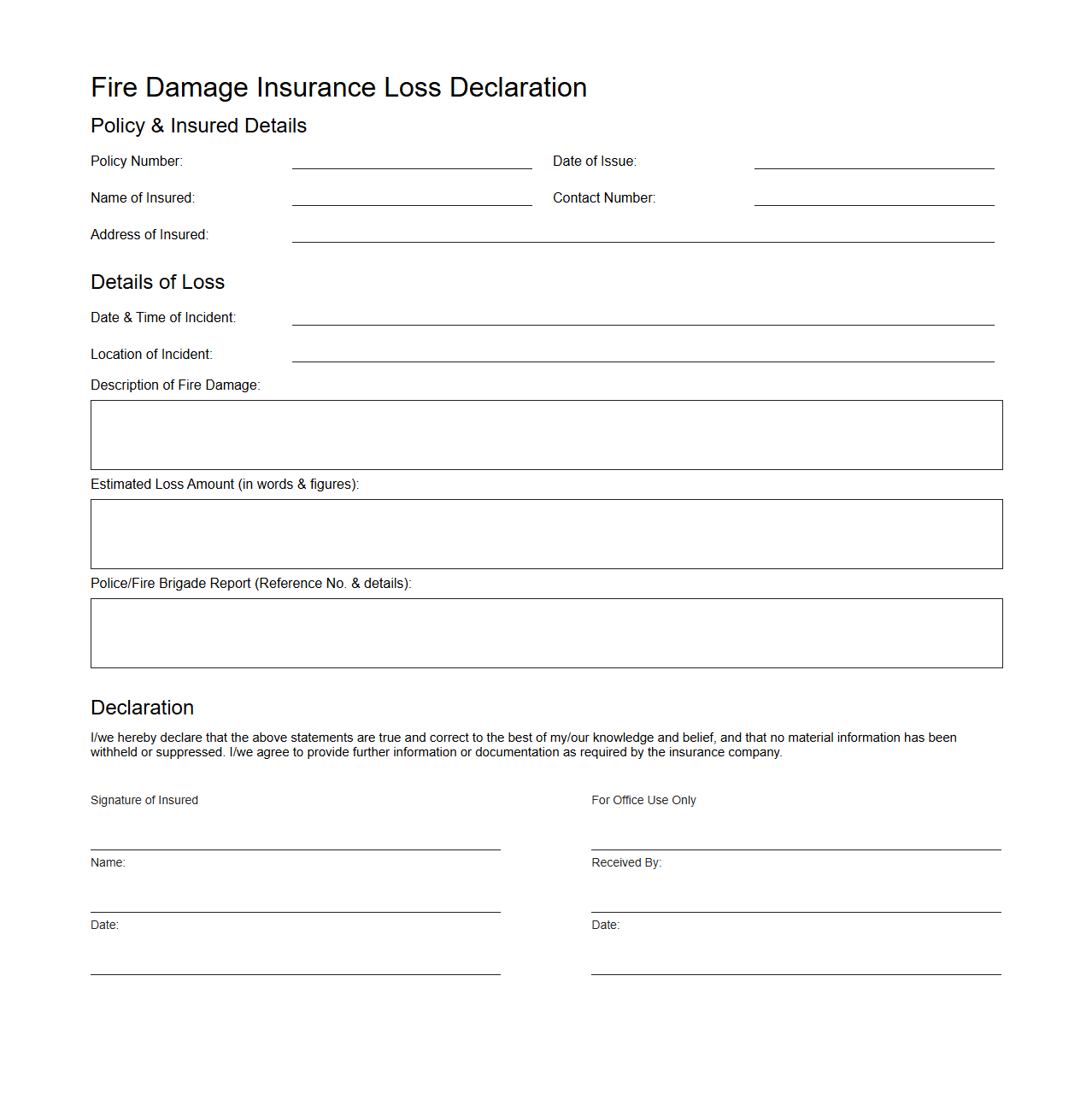

Fire Damage Insurance Loss Declaration

A

Fire Damage Insurance Loss Declaration document is a formal statement provided by a policyholder to an insurance company detailing the extent of damages caused by fire. It includes specific information such as the date and cause of the fire, a comprehensive list of lost or damaged property, repair or replacement costs, and any supporting evidence like photos or receipts. This declaration is crucial for initiating the claims process and ensuring accurate compensation under the insurance policy.

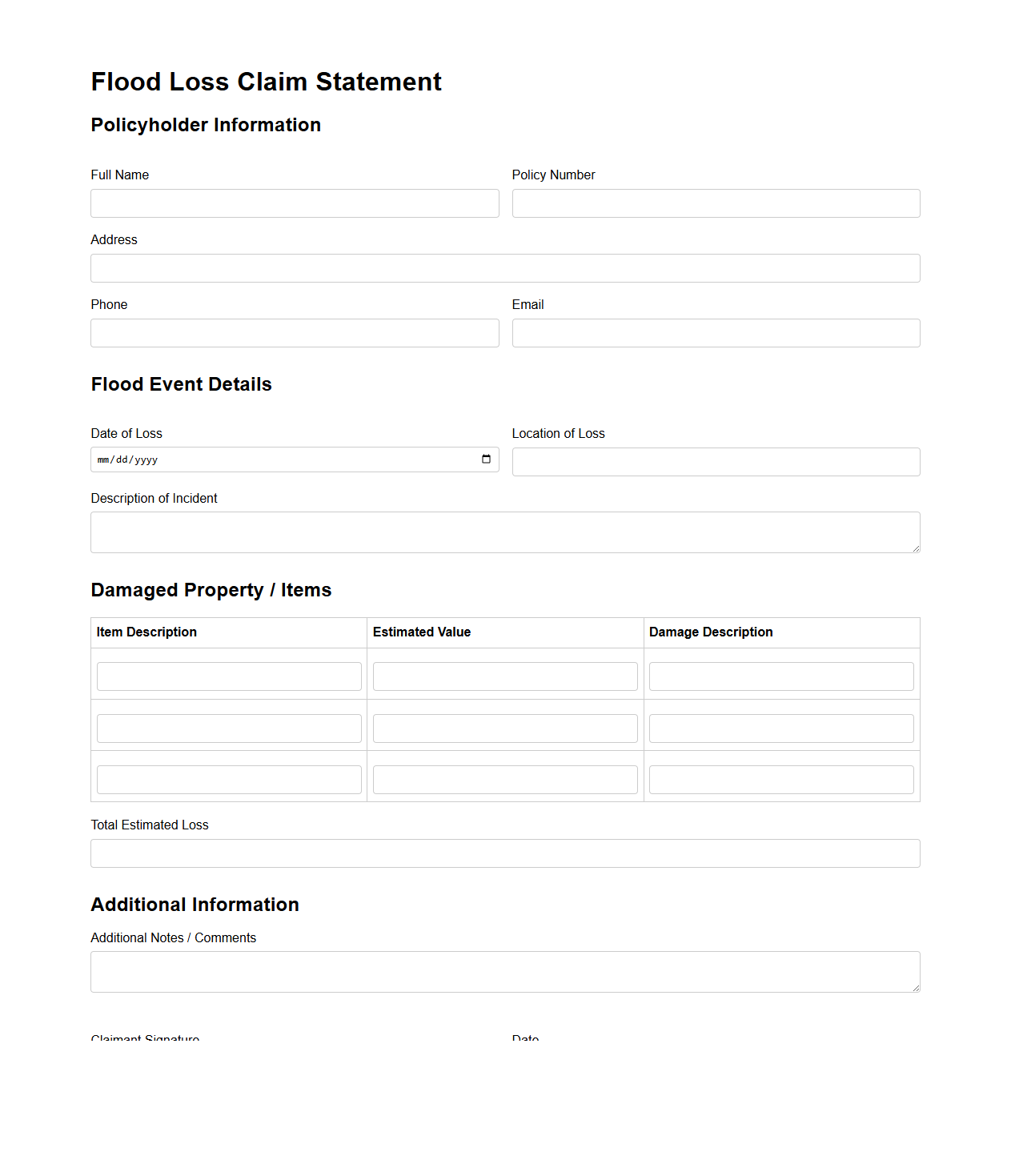

Flood Loss Claim Statement Template

A

Flood Loss Claim Statement Template is a standardized document used by policyholders to report and detail damages caused by flooding to their insurance company. It typically includes fields for itemizing losses, describing the extent of water damage, and providing relevant dates and supporting evidence to facilitate claim processing. This template ensures accurate and organized submission, speeding up insurance reimbursements and minimizing disputes.

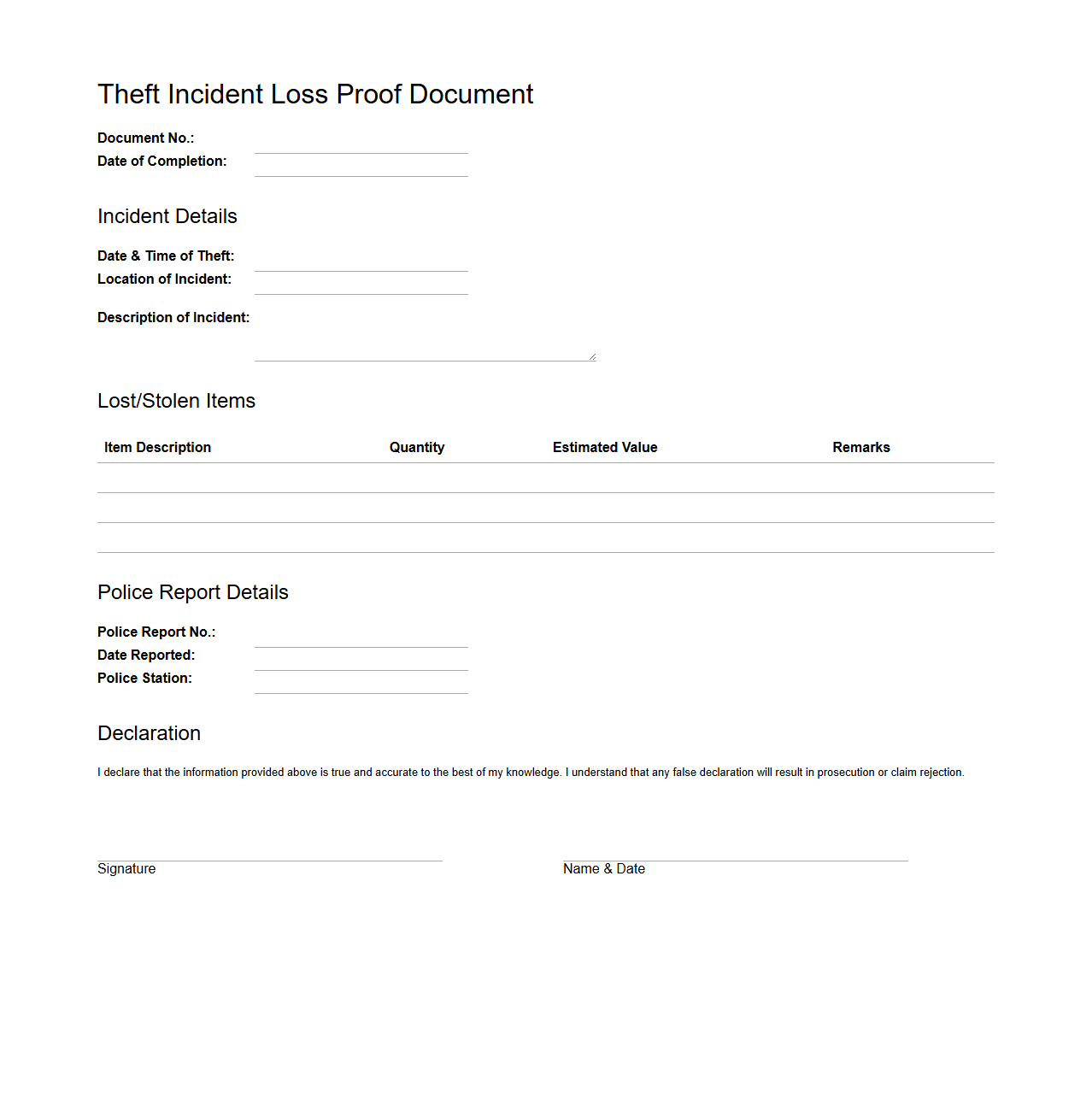

Theft Incident Loss Proof Document

A

Theft Incident Loss Proof Document serves as an official record verifying the occurrence and details of a theft-related loss. It includes essential information such as the date, time, location, description of stolen items, and police or investigative reports. This document is crucial for insurance claims and legal proceedings, ensuring accurate and credible evidence of the loss.

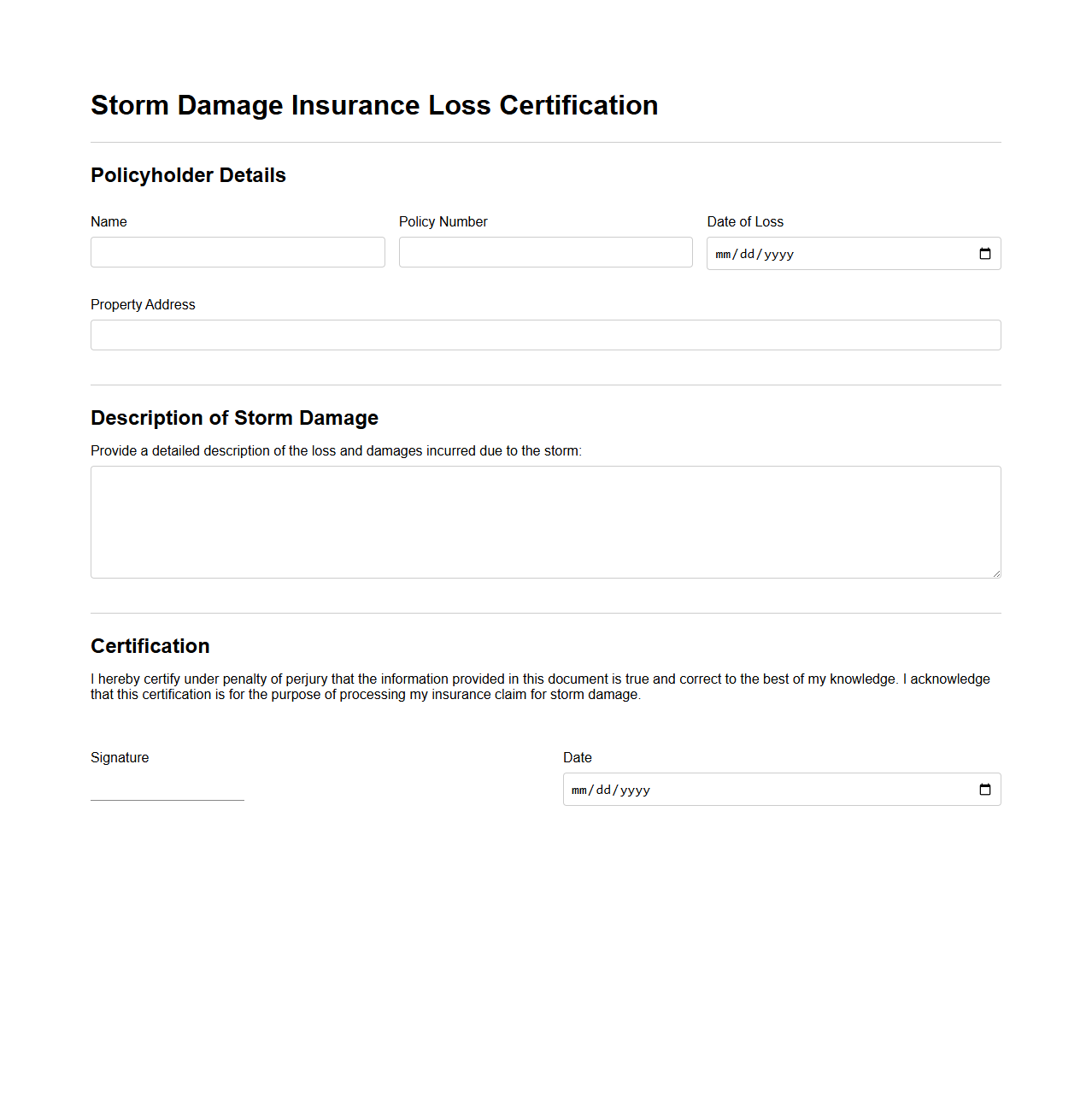

Storm Damage Insurance Loss Certification

A

Storm Damage Insurance Loss Certification document serves as an official verification of property damage caused by a storm, essential for processing insurance claims. This certification provides detailed assessments from experts confirming the extent and nature of the loss, facilitating accurate claim settlements. Insurers rely heavily on this documentation to determine coverage eligibility and the appropriate compensation amount.

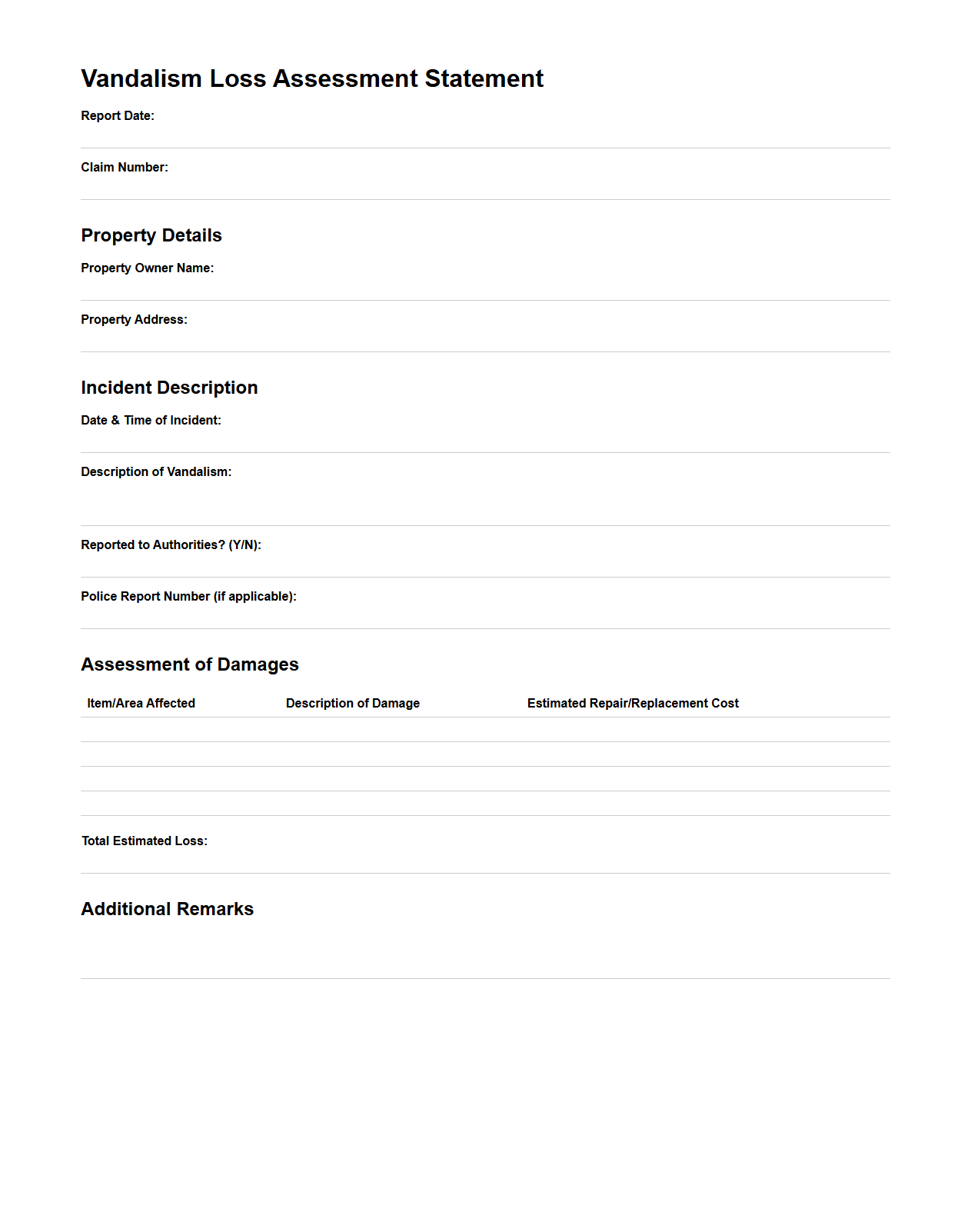

Vandalism Loss Assessment Statement

A

Vandalism Loss Assessment Statement document provides a detailed account of damages caused by intentional destruction or defacement of property. It includes descriptions of the affected areas, estimated repair costs, and evidence supporting the claim for insurance or legal purposes. This assessment is essential for accurately processing claims and facilitating prompt compensation.

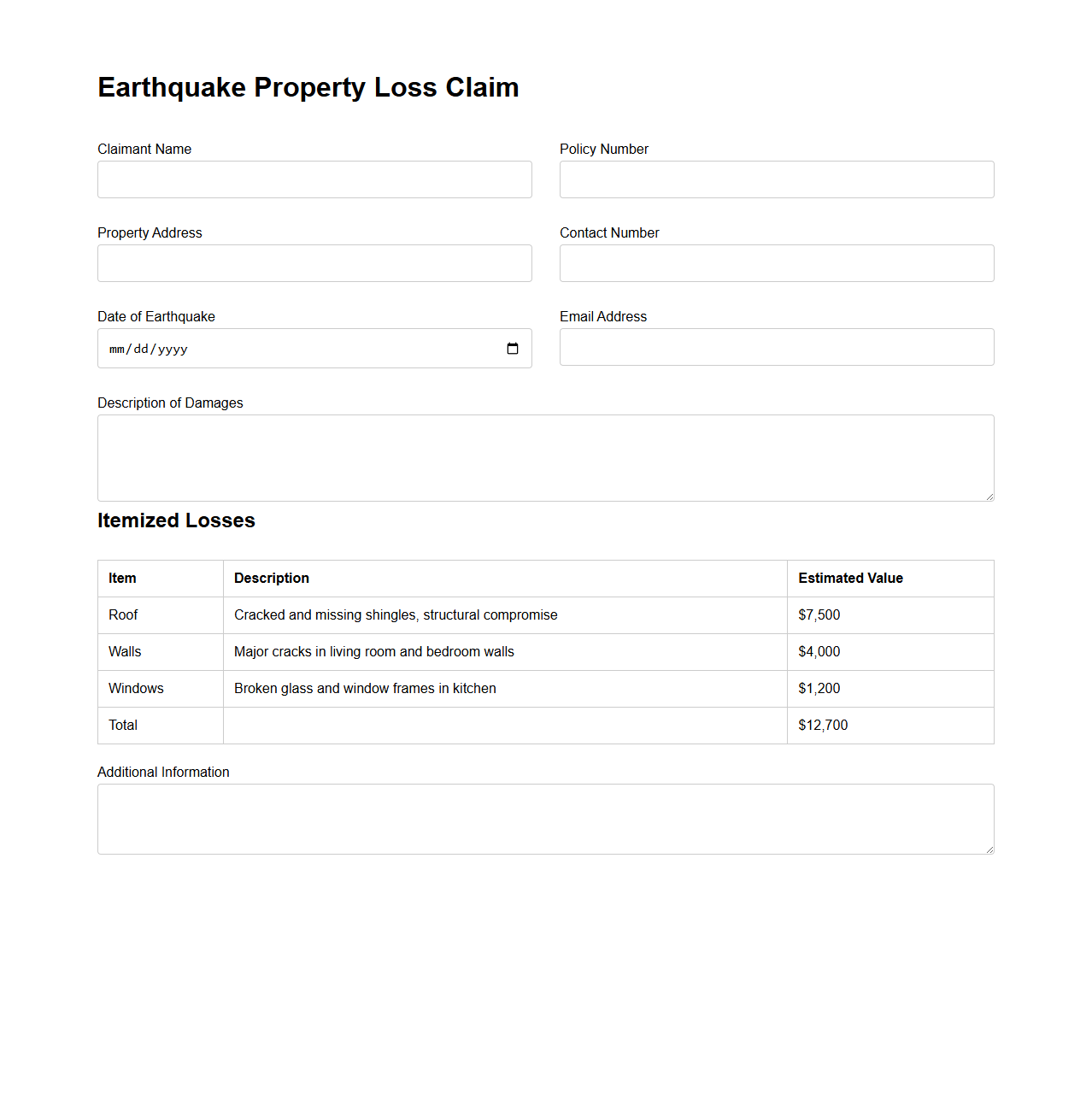

Earthquake Property Loss Claim Example

An

Earthquake Property Loss Claim Example document serves as a detailed template demonstrating how to file an insurance claim for damages caused by an earthquake. It typically includes sections for describing the event, listing damaged property, estimating repair costs, and providing necessary proof such as photos and receipts. This document helps policyholders accurately document losses and streamline the claims process with their insurance provider.

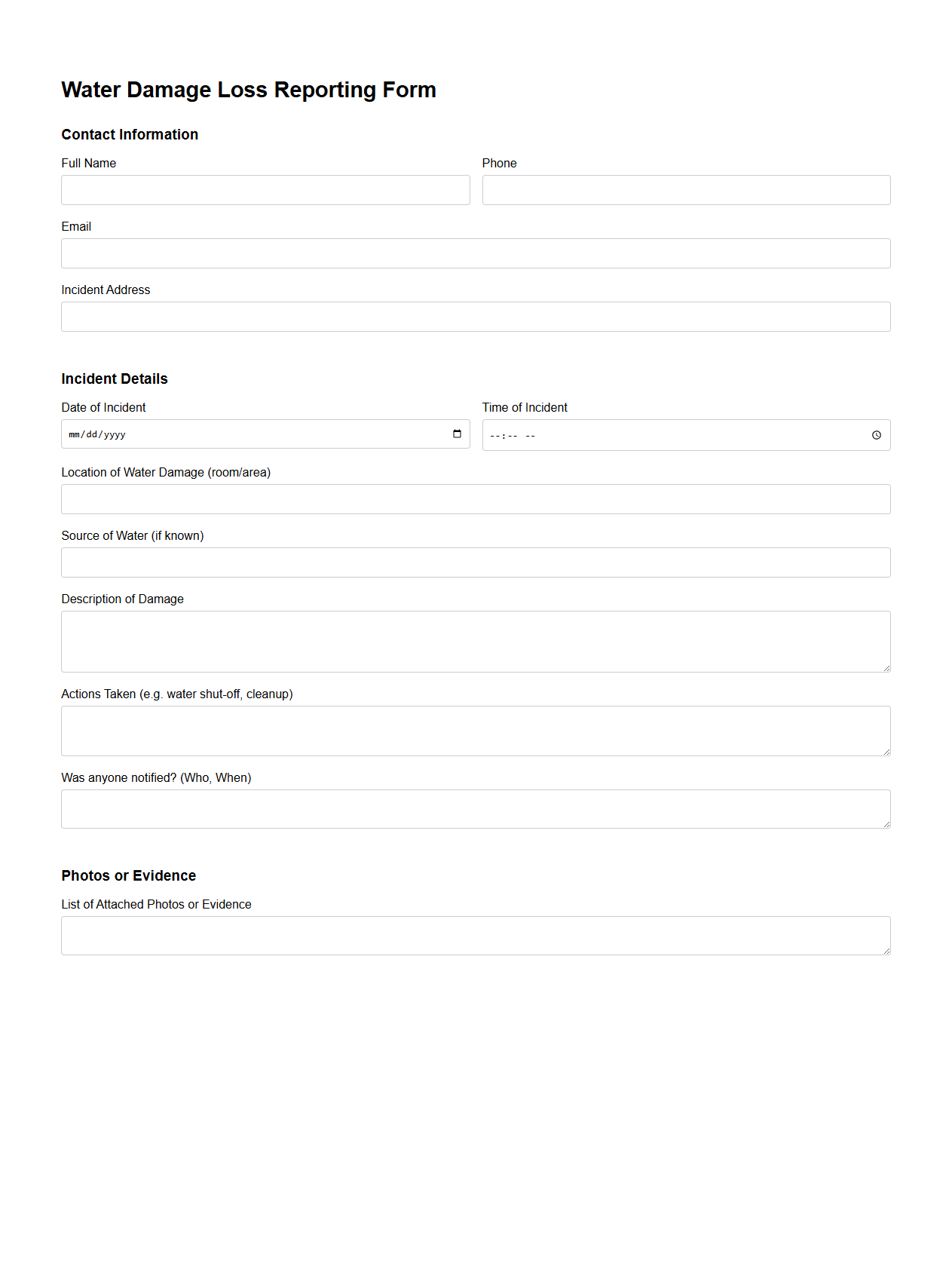

Water Damage Loss Reporting Form

A

Water Damage Loss Reporting Form document is used to systematically record details about water-related property damage, including the cause, extent, and impact on the affected area. It helps insurance companies, claims adjusters, and restoration professionals assess and process water damage claims efficiently. Accurate and detailed reporting in this form ensures timely evaluation and effective coordination of mitigation and repair efforts.

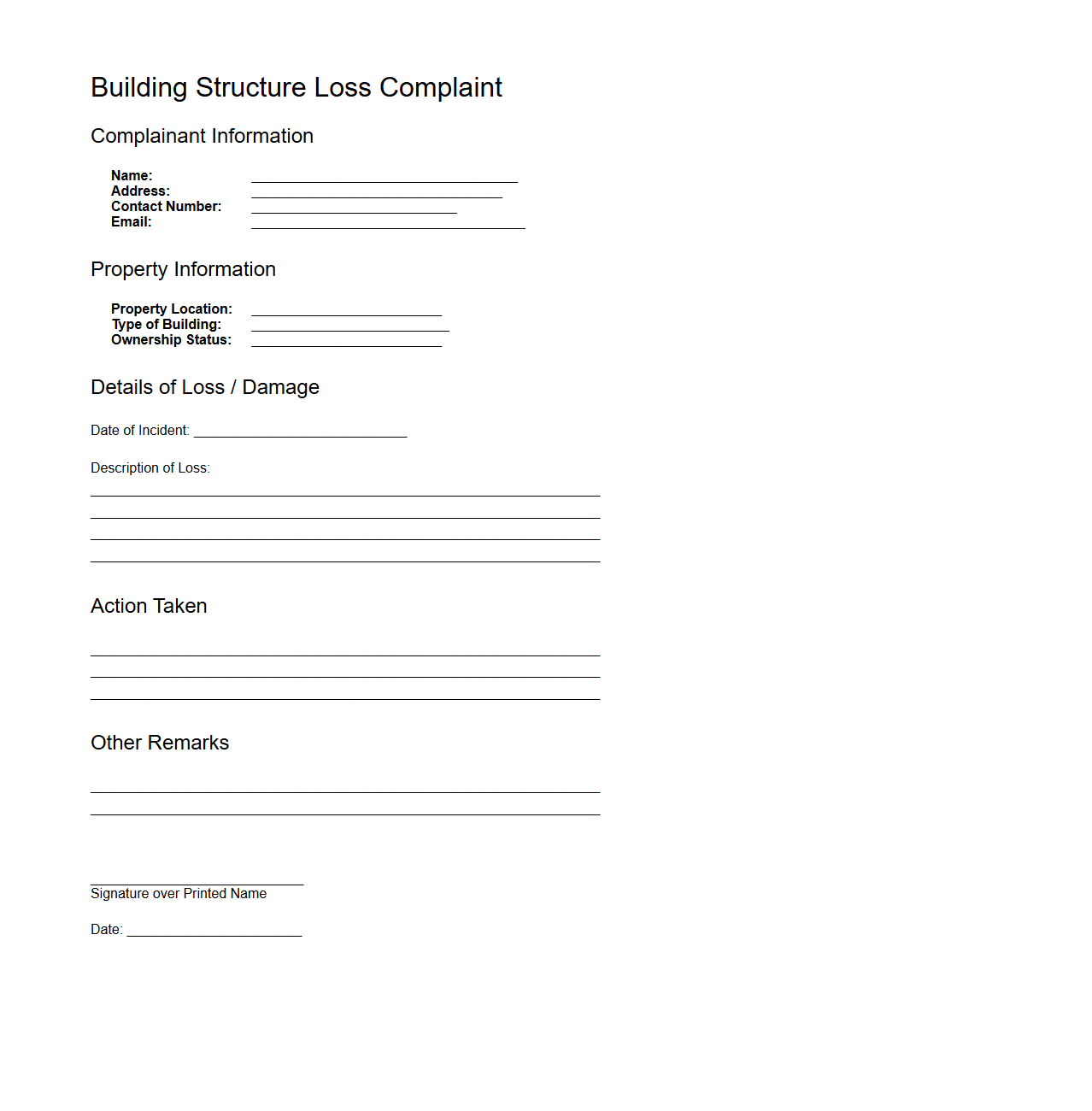

Building Structure Loss Complaint Sample

A

Building Structure Loss Complaint Sample document serves as a formal template for individuals or companies to report damages or losses related to a building's structural integrity. It outlines critical details such as the nature of the damage, the estimated repair costs, and responsible parties, aiding in efficient communication with insurance companies, contractors, or legal entities. This document ensures that all essential information is captured systematically to support claims and expedite resolution processes.

What key information must be included in a Proof of Loss document for property insurance claims?

A Proof of Loss document must contain the insured's details, including their name and policy number. It should clearly describe the nature and extent of the loss or damage. Additionally, an itemized list of the damaged or lost property along with the estimated value is essential.

How does the Proof of Loss document establish the insured's ownership and value of the damaged property?

The document requires the insured to affirm ownership of the damaged property under oath or declaration. It supports the claim by providing evidence of value through receipts, appraisals, or detailed inventories. This establishes a clear link between the insured and the claimed loss, facilitating accurate claim assessment.

In what scenarios is submitting a Proof of Loss document mandatory for claims processing?

Submitting a Proof of Loss is typically mandatory for large or total loss claims under property insurance policies. Insurers may also require it when the claim amount exceeds a certain threshold. Failure to submit this document in such cases can result in denial or delay of the claim.

What are the legal implications of inaccuracies or omissions in a Proof of Loss document?

Inaccuracies or omissions can lead to the claim being denied or voided due to potential misrepresentation. Providing false information may expose the insured to legal penalties including fraud charges. Insurers use it to assess the legitimacy and extent of the claim, so accuracy is critical.

How is the timeline for submitting a Proof of Loss document typically determined by insurers?

Insurers usually specify a deadlines for submitting the Proof of Loss within the policy terms, often 60 to 90 days after the loss. This timeline ensures prompt claim investigation and processing. Failure to meet the deadline can result in forfeiture of claim rights under many insurance contracts.