A Proof of Loss Document Sample for Fire Insurance provides a detailed statement submitted by the policyholder to the insurer, outlining the extent of damage and claimed losses due to fire. This document typically includes information such as the date of the fire, description of damaged property, estimated repair or replacement costs, and supporting evidence like photos or receipts. Accurate completion of the Proof of Loss Document Sample for Fire Insurance is essential for expediting the claims process and ensuring fair compensation.

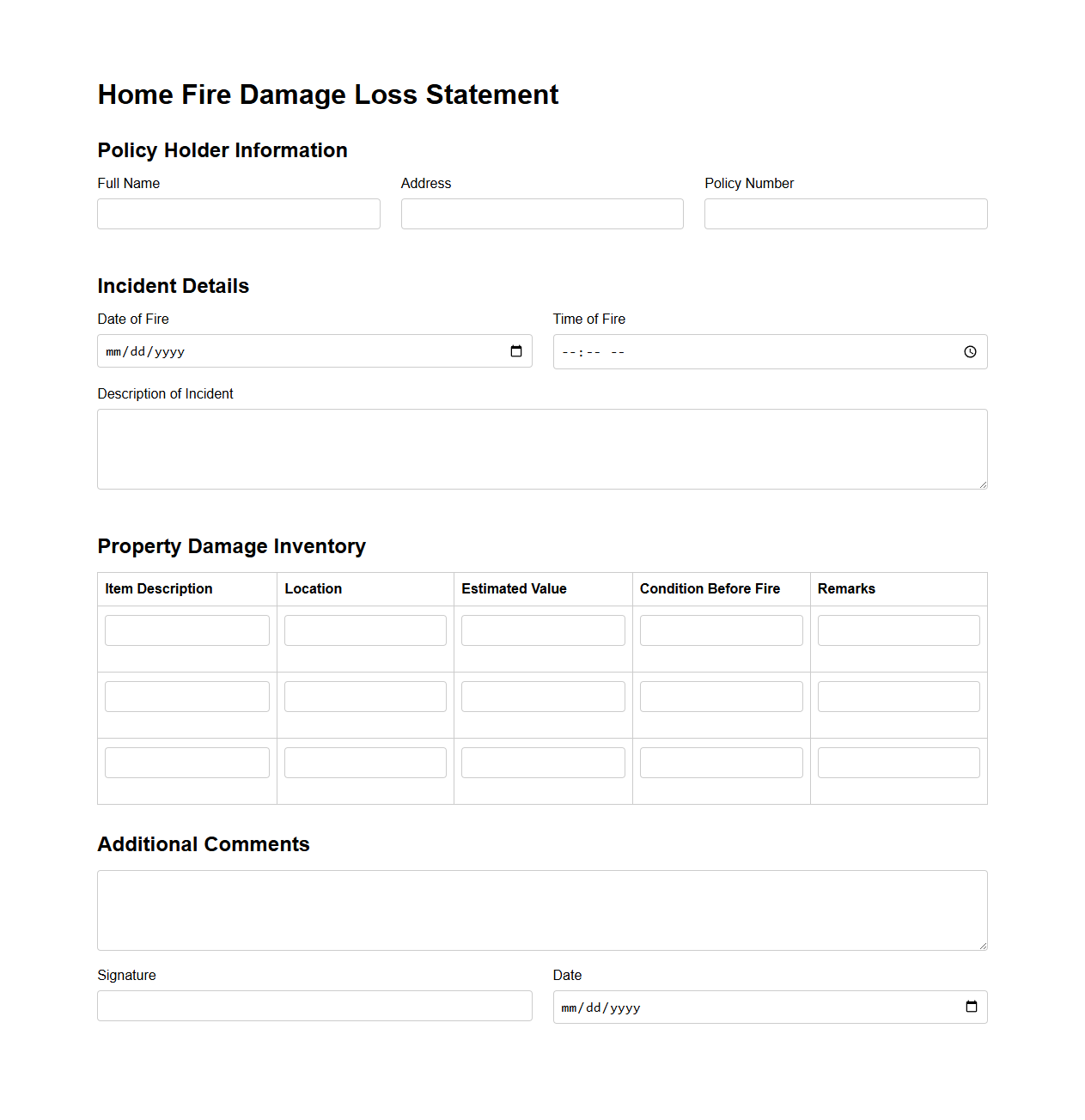

Home Fire Damage Loss Statement Template

A

Home Fire Damage Loss Statement Template is a standardized document used to itemize and report losses incurred due to fire damage in a residential property. This template helps homeowners systematically document damaged items, estimate repair costs, and provide detailed descriptions essential for insurance claims. Accurate completion of this document facilitates efficient communication with insurance companies and expedites the claims process.

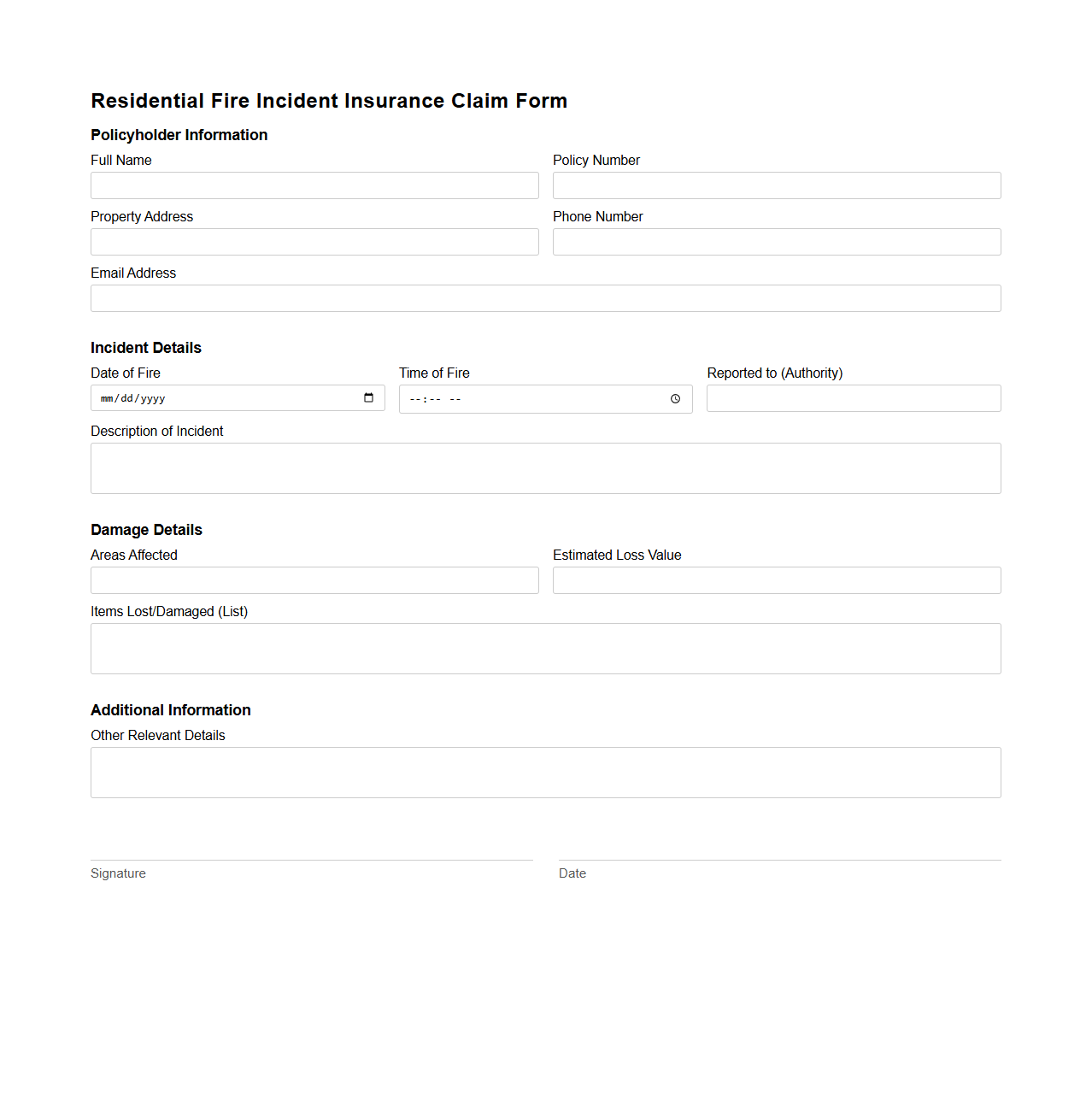

Residential Fire Incident Insurance Claim Form

A

Residential Fire Incident Insurance Claim Form is an essential document used to report and request compensation for damages caused by a fire in a residential property. It collects detailed information about the incident, including the date, cause of the fire, extent of damage, and personal or property losses incurred. This form is crucial for facilitating the claims process between the policyholder and the insurance company, ensuring accurate assessment and timely reimbursement.

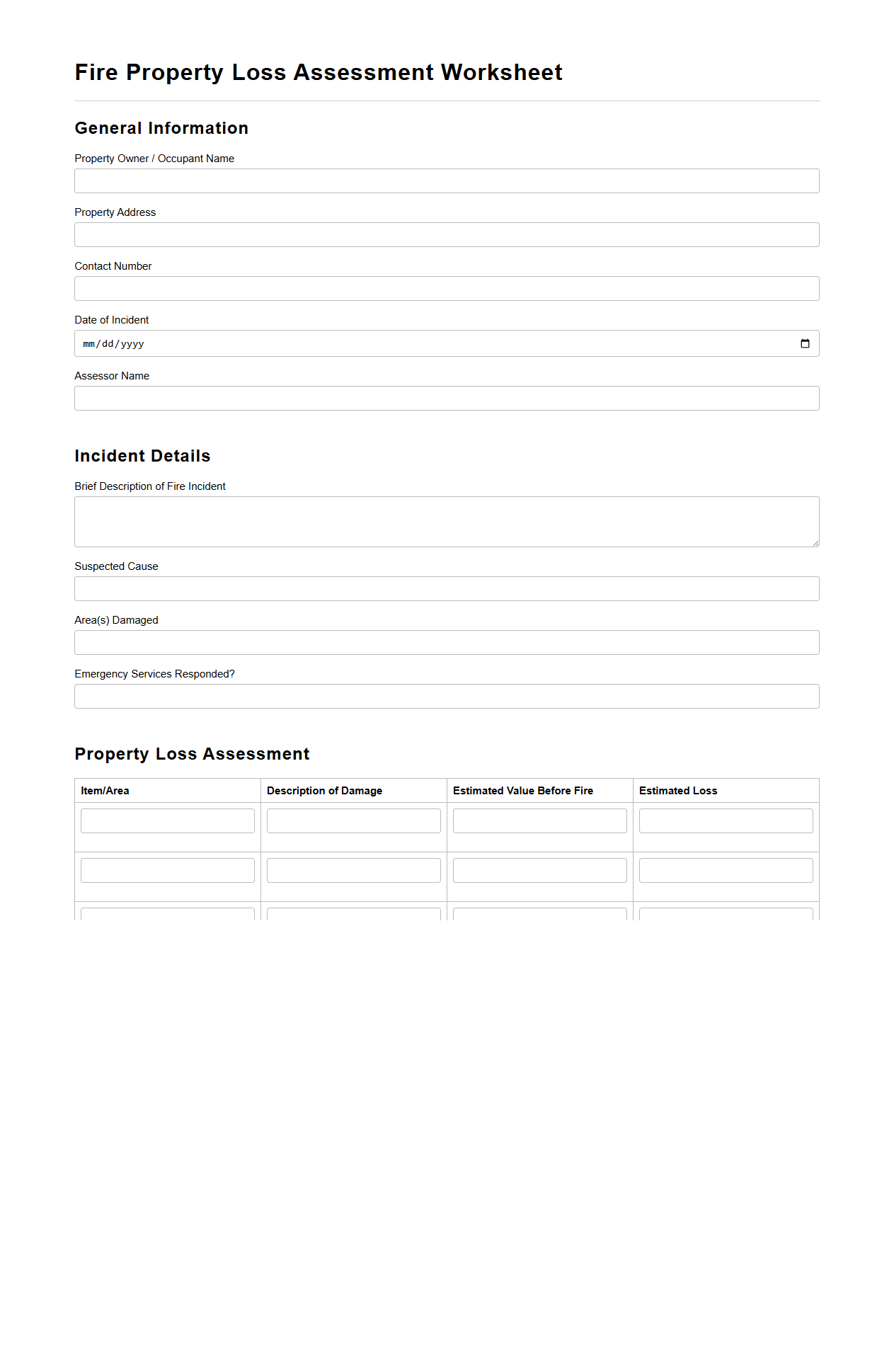

Fire Property Loss Assessment Worksheet

A

Fire Property Loss Assessment Worksheet is a detailed document used to evaluate and quantify the extent of damage caused by fire to a property. This worksheet helps insurance adjusters, property owners, and restoration experts systematically document losses, itemize damaged assets, and estimate repair or replacement costs. It serves as a critical tool for claim processing, ensuring accurate financial recovery and facilitating effective restoration planning.

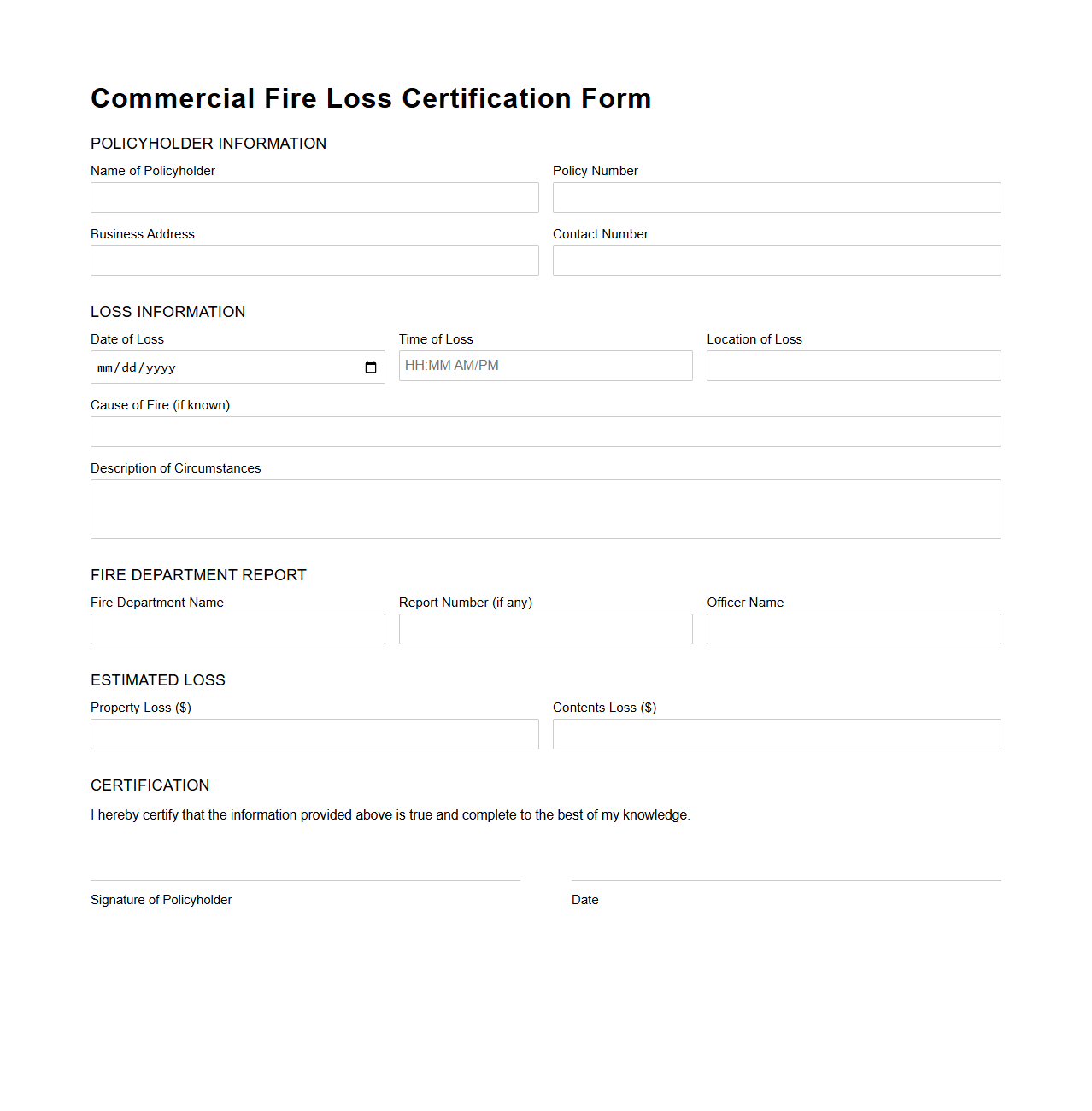

Commercial Fire Loss Certification Form

The

Commercial Fire Loss Certification Form is a crucial document used by businesses to officially report damages and losses resulting from a fire incident. This form provides a detailed account of affected property, inventory, and operational impacts, serving as essential evidence for insurance claims and regulatory compliance. Accurate completion ensures timely processing and support for recovery and financial restitution.

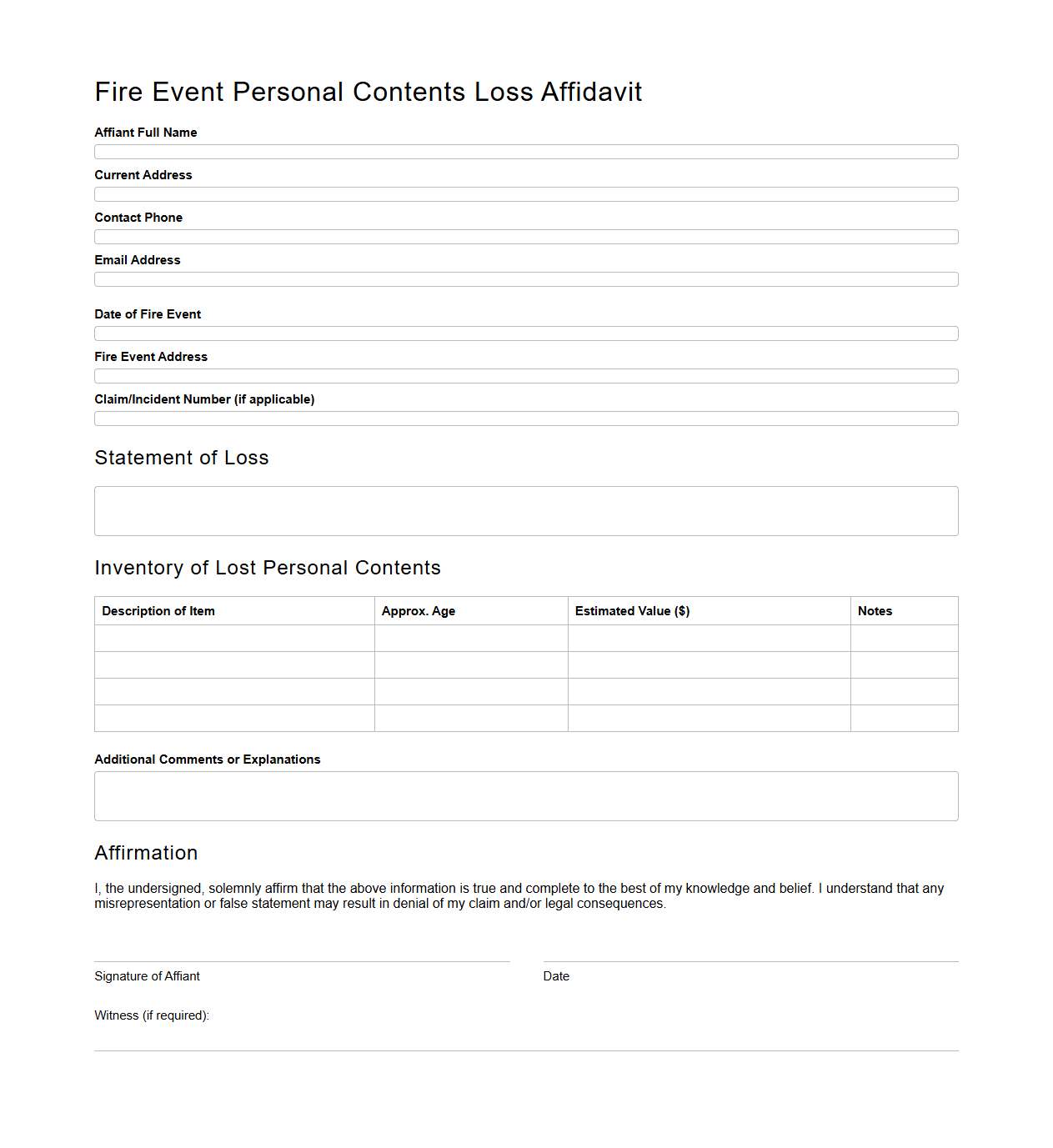

Fire Event Personal Contents Loss Affidavit

The

Fire Event Personal Contents Loss Affidavit document serves as a formal statement detailing the personal belongings lost or damaged during a fire incident. This affidavit is essential for insurance claims, providing a verified inventory and estimated value of destroyed items to support the claim process. Accurate completion of this document helps expedite compensation and ensures transparency between the claimant and the insurer.

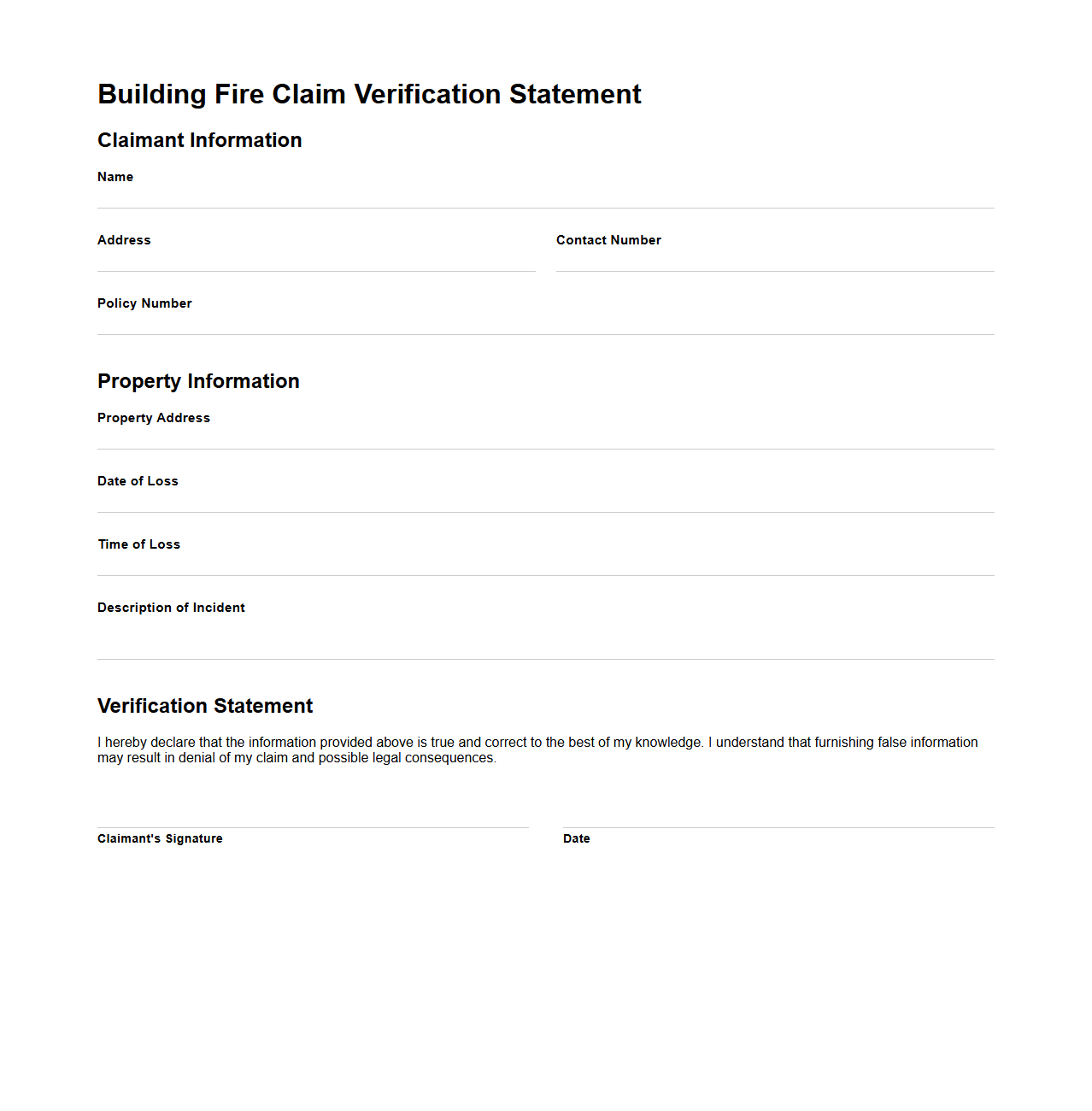

Building Fire Claim Verification Statement

A

Building Fire Claim Verification Statement document is a formal record used to confirm the details and extent of damage sustained by a property due to fire. It serves as essential evidence for insurance claims, outlining the date, cause, and estimated loss to facilitate accurate assessment and compensation. This document ensures transparency and supports the validation process between policyholders and insurers.

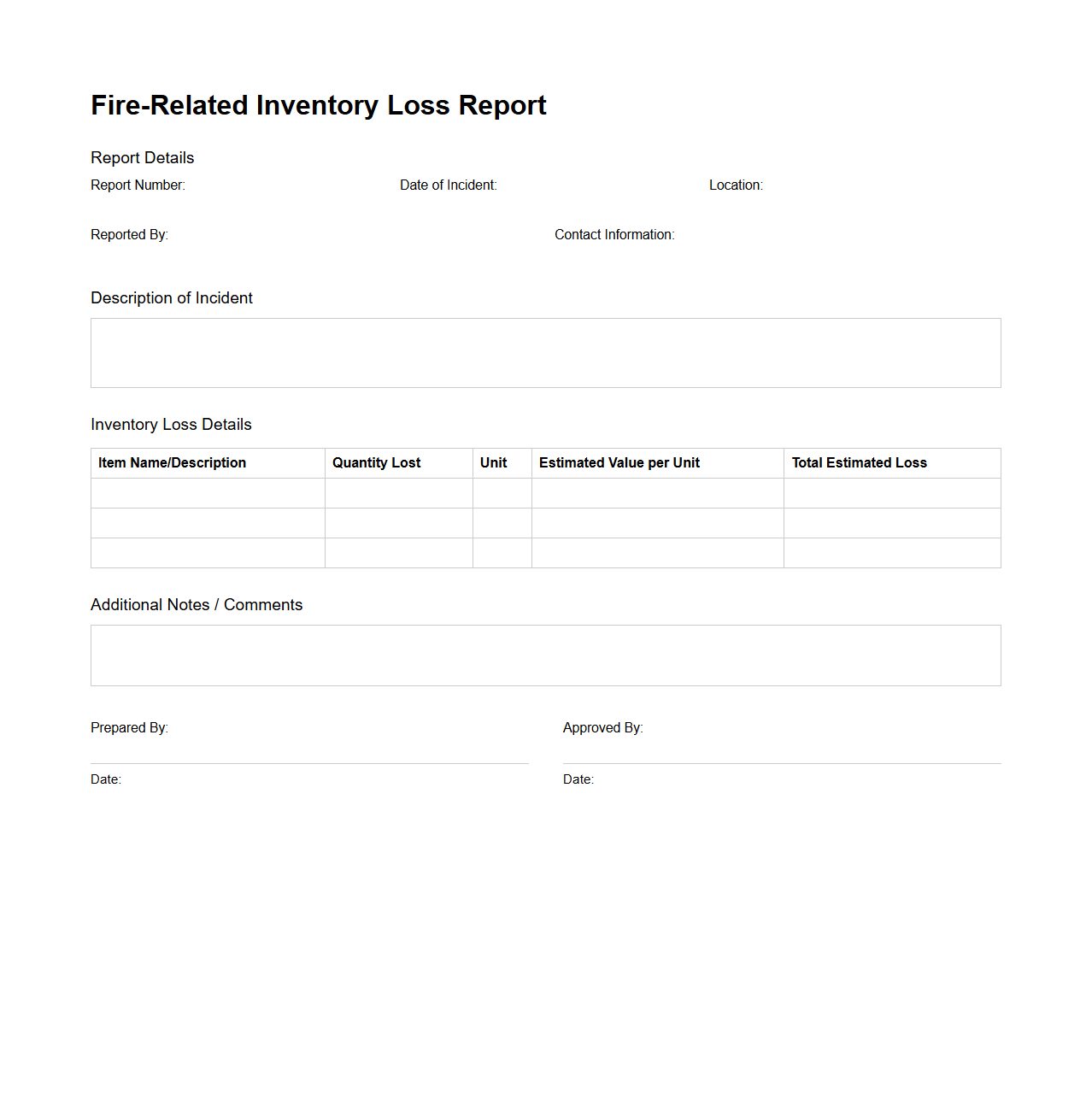

Fire-Related Inventory Loss Report Sample

The

Fire-Related Inventory Loss Report Sample document provides a detailed template for recording inventory losses caused by fire incidents. It includes fields for item descriptions, quantities affected, estimated damage value, and specific circumstances of the fire event. This report helps businesses systematically document losses for insurance claims, risk assessment, and inventory management purposes.

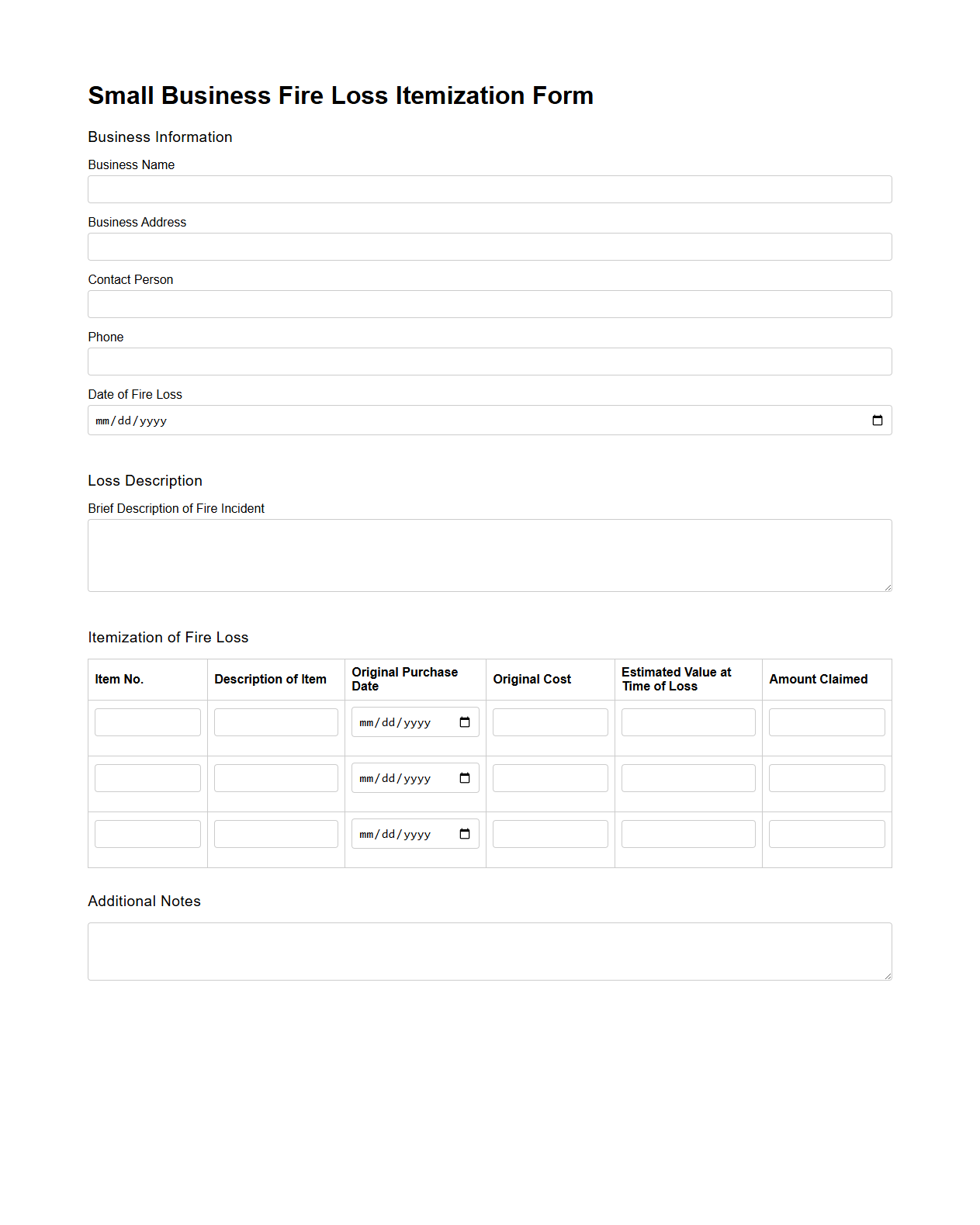

Small Business Fire Loss Itemization Form

The

Small Business Fire Loss Itemization Form is a detailed document used by small businesses to systematically record and quantify the losses incurred due to fire damage. It captures essential information such as the description, quantity, and value of damaged or destroyed items, facilitating accurate insurance claims and financial recovery. Proper completion of this form ensures comprehensive documentation that supports claim verification and settlement processes.

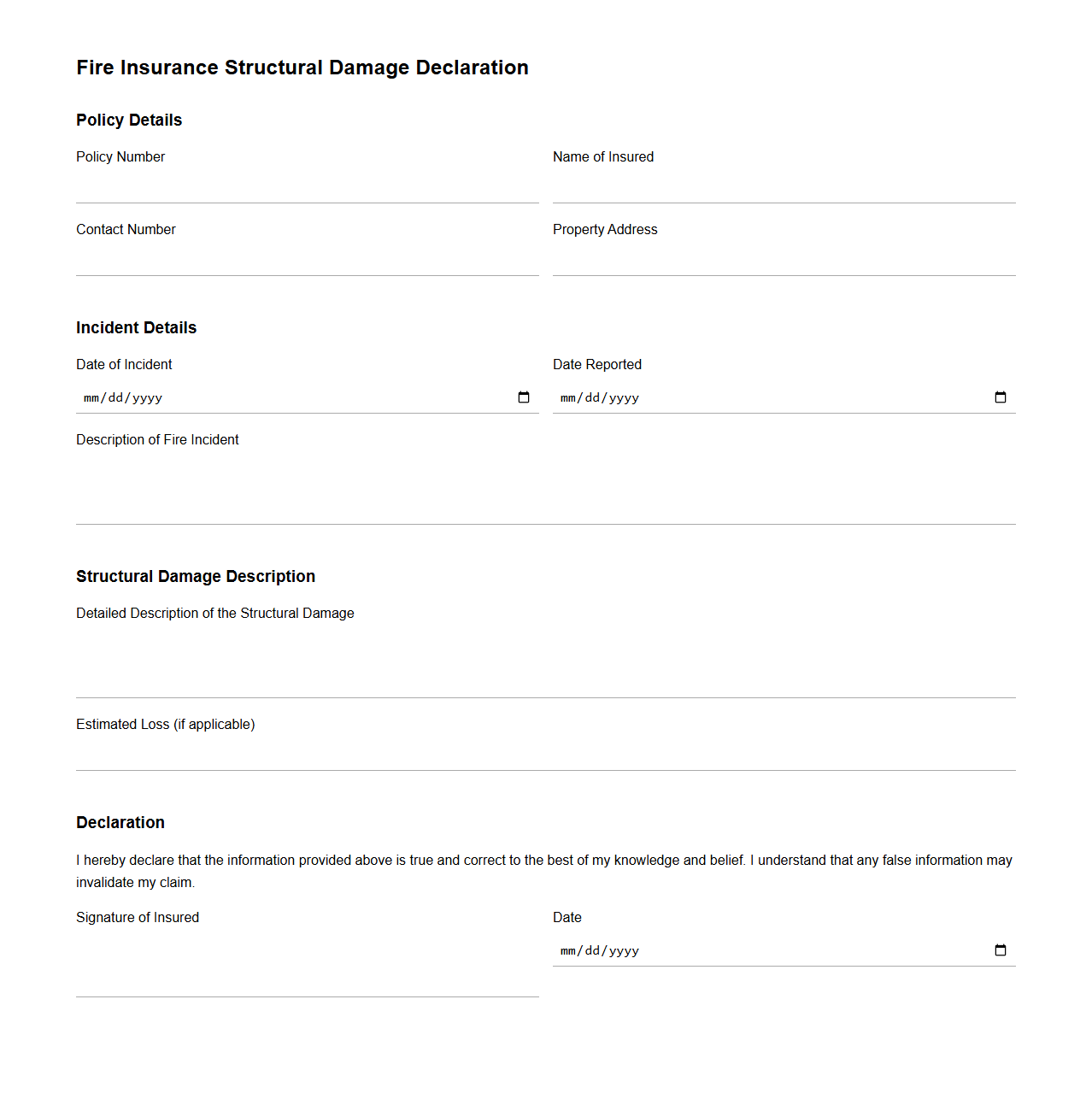

Fire Insurance Structural Damage Declaration

The

Fire Insurance Structural Damage Declaration document is an essential form used to report and assess damages to a property's structure caused by fire incidents. It serves as a formal record submitted to insurance companies to validate claims and initiate the compensation process. This document typically includes detailed information about the extent of fire damage, repair estimates, and relevant property details to ensure accurate claim evaluation.

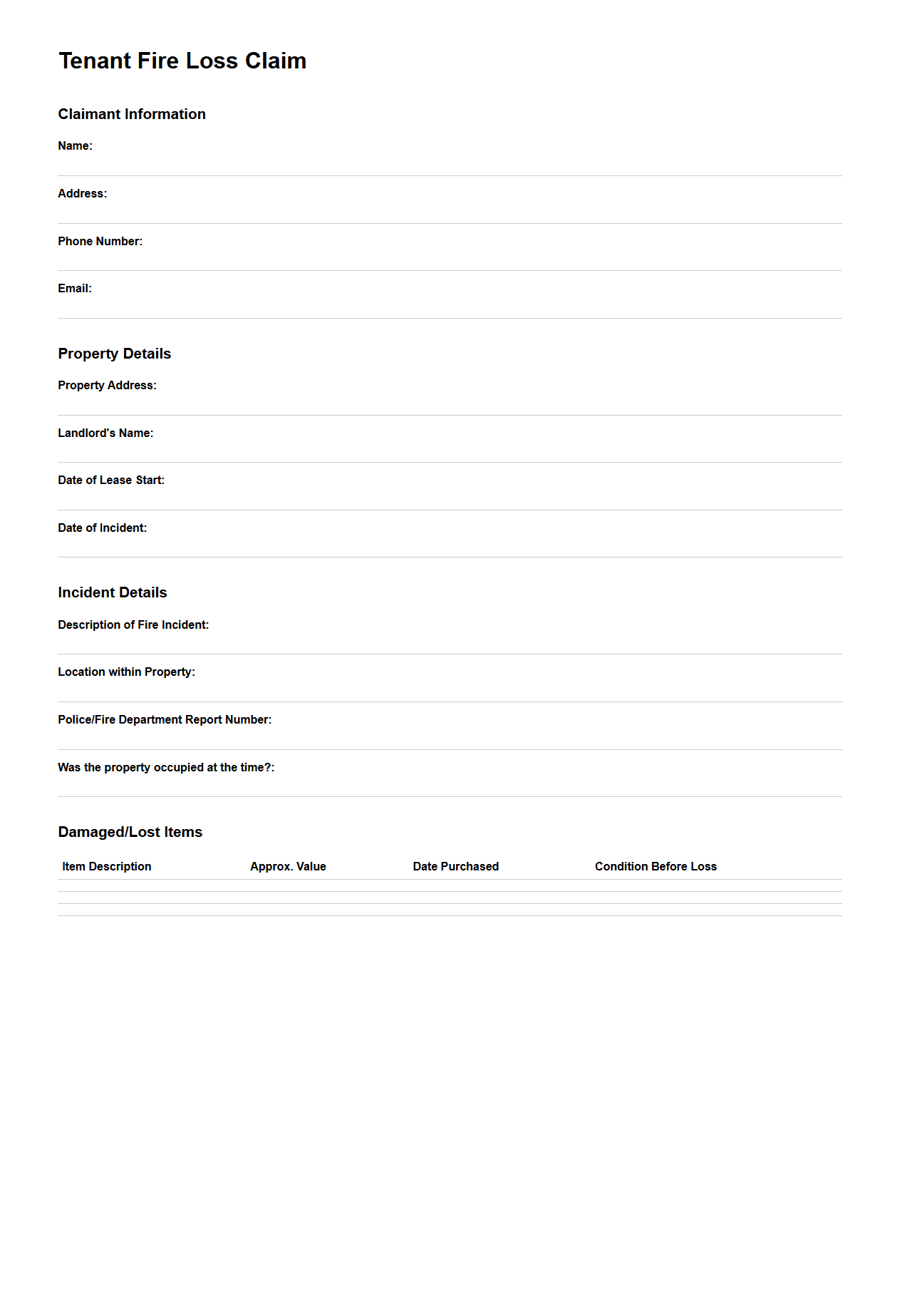

Tenant Fire Loss Claim Sample Document

The

Tenant Fire Loss Claim Sample Document serves as a template for tenants to report damages and losses resulting from fire incidents in rental properties. It provides a structured format to detail the extent of property damage, itemize personal belongings affected, and outline the estimated financial impact. This document is essential for facilitating accurate insurance claims and expediting the reimbursement process for tenants.

What key details must be included in a Proof of Loss document for fire insurance claims?

The Proof of Loss document must include detailed information about the insured property, the extent of the damage, and the date of the fire incident. It also requires the policy number, claim number, and contact details of the claimant to ensure proper identification. Accurate and complete documentation of these key details is essential for the smooth processing of the fire insurance claim.

How does the Proof of Loss document establish the value of damaged or lost property?

The Proof of Loss document establishes the value of property by itemizing and quantifying damages or losses, often including cost estimates or repair quotes. It provides a factual basis for the insurer to assess the claim's validity and the appropriate settlement amount. This valuation helps to prevent disputes and ensures transparency during the claims adjustment process.

Which supporting evidence should accompany the Proof of Loss document to ensure validity?

Supporting evidence such as photographs of the damaged property, repair estimates, purchase receipts, and inventory lists should accompany the Proof of Loss document. These documents substantiate the claimed losses and reinforce the credibility of the claim. Providing comprehensive evidence reduces the likelihood of claim denials or delays.

What is the significance of policyholder signatures and declarations within the Proof of Loss form?

Policyholder signatures and declarations are critical as they legally affirm the truthfulness and accuracy of the information provided. This acknowledgment holds the claimant accountable and deters fraudulent claims. Insurers rely on these signatures to proceed confidently with claim processing.

How does submitting a completed Proof of Loss document affect the fire insurance claim process timeline?

Submitting a fully completed Proof of Loss document accelerates the fire insurance claim assessment and approval process. It allows the insurer to promptly verify details and initiate settlement procedures without unnecessary delays. Timely submission is key to receiving compensation quickly after a fire loss event.