A Surrender Form Document Sample for Whole Life Insurance provides a template for policyholders to officially request the termination of their whole life insurance policy. This document outlines essential information, including the policy number, surrender value, and signature confirmation to ensure a smooth transaction between the insured and the insurance company. Using a clear and accurate surrender form helps expedite the process and avoid potential disputes or delays.

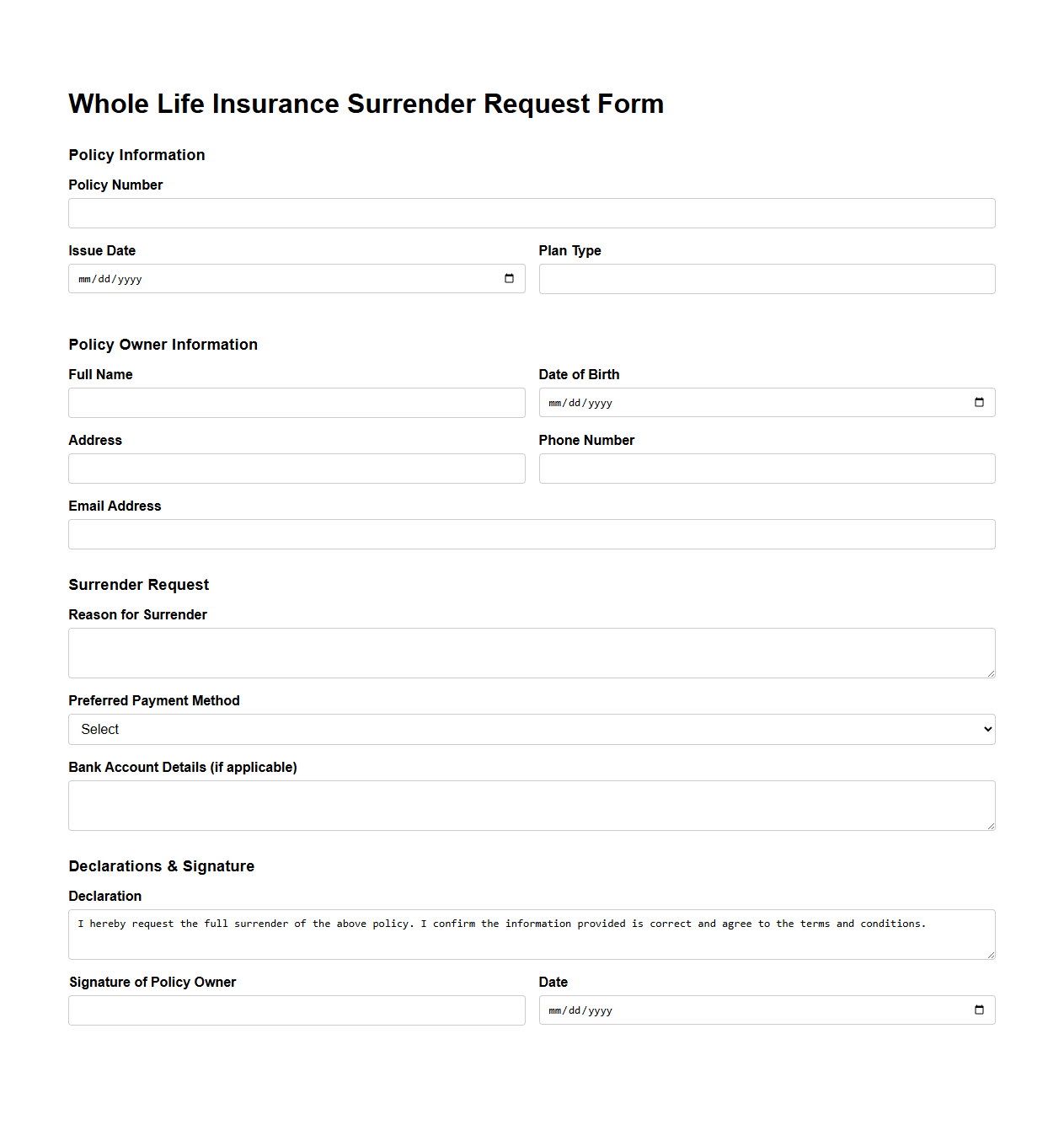

Whole Life Insurance Surrender Request Form Template

The

Whole Life Insurance Surrender Request Form Template is a structured document used by policyholders to formally request the cancellation and cash surrender of their whole life insurance policy. It captures essential details such as policy number, personal identification, and the desired surrender date, streamlining communication with the insurance company. This template ensures the policyholder's instructions are clear, facilitating efficient processing and accurate payout based on the policy's cash value.

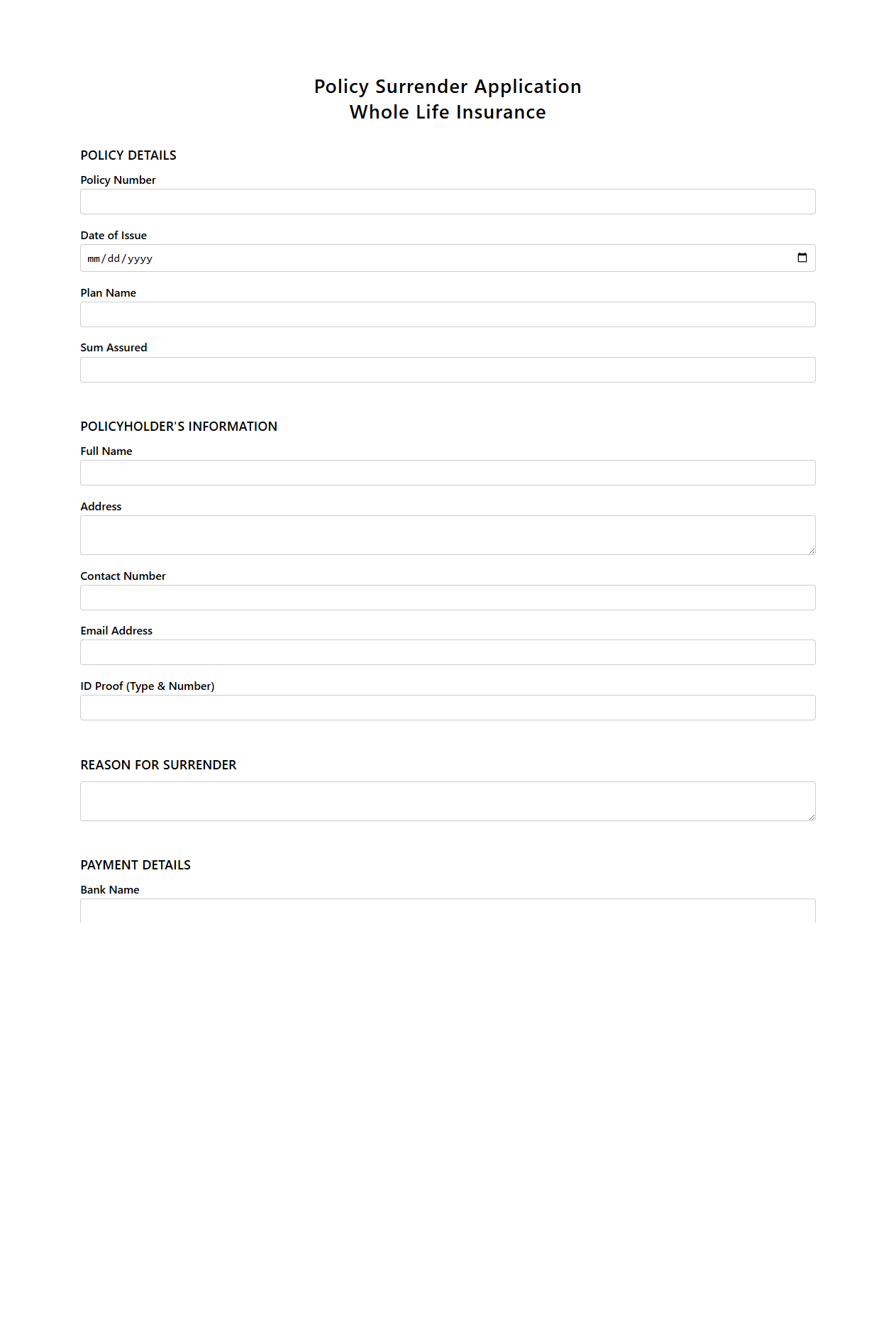

Policy Surrender Application for Whole Life Insurance

A

Policy Surrender Application for Whole Life Insurance is a formal request submitted by the policyholder to terminate their life insurance coverage and receive the accumulated cash value. This document outlines the surrender terms, possible fees, and the amount payable upon early termination of the policy. Proper understanding of this application helps policyholders make informed decisions about accessing their policy's cash benefits before maturity or death.

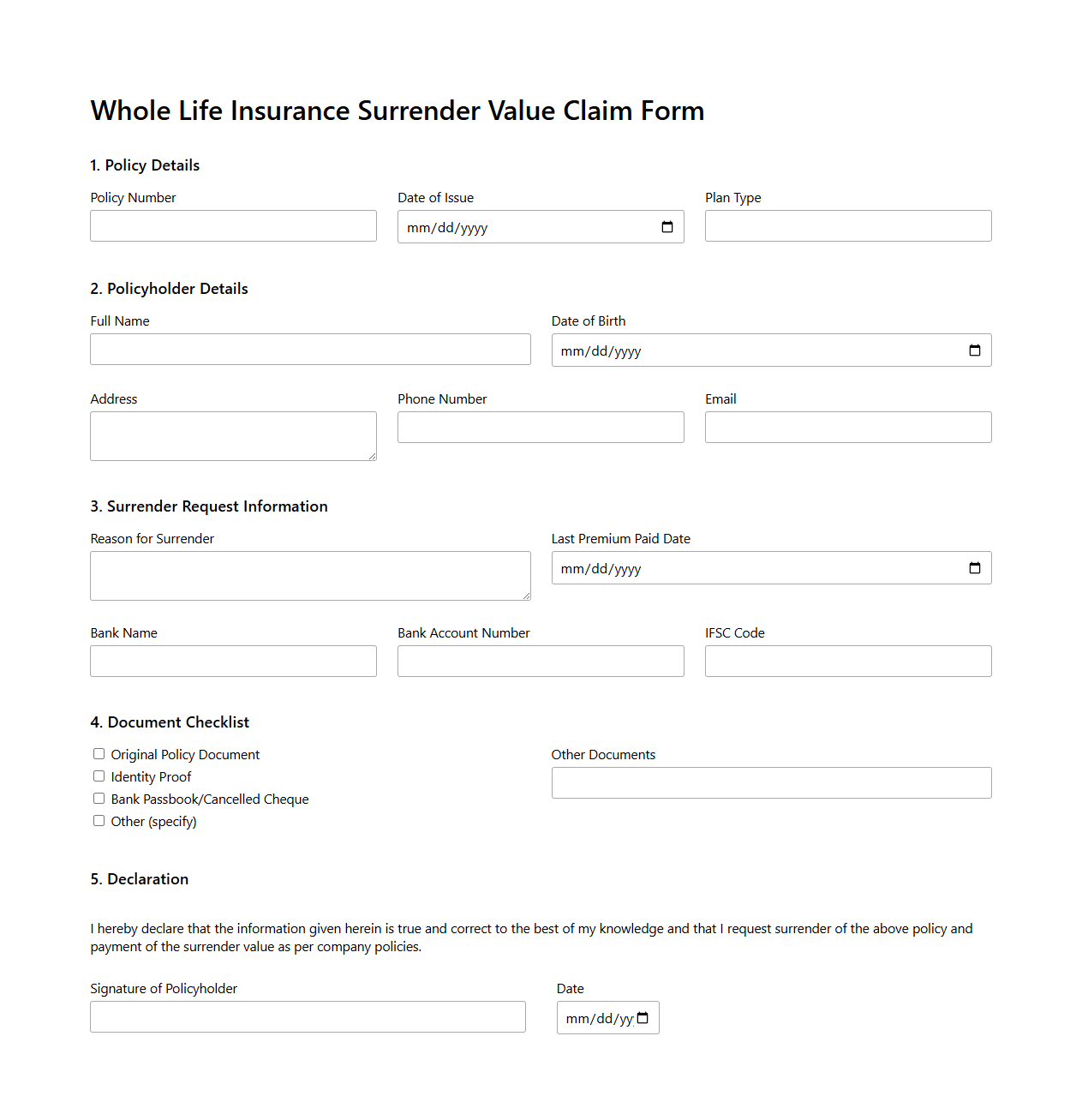

Whole Life Insurance Surrender Value Claim Form

The

Whole Life Insurance Surrender Value Claim Form is a crucial document used by policyholders to initiate the process of cashing out their whole life insurance policy before its maturity or beneficiary claim. It captures essential details like policy number, personal information, and the requested surrender amount, facilitating verification and payout calculation by the insurance company. Submitting this form correctly ensures a smooth transaction of the policy's surrender value, which represents the accumulated cash value available to the insured upon policy termination.

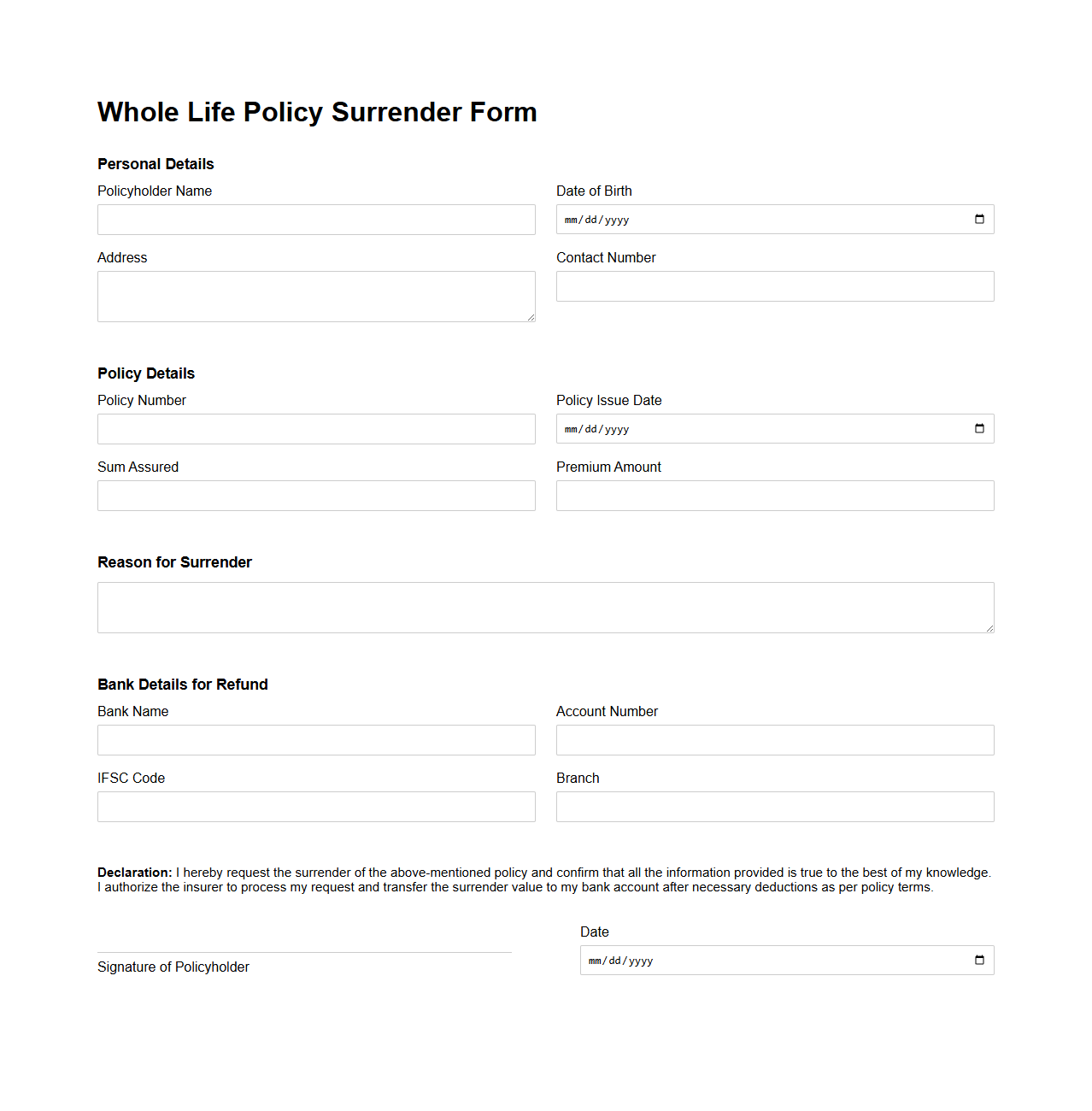

Whole Life Policy Surrender Form Example

A

Whole Life Policy Surrender Form Example document serves as a template that guides policyholders in formally requesting the cancellation of their whole life insurance policy. This form typically includes sections for personal information, policy details, reason for surrender, and authorization signatures to ensure proper processing by the insurance company. Using a clear and accurate surrender form helps expedite the claim of the policy's cash value and avoids potential delays in the policy termination process.

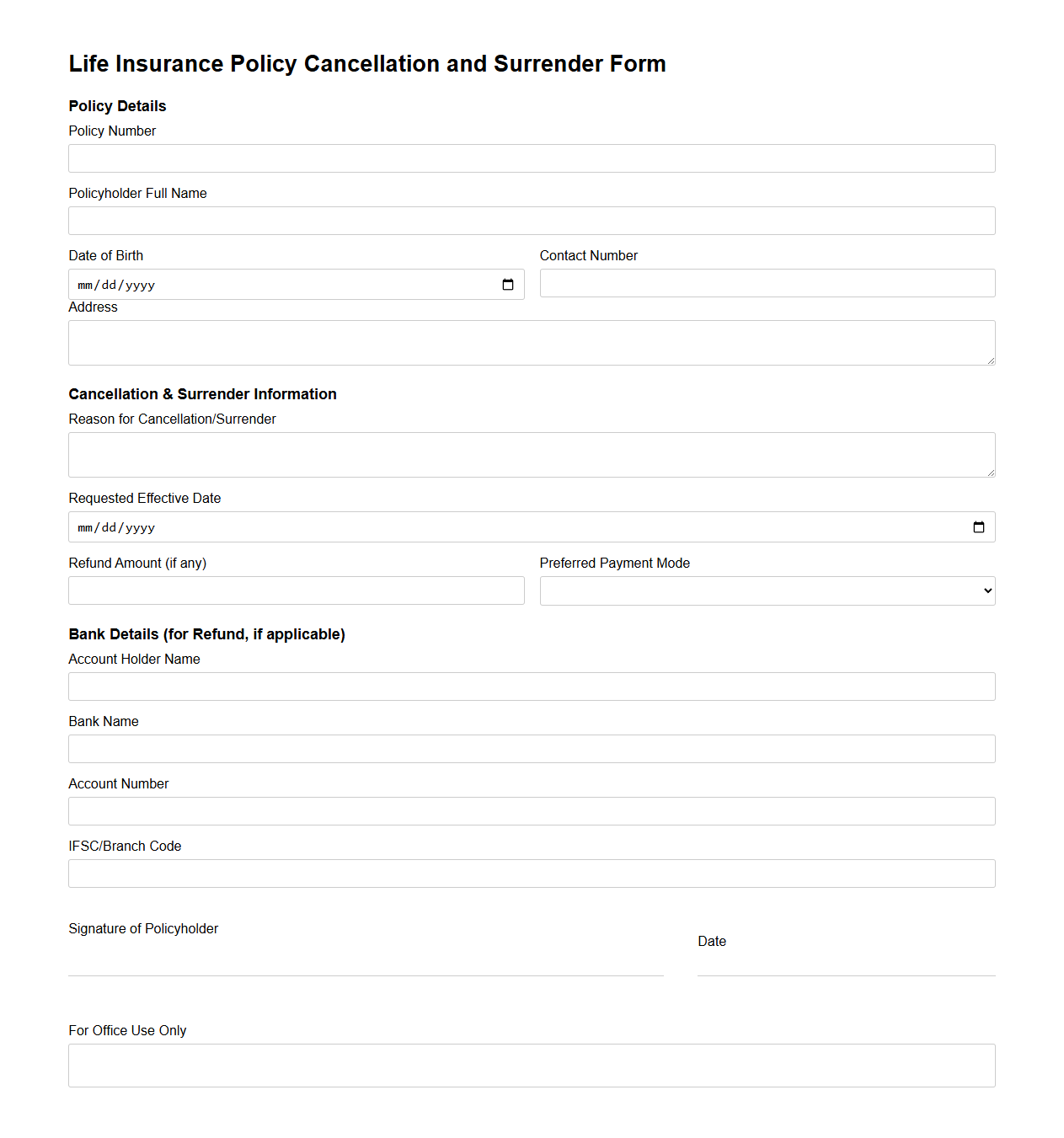

Life Insurance Policy Cancellation and Surrender Form

A

Life Insurance Policy Cancellation and Surrender Form is an official document used by policyholders to terminate their life insurance contract and claim the surrender value, if applicable. This form typically requires details like policy number, personal identification, and reason for cancellation. Submitting this document initiates the process of nullifying coverage and can result in receiving any accumulated cash value or refunds specified in the original policy terms.

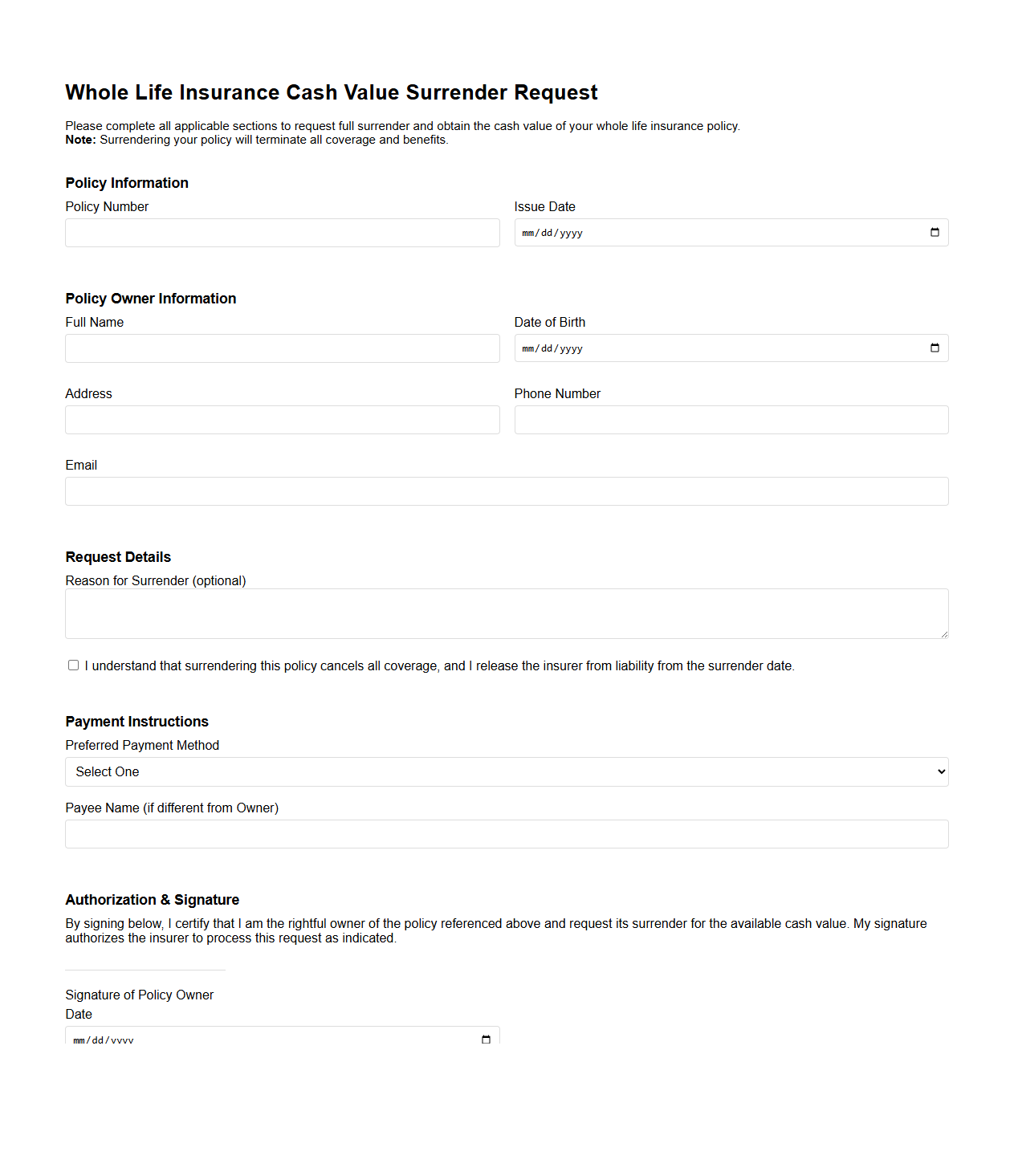

Whole Life Insurance Cash Value Surrender Request

A

Whole Life Insurance Cash Value Surrender Request document is a formal form submitted to an insurance company to initiate the process of surrendering a whole life insurance policy in exchange for its accumulated cash value. This document outlines the policyholder's intent to terminate the policy and withdraw the cash value, which can include accumulated dividends and interest, subject to surrender charges and tax implications. Processing this request typically results in the cessation of coverage and the payment of the policy's cash surrender value to the policyholder.

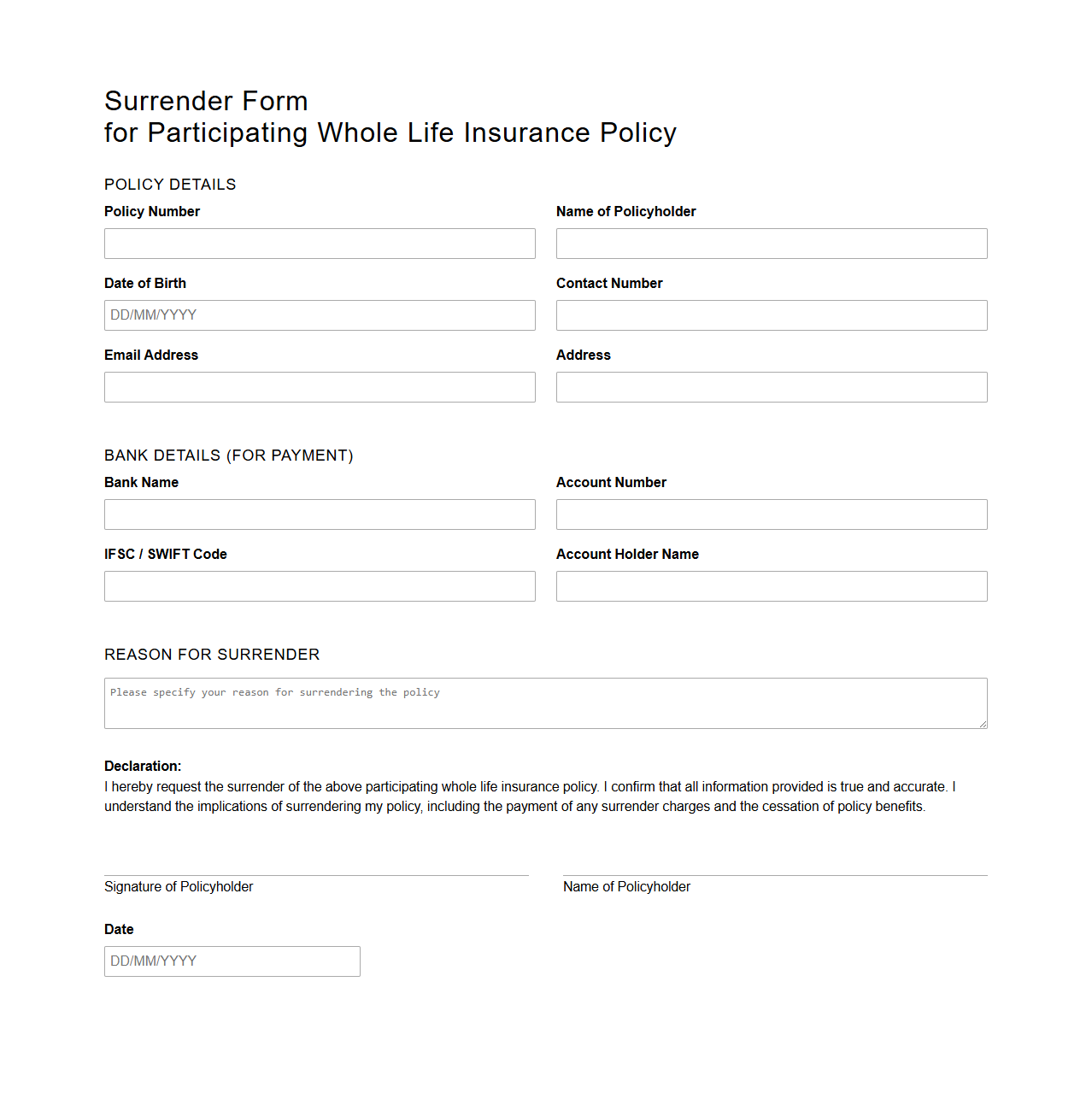

Surrender Form for Participating Whole Life Insurance Policy

A

Surrender Form for a Participating Whole Life Insurance Policy is a document required to formally request the cancellation of the policy before its maturity or insured event. It initiates the process by which the policyholder receives the cash surrender value, which depends on the policy's accumulated dividends and premiums paid. This form ensures the proper processing of the policy's termination and the disbursement of any eligible funds to the insured.

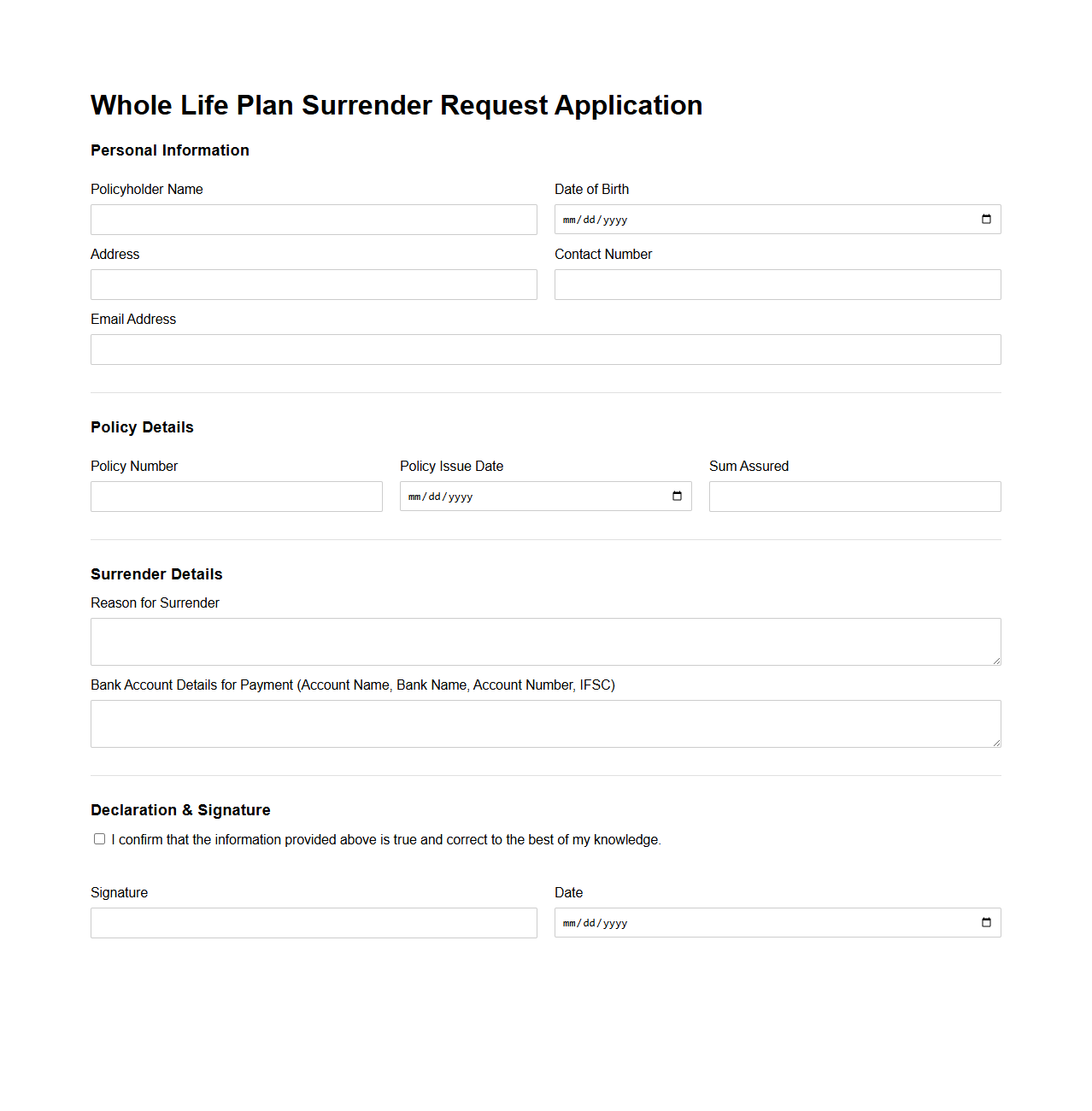

Whole Life Plan Surrender Request Application

The

Whole Life Plan Surrender Request Application document is used by policyholders to formally request the cancellation of their whole life insurance policy. This application initiates the process of surrendering the policy, allowing the insured to receive the cash surrender value based on the terms outlined in the policy contract. It typically requires personal information, policy details, and the policyholder's signature to validate the request.

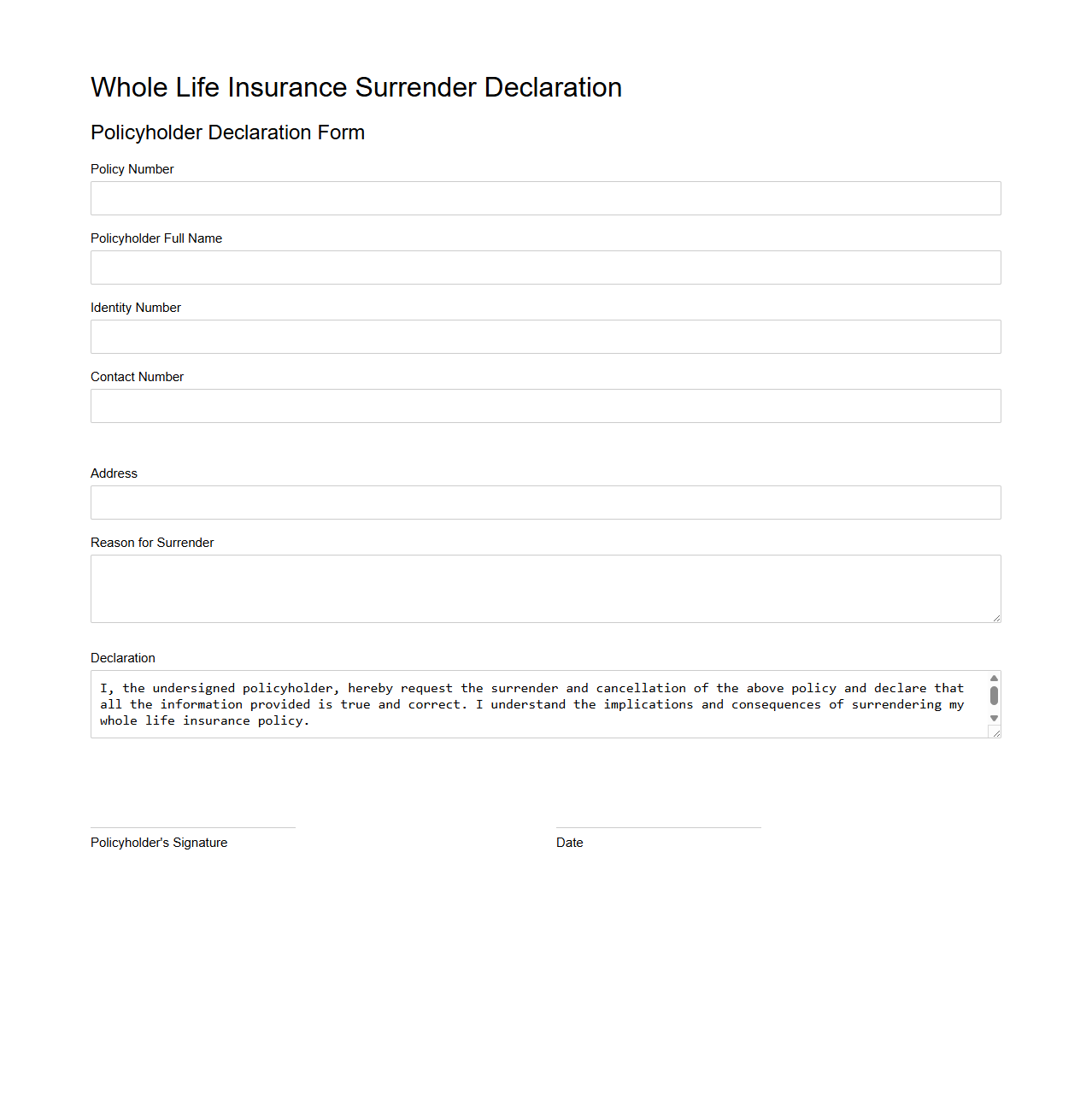

Policyholder Whole Life Insurance Surrender Declaration

The

Policyholder Whole Life Insurance Surrender Declaration document is a formal statement submitted by the insured to request the termination of their whole life insurance policy in exchange for its cash surrender value. This document outlines the policyholder's decision to relinquish coverage and receive the accumulated cash value, effectively ending the insurance contract. It is essential for processing the surrender transaction, ensuring the insurer acknowledges the policy termination and initiates the payout.

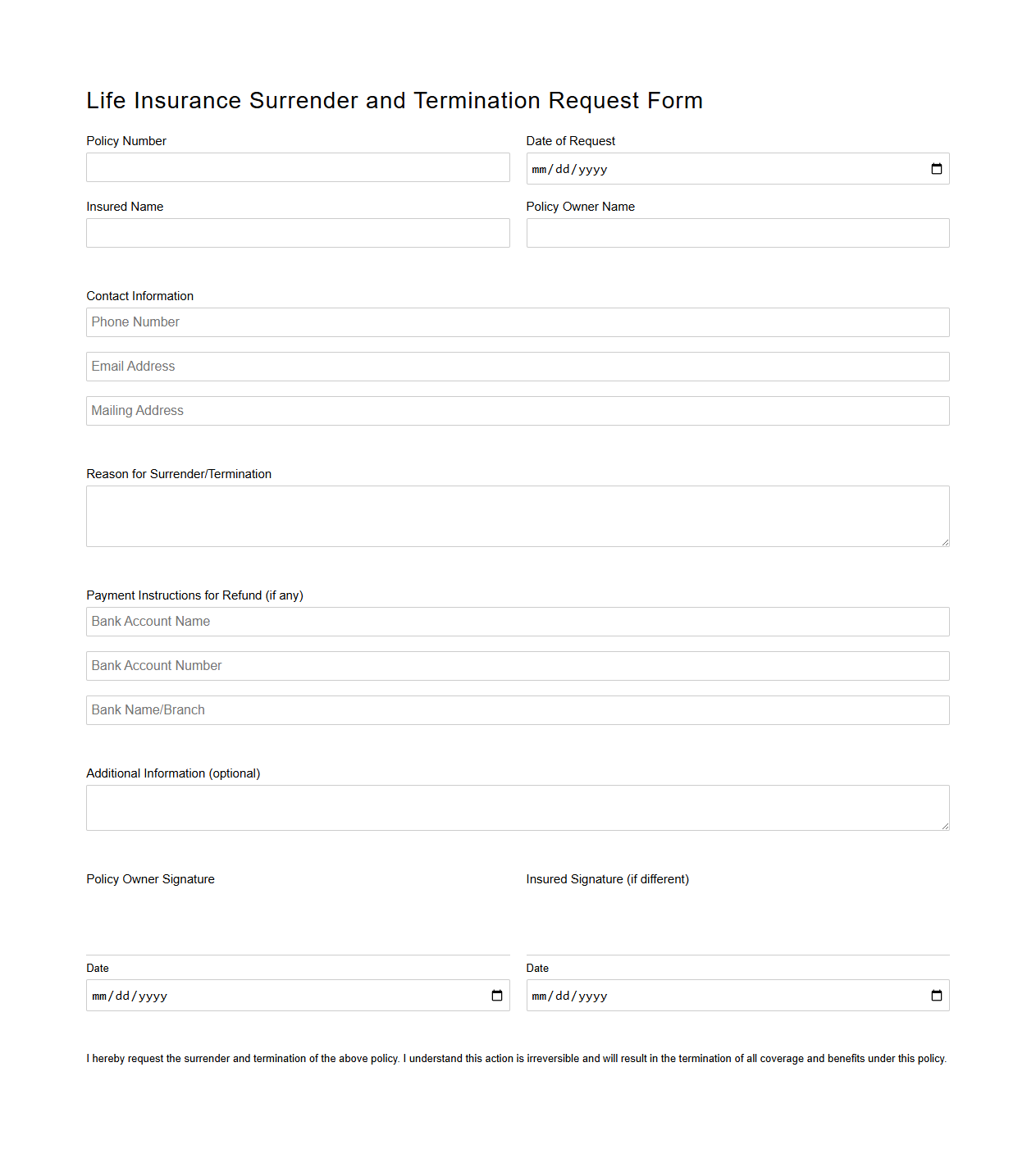

Life Insurance Surrender and Termination Request Form

The

Life Insurance Surrender and Termination Request Form is a crucial document that policyholders use to formally request the cancellation or surrender of their life insurance policy. This form captures essential details such as policy number, personal information, and the reason for termination, facilitating the insurance provider in processing surrender benefits or refunds. Submitting this form initiates the official termination process and impacts the policyholder's coverage and potential cash value payout.

What personal details must be provided by the policyholder on the Surrender Form Document?

The policyholder must provide their full name, contact details, and policy number accurately on the Surrender Form Document. Verification of identity is essential to ensure the surrender request is legitimate and properly authorized. Additionally, the policyholder's signature is required to confirm consent for the policy surrender.

Which policy information is required to process the whole life insurance surrender request?

The surrender request requires complete details of the whole life insurance policy, including the policy number, start date, and coverage amount. Clear identification of the policy ensures the insurance company can retrieve all relevant records. Providing precise policy information helps avoid delays in handling the surrender application.

What are the consequences or implications of surrendering the whole life insurance policy as stated in the form?

Surrendering the policy may result in the loss of certain benefits and coverage secured under the insurance contract. The policyholder typically receives a surrender value, which is often less than the total premiums paid. This action usually terminates the policy, leaving the insured without future death benefit protection.

Which documents must be attached or submitted alongside the Surrender Form?

Along with the completed surrender form, a copy of the original insurance policy document and valid identification must be submitted. Additional documents might include proof of ownership or beneficiary consent if applicable. Ensuring all required documents are attached facilitates a smooth surrender process.

What payment or refund methods are indicated for disbursing the surrender value in the sample form?

The surrender value is typically disbursed through a direct bank transfer or cheque as stipulated on the sample form. Policyholders may specify their preferred payment method when filling out the surrender form. Clear instructions for payment ensure timely and accurate refunds to the policyholder.