A Policy Surrender Document Sample for Whole Life Insurance provides a clear template outlining the necessary steps and information required to surrender a whole life insurance policy. This sample helps policyholders understand the documentation needed, including surrender forms, identification, and any financial details related to the cash surrender value. It serves as a useful guide to ensure a smooth and accurate policy termination process.

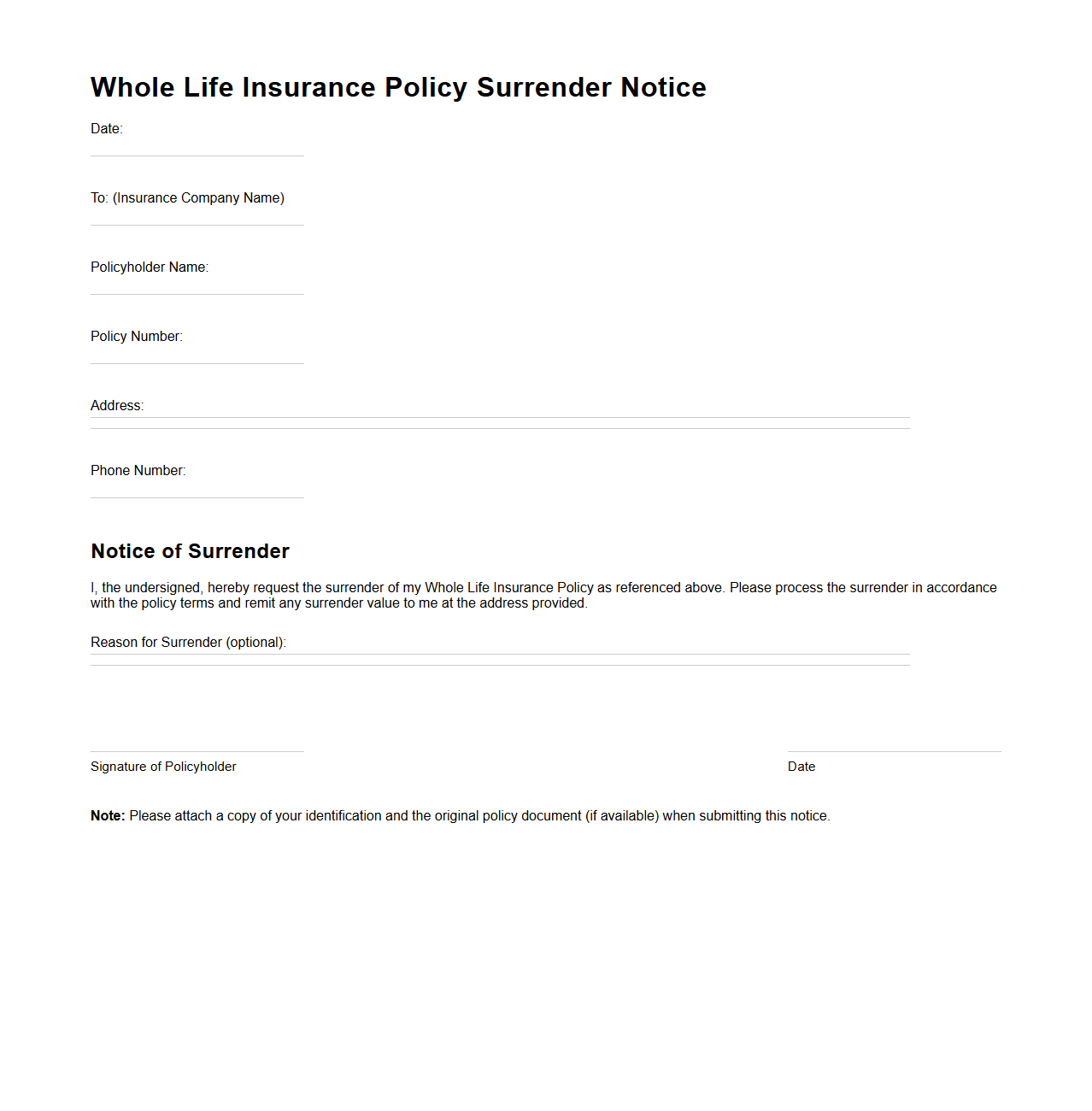

Whole Life Insurance Policy Surrender Notice Template

A

Whole Life Insurance Policy Surrender Notice Template document is a formal written notification used by policyholders to request the termination and cash surrender of their whole life insurance policy. This document includes essential details such as the policy number, insured's information, surrender date, and instructions to receive the policy's cash value. It streamlines the surrender process, ensuring clear communication between the insured and the insurance company while protecting the rights and financial interests of both parties.

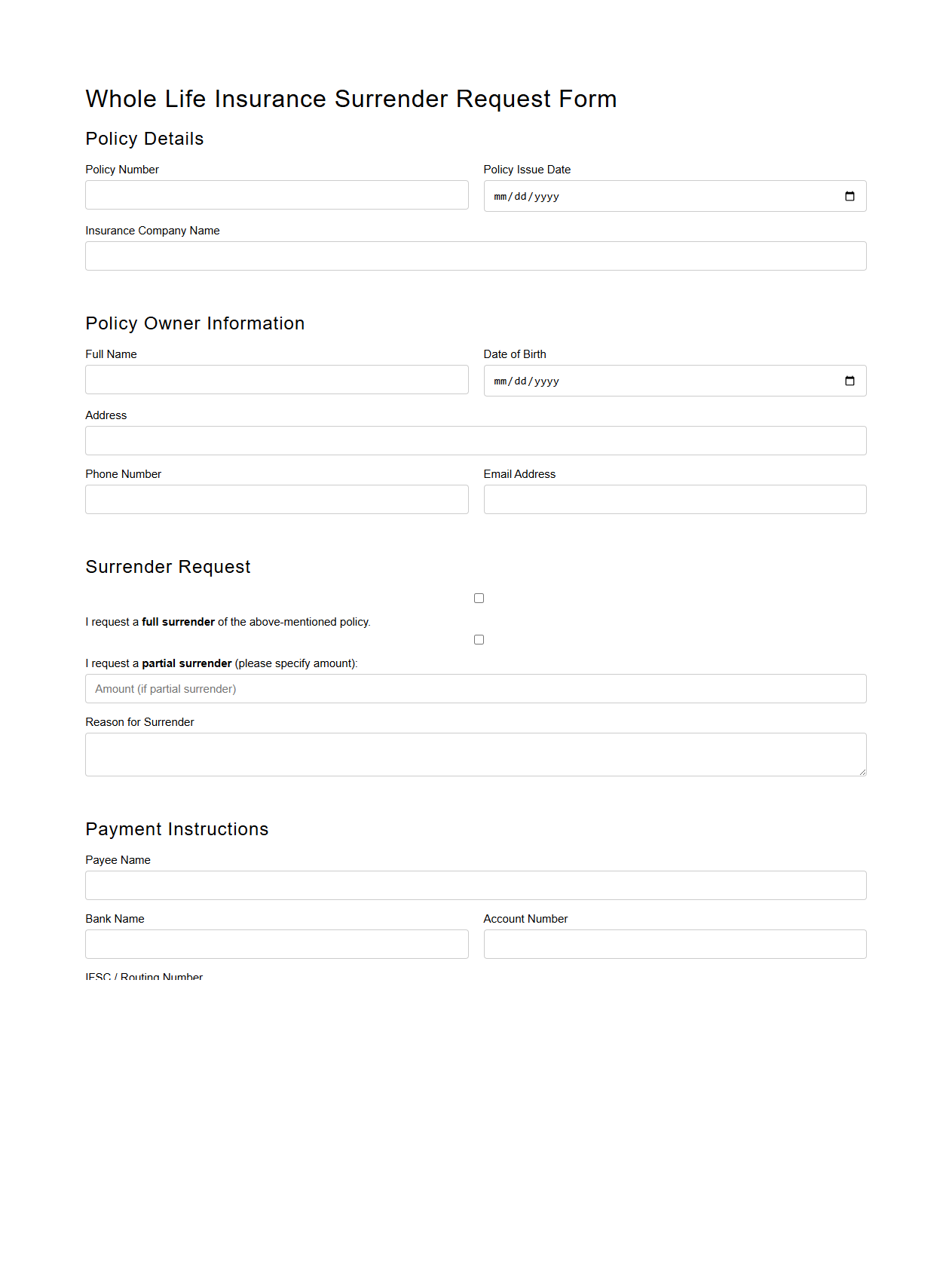

Whole Life Insurance Surrender Request Form Sample

A

Whole Life Insurance Surrender Request Form sample document is a template used by policyholders to formally request the cancellation of their whole life insurance policy. This form typically includes essential details such as the policy number, personal information, reason for surrender, and the signature of the insured. Submitting this document initiates the process of receiving the policy's cash surrender value, which is a key benefit of whole life insurance policies after the surrender period.

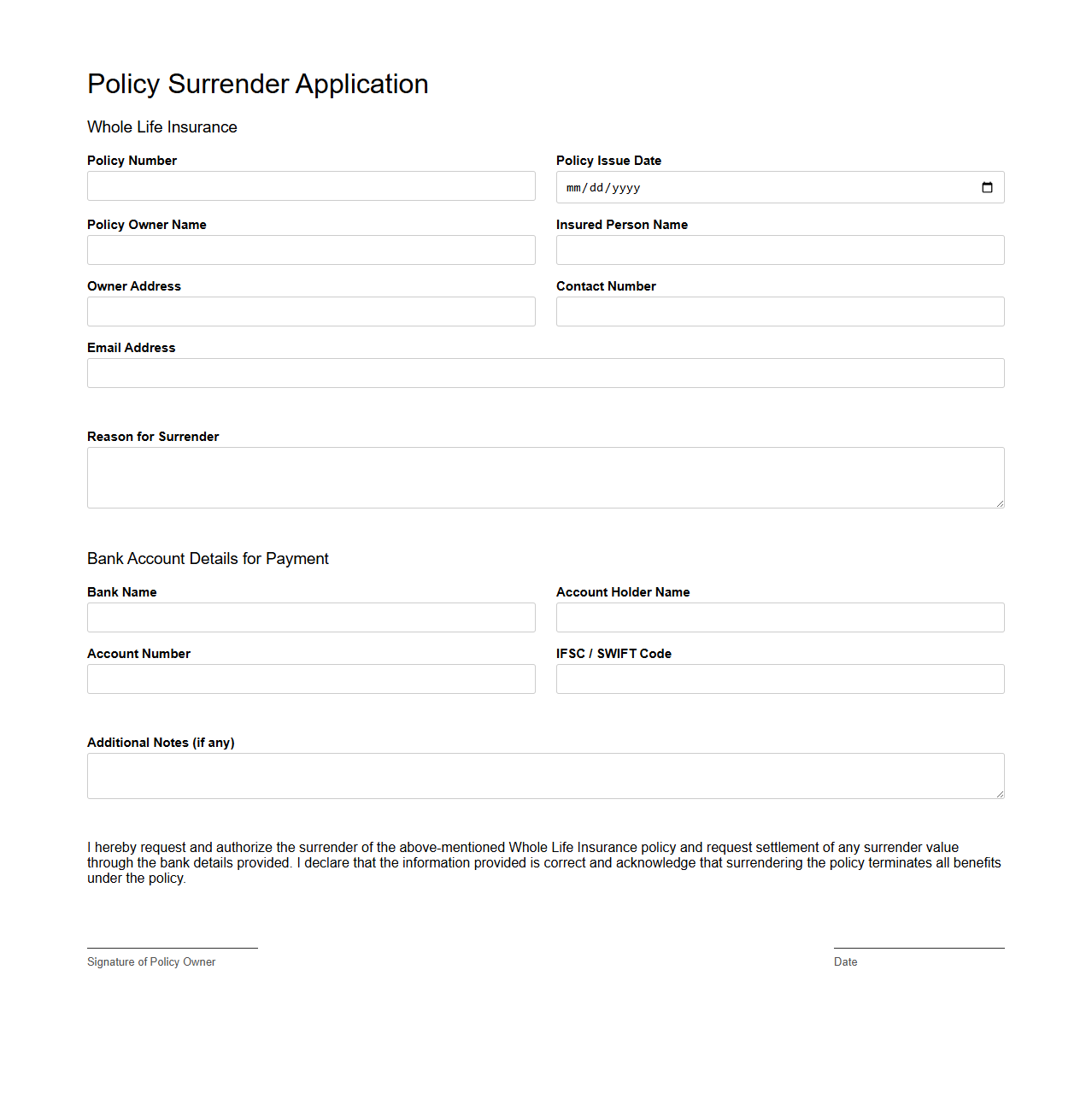

Policy Surrender Application for Whole Life Insurance

A

Policy Surrender Application for Whole Life Insurance is a formal request submitted by the policyholder to terminate their insurance contract before its maturity. This document details the intention to receive the policy's cash surrender value, which is the amount payable after deducting any surrender charges or outstanding loans. It is essential for processing the cancellation and facilitating the payout according to the insurer's terms and conditions.

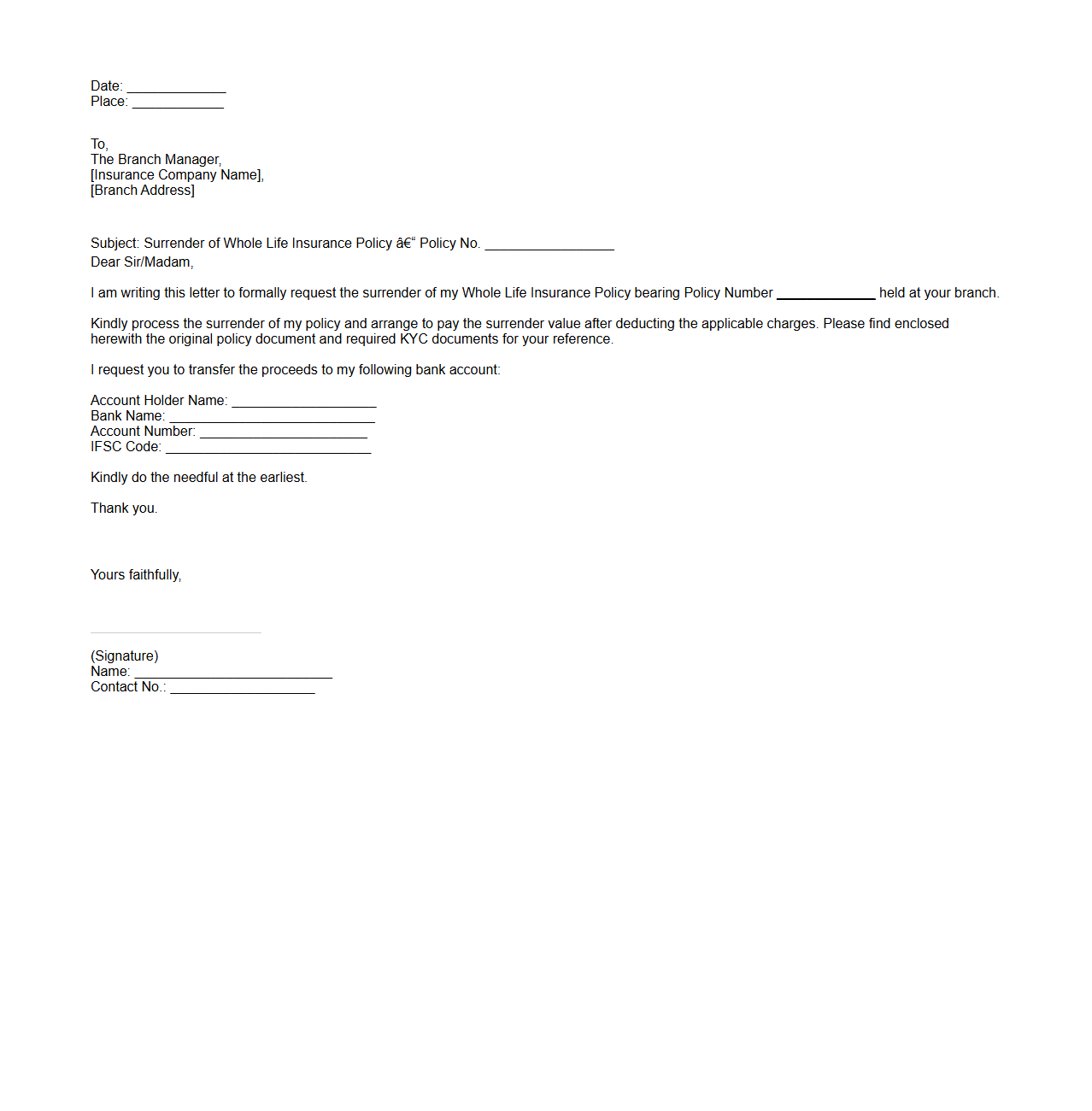

Whole Life Policy Surrender Letter Format

A

Whole Life Policy Surrender Letter Format document is a formal written request submitted by a policyholder to an insurance company to terminate their whole life insurance policy. It typically includes essential details such as the policy number, the insured's personal information, the reason for surrender, and a request for the cash surrender value payout. This document ensures clear communication and facilitates a smooth transaction process for policy cancellation and fund disbursement.

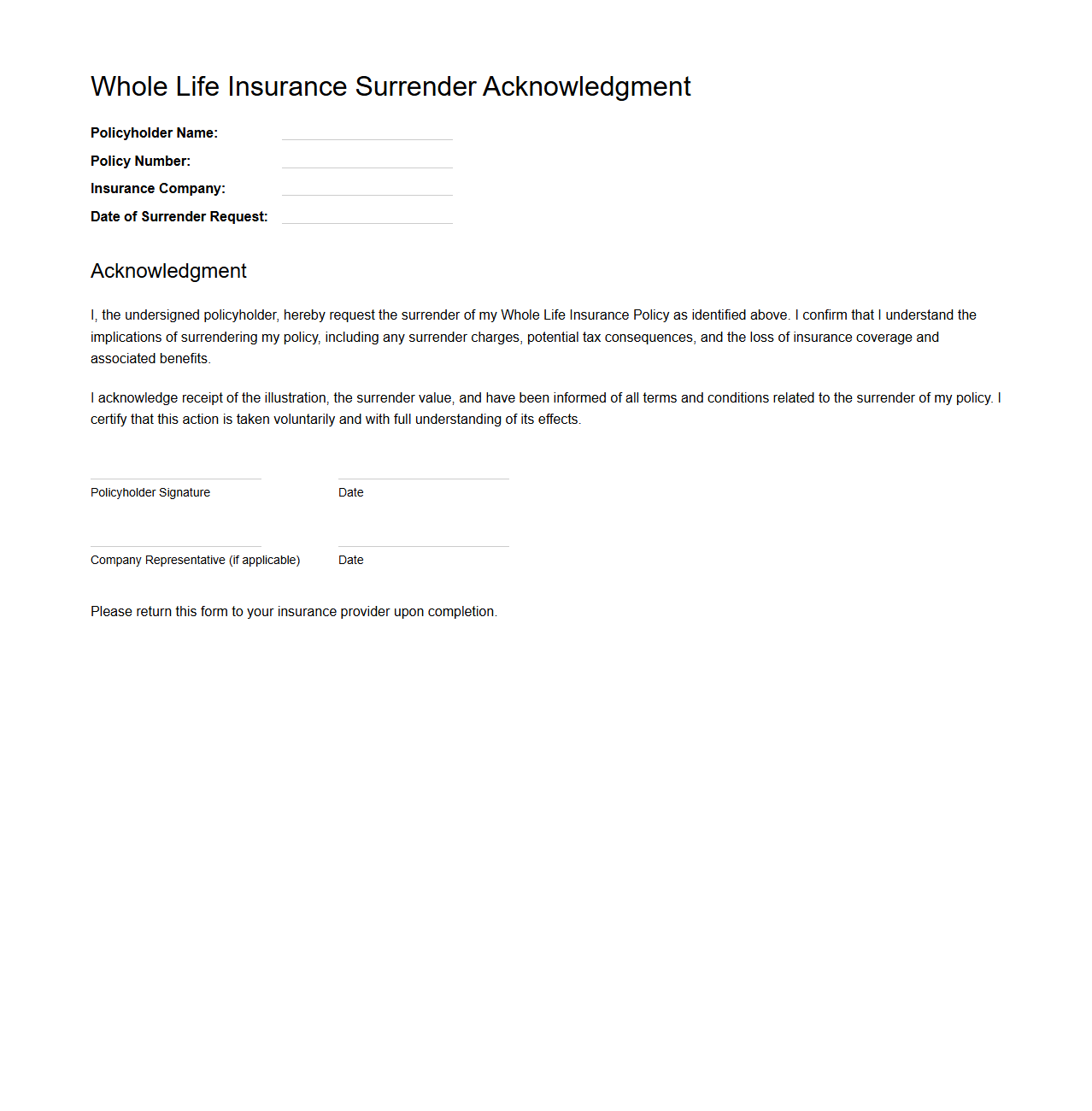

Whole Life Insurance Surrender Acknowledgment Sample

A

Whole Life Insurance Surrender Acknowledgment Sample document serves as a formal record confirming that a policyholder has requested to surrender their whole life insurance policy. It outlines the policy details, surrender value, applicable fees, and the date of surrender, ensuring mutual understanding between the insurer and the policyholder. This document is essential for legal clarity and transparency during the policy termination process.

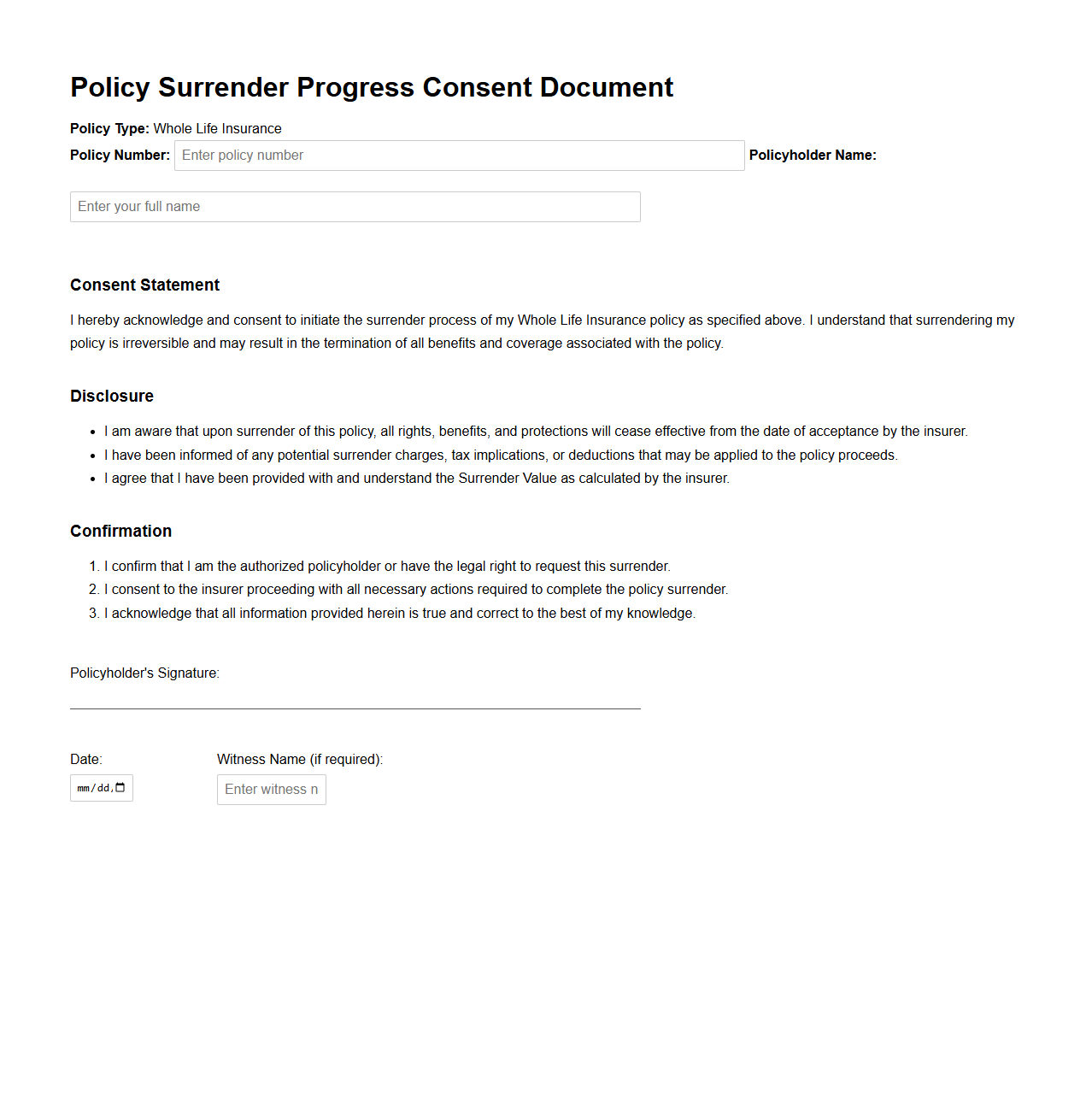

Policy Surrender Progress Consent Document for Whole Life Insurance

The

Policy Surrender Progress Consent Document for Whole Life Insurance serves as an official agreement between the policyholder and the insurer, authorizing the initiation of the surrender process for the insurance policy. This document outlines the terms, including any applicable surrender charges, cash surrender value, and the impact on coverage and benefits upon policy termination. It ensures the policyholder is fully informed and consents to the conditions governing the policy's early termination.

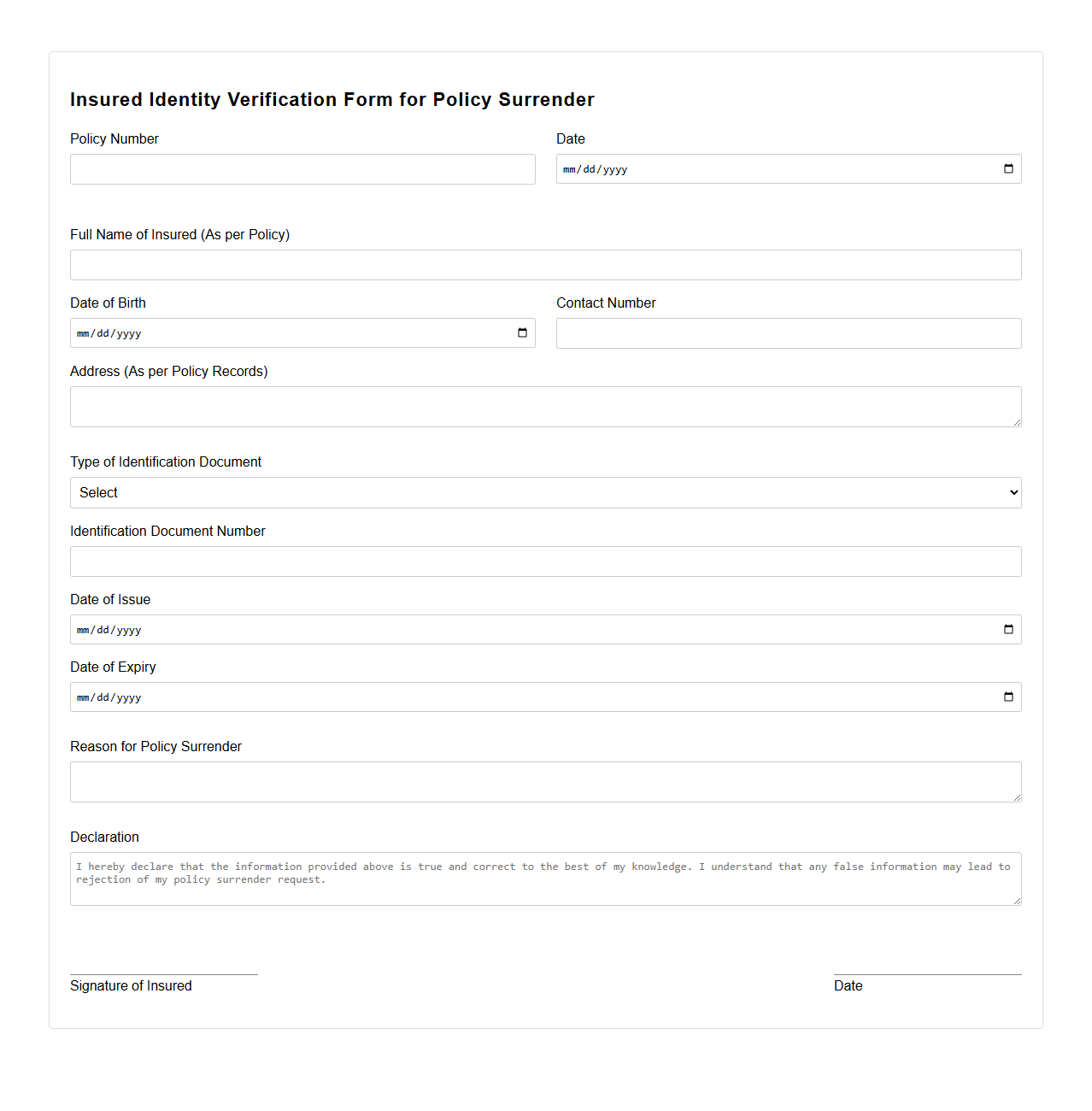

Insured Identity Verification Form for Policy Surrender

The

Insured Identity Verification Form for a Policy Surrender document serves as a critical security measure to confirm the identity of the policyholder requesting the surrender of their insurance policy. This form requires detailed personal information and supporting identification documents to prevent fraud and unauthorized access to the policy funds. Insurance companies use this verification process to ensure that only the rightful owner can initiate policy termination and receive the associated surrender value.

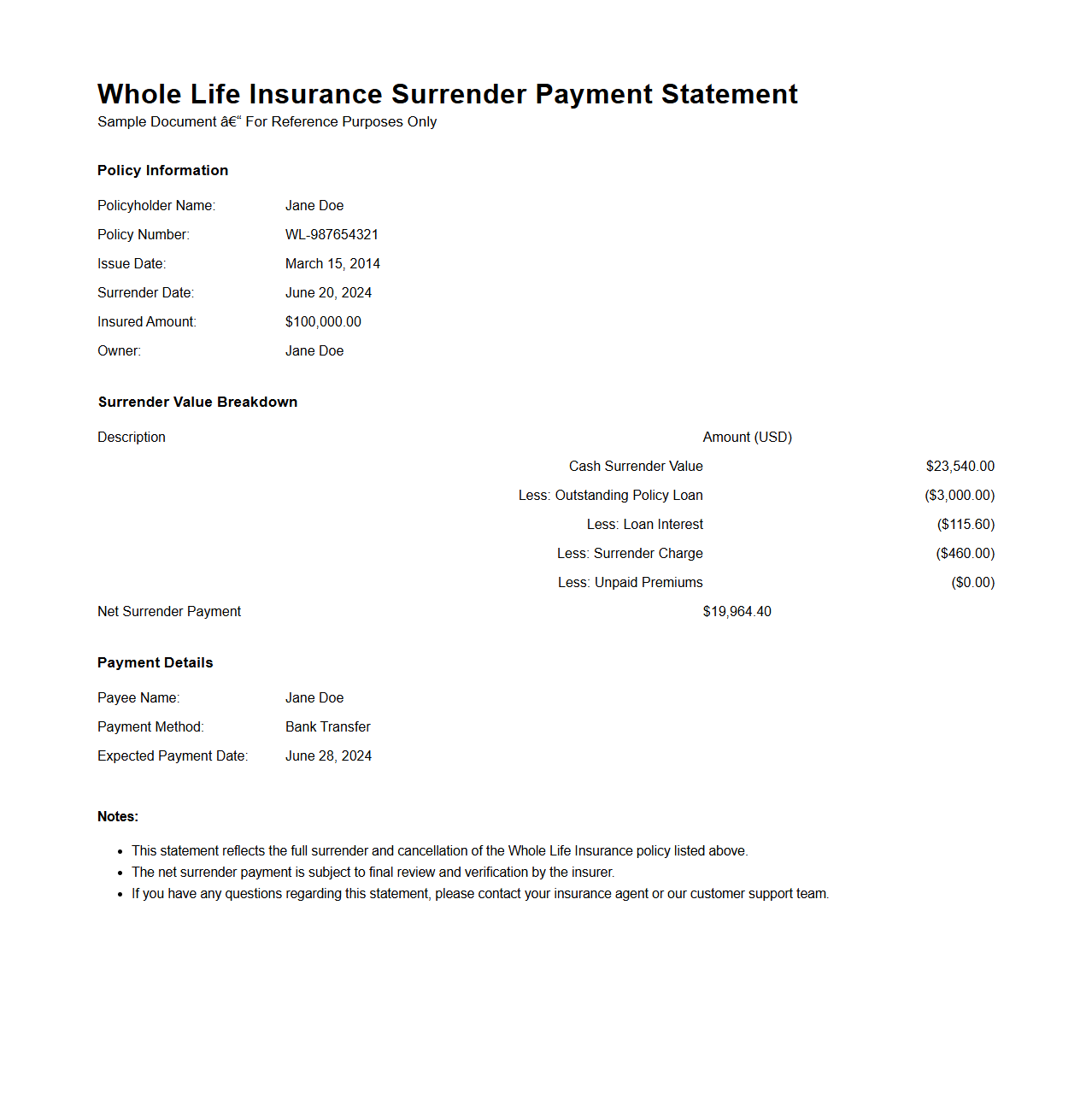

Whole Life Insurance Surrender Payment Statement Example

A

Whole Life Insurance Surrender Payment Statement Example document details the financial breakdown provided to a policyholder when they cash in their life insurance policy before maturity. It includes the surrender value, any applicable fees, outstanding loans, and the net amount payable to the insured. This statement helps policyholders understand the monetary implications and the total payout they will receive upon surrendering their policy.

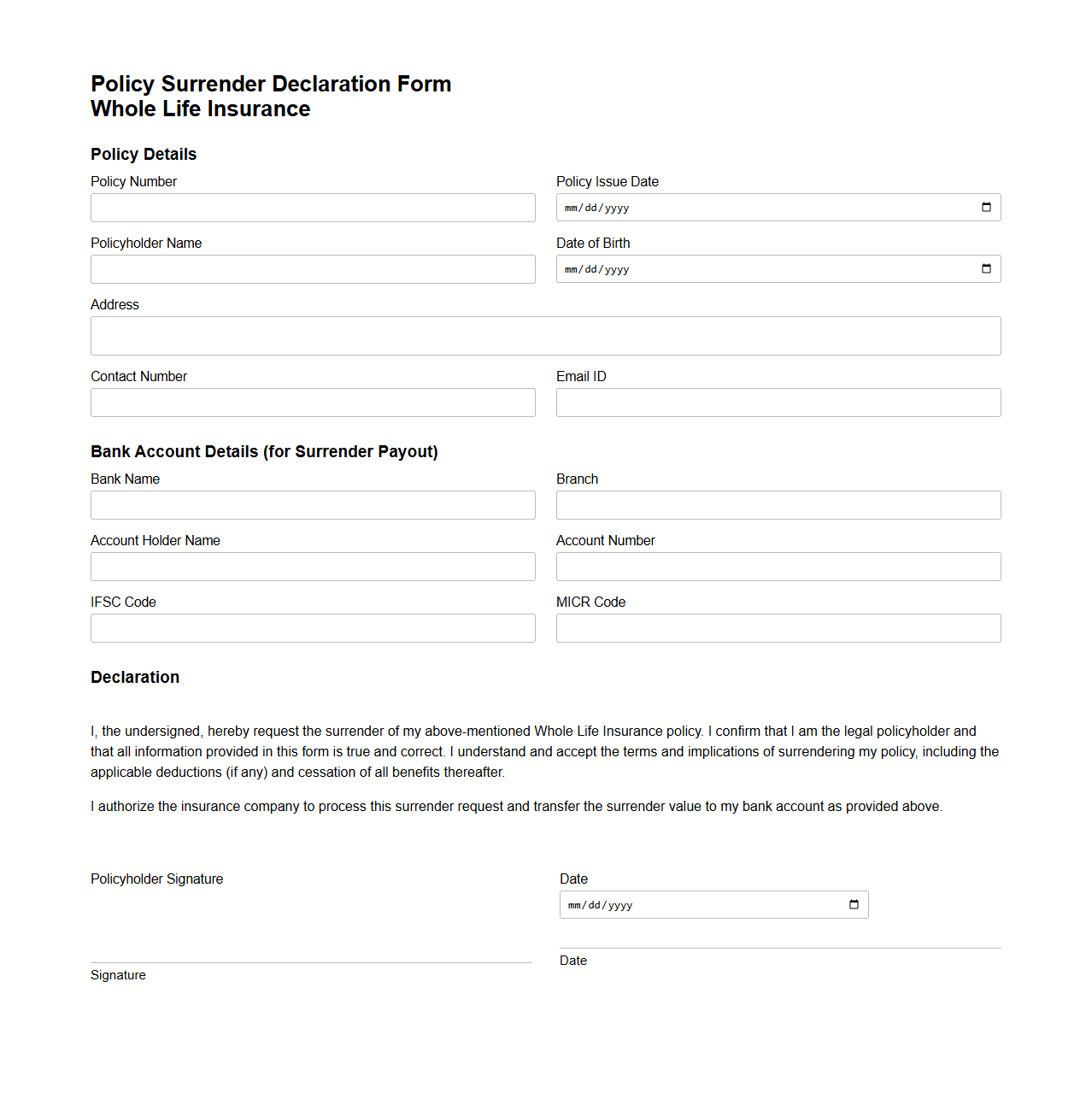

Policy Surrender Declaration Form for Whole Life Insurance

The

Policy Surrender Declaration Form for Whole Life Insurance is a legal document used to officially request the termination of a whole life insurance policy before its maturity or the insured's death. This form typically requires the policyholder to provide their personal details, policy information, and confirmation that they understand the consequences of surrendering, including the surrender value and potential loss of benefits. Submitting this declaration enables the insurance company to process the surrender, calculate the cash value payable, and close the policy account accordingly.

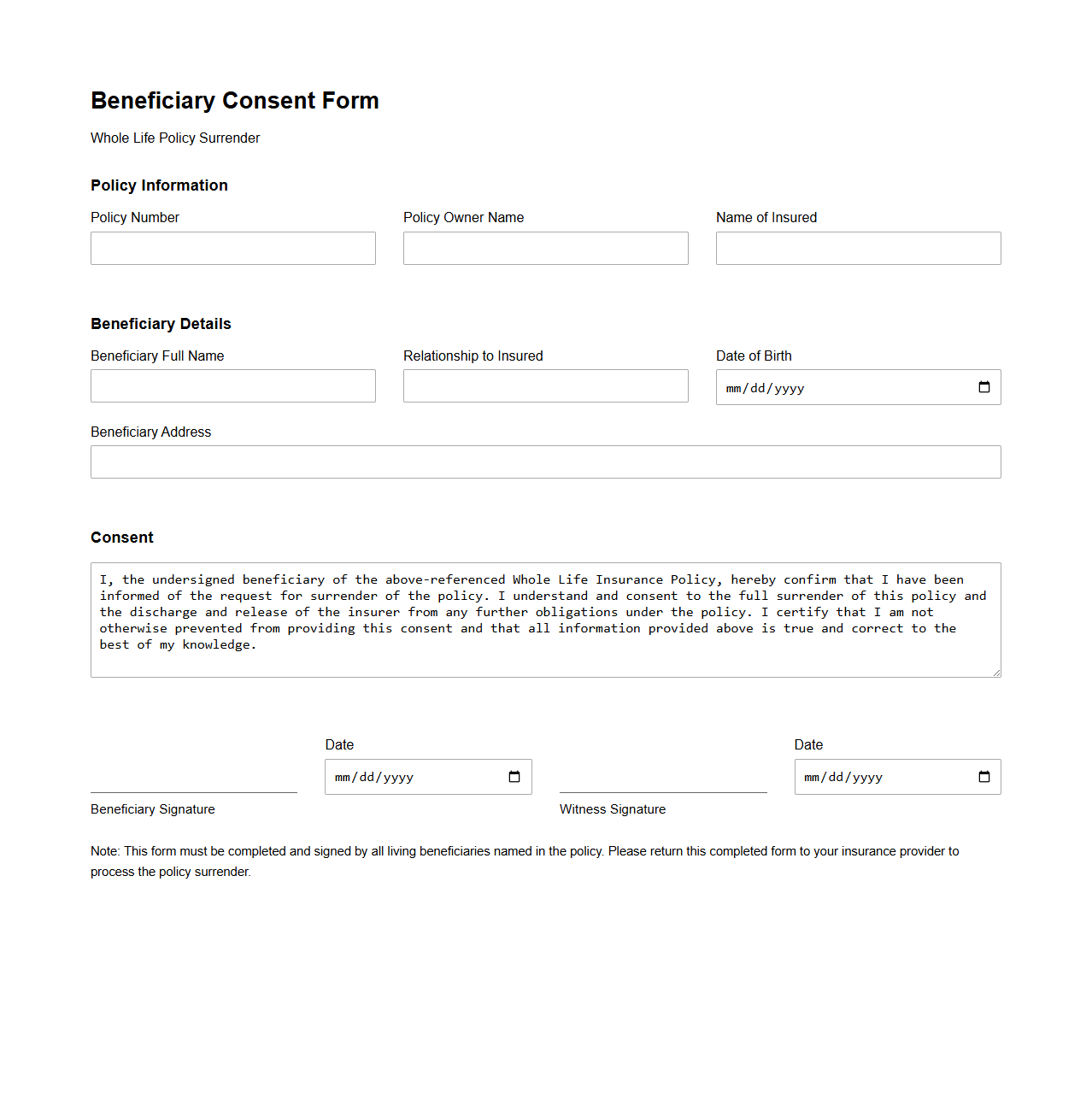

Beneficiary Consent Form for Whole Life Policy Surrender

The

Beneficiary Consent Form for Whole Life Policy Surrender is a crucial document that authorizes the insurance company to proceed with the surrender of a whole life insurance policy. This form ensures that all named beneficiaries are informed and agree to the policy's termination, preventing any future disputes regarding the policy benefits. It typically requires signatures from beneficiaries to confirm their consent, protecting both the insurer and the policyholder's interests during the surrender process.

What is the process outlined for surrendering a whole life insurance policy in this document sample?

The process to surrender a whole life insurance policy involves submitting a duly completed surrender form along with all necessary documents. Policyholders must ensure that the policy is in force and all premiums are up to date before initiating the request. The insurer then processes the surrender application and calculates the surrender value based on the policy terms.

Which mandatory documents and identification proofs are required for policy surrender according to the sample?

The sample specifies that the policyholder must provide the original policy document along with a valid government-issued identification proof, such as a passport or driver's license. Additionally, a recent passport-sized photograph and a duly signed surrender form are mandatory. These documents help verify the identity and consent of the policyholder for smooth processing.

What are the stated conditions or charges applicable upon surrendering the policy as per the sample?

The document states that surrendering the policy before a certain period may attract surrender charges or penalties as outlined in the policy contract. The surrender value is typically reduced by these applicable fees and outstanding loan amounts, if any. Furthermore, the policyholder may forfeit certain benefits or bonuses accrued under the policy upon surrender.

How is the surrender value calculated and when is it payable, based on the sample document?

The surrender value is calculated based on the premiums paid, policy duration, and any bonuses that have vested up to the surrender date. The insurer usually pays the surrender value within a specified period, often 15 to 30 days after receiving all required documents. This value represents the amount payable to the policyholder upon policy termination.

Who should be contacted or where should the completed surrender form be submitted, as detailed in the document sample?

According to the sample, the completed surrender form and supporting documents should be submitted to the insurance company's nearest branch office or the official service center. Policyholders are encouraged to contact the customer service helpline for guidance on the submission process. Proper submission ensures timely processing and disbursal of the surrender value.