An Escrow Agreement Document Sample for Real Estate Deposits outlines the terms under which a neutral third party holds funds during a property transaction to ensure security for both buyer and seller. It specifies conditions for the release of the deposit, protecting all parties involved from potential disputes. This document is essential for creating trust and clarity in real estate deals.

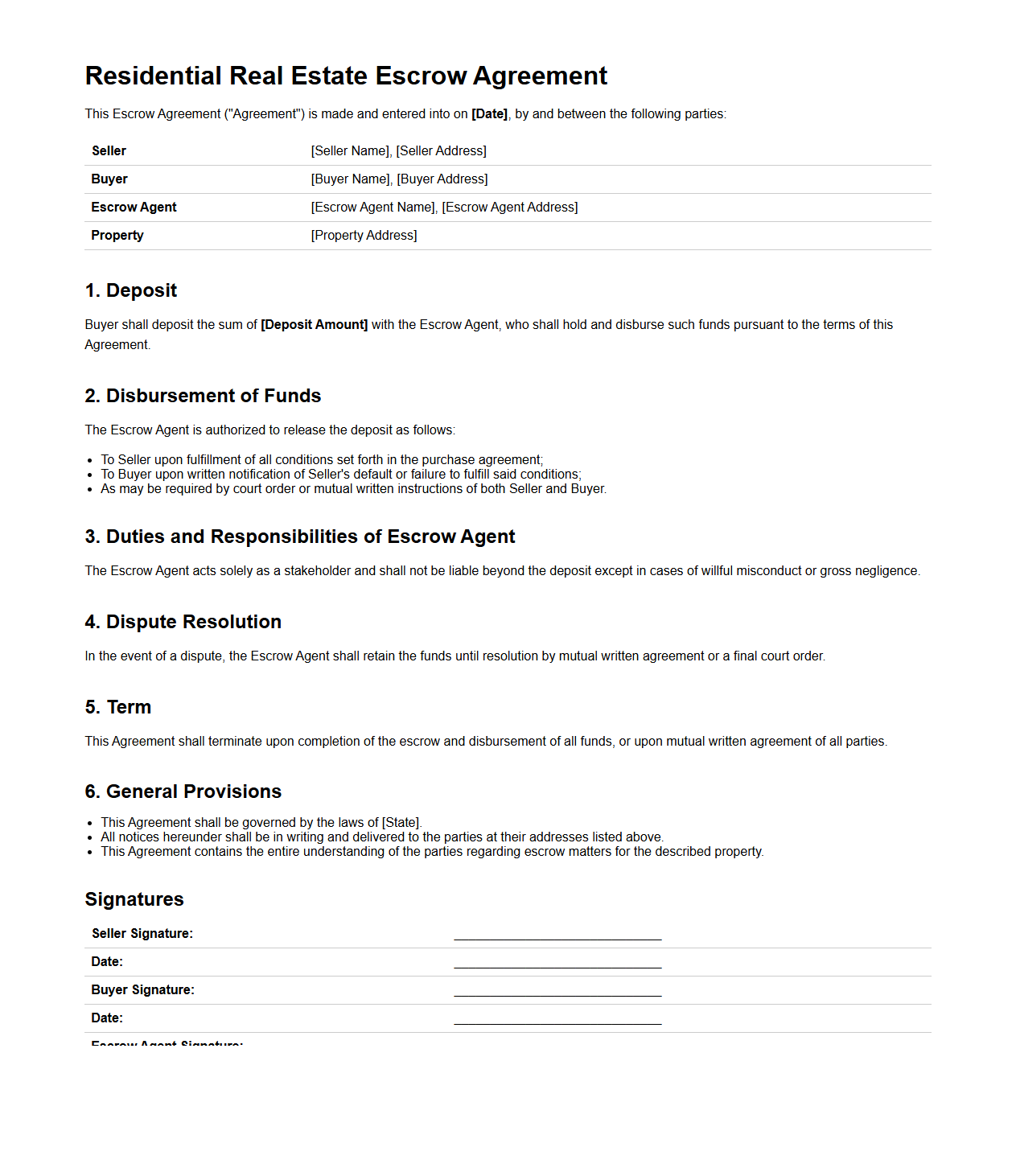

Residential Real Estate Escrow Agreement Example

A

Residential Real Estate Escrow Agreement Example document outlines the terms and conditions under which a neutral third party holds funds and documents during a property transaction. It specifies the responsibilities of the buyer, seller, and escrow agent to ensure a secure and transparent transfer of ownership. This agreement protects all parties by clearly defining the escrow process, timelines, and contingencies involved in residential real estate deals.

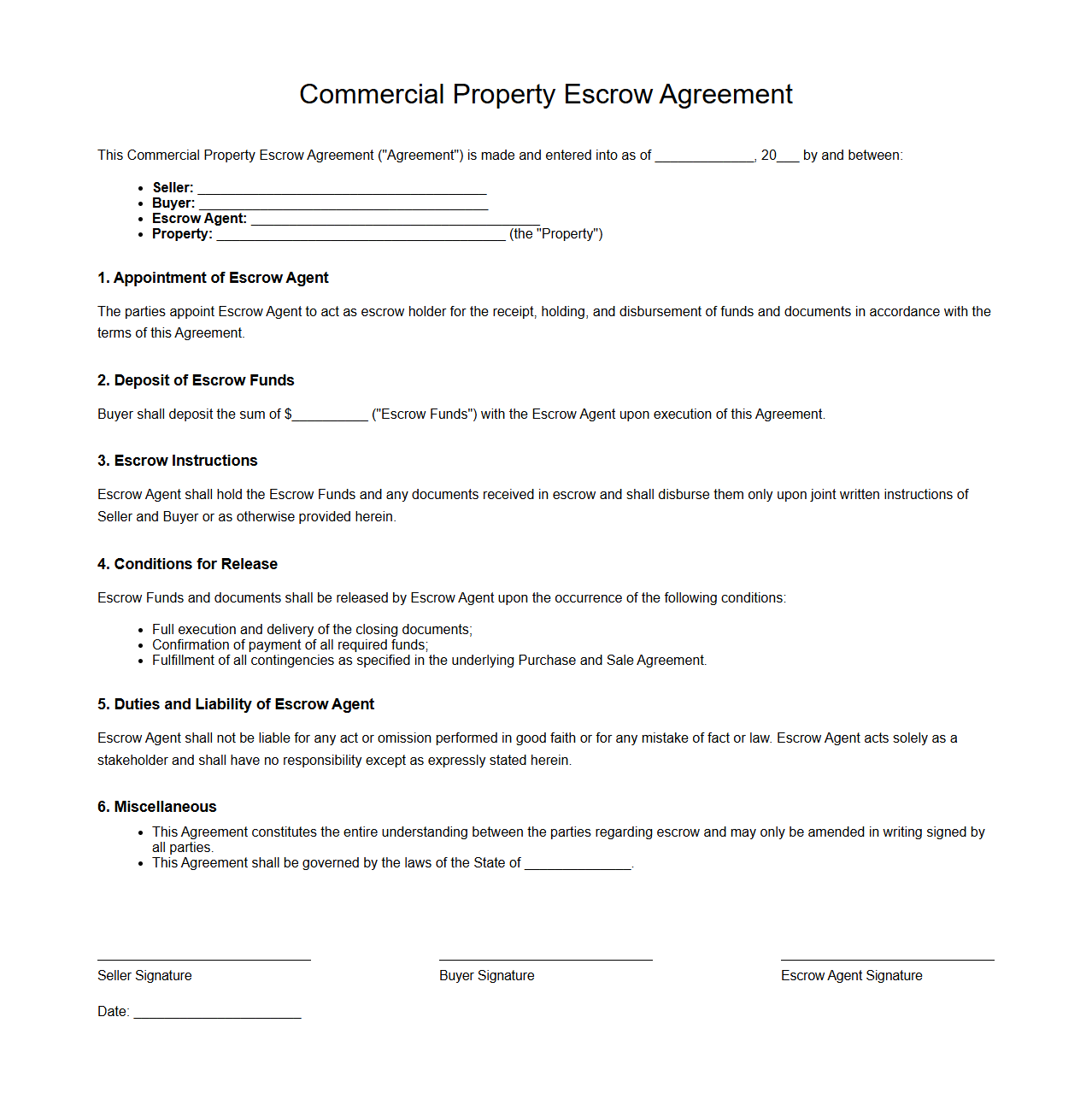

Commercial Property Escrow Agreement Template

A

Commercial Property Escrow Agreement Template document outlines the terms and conditions under which funds or documents related to a commercial real estate transaction are held by a neutral third party until all contractual obligations are fulfilled. This template ensures clarity on the responsibilities of the buyer, seller, and escrow agent, protecting all parties involved during the closing process. It provides a legally binding framework that helps secure the transfer of property ownership while mitigating risk and facilitating smooth transaction completion.

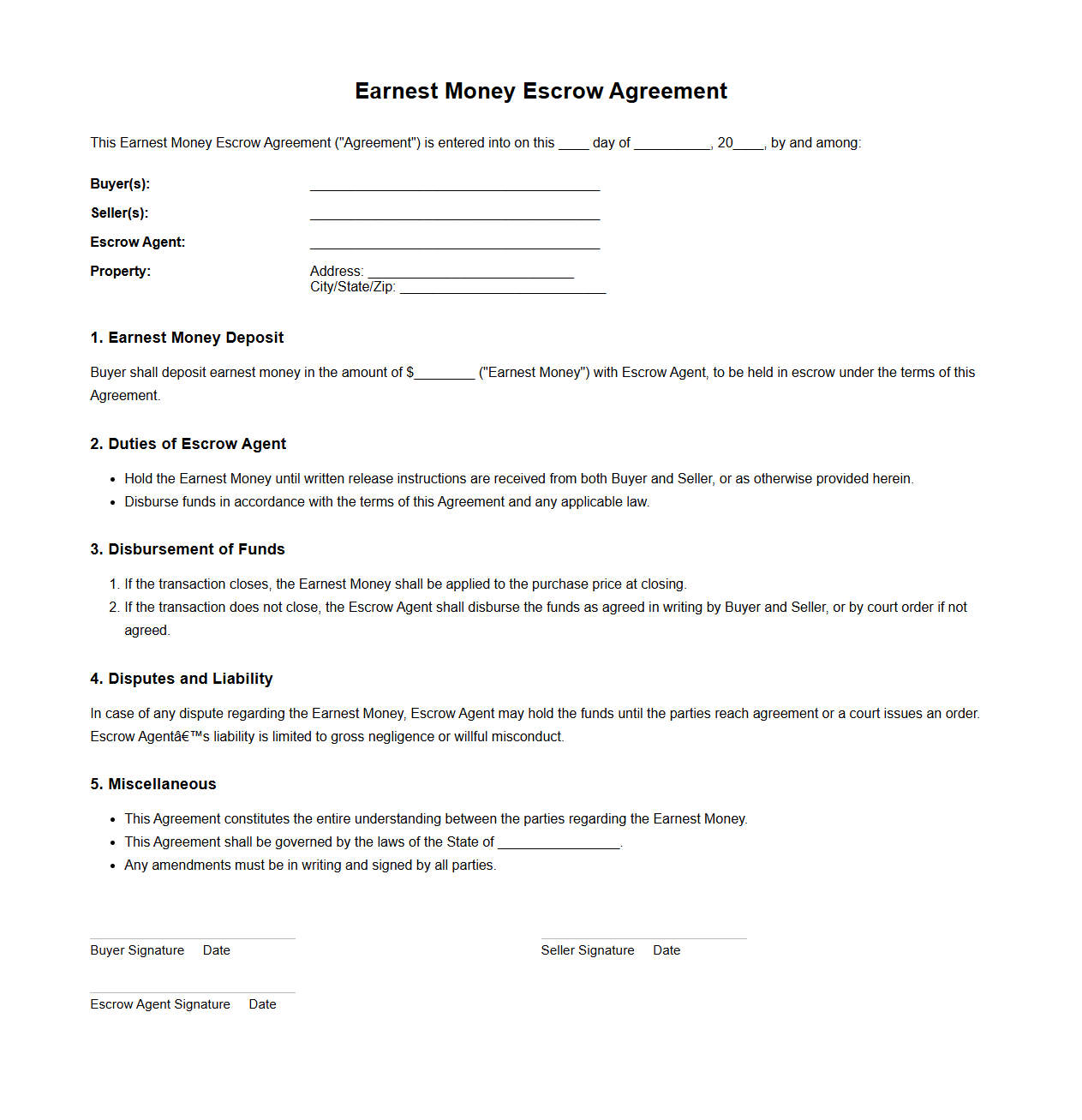

Earnest Money Escrow Agreement for Home Purchase

An

Earnest Money Escrow Agreement for a home purchase is a legal document outlining the terms under which the buyer's earnest money deposit is held by a neutral third party during a real estate transaction. This agreement ensures the funds are securely maintained in an escrow account until the sale is completed or terminated according to the contract's conditions. It protects both the buyer and seller by clearly defining how and when the earnest money can be released, helping to prevent disputes over the deposit.

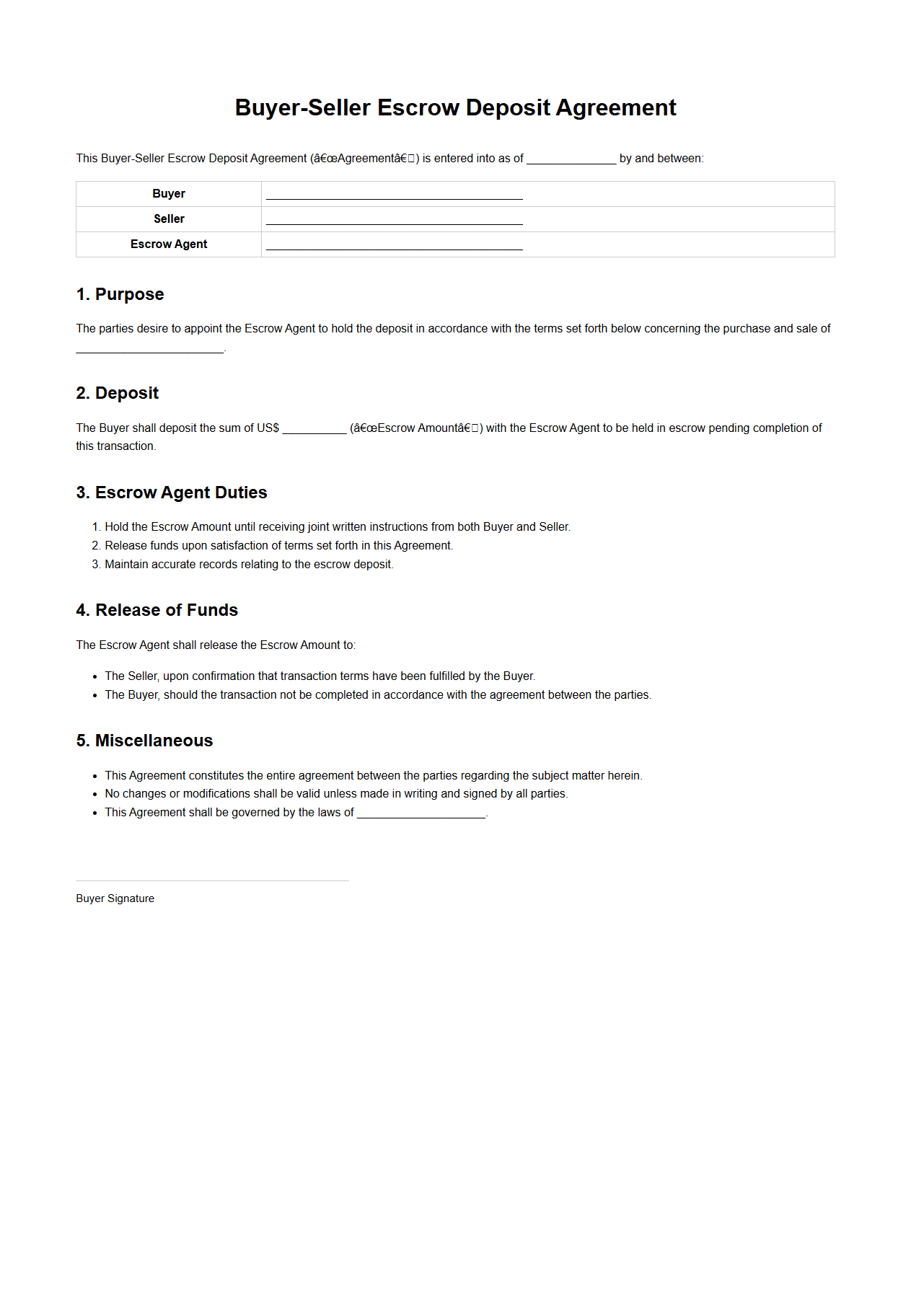

Buyer-Seller Escrow Deposit Agreement Format

A

Buyer-Seller Escrow Deposit Agreement Format document outlines the terms and conditions under which escrow funds are deposited, held, and disbursed during a transaction between a buyer and seller. It serves to protect both parties by ensuring that the deposit is securely managed by a neutral third party until all contractual obligations are met. This format typically includes details about the escrow agent, deposit amount, release conditions, and dispute resolution procedures.

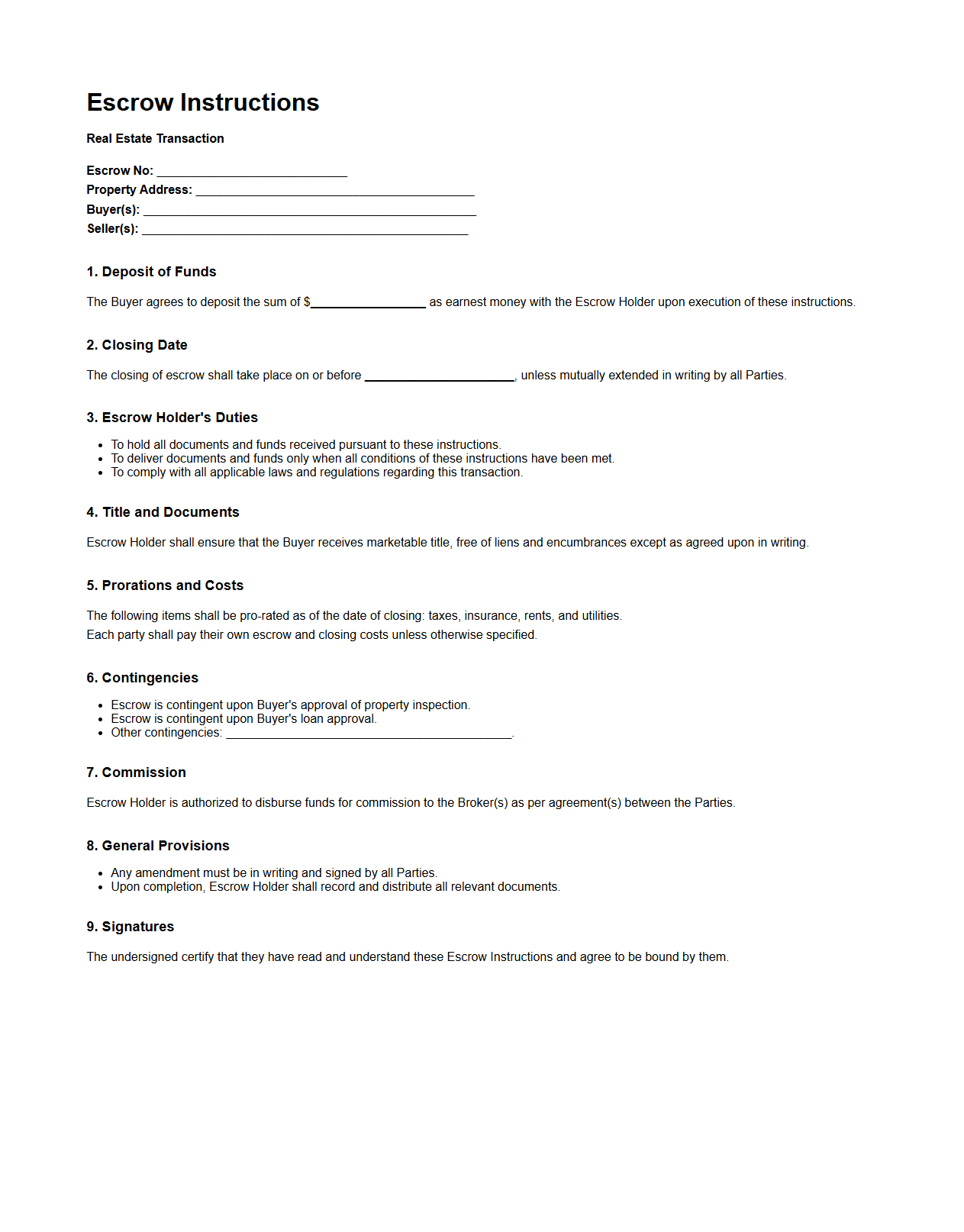

Escrow Instructions for Real Estate Transactions

Escrow Instructions for Real Estate Transactions document outlines the specific terms and conditions agreed upon by the buyer, seller, and escrow agent to ensure a secure and transparent property transfer. This document details the duties of the escrow holder, the timeline for disbursing funds, and the necessary steps to fulfill contractual obligations, safeguarding all parties involved. Clear

escrow instructions help prevent disputes and ensure compliance with legal and financial requirements throughout the transaction process.

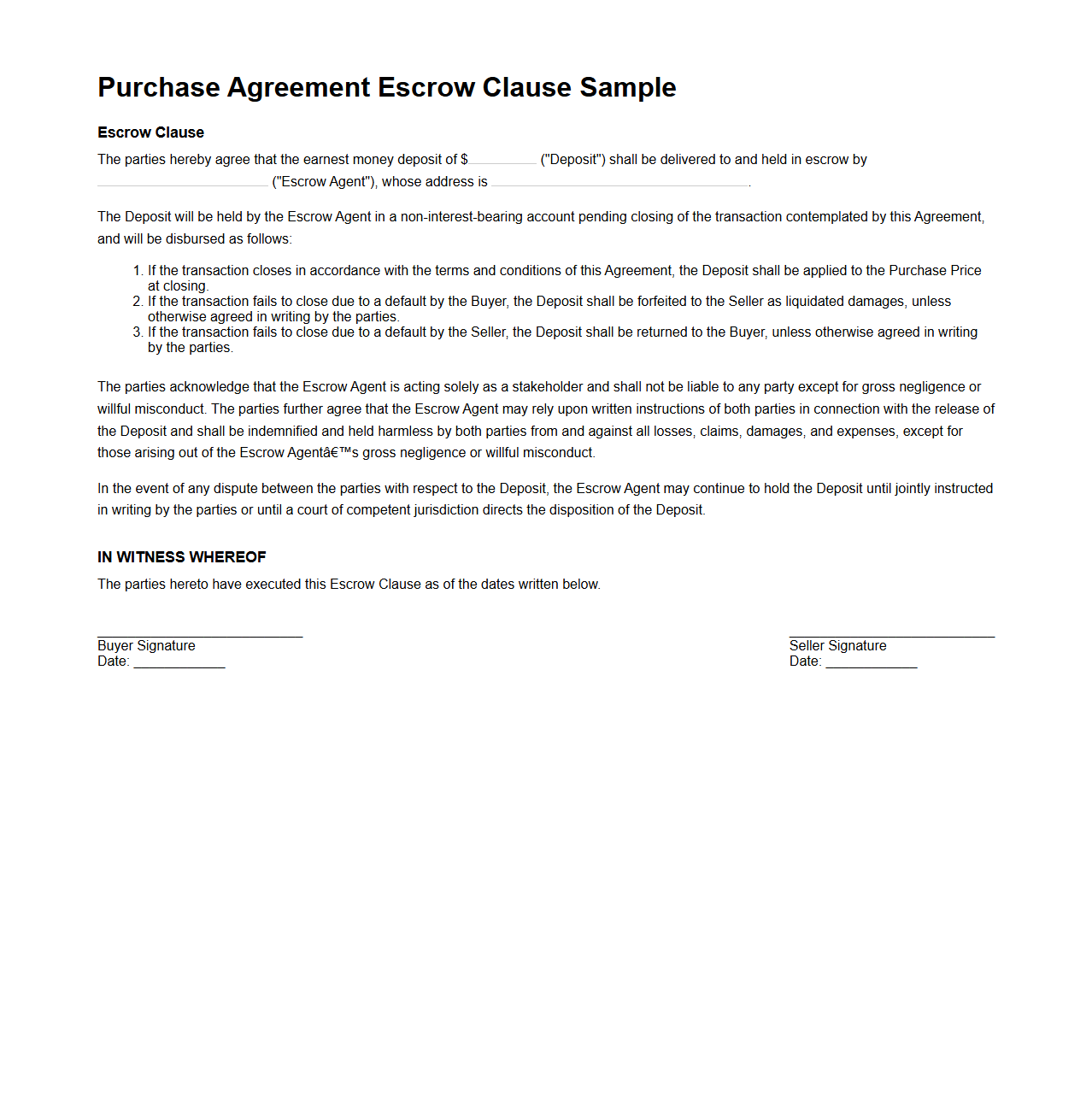

Purchase Agreement Escrow Clause Sample

A

Purchase Agreement Escrow Clause sample document outlines the terms and conditions under which funds or assets are held by a neutral third party during a transaction to ensure protection for both buyer and seller. This clause specifies the amount to be held in escrow, the responsibilities of the escrow agent, and the conditions for releasing the funds upon fulfillment of contractual obligations. Such documents are essential in real estate, mergers, and acquisitions to mitigate risks and provide security in the transaction process.

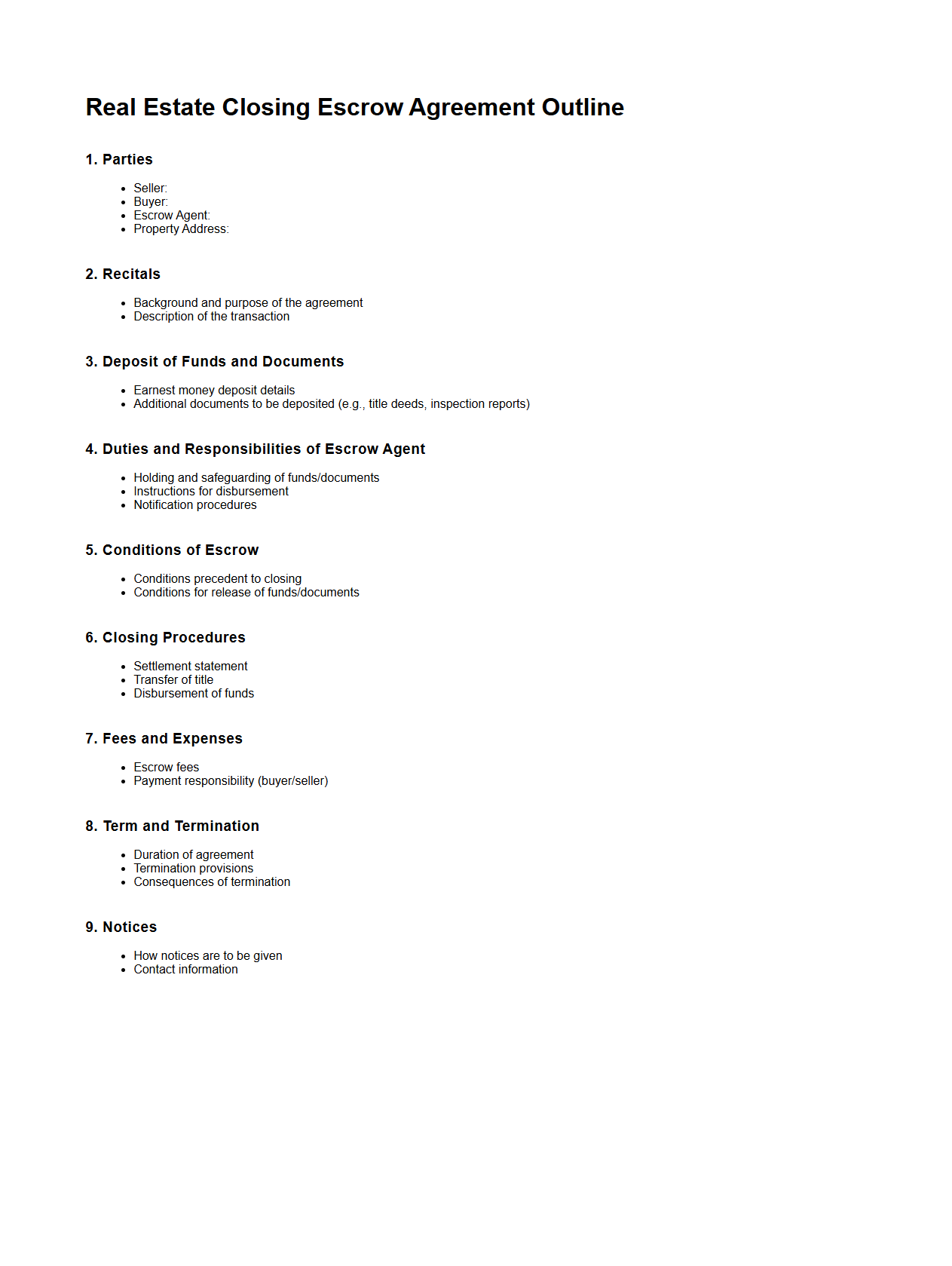

Real Estate Closing Escrow Agreement Outline

A

Real Estate Closing Escrow Agreement Outline document serves as a detailed framework specifying the responsibilities and obligations of the escrow agent during the closing process of a property transaction. It delineates key elements such as the disbursement of funds, delivery of documents, and conditions that must be met before the transaction's completion. This document ensures a secure, transparent, and organized transfer of ownership by holding all parties accountable and managing the transaction's critical components in a legally binding manner.

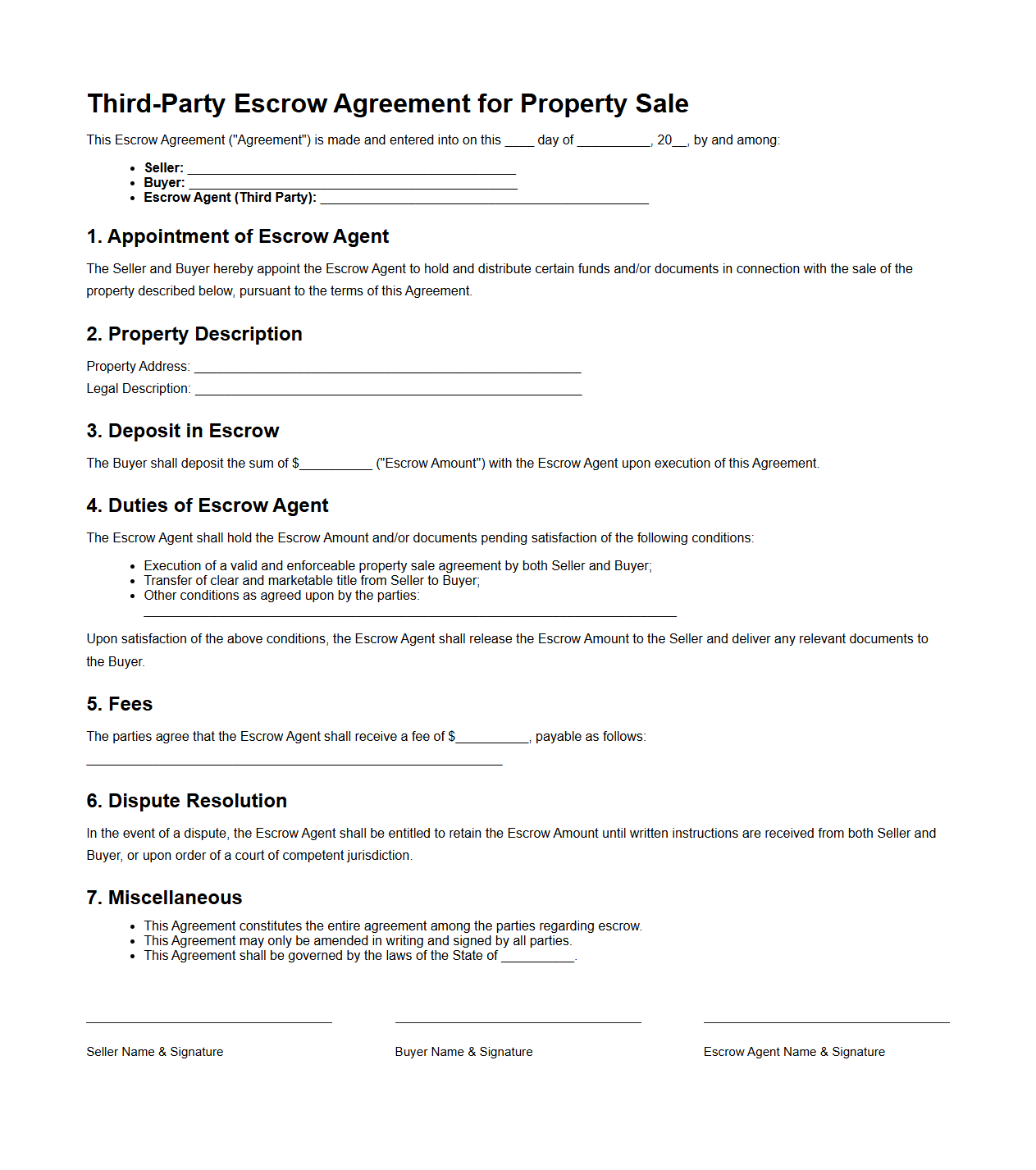

Third-Party Escrow Agreement for Property Sale

A

Third-Party Escrow Agreement for Property Sale is a legal document that designates a neutral third party to hold funds and documents during a real estate transaction until all contractual conditions are met. This agreement ensures that the buyer's payment and the seller's property deed are securely exchanged, minimizing the risk of fraud or breach. It provides a structured protection mechanism for both parties by outlining specific terms regarding the release of funds and property rights.

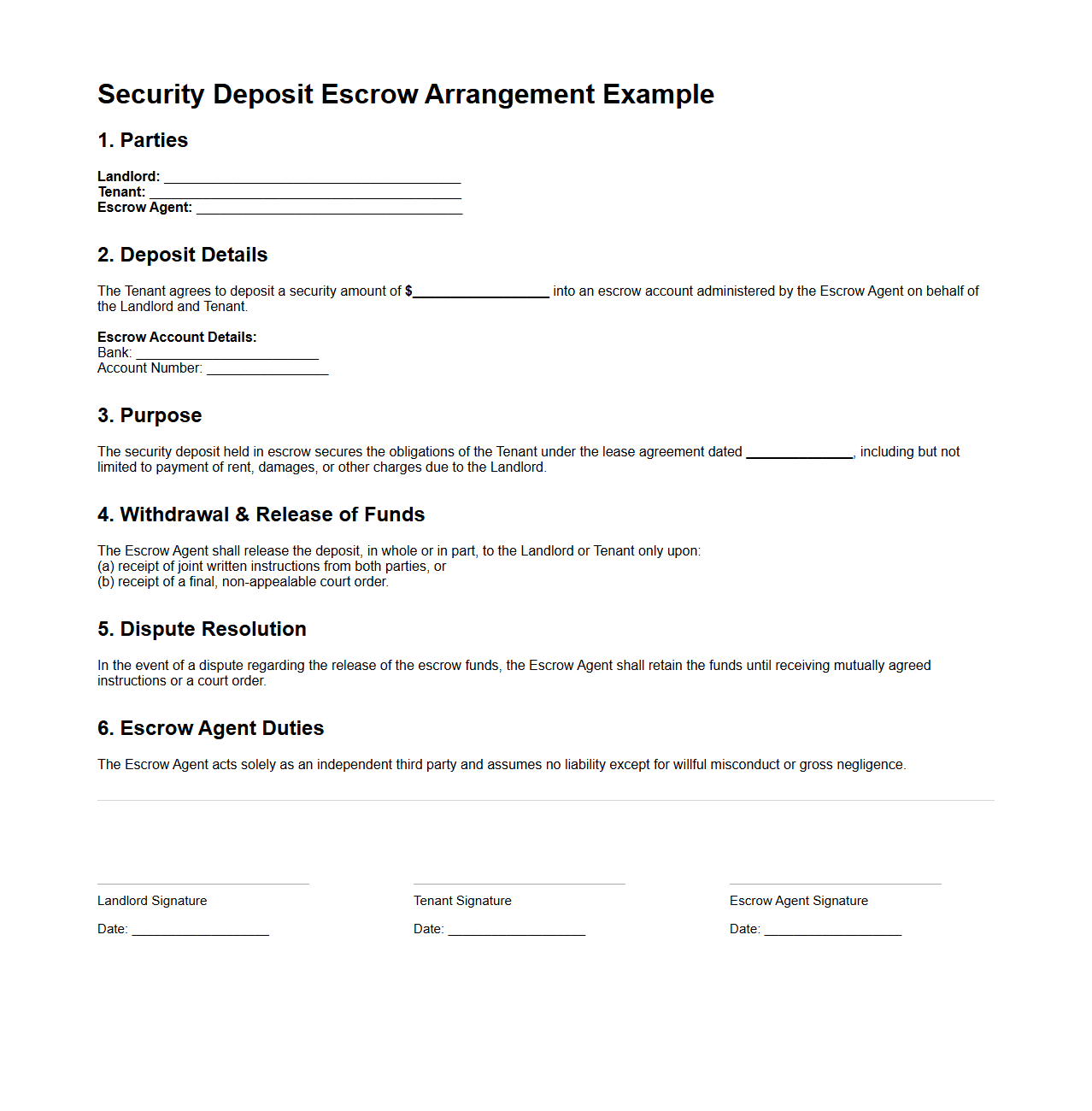

Security Deposit Escrow Arrangement Example

A

Security Deposit Escrow Arrangement Example document outlines the terms and conditions under which a security deposit is held by a neutral third party during a transaction, typically in real estate or rental agreements. This document specifies the responsibilities of the escrow agent, the conditions for release of funds, and dispute resolution mechanisms. It ensures the protection of both parties by safeguarding the deposit until contractual obligations are fulfilled.

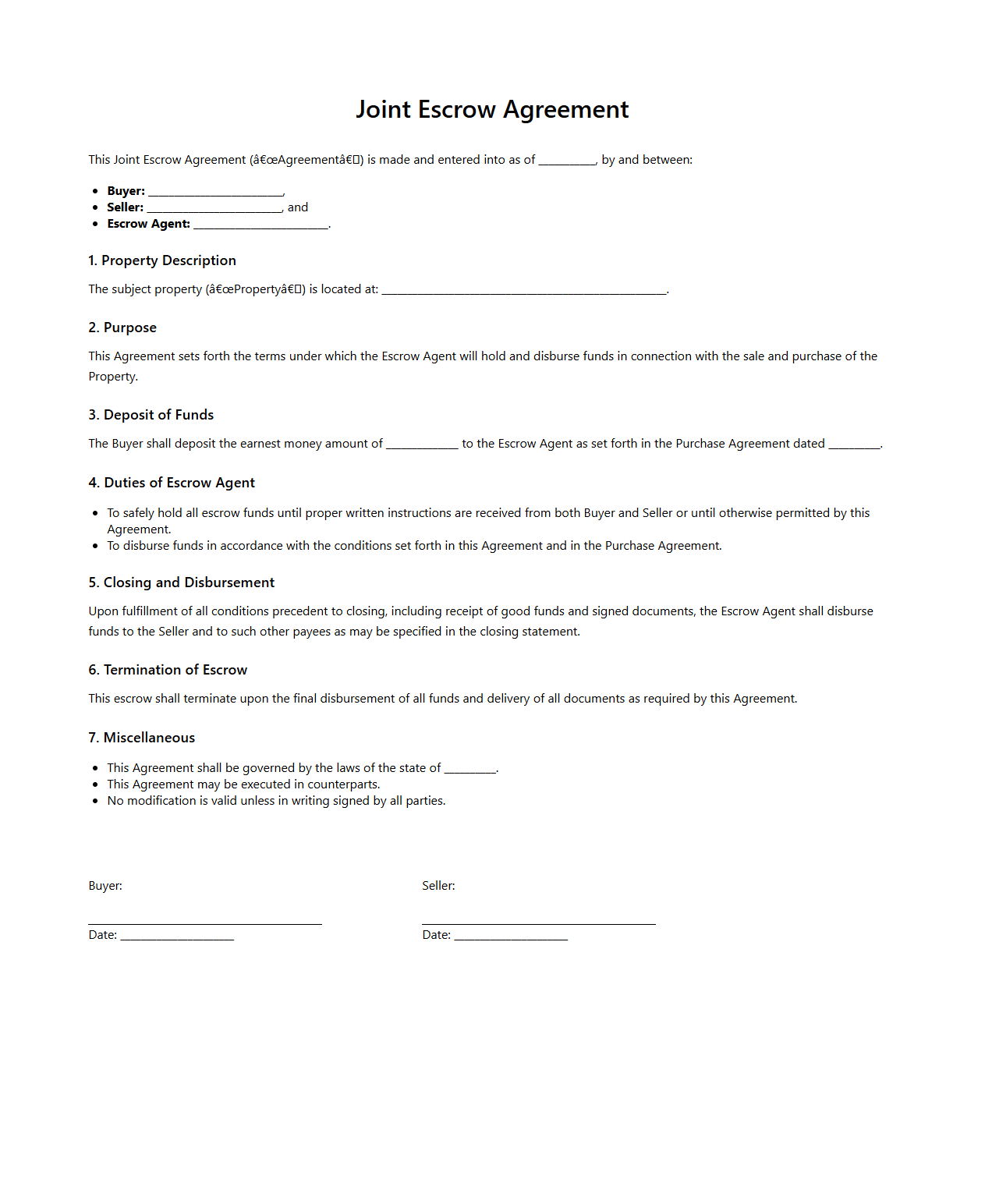

Joint Escrow Agreement for Real Estate Buyers and Sellers

A

Joint Escrow Agreement for real estate buyers and sellers is a legally binding document that outlines the terms and conditions under which escrow funds or property titles are held by a neutral third party during a real estate transaction. This agreement ensures that both parties meet all contractual obligations, such as inspections, financing, and closing requirements, before funds or ownership rights are released. It provides security, transparency, and a clear process for dispute resolution, protecting the interests of both buyers and sellers throughout the transaction.

What are the specific release conditions for the deposit in the Escrow Agreement?

The release conditions for the deposit in the Escrow Agreement are clearly defined within the document. Typically, the funds will be released upon the fulfillment of predetermined contractual obligations by the parties involved. Any deviation from these conditions requires mutual consent or a court order to authorize the release.

How are dispute resolutions handled according to the Escrow Document terms?

Dispute resolution mechanisms in the Escrow Agreement often include mediation, arbitration, or legal proceedings. The document specifies the preferred method and outlines the procedural steps for resolving conflicts. This structured approach ensures disputes are managed efficiently without unnecessary delay in fund disbursement.

Are there any stipulated timeframes for escrow deposit disbursement?

The Escrow Agreement usually contains precise timeframes for deposit disbursement to ensure timely processing. These timeframes depend on the fulfillment of release conditions or resolution of disputes. Adhering to these deadlines helps maintain trust and accountability among the contracting parties.

Who are the authorized parties to amend or terminate the Escrow Agreement?

Only the authorized parties, typically the original signatories or mutually agreed representatives, are permitted to amend or terminate the Escrow Agreement. Such actions often require written consent and adherence to any procedural requirements stated within the document. This ensures all changes are transparent and legally binding.

What are the escrow agent's legal liabilities in the event of a default?

The escrow agent holds significant legal liabilities if they default on their duties specified in the Escrow Agreement. They may be held accountable for negligence, breach of trust, or failure to comply with stipulated terms. The agreement usually outlines potential legal consequences and remedies available to the affected parties.

More Real estate Templates