A Mortgage Application Document Sample for Real Estate Financing provides a clear template outlining the necessary personal, financial, and property details required by lenders. This sample helps applicants organize their information efficiently to streamline the loan approval process. Properly completed documents reduce errors and accelerate the review timeline for real estate financing.

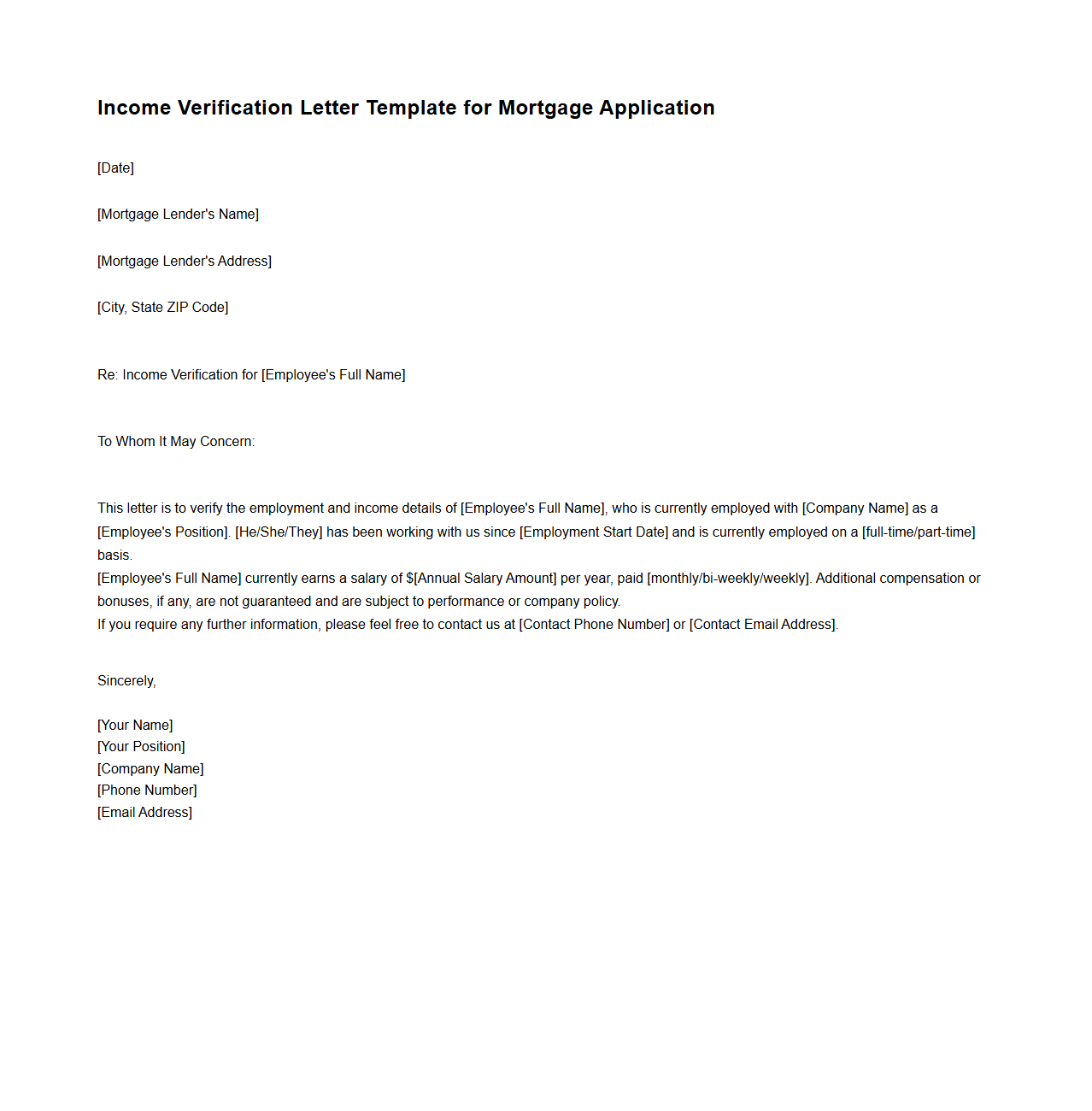

Income Verification Letter Template for Mortgage Application

An

Income Verification Letter Template for Mortgage Application is a standardized document used by borrowers to provide proof of their income to lenders during the home loan process. It typically includes detailed information such as the borrower's employment status, salary, duration of employment, and any additional income sources. Lenders rely on this document to assess the borrower's financial stability and ability to repay the mortgage loan.

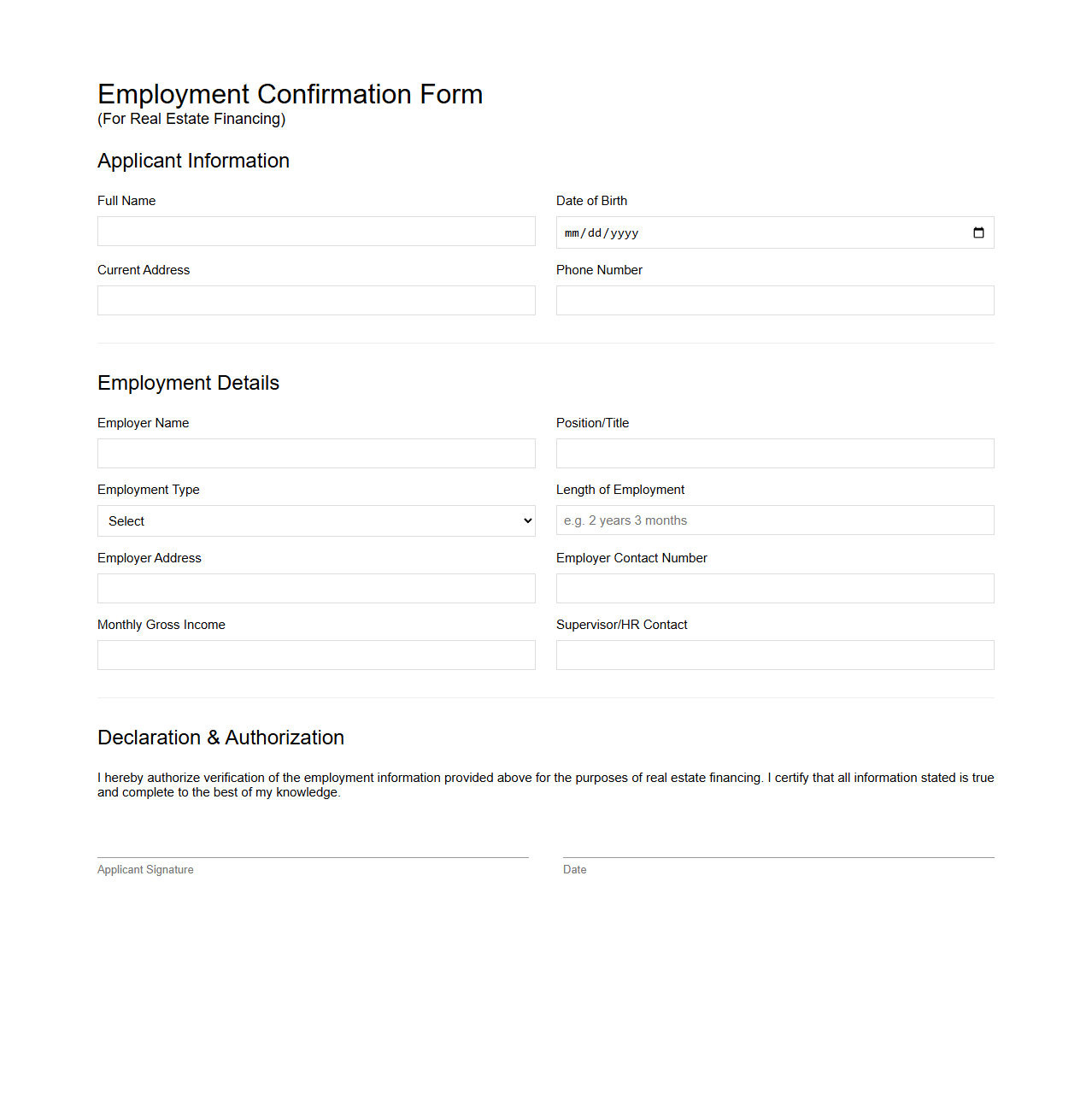

Employment Confirmation Form for Real Estate Financing

An

Employment Confirmation Form for real estate financing is a crucial document used by lenders to verify a borrower's current employment status and income details. It typically includes information such as job title, length of employment, salary, and employer verification to assess the borrower's ability to repay the loan. Accurate completion of this form helps streamline the mortgage approval process and reduce the risk of loan default.

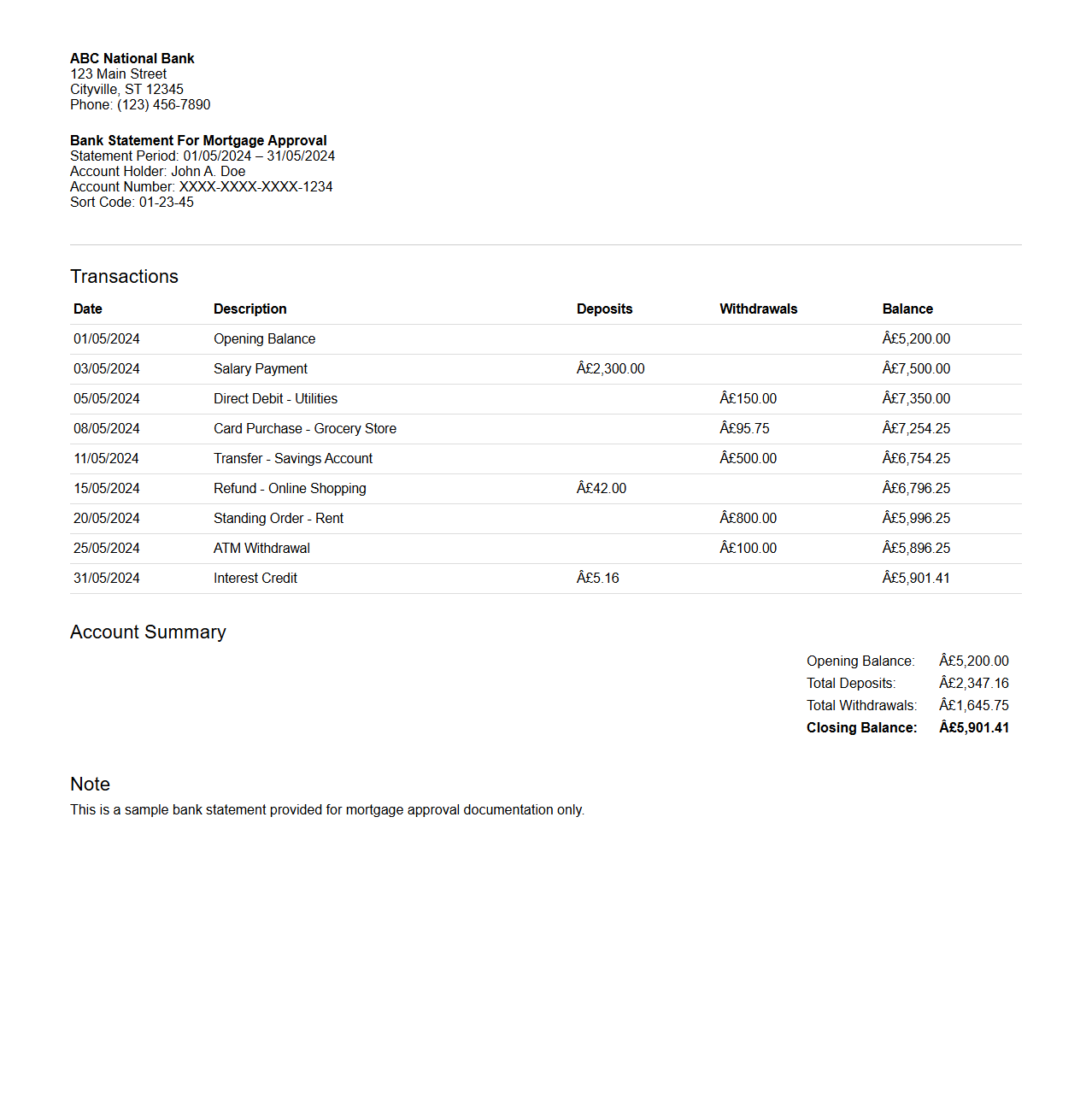

Bank Statement Example for Mortgage Approval

A

Bank Statement Example for Mortgage Approval document is a detailed record of an applicant's financial transactions over a specific period, typically three to six months, used by lenders to verify income and assess financial stability. This statement includes deposits, withdrawals, and account balances, helping mortgage underwriters evaluate the borrower's ability to make consistent payments. Clear and accurate bank statements support loan approval by demonstrating reliable cash flow and sufficient funds for down payment and closing costs.

Credit Report Summary Document for Home Loan

A

Credit Report Summary Document for a home loan is a detailed overview of an individual's credit history used by lenders to assess creditworthiness. It includes critical information such as credit scores, outstanding debts, payment history, and public records like bankruptcies or liens. This summary helps mortgage providers make informed decisions regarding loan approval and terms.

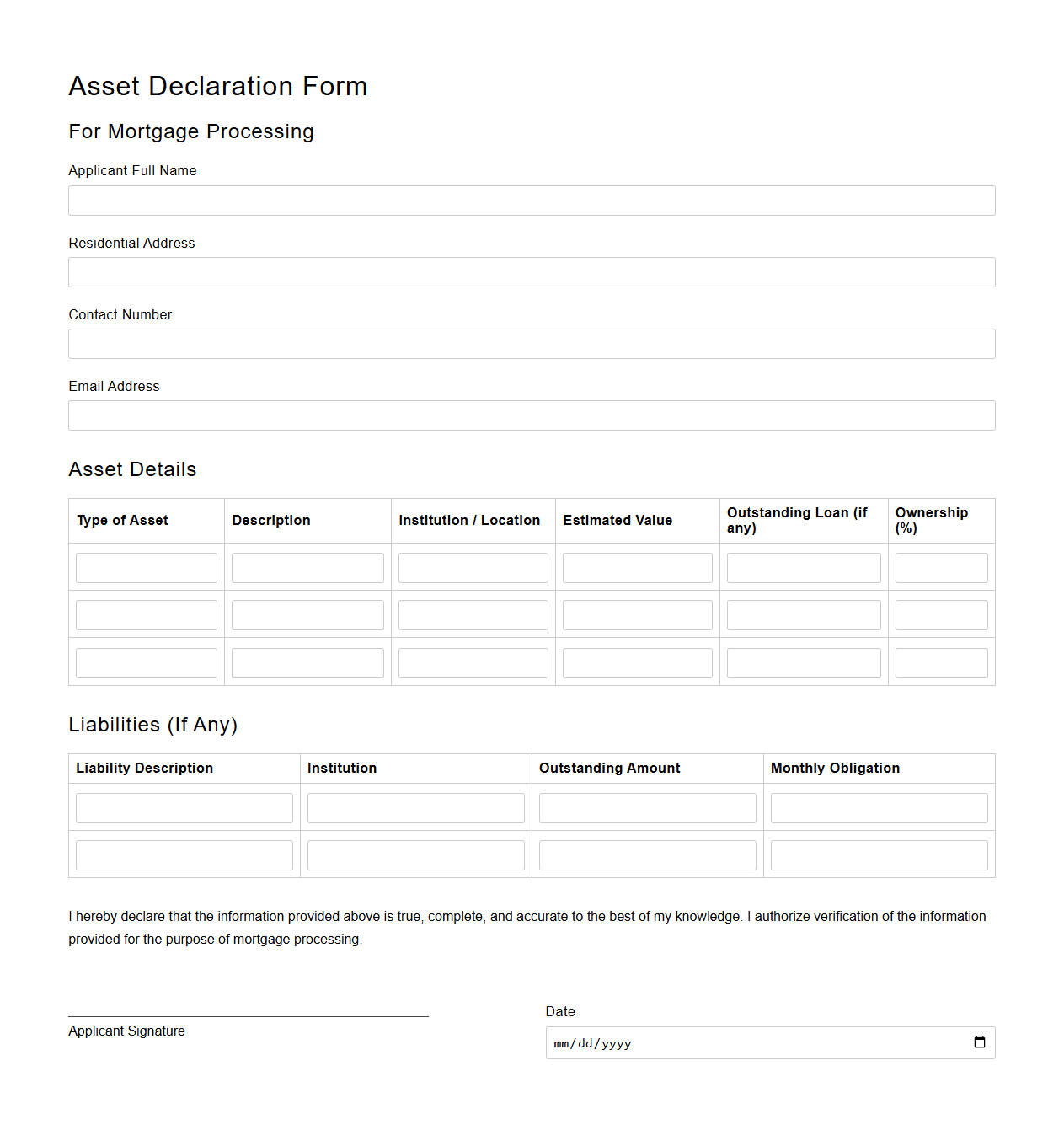

Asset Declaration Form for Mortgage Processing

An

Asset Declaration Form for mortgage processing is a critical document that requires borrowers to disclose their financial assets, including bank accounts, investments, real estate, and other valuable holdings. This form helps lenders evaluate the borrower's financial stability and ability to repay the loan by providing a clear picture of available resources. Accurate and complete asset information ensures a smoother mortgage approval process and helps prevent potential delays or loan denials.

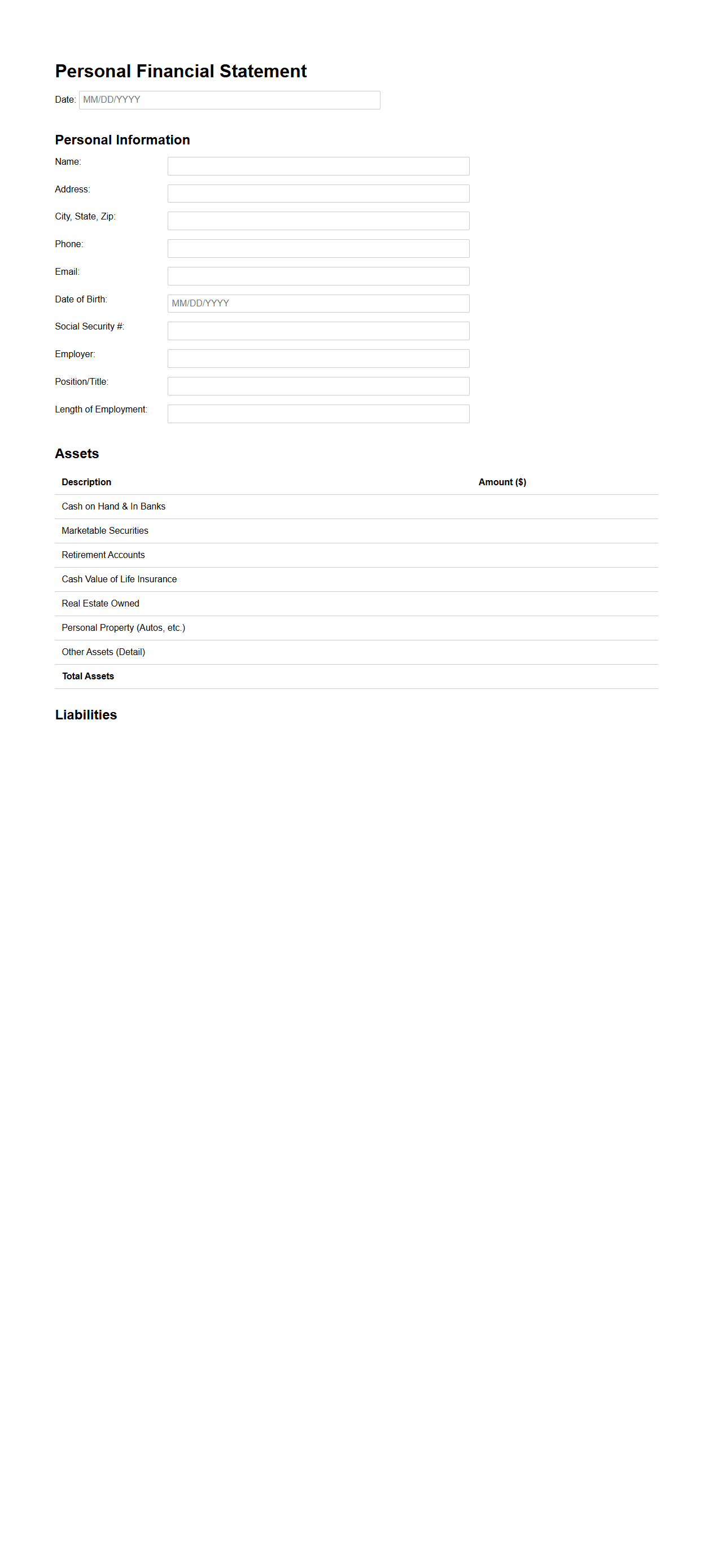

Personal Financial Statement Sample for Real Estate Loan

A

Personal Financial Statement Sample for Real Estate Loan is a detailed document that outlines an individual's assets, liabilities, income, and expenses to assess their financial standing when applying for a real estate loan. This statement helps lenders evaluate the borrower's creditworthiness and repayment ability by providing a clear snapshot of their net worth and cash flow. Accurate completion of this form is crucial for securing loan approval and favorable terms.

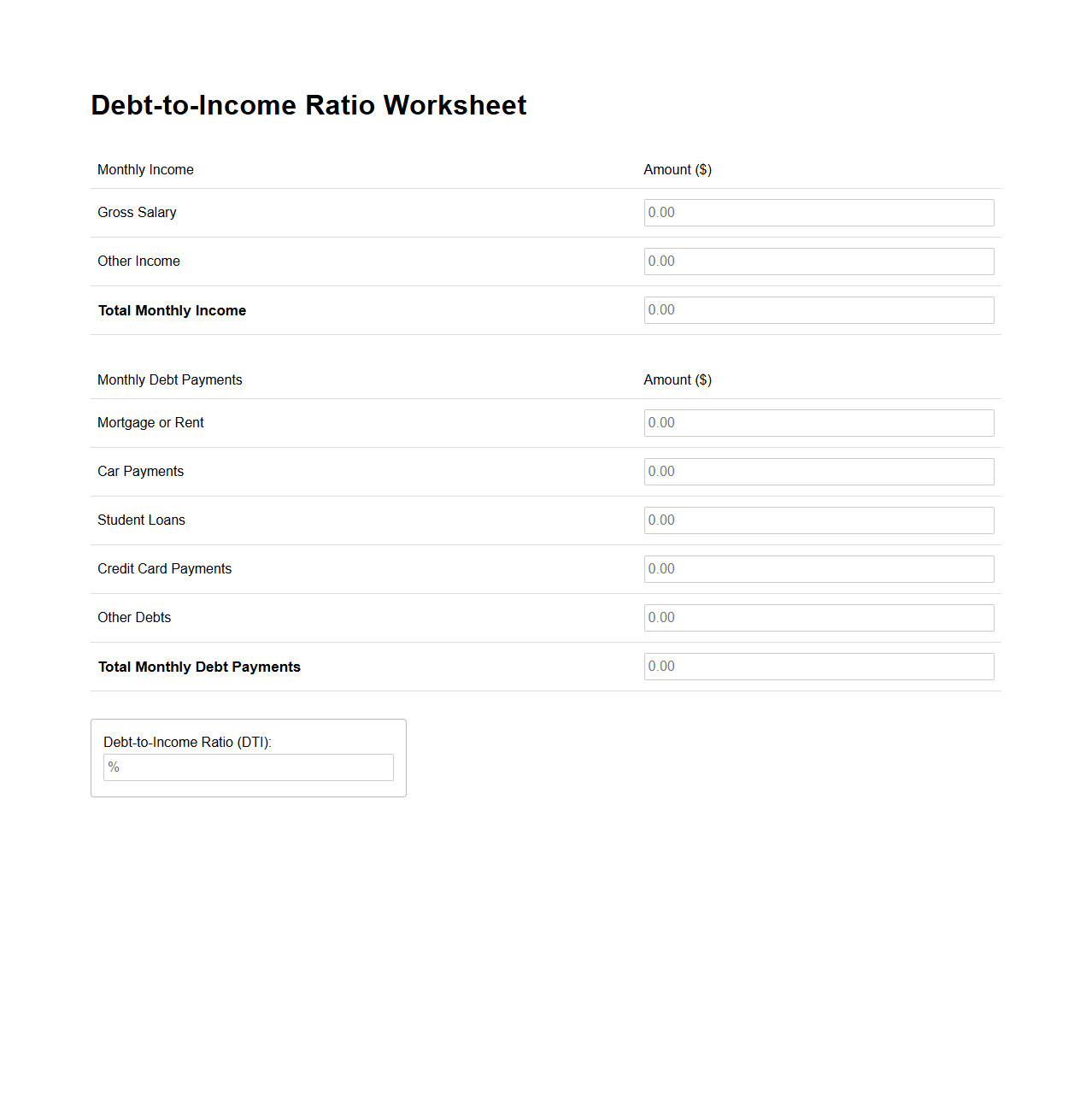

Debt-to-Income Ratio Worksheet for Mortgage Evaluation

The

Debt-to-Income Ratio Worksheet for mortgage evaluation is a financial document used by lenders to assess a borrower's ability to repay a mortgage loan. It calculates the proportion of a borrower's monthly debt payments relative to their gross monthly income, helping determine mortgage eligibility and loan risk. Accurate completion of this worksheet ensures a clear understanding of the borrower's financial obligations and affordability.

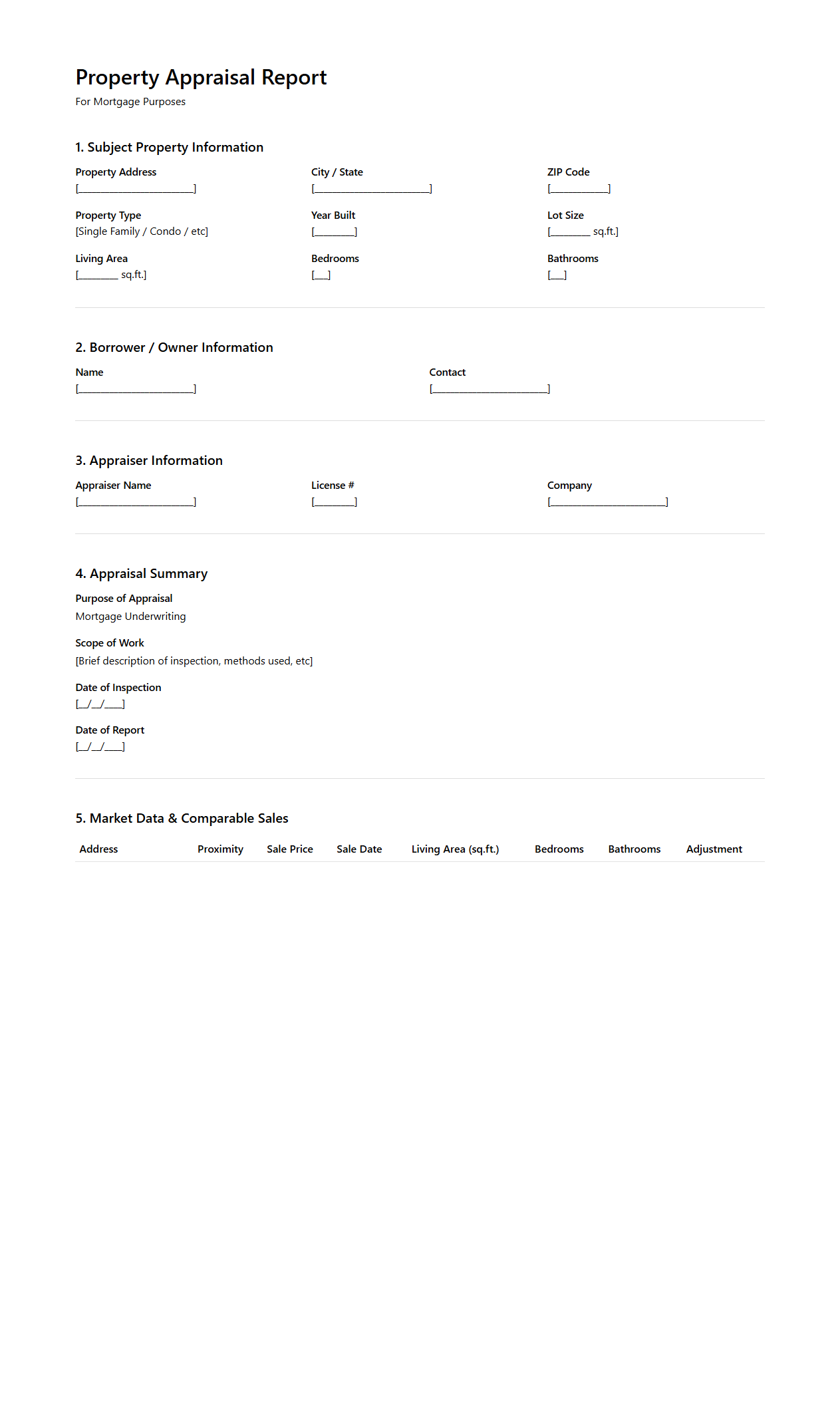

Property Appraisal Report Sample for Mortgage

A

Property Appraisal Report Sample for Mortgage is a detailed document prepared by a licensed appraiser to estimate the current market value of a property. This report includes critical data such as property condition, location, comparable sales, and market trends to support the lender's decision-making process. Accurate appraisals help ensure that the mortgage amount aligns with the property's true value, reducing financial risk for both lenders and borrowers.

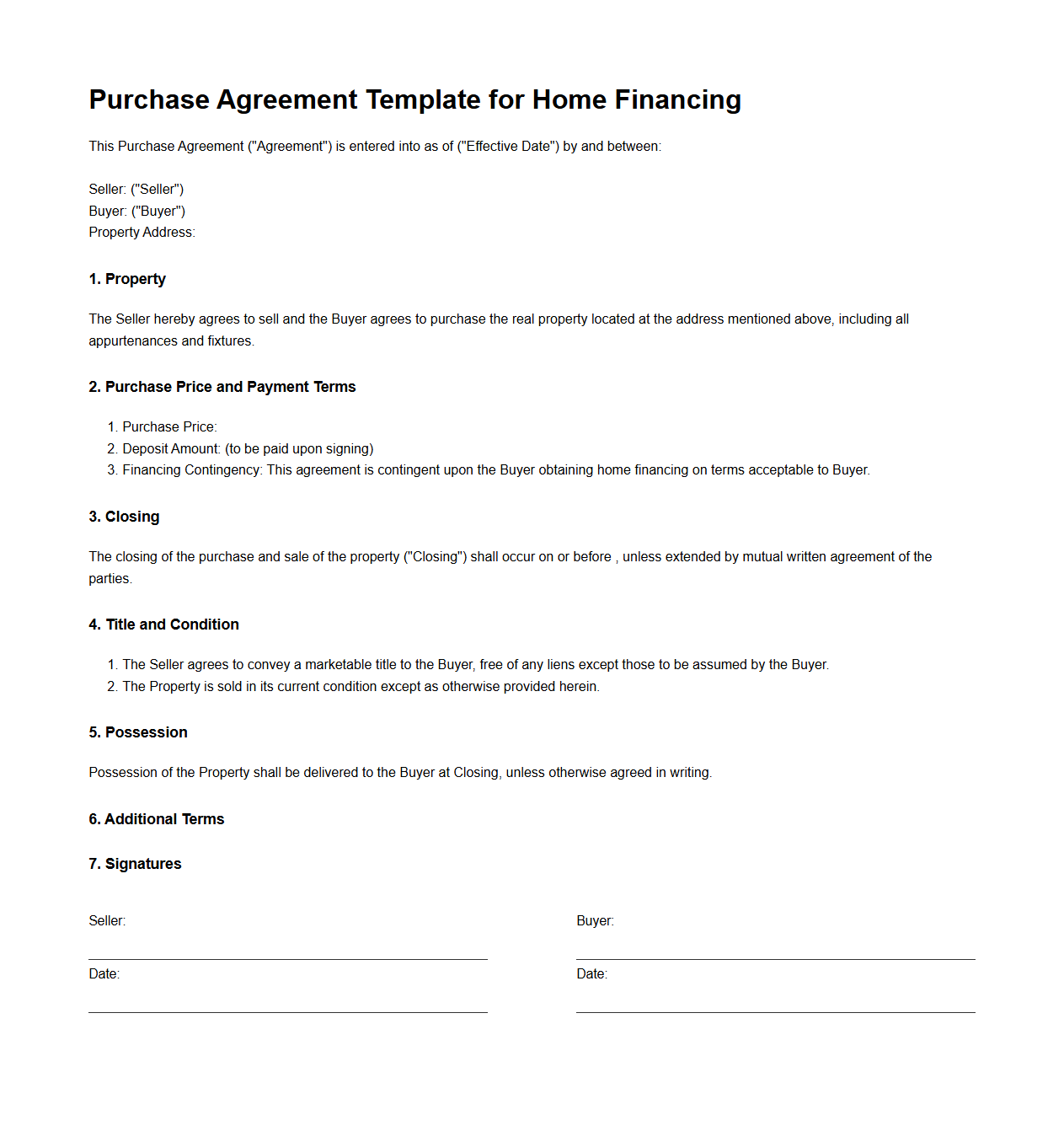

Purchase Agreement Template for Home Financing

A

Purchase Agreement Template for Home Financing is a legal document outlining the terms and conditions between a buyer and seller during a real estate transaction, specifically tailored to include financing details. It specifies purchase price, payment schedule, contingencies related to mortgage approval, and responsibilities of both parties to secure home financing. This template ensures clarity and legal protection, streamlining negotiations and reducing the risk of disputes in the home buying process.

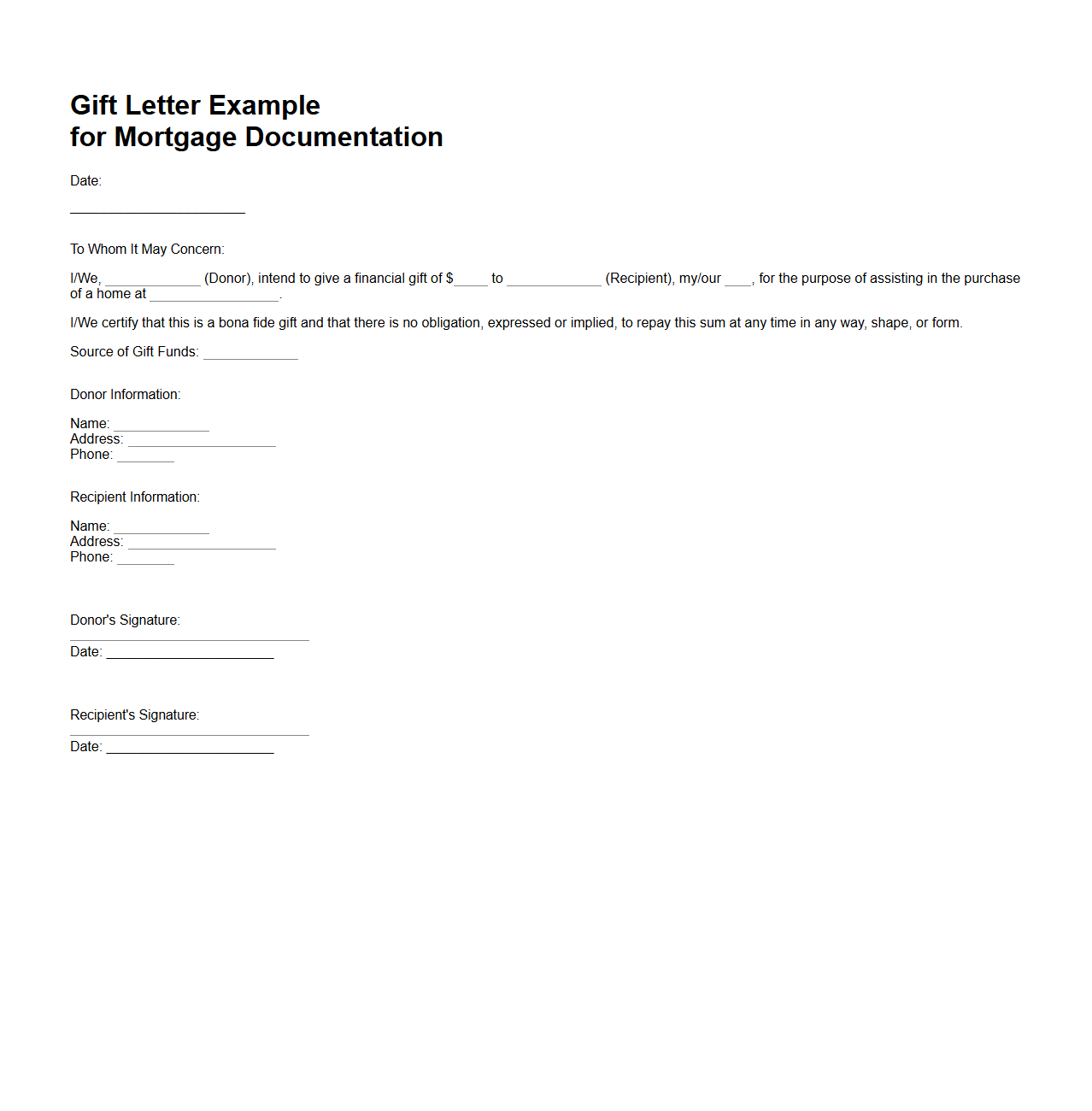

Gift Letter Example for Mortgage Documentation

A

Gift Letter Example for Mortgage Documentation is a formal document that verifies a financial gift from a donor to a homebuyer, ensuring the gifted funds contribute to the down payment or closing costs without the expectation of repayment. It typically includes essential details such as the donor's name, relationship to the borrower, the gift amount, and a statement declaring the funds are a gift, not a loan. Mortgage lenders require this letter to comply with underwriting guidelines and confirm the source of the funds used in the mortgage application.

What specific income verification documents are required for self-employed mortgage applicants?

Self-employed mortgage applicants must provide tax returns typically for the last two years, including all schedules. Lenders often require profit and loss statements to assess current income levels. Additional documents may include bank statements and a CPA letter verifying business stability.

How should assets be documented for a jumbo mortgage application?

Assets for a jumbo mortgage application need to be verified through bank statements covering at least two months. Retirement accounts and investment portfolios must have recent account statements to confirm availability of funds. Providing a letter of explanation for any large deposits is also usually necessary.

What are the acceptable formats for proof of down payment sources?

Proof of down payment sources can be documented using bank statements, canceled checks, or gift letters if funds are gifted. Lenders may accept digital statements if they are downloadable and verifiable. Documentation must clearly show the origin and ownership of the funds used.

Which supporting documents are needed for mortgage applicants with foreign income?

Applicants with foreign income must provide translated and notarized foreign tax returns or income statements. Bank statements from foreign accounts and employment verification letters are typically required. Conversion of income to U.S. dollars, with an explanation of exchange rates used, is also necessary.

How recent must credit and employment letters be for mortgage approval?

Credit reports should be no older than 30 days to ensure accuracy in mortgage approval. Employment verification letters must be dated within 30 to 60 days depending on lender requirements. Timeliness in these documents reflects current financial standing and job stability.

More Real estate Templates