A Escrow Instructions Document Sample for Property Closing outlines the specific terms and conditions agreed upon by the buyer, seller, and escrow agent to ensure a smooth and secure transaction. This document details instructions regarding the disbursement of funds, title transfer, and the handling of contingencies during the closing process. Accurate escrow instructions help prevent disputes and facilitate a timely property transfer.

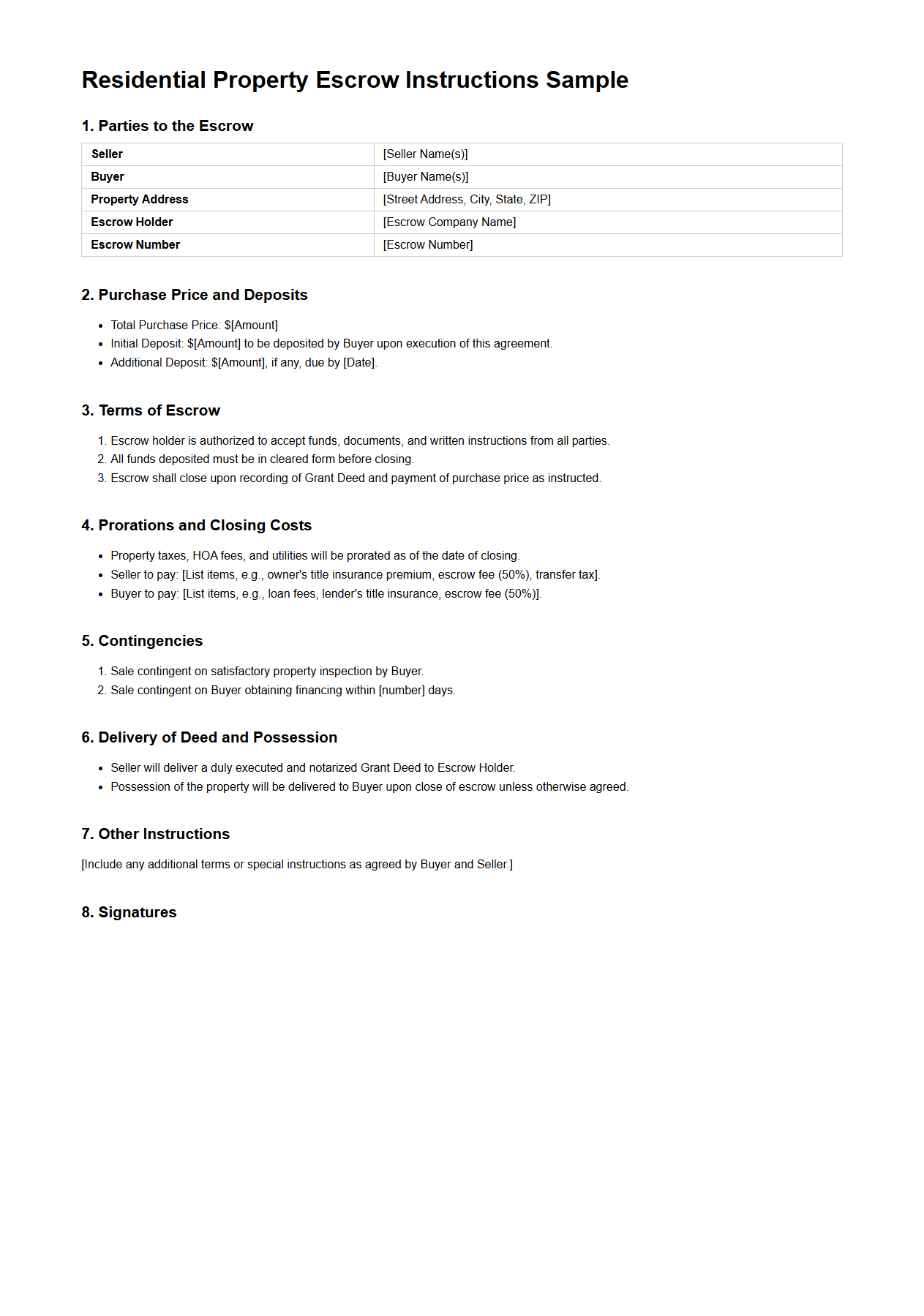

Residential Property Escrow Instructions Sample

Residential Property Escrow Instructions Sample document serves as a detailed guide outlining the specific terms and conditions under which funds and property ownership are managed during a real estate transaction. This document ensures that all parties involved understand their obligations, timelines, and contingencies, providing a clear framework for the escrow agent to hold and distribute funds securely. The

Residential Property Escrow Instructions sample is essential for minimizing disputes and facilitating a smooth closing process.

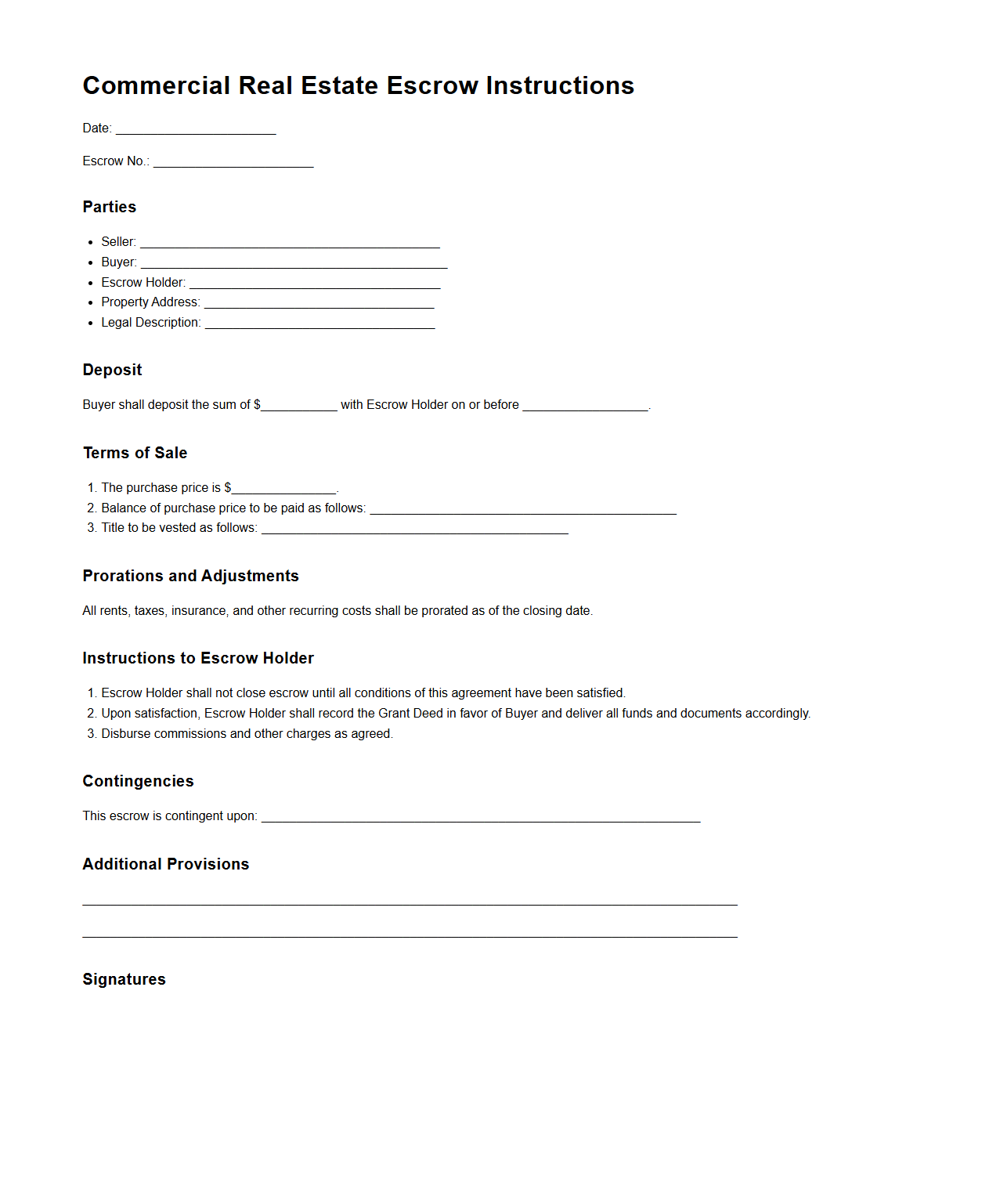

Commercial Real Estate Escrow Instructions Template

A

Commercial Real Estate Escrow Instructions Template document outlines the specific terms and conditions for handling funds and documents during a commercial property transaction. It ensures all parties involved understand their responsibilities, including payment schedules, contingencies, and the release of escrowed funds upon meeting contractual obligations. This template streamlines the escrow process, reducing disputes and facilitating a smooth closing.

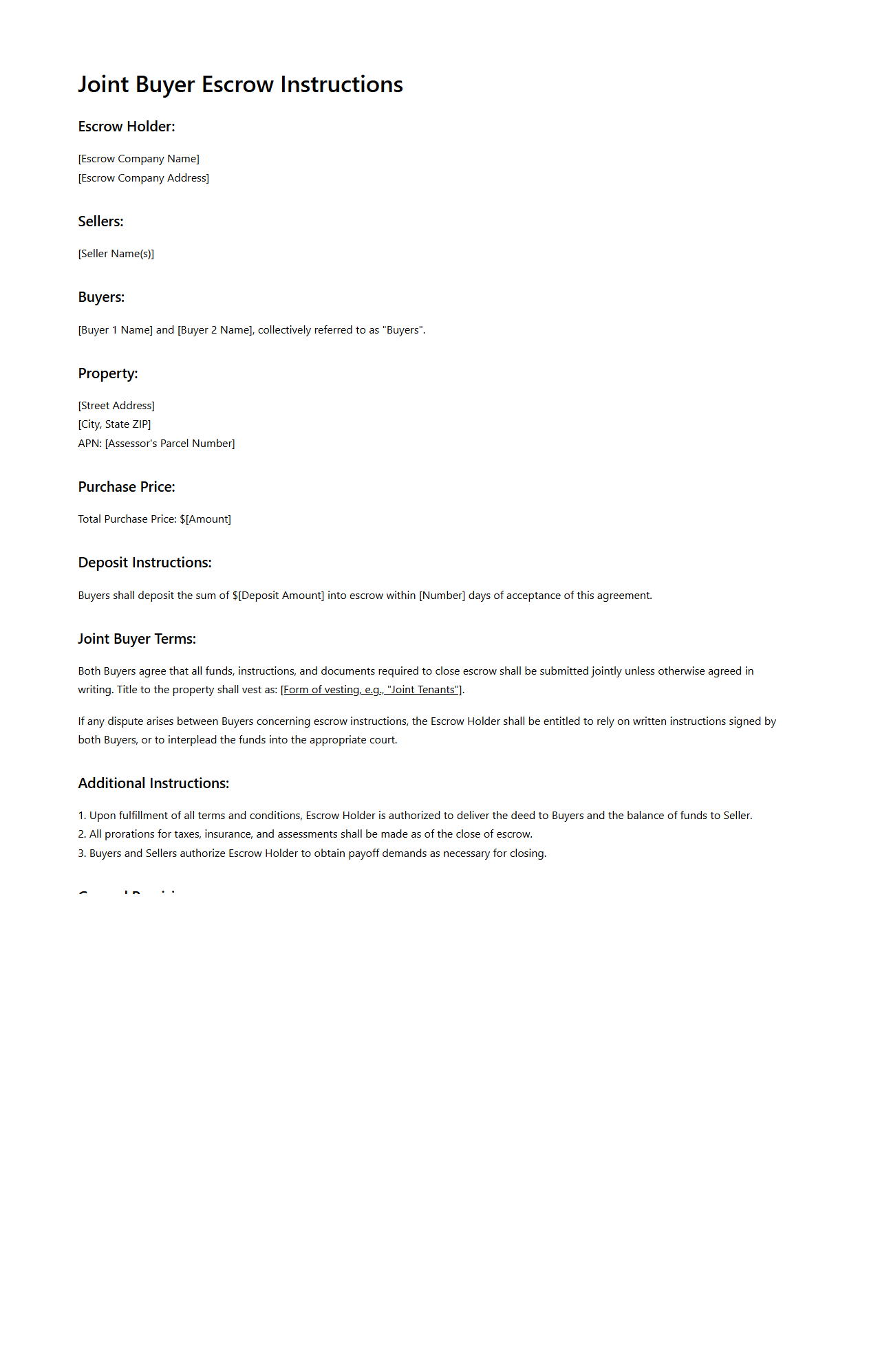

Joint Buyer Escrow Instructions Example

The

Joint Buyer Escrow Instructions Example document serves as a detailed guide for multiple buyers involved in a property transaction, outlining how escrow funds should be managed and disbursed. It ensures all parties agree on the terms for handling deposits, contingencies, and closing processes, minimizing disputes and clarifying responsibilities. This document is essential in real estate deals where buyers share financial obligations, providing transparency and legal protection throughout the escrow period.

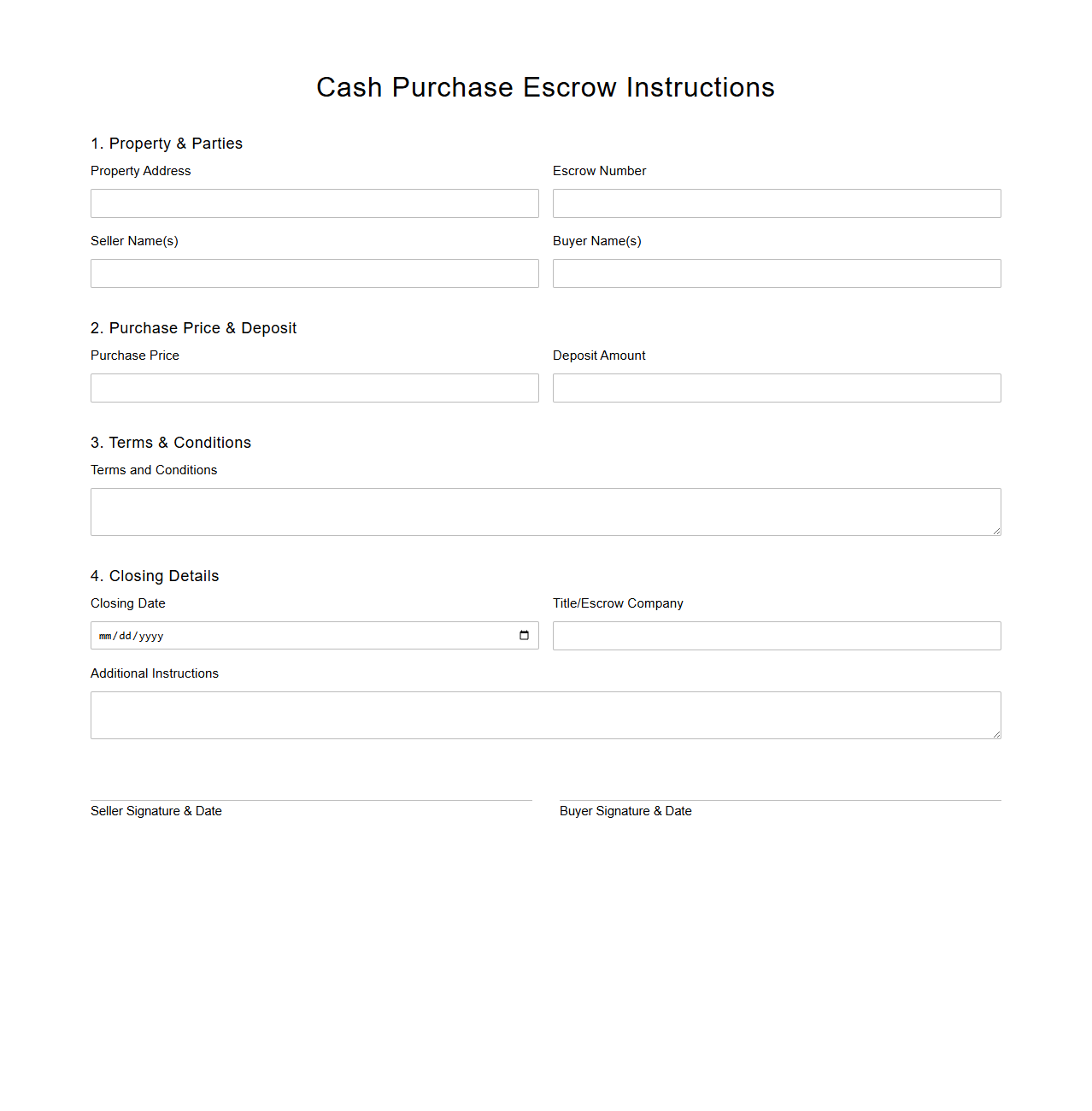

Cash Purchase Escrow Instructions Form

The

Cash Purchase Escrow Instructions Form is a legal document used in real estate transactions to outline the specific terms and conditions for handling funds transferred through escrow during a cash purchase. It details instructions for the escrow agent on how and when to disburse payments, ensuring both the buyer's and seller's interests are protected throughout the closing process. This form plays a crucial role in preventing disputes by providing clear, written guidelines for managing the escrow account.

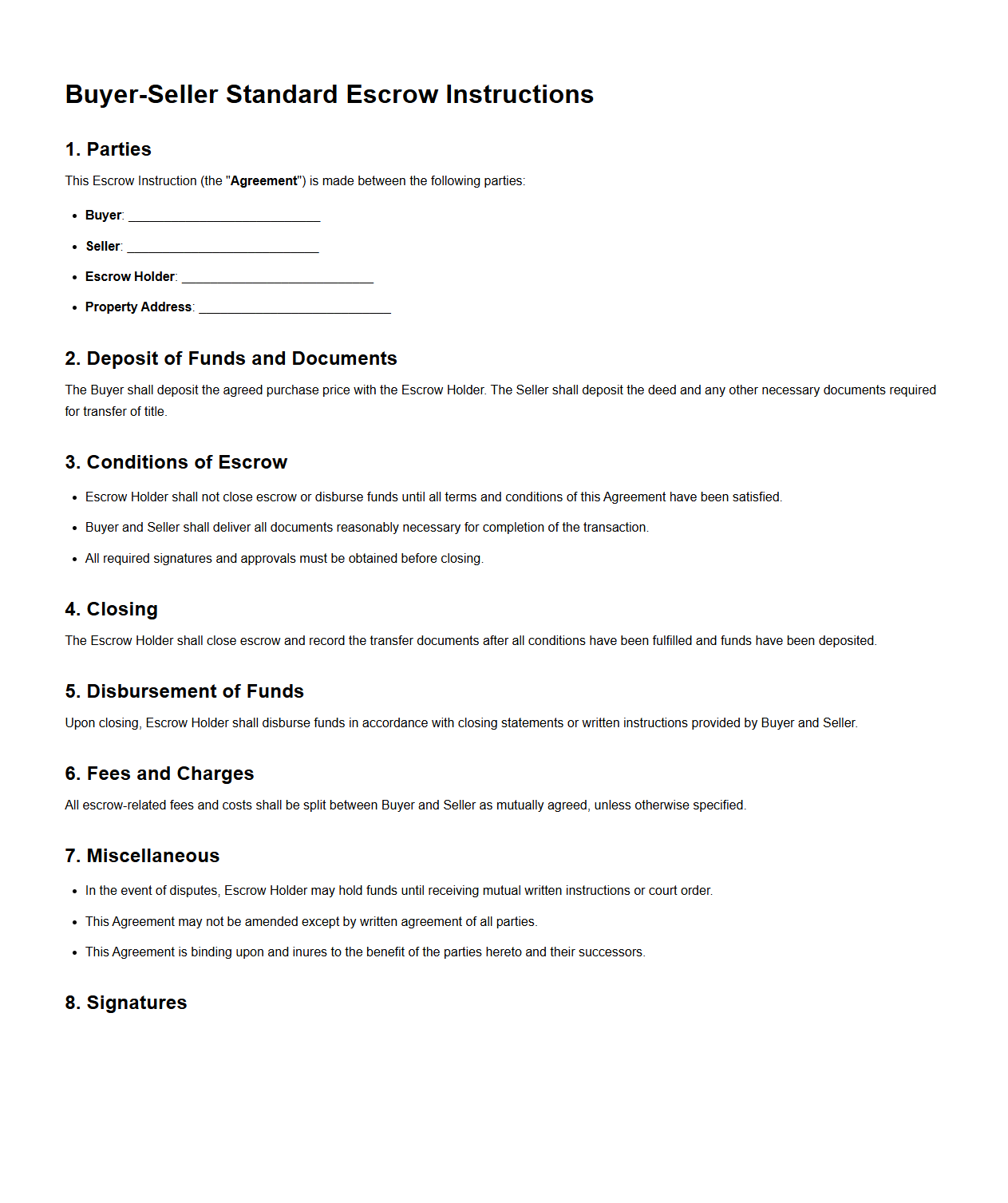

Buyer-Seller Standard Escrow Instructions Sample

The

Buyer-Seller Standard Escrow Instructions Sample document outlines the agreed terms and conditions governing the escrow process between the buyer and seller in a real estate transaction. It specifies the responsibilities, timelines, and procedures for handling funds, documents, and contingencies to ensure a secure and transparent exchange. This sample serves as a template to help both parties understand their obligations and protect their interests throughout the escrow period.

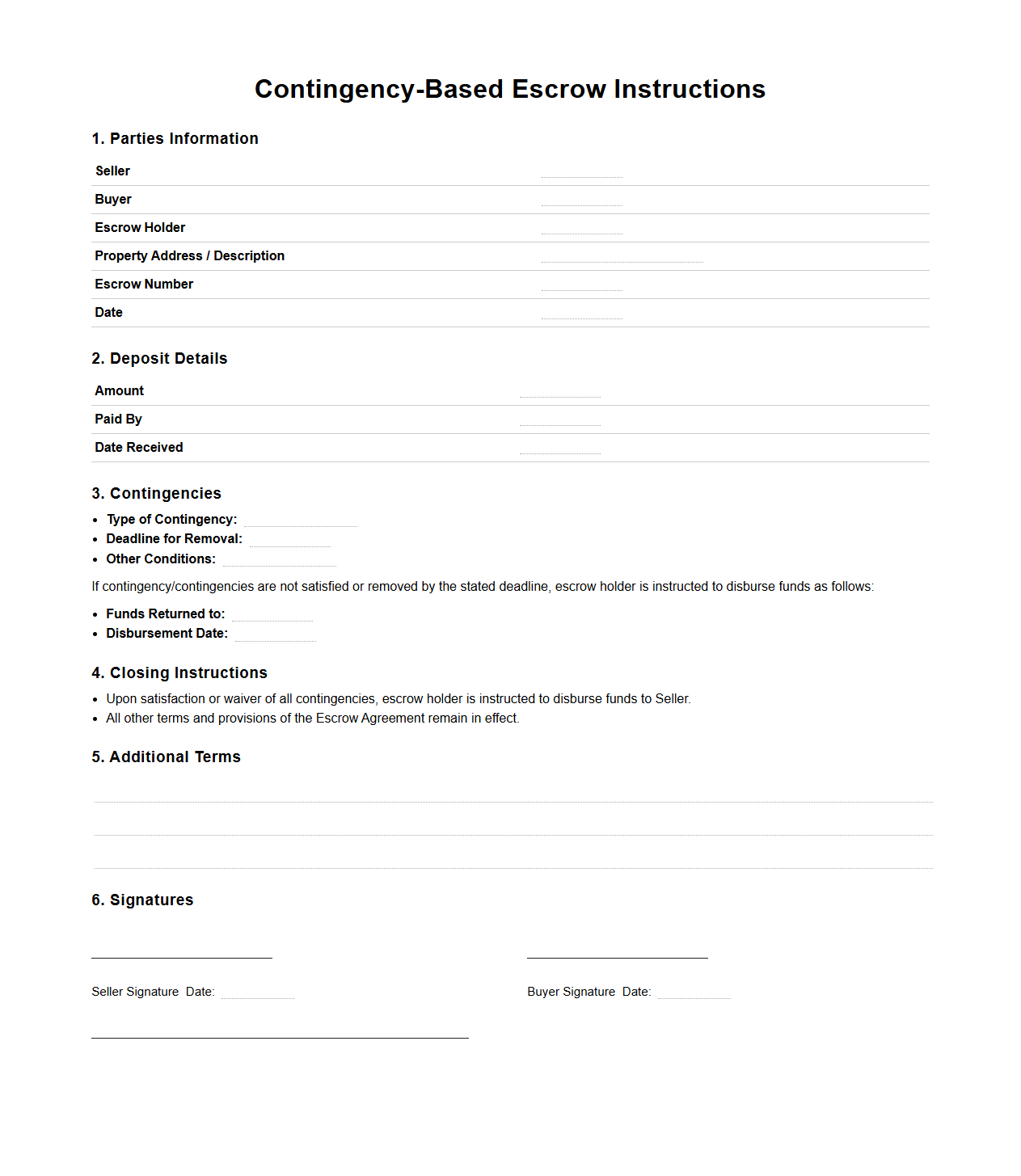

Contingency-Based Escrow Instructions Format

The

Contingency-Based Escrow Instructions Format document outlines specific conditions under which escrow funds are to be released or held, ensuring protection for all parties involved in a transaction. It defines clear triggers related to contingencies such as inspection results, financing approval, or contract amendments. This format helps streamline escrow management by providing precise, legally binding guidance tailored to the unique aspects of a deal.

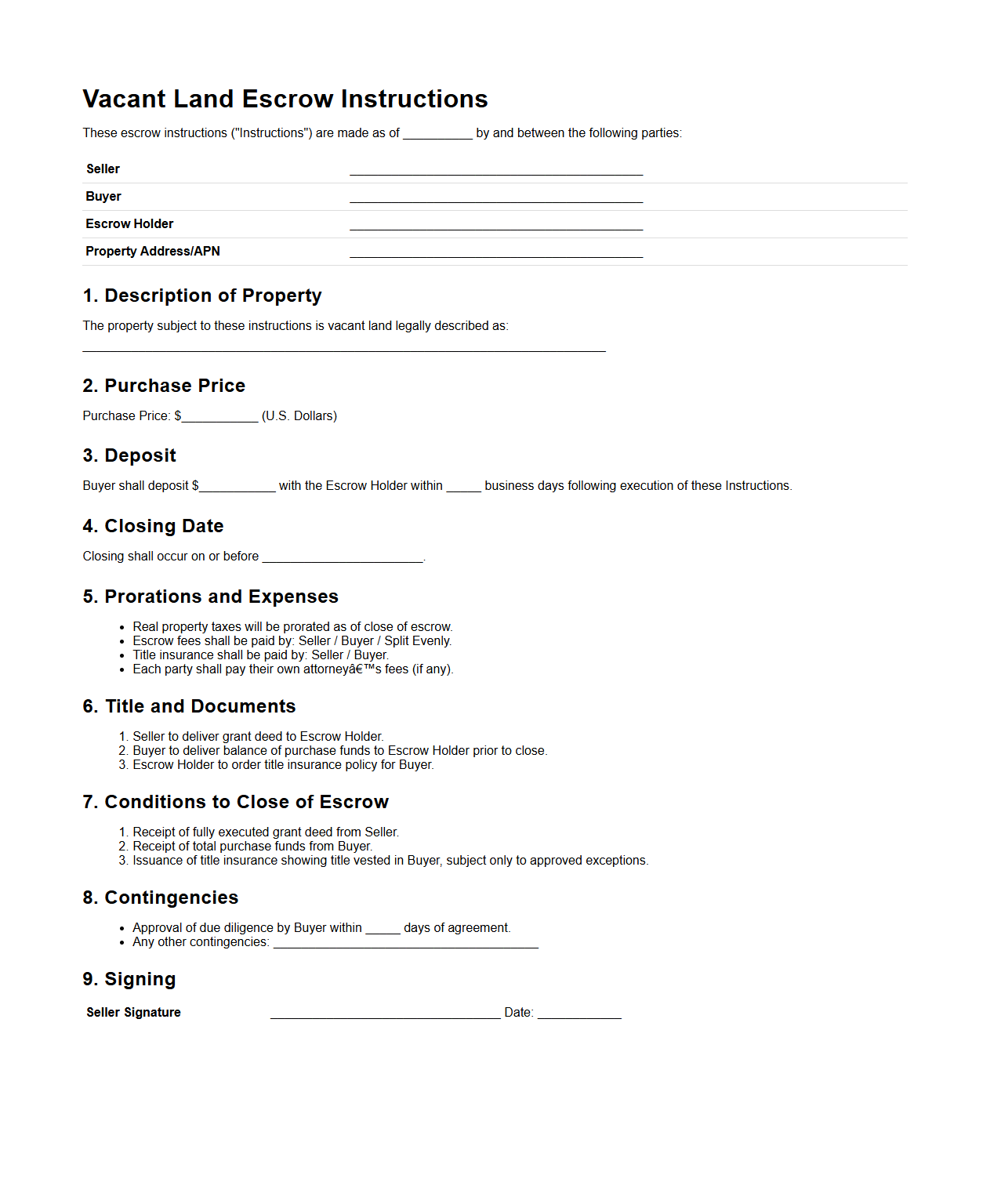

Vacant Land Escrow Instructions Example

Vacant Land Escrow Instructions Example is a detailed

legal document that outlines the specific terms and conditions for the escrow process in a vacant land transaction. It includes instructions for the escrow agent regarding the deposit, title clearance, contingencies, and disbursement of funds to ensure a smooth transfer of ownership. This document serves as a binding agreement to protect both buyer and seller interests during the sale of undeveloped property.

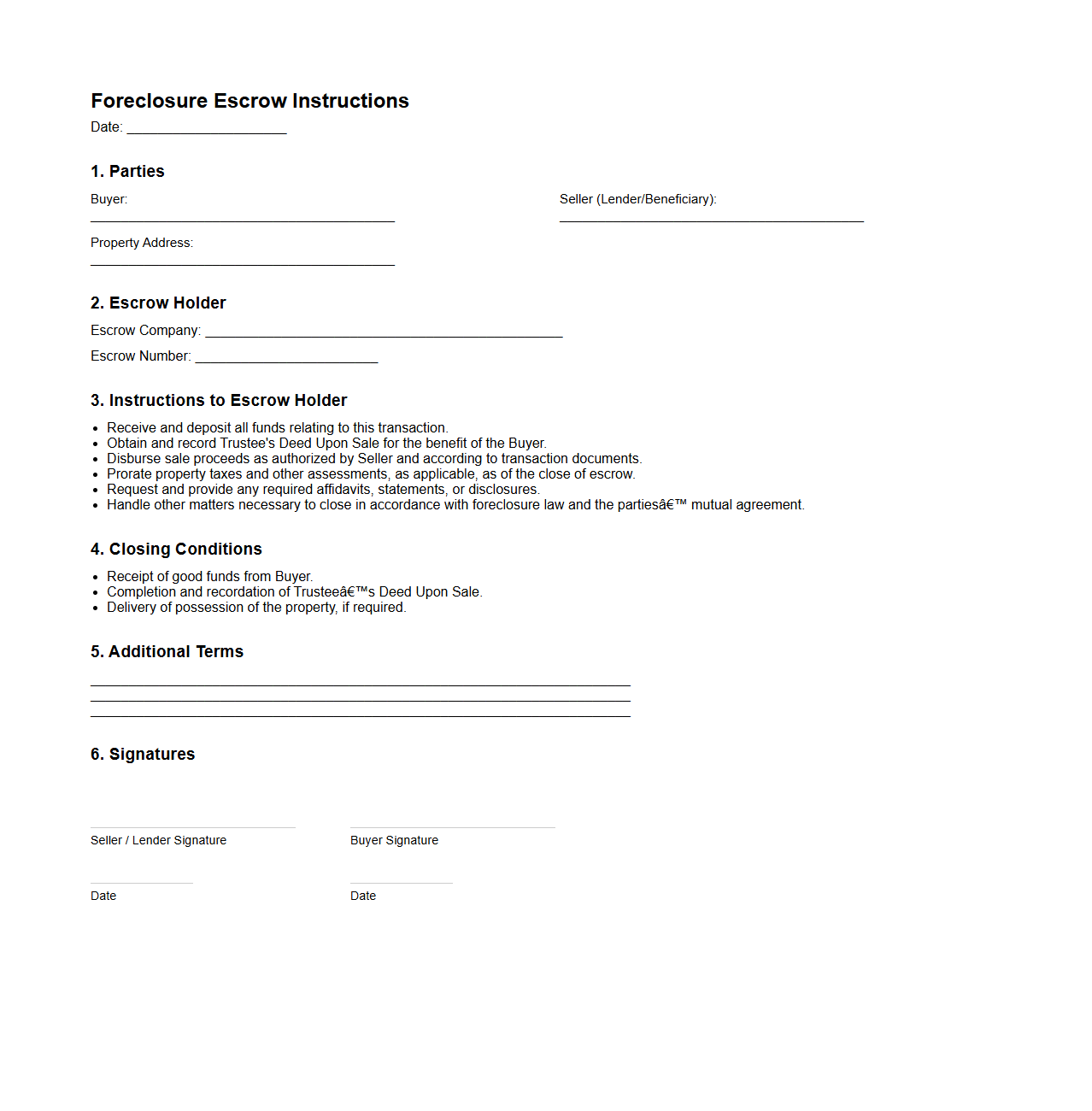

Foreclosure Escrow Instructions Document

The

Foreclosure Escrow Instructions Document outlines the specific procedures and responsibilities for managing funds held in escrow during a property foreclosure process. It ensures that all parties involved--such as lenders, buyers, and escrow agents--adhere to agreed terms for disbursing payments and resolving liens. This document is essential for maintaining legal compliance and facilitating a smooth transfer of ownership.

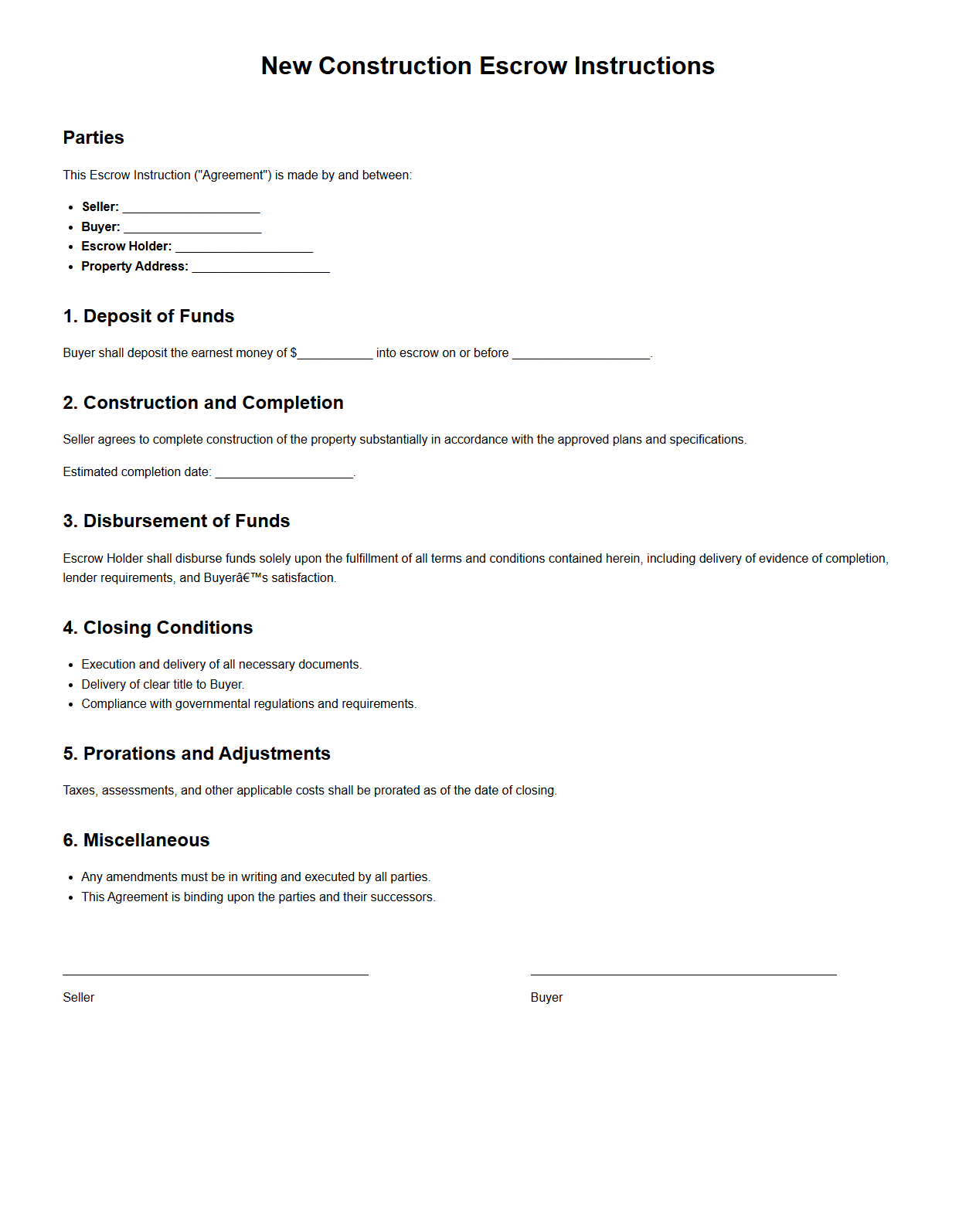

New Construction Escrow Instructions Sample

New Construction Escrow Instructions Sample document provides detailed guidelines and terms for managing funds during a new construction real estate transaction. It ensures that payments are securely held and disbursed according to agreed milestones, protecting both buyers and builders. This document is essential for clarifying responsibilities and facilitating smooth financial transactions in

new construction escrow processes.

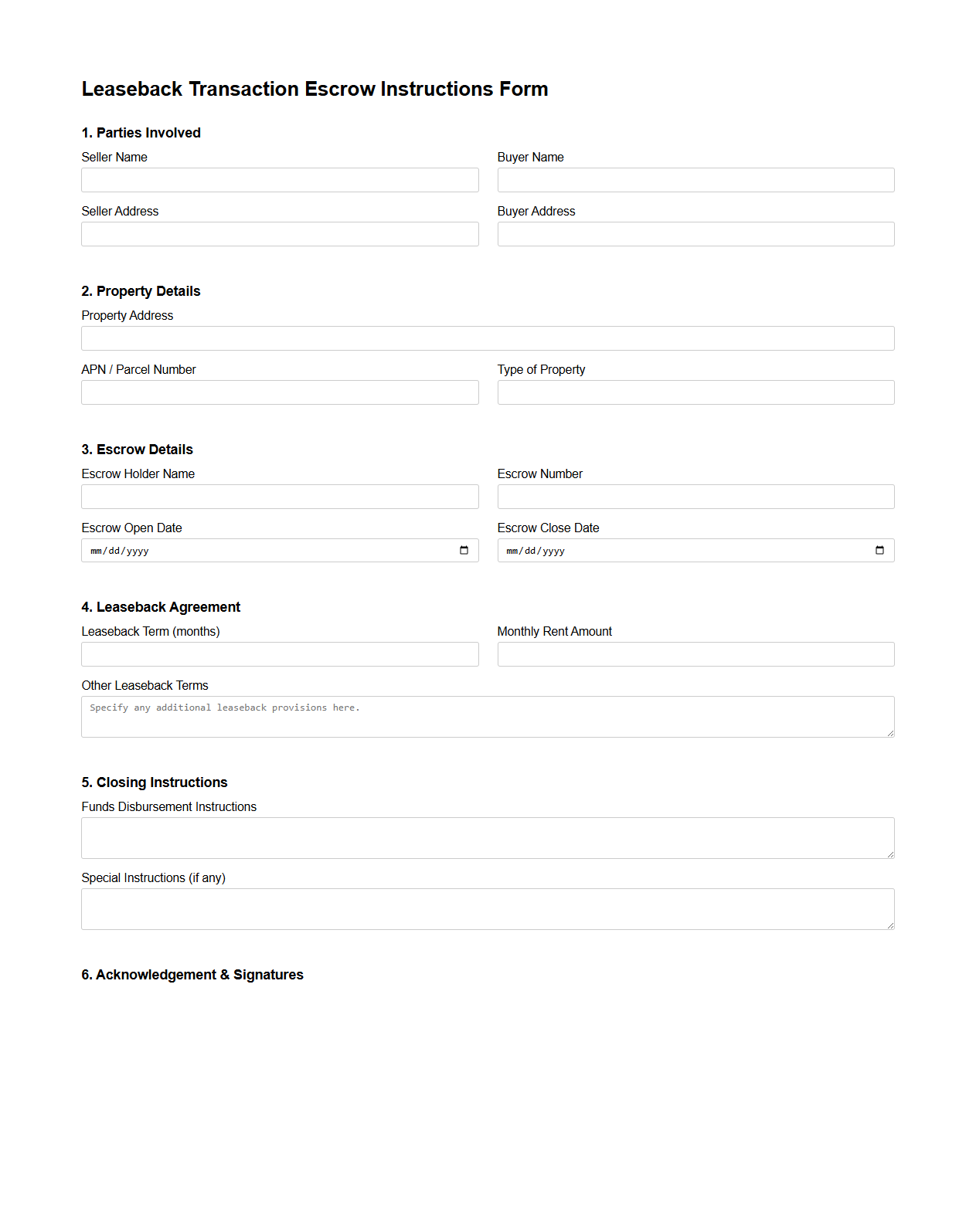

Leaseback Transaction Escrow Instructions Form

The

Leaseback Transaction Escrow Instructions Form is a crucial document that outlines the specific terms and conditions directing the escrow agent in handling funds and documents during a leaseback transaction. This form ensures that all parties agree on how money, property deeds, and related paperwork will be managed, safeguarding the interests of both the buyer and seller. Clear instructions within the escrow form help prevent disputes and facilitate a smooth closing process in leaseback agreements.

What are the specific disbursement conditions outlined in the Escrow Instructions for Property Closing?

The disbursement conditions in the Escrow Instructions specify the exact criteria that must be met before funds are released. These conditions typically include the receipt of all required documents, confirmation of title clearance, and authorization from both buyer and seller. Ensuring all criteria are met protects both parties during the property closing process.

How are prorations for taxes and utilities addressed in the Escrow Instructions Document?

The Escrow Instructions clearly address prorations by outlining the method to calculate and allocate taxes and utilities between buyer and seller. These prorations are usually based on the closing date, ensuring equitable financial responsibility. Proper handling of prorations prevents disputes over shared expenses after closing.

What are the seller's obligations regarding title clearance in the Escrow Instructions?

The Escrow Instructions impose a title clearance obligation on the seller, requiring them to provide clear and marketable title at closing. The seller must resolve any liens, encumbrances, or defects to ensure a smooth transfer of ownership. Meeting this obligation is crucial for the buyer's assurance and finalizing the sale.

Are deadlines for document submission explicitly specified in the Escrow Instructions for closing?

Yes, the Escrow Instructions explicitly specify deadlines for submitting necessary documents required for closing. These deadlines ensure an organized and timely closing process, helping avoid delays or financial penalties. Adhering to these timeframes facilitates a smooth transaction for all parties involved.

How do the Escrow Instructions handle amendments or modifications prior to property closing?

The Escrow Instructions typically include provisions for amendments or modifications, requiring them to be made in writing and agreed upon by all parties. This formal process prevents misunderstandings and maintains the integrity of the original agreement. Clear guidelines for changes ensure flexibility while preserving legal enforceability.

More Real estate Templates