A End-of-Day Reconciliation Document Sample for Retail Cashier is a crucial tool that ensures accurate tracking of daily cash transactions and sales. It helps in identifying discrepancies between the cash drawer and sales records, promoting accountability and transparency. This document typically includes sections for cash counts, credit card totals, refunds, and other payment methods to streamline financial auditing.

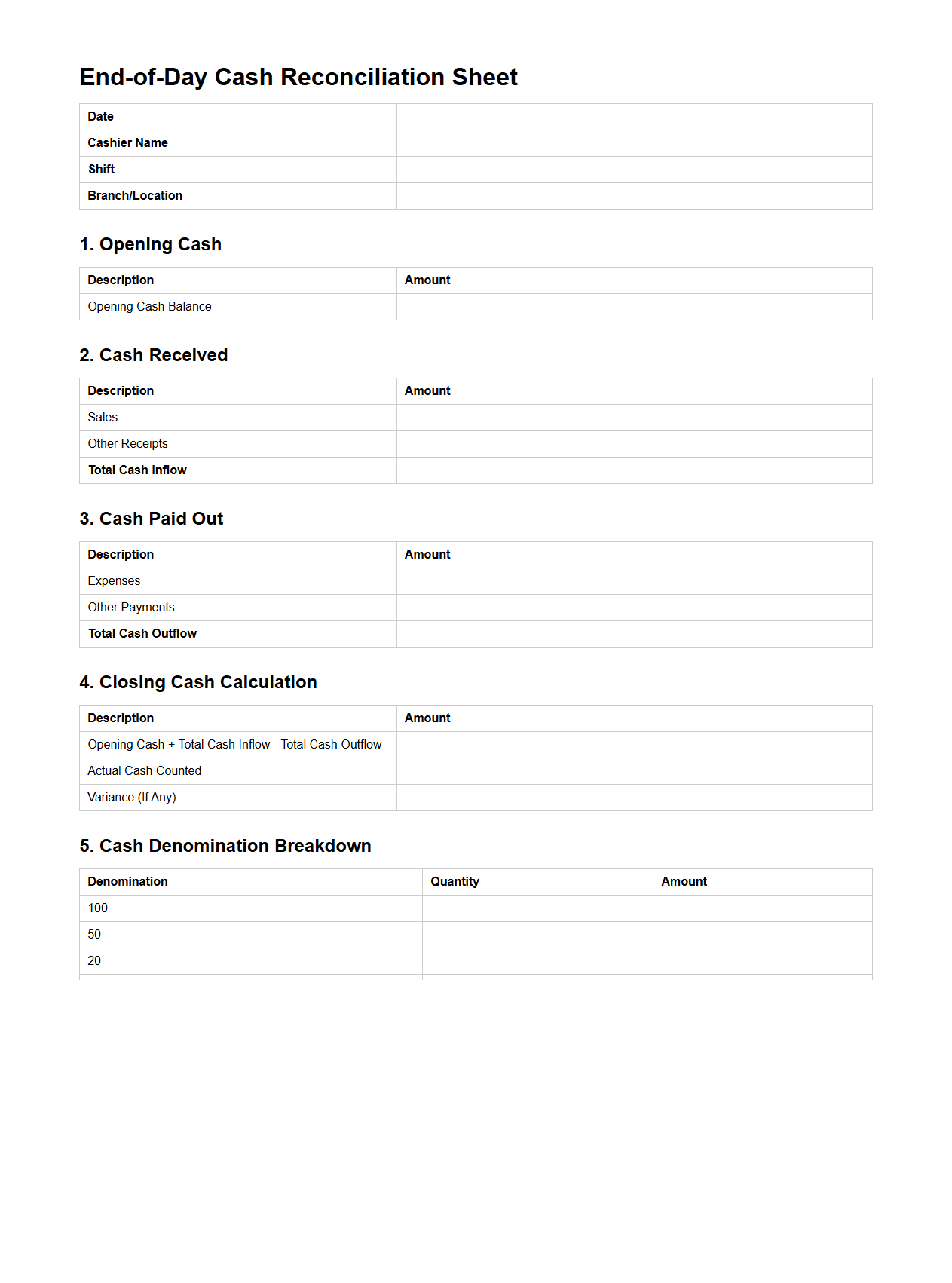

End-of-Day Cash Reconciliation Sheet Template

The

End-of-Day Cash Reconciliation Sheet Template is a financial document designed to accurately record and verify daily cash transactions, ensuring that cash inflows and outflows are balanced. It systematically tracks cash sales, withdrawals, deposits, and discrepancies, providing a clear summary of the cash position at the end of each business day. This template supports accurate financial reporting, reduces errors, and aids in identifying potential cash handling issues promptly.

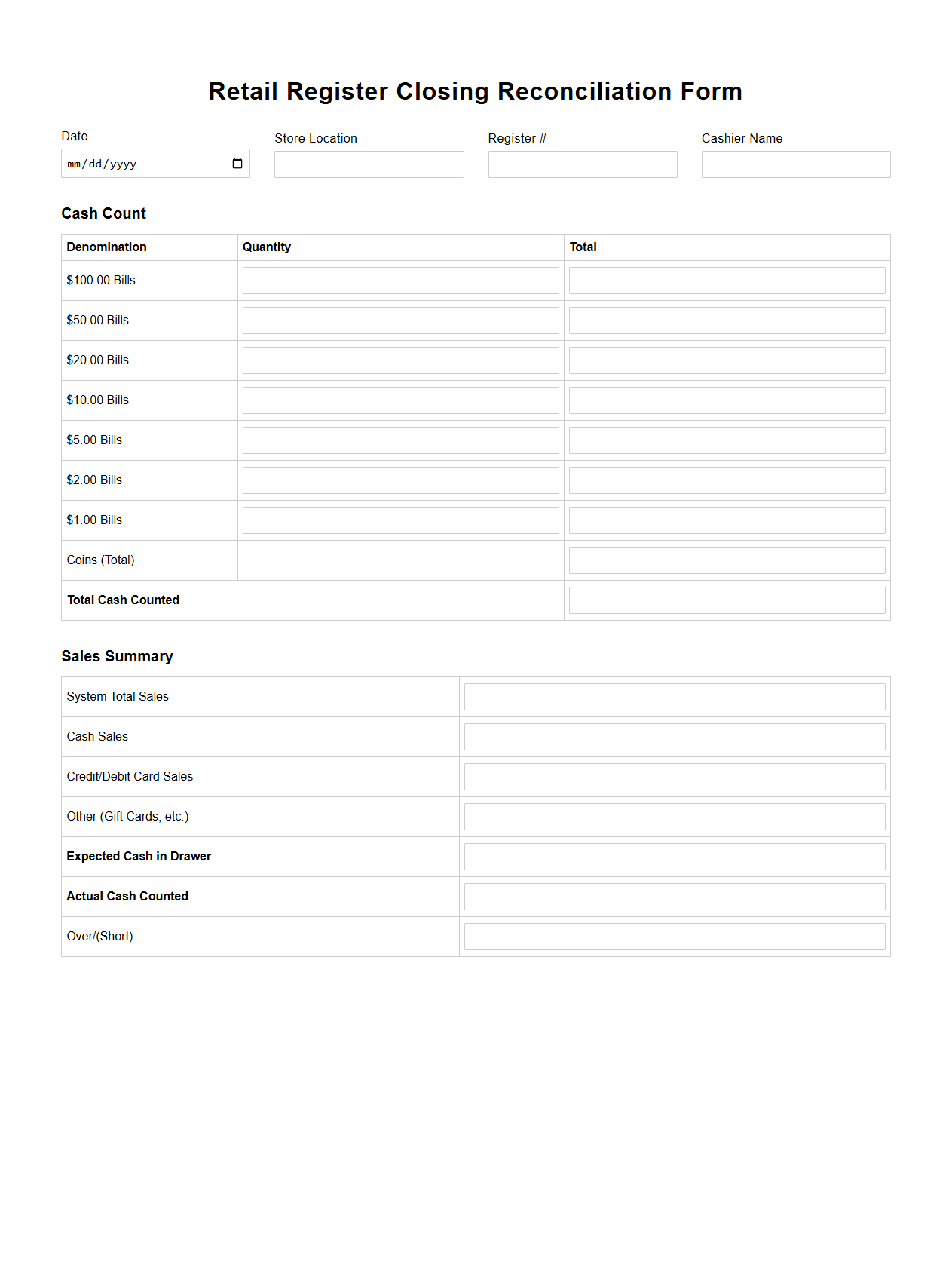

Retail Register Closing Reconciliation Form

The

Retail Register Closing Reconciliation Form is a crucial document used to verify and record the accuracy of daily cash transactions at a retail register. It ensures that the total sales, cash in the drawer, credit card receipts, and other payment methods align with the recorded sales figures. This form helps identify discrepancies, prevent theft, and maintain accurate financial records for end-of-day reconciliation.

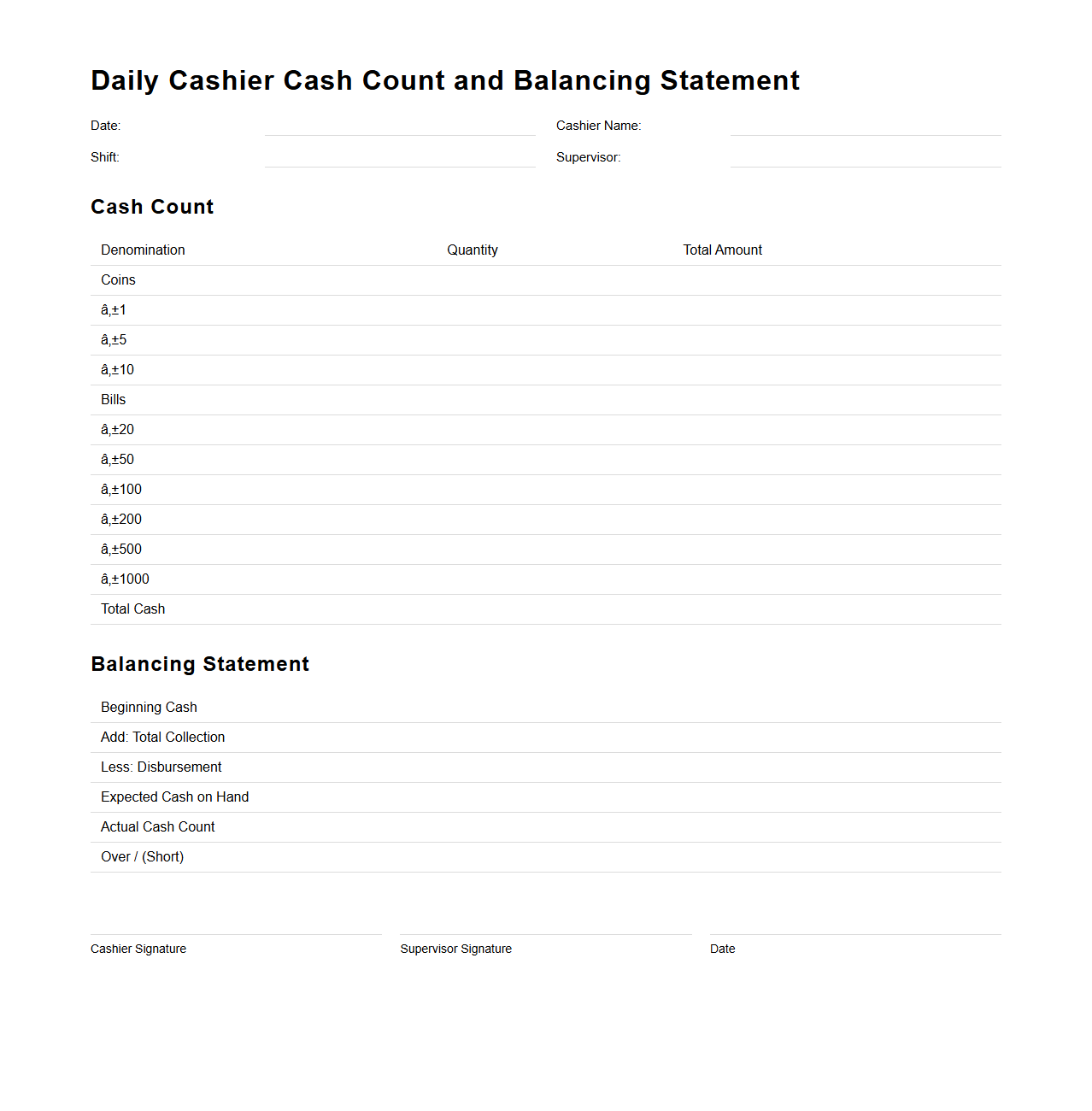

Daily Cashier Cash Count and Balancing Statement

A

Daily Cashier Cash Count and Balancing Statement document is used to record and verify the amount of cash on hand at the end of a cashier's shift. It ensures accurate tracking of cash inflows and outflows by comparing the counted cash against sales receipts and transaction records. This statement helps identify discrepancies, prevent theft, and maintain financial accountability in retail or service environments.

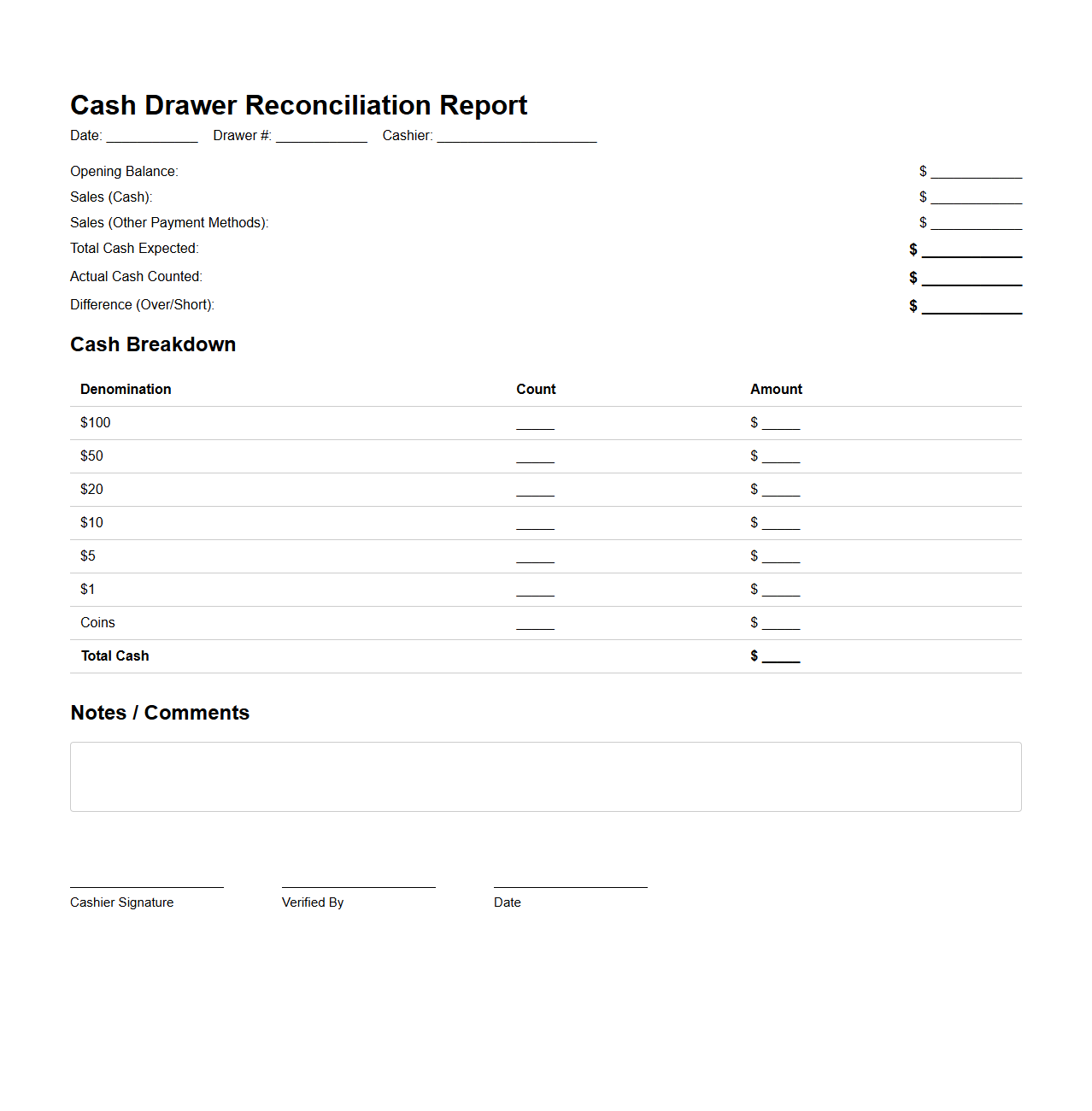

Cash Drawer Reconciliation Report Example

A

Cash Drawer Reconciliation Report is a financial document used to verify the accuracy of cash transactions within a specific period by comparing the recorded sales against the actual cash in the drawer. This report typically includes details such as opening cash balance, total cash sales, cash withdrawals, and the closing balance to identify discrepancies or errors. Businesses use this report to maintain accountability, prevent theft, and ensure accurate cash handling procedures.

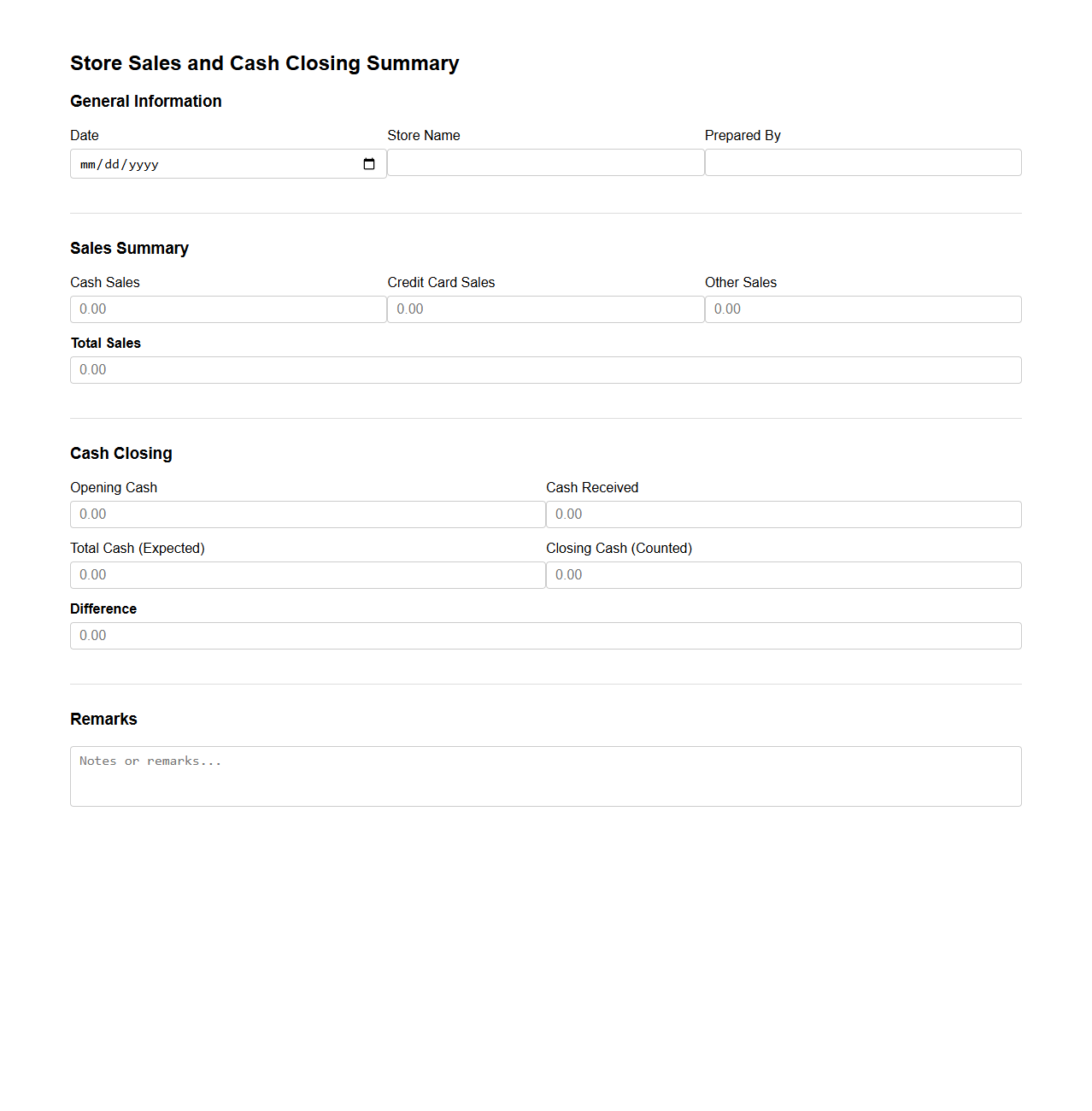

Store Sales and Cash Closing Summary

The

Store Sales and Cash Closing Summary document provides a detailed report of daily sales transactions and cash flow activities within a retail store. It summarizes total sales, payment methods, cash deposits, and petty cash usage, ensuring accurate reconciliation between sales recorded and cash on hand. This document is essential for financial audits, inventory management, and identifying discrepancies in store operations.

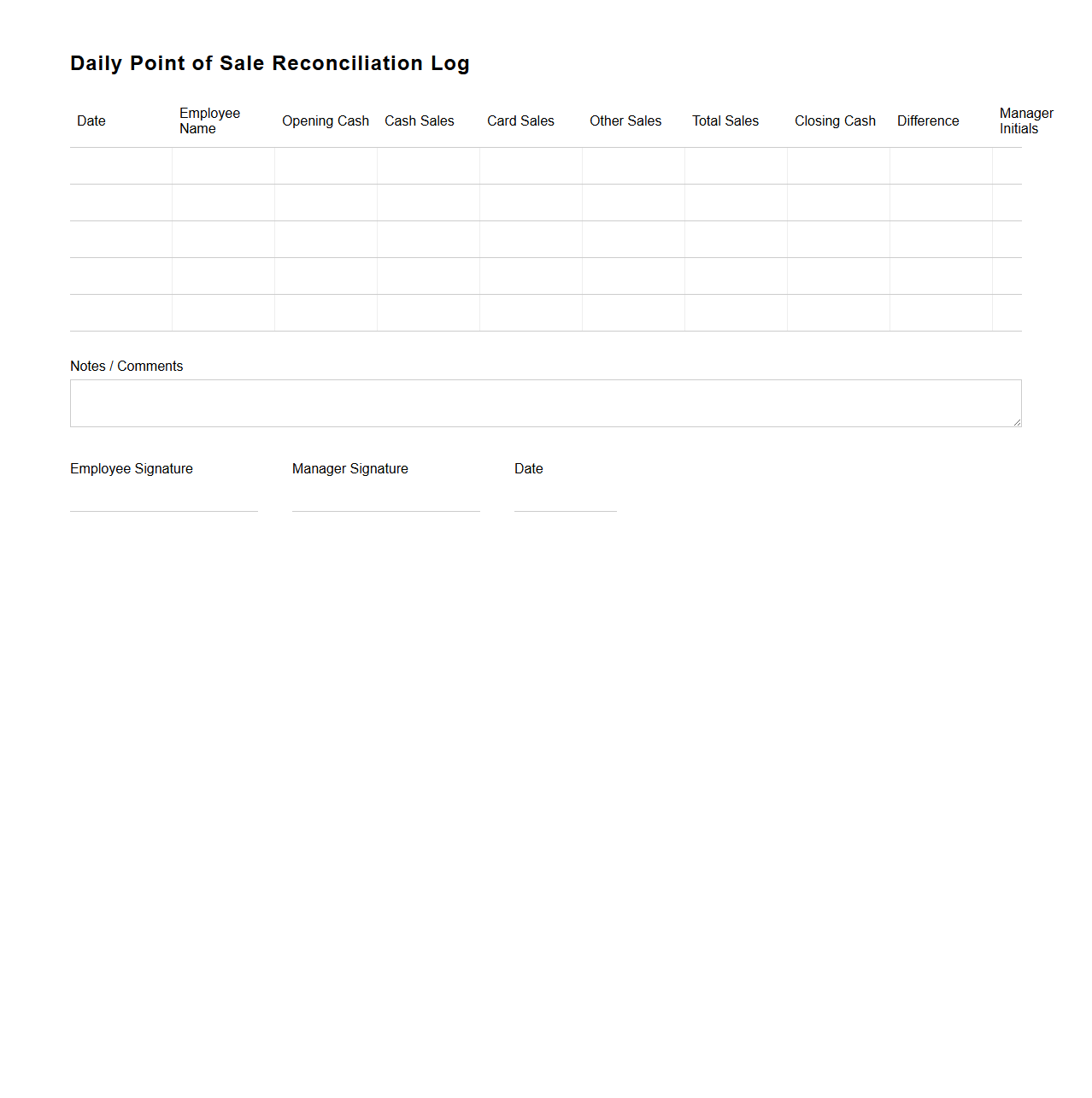

Daily Point of Sale Reconciliation Log

The

Daily Point of Sale Reconciliation Log document is a critical record used by businesses to verify and balance sales transactions recorded by the point of sale (POS) system against actual cash, credit, and other forms of payments received daily. This log helps identify discrepancies, prevent fraud, and ensure accurate financial reporting by documenting each sale, payment type, and any adjustments or refunds processed. Maintaining this log supports efficient financial audits and operational transparency within retail and hospitality environments.

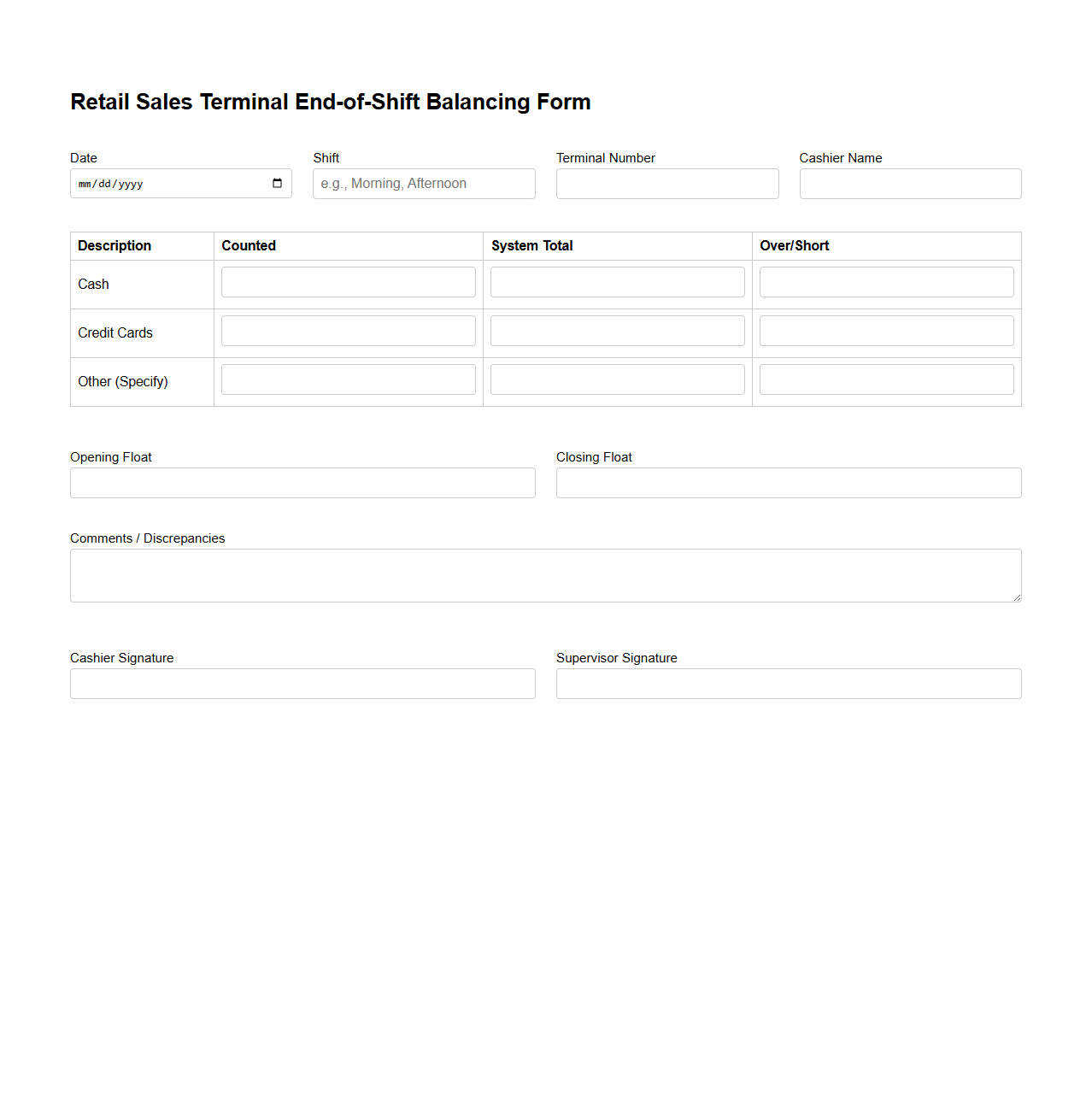

Retail Sales Terminal End-of-Shift Balancing Form

The

Retail Sales Terminal End-of-Shift Balancing Form is a crucial document used to reconcile and verify all transactions conducted during a specific sales terminal's shift. It captures detailed records of cash, card payments, returns, and discrepancies, ensuring accurate financial reporting and accountability. This form helps identify variances instantly, enabling timely resolution and maintaining operational integrity.

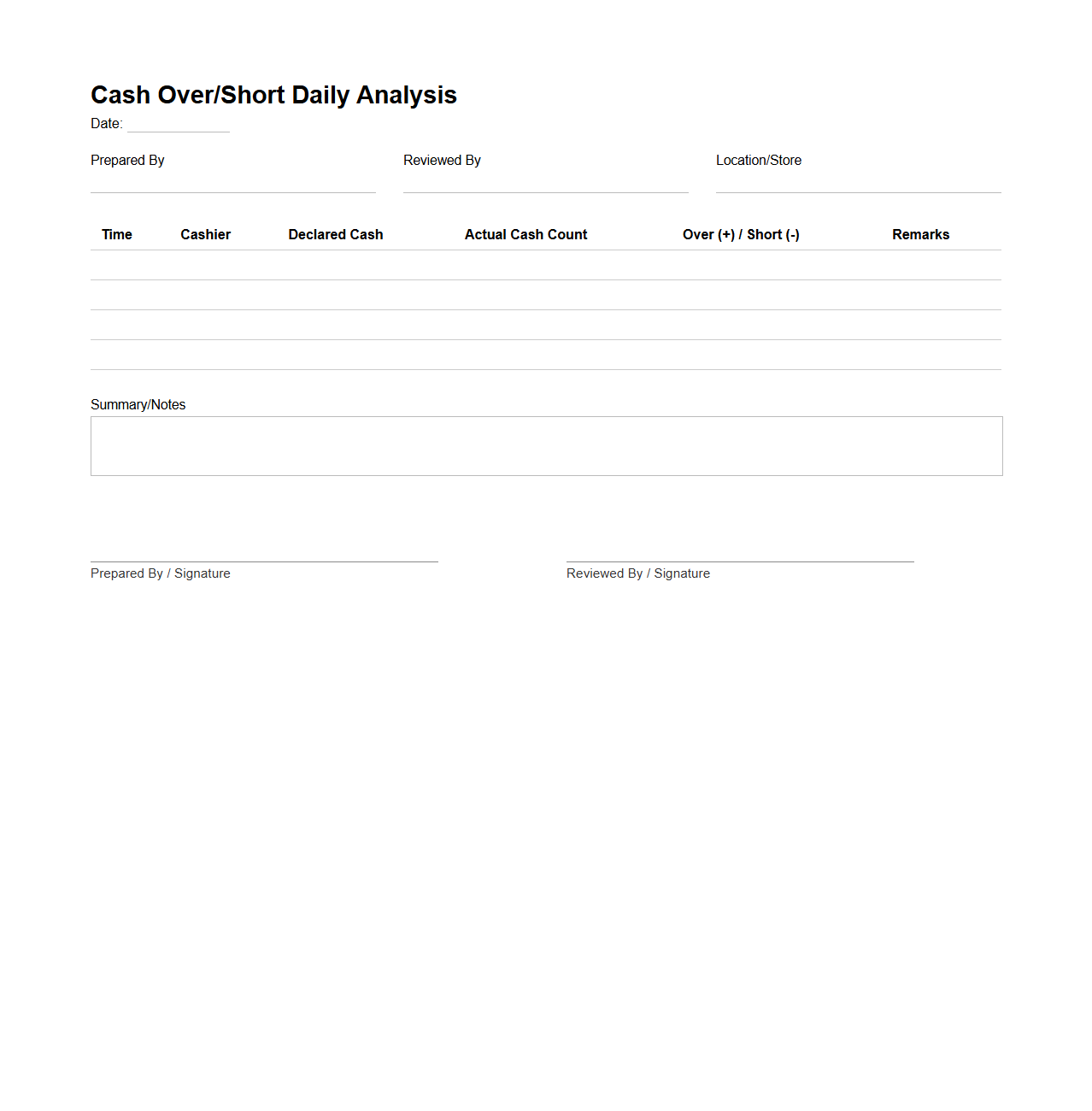

Cash Over/Short Daily Analysis Document

The

Cash Over/Short Daily Analysis Document is a financial report used to track discrepancies between recorded cash transactions and actual cash on hand at the end of each business day. It helps identify cash handling errors, theft, or system inaccuracies by documenting overages and shortages systematically. This document is essential for maintaining accurate cash flow records and ensuring accountability in cash management processes.

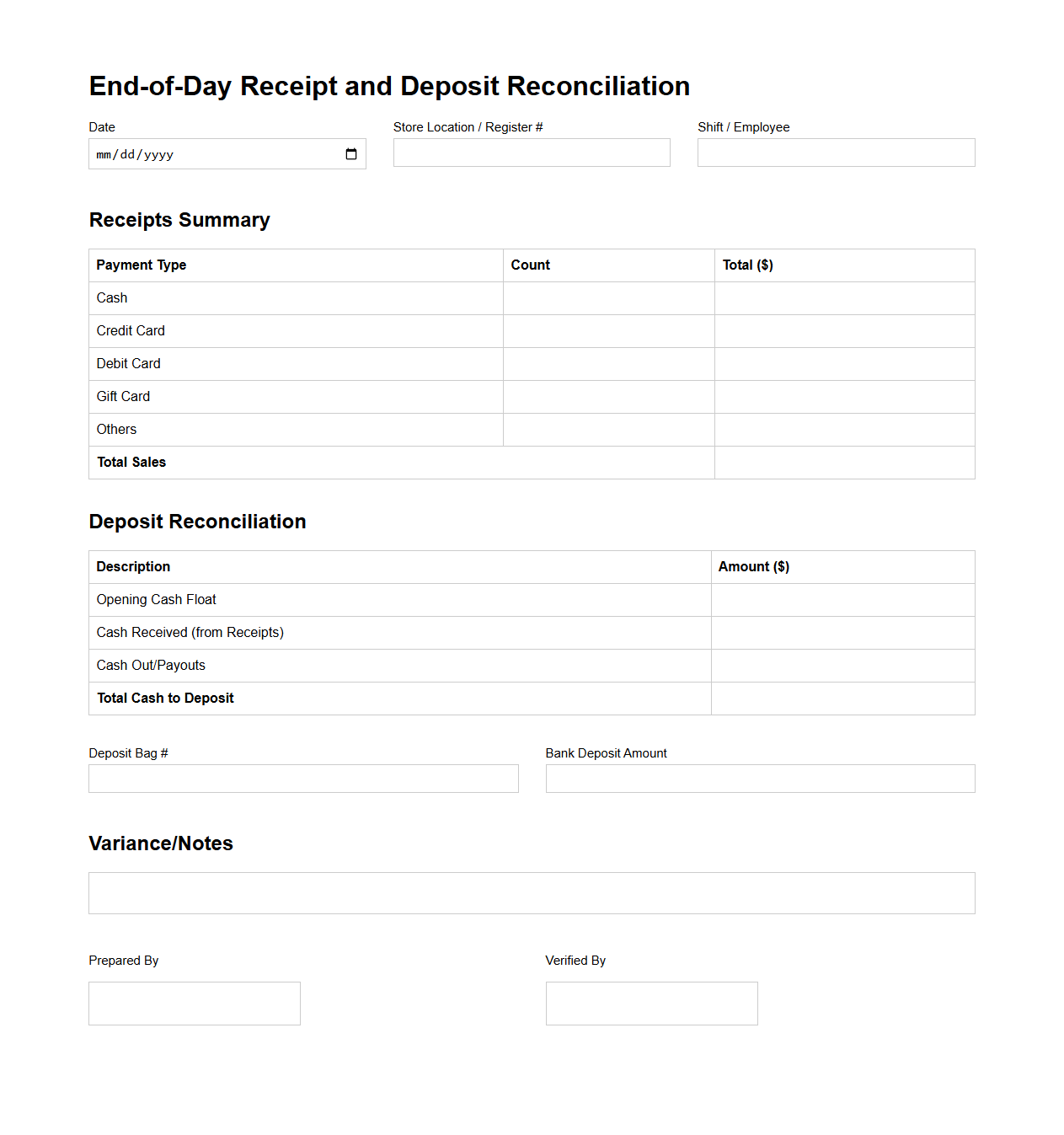

Retail End-of-Day Receipt and Deposit Reconciliation

The

Retail End-of-Day Receipt and Deposit Reconciliation document is a critical financial record that summarizes daily cash transactions and verifies the accuracy of receipts against bank deposits. It ensures all sales, refunds, and cash handling activities are accounted for, minimizing discrepancies and potential errors. This document is essential for maintaining retail financial integrity and supporting audit compliance.

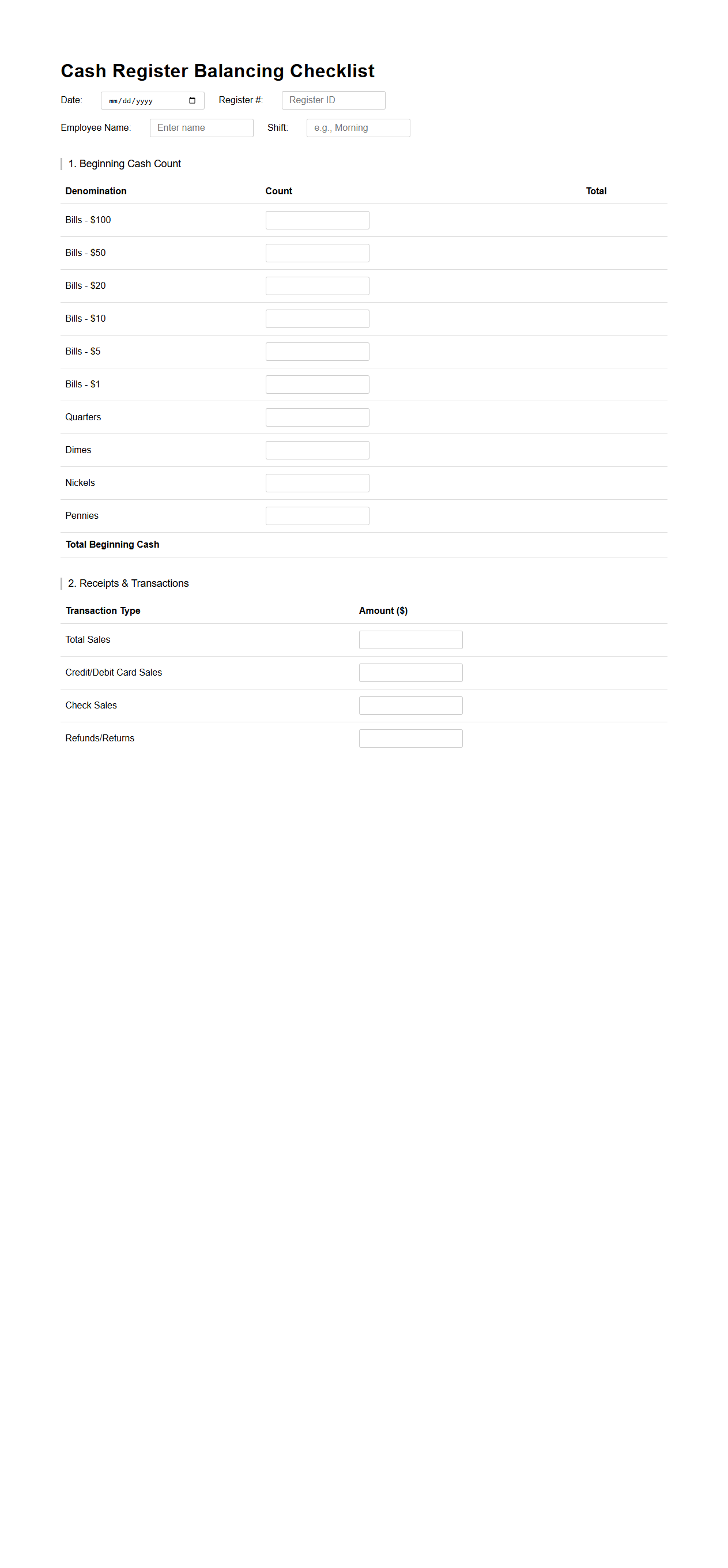

Cash Register Balancing Checklist for Retail

The

Cash Register Balancing Checklist for retail is a vital document used to verify and reconcile the cash transactions at the end of a business day or shift. It ensures accuracy by comparing the total cash received with sales records, receipts, and any other forms of payment, helping to identify discrepancies or errors promptly. This checklist enhances financial accountability, supports auditing processes, and prevents cash handling fraud in retail environments.

Key Details in End-of-Day Reconciliation Document for Retail Cashiers

The end-of-day reconciliation document must include the total cash sales, credit card transactions, and any other payment methods accepted. It should also record the beginning cash float and the final cash count. Additionally, the document must note any returns or voids processed during the shift.

How Reconciliation Identifies Discrepancies Between Cash Register Totals and Actual Cash

The reconciliation process compares the cash register sales total to the actual cash counted at the end of the day. Any variations between the expected and actual amounts highlight potential discrepancies. This allows management to investigate causes such as errors or theft promptly.

Sections Ensuring Accuracy in Daily Cash Handling

The reconciliation document includes sections for the starting cash balance, total sales, cash received, and amounts disbursed for expenses or refunds. It also requires the cashier to provide an endorsement or signature confirming the accuracy of the information. These sections collectively help maintain strict cash control.

Supporting Documentation Attached for Verification

Supporting documentation should include the cash register tape or electronic sales reports, bank deposit slips, and receipts for any expenses paid from the cash drawer. These attachments validate the figures recorded on the reconciliation document. They provide an audit trail for future reviews and investigations.

Facilitating Accountability and Transparency in Cashier Operations

The reconciliation document creates an official record that holds cashiers accountable for their cash handling duties each shift. It promotes transparency by ensuring all cash movements are documented and verifiable. Regular review of these documents helps prevent errors and reduces the risk of fraud within the retail environment.