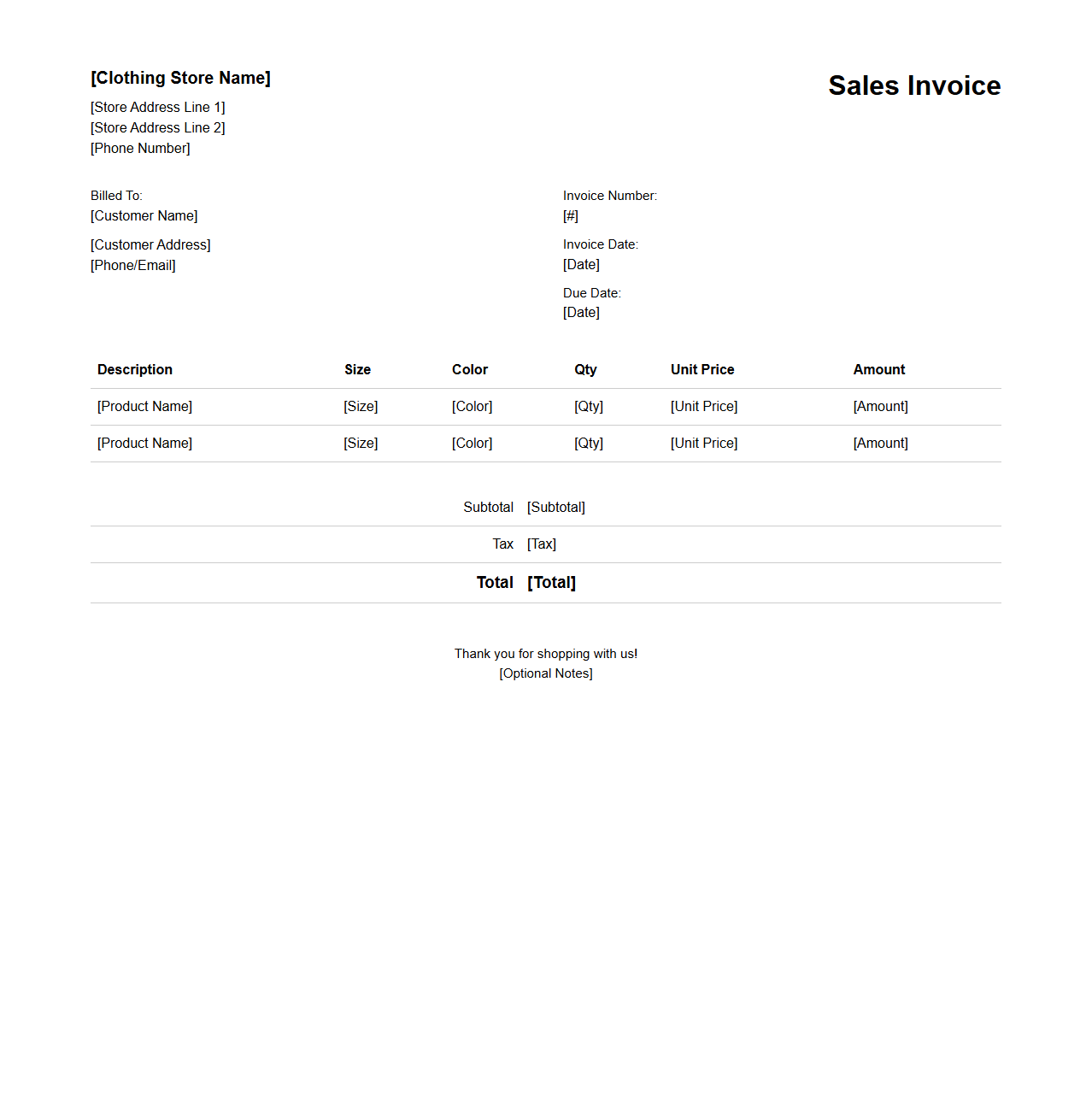

Clothing Store Sales Invoice Template

A

Clothing Store Sales Invoice Template document is a pre-designed form used to itemize and record the sale of apparel and accessories. It typically includes fields for product descriptions, quantities, unit prices, total amounts, taxes, and payment details, ensuring accurate transaction tracking and customer record-keeping. This template helps streamline billing processes and maintain financial accuracy in retail clothing businesses.

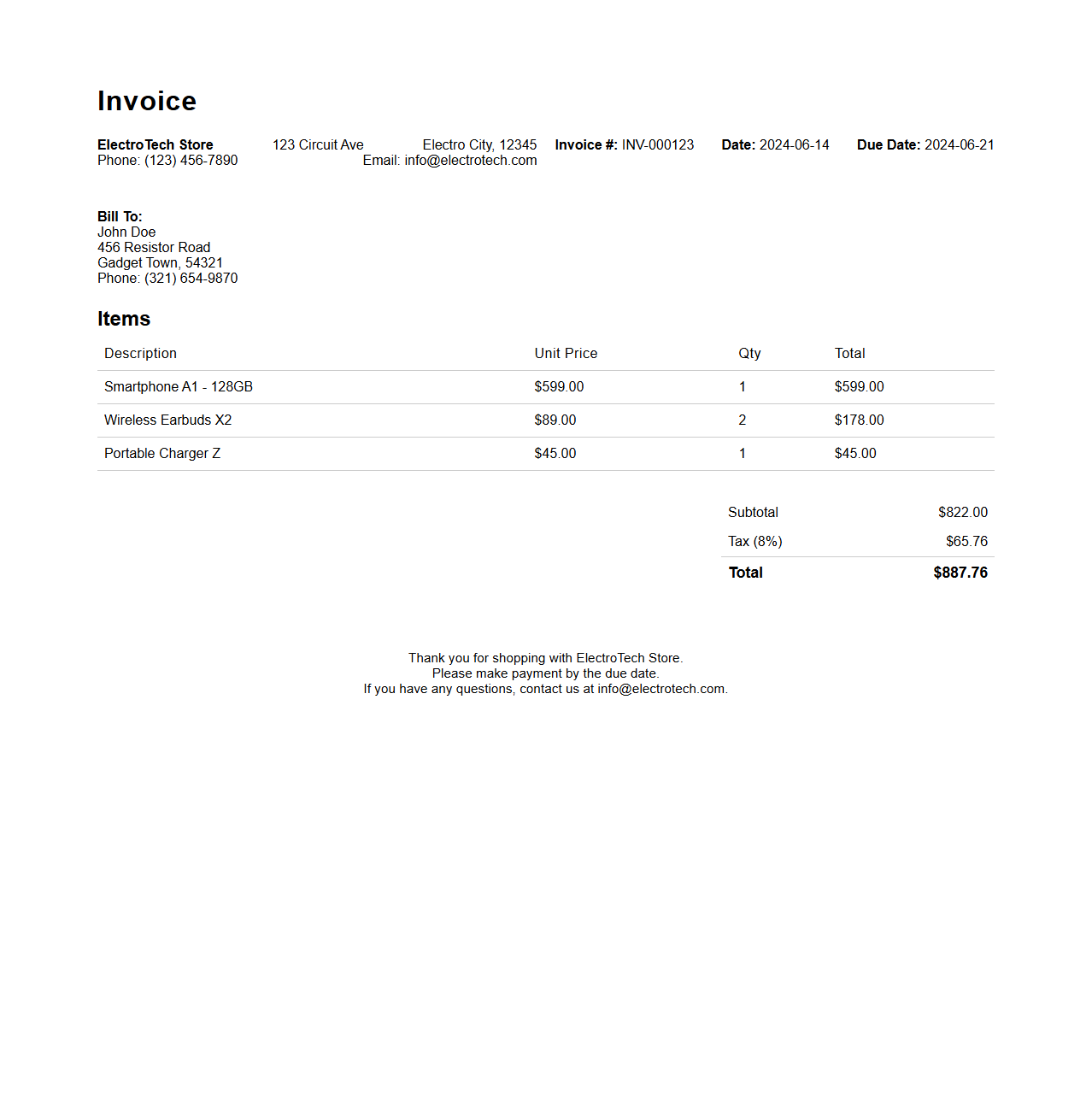

Electronics Retail Invoice Sample

An

Electronics Retail Invoice Sample is a document that itemizes the sale of electronic products, detailing product descriptions, quantities, prices, taxes, and total amounts payable. It serves as a proof of purchase for customers and a record for retailers to track sales transactions and inventory. This document is essential for warranty claims, returns, and accounting purposes within the electronics retail industry.

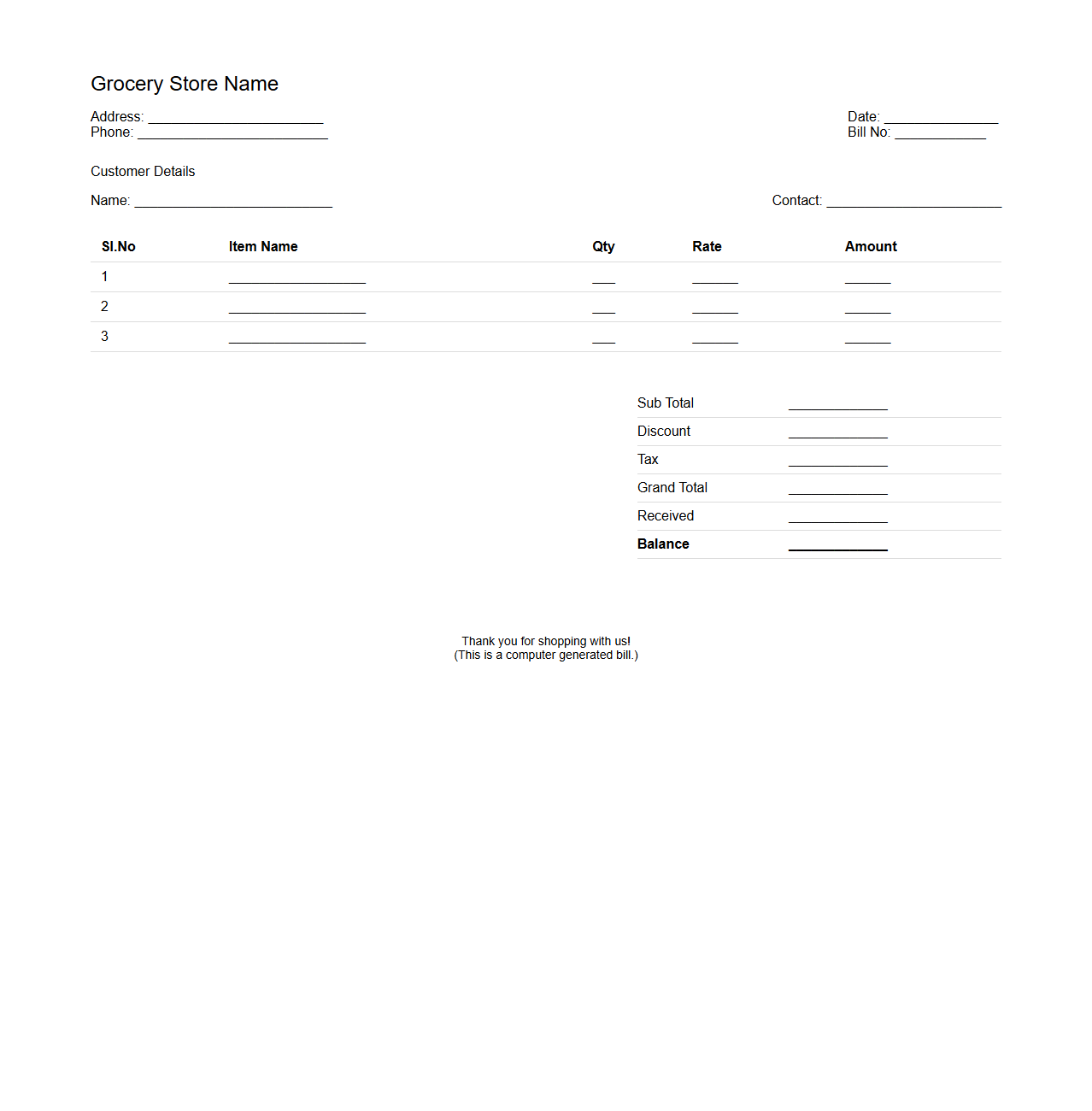

Grocery Store Sales Bill Format

The

Grocery Store Sales Bill Format document is a structured template used to record detailed transactions in a grocery store, including item names, quantities, prices, and total amounts. This format ensures accurate billing, transparent customer transactions, and efficient inventory tracking for the retailer. It typically includes essential elements such as store details, date of sale, bill number, itemized list, taxes, discounts, and payment method.

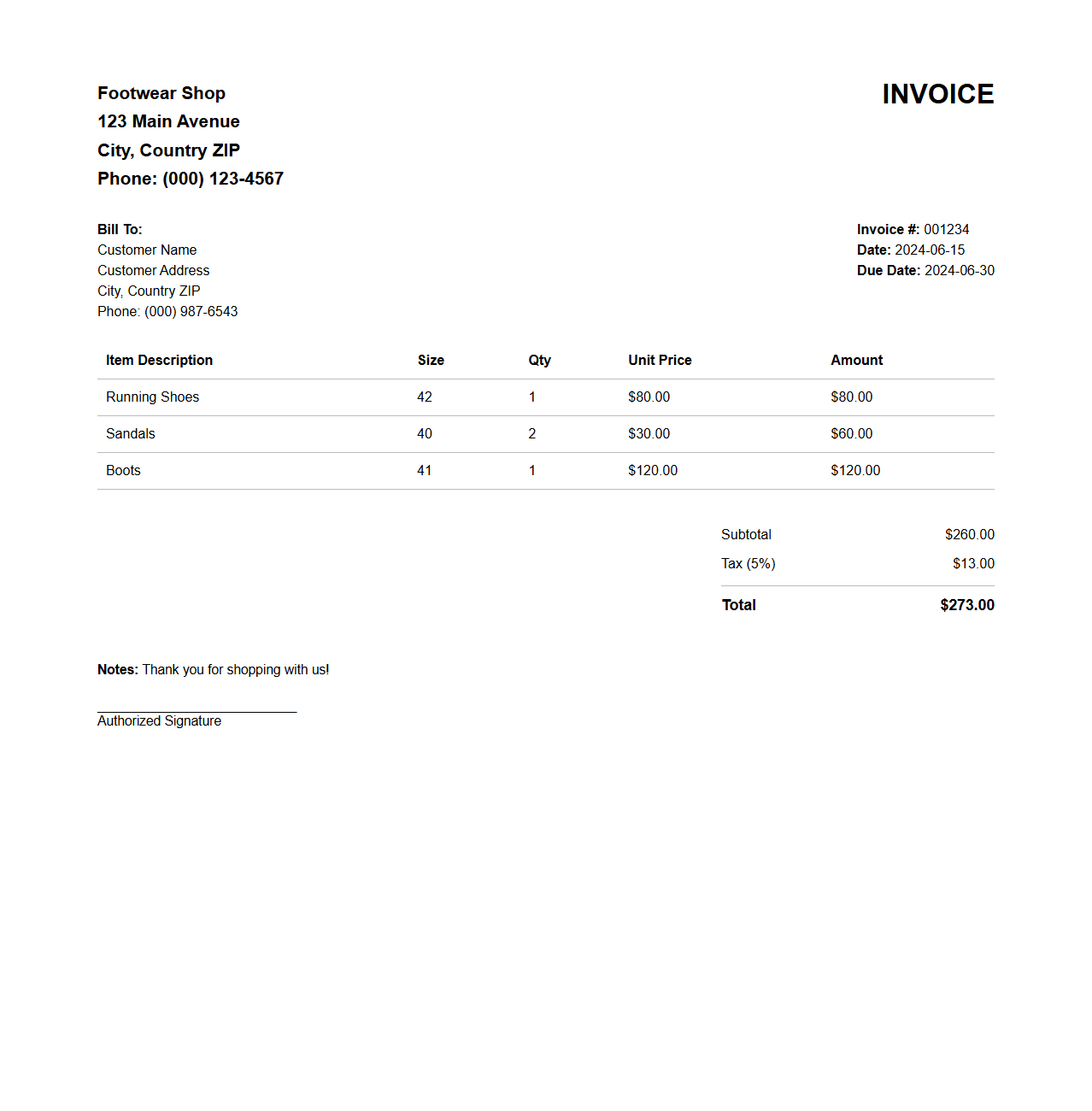

Footwear Shop Invoice Document

A

Footwear Shop Invoice Document is a detailed record issued by a footwear retailer that outlines the transaction between the shop and the customer. It typically includes essential information such as the buyer's details, list of purchased footwear items, quantities, prices, taxes, and the total amount payable. This document serves as proof of purchase and is crucial for warranty claims, returns, and inventory management.

Furniture Retailer Sales Invoice Example

A

Furniture Retailer Sales Invoice Example document serves as a detailed record of a transaction between a furniture retailer and a customer. It typically includes essential information such as item descriptions, quantities, prices, payment terms, and tax details, ensuring clarity and transparency in the sale process. This document aids in accurate accounting, inventory management, and serves as proof of purchase for both parties involved.

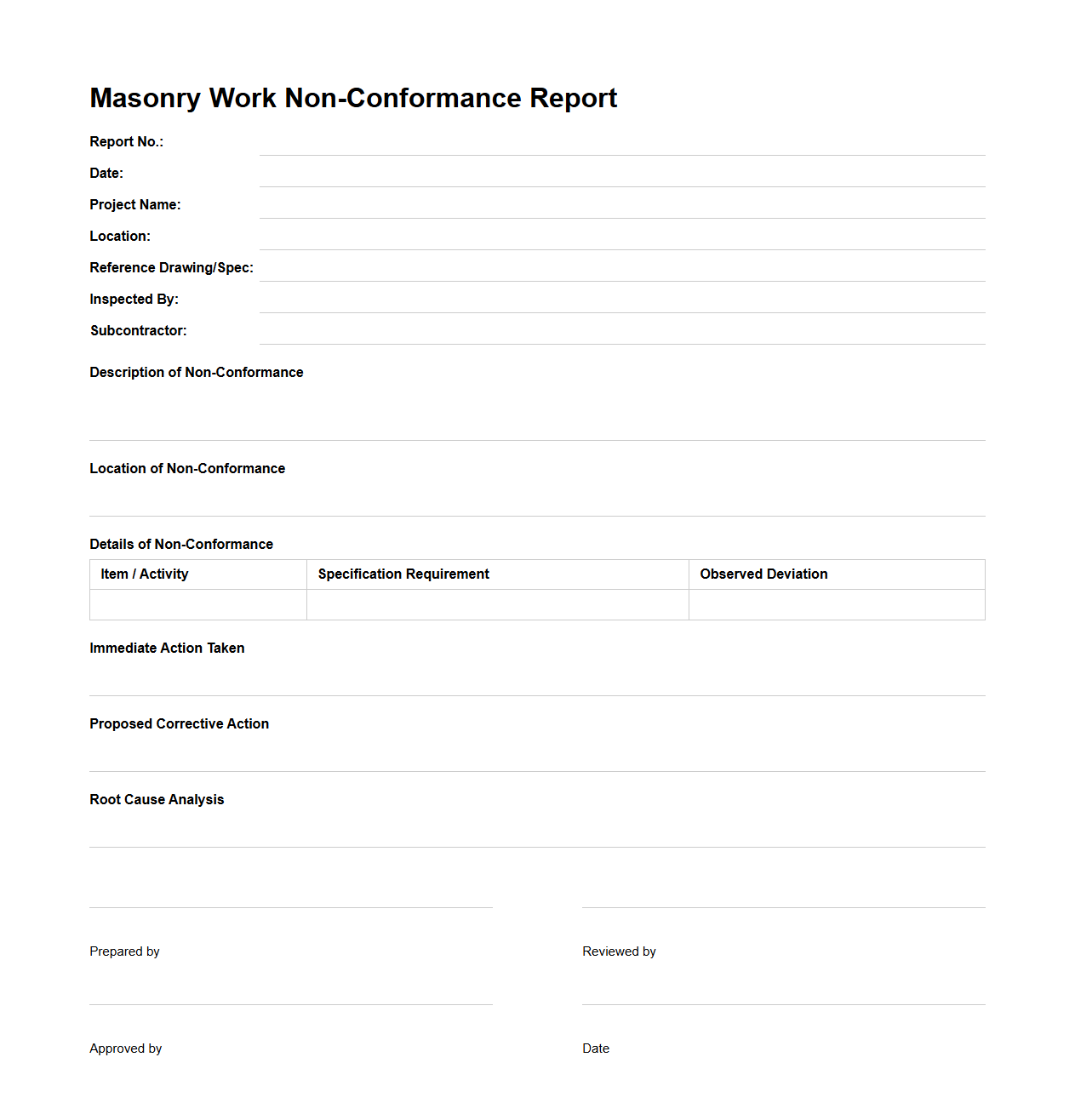

Jewelry Store Sales Receipt Template

A

Jewelry Store Sales Receipt Template document is a structured format used to record detailed information about jewelry transactions, including item descriptions, prices, quantities, and payment methods. This template ensures accurate tracking of sales and inventory, providing clear proof of purchase for customers and simplifying accounting processes for the store. Utilizing a standardized receipt enhances transparency and customer trust while streamlining business operations.

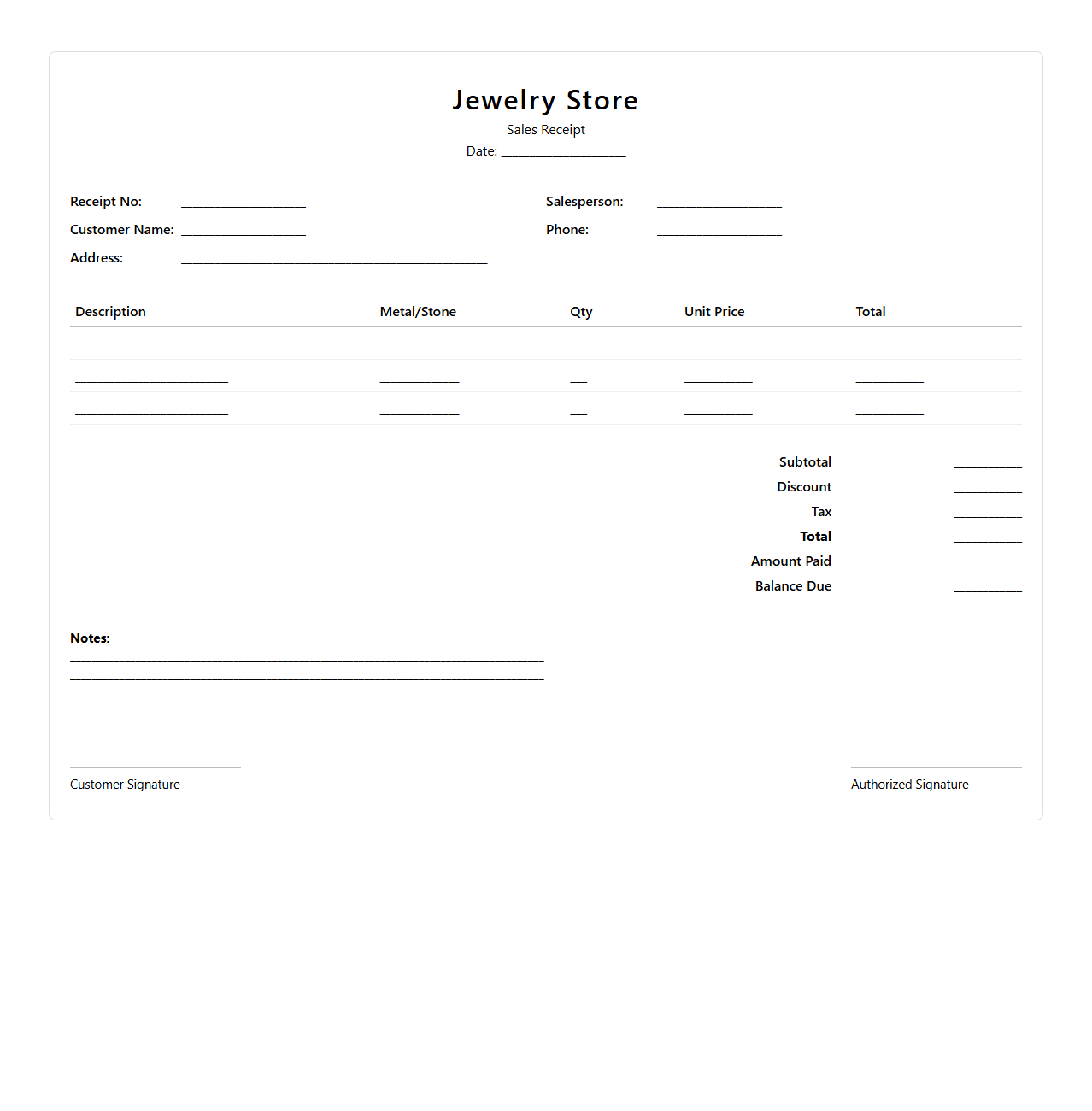

Pharmacy Retail Sales Invoice Format

A

Pharmacy Retail Sales Invoice Format document is a standardized template used to record the sale of medicines and health products in a pharmacy. It includes essential details such as customer information, product names, quantities, prices, batch numbers, expiration dates, and payment methods, ensuring accurate transaction tracking and compliance with regulatory standards. This format helps maintain transparent records for inventory management, customer reference, and legal auditing purposes.

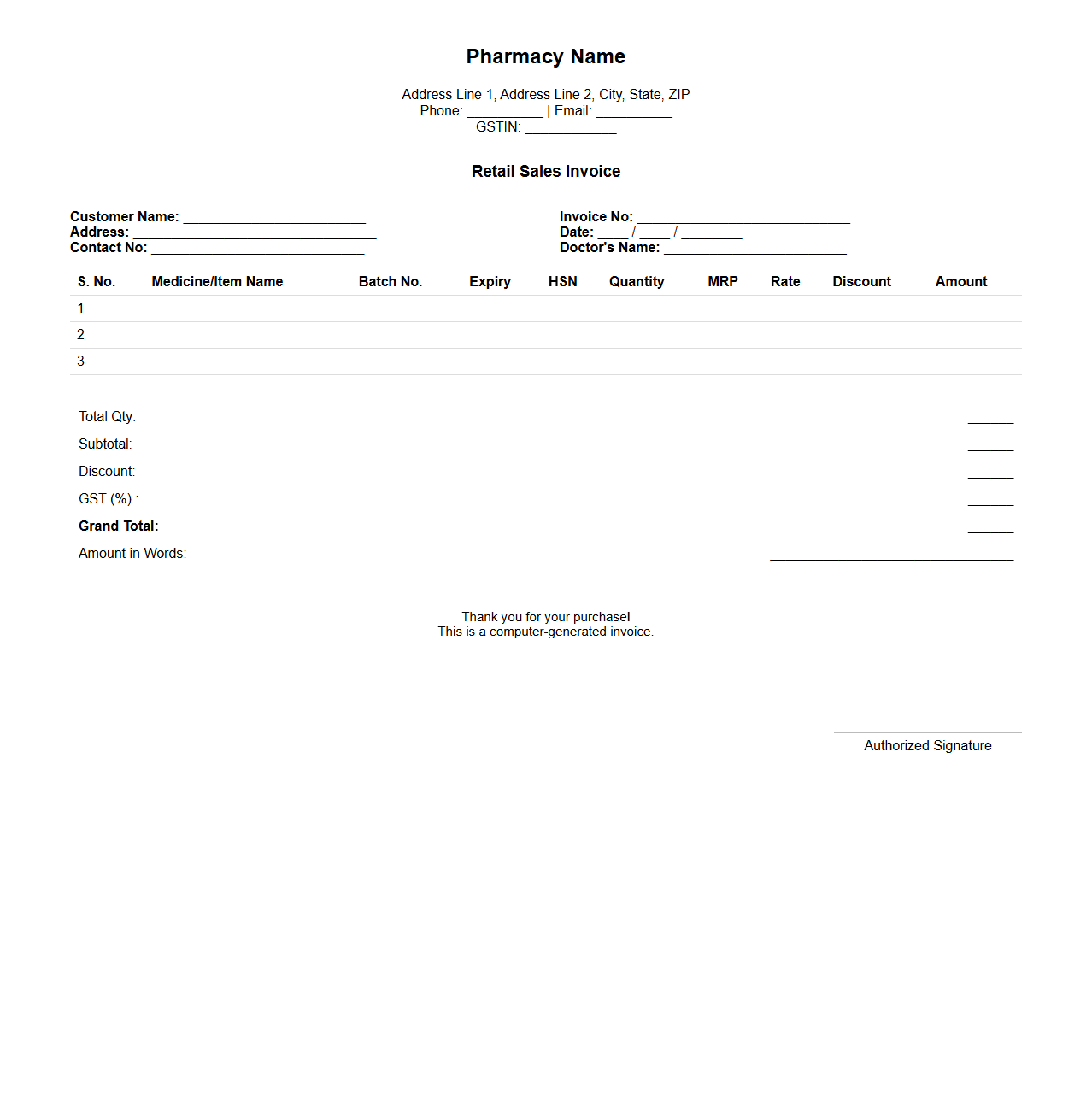

Bookstore Sales Invoice Sample

A

Bookstore Sales Invoice Sample document is a detailed record of a transaction between a bookstore and a customer, outlining purchased items, prices, quantities, taxes, and total amount due. This invoice serves as proof of purchase and is essential for inventory management, accounting, and customer service. It typically includes critical information such as invoice number, date, payment terms, and store contact details.

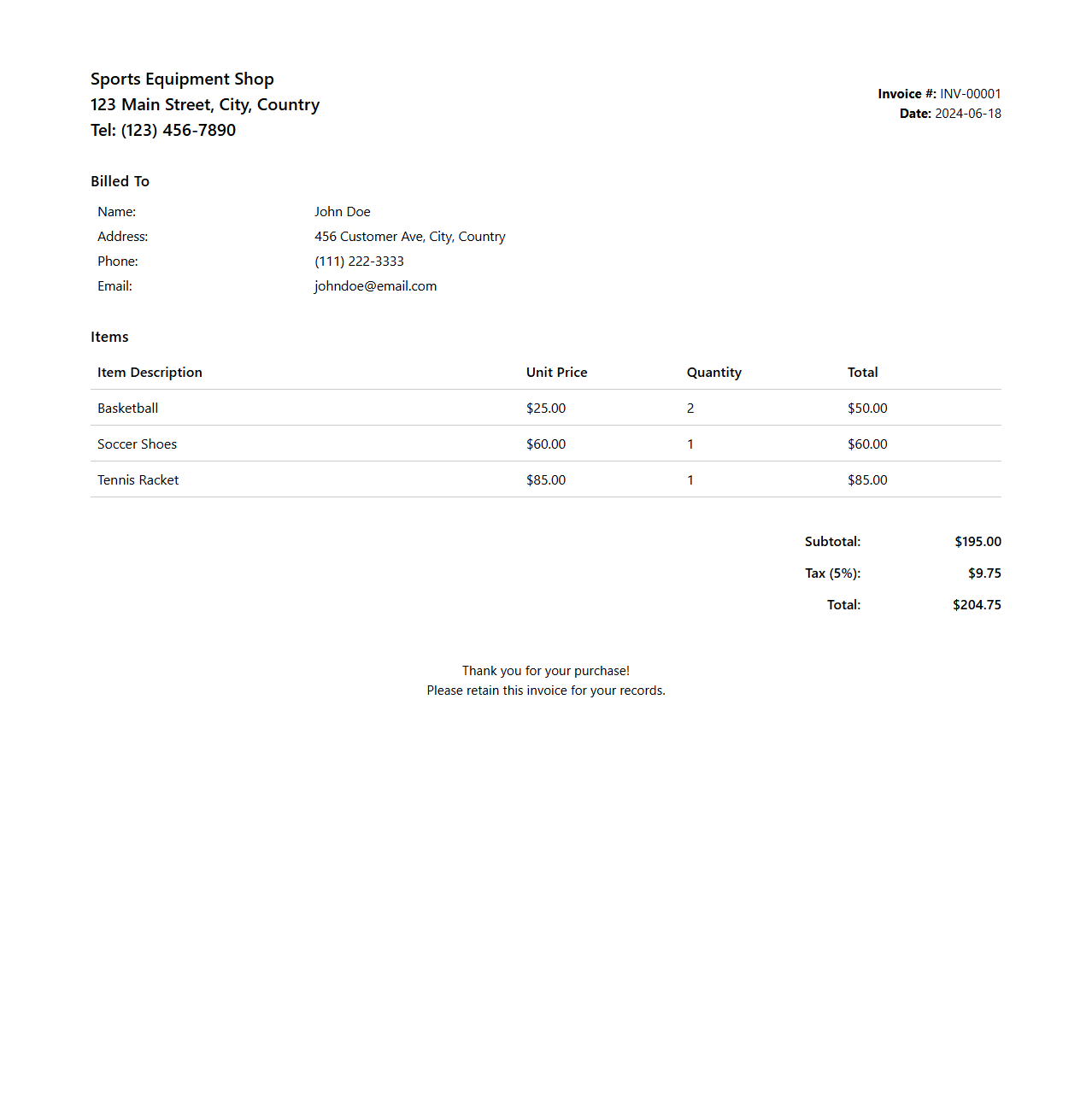

Sports Equipment Shop Invoice Document

A

Sports Equipment Shop Invoice Document is a formal record detailing the sale of sports gear and accessories, including item descriptions, quantities, prices, and transaction dates. It serves as proof of purchase for customers and a financial record for the retailer to track sales and manage inventory. This document also ensures transparency in billing and supports accounting and tax reporting processes.

Home Appliance Retail Invoice Template

A

Home Appliance Retail Invoice Template is a structured document used by retailers to itemize sales transactions involving home appliances such as refrigerators, washing machines, and microwaves. It includes essential details like product descriptions, quantities, unit prices, total amounts, taxes, and customer information to ensure accurate billing and record-keeping. This template streamlines the invoicing process, enhances professionalism, and facilitates efficient financial tracking for both sellers and buyers.

What key customer information is typically included on a retail sales invoice document?

A retail sales invoice typically includes customer name, contact details, and billing address to ensure accurate transaction identification. The inclusion of a valid phone number and email address facilitates communication regarding the order. Additionally, customer identification numbers or account IDs may be present for loyalty or tracking purposes.

Which sections of a sales invoice sample detail the products or services sold?

The product or service description section lists the items sold along with their specifications. Each line typically includes quantity, unit price, and total price to clarify the transaction details. This section may also include product codes or SKU numbers for inventory tracking.

How does the sales invoice document indicate payment terms and due dates?

Payment terms are usually displayed in a dedicated payment terms section specifying conditions like "Net 30" or "Due on Receipt." The due date is explicitly mentioned to inform the customer when payment must be completed by. Clear terms help minimize disputes and ensure timely payments.

What tax-related fields are commonly present on a retail store sales invoice?

Common tax-related fields include the tax rate, tax amount, and tax identification numbers relevant to the transaction. The invoice often specifies whether prices include tax or if tax is added separately. This transparency is crucial for compliance and customer clarity.

Where is the total payable amount clearly displayed on a standard retail sales invoice?

The total payable amount is prominently displayed, typically at the bottom or in the summary section of the invoice. It reflects the sum of product costs, taxes, and any additional fees. This clear visibility ensures customers know the exact amount due for payment.