A Beneficiary Nomination Document Sample for Term Life Insurance clearly outlines the designated individuals who will receive the policy's death benefit upon the insured's passing. This document ensures that the payout is distributed according to the policyholder's wishes, avoiding disputes among heirs. It serves as a crucial part of the insurance process by providing legal proof of the beneficiary designation.

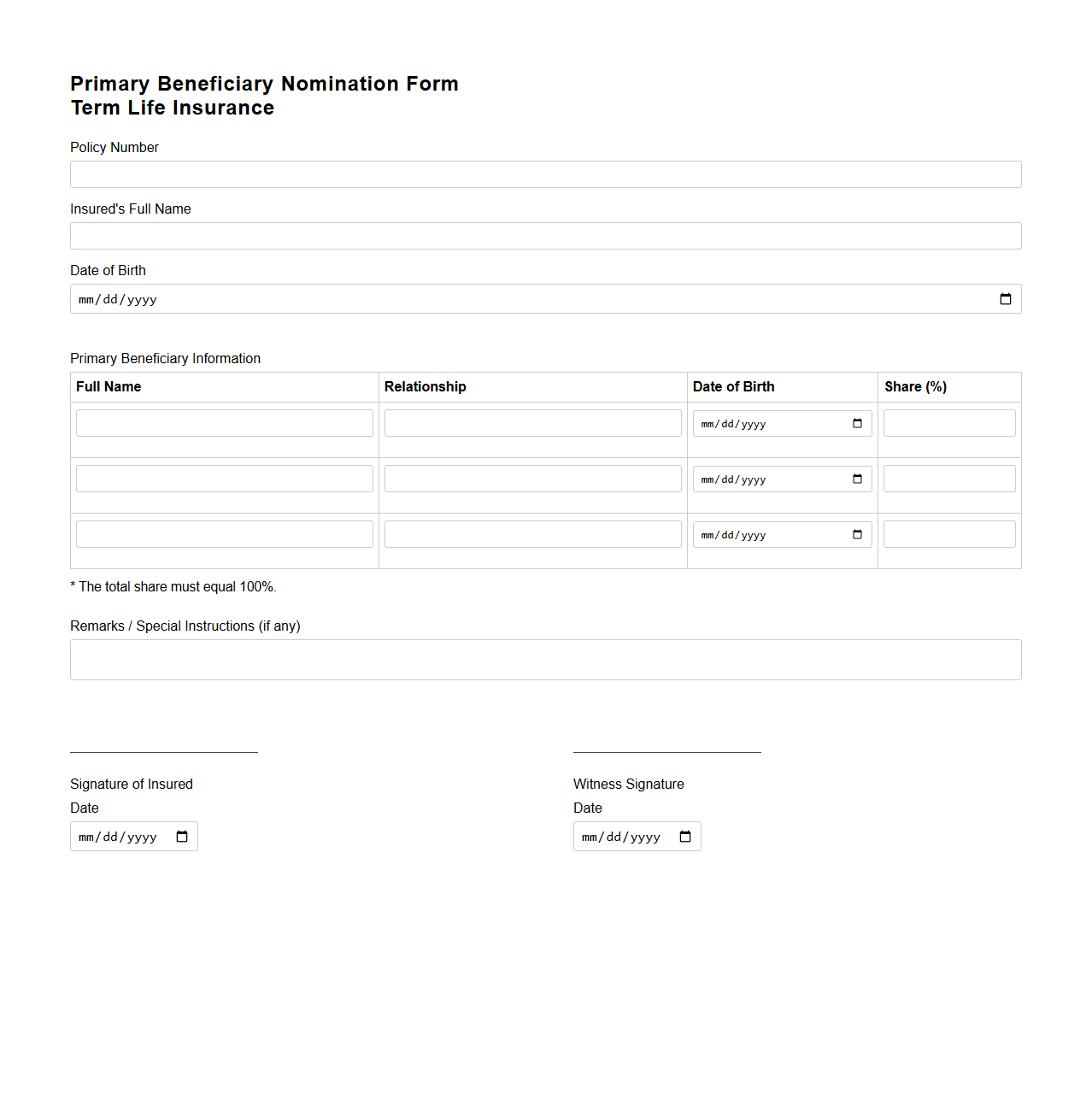

Primary Beneficiary Nomination Form for Term Life Insurance

The

Primary Beneficiary Nomination Form for Term Life Insurance is a legal document that designates the individual(s) or entity who will receive the policy's death benefit upon the insured's passing. This form ensures that the payout is distributed according to the policyholder's wishes, avoiding potential disputes or delays. Proper completion and updating of this form is crucial to maintaining clear beneficiary instructions for the insurance provider.

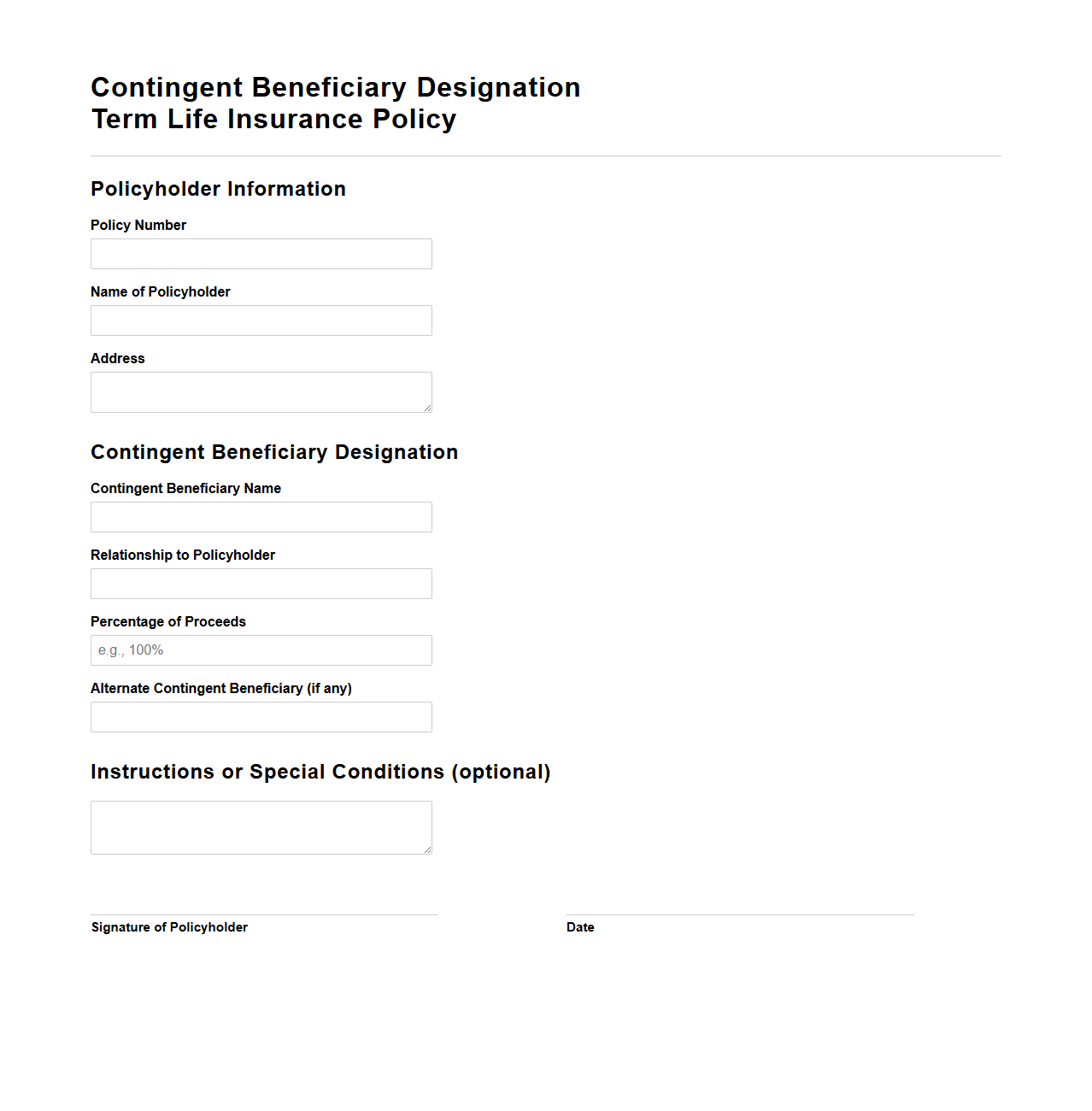

Contingent Beneficiary Designation Template for Term Life Policy

A

Contingent Beneficiary Designation Template for a Term Life Policy document specifies the secondary individuals or entities entitled to receive the policy benefits if the primary beneficiary is deceased or unable to claim the proceeds. This template ensures clarity and legal precision in naming alternate recipients, helping avoid disputes and delays in benefit distribution. Proper use of this document supports efficient estate planning and protects the policyholder's intentions.

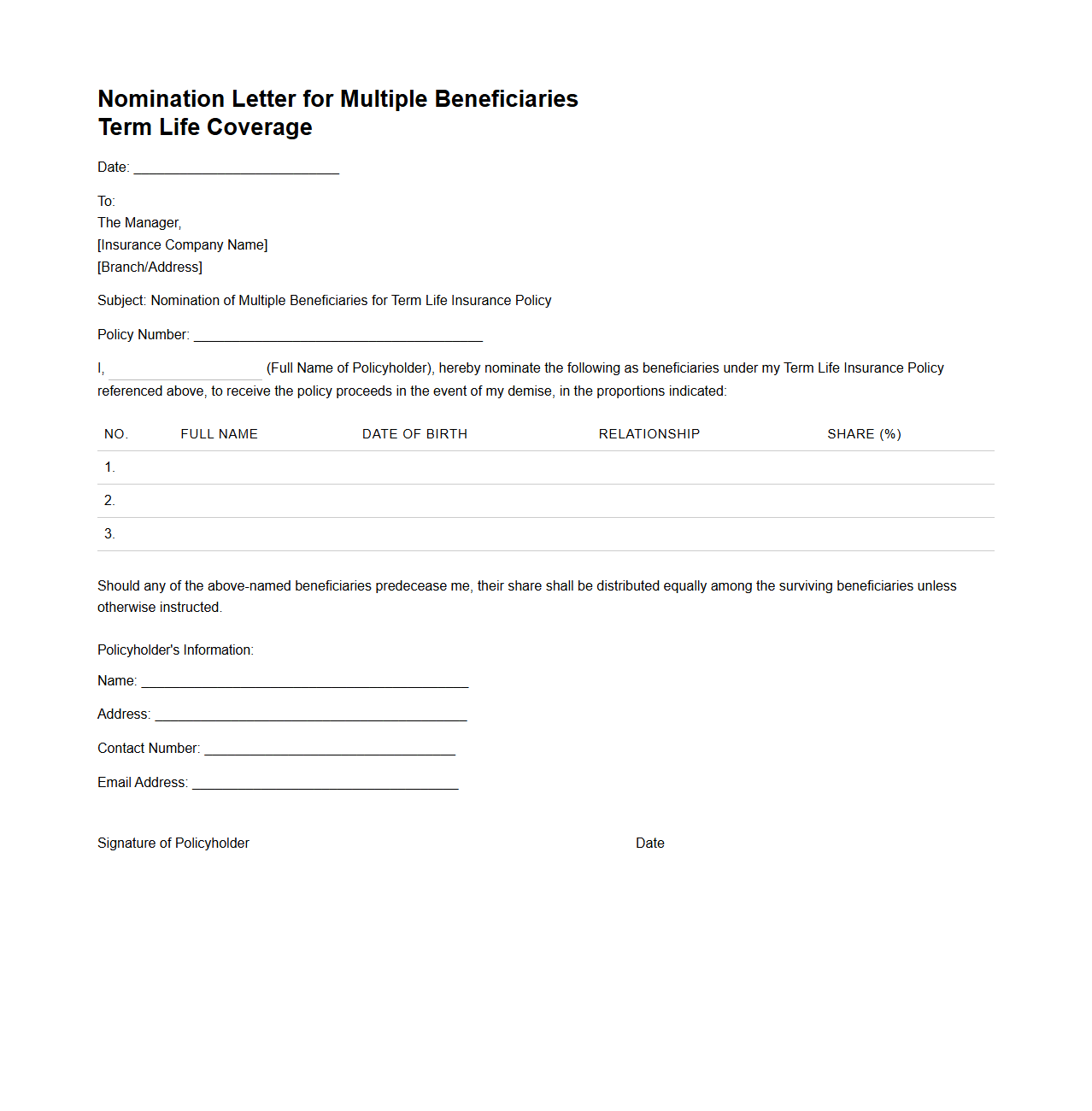

Multiple Beneficiaries Nomination Letter for Term Life Coverage

A

Multiple Beneficiaries Nomination Letter for Term Life Coverage is a formal document used to designate more than one beneficiary to receive the death benefit from a term life insurance policy. It specifies the names, relationships, and percentage shares allocated to each beneficiary, ensuring clarity in the distribution of proceeds. This letter helps prevent disputes and ensures the policyholder's wishes are honored upon their passing.

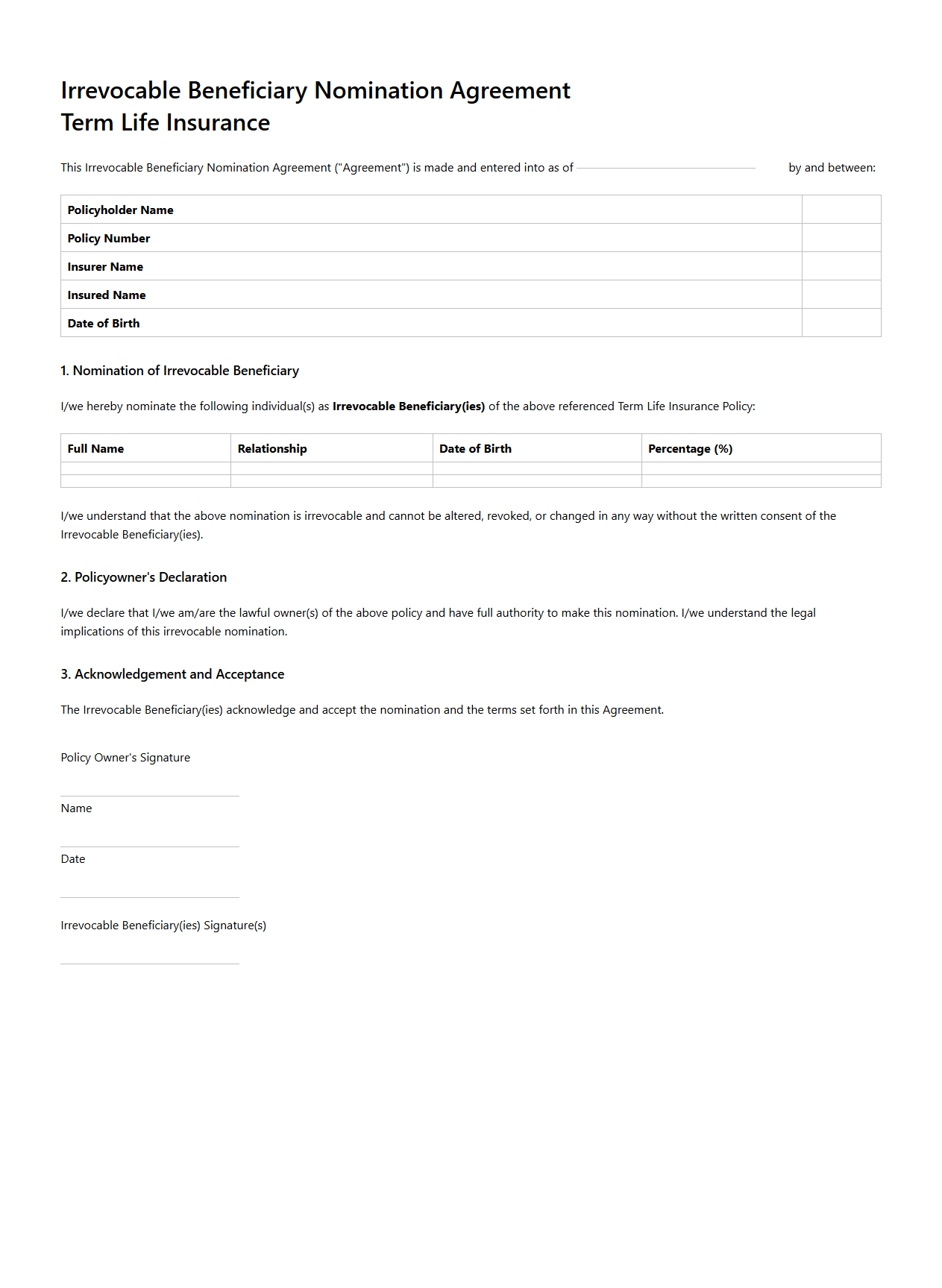

Irrevocable Beneficiary Nomination Agreement for Term Life Insurance

An

Irrevocable Beneficiary Nomination Agreement for Term Life Insurance is a legal contract that designates a specific beneficiary who cannot be changed without their consent. This agreement ensures that the life insurance proceeds are securely directed to the chosen beneficiary, providing financial protection and certainty. It is commonly used in estate planning to safeguard the interests of dependents or business partners.

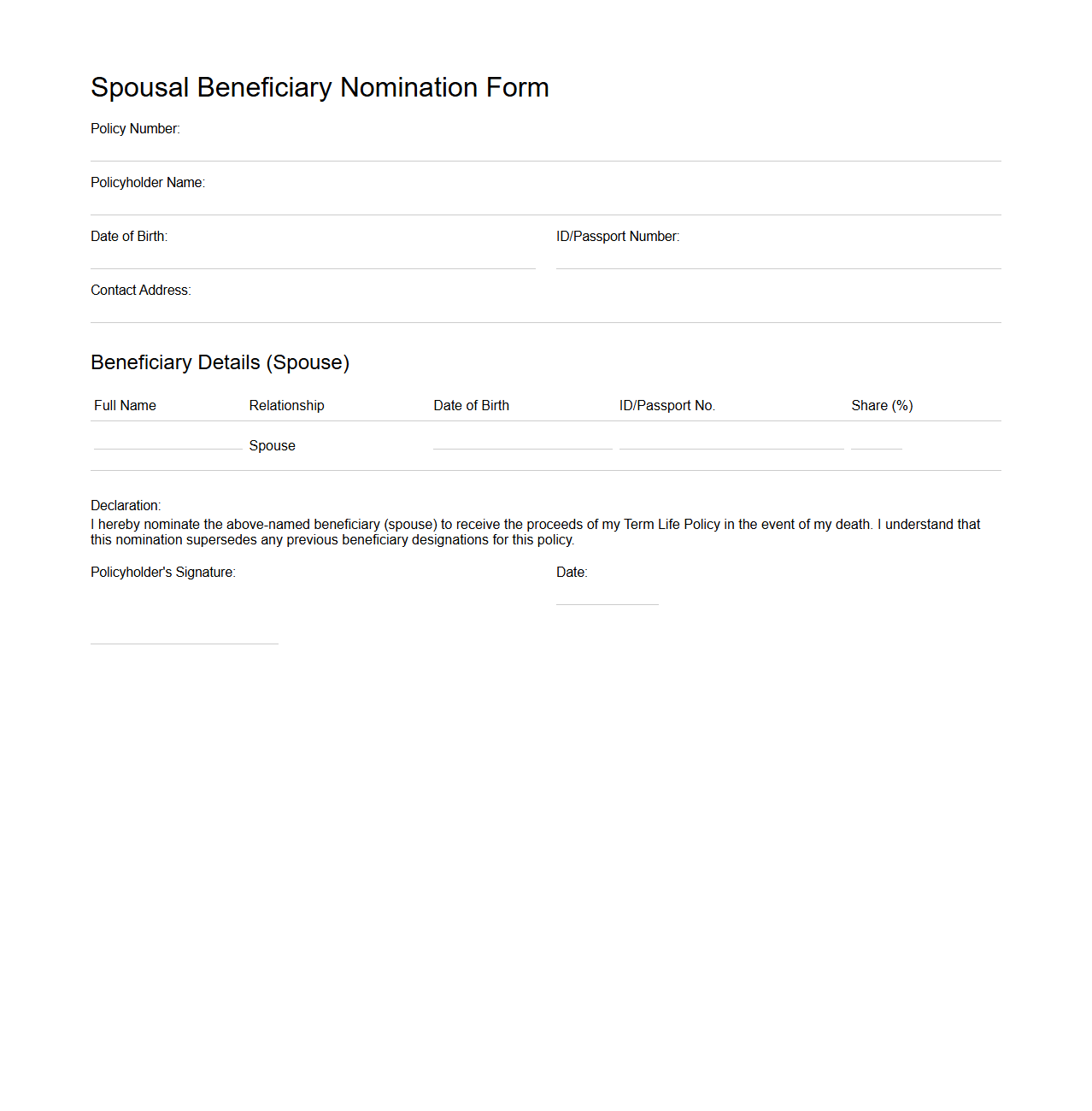

Spousal Beneficiary Nomination Sample for Term Life Policy

A

Spousal Beneficiary Nomination Sample for a Term Life Policy document illustrates how policyholders can legally designate their spouse as the primary recipient of death benefits. This sample ensures clarity in beneficiary designation, reducing disputes and expediting claim settlements. Properly completed, it serves as a binding agreement recognized by insurance providers and courts.

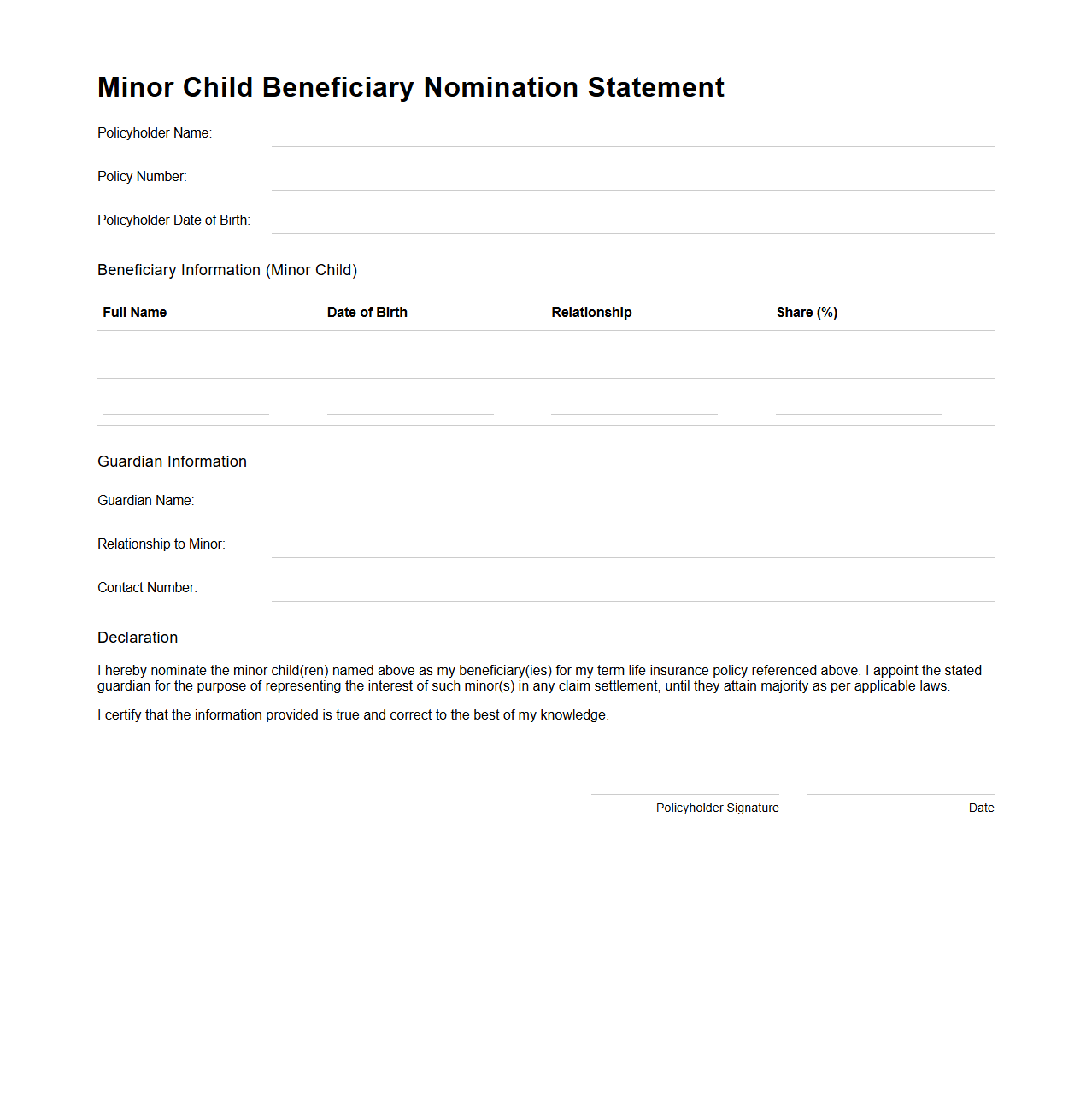

Minor Child Beneficiary Nomination Statement for Term Life Insurance

A

Minor Child Beneficiary Nomination Statement for Term Life Insurance is a legal document that designates a minor child as the beneficiary of a term life insurance policy. This statement ensures that the insurance proceeds are directed specifically to the minor child, often requiring the appointment of a guardian or trustee to manage the funds until the child reaches legal adulthood. This nomination protects the child's financial interests and provides clarity on the distribution of the death benefit.

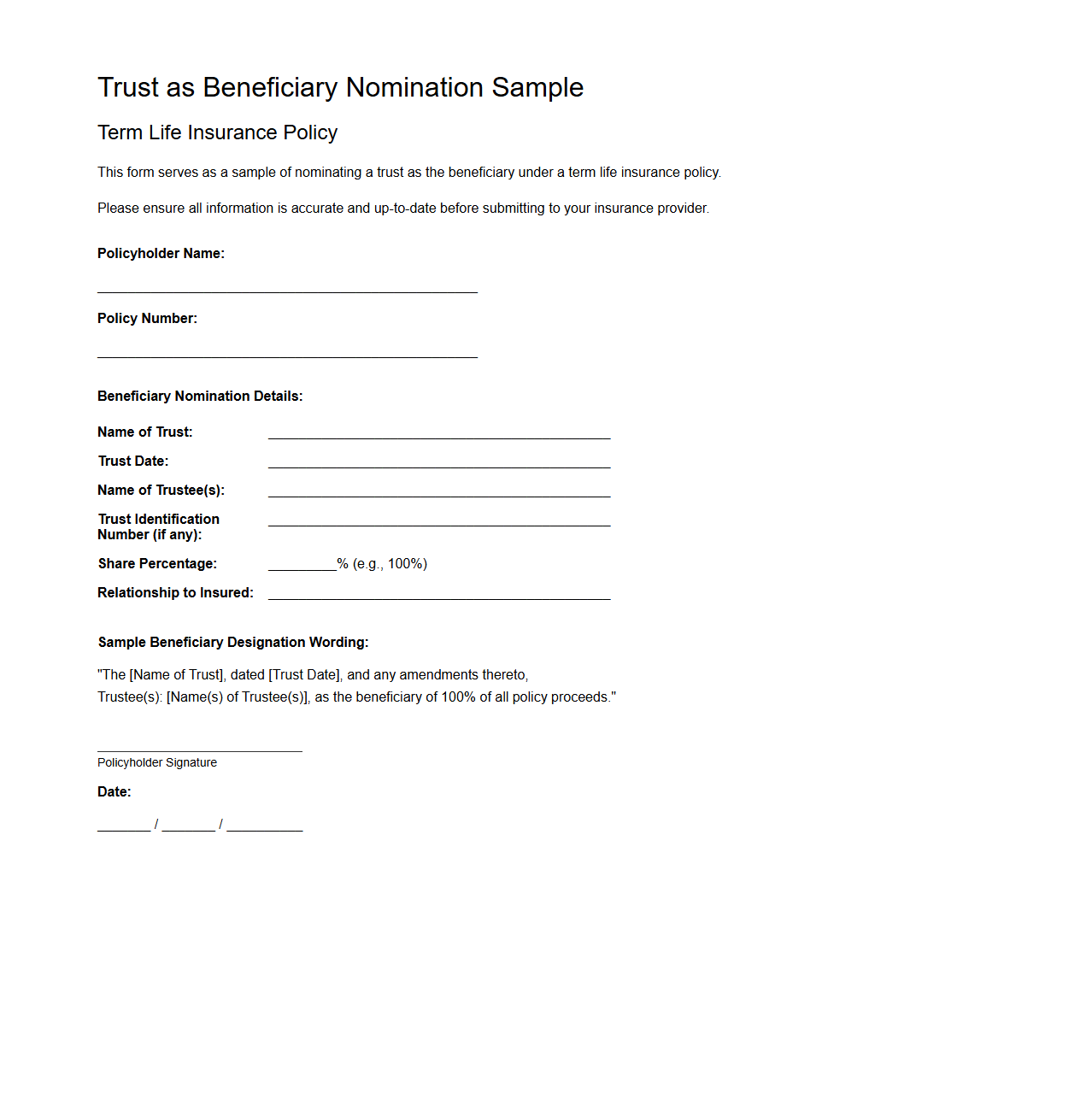

Trust as Beneficiary Nomination Sample for Term Life Insurance

A

Trust as Beneficiary Nomination Sample for Term Life Insurance document outlines how policyholders designate a trust to receive life insurance proceeds upon their death. This legal arrangement ensures funds are managed according to the trust's terms, providing financial security and clear instructions for beneficiaries. Using a trust as beneficiary can also help avoid probate and offer potential tax benefits.

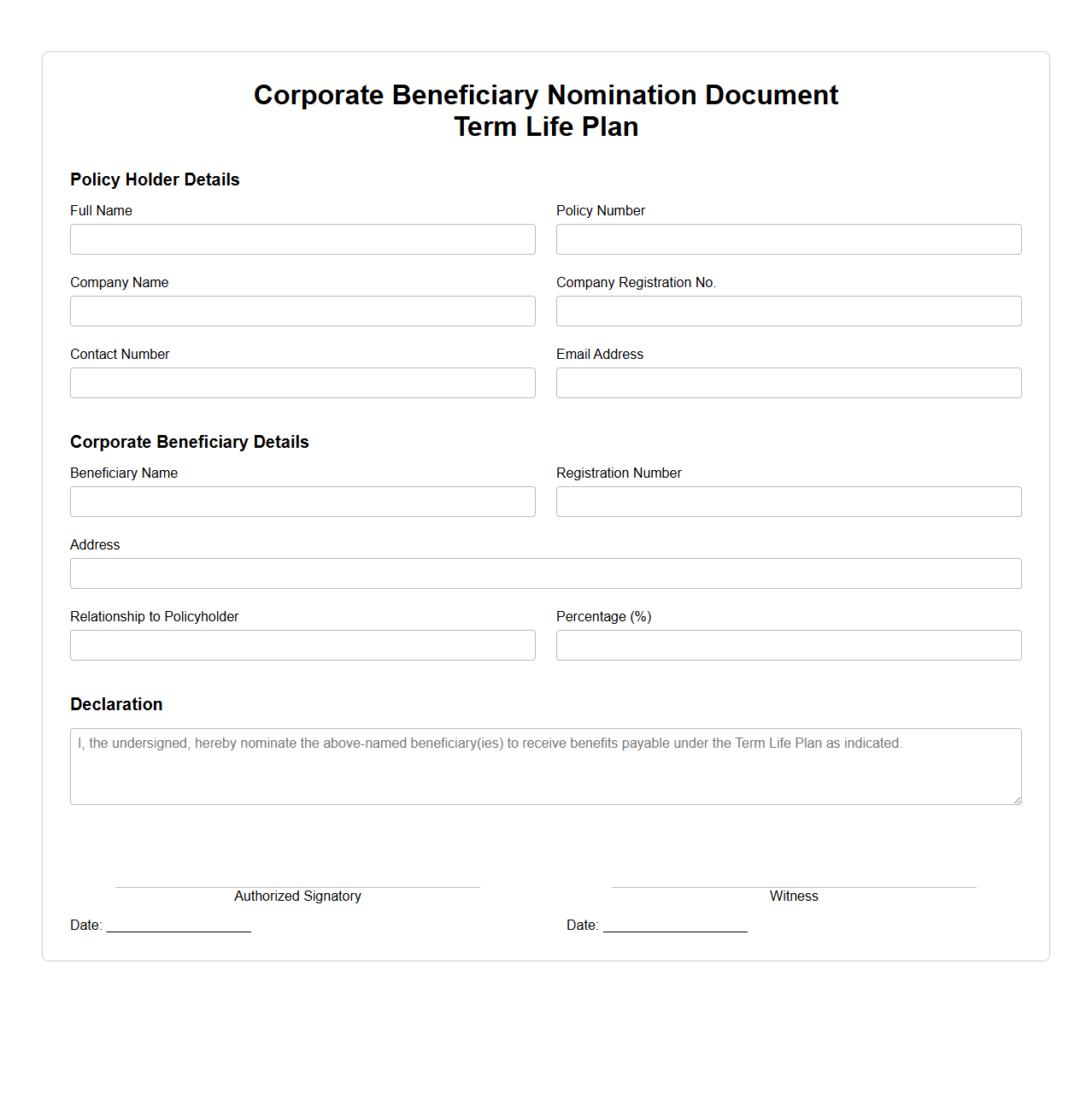

Corporate Beneficiary Nomination Document for Term Life Plan

A

Corporate Beneficiary Nomination Document for a Term Life Plan is a legal form that allows a corporation to designate specific individuals or entities as beneficiaries to receive the death benefit proceeds. This document ensures that the payout from the term life insurance policy is directed according to the corporation's intentions, providing financial protection to nominated parties. It is essential for clarifying beneficiary rights and avoiding disputes in the event of the insured employee's death.

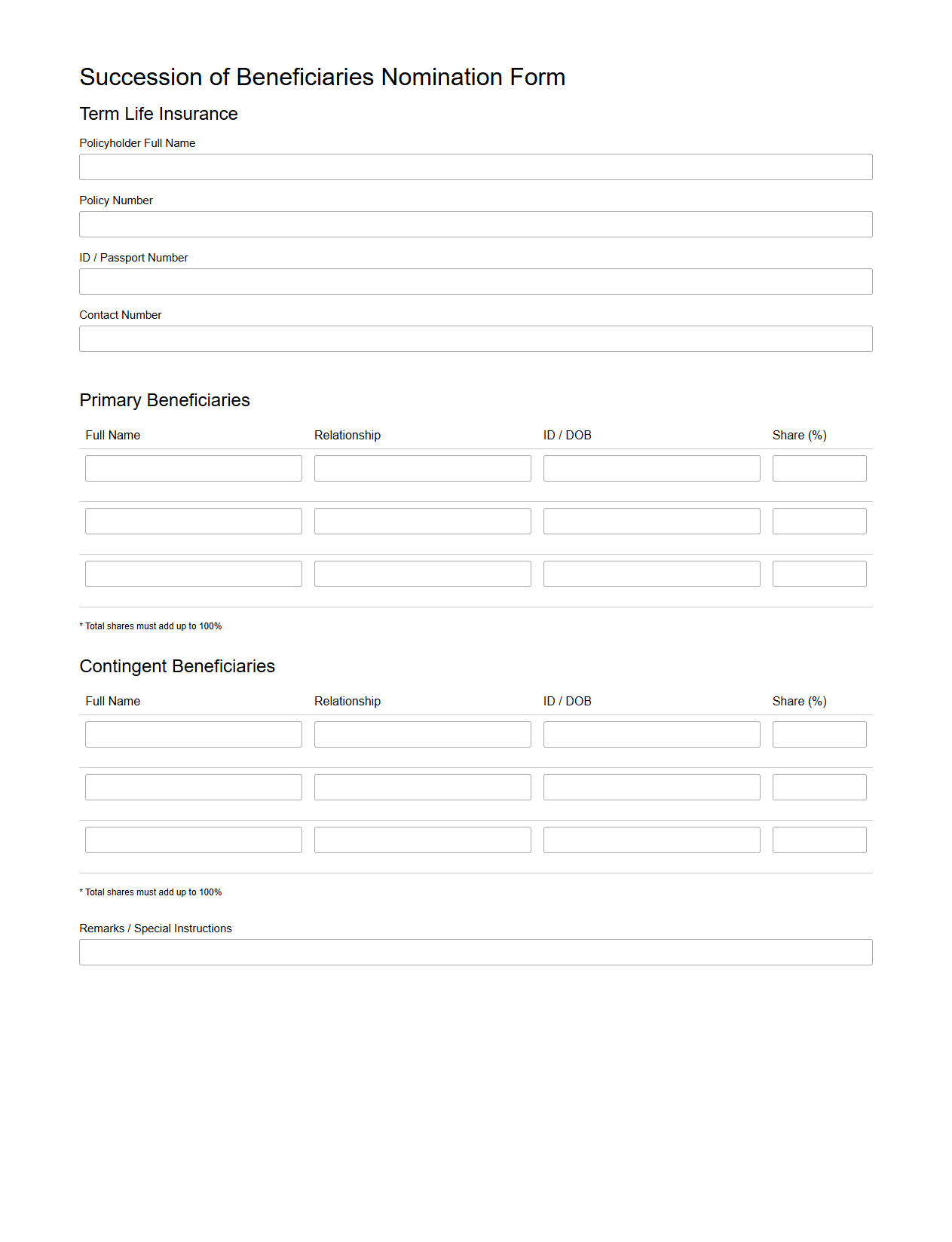

Succession of Beneficiaries Nomination Form for Term Life Insurance

The

Succession of Beneficiaries Nomination Form for Term Life Insurance is a legal document that allows policyholders to specify the order in which beneficiaries will receive the death benefit. This form ensures clarity and prevents disputes by outlining a clear succession plan for the distribution of insurance proceeds. It is essential for maintaining effective estate planning and protecting the insured's financial legacy.

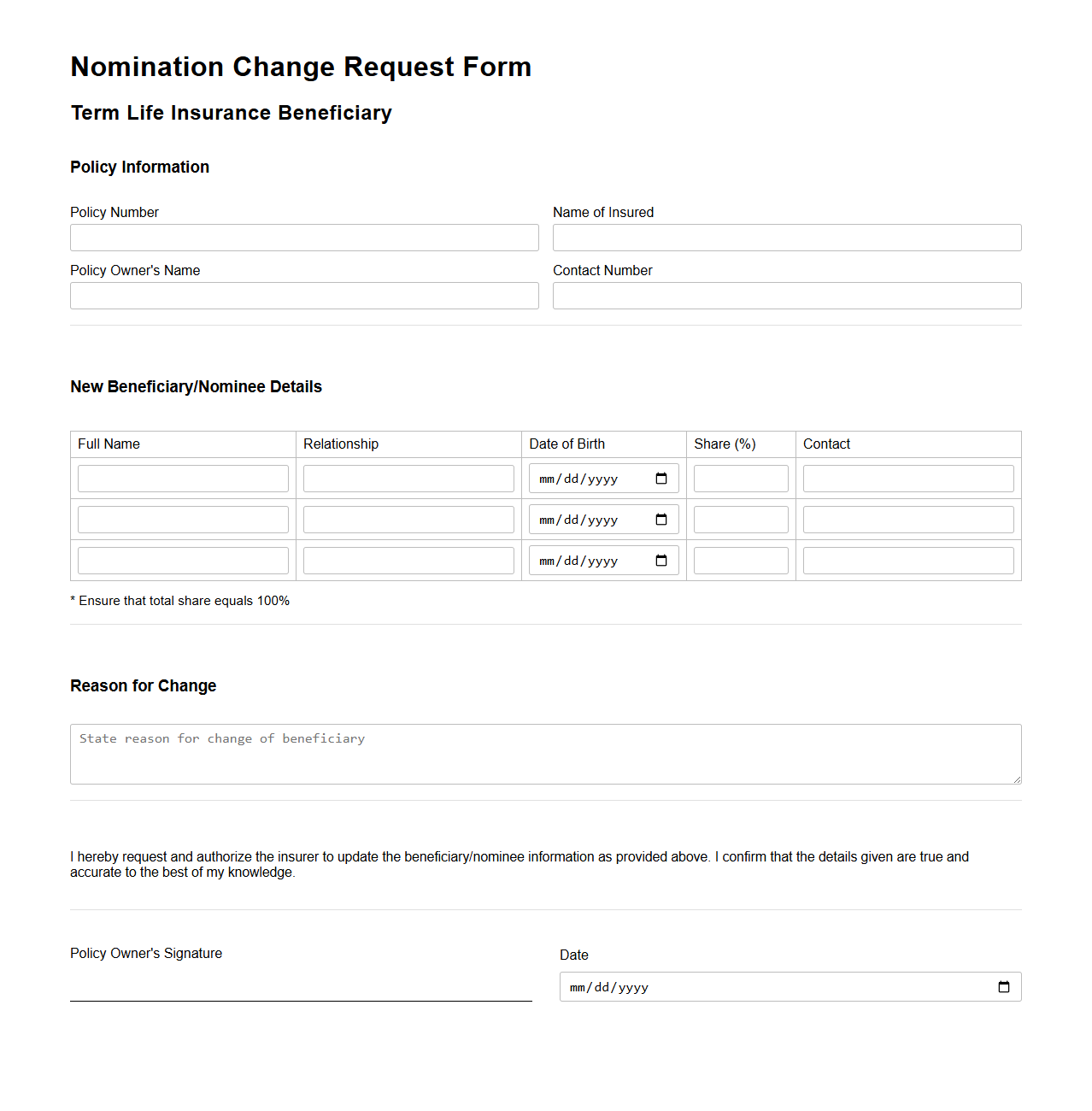

Nomination Change Request Form for Term Life Insurance Beneficiary

The

Nomination Change Request Form for Term Life Insurance Beneficiary is a formal document used to update or modify the designated beneficiary of a term life insurance policy. This form ensures that the policyholder's death benefits are directed according to their most current wishes, providing clarity and legal validation. Timely submission of this form is essential to avoid disputes and guarantee the proper distribution of insurance proceeds.

What information must be included to identify the primary beneficiary in a term life insurance nomination document?

The nomination document must include the full name of the primary beneficiary to ensure accurate identification. It should also provide the beneficiary's relationship to the policyholder and their contact details such as address or phone number. Precise information helps avoid disputes and ensures the correct individual receives the benefits.

How does the Beneficiary Nomination Document address contingent (secondary) beneficiaries?

The document outlines provisions for contingent beneficiaries who receive benefits if the primary beneficiary is deceased or unable to claim. It requires the policyholder to name these individuals clearly along with their details. This arrangement guarantees uninterrupted benefit distribution in the absence of the primary recipient.

What legal requirements must be met for a Beneficiary Nomination to be considered valid?

A valid nomination must be made in written form and signed by the policyholder to comply with legal standards. It should be witnessed or notarized depending on the jurisdiction's specific insurance laws. Meeting these requirements ensures the nomination is legally recognized and enforceable.

How does the document specify the proportion of benefits among multiple beneficiaries?

The document requires the policyholder to detail the percentage or share of the total benefits allocated to each beneficiary. Clear specification of proportions prevents confusion and potential conflicts among the beneficiaries. It is essential that the total allocation percentages add up to 100%.

What procedures are outlined in the document for updating or revoking a beneficiary nomination?

The document typically sets forth a process for the policyholder to update or revoke a nomination by submitting a formal written request. It often requires the same level of authorization and witnessing as the original nomination. These procedures ensure that changes are documented and legally valid to protect all parties involved.