A Underwriting Questionnaire Document Sample for Critical Illness Insurance helps applicants provide detailed health and lifestyle information to assess eligibility. This document typically includes questions about medical history, family health background, and existing conditions to support accurate risk evaluation. Insurers use this sample to streamline the underwriting process and ensure comprehensive data collection.

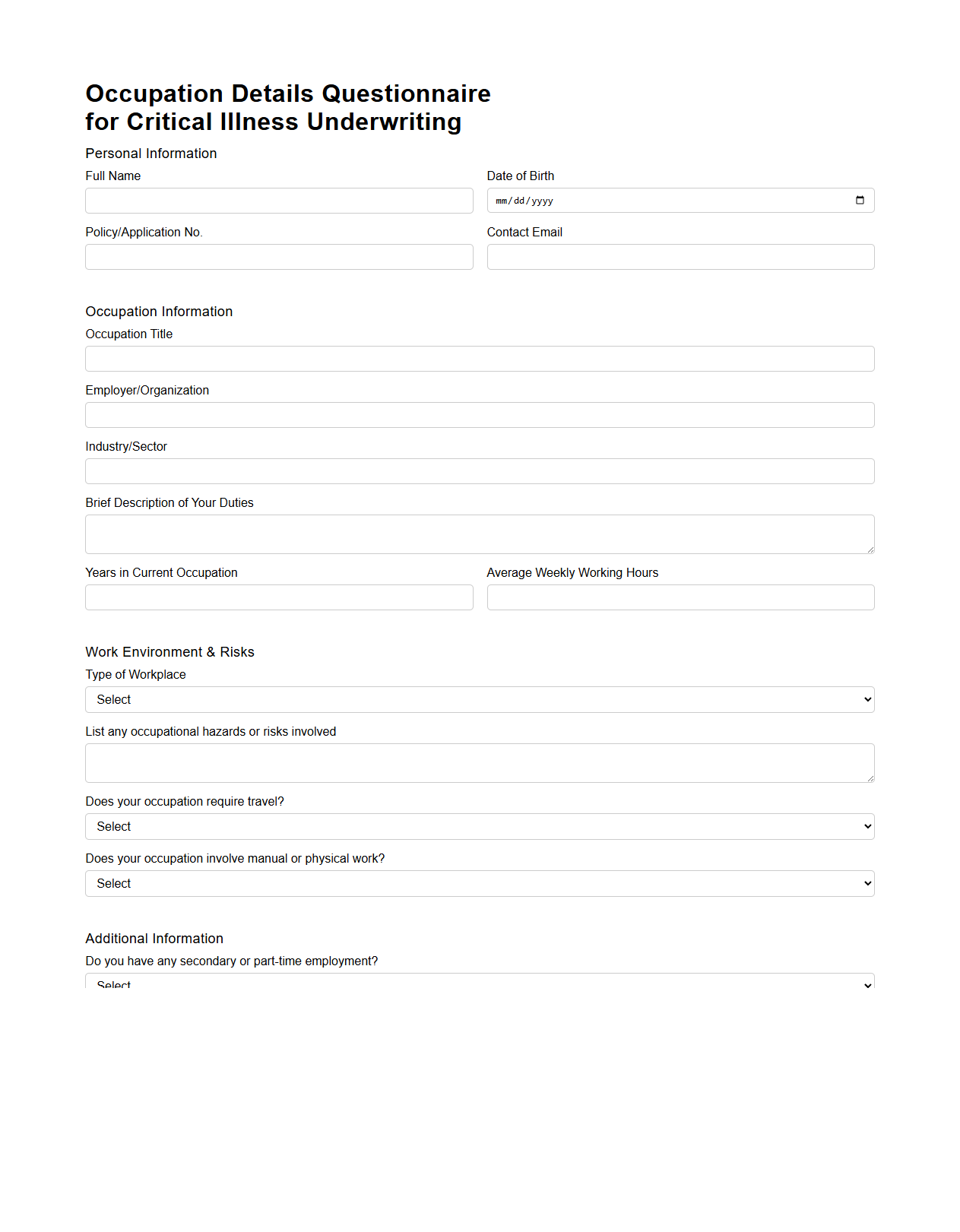

Occupation Details Questionnaire for Critical Illness Underwriting

The

Occupation Details Questionnaire for Critical Illness Underwriting is a specialized document used by insurance underwriters to assess the risk associated with an applicant's job. It collects detailed information about the nature of the applicant's occupation, including physical demands, exposure to hazardous environments, and stress levels that could impact the likelihood of critical illness. Accurate data from this questionnaire helps insurers determine appropriate premiums and coverage terms for critical illness policies.

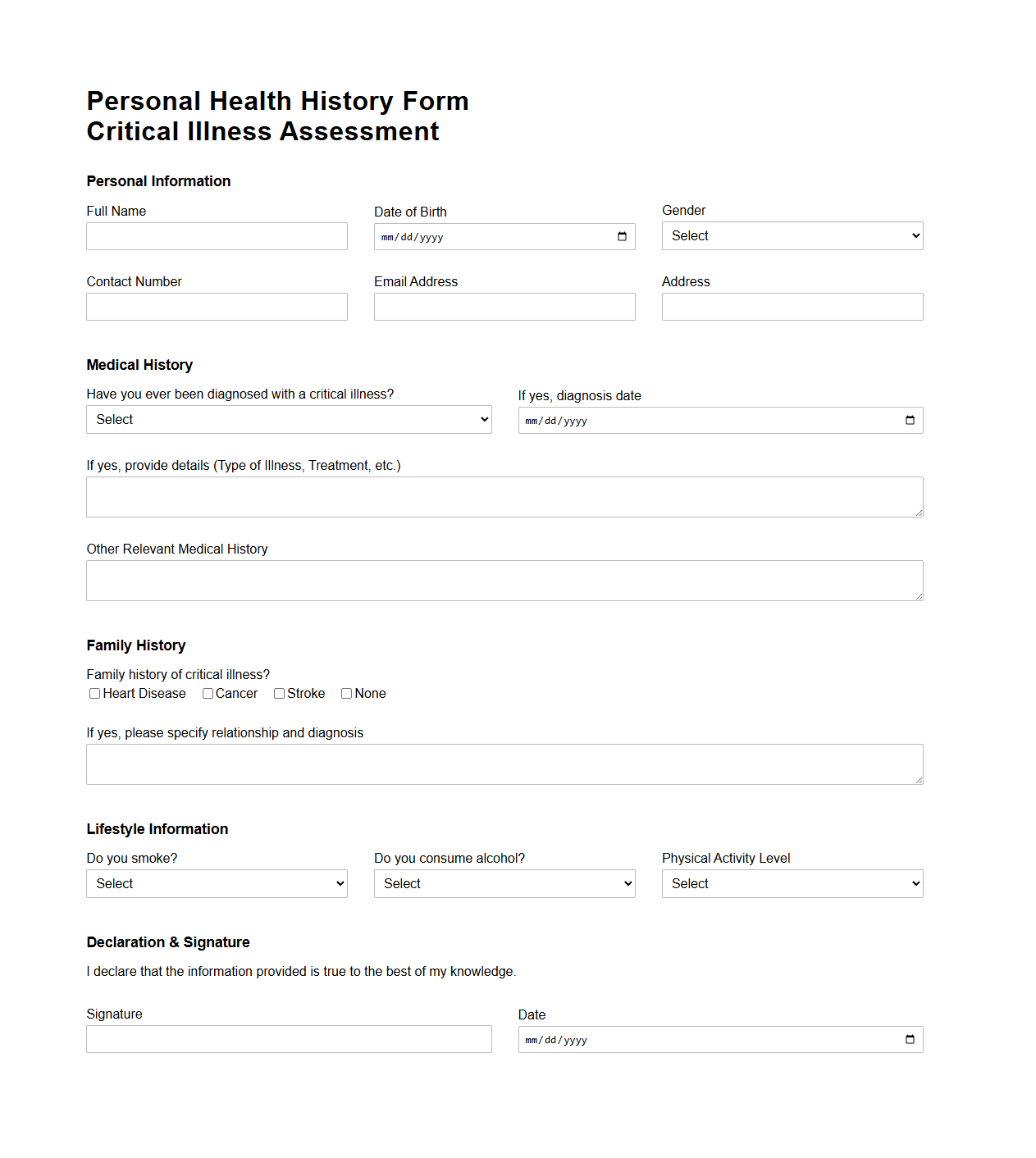

Personal Health History Form for Critical Illness Assessment

A

Personal Health History Form for Critical Illness Assessment is a document used to collect detailed information about an individual's past and current health conditions, family medical history, and lifestyle factors. This form helps healthcare providers evaluate the risk of developing critical illnesses such as cancer, heart disease, or stroke by analyzing personal and hereditary health data. Accurate completion of this form is crucial for personalized risk assessment and preventive healthcare planning.

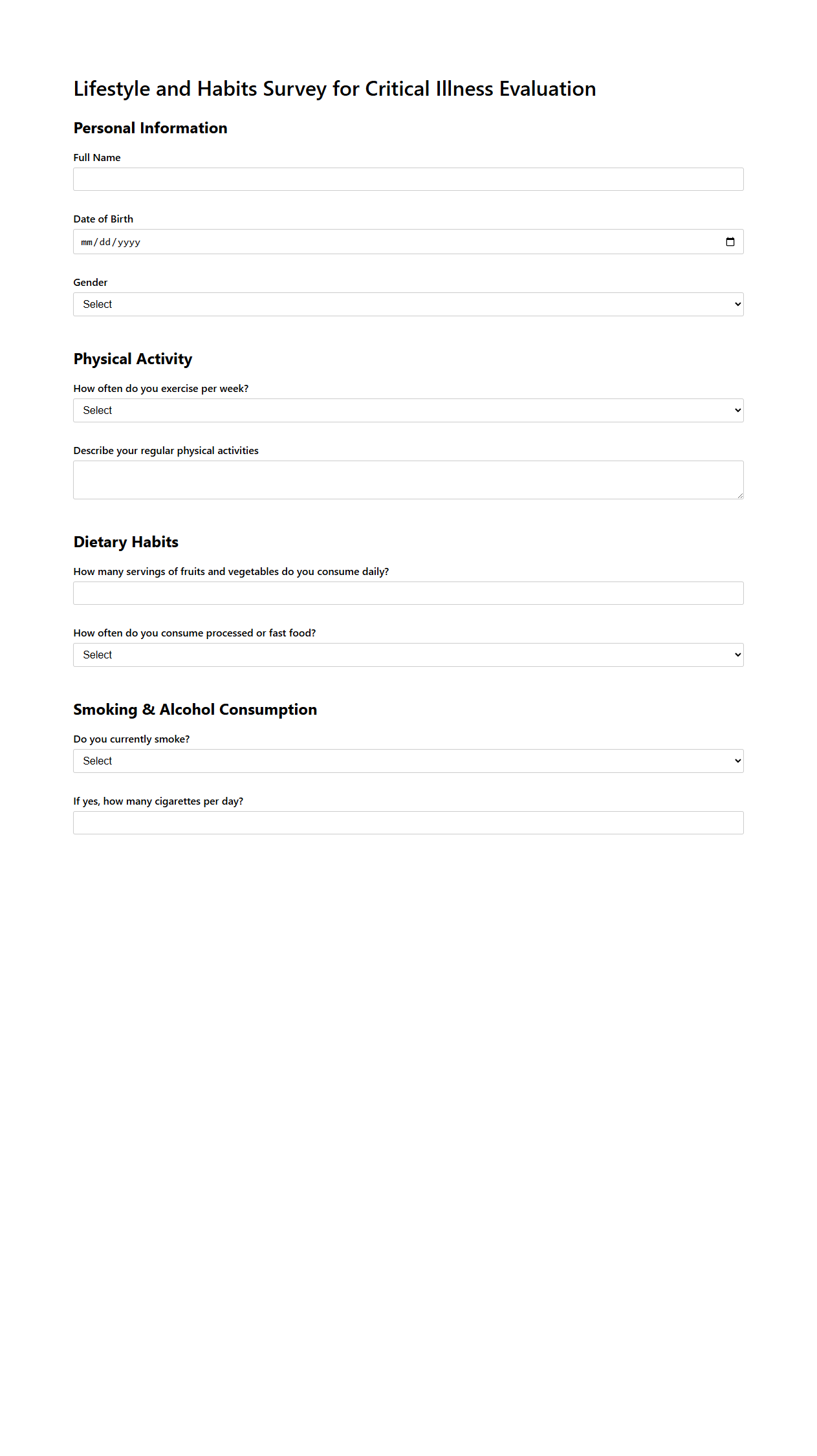

Lifestyle and Habits Survey for Critical Illness Evaluation

The

Lifestyle and Habits Survey for Critical Illness Evaluation document gathers detailed information about an individual's daily routines, health behaviors, and environmental factors to assess risk levels for critical illnesses. This survey analyzes patterns such as smoking, diet, physical activity, and stress, providing essential data to medical professionals for early detection and personalized preventive strategies. Accurate insights from this assessment enable improved disease management and enhanced patient care outcomes.

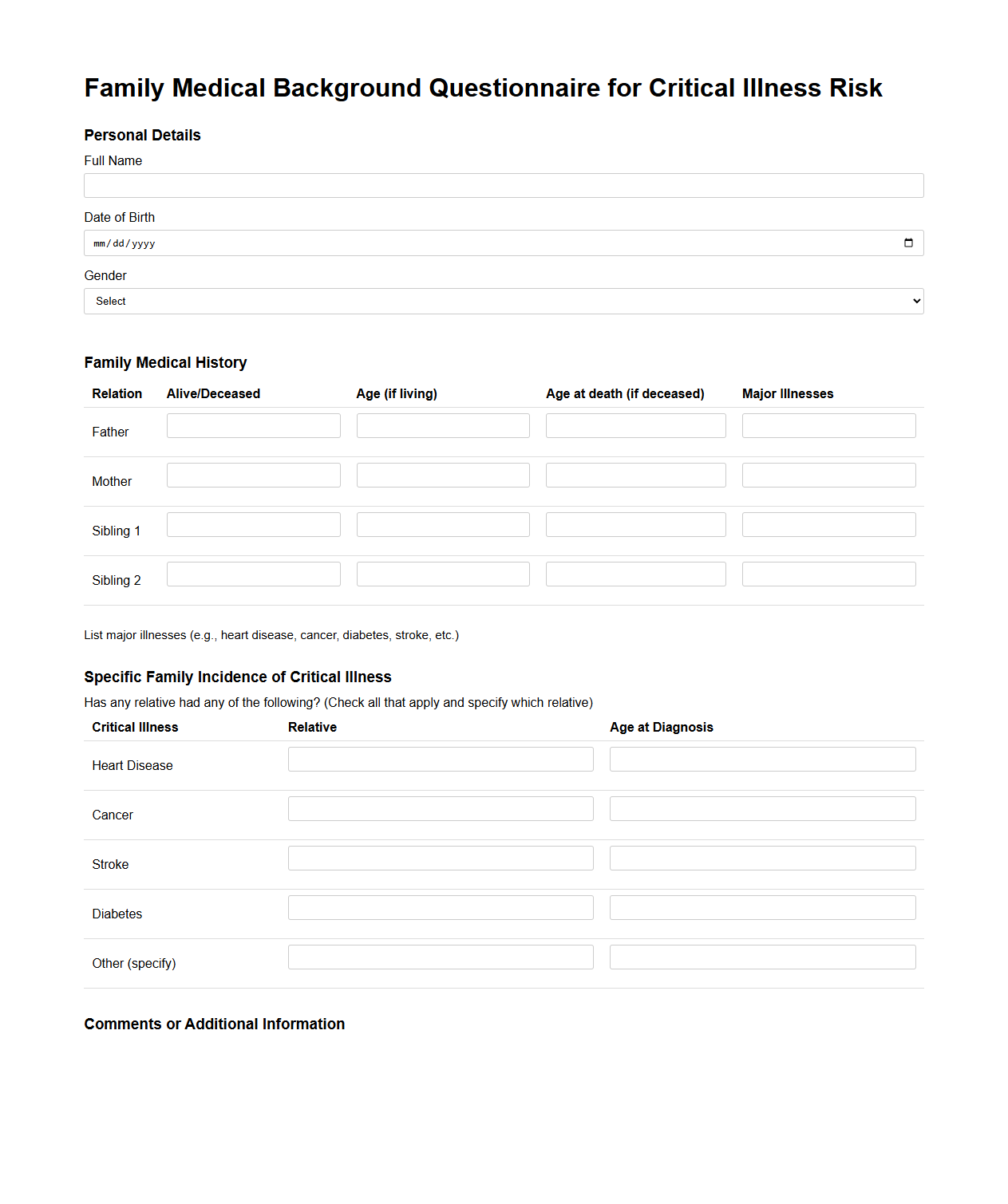

Family Medical Background Questionnaire for Critical Illness Risk

The

Family Medical Background Questionnaire for Critical Illness Risk document collects detailed information about the medical history of close relatives to assess an individual's susceptibility to hereditary diseases such as cancer, heart disease, and diabetes. This data helps healthcare providers and insurers to evaluate potential genetic risk factors and develop personalized prevention or treatment plans. Accurate completion of this questionnaire is essential for effective risk stratification and early intervention strategies.

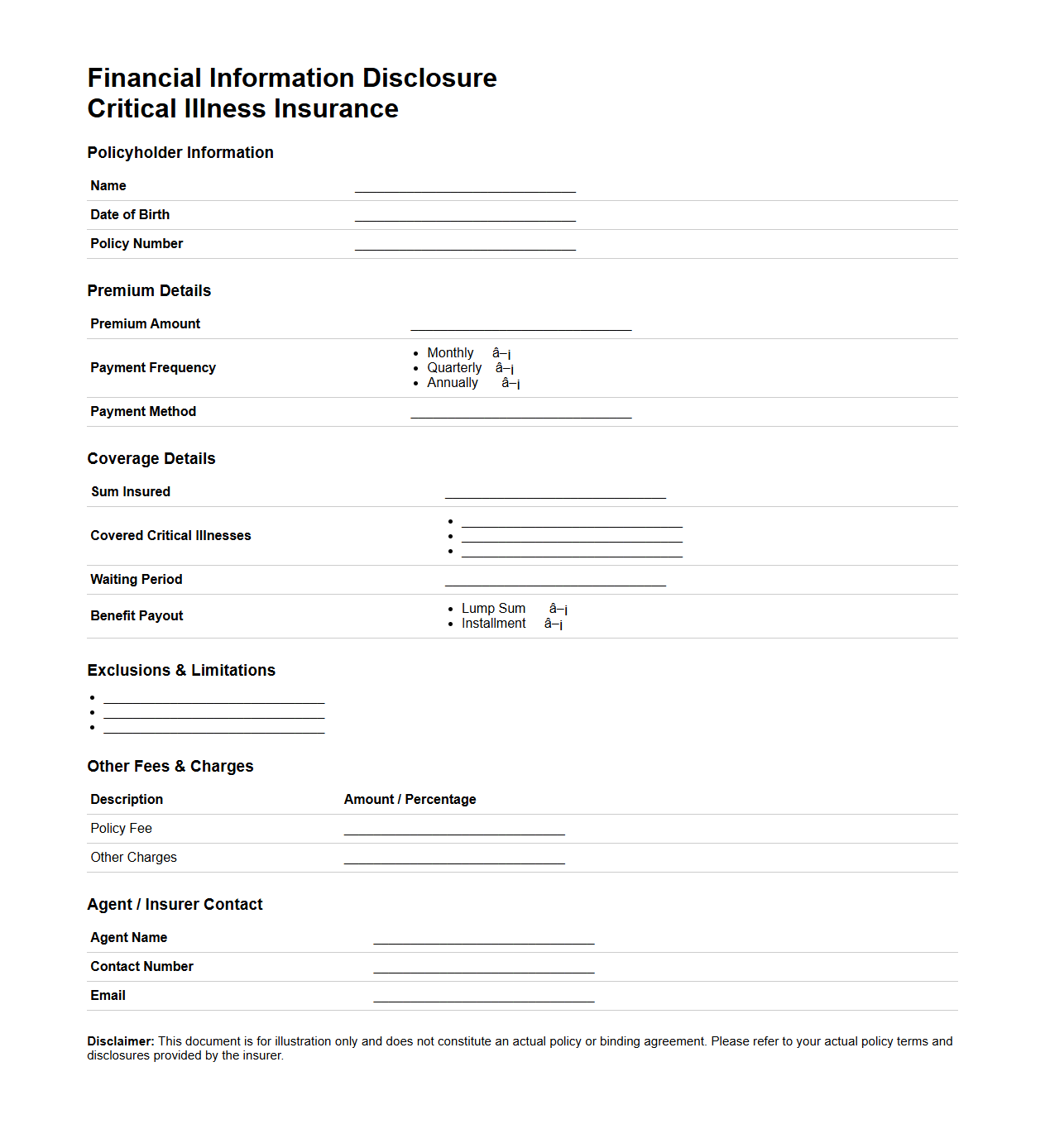

Financial Information Disclosure for Critical Illness Insurance

Financial Information Disclosure for Critical Illness Insurance document provides a detailed overview of an applicant's financial status to assess their ability to pay premiums and validate the insurance policy's suitability. It includes income, assets, debts, and other relevant financial data to ensure transparency and proper risk evaluation by the insurer. This

disclosure is essential for accurate underwriting and protecting both the insurer and the insured from potential financial misrepresentation.

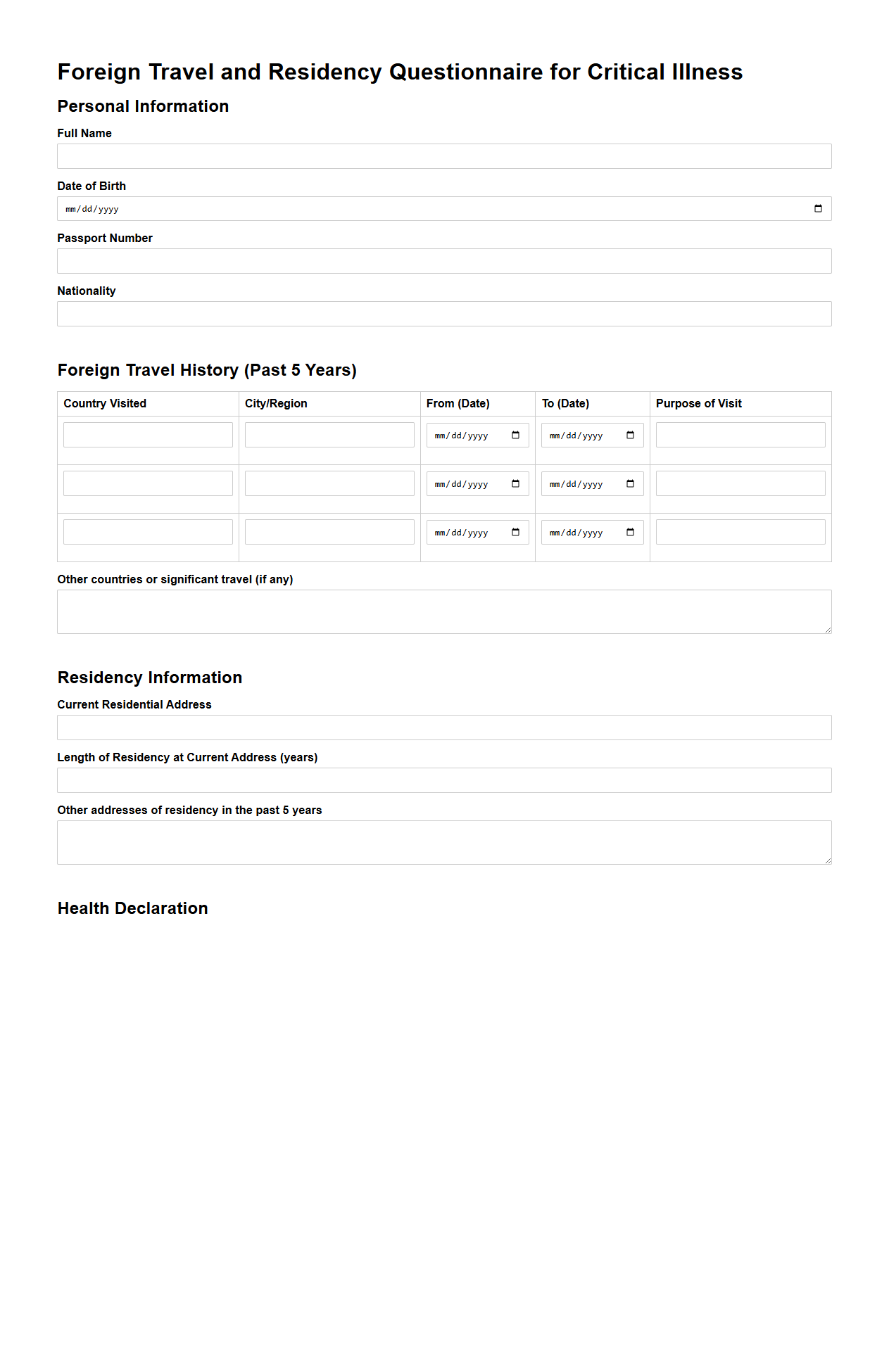

Foreign Travel and Residency Questionnaire for Critical Illness

The

Foreign Travel and Residency Questionnaire for Critical Illness document collects essential information about an individual's travel history and residency abroad to assess risk factors related to critical illness insurance coverage. It helps insurance providers evaluate exposure to health risks associated with different geographic regions, ensuring accurate underwriting and premium determination. This questionnaire is crucial for maintaining policy validity and tailoring coverage based on the applicant's international movements.

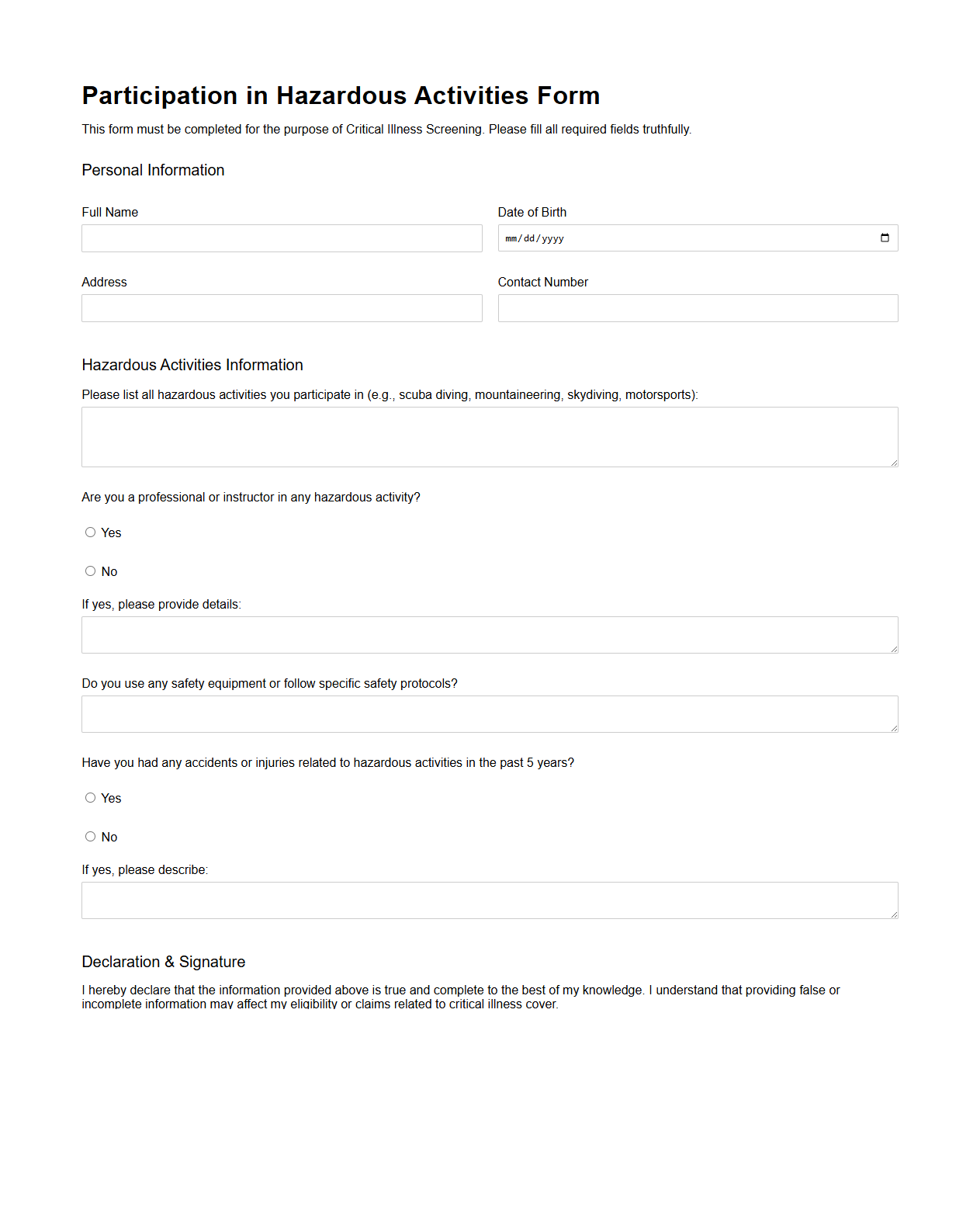

Participation in Hazardous Activities Form for Critical Illness Screening

The

Participation in Hazardous Activities Form for Critical Illness Screening is a crucial document used to assess an individual's involvement in high-risk activities that may increase their likelihood of developing critical health conditions. This form collects detailed information about participation in activities such as extreme sports, hazardous occupations, or other potentially dangerous hobbies, helping healthcare providers evaluate risk factors more accurately. Accurate completion of this form enhances the effectiveness of critical illness screening by identifying behaviors that could impact diagnosis, treatment, and insurance eligibility.

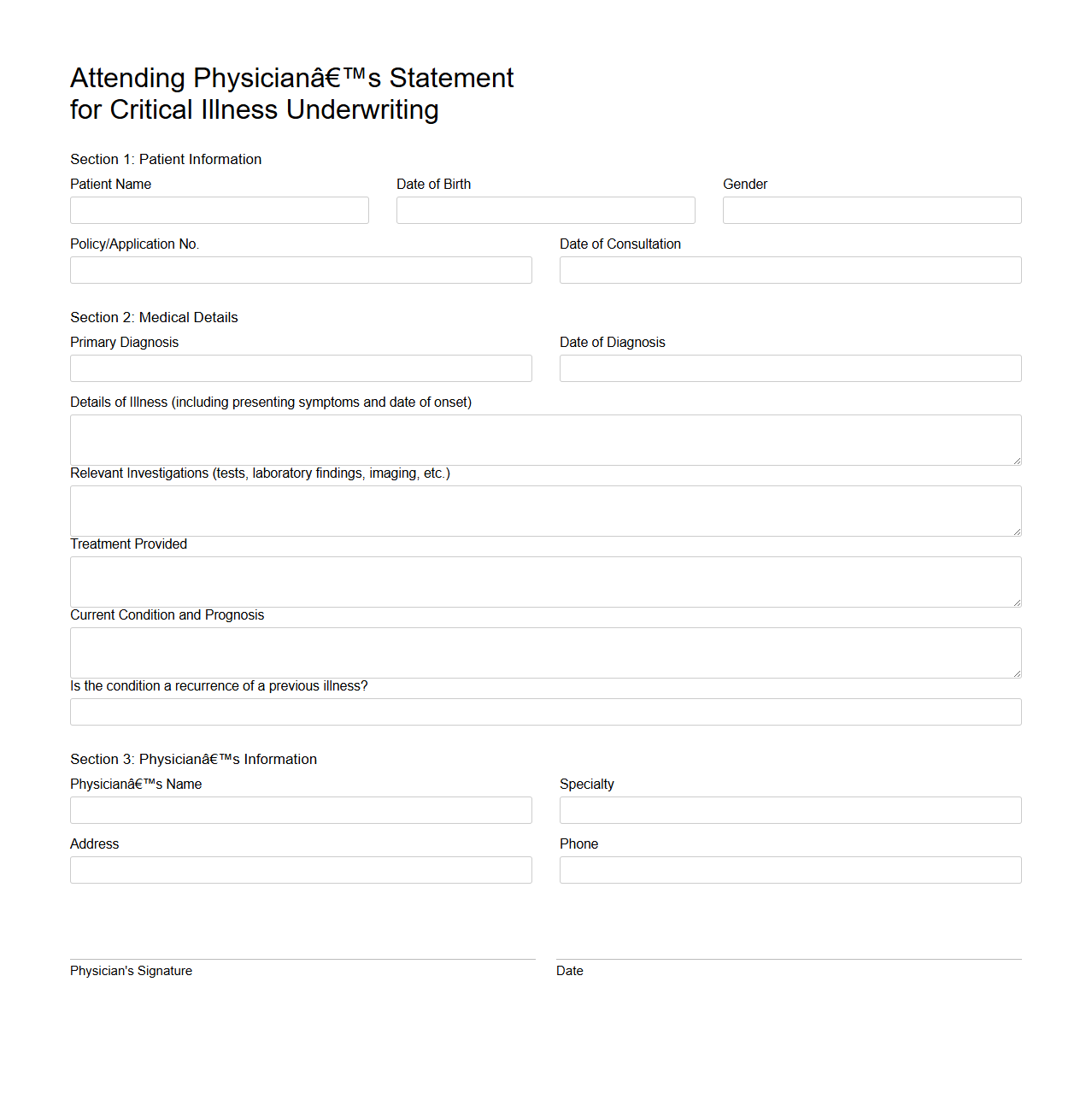

Attending Physician’s Statement for Critical Illness Underwriting

The

Attending Physician's Statement (APS) for Critical Illness Underwriting is a detailed medical report completed by a healthcare provider to support insurance risk assessment. It includes comprehensive information on the applicant's diagnosis, treatment history, current health status, and prognosis related to critical illnesses. This document helps underwriters accurately evaluate the medical risks and determine the appropriate coverage and premium rates.

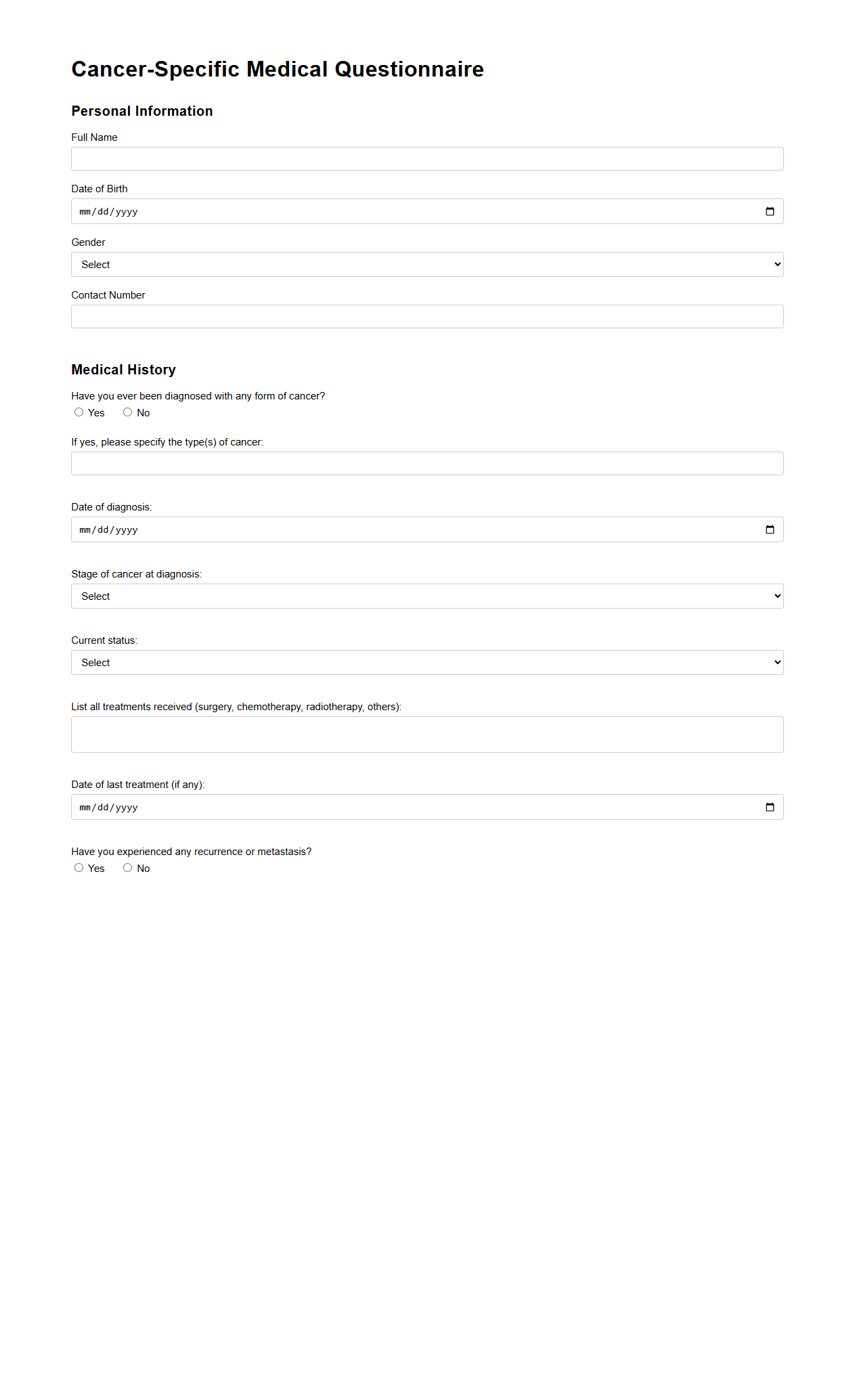

Cancer-Specific Medical Questionnaire for Critical Illness Coverage

The

Cancer-Specific Medical Questionnaire for Critical Illness Coverage is a detailed form used by insurance providers to assess an applicant's medical history related to cancer. It collects vital information such as previous cancer diagnoses, treatments received, family history, and current health status to evaluate the risk and determine eligibility for critical illness insurance. This document helps ensure accurate underwriting and personalized coverage for individuals with cancer-related health concerns.

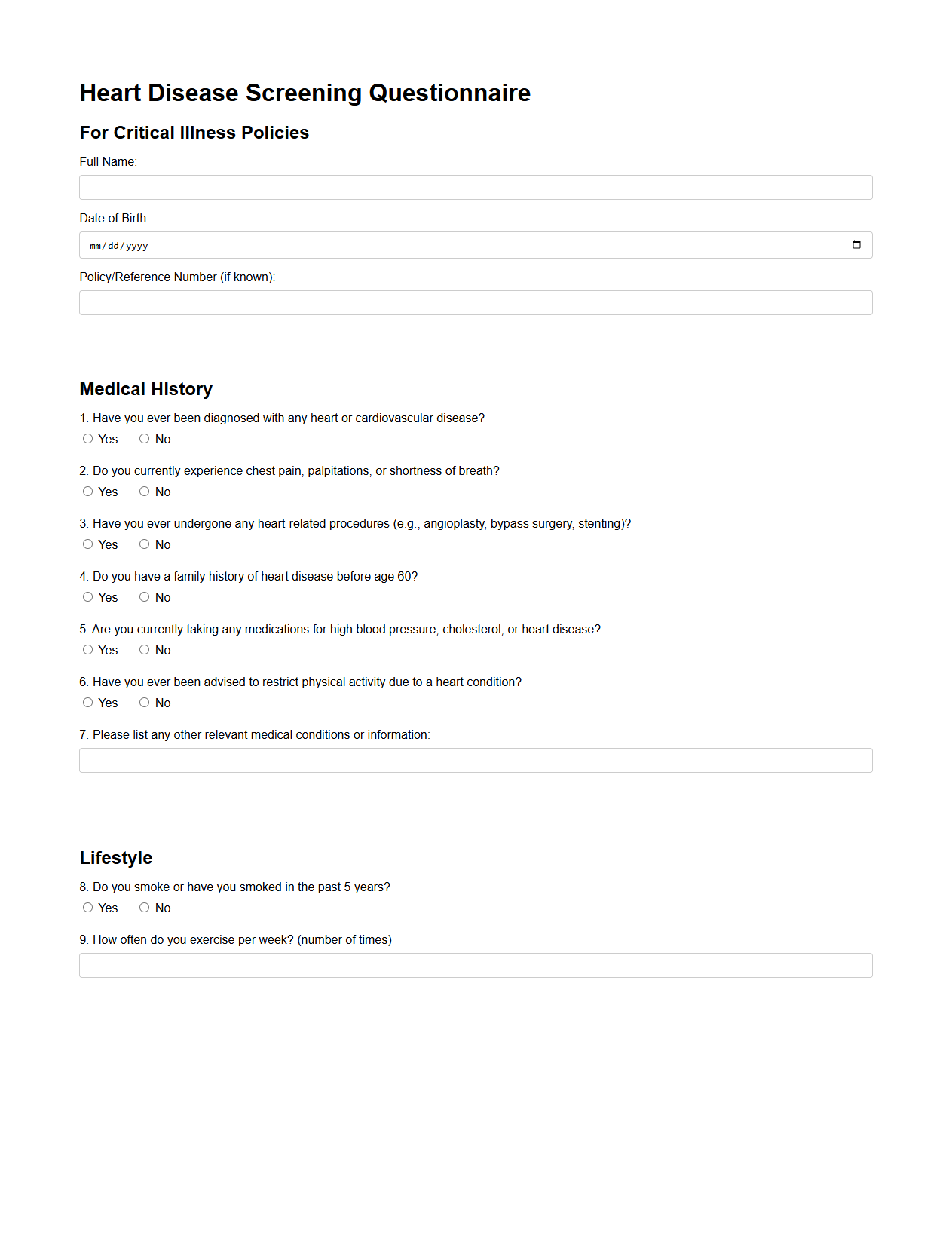

Heart Disease Screening Questionnaire for Critical Illness Policies

The

Heart Disease Screening Questionnaire for Critical Illness Policies is a detailed assessment tool used to evaluate an individual's risk factors and medical history related to heart conditions before policy approval. This questionnaire collects vital information such as previous cardiac events, family history, lifestyle habits, and existing symptoms to help insurers determine eligibility and coverage limits accurately. Accurate completion of this document ensures thorough risk evaluation, enabling tailored insurance plans that address potential heart-related critical illnesses.

What is the purpose of the Underwriting Questionnaire Document for Critical Illness Insurance?

The Underwriting Questionnaire Document serves to assess the risk profile of the applicant for critical illness insurance accurately. It helps insurers determine eligibility and premium rates by collecting detailed health information. This document ensures that the insurance coverage aligns with the applicant's health risks.

Which specific critical illnesses are addressed or required to be disclosed in the questionnaire?

The questionnaire typically requires disclosure of major critical illnesses such as cancer, heart attack, stroke, kidney failure, and multiple sclerosis. Applicants must provide details about any history or diagnosis of these illnesses. This information is vital for accurately assessing the insurance risk involved.

How does the document gather information on the applicant's medical history and risk factors?

The document uses targeted questions about past medical conditions, surgeries, medications, and family history of critical illnesses. It also inquires about lifestyle factors such as smoking, alcohol use, and occupational hazards. These responses help insurers evaluate the potential risk and underwriting suitability.

What supporting documents or evidence may be requested in conjunction with the questionnaire?

Insurers may request medical reports, test results, hospital discharge summaries, and physician statements alongside the questionnaire. These documents validate the applicant's disclosures and provide a comprehensive health overview. Supporting evidence ensures the accuracy of the underwriting process.

How is the confidentiality and security of the applicant's health information ensured within the document?

The questionnaire complies with strict data protection regulations to maintain confidentiality and secure applicant information. Insurance companies implement encrypted storage and controlled access to prevent unauthorized disclosure. These measures safeguard sensitive health data throughout the underwriting process.