A Consent Form Document Sample for Critical Illness Insurance outlines the agreement between the insurer and the insured, ensuring clear understanding of policy terms and conditions. It typically includes personal information, details of the critical illness coverage, and an acknowledgment of risks involved. This document is essential for legal compliance and protects both parties by confirming informed consent.

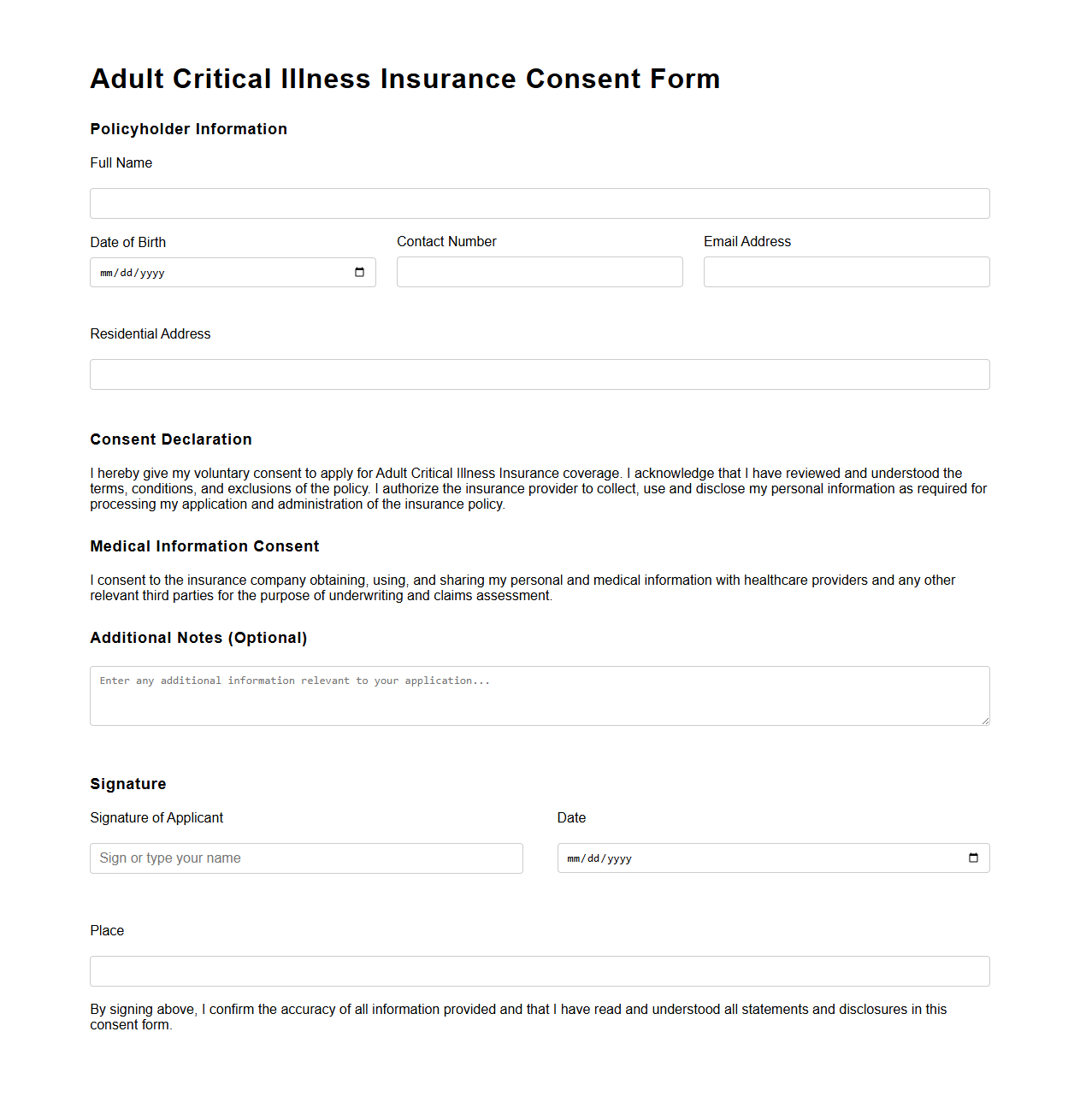

Adult Critical Illness Insurance Consent Form Template

The

Adult Critical Illness Insurance Consent Form Template is a legal document used to obtain the insured individual's permission for collecting and processing personal and medical information related to critical illness coverage. This template ensures compliance with privacy regulations while clearly outlining the scope of consent required for underwriting and claims evaluation. It protects both the insurer and the insured by establishing a transparent agreement on data use and disclosure.

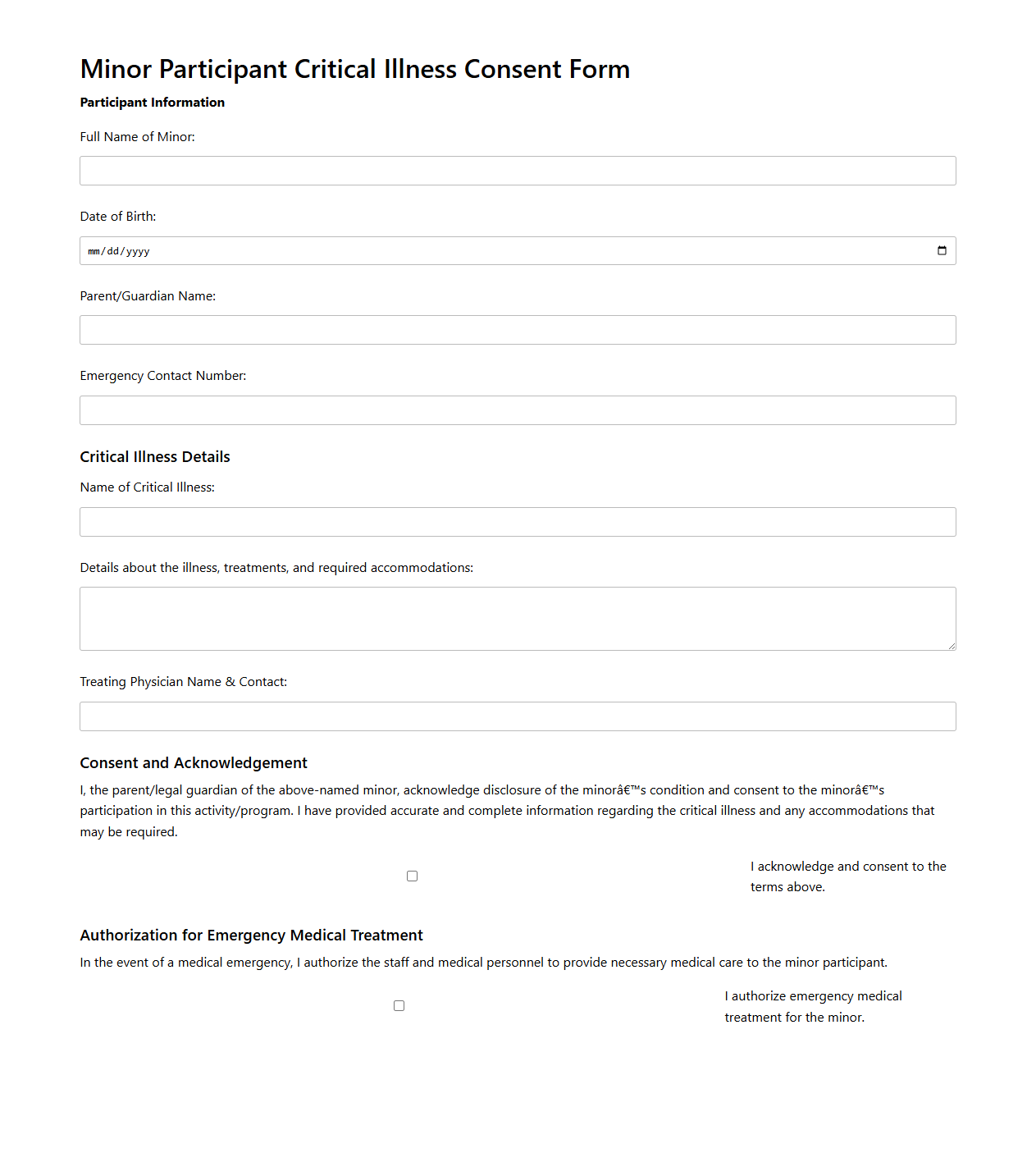

Minor Participant Critical Illness Consent Form Example

The

Minor Participant Critical Illness Consent Form Example document serves as a legally binding agreement that authorizes medical treatment for a minor diagnosed with a critical illness during research or clinical trials. It provides detailed information on the nature of the illness, treatment options, potential risks, and the rights of both the minor participant and their legal guardian. This form ensures compliance with ethical standards and helps protect the welfare of the minor by securing informed consent from authorized parties.

Spousal Consent Form for Critical Illness Coverage

A

Spousal Consent Form for Critical Illness Coverage is a legal document that confirms a spouse's agreement to include or waive critical illness insurance coverage on a policyholder's plan. This form ensures that the spouse acknowledges the terms and conditions related to the coverage, protecting both parties' rights and interests. It is often required by insurance providers to validate the addition of coverage affecting both the policyholder and their spouse.

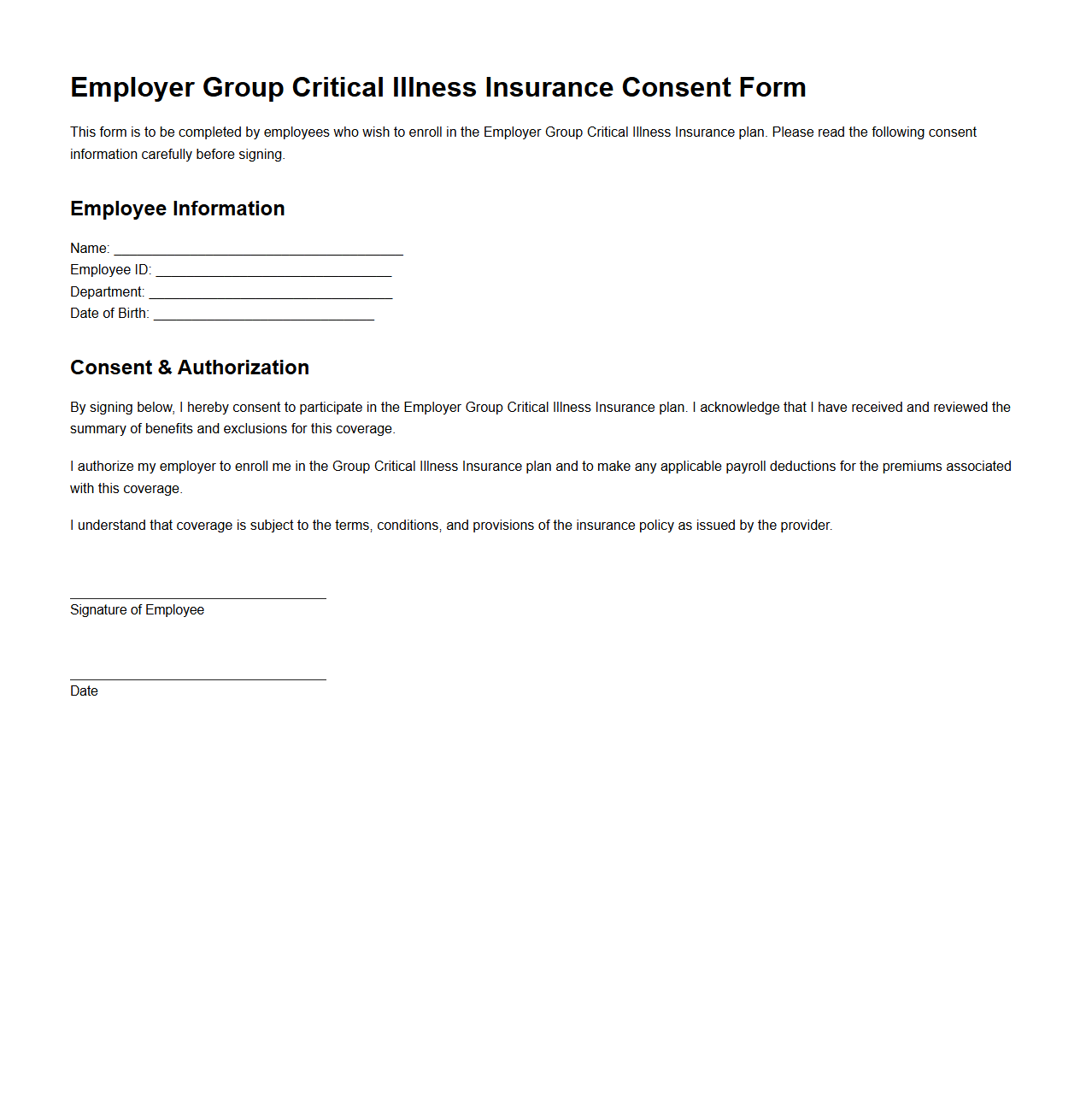

Employer Group Critical Illness Insurance Consent Sample

An

Employer Group Critical Illness Insurance Consent Sample document outlines the agreement between an employer and employees regarding participation in a critical illness insurance plan. It specifies the employee's understanding and consent to the terms, coverage details, and data usage related to the insurance policy provided by the employer. This document ensures compliance with legal requirements and serves as proof of informed consent for insurance enrollment.

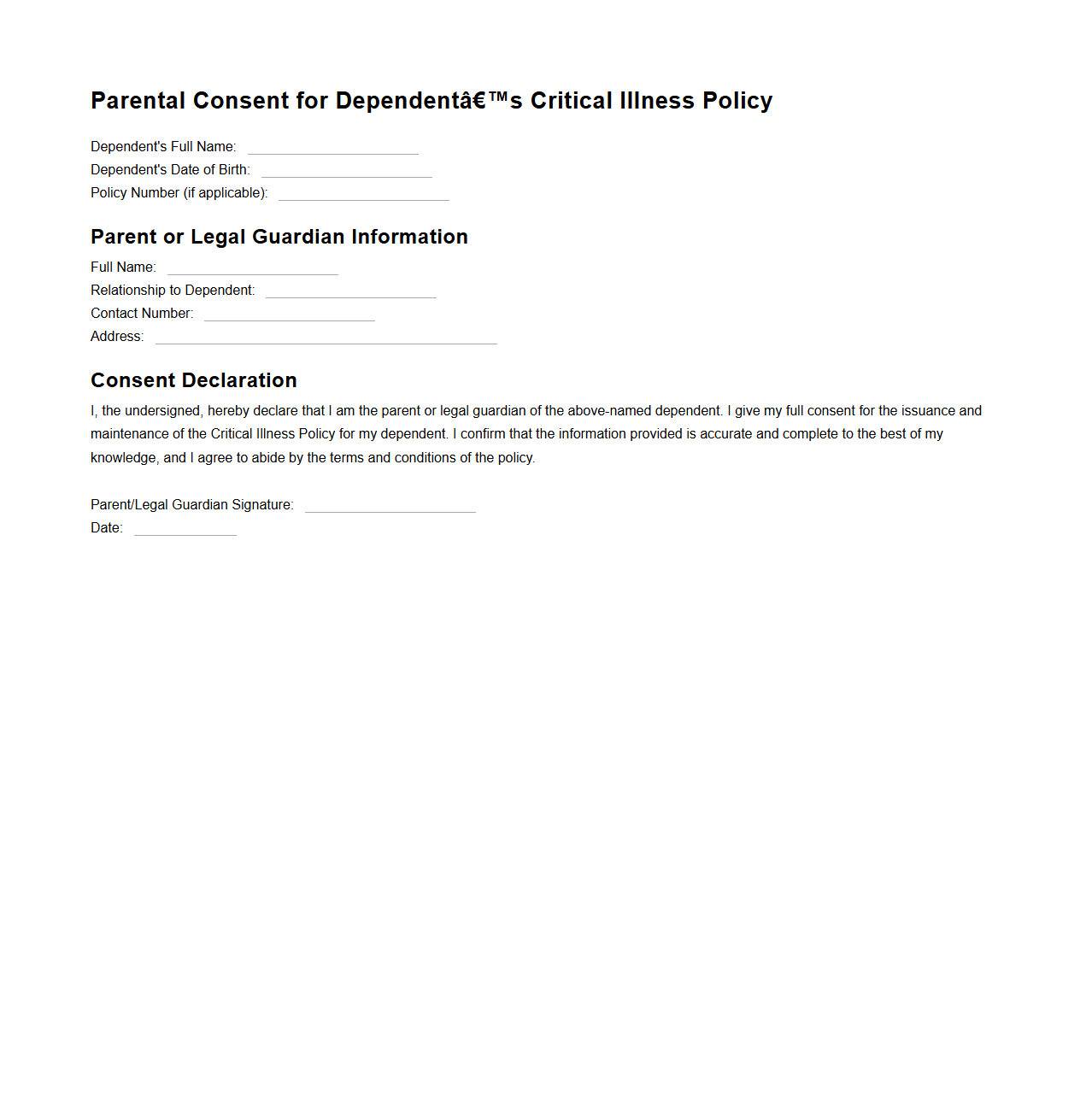

Parental Consent for Dependent’s Critical Illness Policy

Parental Consent for Dependent's Critical Illness Policy is a legal document that authorizes an insurer to provide critical illness coverage for a minor dependent. It confirms that parents or legal guardians agree to the terms, conditions, and medical evaluations involved in the insurance policy. This consent ensures protection for the dependent while fulfilling regulatory requirements and safeguarding the rights of all parties involved.

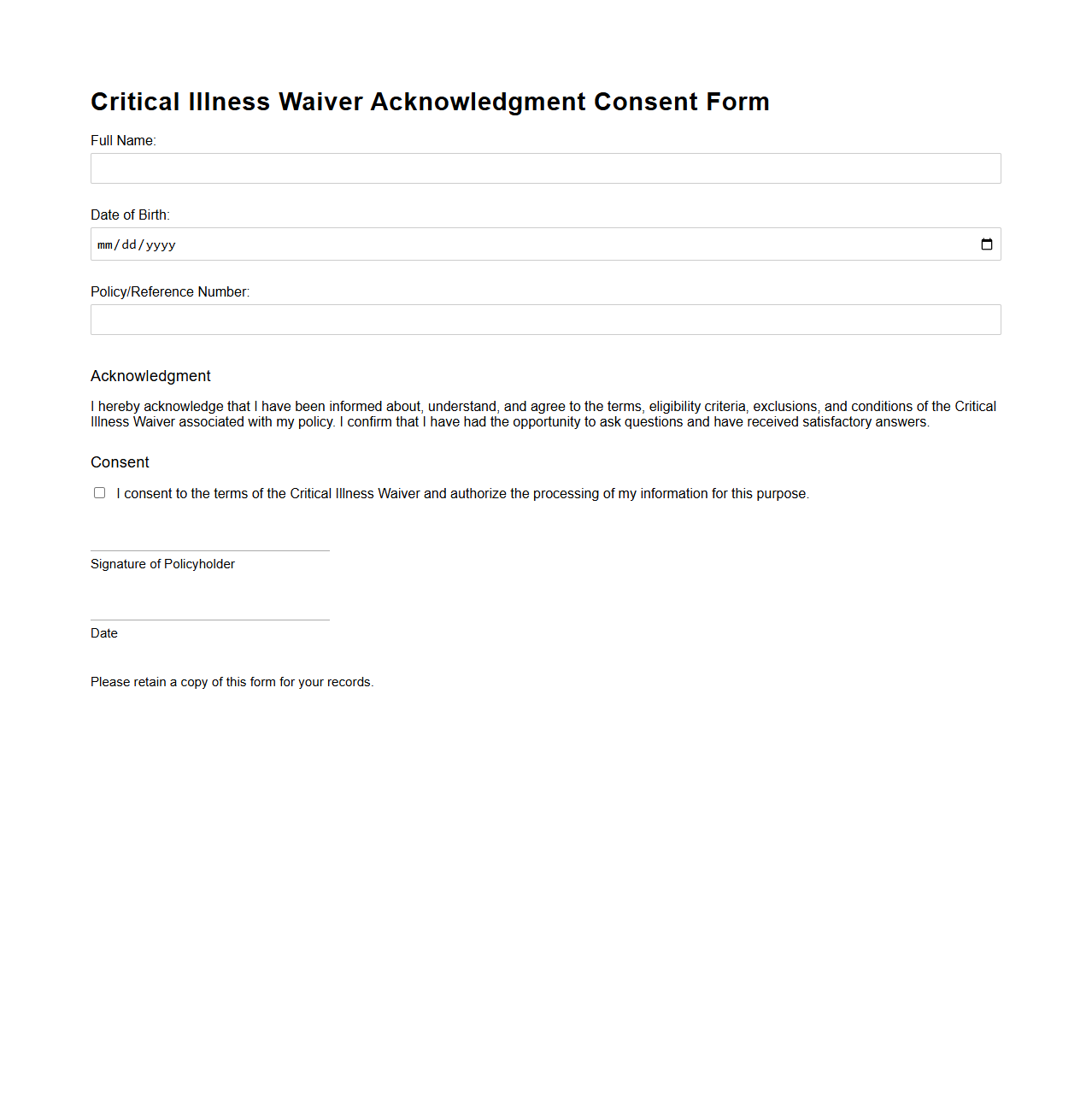

Critical Illness Waiver Acknowledgment Consent Form

The

Critical Illness Waiver Acknowledgment Consent Form is a legal document that confirms an individual's understanding and acceptance of waiving certain benefits or claims related to critical illness coverage in an insurance policy. It ensures that the policyholder is fully informed about the limitations or exclusions before signing, protecting the insurer from future disputes. This form is essential for clear communication between the insurer and insured regarding the scope of critical illness protection.

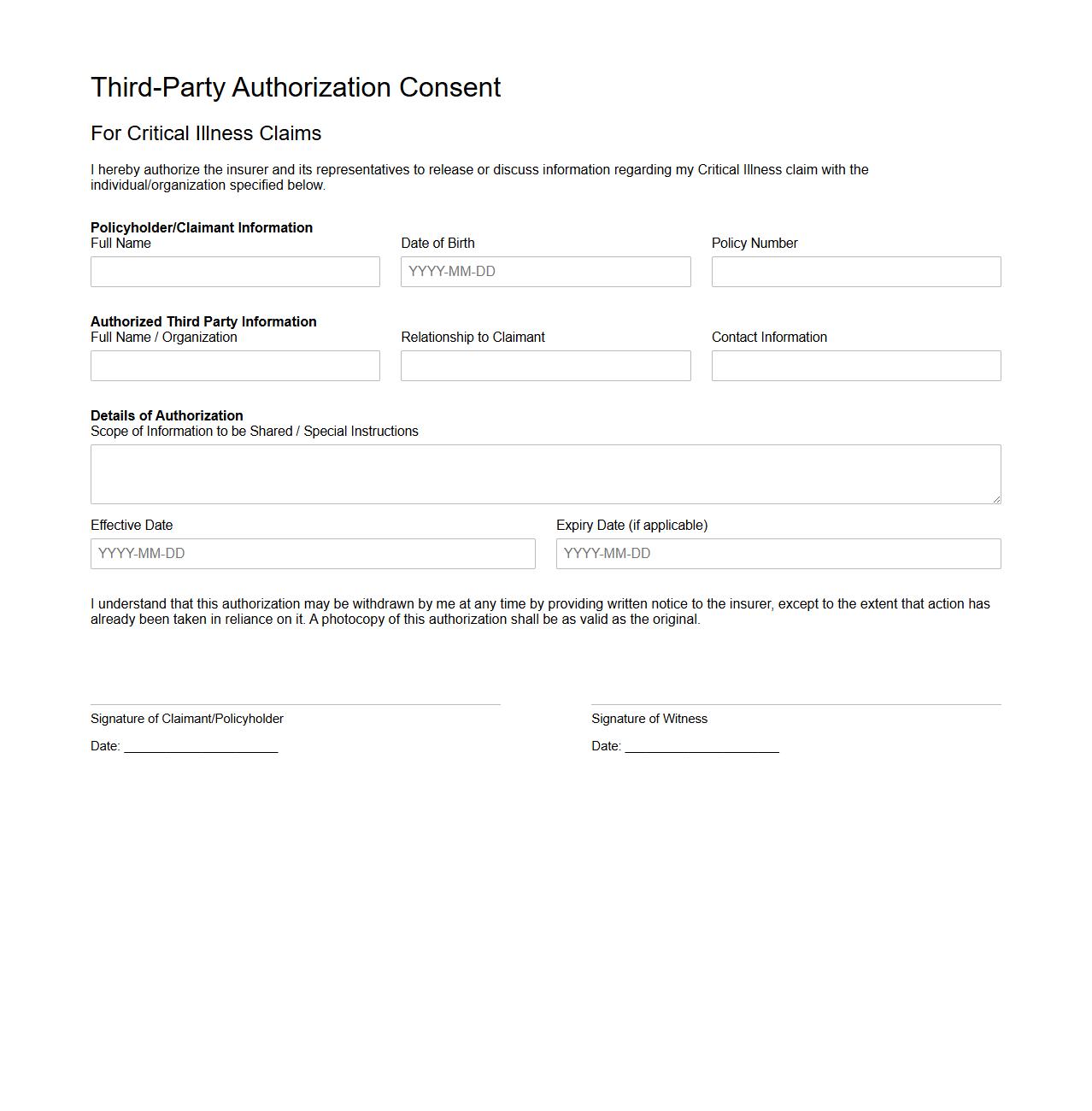

Third-Party Authorization Consent for Critical Illness Claims

The

Third-Party Authorization Consent for Critical Illness Claims document grants permission for an authorized individual or organization to access and manage a policyholder's sensitive health and insurance information during the claims process. This consent ensures that insurers can communicate with designated third parties, such as healthcare providers or legal representatives, to verify claim details and expedite settlement. It safeguards the claimant's privacy while streamlining critical illness claims processing through clear authorization protocols.

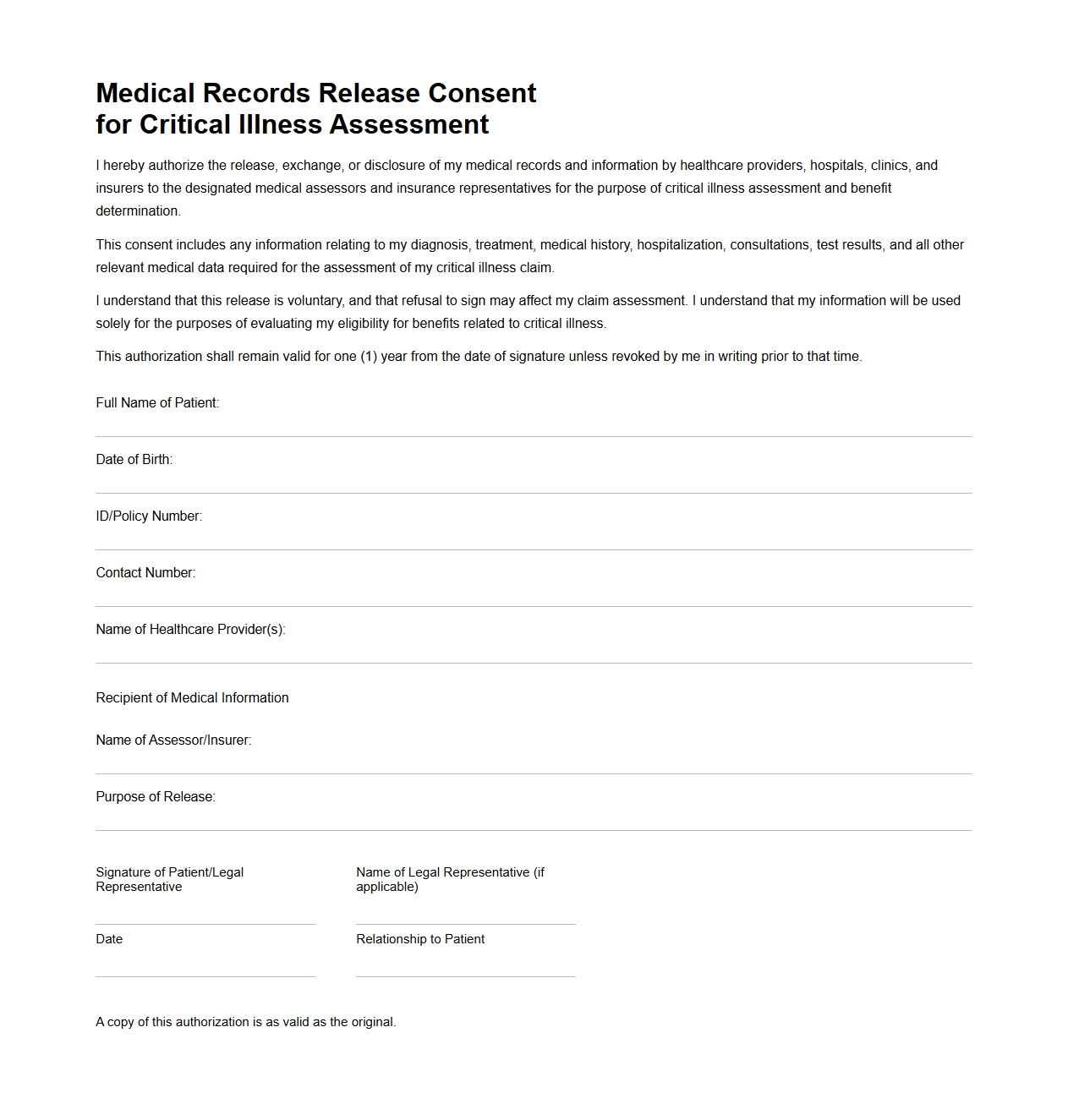

Medical Records Release Consent for Critical Illness Assessment

The

Medical Records Release Consent for Critical Illness Assessment document authorizes healthcare providers to share a patient's medical history and relevant health information with insurance companies or medical evaluators. This consent is essential for accurately assessing the severity and coverage eligibility of a critical illness claim. It ensures that all pertinent medical evidence is accessible to support timely and informed decision-making in the insurance approval process.

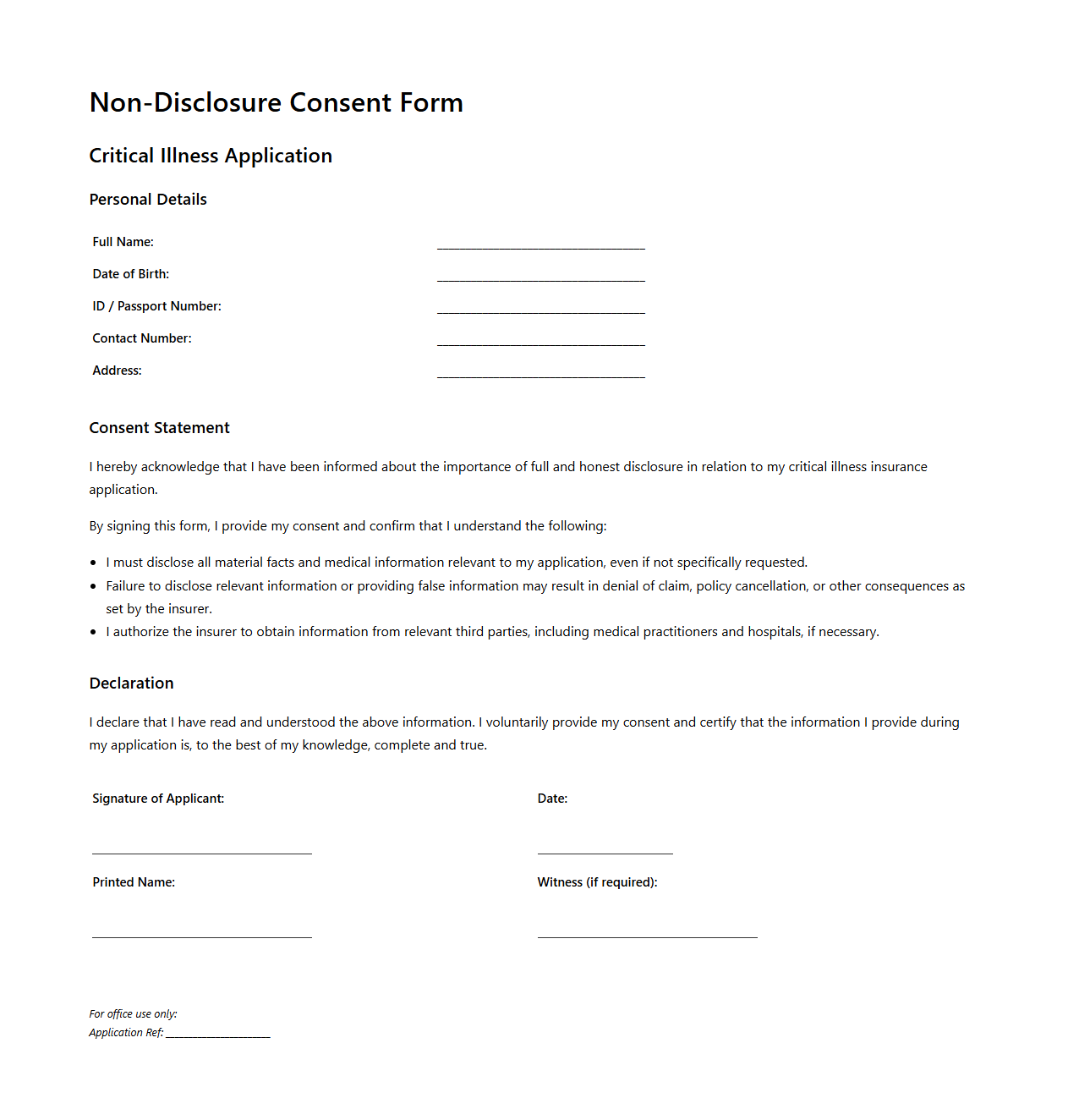

Non-Disclosure Consent Form for Critical Illness Application

A

Non-Disclosure Consent Form for Critical Illness Application is a legal document that authorizes the sharing of sensitive medical information between the applicant and the insurance provider. This form ensures confidentiality by restricting the disclosure of personal health details to authorized parties only. It plays a crucial role in the insurance underwriting process, safeguarding applicant privacy while facilitating accurate risk assessment.

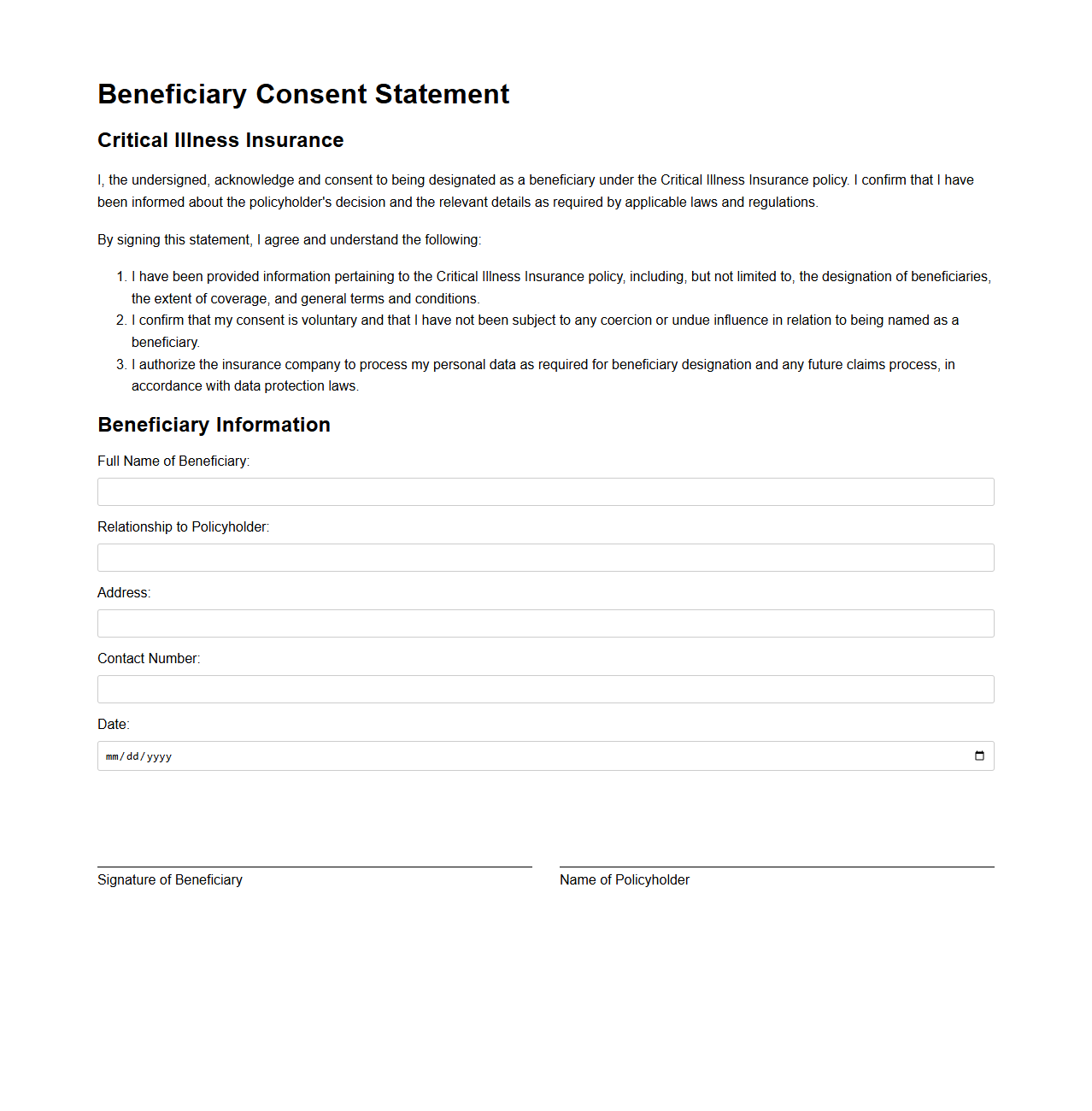

Beneficiary Consent Statement for Critical Illness Insurance

A

Beneficiary Consent Statement for Critical Illness Insurance is a legal document where the designated beneficiary acknowledges and agrees to the terms of the insurance policy and the payout conditions. This statement ensures that the beneficiary is informed about the critical illness coverage and consents to receive the benefits in the event of a claim. It is an essential part of the insurance process to validate the rightful claim and prevent disputes.

What personal information is required to complete the consent form for critical illness insurance?

The consent form requires essential personal details such as full name, date of birth, and contact information. It also asks for identification numbers like social security or national ID for verification purposes. Additionally, applicants must provide relevant medical history and current health status to assess eligibility.

How does the consent form explain the use and sharing of your medical data?

The form clearly states that your medical data will be used to evaluate risk and process the insurance application. It explains that data may be shared with medical professionals and insurance partners strictly for assessment and underwriting. Privacy measures and compliance with data protection laws are emphasized to ensure confidentiality.

What are the specific declarations and agreements the policyholder must acknowledge in the document?

The policyholder must declare the accuracy and completeness of all provided information under penalty of law. They agree to the insurer's right to verify medical information and conduct necessary inquiries. Additionally, the policyholder consents to the terms regarding data usage, risk assessment, and future communications.

Which parties or organizations are authorized to access the information provided in the consent form?

Authorized parties include the insurance company's underwriters, medical professionals, and designated third-party service providers involved in the claim process. Regulatory bodies may also access information when required by law. This controlled sharing ensures the appropriate management and evaluation of the insurance application.

What is the process for withdrawing consent after signing the critical illness insurance consent form?

To withdraw consent, the policyholder must submit a written request to the insurance company's data protection officer or customer service. The insurer will then acknowledge the request and cease further processing of medical data, except where retention is legally required. This ensures the policyholder's rights are respected while maintaining compliance.