A Evidence of Insurability Document Sample for Disability Insurance demonstrates the required information to verify an applicant's health status when applying for disability coverage. This sample typically includes personal health details, medical history, and any pre-existing conditions to assess the risk for the insurer. Providing accurate and complete evidence of insurability is essential to secure appropriate coverage and benefits.

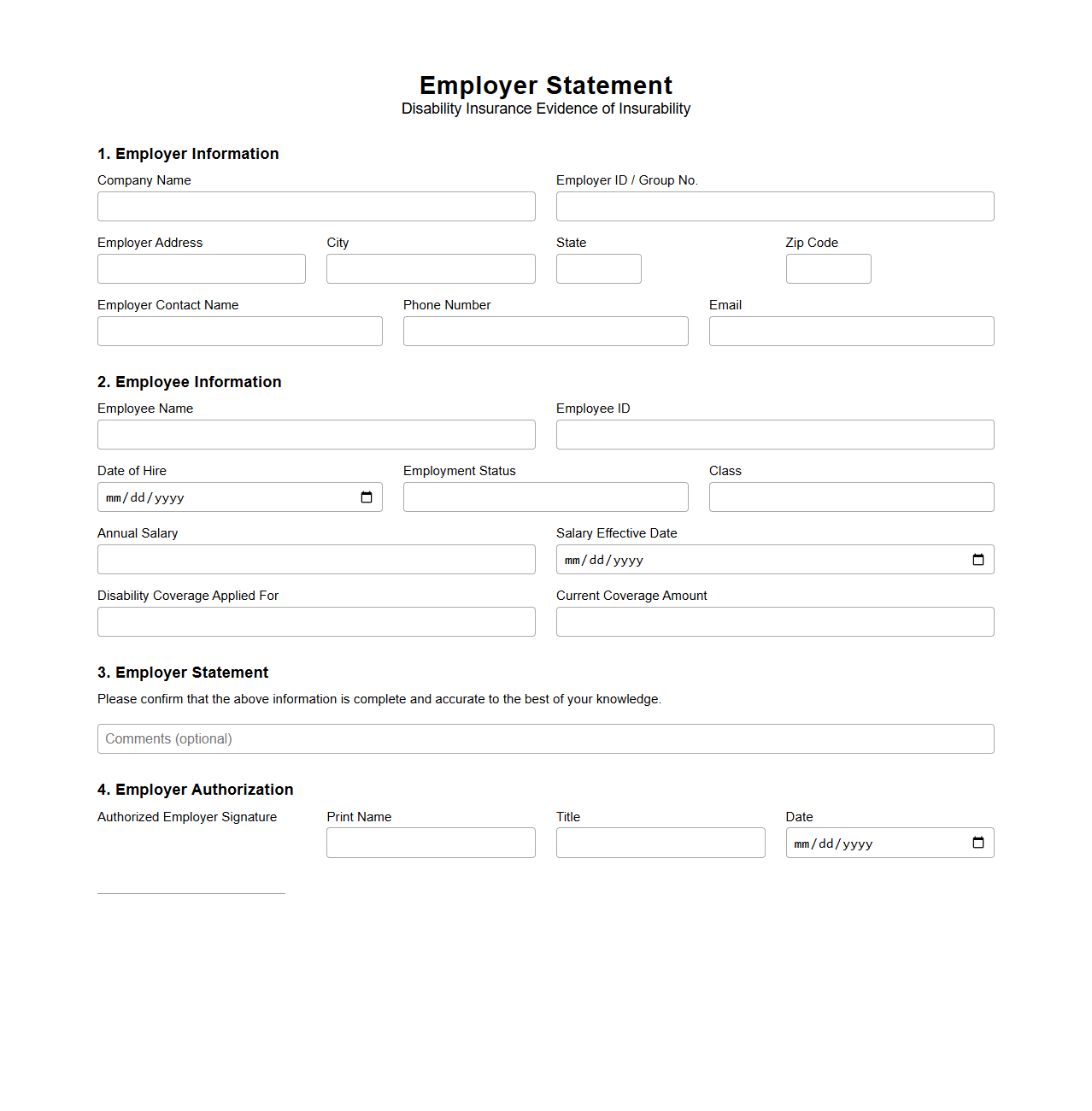

Employer Statement for Disability Insurance Evidence of Insurability

An

Employer Statement for Disability Insurance Evidence of Insurability is a formal document completed by an employer to verify an employee's job status, income, and work duties as part of the disability insurance underwriting process. It serves as critical evidence for insurers to assess eligibility and risk when approving or denying disability insurance coverage. This statement helps ensure accurate representation of the employee's employment conditions, supporting fair evaluation of the insurance claim.

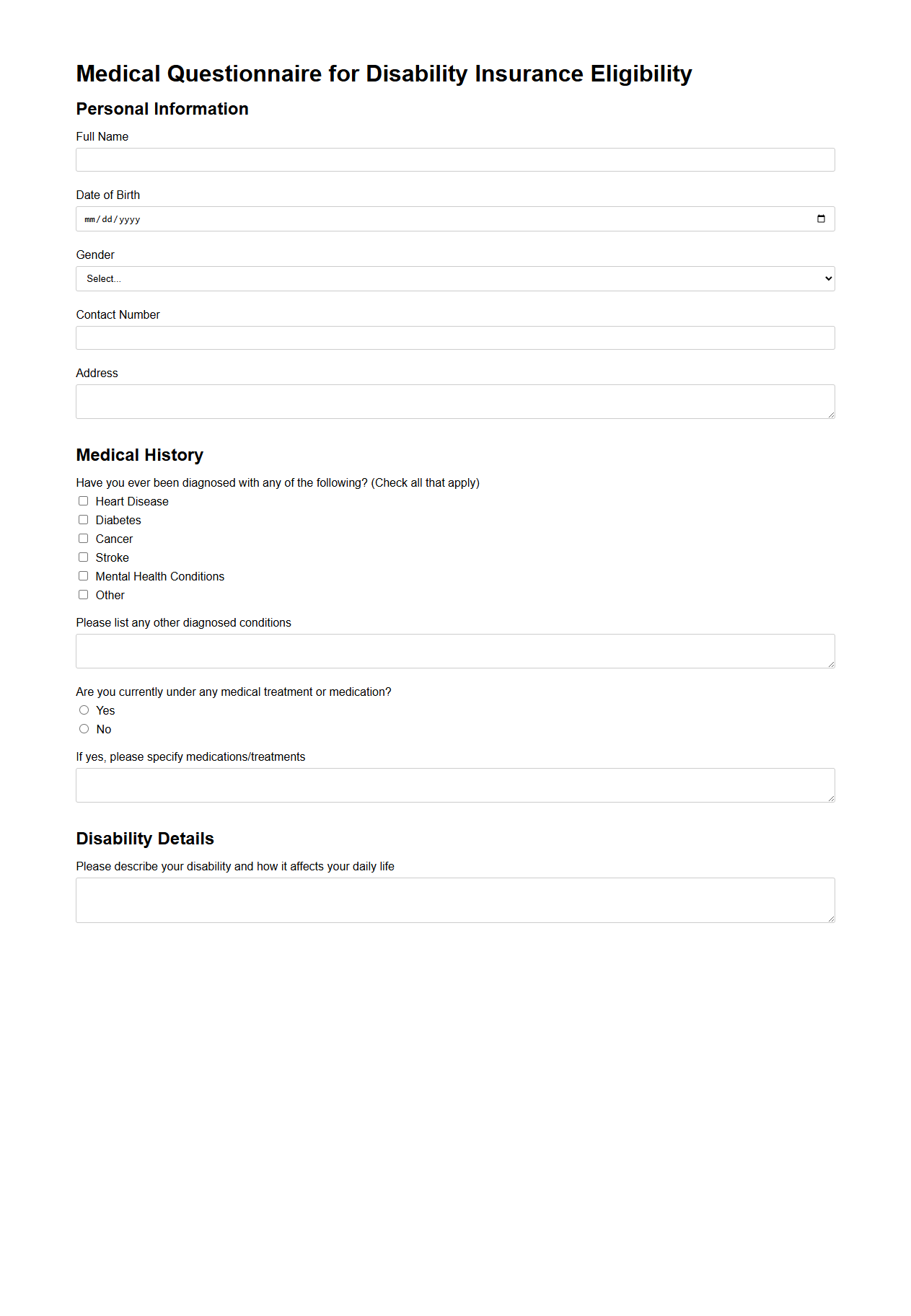

Medical Questionnaire for Disability Insurance Eligibility

A

Medical Questionnaire for Disability Insurance Eligibility document gathers essential health information to assess an applicant's current medical condition, history, and potential risk factors. This questionnaire helps insurers evaluate the likelihood of a disability claim and determine appropriate coverage terms and premiums. Accurate completion ensures proper risk assessment and eligibility confirmation for disability insurance benefits.

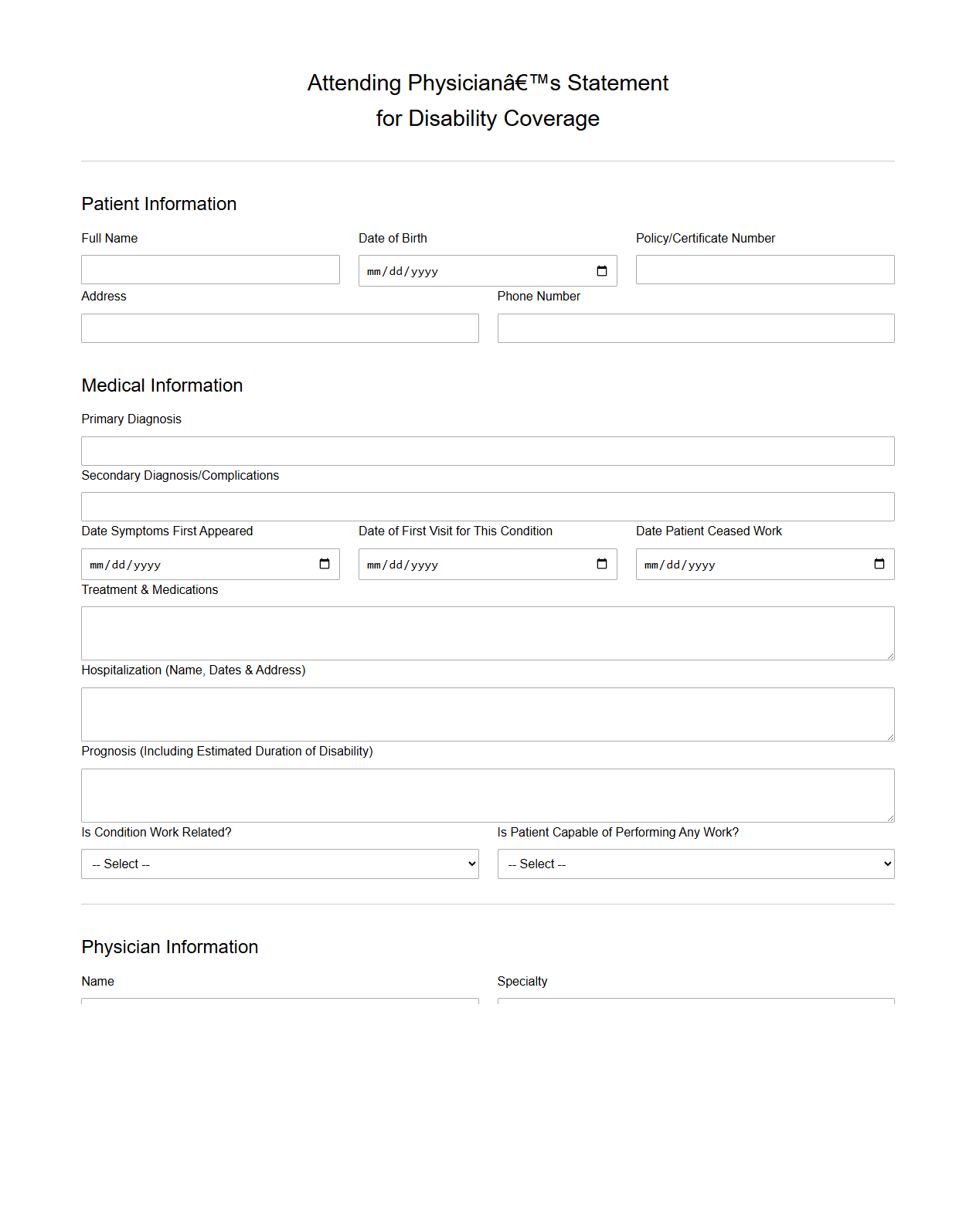

Attending Physician’s Statement for Disability Coverage

The

Attending Physician's Statement (APS) for Disability Coverage is a detailed medical report provided by a healthcare professional that outlines a patient's diagnosis, treatment, and prognosis related to their disability claim. This document plays a crucial role in assessing the legitimacy and extent of the disability to determine eligibility for benefits. Insurers rely on the APS to make informed decisions regarding claim approval and ongoing coverage.

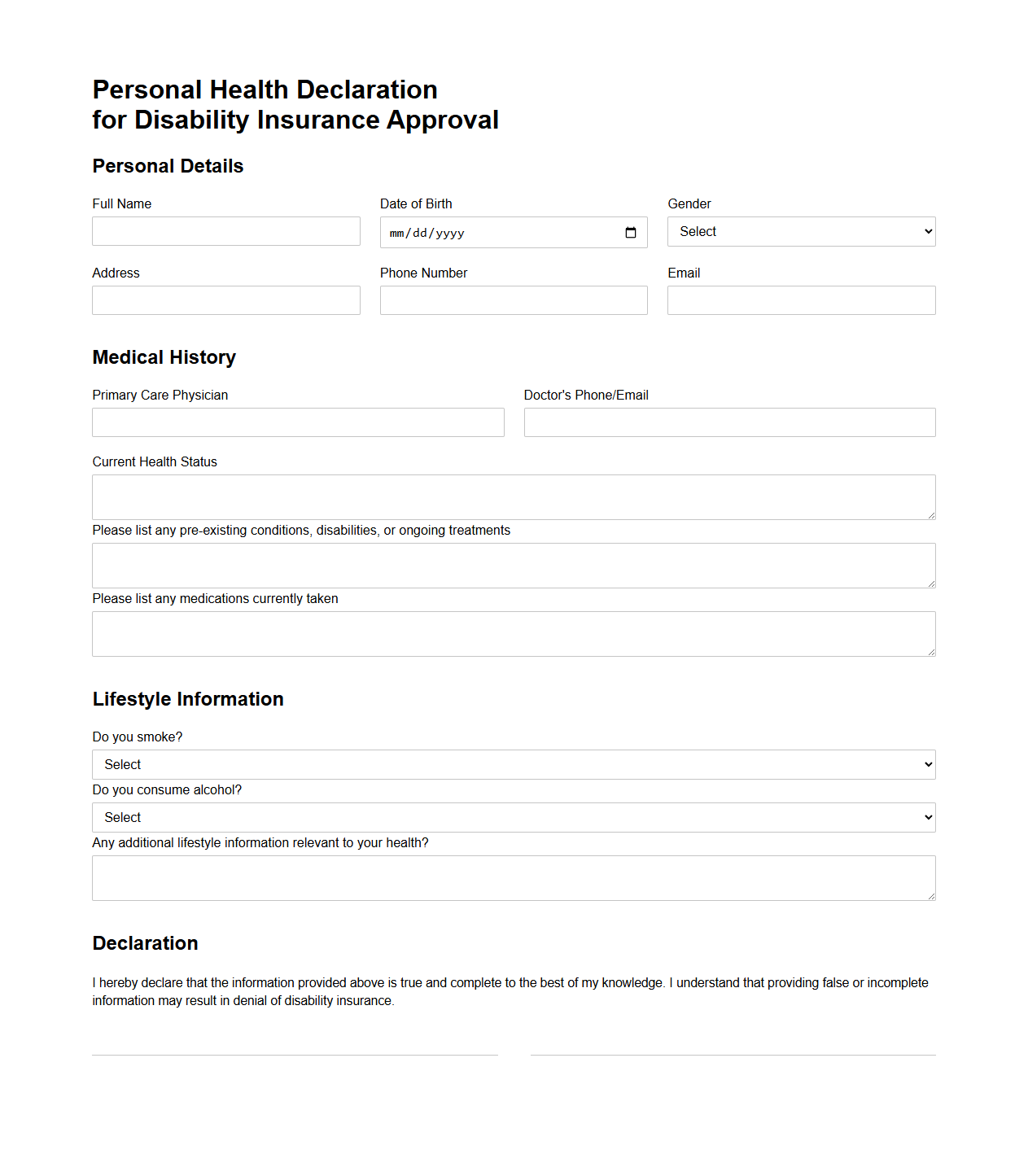

Personal Health Declaration for Disability Insurance Approval

A

Personal Health Declaration for Disability Insurance Approval is a detailed document where applicants disclose their medical history, current health status, and any pre-existing conditions. Insurers use this information to assess risk and determine eligibility, coverage limits, and premium rates. Accurate completion of this form is essential to avoid claim denials and ensure proper policy issuance.

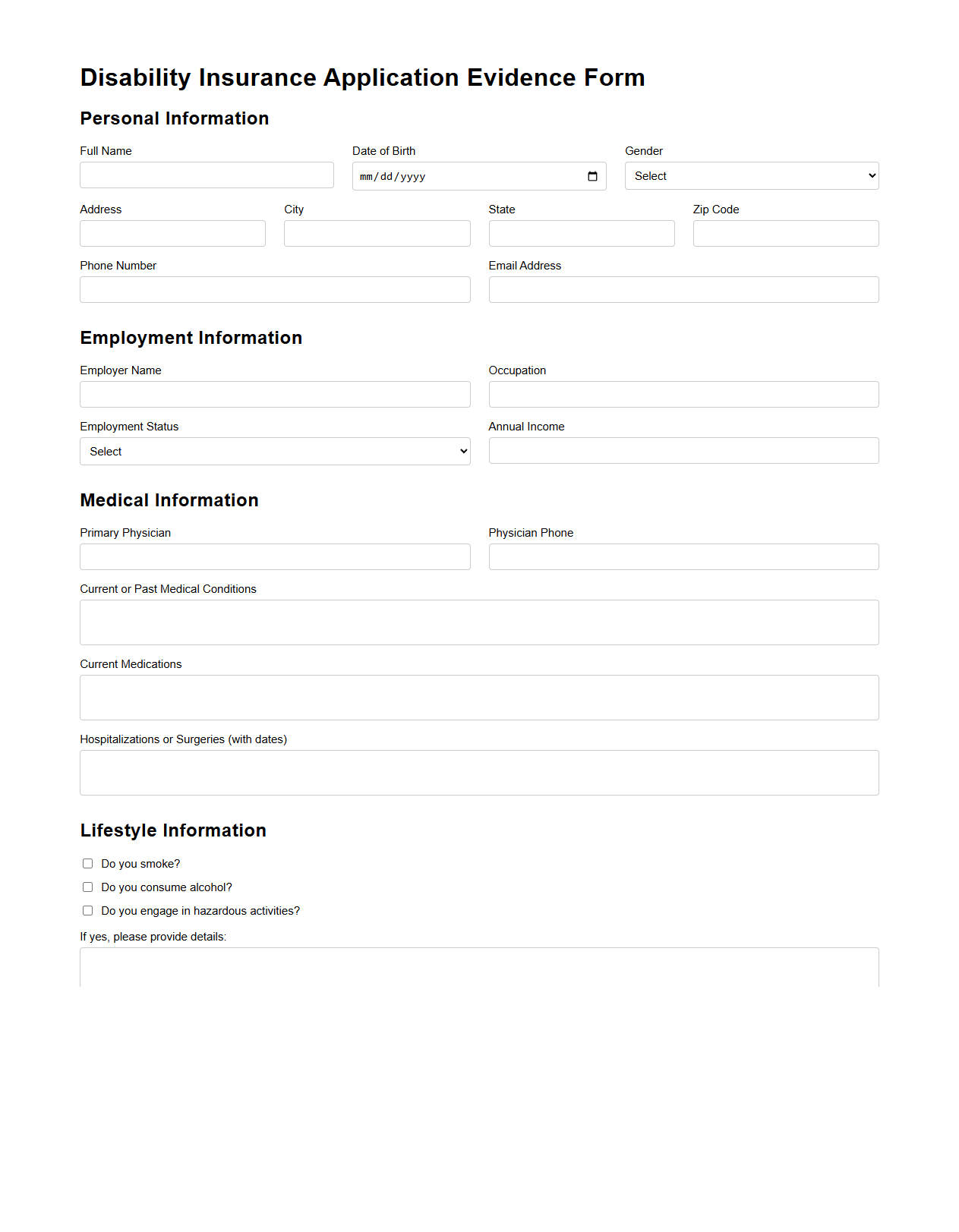

Disability Insurance Application Evidence Form

The

Disability Insurance Application Evidence Form is a critical document used to verify an applicant's medical condition and eligibility for disability benefits. It collects comprehensive information from healthcare providers, including diagnosis, treatment history, and functional limitations. This form plays a vital role in the evaluation process to ensure accurate assessment of disability claims.

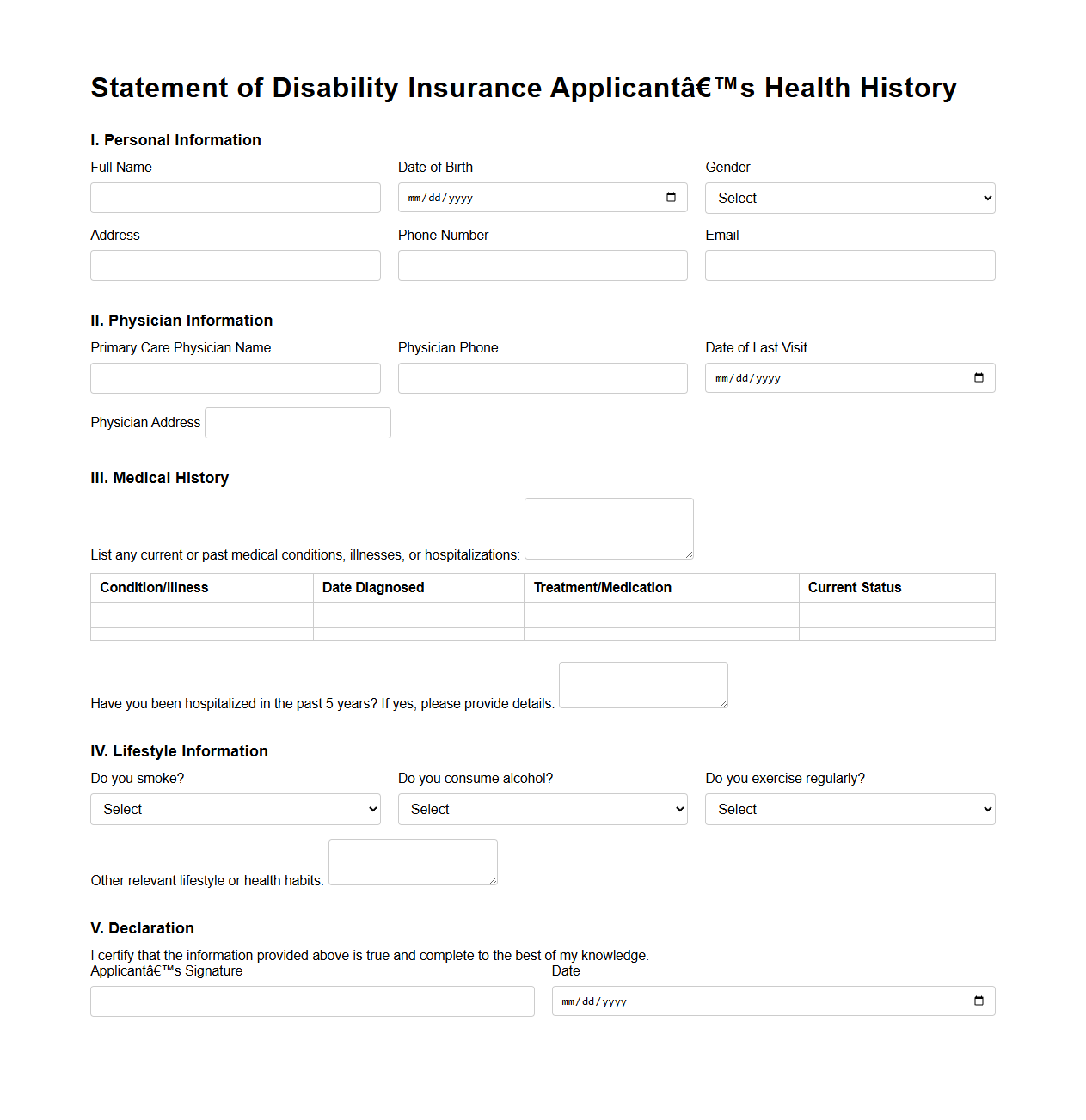

Statement of Disability Insurance Applicant’s Health History

The

Statement of Disability Insurance Applicant's Health History document is a detailed record used by insurance companies to assess an applicant's medical background and current health status. It includes information about past illnesses, treatments, surgeries, medications, and any ongoing health conditions that could impact disability insurance eligibility. This document helps insurers evaluate risk factors and determine appropriate coverage terms and premiums.

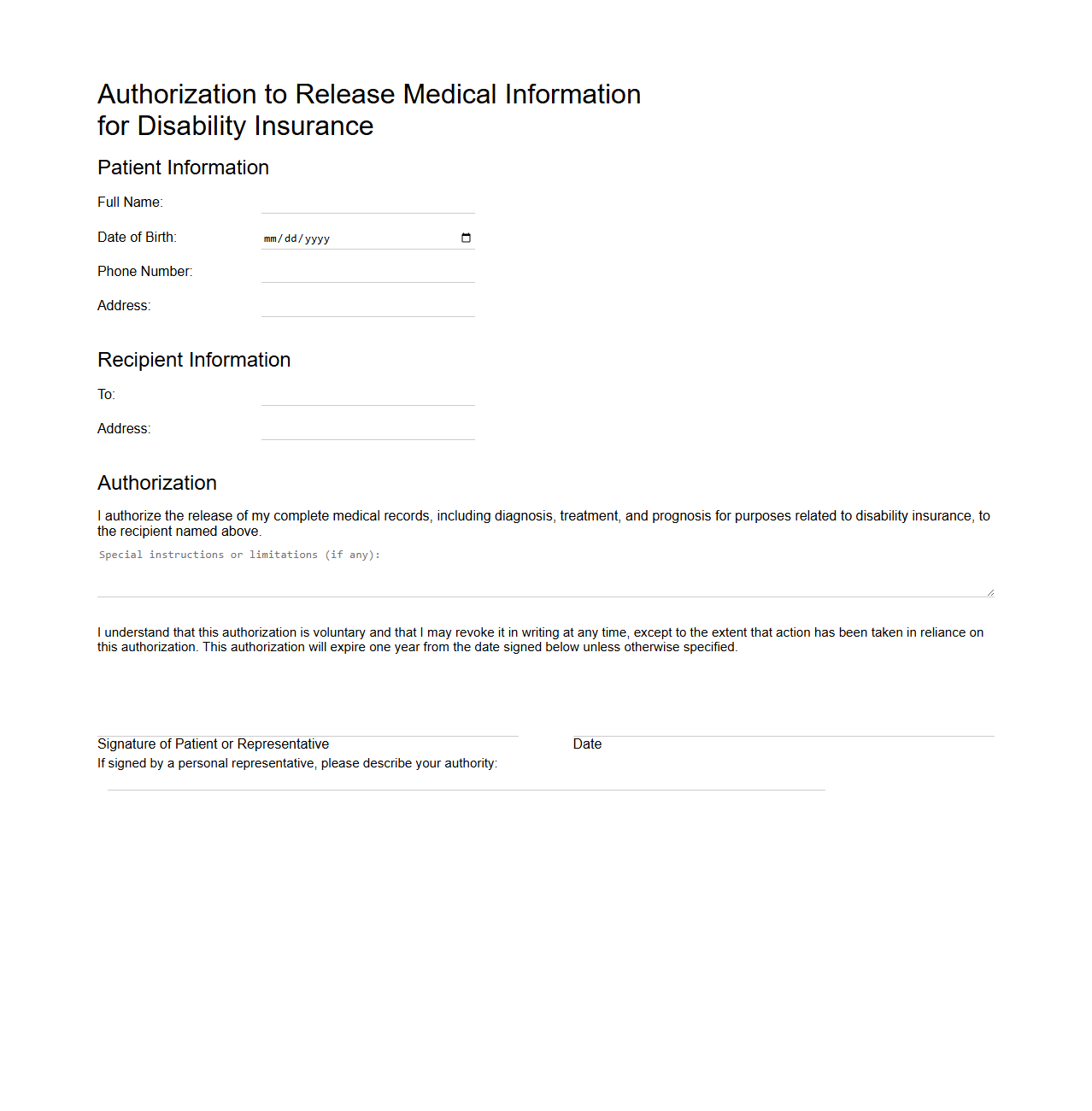

Authorization to Release Medical Information for Disability Insurance

The

Authorization to Release Medical Information for Disability Insurance document is a legal form that permits healthcare providers to share an individual's medical records with a disability insurance company. This authorization ensures the insurer can verify the claimant's health status and disability claim details to process benefits accurately. It protects patient privacy by specifying what information can be disclosed and to whom, complying with regulations like HIPAA.

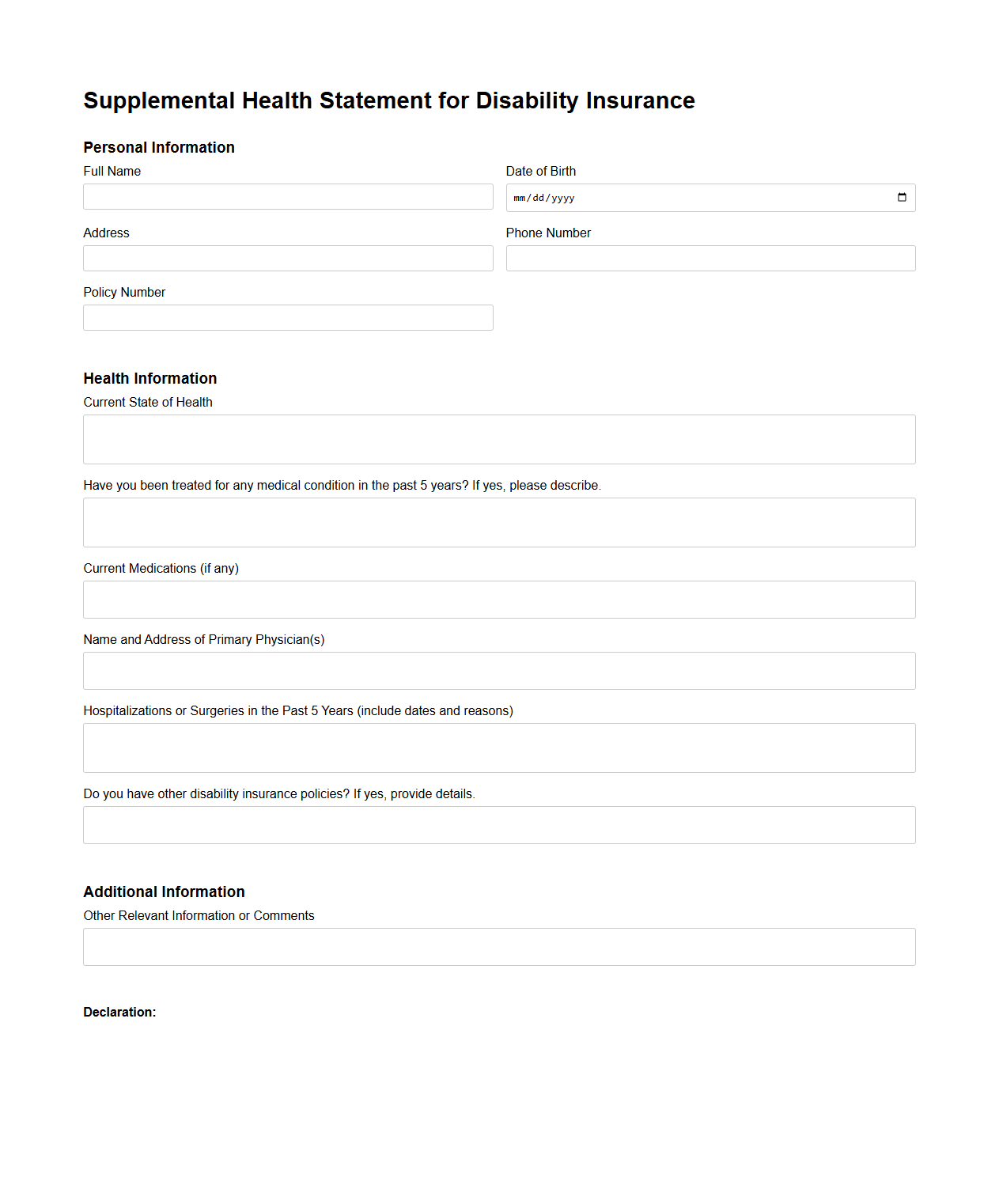

Supplemental Health Statement for Disability Insurance

A

Supplemental Health Statement for Disability Insurance is a detailed medical questionnaire required by insurers to assess an applicant's health status and potential risks. This document gathers additional health information beyond the initial application, including medical history, current conditions, treatments, and lifestyle factors. Insurers use this data to determine eligibility, underwriting decisions, and appropriate premium rates for disability coverage.

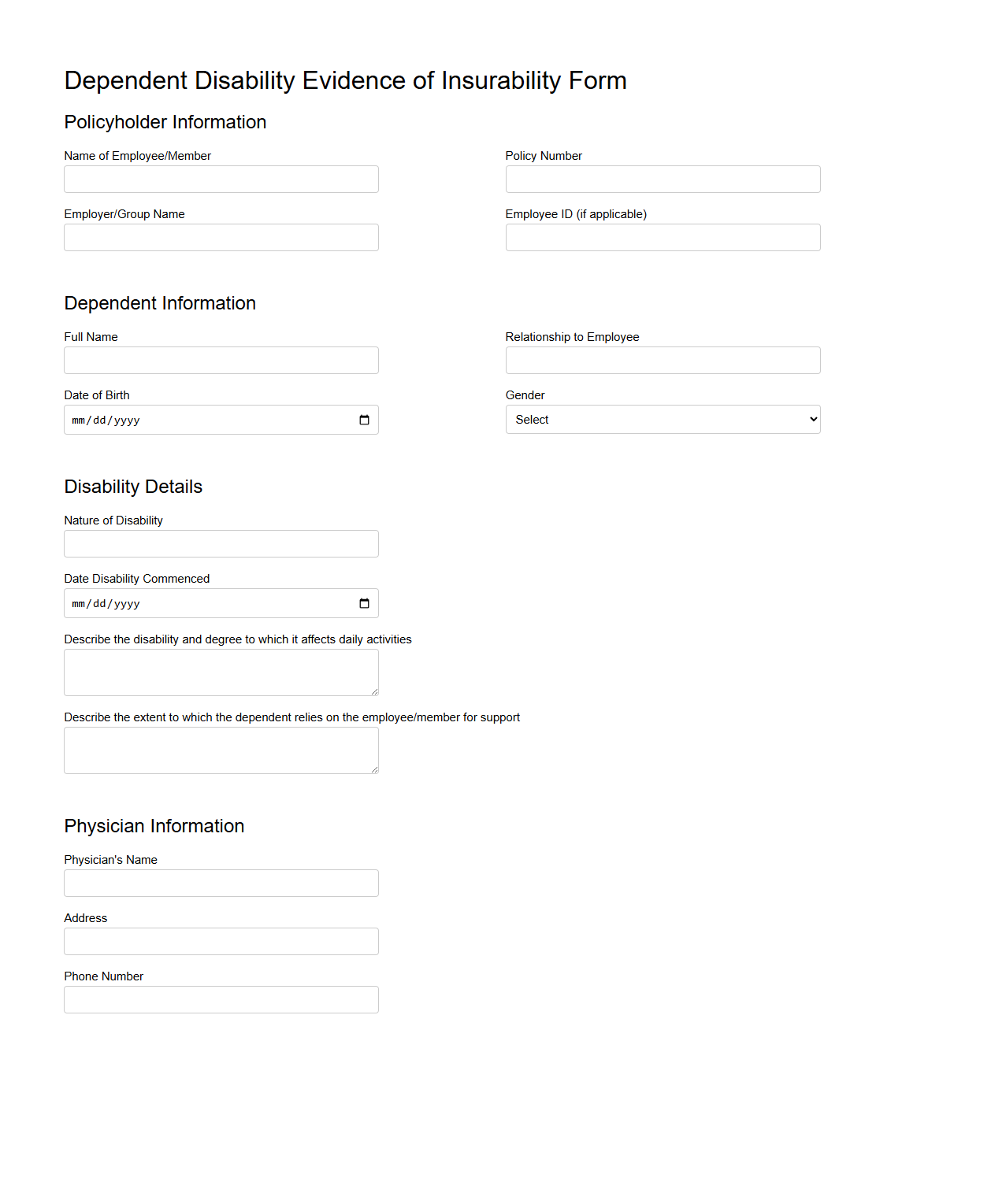

Dependent Disability Evidence of Insurability Form

The

Dependent Disability Evidence of Insurability Form is a crucial document used by insurance providers to assess the eligibility of a dependent for disability coverage. It requires detailed medical and personal information to verify the dependent's current health status and ensure compliance with policy requirements. This form helps insurers determine the level of risk and coverage options available for dependents under a disability insurance plan.

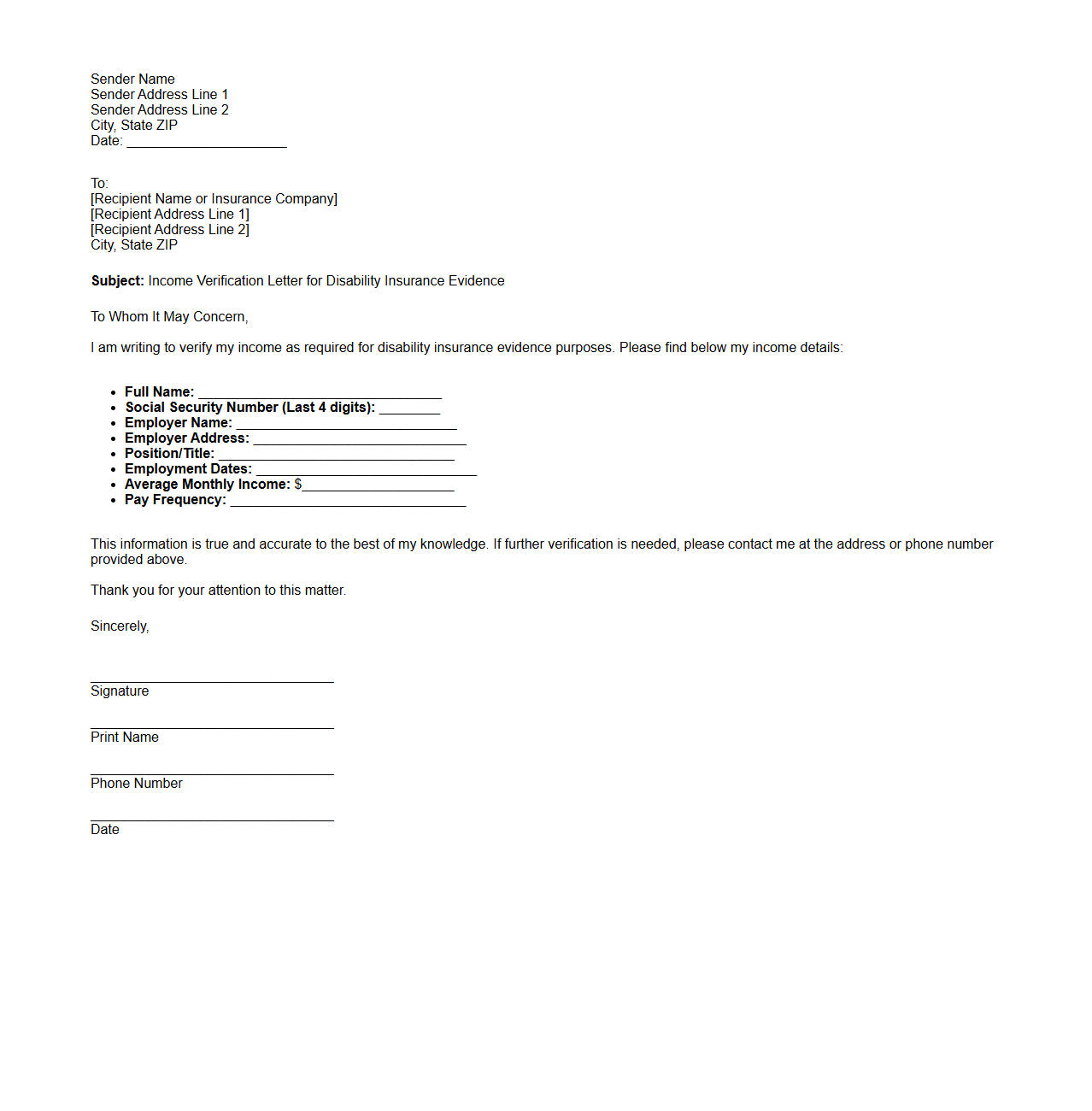

Income Verification Letter for Disability Insurance Evidence

An

Income Verification Letter for Disability Insurance serves as a crucial evidence document that confirms an individual's earnings prior to the disability claim. This letter typically includes detailed information about salary, employment duration, and any additional sources of income to verify the insured's financial status. Insurance providers use this document to assess eligibility and determine the appropriate benefit amount for disability coverage.

What specific personal details are required in the Evidence of Insurability Document for disability insurance?

The Evidence of Insurability Document requires comprehensive personal details such as full name, date of birth, and social security number. It also asks for contact information including address and phone number. Accurate personal details ensure proper identification and processing of the disability insurance application.

Which medical history questions must be answered on the document?

The document includes questions about past and current medical conditions, surgeries, hospitalizations, and treatments. Applicants must disclose any chronic illnesses, medications, and recent medical examinations. This information helps assess the risk and eligibility for disability insurance coverage.

What employment information is necessary to include in this sample?

The form requires details on the applicant's current occupation, employer's name, and duration of employment. It may also ask about job duties and work environment to evaluate the risk factors related to the occupation. This data assists the insurer in determining appropriate coverage and premiums.

How does the document address pre-existing condition disclosures?

The document mandates clear disclosure of any pre-existing medical conditions prior to the coverage effective date. It specifies the time frame during which conditions must be reported and may detail exclusions or waiting periods. This transparency helps prevent claim denials related to undisclosed health issues.

What supporting documentation or signatures are required for submission?

Applicants must provide medical records or physician statements if applicable, along with a personal signature to authenticate the information. Some forms also require an employer or witness signature to verify employment details. These elements ensure the completeness and validity of the insurance application.