A Subrogation Agreement Document Sample for Liability Insurance outlines the process by which an insurer assumes the policyholder's right to pursue third parties responsible for a loss. This document ensures clear terms for recovering costs from liable parties while protecting both insurer and insured interests. Using a well-structured sample helps streamline claims management and legal procedures in liability insurance cases.

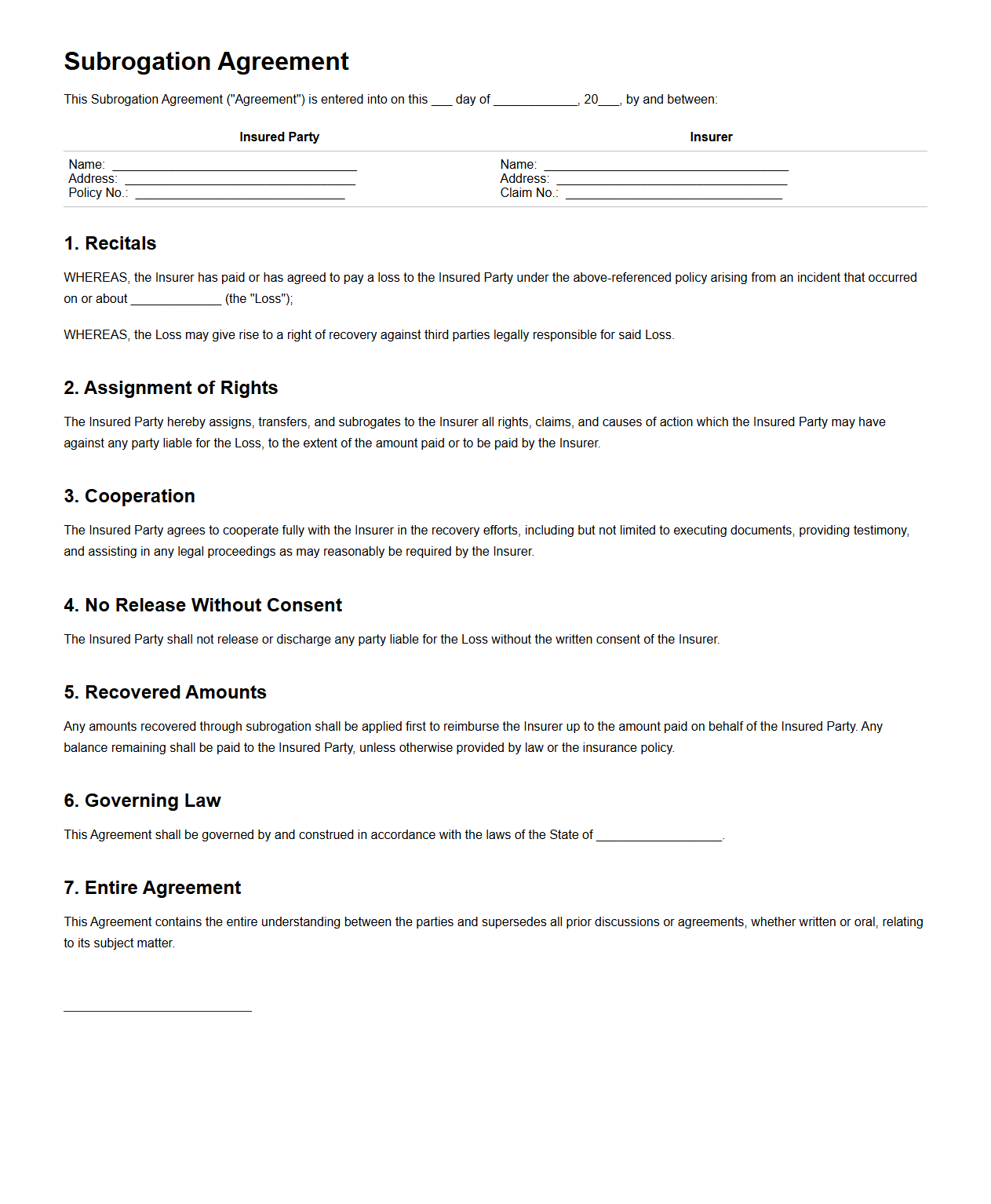

Subrogation Agreement Template for Liability Insurance Claims

A

Subrogation Agreement Template for Liability Insurance Claims is a legal document used to outline the rights and responsibilities between an insurer and the insured regarding the insurer's authority to pursue recovery from a third party responsible for causing a loss. This template ensures clear terms for the transfer of the insured's right to claim damages, helping to minimize disputes and streamline the recovery process. It is essential for managing the financial interests of both parties in liability insurance cases.

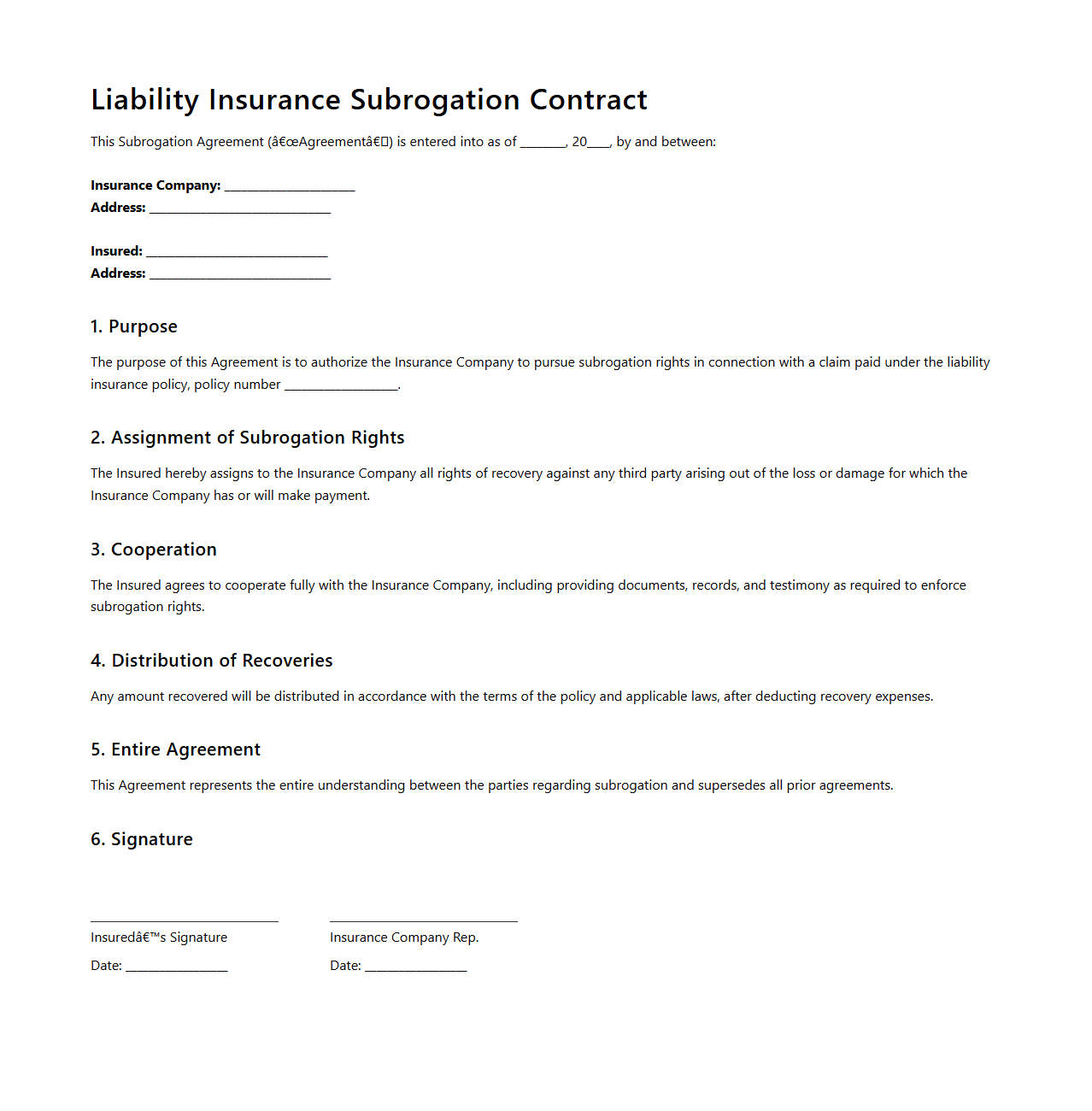

Liability Insurance Subrogation Contract Example

A

Liability Insurance Subrogation Contract document outlines the agreement between an insurance company and a third party regarding the insurer's right to pursue recovery of claims paid on behalf of the insured. This contract details the terms under which the insurer can seek reimbursement from the responsible party for damages caused by an insured event. It serves as a legal framework to protect the insurer's financial interests while ensuring compliance with insurance laws and policies.

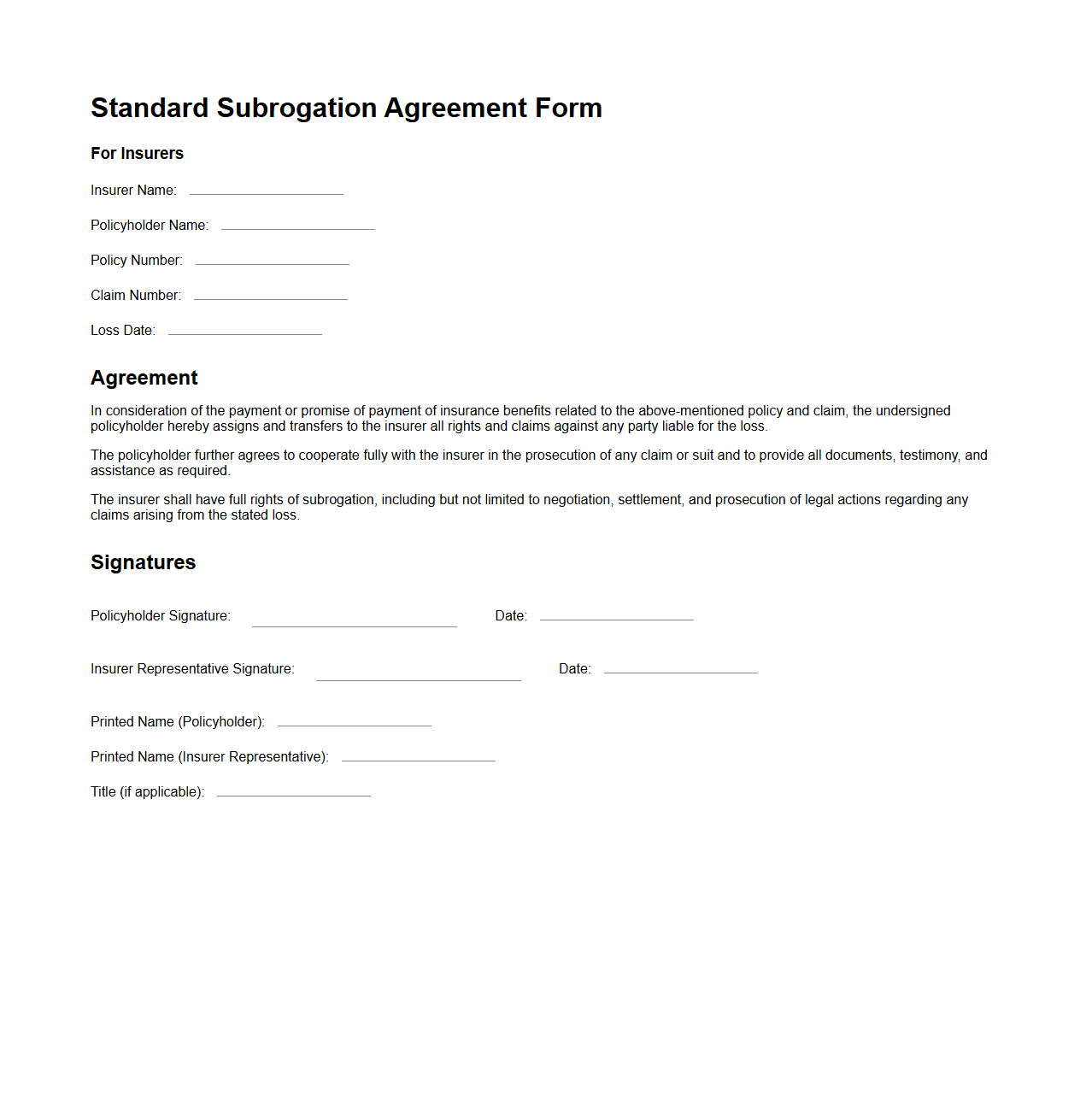

Standard Subrogation Agreement Form for Insurers

The

Standard Subrogation Agreement Form for Insurers is a legal document that outlines the transfer of recovery rights from an insured party to the insurer. This form enables insurers to pursue reimbursement from third parties responsible for damages or losses covered under the insurance policy. It ensures clear terms for subrogation claims, protecting the insurer's interests and facilitating efficient claims recovery processes.

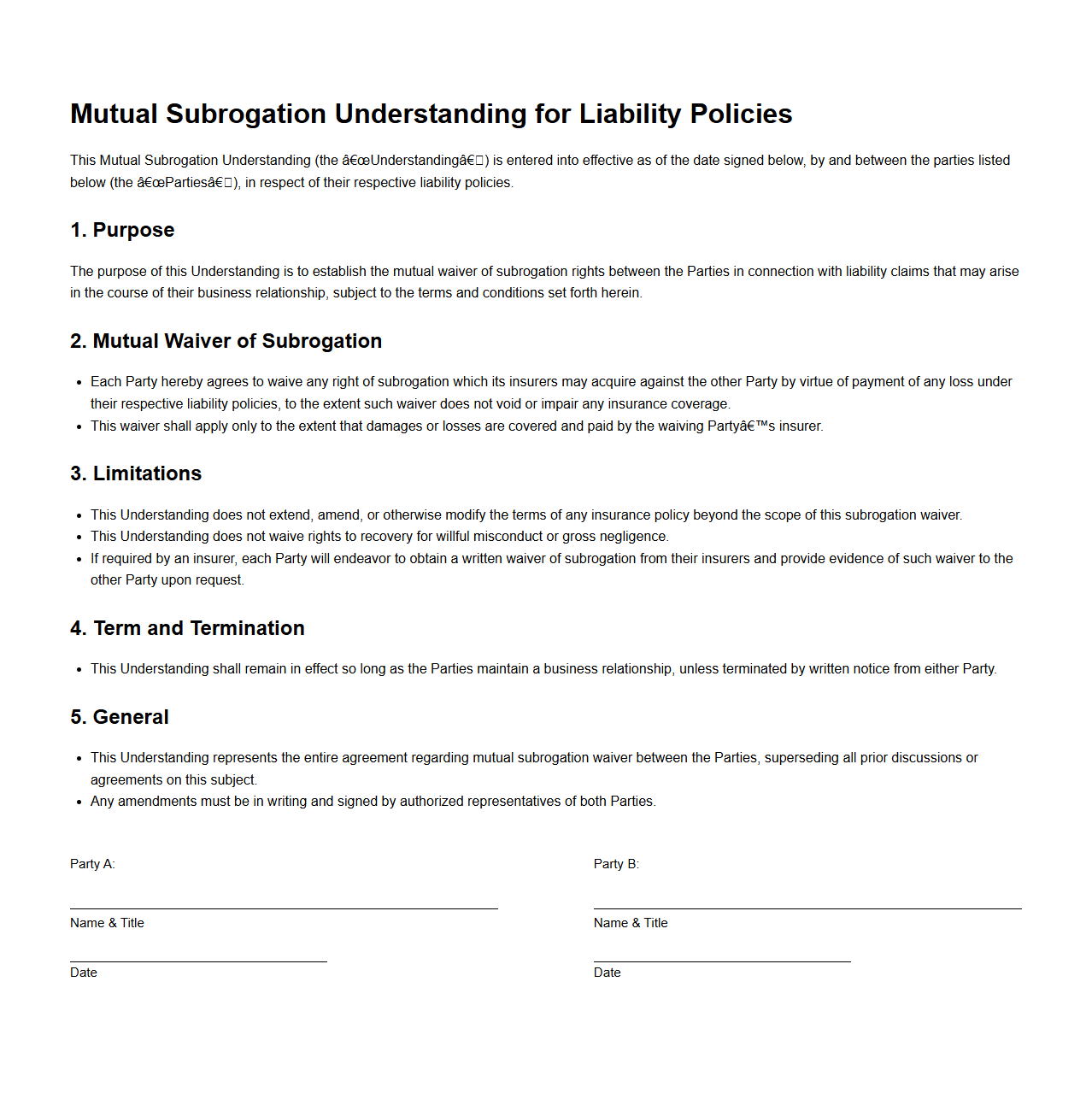

Mutual Subrogation Understanding for Liability Policies

Mutual Subrogation Understanding for Liability Policies is a crucial agreement that defines how insurers collaborate to handle claims involving multiple parties with shared liability. This document outlines the processes for recovering costs and allocating responsibility between insurers to prevent duplicate payments and ensure fair indemnity. Clear guidelines within the

Mutual Subrogation Understanding help streamline claim settlements and reduce disputes among liability insurers.

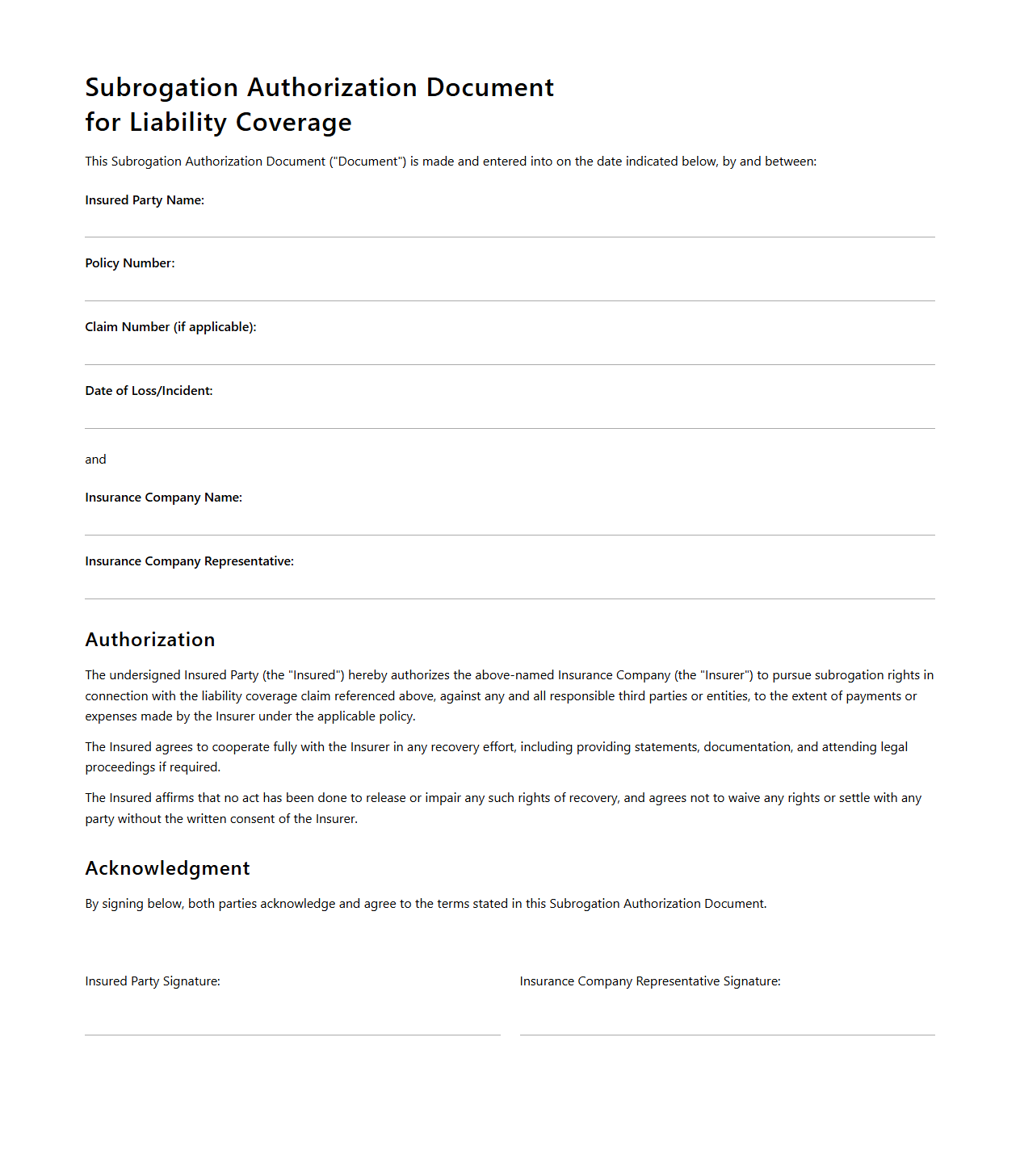

Subrogation Authorization Document for Liability Coverage

The

Subrogation Authorization Document for Liability Coverage is a legal form that grants an insurance company the right to pursue a third party responsible for causing a loss or damage after compensating the insured. It ensures the insurer can recover the amount paid on the claim by seeking reimbursement from the liable party or their insurer. This document is crucial for protecting the insurer's financial interests while allowing the insured to receive timely claim payments.

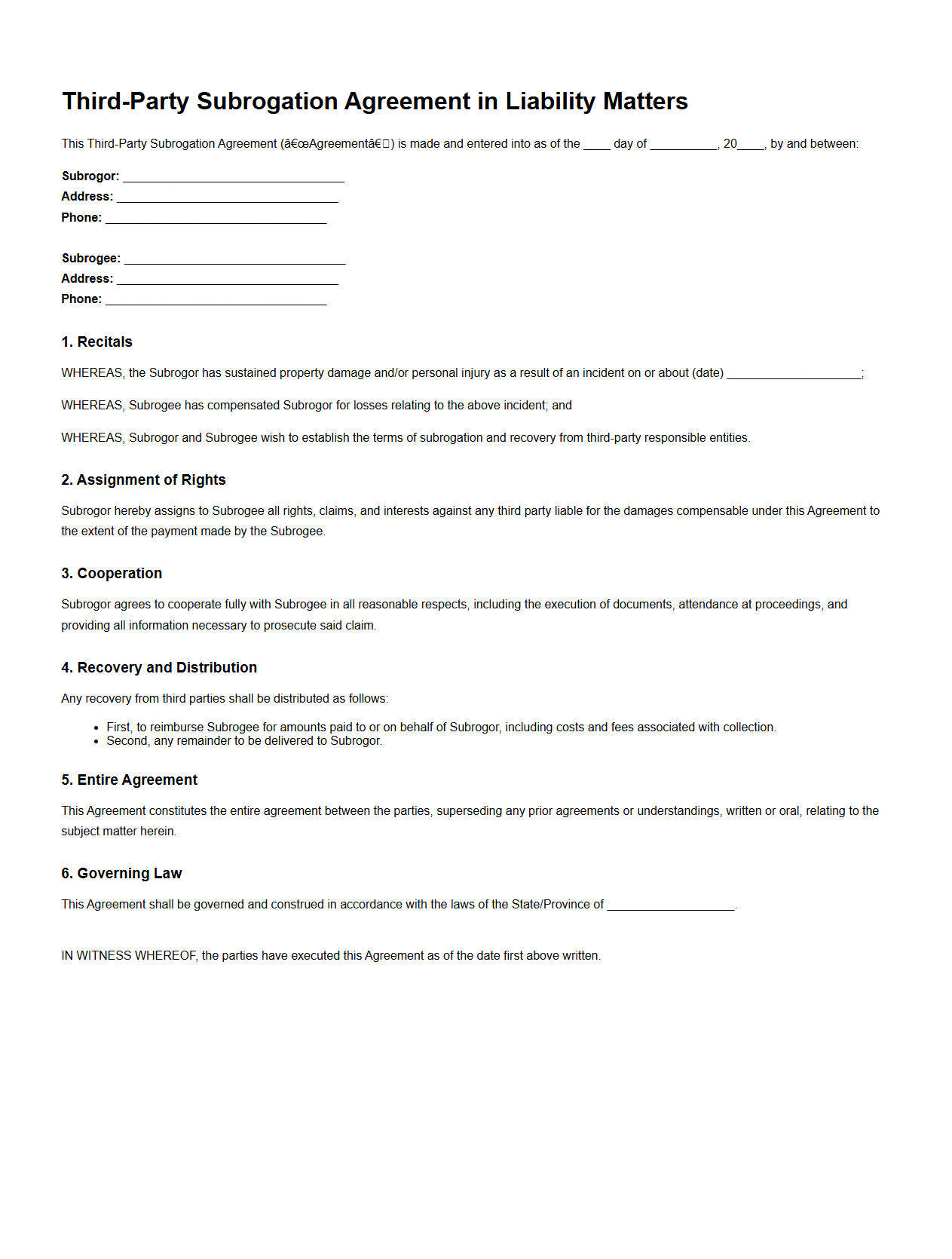

Third-Party Subrogation Agreement in Liability Matters

A

Third-Party Subrogation Agreement in liability matters is a legal contract where one party agrees to pursue a claim against a third party on behalf of another, typically after compensating the injured party. This document outlines the rights and responsibilities related to recovering damages from the liable third party, ensuring proper reimbursement. It plays a crucial role in managing liability claims and enhancing financial recovery processes.

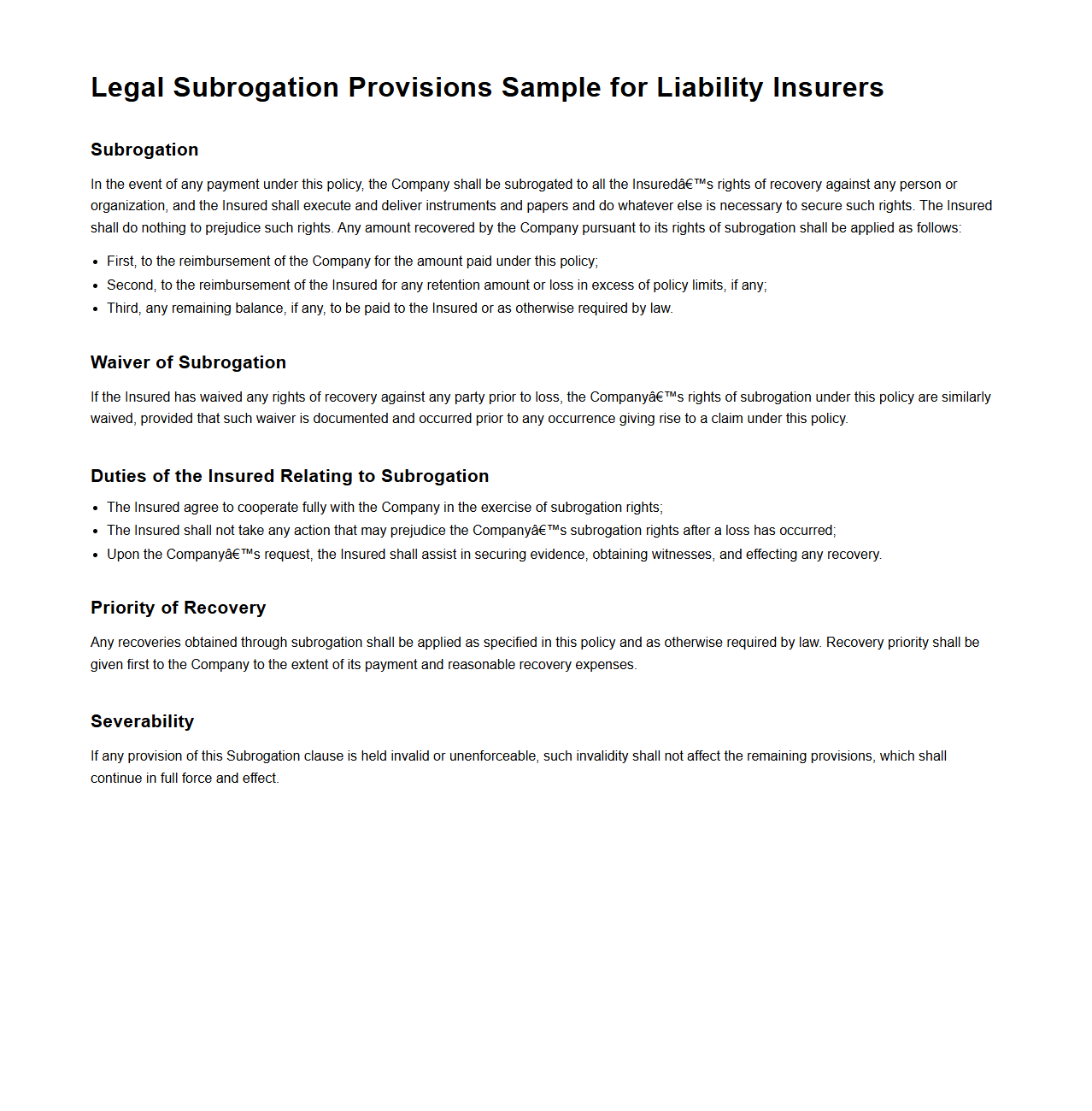

Legal Subrogation Provisions Sample for Liability Insurers

A

Legal Subrogation Provisions Sample for Liability Insurers document outlines the contractual clauses that permit an insurer to assume the insured's rights to recover costs from a third party responsible for a loss. It serves as a standardized reference for drafting subrogation rights, ensuring insurers can effectively pursue reimbursement without compromising the insured's interests. This document is essential for risk management and maintaining the insurer's ability to mitigate financial exposure in liability claims.

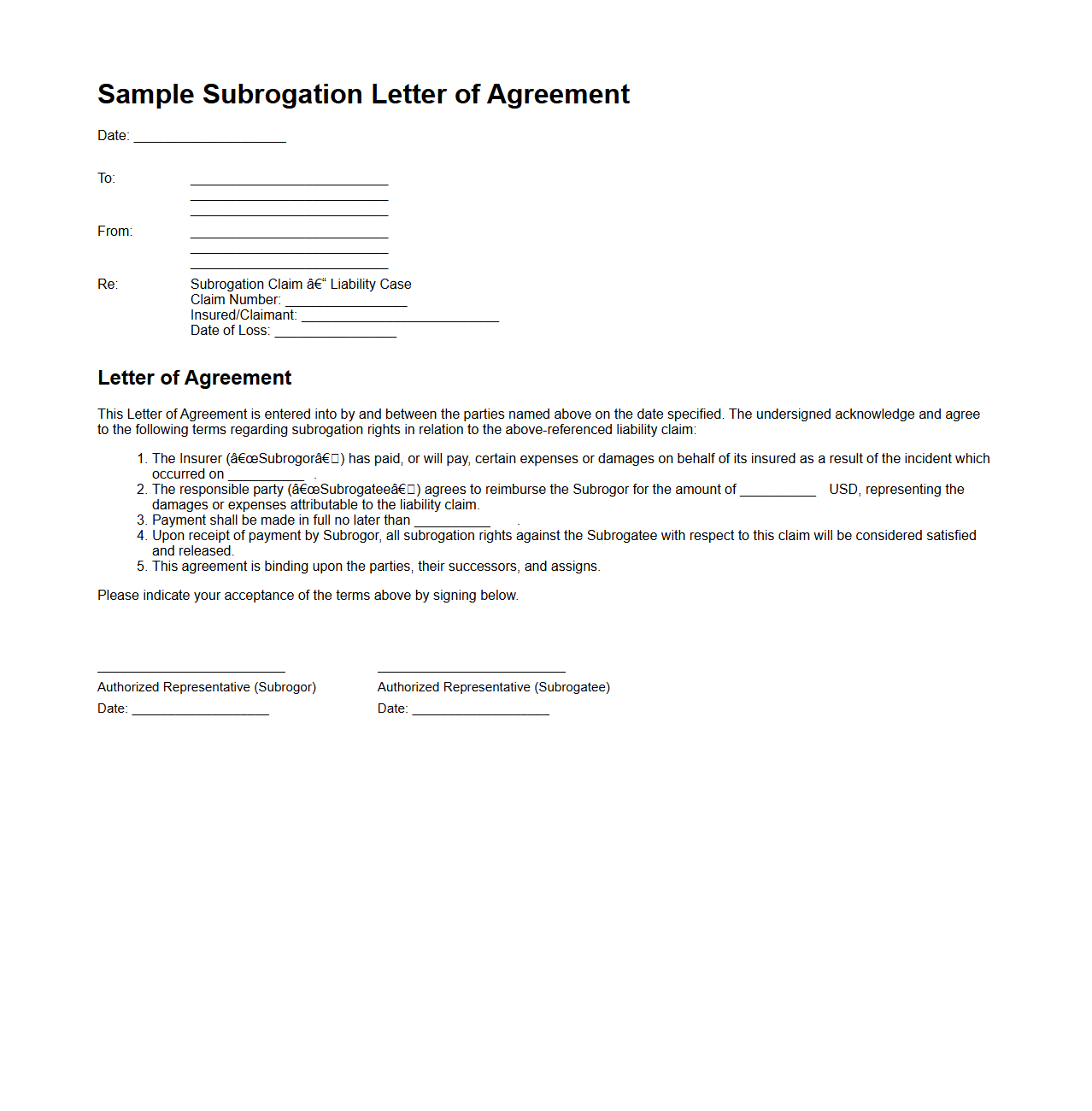

Sample Subrogation Letter of Agreement for Liability Cases

A

Sample Subrogation Letter of Agreement for Liability Cases is a legal document that outlines the terms under which one party, typically an insurance company, assumes the rights to pursue recovery from a third party responsible for damages or loss. This agreement clearly defines responsibilities, repayment processes, and settlement conditions to protect the interests of both parties involved. It serves as a critical tool to formalize claims and ensure efficient resolution of financial liability in personal injury or property damage cases.

Simple Subrogation Agreement for General Liability Insurance

A

Simple Subrogation Agreement for General Liability Insurance is a legal contract that allows an insurer to recover costs from a third party responsible for a loss after compensating the insured. This document clarifies the rights and responsibilities of involved parties, preventing the insured from waiving the insurer's subrogation rights. It ensures efficient claims handling and reduces disputes by specifying how indemnity and recovery processes are managed.

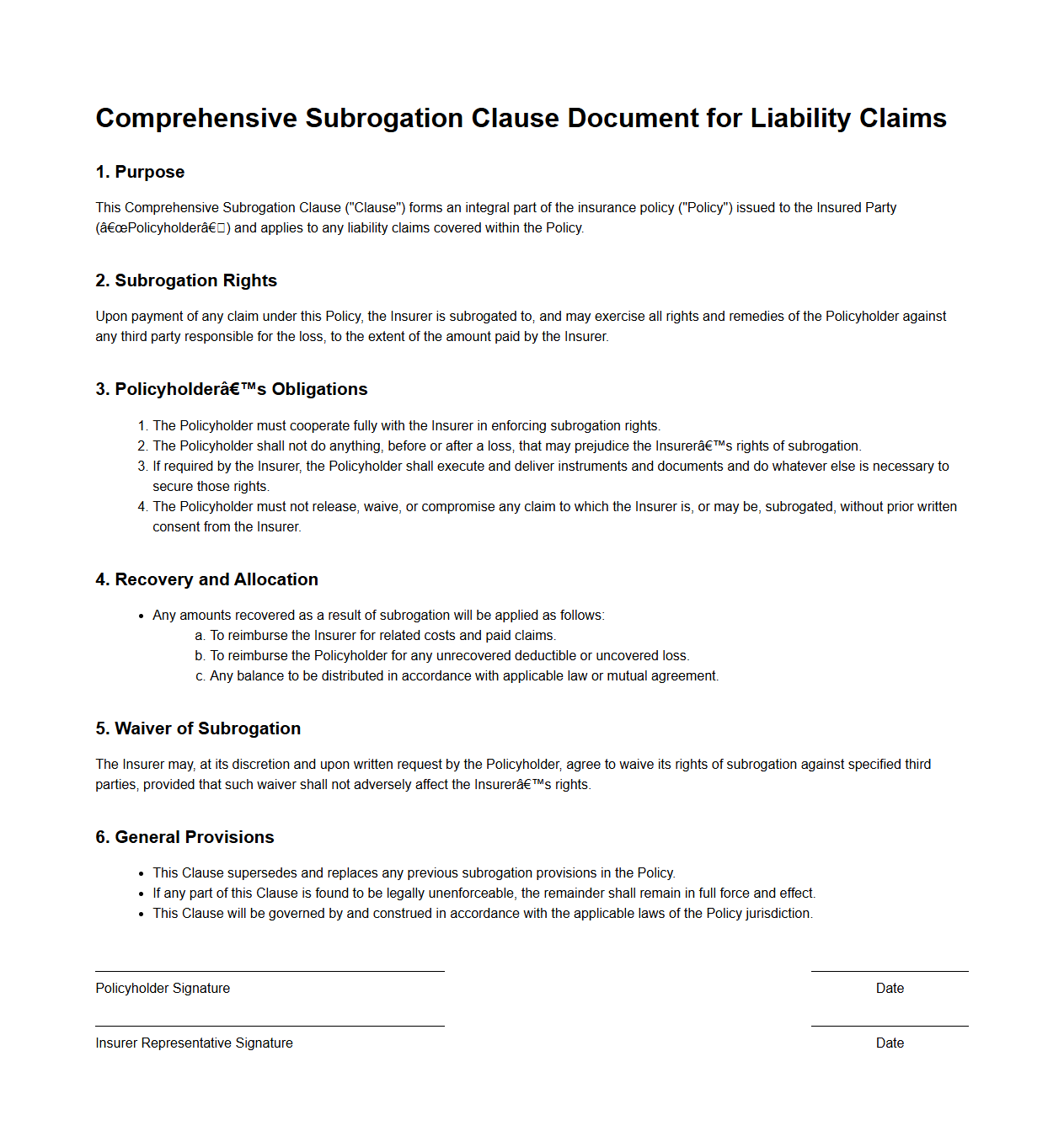

Comprehensive Subrogation Clause Document for Liability Claims

A

Comprehensive Subrogation Clause Document for liability claims outlines the rights and responsibilities related to the recovery process when one party assumes the legal right to pursue a third party responsible for causing a loss. This document ensures that the insurer or indemnifying party can seek reimbursement from the liable party after compensating the insured. It helps clarify the scope of subrogation rights, preventing disputes and streamlining claim settlements in liability insurance cases.

What parties are identified as having rights and obligations in the subrogation agreement?

The parties identified as having rights and obligations in the subrogation agreement are primarily the insurer and the insured. Both parties must adhere to the terms regarding claims and recovery rights. The agreement may also involve third parties against whom the insurer seeks recovery.

Under what conditions does the insurer gain subrogation rights from the insured?

The insurer gains subrogation rights when it pays a claim to the insured under the insurance policy. This transfer of rights allows the insurer to pursue recovery from responsible third parties. Conditions typically include the insured's acceptance of the claim payment and adherence to the policy terms.

What types of claims or losses does the subrogation agreement specifically address?

The subrogation agreement specifically addresses claims or losses for which the insurer has indemnified the insured. This often includes property damage, personal injury, or liability claims covered by the insurance policy. The agreement ensures recovery efforts are focused on reimbursing paid losses.

How are recoveries from third parties to be distributed between insurer and insured?

Recoveries from third parties are generally distributed to reimburse the insurer for the amount paid in claims first. Any remaining amounts may then be shared with the insured as stipulated in the subrogation agreement. The exact distribution method is clearly outlined to prevent disputes over recovered funds.

What are the insured's responsibilities for cooperating with the insurer during the subrogation process?

The insured must provide timely and full cooperation to assist the insurer in pursuing third-party recoveries. This includes providing documentation, evidence, and possibly testimony. Failure to cooperate can hinder recovery efforts and may impact the insured's coverage or claims.