A Reinstatement Request Document Sample for Lapsed Insurance Policy serves as a formal template to help policyholders request the revival of an expired insurance policy. This document typically includes essential details such as the policy number, reason for lapse, and the request for reinstatement to restore coverage. Using a clear and concise sample ensures the request meets the insurer's requirements, facilitating a smoother approval process.

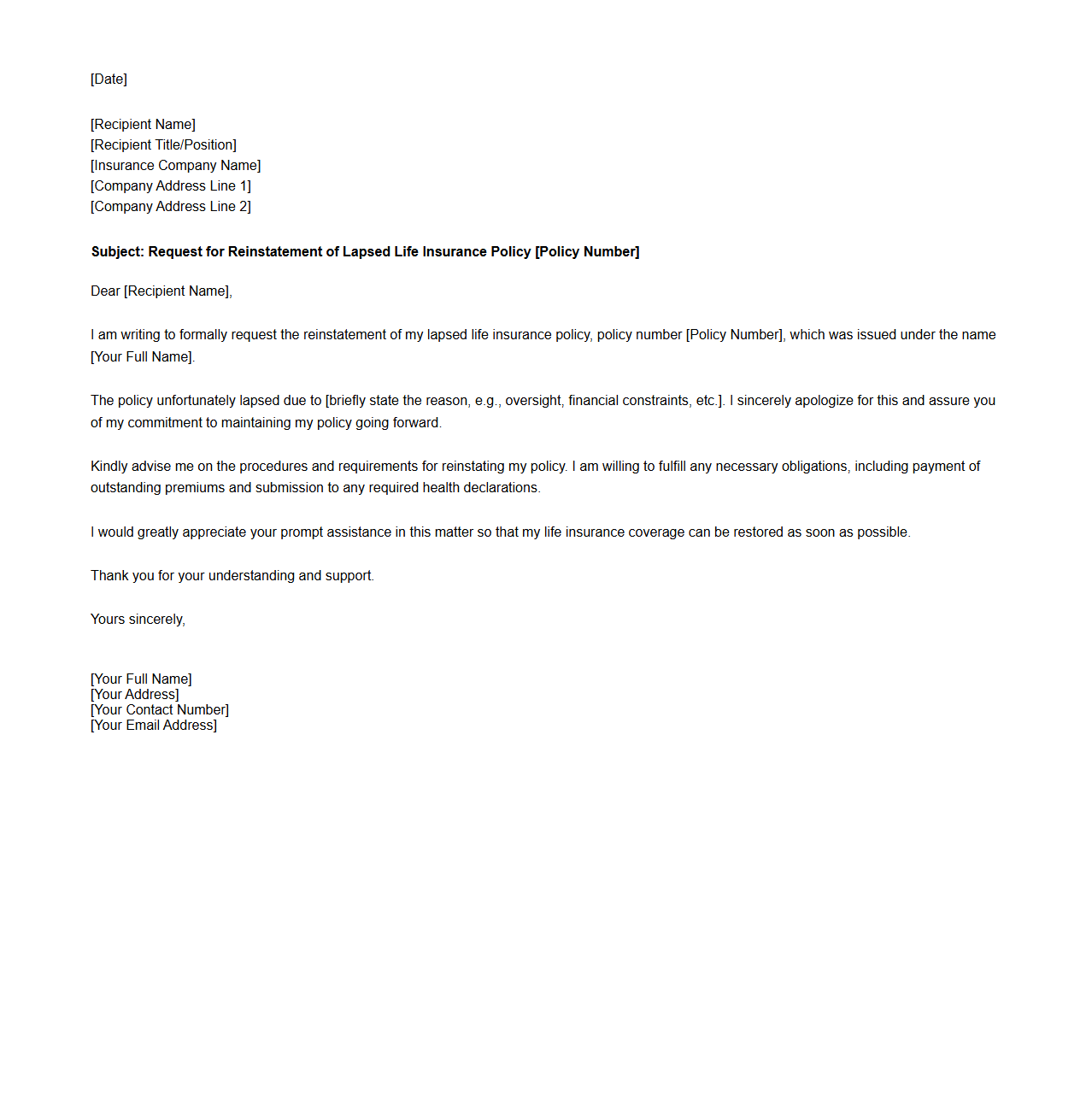

Reinstatement Request Letter for Lapsed Life Insurance Policy

A

Reinstatement Request Letter for Lapsed Life Insurance Policy is a formal document submitted by the policyholder to the insurance company seeking to reactivate a life insurance policy that has lapsed due to non-payment of premiums. This letter typically includes details such as policy number, reasons for lapse, and a request to reinstate the policy by paying overdue premiums along with any applicable interest or fees. Insurers use this document to evaluate the possibility of restoring coverage based on the policyholder's health status and compliance with company guidelines.

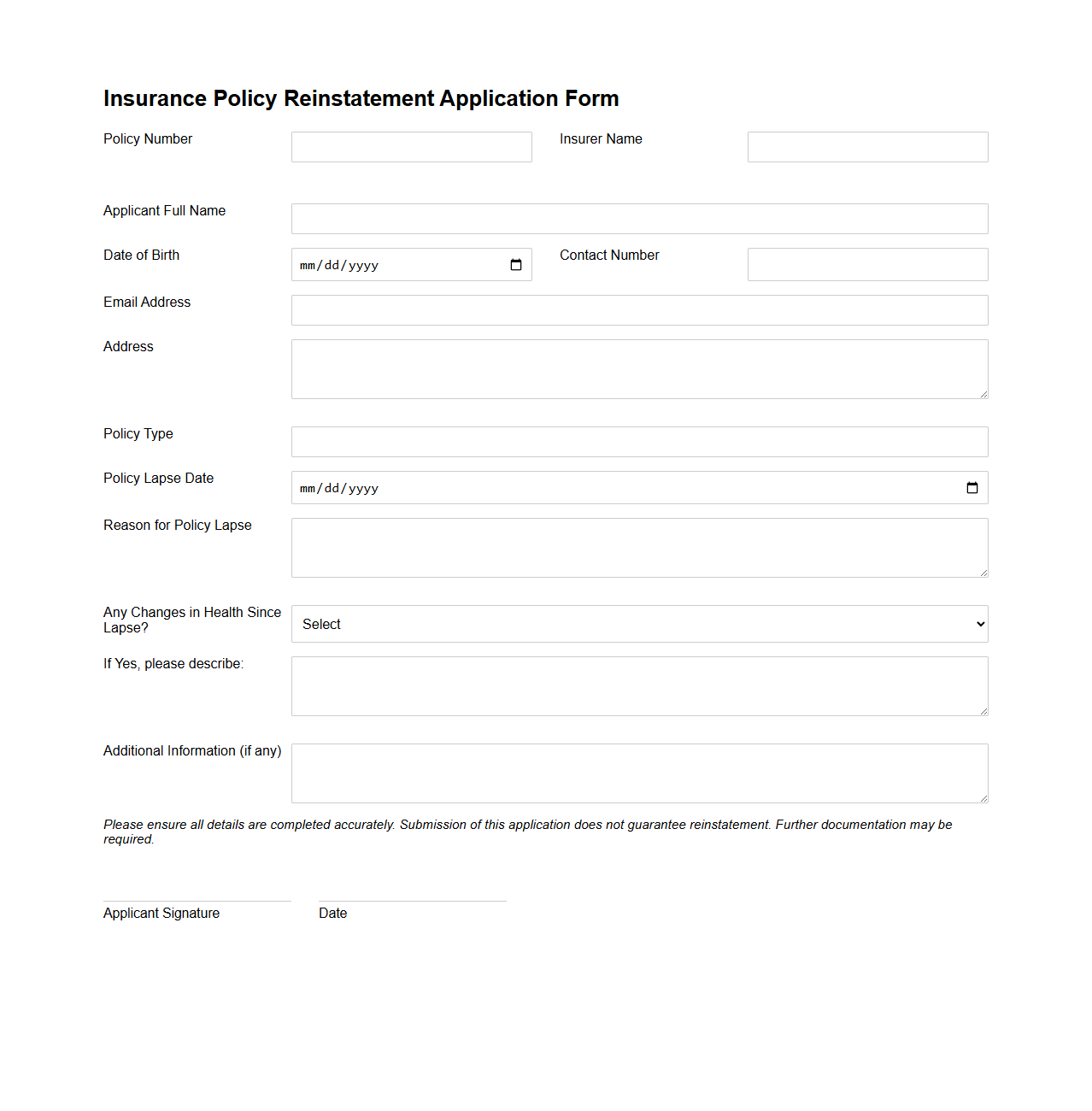

Insurance Policy Reinstatement Application Form

An

Insurance Policy Reinstatement Application Form is a document submitted by policyholders seeking to reactivate a lapsed insurance policy. It contains personal details, policy information, and reasons for reinstatement, often requiring medical examinations or proof of insurability. Completing this form accurately and promptly increases the chances of restoring coverage without losing accrued benefits.

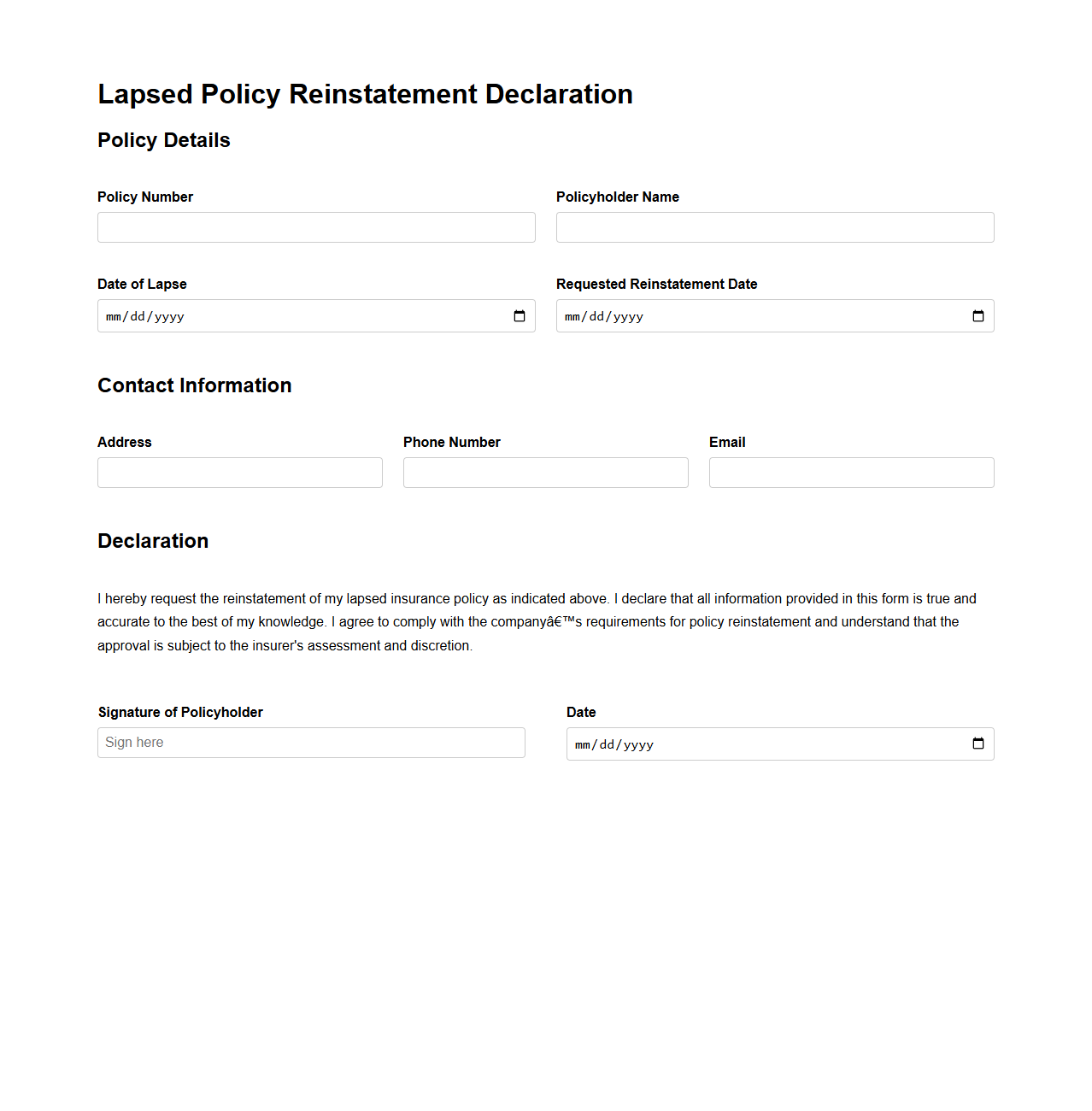

Lapsed Policy Reinstatement Declaration Template

The

Lapsed Policy Reinstatement Declaration Template document serves as an official form used by policyholders to request the reactivation of an insurance policy that has expired or lapsed due to non-payment or other reasons. It typically requires detailed information about the insured, policy details, reason for lapse, and confirmation that the policyholder agrees to the terms of reinstatement, including any outstanding premiums or penalties. This document is crucial for insurers to assess eligibility and process the reinstatement within regulatory and policy framework.

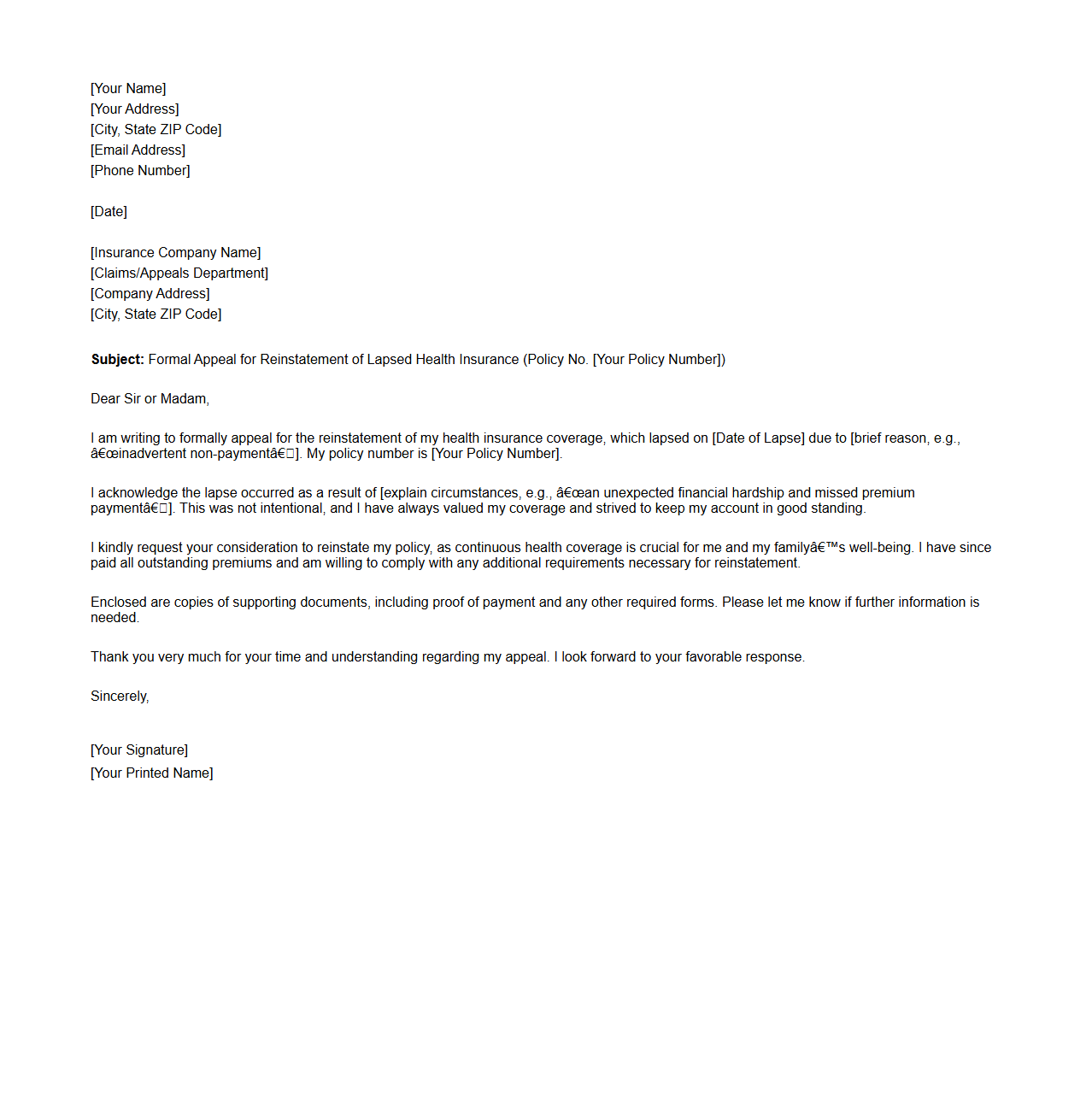

Formal Appeal for Reinstatement of Lapsed Health Insurance

A

Formal Appeal for Reinstatement of Lapsed Health Insurance document is a written request submitted by a policyholder to an insurance company seeking to reactivate a health insurance policy that has expired due to non-payment or other reasons. This document typically includes the policyholder's personal information, policy details, reasons for the lapse, and any supporting evidence justifying the request for reinstatement. The appeal aims to demonstrate the policyholder's intent to continue coverage and comply with the insurer's terms to restore active health insurance status.

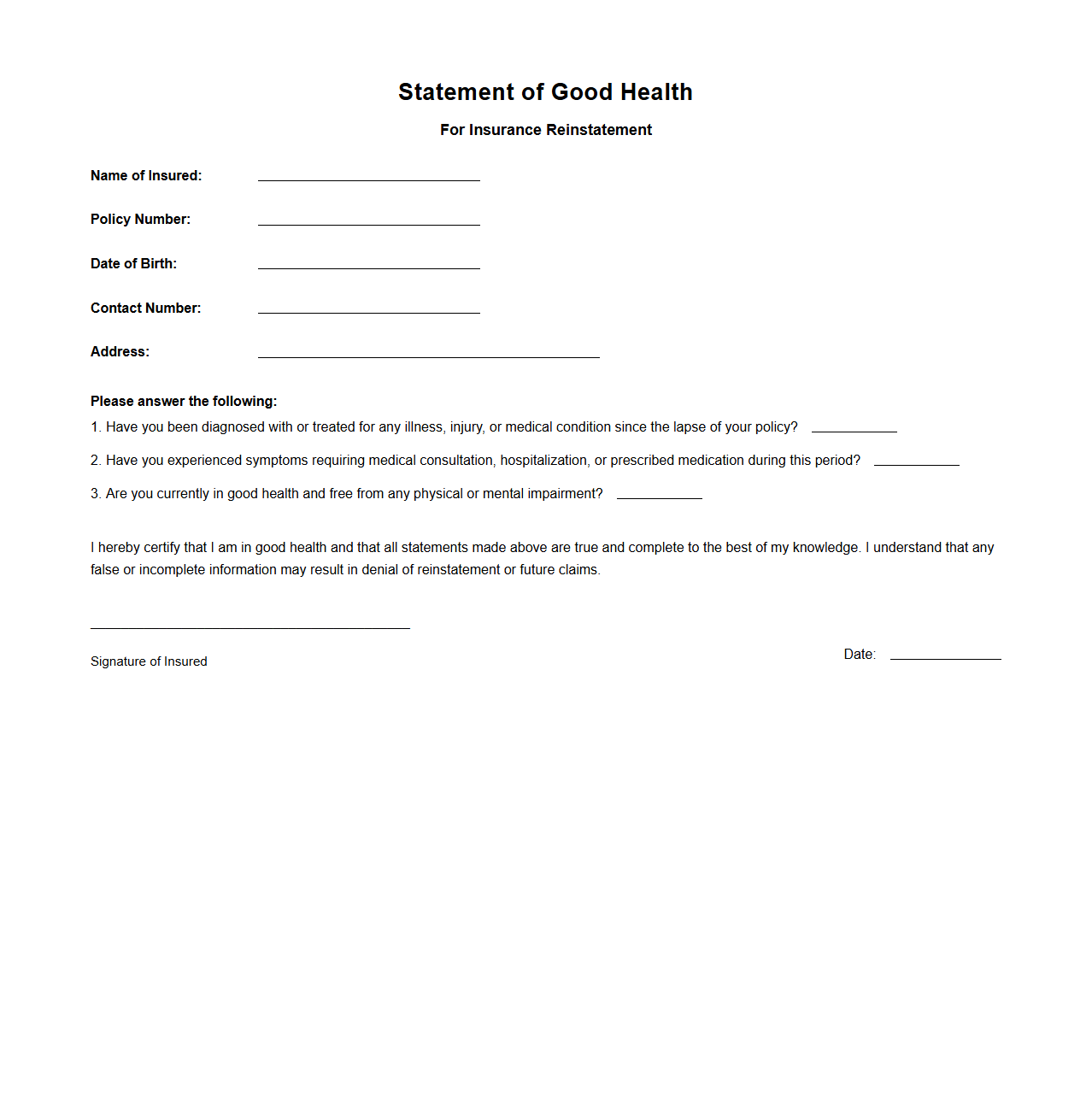

Statement of Good Health for Insurance Reinstatement

A

Statement of Good Health for Insurance Reinstatement is a formal document required by insurance companies to confirm that the policyholder is currently in good health after a lapse or cancellation of their insurance policy. This statement helps the insurer assess the risk before reinstating the coverage without requiring a full medical exam. Providing accurate health information ensures a smoother reinstatement process and prevents potential claim denials.

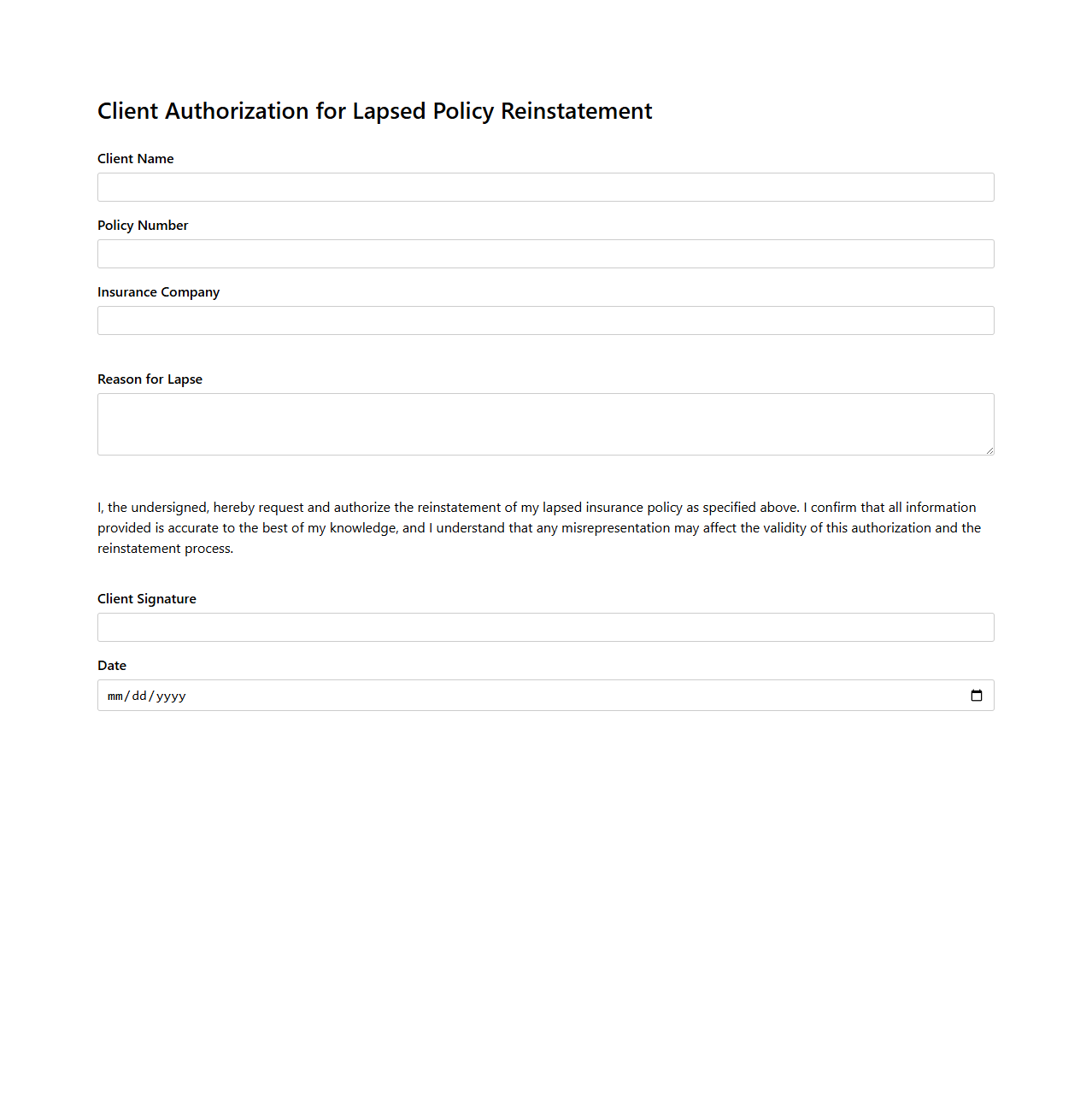

Client Authorization for Lapsed Policy Reinstatement

The

Client Authorization for Lapsed Policy Reinstatement document grants formal consent from the policyholder to reactivate an insurance policy that has expired due to non-payment or other reasons. This authorization ensures compliance with regulatory requirements and confirms the client's understanding of any revised terms, conditions, or premiums associated with the reinstated policy. It serves as a crucial record for both the insurance provider and the client, safeguarding the reinstatement process and preventing potential disputes.

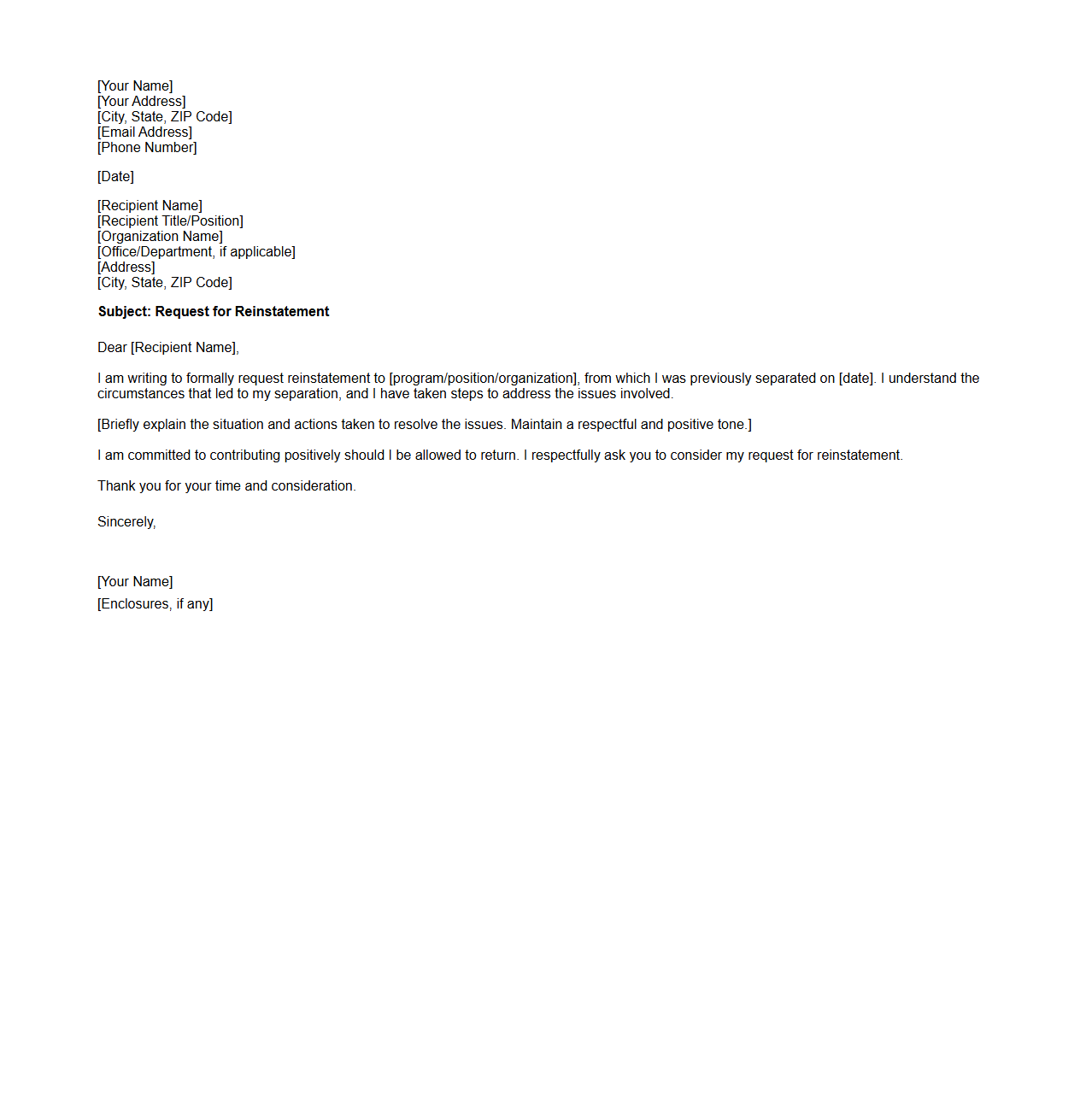

Reinstatement Request Cover Letter Format

A

Reinstatement Request Cover Letter Format document serves as a formal template to help individuals or businesses request the restoration of a previously terminated or suspended service, account, or membership. This document outlines the necessary components such as the reason for reinstatement, relevant identification details, and a polite appeal to the recipient, ensuring clarity and professionalism. Using a standardized format increases the likelihood of a successful reinstatement by presenting the request in an organized and persuasive manner.

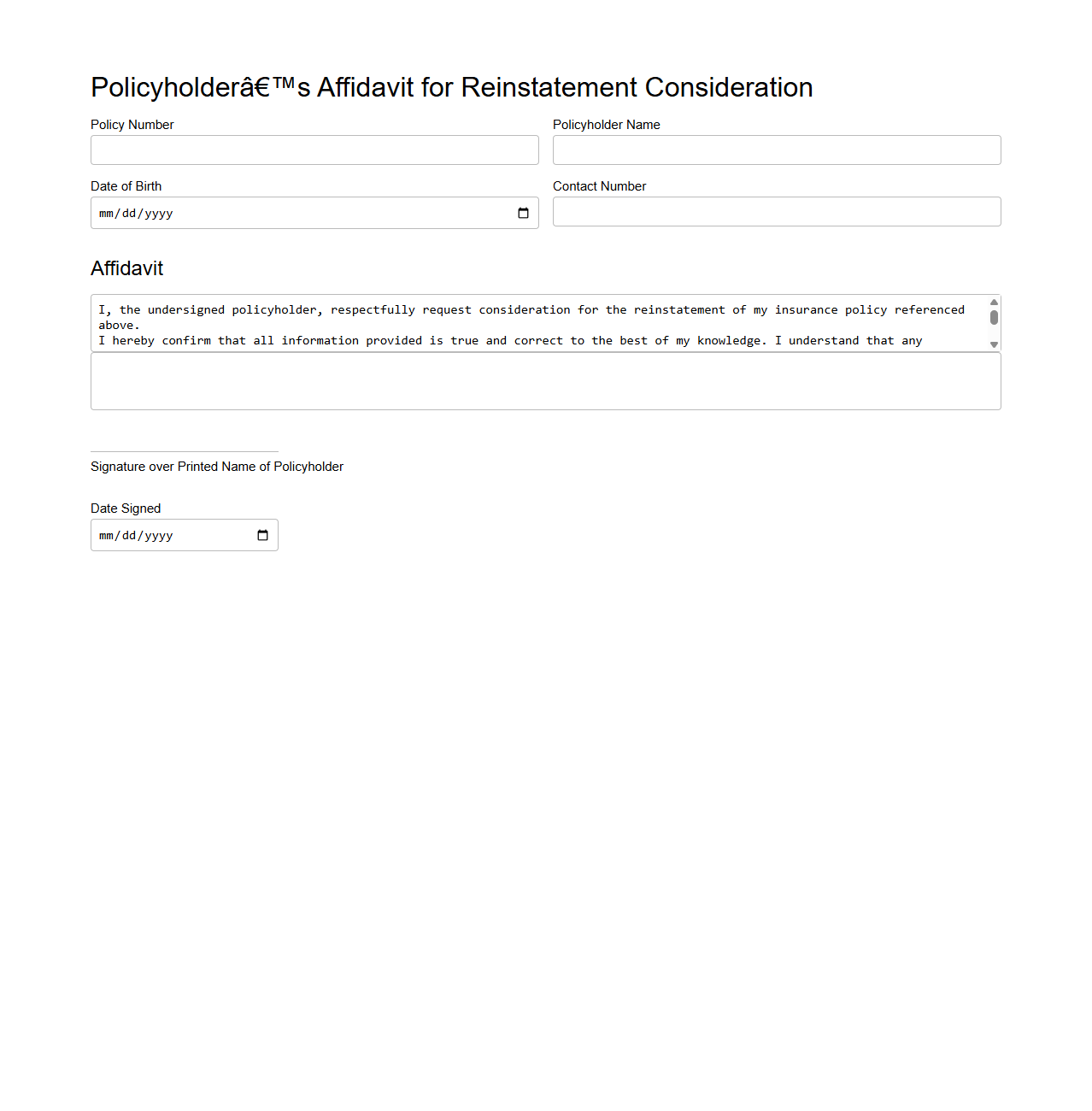

Policyholder’s Affidavit for Reinstatement Consideration

A

Policyholder's Affidavit for Reinstatement Consideration is a sworn statement submitted by the insurance policyholder to request the reinstatement of a lapsed insurance policy. This document typically includes details about the policyholder's identity, the reason for lapse, and assurance of outstanding premium payments. Insurers use this affidavit to evaluate the validity of the request and ensure compliance with policy terms before restoring coverage.

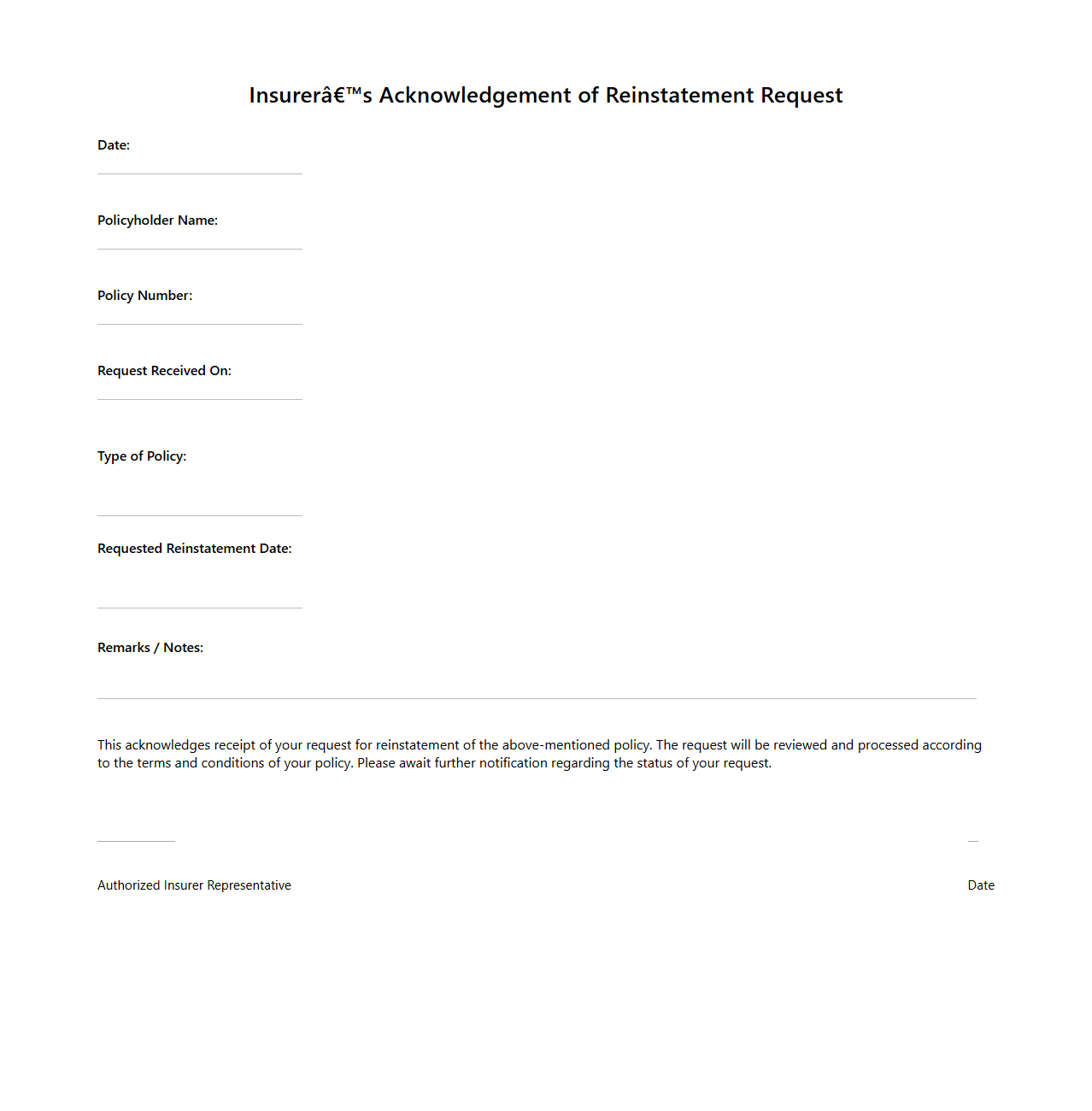

Insurer’s Acknowledgement of Reinstatement Request

The

Insurer's Acknowledgement of Reinstatement Request document serves as formal confirmation from the insurance company that it has received a policyholder's request to reinstate a lapsed insurance policy. This document outlines the conditions and necessary steps the policyholder must fulfill to reactivate coverage, such as payment of outstanding premiums or submission of additional medical information. It is an essential record ensuring transparent communication between the insurer and policyholder during the reinstatement process.

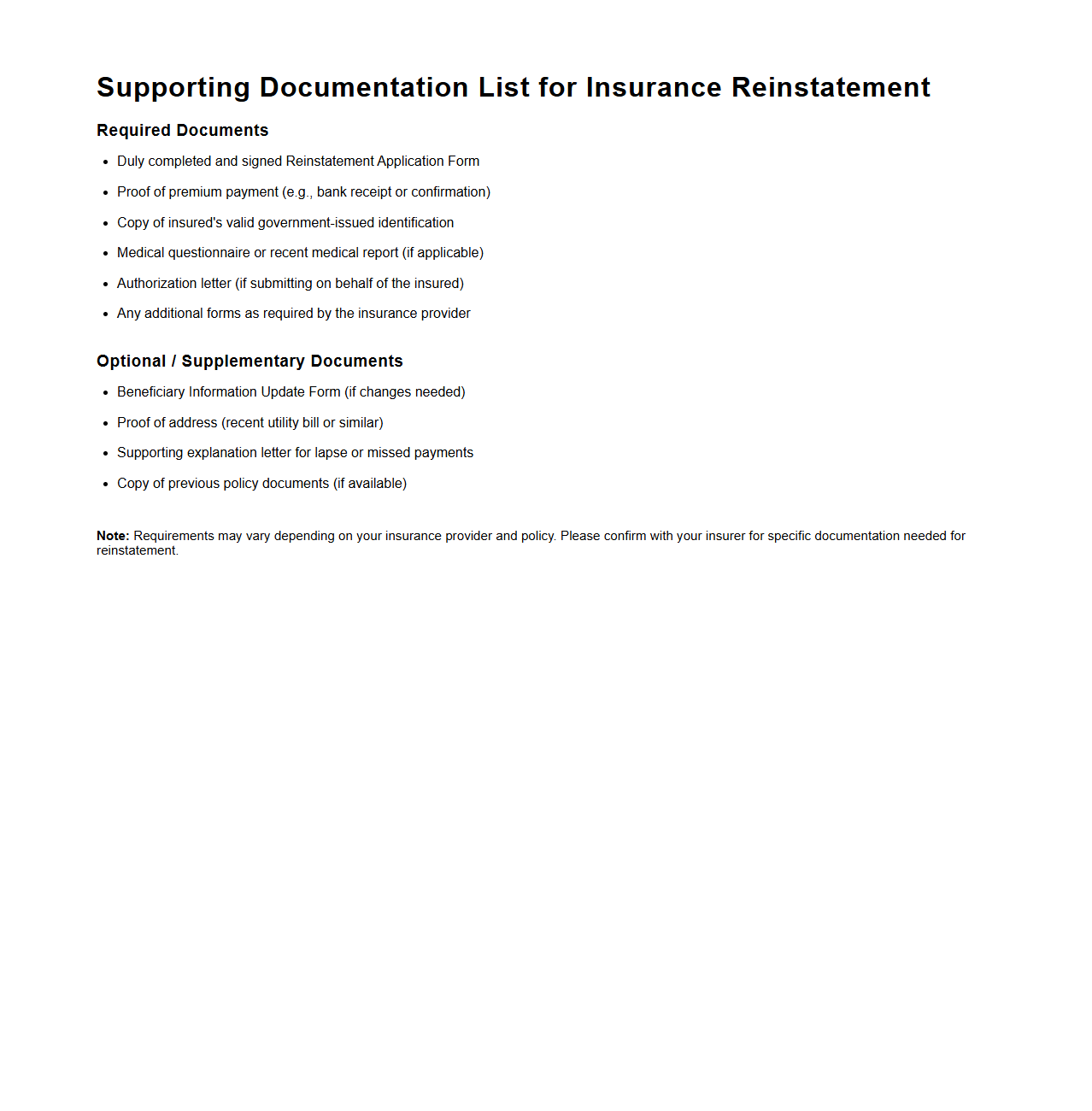

Supporting Documentation List for Insurance Reinstatement

The Supporting Documentation List for Insurance Reinstatement is a detailed compilation of essential documents required to restore a lapsed insurance policy. This list typically includes proof of identity, previous policy details, payment receipts, and any medical or inspection reports relevant to policy evaluation. Ensuring the submission of all

supporting documentation facilitates a smooth and timely reinstatement process with the insurance provider.

Key Information for a Reinstatement Request

A reinstatement request must include the policyholder's full name, policy number, and the reason for the lapse. Clear mention of the date when the policy lapsed is essential to process the request accurately. Including the amount of premium payment being submitted for reinstatement accelerates the review timeline.

Supporting Documents Required

Typically, a reinstatement request needs to be accompanied by proof of payment for outstanding premiums. Medical reports or health declarations might be required depending on the period of lapse and the insurer's policies. Additionally, a valid government-issued identification document is often mandated for identity verification.

Common Reasons for Policy Lapse

The reinstatement request usually addresses reasons such as financial difficulties, oversight, or missed premium payments. It may also mention any changes in the policyholder's contact information or banking details that caused delays. A clear explanation helps insurers understand the lapse context and assess the reinstatement feasibility.

Addressing Health Status in the Request

Insurance companies require updated information on the insured's current health status to reassess risk accurately. The request may include a health declaration form or recent medical check-up results. Transparency about any health changes since the last policy period is critical for approval.

Structure of a Reinstatement Request Letter

The letter typically follows a formal format beginning with the policyholder's information, followed by a clear statement of intent to reinstate the lapsed policy. It includes detailed reasons for the lapse, supporting documents, and a polite request for favorable consideration. A closing section with a thank you and contact details ensures professionalism and easy follow-up.