A Loss Notification Document Sample for Business Interruption Insurance outlines the formal process of reporting a financial loss due to unforeseen disruptions in business operations. This document includes critical details such as the nature of the interruption, estimated loss amount, and supporting evidence to facilitate prompt claim assessment. Using a well-structured sample ensures insurers receive clear and accurate information, expediting the reimbursement process.

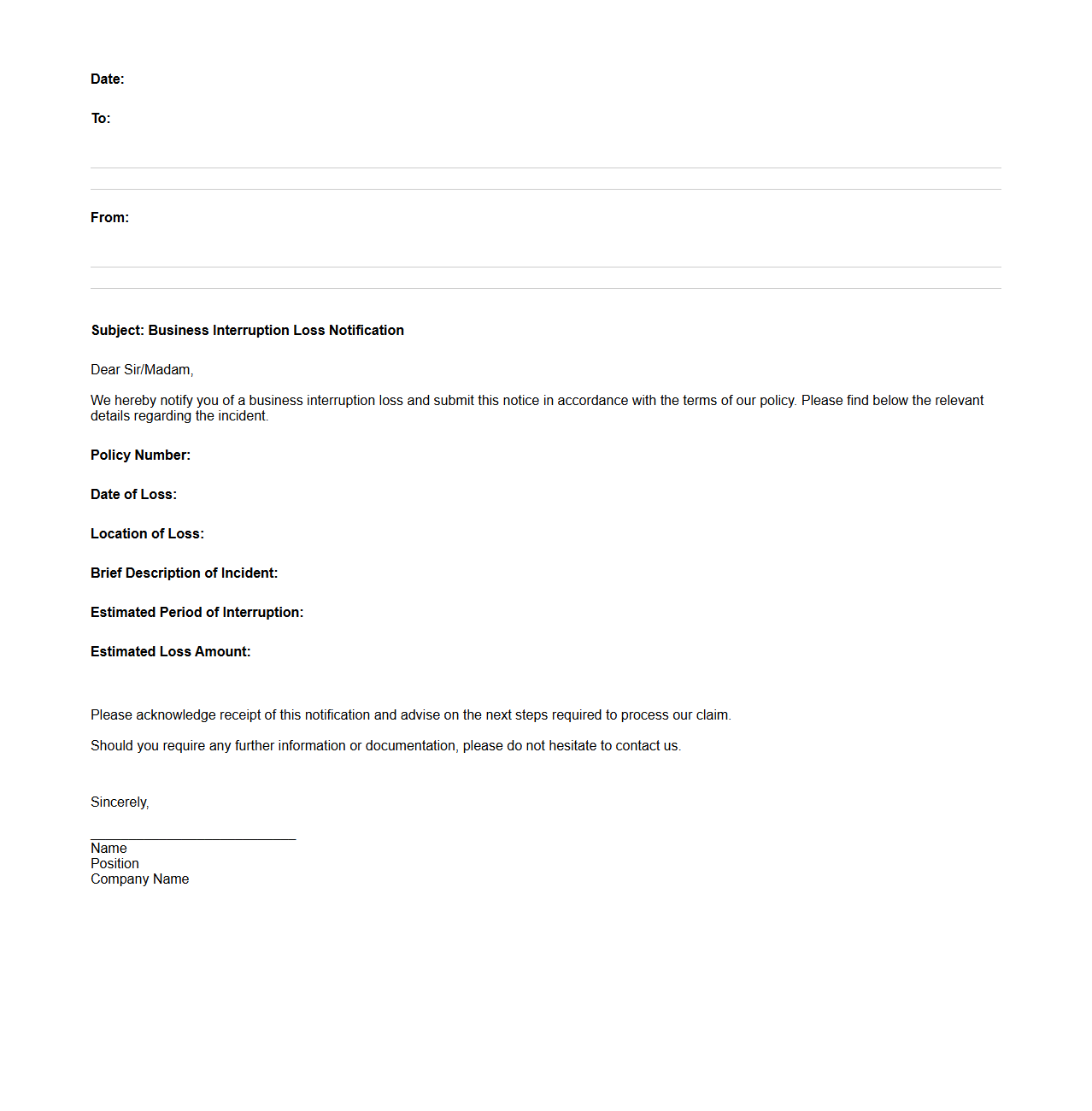

Business Interruption Loss Notification Letter Template

A

Business Interruption Loss Notification Letter Template document serves as a formal communication tool used by businesses to notify their insurance providers about interruptions causing financial losses. This template streamlines the reporting process by including essential details such as the nature of the interruption, the period affected, and estimated financial impact. Utilizing this template helps ensure timely and accurate claims handling, facilitating quicker recovery for the affected business.

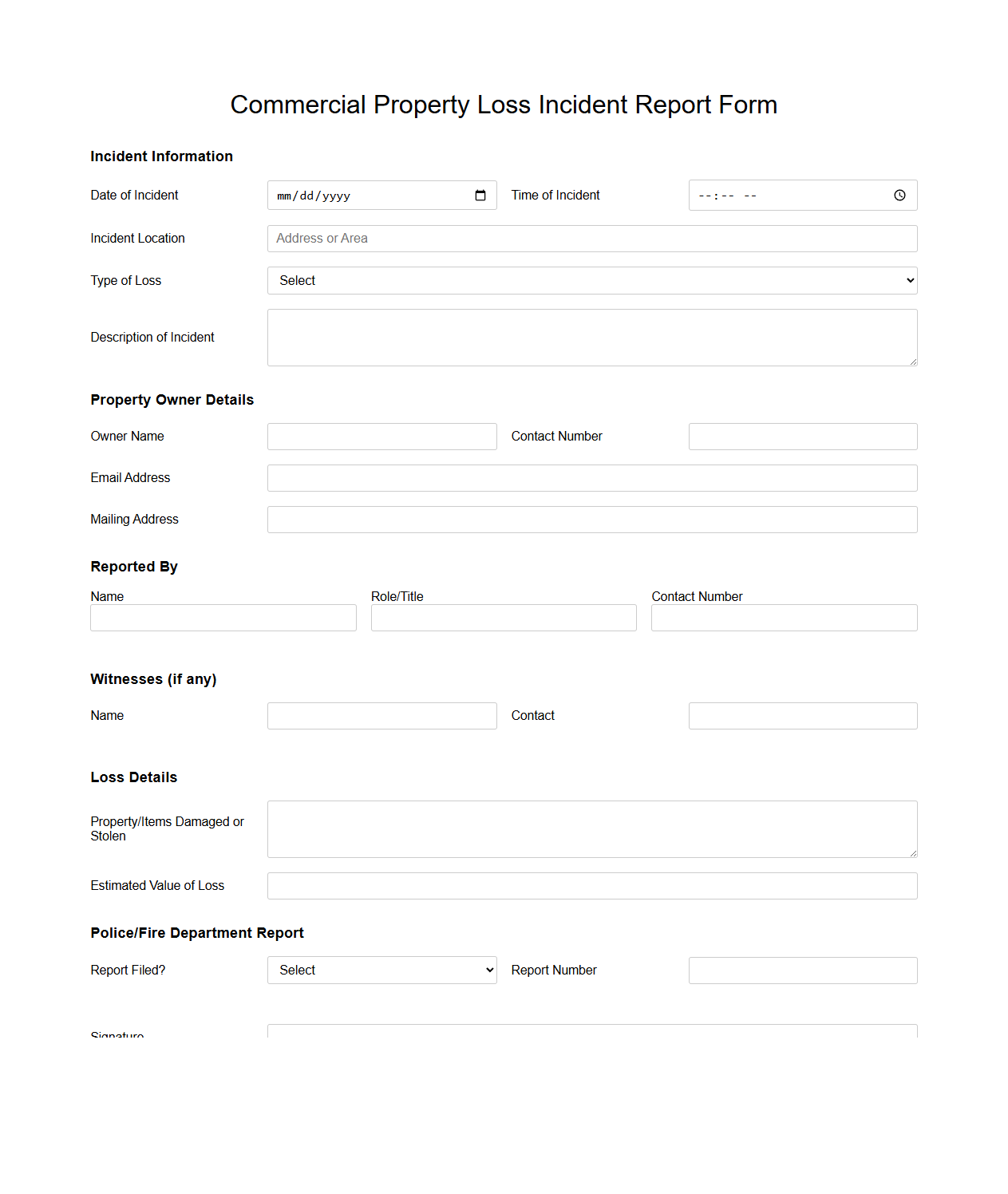

Commercial Property Loss Incident Report Form

A

Commercial Property Loss Incident Report Form is a critical document used to record detailed information about damages, losses, or incidents affecting commercial real estate assets. It captures essential data such as the date, time, nature of the incident, property details, and parties involved, ensuring accurate documentation for insurance claims and risk management. This form supports businesses in promptly addressing property issues, facilitating recovery processes, and maintaining compliance with legal and regulatory requirements.

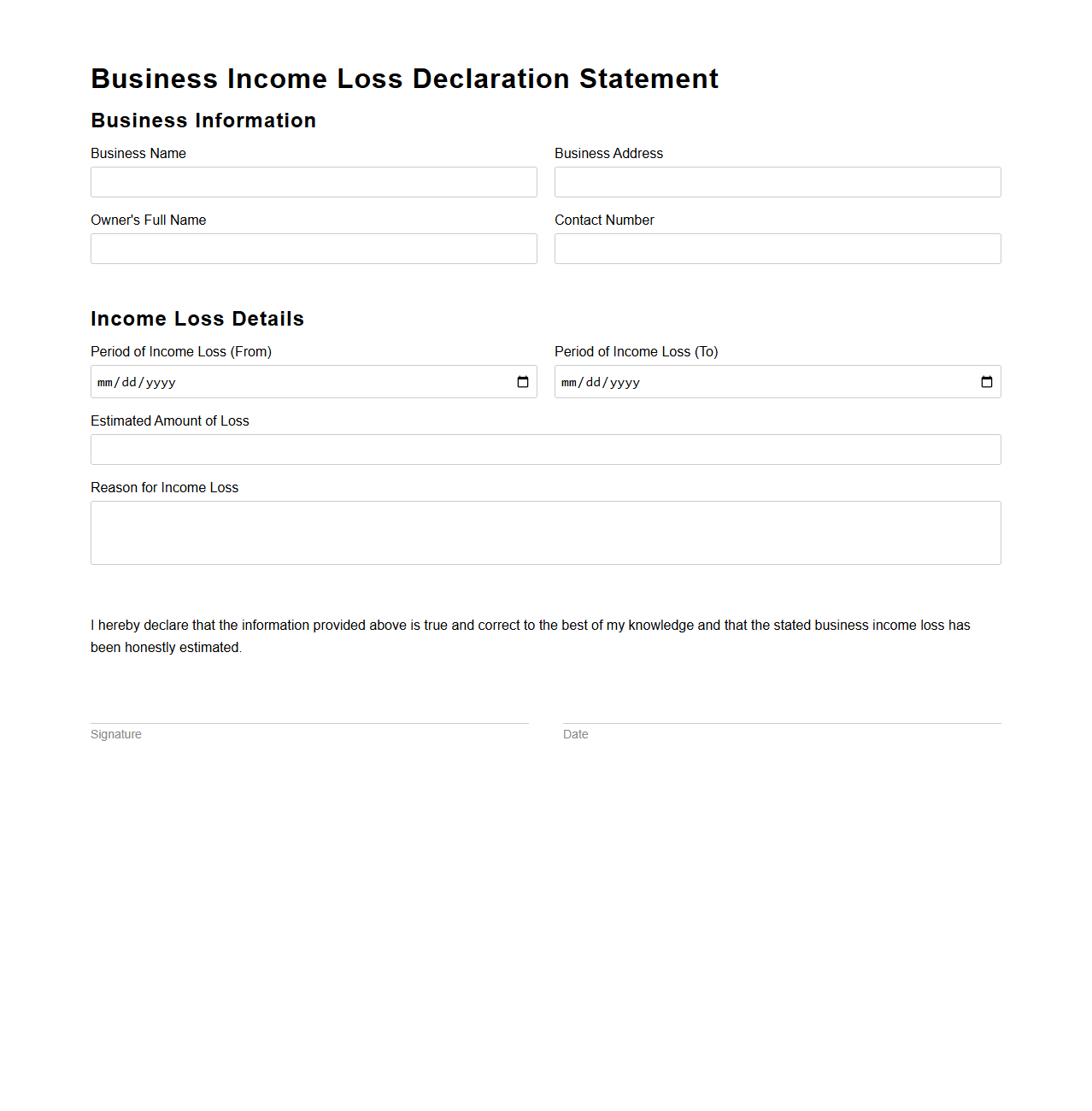

Business Income Loss Declaration Statement

A

Business Income Loss Declaration Statement document serves as a formal record used by businesses to report losses incurred during a specific financial period. This statement outlines detailed financial data, including revenue shortfalls and expense increases, which support claims for insurance, tax adjustments, or financial assistance. Accurate completion of this document is essential for substantiating income loss and facilitating proper compensation or relief measures.

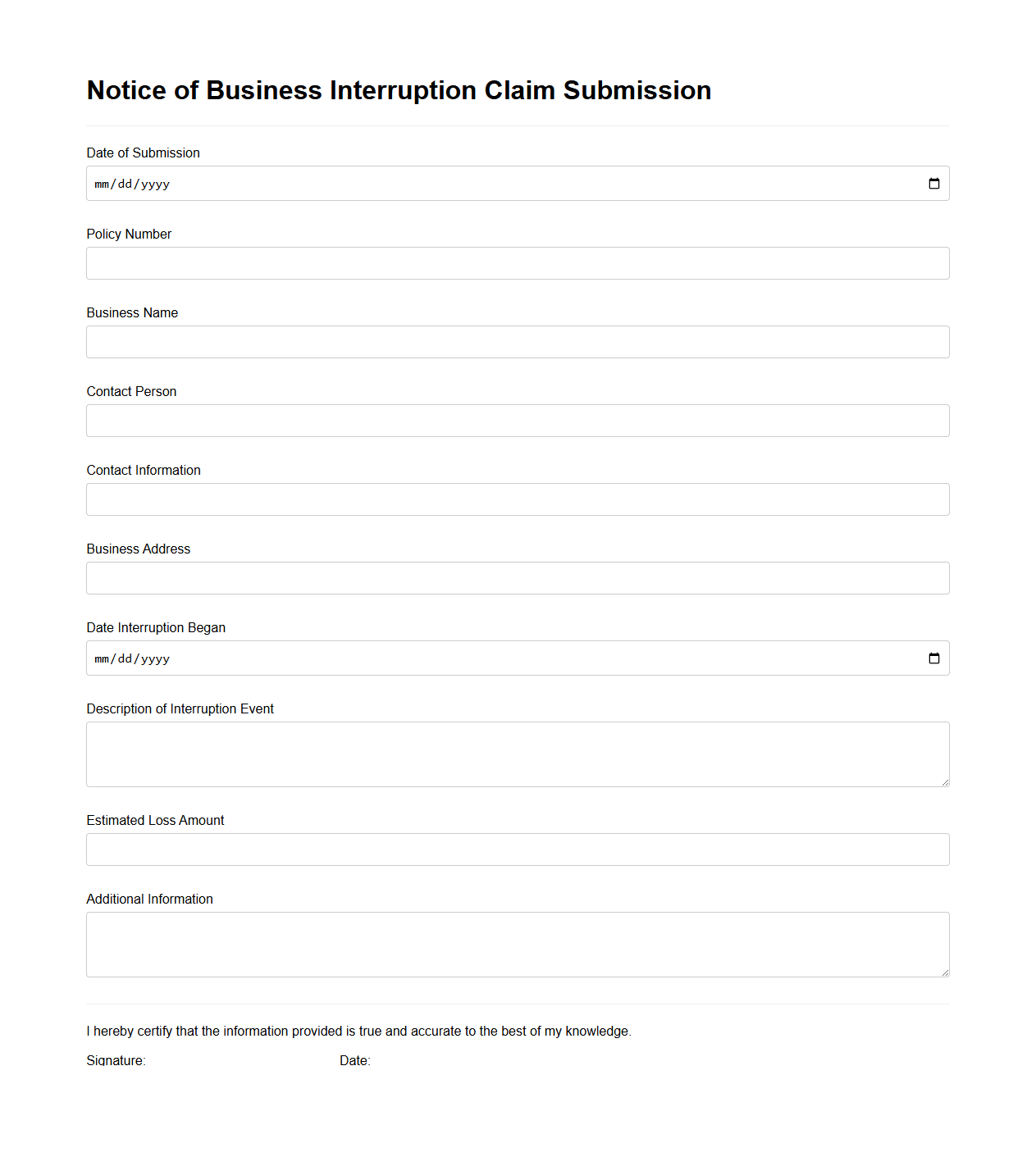

Notice of Business Interruption Claim Submission

A

Notice of Business Interruption Claim Submission document formally informs the insurance company about a business interruption loss due to events like natural disasters or accidents that disrupt normal operations. It includes essential details such as the date of loss, cause, estimated financial impact, and supporting evidence to initiate the claim process. Timely submission helps ensure accurate processing and faster recovery of insured business income losses.

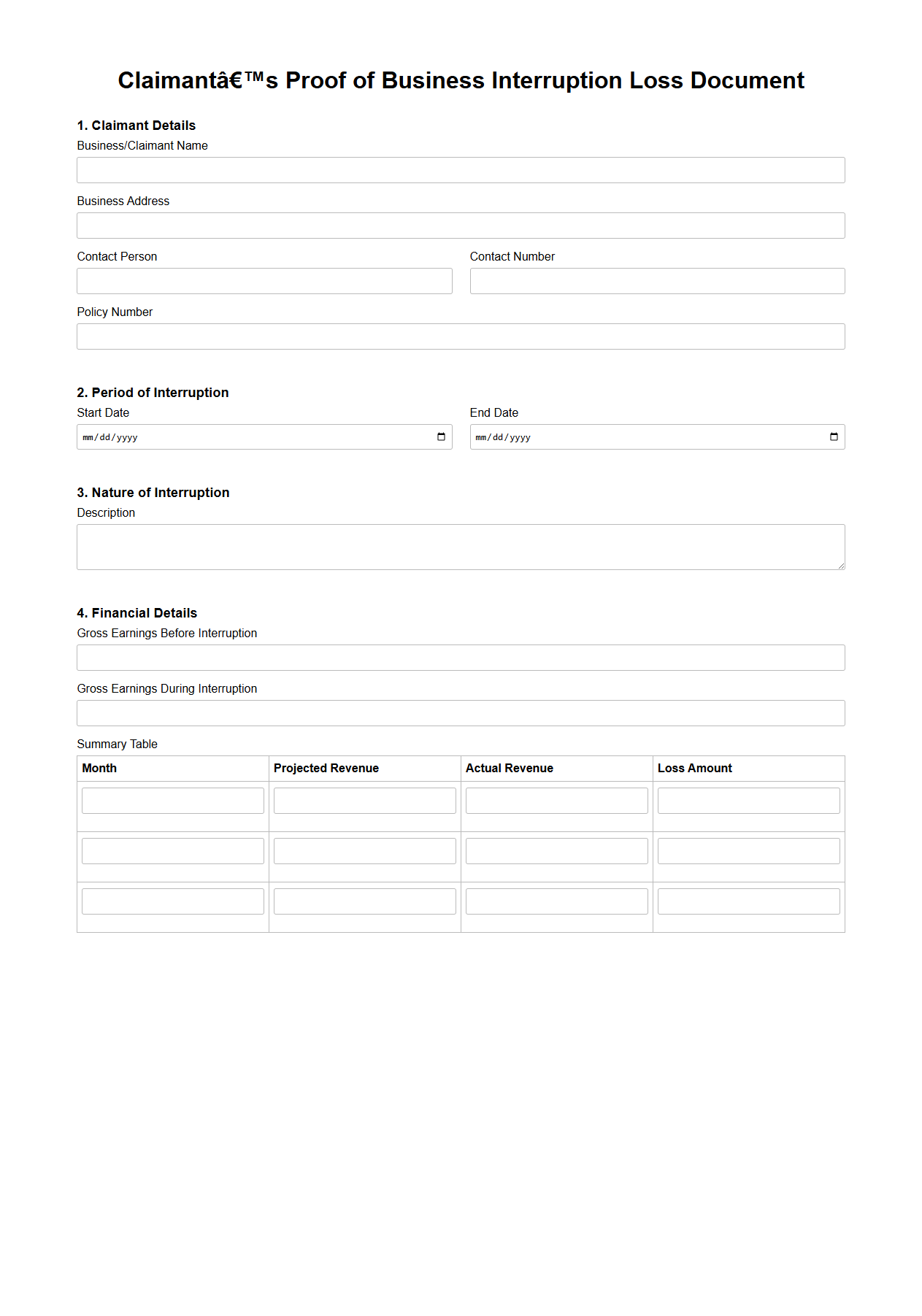

Claimant’s Proof of Business Interruption Loss Document

The

Claimant's Proof of Business Interruption Loss Document serves as vital evidence to substantiate financial losses incurred due to business interruptions, typically resulting from insured events like natural disasters or accidents. This document compiles detailed records such as revenue statements, expense reports, and operational data to quantify the period and impact of disruption on business income. Accurate submission of this proof is essential for processing insurance claims and securing appropriate compensation for the verified losses.

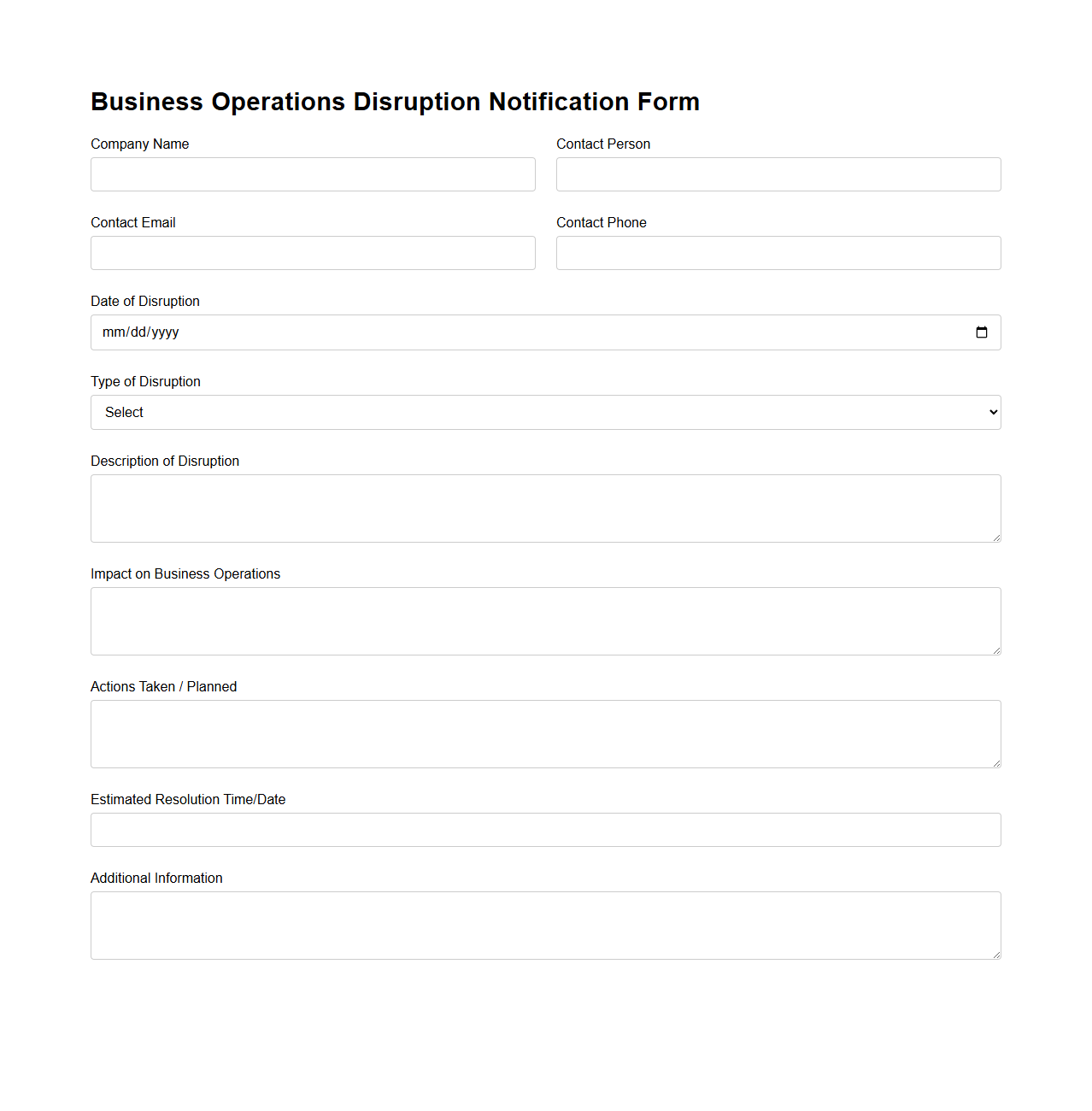

Business Operations Disruption Notification Form

The

Business Operations Disruption Notification Form document serves as a standardized tool for organizations to promptly report and communicate any interruptions affecting their business processes. It includes critical details such as the nature of the disruption, affected departments, estimated downtime, and initial mitigation steps, enabling stakeholders to respond swiftly and coordinate recovery efforts. This form enhances transparency and supports risk management by ensuring timely information flow during operational disruptions.

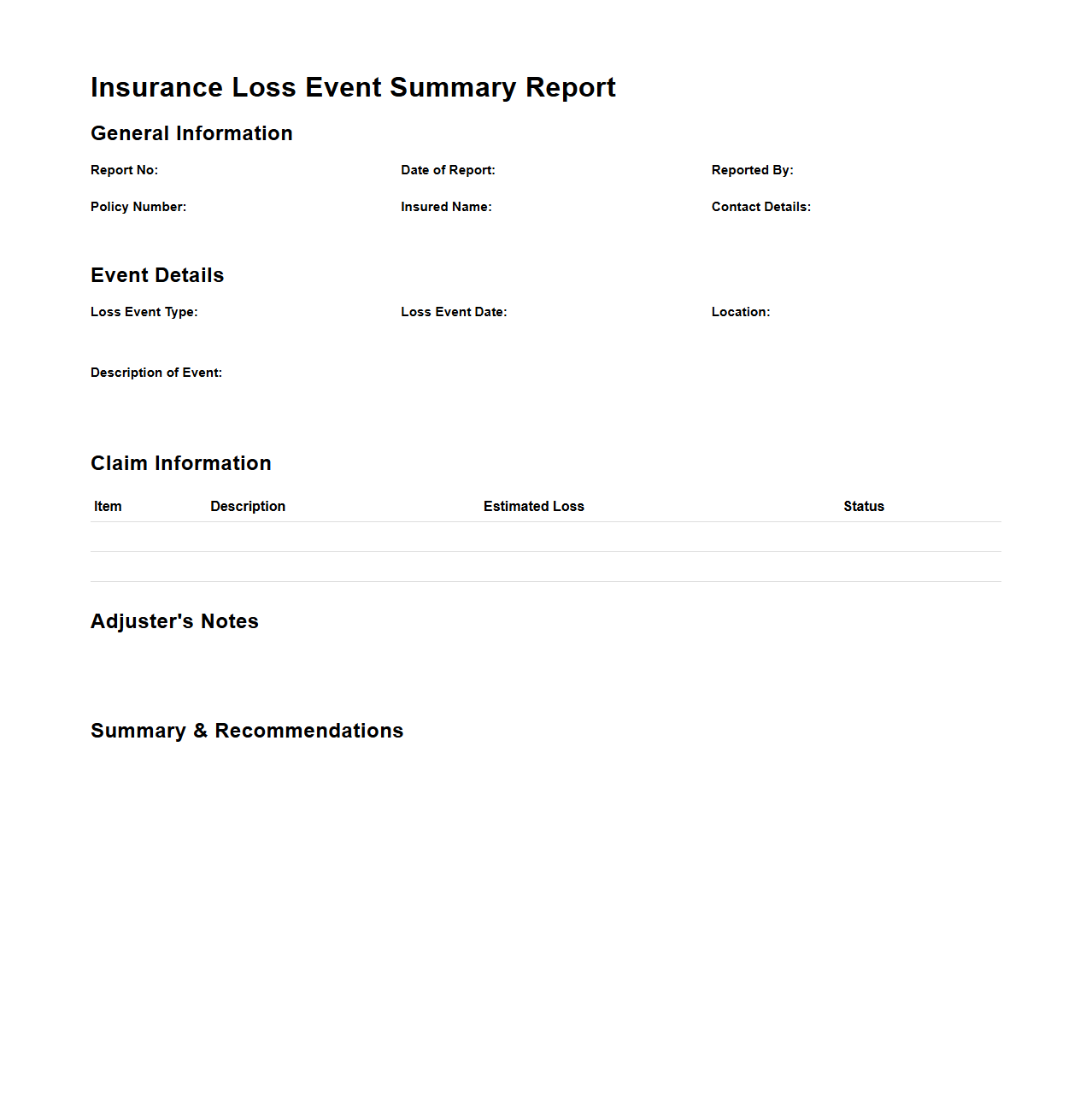

Insurance Loss Event Summary Report

An

Insurance Loss Event Summary Report is a detailed document that outlines the specifics of a loss event, including the nature, cause, and financial impact of the claim. It provides insurers and policyholders with a comprehensive overview of the incident, supporting accurate assessment and processing of claims. The report plays a critical role in risk management by helping identify patterns and mitigating future losses.

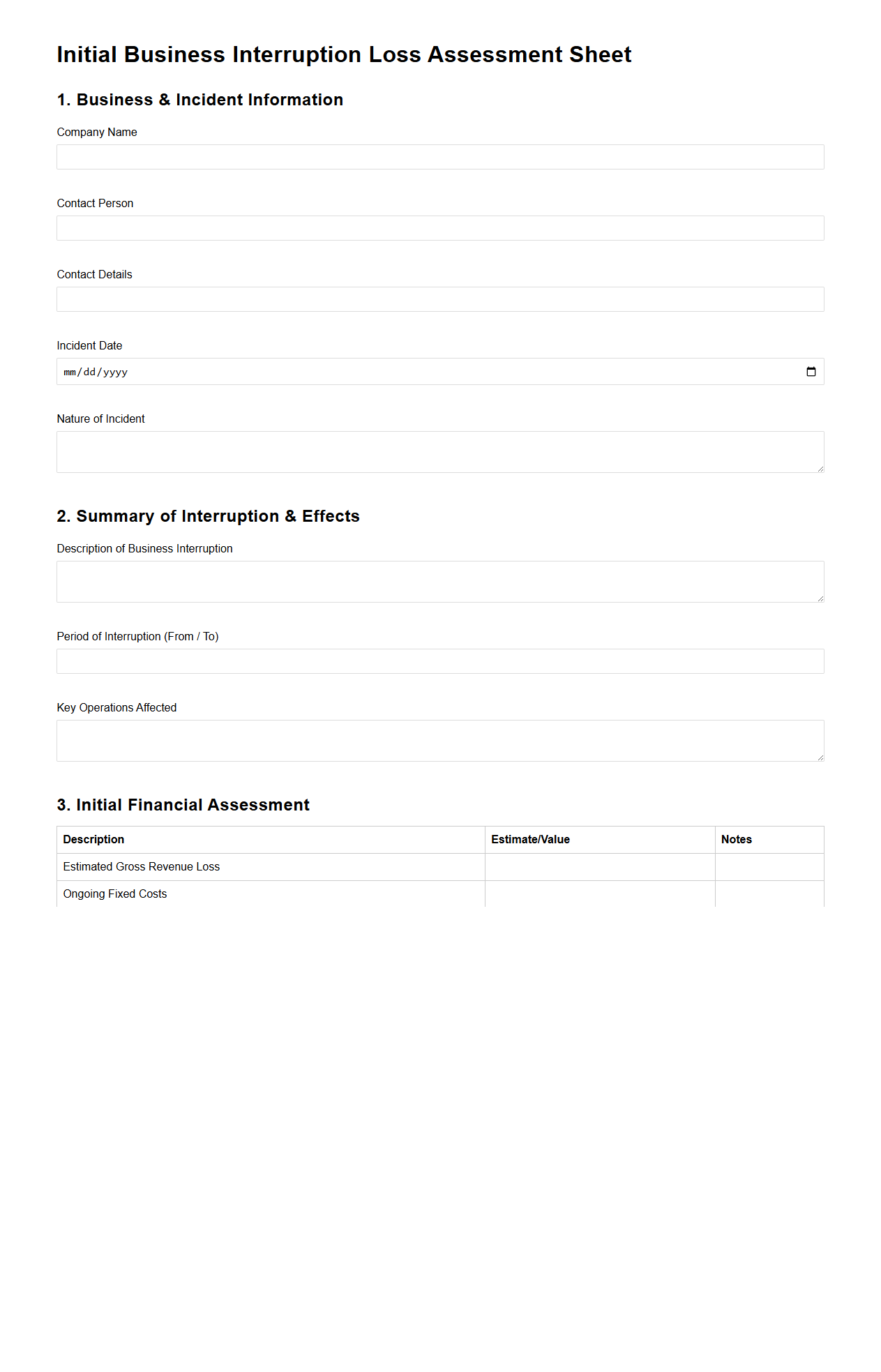

Initial Business Interruption Loss Assessment Sheet

The

Initial Business Interruption Loss Assessment Sheet is a critical document used to evaluate the preliminary financial impact of business disruptions caused by unforeseen events such as natural disasters, accidents, or operational failures. It systematically records estimated revenue losses, extra expenses incurred, and other relevant financial metrics during the interruption period. This assessment provides insurers, stakeholders, and business owners with a foundational understanding of the economic damage, facilitating accurate claims processing and recovery planning.

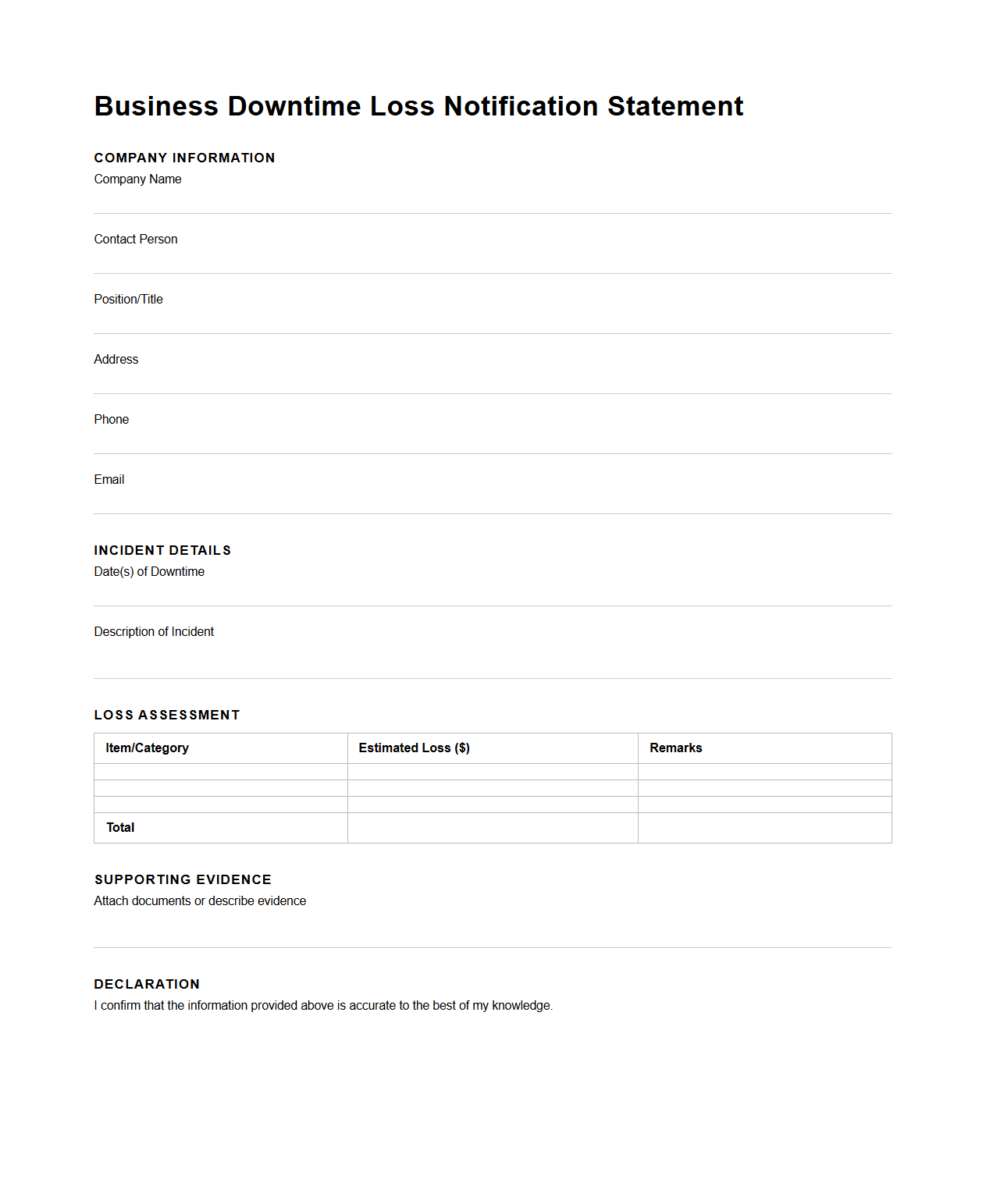

Business Downtime Loss Notification Statement

A

Business Downtime Loss Notification Statement document formally communicates the financial and operational impact experienced by a company due to unexpected interruptions in business activities. It details the duration, causes, and extent of downtime, alongside estimated revenue losses and associated costs. This document is essential for claims processing, insurance purposes, and informing stakeholders about the disruption's scope and consequences.

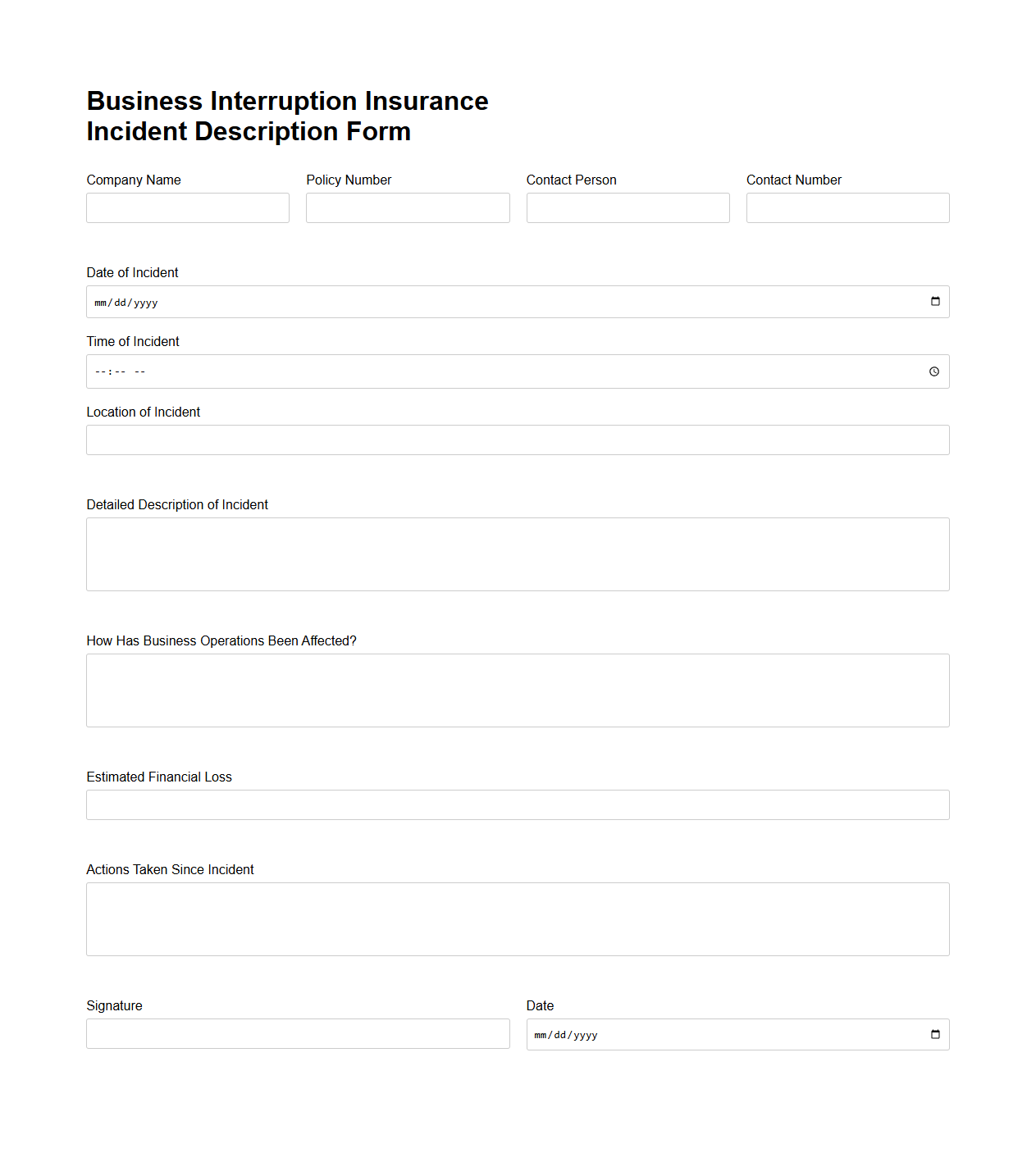

Business Interruption Insurance Incident Description Form

The

Business Interruption Insurance Incident Description Form is a crucial document used to detail the circumstances and impact of an event that disrupts normal business operations. It captures vital information such as the nature of the incident, the date it occurred, and the extent of financial losses incurred, facilitating accurate claim processing. Proper completion of this form ensures timely compensation under a business interruption insurance policy, minimizing the financial strain on a company during recovery.

Specific Event or Incident Reported for Business Interruption Coverage

The loss notification document specifically reports a fire incident that occurred at the insured premises, causing significant operational disruption. This event is detailed as the primary cause of the business interruption claim. Accurate reporting of such incidents ensures the claim aligns with the policy's coverage terms.

Business Operations or Revenue Streams Impacted

The document highlights the interruption of critical manufacturing and sales operations as the main affected areas. Additionally, it outlines the loss of revenue from both direct sales and contracted services during the downtime. These details are essential for quantifying the financial impact of the interruption.

Supporting Evidence Required to Substantiate the Claim

The notification requires submission of financial records, repair estimates, and incident reports as evidence for the claim. Supporting documentation such as profit and loss statements before and after the event is critical. This evidence validates the extent and legitimacy of the business interruption.

Authorized Signatories or Responsible Parties for Submission

The document names specific company executives or claim managers responsible for submitting the notification. These authorized signatories ensure accountability and compliance with insurance protocols. Their signatures verify the authenticity of the claim information provided.

Timeline and Communication Procedures for Follow-up

The loss notification specifies a strict timeline for follow-up communications within 30 days of the incident report. It mandates regular updates through designated contacts to track claim progress. This structured communication ensures timely resolution and claim processing efficiency.