A Policy Application Document Sample for Life Insurance provides a clear template outlining the necessary information required to apply for a life insurance policy. It typically includes personal details, health history, and beneficiary information, ensuring accurate and efficient processing. Using this sample helps applicants understand the format and essential components needed to complete the application correctly.

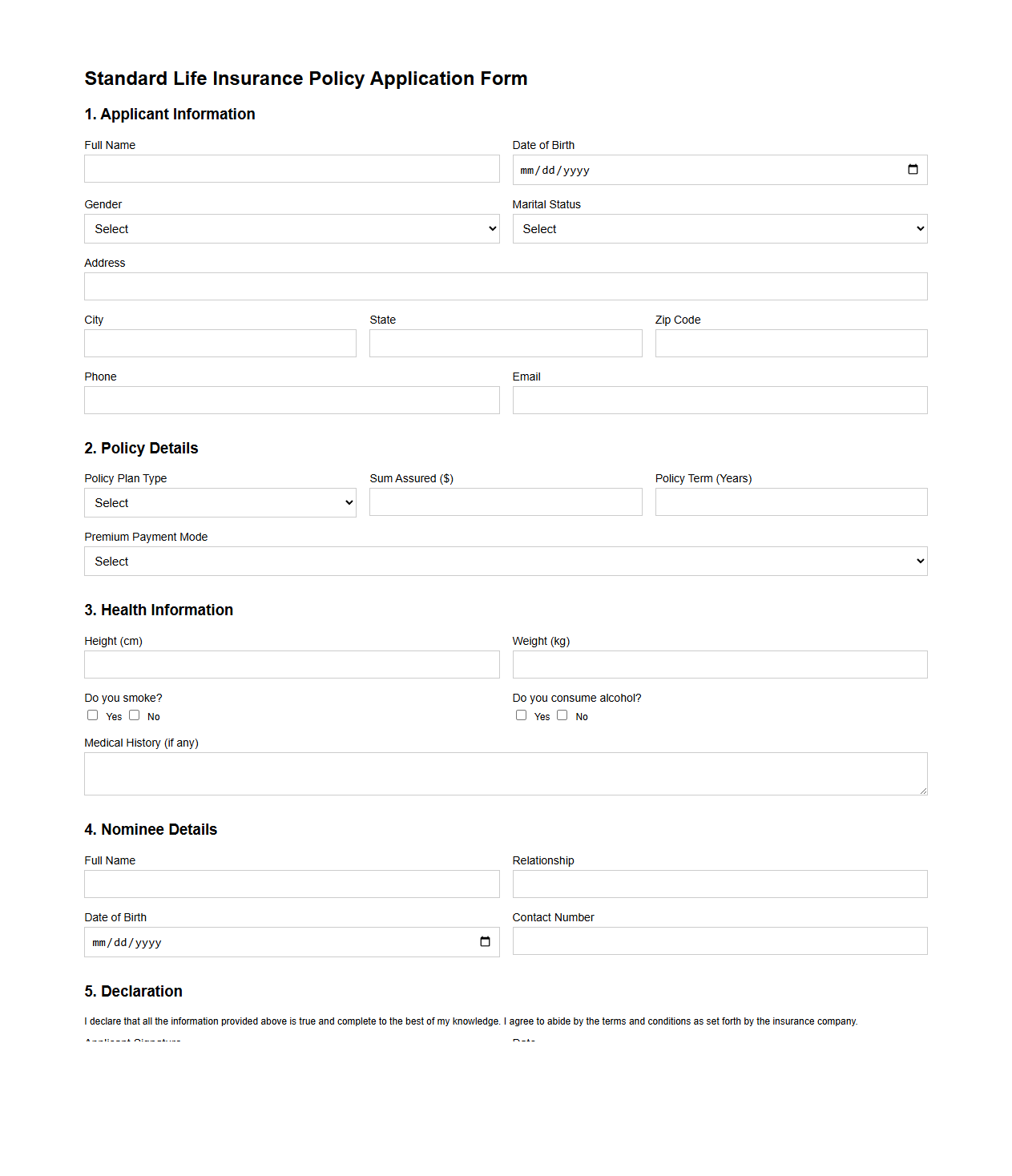

Standard Life Insurance Policy Application Form

The

Standard Life Insurance Policy Application Form is a critical document used by applicants to provide essential personal, health, and financial information required for policy underwriting. It typically includes sections on the applicant's identity, beneficiary details, coverage options, and declarations necessary to assess risk and eligibility. Properly completed forms ensure accurate processing and timely approval of life insurance coverage.

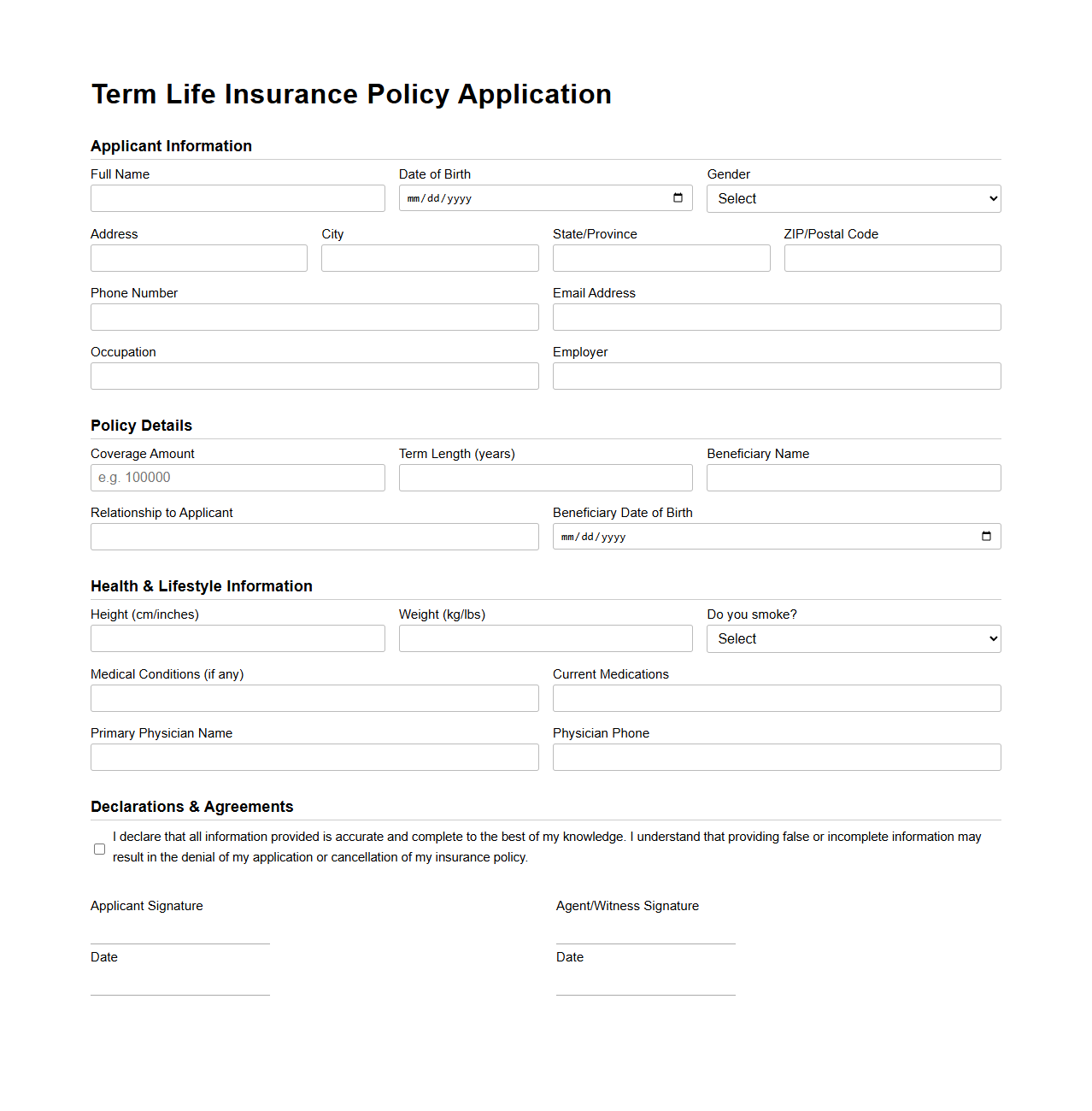

Term Life Insurance Policy Application Template

A

Term Life Insurance Policy Application Template document is a structured form designed to streamline the process of applying for term life insurance coverage. It includes essential sections for personal information, health history, coverage amount, and beneficiary details, ensuring accurate and efficient data collection for underwriting purposes. This template helps applicants provide all necessary information consistently, reducing errors and expediting policy approval.

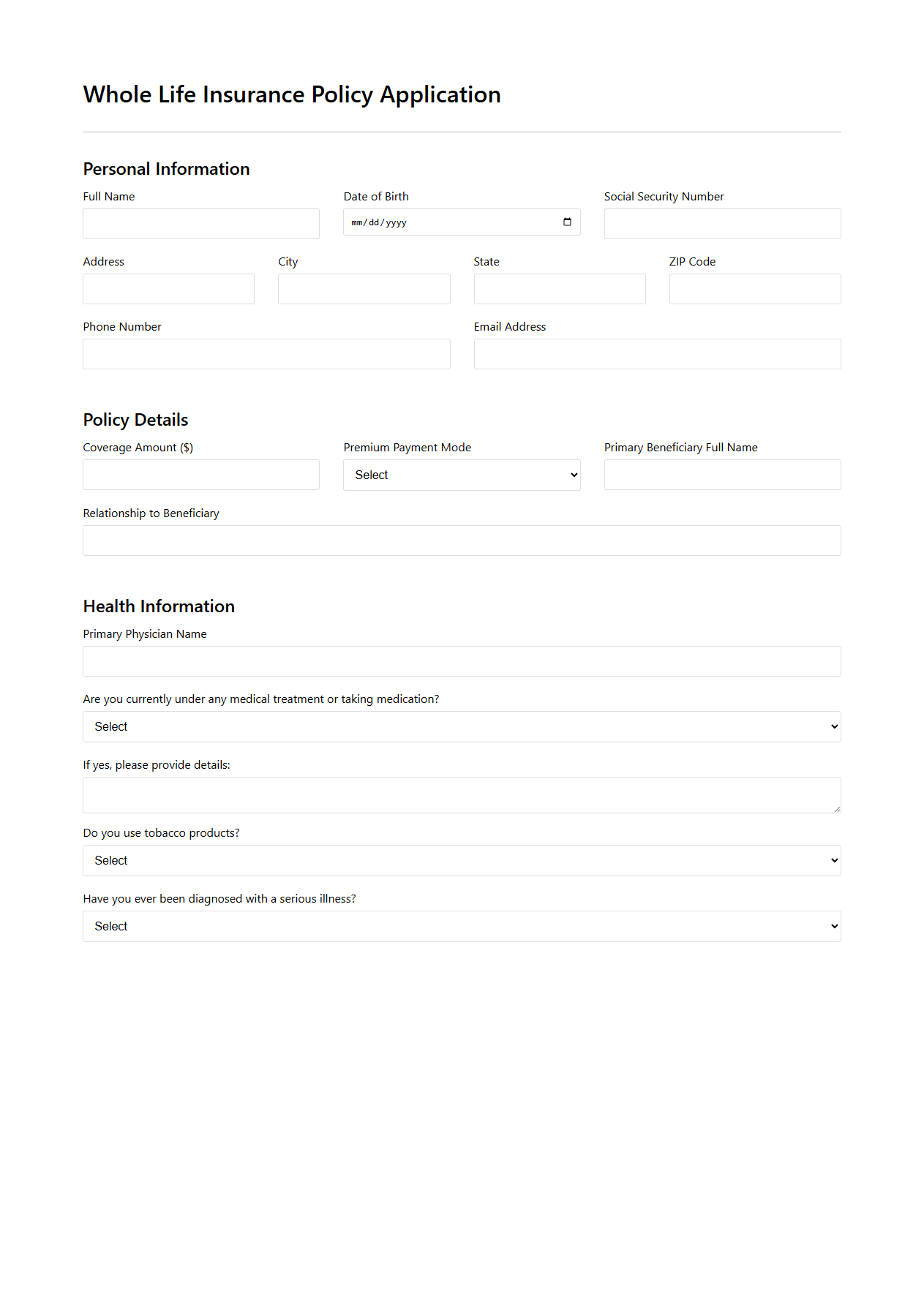

Whole Life Insurance Policy Application Example

A

Whole Life Insurance Policy Application Example document serves as a detailed template illustrating how to correctly complete an application for a whole life insurance policy. It includes sections for personal information, health history, beneficiary details, and payment preferences, ensuring applicants provide accurate and comprehensive data. This example aids applicants and agents in understanding the specific requirements and format needed to facilitate a smooth underwriting process.

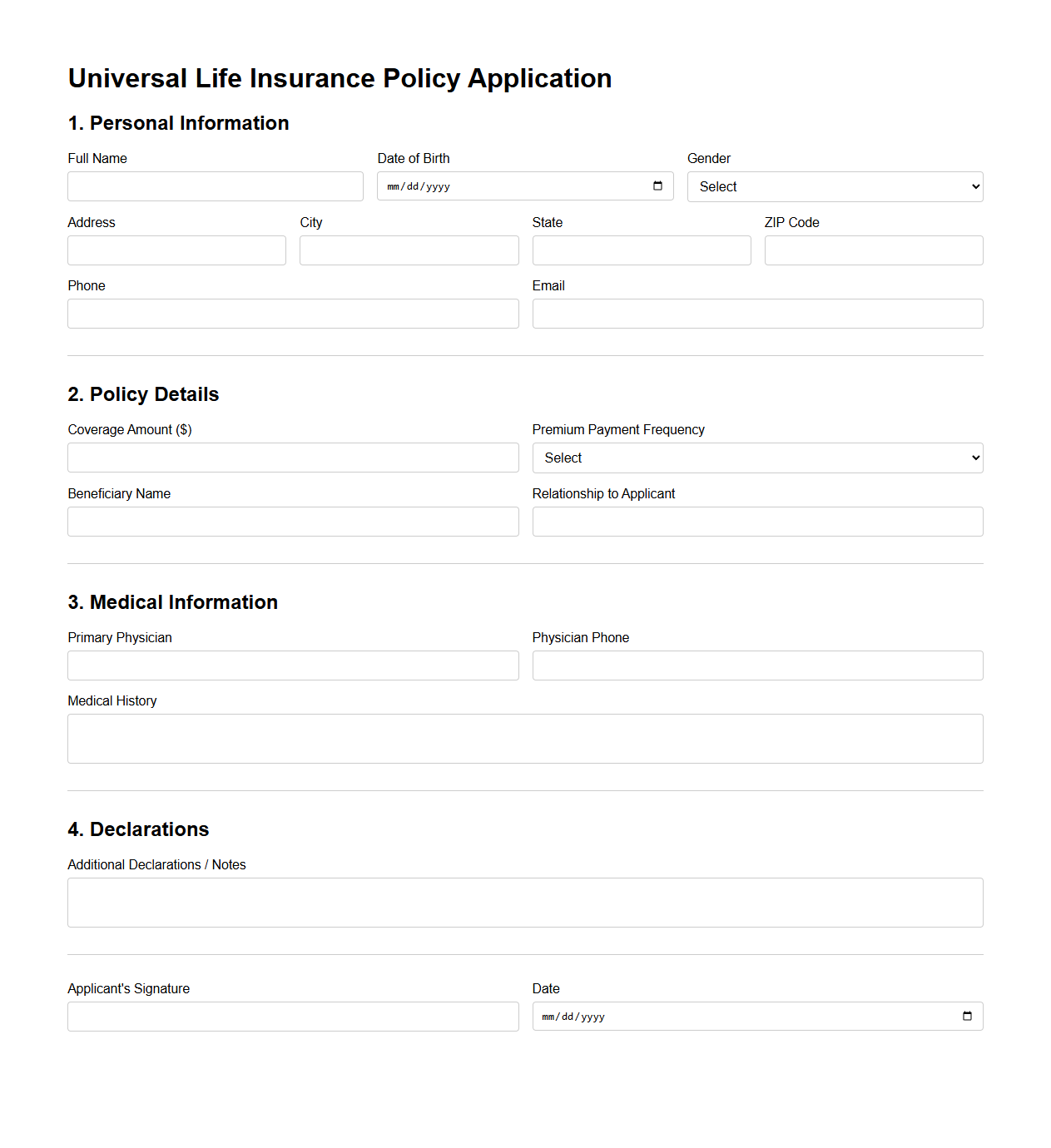

Universal Life Insurance Policy Application Format

The

Universal Life Insurance Policy Application Format document serves as a standardized template for individuals seeking to purchase a flexible life insurance plan that combines lifetime coverage with a cash value component. It typically includes sections for personal information, beneficiary details, coverage amount, premium payment options, and medical history to assess risk. This format ensures clear communication between the applicant and insurer, streamlining the underwriting process for customized policy issuance.

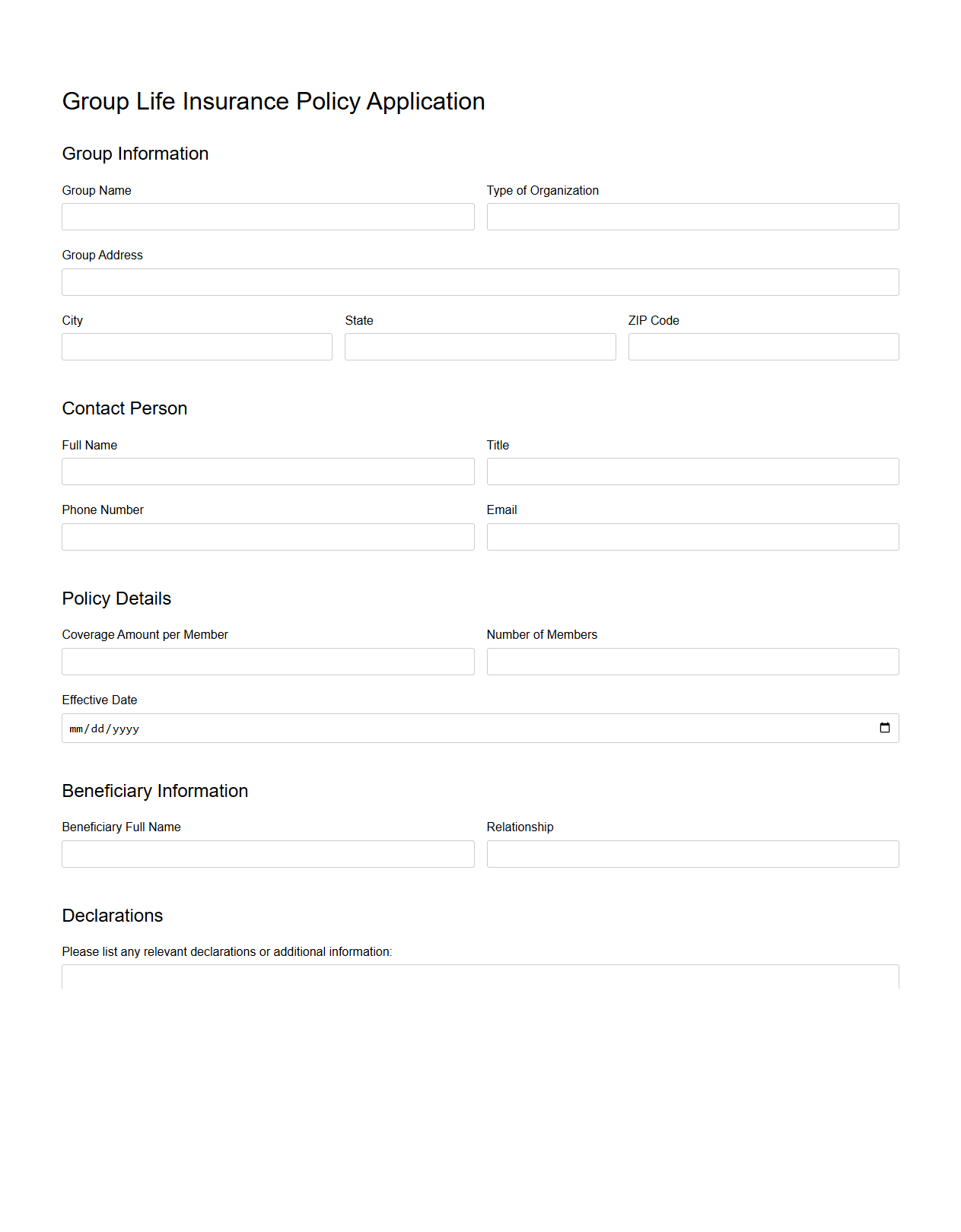

Group Life Insurance Policy Application Sample

A

Group Life Insurance Policy Application Sample document serves as a standardized template used by organizations to apply for group life insurance coverage on behalf of their employees or members. It typically outlines essential details such as the policyholder's information, number of individuals covered, coverage amount, and beneficiary designations, facilitating a streamlined and efficient application process. This sample document ensures clarity, compliance, and accuracy when submitting requested information to insurance providers.

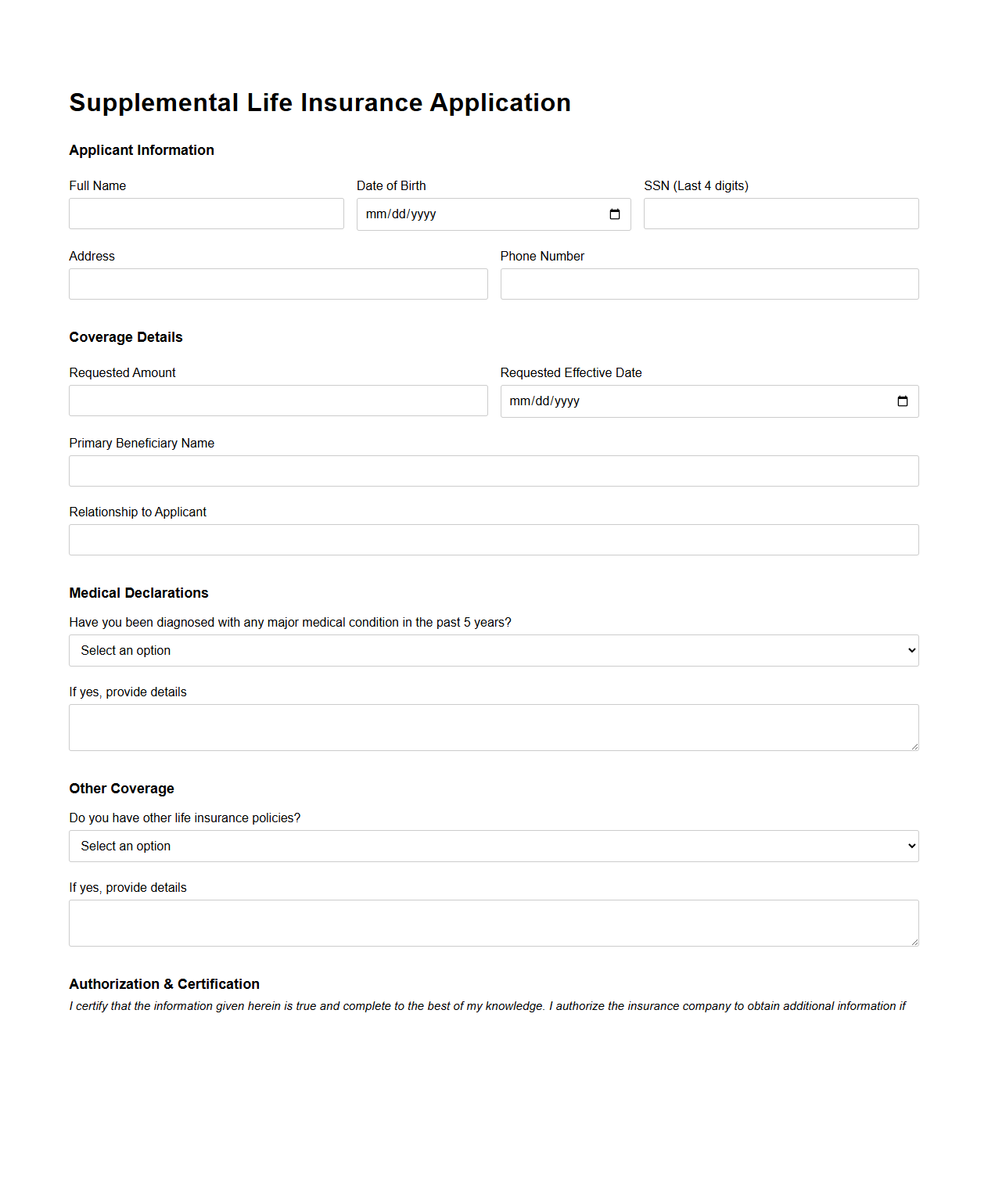

Supplemental Life Insurance Application Document

The

Supplemental Life Insurance Application Document is a formal form used to request additional life insurance coverage beyond the basic policy limits. It collects detailed personal, health, and beneficiary information to assess eligibility and underwriting requirements. This document ensures accurate risk evaluation and helps secure the desired supplemental coverage amount.

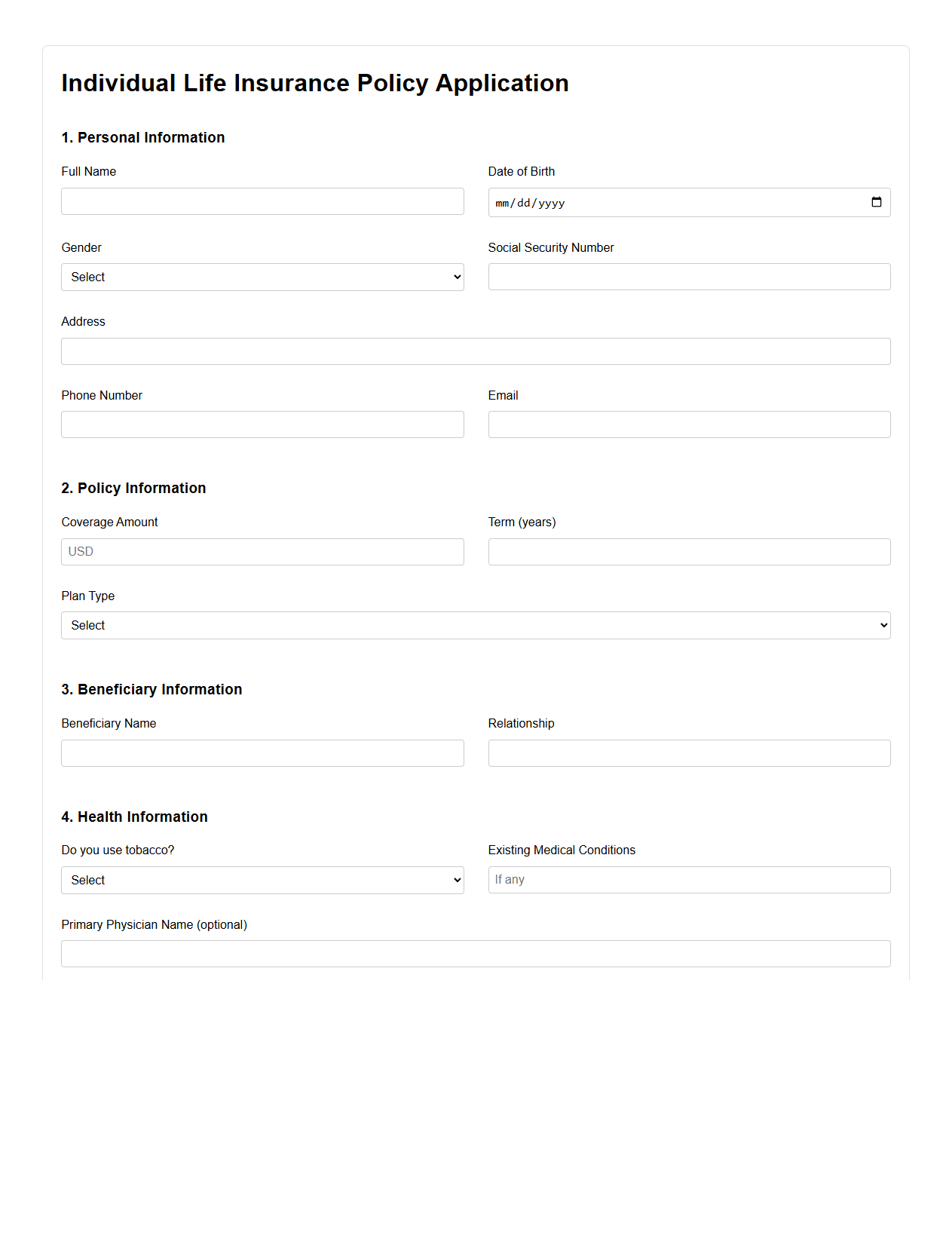

Individual Life Insurance Policy Application Example

An

Individual Life Insurance Policy Application Example document serves as a practical template that illustrates the essential information and format required to apply for a personal life insurance policy. It typically includes sections for personal details, beneficiary designations, health declarations, and coverage preferences, helping applicants understand the data needed to initiate coverage. This example ensures applicants provide accurate and complete information, streamlining the underwriting process and improving approval chances.

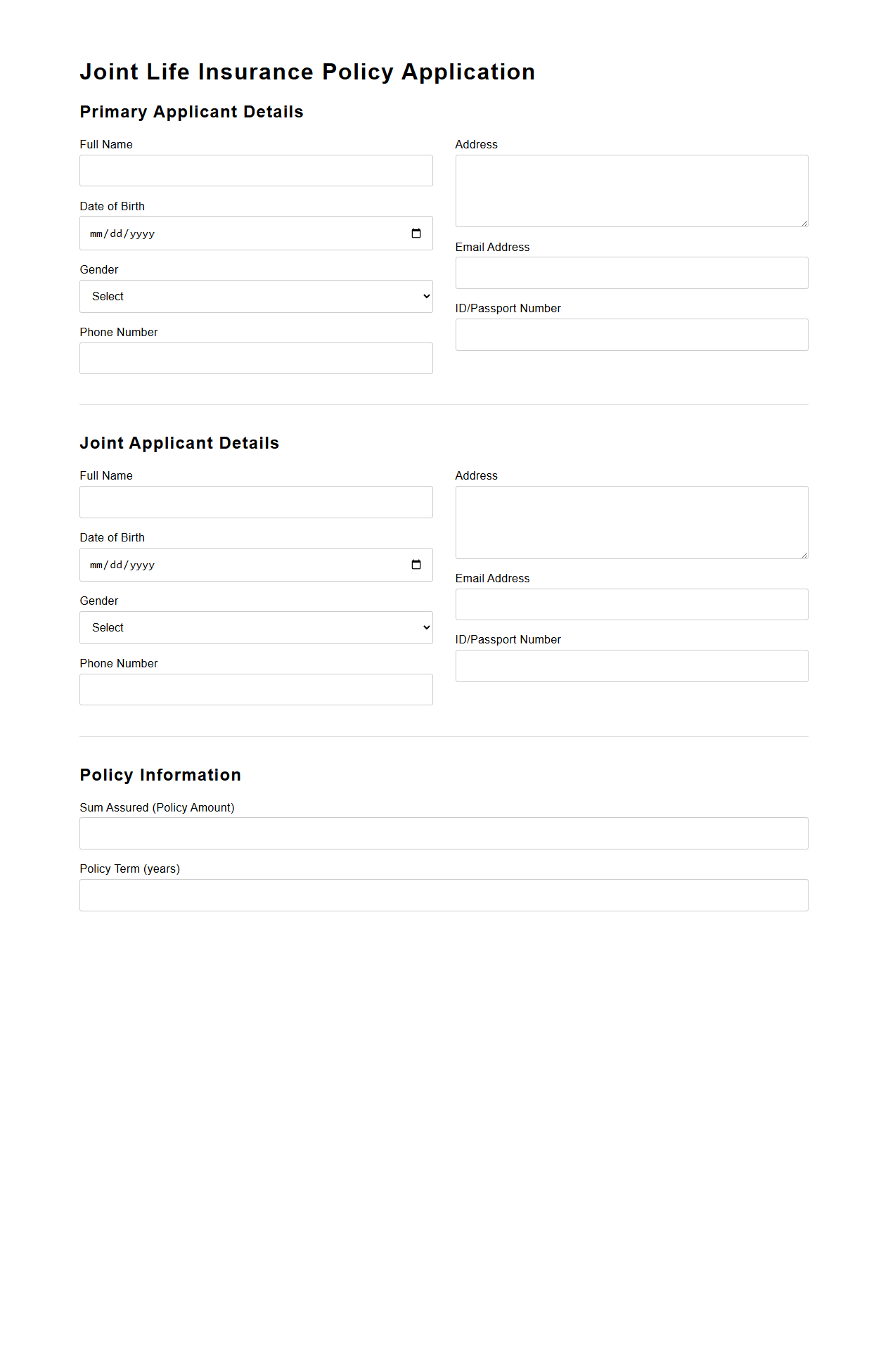

Joint Life Insurance Policy Application Template

A

Joint Life Insurance Policy Application Template document is designed to streamline the process of applying for a life insurance policy that covers two individuals under a single contract. It includes sections for detailed personal information, health history, and beneficiary designations for both applicants, ensuring accuracy and compliance with insurer requirements. This template helps applicants and agents efficiently gather and organize all necessary data to facilitate underwriting and policy issuance.

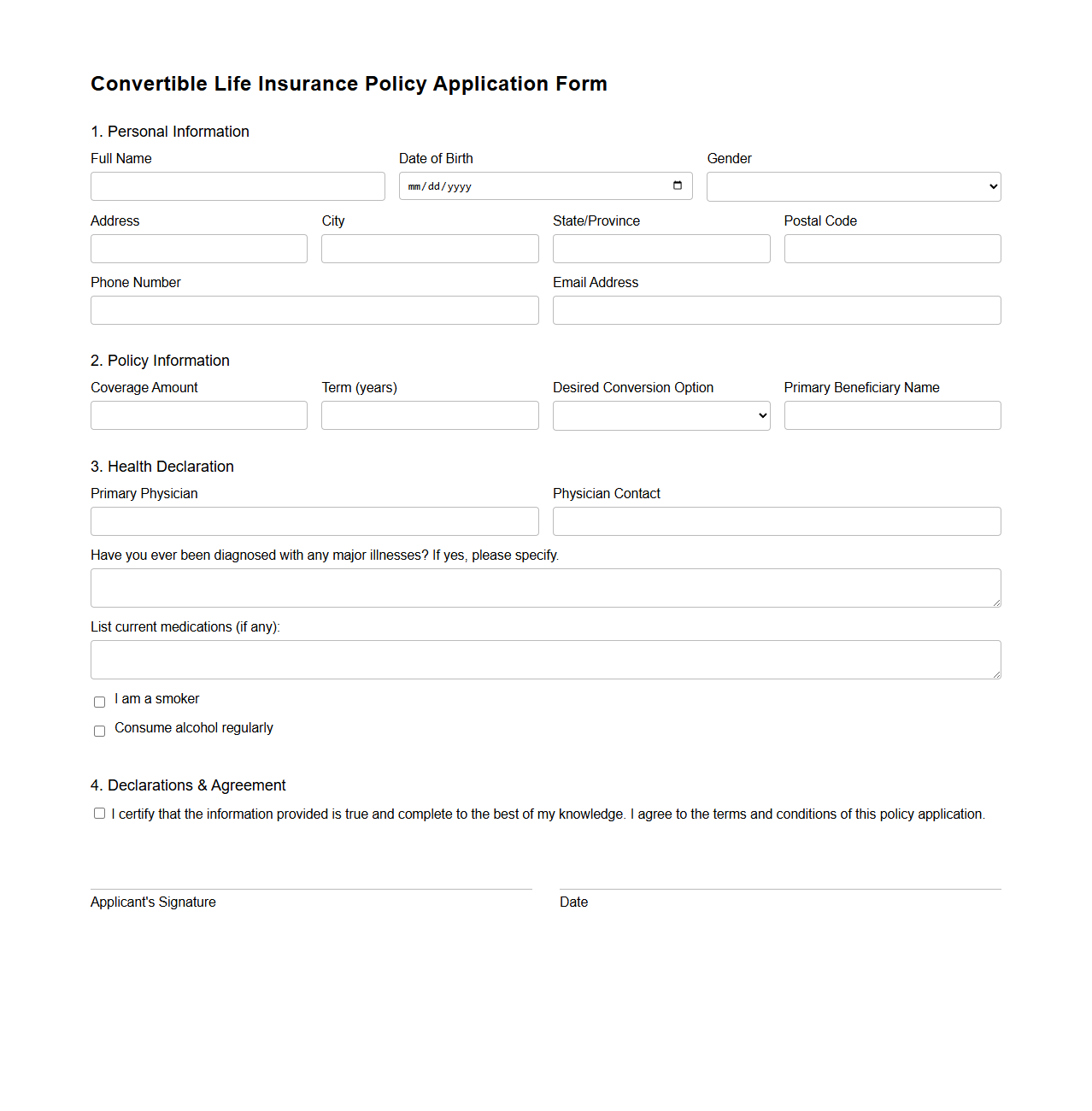

Convertible Life Insurance Policy Application Form

The

Convertible Life Insurance Policy Application Form document is used by policyholders to request the conversion of a term life insurance policy into a permanent life insurance policy without undergoing a medical exam. This form captures essential personal details, current policy information, and selection of new coverage options to facilitate the policy transformation. It serves as a formal record to initiate and process the conversion, ensuring continuity of coverage with enhanced benefits.

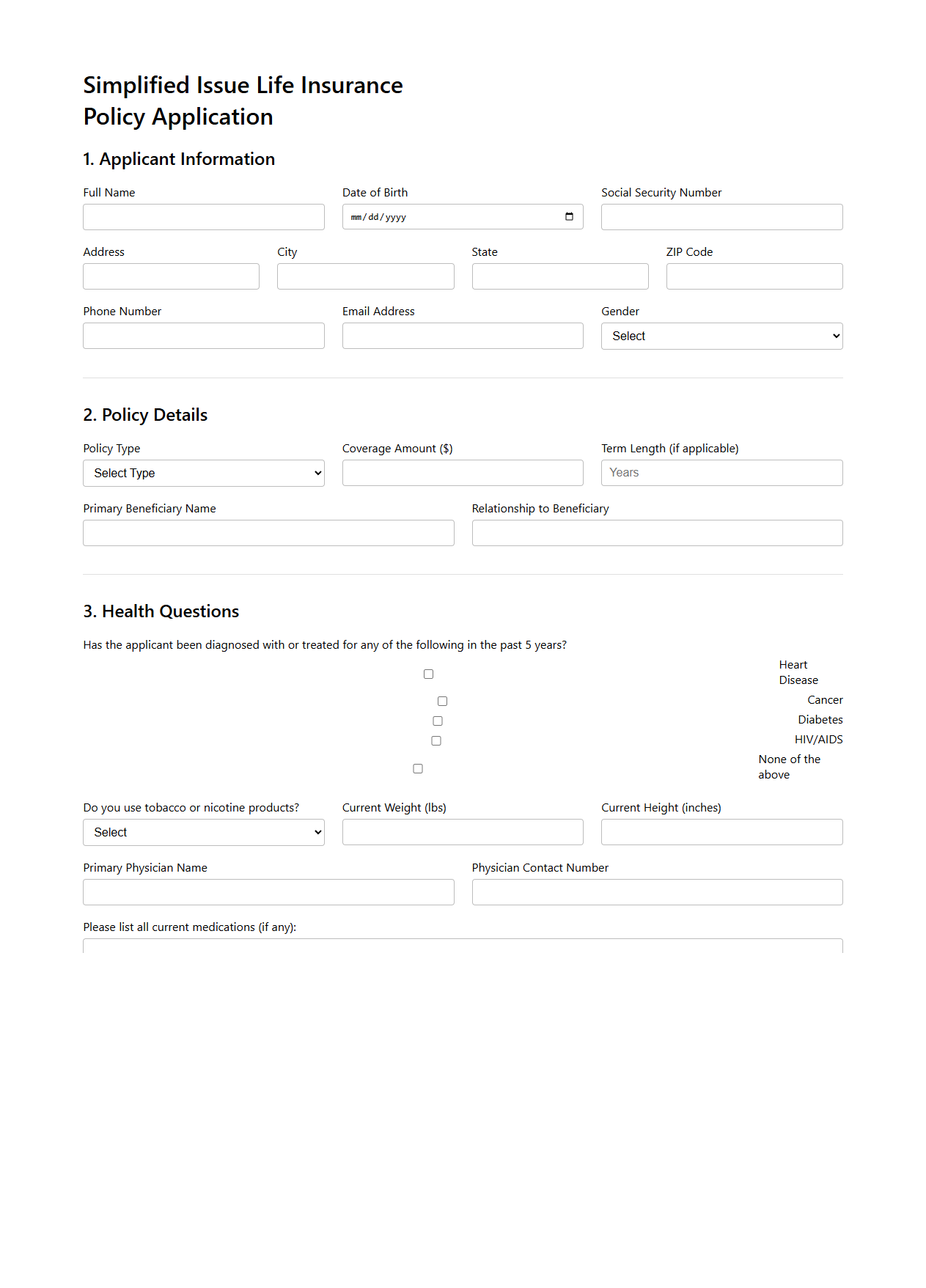

Simplified Issue Life Insurance Policy Application Sample

A

Simplified Issue Life Insurance Policy Application Sample document provides a streamlined template for applying for life insurance without requiring extensive medical examinations. It includes basic health questions and personal information to expedite the approval process, making it ideal for those seeking quick coverage. This sample helps applicants understand the necessary details and requirements involved in simplified issue life insurance policies.

What personal details are required in a Policy Application Document for life insurance?

The Policy Application Document requires essential personal details such as full name, date of birth, and contact information. Applicants must also provide their social security number and residential address. Additionally, employment details and income information are requested to assess eligibility and premium rates.

How does the applicant specify the desired coverage amount and policy type in the application?

The application includes a dedicated section where the applicant indicates the desired coverage amount in monetary terms. Applicants select the preferred policy type, such as term life, whole life, or universal life insurance. This ensures the coverage aligns with their financial goals and protection needs.

What sections in the document address beneficiary designation and their relationship to the insured?

The application contains a specific beneficiary designation section where the applicant names primary and contingent beneficiaries. Applicants must specify each beneficiary's full name, date of birth, and their relationship to the insured. This information directs where the death benefits will be distributed upon the insured's passing.

Which disclosure statements or health-related questions must the applicant answer?

The document includes detailed health-related questions covering medical history, current health status, and pre-existing conditions. Applicants must disclose lifestyle habits such as smoking and alcohol consumption. Furthermore, the form contains disclosure statements about the accuracy of information and the potential consequences of misrepresentation.

What are the policyholder's responsibilities and obligations outlined within the document?

The policyholder is obligated to provide truthful and complete information throughout the application process. They must pay premiums on time to maintain policy validity and notify the insurer of any changes affecting risk. The document also outlines the responsibility to disclose any material changes in health or lifestyle during the policy term.