A Discharge Voucher Document Sample for Business Interruption Insurance serves as a formal record confirming the settlement of claims related to business interruption losses. This document outlines the details of the compensation paid, ensuring transparency and accountability between the insurer and the insured. It is essential for maintaining accurate financial records during the insurance claim process.

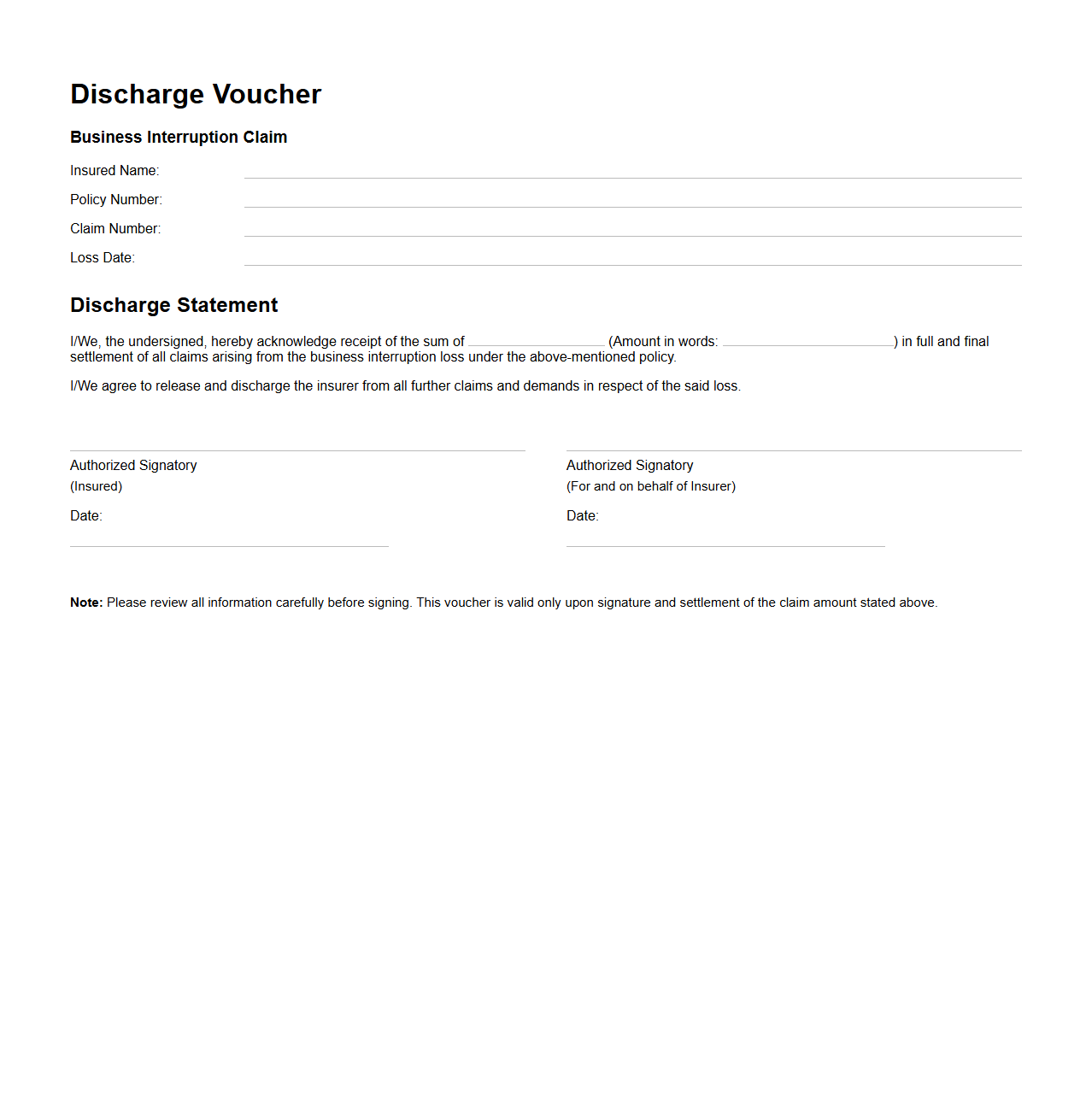

Discharge Voucher Template for Business Interruption Claims

A

Discharge Voucher Template for Business Interruption Claims document is a standardized form used to acknowledge the receipt and settlement of compensation related to business interruption losses. It serves as proof that the claimant has received the agreed payment, thereby releasing the insurer or payer from any further liability. This template ensures clear documentation, streamlining the claims process and preventing disputes.

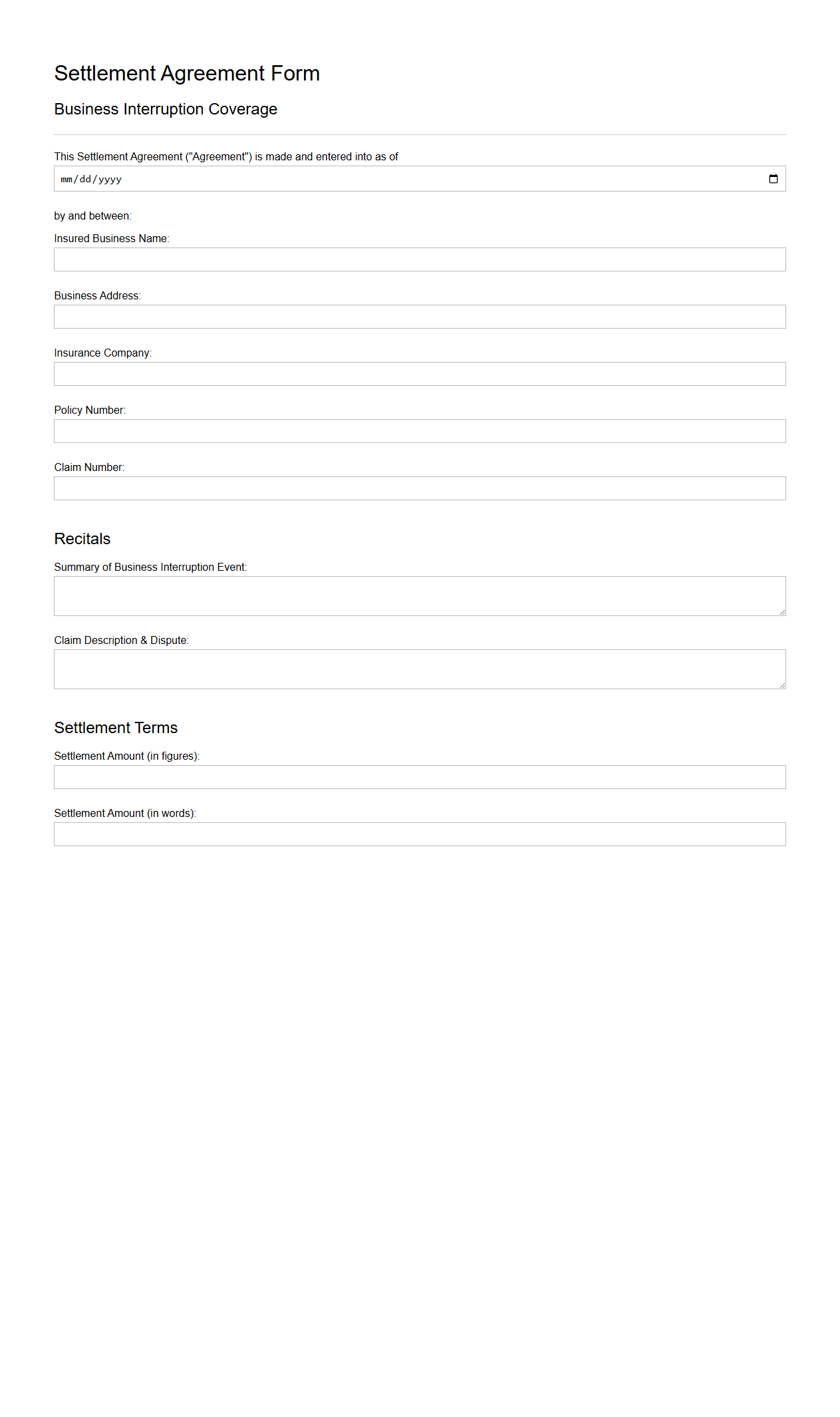

Settlement Agreement Form for Business Interruption Coverage

A

Settlement Agreement Form for Business Interruption Coverage is a legal document used to finalize claims related to losses incurred during a business disruption, such as those caused by natural disasters or other covered events. This form outlines the agreed compensation amount between the insurer and the policyholder, specifying the terms and conditions for resolving the claim without further disputes. It ensures clear communication, protects both parties' rights, and facilitates timely settlement of financial losses during business interruptions.

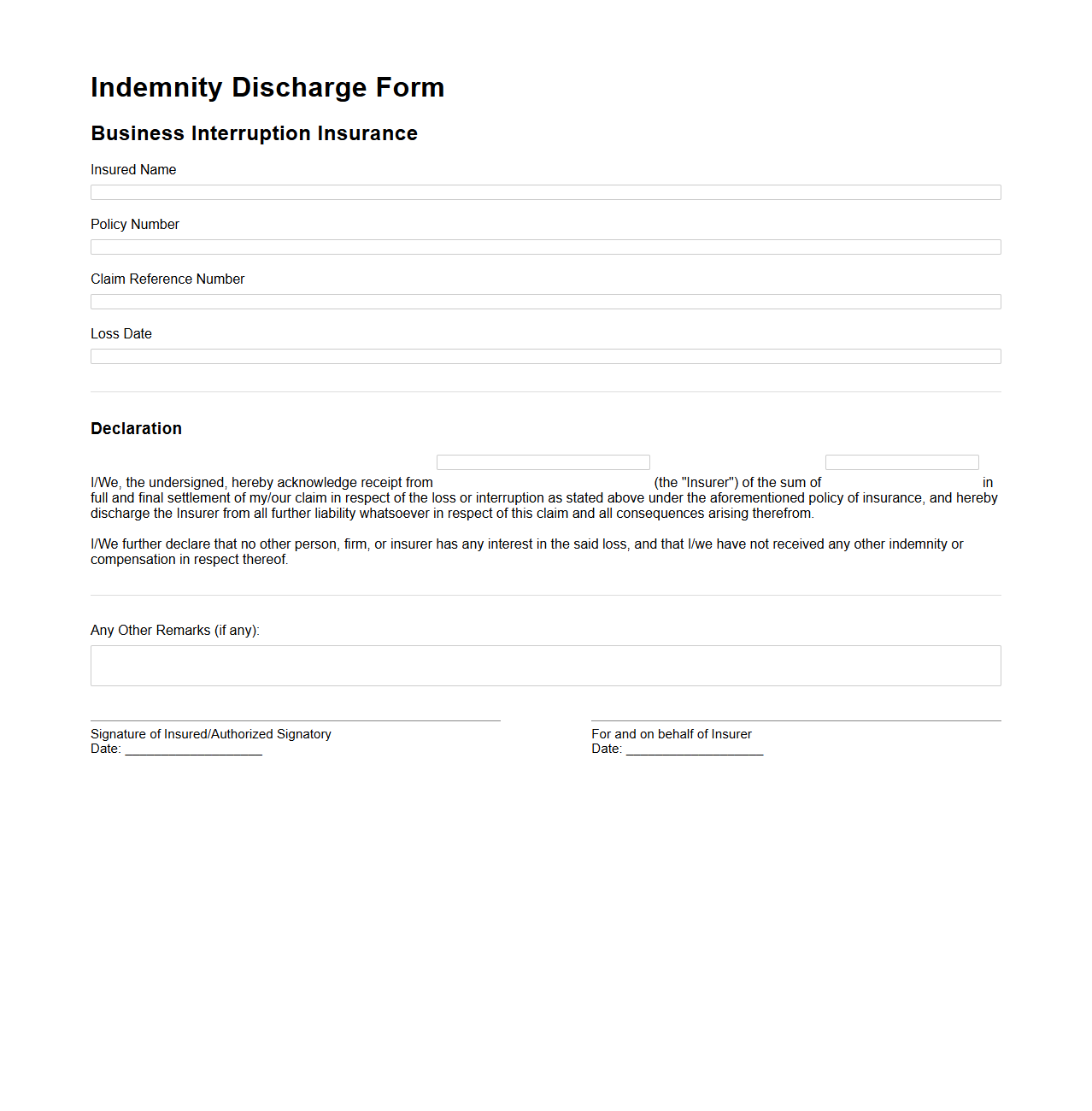

Indemnity Discharge Form for Business Interruption Insurance

An

Indemnity Discharge Form for Business Interruption Insurance is a legal document that formalizes the settlement of a claim between the insurer and the insured after a business interruption event. It outlines the agreed compensation and confirms that the insured releases the insurer from any further liability related to that specific claim. This form protects both parties by ensuring clear communication and preventing future disputes over the insurance payout.

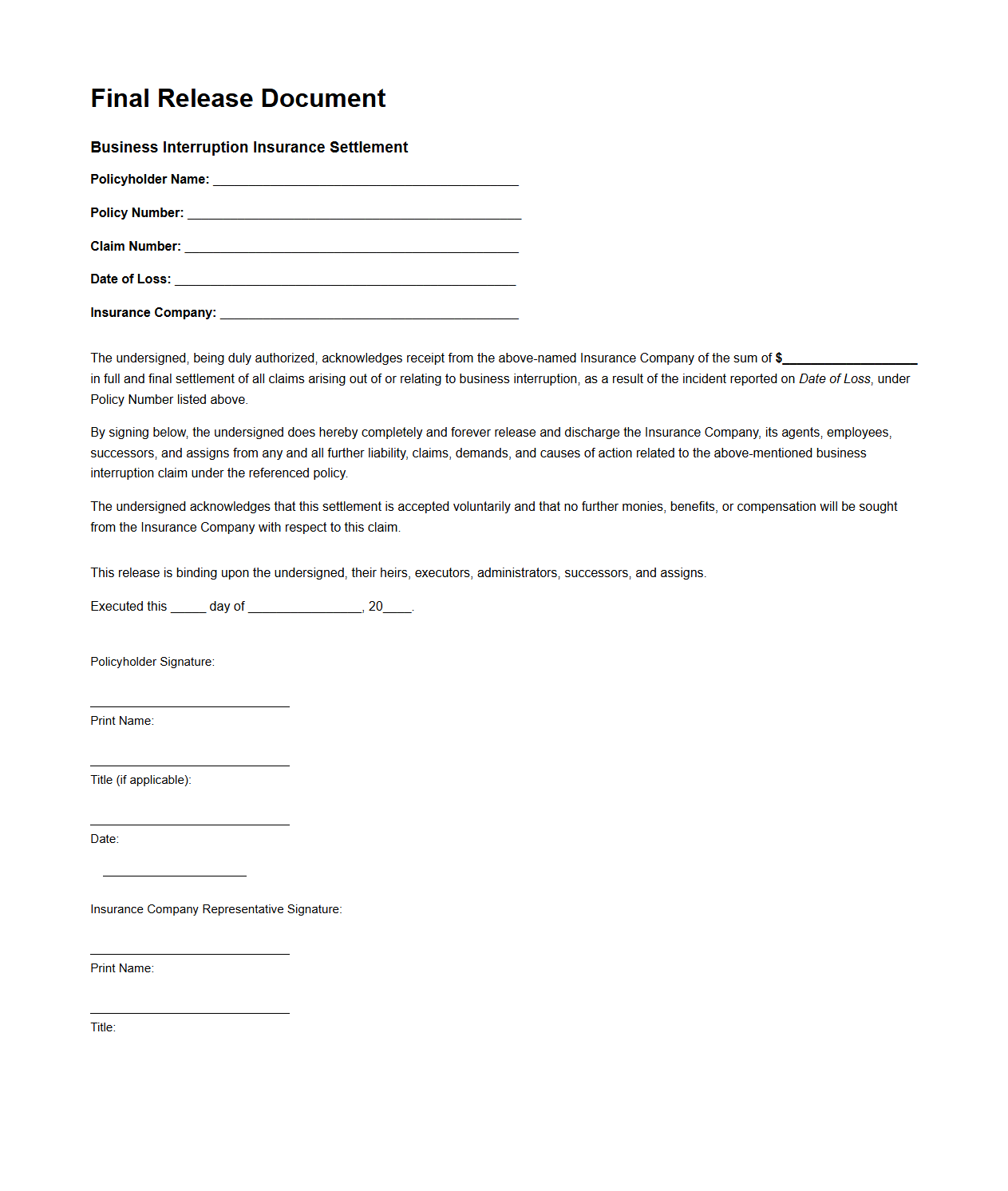

Final Release Document for Business Interruption Insurance Settlement

The

Final Release Document for a Business Interruption Insurance Settlement is a legally binding agreement that confirms the resolution and closure of all claims related to business interruption losses. It outlines the settlement amount paid by the insurer and releases the insurer from any further liability or claims arising from the covered event. This document ensures that both parties agree to the terms and finalize the insurance claim process.

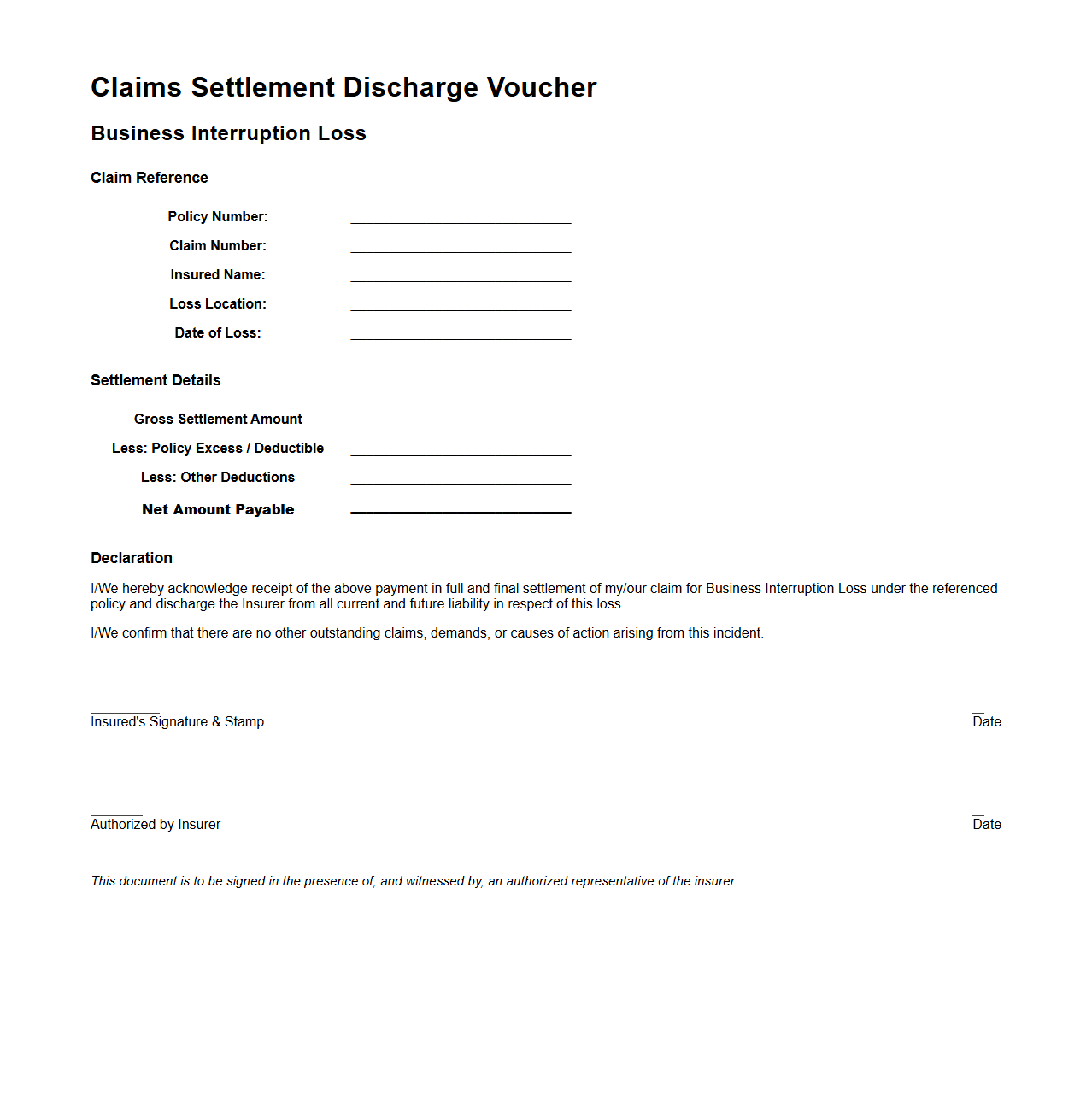

Claims Settlement Discharge Voucher for Business Interruption Loss

A

Claims Settlement Discharge Voucher for Business Interruption Loss is a formal document issued by an insurance company confirming the settlement of a claim related to financial losses incurred due to the suspension of business operations. This voucher serves as a proof of payment and complete discharge of liability by the insurer towards the insured party for the agreed compensation amount. It is an essential record for both parties to ensure transparency and avoid future disputes regarding the business interruption claim.

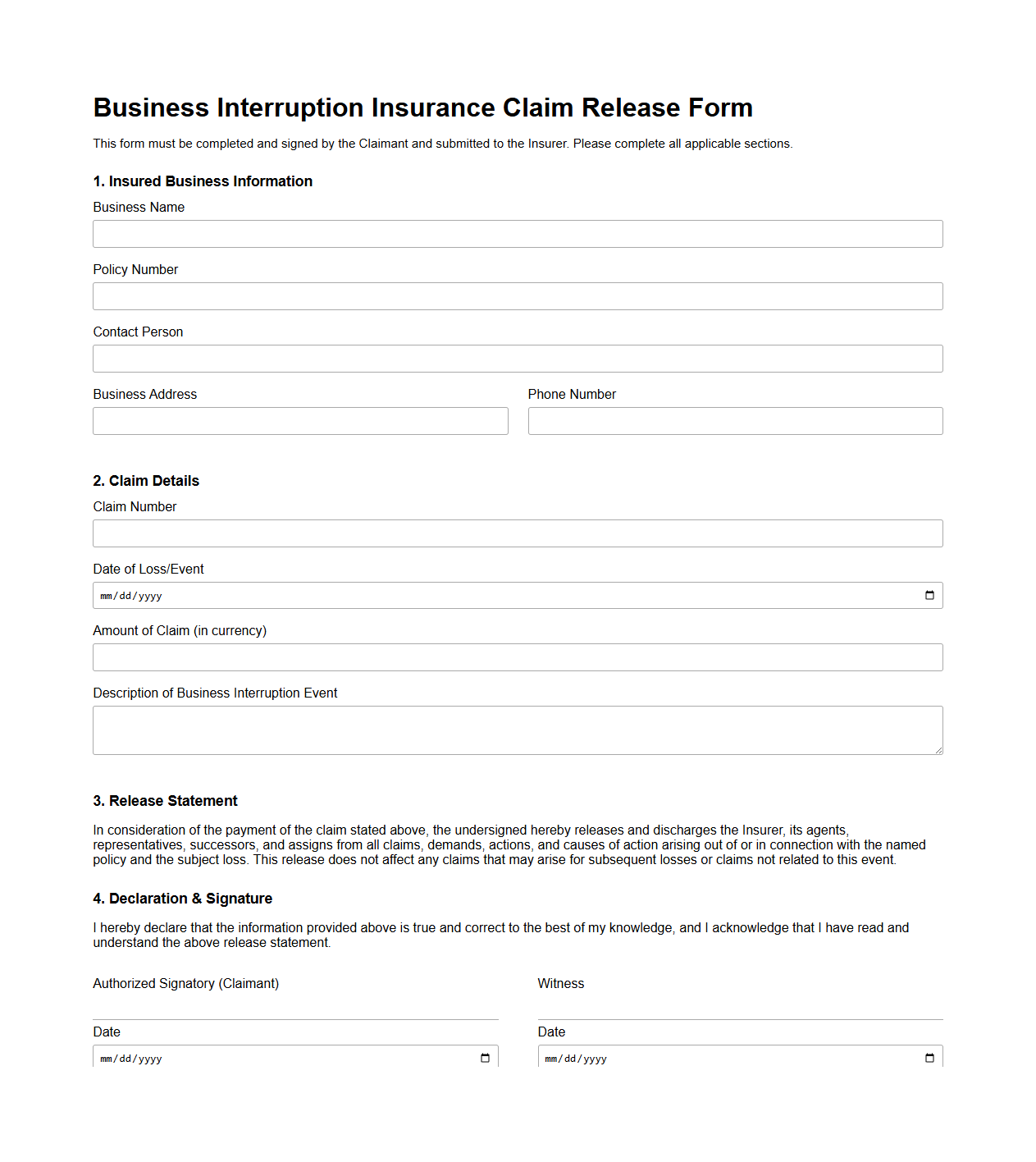

Business Interruption Insurance Claim Release Form

A

Business Interruption Insurance Claim Release Form is a legal document used to formally settle and close a business interruption insurance claim between the insured party and the insurer. This form outlines the agreed compensation and releases the insurer from future liability related to the specific claim. It ensures clarity on the payment terms and confirms that all losses due to business interruption have been addressed.

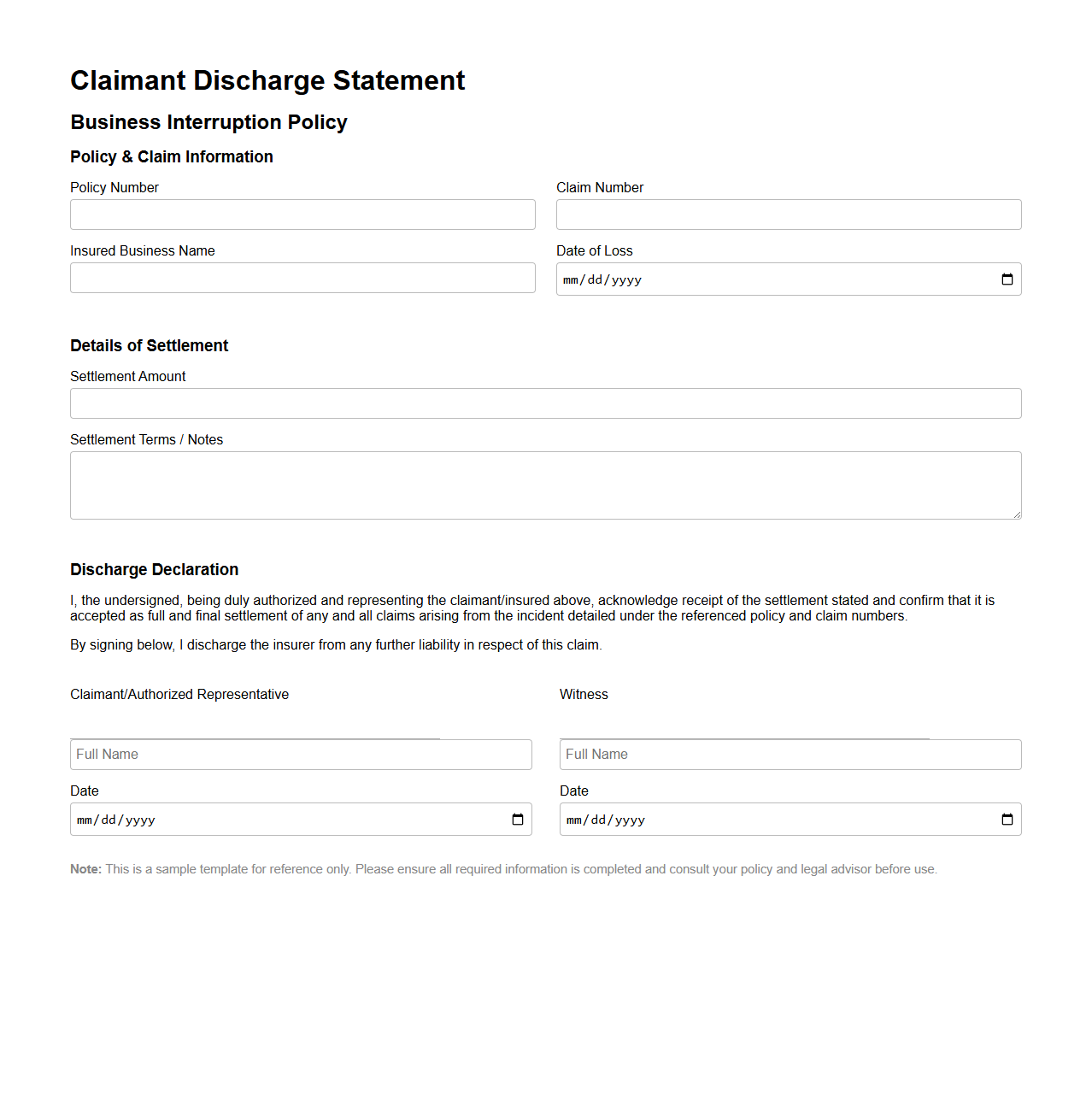

Claimant Discharge Statement for Business Interruption Policies

A

Claimant Discharge Statement for Business Interruption Policies is a formal document that confirms the claimant has received payment or compensation related to their business interruption insurance claim. This statement serves as proof that the insurer has fulfilled their financial obligations, releasing them from further liability under the specific claim. It is essential for ensuring clear and legally binding closure between the insurer and the policyholder.

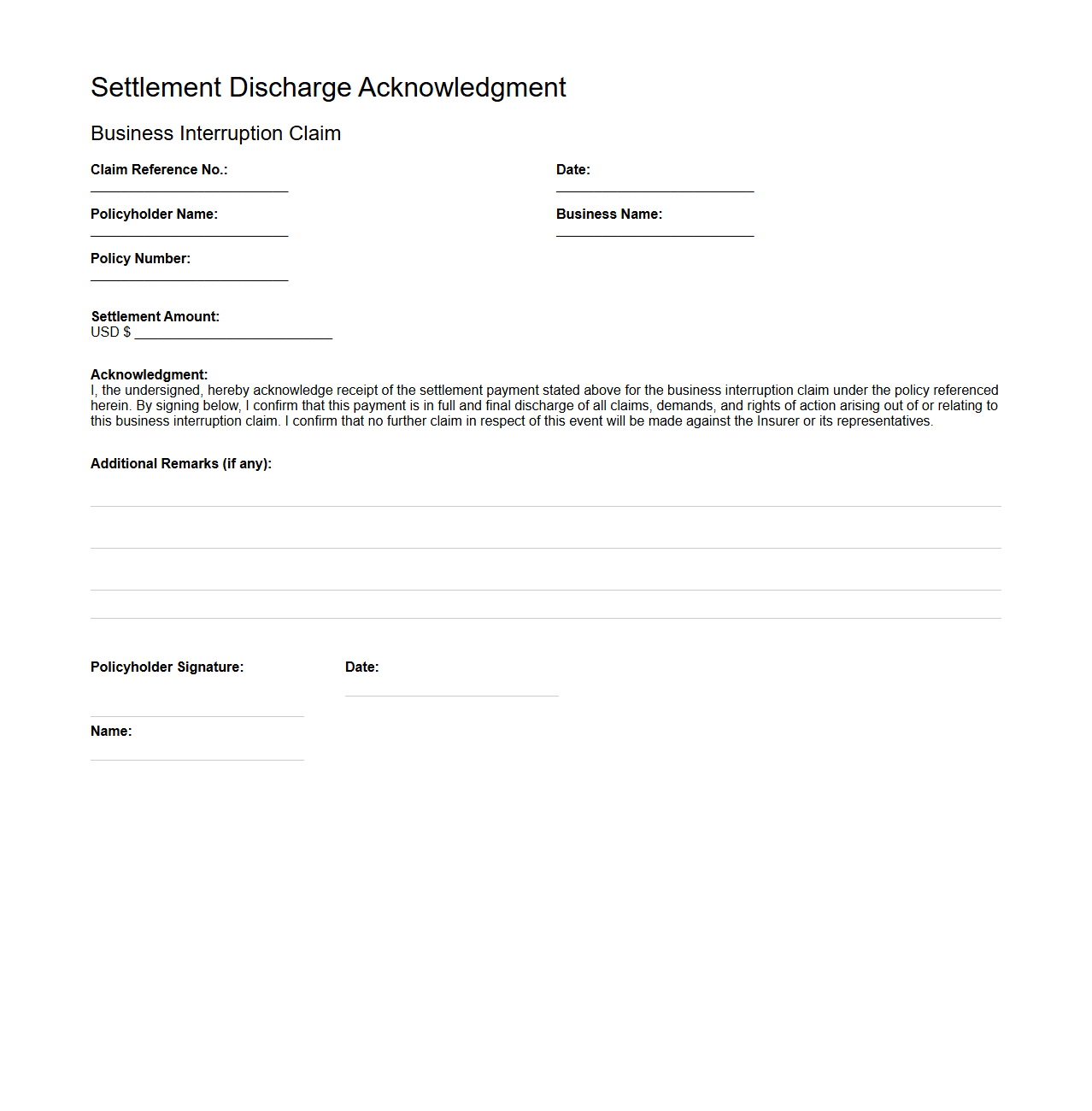

Settlement Discharge Acknowledgment for Business Interruption Claims

A

Settlement Discharge Acknowledgment for Business Interruption Claims is a legal document that confirms the claimant has agreed to the terms of a settlement with the insurer. This document formally releases the insurer from any further liability related to the specific business interruption claim once the agreed-upon compensation is received. It serves as proof that the claim has been resolved, protecting both parties from future disputes over the same incident.

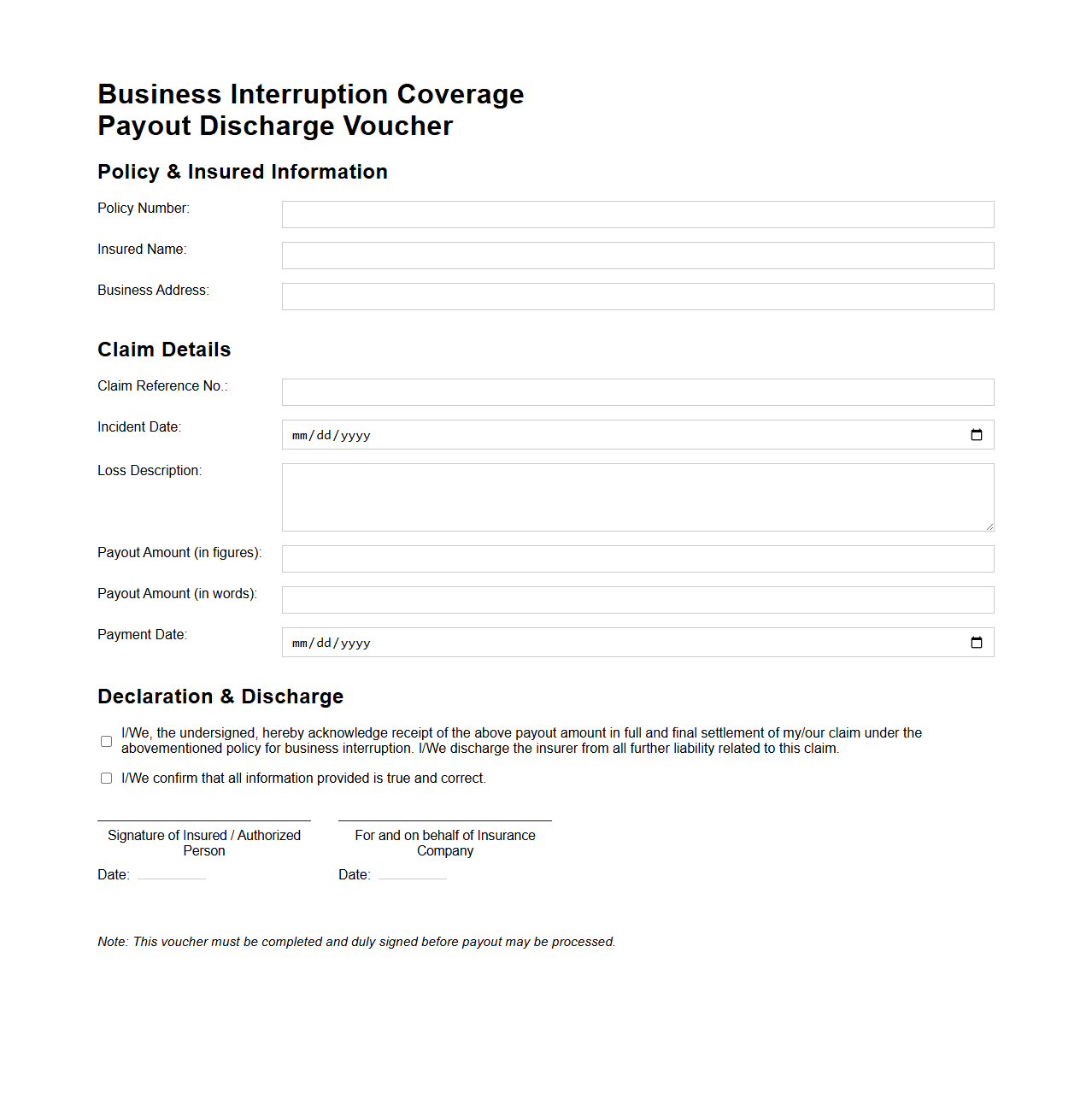

Business Interruption Coverage Payout Discharge Voucher

A

Business Interruption Coverage Payout Discharge Voucher is a formal document issued by an insurance company confirming that the payout for a business interruption claim has been fully settled. It serves as proof that the insurer has disbursed the agreed compensation to the policyholder, releasing the insurer from any further liability related to that specific claim. This voucher is essential for record-keeping and ensures transparency in the claim settlement process.

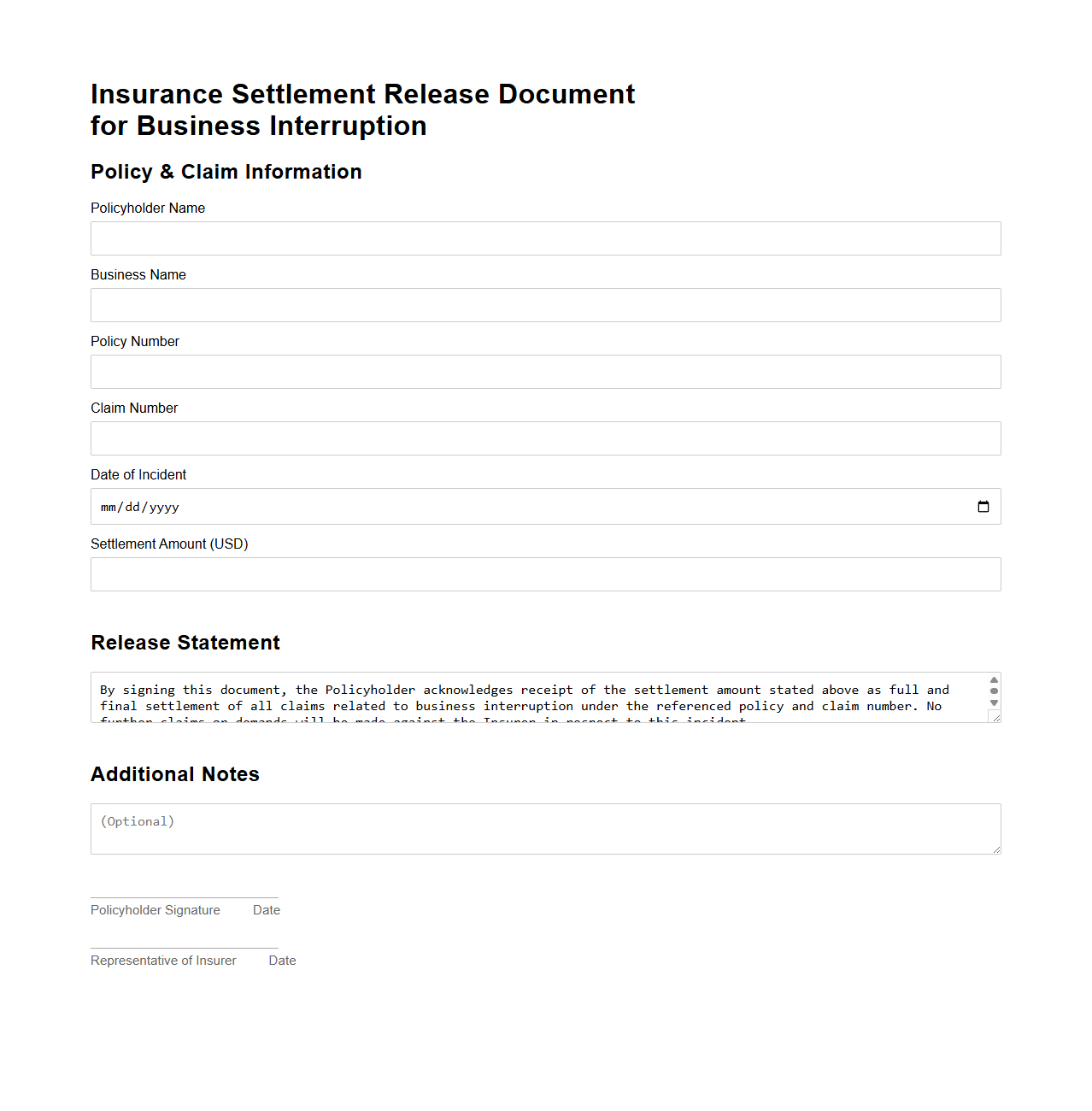

Insurance Settlement Release Document for Business Interruption

A

Insurance Settlement Release Document for Business Interruption is a legally binding agreement that finalizes the resolution between a policyholder and the insurer regarding compensation for losses during a business interruption. This document outlines the terms under which the insurance company agrees to pay the settlement amount and the policyholder releases the insurer from any further claims related to the covered event. It is crucial for ensuring clarity on the extent of coverage and preventing future disputes over the claim.

What key information must be included in a discharge voucher for business interruption insurance claims?

A discharge voucher must contain detailed information about the policyholder, the insurer, and the specific insurance policy. It should include the claim number, the amount paid, and a clear description of the business interruption event covered. Additionally, the document must specify the date of settlement and reference the associated claim documentation.

How does the discharge voucher confirm the settlement amount and terms agreed upon by both insurer and policyholder?

The discharge voucher explicitly states the settlement amount agreed upon for the business interruption claim. It outlines the terms and conditions under which the payment is made, ensuring both parties acknowledge the agreed settlement. This confirmation serves as a legally binding record extinguishing further claims related to the same event.

Which parties are required to sign the discharge voucher to validate the release of liability?

The discharge voucher must be signed by authorized representatives of both the insurer and the policyholder. In some cases, witnesses or legal representatives may also be required to sign to reinforce the document's authenticity. These signatures validate the release of liability and the acceptance of the settlement terms.

What legal statements or disclaimers are typically present in a business interruption insurance discharge voucher?

Legal statements often include disclaimers releasing the insurer from further liability concerning the settled claim. The voucher typically contains language confirming that the settlement fully satisfies all claims arising from the business interruption. It may also include clauses about confidentiality and the finality of the agreement.

How does the discharge voucher outline the finality of the insurance claim and prevent future disputes?

The discharge voucher explicitly declares that the agreed settlement represents the final resolution of all claims related to the insurance event. It serves as evidence that both parties have agreed to the settlement without reservation. This explicit finality prevents any future disputes by legally binding both parties to the terms stated.