A Medical Information Request Document Sample for Critical Illness Insurance helps streamline the process of obtaining essential health details from policyholders or healthcare providers. It ensures accurate and comprehensive medical data collection, facilitating a quicker claim decision. Precise documentation supports effective risk assessment and enhances the overall insurance claim experience.

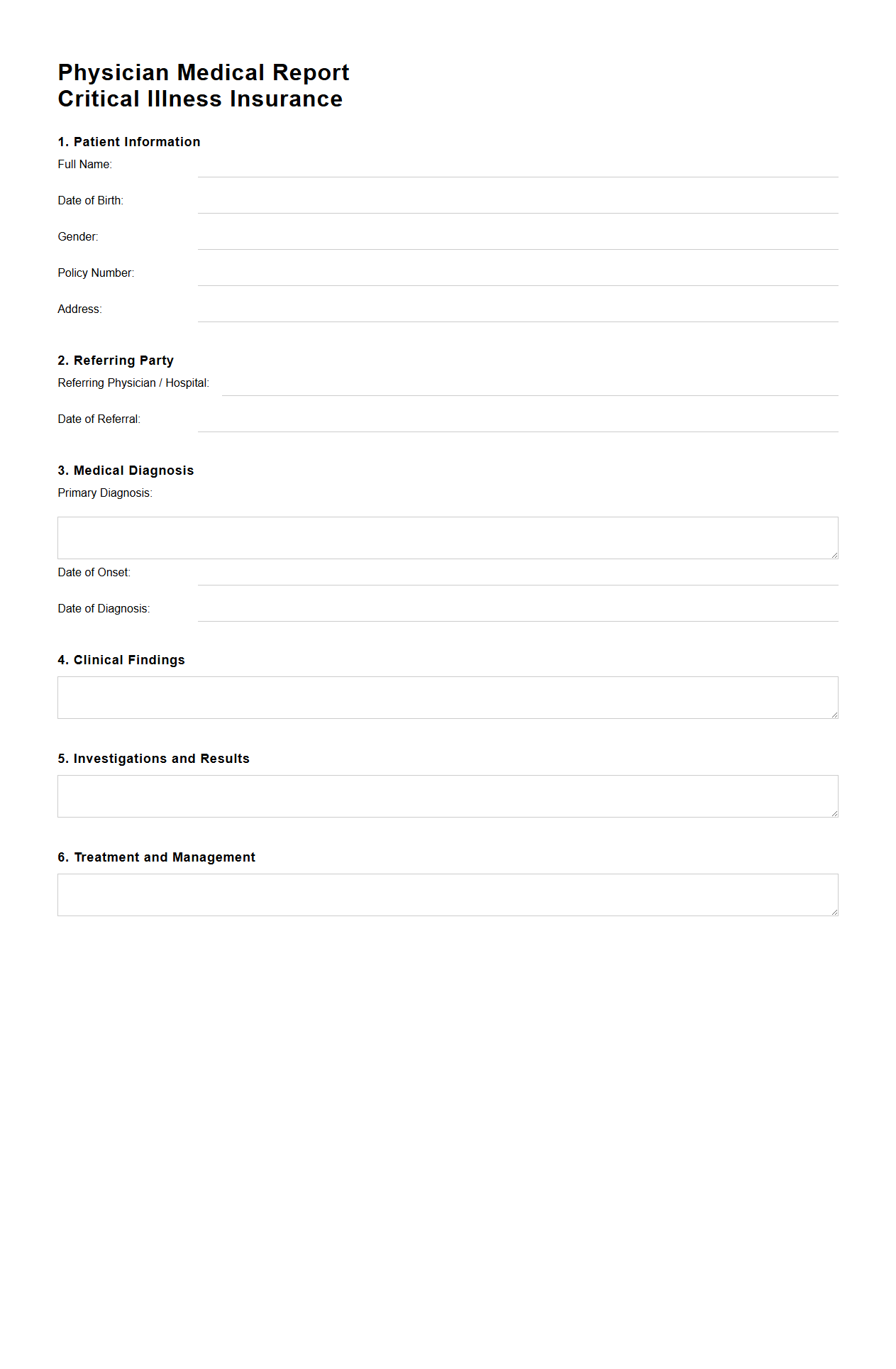

Physician Medical Report for Critical Illness Insurance

A

Physician Medical Report for Critical Illness Insurance is a detailed medical document prepared by a licensed physician that provides an in-depth evaluation of a claimant's health condition related to a critical illness diagnosis. This report includes clinical findings, diagnostic test results, treatment history, and the physician's professional opinion on the severity and prognosis of the illness, which are essential for the insurance company to assess claim validity. It serves as a critical piece of evidence to determine eligibility for insurance benefits under a critical illness policy.

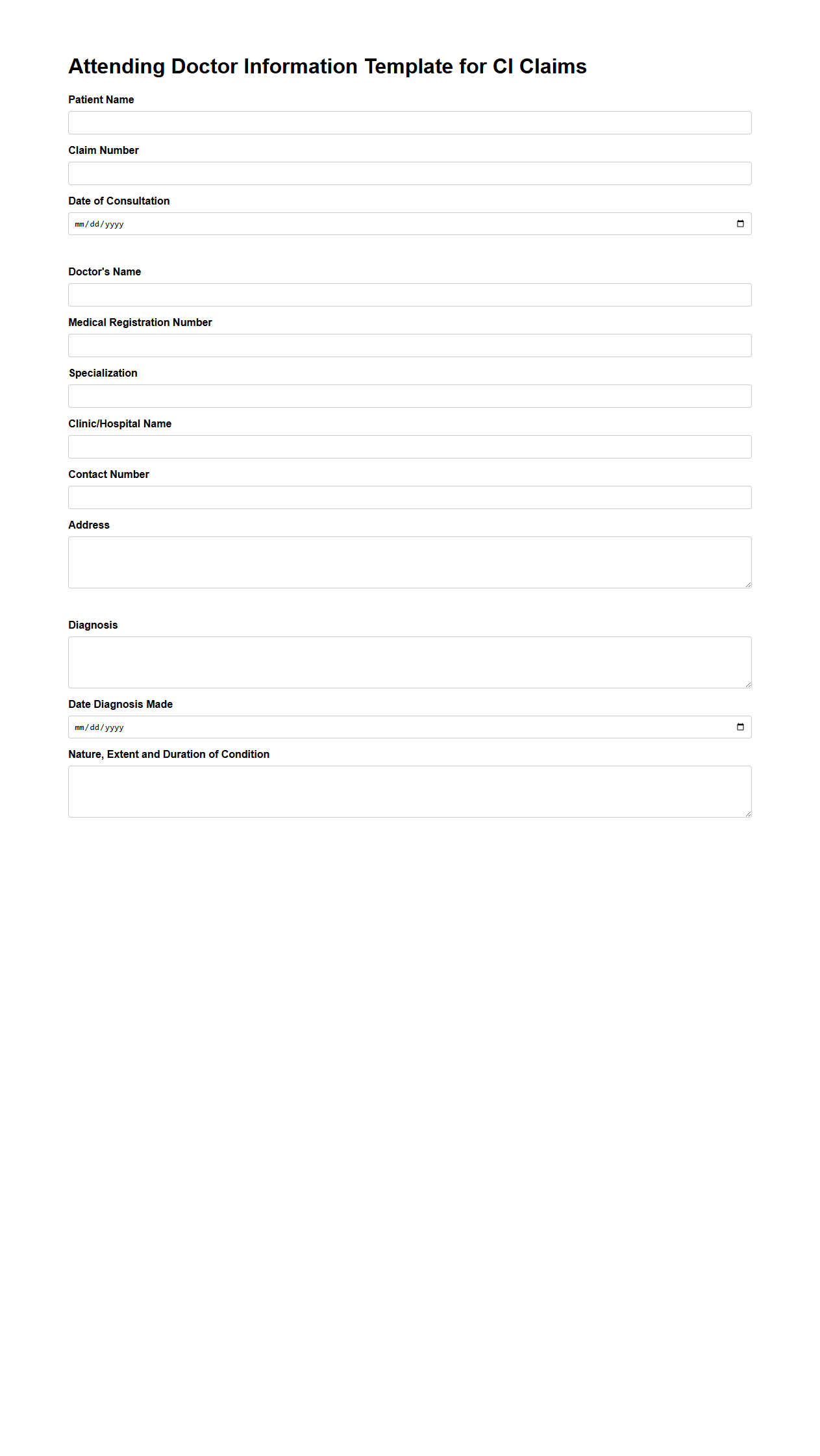

Attending Doctor Information Template for CI Claims

The

Attending Doctor Information Template for CI Claims document captures detailed medical provider data essential for critical illness insurance processing. It includes the attending physician's name, contact details, specialty, and treatment dates to verify the medical diagnosis and treatment authenticity. This template streamlines claim assessment by providing accurate doctor-related information directly linked to the claimant's medical records.

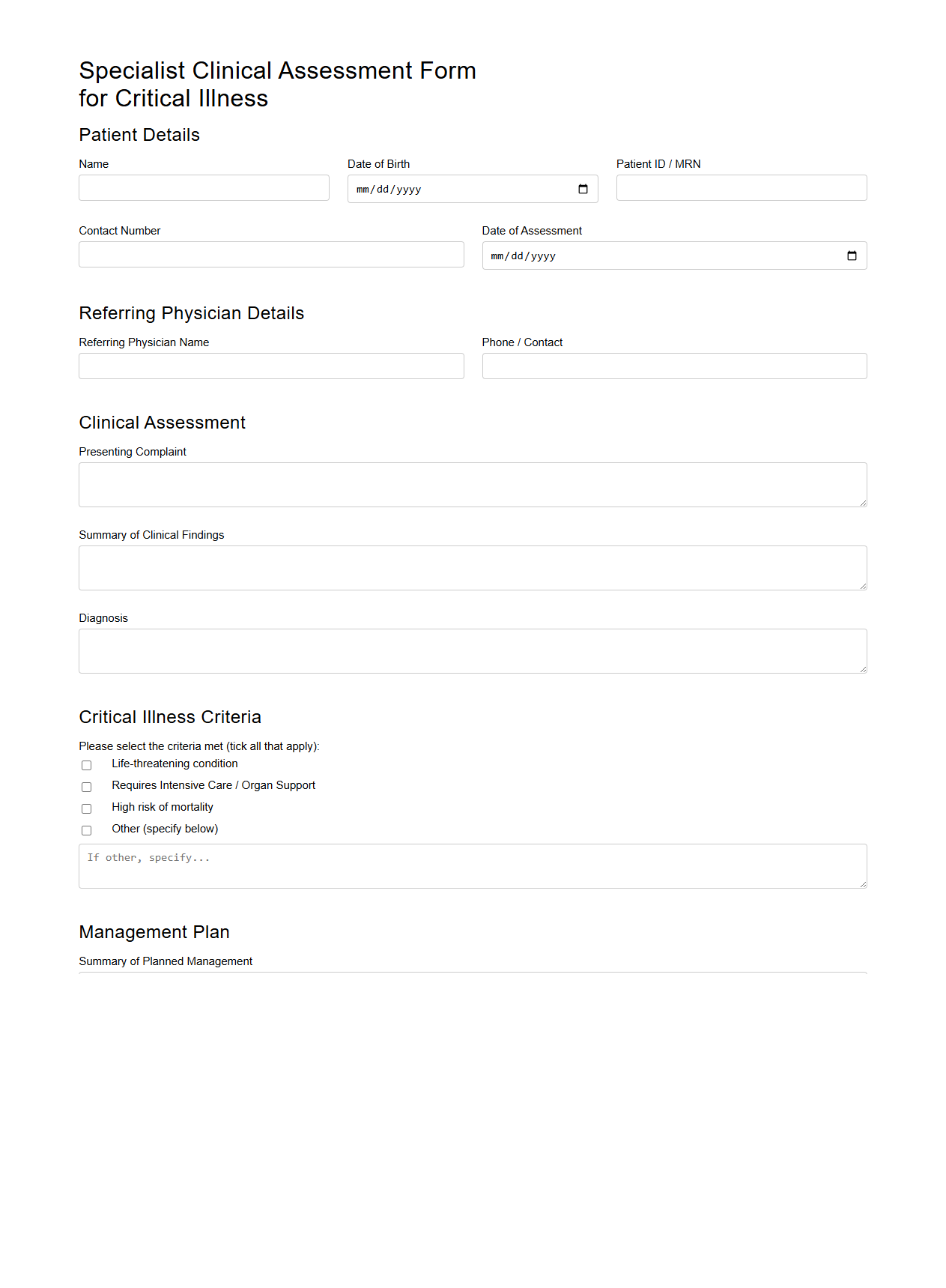

Specialist Clinical Assessment Form for Critical Illness

The

Specialist Clinical Assessment Form for Critical Illness document serves as a comprehensive tool used by healthcare professionals to evaluate patients presenting with severe medical conditions. It systematically records vital clinical information, including symptoms, diagnostic results, and specialist opinions, ensuring accurate assessment and collaborative care planning. This form is essential for facilitating timely interventions and improving outcomes in critical illness management.

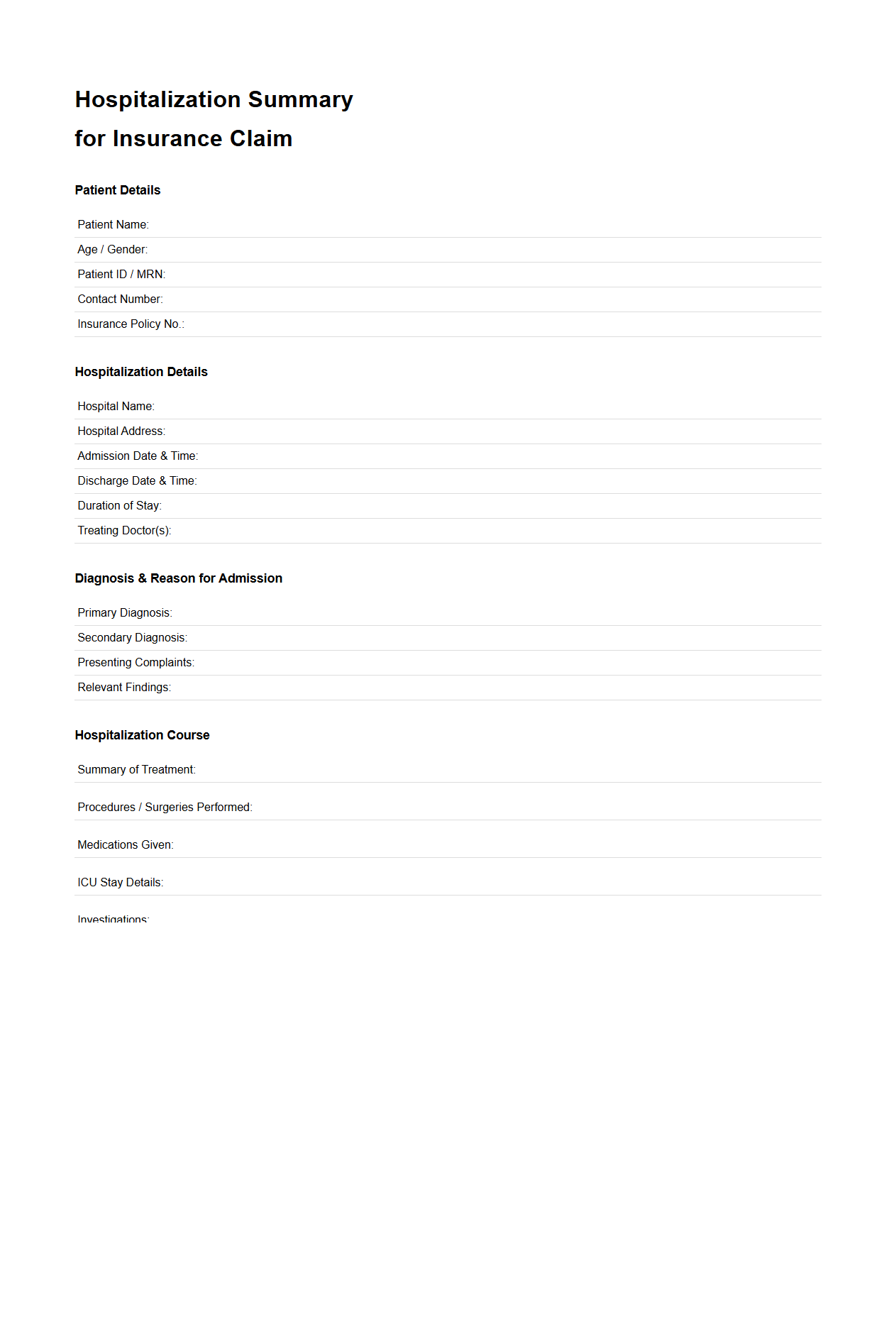

Hospitalization Summary for Insurance Claim

A

Hospitalization Summary for Insurance Claim document is a vital medical record that provides a detailed account of a patient's hospital stay, including admission and discharge dates, diagnosis, treatments, procedures performed, and medications administered. This summary serves as essential proof for insurance companies to validate and process claims related to inpatient care. Accurate and comprehensive documentation in this summary ensures streamlined claim approval and timely reimbursement for hospitalization expenses.

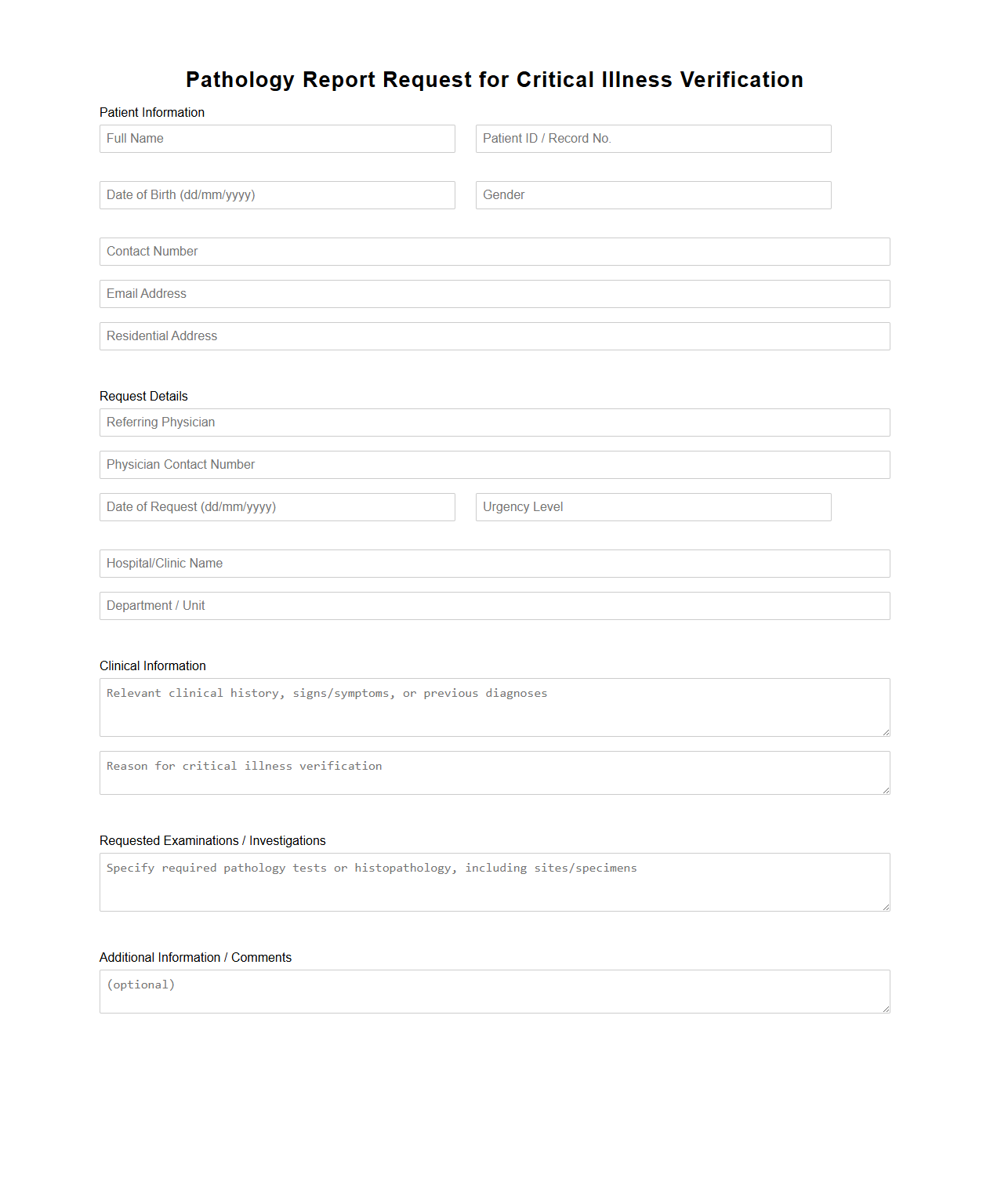

Pathology Report Request for Critical Illness Verification

A

Pathology Report Request for Critical Illness Verification document is a formal application used by patients or healthcare providers to obtain detailed pathology findings necessary for confirming the diagnosis of a critical illness. This report contains essential information such as biopsy results, histopathological examination, and laboratory data that verify the presence and severity of a disease. Accurate pathology reports are crucial for insurance claims, treatment planning, and legal documentation related to critical illness.

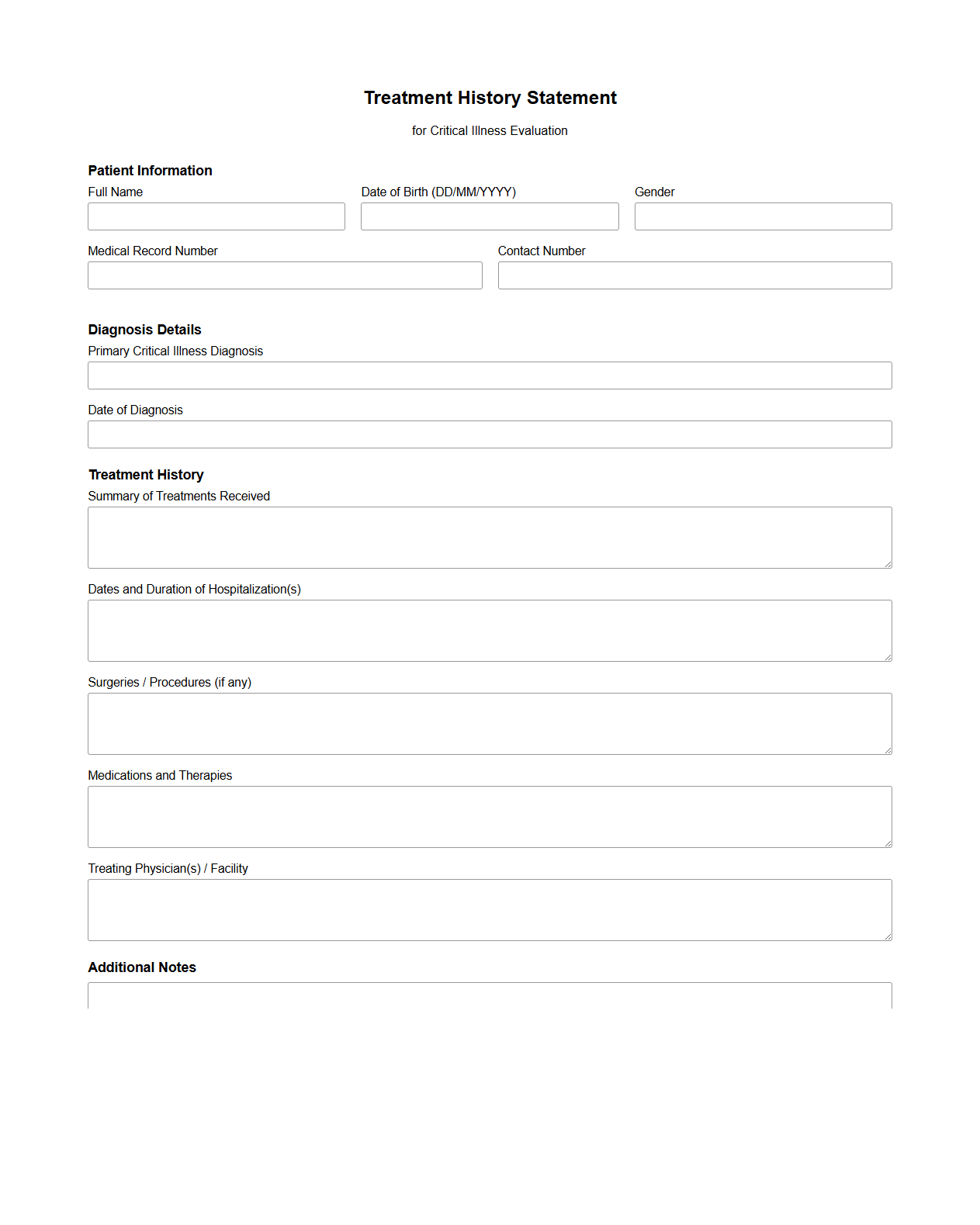

Treatment History Statement for Critical Illness Evaluation

A

Treatment History Statement for Critical Illness Evaluation is a comprehensive document that records a patient's past and ongoing medical treatments related to critical illnesses. It provides detailed information about diagnosis dates, therapies administered, medication history, and response to treatments, enabling healthcare providers and insurers to accurately assess the severity and progression of the condition. This statement is essential for evaluating insurance claims, determining eligibility for benefits, and facilitating informed medical decisions.

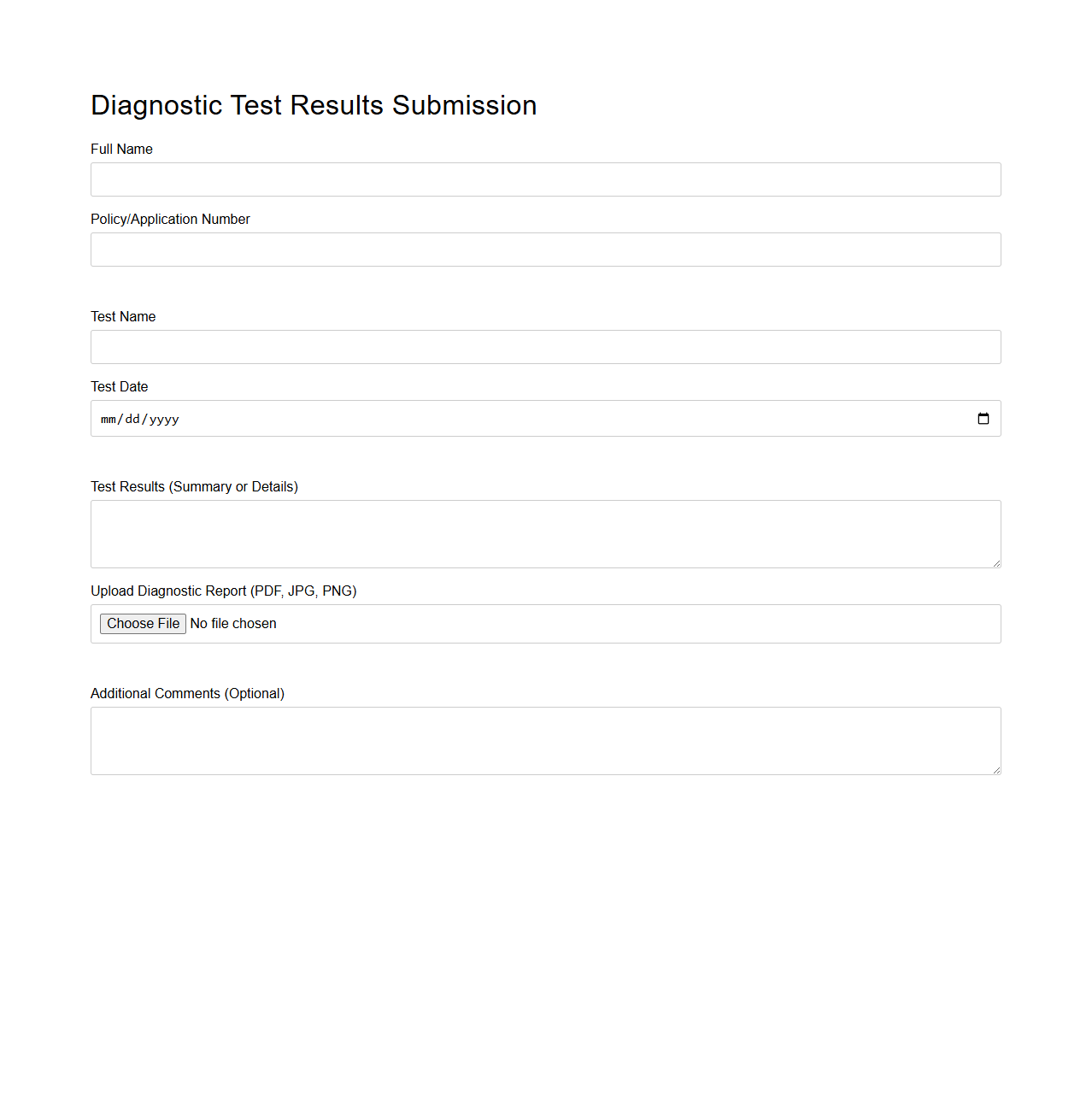

Diagnostic Test Results Submission for Insurance Application

The

Diagnostic Test Results Submission for an insurance application is a critical document that provides detailed medical test outcomes required by insurance companies to assess an applicant's health status. It includes laboratory reports, imaging results, and other relevant diagnostic information that help underwriters evaluate risk and determine policy eligibility and premiums. Accurate and timely submission of these results ensures a smooth underwriting process and helps prevent delays or denials in insurance coverage.

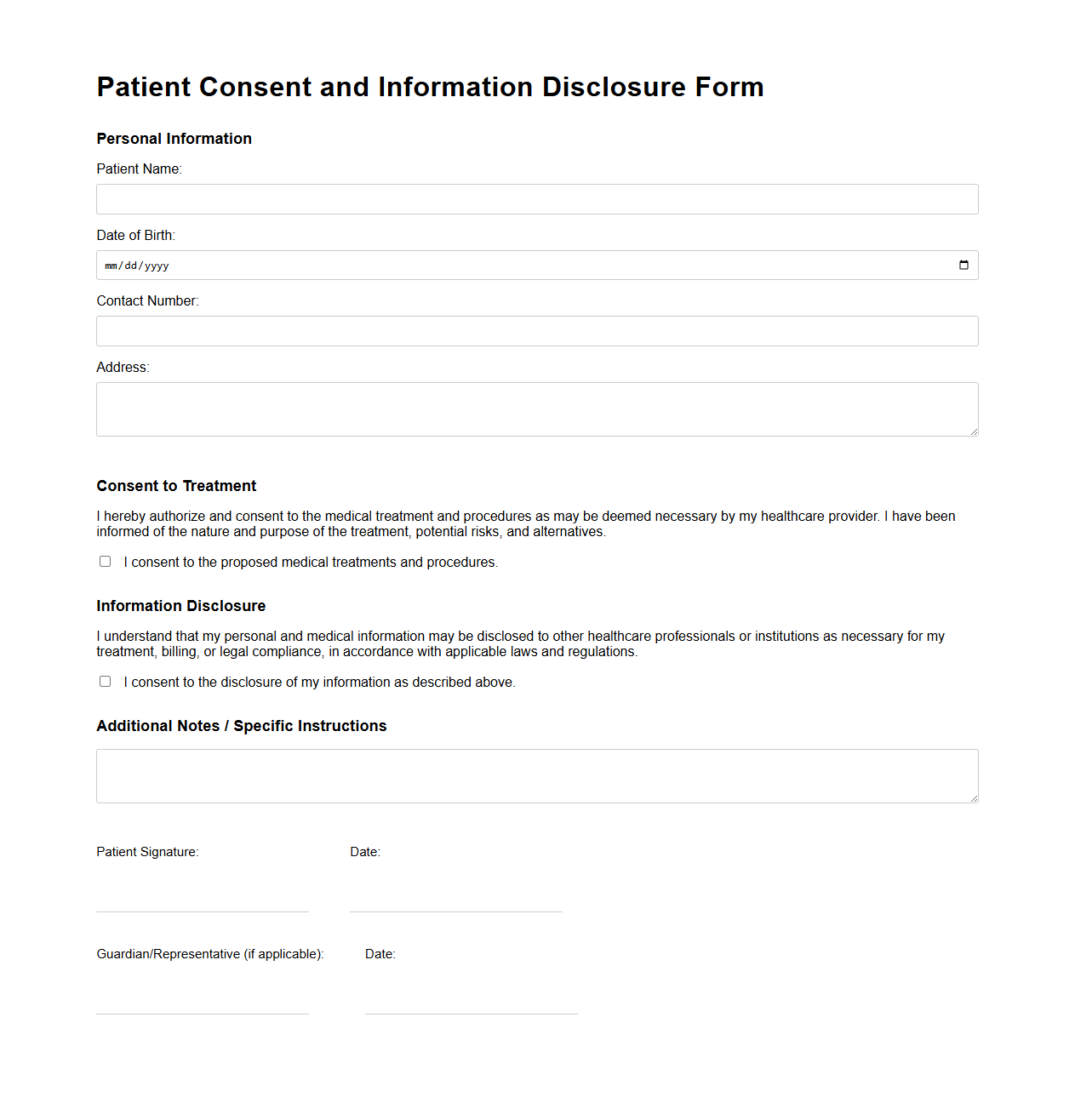

Patient Consent and Information Disclosure Form

A

Patient Consent and Information Disclosure Form is a critical legal document that authorizes healthcare providers to share a patient's medical information with designated parties. It ensures patients understand how their personal health data will be used, protecting their privacy in compliance with laws like HIPAA. This form also confirms that the patient agrees to specific treatments or procedures after being fully informed of potential risks and benefits.

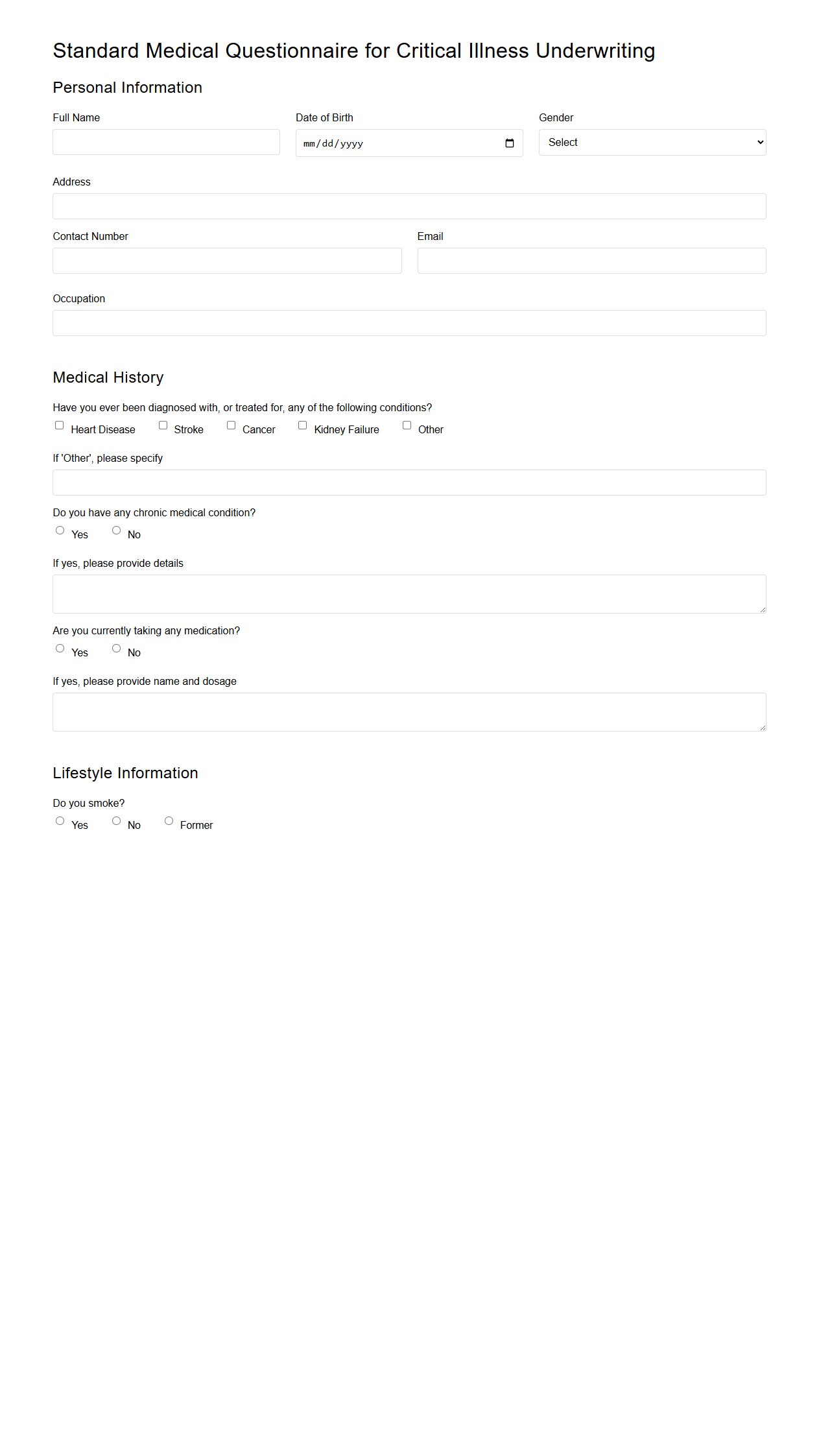

Standard Medical Questionnaire for Critical Illness Underwriting

The

Standard Medical Questionnaire for Critical Illness Underwriting is a detailed document used by insurance companies to assess an applicant's health status and medical history when applying for critical illness coverage. This questionnaire collects information on pre-existing conditions, family medical history, lifestyle factors, and recent medical treatments to evaluate risk accurately. The data provided helps underwriters determine eligibility, coverage limits, and premium rates for critical illness insurance policies.

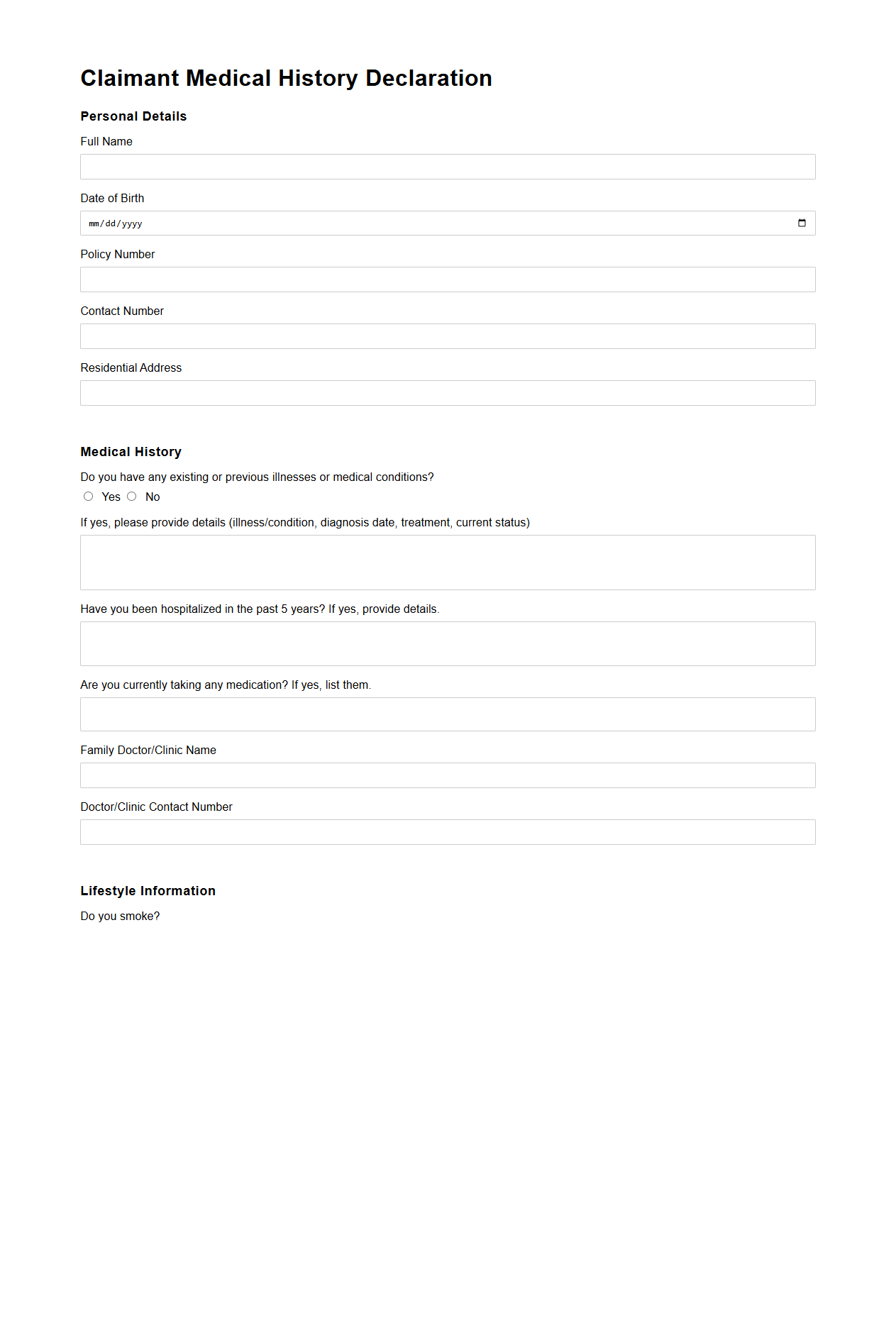

Claimant Medical History Declaration for Insurer

The

Claimant Medical History Declaration for Insurer document is a detailed form used to collect an individual's past and present medical information relevant to an insurance claim. This document enables insurers to assess risk accurately, verify the claimant's health status, and determine the validity of the claim. Accurate and complete medical history declarations are crucial for ensuring fair claim processing and preventing fraudulent claims.

What specific critical illness diagnoses qualify for coverage under this insurance policy?

The insurance policy covers a range of critical illness diagnoses including cancer, heart attack, stroke, kidney failure, and major organ transplants. Each condition must meet precise medical criteria outlined in the policy documents. Only those diagnoses that fulfill the defined definitions are eligible for claim approval.

Which medical documents are required to support a critical illness claim?

To support a critical illness claim, the claimant must submit medical reports such as diagnosis confirmation, hospital records, and specialist opinions. Detailed pathology reports and imaging results are often necessary for validation. These documents ensure the claim is thoroughly verified and processed accurately.

How is the date of diagnosis determined and documented for claim approval?

The date of diagnosis is identified as the day a recognized medical specialist confirms the critical illness with documented evidence. This date must be clearly recorded in the medical reports submitted. It serves as a key factor in assessing claim eligibility and timing.

Are there any exclusions or waiting periods detailed in the document for certain conditions?

The policy may include specific exclusions and waiting periods for pre-existing conditions or certain illnesses. Waiting periods typically start from the policy inception date and vary depending on the condition. Understanding these clauses is crucial to avoid claim denials.

What process is outlined for obtaining and submitting additional medical information if requested?

If additional information is requested, the claimant must provide further medical documentation within a specified timeframe. This may involve authorizing access to medical records or attending supplementary medical examinations. Timely submission ensures smooth progression of the claim review process.