A Nomination Document Sample for Term Insurance provides a clear template for policyholders to designate beneficiaries efficiently. This document ensures that the insurance benefits are transferred smoothly to the nominated individuals in case of the policyholder's demise. Properly filling out this sample helps avoid legal complications and secures the financial future of loved ones.

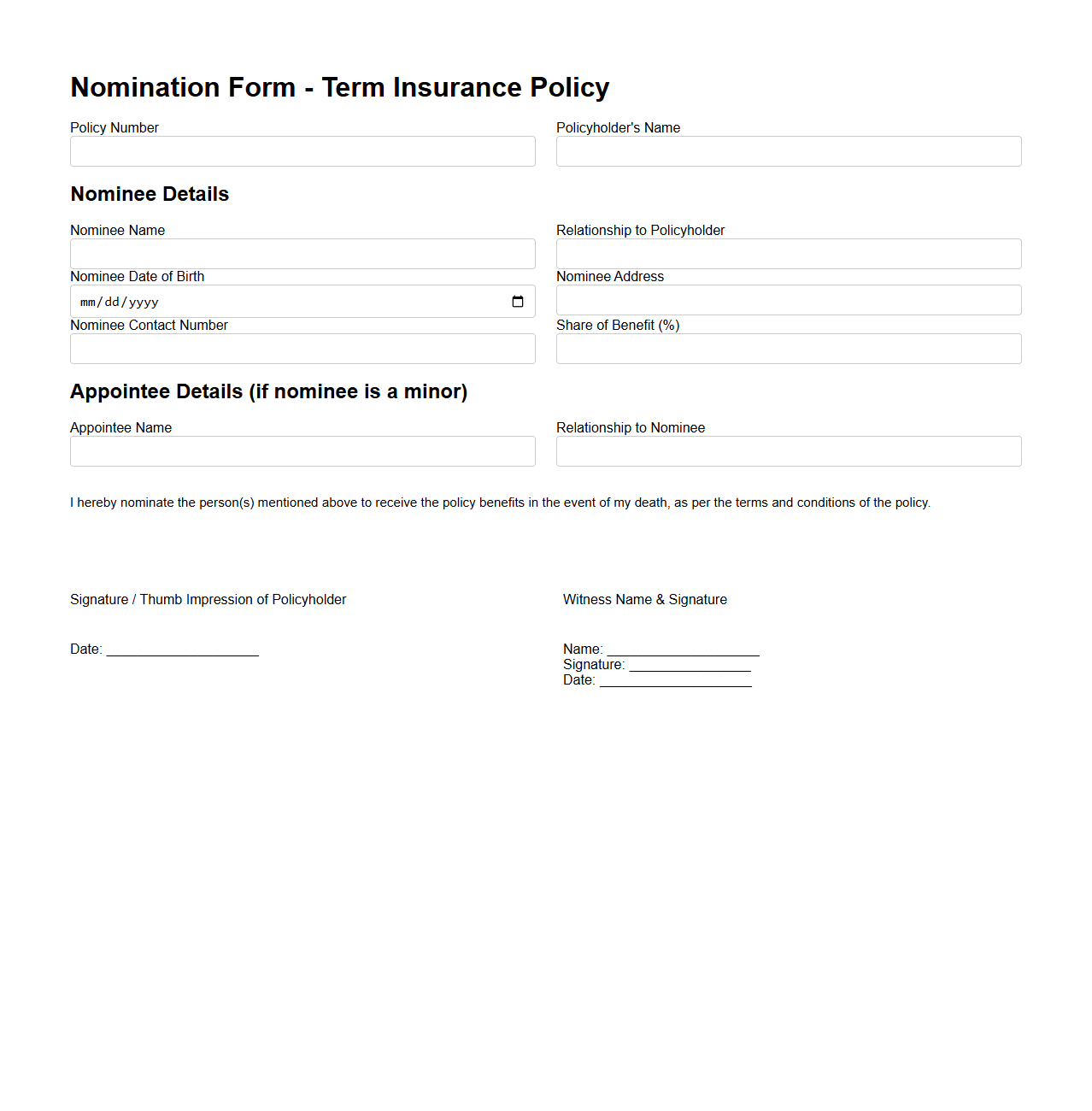

Nomination Form Template for Term Insurance Policy

A

Nomination Form Template for a Term Insurance Policy is a standardized document used to designate beneficiaries who will receive the insurance payout in the event of the policyholder's demise. It ensures clear identification of nominees, preventing disputes and facilitating smooth claim processing. This template typically includes fields for nominee details, relationship to the policyholder, and percentage of benefits allocated.

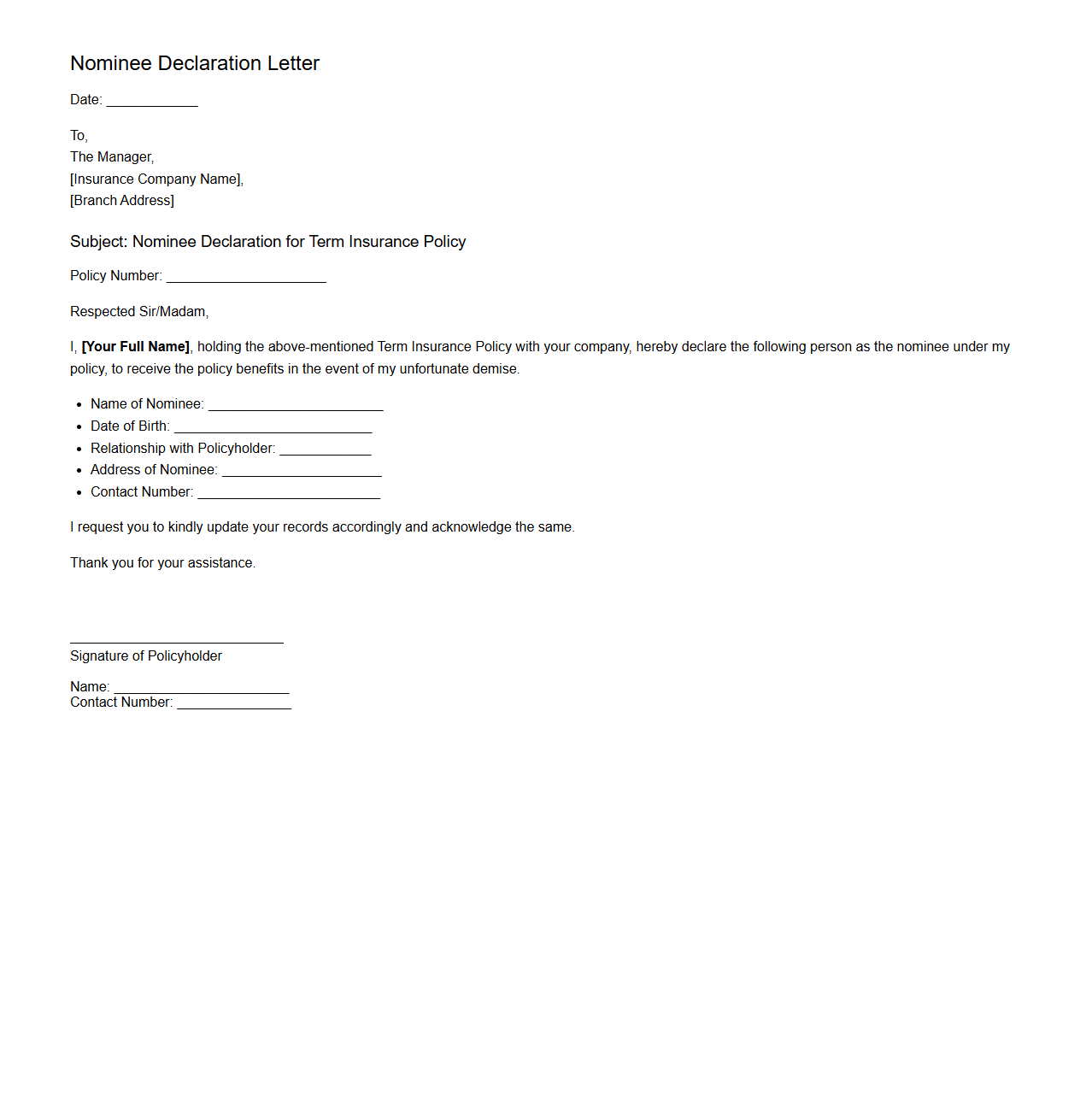

Standard Nominee Declaration Letter for Term Insurance

A

Standard Nominee Declaration Letter for Term Insurance is a formal document used to appoint a nominee who will receive the insurance benefits in the event of the policyholder's demise. It ensures the insurer recognizes the specified nominee, avoiding claim disputes and facilitating smooth claim settlement. This declaration is essential for safeguarding the policyholder's interests and providing financial security to the chosen beneficiary.

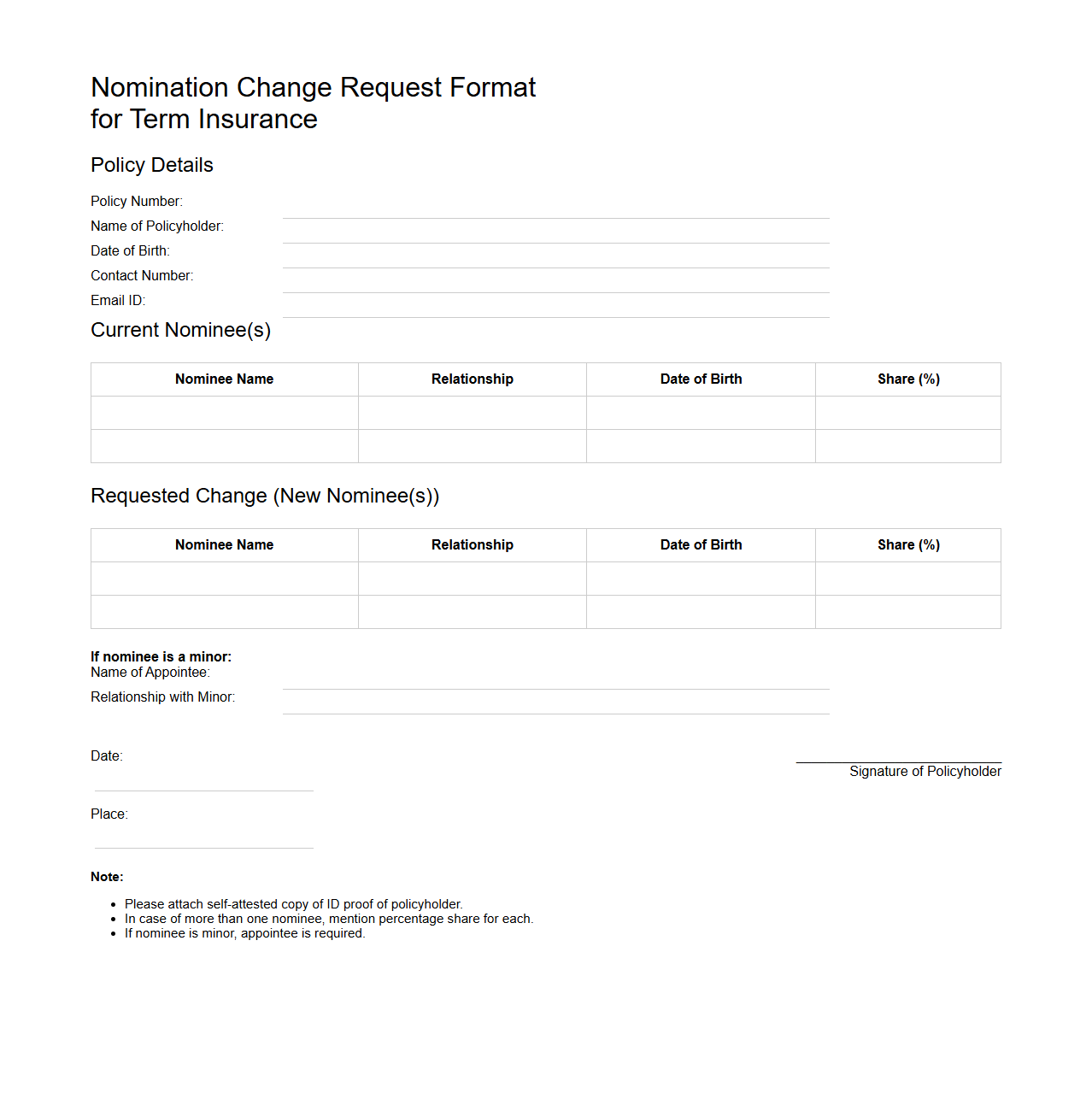

Nomination Change Request Format for Term Insurance

A

Nomination Change Request Format for Term Insurance document is a formal application used by policyholders to update or modify the nominee details linked to their term insurance policy. This format typically requires essential information such as the policy number, current nominee details, new nominee information, and the policyholder's signature for verification. Accurate completion of this document ensures that policy benefits are directed to the correct nominee in the event of the insured's demise.

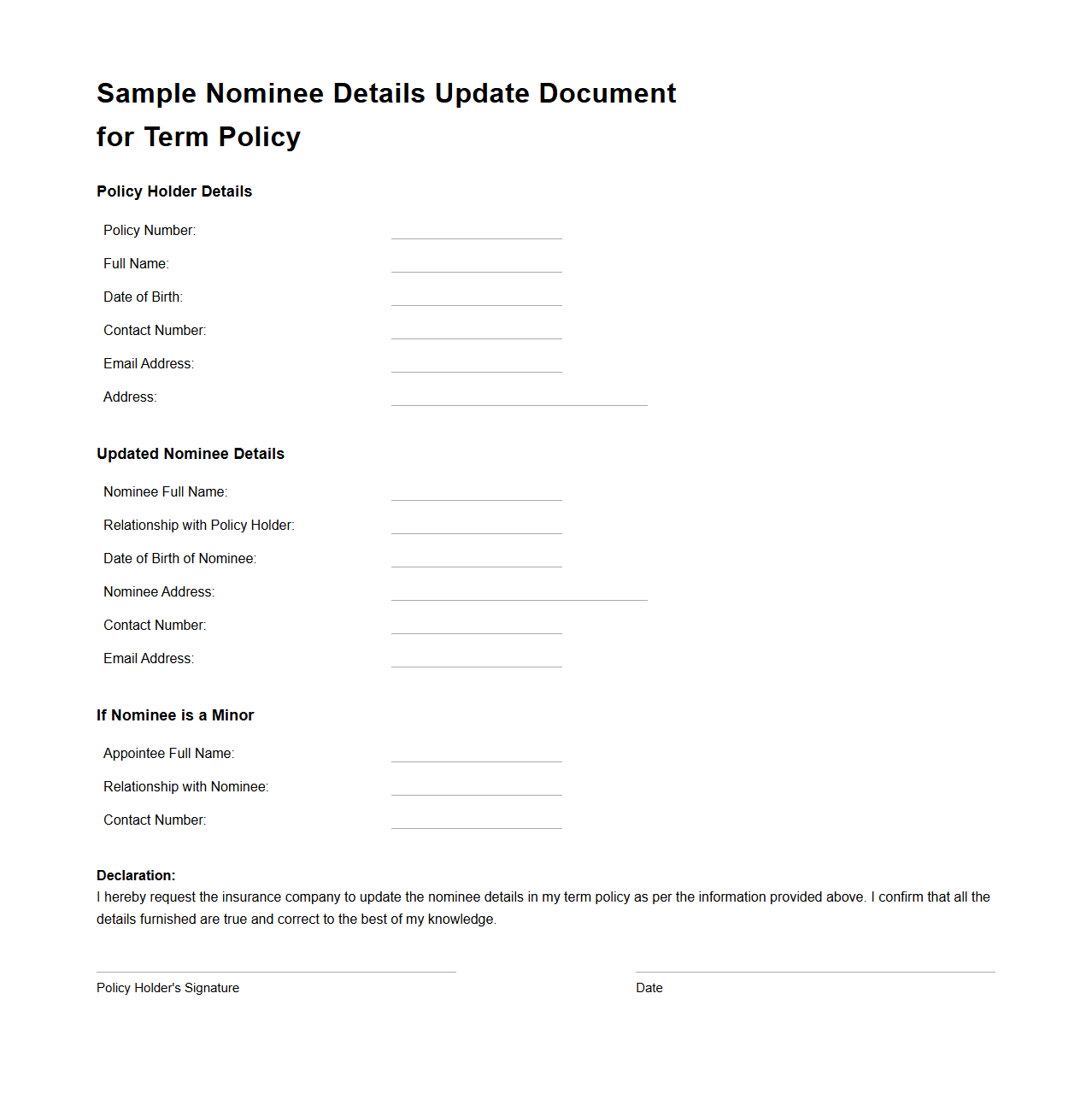

Sample Nominee Details Update Document for Term Policy

The

Sample Nominee Details Update Document for a Term Policy serves as an official form used by policyholders to modify or update the nominee information associated with their life insurance term policy. This document ensures that the insurer has accurate and current nominee details, which is critical for the smooth processing of claims in the event of the policyholder's demise. Keeping nominee information up-to-date helps secure the intended beneficiary's rights and provides clarity during claim settlements.

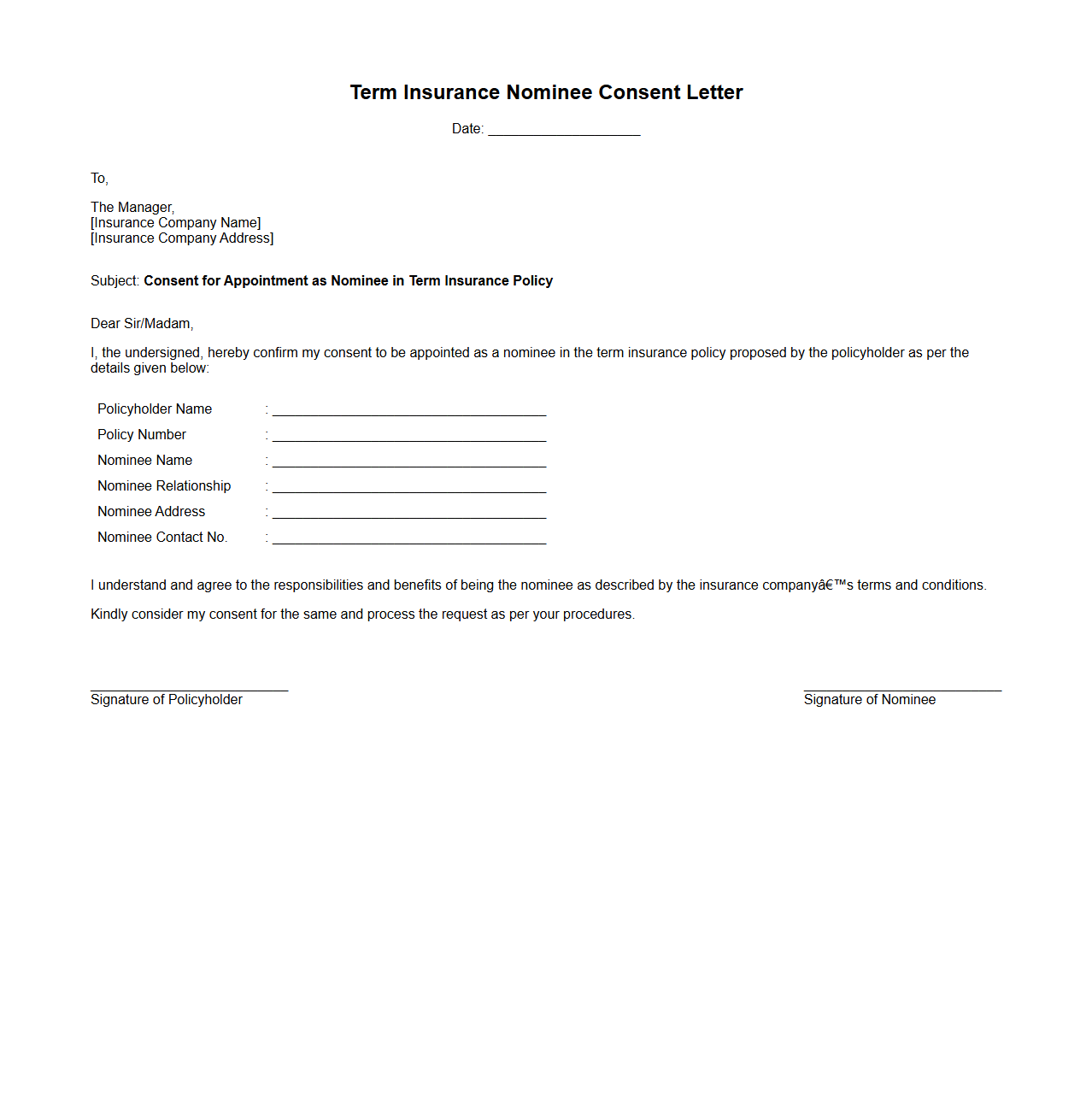

Term Insurance Nominee Consent Letter Sample

A

Term Insurance Nominee Consent Letter Sample document serves as a formal written consent from the nominee, confirming their acceptance to be the beneficiary of the policyholder's term insurance. This letter ensures clarity and legal acknowledgment, preventing disputes related to claim settlements. Insurers often require this document to validate the nominee's consent before processing any claims or policy changes.

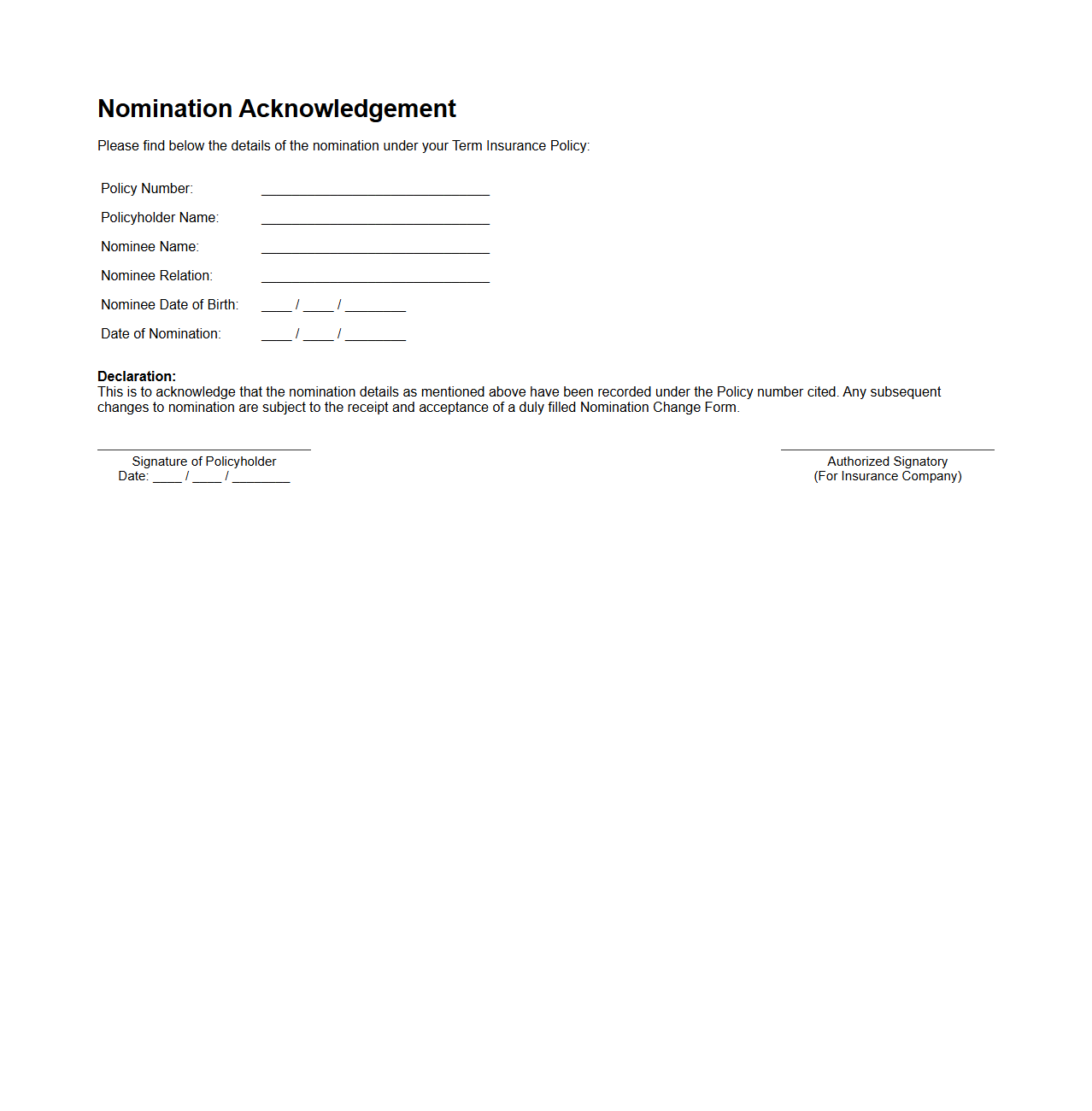

Nomination Acknowledgement Format for Term Insurance

Nomination Acknowledgement Format for Term Insurance is an official document that confirms the nomination details of the policyholder. It serves as proof that the nominee has been correctly registered to receive benefits in case of the policyholder's demise. This format is crucial for ensuring the timely and accurate disbursement of the

insurance claim amount to the rightful nominee.

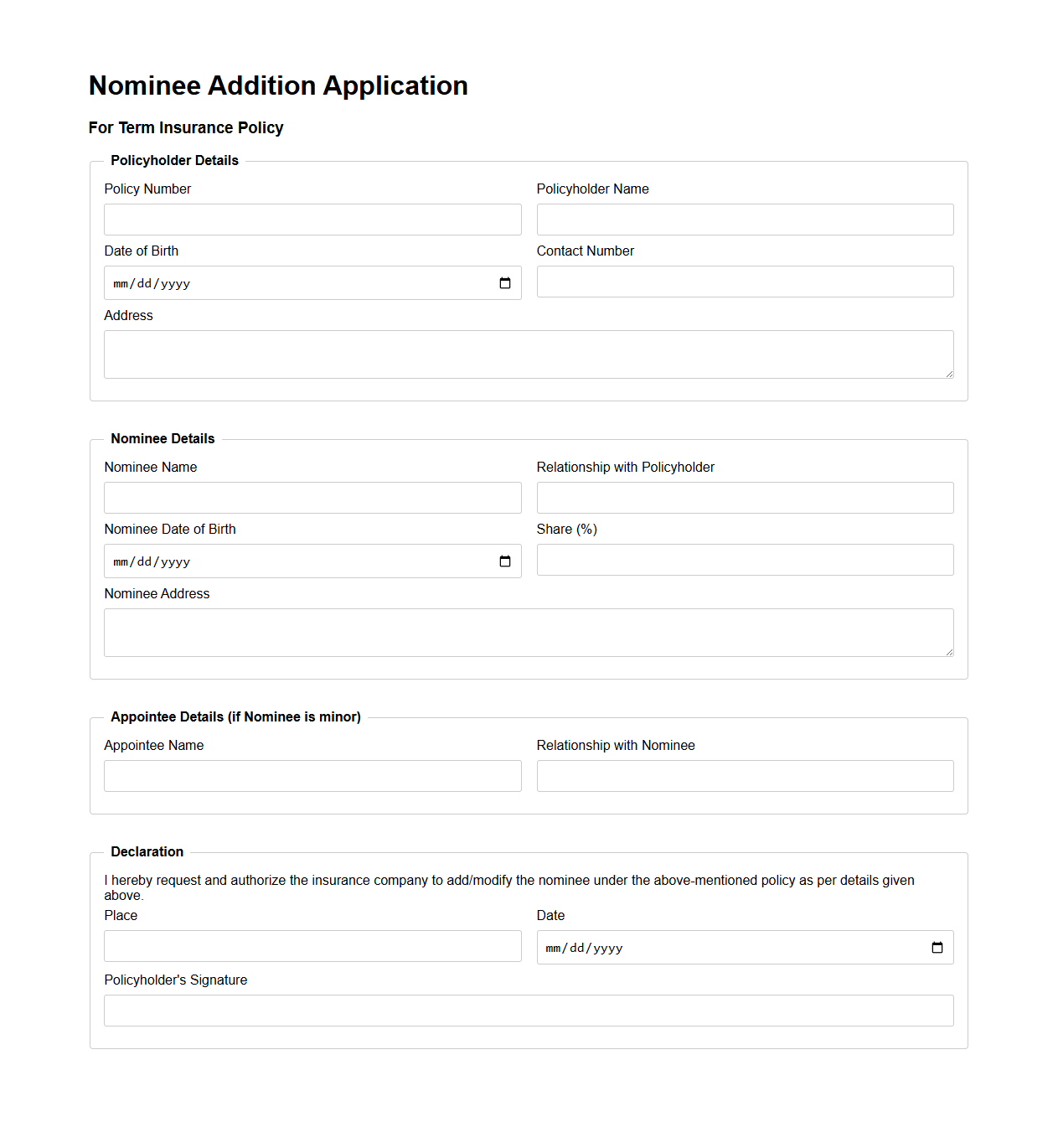

Nominee Addition Application for Term Insurance Policy

A

Nominee Addition Application for a Term Insurance Policy is a formal request submitted by the policyholder to designate or add one or more nominees to their existing term insurance policy. This document ensures that in the event of the policyholder's demise, the specified nominees receive the death benefit as per the policy terms. Proper submission of the nominee addition application helps in smooth and timely claim settlement without legal complications.

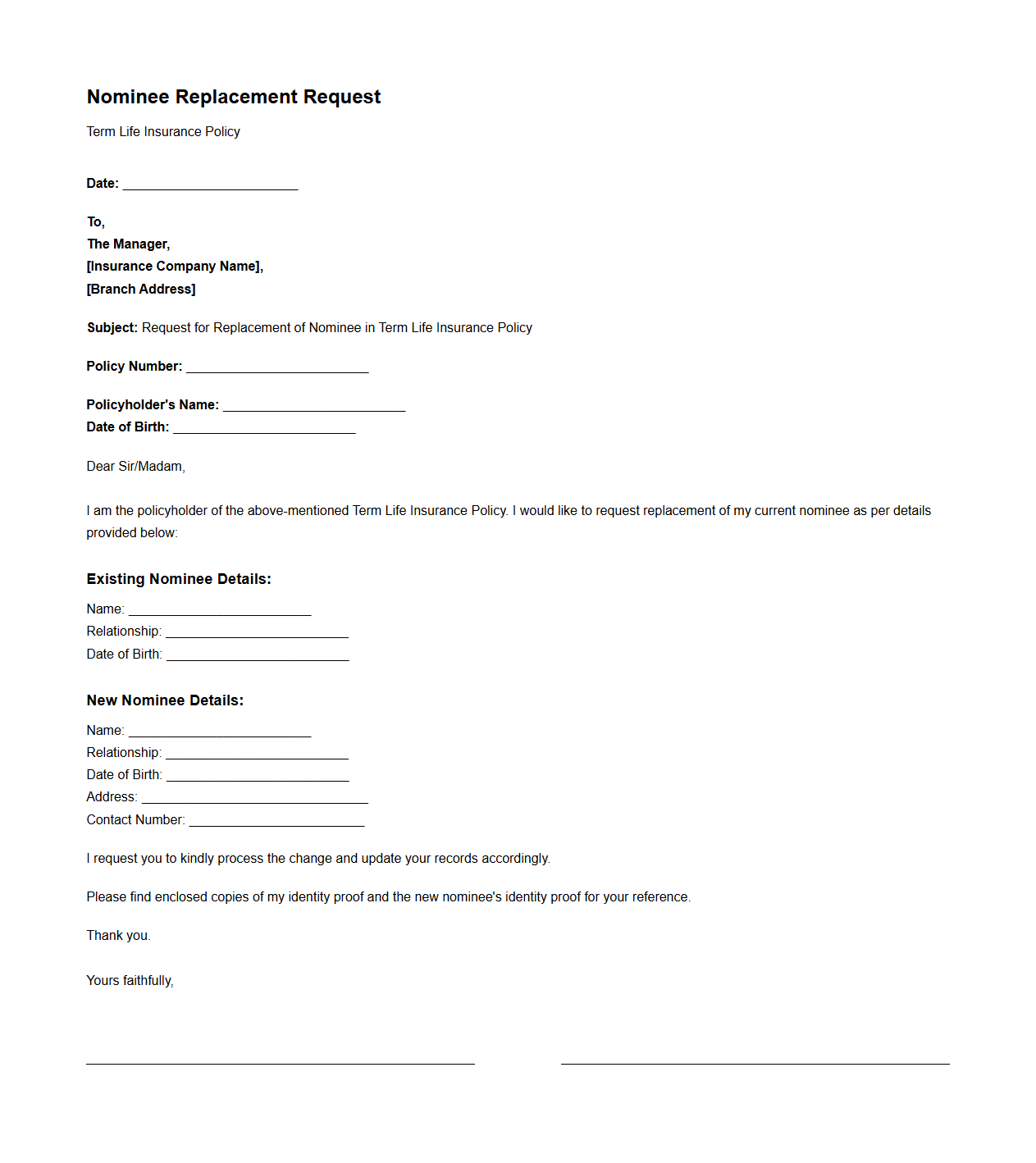

Sample Nominee Replacement Request for Term Life Insurance

A

Sample Nominee Replacement Request for Term Life Insurance document is used to formally update or change the beneficiary designated to receive the policy benefits in case of the insured's death. This document ensures that the insurance company has accurate and current information regarding the nominee, which is critical for seamless claim processing. It typically includes details such as the policy number, current nominee information, new nominee details, and the insured's signature for authorization.

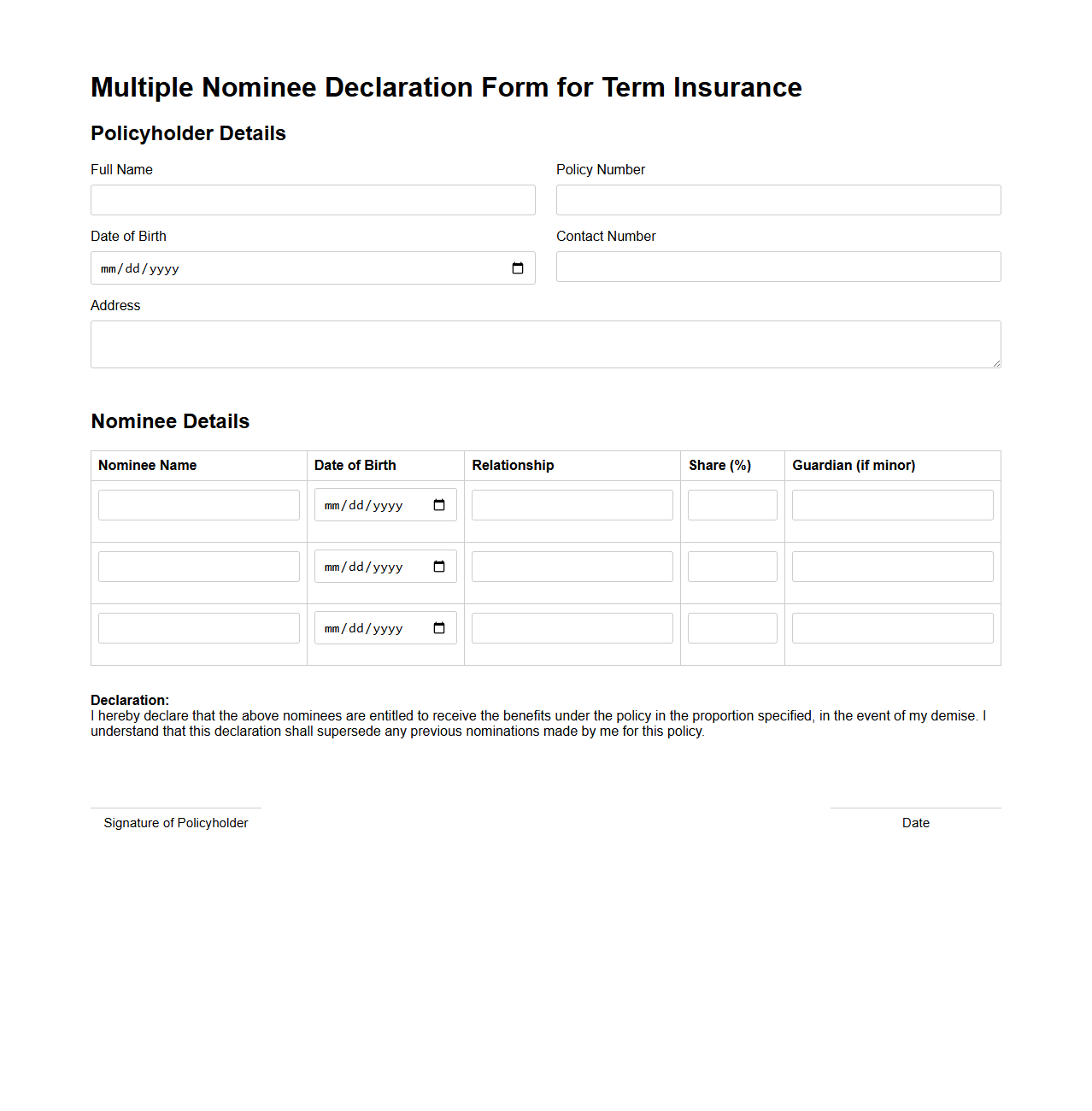

Multiple Nominee Declaration Form for Term Insurance

The

Multiple Nominee Declaration Form for a Term Insurance document is used to designate more than one beneficiary for the insurance policy proceeds. This form specifies the percentage share or amount each nominee will receive in the event of the policyholder's death, ensuring clear distribution of benefits. It helps avoid disputes among nominees and facilitates smooth claim settlement with the insurance company.

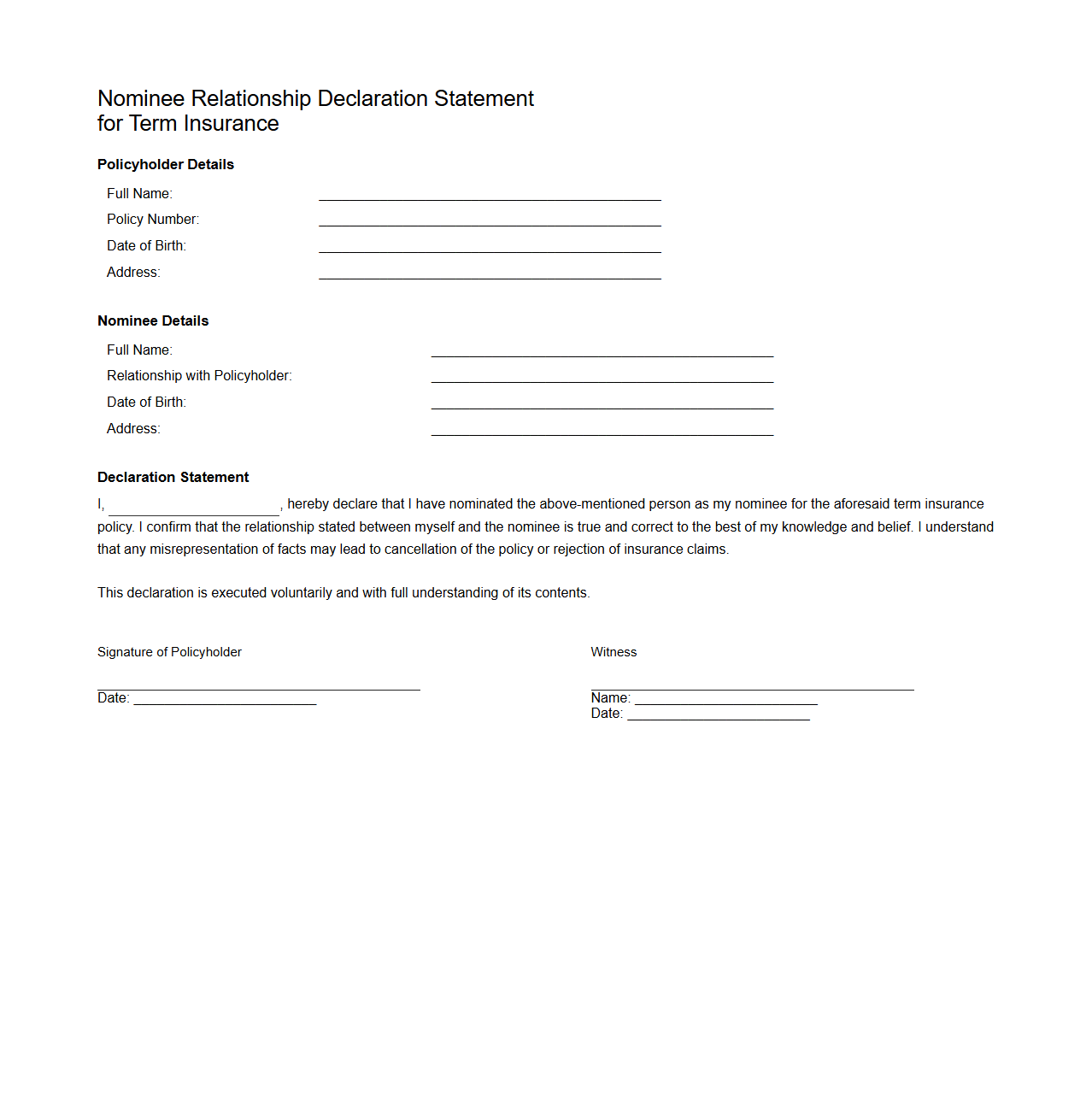

Nominee Relationship Declaration Statement for Term Insurance

A

Nominee Relationship Declaration Statement for a Term Insurance document specifies the exact relationship between the policyholder and the nominee, ensuring clarity in the beneficiary designation. This declaration helps insurance companies process claims efficiently by eliminating ambiguity regarding entitlement. It serves as a vital legal record to protect the nominee's rights in the event of the policyholder's death.

What is the primary purpose of a Nomination Document in term insurance?

The primary purpose of a Nomination Document in term insurance is to clearly identify the person who will receive the insurance proceeds upon the policyholder's death. This document ensures that the claim amount is paid to the rightful beneficiary without any legal complications or delays. It acts as a crucial legal tool to streamline the claim settlement process.

Who can be nominated as a beneficiary in a term insurance policy?

Generally, any individual can be nominated as a beneficiary in a term insurance policy, including family members, dependents, or even friends. Typically, policyholders nominate their spouse, children, or parents to secure their financial future. The nominee should be a person who can legally receive the insurance payout according to the insurer's terms.

When does the nomination in a term insurance policy become effective?

The nomination in a term insurance policy becomes effective as soon as the nomination document is duly signed and registered with the insurance company. This means that from that point forward, the nominee is legally recognized to claim the insurance benefits. It is important for the policyholder to ensure the nomination details are correctly recorded to avoid disputes.

How can a nominee's details be changed or updated in the document?

A policyholder can change or update the nominee's details by submitting a formal request to the insurer along with the required documentation. This process involves filling out a nomination amendment form provided by the insurance company and may require the policyholder's signature. Regularly updating the nominee information helps keep the policy relevant and valid.

What are the legal implications if no nominee is mentioned in the Nomination Document?

If no nominee is mentioned in the Nomination Document, the insurance proceeds may be paid to the legal heirs as per the succession laws of the policyholder's jurisdiction. This can lead to delays in claim settlement due to legal scrutiny and potential disputes among heirs. It is highly recommended to always specify a nominee to ensure smooth and timely disbursement of benefits.