A Endorsement Document Sample for Property Insurance illustrates specific modifications or additions to the original insurance policy, clarifying coverage details or terms. This sample helps policyholders and insurers understand how endorsements affect protection against property damages or losses. It serves as a crucial reference for customizing insurance policies to fit individual property needs.

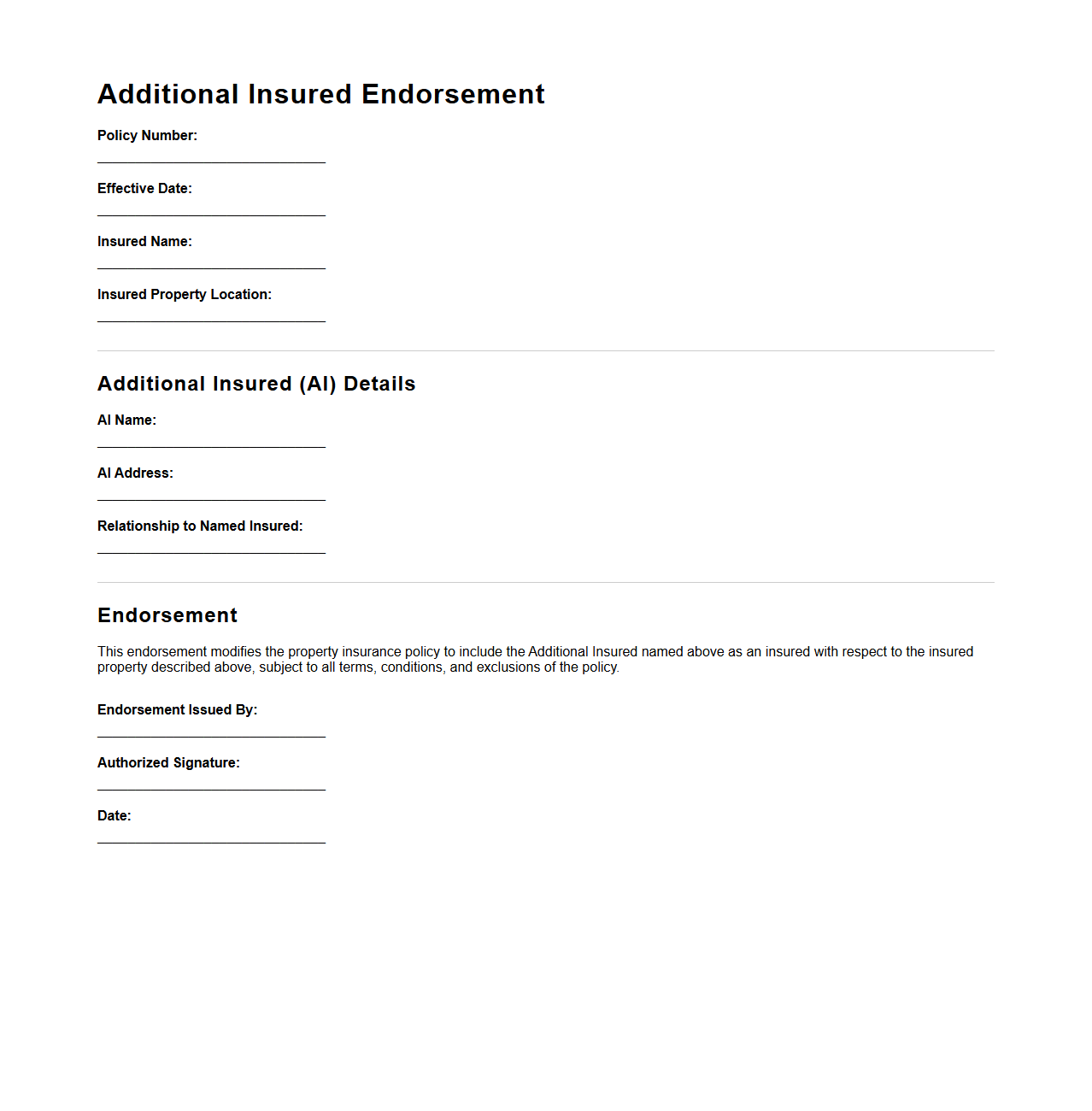

Additional Insured Endorsement for Property Insurance

An

Additional Insured Endorsement in a property insurance document extends coverage to a party other than the primary policyholder, protecting their interests in case of property damage or liability claims. This endorsement is crucial for landlords, contractors, or business partners who require assurance against potential losses linked to the insured property. It modifies the original policy to include the additional insured, ensuring they receive defense and indemnity benefits under the same terms.

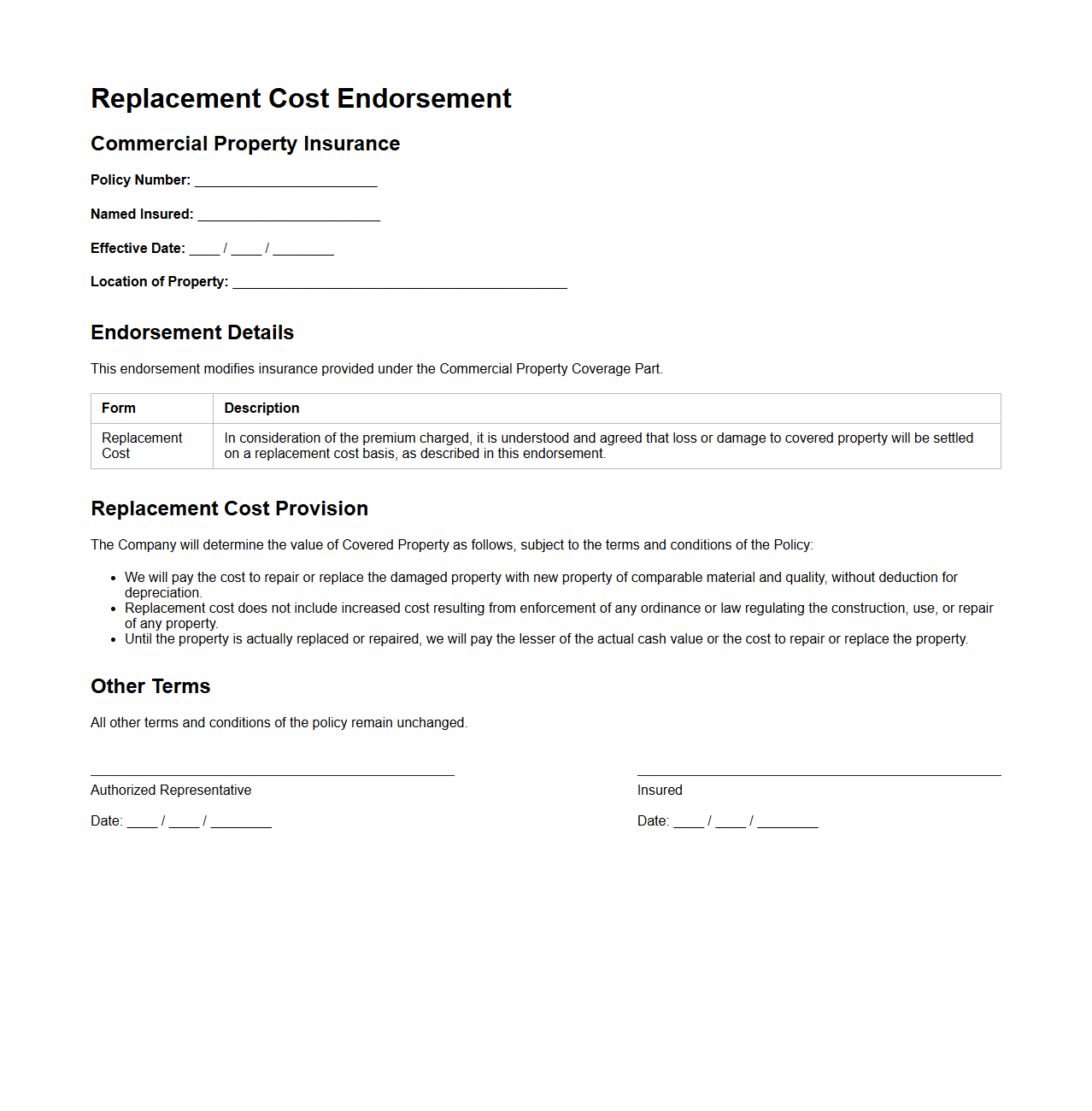

Replacement Cost Endorsement for Commercial Property

Replacement Cost Endorsement for Commercial Property is a crucial insurance provision that ensures coverage for repairing or rebuilding a business property at current market prices without depreciation deductions. This endorsement guarantees that the insured receives sufficient funds to restore the property to its original condition using materials of similar kind and quality.

Replacement cost coverage protects businesses from unexpected financial burdens due to inflation or increased construction costs following a loss.

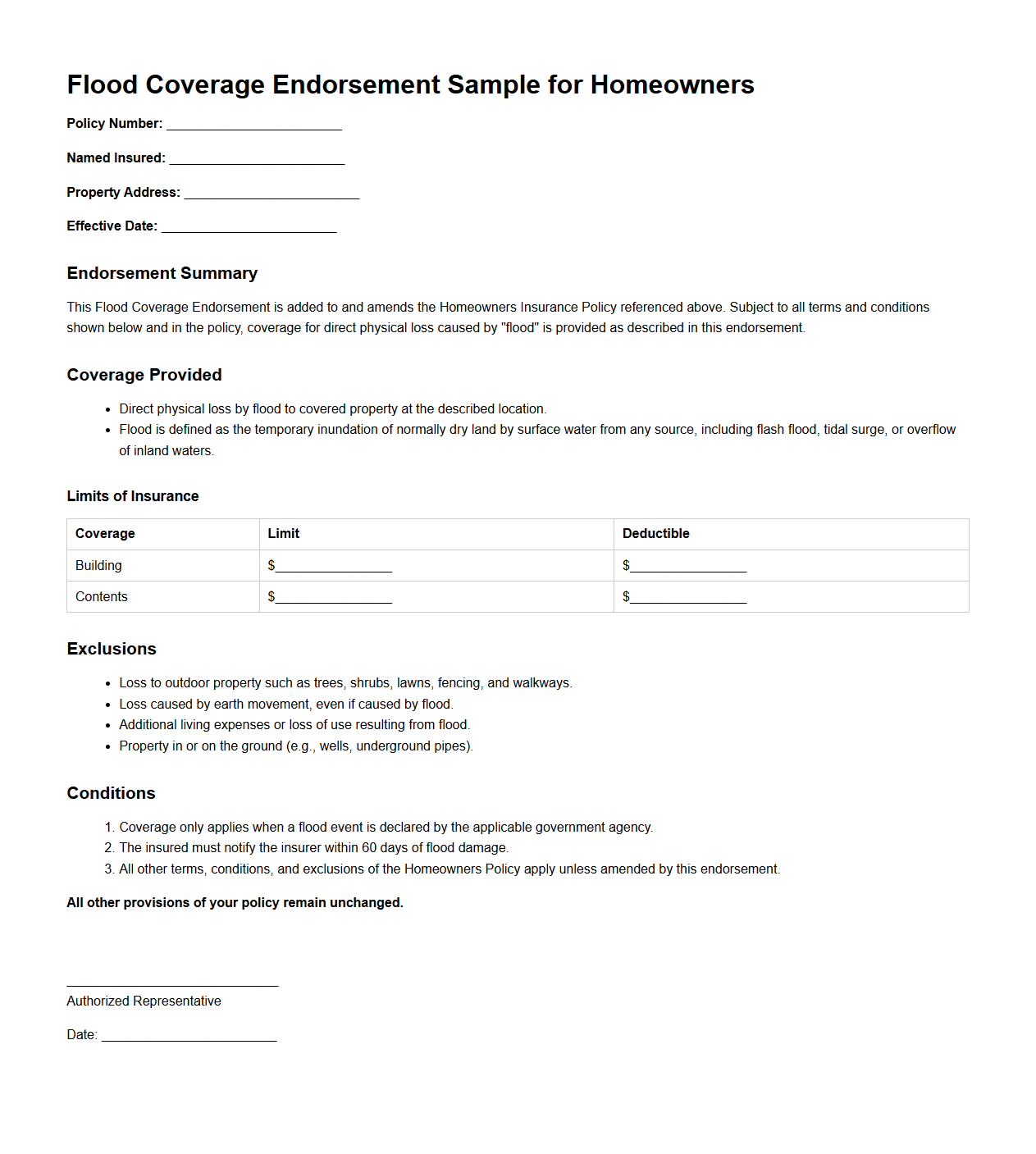

Flood Coverage Endorsement Sample for Homeowners

Flood Coverage Endorsement Sample for Homeowners is a crucial document that outlines the specific terms and conditions under which flood damage is covered in a homeowner's insurance policy. This endorsement provides detailed information on coverage limits, exclusions, and claim procedures related to flood events, ensuring homeowners understand their financial protection against flood risks. Understanding the

Flood Coverage Endorsement helps homeowners make informed decisions about their insurance needs and potential flood-related losses.

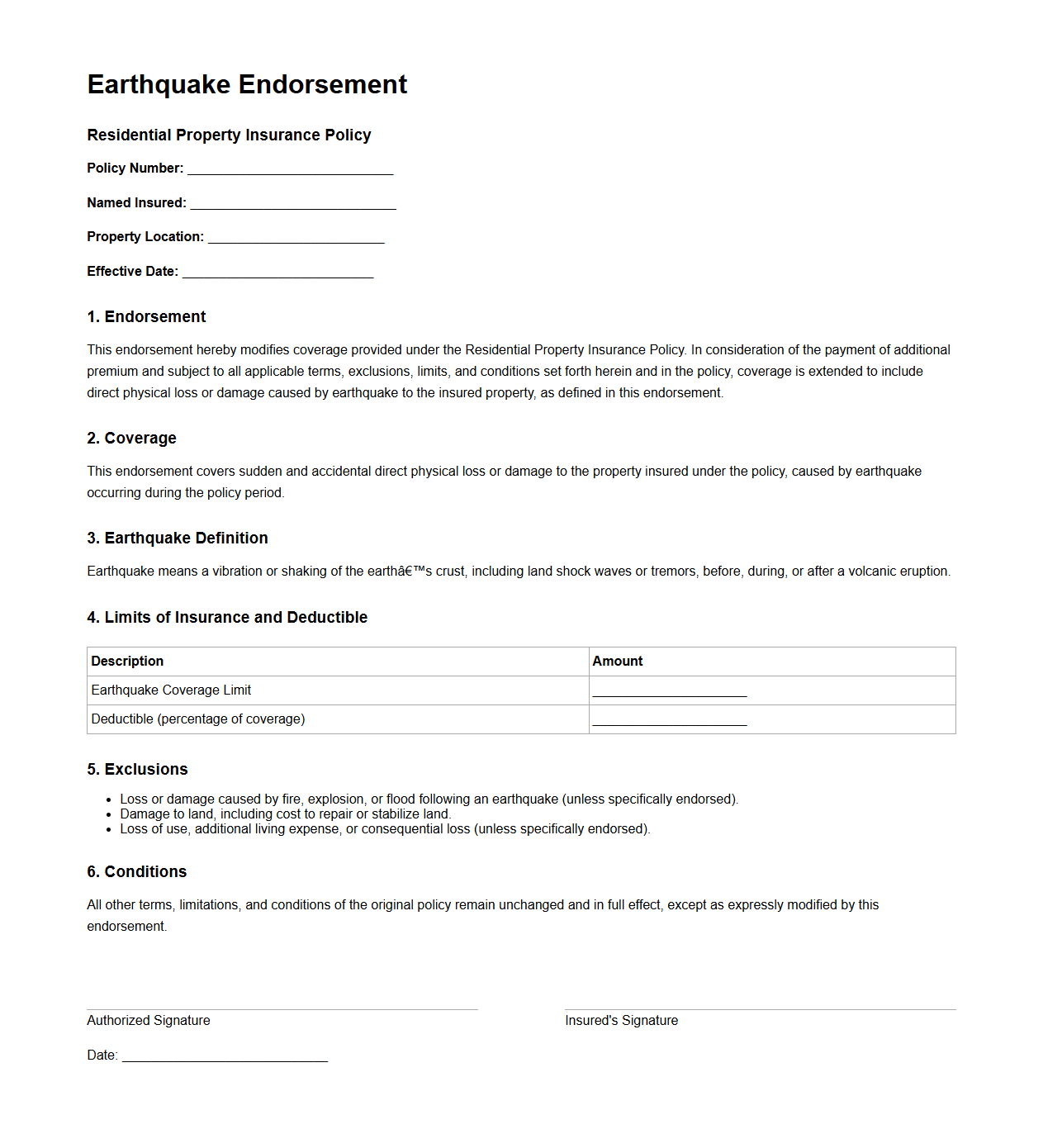

Earthquake Endorsement for Residential Property Insurance

An

Earthquake Endorsement for Residential Property Insurance is a policy add-on that provides coverage for damages caused specifically by earthquakes, which are typically excluded from standard homeowner's insurance. This endorsement helps protect homeowners from costly repairs or replacements resulting from seismic events, including structural damage, foundation cracks, and personal property loss. It is essential for properties located in earthquake-prone areas to ensure comprehensive financial protection against natural disaster risks.

Building Ordinance or Law Endorsement Template

A Building Ordinance or Law Endorsement Template document serves as an official certification verifying that a construction project complies with local building codes, zoning regulations, and safety standards. It is often required by government agencies or financial institutions before issuing permits, loans, or occupancy approvals. This document ensures legal adherence and helps prevent potential disputes related to

building code compliance.

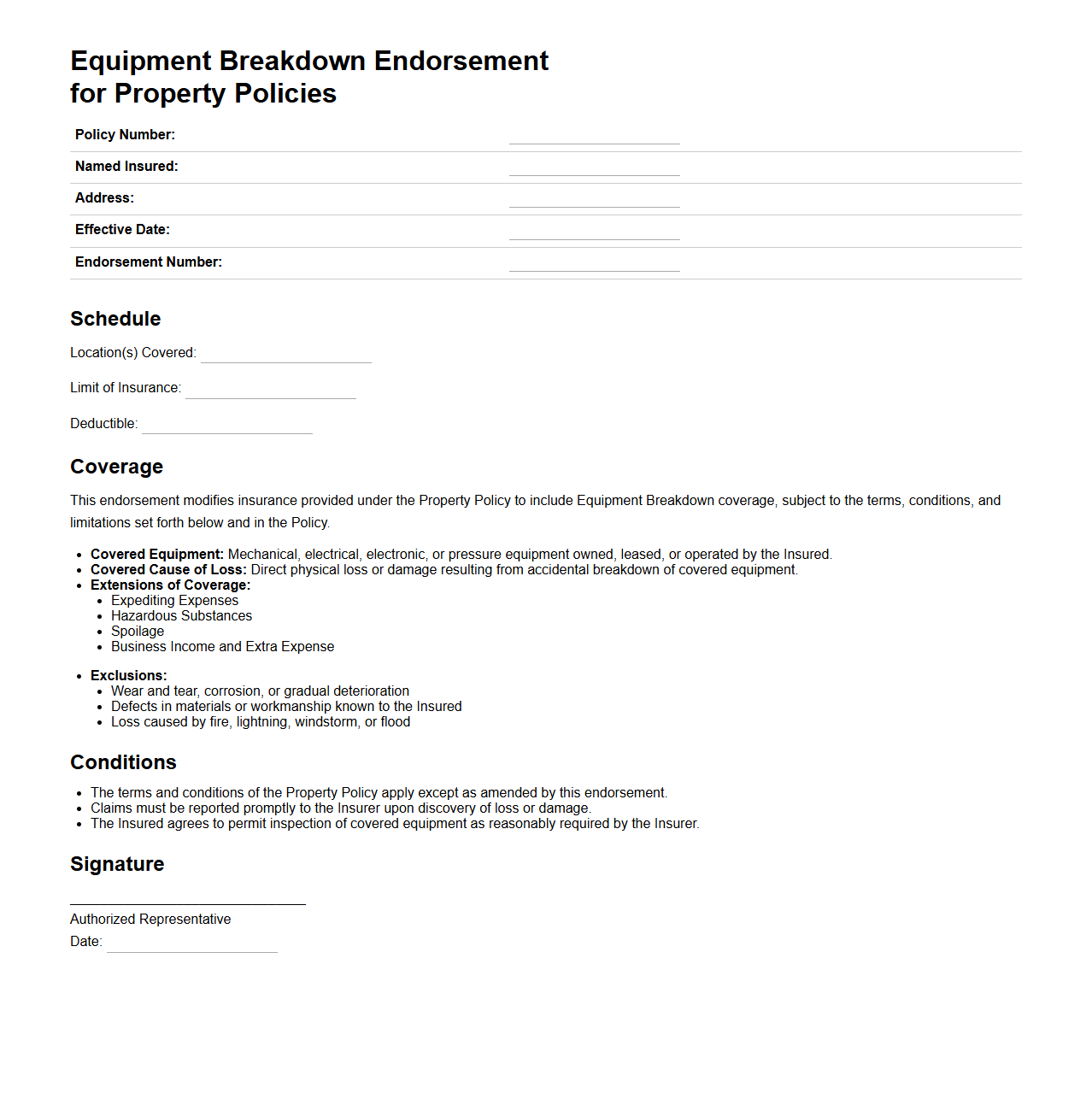

Equipment Breakdown Endorsement for Property Policies

The

Equipment Breakdown Endorsement for Property Policies document provides coverage for physical damage and financial loss resulting from the sudden and accidental breakdown of covered equipment, including boilers, machinery, and electrical systems. This endorsement helps businesses recover repair or replacement costs and mitigates business interruption losses related to equipment failures. It extends protection beyond standard property insurance by addressing mechanical and electrical breakdown risks often excluded in basic policies.

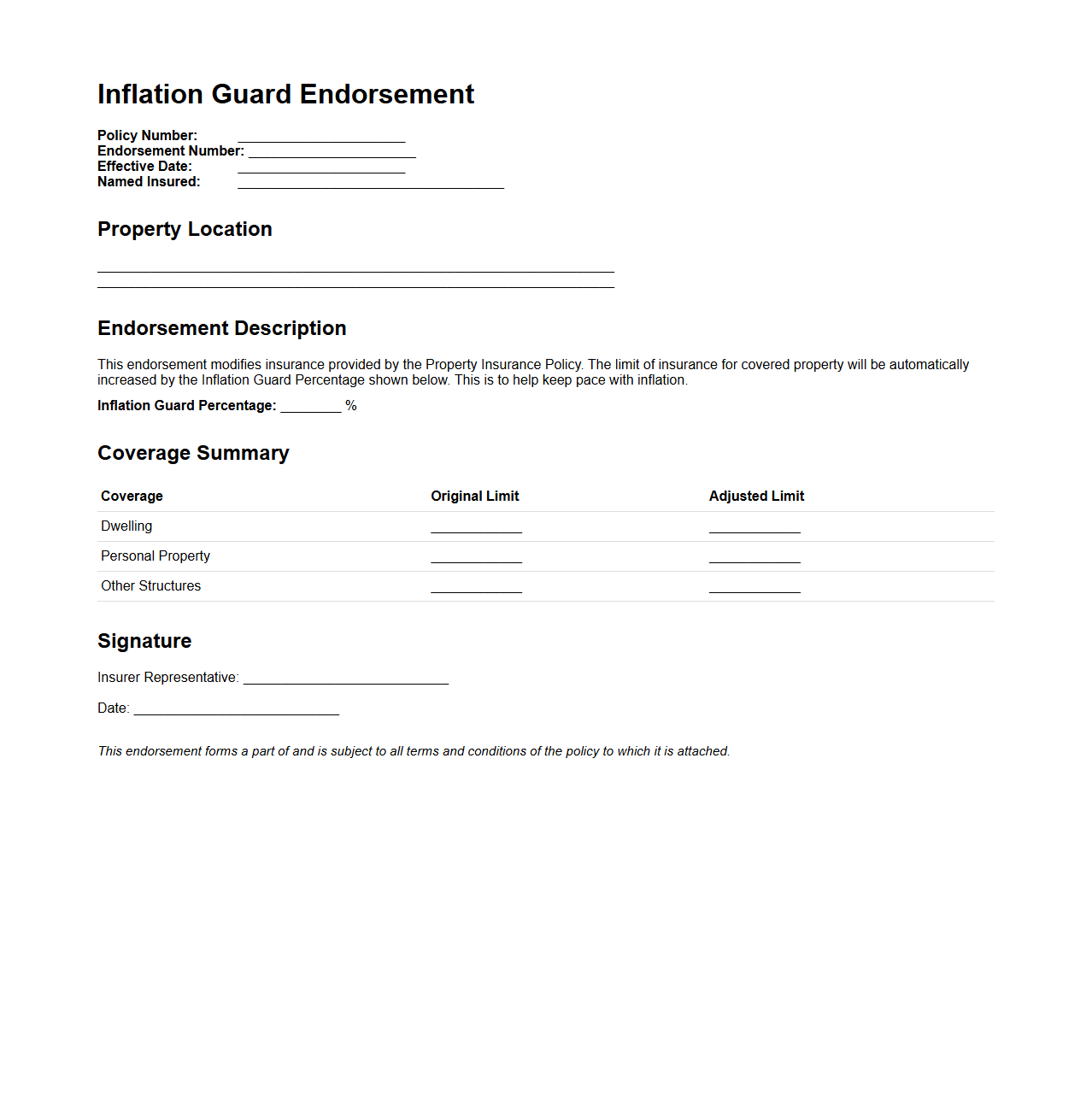

Inflation Guard Endorsement for Property Insurance

The

Inflation Guard Endorsement for property insurance is a policy feature that automatically adjusts the coverage limits to keep pace with inflation and rising construction costs. This endorsement helps ensure that the insured property remains adequately protected by increasing the dwelling coverage amount periodically without requiring manual updates. It prevents underinsurance by aligning the policy value with current market conditions, reducing the risk of coverage gaps during claims.

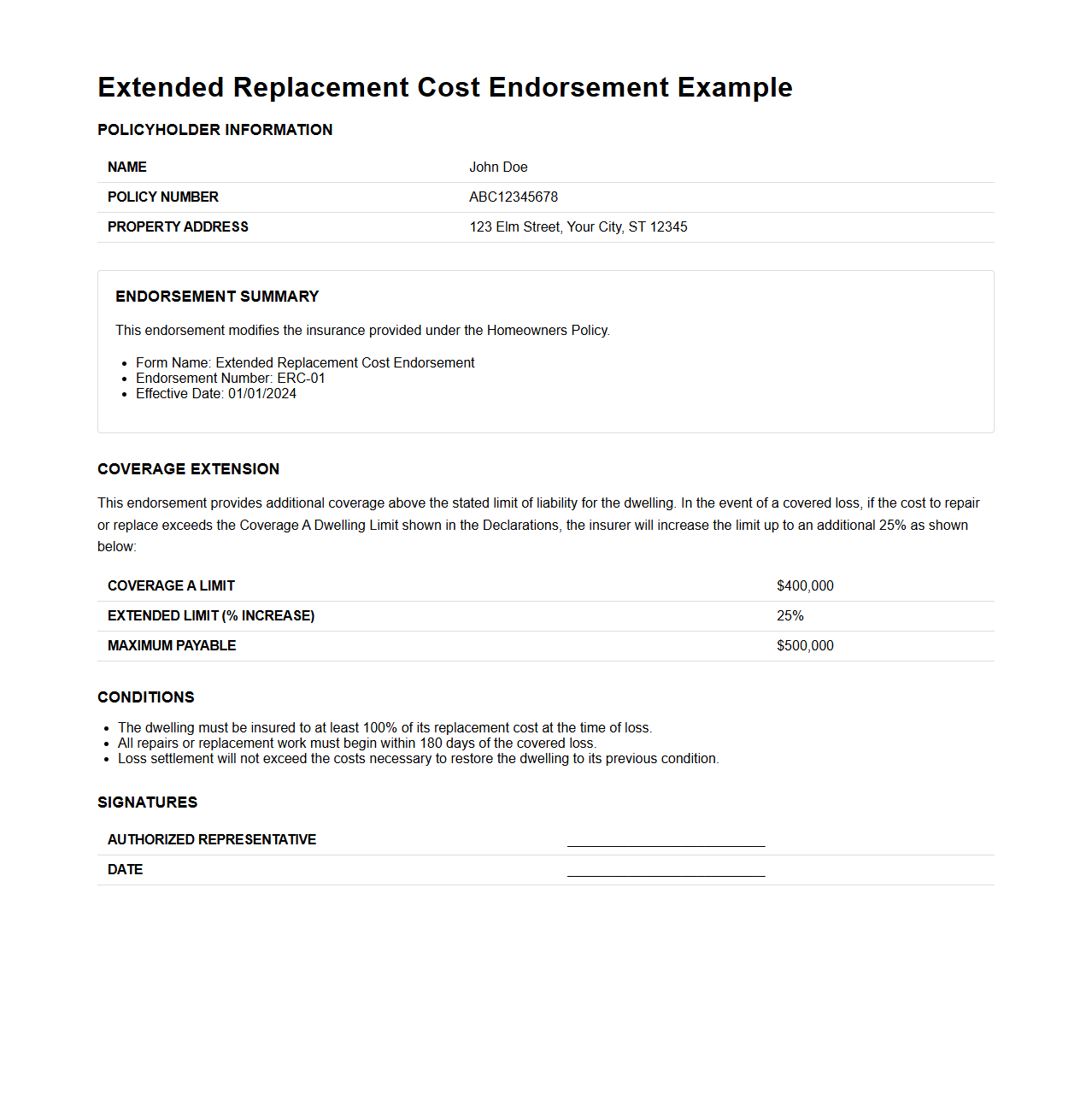

Extended Replacement Cost Endorsement Example

The

Extended Replacement Cost Endorsement document outlines the terms under which an insurance policy provides coverage that exceeds the standard replacement cost limit, offering additional financial protection for rebuilding or repairing property after a loss. This endorsement ensures policyholders are compensated beyond the insured amount up to a specified percentage, addressing cost overruns caused by inflation or unforeseen expenses. It is a crucial addendum for property insurance policies, especially in areas prone to rapid cost increases or extensive damage.

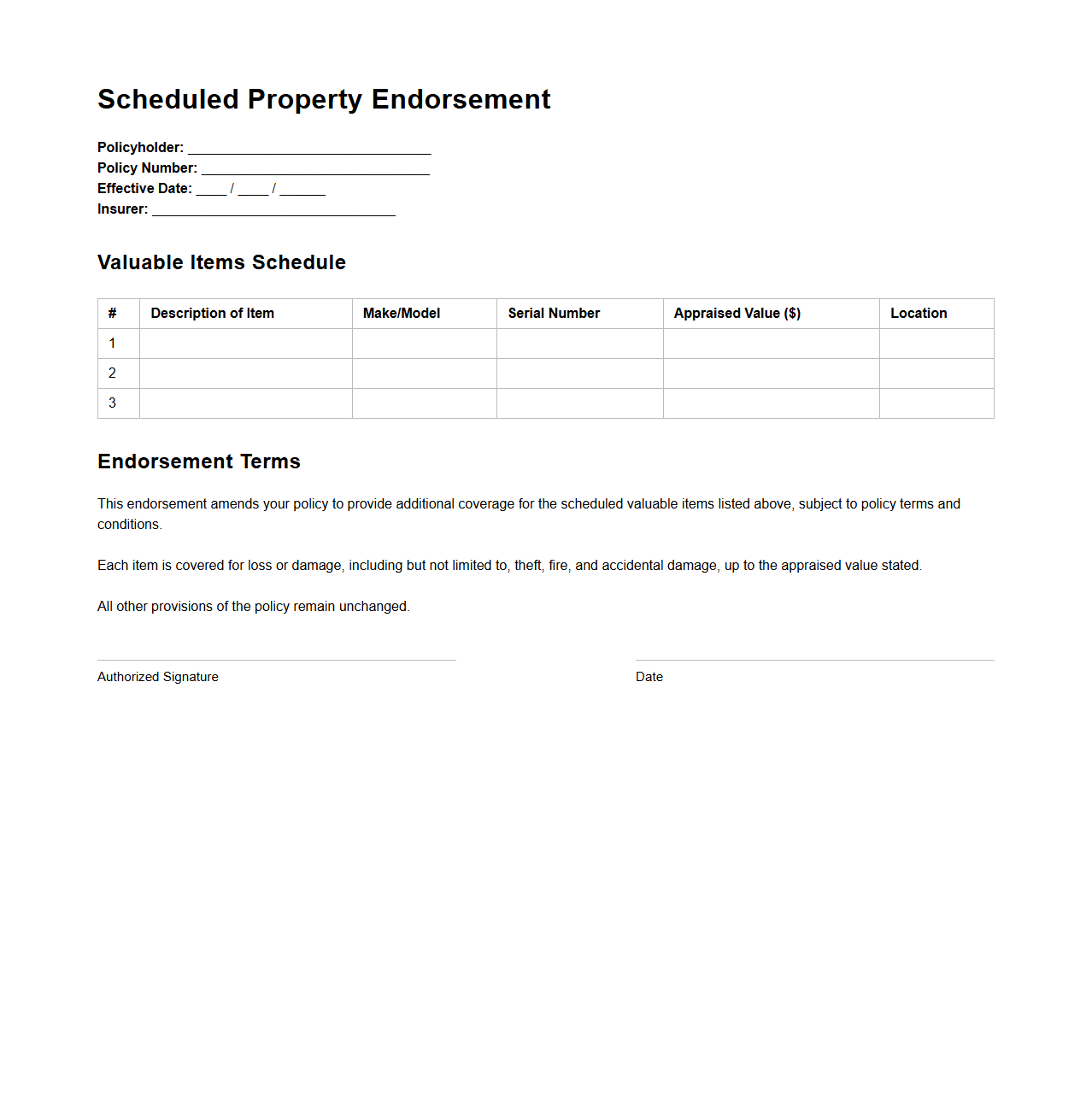

Scheduled Property Endorsement for Valuable Items

A

Scheduled Property Endorsement for Valuable Items is an insurance document that provides specific coverage for high-value possessions by listing each item individually along with its appraised value. This endorsement ensures that valuable assets such as jewelry, artwork, or collectibles receive tailored protection beyond standard policy limits. It offers enhanced financial security by accurately reflecting the worth of each item, facilitating precise claims processing in case of loss or damage.

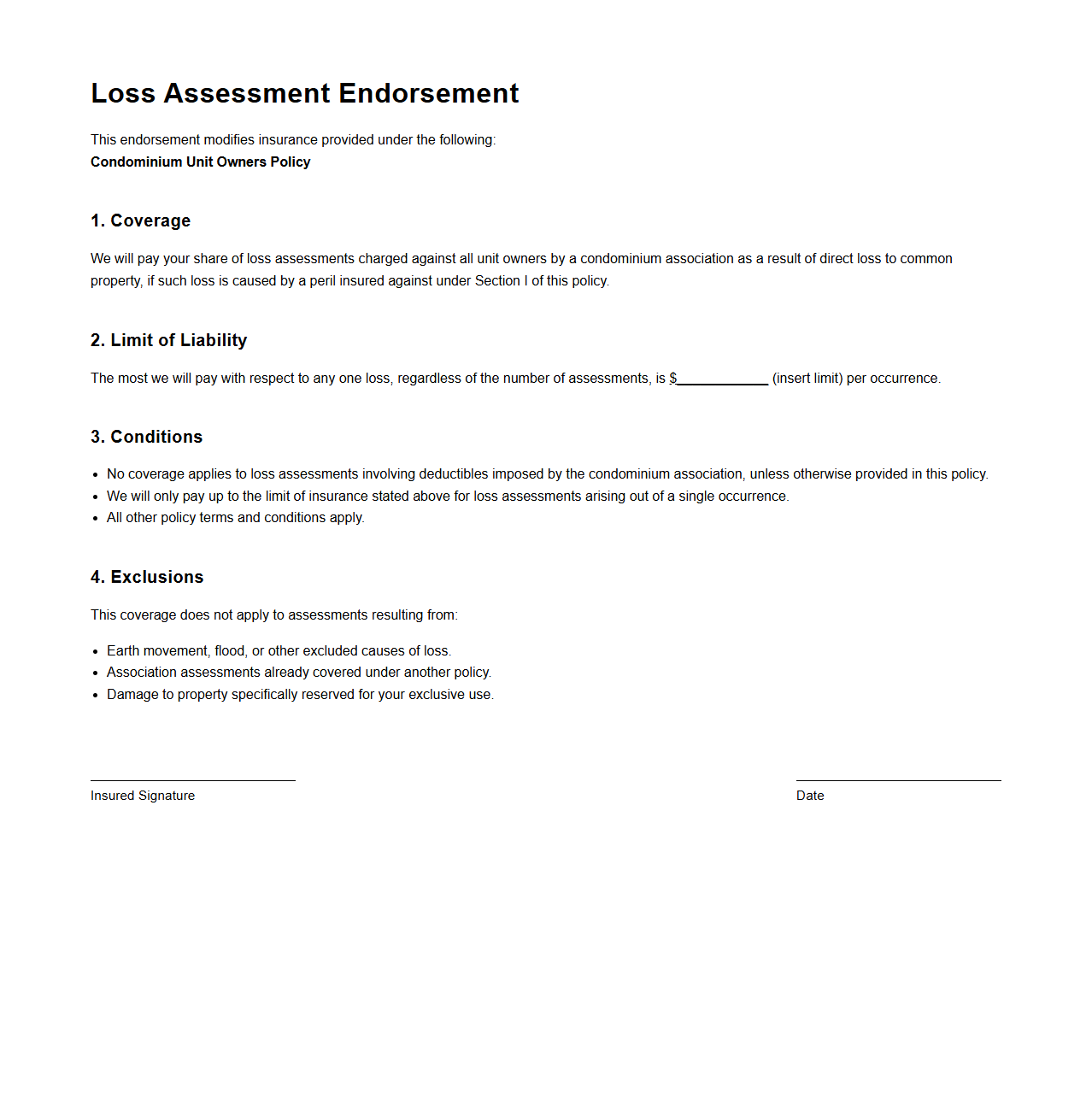

Loss Assessment Endorsement for Condominium Owners

A

Loss Assessment Endorsement is an insurance policy add-on that provides coverage for condominium owners when the condominium association levies a special assessment to cover property damage or liability claims exceeding the association's master policy limits. This endorsement ensures individual unit owners are financially protected against unexpected expenses arising from shared property losses or legal judgments. It is essential for safeguarding personal assets from assessments related to common area repairs, lawsuits, or uninsured losses.

What specific coverage modifications are detailed in this property insurance endorsement document?

The endorsement document specifies modifications related to property damage coverage, adjusting protections against certain perils. It includes additions for new types of risks while excluding others previously covered. This ensures that the policyholder's protection is clearly tailored to specific property insurance needs.

Which policy provisions are amended or added by the attached endorsement?

The attached endorsement amends provisions concerning deductible amounts and introduces new clauses on claim procedures. It also adds supplemental coverages for emerging risks like cyber-related property damage. These changes refine the policy terms to reflect updated risk assessments and coverage applicability.

What effective date is specified for the endorsement's applicability to the insurance policy?

The endorsement document clearly states that the effective date is the date it is issued or a specified future date agreed upon by both parties. This date determines when the modified coverage terms begin to apply. It is critical for ensuring the timely implementation of updated protections under the policy.

How does the endorsement document define the limits and exclusions of coverage?

The document outlines coverage limits by specifying maximum payout amounts for each type of claim. It also includes detailed exclusions that void coverage under defined circumstances. These definitions help avoid ambiguity and provide clarity on the scope of the insured risks.

Who are the parties acknowledged and authorized in the endorsement agreement?

The endorsement agreement names the insured policyholder and the insurance company issuing the modification. It also identifies authorized representatives responsible for approving the endorsement. This ensures all relevant parties are formally recognized and bound by the updated terms.