A Underwriting Questionnaire Document Sample for Property Insurance helps insurers gather essential information about a property to assess risk accurately. The document typically includes questions about the property's location, construction type, security features, and previous claims history. This standardized questionnaire streamlines the underwriting process and supports precise premium determination.

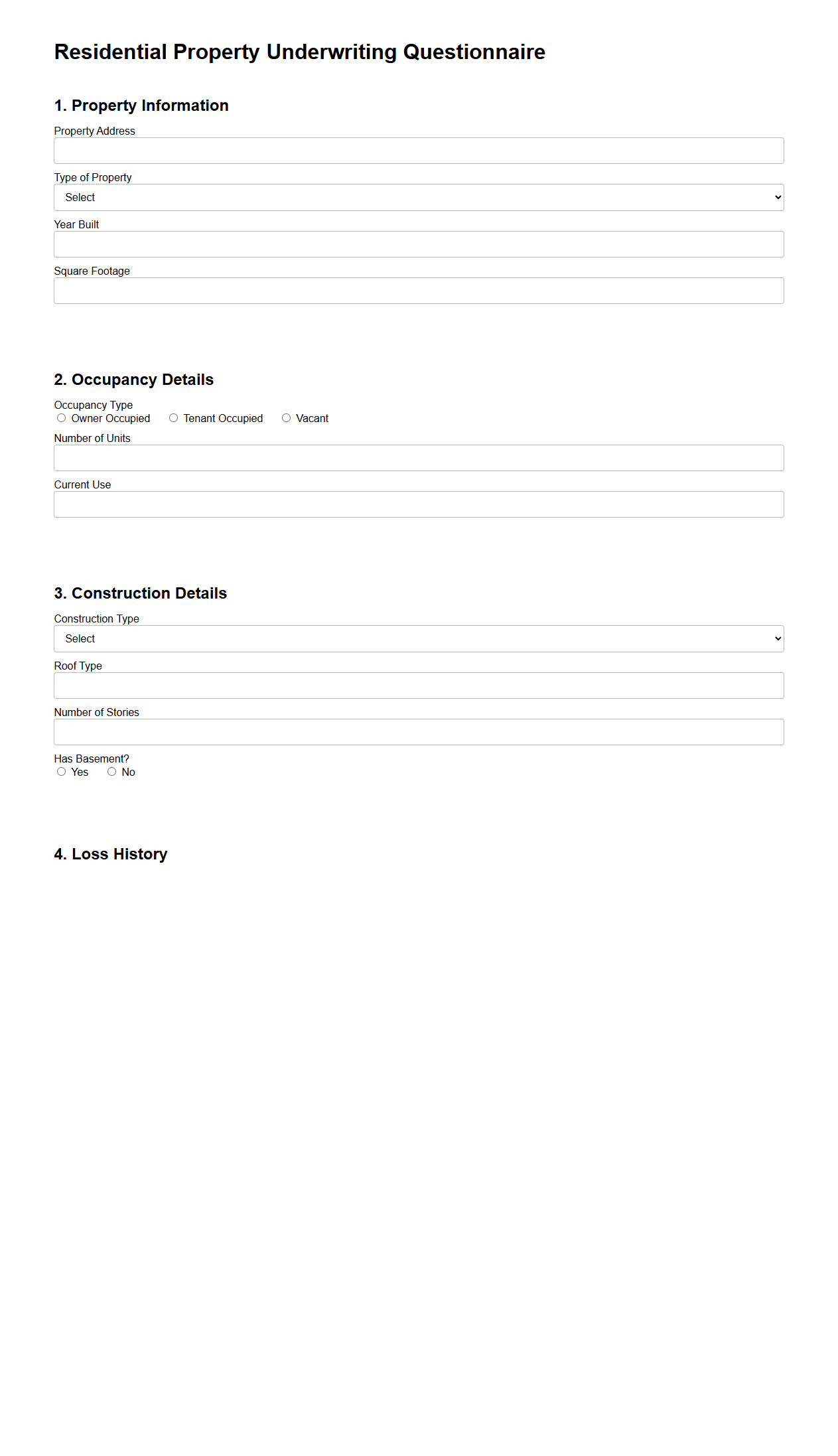

Residential Property Underwriting Questionnaire

The

Residential Property Underwriting Questionnaire is a detailed document used by insurers and underwriters to assess the risks associated with a residential property before issuing a policy. It collects critical information such as property age, construction materials, security features, previous claims history, and occupancy details to evaluate potential hazards and determine appropriate coverage terms. Accurate completion of this questionnaire ensures tailored insurance solutions and helps in minimizing underwriting risks.

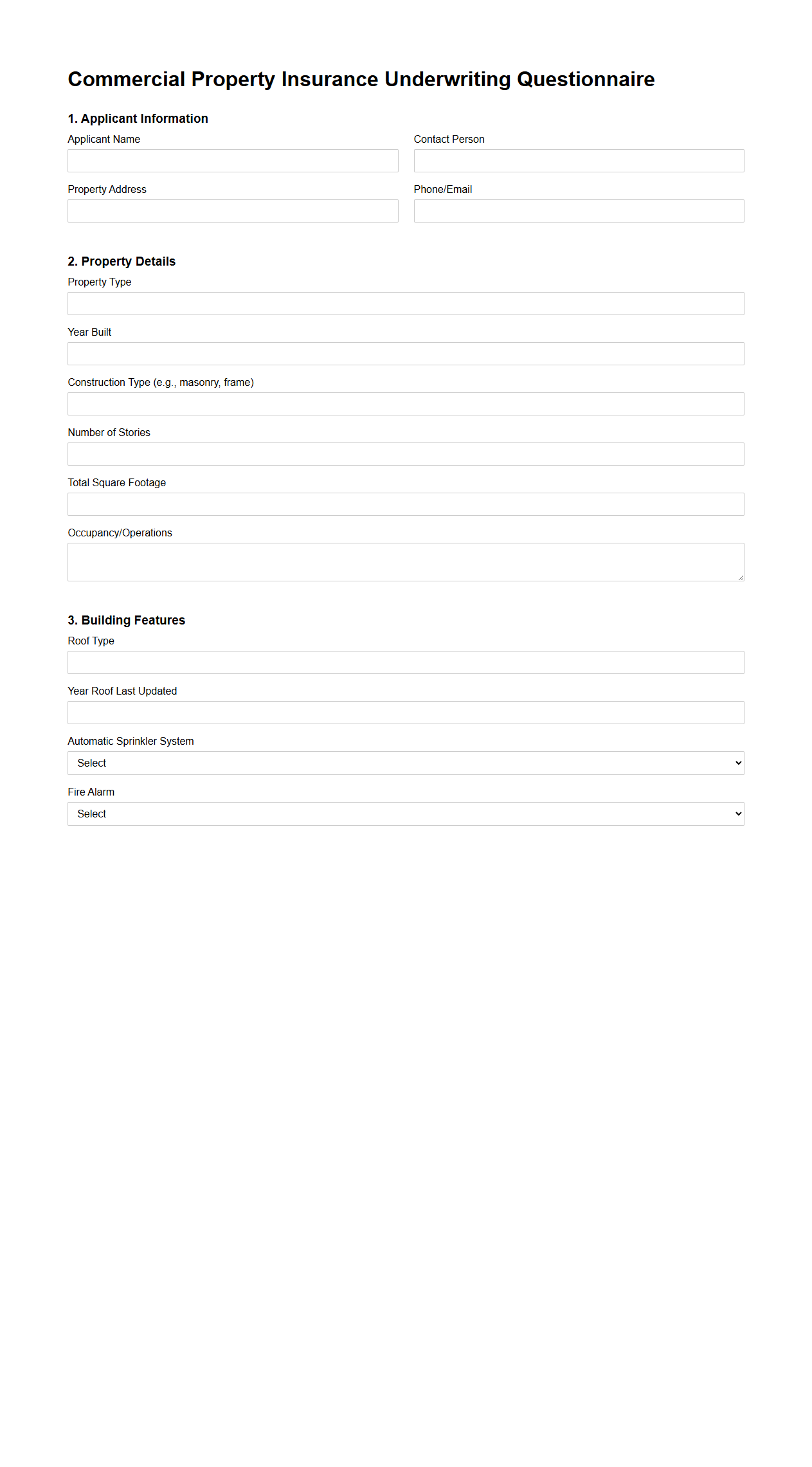

Commercial Property Insurance Underwriting Questionnaire

The

Commercial Property Insurance Underwriting Questionnaire is a detailed document used by insurers to assess risks associated with commercial properties before issuing a policy. It collects critical data about the property's construction, location, safety features, occupancy, and potential hazards to determine appropriate coverage and premiums. Accurate responses ensure proper risk evaluation, helping underwriters offer tailored insurance solutions that protect business assets effectively.

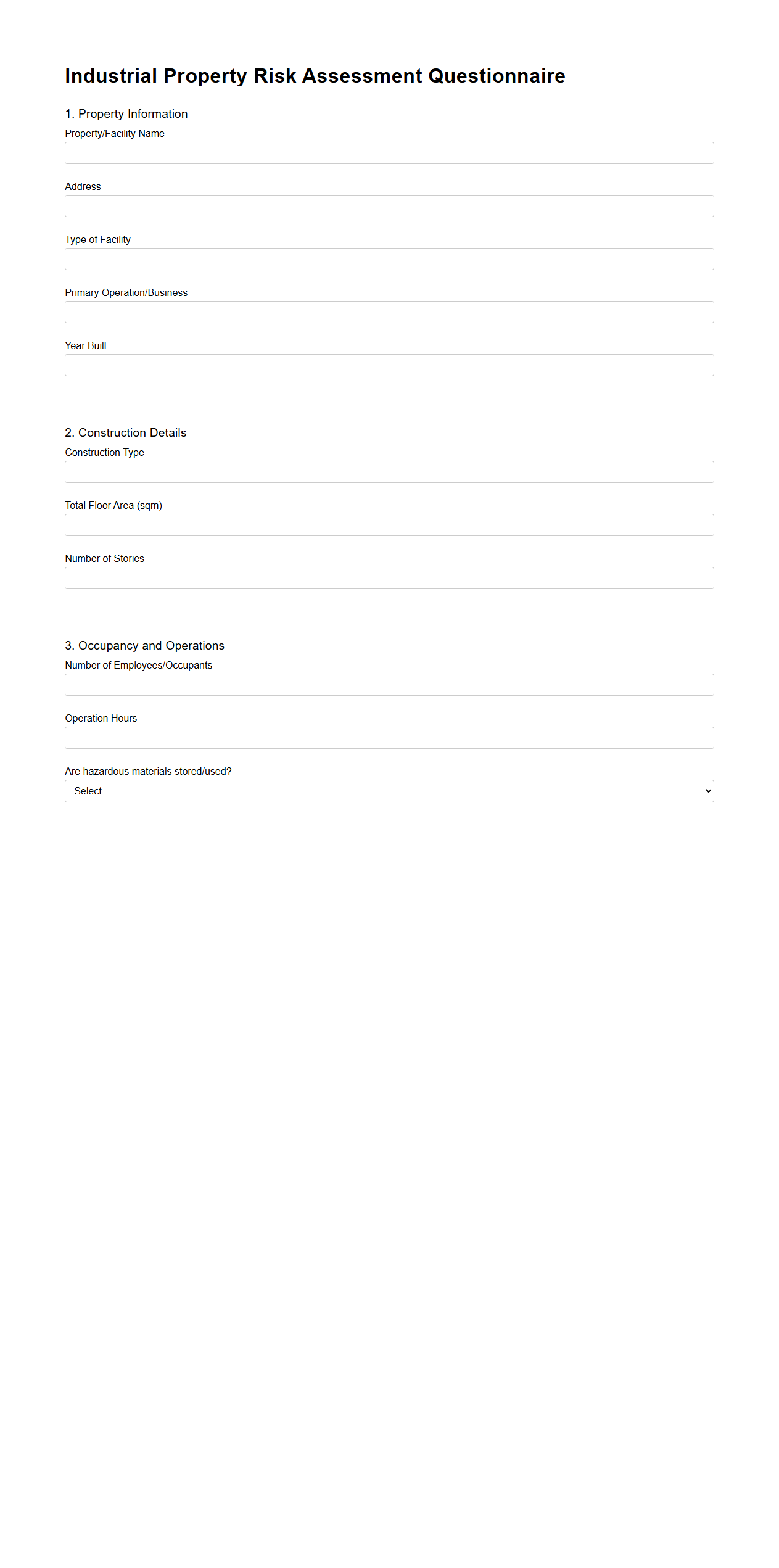

Industrial Property Risk Assessment Questionnaire

The

Industrial Property Risk Assessment Questionnaire document systematically evaluates potential risks associated with industrial property assets, focusing on safety, environmental impact, and compliance with regulations. It collects detailed information about machinery conditions, hazard controls, operational processes, and emergency response plans to identify vulnerabilities. This questionnaire supports risk management by guiding mitigation strategies and ensuring adherence to industrial safety standards.

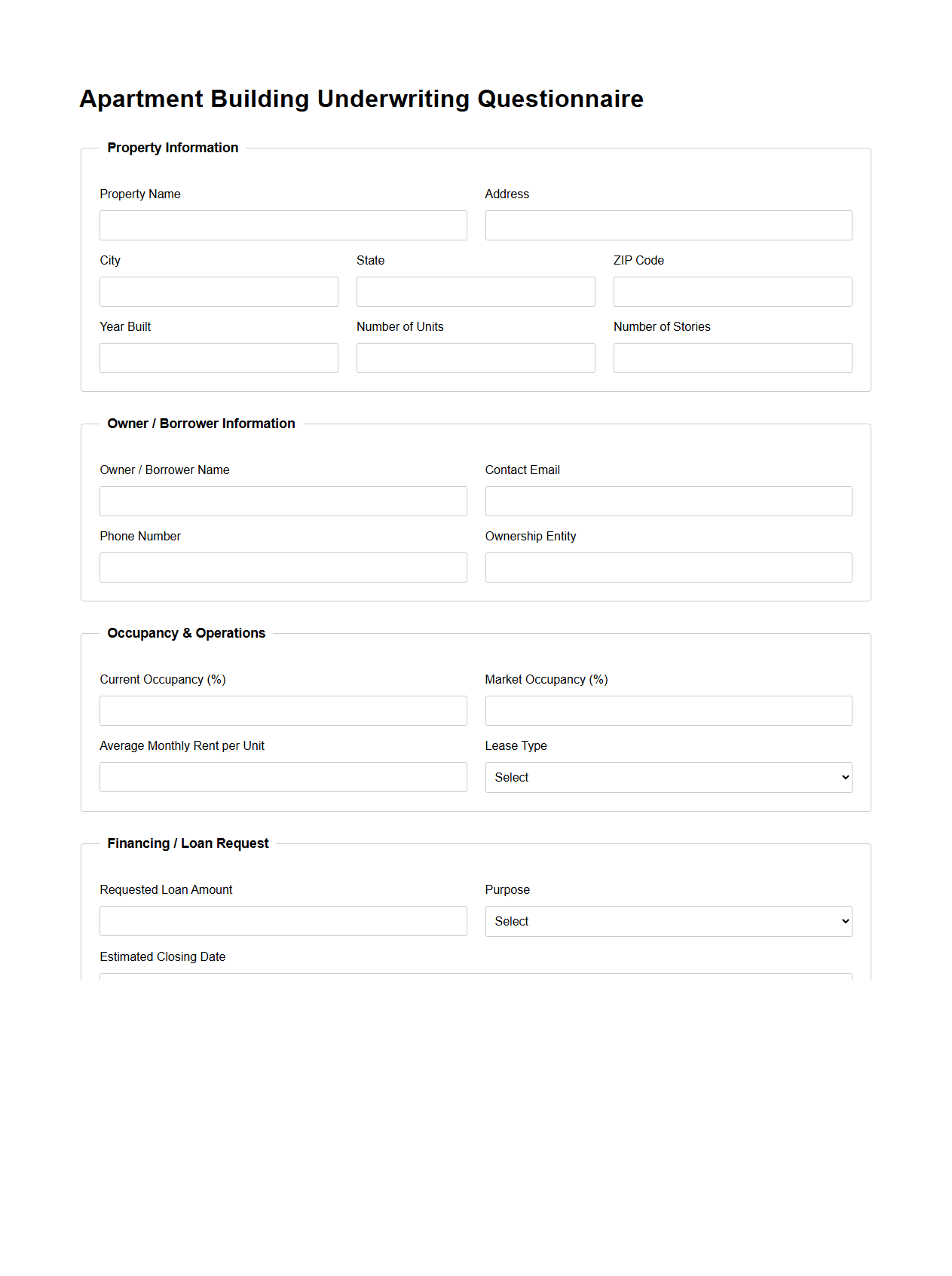

Apartment Building Underwriting Questionnaire

An

Apartment Building Underwriting Questionnaire is a detailed document used by lenders and investors to assess the financial viability and risks associated with a multifamily property. It collects comprehensive data on the building's physical condition, tenant demographics, lease structures, income and expense history, and management practices. This questionnaire plays a crucial role in underwriting by providing essential information that supports accurate property valuation and loan decision-making.

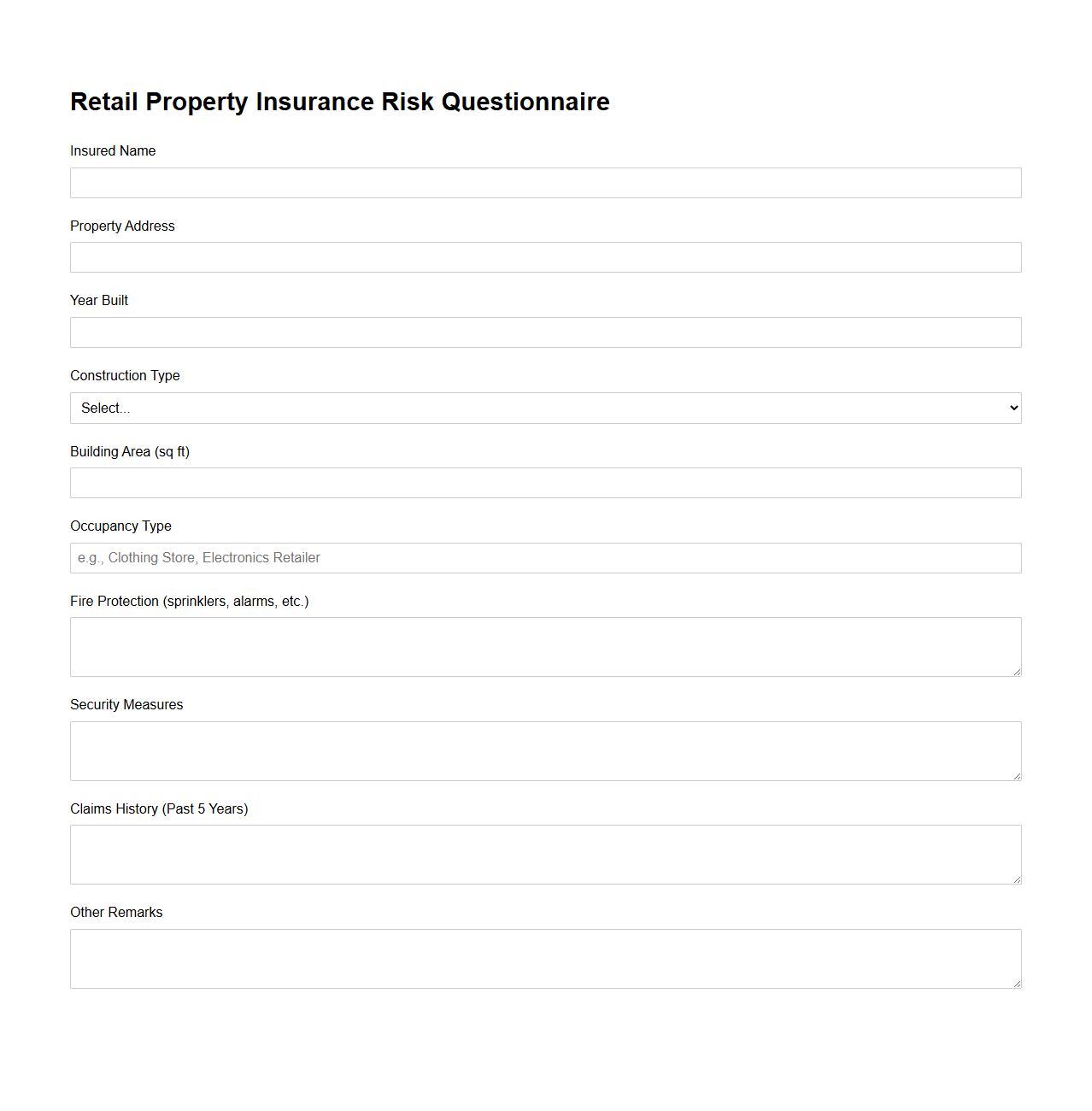

Retail Property Insurance Risk Questionnaire

The

Retail Property Insurance Risk Questionnaire document is designed to systematically assess potential risks associated with retail properties to ensure adequate insurance coverage. It collects detailed information on property characteristics, security measures, fire protection systems, and past claims history, enabling insurers to evaluate risk exposure accurately. This questionnaire helps streamline the underwriting process and tailor insurance policies that protect retail property owners effectively.

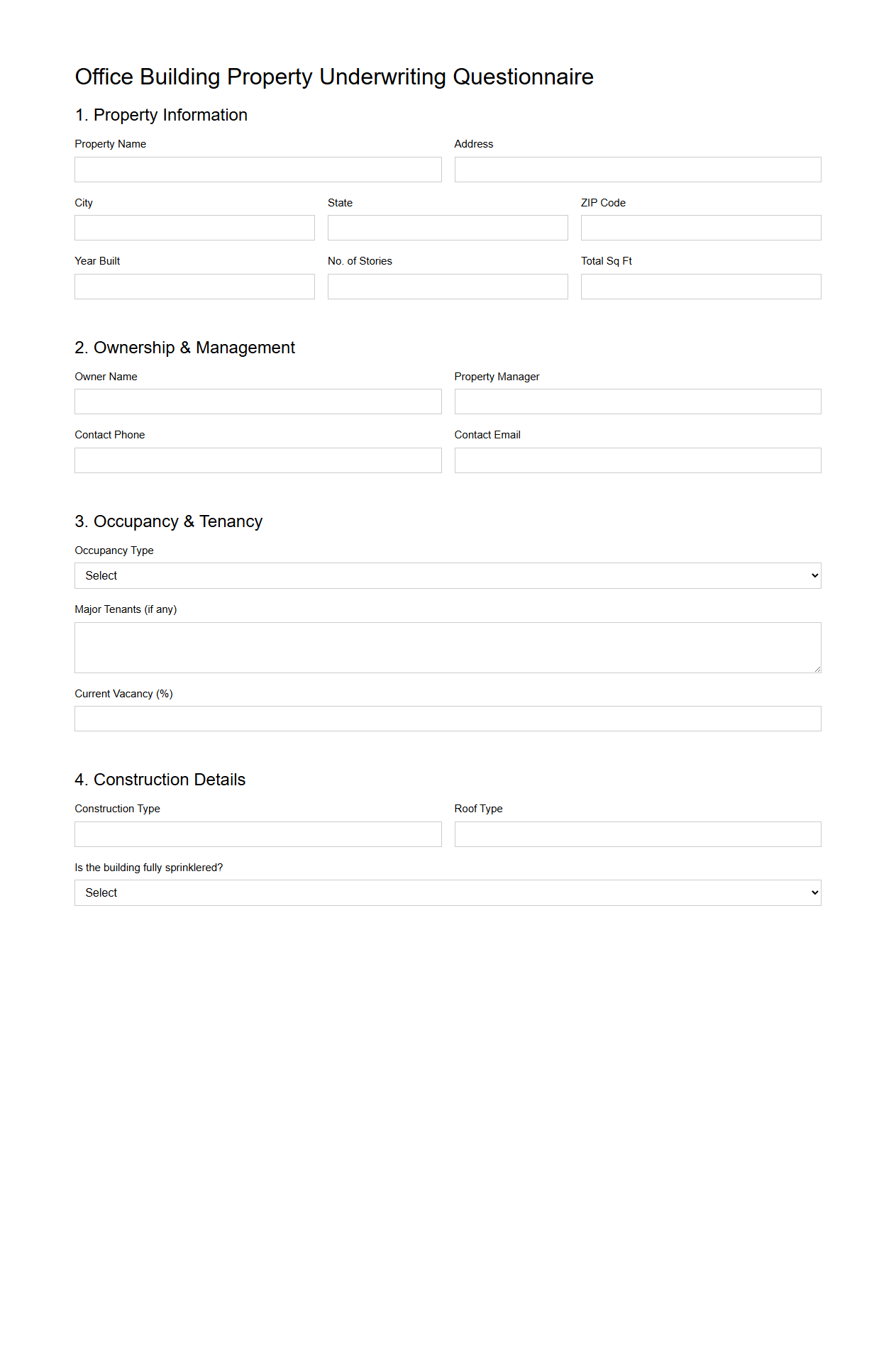

Office Building Property Underwriting Questionnaire

The

Office Building Property Underwriting Questionnaire document is a critical tool used by insurance underwriters to assess the risks associated with insuring office buildings. It collects detailed information about the property's construction, occupancy, safety features, maintenance practices, and previous claims history to determine eligibility and coverage terms. Accurate completion of this questionnaire ensures precise risk evaluation and helps tailor insurance policies to the specific characteristics of office building properties.

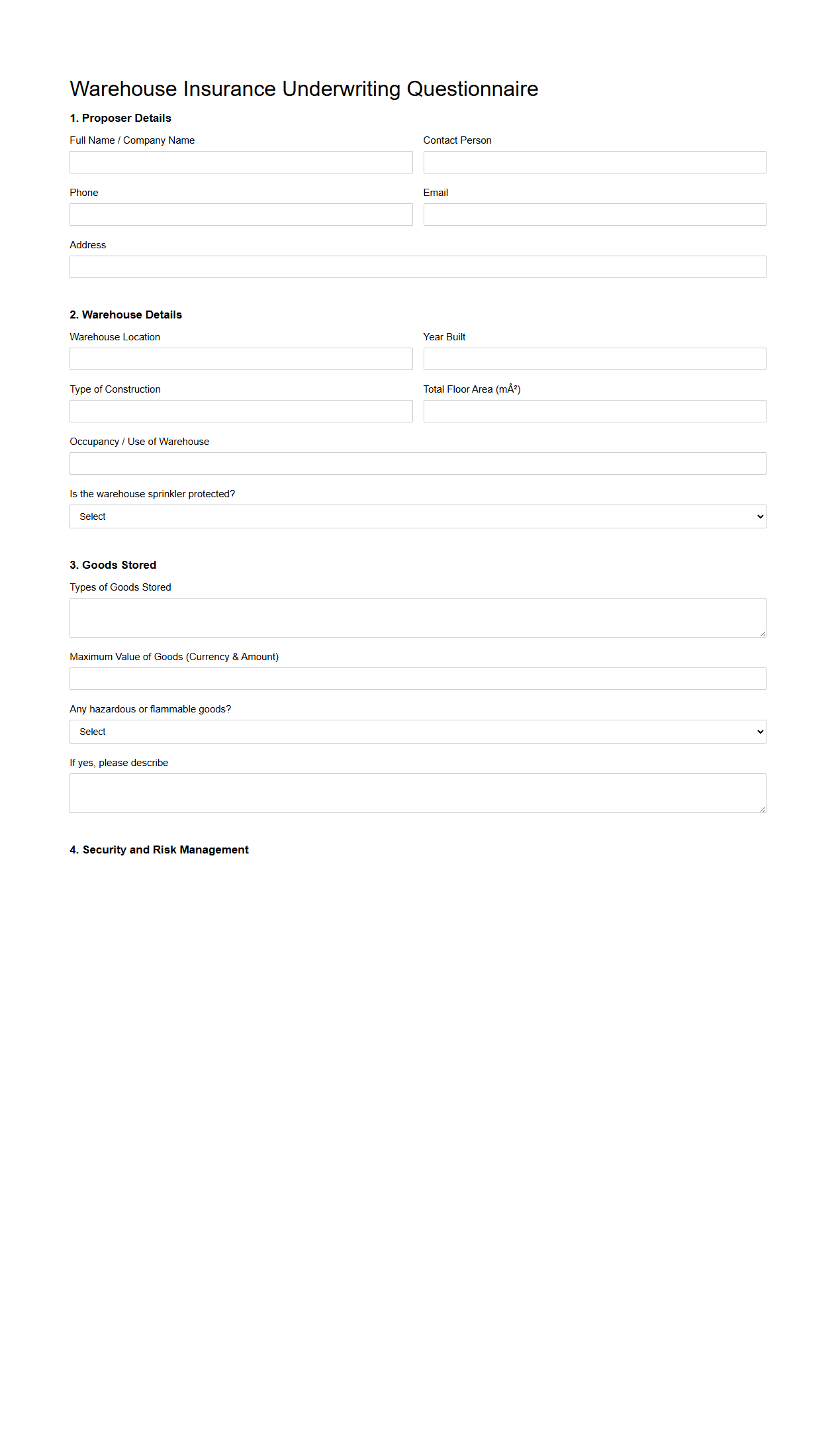

Warehouse Insurance Underwriting Questionnaire

A

Warehouse Insurance Underwriting Questionnaire document collects detailed information about a warehouse's structure, operations, and risk management practices to assess insurance eligibility and premium pricing. It typically includes questions on inventory types, security measures, fire prevention systems, and past claims history. This questionnaire helps insurers accurately evaluate potential risks and tailor coverage options to the warehouse's specific needs.

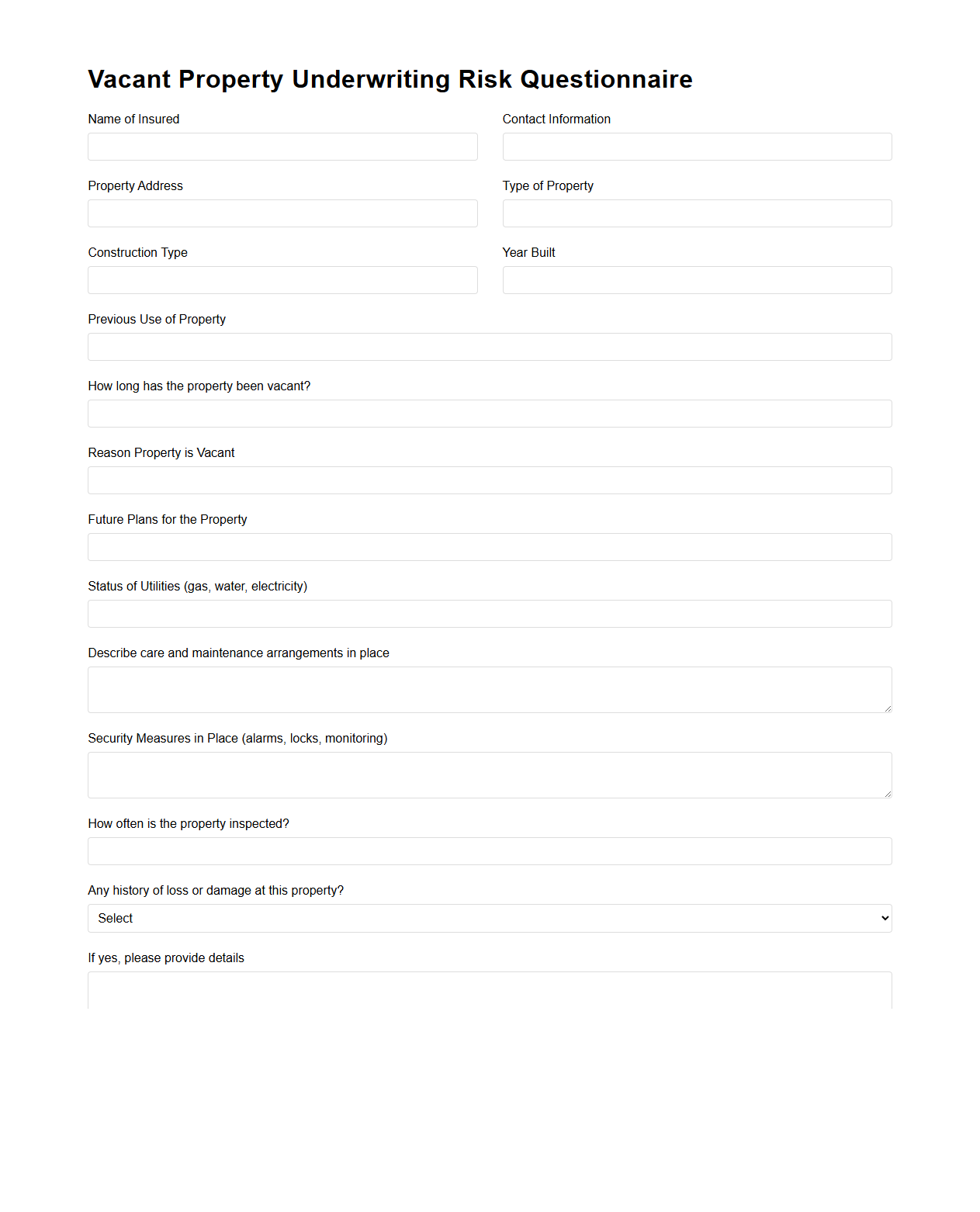

Vacant Property Underwriting Risk Questionnaire

The

Vacant Property Underwriting Risk Questionnaire document is designed to assess the potential risks associated with insuring vacant properties. It collects detailed information on property condition, security measures, and vacant duration to help underwriters evaluate exposure to hazards such as vandalism, theft, and property damage. This comprehensive risk assessment supports accurate premium calculation and coverage decisions for insurance providers.

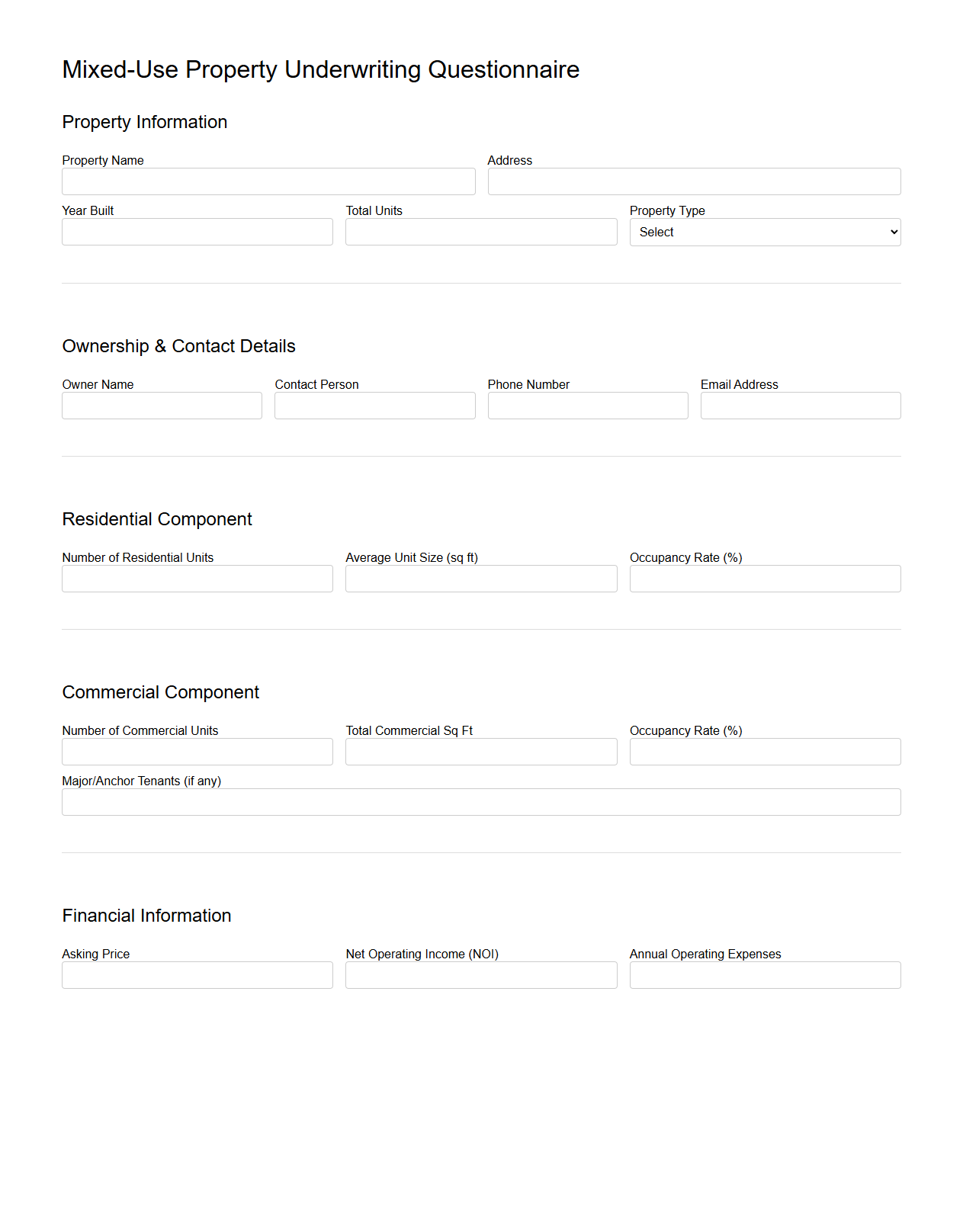

Mixed-Use Property Underwriting Questionnaire

The

Mixed-Use Property Underwriting Questionnaire document is a detailed form used by lenders and underwriters to assess the risks and financial viability of properties combining residential, commercial, and sometimes industrial spaces. It gathers crucial information such as property type distribution, tenant profiles, lease terms, income streams, and operating expenses to evaluate cash flow stability and default risk. This document plays a vital role in underwriting decisions by providing comprehensive data that supports accurate risk assessment and loan structuring for mixed-use real estate projects.

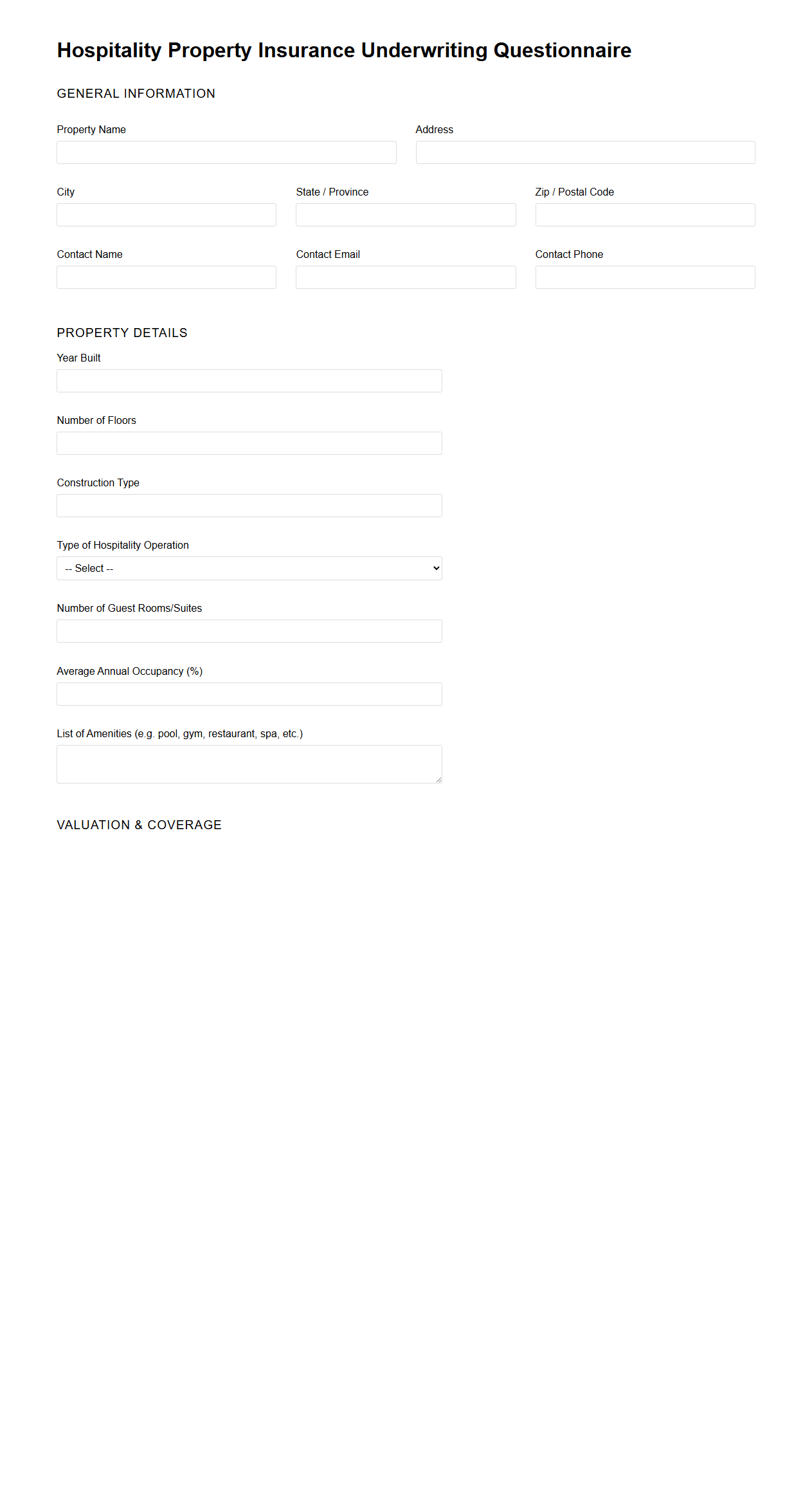

Hospitality Property Insurance Underwriting Questionnaire

The

Hospitality Property Insurance Underwriting Questionnaire document gathers detailed information about a hospitality property's physical characteristics, operations, and risk factors to accurately assess insurance coverage needs. It includes data on building construction, fire protection systems, occupancy types, and loss history to help underwriters evaluate potential hazards and determine appropriate premiums. The questionnaire ensures thorough risk evaluation tailored to hotels, motels, restaurants, and other hospitality businesses.

Primary Use and Occupancy Type of the Insured Property

The underwriting questionnaire identifies the primary use of the insured property as residential. It specifies the occupancy type, categorizing it as a single-family dwelling. This classification is essential for determining the insurance risk and coverage details.

Prior Loss History or Claims Associated with the Property

The questionnaire clearly indicates whether there is any prior loss history tied to the property. It documents previous claims made by the insured, if any, providing insight into past incidents. This information helps underwriters assess the risk more accurately.

Risk Mitigation Features Reported in the Underwriting Document

The underwriting document lists key risk mitigation features such as fire alarms, smoke detectors, and security alarm systems. These features play a crucial role in reducing the likelihood and severity of potential losses. Their presence can lead to favorable underwriting decisions and premium discounts.

Disclosed Structural Modifications or Renovations

The questionnaire captures any disclosed structural modifications or renovations made to the property. Details about the nature and extent of these changes are important for underwriting purposes. Such information helps identify potential risks associated with construction quality or code compliance.

Proximity of the Property to Known Hazards

The document specifies the proximity of the property to recognized hazards like flood zones and wildfire-prone areas. This geographic information is vital for risk evaluation and premium calculation. Underwriters use this data to determine the necessity of additional coverage or exclusions.